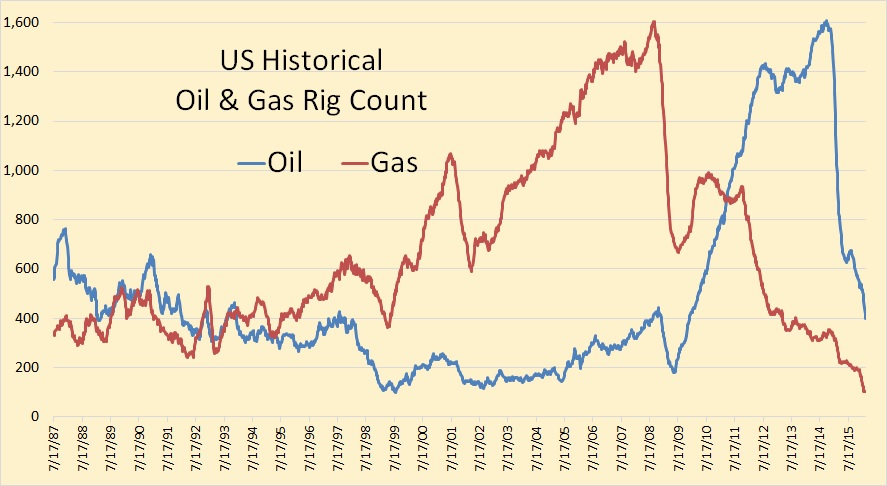

The North American Baker Hughes Rig Count came out Friday. The decline continues. Baker Hughes gives an oil and gas breakout for every basin and state with five years of historical data.

Baker Hughes has twenty eight and one half years of historical data for total US rigs but only five years for individual basins. Gas rigs peaked in August 2008 at 1,606 rigs, over six years before the peak in Oil rigs. On February, 26, gas total US gas rig count stood at 102, a decline of over over 93%.