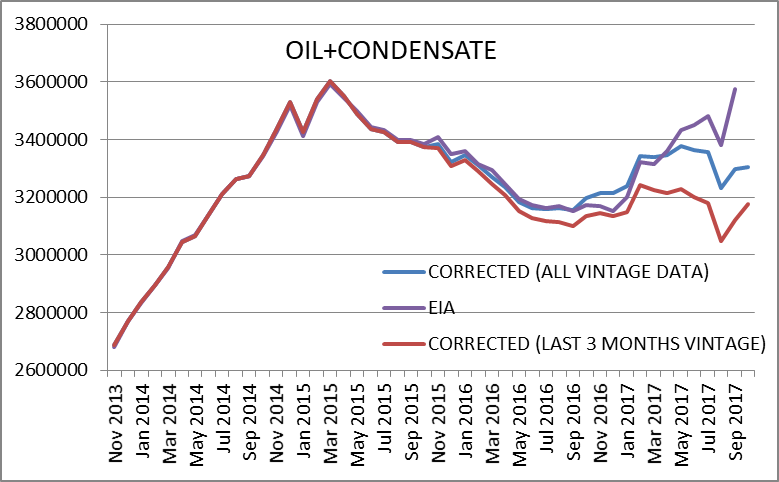

Dean Fantazzini’s estimate for the recently updated RRC data in two charts. For all vintage oil plus condensate estimate (using all RRC data from April 2014 to Oct 2017), Sept17 is 3296 kb/d and Oct17 is 3305 kb/d.

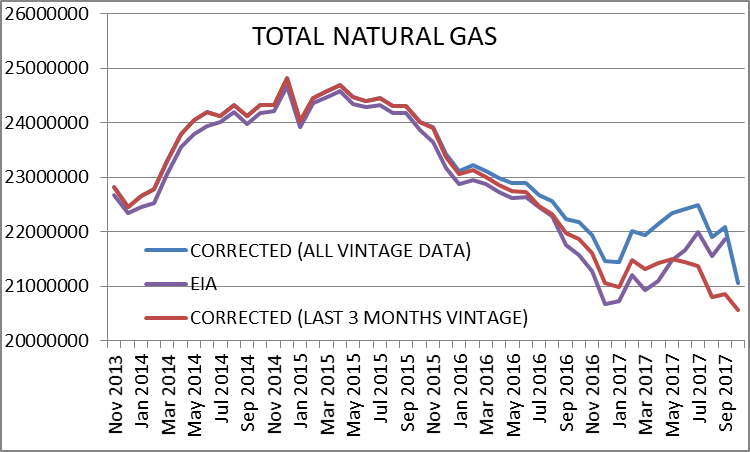

For natural gas (all vintage data), Sept 2017 was 22,080,000 and Oct 2017 was 21,066,000.

So, is there a big wall of US shale oil coming from Texas that will dash my “happy times” of $55-65 WTI?

So thankful to get up to this level after 36 months of headaches about the oil price. Seems the only thing that could screw it up is US shale, which apparently is set to explode in 2018.

I saw someone touting Halcon stock today on SA. Making a big deal about having little debt. Too bad they flushed about $3 billion of debt when they went BK. I’m sure Mr Wilson (CEO) is, “still getting his” so to speak.

My brother is griping about why he hasn’t been able to draw a salary for the last three years, heck all the shalie management has! Have to remind him we aren’t in the shale fantasy land. He knows, he’s just blowing like I’m prone to do.

If I don’t post anymore this year, happy New Year everyone!! Things are looking up, just hope the shale industry doesn’t torch it again!

Hi shallow sand,

I doubt LTO output will increase by more than 600 kb/d in 2018. Demand will probably go up by about 900 kb/d, so if OPEC and Russia keep output level and other nations (Canada and Brazil) don’t increase output by more than 300 kb/d (and my guesses are roughly right), then prices may remain in your sweet spot.

Happy new year to you, and here’s to oil prices at $60/b or higher!

WTI futures price for the Feb 2018 contract at $59.69/b.

Shallow sand,

IN my view you will be sleeping well in the next year. Shale increases mostly the supply of condensate and light distillates, which does little to cover the worldwide shortage of middle distillates. So, the price of ‘real’ oil will very likely increase over the next future whereas the prices of light distillates (propane, butane, pentane , LPG, NGPL composite….. ) are very likely depressed. Light distillates can substitute middle distillates to some degree, yet the potential is limited. So, in that sense I wish you a happy and successful New Year.

Hi Heinrich,

Can you tell my what evidence there is for a shortage of middle distillates? I haven’t come across this before.

INEOS Forties Pipeline System Media Update – 28/12/2017

All restrictions on the flow of oil and gas from platforms feeding into the pipeline system have been fully lifted. All customers and control rooms have now been informed.

https://www.ineos.com/businesses/ineos-fps/news/ineos-forties-pipeline-system-media-update/

https://uk.reuters.com/article/forties-oil/update-1-ineos-sees-forties-oil-flows-back-to-normal-around-new-year-idUKL8N1OS0VU

https://mobile.nytimes.com/2017/12/27/world/americas/venezuela-oil-pdvsa.html?action=click&module=Top%20Stories&pgtype=Homepage

Oil production in Venezuela appears to be in free fall.

Shale gas revolution did not last long for BHP – the Fayetteville story

http://crudeoilpeak.info/shale-gas-revolution-did-not-last-long-for-bhp-the-fayetteville-story

There is no question, Shale is a disaster for investors. Nevertheless, it is a blessing for Wall Street as high oil and gas production ensures dollar stability and a growing bond bubble. The only question is when will investors will wake up. As it is perfectly OK for small companies to sacrifice themselves and burn the cash of investors through, big companies are less willing to do so. Who is next? XOM, Statoil , APA…?

PUNTO FIJO, Venezuela (Reuters) – A furnace exploded during a unit restart at Venezuela’s largest refining complex, injuring two workers, a union leader and a family member of one of the victims said on Wednesday.

The complex is the largest refining center in the country and one of the largest in the world with a capacity of 955,000 barrels per day (bpd). However, operations have been negatively impacted by constant failures and a lack of crude to process.

https://www.reuters.com/article/us-venezuela-refinery/explosion-at-major-venezuela-refinery-injures-two-sources-idUSKBN1EM04R

29/12/2917

Impact of oil production decline and low oil prices: Venezuela (part 1)

http://crudeoilpeak.info/impact-of-oil-production-decline-and-low-oil-prices-venezuela

The ratio of commodities / S&P500 is at a record low, S&P_GSCI / S&P_500

The S&P GSCI currently comprises 24 commodities from all commodity sectors – energy products, industrial metals, agricultural products, livestock products and precious metals.

Bloomberg chart on Twitter: https://pbs.twimg.com/media/DSCfWj6W4AA7xyW.jpg

https://www.bloomberg.com/news/articles/2017-12-27/all-that-new-shale-oil-may-not-be-enough-as-big-discoveries-drop

Discoveries of new reserves this year were the fewest on record and replaced just 11 percent of what was produced, according to a Dec. 21 report by consultant Rystad Energy. While shale wells are creating a glut now, without more investment in bigger, conventional supply, the world may see output deficits as soon as 2019, according to Canadian producer Suncor Energy Inc.

Are we not now near enough to 2019 to say that there just isn’t time to bring major new conventional projects on-line before mid to late 2019? The only offshore projects that could be approved and developed earlier than that would be single well tie backs using the wildcat/appraisal well as a producer, probably no more than 5 to 10 kbpd and in immediate (and likely rapid) decline, and would be dependent on there being spare processing capacity on a nearby hub (i.e. production the new production would be mitigating decline not adding output).

Hi George,

Perhaps they are saying that other shorter term projects are unlikely to meet demand after Dec 2018. In any case, the article seems to agree with your analysis to some degree, though perhaps it is less pessimistic.

But the issue isn’t lack of discoveries this year, as the headline implies, it’s the lack of recent FIDs which might be in part because of the drop off in discoveries in 2012 to 2015 (for all oil, but particularly easily developed oil), coupled with high debt loads, and prices that aren’t high enough (or at least not yet for long enough) to allow development of what resources there are available to the IOCs. As prices rise and IOCs become more confident and are able to pay dividends as well as fund longer term developments then the really low discoveries in 2015 to 2017 might give them far fewer options than people expect (noteworthy is that any discoveries in that period that have been attractive, like Liza, have been immediately fast-tracked, so there really isn’t much of a backlog of attractive projects at all).

Hi George,

Headlines are almost always not quite right.

I was basing my comment on what the article said. Many of the companies are aware that discoveries have been low and not many projects will be coming online soon.

Mexico may be heading for a period of accelerated decline (above 10%). Their two onshore regions and the southern marine region are falling at 15 to 20%, and the largest producing region (Northern Marine, which includes KMZ and Cantarell) looks like it may be starting to accelerate. The non KMZ nd Cantarell fields had been the only ones increasing, but look to now be in decline or at least on plateau, and by PEMEX forecast KMZ should be off plateau in the next couple of months or so. Mexico has now stopped exporting light oil (which mostly comes from the three smaller regions, with KMZ and Cantarell producing heavy and medium heavy) and will presumably be looking for increasing imports of it, which is probably good for the Texas LTO producers. Operating rigs have recently been declining fast.

(Apologies if this has already been posted)

ps – for numbers: last month C&C was down 35 kbpd, and overall 210 kbpd y-o-y (almost exactly 10%).

Hi George

Do you have any information on how the ramp up of production is going for the Western isles project following first oil on 15th November.

On a side it looks like the Weald basin myth is starting to unravel.

Not yet -first numbers for December start-up should be in March, it’s a question of limiting their losses at current prices I think. All the wells were predrilled so ramp up should be fast but I wouldn’t be surprised if they get pretty low reliability in the first 6 to 12 months given all the construction problems they had. Also interesting that Catcher started up on time, against most expectations. Wonder if Clair Ridge will make it this year – do you know if there are big tax benefits from depreciation for starting within a given calendar year in the UK (or might be financial yar end is more important)?

This shows how fast the SW marine region fields are now falling (a lot of small fields were added 2007 to 2015 and are now in steep decline).

There seems no reason this and the two land regions shouldn’t continue to fall at current rates (they may even accelerate given how the rig count has dropped), and if KMZ follows the predicted PEMEX curve Mexico could drop around 350 kbpd this year, possibly the same in 2019 in decline (but with 60 kbpd additions due from Abkatun), but maybe approaching as low as 1000 kbpd by mid 2020, which is probably the earliest ENI will be able to get their shallow water field on line if they fast track it.

thanks, George

Dallas Fed Energy Survey – December 28, 2017 – At what West Texas Intermediate (WTI) crude oil price would you expect the U.S. oil rig count to substantially increase?

Above $60, chart on Twitter: https://pbs.twimg.com/media/DSJdl-zX0AAUwD4.jpg

https://www.dallasfed.org/research/surveys/des/2017/1704.aspx#tab-questions

$16B Mackenzie pipeline project cancelled

CALGARY — Imperial Oil says its much-delayed $16.1-billion project to build a natural gas pipeline across the Northwest Territories from the coast of the Beaufort Sea to northern Alberta has finally been cancelled.

IRAQ FORMS PANEL TO OPERATE MAJNOON FIELD

Originally the plan was to increase Majnoon to over 1 mmbpd. That has now been downgraded to 400 kbpd (from current 220). Shell and Petronas have pulled out and a “government panel” will oversee the development. I’d bet on continued decline rather than any increase, and potential for significant reservoir damage along the way.

Similarly for Nasirya oil field – intend is to increase from 90 kbpd to 200, using a local oil company that also sounds like it has a lot of government input.

To me none of this ever declining brownfield development with IOCs pulling out, and promises of more exploration “coming” is compatible with the claims for their discovered resources (developed or not), or any chance of a quick ramp up if oil prices start to inflate rapidly after 2018.

http://www.ogj.com/articles/2017/12/iraq-forms-panel-to-operate-majnoon-field.html

Ventura natural gas spot prices just hit 100 USD per mcf yesterday (in words hundred). See http://www.naturalgasintel.com. This is what can happen in the gas market when things are really tight. Next week will be very interesting as it will show if there will be some freeze offs in the Appalachian, which I think will be very likely. This can drive down production quite substantially and propel prices much higher.

So far, the experiences about freeze off Shale wells are limited. Will glycol also work for Shale wells when there is much water involved? I think nobody knows yet how big the impact of the cold will be on Shale wells. However, it looks like shorts are getting hyper-nervous.

Oil and Gas Producers Find Frac Hits in Shale Wells a Major Challenge

In North America’s most active shale fields, the drilling and hydraulic fracturing of new wells is directly placing older adjacent wells at risk of suffering a premature decline in oil and gas production.

The underlying issue has been coined as a “frac hit.” And though they have long been a known side effect of hydraulic fracturing, frac hits have never mattered or occurred as much as they have recently, according to several shale experts who say the main culprit is infill drilling.

“It is a very common occurrence—almost to the point where it is a routinely expected part of the operations,” said Bob Barree, an industry consultant and president of Colorado-based petroleum engineering firm Barree & Associates.

He added that frac hits are also an expensive problem that involve costly downtime to prepare for, remediation efforts after the fact, and lost productivity in the older wells on a pad site.

A frac hit is typically described as an interwell communication event where an offset well, often termed a parent well in this setting, is affected by the pumping of a hydraulic fracturing treatment in a new well, called the child well. As the name suggests, frac hits can be a violent affair as they are known to be strong enough to damage production tubing, casing, and even wellheads

https://www.spe.org/en/jpt/jpt-article-detail/?art=2819

FWIW The first SPE paper referenced discusses mediating the negative nature of frac hits. It discusses the refrakking of a six well pad drilled in 2010 in the middle Bakken and three forks, North Fork Field, McKenzie. The six wells have a cumulative oil production to date of 3.6mmboe and 7.7bcf.

Since I am not in the field, much of the paper went over my head, I merely skimmed through it, however it appears that well communication was observed for horizontal and vertical spacing of 1000 feet.

EIA 914 Survey, October crude oil production 9,637 kb/day, +167 kb/day m/m. September revised down -11 kb/d to 9,470 kb/day

Texas October 3,767 kb/day, September 3,561 kb/day revised down -13 kb/d

Gulf of Mexico October (Hurricane Nate) 1,449 kb/day, September 1,649 kb/day, revised -1 kb/d

https://www.eia.gov/petroleum/production/#oil-tab

EIA estimated Texas production at 3767000 bpd vs Dr Dean’s above estimate of 3305000 bpd a difference of 462000 bpd. Wow that is a big difference.

Yes, it is unreal: either at the Texas RRC they had really HUGE problems in the past months collecting data, or the EIA used only model estimates without any form of revision.

The correcting factors of the Texas RRC have not changed much and they showed they usual variability, so that I cannot explain why there is such a big divergence between corrected RRC data and EIA. They only problem that I can think of (on the part of the RRC) is that the hurricane completely disrupted their work: does anyone know whether the offices and data servers of the Texas RRC were damaged during the hurricane? Thanks for the information.

I had a very interesting discussion on Twitter: operators in Texas confirmed me that the RRC offices were not affected by the hurricane and data reporting proceeded normally. At this point the only (legal) reason left to explain the divergence is that the EIA has started including NGL into their numbers:

https://twitter.com/ZmansEnrgyBrain/status/946796541406208000

This is raw data from the initial production report combined with the pending data file. I did this last month, and October showed an increase in the pending data for August of 49k and for Sept of 116k. Months before that did not show an increase in the pending data file from Sept. data. Note the increase in the pending data file since about May 2017. As that shows up later as “late posting” to the initial, you may see how it could affect just estimating on the initial data file. Previous months to May for about a year showed a smaller amount in pending data, and a small adjustment for “late posting”. The data is easily obtained from RRC by request and payment of $10. I am not making any estimates, and am only posting this for you to see if it could have potential benefit in your estimating production. I see it, and I am quite tired of arguing it with Dennis. First column is month and year, second is the pending data amount, third is the initial production, fourth is the combined total, fifth is the EIA estimate, and the last column is the difference. The vast difference in the last two months is explained by the potency of what was smoked by EIA staff. However, if you input the total combined alongside your chart, without estimating late posting, it is higher than your last two months on the chart.

pend initial total 914 diff

2017-10 604 2722 3326 3767 441

2017-9 565 2553 3118 3574 456

2017-8 537 2683 3220 3381 161

2017-7 527 2708 3235 3482 247

2017-6 463 2801 3264 3451 187

2017-5 437 2729 3166 3434 268

2017-4 295 2921 3216 3360 144

2017-3 291 2796 3087 3316 229

2017-2 286 2816 3102 3321 219

2017-1 224 2751 2975 3202 227

2016-12 263 2686 2949 3153 204

2016-11 253 2719 2972 317 1 199

2016-10 228 2683 2911 3172 261

2016-09 247 2679 2926 3152 226

2016-08 268 2735 3003 3170 167

2016-07 307 2753 3060 3161 101

2016-06 141 2735 2876 3174 298

2016-5 147 2674 2821 3193 372

2016-4 158 2804 2962 3245 283

2016-3 167 2835 3002 3295 293

2016-2 198 2746 2944 3315 371

2016-1 252 2772 3024 3361 337

2015-12 290 2736 3026 3348 322

2015-11 293 2691 2984 3409 425

2015-10 429 2744 3173 3384 211

2015-09 383 2778 3161 3398 237

Of course, that is a comparison to EIA, and not to finalized RRC totals. Like the EIA estimate for 2015-11 was 151k over actual, but most are pretty close to actual up to Feb 2017. After that, RRC data would not be “complete”.

Hi Guym,

What do you mean by ” like the EIA estimate for 2015-11 was 151k over actual”?

The RRC has Nov 2015 C+C output as 3366 kb/d, while EIA estimates 3409 kb/d and drilling info estimates 3376 kb/d. I get 43 kb/d for RRC data and 33 kb/d for the drilling info estimate (about 1% too high).

It is not clear what you mean by “actual”.

See Texas (TX) tab of file lnked below.

https://www.eia.gov/petroleum/production/xls/comp-stat-oil.xlsx

I divided by 31, instead of 30. I said most are pretty close, so what’s the big deal? Sue me,

Hi Guym,

I just couldn’t understand where the 151 kb/d came from, now it is clear, thanks.

Guym. So what the heck is going on here?

I have not been following as closely as in the past.

Seems the EIA is following through with the “wall of Permian oil” mantra, while no one else is seeing it in the data?

Thank you for your post. 400K+ BO is a big deal.

It would be tough to estimate just on the initial plus pending in the current month. However, after a month or two passes, and the pending file is updated, it is more apparent. Up to August, EIA seems consistent. Then, who knows?

Oct shows an uptick that I don’t think is reflective of trying to increase production towards the end of the year. I think that completions were thwarted during the two weeks from the end of Aug to first part of Sept. increased activity to make up the delayed completion towards the end of Sept to the first part of Oct probably caused Oct increase. Not likely to be seen in Nov and Dec. Just my guess. I am still guessing that Dec production will be slightly south of 3.5 million barrels a day. For the US to average 10 million barrels a day for 2018 is a disconnection from reality, IMO.

Shallow; Hurricane Harvey disrupted some, but not very much, EF production. Most of the production drops were related to refinery closers along the GC that curtailed ALL producers in Texas. That storm had no affect whatsoever in Austin other than some rain and did not affect TRRC reporting. There were other electronic issues with TRRC reporting that are now back on the mend.

The EIA, like all government entities, is a mess; some years back it got confused and with a snap of the finger stopped reporting on-lease production storage. Now now all of a sudden it is reporting gas liquids and anything else it can to make production appear higher than it is. Is there an intentional motivation in that? You decide. Harold already has. EIA 914 surveys are ESTIMATES too; people don’t seem to get that. Otherwise this TRRC debate has reached absurd proportions; the EF is on its way down the toilet, check Enno’s latest post. The Permian is still growing but that rate of growth is going to slow; things out there are getting way gassier and way lighter. There is no place to put the stuff anymore.

I liked your comment about Floyd Wilson; he is a trip. Reminds me of Billy Bits at Shale R Us: https://www.linkedin.com/feed/update/urn:li:activity:6351385280427196416/

I think “our” happy price for 2018 is going to hold. Happy New Year, buddy !

Mike

Thanks Guym. I have had a really interesting discussion on Twitter which is increasing by the hour:

https://twitter.com/DeanFantazzini/status/946798688642519041

The main suspect for the increasing divergence is now the inclusion of NGLs into the EIA computation

Which is a gas. Isn’t that eventually included in RRC gas production?

“The main suspect for the increasing divergence is now the inclusion of NGLs into the EIA computation”

Duh.

Definitions are more or less always changed to meet agenda.

Same trick was pulled by Russia now report total liquids.

The EIA estimates for Aug to Oct are probably too high by 50 to 100 kb/d.

Mike is correct that the EIA makes estimates, as does drilling info based on RRC data.

The average correction factor for the most recent two months of drilling info data (Aug and Sept) is 42 and 287 kb/d respectively based on past data sets from Aug 2015, Mar 2016, May 2016, Aug 2016, May 2017, Jul 2017, Aug 2017, Sept 2017, and Oct 2017 compared to the Dec 2017 data set from drilling info. In the chart below the Dec 2017 drilling info data set is “corrected” in this way (adding 42 kb/d to August and 287 kb/d to Sept.)

An alternative is to compare the 914 survey data to the drilling info estimate from May 2015 to July 2017, the average difference was 320 kb/d over that period. So I show the 914 survey plus 320 kb/d also in the chart below.

Through July 2017 we have pretty good estimates for Texas C+C, after that it is difficult to say which estimate is correct. Note that the 914 survey has differed from the drilling info estimate by as little as 275 kb/d and as much as 365 kb/d from May 2015 to July 2017, so the 914 survey plus 320 kb/d might be off by +/-50 kb/d, especially for Aug to Oct 2017 period.

The latest STEO forecast from just 2 weeks ago…

EIA, Short-Term Energy Outlook (December 12, 2017 ), Domestic Production, October 9.3 million b/day

For comparison EIA estimates US output was 9637 kb/d in Oct 2017, though perhaps the Texas estimate is high by about 80 kb/d, so 9560 kb/d might be a better estimate, unless the estimates for other states are too low.

Looks like the STEO expected a 180 kb/d decrease in October and instead there was roughly a 160 kb/d increase. Perhaps the correct final data will be between 9300 and 9640 kb/d. The most recent month’s estimate is often revised by 1% or more.

300 kbpd was taken out for GoM in October because of Nate, there is still 100 kbpd out because of the Enchilada pipeline failure in November and some problems with the Delta House platform, plus there’s about 15 kbpd per month natural decline, with currently nothing really ramping up. I don’t know when all that gets taken into the EIA numbers, but it doesn’t seem to be all included at the moment.

US crude oil exports at 1,731 kb/day in October, a new record high

https://www.eia.gov/dnav/pet/pet_move_expc_a_EPC0_EEX_mbblpd_m.htm

I don´t know what to say, but it somehow does not make sense. Something is very fishy here. Makes me very confident about my bullish oil price predictions for 2018.

Politics is a major part of oil markets, and keeping Russia at bay is a goal for the administration I guess. And so is the target of 3% gdp growth for the president. But the profound backwardation in the futures market for Brent at the moment tells me that reality is storage withdrawal until shortage for oil. Especially distillates is under scrutiny because of lack of Venezuela heavy oil and too much light oil from Texas. Conventional oil worldwide is suffering from underinvestment and OPEC policy is as expected to serve their own interests. The main problem is easy oil mid API range (too much exploitation).

Liquefied Petroleum Gases (ethane+propane+butane), October production: 3,499 kb/day +281 m/m

https://www.eia.gov/dnav/pet/pet_pnp_gp_dc_nus_mbblpd_m.htm

Energy News,

Your posts meets exactly my point, as Shale increases the supply of light distillates, yet does little to cover the growing worldwide shortage of middle distillates. As the US exports mostly cheap light distillates and imports expensive real crude oil, the recent trade numbers confirm a swift deteriorating goods trade deficit and consequently a sharply falling US dollar as we have seen over the last few days. All what Shale is currently doing is to depress the price of light distillates, yet it leaves the growing supply shortage of real oil unaffected.

Hi Heinrich,

The increased LPG is due to increased natural gas production, especially “wetter” natural gas. The has less to do with LTO output and more to do with shale gas output.

It also has very little to do with condensate which is liquids that condense at the lease (it is called “lease condensate”) at ambient temperature and pressure.

LPG is at either higher pressure or lower temperature than ambient conditions.

https://www.zerohedge.com/news/2017-12-29/crypto-qatar-these-are-best-worst-assets-2017

NG – Ugly.. A Trainwreck for 2017.

What Coke Nose Jim Crammer use to say? time to BACK UP THE TRUCK?

As it is too early to assess the impact of the current cold on gas production, the recent 40% Canadian rig count slump may serve as a harbinger for the US for next weeks . It is not only freeze offs, but but also transport, infrastructure and pipeline constraints.

Hi Heinrich,

Canadian rig count always drops over the Christmas to New Year’s holiday, this is not unexpected.

Haven´t seen it posted here yet. Euan Mearns, who sometimes post here, has a new blog post on “oil price scenario for 2018”: http://euanmearns.com/oil-price-scenario-for-2018/. I like figure 4, think that Ian Schindler has showed something similar for longer time periods (70/80´s).

Euan lacks at least two factors but they are more or less impossible to forecast, particularly: i) economic growth (demand), ii) how much of the OPEC cuts are voluntary. Also, his calculation of natural decline is wrong, he assumes all legacy production is in decline.

Hi Jeff,

Thanks. I think Euan has the price about right ($80/b at the end of 2018 for Brent), but I disagree with him on World oil output in 2018. I think World C+C output will increase at about 600 kb/d per year over the next few years, until about 2020 and then will gradually slow down as LTO output and oil sands output will not increase rapidly enough to offset declining output elsewhere in the World by 2025, potentially there could be a short plateau until 2028, or a longer plateau from 2022 to 2029, the higher World output goes, the more likely that any plateau will be very short. I agree with your assessment that Euan has overestimated the World decline rate at about 8%, which for C+C would be about 6.5 Mb/d, not all of World C+C oil fields are in decline, some are on plateau and a few are increasing output (at the field level), though if one considers individual oil wells, probably 99% of oil wells currently producing (weighted by daily output) are likely to be in decline.

Euan may be looking at things from that perspective, which would mean (assuming my 98% guess is correct and that those wells decline at an average annual rate of 8%) we would need 6.4 Mb/d of newly completed wells just to offset the declining wells in order to remain on a plateau.

Euan believes the World will just be able to manage this, I think higher oil prices will enable 7.1 Mb/d of oil completions Worldwide over the next year with a net increase in World C+C output.

We will not really even know World C+C output for 2017, until March 2018 (I use EIA estimates), and 2018 output will be unknown until March 2019.

The most recent 12 months of World C+C output (average monthly output from Oct 2016 to Sept 2017) was 80,999 kb/d based on EIA data.

The latest numbers out of China say oil consumption growth this year, 2017, will be double last year’s. This year is pegged at 6.5% with a month to go. India numbers as of Oct say their 2017 growth rate will be about 8%, as it was last year.

China’s crude oil stockpiles, the latest numbers: There is a big difference between China’s official numbers and analysts calculated numbers (China says +90 kb/day vs IEA up to +1000 kb/day)…

BEIJING, Dec 29 (Reuters) – China had stored 37.73 million tonnes, or 275 million barrels, in nine bases by mid-2017, up from 33.25 million tonnes at the end of June the previous year, according to the data from the National Energy Administration (NEA).

Adding 4.48 million tonnes of crude oil over the 12 months to June 2017 is equivalent to adding 89,600 barrels of oil per day (bpd).

Reuters (December 29, 2017) https://www.reuters.com/article/china-crude-reserves/update-2-china-accelerates-stockpiling-of-state-oil-reserves-over-2016-17-idUSL4N1OT2HF

China’s (commercial) crude inventories in November hit a seven-year low of 26.15 million tonnes, Xinhua data showed.

Reuters (December 28, 2017) https://www.reuters.com/article/us-global-oil/oil-prices-stay-near-high-on-strong-u-s-refinery-runs-china-data-idUSKBN1EM04P

You’ll remember this…

LONDON, October 12th 2017 (Reuters) – China has built its crude oil stockpiles at a record pace in 2017 and while its purchases could tail off towards the year-end, inventories could hit the billion-barrel mark in six months, the International Energy Agency said.

The agency estimates that over the first half of 2017, Chinese stockbuilding hit a record 1 million b/day.

https://uk.reuters.com/article/oil-iea-china/chinas-crude-oil-buying-spree-looks-set-to-continue-iea-idUKL8N1MN2GO

Anybody knows what the definition of crude oil by Texas RRC is? The reason I ask the question is because the production increase up to API gravity 40 is only 70K/day out of 767 K/day from November 2016 to October 2017. PAA said in the conference call that Delaware basin is producing mostly oil with APII gravity higher than 45 and needs to be exported as our US refiners will not touch it.

Krisvis,

Thanks for posting your comment. This is exactly my point.

Shale produces mostly condensates and light distillates, which are an excellent feedstock for the chemical industry. However, this concerns just 15% of the oil market. At the beginning of the Shale boom Shale light distillates could substitute a lot of conventional oil, which was previously used in the chemical feedstock market. This brought down the oil price.

As Shale oil has now serious troubles to enter the transportation fuel market (due to a lack of middle distillates), the US is forced to sell cheap light distillates on export markets and import on the same time expensive real oil containing middle distillates at a high price. So, US imports of real oil are on the rise again. This is why we are seeing a rising oil price and US oil trade deficit again. The dollar has already reacted by a steep slump over the last days.

When one looks at the price of oil with API 40-45, it trades at a premium to heavy oil. Oil above 45 or 50 API is typically classified as condensate.

As George has commented repeatedly, most of World output is getting heavier and is more expensive to refine. There are many customers around the World that need the lighter oil to blend with heavier crude. In fact much of the US condensate goes to Canada to blend with bitumen so it will flow through pipelines.

For net crude oil imports for the US see

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCRNTUS2&f=M

Wrong chart in comment above, sorry( link has updated chart)

This chart is from EIA (chart above used the EIA data Jan 2015-Oct 2017).

The US has had net imports of crude oil since 1945 (based on monthly data).

On an annual basis, the last year the US was a net exporter of crude oil was 1943. Net imports of crude peaked (annual data) in 2005 at over 10 Mb/d and fell to 6.9 Mb/d in 2015 and rose slightly in 2016 (by 0.36 Mb/d) to 7.26 Mb/d, in the most recent 12 months net imports have fallen to 6.99 Mb/d.

Hi Krisvis,

WTI has a range for acceptable API from 38 to 42 degrees, the typical cutoff for crude is 44.9 API.

Tapis crude from Malaysia is 43 to 45 API and sells for $69/b, see

https://oilprice.com/oil-price-charts

and

https://en.wikipedia.org/wiki/Tapis_crude

One thing to emphasise maybe: shipping be sea isn’t vey expensive, maybe only $2 per barrel, which is less than rail within North America and similar to a pipeline; so getting oil to Europe or Asia for refining might not cost much more than to a US refinery. The arbitrage gains are more than these costs for US light oil at the moment, and it is definitely not worth the capital outlay to allow all the oil to be refined at home.

“Whatever the case, nothing creates job and opportunities the way oil and natural gas exploration does at this time”

https://oilprice.com/Energy/Energy-General/GOP-Tax-Bill-Is-A-Boon-For-Oil-And-Gas.html

choke on it boys the truth comes out…making america great again…not just a slogan anymore?

Companies losing money don’t pay income taxes anyway. A cut won’t do them any good.

“Given President Donald Trump’s obsession with reviving the dying industry, it’s almost surprising that the Republican tax bill doesn’t contain any new breaks or incentives that explicitly help coal. ‘Energy is actually the least of the beneficiaries in this bill, and the simple reason is that energy already has so many carve-outs and exemptions in the tax code that a lot of U.S. based companies just pay hardly any income tax as it is,’ said Pavel Molchanov, an energy research analyst at the financial firm Raymond James. ‘So there is virtually no effect on energy of any kind, either positive or negative, and that includes coal.’”

https://newrepublic.com/article/146388/tax-bills-gift-big-coal

Choke on this tee tee: because the shale oil industry can’t keep its MasterCard(s) in its pants, its overleveraged LTO oversupply is the direct cause of low, volatile oil prices that has resulted in the loss of over 440,000 oil and gas jobs around the world since 2014. https://www.rigzone.com/news/oil_gas/a/148548/More_Than_440000_Global_Oil_Gas_Jobs_Lost_During_Downturn. There are still an estimated 55,000 still out of work in America in EOR, GOM and in stripper well production. Your beloved shale industry got nothing, nada, zip out of the new tax law except interest deduction limits, which will hurt it, not help it.

Hi Mike,

If most of the LTO companies are losing money, I don’t think they pay federal taxes on losses, so the reduction in tax deduction for interest paid would have no effect.

Am I missing something?

No, but tee tee is. Its not easy, you know, getting thru.

Take for instance the help the oil and gas industry is getting by opening ANWAR. Who is that going to help, particularly since there is countless geological and depositional studies done that pretty much condemn the entire area? Or, lets take the “roll back” of certain MMS/BSEE regulations regarding multi-string pressure and BOP testing in the GOM after the Macondo incident? That is stupid shit that dumb, uninformed people buy into that has nothing to do with reality. Reality is those regulations were on the books and un-enforced. It cost BP, what, $80B to cut some corners? Nobody, I repeat nobody is going to let that happen again. Whatever the current BS is about reducing regulations on the oil industry and helping American become great, again, by unleashing its hydrocarbon “might,” on the rest of the world, is laughable. Who is laughing all the way to the bank?

OPEC and Russia, dat’ who. They are watching America’s energy policies get worse, not better.

you can educate the ignorant but not the stupid…who said that…oh yea, me. any one of my birddogs knows more about north slope geology than you mike. perhaps you can make a new years resolution…try to be accurate at least once in 2019, gonna be hard for a “man” like you but give it a shot? oh yea surely you can do better than bathroom jokes after all a “man” of your intellect should…oh never mind?

“you can educate the ignorant but not the stupid…who said that…oh yea, me. ”

Enough said

I am wondering if EIA is including NGLs as I see OK production has ramped up quite a bit.

A lot of OK liquids are 55+ API.

Read the post twitter link Dean posted above. Most interesting is a post by a CPA who was involved with the 914 reporting. He thinks it is double counting the M&A production. However, within his post he describes that the 914 survey is actually done by a third party contractor. In his discussion with him, they were using the higher of projected drilling info, or operator report. To put it in my perspective, I don’t see the 914 having anything like the consistency of the RRC. IMG Crown Energy Services is the third party contractor. Look up their website. Not a lot of time spent on it for a heavy duty IT company, so no warm fuzzies there. One could speculate that the primary income is from the EIA contract. EIA paints themselves into a corner with wild projections on Texas production. They call up the third party contractor and question the figures they think are too low. Contractor has to do something to keep the contract, don’t they?

Now, nobody at EIA can get fired for cooking the books, because they have plausible deniability.

Hi Guym,

From May 2015 to July 2017, the 914 survey was pretty consistent (within 275 kb/d and 365 kb/d of drilling info estimate, average 320 kb/d). Perhaps that has changed, I would not put much weight on a Twitter comment by a CPA. We will see in a few months what the drilling info estimates are, which are usually within 1% of the final output after 3 to 5 months. So by March or April we may know what Oct 2017 TX C+C output is.

As Mike says, in Texas they are patient. 🙂

That CPA owns his own oil company who reports to the contractor. Do you?

No. Has he been reporting NGL, (in the US this would be natural gas plant liquids) to the contractor as C+C?

In any case, I agree with Mike, patience is needed. Perhaps the 914 survey is now covering a much higher percentage of Texas C+C output relative to the May 2015 to July 2017 (27 month long) period.

Time will tell.

“Double counting M&A production” has nothing to do with NGLs. He was admonished by the contractor for under reporting production that was sold off. Instead of using his figures they used his old wells as listed in the drilling info estimate. Hence, double reporting it. But what was more interesting is the contractor part. They can send out the survey, but can determine whatever they want to include.

Hi Guym,

The EIA contractor checks with operators when reported numbers are different than expected and sometimes they use the drilling info data instead, if the numbers don’t look right.

The numbers are revised over time as more data comes in. These are estimates, nobody knows final output for many months (for the entire state of Texas or all of the US).

Hi Guym,

The link below covers the 914 survey methodology. Yes mergers and acquisitions are a potential problem. The EIA does it’s best to account for these, to avoid double counting.

About 450 of the largest oil and gas companies that produce about 90% of US oil and gas output (of approximately 13,000 petroleum producers in the US) fill out the 914 survey.

https://www.eia.gov/petroleum/production/pdf/eia914methodology.pdf

Hi Shallow sand,

No not NGL only crude plus lease condensate. The EIA has never based C+C on API gravity, just liquids produced in the oil field as far as I know.

A bit of recap for newcomers:

API gravity is a density measurement of oil. Measures how heavy it is compared to water. The higher the API number, the lighter the oil.

Refineries do not create “middle distillates” out of nothing. They extract them from oil. “Middle distillates” are middle heavy liquids within oil. Diesel and Kerosene. Read truck/tractor fuel and jet fuel. Gasoline is a light distillate. Heavy distillates would be something like bunker fuel or asphalt.

This is all within the same liquid called “crude oil”. Traditional labels are applied as regards the word “quality”. High “quality” crude oil was light and “sweet”. Sweet refers to having low content of materials that cause problems in refining. Like sulphur or vanadium. But tradition has run up against the new nature of crude oil. It has gotten too light. It often lacks middle distillates.

Here is a chart posted a year or so ago by Jeffrey Brown:

https://imgur.com/a/cqtvu

I have examined assays of many different oil types from all over the world. Jet fuel boils about 160 degs C, and the heaviest diesel boils up around 350 degs C. So “middle distillates” that are actual fuel for things that matter are in the assay between those temps.

https://www.statoil.com/en/what-we-do/crude-oil-and-condensate-assays.html

Scroll down to their .XLS spreadsheets for various blends that they have assay’ed. I would say it does not conform to the chart. BUT. There are some caveats scattered around. “Blend”. Dumbbell liquid. This means if oil from one field doesn’t have what you want in it, you add oil from another field to it to get the constituent parts. Assay it and declare it looks good. BP has an assay website, as do others, like Capline from Marathon.

All this was to address the question above — “what is the definition of oil”. Study all that and you’ll see that the definition is whatever the money agenda says it should be that moment.

Crude oil is only getting lighter in the US, everywhere else it’s getting heavier and the light LTO is likely to be in greater demand for blending. Refineries set up for heavier oil usually have crackers – either fluid crack crackers or hydrocrackers – which can convert heavier components to gasoline and diesel, but can only go so far and blending lighter oil allows the throughput to be maximised. There is no current problem from the oil range of oils being produced.

HOUSTON (Reuters) – Several oil pipeline companies this month agreed to move ahead on multi-billion-dollar projects that would link Texas shale fields to Gulf Coast export hubs, offering new outlets for burgeoning output expected in 2018.

https://www.reuters.com/article/us-usa-oil-pipelines/pipeline-projects-move-ahead-to-tackle-rising-texas-shale-output-idUSKBN1EN1PD

That information must leave many readers here perplexed. You have pipeline companies, refineries etc. building out the infrastructure to process and transport the oil, but Mike tells us it’s all hype, not to be believed…geez and even Dennis agrees with him…what are we to believe? I bet they did not do their due diligence, probably just read a few presentation and decided, hey lets go spend a few billions of dollars for the hell of it, Right Mike? I think I will follow the money on this one and not the want-to-be, pretend, only in cyber space, oil men bloggers?

TT.

All I’m worried about is you shalies killing the oil price again. 2015-17 not good for anyone actually making $$ from the commodity of oil. (Corporate management gets theirs regardless of profits, so I don’t count them).

And if your response is “compete” I will know you are not for real on owning oil. Because I don’t know how a non-op can make $$ on wells that do not payout. Shale CEO’s can, but non-ops can’t IMO. So I don’t know how you could be happy seeing Shale getting ready to kill the oil price again?

The only thing I can see killing $55-65 WTI at this point is overproduction of US shale. And it will hurt them too, if they overproduce. The shareholders, not the management. But it should absolutely destroy non-ops like you if we once again have $25 oil and $1.50 gas.

Corporate shale CEO’s receive enormous salaries and compensation packages based on booking fake reserves. The profitability of their corporations, or shareholder equity, means little to them. Midstream companies that gather shale oil and shale gas are totally reliant on the shale oil industry to continue to be able to borrow more money. They are sheep in a flock. The entire thing, from the top, down, is a façade using OPM. Nobody borrowing this money is personally on the hook; there are no personal loan guarantees, nobody is going to be ruined when the entire thing collapses. The scheme is based on getting as much as you can, as fast as you can, and getting out unscathed.

Why promote, or cheerlead for an industry that is obviously grossly unprofitable and that is going to ultimately leave hundreds upon hundreds of billions of dollars of debt for our children to deal with? Because, you don’t care. You don’t give a rat’s ass. Because exactly like a corporate shale oil CEO, royalty owners receiving income from shale wells, free and clear of all costs, don’t care about debt, about profitability, about depleting our nations remaining hydrocarbon resources and conservation…they just care about themselves.

The Peak Oil Barrel community can decide for itself who the “pretenders” actually are.

Mike.

Unless I missed it, I am still waiting for TT to explain how he finances the huge AFE’s he must routinely get from $10+ million STACK and SCOOP wells.

Was doing some tax work earlier today, and noted for June, 2017 oil we got $40.71 per barrel. If 12/29/17 close holds we get $56.

$15.29 more on every barrel is huge for us, as it is for everyone who operates wells, Be it you, XOM, Harold Hamm, Russia, OPEC, etc.

As I recall, oil prices rebounded in late 2016, then shale went nuts, and the price tanked. Their shares tanked too, as I recall.

Say TT owns 10% of a shale monster well that cranks out 200K BO in year one. Say his NRI is 8%.

So, he got billed $1 million for his part of the well. A $15 higher oil price nets him $240,000 more in year one, before deducting severance tax.

So, I assume TT would rather get an extra $240,000 in year one and have shale not go crazy talk and crazy drill again, as opposed to being able to crow about political crap?

Mike, do you know any non-op’s on shale wells? How the heck do they finance them?

PS. I know you think it’s cold down there in Texas, but in my part of the Mid Continent it will be -5 F later tonight. 1 stinking degree F right now. Ouch!!

Happy New Year, Shallow, and to the rest of the POB community. We close our schools in Texas when it gets below 40, almost. We are expecting low 20’s here each night for the next three nights and we are all standby in the field to deal with an array of frozen, broken messes. This is not a good time of year to be in the oilfield. I don’t know how you folks stand it up north.

You know quite well the story of tiny NPRI owners not wishing to be pooled in Bakken units and instead electing to assume WI ownership in well(s), then going non-consent in hopes of backing in after payout and becoming real oilmen. That was a disaster. Their expenses now exceed their income and they are on the hook for plugging and decommissioning costs…they’d give that stuff away if they could. You have shown us all numerous of these type of WI’s for sale on energy.net

In the beginning I knew numerous folks in the EF and PB who turned deals with small carried WI, or reversionary back ins after payout. I also knew folks who farmed out shale rights and kept WI. They did so, I believe, thinking fiscal responsibility and profitability was the order of the day, like it always has been in our industry, but quickly found out that was not the case and were literally spent into the dirt within a year or so. They sold their WI to operators as fast as they could, never to return. I am sure there are exceptions, but not many. It is a big boys game now run by lenders with very onerous loan covenants. How does a 1/32nd or a 1/16th WI pay its share of 15) $10M wells that take 3, 4 and 5 years to payout, if ever? They don’t. Not without borrowing money themselves.

If on the other hand one includes RI and ORRI in the well(s) with the NRI from your WI, nd pay 1/16th of the costs for say. 0.10000 total interest, then you can puff up like a rooster and say I own WI in shale oil wells and they all “make” money. The only people making money in this shale gig is royalty owners, overriding royalty owners, CEO’s and lenders on interest income. That’s just a fact.

Stay warm, man.

For the life of me SS, I am not sure what is so freaking confusing. I have said numerous times the world needs $70 oil. That is a price level that folks like you and most others can make enough money and produce free cash flow to fund new projects. Fact not fiction. BUT. I have also said, I live and work in the real world where we actually do real work, well by well, section by section to find opportunities.

Just to restate the facts, we have conventional production in 5 states, both working interest and royalty interest.(spread the risk) we do not borrow money, everything we do is out of cash flow. On most of our wells we lease part of the minerals we acquired and drill a portion of the minerals we acquired. What you may not know is many operators in the better shale plays are actively buying royalty to increase their NRI but of course they are a bit late to the party. The wells we drill, are at current prices very economical. freaking do the math. at $50 oil and $4.00 nat gas(btu adjusted) @2 % tax rate in the first 2 years and wells that will produce 400,000BO and 5BCFG. The gas alone pays for the wells and the oil is “free”. We started thinking we might get 5-6 wells a section now that number is 15 wells per section.

It is a much longer conversation, most of which would be way over the heads of the readers of this blog, the improvement in production numbers (new frac techniques) over the last 18 months we are seeing are out of this world. 30% at the low side at 100% at the high end increased in production with a 11 month comparison period. How this translates to ultimate EUR i am not prepared to say, what I will say is that based on 35 years of experience it looks great.

A couple of takeaways. One, there is a point to be made, some, maybe even most of the shale guys have played fast and loose with normal best practices with regard to finances. But because we have alcoholics we don’t condemn the entire industry, or impose prohibition, which is the argument Mike like’s to make.

This is a process, what works and does not work will be sorted out by the market place as it should be, MUCH will WORK that IS a fact. What the folks who are building pipelines and refineries and other midstream and downstream infrastructure sees, is what we see, their in the real world where we deal in facts and allocate our money accordingly.

best wishes for 2018

TT. If you came into shale with a lot of rock solid conventional, paid for in full, I can see how you could come up with the money.

However, I am then also sure that you, just like us, went from making a killing on low decline conventional and $90 oil, to making much, much less, and in your case were using almost all cash to pay for new shale well AFE’s.

Even if you have zero debt, I assume you at least have an un drawn credit facility just in case a good, big deal were to arise. And therefore, I assume you were none too pleased when your borrowing base dropped by more than 2/3 from 2014 to 2015, and again another 20+% in 2016, due to shale over production crashing oil and NG prices.

If you are big enough to cash flow several shale AFE, I assume you have net production of somewhere between 2,000-10,000 BOEPD?

So, let us say 5,000 BOEPD. Again, just hypothetical to show what shale did to a larger private independent, owned by maybe 2-4 shareholders, who got very rich 2005-14.

2014 say you could have cashed out for $500 million. 2016 likely cashed out for 1/3 to 1/4 of that. Quite a hit to the net worth.

Further in 2014 you maybe cleared $90+ million pre income taxes, before CAPEX on that 5,000 BOEPD? 2016, that went to $18 million maybe, and of course you are getting AFE and JIB on the shale that is draining that the near zero? So no shareholder dividends or distributions in 2015 and 2016, after getting big ones in prior years.

We are small, and not in a shale area, but we have been around the block, Dad has been in since the Arab Embargo. Pretty much everyone had to fire someone in 2015-16, it’s good if you didn’t. Pretty much everyone had the rug pulled out from under them, just like in 1986 and 1998.

Thing is, I think even most of the shale guys aren’t real happy about shale. They know shale overproduction will drag the price. Same bittersweet deal as farmers growing a bumper crop. Farmers made the most $$ during 2012-13, even though most places 2012 was terrible drought. US commodity producers never do good during periods of oversupply. Just the middle men do good then.

Again, I’m just speculating on how you do things, numbers etc. I may be all wrong. If I am I apologize.

I just know in 2015 and 2016 there were a ton of shale wells completed that won’t payout. Maybe not as many in 2017, but they are still out there. Further, they hurt cash flow, especially when you cannot control the expense recognition time frames as a non-op.

I am so glad we did not own non-op where drilling was going on 2015-17, as it would have sucked away all our cash, and then some, plus sold our flush production at market lows.

I am happy to see you want $70, even higher than me. So I’ll leave you alone now. Take care. I think maybe deep down you too hope US doesn’t ram through 10 and then 11 million BOPD next year?

Your 2% production tax in Oklahoma is going back to 7%, tee tee; you and Mr. Blackmon are definitely on the same ‘mindless’ page regarding the future of shale oil: https://www.forbes.com/sites/davidblackmon/2017/12/31/the-oil-and-gas-situation-a-preview-of-2018/#7b9a4fe67613

You are insulting to people here, who actually understand the basic arithmetic of the oil business a little better than you give them credit for. There is very clear, mounting evidence that things are not getting better in your industry, they are actually getting worse. You, on the other hand, seem to struggle with reality. Five days ago gas was trading at $2.55 per MMBTU, not $4 and after royalty deductions, interest expenses, etc. etc., 5 BCF will not come close to paying for a $10-11M well. I understand now that even after 35 years of whatever it is you do, you can’t insult me anymore than you have already tried. I would have to value your opinion first.

If you want to win friends and influence people here on POB it would be helpful if you were to give us your name, your company’s name, where these awesome wells are so we can check production data and tax roles, etc. That would give you credibility and strengthen your arguments. Otherwise you are just a cute name, embarrassing as that is to my beloved Texas, who likes to brag about how much money he makes in the shale oil business. We’re interested in the big picture here, not you personally.

I still get the feeling that this is a sales job. Why tout the industry doing so great if you don’t need investors and lenders?

I found this. It is from 2016 and it is based on privately held companies. Oil and gas extraction companies was the least profitable industry.

https://www.forbes.com/sites/sageworks/2016/10/03/the-15-least-profitable-industries-in-the-u-s/#2c690cbf618a

I just found the same article for 2017. Oil and gas still tops the list.

https://blogs-images.forbes.com/sageworks/files/2017/09/least-profitable-industries-ttm-07312017.png

@TT

Cling to whatever makes you feel good dude. I guess when you’re favorite industry produces a lot of product but can’t make any profits doing so one has to find the silver lining wherever they can. Shale is a Ponzi scheme. It won’t be long until the music stops and the investors lose their shirts.

go f your self….what the hell are your credentials… not better than most here. the totality of your experience in the “oil” business is probably limited to buying lube

(for your bicycle chain)?

My credentials are irrelevant to the fact that shale oil is a profitless venture. If not for profit then what’s it all about? Take a long hard suck on my ass fuck face. Fucking retard.

well there you go, proof that many here are illiterate and ignorant. you resort to profanities when you have no facts. I bet your parents are proud of you?

shale oil is a profitless venture. Deal with it fuck head.

I have seen many folks in foreign countries tuck in the pant leg of their trouser in their socks so that it does not keep getting in the chain of their bicycle, I bet you can tell us, does that work for dresses too?

Here’s one for the Texas teabagger aka the Lone Star State scrotum sucker.

Im guessing it didn’t go to business school.

https://seekingalpha.com/article/4084591-new-darlings-wall-street-folly-oil-fracking-investing

https://www.cnbc.com/2017/09/13/us-shale-oil-and-gas-investors-are-on-road-to-ruin-warns-jim-chanos.html

Until you post a name and a company, you can’t complain about anyone else’s credentials.

We know who Mike is. You are nameless, likely lying, and probably a charlatan.

And the emojis prove you are a moron.

Damn, when did this start.

Why is invasion of privacy a good thing? Think bitcoin.

Watcher…I didn’t say he had to identify himself, I just pointed out that he was a hypocrite to demand other people’s credentials without presenting his own.

To the Teabagger, I say “Put up or shut up.”

Though I do prefer “shut up”.

-Lloyd

Hi Texas Tea,

I agree with Mike that LTO producers are not profitable (as a group).

I have suggested that if oil prices remain under $65/b (WTI price), that US output may increase by about 600 kb/d (average annual C+C output) in 2018 compared to 2017. If oil prices are higher, output may be higher, if you tell me what that average oil price will be in 2018, I can make a better output estimate.

I also agree with Mike that I do not know what the future oil price will be.

Generally higher World output levels result in lower oil prices (as in 2015-2017) and generally lower oil prices result in lower profits for oil companies, ceteris paribus.

Of course I complain about -5 F. Wow, much worse in Bakken.

Major respect for folks working outside always, but especially in the Bakken tonight.

Take care up there. Seeing -32 F in Sidney MT and -25 F in Williston ND.

Shallow,

The oil price may improve in 2018. However, it will likely go DOWN CONSIDERABLY first before it continues higher. According to the COT REPORT (Commitment Of Traders), there is a record Commercial Short Position against oil going back 23 years.

You will notice, right before oil fell from $100 in 2014, there was also a high amount of Commercial Short Positions. Today, that level is even higher.

steve

Hey Steve, show us how your predictions on gold prices have done over the last 5 years…ooops next to mike you almost look like a genius.

https://www.marketslant.com/article/zombie-shale-oil-killing-itself-survive

You’re a living joke.

Let me know when shale turns a profit.

Hi Shallow sand,

Not a lot of completion work occurs at those temperatures, I would think.

Not much fun outside in this weather.

EIA Today In Energy: What are natural gas liquids and how are they used?

Table on Twitter: https://pbs.twimg.com/media/DSarQ0wUEAACODP.jpg

https://www.eia.gov/todayinenergy/detail.php?id=5930#

World demand for oil products – JODI Data – As everyone knows January is the seasonal low for demand. Comparing demand in December to January of the next year shows an average drop of -2.2 million barrels per day.

Chart on Twitter: https://pbs.twimg.com/media/DScZ25HX4AAdDwB.jpg

Rather Crude product sort out by molecular weight: WTI is refined to 6% Diesel while global crude average is 34% Diesel.

https://www.economist.com/news/christmas-specials/21732697-crude-oil-most-traded-commodity-world-what-it-made-and-where-does

http://infographics.economist.com/2017/xmas/20171223_XMC600_weblarge.png

One more for the Texas Teabagger

https://www.bloomberg.com/news/articles/2017-11-01/fracking-boom-hits-midlife-crisis-as-investors-geologists-see-shale-limits

George, don’t want to scroll way up.

Don’t suppose you know if oil fields do blending prior to sending to assay? Doesn’t seem too very conspiratorial. Someone could gin up a rationale and no one would complain provided the refiner gets the same blend as assayed.

Most are blends – i.e. a bunch of producers discharge into a pipeline and what comes out the end is the cargo – it varies a bit depending on the relative flows from each platform and they might have to blend further in the tank farm (e.g. Forties delivers Brent crude, I think from 15 to 20 different platforms). I can only think of one time there might not be blending of some kind, which is if an offshore platform with storage (e.g. FPSO) unloads as repeated cargoes which always go to one specific refinery (probably the platform operators – but even then there are usually more than one owner and they often take the cargos separately in proportion to their stake).

https://www.researchgate.net/profile/Hassan_Harraz/publication/301842929_BENCHMARKS_OF_CRUDE_OILS/links/572a065b08aef7c7e2c4ede8/BENCHMARKS-OF-CRUDE-OILS.pdf

This is from 2015/2016 – but prices are still light/sweet -> expensive; heavy/sour -> cheap. The only thing that can mess that up is if there are transport bottlenecks, which is why WTI is a bit cheaper than Brent (it wasn’t before LTO came on line). Tapis is still the lightest and costliest, although almost none of it is produced it is still a useful benchmark against which other oil can be rated. Although there are benchmark crudes I think every cargo is basically a negotiated price between the refinery and the producer (there can be penalties if it isn’t quite the quality agreed on, and it could even be rejected, and I think there is an adjustment based on the latest benchmark prices as the contract price would have been negotiated well ahead of delivery). And that is about as much as I know about the trading business, except there is a lot of money that can be made and lost on very small margins and variations.

source of interest my recall of Bakken and Eagle Ford assays of yrs ago and how, with an increase in API degs reported in the new assays, the middle distillate yield hasn’t changed. Should not be — well it’s possible but should not be likely.

Hi George

From memory Brent crude got heavier when Buzzard came online.

https://www.zerohedge.com/news/2018-01-02/peak-mexico

US implied domestic demand, monthly figures – seasonal

(Finished Motor Gasoline + Finished Aviation Gasoline + Kerosene-Type Jet Fuel + Distillate Fuel Oil + Residual Fuel Oil + Lubricants + Asphalt) but no NGLs

From here: EIA – Finished Petroleum Products – Products Supplied: https://www.eia.gov/dnav/pet/pet_sum_snd_d_nus_mbblpd_m_cur.htm

The January dip in demand, table on Twitter

https://pbs.twimg.com/media/DSki1qFWsAAK6zX.jpg

Yearly averages & the year over year change. 2017 to Oct.

https://pbs.twimg.com/media/DSko0eLXcAEyl8L.jpg

First chart from comment above

Second chart in link from energy news. Thanks!

U.S. oil production booms to start 2018

Updated 8:39 AM; Posted 8:39 AM

By The Washington Post

http://www.nola.com/business/index.ssf/2018/01/us_oil_production_booms_to_sta.html

U.S. crude oil production is flirting with record highs heading into the new year, thanks to the technological nimbleness of shale oil drillers who have unleashed the crude bonanza.

The current abundance has erased memories of 1973 gas lines, which raised pump prices dramatically, traumatizing the United States and reordering its economy. In the decades since, presidents and politicians have mouthed platitudes calling for U.S. energy independence.

President Jimmy Carter in a televised speech even compared the energy crisis of 1977 to “the moral equivalent of war.”

“It’s a total turnaround from where we were in the ’70s,” said Frank Verrastro, senior vice president at the Center for Strategic and International Studies.

Shale oil drills can now plunge deep into the earth, pivot and tunnel sideways for miles, hitting an oil pocket the size of a chair, Verrastro said.

The United States is so awash in oil that petroleum-rich Saudi Arabia’s state-owned oil and natural gas company is reportedly interested in investing in the fertile Texas Permian Basin shale oil region, according to a report last month.

That is a far cry from the days when U.S. production was on what was thought to be an irreversible downward path.

“For years and years, we thought we were running out of oil,” Verrastro said. “It took $120 for a barrel of oil to make people experiment with technology, and that has been unbelievably successful. We are the largest oil and gas producer in the world.”

The resilience of U.S. oil producers has come as the price of crude rose above $60 per barrel on world markets. Many shale drillers can start and stop on a dime depending on the world oil price. The sweet spot for shale profit is in the neighborhood of $55 to $60 per barrel.

awesome article!

American consumers have been mislead, intentionally, I believe, into believing the mere existence of unconventional shale resources in America has forever changed the world oil order. Take for instance this article, from the Washington Post, no less: “Abundance.” In most people’s minds there are no geological constraints to this imaginary shale “abundance;” we are literally sitting on the Atlantic Ocean of shale oil in America.” Technically recoverable shale oil resources are done deal, most would say. We have 200 years of the stuff. That is simply not true. “Technological nimbleness” has nothing to do with the recent spurt of shale oil growth. The Permian Basin and junk bonds, do. “America is the largest producer” in the world. If it were to get off the drilling hamster wheel, in less than a year it would lose approximately 34% of its current production rate and drop precipitously from there. “Unbelievably successful.” For the American consumer, not for the companies extracting the stuff, not from a business standpoint. “Resilience…has come with $60 oil.” $60 oil is less than 15 days old. The shale industry’s resilience has nothing to do with price, it was growing production at $40. The shale industry’s resilience is based on the availability of low interest capital. It can only “start and stop on a dime” providing it has other people’s money to do so. The “sweet spot” for enough profit to pay down massive amounts of debt is way more than $60.

There are no “miracles” in the oil business. For the American shale oil industry to deliver on its claims, it has be to profitable. Its not. Continuing to pour low interest capital, on top of massive amounts of legacy debt, is NOT an indication of success. To me its actually an indication that something in the business model is horribly wrong.

So I just checked out the article.

This seems to be the key quote.

“If producers can set the price, then oil companies can be a great investment,” McMillan said. “If they are forced to compete, oil companies won’t be.”

And of course it appears that right now they can’t set the price. And every article that brags “abundance” helps to keep the price low.

I am watching an industry prematurely destroy itself.

Thanks Mike,

I agree that the article that Daniel thinks is “awesome” is simply a bunch of cheerleading hype that is completely misleading.

The LTO industry needs $85/b to be profitable rather than the $60/b that the article states, we are a long way from $85/b. Though if the lack of investment by most of the oil industry (aside from LTO) is any indication, there may be a lack of supply by mid 2018 which might drive oil prices to levels where LTO producers can make profits and pay down debt.

I know you think this is unlikely and I am not holding my breath, but my guess is that such a scenario is more likely than not (51% probability).

I would also note that you have probably forgotten more than I will ever know about the oil industry, so your guess would be better (you don’t make such guesses at least not in public).

As far as I can tell, the primary reason to predict so much oil on the market is to lure unsophisticated money into funding more production.

A glut of oil doesn’t raise prices, and therefore doesn’t help the bottom line of current producers.

The other possible reason for the cheerleading could be to prop up Trump. Make voters think everything is great, even if it isn’t.

Cat,

“Shale oil drills can now plunge deep into the earth, pivot and tunnel sideways for miles, hitting an oil pocket the size of a chair.”

I’m not an oil man, so maybe you can help me out here. About how much of that drilling, plunging, and tunneling sideways for miles can be paid for by an oil pocket the size of a chair? Please do enlighten me.

Stan

ClipperData: US Gulf exports, updated to December

https://pbs.twimg.com/media/DSmzP-lXUAccetp.jpg

Rystad – US Crude Oil Production Capacity Has Reached 10 Million Barrels Per Day (Dec 29, 2017)

https://www.rystadenergy.com/NewsEvents/PressReleases/crude-production-10mbpd

Hi Energy news,

The weekly data is often wrong by 200 to 300 kb/d. US C+C may hit 10 Mb/d in 2018 (for a month or 2) perhaps in summer or fall if there are not too many Hurricanes in the fall of 2018.

The highest trailing 12 month average US C+C output was 9753 kb/d in July 1971, the most recent trailing 12 month average for US C+C output in Oct 2017 was 9119 kb/d.

For the past 5 months the trailing 12 month average output has been increasing at an annual rate of 692 kb/d. If that rate of increase continues (unknown of course) we would surpass the July 1971 record for TTM C+C output by Oct 2018 or sooner. Output for TTM C+C would be at 9811 kb/d in Oct 2018 for that scenario.

Note also this is a long way from dependence on oil imports as the crude oil input to US refineries for the most recent 12 months was 16.47 Mb/d.

At some point in the future (probably by 2020) the tier 1 areas (so called sweet spots) of the US LTO plays may be fully drilled and it will be exceedingly difficult to increase US output any further at that point. LTO output may reach 6.7 Mb/d at the peak, but there will be declining conventional and Gulf of Mexico output which will offset some of the increased LTO output.

It is unlikely that the US peak for trailing 12 month average C+C output will reach even 10,100 kb/d and perhaps will never get to 10,000 kb/d. The peak for US C+C output (12 month centered average) is likely to be reached in 2020 to 2022 especially if oil prices increase to $85/b or more.

And Rystad is just quoting EIA numbers. I have no doubt, that up to July, EIA numbers were close. But just look at their progression of numbers since Dec 2016, at the low point. As completions picked up in 2017, it slowly rose to 3484 in July from 3153 in Dec of 2016. So, in a seven month period of increased drilling, it slowly rose to over 300k barrels. September and August had Harvey, and decreased completions. October was probably normal to July, yet EIA reports another 300k increase within a three month period. Hard to buy, no matter how you look at it.

Hi Guym,

I agree that the EIA estimate is too high by 80 to 130 kb/d, in a few months (end of February) we will know what actual output was in Sept 2017 by looking at the Drilling info data and we will have a better estimate for Oct 2017 output at the end of March 2018 and for Sept 2017 at the end of February 2018.

My best guess as to what is happening is this. Delaware basin oil is way too light and refiners do not want it. This is according to Chiang of PAA in the latest conference call. Delaware basin is removing the lights (including C5) in a distillation column and stabilizing the oil. The C5 can be sold in gasoline pool. and it is NGL.

The stabilized crude should have lower API gravity and is easier to sell without much blending.

As many pointed out here, shale is not a substitute for heavier oil as diesel make is lower.

The lights cut could be as high as 15%.

It is possible that EIA 914 received information on light oil that was not stabilized. The oil production may be overstated by the lights removed. EIA 914 wants to change this scenario as shown below.

https://www.gpo.gov/fdsys/pkg/FR-2017-04-04/html/2017-06501.htm

Ok, whoops a mistake. Only, it conveniently supports their mad hatter projection of oil, in the meantime.

All oil is stabilised to some degree by removing gas and NGLs. Crude for purchase has maximum RVP and/or TVP limits, otherwise the refineries won’t take it (too many lights and the liquid would mess up the storage tans and possibly the processing systems). The gas and NGLs go to a gas plant and get further separated to stable gas and separate gas, C2, C3/C4 and condensate streams. The US refineries might not like the lighter LTO oils but plenty of other refineries around the world do. Not the light NGLs can be turned into good quality (high octane) gasoline through alkylation, which is based on iso-butyl, but not many refineries have such systems, if there really was a problem with too light crude that couldn’t be processed then more such systems would be added, but there isn’t.

I am specifically talking about Permian oil from Delaware basin. This basin is producing oil where 56% of the oil has higher than API gravity 50. My belief is that the lights have been stripped out. C5 portion can be mixed with gasoline . When I worked for Oxy we sold C5 gasoline to Citgo from ethylene plant after hydrogenating isoprene.

My further point is that Delaware basin oil cannot be sold “as is” and it has to be upgraded. And when you strip the lights out, API gravity of the rest of oil decreases.

https://twitter.com/kxviswan123/status/939164485012656129

Are you saying there isn’t a global market for this stuff, because I’m pretty sure there is. Lease condensate and NGLS from US have gone up 50% or more over the last five or six years and the world market has not complained, so why should this particular LTO be of concern?

Hi Krisvis,

C5 has always been included in the US reported C+C, it is only C5 separated at natural gas processing facilities that the US reports as NGPL (natural gas plant liquids) along with butane, propane, and ethane. Much ado about nothing really.

Also the LTO output from the Delaware basin is not that much, about 40 kb/d of C+C was average output in Oct and Nov 2017 and LTO output has been 40 kb/d or less for 13 months, the high point was 60 kb/d in April 2015. Most of the Permian basin output is from the Wolfcamp, Bonespring, and Spraberry (about 95% in Nov 2017).

Production from the Delaware Basin is most certainly not 40k bbl/d. I think maybe you’re confusing the data from your source — the Bone Spring is a target in the Delaware but not the Midland, the Wolfcamp is a target in both, and the Spraberry is a target in the Midland but not the Delware.

Hi Krisvis,

Delaware basin LTO output is 40 kb/d (including New Mexico output) or about 2% of all Permian Basin LTO output (2048 kb/d in Nov 2017).

C5 has always been mixed with heavier oil in the field, only stuff that vaporizes at atmospheric pressure and ambient temperature is removed in the field, production that is too light is sold as condensate.

You are speculating on NGL being included, C5 has always been a part of the C+C mix, shorter molecules (butane, propane, and ethane) are removed in stabilizers so that the oil is safe to transport and is not included in the reported C+C.

You are inventing problems or overstating problems. That memo was to explain a proposed change in the 914 so that the EIA can report in greater detail the NGL produced in stabilizers as currently it only reports NGPL produced at natural gas processing plants.

Nothing was implied by that memo that NGL was being reported as crude.

WTI nearing $62. Blip or trend?

US storage numbers, even with US exports rising and all sorts of other oil in storage or transport they still seem to be the thing the traders look at, and they are still trending down.

Hi George,

I agree, storage numbers seem to be the thing that controls the price.

Maybe this comment will throw a little light on why inventory seems to play such a big role in the short term price of oil. Sometimes an amateur outsider sees more than a pro who is too busy to step outside his industry and look at how inventories control prices in other industries.

In the last analysis, sales to the end user, the FINAL COLLECTIVE CUSTOMER, determines the short and to some extent the medium term price of any commodity, in my experience.

So when the supply chain, between the original producer of raw materials, and the end user is long, geographically, long politically, long in terms of processing, etc, there’s not much if any short term correlation between the end price paid by the customer and the whole sale price, short term.