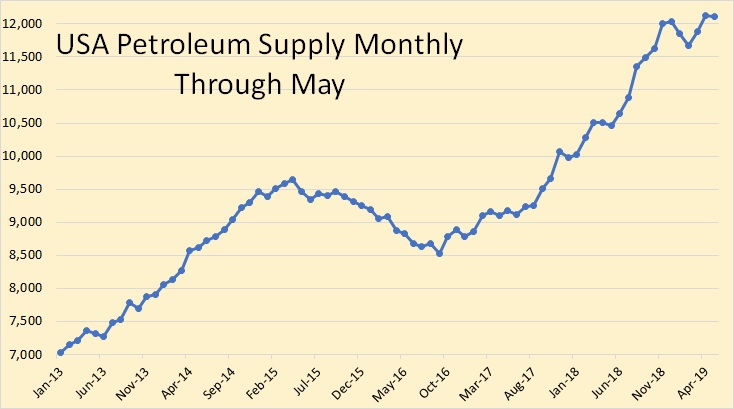

The USA data below was taken primarily from the EIA’s Petroleum Supply Monthly while some were taken from the EIA’s Monthly Energy Review.

I have some bad news to report. The EIA no longer published World production data or Non-OPEC production data. This data had previously been published in the Monthly Energy Review.

The Monthly Energy Review’s data was one month behind the Petroleum Supply Monthly but now they jumped two months and are now one month ahead of the Petroleum Supply Monthly. They now publish the previous month’s numbers, June in this case, but now publish only US data. The Petroleum Supply Monthly is unchanged.

EDIT: The Petroleum Supply Monthly does publish some, incomplete, world data… through April or one month behind their USA data. I will use that with an explanation and comments next month.

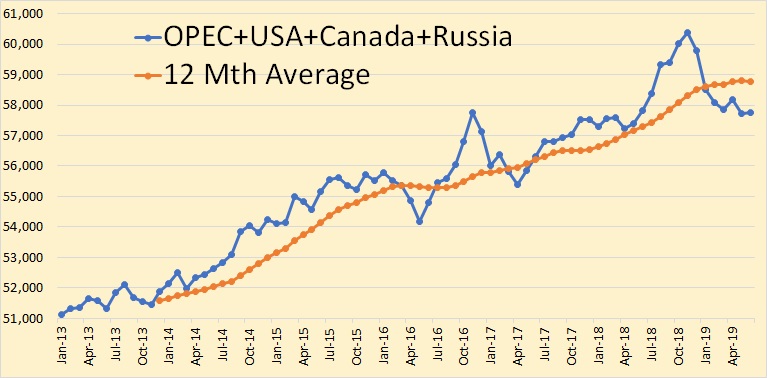

The closest I can come to World oil production, through June, is the combined production of OPEC, Russia, the USA, and Canada. This is 70% of total World Production.

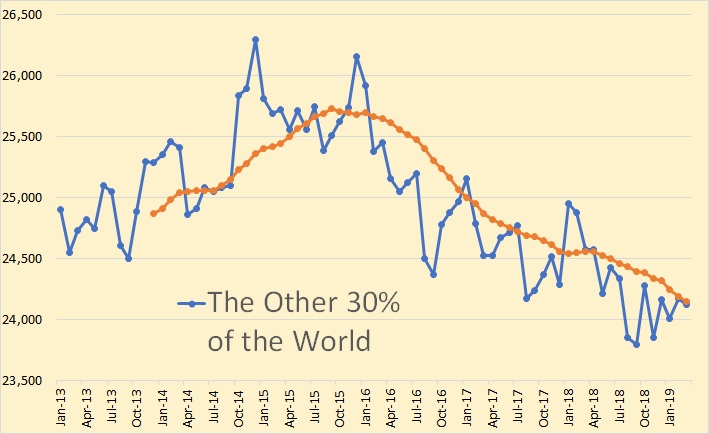

Here is the other 30% of World oil production. However, this data is only through March. Unfortunately, I can never update this chart because the EIA no longer publishes the data

This 30% of World oil production peaked in late 2015 and has declined an average of 450,000 barrels per day per year every year since.

Actually, in 2015 these countries averaged about 32% of World oil production but now averages about 29%.

I have no other source for World oil production. The IEA publishes quarterly projected data for the World and Non-OPEC. But this data is total liquids and only quarterly projections that bears little resemblance to actual C+C production.

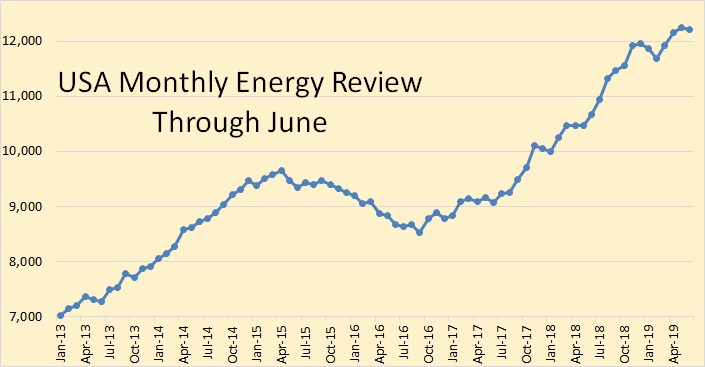

USA production according to the EIA’s Monthly Energy Review, through June 2019.

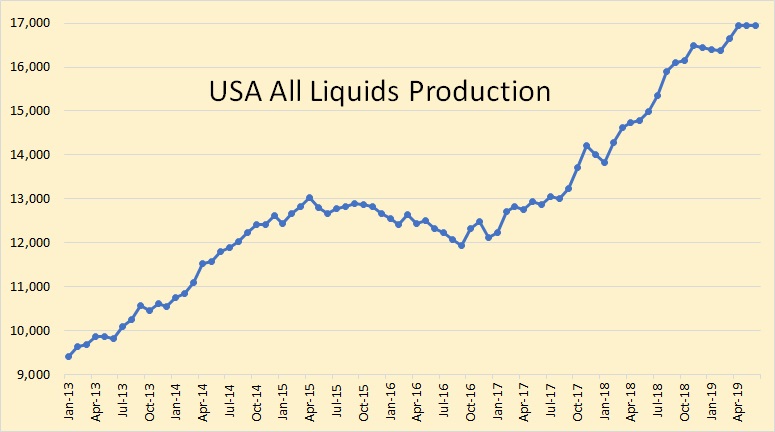

The Monthly Energy Review also produces total liquids data. This data is through June. The Monthly Energy Review is more of a guess and they eventually publish the same numbers as the Petroleum Supply Monthly.

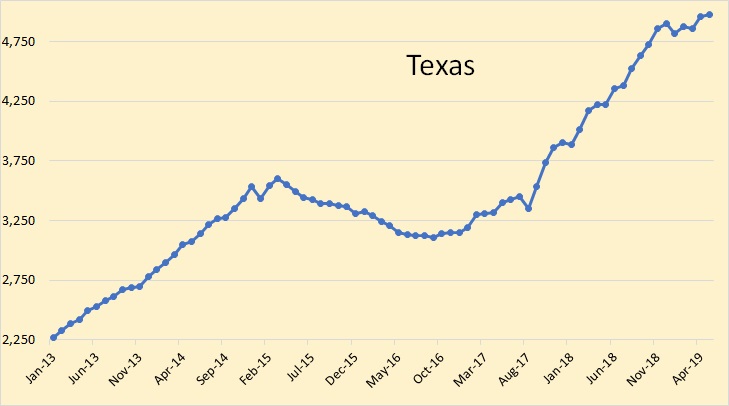

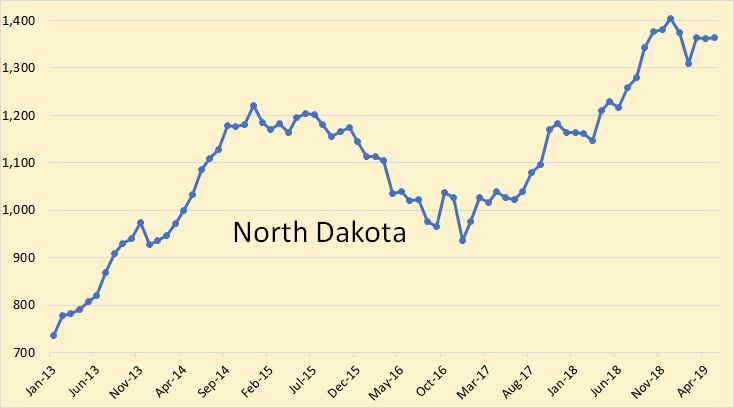

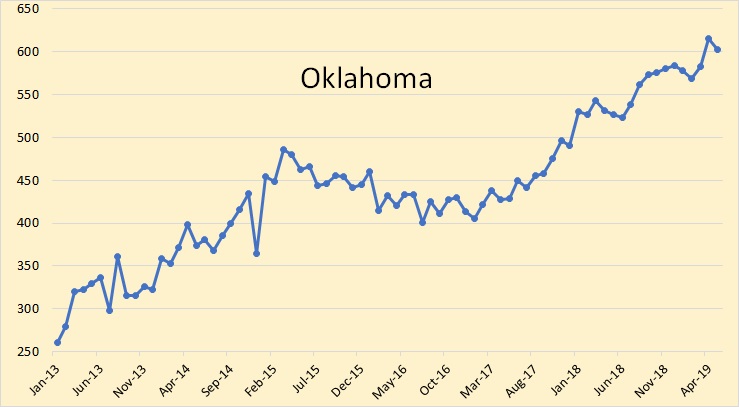

All the below data is from the EIA’s Petroleum Supply Monthly and is through May 2019.

USA production was down 26,000 barrels per day in May.

Texas oil production was up 16,000 barrels per day in May. Texas production is definitely slowing down.

North Dakota was up a mere 3,000 bpd in May. North Dakota has definitely plateaued.

Oklahoma oil production was down 12,000 bpd in May.

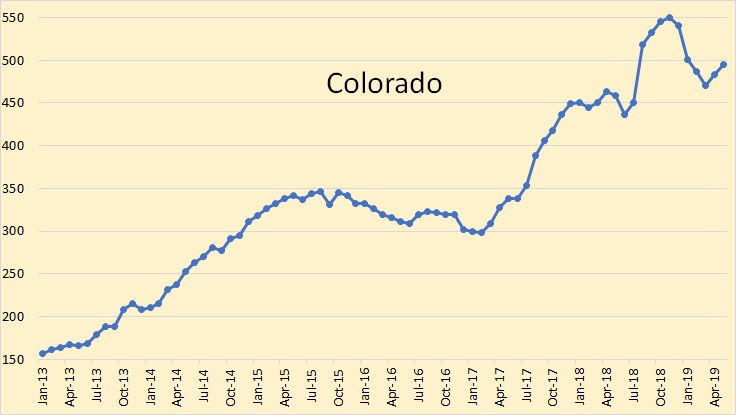

Colorado oil production was up 12,000 bpd in May.

New Mexico was up 33,000 barrels per day in May and now produces 900,000 barrels per day.

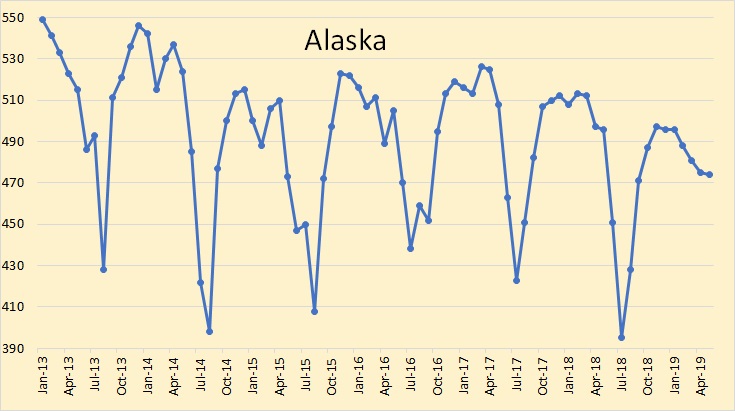

Alaska was down just 1,000 bpd in May but is down 22,000 bpd from May of 2018.

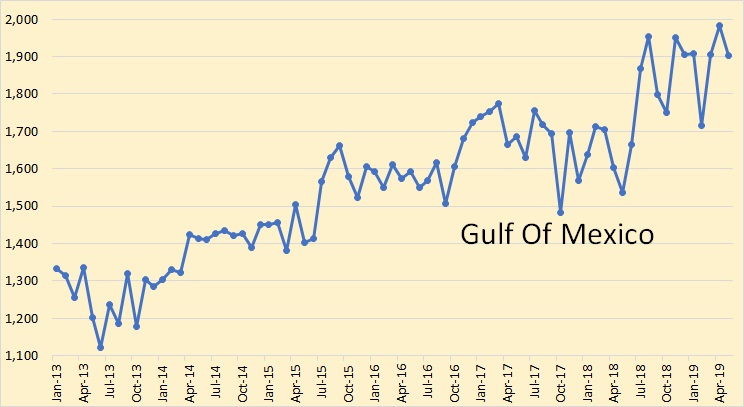

The Gulf of Mexico was down 78,000 bpd in May to 1,904 bpd.

How is the oil production in USA without shale, without GOM, and without Alaska? Does its dynamics still follow Hubbert curve?

Alaska fits peak dynamics almost to textbook.

https://images.app.goo.gl/RCNFEYxsK4DMEyeQA

Gulf is erratic because it is multiple discreet resources rather than one field. The individuals peak and decline but the basin as a whole hasn’t. GOM is also prone to external disruptions that interfere with maximum possible production- hurricanes annually and the Deepwater Horizion moratorium.

https://images.app.goo.gl/Ztqc4s3aJTBWcT2RA

Thanks.

However, it looks like USA-Alaska-GOM-shale has stayed roughly at 2mbd for 20 years or more (found charts only since 2000). How such a long plateau is possible?

“multiple discreet resources rather than one field“ PP

My guess is cuz they just keep drilling new ones to augment the old ones, and so far it seems to keep the aggregate production from declining.

Nevertheless, it is a bit strange that so constant, I mean if that are multiple discreet sources, then it would follow that they are also of similar volume (constans meaning that they are exchangeable), and that there are MANY OF THEM. If the latter, then the drilling dynamics is very different than in shale case; there is no rush to increase production (which should be possible since sources are exchangeable and numerous), only to keep it steady.

Maybe here lies a hope for Saudis then, who are supposed to have something like multiple discreet sources in the Kuwait corner of their sandy realm.

Haven’t run out of discoveries to exploit yet; leadtime on deepwater is fairly long.

It will decline once there are inadequate new discoveries. Here is an article Ron had last year on OilPrice.

https://oilprice.com/Energy/Crude-Oil/Can-We-Expect-A-Rise-In-Gulf-Of-Mexico-Oil-Production.amp.html

But non-GOM, non-Alaska conventional oil? I have meant this conventionl production in USA. It has been around 2mbd for the last 20 years or more. Why it is not falling?

The reason it is not falling is that at least 750K wells are producing that 2 million BOPD. Many of them were completed from 1975-1985. Wells that old decline little. They are also expensive to operate, and typically small family owned companies are the only ones who can operate them efficiently.

Stripper well operators are a virtual unknown to the majority of US residents. When politicians talk about oil producers it is usually in the vein of the Darth Vader’s at ExxonMobil and Chevron. The public either thinks that, or JR Ewing.

Tons of small businesses in the lower 48 upstream industry. People from all different backgrounds. Mostly rural people. One of my best friends has been making a living for the past 20 years on about 20 net barrels a day that he pumps himself. He takes one week off a year, and took no vacation 2015-17. 7 days a week. 365 days a year for three solid years.

A $10 drop in the oil price costs him $6,000 per month.

When prices were high, he donated a lot of $$ to charity, and didn’t ask for any recognition. I found this out not from him, but third parties who are on the boards of the charities.

Not all oil producers are the devil.

2mbd is a lot, more than Norway. Maybe this is future employment for Arabs in the Gulf…. Everyone gets a stripper well to tend. Don’t know how many wells have been drilled in Saudi Arabia till now, though.

But it sounds like a lot of work for your friend…. Can’t you switch off such a well for a week or a month? I would think that it is just emptying the bucket every evening and every morning….? I mean there are no more active measures like water or gas injection, or other kind of investments? Only power for a pump?

I suggest to blog proprietors a separate post on economy of stripper wells and how long they can last… that will be a future anyway. That would be some change of subject from the shale. Also, a lot of shale will turn into stripper wells finally, no?

Some stripper wells do only pump part time. Many pump full time. Depends primarily on how much water each produces.

Many are part of a waterflood. Or produce enough water that it is not economical to truck haul produced water from the lease. So the produced water is separated from the crude oil and pumped through a pump back down injection and/or disposal wells.

Most stripper wells required a down hole chemical application to prevent corrosion to the down hole equipment.

The pumper checks all wells daily at a minimum, as well as gauges the stock tank, checks for leaks, checks belts, applies chemical treatments (weekly or Bi-weekly usually) and many other things. The pumper ultimately has much to do with the economic success or failure of the well(s).

A lot of shale wells are stripper wells already, particularly in the EFS, Permian and Niobrara. I would argue that a well that produces under 50 BOPD from a horizontal wellbore that has a TVD of 3 miles or more and a lateral of a mile or more should probably be counted as a stripper well. Technically, however, a stripper well produces under 15 BOPD for oil, under 90 MCF for gas.

For example, Enno Peters has a new EFS post today. It appears that the average 2012-2014 first production EFS well produces a little more than 20 BOPD. Given the expense those wells cost I would say they have similar, if not worse, economics as conventional stripper wells in the US.

Thanks for explanations. Now the last question:

And how long can such a well go? what is the ultimate recovery of a stripper well in relation to its pre non-stripping period recovery?

OneofEU,

It depends on a number of factors, the price of oil, water disposal cost, price of replacement pumps when there are downhole failures, there are no general rules of thumb, each well is unique from what shallow sand and Mike shellman have explained in the past.

I believe that is why they are skeptical of my simple models, there is no way it could be as simple as my models. They are of course correct the model is a simple guess.

I would say an assumption of a 4% decline in output would probably be realistic in a moderate price environment for stripper wells, but I would defer to experts who actually run these wells, when I have asked the same question in the past I got no answer. There probably is no answer to your question, or it is a well kept secret.

The Mclintock well number 1 has been producing since 1807 in Penn. There is no answer. Answer to Dennis, below. Yeah, the well was not drilled until then, but the land produced oil since 1807. Reminds me of the Clampetts. Shoot bullet, and oil comes out.

http://www.energyglobalnews.com/mcclintock-well-1-worlds-oldest-producing-oil-well/

GuyM,

I think it was 1861 when that well was drilled.

https://www.reuters.com/article/us-oil-oldest-idUSTRE77H5RP20110818

Oldest well drilled in US was in 1859 ( a different well).

I agree there is no general answer.

Fat-tail statistics rule. If the collecting region is extensive, oil can always diffuse and diffusion is fat-tail over time. This is one of those behaviors that is universal across all physical domains. Don’t even have to be an expert.

Paul,

Yes for a region I suppose that is correct, though the specifics of how much oil a set of wells will produce, will depend on the number of wells, when they are drilled, the specifics of the geology and how much oil was originally trapped by the specific geological seals that have existed over time, so I stand by the statement that there is no general rule it will depend on the specific physical characteristics of the region in question to which the physics will be applied. Kind of like a planet and moon’s physics will be determined by distances and masses of the objects involved. For oil and gas it is a bit like not knowing the masses or distances involved. In astronomy these can often be deduced, with oil and natural gas we can sometimes do this with good output data and other observations, but often finding the needed data is difficult. Knowing average well profiles and number of completions over time can get us pretty far, for 750,000 wells with unknown average well profiles and unknown completion dates, it is a bit tricky, at least for me.

Dennis,

I was just getting at the virtual impossibility of maintaining a flow for >100 years without some sort of diffusional mechanism behind it.

The next question is when the flow drops below a certain level, what to do?

Paul,

Got it. The well in Pennsylvannia is a bit unusual, most wells become uneconomic within 30 to 40 years, seems they use pumps at the tail though perhaps it is diffusion that gets the oil to the wellbore.

GuyM,

Got it now, I was unfamiliar with that history, pretty amazing.

The oldest well we operate will turn 114 later this year. We operate many that were completed 1905-1912.

We also operate several completed in the late 1950s.

The majority were completed 1975-85.

Most are producing under 1 BOPD. However, almost all are under 1,000’

A ballpark total cost would be $60-80K for one well. We would hope 30 year production would exceed 10K BO. Most drilled in the 70s-80s have, the best have almost hit 50K BO.

Hi shallow sand,

Based on EIA data in 2017 there were 351,555 oil wells that produced 15 b/d or less with average output of 2.419 b/d, of these wells 330,234 of them produced 10 b/d or less with average output per well of 1.86 b/d. Total oil wells in 2017 producing in the US was 435,460, with 81% of those wells being strippers (15 b/d of less). The 105,000 highest producing wells produced about 90% of the oil in the US.

You were probably including the gas wells also with 15 boe/d or less, there are another 434,050 of stripper gas wells for a total count of 764,284 stripper wells (both oil and natural gas) in the US.

A lot of wells for sure. Total US oil and gas wells producing at the end of 2017 was 990,677.

Dennis. I was probably including gas wells, just threw out the number from memory.

shallow sand,

I had remembered differently (350k) so I checked, then realized that you were probably including gas wells.

Of the 1975-1985 wells you have operated, what is your guess as to the average life? Many have been going for 34 to 44 years already, roughly what percentage of those vintage wells have you needed to shut in permanently? I would think some of them become uneconomic, but I am often wrong.

Thanks.

I would th

One of EU,

Before 2000 there was very little tight oil output so one could simply assume that was zero before 2000. In any case a chart from 2000 to 2019 has a trend of a 1.2% annual decline rate, quite low. No tight oil data prior to Jan 2000.

I smell a political rat. Compiling the missing world data wouldn’t cost hardly anything at all, just a few minutes of computer time for one or two people familiar with the job. This little chore is probably mostly already automated ANYWAY.

It’s just like the current administration to pull this sort of trick, in order to protect the BAU establishment from people coming to understand that oil is on it’s way OUT, no matter WHAT, due to depletion alone.

The revolution will not be televised.

Yep–

https://www.youtube.com/watch?v=QnJFhuOWgXg

He knew it in the 1960’s.

being not an American I can’t say much for which administration would stop publishing but I’d posit that both would , well you don’t want to frighten the horses , do you ?

We get that over here, stop publishing the data and hey presto , you don’t have to explain it…;-)

Forbin

This is the same way they solved climate change.

There’s this notion that the U.S. Majors are going to be able to do the SHALE BIZ much more successfully than their small-mid sized brethren. This, of course, is PURE FOLLY.

I wrote an article showing that ExxonMobil’s U.S. upstream earnings to CAPEX spending was a disaster in Q1 2019, and I look forward to seeing their results for Q2 released tomorrow. However, ConnocoPhillips released their results a few days ago, and let’s just say, WHAT A FRICKEN MESS.

If you look at the attached table, and compare ConnocoPhillips Earnings per CAPEX, you will notice what a disaster is taking place in the LOWER 48 segment. COP spent more than 50% of its CAPEX on the Lower 48 only to make 12% of its overall earnings.

Please compare the other segments earnings to CAPEX spending and we can clearly see that COP is investing GOBS of money in its U.S. Lower 48 sector, to only make PEANUTS.

How long before large shareholders of the MAJORS tell the management to stop BLOWING money on shale, and instead buy back more stock and pay more dividends.

IT’S COMING….

How long can the buy back stocks and pay more dividends game run before the stockholders realize it’s time to get out?

“Getting out” is going to be way down the list of problems.

It will be a considerably smaller problem for stockholders who get out in time, but I tend to agree, everything else held equal.

On the other hand, there IS a real possibility that oil supplies will hold up well enough that the price of oil will not bring about the next major economic depression or that outright economic collapse won’t come about as the result of a lack of oil.

I didn’t think I would ever say this four or five years ago, but since then, the prices of renewable electricity and batteries suitable for use in cars and trucks have fallen so fast that electrified transportation may actually result in demand for oil falling off fast enough that we won’t have to deal with oil shortages in and of themselves any time soon.

Imho, currencies is the main issue. They will be devalued, at gunpoint if necessary. The oil must flow, electronic payments, and restrictions…..

will make sure there’s no alternative. Banks and countries bailed out, as we know. Fundamentals, like oil. Oil will be bailed out too, ‘subsedized’.

Whether we want it or not.

Devalued? With respect to what? Other currency?

Who wants their currency to be strong? A strong currency harms your exports.

It’s unwise to think about money wrt oil. It’s best to think about oil, wrt oil.

For God’s sake people, China is buying oil hand-over-fist and they’re paying for it with currency that is pegged to the dollar.

Well, it is pegged to a basket of currencies, and the basket is mostly filled with USD. Think about this. Every single day think about this. They are buying oil with yuan that has a fixed USD conversion.

Watcher, devalued against the real world, all currencies together. Until they will be abandoned en masse.

$7 trillion in negative yielding debt. Trillions in pension shortfalls. The financial system is a very sick old man. Stocks at all time highs through buybacks and ZIRP. A currency is backed by debt, and debt is backed by promises that won’t be kept. Net energy is in decline while the debt system needs growth, an exponential road to nowhere. Who do you think will pay for the monetization of shale? Oil majors shareholders? Wrong. We all will. Through currencies that will be worth less by the year, month, etc.

Because that is our current base. And it is sick as hell.

‘Healthy markets’;

My mistake, 14tn in negative yielding debt, not 7. Exponential factors travel faster than we think.

https://1.bp.blogspot.com/-g6F9p07FJ_g/XUSZBdtP9rI/AAAAAAABbpM/8ci8XwnTxmcYEMFPbIaUX-jkKtP4jAB9QCLcBGAs/s1600/negative%2Byield%2Bdebt.png

They have to buy shit loads of US dollars or US dollar equivalents mainly US treasuries in order to keep the peg. And if they fail to buy US dollars the peg gets broken.

There i thought about it.

Steve. Waiting for your comments on XOM and CVX.

Am I reading it wrong or did XOM burn an incredible amount of cash in Q2?

I know they have dropping lots ( XOM) on their new refineries and chemical plants for Permian high level API stuff. Temporary, and long term beneficial. No comment on the other.

XOM had negative free cash flow for the 2Q and spent 52% of their

upstream CapEx in the US. Doubling down in the Permian!

Shallow,

Yes, I was waiting all week for Exxon’s Q2 2019… and wasn’t disappointed. Furthermore, I had a bit of a TIT for TAT Twitter exchange with Art Berman in regards to Exxon’s miserable U.S. upstream , or oil and gas earnings vs. CAPEX. Art replied by saying the following:

Art Berman @aeberman12

Replying to @SRSroccoReport and @Jazzmatazz76

It’s Exxon’s book, not mine nor yours. Problems with tight oil not going to crater US. or global economy as you have predicted. It’s not a big enough part of the economy. Even in an apocalyptic scenario, U.S. govt will be the under-writer of last resort. Oil’s too important.

SRSrocco Report @SRSroccoReport

Replying to @aeberman12 and @Jazzmatazz76

U.S. oil production growth 2008-2018 accounted for over 75% of global growth, mostly from shale. I gather you understand that Global GDP growth based on global oil production growth?? Correct? Money printing & Zero interest rates don’t work in a peak oil scenario.

—————–

Art says “It’s Exxon’s book, not mine nor yours.” What sort of response is that?? Aren’t analysts supposed to go over companies data to make “calculated assessments?””

Anyhow… ExxonMobil had another MISERABLE quarter in their U.S. upstream earnings versus CAPEX spending. (INT. = International, Non-US)

Exxon Q2 U.S. Upstream Earnings = $355 million

Exxon Q2 U.S. Upstream CAPEX = $3.2 billion

Exxon Q2 INT. Upstream Earnings = $2.9 billion

Exxon Q2 INT. Upstream CAPEX = $2.9 billion

So, Exxon spent nearly TEN TIMES the CAPEX to earnings in its U.S. oil and gas sector. But, it’s even worse than that.

Exxon Q2 U.S. oil production = 662,000 bd

Exxon Q2 U.S. upstream CAPEX = $3.2 billion

Exxon Q2 U.S. CAPEX per Oil Barrel = $53

Exxon Q2 INT. oil production = 1,727,000 bd

Exxon Q2 INT. upstream CAPEX = $2.9 billion

Exxon Q2 INT. CAPEX per Oil Barrel = $18

Exxon is spending nearly three times the CAPEX per barrel of oil production per quarter in its U.S. upstream sector than it is in its International or Non-U.S. sector.

And, in spending three times the CAPEX per barrel, Exxon’s U.S. upstream earnings are only 12% of their International upstream earnings.

This is GOOD NEWS ART BERMAN??? LOL

steve

Steve. Somehow I missed your post when I posted below.

Yes, XOM hasn’t figured out how to break even at $15 WTI like I think their CEO has claimed they would.

Looks like US will be flat or start to decline this year, guess Russia not have much to add eighter OPEC. Than future oil price depend on if there will be trade agreement and if the situation with Iran is getting wurst. Low oil price combined with low gaz price is bad for many oil majours that mostely have gaz resourses left.

Freddy,

Doubtful that US output will be flat before 2025.

Doubtful that US output will be flat before 2025.

Dennis, you’re dreaming. A 12-month average proves nothing. It could turn down in a few months. The six-month average is almost flat. And when the July data gets here, it will be flat. But that proves nothing either. It’s what’s happening in the oil patch that’s important. And US production will, I believe, plateau in 2019 and turn down in 2020. Okay, I could be a year off but no more than that. But 2025 ? That is beyond all reason.

I talked to a guy with a pretty key position in a pipeline company recently.

He says everything USA lower 48 other than shale is completely dead, and has been for sometime. He said look at Kansas since 2014. That is pretty much the rest of conventional lower 48.

He also said they are getting nervous about shale because the financial people in New York are turning against it. He says it is not profitable sub $75 WTI and if the money is cut off, it’s going to fall like a rock.

They are also concerned about 2020 big time. A lot of wasted money on new pipes if there is a fracking ban, which they are taking seriously.

Shallow sand,

A fracking ban has less than a 1% chance of occurring for the US as a whole, California, Oregon, Washington, New York, and New England perhaps, for North Dakota, Rocky Mountains, Texas, New Mexico, Oklahoma, Louisiana, and some midwestern States snow in hell is more likely. 🙂

I don’t see a fracking ban, either. For communities that don’t want it within their borders, there might be restrictions, but a nation-wide ban would be a crude way to reduce oil consumption. Politically it’s not the best route.

Dennis.

What do you think Joe Biden meant in the debate earlier this week when asked about fracking?

I’d say the chances of a national fracking ban are much higher than 1%. Not entirely sure what a fracking ban would mean. Would that include all fracking or just the “shale kind.”

Do any of the dem candidates or Trump even have a clue about any of this?

I assume this would be tied up in the courts and possibly Texas, NM and ND courts would enter temporary injunctions allowing the fracking of shale wells to continue.

It seems everyone here is just blowing this off as campaign talk. Maybe it is?

Most of what we hear in the debates is just campaign talk. Nothing new there.

Fracking may be banned once there is no more oil or gas to recover.

On the other hand, I wouldn’t be surprised to see some regulations requiring disclosure of fracking materials, or waste water handling procedures.

Shallow sand,

Politicians say stuff to win nomination that they know will never happen. I haven’t watched debates or paid much attention. Seems Dems have proposed a bunch of dumb ideas, very little will come of it in my view.

“He also said they are getting nervous about shale because the financial people in New York are turning against it. He says it is not profitable sub $75 WTI and if the money is cut off, it’s going to fall like a rock. ”

Yes. No money, no fracking. This is the reason why we don’t see much growth in US LTO production so far in 2019.

Unless oil prices increase, I don’t think we’re going to see much growth in LTO production.

That is very true. And, internally, most of the companies can not provide a lot of capex, without more funding. No matter what the price of oil goes to. So, it may be awhile, before we can see an increase. My bet is that it will be falling sometime in the next year.

GuyM,

Many of the big independents in the Permian basin were cash flow positive in 2018.

So far in 2019 tight oil growth has been slower than 2018 by about a factor of 3 (500 vs 1500 kb/d).

I agree growth will be lower, the argument that there will be no growth in tight oil output is not correct in my view.

It won’t increase. It may not dive, but, in order for things (in all shale) to keep increasing, there will have to be funds available. It’s not there. Find a way to fund it, you will be correct, and a hero.

In short, financials trump, and credit availability, override very accurate predictions.

GuyM,

In order for output to remain flat the completion rate will need to fall by 25% or more, I doubt that will be the case, but it is possible I am wrong. An increase in tight oil output simply requires the same completion rate as the first 6 months of 2019, my guess is that poorly run companies will decrease the number of completions and the better companies will increase the number of completions and overall the level will remain flat until oil prices start to increase, then we may see an acceleration in the completion rate by majors and well run independents.

Tita,

For the first 6 months of 2016 about 456 tight oil wells were completed on average in the Permian basin, there is still money being spent, though perhaps at a lower rate of growth in spending. Note also that the average completion rate in the Permian basin for the first 6 months of 2018 was only 396 tight oil well completions per month on average, so we have seen an increase in the number of completions in 2019 compared to 2018 for the Permian basin. For second half of 2018 the average completion rate increased to 437.5 new wells per month and then increased further to 456 new wells per month in the first half of 2019.

Most of the growth in US tight oil output over the past 6 months has been from the Permian basin, in other tight oil plays some plays have seen decreasing output while others have been increasing but overall outside the Permian basin output has been relatively flat (down about 0.06% from Dec 2018 to June 2019).

Hi Ron,

We will see in 2022 who is correct. I am confident that US output in 2025 (12 month average output) will be higher than 2018 or 2019. It is possible US output could plateau, but my focus is always on 12 month output, if there is a brief plateau or even a slight decrease in 12 month average output, it will be followed by a rise in output, even the most pessimistic scenarios I can envision will likely peak in 2024, but the more likely scenario is a peak in 2025 for US C+C 12 month average output, in my opinion.

Actually, Dennis, my estimate was based on what is happening in the oil patch, primarily the Permian Basin.

The Permian Boom Is On Its Last Leg By Robert Rapier – Jul 28, 2019

In the past, you have put a lot of faith in what Robert Rapier has said, especially his optimistic predictions. Have you lost faith in him now that he has a pessimistic prediction?

The Permian boom is on its last leg. It will begin to decline in 2020. And when the Permian begins its decline, the USA as an oil producer will begin its decline.

Rapier writes some good stuff, I don’t always agree with him just as I don’t always agree with you.

My model suggests Permian output will increase.

Your model appears to be based on the one-year average projection line? Yes? Really Dennis? Hell, you could project that line out ten years and still be climbing. But that line could very easily turn down in less than one year.

In April 2015 that one-year average line was headed up, just like in your chart above. But by December 2015 it had already turned down. The December value was below the November value. And that may very well be the case this year.

All I am saying Dennis is that projecting production based on a one-year trend line is a very poor way to project. What about what’s happening in the shale oil patch. Hint: It ain’t pretty.

Ron,

No the model is based on an assumption that the completion rate in Permian tight oil wells remains flat at the average level of the first 6 months of 2019. (That is the not pretty picture lately in the tight oil industry, low output will likely lead to higher prices and better financial performance.)

It is not just a projection of recent trends in output.

In chart below the low scenario is the “flat tight oil completion scenario” that I have presented in my previous post. The high scenario leaves all tight oil basins except the Permian basin with the same completion levels as the “flat completion scenario” and assumes the completion rate in the Permian basin increases by about 4.5 wells per month on average from Jan 2020 to Dec 2025. Note that from Dec 2016 to Dec 2018 the average 12 month completion rate in the Permian basin increased by 12.9 wells per month on average, so this assumed rate is 2.87 times lower than the 2016 to 2018 rate of increase. For the low/high average scenario it would be about 6 times lower.

In my view the low/high average scenario is quite reasonable, the high scenario is optimistic and the low scenario is pessimistic. My guess is that there is about an 80% probability that US tight oil output will fall between the low and high scenarios presented in the chart below, especially if oil prices are close to the AEO Mod scenario that I have presented elsewhere in the comments.

Note also that I have considered how much the completion rate would need to fall below current completion rates for tight oil output to remain flat at Jun 2019 levels and it is about a 25% decrease in completion rates, basically that is a highly unlikely scenario (less than a 1% probability in my opinion).

Note that it is Rapier that is simply extending trends and I agree that is a very poor way to make predictions because as you correctly point out trends often change.

In fact I have assumed in my models that the completion rate in the Permian basin decreases considerably from the rate over the 2017 to 2018 period (24 months). The low scenario has the monthly rate of increase in tight oil well completions fall from 13/month to zero and the “high” scenario assumes the rate of increase in completion rate falls from 13 to 4.5 completions per month from Jan 2020 to Dec 2025.

Click on chart for a larger chart.

“ A scenario that is completely unlikely.”

It’s trending way down, Dennis. My guess, is that completions for July for EF is back up 15, but that’s not really good news, because they were down about 50% for June. Completions for the Permian will be down about 40. The Bakken is about to cave. Look at WLL. It will get worse as the year wears on, and the price of oil will have little to no effect for a year, at least. That’s reality, as I see it with the most current harbingers. Oxy, EOG, and ConocoPhillips will play it very conservatively. Most of the others, besides the majors, are just waiting for the grim reaper. Because, WTI will remain in the $50 to $60 range, until inventories approximate zero. The paper traders are dumber than a rock.

GuyM,

I was without internet access for a couple of days so missed some of the recent news on tight oil financial results. The Bakken falls in output are being offset by increases elsewhere.

For EF (districts 1 to 5)I have 111 new drill oil completions in June vs 205 in May so a big drop in that case, somehow the drilling info data shows EF output remaining flat, perhaps the completion data or drilling info data is incorrect (or perhaps both). EF output has been pretty flat for all of Jan to June 2019, eventually it may decrease if completion rate falls. I think a 25% drop for total US tight oil completions (about 1000 per month for the first 6 months of 2019, so a drop to 750 completions per month is not very likely in the near term (from now to June 2022). I think higher oil prices can affect capital spending pretty quickly, more like 3 months rather than 12 months especially for tight oil plays (not true for longer term projects like deep water offshore where 3-5 years would be a better estimate.)

Geeze, dude! Pay your internet bill. Your one of the mainstays!?

GuyM,

A visit to a rural area with poor cell coverage and a nice weekend of Jazz and family, was the cause. This will be a problem for most of the rest of the summer, though I will stop in with comments lacking news background from time to time.

Well Dennis, you’re gonna love this latest missive from Robert Rapier – https://oilprice.com/Energy/Energy-General/The-No1-Reason-Why-Oil-Isnt-Trading-Over-100.html

I assert as always, and as per Ron’s charts, that peak is 2018-2019.

Mike Sutherland,

Trends can change and often do, I focus on the 12 month average in World output, the centered average peak is currently in Oct/Nov 2018 based on EIA World C+C data (that is the most recent centered 12 month moving average for World C+C output). In November 2020 we will know if your assertion is correct about a World peak in 2018 or 2019, I think any “peak” over that period will be temporary just like many of the previous “peaks” in World C+C output of the past. The final peak will be in 2024 to 2026, if my medium estimate of World C+C URR of 3100 Gb proves correct and there is no GFC2 prior to 2026. We will not know if my guess is correct until Dec 2027. Like any prediction of the future, odds are near zero that I will be correct.

I have never expected that the high rate of growth of 2018 could be sustained. The high rates of growth were in response to oil prices of over $60/b, the growth rate in US output will likely stabilize at 500 to 700 kb/d at the current oil price level of $50 to $60/bo.

Hi Ron,

What happened in 2015? Oil prices went from $100/b to $40/b. In 2018 oil prices went from $75 to $50, are you expecting a big drop in the price of oil in the coming months? I expect the opposite, I also base my estimates on future completion rate estimates which are very conservative. In the past my estimates have been too conservative though that could change.

Dennis,

When exactly do you expect oil prices to start their perpetual increase?

Iron Mike,

I see what you mean. I guess in reality I do not expect a big increase in oil prices near term, see the price scenario at the link at bottom of comment, after 2036 I expect a plateau at $100/b in 2017$ until 2038 and then a decline in oil prices as transition to electric vehicles reduces demand for oil to less than oil supply. I think oil prices may remain about where they are (with fluctuations above and below current price) until about 2020.

If you look at my oil price scenarios, it is not a perpetual increase.

Oil prices are impossible to predict on a daily basis, I look at long term trends.

The exact time will be noon on Dec 31, 2019. 🙂 Note that the AEO 2018 scenario that I typically use for my tight oil models has the average Brent oil price in 2019 at $56.25/b in 2017$ and it rises to $69.96/b in 2017$ for the 2020 average price, today the Brent future price for Oct 2019 is $61.89/b. For the model price we have $59.68 in 2017$ and Brent future price in 2017$ is $58.90 in 2017$ for Oct 2019 future. Bottom line, oil prices are a little bit higher than the AEO 2018 oil price reference scenario that I use for my models. The perpetual increase will need to wait.

My actual price expectation is based on slower growth in actual World C+C output than is forecast by OPEC, IEA, EIA and other agencies, my expectation for demand growth is a continuation of the 800 kb/d annual increase in World C+C output that has been the general trend since 1983 until oil prices reach $85 or $90/b in 2017$, possibly in 2024 as World growth in C+C output slows to a stop by 2025. At that point demand will be constrained by supply and prices will rise to the point that demand matches available supply. In the long run we cannot consume oil that is not produced as in general we expect conservation of mass (with the exception of small amounts of matter converted to energy in nuclear reactors).

See

https://www.eia.gov/outlooks/aeo/data/browser/#/?id=12-AEO2018®ion=0-0&cases=ref2018&start=2019&end=2036&f=A&linechart=ref2018-d121317a.3-12-AEO2018&sourcekey=0

Hi Dennis,

Thanks for the reply. You wrote above that you expect in the coming months oil prices to rise, i believe. That’s why i was asking. I thought maybe by next year you expect Brent to be around $70/b.

What would be your guess for the average price of Brent for say the next couple of years?

The AEO is a long term prediction that i assume you agree with, but is almost certainly wrong in my opinion.

My guess is that spot prices will determine more the movement in oil prices during the next year and a half. Not what paper traders determine. When will that happen, and how much? Don’t ask me, I dunno. Probably a bunch.

And that is probably why there is not much downward movement now, with all the negative BS on oil.

Iron Mike,

I agree the AEO oil price scenario was just an oil price scenario that was easy to download and use and will no doubt be wrong (just like every prediction of the future which typically have odds of success of about zero.)

My guess is that the AEO 2018 forecast is a good starting point, my guess is that if anything it will be too low up to 2027, after that it depend how fast the transition to EVs occurs, my guess is that a realistic scenario has demand falling below supply in 2037, it is difficult to guess how quickly the transition away from oil in land transport will occur and how fast AVs might become approved which could lead to more car pooling and fewer vehicles on the road and less oil demand. Potentially oil demand could be cut quite rapidly.

My guess would be (all in 2019$) for Brent crude about $75/b in 2020, $80/b in 2021, $87/b in 2022, and $97/b in 2023 all annual average oil prices and probably +/-$5/b around each of these guesses. This of course also has approximately a 0% probability of being correct. 🙂

DC and all,

Here are projections for Brent prices per barrel for 2019 from various sources, which I pulled from a leading article at today’s Rigzone:

Fitch Solutions Macro Research (FSMR):

2019 $67/bbl, down from $70/bbl month before. $73/bbl in May.

Bloomberg Consensus:

2019 $67.7

July, from Interfax Global Gas Analytics:

2019 $68/bbl

Ann-Louise Hittle, VP for macro oils at Wood Mackenzie; in June:

2019 $68/bbl.

I’m no expert in this so read the whole article. Wood Mackenzie’s take interests me, since you ask.

Synapsid,

Yes everyone thinks there will be a glut of oil, I just think everyone is wrong, except me. 🙂

Note that the scenario I use (EIA AEO 2018) has an average Brent price of $56/b in 2019 (in 2017$) and the price rises to $70/b in 2020 and $77/b in 2021, and $80/b in 2022 (all in 2017$).

By contrast the short term energy outlook has Brent prices at about $52/b in 2020 in 2017$.

The AEO 2019 has Brent prices rising to $73/b in 2020 and only rising to $74/b by 2022 (prices in 2018$).

The AEO 2018 and AEO 2019 reference scenarios seem pretty reasonable, though I think the peak in World oil output is not expected by the EIA in 2025, so their estimates in 2024 and later may be too low.

Regarding oil prices and the effect on long term (beyond 5 years, say) oil production, we may start to see a big effect from electrification of transport.

I have been skeptical on this before, but plenty of high priced oil may stay in the ground in the second half of this coming decade and beyond, simply because electric transport will be available for cheaper.

BNP Paribas is the 8th biggest bank in the world, and they just released a study that is worth pondering. If their assumptions and analysis are correct, or close, at some point the effect of competition from EV’s will be big.

According to the study, if comparing the mileage derived from oil vs wind/solar, per dollar invested in energy production- it would take oil to be priced at about $10/barrel to equate to the utility scale solar and wind production now feasible. [At the level where the wheel meets the road]

Its probably just a matter of time. Certainly, it will take a long time for the price advantage to filter its way down to the level of the 10 yr old ICE vehicle ‘on the road’ inventory across the world.

At some point earlier, the attitude of ‘only the wealthy’ can afford EV’s, expressed here by some and in the culture at large, will switch. It will become an attitude of ICE travel is for the rich. Only they could afford the high cost/mile.

Wells, Wires and Wheels Aug 2019

[courtesy of IslandBoy]

https://docfinder.bnpparibas-am.com/api/files/1094E5B9-2FAA-47A3-805D-EF65EAD09A7F

Hi Ron,

Using my “medium” (average of low and high tight oil scenarios) tight oil scenario and the trend in non-tight US C+C from 2005 to 2019 to project the rest of US output, the scenario below shows a US C+C output scenario from 2019 to 2039 with peak output of 14400 kb/d in 2024 (10000 kb/d of tight oil output at peak).

Wow! You have shale oil output rising much faster than the EIA, peaking at about the same level, but much sooner.

EIA: U.S. shale output to keep rising until peak after 2030

March 29 (UPI) — Production of the so-called shale, or tight oil, will continue to increase through 2030 and reach more than 10 million barrels per day in the early 2030s, the Energy Information Administration said.

“EIA projects further U.S. tight oil production growth as the industry continues to improve drilling efficiencies and reduce costs, which makes developing tight oil resources less sensitive to oil prices than in the past,” according to the EIA’s Annual Energy Outlook 2019.

I can understand the EIA’s optimism, but not yours. I am really shocked at your outlook Dennis. For shale oil to peak at about 10 million sometime after 2030, the EIA has the increase in shale oil production slowing dramatically. But you don’t think that is going to happen. I am shocked.

Of course I think you are both wrong. And so do a lot of other folks in the oil business. The bad news just keeps pouring in from the shale oil patch.

Hi Ron,

The EIA expects Brent oil prices will remain about $70/b in 2019$ until 2022, I believe their estimate is incorrect, a lower oil price scenario would lead to a lower tight oil scenario with perhaps a peak of 9 Mb/d in 2024, the EIA’s outlook through about 2027 is fairly reasonable, after that they will be incorrect as they expect a long plateau in tight oil output.

My models for tight oil are based on the oil price scenario below, well profiles estimated using data from shale profile.com and well cost estimates, OPEX, transportation cost, royalty and taxes, etc based on conversations with oil professionals.

The “medium scenario” assumes an increase in the completion rate that is 6 times slower than the rate of increase in the tight oil completion rate from Jan 2017 to Dec 2018. A “flat” or no increase in completion rate scenario has a lower peak of 9.1 Mb/d in 2024 rather than 10 Mb/d in 2024.

The tight oil producers that are doing poorly will decrease their completion rate while stronger independents like EOG and the majors will increase their completion rates and the result will either be a wash (no increase in the completion rate) or a slight increase in the completion rate (this will depend in part on the price of oil in the future).

Not sure why you are shocked, my tight oil scenarios have not changed much in the past 6 months.

Oil price scenario below, I use AEO mod scenario, this is from the AEO 2018 report.

Ron,

Scenario from Jan 2019, note that the scenario is too low in June 2019 by about 1000 kb/d, scenario has been modified a bit to match model with data through June 2019.

Sorry for fuzzy chart.

Hi Ron,

It is very likely I am wrong as has been the case in the past. Below is an earlier projection from October 2017 (no doubt you thought my projection was too optimistic in that case as well). 🙂

I expected the peak to be about 6800 kb/d in 2021/2022, June 2019 output was expected to be about 5500 kb/d.

In general my projections have proved to be too pessimistic rather than the reverse, but of course things might change, hey I might even be roughly correct with my 10 Mb/d+/-1 Mb/d peak tight oil estimate in 2024/2025. Time will tell.

Hi Ron,

The World C+C output through April 2019 can be found at the International section of the EIA website.

https://www.eia.gov/beta/international/data/browser/#/?pa=00000000000000000000000000000000002&f=M&c=00000000000000000000000000000000000000000000000001&tl_id=5-M&vs=INTL.57-1-WORL-TBPD.M&ord=CR&cy=199401&vo=0&v=H&start=197301&end=201904

Chart below has data from Jan 2017 to April 2019 and trailing 12 month output, with peak in April 2019 at 82925 kb/d.

Better chart, first chart has last few data points cut off.

Thanks Dennis, they don’t make it easy to find. But I can definitely use this in my next post. I do hope they update it every month.

Dennis

Something does not add up.

If Global oil production has fallen by 2 million barrels per day, yet global consumption has increased by 600,000 C and C. The price should be much higher.

There must be oil being produced that is being hidden from those trying to compile the data

Or, we are in the beginning of some pretty large inventory drops.

Hugo,

There are oil stocks, but visibility of stock levels is not very good. The data is not perfect in the short run, long run data is better.

There is no real, concrete reason why oil prices “should” be anywhere. There is still a huge gap between lowest production costs and highest consumption values. Prices seesaw somewhere in between.

Price are set by short term considerations only. Arguments about long term profitability, ROI, total system costs etc do not determine prices. As Keynes put it, in the long term we’ll all be dead.

I really should have stuck to my first point.

You cannot have a drop in oil production of 2 million barrels per day and an increase in consumption of over half a million barrels per day in 6 months.

US stock have gone up in that time.

Hugo,

Consumption numbers are estimated by production and stock level changes, all the numbers in the near term are not very good (production estimates are probably best). The US is only 20% of the crude plus condensate consumed in the World, so US stocks are just a part of the story, OECD stock levels are far more important, and even those are just a part of World stock levels, non-OECD stock level information is very poor. What we have is a black box on stock levels and consumption at the World level.

Also, focus on the trailing twelve month (TTM) average in World output on the chart a few comments up the page. In 2018 the TTM average World C+C output increased by 2000 kb/d, where the long term change in C+C output for the World has been about 800 kb/d from 1982 to 2018. So output increased by 1200 kb/d too much and for the past few months (Dec 2018 to April 2019) OPEC has cut back output to get the World oil market back in balance. In October 2018 the World realized the market was oversupplied leading to a fall in oil prices, perhaps the market will be back in balance by the end of 2019. The market will mainly focus on OECD stock levels, it would be nice if China and India provided better visibility for their oil stock levels as they are consuming large quantities of oil and have become far more important (most of the World’s consumption growth is coming from these two nations).

You know, big companies configure themselves to have profit centers and cost centers.

Just watch the 10 yr bond. Shouldn’t be too much longer before Exxon can create a new profit center called debt. Like Europe has. If you borrow money, the lender pays you to lend. That’s profit. Revenue comes in and there are no costs.

Really hard to lose money if you get paid to borrow.

WLL is getting crushed today, lost 40% of its value between earnings and crude cratering on the tariff announcement. Investors seeing serious risk of bankruptcy.

Concho Resources also down a WHOPPING 22% today.

Gosh, what a FRICKEN MESS the U.S. Shale Oil Industry. Any folks here who still have a large LUMP SUM of FIAT MONEY invested in this garbage industry… you have my sympathies.

Steve

Just a wild ass guess, but I would say that as far as the shale industry is concerned, the shit is about to hit the fan.

Ron,

Agreed. Gosh, I might as well post Whiting’s Chart. Looks more impressive than Concho’s.

https://srsroccoreport.com/top-bakken-shale-producer-stock-plummets-nearly-40-today/

Also, we must remember that Whiting did a 4-1 reverse split back in Nov 2017. So, a more realistic stock price for Whiting is $2.71… LOL

God hath a sense of humor…

steve

I shorted the naked shorts. Fingers crossed.

Survivalist,

Are you shorting?? LOL. Don’t know what you mean, but anyone who thinks WLL might turn around and head back up much higher needs to understand that the Former Louisiana Attorney General Charles Foti is investigating Oasis and Whiting. Why?

Well, Law Firm Kahn Swick & Foti are focusing their investigation on whether Oasis & Whiting’s management breached their fiduciary responsibilities in regards to warning shareholders of the rapid decline rate and its negative impact on the financials and share price.

I believe we are going to begin to see a BUNCH of class action lawsuits when the FAN hits the SHALE SHYTE. Virtually, no shale company has warned their investors of the rapid decline rate.

steve

Lol, that was my guess a while back. But, I think I worded it “when the fit hits the Shan.”?

Lenders took the treadmill away. Now, there is not even the appearance of moving. Or, is it spelled treadmeal.

GuyM,

No doubt there will be bankruptcies of the weaker players, the better companies and the majors will pick up the better leases on the cheap and a lot of debt will be wiped out.

It is called capitalism, some win and some lose, same as it ever was.

The death of the tight oil industry has been greatly exaggerated, it will slow down, and by 2025 it will peak. Much depends on the price of oil, if supply is short oil prices will rise, and output will increase until market is balanced. Price that I think is reasonable below (AEO Mod), it is based on AEO 2018 reference oil price scenario for Brent up to $100/b in 2017$, eventually demand declines below supply and oil prices fall.

I think you are close, but like Ron, I think you are on the optimistic side. I’m tend to think March 2019, is going to be the high, or close to it. While the Permian is the strongest horse pulling the coach, it will be slowed down by others. And, frankly, the Permian players are not so strong, as a whole.

The give away to me, is that you don’t realize that there are parts of the capex that are not expensed in the current year. Sources of funds were not so restricted in 2018. Some of the debits are in the balance sheet, and not in expenses in the income statement. It’s what has been the impetus for years. It ain’t there no more. In the past, you could have borrowed a lot more to increase income, which is not fully matched on the income statement, thus increasing net income. It’s gone.

As it not the case with some (very limited players), the whole game was a house of cards, and the wind came?

It’s why I have been stressing the limited borrowing power in the shale area, it’s the yin and the yang.

A plateau or broad peak centered at 2025 are at least necessary to maintain the crude oil production that the economy demands.

A plateau may support growth if exports are reduced and the transition to electric continues.

Er, someone tell the investors about that requirement. Don’t think it means shit to a tree, as the song goes.

How did the original shale escalation happen then? BTW, never heard that song

Jefferson Airplane, Grace Slick, probably way before your time.

FCC radio filter on that one

Here are two statements from XOM AND CVX. They are planning on increased production. Will the other company decline rates offset the predicted increases by XOM and CVX

“ExxonMobil said Friday that its oil-equivalent production in the Permian averaged 274,000 boe/d in Q2, a 21% increase from Q1 and a 90% jump from Q2 2018, as it looks to average 1 million in the basin within five years.”

“Likewise, Chevron produced 421,000 b/d of oil equivalents in the West Texas and New Mexico basin, an increase of 155,000 boe/d, or 55%, over the same period in 2018, Jay Johnson, executive vice president of upstream, said during the company’s Q2 earnings conference call.

The company expects to deliver 900,000 boe/d in the Permian by 2023, with what Johnson called a “relatively steady rig count” of 20 company-operated rigs and about seven to 10 net non-operated rigs.

The company said it is also increasing the lateral length of its horizontal Permian wells, and these should approach 10,000 feet next year in development areas — a length that is standard for many independent Permian producers.”

Ovi,

Those figures aren’t for barrels of crude; they’re for barrels of oil equivalent, boe, and that figure includes NG. They’ve been flaring NG in the Permian like there’s no need for it but they use it in the boe figures so they look larger.

Synapsid

Understood BOE but did not realize they could count flared and uncaptured NG.

I had not thought of that. NG before it is flared is counted in production. Flared is just a disposition category.

Whoops. I meant April the high, not March.

USA All Liquids Production chart/data-

does that include the ethanol derived from corn [40% of the acreage devoted to corn]?

Yes, all liquids includes ethanol from corn or sugar cane.

Thanks.

Thats a little over 1 mbpd in 2018

[corn ethanol in USA]

“By 2020, the U.S. will become a net energy exporter due to increased production of crude oil, natural gas and NGL combined with the slowing energy consumption in the domestic market. ”

Assumes more Drill Baby Drill. Author argues that Midstreams should be isolated from the Carnage of the E&P’s. Drilling Diversity? Of Interest is info on NGL’s exports. Seeking Alpha Links go behind a paywall in a few days.

https://seekingalpha.com/article/4278930-one-6-percent-yield-want-dividend-pipeline-enterprise-products-partners

Graph from SA Article above. Assest concentration.

If FED doesn’t come out with guns a blazing to support US equity market here. 400-500 point down days will become normal. They can’t afford not to. The entire yield curve all the way out to the 10 year will be going negative. While their benchmark rate remains at 2.25%. If they don’t step in. But they will step in. They absolutely have no choice. How far do US equities have to fall before mass layoff start happening because every major US corporation has done massive buybacks. Levered buybacks! If FED doesn’t support US equities how much of corporate USA goes bankrupt here? Most of it is the answer. If corporate USA goes bankrupt then so do most if not all pension funds.

They either support the market or the whole lie we’ve been living since 2009 comes unraveled. There was

nothing real about the recovery from 2009.

When it becomes clear that they are going to step in. There is the go long oil trade. Equities might have to fall a bit before it becomes clear. And oil price will likely continue to fall right along with them until FED gives. Our reality depend on and ever increasing amount of debt at an ever decreasing interest rate. Sad but true.

HHH, here is my take. Many of the oil companies’ financials are in the latrine no matter what the price of oil is selling for. They are already beginning to be punished for that, and I don’t see an end in sight. After it leaves the companies’ wells, it becomes a commodity. An initial big drop in the financial markets will make the price of oil go down for awhile. Investors are both in the commodities and in stocks, bonds, and whatnot. When they have to sell commodities to cover margin calls in other areas, the price of oil does go down. Too many sellers, and not enough buyers. That would be true, even if there was an acute shortage in the commodity. Which there is, it’s just not recognized yet. When the pain ends, the commodity becomes even more valuable, and will eventually go up. And if the commodity becomes too scarce, the bidding on the commodity becomes the most important source of price determination, not financial traders. By oil definitions, that would be the “spot price”. The actual commodity, and not paper representations. The highest bidder gets the oil, and all the rest push carts. Countries who can pay more will get it, the others will become “have nots”. Extreme example, but it’s not too far from happening.

In short, in the long run oil prices will rise, my guess is 2021.

Falling US equities is a major problem for Japan and Europe. Makes their currency appreciate. More so the Yen than the Euro. Simple carry trade unwind as Japan and Europe have NIRP and US has positive interest rates. So if FED allows US equities to fall that is dollar negative. If they step in and support market through more interest rate cuts and more eventual QE that is also dollar negative. US equities would have to go up without any help from the FED to be dollar positive.

Massive bearish shooting star on dollar index weekly chart. I trade price action more than i trade trendlines or any other technical stuff. That turn in the dollar is seen in every major currency pairs. it’s even seen in currency pairs that aren’t dollar base like AUD/CAD. WTI had an inside day Friday. Which is bullish for price. It reflects the turn in the dollar. If traders are setting up for a dollar short here it’s probably going to carry the price of oil with it. It just won’t be tick for tick. The bottom for oil might come a week or two later after the turn in the dollar. But if that inside day holds on WTI chart and the top on the dollar index holds. The low on WTI might coincide in the same week.

Might take a 10-20% correction of US equities before the FED comes out blazing though. So oil price might still have a little further to fall.

Glad you guys are still here! smile

An old thought just re-surfaced when seeing again (Tom Whipple) the oft quoted ‘fifth of world oil supply’ (20mbpd) goes through the Gulf of Hormuz. What is the latest on ‘exported’ world oil? A lot more than a fifth of internationally traded crude + cc must exit through that strait? Does anybody keep a ready reckoner?

best

Phil H

http://www.worldstopexports.com/worlds-top-oil-exports-country/

But, the worry is not in the Straight. It’s in Texas and US production, who won’t get near the 2 to 3 million barrels a day being counted for 2019-2020.

GuyM,

On this we agree, US tight oil will probably increase about 1.5 Mb/d from Dec 2018 to Dec 2020 for the 12 month trailing average output, that is about half of the increase expected by IEA and OPEC.

Note that the increase in the trailing 12 month US tight oil output from Dec 2018 to Dec 2019 is likely to be 1000 kb/d, in the first 6 months of 2018 the trailing 12 month average of tight oil output has increased by 638 kb/d.

Tight oil output will continue to slowly increase over the next 5 or 6 years.

Hi Ron

EIA short term outlook publishes monthly data for non-OPEC oil production from 2015 onwards. (Table 3b)

Although that is probably for all liquids but crude oil production can estimated using historical proportions between crude and all liquids. I think for most countries the non-crude part is very small.

Condensate has corrupted all historical measures.

Watcher,

No not really, condensate is not a big factor for most of the World and crude in general at the World level is getting heavier, the US is not the World and the extra light oil in the US can be exported elsewhere if refinery capacity is not developed to utilize the lighter crude streams from tight oil.

Y’all might want to focus on the more important parameter between price and interest rates.

A lender’s decision gets adjusted by what he can get for his money “elsewhere”.

Meaning, if you might lend your money to an entity that pays negative interest rate, vs a shale driller con artist who MIGHT be able to repay you 6% if he can get a price rise — well, that tightness in Wall Street may loosen with every downtick of the 10 yr bond yield.

Fun in Truskavetts, Ukraine. Seems my buddy at the Villa Kristina, where I am staying is Manager of the place. His wife is manager of Mirotel Hotel. That is where the new President of the Ukraine will be, and will be speaking for the next couple of days. They have pictures of him staying at Villa Kristina ten years ago. He advised me that security at breakfast at the Mirotel May be more active, as our breakfast at Mirotel is one floor below. Damned interesting choice for a vacation spot. President is a valid and well established comedian, not like ours, who is just a buffoon, at best.

https://corporate.exxonmobil.com/

From Exxonmobil 2Q result I read they have increased their production in Permian by 90% the huge question is do tjey earn money on thoose barrels with oil price WTI in range 50 -60 usd. From Compared to Q2 2018 the report shows income decrease from 439 Musd to 335 Musd Q2 .2019 or – 23%. Income outside US from mostely offshore field increase from 2 601Musd to 2 926 Musd or 12,5% in the same period. I believe Exxson like other oil majours not earning money in US shale play and they might already look for buyers for their assets like some other are that have assets in EF. Oil Companys have a urge to attract investors that always will look at anual interest of their investment.that is why. Exxson depend on projects that will get fast payback and dividend to owners. From Q2 report it seems their investment in US shale with todays oil price level not benefits the owners as it actual might have reduced dividend.

XOM spent $10.5 billion in CAPEX in US to increase production by 107,000 BOPD during the last four quarters, and increase gas production by 250,000 MCF during the last four quarters. The oil is not all oil, but are liquids.

Q2 US upstream EPS was slightly more than 1/10 of Q2 US CAPEX.

XOM is spending a lot of $$ on US upstream, so far not generating a lot of EPS. Just over 10% of upstream EPS was US, even though US upstream accounted for 52% of upstream CAPEX.

Not sure why XOM would thrive in US shale when others aren’t. Have to think XOM overhead has to be high, or at least comparable, to the independents.

shallow sand,

The major players in the Permian basin all made money in 2018, I imagine a well run oil company can accomplish that and their pockets are very deep. It takes a lot of capex to get started in tight oil (or any business), so the initial few years when output is growing rapidly will not look as good on the financials.

Dennis.

Keep in mind US for XOM includes GOM and conventional production.

Also, although XOM is constantly being thought of as a new entrant into shale, it isn’t. It has owned XTO for many years. It has been a major player in the Bakken for a decade.

As discussed since 2014, shale requires never ending large amounts of CAPEX, just to keep production flat, let alone grow it.

As to making money in 2018, that is debatable. As discussed many times, GAAP EPS is not always a good metric. Major asset write downs occurred in 2015-2016, which lowered DD&A. The companies exaggerate EUR, which causes unit cost depletion to be much lower upfront than it should be.

I guess some of us here feel vindicated to see that finally the mainstream is acknowledging what we have been arguing for about 5 years. Shale doesn’t work economically without high oil prices.

XOM is a great example of how uncompetitive financially US shale is with other oil production around the world. XOM spent less than half it’s CAPEX on international, yet that is where almost 90% of its upstream earnings were derived.

I am not making any arguments as to US future production growth, because economically it shouldn’t have been anywhere near what it has been since 2014. Just making the point that XOM results continue to prove that shale needs higher prices.

shallow sand,

I was looking at more tight oil focused companies in the Permian such as EOG, Concho, Pioneer, Anadarko, and Occidental.

I agree growth in tight oil has been higher than is sensible, most of these companies were cash flow positive in 2018. I certainly would agree that they will not do well at lower oil prices, but I doubt oil prices will stay low.

Those that believe the World economy is about to crash have been claiming this for quite a while, eventually they will be correct, my guess is in 2030 or so. In the mean time oil prices will rise.

Guym, as one ol bean counter to another, can you explain a little of what you said above.

“you don’t realize that there are parts of the capex that are not expensed in the current year.”

Capex used to be capitalized expenditures which went to the balance sheet then were amortized based on estimated future production. I believe estimates of future production are widely overstated leading to inadequate DD&A charges in the income statement, and think you probably agree. Is there something else you are thinking of when you say expenses are understated?

Expenses are not understated. Did not mean to say that. But, most of the capex is thrown into the balance sheet. So, if you borrow lots to drill, the income statement looks good now, but if you can’t borrow anymore, it’s time to pay the piper.

IRS and AICPA need to look at their rules for shale oil. To get a better matching. Like allowing a 60% depletion per year on the remaining balance in CAPEX.

As it is, if you stop drilling, and eliminate all admin costs, you’d still operate at a loss due to amortization being higher than income.

Or, get rid of a third of your employees, like some companies are going to. Kinda doubtful they can maintain, much less increase production doing that.

Guym thanks for the clarification. I believe we are in agreement that unit of production amortization based on the assumed long life of shale wells distorts economic earnings. Often units to be produced are overstated, as in the 30 year life of the well as presented by some companies. Further, a lack of any recognition or adjustment to reflect that after the first years of production, any units produced will be burdened by much higher per unit opex leaving little if any margins.

The result of this accounting bias has been that financials look better while drilling and production is increasing. Many of the companies that have gone Bk looked relatively good up to the time at which it became necessary for them to reduce capex. Once capex and production begin to decline it becomes evident that they have too much debt, then the spiral hits, and the only chance for them to avoid BK is much higher prices.

I wish I had understood this better 4 years ago, but now its evident to many. WLL’s recent results are one of the latest examples. Whiting was over 50 last October, about 10 now, and absent rapid oil price increases, they may be BK in another year. I believe the market is responding much quicker to this distress than it did earlier in the cycle.

Oh, heck, DC, they are gone. No more. More than pissed off. They won’t come back.

dc and guy.

I mentioned NOL’s these companies have awhile back.

Any thoughts on those?

They sure don’t seem to pay income taxes. GAAP yes, but all deferred.

Not sure, but right now, I see it as another debit they will lose.

Hi Shallow. Generally their tax NOL’s aren’t recognized in the financials as an asset. Accounting rules used to allow recognition in certain circumstance where recognition of the NOL was almost assured. This was rare. Even though they can’t usually recognize an asset on their financials, they can and do talk up the NOL like their ultimate recoveries after producing their shale wells 30 years.

I may have mentioned this before, but one of the things that surprises me is that the shale cos haven’t figured out a way to peel off the IDC and sell it to investors. Maybe that will be in the next tax simplification bill.

In previous comments I have argued that if declining oil supplies trigger a military response, I don’t expect it to be with bombs or invasions. Cyber warfare is cheaper. And so is biological warfare.

“Biological weapons are very attractive to the terrorist because of several characteristics. Aerosols of biological agents are invisible, silent, odorless, tasteless, and are relatively easily dispersed. They are 600 – 2000 times cheaper than other weapons of mass destruction. It is estimated that the cost would be about 0.05% the cost of a conventional weapon to produce similar numbers of mass casualties per square kilometer. The production is relatively easy, using the common technology available for the production of some antibiotics, vaccines, foods, and beverages. The delivery systems such as spray devices from an airplane, boat or car are commonly available. The natural lead time provided by the organism’s incubation period (3 to 7 days for most potential organisms) would allow for the terrorists’ escape before any investigation starts. In addition, the use of an endemic infectious agent may cause confusion because of the inability to differentiate a biological warfare attack from a natural epidemic. For some agents potential exists for secondary or tertiary transmission by person-to-person transmission or natural vectors.”

https://www.siumed.edu/im/overview-potential-agents-biological-terrorism.html

Ok, Dennis, I was wrong on the comparison to EF production vs Delaware. This is EOG’s dog and pony show for the second quarter. Interesting metrics in the Appendix:

http://investors.eogresources.com/Cache/1001255228.PDF?O=PDF&T=&Y=&D=&FID=1001255228&iid=4075407

GuyM. Thanks for posting.

Thanks GuyM,

Not sure if those EUR estimates are realistic, they are far higher than the industry average. According to shaleprofile EOG wells are about 24% more productive than the industry average in the Permian for 2017 and 2018 wells, that suggests an EUR of about 480 kb for the average EOG Permian basin well, while EOG claims about a 700 kb EUR for a typical Permian basin well or about 46% too high.

My Permian basin model assumes the average 2018 Permian basin well has an EUR of 400 kb vs the EOG “typical” Permian well at 700 kb.

I never take the EUR that is claimed in investor presentations at face value, shaleprofile.com is the best place to find this data.

Well, EOG, so far, is the only one trying to do any extensive Enhanced production. They report good results on it. Too soon to tell, for sure what a realistic EUR may be on some of the last three years of wells. They did not say anything to us about any enhanced recovery on the Raindrop new series. But, they may be experimenting. Prior to drilling the additional Raindrops, the original was down to around 1500 barrels a month. The next two months after drilling, the totals were less than 500. Which makes sense for one month, because they shut in the well for completions and tie in. Not two months. The last month is now at over 3900 barrels, which is contrary to any type of parent/child norm. Their procedure, it has been said, is to pump gas into the well, shut it off for a month, or so, and then open it up again. Results are slow. I’ll keep an eye on it.

At it’s then current production, Raindrop would easily exceed 300k EUR. At a 33% increase, it would be over 400k EUR.

But, all of this is in the EF, and not what you are talking about. Your talking of the Permian horizontals which were not sprung until 2014. EOG entered later, so how can we be close to determining EUR, yet. Probably, the first wells of EOG of any volume, were only about three years ago. Learning curves, and all that, means EOG is a real newbie. But, 700 seems a bit high. Everyone over hyped the EF in the first five years, too. Some still do. Thirty impossible years of production, and yadda, yadda, yadda.

And, there is no way that EOG could use the same EOR methods in the Permian. They’d wind up blowing the remaining oil into the next county.

And, I did notice one other very questionable thing in the dog and pony. EOG is dropping their well spacing in the Permian. Looks close to 400 ft. They will be sorry.

GuyM,

The EOR results will be interesting, I imagine they might be able to use what they have learned in the EF in the gassier areas of the Delaware perhaps, though the geology may be very different and the same rules may not apply.

One can take 24 months of data and fit to a hyperbolic using solver in excel with a least squares type of minimization to get a rough idea of EUR. I just took the hyperbolic fit I have for all companies and compared with first 12 months of output for EOG wells vs all companies. EOG was about 25% higher, I assumed that the entire well profile was 25% higher for EOG so if it was a 377 EUR for all Permian producers, EOG was assumed to be 377*1.25=471 kb.

I did not look at Eagle Ford in this case.

The reason the EOR in the EF works, is because the EF is trapped between the Austin Chalk and the Buda. Both fairly hard ceilings and floors. And, the EF is pretty tight, too. You don’t have that in the Delaware. The oil moves as it is accessed, and pressurized. They may spend most of their time and money, chasing it. But, I should shut up, I don’t know the first thing about geology.

I was vouchsafed a vision today.

In our little country town, they had a “parade.” This is when a bunch of internal combustion engines line up on the road to make a lot of pointless noise.

Meanwhile, traffic on the very busy road that runs through town had to be diverted down our “back” road in order to make the stupid parade possible.

So, I have spent all morning listening to loud diesel stacks, muffler-less motorbikes with radios blaring, stupid, stupid American noise, defiling our country road. They are impatient that they can’t drive fast and constantly honk their horns at each other.

And all for nothing.

We’re fucked.

M. the lurker.

How many EV have driven down your road today?

Zero, AFAIK. They all made noise. Large trucks with loud mufflers. Poor, rural area.

Dennis, Guy

Can this statement be verified through some other source? It is taken from the Q2 report of Baytex Energy.

“Production in the Eagle Ford averaged 39,822 boe/d (76% liquids) during Q2/2019, as compared to 41,097 boe/d in Q1/2019. The lower volumes during the quarter reflect the timing of completion activity. We commenced production from 29 (5.0 net) wells during the second quarter, as compared to 36 (8.9 net) wells during the first quarter. The wells brought on-stream generated an average 30-day initial production rate of approximately 2,045 boe/d per well.

That 2045 number is three times the average that Enno is showing for EF.

Quick look revealed not much in either district one or two. It’s a very small quantity, and I don’t have the producer’s rrc number. Note the increase indicates only one completion. Could have missed it, or it could be a pending lease.

But, no. The more I read it, the more confused I am. Doesn’t make sense. Are they drilling under some other name? In other words, are they the primary operator? That’s a lot of wells to miss. And, a decrease in production is not entirely logical at over a 2000 barrel a day 30 day initial average. They decreased well from 36 to 29, and there is a decrease in production?

Baytex is a non op in the eagle ford for the most part.

Thanks. So, nothing is verifiable via RRC. It could be anything. For a little clarity, they are not usually the operator, but they have an operating agreement with royalty owners. Usually, that means they have agreed to participate with the majority leasehold owner, who is the operator. If that was not clear in their dog and pony, it’s probably all BS.

I wonder is this statement is a clue that they are not the operator without actually saying i.e. “production from 29 (5.0 net) wells”. 29 wells and their portion is the equivalent of 5.

Thanks Guy

US manufacturing lowest in a decade and heading lower:

https://tradingeconomics.com/united-states/manufacturing-pmi

https://www.businesscycle.com/ecri-news-events/news-details/economic-cycle-research-ecri-lakshman-achuthan-business-cycle-pmis-have-not-bottomed-yet

The global economy is getting weaker, not stronger. This happens in the midst of a de-globalization that predates the trade-wars but can only accelerate with them: