The Texas RRC Oil and Gas Production Data is out with the June production numbers. I must repeat, as I do every month, that this data is much delayed and is and will be subject to updates every month, for about two years. Of course the latest months will be the ones which will be subject to the greatest revisions.

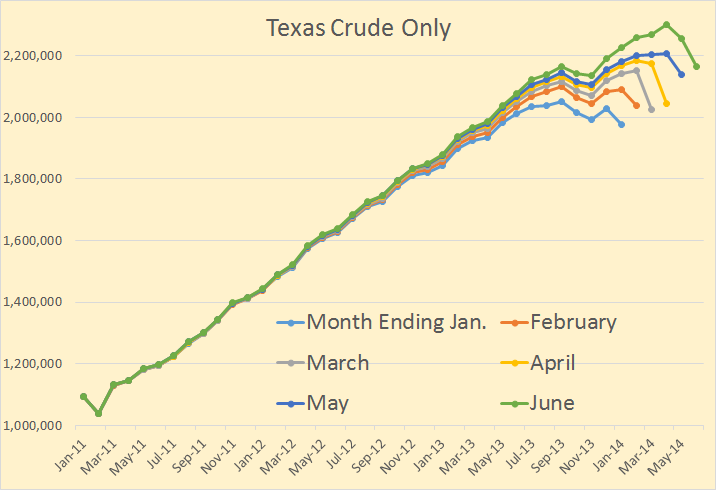

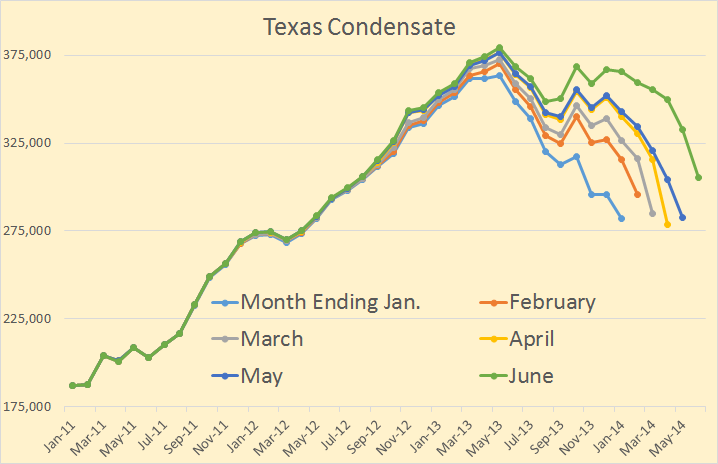

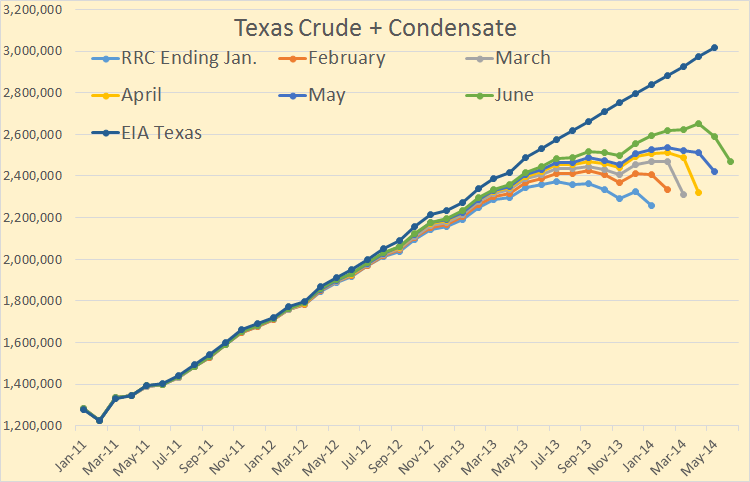

All oil data is in barrels per day. The last data point on all charts is June 2014.

I have six months of data here to give you some idea of the revisions that can be expected in the coming months. Texas crude only is still increasing. My guess is that it is increasing by about 40 thousand barrels per month.

Texas condensate declined for three months in June, July and August of 2013 but has now started to increase again. I estimate that Texas condensate is currently increasing but only some months. It looks like Texas condensate production in some months is declining but in other months is still increasing by as much as 4 to 6 thousand barrels per month.

Texas Crude + Condensate is still increasing from between 40 and 45 thousand barrels per day. The EIA has estimated that Texas C+C will increase by 44 thousand barrels per day after all the revisions have come in. I originally thought that was a little high but now believe that is pretty close.

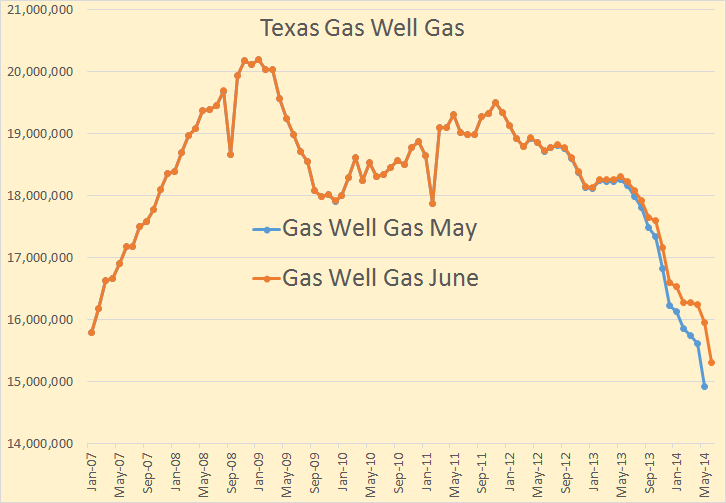

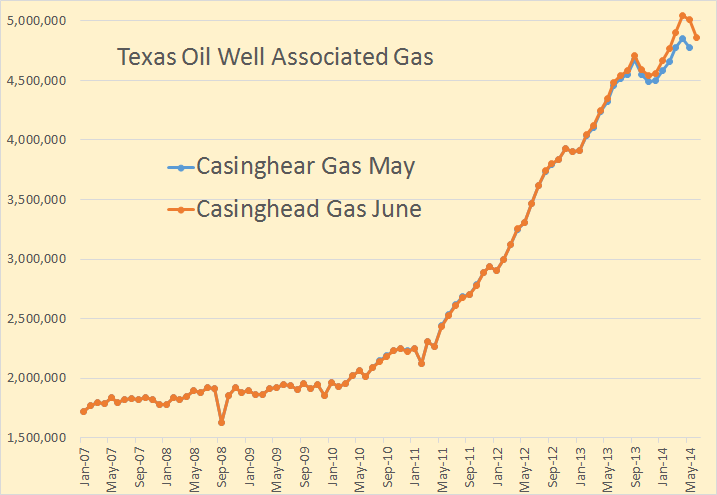

Below are charts for Texas oil well gas and casinghead or associated gas. All gas numbers are in thousand cubic feet per day. I currently only have two months data but will keep it until I have six months data and will hold all charts at that number.

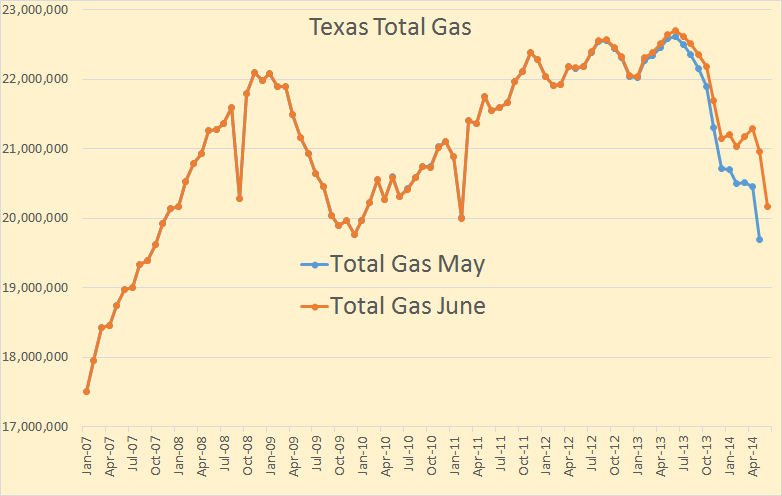

Texas gas well gas is clearly in decline though there are and will continue to be some months where production will increase. The decline is primarily because of the price of gas. Rigs are switching from gas to oil.

Associated gas production continues to increase as rigs switch to oil drilling.

Combine the two and we get Texas total gas production. Texas total gas appears to have peaked in June 2013. It declined for six months and has now started to increase slightly. But unless the price of gas increases I don’t believe it will reach last year’s high again.

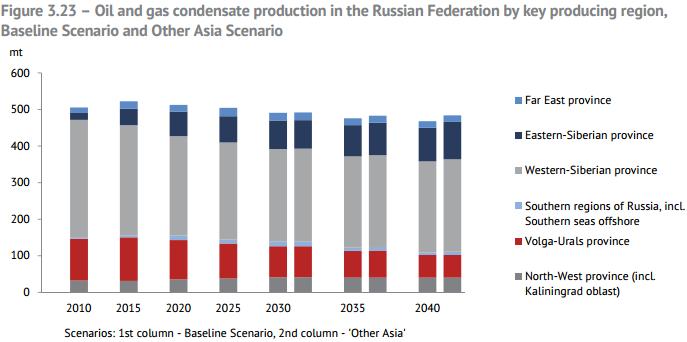

Now I would like to mention a couple of things about Russia that I missed in my last Russian post, starting with the following graph from this PDF file: Global and Russian Energy Outlook to 2040.

Between 60 and 70% of Russia’s oil production comes from their old super giant fields in Western Siberia. But they are depleted and declining pretty fast. For several years massive infield drilling kept their production relatively flat while production from other areas of Russia increased. So where will Russia’s future oil production come from?

Now wait a cotton picking minute here. The lions share of future Russian Oil production is still coming from those tired old field in Western Siberia. How is that possible? They say the answer is simple, those tired old fields are gonna grow!

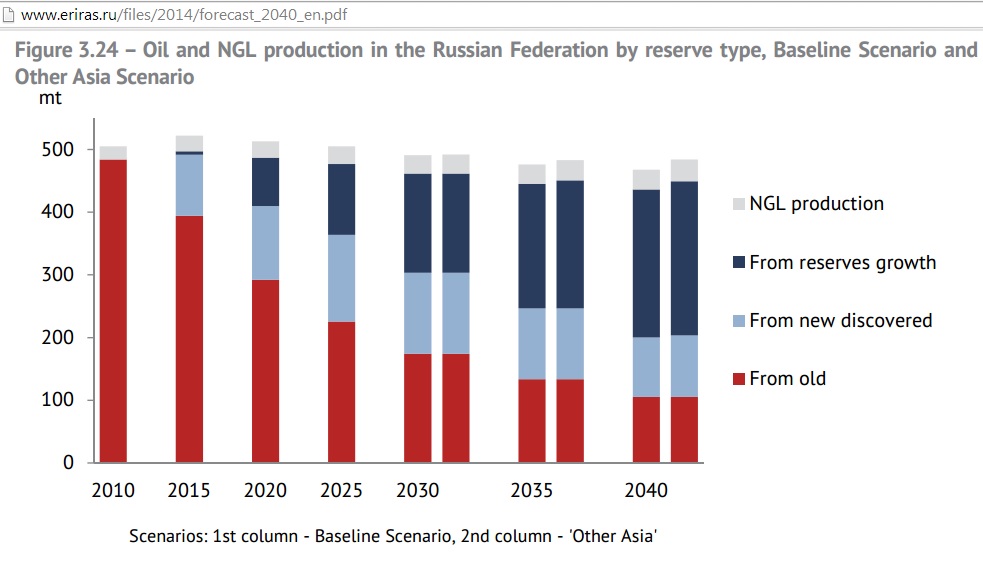

In 2015 old fields are producing about four fifths of Russia’s crude oil with new discoveries about one fifth. In future years those old fields will decline until in 2040 they will produce a little over one fifth of Russia’s production. New production will then produce about the same amount as those old fields. All the rest, about 60 percent of Russia’s oil will then come from”Reserve Growth”.

Now reserve growth, as described by the EIA and other oil reporting agencies, is nothing more than a revision of original estimates of the URR of a field. And since Russia’s old fields were discovered many decades ago shouldn’t they have already undergone all the growth they are going to grow? Well not exactly because in Russia the term “reserve growth” means something slightly different.

Russian reserves are A, B, C1 and C2. The first three correspond to what we would classify as 1P, 2P and 3P reserves. We don’t have a 4P. They do and they call it C2. Well they even have a C3, D1 and D2. But C2 is as far as we need to go because that is where all this reserve growth is going to come from. From afore mentioned PDF flile:

One should point out the significant role that will need to be played by geological exploration during the forecast period, since by 2040 more than 50 per cent of production in all scenarios will need to come from growth in reserves, and final reconnaissance of fields resulting in category C2 reserves becoming category C1.

Russian Classification of Reserves

Category C2 reserves are preliminary estimated reserves of a deposit calculated on the basis of geological and geophysical research of unexplored sections of deposits adjoining sections of a field containing reserves of higher categories and of untested deposits of explored fields. The shape, size, structure, level, reservoir types, content and characteristics of the hydrocarbon deposit are determined in general terms based on the results of the geological and geophysical exploration and information on the more fully explored portions of a deposit. Category C2 reserves are used to determine the development potential of a field and to plan geological, exploration and production activities.

They are talking about the area adjoining the old fields! The damn fields are literally going to grow! Or so they believe.

Notice: Not much data is due to be released in the next couple of weeks or so, so unless I have a guest post or two there will not be a lot of new posts coming out in the next couple of weeks. There are likely to be more than three days between posts for a while.

Maybe Russian oil fields will grow because of abiotic oil theory ?

Or maybe they have grown geographically in the recent past, and therefore it is likely that they will continue to grow. Doesn’t a major oil field have “foothills” where more oil an reside?

One would think that this idea comes from somewhere and is not just made up.

Perchè i dati del Texas vengono sempre e solo rivisti al rialzo?

Poiché l’errore è da pozzi in ritardo di segnalazione. Non è una revisione di pozzi che già segnalati.

tank you

Poiché i texani hanno adottato il concetto italiano del dolce far niente >;-)

Russia is a big deal and hate to toss out something oblique, but did you guys note that Tripoli is being bombed by jet aircraft from an unknown source? Everyone imaginable is denying it, but precision strikes were made on rebel forces around Tripoli. The Libyan air force doesn’t have precision munitions, or are not supposed to have them.

The spike must flow from there. Frankly, THIS is the news that has driving oil’s price down. Pretty much nothing else. It suggests foreign air force efforts to get the spice flowing.

A moment for precision munitions. They come in flavors. Laser guided, or GPS/INS guided. It does you no good to key in GPS lat/long for a guided bomb if the target can move. The INS aboard is to coast a nav solution if GPS is jammed, but it can’t do anything about the target moving.

Moving targets are designated by laser and a guidance package seeks the reflection. This doesn’t work too well on cloudy days or when there is smoke on the battlefield.

So whoever hit these targets had first glass weapons. The US, particularly, has denied involvement. So has Italy, but my money is on them.

my kingdom for an editor

Ebola Outbreak Worsens With Missing Patients

Early Saturday morning, a mob looted an Ebola center in West Point, Liberia, stealing contaminated equipment, bloodstained mattresses and sheets, according to the Associated Press. An estimated 37 patients fled during the raid, 20 of whom have returned. The remaining 17 patients are still missing.

Ebola Kills Another 84 in West Africa over 3-day period

The World Health Organization said another 84 people have died in West Africa as a result of the Ebola virus, bringing the death toll from the epidemic to 1,229.

The U.N. health agency on Tuesday announced the number of confirmed and likely infections has risen to 2,240, including 113 new cases reported late last week.

The majority of the new deaths were in Liberia, where authorities are struggling to contain the virus.

Between Aug. 14-16, Liberia recorded 53 new deaths, followed by Sierra Leone, with 17, and Guinea, with 14.

Just saw a platts article saying oil drilling in the region, particularly Liberia, has been delayed because of ebola.

http://www.platts.com/latest-news/oil/capetown/liberia-offers-new-acreage-despite-no-update-26856529

Now, possibly the Congo also:

http://in.reuters.com/article/2014/08/20/health-ebola-congodemocratic-idINL5N0QQ36R20140820

http://online.wsj.com/articles/apache-makes-big-oil-find-off-western-australia-1408341216

ENOUGH FOR THREE OR FOUR MORE DAYS

Some years ago I came across some specific definition for oil field size, but I have lost them.

Big, Huge, Major, Elephant, Giant, SuperGiant — that sort of thing. They all had numerical definitions.

Be nice to have that again.

With that one could cause all sorts of annoyance by telling people, That’s not a Giant field, that’s a Major field.

Giant Oil Fields. Summery of a classic study from the RAND Corporation – Richard Nehring 1978. I believe that he later became somewhat more optimistic than this excerpt might suggest. http://www.rand.org/pubs/reports/R2284.html

I now note that a free download is available. Prudhoe was #18 on the list, East Texas #31. Laherrere later published interesting updates, including one on the East Texas Field. http://www.rand.org/content/dam/rand/pubs/reports/2006/R2284.pdf

Cool, some definitions. Maybe the whole table is in there somewhere.

Indeed, the chart is there. Circa 1978 I made it into a giant poster. For years this was my favorite oily article. Nehring spoke at the 2007 ASPO-USA meeting along with Boone Pickens and others. Nehring predicted a peak (or plateau) 2020 – 2040.

-Incidentally I flew with Boone, his latest wife and some old Amarillo High School friends from Dallas to his Panhandle Ranch this past weekend. Pictures are inadequate. Mesa Vista almost rivals Hearst Castle but without the European Bias.

http://321energy.com/editorials/cohen/cohen092607.html

Super. Will save this.

Robelius has become the defacto source for naming field size

http://www.tsl.uu.se/uhdsg/Publications/GOF_decline_Article.pdf

http://www.thehillsgroup.org/

Your Uppsala link don’t work.

BTW Hill guy, re: biocide in all fresh water used at the Bakken for initial frack and post production salt encrustation dissolving — that’s how you do irreparable harm to an oil field. You inject the right critters to eat the oil.

The Robelius thesis can be downloaded at

http://uu.diva-portal.org/smash/get/diva2:169774/FULLTEXT01.pdf

It is long, but very well done in my opinion.

A shorter article on the Robelius dissertation can be found at the link below.

http://www.peakoil.net/GiantOilFields.html

The last sentence from Robelius’ thesis is:

“Thus, global peak oil will occur in the ten year span between 2008 and 2018.”

The thesis was defended in March 2007, clearly if it were written today the peak would be forecast as 2013 to 2018.

Kinder Morgan, MLPs and the sell case

Izabella Kaminska, FTAlphaville, FT.com, Aug 18 14:30

The Shale Sugar Lick

By Deborah Lawrence, Energy Policy Forum,

Hat Tip: Resilience

chart for comment above…

A readable chart for the comment above…

If rates rise, a lot of things have problems. And so they won’t rise.

And this is just interest expense, not amortization of the debt. Unless they can roll the debt when it is due repayment has to come of the remaining income (unless they have large non-operating sources of income..)

Rgds

WP

Watcher,

I don’t expect interest rates to rise for the same reason as you.

What is pretty impressive in this very low interest rate period is that so much of these companies operating income is being eaten up by interest expenses. This is as good as it gets… and it doesn’t look good.

The Fed will goose the short end up and celebrate what a booming economy 2% GDP is, but the long end will yawn and ignore them, and chase Germany’s 10 yr at 1.06%.

City of Burnaby enforcing bylaws that prohibit Kinder Morgan’s access to Burnaby mountain

Vancouver Observer, Aug 20th, 2014

The latest from Carbon Tracker…

Oil & Gas Majors: Fact sheets

As noted before, Suncor sewed up all the sweet oil sands spots. The rest are johnny come latelys.

Is American Energy Dominance the New Normal?

[Excerpt from article]

People who think America’s oil boom will prove to be short lived fail to realize that the United States has some of the largest shale formations in the world. For example, the Permian Basin, where reserve estimates are up 50% in just the last year alone, is larger than Saudi Arabia’s Ghawar super-giant oil field.

The EIA estimates the U.S. has 223 billion barrels of technically recoverable shale oil, but that figure is likely to greatly increase. This is because the last time the EIA’s world shale report was updated between 2011 and 2013, its global estimate for technically recoverable reserves increased 11-fold.

If history is any guide those reserve estimates will continue to grow as long as sufficient capital is available to fund the necessary infrastructure and technological improvements to drill deeper and extract more efficiently. And when it comes to investments in US energy, the boom is just getting started.

Consultancy firm IHS estimates that $890 billion will be invested into the U.S. energy sector through 2026. Analyst firm McKinsey estimates that this mammoth investment will result in 1.7 million new, high-paying jobs by 2020 alone.

Thanks to chaos in the Middle East and sanctions against Iran, 4% of the world’s oil supplies are offline.

If sanctions against Russia over the conflict in Ukraine escalate, even more of the world’s oil could become unavailable, theoretically resulting in a large price shock that could derail global economic growth. Yet despite turmoil around the world, oil prices are at 13-month lows; analysts at Goldman Sachs expect them to remain stable over the next year thanks to America’s production boom replacing oil from less stable areas of the world.

Before 2008 and the onset of the modern unconventional oil boom, people spoke in worried tones of peak oil and an age of resource scarcity. Today the world faces a new reality — one of American energy dominance that replaces Saudi Arabia and the volatile Middle East in importance and brings the promise of more stable energy prices, scores of new high-quality jobs, and increased world stability.

[End of excerpt]

I don’t remember seeing many things with the FOOL that are not written with the intent of selling the idea that the party will last forever- no body need ever sober up and go to work on Monday morning.

It would be nice to be naive enough to believe in the eternal party, almost as nice as believing in Heaven just for being good.

From the comment above:

“The EIA estimates the U.S. has 223 billion barrels of technically recoverable shale oil, but that figure is likely to greatly increase.”

The EIA does not do a good job of estimating technically recoverable resources, does anybody remember there overly optimistic estimates of shale oil from the Monterrey play in California?

Much better estimates come from the USGS, which estimates 13 Gb of undiscovered technically recoverable resources (UTRR), if we add the proven reserves from Texas and North Dakota that have been added since 2007 (about 7.7 Gb) we get about 21 Gb.

The USGS estimate may be conservative and could be low by as much as a factor of 2 (so possibly there could be 35 to 40 Gb of LTO produced in the US, though I doubt it.) The EIA estimate is too high by at least a factor of 5 and will decrease in the future, just like the very poor Monterrey shale estimate.

Regarding Texas oil production: In my mind I am connecting the ‘first dot’ from each data set. While these data points all share the greatest lack of completeness; this also makes them comparable. They can provide an early change in overall direction. The slope from light blue dot to green dot represents the new rate of rise.

http://www.desertsun.com/longform/news/environment/2014/05/31/global-warming-joshua-tree-national-park/9729285/

It’s gonna get worse .

Gas to liquid technology may be approaching commercial feasibility soon,maybe even today.

But if it works as advertised gas will go up- maybe to the point it doesn’t work anymore!

http://www.xconomy.com/san-francisco/2014/08/20/siluria-bags-30m-from-saudi-aramco-for-natural-gas-to-gasoline-tech/?utm_source=rss&utm_medium=rss&utm_campaign=siluria-bags-30m-from-saudi-aramco-for-natural-gas-to-gasoline-tech

Hey, check this one out: Oil ‘super spike’ is coming!

From the video four and one half minute video:

What we have are unbelievable risks, geopolitical risks to oil barrels, and yet we don’t have a speculative bid that’s following that along.

From the text:

The demise of offshore oil drilling could also be a catalyst in Dicker’s mind, not to mention oil supplies going offline in places like Libya, and decreasing in countries like Iran and Iraq. This is leading to an upcoming oil supply crisis he says, and ultimately with liquidity not what it once was, and with the cost of oil now making it prohibitive to develop new sources, ultimately the fundamentals will have to matter again.

“When you have an oil price that’s hanging around $95, you won’t see a $10 spike, you’ll see a $40 spike, because that’s what will be necessary to get these guys (oil exploration and production companies) ginned up” in order to produce more crude supply.

This is a contrarian view to all the happy talk that has been all over MSM the last several months.

Ironically I think that oil prices are more likely to go lower in the coming months. The markets are full of bad economic news from Europe and low demand from China. US production numbers keep rising, and they don’t notice it is mostly condensate. If Ebola breaks out of Africa demand for aviation fuel will collapse as panic spreads (even if Ebola doesn’t). US NG demand is low. The supply situation in the ME is so volatile that I am guessing the traders are simply discounting the news.

If prices slumped to say, $80, what would that do the shale oil companies? Would they go broke? Would it trigger another banking crisis , or would they actually stop drilling? My bet is that the drilling would continue flat out, even if the Fed had to pay for it up front.

“My bet is that the drilling would continue flat out, even if the Fed had to pay for it up front.”

Pretty much that. The hit on GDP putting all those truckers out of work, all those railway workers out of work . . . . . . They won’t allow it.

In fact, now that I think about it, the various regulatory stops that might be imposed on flaring or production water disposal . . . not gonna happen. The feds will stop anything of the sort.

Watcher, there is a difference between “The Fed”, (the central bank), and “the feds”, (members of the federal government, the FBI, congressmen and such).

Ralph, I think, was talking about “The Fed” and you seem to be talking about a different group of people altogether, “the feds”.

Or perhaps I am mistaken, perhaps Ralph was talking about “the feds” and not “The Fed” after all.

Excuse my nitpicking but this is one place were the difference makes all the difference in the world so you should be clear as to what you are talking about.

Bakken oil is already below $80 a barrel. From the Director’s Cut:

May Sweet Crude Price = $88.31/barrel

June Sweet Crude Price = $90.03/barrel

July Sweet Crude Price = $86.20/barrel

Today’s Sweet Crude Price = $79.50/barrel (all-time high was $136.29 7/3/2008)

My bet is that the drilling would continue flat out, even if the Fed had to pay for it up front.

I don’t think that could happen. The Fed is just the Central Bank of the United States. They don’t have the authority to do that and why would they do such a thing with the bank’s money? But if you are talking about a bailout, or something like General Motors had, then Congress has to authorize such a thing and the President must sign it.

If the price of oil dropped below what the shale oil drillers needed to make money, nothing would happen right away but gradually they would stop drilling. That is what happened to natural gas and why gas well gas is declining in Texas. But it wouldn’t happen right away because so much money is already invested in mineral rights, leasing and such. In other words a lot of the capex has already been spent. The price would have to drop below what new capex is needed before they stopped drilling. Of course if the price drop lasted long enough then no new leases would be bought and shale oil would eventually disappear.

The worth of dollars, and all fiat currencies worldwide, is zero. They only attain a momentary worth at the moment of exchange, at which point they become a representation of work done, and can therefore be used to cross reference prices.

Seen in this light, it’s actually fairly meaningless what the dollar price of oil is, except for the fact that producers need higher prices and consumers need lower prices. The real cost of production, meanwhile, rises relentlessly.

So now it doesn’t really matter. If the dollar price drops too low, oil gets shut in, is not produced, and we have shortages and recession. If the dollar price goes too high, oil is produced but nobody can afford it, so we have recession for everybody but the super rich. So we are not far from seeing the entire system of dollar prices fail, and we very well might see barter return (exchange done using barrels of oil and quantity of another good (gold?), and bypassing dollars altogether).

Do not think this is possible? How many people predicted 9/11 or the financial crisis?

The worth of dollars, and all fiat currencies worldwide, is zero.

Sorry but this is just not the case. The dollar is based on the “the full faith and credit of the US Government”. So as long as the government stands the dollar will have value. It may be inflated or deflated but still have worth. The dollar is as sound, or sounder, than any other currency in existence. There is no reason to believe the dollar will fail before the Euro or the Pound. All are fiat currencies based on the faith and credits of the governments backing them. And that, in my opinion, makes the dollar far more sound than the Euro. Others might argue that point however.

No, a barter system simply would not work in the modern globalized world. After a worldwide collapse then there might be a return to the barter system. But could only happen after a catastrophic collapse in a chaotic world.

No one predicted 9/11. No one can read the minds of terrorist. However here is Peter Schiff predicting the financial crisis… over and over again and everyone else telling him he is full of shit.

Please send me all those worthless dollars that you have. I will dispose of them on your behalf. just send me an email and I’ll send give you the address to send your worthless dollars to.

Thanks a lot!

Rgds

WP

“The Fed is just the Central Bank of the United States. They don’t have the authority to do that and why would they do such a thing with the bank’s money? But if you are talking about a bailout, or something like General Motors had, then Congress has to authorize such a thing and the President must sign it.”

Correct, and less so. The Fed can be the source of money. But there was never a bill passed through Congress mandating a GM bailout. I am pretty sure that was TARP money that was not targetted at GM.

The political mechanism for keeping the oil flowing is a good question. Bipartisan palatable would be the challenge. Tax cuts/subsidies for the drillers would get GOP support, and to get the Dems on board you might have to unionize the truckers — or extend the tax breaks to BNSF, which would flow into Buffett’s pocket, who would donate to the DNC. The fiscal deficit grows, those bonds bought by the Fed in QE4.

The mountain doesn’t look that high to climb.

I am pretty sure that was TARP money that was not targetted at GM.

True it was TARP money but it was targeted at GM and it was authorized by the President.

The Auto Bailout and the Rule of Law

On December 11, 2008, the House of Representatives buckled under the automakers’ demands, voting (largely along party lines) in favor of a $14 billion bailout. The next day, however, the Senate voted down the legislation. A week later, lame-duck President George W. Bush and Treasury Secretary Henry Paulson intervened. Announcing that the administration would offer the automakers loans with terms similar to the ones Congress had voted down, Bush gave GM and Chrysler three months to develop restructuring plans and prove they could become viable companies. To help the automakers through that phase (and a possible Chapter 11 bankruptcy), the administration extended them $17.4 billion from the Troubled Asset Relief Program, which had originally been set up to buy assets and equities from the financial sector in the wake of the mortgage crisis.

In March 2009, when the lifeline extended by the Bush administration had run out, President Obama stepped in. The administration forced out the CEO of General Motors, Rick Wagoner, and gave Chrysler 30 days to finalize a merger with the Italian automaker Fiat. In exchange, the companies received another (and even larger) round of government loans. In the end, almost $77 billion in TARP funds was diverted to GM and Chrysler.

Well, of course money targeted at GM by Bush was targeted at GM, by definition. It is TARP that was not targeted at GM. Chunks of it were sent to GM and my recall is Congress never voted for that to happen. The primary function of TARP was to provide leverageable cash to buy preferreds from banks loaded down with worthless MBS. The legislation was broad enough that the Bush administration, and a few months later the Obama admin, could spend it with way more latitude than proper legislation constrains.

Sort of a moot point. All we need is political consensus to throw money at the Bakken and Eagle Ford. You get that by tossing goodies to both parties. Tax cuts for oil companies in two red states will please the GOP and unionizing truckers or getting money to Buffett (and indirectly the DNC) will please the Dems.

The Fed can be the source of money.

Depends on what you are talking about. The Fed is the source of money for the federal government, not anything or anyone outside the government. The government issues bonds and The Fed buys them. That is the source of money for the government. The government, not The Fed, must be the source of money for any bailout or any outside financial assistance of any kind.

Ron, I don’t fully understand how Germany was able to finance industrialization, preparation for WWII and the actual war following problems related to post WWI hyperinflation and the depression of the 30’s. They did ignore debts, were self sufficient to some extent and presumably stole gold and other valuables from some residents. But I remain perplexed. They had to pay the troops, the workers and at least some foreign suppliers without reverting to hyperinflation. Any comments?

Robert, the German economy after WWI is way outside my field of expertise. But I also don’t understand the connection. What inference are you trying to draw here?

No particular inference. No connection other than an interest in central banking and wondering how we will finance WWII+ or whatever.

–There has been considerable recent interest in WWI since it is the centenary. I have seen TV documentaries, advertisements for books and recently attended an excellent adult education lecture on the ‘Great War’ by a Cal State Channel Islands History Professor. Some have argued that WWII was essentially a continuation of WWI.

“Some have argued that WWII was essentially a continuation of WWI.”

The French Marshal Ferdinand Foch knew it right away:

On 11 November 1918 Foch accepted the German request for an armistice. Foch advocated peace terms that would make Germany unable to pose a threat to France ever again. After the Treaty of Versailles, because Germany was allowed to remain a united country, Foch declared “This is not a peace. It is an armistice for twenty years”. His words proved prophetic: the Second World War started twenty years and 65 days later.

http://en.wikipedia.org/wiki/Ferdinand_Foch

Germany achieved it all with a shadow central bank they created to generate the money needed to build up their military. The Treaty monitors were not configured to count money that didn’t come from the primary government central bank.

It’s a VERY good question that is usually glossed over by history. There is no way in hell Germany should have been able to fund military build up. They did it off the books through the magic of money creation from thin air out of a semi secret entity secondary central bank.

Which is why I harp on not paying all that much attention to oil price and oil profits. When you HAVE to have it, you will create the money to get it.

Watcher, you are a very astute student of history. Far better than I, that’s for sure. But I have serious problems with your views on the economy. The price of oil is a very critical part of the economy. If the price of oil is low then the economy booms. If the price of oil is too high then the economy goes into a recession.

Oil is energy. Not our only source of energy but by far our most important source of energy. Our economy waxes and wanes with the price of oil. No other commodity is as important as oil. And the price of oil has a far greater effect on the health of the economy than the price of any other commodity.

We’re not really in any profound disagreement on this matter. And 10 yrs ago I would have probably not disagreed at all.

But the Apocalypse of 2008 changed everything. QE pointed a bright spotlight onto the meaninglessness of money and largely also of economics — and not just in the US. Money pours from the BOJ like water from a cleft rock. The result? The lowest interest rate on gov’t bonds that you can imagine.

There are a lot of folks that point at the early 1900s when the Fed was created as the beginning of all horrors, but I look at what you look at. Oil only began to define all civilization in the 1900s so pointing at something else in the early 1900s as decisive is not all that much an isolated variable.

I particularly watch Mario Draghi and the ECB and their failure to outright execute QE. The Eurozone is in recession now and the temptation must be enormous to go ahead and print the money, but I do suspect it is the Kremlin and not the Bundesbank that forbids it. Money just isn’t all that meaningful. The spigot is.

I pointed to nothing in the early 1900s. I really don’t know why you brought that up, unless it was because Robert brought up WWI.

Money just isn’t all that meaningful. The spigot is.

Are you talking about the oil spigot or the money spigot. But it really makes no difference because oil is money and money is oil… as long as it lasts.

Money makes all the difference in the world. There are rich people and poor people. The difference is money. There are rich nations and poor nations. The difference is money. Oil money drives the petroleum producers to keep the oil flowing.

It was oil and money, or the lack of it, that brought down the Soviet Union. There is nothing more important in the world of economics than money. Oil brings in money. And when you don’t have enough money… why you collapse of course. Men and families become homeless without money. Towns become ghost towns without money. Countries and Empires collapse without money. There is nothing more meaningful to any economy than money.

What Really Killed Soviet Union? Oil Shock?

Empire glue

Oil, however, shackled the whole damn empire together. Cheap petroleum kept eastern Europe under communist control while oil export revenue paid for essential grain imports along with bottles of vodka for state elites.

Oil was sold for money. Money bought grain and vodka. Without money, or enough money, the empire collapsed.

I brought up the early 1900s as the birthdate of the Federal Reserve (1913ish). Money was somewhat backed by gold before that. But thereafter the Fed could create money at will, without regard for how much oil was coming out of the ground or under it.

In Sept 2012 (thereabouts) the Fed embarked on QE3 to the tune of over $1 T per year. Now the US economy, which is supposed to be the underpinning of the currency, did not suddenly become worth $1T more in 2013. There is no gold standard. So what was the basis? Whimsy. Educated whimsy. Bernanke thought another Apocalypse was about to hit so he fired a pre-emptive strike. Those new dollars didn’t have any brand new underpinning. Thin air.

The overall point being, how meaningful can money be when it is created like that.

I’m pretty cool with the idea that oil price increases smash GDP, but let’s keep in mind oil has only been civilization defining for about 100 years. It’s hard to call something only 100 years old some sort of law of nature.

The overall point being, how meaningful can money be when it is created like that.

There is no nation, no currency, on earth who’s currency is backed by anything except faith. The US went off the gold standard in 1971 simply because we were running out of gold, or would have run out in a few more years if we had kept on the gold standard. Our balance of trade deficit was draining the country of gold. Foreign nations were demanding gold in exchange for the dollars we were sending them for their stuff. Read all about it here:

The Gold Standard

The overall point being, how meaningful can money be when it is created like that.

My overall point being that it is the only system possible. It is the system of every nation on earth. No one but no one is suggesting anything different because there is no other way to make the economic system of the global economy work.

If the US existed in total isolation then we could have a gold standard. But once the global economy came into existence, to the extent it became a global economy in the 60s, it became obvious to everyone that a gold standard was impossible. All the gold started to disappear. Imagine the calamity that would take place when one day all the gold was gone. A nation on a gold standard without any gold!

The gold standard was eased away from and then ejected outright for pretty good reason — it restricted GDP growth explicitly to mining output. If you don’t mine more gold, you don’t have more money and the economy chokes.

But . . . the replacement was whimsy. Create what you want to create, regardless of need. Create it if you guess that’s what you should do.

Oh ya, with 7 billion people walking around you need a medium of exchange, you’re dead on right on that — but do we really think the People’s Bank of China operates on the same ground rules as the Fed in what amounts they think they should create? Or BOJ? It’s all whimsy.

The reason why Germany was able to get up so quickly was that they actually had the resources and the industry. The crisis of 1929 was mainly an “organizational” crisis… there was more than enough cheap resources and real physical investment capital everywhere, it just wasn’t well distributed and allocated. The Nazi dictatorship enabled limitless directed allocation of capital (real capital, not money) into infrastructure and war preparations. Similarly how the New Deal in the USA was used to build huge infrastructural projects.

Try: The Wages of Destruction by Adam Tooze for a comprehensive explanation of how Naxi Germany financed its military before and during the war. http://www.theguardian.com/books/2006/aug/12/featuresreviews.guardianreview16

Fed actions help to keep down / bring down interest rates on debt encouraging individuals and companies to take on higher debt burdens.

Quantitative easing is also not only reserved to buying government bonds (as far as I can see). Mortgage backed securities are also bought which means money flows straight to the banks who then lend it back out in to the economy at large (although not all of it). The money doesn’t just float about in the U.S economy but is sloshing over in to developing economies. Between 2009 and 2013 Peru’s dollar reserves increased by $35 billion, more than a twofold increase in reserves. Some of that will be natural but Peru’s economy was growing well prior to the crisis and didn’t see such massive investment back then.

Further Fed stimulus could feasibly stimulate more development of wells if investors perceive that they will have a high return. Further Fed stimulus will be unlikely (in my opinion) as from what I can gather each round is less effective than the last, also there are fears about the negative effects QE is having such as a ludicrously high stock market.

“Mortgage backed securities are also bought which means money flows straight to the banks who then lend it back out in to the economy at large (although not all of it). ”

No, not all of it. Not even most of it. In fact, the tiniest of fractions.

The Excess Reserves deposit by member banks at the Fed now amount to a total only a few hundred billion less than the total amount of QE since the start of QE.

In other words, the Fed bought the worthless mortgages for 100X their value (in the MBS entities) and the banks took that money and redeposited it at the Fed as Excess Reserves, on which they are paid 0.25% annual interest.

It’s not very stimulative when it leaves the Fed and then returns to the Fed.

The main reason for TARP (Troubled Asset Relief Program) was to prevent banks from going bankrupt. They had assets (like mortgages ) on their books which were difficult to value. The way tradable assets like mortgages are valued is that you send a list of the securities you own to counterparties who will send you back a price list of what they’d be willing to pay for it. Usually there are “indicative” bids and real bids. The “indicative bid is a price which the counterparty would hypothetically pay for the asset assuming all else was all right. Mortgages specifically are usually not prices on a dollar basis but on a spread basis: for example: the FNM 98-27R (a specific tranche of a pool of mortgages) is prices as +27. What that means is that the counterparty will price is such that it will yield 0.27% over the yield of a reference 10 year UST bond. As such bonds are priced at a specific time (because prices move all the time) and settle date (because interest accrues every day). In 08 most people who had any inventory in those bonds were not trading them and not quoting them because they did not want to have to honor any quote – markets were too unstable. That in turn messed up the repo market where those mortgages were no longer acceptable collateral for loans because of the uncertainty of what their market price was.

The Treasury through the Federal Reserve then stepped in and bought those bonds at values which by any measure were considerably higher than market price (but there often wasn’t really a market price) as a way to free up cash for banks.

What may have made more sense with 20/20 hindsight was to engage in a repo where the Fed would buy all those bonds with an obligation for the banks to buy them back at some time hence. However, that may have not been enough because at that point in time there was a real sense of doom and as it turned out a number of financial institutions in fact disappeared. Although the whole TARP program did not seem fair I don’t know how much of a choice the government really had. Where they did strike out is/was the lack of regulation and control which could have been enacted afterwards.

Rgds

WP

Will America’s love affair with the Nazis ever end? These comments are so bizarre and otherworldly.

It is generally argued by a lot of historians that the treaty terms that came with the end of WWI were a direct and major cause of WWII.

I am only an armchair historian but i have spent many an evening reading history rather than watching football or the Simpsons or whatever and I agree with that assessment.

The treaty was in great measure, maybe even primarily responsible for the awful economic troubles wracking Germany even before the depression started and these troubles in played a very large part set the stage for Hitler’a rise to power.

I personally believe that Hitler would never have made it to the top if the treaty had been realistic in terms of Germany’a ability to pay reparations.

Now as to the causes of the crash and the Depression– about the only thing to the best of my knowledge that is generally agreed on by historians and economists is that neither the crash nor the following depression resulted from actual physical shortages of natural resources on a world wide basis.

It is true however that these resources were unequally distributed and that once the dogs of competition are loose and the dogs of war are straining at their leases actual fighting ensues quite often.

I have pointed out often that although Germany was float broke in the conventional sense She still managed to build the most powerful war machine that ever existed in a short period of time . So far as i am concerned this is all the proof needed to make my case in contending that once the fecal matter is well and truly in the fan that a country such as the US need not collapse as the result of financial mismanagement or trade issues– if the country is big enough and powerful enough and well enough endowed with natural resources to go it alone.

It is debatable whether this country haas sufficient resources to go it alone from this point forward but it is absurd to think we really need Chinese consumer goods except on a short term basis.We used to make our own and we can do so again. Ditto everything else that really matters.

We could get by on our domestic oil production if we had to- Europe gets by on about that much per capita.The only thing really stopping us from really getting busy on energy conservation and efficiency is complacency and inertia.

The bricks of reality that are going to be smacking upside our heads in the not so9 distant future will work wonders in doing away with that complacency and inertia although ” upside the head”the wake up call may come too late.

“So far as i am concerned this is all the proof needed to make my case in contending that once the fecal matter is well and truly in the fan that a country such as the US need not collapse as the result of financial mismanagement or trade issues– if the country is big enough and powerful enough and well enough endowed with natural resources to go it alone. ”

Yup. A Lehman redux is not going to take The System down. We saw how it can be addressed. Just create money and pay off the debts. Bail out the banks and keep the wheels turning.

Seriously, when did anyone last find within themselves the silliness to mention monetary “moral hazard”. The phrase has become laughable.

What takes The System down is gonna be oil scarcity. The Fed will definitely TRY to print barrels, and so will the BOE, BOJ, ECB and PBOC. They’ll THROW money at oil fields. But they’ll fail.

Argentina moves to cut out the sociopathic blood suckers:

http://www.theguardian.com/world/2014/aug/20/argentina-cut-hedge-funds-lenders

We will se how the global elite reacts.

The whole idea of paying back what you borrowed is crazy….

Rgds

WP

What takes the system down? Enough people around the world getting tired of financial repression via central bank induced monetary inflation.

Argentina seems to be pioneering resisting financial repression.

I was there not too long ago, and things seem to be going along fine.

It has a small, well educated and very politically literate populace, with massive resources.

It only looks bad if you are a neoliberal economist, and then the box is small enough.

Record Decline Of Ice Sheets, Except East Antarctica

The results reveal that Greenland alone is reducing in volume by about 375 cubic kilometers per year.

“When we compare the current data with those from the ICESat satellite from the year 2009, the volume loss in Greenland has doubled since then. The loss of the West Antarctic Ice Sheet has in the same time span increased by a factor of 3. Combined the two ice sheets are thinning at a rate of 500 cubic kilometres per year. That is the highest rate observed since altimetry satellite records began about 20 years ago,

Here Comes Cheaper Oil: Why Prices Are Set to Fall

[Excerpt from article]

On July 14, 2008, with oil prices at all-time highs of $144 a barrel, then-President Bush approached a microphone and announced that the executive moratorium on drilling on the outer continental shelf (OCS) would expire. Oil prices dropped 8% as he made the announcement and they never recovered.

Then after a violent 30% rally that September, Nancy Pelosi buckled and announced an end to the congressional moratorium on drilling. Oil prices fell from $120 the day she made the announcement to $66 per barrel by December. Here’s the kicker: neither of these announcements actually ever manifested as anything more concrete than hot air. I acknowledge that the great recession was underway but initially, oil prices defied that unfolding catastrophe.

I use these examples to illustrate how just the threat of a policy action can drive prices. Now, let’s discuss what just happened that I think will drive prices lower in the future.

The Bureau of Energy Management announced two weeks ago that for the first time since 1983, the U.S. government would allow seismic analysis of the outer continental shelf off of the southern Atlantic coast. This is a significant policy change. Meanwhile, Mexico is hurriedly engaging foreign private companies to help them exploit their huge reserves.

Oil prices have a long way to fall if this continues.

Somehow, falling demand and rising supplies have failed to reduce oil prices. In fact, this is the longest period ever that gasoline prices have remained above $3.00 per gallon despite the weak economy. Turns out the U.S. government’s moratorium on drilling for oil where it’s cheap and plentiful has created scarcity of low cost fuel.

The U.S. is projected to surpass Saudi Arabia in production due to fracking. But despite its abundance, oil obtained from fracking is not the answer to lower prices because it’s so expensive to produce – $70 to $90 per barrel. This is over 3x the cost of oil derived from areas currently off-limits to drilling – many billions of barrels lie accessible on Federal lands in the ANWR and in shallow water on the outer continental shelf as well as in the Eastern Gulf of Mexico.

Turns out that Democrats from Atlantic coast states like Virginia, rich with offshore oil deposits, are under political pressure as we near midterm elections. It was Governor Terry McAuliffe, along with the state’s two Democrat Senators that pushed the state department to allow exploration off Virginia’s coast. I say this while acknowledging that Republican George H.W. Bush first imposed the moratorium on drilling in the OCS (proving that bad policy is not restricted to one party). The fact remains that political forces are driving both parties to move towards liberalizing oil development right now and if the Republicans take the Senate in November, the move toward liberalization will accelerate.

[End of excerpt]

“The U.S. is projected to surpass Saudi Arabia in production due to fracking. But despite its abundance, oil obtained from fracking is not the answer to lower prices because it’s so expensive to produce – $70 to $90 per barrel. This is over 3x the cost of oil derived from areas currently off-limits to drilling – many billions of barrels lie accessible on Federal lands in the ANWR and in shallow water on the outer continental shelf as well as in the Eastern Gulf of Mexico.”

So they are saying that Producing oil from ANWR and the Eastern Gulf of Mexico would cost from $24 to $30 per barrel.

Ladies and gents, if you look carefully through the early morning mist rising from the valley where the rainbow framed waterfall cascades from the snow capped mountains on to the verdant plains below, you will see the herd of invisible pink unicorns peacefully grazing by the banks of the beautiful river of dreams flowing swiftly by…

The only thing in the way are those evil, hippie, peacenik, commie, greenie weenie environmentalists! So step right up and grab a torch and a pitchfork, only $9.99 ea. at your local Wallymart, (they accept all major credit cards with 29.9% APR), Load them into your plant food producing, multi ton SUVs and pick ups and go bust some ass! You’ll be doing your patriotic duty and you’ll feel much better afterwards!

Hi Fred ,

Ya got it all right, actually perfect, except the river of dreams flows gently and runs deep. Take it from an old long hair who knows , lol.

Maybe you can expand on this comment and work in a bit about how well the moonshine in gasoline ( in combination with gasoline fumes) works as a hallucinogenic narcotic.

But you are going to be remembered for the duration by literary historians for this one comment alone.

OFM,

LOL!

As for “…the river of dreams flows gently and runs deep.”

Methinks, that this is only true for those who are still deep in the dream state!

For the few of us who are up in the mountains and can see the whole valley bellow us, we see where the channel deepens and the waters pick up speed and where the white foam swirls around the big rocks. We can also see where the river suddenly disappears in gigantic clouds of spray over the edge of a huge cliff.

So, warily warily rowing their boats, not so gently down that stream above the cliff, will be a very rude awakening for those folk who are still dreaming, they will find out the hard way that life, IS NOT, but a dream!

I’ll see what I can do about entertaining future literary historians with a story or two about those hallucinogenic moonshine and gasoline fumes >;-)

Cheers!

Fred

Hi, Fred, good to see you and OFM and a few other of the good ol’ boys from the Oil Drum every now and then.

But, gotta make a correction to your great remarks- sorry, we ain’t up on a mountain, just on a real big rickety mast sticking up on the same boat as everybody else, and going over that cliff up ahead, only advantage we have is that we might hit the rocks on the bottom a couple of split seconds after all the others have done gone and splat.

Hi there wimbi, good to see you here as well! Yeah, I’m afraid you are probably right… Anyways how’s that bicycle drive train idea, you were working on, coming along? You might like this foldable spokeless bike

That is some nifty engineering!

Tis indeed! here’s a link to the young italian designers info:

http://www.sadabike.it/en/about-me/

Neaat! I will ship this one off to my business type son in Portland OR, bike capital, who is now doing the engineering on that transmission, I having finished the R&D part.

The variable transmission turned out to be a winner- light, smooth, automatic, wide speed range, and real cheap- no gears, no chain. Son is aiming at the geezer trike market, so as to sell at absurdly high profit.

On that boat back up there-

“From up that mast we gave the warning shout,

Now down off our perch and turn the boat about.”

“Son is aiming at the geezer trike market, so as to sell at absurdly high profit.”

let me know how that works out. There might be a geezer trike market down here where I live in south Florida.

BTW, Do you think that variable speed transmission could be adapted to my bamboo bike?

meant to add this picture

VT will fit anywhere standard derailleur will fit. Best for any bike demanding a lot of grunt work-or having a weak rider.

That Forbes article is cherry picking crap. In July the economy of much of the Western World went into a tailspin and crashed. Oil rallied in September but only slightly before continuing its direction down, right along with the economy. A long recession ensued.

It was not words that caused the crash it was pure supply and demand. Oil prices were bubbly and exuberant because we were in an economic bubble. When the bubble burst then the oil prices crashed right along with everything else.

Forbes column from 2004:

Digital Rules

Capitalism’s Amazing Resilience

Rich Karlgaard, 11.01.04, 12:00 AM ET

http://www.forbes.com/forbes/2004/1101/041.html

Excerpt:

Yergin 10 years later

Back when Yergin used to predict oil prices, I coined the term “The Yergin Indicator,” to-wit, oil prices tended to trade at about twice Yergin’s predicted price level, within one to two years of his prediction. I don’t know how the Yergin Indicator would work, applied to predicted production levels, especially given the long term involved (22 years), but I guess we can at least see how it turns out over the next few years.

In any case, if we assume that the underlying decline rate from existing US oil wells rises to about 12%/year, my ballpark guess is that the industry would have to put on line something like 40 mbpd of new C+C production over the next 22 years in order to hit 14 mbpd in 2036. Or, on average, this would require the industry to put on line the productive equivalent of the peak production rate of Alaska’s North Slope, every year, for about 20 years.

A Shocking Prediction for U.S. Oil Production

http://www.dailywealth.com/2813/a-shocking-prediction-for-u-s-oil-production

*Actual and projected US C+C production (EIA high case):

http://files.dailywealth.com/images/CY-73424653_KSANDS6RQC.png

My comments on US production:

Jeff,

Well, I don’t know. You’re not giving Yergin enough credit where credit is due. 14 mbd isn’t that far off. And with a little luck and a great deal of Funnel Fan capitalism, we might just get there.

So what that Yergin got just about all of his oil forecasts wrong… he’s bound to get one right sooner or later. Which means, the decent thing to do, is give the man a change at redeeming himself.

Furthermore, if other countries took the same approach as Mexico, and counted water as oil for the last umpteen years, it’s very possible to increase overall production for quite some time.

Jeff you see… it’s all in the way we “Account” things. Nothing wrong with making nice charts that shows oil producing increasing towards the heavens while omitting the decline and depletion rate function.

Hell, if Wall Street can MARK TO MODEL their assets… then why can’t the oil analysts MARK TO MODEL future oil production.

steve

Techno optimists are always right until they are wrong.

In the case of oil production rising indefinitely being wrong just once is enough to mean the end of business as usual.

Batting nine hundred is not good enough if the penalty for failure to get on base is having your head removed.

Watch West Point… West Point Liberia that is. West Point is a borough of Monrovia. It is a peninsula, surrounded on three sides by water so it is easy for the officials to quarantine. But the borough holds 50,000 people, all living in very close quarter slum dwellings. And ebola may, just may, spread rapidly through the slums.

Clashes Erupt as Liberia Sets an Ebola Quarantine

Last week, Health Ministry officials quietly turned a primary school in West Point into a holding center for Ebola patients without informing the residents. Over the weekend, hundreds of residents invaded the center, enraged that outsiders were also being transferred there. Their community, they believed, was becoming a dumping ground for Ebola patients. Residents stormed through, running off with a generator and supplies like mattresses, some soaked with the blood of patients who were believed to have Ebola.

Images of West Point Liberia.

I see this as a trial run. If you can’t quarantine West Point then you may as well give up and go home.

Another way the cynic in me sees this, it makes a very good petri dish to see how an out of control ebola outbreak would progress in an uneducated slum. If it burns itself out without major casualties, then we can stop panicking.

http://headlines.ransquawk.com/headlines/us-oil-demand-hits-highest-july-figure-in-four-years-according-to-the-api-monthly-statistical-report-21-08-2014

Great goods from you, man. I have understand your stuff previous to

and you are just extremely fantastic. I really like what you have acquired here, really like what you are stating and the way in which you say it.

You make it enjoyable and you still take care of to keep it sensible.

I cant wait to read far more from you. This is actually a terrific web site.

The NY Times is running an article about the difficulties in producing natural gas in China. Yet another example of shale disappointing the early optimism. Here’s the link:

http://www.nytimes.com/2014/08/22/business/energy-environment/chinas-effort-to-produce-natural-gas-falls-far-short.html

““In the United States, it comes to the surface easier,” said Robert Hockert, a longtime Wyoming shale gas and coal bed methane drilling manager who is now the China country manager for Far East Energy. “Here, you’ve got to work at it.””

Final paragraph. The most meaningful. If you need expertise, you hire it. And even with it, they aren’t succeeding.

I am somewhat of a pessimist in respect to the likelihood of very many Bakken like sweet spots being found any where at all but on the other hand I am only a layman who reads sites such as this one.

Have any really good tight oil deposits been found and proven up outside the US?

By proven I mean that exploratory and test wells are actually producing enough oil to make development likely.

There is a hell of a difference between oil in the bush known to be down there and oil in the truck to be hauled away.

Have any really good tight oil deposits been found and proven up outside the US?

Yes, the Bazhenov Formation in Russia has a lot of tight oil. The problem with it is it will be very expensive to extract, likely at about twice the cost of Bakken production. And the Russian’s do not have the technical expertise nor the proper equipment to do it with. At the present they would have to rely on contractors from the US to do the job. That is not going to happen any way soon.

There are a few other places that would have similar problems.

Permian production gluts forces oil companies to discount crude

“It’s indicating a problem in the transportation system where all these producers in West Texas from Midland out to Pecos are bringing in tremendous amounts of crude production and yet the infrastructure is not there to get it out of here to the refineries that need it and can process it,” said Kirk Edwards, president of Las Colinas Energy Partners. “The producers will be alarmed, because that’s not at all what they are figuring their economics on right now. I could see some people, if that were to persist, holding back on their wells until the costs come back online.”

The Tuesday low reflected a $73.48 barrel price for Midland crude, compared to a $94.48 barrel price in Cushing.

And if those low prices persist for very long they will be cutting back on drilling also.

I guess this means that the lack of infrastructure means that hauling the stuff away is expensive. In other words, the shippers are pocketing the difference.

Note that the article that Ron linked to above also includes the following:

To be sure, many producers selling crude under term contracts were not discounting their crude by that much. Producers with pipeline space secured can sell closer to the Cushing price, said Sandy Fielden, an analyst with RBN Energy. Those include many larger oil companies but they too would have to cut prices for oil that exceeds the pipeline capacity they have.

“It’s only the people who sell it to shippers out of Midland who get stuffed,” Fielden said.

This is mostly a problem with being too successful at producing oil relative to the existing takeaway capacity. Ron is absolutely correct that until takeaway capacity constraints are addressed that drilling of new wells will slow down to a level that will maintain profit expectations. Most oil companies will not invest in new wells when their expected profits are negative.

Generally, the article doesn’t make sense.

If you can’t ship it, how will price change that? Does someone else’s oil not get shipped because the trucks go elsewhere? Do they get cut out of the pipeline because these Permian sources want the pipeline?

Not real clear how cutting the price changes shipability.

Maybe it just doesn’t have in it the same stuff other crudes have in it.

Watcher, the pipeline is contracted for. The contract shippers take up all the pipelines capacity therefore the shippers have to pay to ship it by rail or truck. Of course the pipeline shippers must pay also but the cost of shipping by pipeline will likely be one third the rail cost.

Not real clear how cutting the price changes shipability.

It doesn’t obviously. They are not cutting the price, they are just getting the best price they possibly can at the point of departure, the shipping point.

Every producer of anything must pay shipping cost. If you have a very cheap way of shipping then the more money you make. If your shipping costs are too high then that cuts into your profit.

Yeah, that sounds right.

It also sounds like pipeline capacity is maxed out. Generally speaking, the shale operators are going to need an excuse when it doesn’t flow.

Hi Ron,

Do you have a good grasp of how much of this price differential is due to transportation costs as opposed to the quality of the crude?

I think that in the Permian most of the oil is WTI grade, unlike the Bakken or Eagle Ford where the stuff is usually much lighter. So about all the differential is due to transportation costs. After all, the Permian is “West Texas” where the term “West Texas Intermediate” was coined.

Maybe.

Or maybe Permian shale oil doesn’t look like Permian oil in other rock.

And, of course, per the recent Bloomberg article, the definition of WTI is being “adjusted”.

FYI I just looked for “assay” and “distribution yield” of Permian shale oil.

Nada.

http://www.cnn.com/2014/08/22/world/meast/iraq-violence/index.html

Sunni Mosque massacre, 65 became room temperature. No evidence ISIS did it.

Doesn’t Basra have any Mosques? Maybe they shut ’em all down.

Shi’a militia have shot up Sunni mosques before. It tends to lead to really bad wholesale retaliation.

That’s like asking if Rome has churches. Basra is where they compiled and wrote down the Koran, standardized Arabic grammar and finalized the modern Arabic script by adding vowels etc.

The Talmud, on the other hand, was written in Anbar, mostly in Fallujah. I doubt there’s much left of the Jewish heritage though.

Or anything else for that matter, as the Pentagon claims to have destroyed or badly damaged 12,000 buildings in the second battle of Fallujah. They also claimed to have “cleared” 20,000-30,000 buildings and “entered every room with a boom”.

It seems unlikely that ISIS or the Shi’ite militias will be up to that level of mayhem.

Are Humans Civilized?

…more humans may provide more opportunity for mutation, but there is little evidence to suggest any significant evolutionary mutations have taken place.

I’ve NEVER seen any evidence of “positive” evolution in Humanity. However, I do believe that I have seen evidence of REGRESSION in Humanity – the Human collective mind – to that of destructive resource wars.

…there is absolutely no evidence for civilization, in any form, having existed prior to about 10,000 years ago; whereas humans have been around for at least 200,000 years in almost precisely their current evolutionary state. This means that civilization has existed for about 5% of modern human history. Even then, when we say “civilized” we are really only talking about the types of civilization which encompass a number of key traits – accumulation of surplus; accommodation in areas of dense population; forms of government, also implying hierarchy and power structures; trade beyond the immediate community, and the specialization of roles aside from functional sex divisions.

That measure puts civilization being around for no more than 5000 years, or 2.5% of human history.

Break…

4) Individualism over Collectivism

The term “selfish gene” has been used and misused countless times as a way of justifying individual action by civilized human beings – the claim being that we act in a certain way to benefit ourselves alone because that’s the way we are genetically programmed. Civilization appears to be successful because of the isolating methods used by those in power, urging us to aspire, strive and achieve. Always implicit is for this to happen at the expense of others. Thus, as successful individuals we can uniquely be the best within our social set, or whatever grouping we attach ourselves to. This, we are told, drives humanity forwards towards whatever goals are set for the next stage in our development.

What is never clarified is that human genes, as with all social animals (and, surprisingly, most “solitary” animals) cannot successfully propagate beyond a generation or two in isolation. For one, genetic diversity is required to reduce the risk of dangerous mutations; further, all organisms to a greater or lesser extent, require a level of collaboration in order that the selfish gene pool is successful. The distinction between the gene and the gene pool is critical. Individualism can get you so far, in very particular situations that, usually, require rapid decision making. Collectivism, however, is the only way humans can genuinely thrive for any significant period of time.

And this has been demonstrated repeatedly, even within a civilized environment. As Rebecca Solnit has shown in A Paradise Built In Hell, the natural reaction of even civilized people in crisis situations is to help each other and, in the longer term, build protective communities. We could call this “uncivilized” activity, but really it’s human activity. Collective behaviour is only curtailed where authority is enforced. Humans never evolved to be individuals.

Humans never evolved to be civilized.

Let’s suppose an individual within a tribe has psychopathic tendencies. The first instinct, from a civilized point of view is perhaps that he (for it is predominantly men who exhibit such behaviour) will use their influence to rapidly establish power over the tribe. There are two flaws here. First, the concept of “power” in an ancient tribe is a non sequitur – there are no structures to ascend, beyond titular leadership, no ladders to climb, so there would have to be some kind of precedent to first establish the concept of power. Second, such obvious behaviour that could easily be hidden in a civilized society as “mere” ambition would be anathema to the collectivism of the tribe; thus such a person would likely find themselves ostracised or even banished.

So, how could psychopathy work in an uncivilized context? As we have seen, any activity that does not benefit the whole community is not an evolved response to a situation. But, what if certain non-collective activities could be sold to others as being of longer term benefit to the tribe? In other words, could a person driven by personal gain persuade others to do things that could benefit that person alone, in the belief that everyone would gain from these things? This is tricky as there is conflicting evidence as to whether ancient societies had (have) a concept of the future, but there are societies that do exhibit a greater level of forward planning for whatever reason, for instance forest “gardens” and more established settlements. This type of environment would provide a better platform for the psychopath than tribes that predominantly live in the now. So, it may be that a select group of hunters are instructed to stockpile food for themselves, rather than the whole tribe, in the belief that some hunters need to be better fed. In lean periods those select few would be stronger and, as a result of there being less food available, the remaining people weaker.

Uprooting Civilization

Humans simply don’t belong on The Planet Earth. It is WE, who are UnWorldly. We are NOT a product of some murky and mysterious “evolutionary process” – but the desire to transform The Planet for our purposes will likely destroy The Planet.

Perhaps Humans are the cockroaches of the Universe. Because life is not, in th eUniverse, limited to the Planet Earth.

Evolution of Life On Other Planets: Even the Gods Have Gods

A little knowledge is a dangerous thing- often more dangerous than outright ignorance.

Who ever wrote this twaddle had a strong desire to impose his own thoughts and prejudices on the known facts and has mistaken a whole bunch of facts in a material manner.

Cultural evolution is Lamarckian in nature.Once culture reached a certain stage of development it could grow like a wildfire.We don’t know yet why it took ”modern” culture aka as civilization so long to take root after we evolved into our modern form but we most certainly had culture in previous to the rise of writing and civilizations capable of leaving records and monuments and old cities to be excavated.

( Lamacrk incidentally was a very serious and capable scientist and almost everything any body in or out of academia has heard about him is wrong.This is not to say somatic evolution is Lamarckian, it is not.Anybody interested in knowing the true story of the evolution of evolutionary theory itself should read Gould’s The Structure of Evolution. It is about 1200 pages of dense prose and pretty dry going but it is no doubt the definitive history of evolutionary theory up until the date of publication.)

When people learn something or devise a new way of organizing themselves the new knowledge and method can spread by imitation meaning it can spread as fast as a wild fire.This is Lamarckian type evolution in action.

We often use words like progress and regression and higher and lower in discussing evolution but in actual fact these terms mean nothing whatsoever to a serious biologist except as handy shorthand terminology.

People in the social sciences and humanities very seldom ever understand this critical fact.Evolution does tend to produce more complicated organisms under certain circumstances which we refer to in shorthand as higher and simpler ones under other circumstances which we refer to as lower.

But there is no meaningful information imparted in evolutionary terms in describing a human being as a higher organism than an earthworm. We are different creatures that evolved to fill different niches in much different niches in the environment.

Now as far as life in the rest of the universe is concerned- I personally believe the odds are extremely high that life does exist in many places and that there are probably other life forms out there that have developed technological civilizations.

The known universe is an awesomely big place. You can see over ten thousand galaxies in a picture taken with a big telescope thru the minuscule space framed by the bucket of the Little Dipper and each of those galaxies has billions of stars.Many billions on average.

But as far as actual evidence of extraterrestrial life is concerned- so far we have absolutely none.We have plenty of speculation and that is it. Period.

Physical evolution- meaning the evolution of bodily form – is not directional in any meaningful sense except that more complicated forms can sometimes out compete less complicated forms and displace them in the environment.But there is no master plan for any species to continue to get better and dominate. Evolution is a blind and random process that simply selects winners thru survival of the fittest on a statistical basis. If a randomly evolved design works well it may dominate for a time- and then it may very well vanish when conditions change.

Humans may very well do themselves in thru being so successful that we over run and destroy the environment that supports us. IF we perish nature could not care a rats ass less. Nature is not capable of caring.It strictly evolutionary terms, in strictly biological terms, the rise and fall of any given species or even whole branches of life such as the dinosaurs means nothing at all- nada.

This sort of thing only matters to us.When we try to make it matter to a non living non thinking non judgmental statistical process such as evolution we are making a fundamental mistake.

We can say it ” matters” to a song bird or a rabbit but it ”matters” to those organisms in the same sense that the eruption of a super volcano or an asteroid strike matters.

“Anybody interested in knowing the true story of the evolution of evolutionary theory itself should read Gould’s The Structure of Evolution.”

LOL! I own a copy and have to say, it is one of the best paper weights I’ve ever had >;-) I do kinda miss old Steven though. I especially used to like his monthly columns in Natural History magazine.

Skip the first 500 pages to get to the good part, as I recall. Also the book’s title is completely unjustified.

This is not to say somatic evolution is Lamarckian, it is not.Anybody interested in knowing the true story of the evolution of evolutionary theory itself should read Gould’s The Structure of Evolution.

I cannot agree. No doubt Gould was an evolutionary giant, he had his quirks. He let his socialist politics interfere with his science.

Gould was an early hero of mine. One of the first books I ever read on evolution was his “Ever Since Darwin”, a collection of his essays from the magazine “Natural History”. He published several other books of essays from that same publication. I have read most of them and loved most of them, but not all.

Gould could never accept the findings Edward O. Wilson, Stephen Pinker, Richard Dawkins or any of the other many Sociobiologist. He rebelled against it with his book “The Mismeasure of Man” and wrote the introduction to the behaviorist book “Not In Our Genes” by R. C. Lewontin, Steven Rose and Leon J. Kamin. He was a behaviorist to the enth degree and simply refused to accept that any characteristic of human behavior or human ability was genetic. To my way of thinking that is an unbelievable position for an evolutionist to take.

I, along with a lot of others, believe this was due to his Marxist philosophy. Now I am a liberal myself but science is science and when science conflicts with ideology, I try as best as I can to come down on the side of science.

For a better definition of Gould’s position versus Sociobiology, see the following book.

Dawkins Vs Gould: Survival of the Fittest

An international bestseller when originally published, this brand-new and completely revised edition updates the story of one of science’s most vigorous arguments. Science has seen its fair share of punch-ups over the years, but one debate, in the field of biology, has become notorious for its intensity. Over the last twenty years, Richard Dawkins and Stephen Jay Gould have engaged in a savage battle over evolution, which continues to rage even after Gould’s death in 2002. Kim Sterelny moves beyond caricature to expose the real differences between the conceptions of evolution of these two leading scientists. He shows that the conflict extends beyond evolution to their very beliefs in science itself; and, in Gould?s case, to domains in which science plays no role at all.

Evolution of Life On Other Planets:

I watched most of this video. It is one of the biggest loads of horseshit I ever tried to sit through.

Steven Pinker, on the other hand, argues that although the 20th century was pretty violent in absolute terms, the numbers of victims of violence has not kept up with population growth, meaning mankind has gotten much more peaceful.

And despite the endless brouhaha in the American media about the political mess in the Mideast, the world has gotten a lot more peaceful since the end of the Cold War. Look at the numbers of murders and battle deaths at gapminder.org.

“…more humans may provide more opportunity for mutation, but there is little evidence to suggest any significant evolutionary mutations have taken place.”

That statement is 100% false! One can’t make something up out of whole cloth and attempt to present it as fact! There is plenty of evidence that modern humans are evolving and there are myriad documented evolutionary mutations that have taken place in the last few thousand years, I’ll cite lactose tolerance as but one.

Please, do yourself, and the rest of us as well, a favor and at least do a Google scholar search before posting such pablum.

Fred, many evolutionary changes have taken place in man, since the dawn of modern man some… many thousands of years ago. Lactose tolerance is just one of them. But I doubt that modern man has undergone many changes unless… well I won’t talk about that.

But in times of plenty, which has been responsible for the population explosion, natural selection loses its grip. After all, when almost everyone survives then not only the fittest but the also unfit survives.

Natural selection works the fastest when only a few progeny survive. When only the fittest survive, or in most cases that is.

“But in times of plenty, which has been responsible for the population explosion, natural selection loses its grip.”

Yes, but… We’re only talking about a period of roughly 200 years there. Modern man has been around for about 200,000 years or so and we do have clear evidence of evolution during that period and more importantly, in very recent times.