The Texas Rail Road Comission has has released their production numbers for March. The data is always incomplete and the most recent data is always the most incomplete. Nevertheless one can glean quite a bit from the data even though it is incomplete.

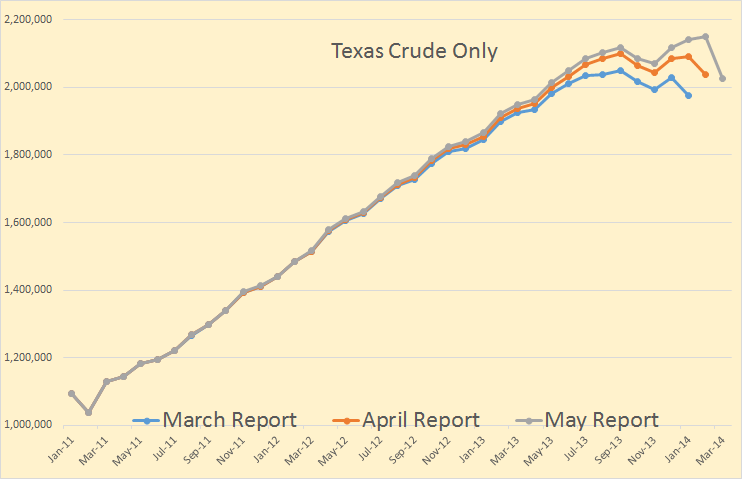

The May Report has data through March, April through February and the March report has data through January. You can see from this chart how Texas upgrades their data as data comes trickling in.

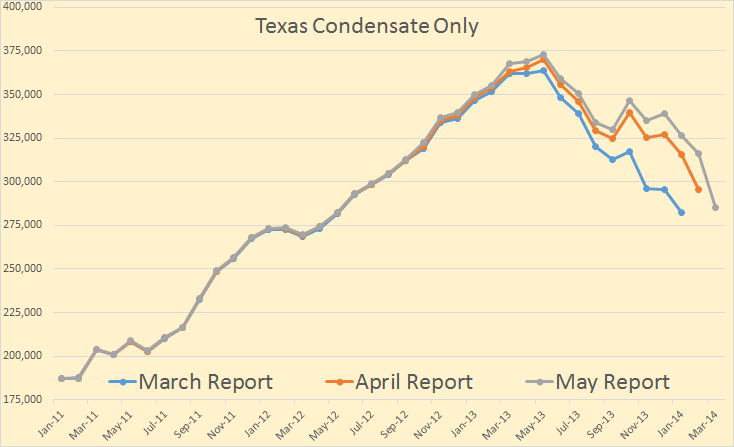

I looks like Texas condensate has peaked. May 2013 is the peak so far. October 2013 is creeping up but I don’t think it will overtake May. Regardless of whether May will be the ultimate peak or not there is no doubt that there has been a dramatic slowdown in Texas Condensate production.

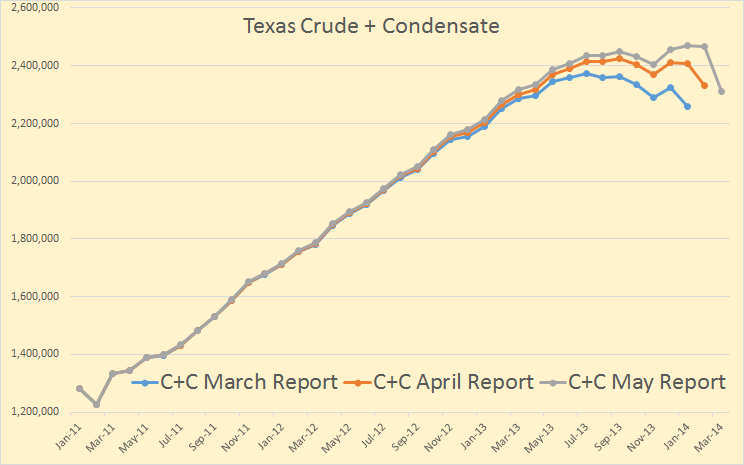

Combine the two and we get what the EIA counts as C+C. C+C has not peaked but I think the increase in production is slowing down.

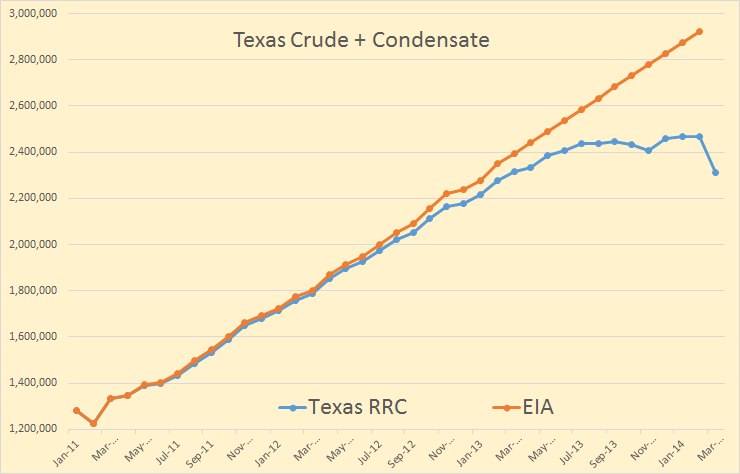

The EIA data is through February while the RRC data is through March. But you can see that the EIA has Texas on a straight line increase for one full year. No doubt the RRC data will keep inching up but I don’t think it will ever reach the EIA’s estimate of where it will wind up.

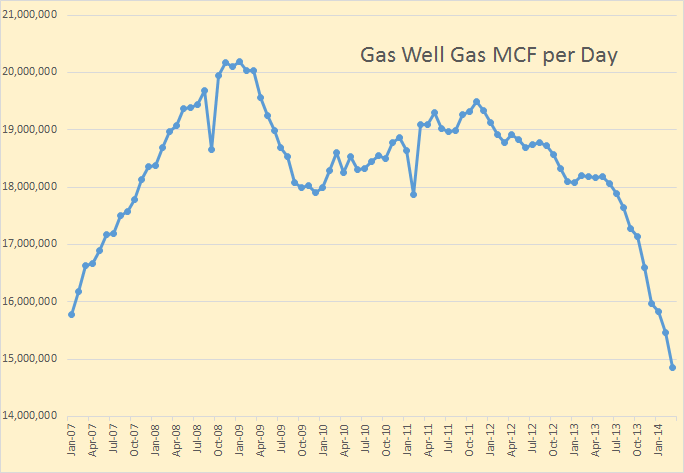

Here there is no doubt that Texas Gas Well Gas peaked back in the winter of 08 and 09. It is down about 25% from that high and still dropping every month.

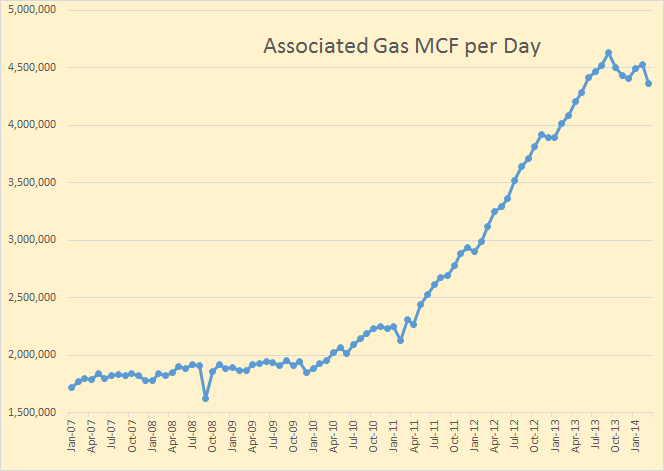

Associated gas, or what the RRC calls casinghead gas, likely has not yet peaked. However it is obvious that something happened back in October. Things are changing in the Gas fields of Texas and it is not for the good.

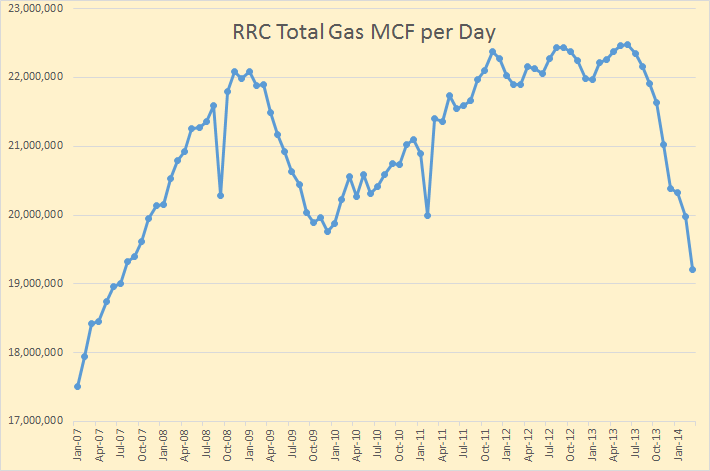

The increase in associated gas is has not been nearly enough to keep gas production increasing in Texas.

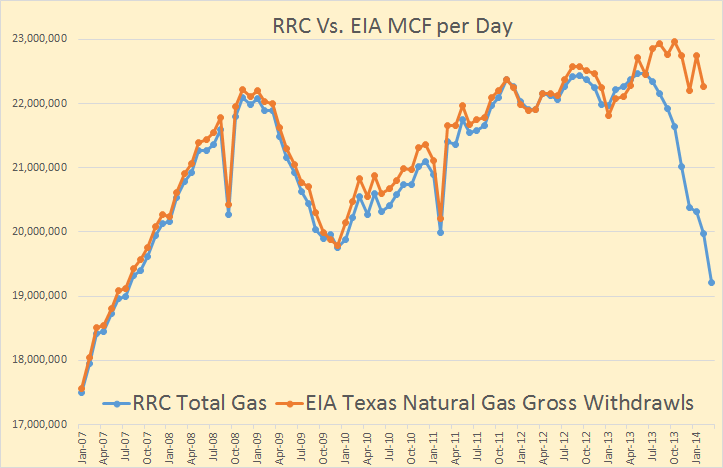

But I decided to see what the EIA said about Texas production of Natural Gas. Their data can be found here Natural Gas Gross Withdrawals and Production. (Then download the Excel data for individual states.)

The data is pretty close up through June 2013 then it suddenly diverges. That is very strange. I don’t think that can be explained by the EIA trying to compensate for the RRC’s delay in reporting. Some of it can but not that much.

Other news: This article states that not just the UK but the entire European Union is running out of fossil fuel:

Fossil fuels: UK to ‘run out of oil, gas and coal’ in five years

The UK is set to run out of its oil, coal, and gas supplies in a little over five years, a new report had claimed.

The research from the Global Sustainability Institute has said that other European countries are facing similar shortages and that many nations will become entirely dependent on energy imports in the next few years.

“The EU is becoming ever more reliant on our resource-rich neighbours such as Russia and Norway, and this trend will only continue unless decisive action is taken,” said Dr Aled Jones, the director of the institute.

This interview with former BP geologist, Dr. Richard Miller was published by Resilience.org back in February. I don’t know how I missed it until now but it is one of the best things I have read in years:

“Peak is dead” and the future of oil supply

Q: You’ve also been quoted as saying that “we’re probably in peak oil today, or at least in the foothills. Production could rise for a few years yet, but not sufficiently to bring the price down. Alternatively, continuous recession in much of the world could keep demand essentially flat for years at today’s price of $110” [the Brent price]. Yet there are several commentators who believe that prices are setting up for a modest decline. If prices did drop, say $20 over the course of a year, what impact do you think that would have on world oil supply on down the road?

Miller: I think you first have to ask yourself, why would the price fall? You have two possible reasons. One would be an increase in supply of cheap oil. The other would be a decline in demand—a continuation of the current recession. If the price does drop $20, I think it will be more of a signal that world economies are floundering and demand is sinking.

I suspect what we’re looking at into the future is a long set of short-term oil price and economic cycles. At the moment, the US economy is pulling a bit ahead, and the extra oil that involves is probably being produced by shale oil, so it’s not putting an extra load on global demand. But if the European economy tried to pull ahead, it would pull up oil demand, and that would be enough to raise the world oil price. And I think we’re probably operating at the maximum price that we can afford at the moment. If the price goes up, the economy slips into recession, demand goes down, oil price goes down, people start buying more oil and the economy goes up again. It becomes an oil price saw tooth that will probably never quite fall as low as it was before, it always keeps the price generally trending up.

I believe that gross gas withdrawals includes things like gas being “recycled” for pressure maintenance, e.g., injected back into a gas cap in an oil field. Where we don’t have dry (processed) gas data, I would go with marketed (wet) gas data. The EIA shows Texas annual marketed gas production as basically being flat from 2012 to 2013, from 20.4 to 20.2 BCF/day. Note that they show a 20% decline in Louisiana’s annual marketed production, from 2012 to 2013.

An item linked on Drudge:

Dozens of Texas communities with less than 90 days of water

http://www.khou.com/news/texas-news/Dozens-of-Texas-communities-with-less-than-90-days-of-water-259782111.html

Jeff,

It would be nice to get some straight unbiased information on the groundwater situation in the Central and Western US. I’ve seen everything from drought/doomsday to cornucopia predictions and not very much in between. Sort of reminds you of oil and gas? I would guess the “less than 90 days of water” report fits neatly into drought-doomsday category?

Doug

Of course, all water is recycled, but Wichita Falls is getting desperate:

http://www.npr.org/2014/05/06/309101579/drought-stricken-texas-town-turns-to-toilets-for-water

(Of course, significant volumes of frac water are lost to the water cycle every year.)

I got to wondering about checks to people with mineral rights to the gas. Are those checks that late in being sent out? Are the checks covering all of the production – Implying that the information has to be available? Or is the Texas RRC just slow in compiling and posting the information or the producers that late in supplying it to the Texas RRC?

Some thing just doesn’t seem right to me? Maybe you or Jeffrey Brown can lend some insite to the royalty payments schedules?

Royalty, and working interest, owners are usually paid two months after the monthly gas production, so gas payments in May would be for March production. They are paid on the basis of gas produced and transported off the lease premises. A big dispute right now, especially in regard to Chesapeake, is in regard to transportation/marketing charges deduced against royalty owner’s payments.

For oil, royalty owners are usually paid one to two months after production. It depends on whether the purchaser or the operator distributes the income.

A recent Fort Worth Weekly article on royalty payment deductions:

http://www.fwweekly.com/2014/04/16/royalty-rip-off/

Definitely worth reading Jeffrey’s link .

More Trivia: Arctic Oil/Gas

There are 19 defined geological basins in the Arctic region: One has experienced intense oil and gas exploration, the North Slope off Alaska where oil was first produced in 1968. Half the basins, including the Beaufort (Canada) and the West Barents Sea (Norway and Russia), have been explored to some degree.

A study describing Arctic potential concludes that the likely remaining reserves will be 75% natural gas and 25% oil. This study, carried out by Wood MacKenzie, highlights four basins that are likely to be a future focus of industry: Kronprins Christian (Kronprins is off northeastern Greenland and belongs to Denmark), the southwest Greenland basin, (proximity to markets), and the oil-prone basins: Laptev (Russian) and Baffin Bay (located between Baffin Island and the southwest coast of Greenland.

http://en.wikipedia.org/wiki/Wood_Mackenzie

Meanwhile, closer to home, the Mackenzie Valley Pipeline has been proposed to transport gas from the Beaufort Sea through Canada’s NWT to Alberta. The project was first envisioned in the 1970s: Estimates suggest there are natural gas reserves of 1.9 trillion cubic metres (or meters for Yanks) in the Beaufort. The pipeline, which would go south through the Mackenzie Valley and continue south to Alberta, is currently on hold owing to low gas prices. There has been talk of a potential Alaska gas pipeline as well.

@ Doug Leighton. re: More Trivia: Arctic Oil/Gas, mackenzie ipeline

we were drilling the river crossings for that pipeline north of fort simpson in early 1974… drilling through the ice before breakup…

in a noisy bar in norman wells, i tried to call you

she snuck up from behind, swung round and punched me hard in the nose… the crew laughed

she nuttered something about “wise-ass you-all white guys” and went back to her beer

i shoulda bought her a sandwich

he lived in a willow patch on a sand bar 110 or 20 milles north of simpson…i’d see him every trip, up to six or eight trips a day…

then one day i see these guys walking up the river… the next trip, they had the moose down, and the trip after that, it was as if nothing had, except the moose was gone

there was something real impressive about the efficiency of the operation

wadosy,

I’d be surprised if our paths haven’t crossed: Perhaps you climbing out of an old Beaver (or Otter) while I waited to board; or vise versa. Regardless, I enjoy your poetic banter: a skill I’ve never had.

Doug

i’m uneasy with that sandwich joke

Ron, thanks for these updates, but I do find the revisions and difference between the RRC and EIA difficult to fathom. The RRC data seem to point to the Eagle Ford party coming to an end?

FF in the UK running out in 5 years. This is dross written by kiddies that shouldn’t get to go to University 😉

I had a look at Germany, famous for its energy transition that is now failing. 13 charts in all. Don’t know which one to post here. This is the one that intrigues me most – still trying to work out the equivalence of energy and $£€. Next up will be USA.

Germany: energiewende kaput?

Congrats on 1 MM hits, I’m trailing a bit….

Actually those hits are a little inflated. Every time you click on “Continue Reading” or refresh to see if there are any more comments, that’s another hit. WordPress stats says I am getting about 2500 hits per day and distinct visits are likely about half that.

Ah hah, I’m getting about 800 page views / day now. 127,000 since I began 7 months ago. Peak of 2328 / day. Your site is one of my top 5 refers.

My best day, according to WordPress stats, was 3,481 on April 28th. (Is Peak Oil Waiting for Godot.)

Ron,

Alexa.com is a good site that provides traffic data for websites. Your site is doing well globally. It’s up nearly 220,000 spots. Is your site based out of Belgium? It says, you are ranked 4,204 in Belgium. I thought the U.S. would be where most of your readers come from.

steve

No, my hosting site, Bluehost is based in Utah. I did not know I had any followers in Belgium. Most of my readers are from the US but I am sure peak oil is a subject of interest all over the world. Therefore I am sure I get hits from just about everywhere.

There seems to be a lot of international banking and such associated with the Euro zone and so forth located in Belguim.

I would not be surprised if some of the bureaucrats there are checking this site for energy data that has not been scrubbed and polished to suit other portions of the bureaucracy.

Deep thinking – adds a new disinmeon to it all.

well I really like Hoegaarden, but I don’t think it affects my IP address

I am sure 99% is me from Belgium . In the last 8 years have met only 2 persons who were peak oil aware . I ask about peak oil of at least 2 persons (strangers)a working day which means 2×250(working days)x 8 years = 4000 persons . Maybe Janet Yellen has a better answer 😉

I am also reading all your article on a dayly basis. This is one of my favorite site on peak oil. Many people I speak to are now peak oil (and everything) aware. It looks like we are now on the peak. The fracking has given a 5 years delay in peak oil but fracking is also going to peak soon.

Cheers from Belgium

I’m from Belgium as well and reading your blog on a daily basis. I’m aware of our predicament since 2005 and follow peak oil discussions since then. Most of people around me seems to understand that we may have a problem but either they don’t want to talk about it either they totally misunderstand or downplay the consequences of it. I know as well that our federal institutions such as the foreign ministry have absolutely no clue what’s going on regarding peak oil. It seems to me that they rely 100% on IEA reports without being able to read between the lines…

Thank you Ron for your hard work and dedication, and all for your wise comments!

Can’t understand chart.

Watcher,

It came home from a kiddies play school “art” project. I think?

Doug

Are you talking about my chart – a work of art in the making. The general hypothesis is that economic activity turns energy into money. The dashed line is a surprise since it is a line of equal efficiency at doing this (about $12,000 per tonne oil equivalent). Turkey and Portugal are just as energy efficient as Germany in that regard, but since Germany uses more energy it is wealthier on a per capita basis. To become wealthier, Turkey will need to raise its energy consumption, a lot.

The data are time series from 1980, starting at the bottom and rising (normally). Many countries show what I expect, rising energy consumption is required to create growing GDP (GNI PPP). But not in the mature OECD economies.

“The general hypothesis is that economic activity turns energy into money.”

If a man puts out effort (energy) he potentially gets paid money for working. To work he needs to eat which provides energy so you could argue that food (energy) creates money (via the man). In other words, you could say that his activity (work) turns energy (food) into money. So work is economic activity, right? Selling stocks and bonds is also economic activity, perhaps that’s what you are talking about: This certainly has the potential to move a lot of money about.

Of course, assuming there is extra food floating around; our man could also sell this for money. My understanding is lots of people do this. The Saudis sell lots of energy in return for money which generates a fair amount of economic activity. This “general hypothesis” I can understand. Somehow I thought you started with energy, employed “economic activity” and this generated the money. Of course I’m not an economist and may have this backwards.

But heh, I h’ve got another idea. Why don’t we just generate a bunch of thermodynamic equations, bring in some really confusing esoteric language, create totally bewildering pictures then some of the people might assume we know what we’re talking about? Or, at least they’ll lose confidence in their own “simple” logic.

I bounced this idea off my wife and she thought that I was being small minded. Then she suggested the problem could be tackled with vertex operator algebras (as used in String Theory) but the price is too high: She would have to do the math (economic activity): that means very expensive wine (money)!

So the point seems to be that . . . without specifying the independent vs dependent variable . . . high oil consumption means high gdp. But . . . if you already have high GDP you can hang onto that GDP without oil consumption.

Seems dicey. GDP definitions aren’t constant and a developed country will already have had its entrepreneurs realize that they can make more money if they fire everyone and concentrate on creating phone apps. GDP definitions now include these and so they can hold onto that number despite firing people — who don’t drive to work anymore consuming oil.

Interesting post

I have calculated the nuclear capacity Germany has prematurely retired

http://crudeoilpeak.info/germany-energy-transition

Let’s hope these nuclear power plants are kept in operating condition so that they can be used if need be.

Are they privately owned? Without revenue how can maintenance be funded?

Euan,

I put a post about the failure of Germany’s Enereigwende program on my site a few weeks :

http://srsroccoreport.com/germany-death-of-renewable-energy-bring-on-the-dirty-coal-monsters/germany-death-of-renewable-energy-bring-on-the-dirty-coal-monsters/

Of course the situation is more complex, but to see those huge Krupps 288 Bagger bucket-wheel excavators tear into the earth to remove subpar coal (lignite) to power Germany’s electric power needs is truly an amazing sight.

They moved and leveled more than a dozen towns-village to make way for the expansion of their Western Lignite Coal mines in Germany.

The town of Immerath was the latest victim where 900 inhabitants were relocated to make way for the Massive Garzweiler II open-pit lignite coal mine expansion.

steve

Steve, awesome pics. I don’t fully understand why the Germans do this. They could easily afford to import this coal. Or to use nuclear power. To my mind this is environmental total destruction.

Which is more important for our energy future:

1) failure of Germany’s Enereigwende program

2) failure of Monterey Shale oil

I can see huge implications for both.

IIRC the UK has been a net importer of oil and gas for a good long while now and almost any day you read the energy news you will find articles about the fast decline of North Sea production.

” Out” may be a bit strong but ” desperately short” seems to fit the bill pretty well if you are talking five years down the road.

A 38% fall in UK oil revenue predicted by 2017-18. Production now 1/4 of peak and falling fast. Costs in a upward spiral. Your ” desperately short” is right on the mark.

I expect that if the Germans were relocated to a place with more sun and maybe somewhat better wind resources they would be doing better with their energy transition.

But they have had the choice of spending their money on renewables or consumer goods. They chose renewables. I used to have friends who would spend every last nickel going to see live performances of their favorite bands. Another friend spent HIS money on all the records he could pay for. He still has his vinyl in mostly perfect condition and his record collection is worth a fortune. The travelers have faded memories and faded photographs.

Or they could have spent the money on rebuilding their military industrial complex. We all know what happened the last time they made that choice and were faced with a shortage of oil and other natural resources don’t we?? ??

I have read extensively in the history of Germany and Japan.

Hitler was a mad man but WWII was only incidentally about racism and such matters.

WWII was a resource war first and foremost in both cases.

Now I will not argue that renewables are stressing the books of traditional electricity suppliers.I will not argue that renewables are stressing the grid.

But upgrading the grid and paying the traditional suppliers are not technical or engineering problems. These are just plain old political problems and fixing them requires only that the decision be made to pay for the necessary changes.

Untangling the cats ball of yarn that somewhere in it has the actual costs of renewables is a tough problem and I haven’t been able to do so personally- but I don’t have the accounting and research skills needed for such a job.

But the wind provided over four percent of our electricity last year here in the US. That must represent a savings of pretty close to enough coal and natural gas to have generated that four percent.Multiply that by the minimum life expectancy of twenty years for the existing wind farms and that is one hell of a lot of coal and gas that we otherwise would be paying for as electricity customers.

And while the turbines and generators and gearboxes may not last indefinitely they can be recycled and rebuilt- while the site work permits transmission lines and so forth are there permanently and will require only the same maintenance as any other transmission lines.

Now finding a good estimate of the effect of reducing the consumption of coal and gas enough to account for four percent of the electricity market for those two fuels is another tough nut.But anytime you reduce the demand for a commodity the price will be forced down to some extent.

Now while this effect of reducing price is real thru reduced demand I still expect the DELIVERED prices of both coal and natural gas to continue to go up on a fairly steady basis barring a truly major economic downturn.

Hence the savings from the price reductions of coal and gas brought about by wind and solar power will be lost in the noise- but that doesn’t make them any less real or important.

IF we are lucky and there is not another serious nuclear accident within the next few years I expect the Germans may do the same thing the Japanese are apparently doing- quietly restart their nukes if they haven’t actually dismantled them.

The real question when it comes to the price of renewables is not what they cost but what it will cost to be without them.

There are many strategies that can and will be implemented to help solve the storage problem that can be incrementally put into place.

A smart grid seems to be an inevitability and even if there is no smart grid this does not means there will not be smart houses and smart appliances and meters that can record the time as well as the amount of energy consumed.

So a house with an internet connection can have its appliances programmed to run when the home computer says the wind is blowing or the sun is shining and get the renewables discount. Expensive? No doubt.

But heating oil used to be seventeen cents a gallon and we had single pane leaky windows back in those days and the wood stove was not much used because even at the prices we were getting for our produce and our labor in town it was easier to pay for the oil than it was to gather firewood and tend the stove.

Oil is four bucks now and we have installed insulated vinyl siding and good windows and even thug I am now old and arthritic I am burning wood enough to cut our oil consumption by over eighty percent.

The Snap On tool company has a slogan that is in and of itself priceless.

It goes something to the effect that quality isn’t expensive. It is priceless. Snap On tools generally cost about ten times as much as ordinary ” lifetime warranted ” tools sold at Sears or other retail stores.

But just about every really serious full time mechanic has some and is constantly buying more of them as his finances permit.

Damned old free web hosting – this is a happy joke and not a slight. But an edit function would be nice . Intended to insert a not in the sentences about renewables stressing the grid and the finances of traditional suppliers.

There is free web hosting, Blogspot and a few others, but they are severely limited in what you can do. Bluehost, which I use, is not free. I pay $5.95 a month. The host that carried The Oil Drum was a lot higher but I don’t know how much.

I thought the Texas C+C chart was a joke until I checked the EIA data – since March ’13 they’ve monotonically increased production by 46/48/50 kb/d – 2 months of the 1st amount, 9 months of the 2nd, and now 1 month of the 3rd. So by this simple metric I prognosticate 3674 kb/d – and not one iota less! – for TX in May ’15. Numbers don’t lie! And this will cover the whole US supply gain forecast in the STEO all on its lonesome, too. ND and the GOM can take a break.

Honestly, it looks like an algorithm has become sentient over at the EIA, or more likely someone’s MS Office formula has been left on autopilot. Isn’t this worthy of a story in of itself? Or an email. And perhaps they’re showing equally implausible monthly changes in other data series. I recall some doozies of data revisions in the past, but never anything on the state level that beggared belief like this.

“since March ’13 they’ve monotonically increased production by 46/48/50 kb/d – 2 months of the 1st amount, 9 months of the 2nd, and now 1 month of the 3rd.”

Just another silly model.

“Honestly, it looks like an algorithm has become sentient over at the EIA, or more likely someone’s MS Office formula has been left on autopilot. Isn’t this worthy of a story in of itself? Or an email.”

Suppose it turns out right. Or suppose they make it right by redefining the stuff measured?

No one has anything to gain by them reporting bad news.

I put up a post titled,

CENTRAL BANKS’ BALANCE SHEETS, INTEREST RATES AND THE OIL PRICE

http://fractionalflow.com/2014/05/20/central-banks-balance-sheets-interest-rates-and-the-oil-price/

Looking at the timeline for central banks interest settings, balance sheet growth and the oil price.

“Depletion of oil reservoirs (stocks) and its derivative, declining flows from oil wells, never sleeps.

I am not convinced that those who wish for lower priced oil (thus lower gas prices at the pump) are deeply aware of what they really wish for.

Low interest rates and debt growth (now by sovereigns and “money printing”) are the systems’ response that for some time will abate the effects of higher oil prices.

This looks like temporarily bending The Second Law of Thermodynamics, which is incorruptible.”

Really good analysis with summarization pasted in above. We’re in a pickle. That bending will cause a snap-back (into reality) at some point.

You know, I gotta say, I get really tired of all the criticism directed at the Texas Railroad Commission for not being able to produce all the data that you graph, plot and decline curve guys think you need, when you think you need it. Every barrel of condensate or crude oil that gets produced, lost, spilled, vaporized into thin air, drank or used to lubricate wagon wheels ultimately, always, gets accounted for in Texas. All of it; like money in a bank. If it does not happen on your time frame I suggest you call Uncle Ricky and present a way to fix the problem instead of whining about it all the time.

The difference in 6 months, and 10 months of “accurate” data does not seem like a big deal to me, unless of course there is some kind of Nobel Peak Oil Prize that goes to the guy who says the summit has been reached, stick the flag right…here. Is this a contest?

Its good to make predictions, as long as the message is getting heard by the non-believers. What you guys can’t seem to get is that you muddle the message with the need to predict a peak. In the end, its all speculation and nobody, I repeat nobody, can predict, for instance, what might happen if Texas finally says we are toast down here ( and as Mr. Brown suggests, we are, literally), stop right now using 40 billion gallons per year of human groundwater to frac all these stinkin’ shale wells and start recycling flowback and production water…now. All those great EF decline curve graphs would look like exponential lines straight down in the dirt, with a little poof of dust at the end. Then what?

Unconventional tight oil resource predictions are just one more blowout, or contaminated groundwater resource-bad cement job away from being worthless.

Life is a fluid situation. Relax. Its a finite resource, oil; we are running out. Got it.

God Bless Texas.

Mike,

When did we start running out of oil? This is news to me. What about the 1 trillion barrels of oil shale in the west?

All we need to do is order a few dozen of those German Krupps 288 bucket wheel excavators and start working that oil shale. So what if we have to relocate half of the people in Colorado…. capitalism must go on.

Peak oil…..lol.

Stebe

Stebe, I tend to trust most folks until they prove themselves untrustworthy; that is the Texas way. So I don’t know for sure if you are being rude or actually think I don’t concur with peak oil theories. Let me make myself clear, sir: after 6o years of actually producing the nasty stuff, we are running out of it. No doubt in my mind. The point I was trying to make, that I guess plumb got over you, was about the difference in all this never ending speculating and… reality. Its often just a few months in between. So folks ought not to get their panties all in a bunch about a lag in data.

Holler if you need for me to need to explain that some more.

i think SRSrocco was just being ironic or sarcastic or something… he was agreeing with you

…mostly

What if I like getting my panties in a bunch?

Calhoun has a point- one seldom addressed. People who hang out on sites such as this one are here mostly because they are truly interested in the subject matter.

But there is also an aspect that has to do with interacting with other regulars. Sites like this one are sort of like a neighborhood bar where the regulars show up as much to visit with their online friends.

And we are kind of like sports fans in some ways. Baseball fans are fond of debating statistics. So are some of us.

If your team ain’t winning you can get some satisfaction out of bitching about them losing.

Mike,

Yeah… can you explain somp’em for me. How are we run’ n out of oil if we got trillions of barrels of oil just sit’ n around for easy pickens?

We’ve got more oil here I’m the ground than the entire Middle East.

Stebe

@ Mike

….maybe not

Wadosy,

Pa’lease don’t tell me you’re one of them there peak oilers too? What’s the world come’n to?

Stebe

You know, I gotta say, I get really tired of all the criticism directed at the Texas Railroad Commission …

Mike, get over it. It is our prerogative to criticize whomever we like, whenever we like, whether it tires you or not.

I suggest you call Uncle Ricky and present a way to fix the problem instead of whining about it all the time.

I haven’t a clue who the hell Uncle Ricky is and couldn’t care less. And I am not whining but if I wanted to whine I would do it when I am goddamn ready.

That being said, nowhere in the post did I criticize the RRC. I said the data is always incomplete and it is. That is not a criticism, it is a simple statement of fact. And I will likely remind people who read this blog of that fact the next time I post on Texas.

But we do criticize the EIA, the IEA and the government every chance we get. Texas gets off easy. That should make you proud.

Ron

OTOH why is NoDak better?

The difference is likely that ND includes confidential wells in their state totals and TX does not. It is a pretty simple change that TX could make, but it isn’t important Texans, so it will not change. Just use the EIA data, in the past (about 1 year ago) the EIA estimate was much closer to the current RRC estimate of TX output in March 2013. This may no longer be the case, we will find out in a year.

lol, over and out

German TV Exposes “Gold Price Manipulation Fit For A Financial Thriller” (Don’t think black gold prices are not manipulated either)

Tyler Durden’s pictureSubmitted by Tyler Durden on 05/20/2014 20:46 -0400

While we have done our best to expose the utterly disgusting manipulation that occurs day-in-and-day-out in the precious metals markets over the last few years (how the “fix” is manipulated, who is responsible, and the blowback from European investigations), but mainstream US media remains actively ignorant of exposing these realities (even as another ‘gold-“fixer”‘ gets the ax today). But not the Germans. As the following brief documentary exposes “an examination of gold prices reveals machinations fit for a financial thriller.” With the Germans still wanting their gold back, we suspect this German TV documentary explaining the “lack of oversight.. and serious manipulations of the gold price,” will stir up more than a little public concern about ever getting it back.

http://www.zerohedge.com/news/2014-05-20/german-tv-exposes-gold-price-manipulation-fit-financial-thriller

h/t Koos Jansen

maybe the secret to success is: dont believe in anything, but manipulate everything

“those who are able are obliged to prey on those who are unable to resist”

“whose who choose to be neither prey nor predator are cast out”

To All The Conspiracy Nuts,

I have had it up to here with all this conspiracy stuff. If you can’t see me, I have my hand under my chin touching my neck. That’s how much I am fed up with all the nonsense. Who in the living Hades believes all this peak oil-global warming conspiracy gibber-gagger anyhow?

And to tell you the truth, I am on shaky ground as it is. So, all I need is for some YO-YO to tell me that the U.S. Dollar ain’t worth the paper it’s printed on. Gold manipulation…. lol.

I’m outta here…

God Bless the Federal Reserve

Stebe

Cognitive Dissonance –

Stebe first developed this theory in the 2014’s to explain how members of a cult who were persuaded by their leader, a certain Mr Darwinian, that the earth was going to be destroyed on 21st December and that they alone were going to be rescued by aliens, actually increased their commitment to the cult when this did not happen (Stebe himself had infiltrated the cult, and would have been very surprised to meet little green men). The dissonance of the thought of being so stupid was so great that instead they revised their beliefs to meet with obvious facts: that the aliens had, through their concern for the cult, saved the world instead.

Yep–

Generally speaking I don’t believe commodity prices can be manipulated to any serious extent unless the so called speculator is in a position to control the supply of the commodity in question.

Otherwise any thing bought must eventually be sold and while the speculator may guess right on the direction of the market occasionally he will lose about as often as he wins. And no matter what there is a winner in this sort of game for every loser. A loser for every winner. It’s a zero sum minus trading expenses game.

But now in the case of gold- gold is not an ordinary commodity. Only a very small amount is ever actually used up and lost. I can’t say how much of the gold in the world is owned by central banks and how much is owned, or at least controlled by various large businesses that trade in precious metals, but it must be a significant part of the total supply and it is probably a lot more than half of the total.

Central banks are very powerful institutions able to operate behind closed doors. Some of the traders are able to do that too. Since the central banks are very large and there are only a few of them and they own a lot of gold and the trading houses control a lot I am willing to believe that the price of gold can be manipulated to some extent.

But I nevertheless believe the price of gold is basically controlled by fear. When people are afraid of terrible economic troubles it goes up.When the troubles fail to materialize on schedule the price drifts back down.

Enough of the people in the gold market are there specifically trying to make money that when things are going ok -meaning stocks are going up and paying dividends they bail on gold and get back into stocks.

When things ”are going ok” gold prices are flat or declining almost by definition.

I strongly suspect some Asian central bankers are quietly buying up all the gold they can on price dips with the intention of using it as weapon in currency and trade wars in the not too distant future.

This sort of reasoning may make sense in relation to gold.

It doesn’t make any sense at all in relation to oil or corn or copper or just about any ordinary commodity.

With the possible exceptions of OPEC and maybe Russia there are not any companies or countries with a big enough share of the oil market to control prices.

OPEC and Russia could hold back and cause a run up in prices.BUT I doubt either could produce enough to force prices down very much for very long.

There is not a snowball’s chance in hell that the people who own the oil industry are allowing speculators to get between them and their customers and make a really big profit on trading in oil.

You aren’t going to get to the top slots of an oil company by being that clueless even if you are a hereditary Saudi prince.

If speculation is influencing the price of oil it is necessarily in the form of the actual owners of the oil holding it back off the market. There is little or no evidence of this being the case for the last few years.

But if somebody really tees of Mr Putin he might cut back sales a couple of million barrels a day for a while just to let every body know what the truth is about reserve capacity and prices.

IF anybody outside the management of the biggest oil companies corporate and government and maybe the NSA knows the truth about oil supplies and reserve capacity it is apt to be Putin. The Russian security apparatus has a pretty good rep and it is not trouble much by such impediments as congressional oversight and bribery being a no no.

Climate impacts ‘overwhelming’ – UN

http://www.bbc.com/news/science-environment-26810559

“…The impacts of global warming are likely to be “severe, pervasive and irreversible”, a major report by the UN has warned.

Scientists and officials meeting in Japan say the document is the most comprehensive assessment to date of the impacts of climate change on the world.

Mr Jarraud said the report was based on more than 12,000 peer-reviewed scientific studies. He said this document was: the most solid evidence you can get in any scientific discipline…”

I wouldn’t want anybody to take me for a runaway warming skeptic but 12,000 papers or 120,000 are not the same sort of proof as just one easily repeatable experiment of the sort high school kids do in chemistry and physics classes.

But the fact than the experiment is not repeatable isn’t going to keep us from frying sometime in the next century or so.

Some pundit is going to be famous someday for saying ” Go north, young man, go north!”

If business as usual lasts long enough Vermont and Maine will become very popular retirement destinations.

We have had a full week already of highs in the upper eighties here in the mountains of southwest Virginia and it is only May 21.

I set up an outside work table with good lights and a big fan next to the shop a few years back in order to be able to work outside at night when it is cooler. This is the first year I have used it very much in May.

Local weather is not climate of course but …….I am contemplating planting an acre or so of fruit and nut trees that have never been grown successfully on a consistent basis this far north.

OFM,

I also like the easily-repeatable experiment that you can do right at home and data that isn’t so esoteric, like harbor high-tide measurements dating back centuries, that can be manipulated in minutes with basic high school physics-level calcs to derive meaningful results.

Below is a link to an Op-ed I wrote last year when CO2 first went over 400 ppm, with my own “backyard” experiment and “back of the envelope” calculations.

http://www.redding.com/news/2013/may/25/keith-ritter-how-much-do-you-trust-that-pundits/

he looks american indian to me –the guy next door… he yells, ” smell cigarettes!” through the wall

there’s a certain irony to that, seeing as how the indians were the first tobacco users

anyhow, he’s got one of those voices… when he puts an edge on it, it makes me jump… the problem is, he yells at random… there doesnt seem to be much correlation between my smoking and his yelling… and anyhow, I’m hanging out the window to smoke

he sits on the bus bench in the sun on nice days… sometimes he rocks back and forth

maybe he’s crazy

.

if i had developed a system that worked for thousands of years, and i was displaced by people who seem to have unlimited faith in a doomed system, maybe i’d be crazy, too

ah well

he goes out and cuts down the trees, and she keeps the books and they got this picture of chief joseph on the wall

they watch television for 90 years and die

U.S. officials cut estimate of recoverable Monterey Shale oil by 96%

Federal energy authorities have slashed by 96% the estimated amount of recoverable oil buried in California’s vast Monterey Shale deposits, deflating its potential as a national “black gold mine” of petroleum.

Just 600 million barrels of oil can be extracted with existing technology, far below the 13.7 billion barrels once thought recoverable from the jumbled layers of subterranean rock spread across much of Central California, the U.S. Energy Information Administration said.…

The energy agency said the earlier estimate of recoverable oil, issued in 2011 by an independent firm under contract with the government, broadly assumed that deposits in the Monterey Shale formation were as easily recoverable as those found in shale formations elsewhere.…

The problem lies with the geology of the Monterey Shale, a 1,750-mile formation running down the center of California roughly from Sacramento to the Los Angeles basin and including some coastal regions.

Unlike heavily fracked shale deposits in North Dakota and Texas, which are relatively even and layered like a cake, Monterey Shale has been folded and shattered by seismic activity, with the oil found at deeper strata.

Geologists have long known that the rich deposits existed but they were not thought recoverable until the price of oil rose and the industry developed acidization, which eats away rocks, and fracking, the process of injecting millions of gallons of water laced with sand and chemicals deep underground to crack shale formations.

The new analysis from the Energy Information Administration was based, in part, on a review of the output from wells where the new techniques were used.

“From the information we’ve been able to gather, we’ve not seen evidence that oil extraction in this area is very productive using techniques like fracking,” said John Staub, a petroleum exploration and production analyst who led the energy agency’s research.

“Our oil production estimates combined with a dearth of knowledge about geological differences among the oil fields led to erroneous predictions and estimates,” Staub said….

J. David Hughes, a geoscientist and spokesman for the nonprofit Post Carbon Institute, said the Monterey formation “was always mythical mother lode puffed up by the oil industry — it never existed.”

I know people in the area. This was a big deal focus of fights.

This is huge news. Monumental news.

It is a sledgehammer into the big abundance narrative rock and a fairly big chip knocked out.

if the monterey shale is a bust, who can we nuke?

i bet if we nuked california, their oi production would go way up

so we are morally obligated to nuke california

Someone else will. They burn a lot of oil that someone else will want.

The Watcher Phases of Oil Conflict

1) Secure supply by protecting or installing friendly govts on oil producing land.

2) Deny supply to competing consumers — perhaps via outbidding, perhaps via directing 3rd party tankers elsewhere at gunpoint.

3) Eliminate competing consumers.

so lyour basic moral belief is might makes right

do you think that will work for very long?

Predicting the future does not necessarily mean you approve of what is coming.

Mother Nature does not deal in right and wrong.

God fights on the side of the biggest cannon.

I am reminded of an interview with Gary Taubes:

http://www.epimonitor.net/Interview_Taubes.htm

Epi Monitor: What is the definition of pathological science?

Taubes: This is a term coined by Irving Langmuir, a Nobel prize winning chemist. Langmuir described pathological science as “the science of things that aren’t so,” and further stated that “these are cases where there’s no dishonesty involved, but where people are tricked into false results by a lack of understanding about what human beings can do to themselves in the way of being led astray by subjective effects, wishful thinking, or threshold interactions.” Then he gave symptoms of pathological science.

Monterray news is a huge deal.

re: “Geologists have long known that the rich deposits existed but they were not thought recoverable until the price of oil rose and the industry developed acidization, which eats away rocks, and fracking, the process of injecting millions of gallons of water laced with sand and chemicals deep underground to crack shale formations.”

We keep it up, we can just pump sea water in and watch it eat away the rocks. Georgia Strait scallops not able to survive due to acidification. Oysters are now affected. Their shells can’t form. This has been going on in Washington State for while.

To head off critical replies, this was a joke, but no longer funny. Time to ramp down burning FF, some how or way while there is something left. When Germany accelerates lignite use, while pretending to be ‘environmentally aware’, we have building problems. This is truly the definition of ‘spin’.

Paulo

Paulo

When you have to have it and you don’t have enough — there doesn’t have to be a solution. No law of the universe says there must be a solution.

As I understand, the reason for the increased acidification off the Washington coast is up-welling. The deep ocean is in general much more acidic than surface water. So while acidification in general is increasing in the ocean due to absorption of CO2, that is not the reason that shell fish are having difficulty off the coast of Washington. The article I read pointed out that the up-welling had been going on long time (centuries).

Oldtech,

If the problem is centuries old, why haven’t we noticed the problem with shellfish in the past?

A trip down memory lane . . .

Motley Fuel: Betting on the Monterey Shale (February, 2013)

http://beta.fool.com/insidermonkey/2013/02/06/betting-monterey-shale/23711/

(Meena is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.)

NYT: Vast Oil Reserve May Now Be Within Reach, and Battle Heats Up (February, 2013)

http://www.nytimes.com/2013/02/04/us/vast-oil-reserve-may-now-be-within-reach-and-battle-heats-up.html?pagewanted=all&_r=0

But don’t forget, Jeff, the Monterey Shale still has vast TRR reserves. (Insert the little round yellow face here).

Doug

Has this story gotten any coverage other than the LA Times?

Yes, Ron’s Blog.

Hi Doug,

I found it on CNBC and immediately came here to see if someone had already posted it. Here is the CNBC story.

http://www.cnbc.com/id/101692873

Best,

Tom

Hi Doug,

There are resources, but basically this says they are not technically recoverable.

The last R in TRR is for resource and some resources are reserves, but certainly not all. Hughes posted about the Monterrey Shale a while ago, saying that most of it was not recoverable so this is not news to me.

Ed Morse, et al’s comments about the Monterey Shale Play, from 2012 follow. The only impediment that Ed Morse foresaw to California boosting production by one mbpd was the regulatory burden in California.

ENERGY 2020

North America, the New Middle East?

Citi GPS: Global Perspectives & Solutions

20 March 2012

http://www.morganstanleyfa.com/public/projectfiles/ce1d2d99-c133-4343-8ad0-43aa1da63cc2.pdf

Well, see, that was projected. From a model.

IF the industry manages to extract the whole fifteen billion barrels that would be enough to last us three years or so.Getting it out will take half a century probably.

Methinks there may be something to this peak oil foolishness. 😉

It is true the quantity is only estimated but the estimate could be on the high side.

Just to add some small details to the analysis in the post:

– Using the latest RRC data up to March and the previous data up to February, I computed the amount of corrections that each month should undergo to be close to the real data. In doing this, I consider only the last 24 months (older months have only negligible corrections): what I did was to sum for each month the corrections which took place in the previous “h” months, where I put h=24 for computational simplicity.

For example, the correction for the last month (which is one subject to the highest degree of corrections over time) were equal to 465352 bbl/day (only oil , no condensate).

By doing this for all the past 24 months, I reconstructed the supposed “real” Texas oil production data. The result is the figure attached to this comment.

P.S in the close future, when I will have some time, I plan to do the same thing for Texas gas

Small addendum: using RRC time series data, I found out that the amount of correction is strongly decreasing over time. For example, for the last month available (which is one subject to the highest degree of corrections over time) , the correction required was:

– 465352 bbl/day in March

– 611482 bbl/day in February

– 1404034 bbl/day in January

if this trend will continue also in the summer months, than it will be possible to forecast the amount of corrections required and the potential peak of production. While it is too early to say when this will happen, the downward trend in corrections has been really impressive in the last year and there is not a small probability that the peak may be reached by the end of 2014/beginning of 2015.

Dean, thanks a million for the update. Please keep us informed of your work. I had suspected this was happening but I did not have enough back data to work with. I think condensate has already peaked and from what you are saying, crude oil is not all that far from peaking.

Thanks again

Ron

Dean and Ron,

Is it possible to track the number of new Wells? I think this would be useful to forecast future production. Since LTO wells have such as steep decline, I think you may be able to build a simple module of future production using just the changes in new wells. At least it would could be used to track the rate new production being brought on line. I don’t think it would even matter if the new well has been completed, just that its been drilled since in most cases they will eventually complete the well and it does really matter if it takes about 2 to 6 months for the well to begin producing Oil. Is the RRC for the number of wells better tracked than the actual oil produced?

Sorry if this sounds like a stupid idea. I don’t have the time to pour over the data in detail as you do so I don’t know if tracking new wells is feasible or makes sense.

No, that is not possible. Texas does everything by “Lease” and not wells. And you have no idea how many wells on each lease or when they add wells.

Hi Techguy,

At the link below there is a video from the RRC that shows how the number of wells in the Eagle Ford has changed over time.

http://www.rrc.state.tx.us/eagleford/eagleforddevthru032014.wmv

or you can go the RRC’s Eagle Ford page, the video link is on the right side of the page link below:

http://www.rrc.state.tx.us/eagleford/

Why exactly is NoDak doing a better communications job? Texas has decades of administrative infrastructure on this stuff.

Hi dean,

You seem to be showing an increasing time series. How do you determine the “real” output level? Did you do this on a percentage basis? For example if output 24 months ago was 120 kb/d and needed a 30 kb/d correction to get to the real output level that would be about 25%, if present reported data was 200 kb/d, I would think you would want to correct by 25% rather than by 30 kb/d. So to 250 kb/d rather than 230 kb/d. Did you do an arithmetic or percentage correction?

Thanks for the suggestion. For now I do an arithmetic correction,but I can try to do also a percentage correction. However, the corrected data refer only to oil without condensate, and the peaking of production is not yet so strong.

Hi Dean,

Thanks. An estimate of both crude and condensate combined would be nice so we can see how far off the EIA estimate is.

People in western Europe who have been buying Russian gas and oil better get cracking on some alternatives.

The trouble is that there don’t seem to be many alternatives.

http://www.usatoday.com/story/news/world/2014/05/21/china-russia-gas-deal/9365155/

We hear a lot about the failures of renewables. I do understand that renewables are stressing the grid and stressing the balance sheets of traditional power suppliers.

The grid can be upgraded and the rate structures can be modified to solve the traditional suppliers difficulties.

These are valid arguments but in principle and in terms of engineering and bookkeeping solving them will be a piece of cake.

Deciding who will pay will be the only real problem.

Two of the things that scare me so bad my anus contracts are big government and nuclear power.Two things that scare me even worse are the lack of both given our situation going forward.

I don’t think it is going to be possible to get enough nukes permitted and built in time to save Western European countries from extreme economic hardship as the result of declining oil and gas supplies and consequently rising prices.

Just one modern military aircraft costs into the tens and hundreds of millions of dollars.

Speaking as a generalist rather than a specialist- and as an armchair historian who has read a ton of science fiction as well as real history -I believe it is past time that renewables are considered as investments in national security in the same sense that a navy and air force are considered investments in national security.

(Specialists are generally unable to see outside the boxes they work and live in professionally.If the bill for change is too high to suit them they will resist change as if it is simply not possible.But change is inevitable.It will come whether they like it or not.The question is whether it is worth it to pay a very high price to influence the change that is coming anyway.)

The REAL point in having renewables – from this perspective- is to stretch fossil fuel supplies.

IF I am right then whatever price is paid for wind and solar farms that actually work is going to be seen as a bargain in a decade or two.

But a solar panel installed on the wrong side of roof in Scotland is still going to be worthless.Rune is absolutely right about that.LOL

People is such locations should be spending every possible nickel on conservation and efficiency- which is what everybody should be doing any way on an individual basis.

Unfortunately even though conservation is by far the most cost effective treatment for the energy disease it is not good to put ALL the money in that basket. This would have the effect of stalling the build out of renewables.

Unless the money being spent on renewables were to be spent either on nukes or conservation I don’t believe the ” high cost of renewable energy” argument holds water in the real world.

Whatever we spend on renewables is not totally wasted; but a huge portion of what we spend for various other far less important reasons is basically totally wasted.More freeways more baseball stadiums more flashy city administration palaces more make work of many kind sucks up treasure by the billions of dollars and pounds and euros every single day.

We might as well be supporting the people in construction and manufacturing trades by paying for renewables as by subsidizing automobiles and airlines and Sky Daddy alone knows how many other foolish expenditures.

Other wise we are going to be supporting them on food stamps any way as growth comes to a halt due to running critically short of Mother Nature’s one time gifts.

We have enough four by four six thousand pound trucks being used exclusively to fetch beer and groceries to have built a hell of a lot of wind and solar farms if the money had been spent a little more wisely.

still kinda iffy… the south stream pipeline… maybe europeans understand what’s goin on with the neocons and their PNAC project

but the project has apparently succeeded in one respect… it’s driven russia and china closer together… that’s good.. that will kinda consolidate our perception of our “enemies”

the solution –since mother nature does not deal in right and worng– is to do nuke first strikes on russia and china

good deal

.

don’t think you’re gonna get down

http://music.boredonkey.com/mp3/9/Dont-think-you're-gonna-get-down/qLb5Tt7U/

“the solution –since mother nature does not deal in right and worng– is to do nuke first strikes on russia and china”

That won’t work. Even if in the one in 6 trillion chance the US is able to completely take out all Russian and Chinese Military without them launching Nukes on the US, there is the problem with the doomsday machine. That is the 100+ nuclear reactors in Russia and China and their spent fuel pools that will render most of the planet uninhabitable. Once you take Russia and China out, who is going to maintain the Nuclear plants and their spent fuel pools? Nobody. All of the reactors will melt down, and all of the spent fuel pools will catch fire contaminating the entire northern hemisphere!

TechGuy,

Your nuclear reactor argument makes sense. Perhaps you’ve already said this but the Armageddon scenario could come about via severe unanticipated disruptions. And, these could occur through insurrection(s), economic collapse, etc. I suppose lots of Think Tank discussions have modeled this.

It turns out that during the Fukushima disaster, workers fled the reactor building(s) in panic, not by orderly withdrawal, as is commonly portrayed. Just imaging reactors being abandoned en mass because of one or more drastic event(s).

Doug

OFM wrote:

“People in western Europe who have been buying Russian gas and oil better get cracking on some alternatives.”

I’ve had this thought that the Russians will need to rebuild the iron curtain (the wall) again. This time to keep the Europeans from fleeing into Russia! Once the EU loses access to Russia energy Europe is going to be very unpleasant.

They will always have access.

But there will be a price. And it won’t be quoted in money terms.

”I’ve had this thought that the Russians will need to rebuild the iron curtain (the wall) again.”

I am kicking myself for failing to think of that remark myself.

No worries. According to the following op-ed, just the possibility that the US–currently a net natural gas importer–will be able to export material amounts of LNG to Europe at some point many years hence is already having an impact on the rascally Russians:

US Natural Gas Hurting Putin

http://www.star-telegram.com/2014/05/20/5834404/us-natural-gas-hurting-putin.html

It was not until perhaps the past 5 years that I have noticed what pathetic and bizarre output emerges from US journalists. Yes, that’s an op-ed, but it’s not all the different from the slant of outright articles, a reality defined by what stories get funded.

It’s another of those systemic realities. No reporter goes to work each day with the intention of writing lies. But he is assigned articles to write and a budget exists for them.

I noticed this particularly in the reports of the phone calls Obama and Putin were having. The articles said “Obama made clear” and “Obama told him” and “Obama informed him that”. But where was what Putin said, or Putin’s position? Nowhere. A phone call to the Russian embassy could have gotten the Putin position. It never appeared.

From the Globe and Mail, May 20th:

“As the U.S. approaches energy independence, larger questions loom”

It’s not just US journalists. You’d think that a Canadian business journalist- one who, I don’t know, might have some idea of who purchases 99% of exported Canadian gas and oil (or at least should have, if he’s going to write on this topic) would have a hard time buying into this meme.

I was going to write something about being afraid of being seen as dissidents or Casandras here, but I think it’s something more insidious:

Laziness, cheapness and willful blindness.

On one hand, journalism by press release and herd instinct. On the other, management that won’t pay for the research to disprove it and is unwilling to bite the hands (political and business) that feed it.

-Lloyd

Presentation suggests intimate relationship between Postmedia and oil industry

Jenny Uechi and Matthew Millar, Vancouver Observer, Posted: Feb 4th, 2014

A Joint Venture with CAPP: Canada’s lifeblood

Special to Financial Post | November 12, 2013 11:13 AM ET

More from Special to Financial Post

I watched over the years consultants be told “we want you to come tell us the truth. If you step on toes, step on them. We want to know.”

I also watched as the ones who stepped on toes were not invited back next year.

If you’re an oil consultant, you would be insane to walk into an oil company and tell them their future is not shiny.

I may have, inadvertently, credited this deal to El Paso, instead of Austin.

It was announced in March that Austin Energy would likely be buying electricity from a SunEdison solar power plant for less than 5¢/kWh under a 25-year power purchase agreement (PPA). If you’re not familiar with electricity prices, that’s really low. The final deal was just completed last week but with an unanticipated move – Austin Energy closed negotiations with Recurrent Energy. The Recurrent Energy press release explains that it received “an award from Austin Energy for 150 MW of solar capacity in West Texas. The power will be delivered to Austin Energy pursuant to a 20-year Power Purchase Agreement.”

Recurrent Energy doesn’t mention what happened with SunEdison, of course, but it does pump up its status as a leading utility-scale solar power plant developer:

Recurrent Energy is redefining what it means to be a mainstream clean energy company, with a fleet of utility-scale solar plants that provide competitive clean electricity. The company has more than 2 GW of solar projects in development in North America.

Larry Weis, Austin’s Energy General Manager, and Arno Harris, Recurrent Energy’s Chairman and CEO, further explain:

“With our largest utility scale solar award, we are . . . . .

Read more at http://cleantechnica.com/2014/05/21/austin-energy-cheap-solar-5-cents-kwh-recurrent-energy/#uwT0UHw3IJ2imStv.99

http://cleantechnica.com/2014/05/21/austin-energy-cheap-solar-5-cents-kwh-recurrent-energy/

The Monterey Shale being a bust probably deserves its own post. This alone makes the US being able to hold the sort of production plateau that EIA is hoping for pretty impossible. We know for a fact that the fracking plays decline swiftly and we know for a fact that GOM has gone nowhere so far and is battling major decline rate issues of its own.

Globally, this isn’t the only super giant bust that has happened either. Brazil proved to be technically infeasible at real-world levels of investment and Cash-All-Gone (Kashagan) is delayed another two years before it *starts* production.

Well, yeah, sorta. Some of those examples are mere delays or waiting for techdot.

But there was this:

An assessment by the United States Geological Survey (USGS) in 2010 estimated that the amount of oil yet to be discovered in the NPRA is only one-tenth of what was believed to be there in the previous assessment, completed in 2002.[3] The 2010 USGS estimate says the NPRA contains approximately “896 million barrels of conventional, undiscovered oil”.[3] The reason for the decrease is because of new exploratory drilling, which showed that many areas that were believed to hold oil actually hold natural gas.

That announcement erased 9 billion barrels from reserves. Not delayed. Not waiting for technology.

Erased.

But if we are talking about a decline rate-driven peak, shouldn’t massive delays and waiting for techdot be considered? The second half of the oil is going to be much, much harder to find and get out of the ground than the first half. That has bearing both on price and on availability.

Especially with even the EIA expecting the known US shale plays to top out by 2016, someone else has to start adding ~1.5 million+ bpd *each year* just to hold ground. If mega projects keep flopping, a 92-93m peak may be all there is even if they ultimately produce what they were supposed to in the first place. By the time they are up and running, the world would be several million barrels behind a plateau, let alone the increase that is postulated by IEA et al.

Ya, valid point, but I wasn’t really talking about “peak”. All peaks are artificial by definition. You can always get more, or less.

If you thought you were unfixably past a peak, just order every oil company in the world at gunpoint to deploy rigs, regardless of money. You’ll get more.

This is about viable permeability and porosity itself more than who shows up when.

USGS assesses resources not reserves, there is a big difference. Generally they estimate undiscovered technically recoverable resources (UTRR).

Without techdot, nothing is going to flow.

Ack, confused subjects. That was about NPR-A. If it ain’t there, it ain’t there.

China is busily tucking oil away in its strategic reserve:

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11259195

The article suggests the build is driving oil prices, with the usual subtext that when the build stops, there is abundance and the price can fall.

Hmm.

On second thought, the ramp in WTI started before Ukraine and before Chinese tensions. This story’s causation narrative is suspect.

WTI was $100 Dec 27 of last year.

Dipped to low 90s in early Jan and began a steady climb to $102 before there was even a coup in Ukraine, let alone Chinese tensions.

Watcher Wrote:

“The article suggests the build is driving oil prices, with the usual subtext that when the build stops, there is abundance and the price can fall.”

Unless they are stockpiling in anticipation of war. China has become more aggressive and belligerent by the day. I think the Chinese gov’t is worried about internal civil unrest that could lead to a revolt/revolution that over throws the gov’t. The best way to prevent that if they can’t prop up the economy is to go to war.

There is a faction out there that attributes the 2008 summer price spike to Chinese consumption spike for the Beijing Olympics. Then after it passed, the price fell.

All else is coincidental to that faction.

There does seem to be a big surge of ‘terrorist’ attacks in China at present. About one a day being reported. It is the usual ethnic minorities who have been down trodden for generations being pushed to extreme violence by Islamic extremists. It is certainly being much more openly reported here in the West. I guess it is the old problem – poor people can be kept in line as long as there is prospect of being less poor in the future – but when they realise that this is as good as it gets, they get mean.

” guess it is the old problem – poor people can be kept in line as long as there is prospect of being less poor in the future – but when they realise that this is as good as it gets, they get mean.”

I think its more like they feel they’ve been lied too or ripped off. A lot of people in China got their property stolen as land developed just took it from them. My understanding is that land developers off them pennies on the dollar for their land, and if they refuse, the developers pay thugs to beat them up. If that doesn’t work, then they just kill them.

Inflation is very bad in China and food prices are soaring. This is the number one issue that causes rioting. Its what kicked off the Arab spring.

North Dakota regulator calls Bakken ‘an exclusive club’

North Dakota’s top energy industry regulator says he expects April’s oil production figures to be over 1 million barrels daily.

State Mineral Resources Director Lynn Helms spoke on Wednesday at the Williston Basin Petroleum Conference in Bismarck, which has drawn more than 4,000 people for three days of events. He says he expects oil production to increase from 977,000 barrels daily in March.

Helms says the Bakken shale formation in North Dakota and Montana is “an exclusive club.” He says that out of the 65,000 oil fields worldwide, only 150 including the Bakken have exceeded 1 billion barrels of oil. North Dakota has generated more than 850 million barrels of Bakken crude, and Montana has produced more than 150 million barrels through the first quarter of this year.

From another article, North Dakota governor warns on gas flaring

Helms said that over the next decade, North Dakota can expect to produce another billion barrels of oil every two to three years.

“We’re just scratching the surface at this point,” Helms said.

A billion every 3 years is 330 million per year. That’s 904K bpd, for the next 10 years.

Using the same methodology described above for the case of oil, I proceeded to correct the Texas total natural gas data and the result is in the figure below:

Again a small addendum: : using RRC time series data, I found out that the amount of correction is strongly decreasing over time. For example, for the last month available (which is one subject to the highest degree of corrections over time) , the correction required was:

– 3175720 MCF/day in March

– 3604207 MCF/day in February

– 5453610 bbl/day in January

This means that my correction may probably overestimate a bit the “real” production. Anyway, for the moment I prefer to be conservative than the other way round. Following the interesting suggestion by Dennis Coyne, in the next days I will try to do a correction using percentages instead of absolute values: this should solve the problem of overestimation. Hopefully I will find enough time ^_^

http://headlines.ransquawk.com/headlines/libyan-crude-oil-output-drops-to-200k-bpd-today-according-to-noc-spokesman-22-05-2014

It couldn’t work any better than if the Russians or Saudis were down there with snipers killing anyone who shows any signs of negotiating an agreement.

This story just posted by Chris Martenson (yes, that’s him):

Dream of U.S. energy independence was just revised away

Opinion: Most of the shale oil we were counting on doesn’t exist

http://www.marketwatch.com/story/dream-of-us-energy-independence-was-just-revised-away-2014-05-22

Reference: http://www.latimes.com/business/la-fi-oil-20140521-story.html

I suppose this means the US must get back to ecological reality sooner than expected…

2 days late with that, scroll up.

This one is really good also: Write-down of two-thirds of US shale oil explodes fracking myth

Despite the mounting evidence that the shale gas boom is heading for a bust, both economically and environmentally, both governments and industry are together pouring their eggs into a rather flimsy basket.

Ron,

Actually, this a all depressing to me. It’s depressing because so called “professional” people and organizations shouldn’t be coming up to come up these vastly different numbers. Then, on top of it all you hear: “The US Environment Protection Agency therefore “significantly underestimates” methane emissions from fracking, by as much as a 100 to a 1,000 times according to a new Proceedings of the National Academy of Sciences…” Christ Almighty!

It might be nice to say “we-told-you-so” sometimes but it isn’t this time: It’s just bloody depressing.

Doug

Of course I just finish typing (mistyping) the above then run into this.

“The amount of carbon lost from tropical forests is being significantly underestimated, a new study reports.”

http://www.bbc.com/news/science-environment-27506349

Doug,

Ya better stop looking up all that depressing material. Ain’t nothing good comes from it…. if you know what I mean.

Those in charge making the decisions are completely FOS – Full of Sh*t. All we can do is enjoy the time we got left before the PHAT LADY SINGS.

Stebe

Actually, it should be “Until the PHAT LADY COUGHS UP A LUNG.”

Stebe

From the article that Ron linked to, a good question:

Jeff,

Perhaps a start would be to ban the use of the TRR (Technically Recoverable Resources). What’s the meaning of a reserve/resource without-reference-to-economic-profitability? But there’s that better one: “yet-to-be-discovered”. There must be six cases of yet-to-be-discovered Scotch Whiskey down in my basement . I just haven’t found the stuff yet.

Doug

Start digging. 🙂

Hi Doug,

The resources are what is there, the proved reserves are what can be recovered both technically and economically with a 90% level of certainty. The second R in TRR stands for resources, not reserves.

There are also proved plus probable reserves (2P) which have about a 50% probability of being recovered, as well as the proved+probable+possible (3P) reserves which have about a 10% probability of being produced at current oil price levels.

Dennis,

The oceans contain 10–30 parts per 1,000,000,000,000,000 gold which amounts to approximately 15,000 tonnes of gold: a lot. This is clearly a Technically Recoverable Resource (TRR).

I plan to collect all this gold but I need investors. Shares will be set at $ 10,000 each. They are going fast. How many would you like to purchase?

Doug

Hi Doug,

Is it your expectation that there will be no reserves added in the future?

Let us assume the answer is no.

If there are 1000 Gb of UTRR in the world, do you think the increase in future reserves would be different than if there were 100 Gb of UTRR?

If the answer is no, then we should just ignore UTRR altogether.

Dennis,

During a 35 year professional career I’ve been involved with reservoir calculations on numerous occasions: These have mostly been team endeavors including geologists, engineers, geophysicists, accountants and computer technicians. The teams have included (at various times) Canadians, Americans, Europeans, Japanese and Chinese Geoscientists. At one time there was a great flurry of activity converting (and confirming) Russian derived reserves to assure they met European/North American reporting standards; never, during this time, have seen so-called TRR resources taken seriously.

Doug

Hi Doug,

They are rough guesses, not to be used in financial reporting. For those deciding where to allocate capital for developmental drilling, these estimates would be used.

If there is field A with estimated resources of 3 Gb and field B with estimated resources of 1 Gb with all other field properties fairly similar, the decision would likely be made to do either more exploratory drilling in Field A.

Once the exploratory drilling is finished, the company may have enough data to turn some of these resources into 3P reserves.

The TRR is a very rough estimate in the absence of plentiful data. We could just assume TRR of unexplored areas is zero. We would then often be surprised that the decline in reserves is not as rapid as we imagine because some of these resources become reserves over time.

If you want to attempt to estimate what decline will look like it would be foolish to ignore TRR.

Yep–

This kind of reminds me of the 90% write down of oil reserves in the National Petroleum Reserve in 2010. In that case, it was found that the reserve held mostly gas, not oil.

These two cases may partially debunk the argument by conucopians that oil reserves are continually increasing because of new technology. Also, I wish the Saudis would come clean about their inflated reserves.

Note that it was the EIA that overestimated the Monterrey Shale.

The USGS estimates no LTO output from California.

I took a quick look at the INTEK report, it looked like a cut and paste of investor presentations. The report notes that the USGS had not evaluated unconventional resources in the San Joaquin Basin (or perhaps they did and found that the TRR=0). The USGS estimate of undiscovered TRR for the San Joaquin Basin was 0.4 Gb of conventional resources.

The report also includes the following disclaimer:

“The information in the technology profiles was provided by the host institutions; there has been no independent verification of any of this information. This work was completed under contract number DE-EI0000564 and task order number DE-DT0001772. Neither INTEK, Inc., nor the Department of Energy makes any representation as to the accuracy of the information.”

Bottom line, the EIA is run by economists who find other economists to produce reports for them, not that the USGS necessarily gets thing right, but they do a much better job on these types of estimates than the EIA.

Map of USGS estimate of unconventional(LTO) undiscovered technically recoverable resources (UTRR) at link below (note no resources in California)

http://certmapper.cr.usgs.gov/data/noga00/natl/graphic/2013/mean_cont_oil_2013_large.png

Helms said yesterday he can do a billion barrels every three years for the next ten years.

That’s 900K bpd per year, held flat by whatever, Industrial Commission decree or choking (or decree enforced via choking). That would be just about half that USGS 7 GB over the next 10 years.

Sounds like sound state revenue management.

Oh well, I’m a day late and a dollar short, as usual. But, maybe better late than sorry.

Chris Martenson has a longer discussion (dated yesterday evening) on his blog: