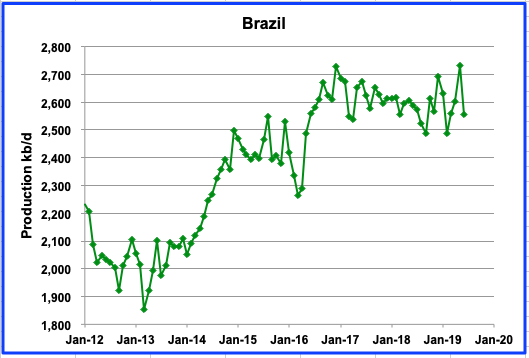

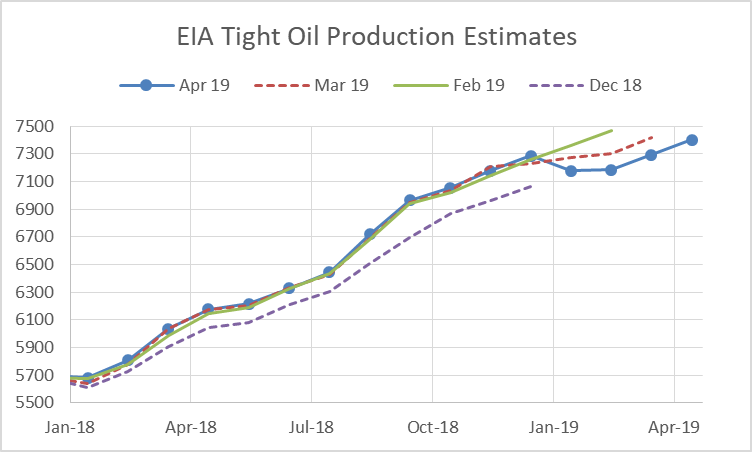

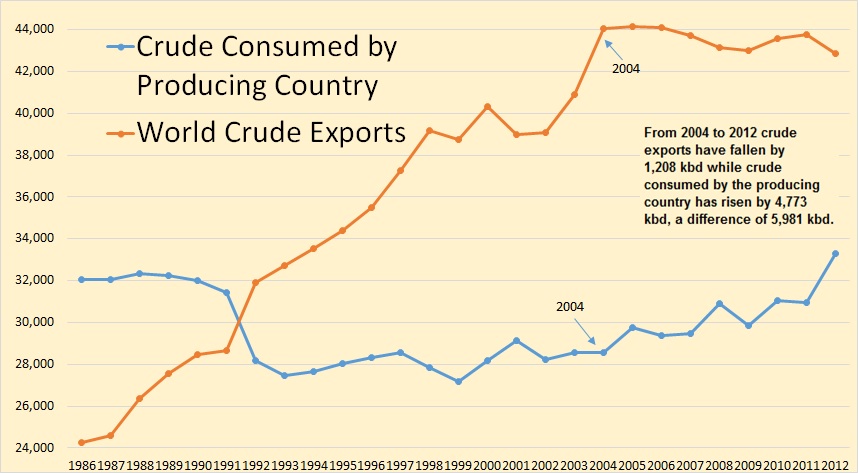

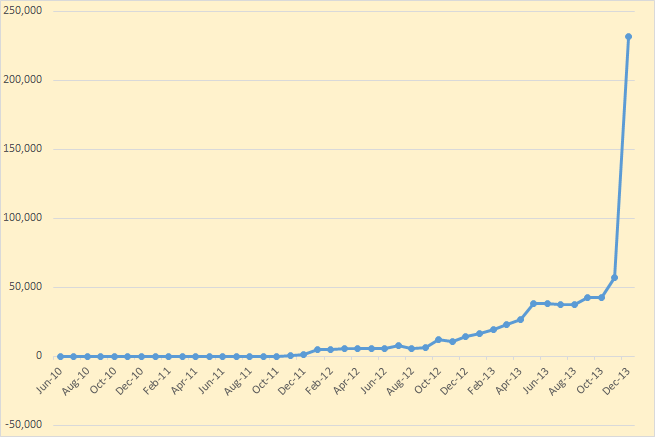

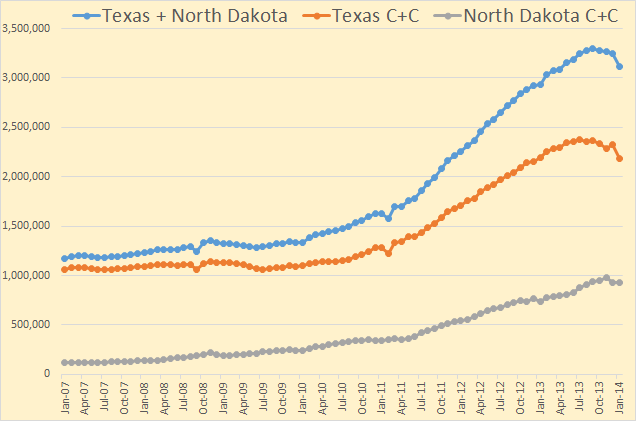

Below are a number of Non-OPEC charts created from data provided by the EIA International Energy Statistics.

Since the EIA site is still in the Beta stage, the data and countries listed change from month to month.

Ron has been doing a lot of work with OPEC production data and the EIA US data. I am adding the EIA’s Non-OPEC charts to provide a world overview of how the production from a range of countries is progressing.

The charts below are primarily for the world’s largest Non-OPEC producers and are updated to June 2019, except for the U.S., which is updated to July 2019. If you are interested in additional countries, let it be known.

The first set of charts is for Non-OPEC countries and the last few provide a world overview. Under some charts, I will add country comments from the IEA since I have updated data from them up to August 2019. While the IEA production numbers reflect “all liquids”, their June to August increments provide an indication of how the trend in the EIA charts will change by August, since that is their latest data.

A personal note: I am not an oil expert. However, I do enjoy playing with numbers and looking at charts. I am a follower of this great site because of my interest in the Peak Oil question/issue. I do appreciate the info and insight provided by the experts on this site and want to thank Dennis and Ron and other posters and followers for keeping this site active and current.