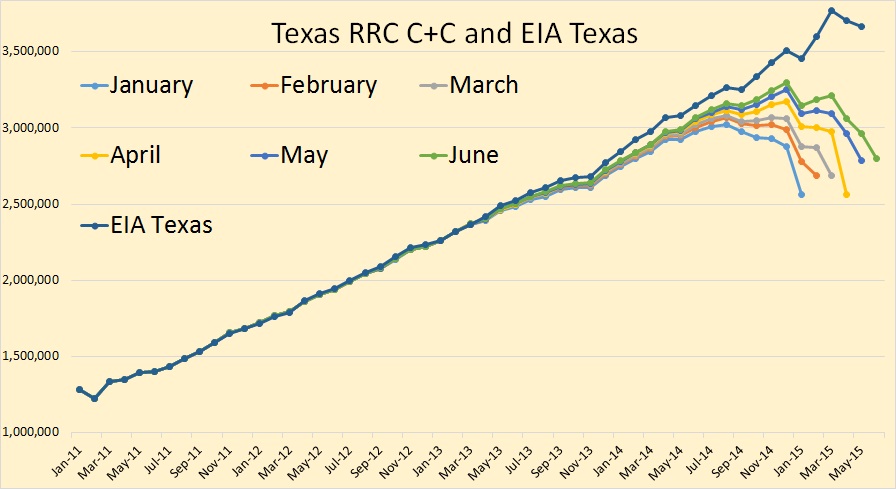

The Texas RRC Oil & Gas Production Estimates are in. By now everyone should know that the Texas oil and gas data is incomplete and the drooping data lines will eventually look more like the EIA lines as the more and more data comes. The EIA data is only through May but all Texas Railroad Commission data is through June.

It appears that Texas C+C was flat to slightly up in June.

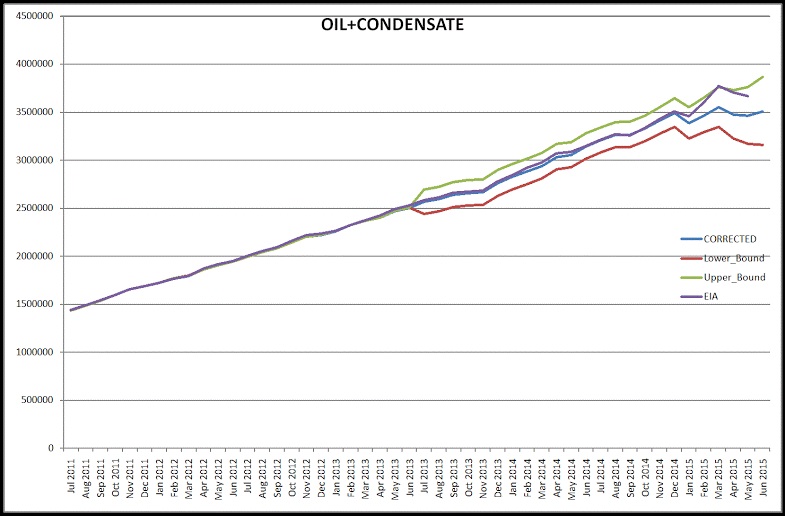

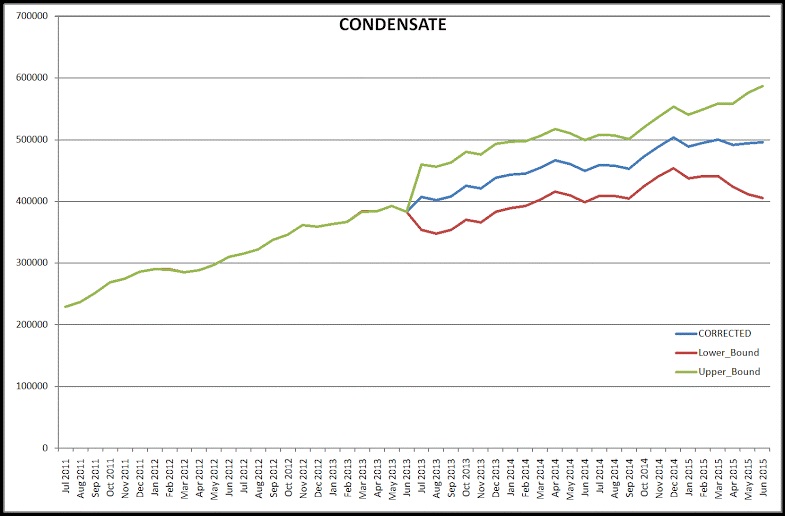

Dr. Dean Fantazzini has a program that attempts to correct for the incomplete data and give a pretty good estimate of what the final data will look like. He has April C+C down, May down also but only slightly so and has June Texas Crude+Condensate up slightly.

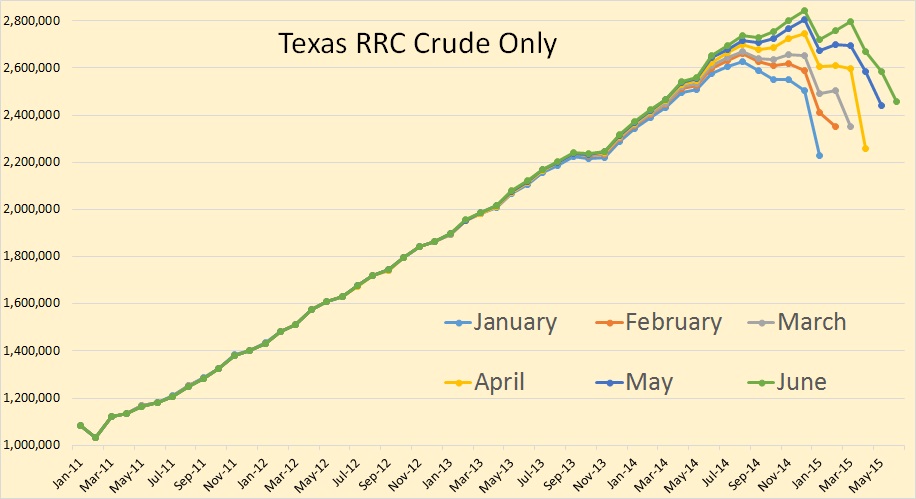

Texas crude only appears to have increased slightly.

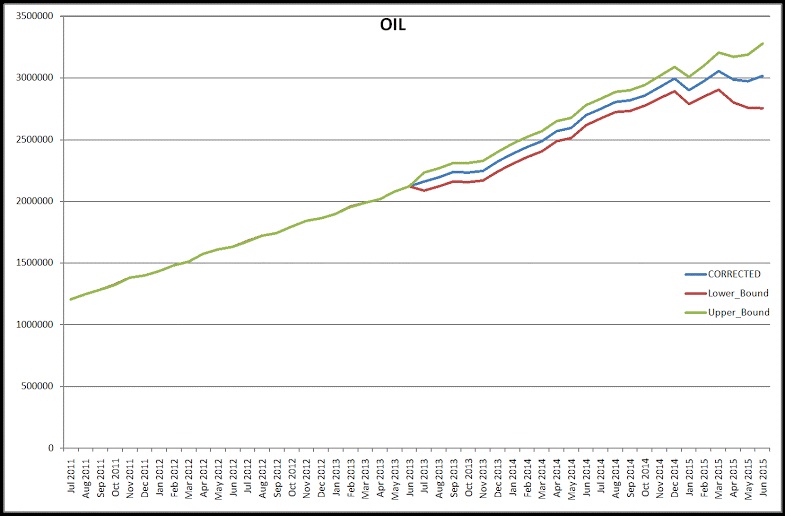

Dean has crude only pretty much the same as C+C for April, May and June except tracking about half a million bpd lower.

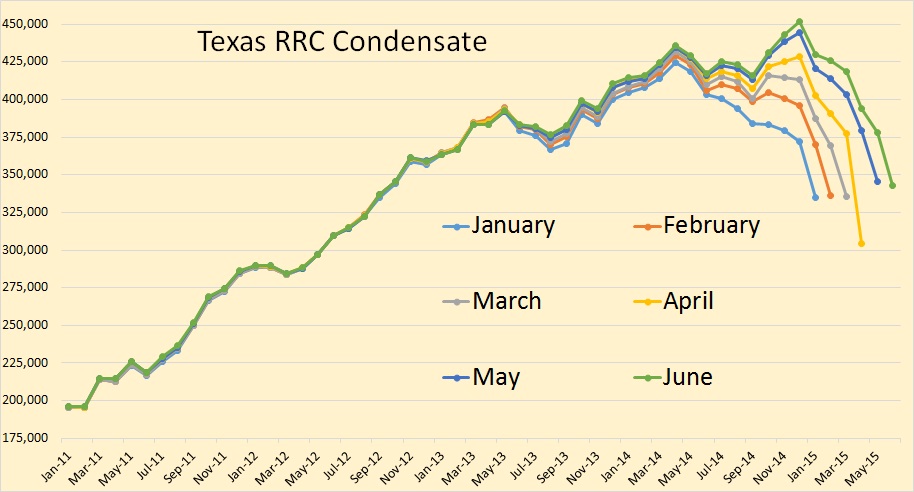

Texas condensate appears to have declined slightly in June.

Dean has condensate flat to slightly up in June.

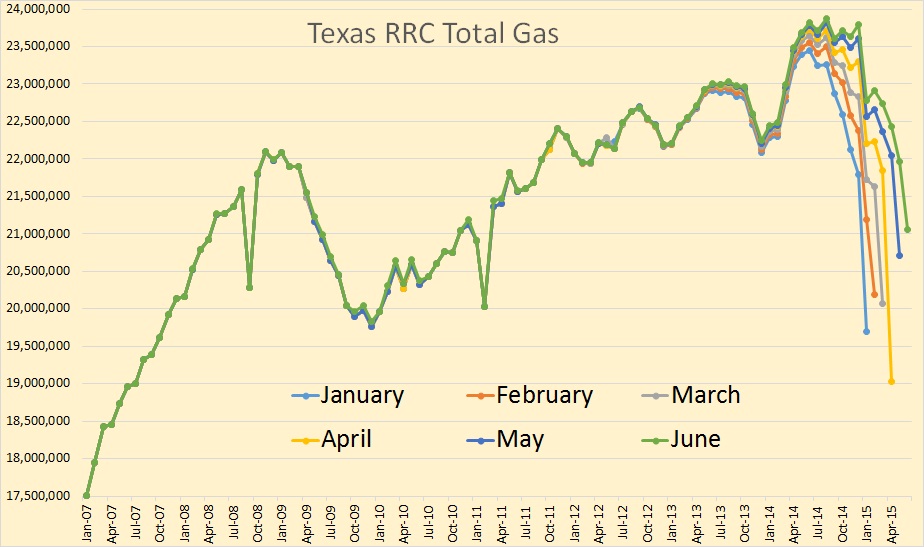

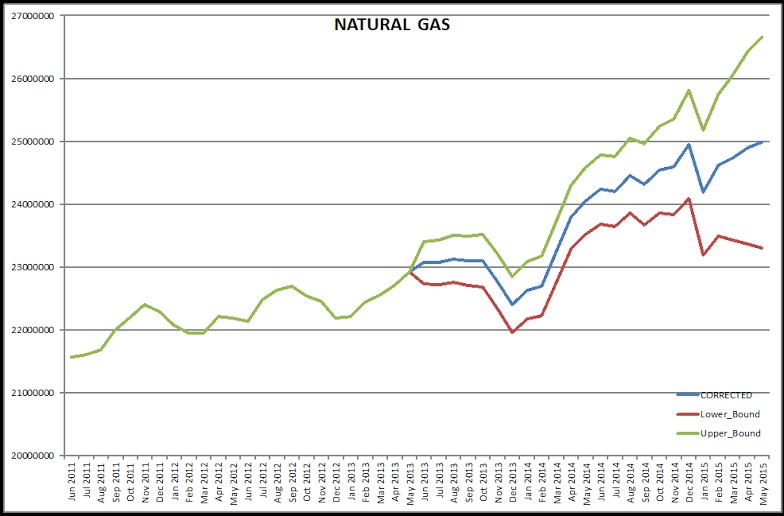

Texas total gas increased slightly in June.

Dean has total gas up slightly also.

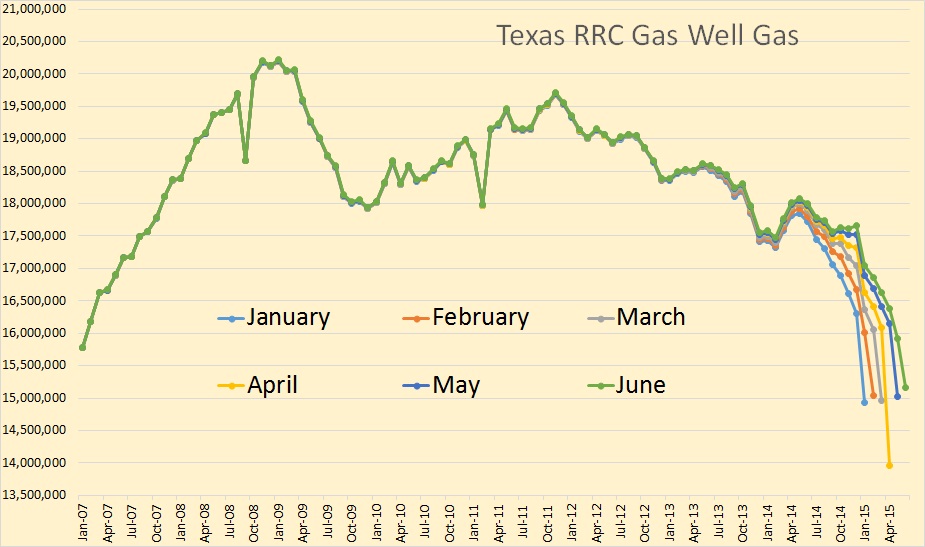

Texas gas well gas peaked way back in 2008 but appears to be holding its own now.

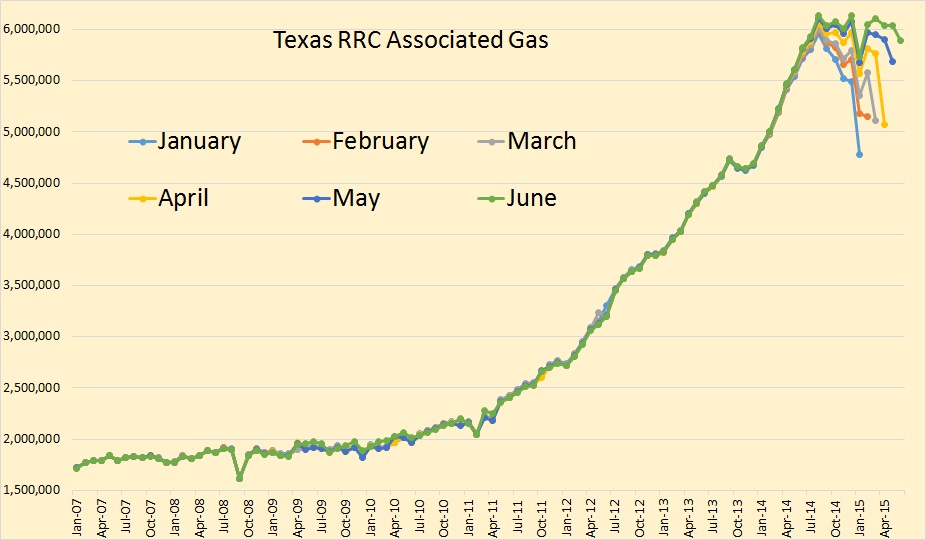

Texas associated gas, or what the RRC calls casinghead gas, has been responsible for keeping Texas total gas increasing. But production of associated gas seems to have hit a snag around September 2014 and has been slowing down since.

A lot of peak oilers were upset over John Mauldin’s column yesterday. It did not bother me however, he is just another ignorant cornucopian who thinks technology will give us an infinite supply of oil. The media is full of such fools and we need not worry ourselves over them. However here is a link to his column.

Mauldin Economics: Thoughts from the Frontline: Riding the Energy Wave to the Future

I have written for years that Peak Oil is nonsense. Longtime readers know that I’m a believer in ever-accelerating technological transformation, but I have to admit I did not see the exponential transformation of the drilling business as it is currently unfolding. The changes are truly breathtaking and have gone largely unnoticed.

Shale companies now produce more oil with two rigs than they did just a few years ago with three rigs, sometimes even spending less overall. At $55 per barrel, at least one of the big players in the Texas Eagle Ford shale reports a 70 percent financial rate of return. If world prices rise slightly, to $65 per barrel, some of the more efficient shale oil operators today would enjoy a higher rate of return than when oil stood at $95 per barrel in 2012.

From this month’s Director’s Cut

May Sweet Crude Price = $44.70/barrel

June Sweet Crude Price = $47.73/barrel

July Sweet Crude Price = $39.41/barrel

Today’s Sweet Crude Price1 = $28.50/barrel

That was August 14th when WTI was at $42.50, today they are likely to be even lower as WTI closed today at $40.80.

James Howare Kunstler rakes Mauldin over the coals in a pretty good article.

As fracking implodes, the clowns deny reality

I thought the below article worth an honorable mention.

As Canada’s Oil Debt Soars to Record, an Industry Shakeout Looms

Canadian energy companies’ debt loads are the heaviest in at least a decade, boosting concern that some won’t survive the collapse in crude prices.

Trican Well Service Ltd., Canada’s largest fracking service provider, said last week it may be unable to continue because it’s in danger of breaching the terms of its debt. It’s the latest firm to see crude’s descent to a six-year low sap the cash flow needed to meet financial obligations.

Oil’s plunge has pushed a measure of the average debt burden among Canadian energy firms to the highest since at least 2002, and another measure of their ability to make interest payments to the third-lowest level in a decade, according to data compiled by Bloomberg. Facing some of the highest production costs in the world and carrying more debt than U.S. peers, the Canadian industry has become ripe for acquisitions.

710 responses to “Texas RRC June Production Data”

A novice investor asks a long-time, astute investor – “How do you make money?” The astute investor asks: “Do you want the long story, or the short story?” The novice says: “Give me the short story.” The astute investor says: “Buy low, sell high.” The novice asks: ” How do you do that?” The astute investor says: “That is the long story.”

Everyone currently has the opportunity [my opinion] to buy low. Many fairly good quality oil & gas companies are trading at 30% to 50% of their recent (1 1/2 years) highs. In 10 years, will oil be plentiful and we no longer need it?? Ask someone I respect: Jeffrey Brown. (And, Mr. Brown, please tell me that is a joke that you are working at a Dairy Queen. If not, I will drive to your location, buy a cone, and give you a gigantic tip for all that you have done. Your analysis is truly appreciated.)

@clueless

I know that you are not trying to give stock advice. Still, I would be very careful to talk about something that you don’t know. Some people on this forum bought some stocks at suppose bottom when oil was $45-50. Well as you can see we have a new bottom today, lower than that bottom of 7-8 months ago. I hate when I see that people loose money out of ignorance. Picking stocks and market timing is fools game. If somebody really wants to know about investing than it better to read some good books than to listen from “newsletter experts” on the internet.

Ves, sage counsel.

http://newnormaleconomics.com/peak-oil/

http://newnormaleconomics.com/2015/08/02/oil-the-cycle-turns/

http://newnormaleconomics.com/2015/08/10/gasoline/

http://newnormaleconomics.com/2015/08/19/natural-gas/

http://newnormaleconomics.com/2015/08/19/imf-the-global-impact-of-lower-oil-prices/

http://www.bloomberg.com/news/articles/2015-08-14/oil-s-worst-ever-summer-signals-price-rout-is-nowhere-near-done

Ves – Right. I do not try to give stock advice. I think that my comment was pretty vanilla and anecdotal. I started working in 1962 [retired in 1999] and I started investing in the stock market in 1965. I got a degree and a masters’ degree, and I had pretty good jobs. I was a partner in one of the big 8 [at the time] international CPA firms. But, by just investing a fraction of my earnings in the stock market [I was net out of pocket with my parents deaths], I have made FAR more money in total from the stock investments than I ever earned in wages. But, to your point, my comment was more properly directed towards readers under age 40.

Just saying, if you do not buy low, when will you buy? And, I left it up to the reader to decide if oil is like the horse and buggy, or not. I do not claim to know for sure.

One further comment. I knew a billionaire fairly well. His statement was: “I never was able to buy a stock at the absolute bottom. If I had been able to, I could have always purchased it cheaper.” So, don’t beat yourself up, or others, if you are not perfect and do not buy at the absolute bottom. It is not, standing alone, a sign of ignorance!

It’s a good advice. I am 30 and I have been looking at buying energy related stocks, even some of the commodities for some time now. Probably it’s best to buy in small amounts every month instead of going all in.

This cycle could last for some time (years) though so it’s not for the faint hearted.

@clueless

I am not sure that you even remotely understand what I am talking about. Even if you made billions from 1965 buying individual stocks I would still say the same to a reader who is new/or old to investing and wants to invest and that is: “If you want to learn about investing you have to first read some good books” (There are also dangerous books, so you have to be careful 🙂 )

I would tell them: “Here are few books http://www.bogleheads.org/readbooks.htm and invest some time reading them and then we can discuss”

Compare this advice to your advice: “Buy low, sell high”!!!!?? What kind advice that is? That is dangerous advice. Sounds like one-liner advice that you get from Homer Simpson show. I have seen so many people get burned by investing with that simplistic advice.

Hi Ves, Clueless,

Except for a very few bucks in a couple of accounts involving working as an employee I have never been in the stock market.

But giving up television and bars means you have hours every day to read, and I have spent a LOT of time reading about stocks and bonds and investing in this and that and every thing else.

Just for the fun of it, here are a few culled observations.

The pros are exactly as competent as a monkey throwing darts . It is well known that the markets are dominated by professional traders- the amateurs manage a trivial percentage of all the stocks and bonds.

Any mathematician will tell you that the pros average return is the same as the average return of the market.

It has been a while since I looked but people in the forestry industry a few years back observed that returns on timberland have historically been as good as returns on stocks.

Fiat money will eat you alive in bonds unless you are living on the proceeds of trading them rather than spending the money as it comes in. Just about everything you might actually NEED will on average go up faster in a world with a growing population and shrinking non renewable resource base faster than you can collect and spend interest.

Your money will be worth maybe a tenth to three quarters what it was the day a long term bond matures compared to the day you bought it- excepting if you spend it in certain limited ways. You will be able to buy a better computer and maybe a new life saving medical treatment but beyond that….. you are almost sure to lose.

If as a young man I had started putting the retail price of one pack of cigarettes a day into the stock market and maintained this practice until today without withdrawals I could sell out and have a shapely blonde a third my age feeding me alternate sips of coffee and fresh fruit and own a Ferrari and a Tesla as well as a blue water sports fisherman, a beach front house and apartments in a few of the more desirable cities off the world- plus a jet of my own. With as equally young and shapely BRUNETTE to fly it for me.

All possible investments are potentially subject to being pumped full of hot air thus creating a bubble that will inevitably burst. Even farmland and timber.

A well informed and technically literate layman has at least as good a chance as professional managers ON AVERAGE of seeing a whole new paradigm emerging as technology progresses and life styles change by choice or by necessity.

Seeing the change coming however is not the same thing as predicting which companies will survive and thrive in a new industry or a new economic paradigm.

Betting on a new industry by going the index route will PROBABLY work if you are right about the new industry- and you don’t jump the gun too badly.

Personally getting down to the nitty gritty I believe that it is still a bit early to be betting on renewables based on the probability of making good financial returns- unless the investment time frame is a minimum of a decade or maybe two.

The big exception imo to this observation would be the battery industry or a start up auto company such as Tesla. GM is not ever going to make a whole lot more money selling pure electrics or plug in hybrids than the company has traditionally made selling conventional cars. My gut feeling is that the battery industry is about out of the toddler stage and will soon be growing like like crazy. Within ten years for sure imo.

ALL the major car companies will be selling electrics by the time GM is selling Volts and Bolts by the millions.

Times really do change and sometimes it really is different this time.

The conventional business model – eternal growth- is going to crash into the concrete bridge abutment of physical limits eventually.

BUT nobody really KNOWS how long that will be.

Growth could continue for quite some time, maybe even half a century , in the face of energy constraints. Naked apes are clever and industrious and might figure out ways of maintaining growth by improving efficiency faster than fossil fuel supplies deplete.

There could be a humongous more or less permanent crash starting later today. There is simply no way the banks and governments and businesses of the world can ever pay the on the books and off the books debts they owe- barring miracles. Praying for miracles is ok but betting on their arrival is not.

Industries that crash, as the oil industry has recently, always come back unless there are new industries coming on strong enough and fast enough to displace them.

Hard crashes are like freeway accidents in that most of those involved survive and relatively few die. Traffic can come to a dead stop or near dead stop driving prices to ridiculously low levels FOR A WHILE. Businesses run like most working people- from paycheck to paycheck. Damned few people who work can make ends meet for more than a few months before they start selling off the second cars etc as their savings deplete. Most companies are in the same situation. They live on receivables from month to month.

The oil industry will survive this crash because there is nothing out there YET to displace it. Twenty years from now… things might be different.

Have I learned anything?

Clueless. Are you talking integrated majors? Or are you including companies with only upstream?

I’d be careful on upstream only. There is something funky going on. Today’s realized BOE for US upstream ranges from $10-25 per BOE. Continuance of that price for a few months will inflict some serious damage.

We are making plans to shut in significant production. We did not do that in 1998-1999.

Maybe that kind of capitulation talk means it is time to buy. However, no oil crash since I have been alive ended without a significant OPEC cut. Not seeing signs of that yet, and the US publicly traded upstream appears it would rather BK than cut production much to conserve cash.

I assume Sheffield at PXD is still adding rigs?

Shallow: Just a general comment. But, look at some oil stocks that have been around 75-100 years. They went through the boom of the 1970’s, only to be decimated in the 80’s and again in 2008/2009. Exxon in July of 1982 was at $3.50 on a multiple split adjusted basis. Over twenty times higher now, 33 years later, at $76, even though significantly down in the last 1 1/2 years. If dividends were reinvested (like in an IRA) you would probably have 30 times your money or more. Lot’s of good companies are in the same situation, both producers and service companies. It depends on your view of the future. Are we going to need oil or not? So, this is more of an industry question than a stock question. Some stories are stock specific, not industry – like the comeback of Apple. I think that it is a little easier when it is an entire industry that is getting dumped on. Stay away from the companies that you point out have liquidity problems. If the world needs anywhere near 90 million barrels/day, capitalism will eventually sort out the price so that quality producers and service companies make a decent return. If in 15 years, you think that we will only need 10 million barrels/day, then I guess most of the posts on this board are pointless and get out now while the getting is good.

Clueless. You mentioned ExxonMobil, and I do not disagree on that one. Most other integrated majors also probably ok.

Two that spun off refining and pipelines, COP and MRO maybe a good speculative bet. However, when a company has to borrow all the money to pay its dividend, not a good sign.

Both paid big time bucks to get into shale. Both also paid to get into tar sands. By my calculation, both need north of $60 per BOE to maintain current production and be cash flow neutral with the dividend. If either cut the dividend, there will be another big drop.

I guess maybe the commodity drop could be impacting me too much because we are so close to it. Could be clouding my vision.

Read about a speaker at Kansas Independent Oil & Gas Association. Made the claim that Gulf OPEC states are shorting oil, that big money center banks are aware of this and are following suit. I don’t know if I believe this, but something strange is going on.

Most companies will be soon selling oil in the $20s un hedged. As almost all US companies have interest payments, have to wonder how many can make those payments.

A conventional producer selling 5000 barrels per month grosses $540K at $90 in the field, $480K at $80 in the field, $125K at $25 in the field. Look at Plains crude bulletin. Some are at $25 already. Probably the best price would be $38 in the field. That is still just $190K.

This really stinks.

clueless said:

Doesn’t that cut to the heart of the matter?

Doesn’t that allude to the same dilemma which James Howard Kunstler points to when he says: “Industrial economies face a fatal predicament: Oil above $75/barrel crushes economies; under $75/barrel it crushes oil companies”?

Doesn’t that allude to the same dilemma which Gail Tverberg’s theorizing broods over?

The underlying question is this: Can capitalism survive the limits of growth?

But an even more fundamental question is: Can modernity survive the limits of growth?

As Naomi Klein said of her trip to the Vatican, the Pope says no: “So, I think what is significant about it [the Pope’s encyclical] is that it is very much a rebuke to the worldview that humans have been put on Earth to dominate and subjugate nature.”

http://www.democracynow.org/2015/8/4/naomi_klein_on_visiting_the_vatican

John Mauldin’s response: “What limits of growth?”

If in 15 years, you think that we will only need 10 million barrels/day, then I guess most of the posts on this board are pointless and get out now while the getting is good.

If in 15 years you think that we will need only 10 million barrels a day then you are a goddamn fool.

Of course I know clueless don’t believe that, and I hope Glenn don’t believe that, but just saying….

The 10 million barrels/day figure derives from societal collapse theories, for example that of the anthropologist Joseph Tainter:

Tainter argues that sustainability or collapse of societies follow from the success or failure of problem-solving institutions and that societies collapse when their investments in social complexity and their “energy subsidies” reach a point of diminishing marginal returns. He recognizes collapse when a society involuntarily sheds a significant portion of its complexity.

According to Tainter’s Collapse of Complex Societies, societies become more complex as they try to solve problems. Social complexity can be recognized by numerous differentiated and specialised social and economic roles and many mechanisms through which they are coordinated, and by reliance on symbolic and abstract communication, and the existence of a class of information producers and analysts who are not involved in primary resource production. Such complexity requires a substantial “energy” subsidy (meaning the consumption of resources, or other forms of wealth).

When a society confronts a “problem,” such as a shortage of energy, or difficulty in gaining access to it, it tends to create new layers of bureaucracy, infrastructure, or social class to address the challenge.

https://en.wikipedia.org/wiki/Joseph_Tainter

Do I believe modern civilization will collapse?

My answer is, I don’t know. I don’t believe its a foregone conclusion (which Tainter doesn’t believe it is either), but on the other hand I don’t believe it’s out of the realm of possibility.

What I believe Klein and the Pope seek to do is to do what they believe is necessary to avoid collapse.

Do I believe modern civilization will collapse?

My answer is, I don’t know. I don’t believe its a foregone conclusion (which Tainter doesn’t believe it is either), but on the other hand I don’t believe it’s out of the realm of possibility.

Well, I believe it is a foregone conclusion. In one of Tanter’s last videos he seemed to be hedging, leaning toward believing it is a foregone conclusion. I will try to find it.

Anyway the fact that we are already way past the long term sustainable population means that the population must collapse.

It does seem pretty bleak.

The only way out, short of some miraculous scientific-technological energy revolution, is a transition to what Almuth Ernsting calls a “low-energy economy and society.”

But, if I understand Tainter’s theory correctly, such a transition is not possible as it would lead to collapse of our highly complex society.

I feel we will be transitioning to a “low-energy economy and society” fairly soon. Whether we like it or not. It will be accompanied by a population bottle neck for the human species. We will call it “collapse of industrial civilization”. It’s not a choice we will make. It will be thrust upon us. Fairly soon I might ad.

I think everybody here is ignoring the painfully obvious.

This planet can’t take more carbon into the atm, in fact, already has way too much, and is NEAR CERTAIN to hit us somewhere real hard, and real soon.

At that point, people wake up, and ff’s are past, not at all because we don’t have them, but because we have decreed that they stay right where they are.

Meanwhile, human ingenuity, always underestimated, will start making solar/wind so good that ff’s are dead anyway, from simple economic forces like what killed the horse & buggy.

I see you are taking a view similar to that of Tony Seba. You condensed his presentation down to three sentences!

Ron and others,

I have long taken the position that the Earth could sustain a population of 60 billion people. However, that is contingent on humanity being smart about how it lives. Almost all my friends are correctly quite critical of my position. They point out how radically unlikely it will be that we will be smart about how we live. They are quite right. However, if we consider the German passive house standard that reduces energy consumption by nearly 90% we know that it is logically possible for us to similar improvements in the energy efficiency of all construction. Living in a smart way entails being focused on achieving such efficiencies in all areas of substantial consumption and achieving a very rate resource recycling. This is similar to what nature seeks in its ecosystems through millions of years of evolution. We just need to more fully understand the principles involved and put them to use.

Yes, Ron, I also expect waves of population decline. We have no reason to think humanity will be smart. That does not mean that we can’t be.

Earth can accommodate 60 billion homo sardinus. But, long term, Homo sapiens is limited to 1 billion.

I have long taken the position that the Earth could sustain a population of 60 billion people. However, that is contingent on humanity being smart about how it lives.

WOW! Claiming that Earth can sustain a population of 60 billion is about as extraordinary a claim as I have ever heard. I expect some very extraordinary evidence to back that up. Nothing in my experience from any scientific field gives me even the remotest hope that that would be possible!

There are fundamental physical limits imposed by the laws of ecosystem thermodynamics that really can’t be surpassed. Maybe if humans colonize the entire solar system and import resources but I seriously doubt that will ever happen!

As for it depending on humanity being smart enough, well, humanity so far has not demonstrated true collective intelligence. Perhaps that will come about as an emergent property of our technological capabilities and humanity will become like a cyborg hive.

Hopefully I will be long gone before anything like that happens because even if any of these things could happen I for one would not want to be a part of such a world!

There are fundamental physical limits imposed by the laws of ecosystem thermodynamics that really can’t be surpassed

Could you expand on that? It seems to me that the only basic limit we’re reaching is the CO2 “sink”, and that’s framing the problem in the wrong way, because CO2 isn’t essential to energy production. I’d call CO2 unnecessary pollution, not something like the essential heat “waste” that’s part of thermodynamics.

For Nick,

I fully agree that CO2 pollution is totally unnecessary. We should be moving as fast a possible to totally renewable energy. As for the 60 billion figure, it is just the obvious result of making all systems as close to 10 times as efficient as we can. Obviously that can be done for housing. Fairly trivial calculations indicate that we really don’t need much space to get the solar energy that we need. And yes we will need to build the systems to store it.

For Fred,

Don’t forget that my goal is to reduce energy consumption by a factory of 10. We really do not need a 4,000 plus pound vehicle for personal transportation. An enclosed powered chair with a highly efficient automated transport system might be quite feasible with a little engineering. Of course, that would not work to maximize the cash flow from consumer’s pockets. I would also not work for those trapped in the ego game of “I have greater status than thou.”

Obviously we need to do significant work to achieve the energy efficiency and renewable systems design to really achieve the intelligent living that is logically possible. And no, I do not want to put a great amount of work in further justifying this vision. As I have been saying the chances that we will be intelligent in this way is quite low. I do like to give a hint to others that it is possible.

Oh, don’t forget that blue-green algae is 10 times as efficient as almost all crops in converting solar energy to biological mass. The invention of single cell protein forms that are both tasty and make use of this efficiency is also logically possible. And most of the oceans of this planet are biological deserts because there are few nutrients. What if we had efficient mechanisms to move nutrients from the ocean bottom to the surface. The small areas of high ocean productivity are associated with ocean upwellings that provide nutrients.

Nick, yes, I could expand on that but it requires some background knowledge. CO2 is far from the only limit we are reaching. Ecosystems are nonlinear, dynamic systems, think tipping points and feedback loops. Here is a primer on basic ecosystem thermodynamics it covers energy flows:

http://goo.gl/GkcKCJ

There are many other kinds of inputs such as nutrients and minerals which are fundamental to ecosystem health and stability. Things like the nitrogen cycle. The biological diversity of the fauna and flora and how they interact. The flow and ebb of the population dynamics of certain predators and their prey. How habitat is impacted by human activities, etc.. etc…

This is definitely not a simple topic to expand on unless you are willing to do some background reading first.

Don, I composed a long response to your reply, unfortunately the internet ate it and I didn’t save a backup…

I’ll just touch on this one point of yours for now

And most of the oceans of this planet are biological deserts because there are few nutrients. What if we had efficient mechanisms to move nutrients from the ocean bottom to the surface. The small areas of high ocean productivity are associated with ocean upwellings that provide nutrients.

Let me just put it bluntly, that would be a very dangerous game even if we could pull it off! I would suggest the application of the precautionary principle in spades before attempting such a venture. We know too little about the unintended consequences of doing something like that.

As for feeding 60 billion people with blue green algae. Don’t even think about it, unless you are planning on really accelerating the mass extinction event we have already set in motion.

No, I really don’t think there is any way we could have 60 billion people living on this planet. It doesn’t even work as a mere thought exercise, let alone in practice.

Also see my comment to Nick, a lot of that same information is the basis for my extreme skepticism.

Don,

Of course, current primary calorie production is probably about 3x what’s needed to feed everybody: half the calories are consumed creating meat, and people overeat by probably about 20%: obesity kills 3x as many people around the world as malnutrition.

So, eliminate over eating, and meat production, and you could feed about 18M people with current agriculture. And, that’s without eliminating non-nutritious crops: coca, marijuana, coffee, ethanol (drinking and motoring)…

Fred,

I read the link you provided. It was helpful.

I still remember some of my college thermodynamics, and since then I’ve followed discussions of exergy and emergy.

I find emergy, and the idea of a literal common energy currency, a bit problematic.

In any case, with that as a foundation, could you expand on the idea that thermodynamics tell us something about limits that might be reached any time soon? I find that puzzling, given that the earth is an open system with so much solar energy flowing through it.

Don, we don’t have to move nutrients from the sea floor. All we need to do is seed the southern ocean with small amounts of iron. I think it’s time to carry out experiments with 10,000 ton injections in an area that’s heavily instrumented to measure the results.

Nick,

You wrote:

In any case, with that as a foundation, could you expand on the idea that thermodynamics tell us something about limits that might be reached any time soon? I find that puzzling, given that the earth is an open system with so much solar energy flowing through it.

It’s Sunday and I’m taking it easy. I’ll try to respond in more detail later.

But in the meantime here is some food for thought…

The Flow of Energy: Higher Trophic Levels

Three hundred trout are needed to support one man for a year.

The trout, in turn, must consume 90,000 frogs, that must consume 27 million

grasshoppers that live off of 1,000 tons of grass.

— G. Tyler Miller, Jr., American Chemist (1971)

Even if humans could change over to a 100% grass diet eliminating all the intermediate trophic levels we would still have to deal with the limits imposed by efficiency losses in energy conversion of all the biological processes involved in the plants producing biomass and then converting that vegetable biomass into energy to sustain our own physical processes and those can best be explained by the laws of thermodynamics.

Then think for a moment about what happens at the other end of the cycle where bacteria and fungi work on decomposing dead plants and animals and all the thermodynamic losses happening there.

Our universe and our ecosystems seem to be heading towards a death by heat loss 🙂

Fred,

Fred, i’m not sure how the details of thermodynamics really help us here.

The losses at each trophic level are pretty easy to understand. I don’t think we really need the laws of thermodynamics to explain that.

It’s not that hard for humans to eat at a lower trophic level. We don’t have to eat native grasses, we can use wheat, corn and soy beans.

Secondly, this stuff applies to food. Most of our discussions on POB are about extrasomatic energy, of which there is an enormous surplus from solar flows.

We went over some scientific literature over the maximum human population capacity in the Population problem article published a few months ago here at Ron’s blog.

The most rational analysis indicate that about 10 billion is a reasonable number for maximum capacity, and even that number might not be sustainable without major changes in the way we live.

Replies to two posters.

First Fernando: We have modest agreement on his point re iron. That is the single most deficient nutrient. Even small experiments such as the suggested 10,000 ton experiment would be certain to produce a substantial increment in local biomass. That would not be adequate to be anything other than a test. Substantial use of minimally productive ocean areas for food would require a sustained research effort and sustained access to incremental nutrients.

Second Fred:

I am quite aware that some people have speculated that there might be negative ecosystem consequences in regard to fertilizing the oceans. However, I have found neither a cogent model of what the consequences might be or evidence of these consequences. The fact that your comment did not provide any confirming evidence is at least tangential support for my position on this matter. If you have real evidence to support your concerns on this I and others will be happy to consider it. Note that I am hardly arguing that the entirety of the ocean deserts be used in this manner. Given the productivity of the most productive ocean areas not much area would be needed. I see no reason not to pursue experiments which are carefully monitored.

Also I have no intention of feeding anyone with blue-green algae. People cannot eat it. My point is that it has an extremely energy efficient mechanism for the conversion of solar energy to biomass. What we would need to do is use this efficiency to maximize an alternative system that produces a form of food that we can eat. And yes we need to reduce the layers of thermodynamic inefficiency in getting to a form that can be consumed. You are concerned with thermodynamic limits and I am just pointing out the obvious solution spaces to those limits.

I have no intention of maximizing our current mass extinction event. I would like to see very significant reduction in the physical footprint of our cities and much greater maintenance of contiguous wild areas. If you have noticed I want a radical increase in our energy efficiency and recycling of resources precisely to be better stewards of the wider ecosystem.

Don you wrote:

Second Fred:

I am quite aware that some people have speculated that there might be negative ecosystem consequences in regard to fertilizing the oceans. However, I have found neither a cogent model of what the consequences might be or evidence of these consequences. The fact that your comment did not provide any confirming evidence is at least tangential support for my position on this matter. If you have real evidence to support your concerns on this I and others will be happy to consider it.

I have to ask, how hard did you actually look?! It really bothers me when people make comments without any knowledge of the fact that there are plenty of scientists who do study this kind of thing. And the last thing we need is people like Fernando who have zero knowledge about how complex ecosystems work to suggest that we should just go out and start fertilizing the ocean. I suggest he stick to his area of expertise which is Petroleum Engineering. I wouldn’t trust him to manage a tiny frog pond, let alone something as complex as the marine ecosystem.

Perhaps you and Fernando both could start here:

https://www.cbd.int/doc/publications/cbd-ts-45-en.pdf

Starting on page 33 the paper addresses the consequences of Observed and Predicted Impacts of Ocean Fertilization Via Controlled Upwelling on

Marine Biodiversity

During all ve ship-based experiments, a consistent increase in phytoplankton biomass and primary production increase was observed following fertilization, with a demonstrated shi in phytoplankton communities from small (10µm diameter) diatom cells. ese observations are supported by long-term study of Station ALOHA, a typical LNLC habitat with non-limiting Fe concentrations

that experiences episodic natural upwelling. Karl and Letelier (2008) later hypothesized that

the controlled upwelling of low NO3-:PO4

3- seawater from below 300 metres in LNLC areas will trigger a two-stage phytoplankton bloom: the first stage characterized by NO3- supported diatoms and the second stage by a N2 fixing bacterial bloom, leading to enhanced N2 fixation, organic matter production and net carbon sequestration of 32.7mmol C m-3 upwelled water142.

The biogeochemical consequences of sustained upwelling of this nature are uncertain. Deep waters are known to contain high concentrations of DIC derived from long-term decomposition of sinking particulate matter, causing most natural upwelling sites to result in a net ocean-to-atmosphere transfer of CO2

143. However due to the regional and seasonal variations in deep-water DIC concentrations, the

observed impacts will be site and depth speci c.

e arti cial upwelling of deep waters also bears the risk of increasing ocean acidi cation and degassing of CO2. Colder deep waters absorb larger amounts of CO2 (cf. section on solubility pump above, and separate synthesis on ocean acidification), which decreases the pH and the calcium carbonate saturation of these waters. Recent hydrographic surveys along the continental shelf of western North America

from central Canada to northern Mexico confirm that seawater, undersaturated with respect to aragonite, upwells onto large portions of the continental shelf, reaching all the way to the surface of northern California. Although seasonal upwelling of the undersaturated waters onto the shelf is a natural phenomenon in this region, the ocean uptake of anthropogenic CO2 has increased the areal extent of the

affected area144. The artifcial up-welling of undersaturated deep water would accelerate the spreading of ocean acidifcation into areas which so far have not yet been impacted. Also, if carried out in tropical areas, the CO2 sequestered by increased phytoplankton growth may be offset by the CO2 released to the atmosphere due to the warming of the deep waters reducing the CO2 solubility (depending on the

localized pCO2).

Reply to Fred on Convention on Biological Diversity document.

Thanks so much for the reference. It does confirm my understandings of some of the possible negative consequences of ocean fertilization. My overview is that these are extremely minimal experiments that would say almost nothing at all about the implications of fertilizing for food production. My major reason for my minimal positive support for Fernando’s suggestion is that it would diminish other nutrients as the water continues on from the point of fertilization. He is right that iron is the major nutrient that is lacking but that does not confirm that it would be adequate alone for an ocean farming operation. Too great an imbalance of nutrients would obviously not work for food production. Also if excessive biomass descends and decomposes to an extent that an anoxic zone is created then the farming model has failed to deliver the biomass in a form useful for people to eat. Beyond that anoxic and hypoxic water can kill fish in a way that is very incompatible with ocean farming. It is a given that farming will not be done until it has been confirmed that these are not significant risks. It would fail as an enterprise if anyone tried it.

Farming of the ocean will of necessity have to emulate some of the positive qualities of the highly productive areas of the existing oceans or it would not work. Any potential ocean farmers will need to have a highly advanced education concerning the ocean ecosystem and how it works. The current research is all oriented toward taking CO2 out of the ecosystem in order to geoengineer a cooler planet. It is vastly less than what is required in order to justify any ocean farming operation.

Don wrote:

Any potential ocean farmers will need to have a highly advanced education concerning the ocean ecosystem and how it works.

On this we are in 100% agreement!

Regarding your comment that the experiments cited in the paper I linked to are minimal, I’d just like to emphasize the fact that there is a very large body of scientific work from multiple disciplines that could be cited to support my position. That paper is but one example .

I also agree that ocean farming is something that will be done on a large scale in the future and it is already happening.

Here is but one example:

http://www.openblue.com/

BTW, while they claim to be a sustainable model, unfortunately the way they currently obtain the feed for the fish they are raising is not even close to sustainable. Of course they don’t tell you that on their website. Though comparatively, the way we raise hogs, cattle and chicken in industrial farms is probably even less so…

Still, ocean farming is definitely the wave of the future, no pun intended.

But for what it is worth simplistic claims that all we need to do is toss some iron ore into the ocean and we’re good, just raise endless red flags for me!

James Howard Kunstler points to when he says: “Industrial economies face a fatal predicament: Oil above $75/barrel crushes economies; under $75/barrel it crushes oil companies”?

It’s helpful to keep in mind that Kunstler doesn’t really know much abut energy, and is a permabear. Look through his works: he says nothing detailed about renewables that makes any sense. I asked him specifically about training and/or experience in energy tech, and he replied that he considered himself an entertainer (the word he used to describe himself was “clown”!). And, he made a very firm prediction that Y2K would absolutely, definitively, without a doubt cause TEOTWAWKI.

And, sadly, Tainter’s work draws from and applies primarily to agricultural societies. It makes no sense in a world where we know how to tap a resource of 100,000TW of solar power.

Personally I don’t have any problem with believing that the economy can easily adapt to seventy five to hundred dollar oil, over a period of a few more years.

But I do have a lot of trouble believing that a decade from now oil will be selling for less than one fifty or so and perhaps a lot MORE.

The real question is whether we can adapt to higher prices and lesser availability faster than oil depletes?

MY gut feeling is that we might hold our own for a few rounds but that in the end depletion is going to put us on the mat with a major depression resulting that will last a LONG time.

It took a five fold increase in price to hold production steady over the last few years up until a year ago.

It is not going to be possible to pay for another five fold increase in the cost of oil and maintain business as usual.

Mac,

Don’t forget, per Jeffrey, the 2008 recession was not caused by oil prices: recent oil prices, as a practical matter, were much higher in the last several years and the economy didn’t crash.

Monthly Brent prices were only over $100 for six months in 2008, whereas starting in February, 2011, monthly Brent prices were over $100 for 42 months, seven times longer than the six month $100 period in 2008.

And the annual Brent price in 2008 was $97, versus an average Brent price of $110 for 2011 to 2013 inclusive.

There are several big questions here:

1) what would have happened to supply if prices had stayed at $100? Would have it continued to expand, creating an larger glut? If so, does that suggest that the current equilibrium price is significantly below $100 – perhaps $75?

2) How much LTO is there in the world? I hear about the Vaca Muerte, and Russian projects. What’s out there? How would they expand if prices rose above $75?

3) What is the cost of alternatives? At $50 a Leaf is slightly cheaper to own and operate than the very cheapest ICE cars on the road. That suggests that above about $60 that oil prices will encounter more and more pressure from substitutes. EVs will continue to get cheaper. Would prices above $100 cause a land rush to EVs?

4) would would be the impact of oil above $100? Oil between 100 and 125 didn’t seem to stop world growth. What would happen with oil above $150? Most analysts just look at oil importers, and just look at the short term. What would happen in the long term? What would happen to the whole world?

Would oil imports drop? How many percentage points of oil importer GDP does imported oil represent – two? five? What would be the change if oil prices rose to $150? Would they reduce consumption by those percentage points, to make room for exports to oil exporting countries? Would they reduce their consumption of other imported goods? Would importers simply “kick the habit”, and switch to EVs and improved transit?

The big game is going to be played out between the Depletionistas and the Economistas.

I will not go so far as to predict that depletion of oil means a permanently crashed economy. But neither do I have faith in the Economistas winning the two team series championship every year year after year.

For some time I took the opposite tack and made many comments to the effect that when the oil shit hits the fan , Leviathan , the nation state , will finally awake from His long slumber and DO THINGS that will prevent the overall economy from suffering a catastrophic crash resulting in widespread violence and LOTS of people dieing hard deaths before their time.

The power of the nation state is almost beyond comprehension once fully aroused. Resources can be marshaled that seem to not even exist and near miracles actually HAPPEN. SOMETIMES.

BUT while I point out that such scenarios can and might come to pass, I do not know that Leviathan aroused will act wisely. Leviathan may act the fool.

LUCK plays a tremendous role in the affairs of individuals, nations, and humanity as a whole.

My own best guess is that MOST of the world will suffer a tremendous crash with enormous loss of life sometime within the next century and more likely within the next five or six decades-

BUT given that POWER (economic, military) and RESOURCES are NOT equally distributed, and geography does not favor all nations equally———–

My belief is that a few countries such as the USA, countries blessed with power and resources plus being favorably situated geographically etc

MIGHT pull thru the next century or two more or less whole.

The pessimists such as Ron win some , the optimists such as Nick G win some.

Things could play out a lot of different ways. ONE way they might play out is fleshed out in the novel ATLAS SHRUGGED.

Just about every body I have ever met, excepting a few hard core conservative republicans who have actually read it has judged Ayn Rand’s novel ATLAS SHRUGGED to be a blue print for disaster.

It was WRITTEN as a blue print for ONE possible disaster- incompetent government corrupted by business interests.

But this novel is nothing more than any other book , just ink on pages. The leftish leaning educational establishment has succeeded in demonizing Rand’s work to the point that I don’t even know a liberal who will admit having ever read it.

SO -They condemn it on the basis of politically correct HEARSAY. Their intellectual masters tell them what to think.

This novel has several separate themes.

ONE is that the LEAD character is a woman who does exactly to suit her self and smashes her way thru the glass ceiling to the very most powerful position in the most powerful company in the world, while conducting her personal and sex life as she pleases and saying so publicly.

I have not ever had a conversation with a true blue looking down her nose at me feminist who realizes this undeniable fact while lecturing me on Rand’s evil philosophy.

Another major theme involves the way business and government can morph into an incestous evil siamese twin , a single entity often described as fascism in the flesh.

They accuse Rand of being the ultimate fascist while in actuality her masterpiece is all about the true evil nature of fascism.

People who believe that the banksters are the ultimate evil masters of the world these days would LOVE this book if they were to read it.

Corrupt government, government controlled by businessmen, leads to the crash of industrial civilization in this novel.

Of course in the end the good guys and girls prevail- sort of at least.

There is a great deal of insight to be gained into the ways history MIGHT play out.

A third theme is the role of new technology in changing the way the economy works and the disruptions brought on new technology. Hank Reardon, one of Dagny’s friends and lovers,is an industrial titan in his own right who comes up with a major improvement in the steel making process effectively bankrupting his competitors- not to mention a new miracle alloy that promises to revolutionize other industries such as railroads.

The competition conspires with government to drive him out of business and then confiscate his tech and plant.

Everybody interested in the future ought to read this novel. But they need to remember it IS ONLY a novel.

Forget Rand as a philosopher. She was bright enough to write a novel but fell victim to the PETER PRINCIPLE when she got to thinking about the status involved in philosophy and got in over her head. WAY over her head.

Incidentally VERY few of the business types who hold her in awe have ever read her work – or much of any thing else for that matter so far as I can estimate from their public pronouncements.

Yogi sez predicting is hard, especially the future.

Mac,

What did you think of my questions, above?

Re: Clueless

Mike and I are (hopefully) using some exaggeration for effect, in regard to talking about our prospective Dairy Queen jobs, but in my case it’s not an exaggeration to say that my meals have certainly shifted to more beans and rice from steak and sea bass. And at current oil prices, it may be beans or rice, but not both. . . .

Regarding oil prices, I may be one of the worst prognosticators around, especially when it comes to demand side analysis. My primary contribution has been as an amateur supply side analyst, especially in regard to net exports.

In any case, earlier this year I thought that Dennis nailed the monthly low in Brent prices for the current oil price decline ($48 monthly average in January, 2015), and I thought we were more or less following an upward price trajectory, from the 1/15 low, similar to the price recovery following the 12/08 monthly oil price low.

Of course, as Shallow noted, the key difference between the 2008/2009 price decline and subsequent recovery and the 2014/2015 decline is that Saudi Arabia cut production from 2008 to 2009 while they increased production from 2014 to 2015.

But for what it’s worth (probably not much), I think that this is a tremendous buying opportunity, especially for quality dividend paying oil and gas stocks (although the dividend levels for some of these companies may be suspect going forward). I have no idea what Warrren Buffet might be doing, but I wouldn’t be surprised to learn that he is currently buying oil and gas stocks.

I also think that oil & gas stocks need to be placed in perspective in light of other investment options, which seem to be pretty poor, and as I have previously noted we may be in a long term period where “Winners” are best defined as those who lose the least.

The bottom line for me is that depletion marches on. A few years ago, ExxonMobil put the decline from existing oil wells at about 4% to 6% per year. A recent WSJ article noted that analysts are currently putting the decline from existing oil wells at 5% to 8% per year (IMO, the 8% number is more realistic). At 8%/year, globally we need about 6.5 MMBPD of new C+C production every single year, just to offset declines from existing wells, or we need about 65 MMBPD of new C+C production over the next 10 years, just to offset declines from existing wells. This is equivalent to putting on line the peak production rate of about thirty-three (33) North Slopes of Alaska over the next 10 years.

And as I have previously noted, it appears quite likely that global crude oil production (45 and lower API gravity crude oil) has been more or less flat to down since 2005, while global natural gas production and associated liquids, condensate and NGL, have (so far) continued to increase.

If it took trillions of dollars of upstream capex to keep us on an “Undulating Plateau” in actual global crude oil production, what happens to crude production given the large and ongoing cutbacks in upstream capex?

And as Heinrich has noted, given the huge rate of decline in existing US gas production, it’s possible that we might see substantially higher North American gas prices this winter.

If you come through Austin, I’ll be happy to buy you a steak.

Following are links to charts showing normalized production values for OPEC 12 countries and global data. The gas, natural gas liquids (NGL) and crude + condensate (C+C) values are for 2002 to 2014 (except for gas, which is through 2013, EIA data in all cases).

Global Gas, NGL and C+C:

http://i1095.photobucket.com/albums/i475/westexas/Global%20Gas%20NGL%20C%20amp%20C_zpskb5bxu6d.jpg

OPEC 12 Gas, NGL and C+C:

http://i1095.photobucket.com/albums/i475/westexas/OPEC%20Gas%20NGL%20C%20amp%20C_zpsox3lqdkj.jpg

Also following is a link to OPEC 12 implied condensate (EIA C+C less OPEC crude) and OPEC crude only from 2005 to 2014 (OPEC data prior to 2005 was for a different set of exporters than post-2005). Obviously, data quality is an issue, and the boundary between actual crude and condensate is sometimes fuzzy. In any case, we have to deal with the data that we have.

As of 2014, OPEC and the US accounted for 53% of global C+C production (41 MMBPD out of 78 MMBPD). Implied OPEC condensate production increased by 1.2 MMBPD from 2005 to 2014 (1.2 to 2.4). The EIA estimates that US condensate production increased by about 1.0 MMBPD from 2011 to 2014. I’m estimating that US condensate production may have increased by around 1.5 MMBPD or so from 2005 to 2014. Based on the foregoing, OPEC and the US may have accounted for about 68% (about 2.7 MMBPD) of the 4 MMBPD increase in global C+C production from 2005 to 2014.

OPEC 12 Crude and Implied Condensate:

http://i1095.photobucket.com/albums/i475/westexas/OPEC%20Crude%20and%20Condensate_zps12rfrqos.jpg

“Everyone currently has the opportunity [my opinion] to buy low. Many fairly good quality oil & gas companies are trading at 30% to 50% of their recent (1 1/2 years) highs.”

Don’t catch a falling knife (my opinion)

Wear thick gloves. I bought in late January and focused on companies with large dividend returns. So far I’m doing ok, the prices go up and down, but the dividends are still coming.

I guess these were not US E&P stocks?

All of them were oil or service company stocks. I buy and hold long term, so I only check every couple of months how they are doing.

I think they’ll be fine, I see Saudi Arabia foreign reserves are dropping at a fast pace at current prices, they can’t take this too long either.

I’ve written that, when it gets like this, there’s a Darwinian process. We will see bankruptcies, properties will change hands, and there’s going to be takeovers and mergers. Large outfits with low debt and cash reserves are like vultures waiting for the weakest cattle to fall down. Then they feed. And I suspect we may see Arab money being funneled to buy USA and Canadian companies who went over the cliff.

“So far I’m doing ok, the prices go up and down, but the dividends are still coming.”

The correct answer of “how are you doing with your investment” is to calculate to a last cent how you are comparing your returns including dividends with broad index returns. Otherwise to whom are you comparing?

Why would I bother to log in to my portfolio merely to answer such a question? And what good would it do? I bought them to see how they do as the oil price returns to $100 per barrel.

Well you said that “you are doing ok with (your oil investment)”. I just asked with whom you are comparing? Are you comparing with Ves, Clueless, or with broad market? If your returns are less than broad market returns, than “you are not doing as well as you could do”. So if you know that info by calculating and comparing returns your better choice of investing would be to invest in broad index market instead of very narrow and risky sector based individual stocks. But on other hand some people are happy with making less than broad index market for no apparent logical reason.

I’m the one who gets to judge about my personal investments. They are doing ok.

AlexS wrote:

“Don’t catch a falling knife (my opinion)”

Good advice. All Commodities are collapsing, its just not Oil. Copper breach a 15 year low this week. This is a very dangerous time to own stocks as the global economy falls into a recession and taking with it stocks and non-gov’t bonds. I don’t think we will see a deep route as 2008-2009, but it could get pretty severe and even the best companies can get hammered. If institutional investment companies are forced to liquidate investments, it could get quite ugly. The valve of cash is likely to rise much further as stocks and bond tank.

http://newnormaleconomics.com/peak-oil/

Ron, I have had some personal interaction with Mauldin since the 1990s, and he’s no one’s fool and definitely NOT ignorant, believe me; but he doesn’t get paid in lucrative referral and investment conference speaking fees to sell out his deep-pocketed, big-money, oil-industry Tejas pals and those hedgies levered long the biotech bubble, in particular.

Mauldin and his pals are VERY WELL AWARE of Peak Oil, although it is not inaccurate to conclude that they don’t fully understand it as many here correctly do (IMO), which, for Mauldin and his pals, is an enviable position because they pile up mountains of coin irrespective of whether they’re correct or otherwise.

Mauldin has developed a golden network of A-list players and he hires bright people to poach/synthesize ideas from others in order to sell premium-priced newsletters with ideas in order to pitch to people with too much money other people who want to make lots of money from people with too much money.

I have often wondered if Mauldin has ever had an original investment idea in his career, but that’s probably just sour grapes talking on my part, when it’s conceivable that Mauldin has made a highly successful career out of NOT having had any original ideas. Ha ha!!!

It’s a great gig if one can get it, and Mauldin has proven that he’s REALLY GOOD at “it”. 😀

BC, many very smart people have an “ignorant blind spot”. That is they are very smart in most areas but in one or two, they simply let their preconceived ideas overrule their common sense. Proclaiming that the free market and technology will provide an infinite supply of a finite resource is such an ignorant blind spot.

I have no doubt that Mauldin is a genus in some fields. But I also have no doubt that he is an ignoramus in others. We all are.

Yes, I take your point, Ron. What might have been missed in the translation from my lack of being more succinct is that Mauldin and his ilk are very well aware that Peak Oil is real and has already occurred, but people at his level of the income strata don’t get paid to “sell” Peak Oil and its implications.

IOW, the rentier top 0.001-1% don’t need the economy to grow. They have detached from productive activities and are “set”, as it were, having accumulated more financial wealth than they and theirs will need for several lifetimes.

This is classic imperial decadence.

Therefore, no one who relies for his or her professional credibility and livelihood selling the Establishment metanarrative of perpetual growth from techno-utopianism to the Elysium-like top 0.001-1% can hope to sustain his or her credibility, professional livelihood, and socioeconomic status by selling THE ANTITHESIS of the fantasy/fallacy that sustains the hierarchical structure of disproportionate upward flows of resources, labor, profits, and gov’t receipts for social goods to the top 0.001-1%.

IOW, Peak Oil is well known by the Establishment intelligentsia, technocrats, politicos, CEO caste, Pentagon planners, and politically vetted military officer caste; but it can’t be articulated and fully framed within the historical, economic, financial, geopolitical, or socio-cultural context so as to fully inform the masses, i.e., you, me, and the readers of your blog.

That is to say, were Peak Oil and its local, regional, national, and global financial, economic, and geopolitical implications to be fully disclosed, contextualized, and become part of the political/geopolitical discourse, including the implied scrutiny of the top 0.001-1% rentier Power Elite’s values, objectives, expectations, and actions, the “story” of how we arrived at where we are today would beg to be scrutinized and thus likely challenged, which in turn would require scrutinizing the gov’t policies employed since the 1970s and thus revisiting the motives, values, expectations, and benefits accrued since, and to whom.

Please forgive the verbosity, but this is a “big idea”, and such a notion often requires rather more space in order to properly present its merits. But, as always, thanks for your kind forbearance and graciousness in permitting me to ramble on. 🙂

sounding like Mike Rupert

Yes, ezrydermike, thanks for noting that. Granted, being too early to the inevitable outcome at a systemic scale has a very high personal/per capita cost, sometimes a terminal cost; no one gets paid for that.

Peace.

yes, talking about peak oil, limits to growth, ecological overshoot, Deep State, etc., does tend to cut down one’s party invitations.

Peace to you BC.

re: “peak oil is well known to the … CEO caste …”

I dunno – was at a conference recently and talking to a consultant.

Big utility (we would all recognize) CEO customer of his says “300 years of natural gas, no need for solar…”

I think that is shockingly insane.

Newsletter guys are 2/20 wannabes that couldn’t gather AUM.

Meaning frustrated hedgie.

Watcher, often the case.

BC,

To me the whole situation looks like Mauldin has to help his rich clients to offload desastrous investments in the oil patch. Are there any dumb investors out there to help him?

Heinrich, I suspect you’re correct. Without “dumb investors”, there would not be much of a market for the predators.

Lots of ways for

1) oil to be scarce and priced low

2) oil to be scarce and priced high but have all the companies producing oil have low OPEX and low interest rates and still be ready to fold

3) oil to be scarce, priced high, and companies be doing well but you, as shareholder, making nothing from it

//////////////////////////////////////////////////////////////

1) scarcity doesn’t have to define price

2) if companies look like they will make too much money, they can be nationalized, or turned into regulated monopolies (regardless of how many of them there are) like utilities. Rather a lot of examples of this around the world, yes? Statoil? Rosneft? Sinopec?

3) The Apocalypse trade never pays off. The system is destroyed and there are no counterparties to write a check.

Devastating scarcity is devastating. As in not survivable. Devastating has a meaning and it’s not “I make a lot of money and competitively elevate .”

More like devastating abundance at this point.

Your only evidence of that is low price, which is not evidence of that.

What would be evidence of devastating abundance?

At today’s prices given current demand?

Oil that can be widely produced at $20 per barrel – all costs included.

That would certainly lead to an oversupplied market, I would think.

6 billion deaths within one year with none of them a result of no food on the shelves.

Obesity? Car accidents?

An abundance of asteroids and large meteors intersecting with the earth. Solves global warming at the same time.

Yes I think people overestimate the legitimacy of current contracts and the maintenance of BAU. Some people will even go so far as to say that TPTB will maintain BAU at all costs, therefore you should remain invested in the system and try to profit from it.

While I sympathize a little with this argument, it still rings hollow for me because natural capital cannot be created by 1’s and 0’s. It can only be extracted and transformed and, in the case of fossil fuels, mostly burnt and lost forever. If somebody out there can’t, or won’t, deliver the commodity, the game ends. Invading and bombing doesn’t help, because in the process you ruin further the production infrastructure.

A dislocation such as we face today is a dislocation, full stop. All bets are off! Deals can be reneged, pacts can be broken, laws can be changed, governments can collapse, currencies can fail. Happens all of the time, will happen more as time goes by.

I use the following as a general rule:

1) big banks and financial firms can play this game, because they profit enormously when they win, and when they lose they still win, because they get more free money from the central bank

2) for the rest of us, we just have to keep working and preparing

That’s it. I don’t think it’s more complicated than that. If you are in category 2 and try to join 1, you will find out very quickly that you don’t belong, and your so-called ticket doesn’t get you a seat at the table.

There is always plan B.

http://video.pbs.org/video/1864227276/

Problem is getting politicians to understand the need for it and show some courage in the face of adversity to implement the public good.

Shale companies now produce more oil with two rigs than they did just a few years ago with three rigs, sometimes even spending less overall.

Does anyone here know what revolutionary new technology came along over the last few years?

As far as I can tell they mainly got better at picking the sweet spots and avoiding the bad spots. I’m just an armchair analyst and make no claim to knowing how they learnt to do that, but it seems to me their success is based primarily upon that sweet spot drilling behaviour.

There is no evidence of this. First few months production has been flat for years (yielding quite the puzzle re stage count) across averaged wells. Lots of work has investigated this in comment threads here and rebutted company claims.

Frugal, my answer to that is….the internet, so called oil, “analysts” everywhere that do not know diddly squat about the oilfield and the new normal for lying.

Rigs don’t make wells, they drill holes in the ground. People make wells. LTO production has been holding steady thru 2015, even with the declining rig count, because shale companies have been frac’ing hundreds of wells drilled in 2014 that distorts the 2015 picture. Any well that still has sufficient induced energy (from the frac) they are producing wide open, they are using bigger fracs, and the flowbacks and subsequent 6 month production rates (note increasing GOR and CH gas (goodonya, Push)) are also wide open.

This is not rocket science. Shale companies are desperate and they desperately need money. There is no “revolutionary” new technology under way that will save their hineys now.

The CEO of H&P says rig commitments are not be renewed and in the next 60-90 days a lot more rigs are going to get stacked, a lot more people are going to lose their jobs.

This is LTO stuff is a bad deal, folks; its total mismanagement of a valuable natural resource. A failed business model. Let’s hope we (all Americans) don’t all end up having to pay the 300 billion dollars of debt off the LTO industry has incurred. When those CEO’s start walking off with big parachutes, remember them fondly.

Mike

Thanks Mike.

As I mentioned before, I am in an area that until recently was trying to decide what to do about fracking within suburban neighborhoods. There has been a lot of push back from people living in those areas. My fear was another boom and bust cycle where companies came in, drilled and created local disruptions, and then when the money ran out, pulled out and left messes.

I joined this forum to monitor decline rates in the Bakken in hopes that economics would make themselves evident before my area sold itself to the oil companies.

With economics being what they are now, I am hoping that the oil lobbying in my area has declined and that the state is thinking twice about concessions it was willing to make. The state is very strong economically right now and doesn’t need additional gas and oil activity to fill the coffers.

Boomer, I am aware of your fears from previous posts. I wish that I could arrest your fears regarding pipelines. I could easily statistically, and from a realistic standpoint, but of course I cannot because I am in the oil business and I am supposedly, bias. So believes the EV gang who has anointed themselves keeper of the future, in the world’s best interest.

I think I may have said this to you before; I have a wealthy, very successful friend is who has a prospect on the east slop of the Rockies in CO that I would die to have a piece of. It is a beautiful prospect that would make Coloradans a boat load of money. He has worked on if for 10 years and cannot get permits to drill it. It will never get drilled. Colorado is the most liberal state in the entire union, even more so than the great state of UCB. I think you are fine and need not worry about pipelines. Which, by the way, I believe, is the single safest means of transporting oil and refined products across our great country, far safer than trains, and way better than ships.

The largest oil spill in the country’s history (for actual harm to the environment) was the incident in Valdez. That oil was destined for Long Beach, California when the Valdez went aground. Californian’s are paranoid about their beaches, but are in great need of much oil and gasoline so they can stay stuck on the 405 for 2 hours at a time. So, for Californian’s, its OK to make a mess in the Gulf of Mexico as long as Texas and LA can get oil and gas to them cheap, and its plenty OK to “import” oil by ship from Alaska, as long as they, Californians, don’t have to deal with those messes. Which to this day they cannot, even over the Valdez incident. Such is the hypocrisy of the anti-fossil fuel crowd.

Again, I think you’ll be fine for several years and won’t have to worry about pipelines. Sooner, rather than later, you will. English law and the rights of private land ownership are being lost in the best interest of the common good of the citizens. Again, another little bit of hypocrisy about the anti fossil fuel, “its OK, I need it, as long as it does not come from my backyard” gang.

Mike

Thanks for your comments.

The pipeline issue doesn’t affect me personally. I bring it up because I know Nebraskans who are against it and I try to explain to Fernando why they are against it. He seems to think Venezuelans are the reason there is any opposition and that isn’t the case.

I am more concerned about tar sand mining. It looks like a messy operation, so I am wary of the economics and environmental damage of that.

Now the fracking discussions are in my state. I’ve lived here long enough to see what an oil bust did to it years ago. So I am wary of seeing that happen again. Now people want to drill in populated areas. So there is more at stake than when the boom was going to happen in unpopulated areas. Back then the oil industry packed up and left that part of the state very rapidly and it had a very negative impact both in those communities and in Denver as well.

I’ve seen how fast the oil companies can leave when the economics change.

What Every Westerner Should Know About Oil Shale: … on May 2, 1982 – a day known on the Western Slope as “Black Sunday” – everything came to a catastrophic halt. Reckoning with falling oil prices that made oil shale no longer profitable, Exxon’s board of directors announced that they would pull the plug on the Colony Project, effective immediately. The evening news delivered the first word most people in Colorado heard about it. Overnight the 2100 people employed on the project became unemployed, locked out and not even allowed to retrieve their personal effects when they showed up at the job site the next morning. The impact shot through the entire region, leaving everyone from construction workers to bus drivers to area business owners to appraise what a post-shale future might hold for them.

Boomer, I am a land owner too and actually have a big pipeline across my place. I don’t think much about it because I think its pretty safe. On the other hand, I understand why Nebraskans would not want one built thru the sand hills that transported oil sand oil from Alberta to the Gulf Coast. I have seen that mess up there and it is blight on Mother Earth in a big way. I wish we did not need to do things like that; its a God awful thing to see.

My industry has done some bad things in the past and disappeared leaving others to clean their messes up. A lot of industries occasionally do the same thing. I try and be a good steward of the land on leases that I operate. Its not my land but I treat it like it is. I think, however, that regulations are becoming so stringent regarding the environment and the correlative rights of others that the oil industry simply will not be allowed to do things the way it use to. Besides regulatory issues, mineral owners are now making mineral leases that are very, very protective of the land and incredibly hard to operate under. To comply with stricter regulations and leasehold terms, operating costs have gone up and most operators carry so much liability insurance for surface and downhole failures it is staggering. Things are changing and I think things will get even better.

Drilling wells in populated areas unfortunately might become more prominent. Rural ranch and farmland is getting overrun with housing developments. It’s a sensitive issue and I understand your concerns. I always think of the Barnett in the DFW area and think that was done pretty well in a very densely populated area.

I love Colorado and caught many wonderful trout in breathtaking places there. I don’t want it messed up either, not in any way. As to that oil shale stuff I hope we never have to open that can of worms.

Mike

Mike, thanks again for your comments.

I have felt that economics, more than safety or the environment, will ultimately determine what happens with future drilling in Colorado. And even the pipeline.

In a place like Colorado, water, land development, recreation, tourism, and agriculture all factor in so there are a variety of stakeholders in the discussions. So who gets priority may end up being an economic decision. Right now, the price of oil and gas being low, and the state booming economically, Colorado doesn’t need the disruptions that new drilling might bring. The conversation has likely shifted from a year or two ago. The conversation could shift again in the future.

In this world, a few Nebraskan farmers don’t amount to a hill of beans in national politics. Keystone XL was frozen by Obama because there’s intense lobbying by people who don’t give a hoot about Nebraska farmers. Their gig is global warming. And when I notice they are also the kind of people who swoon over the Chavista regime, and taking into account the huge amount of money the Chavistas have used to interfere in other countries’s internal affairs, it seems safe to conclude they financed “greens” who oppose Canadian heavy oil but thoroughly ignore the identical Venezuelan heavy oil coming in by tankers.

Keystone XL was frozen by Obama because there’s intense lobbying by people who don’t give a hoot about Nebraska farmers.

You haven’t been following this closely. The pipeline has been stalled because the some farmers have filed a lawsuit which is still going through the Nebraska court process.

Nebraska Judge Stops TransCanada from Using Eminent Domain for Keystone XL

I’m as green as they come, but have zero love for the Chavistas. Please don’t lump the two together.

I didn’t do the lumping. There are thousands of webpages and letters available showing a relationship between organizations and individuals in the USA and the Chávez regime. The leftists are also engaged in environmental causes, and quite often they seem to follow the Venezuelan line.

Do you know what I do? I follow their Twitter, lol at their Facebook pages, read their blogs. And the threads are quite evident.

The financing also flows via Hollywood. For example the Chávez regime paid Danny Glover $18 million for a movie project he never carried out. I’m pretty sure the FBI must have these guys all identified, because a lot of that money is laundered, illegal cash stolen by the Chavistas.

Given the huge pile of cash they stole (at least $20 billion), the “donation” under the table of several hundred million USD to USA and other western outfits seems like a reasonable estimate.

Fernando,

You’re worried about a few piddling billions the Chavistas have stolen?

You seem to be ignoring the biggest crazy aunt in the living room:

Congresswoman Cynthia McKinney Nails RUMSFELD with Hard Questions

https://www.youtube.com/watch?v=Px1t1-a9uxk

Though transparency was a cause he championed when campaigning for the presidency, President Obama has largely avoided making certain defense costs known to the public. However, when it comes to military appropriations for government spy agencies, we know from Freedom of Information Act requests that the so-called “black budget” is an increasingly massive expenditure subsidized by American taxpayers. The CIA and and NSA alone garnered $52.6 billion in funding in 2013 while the Department of Defense black ops budget for secret military projects exceeds this number. It is estimated to be $58.7 billion for the fiscal year 2015.