This is a guest post by Ovi here.

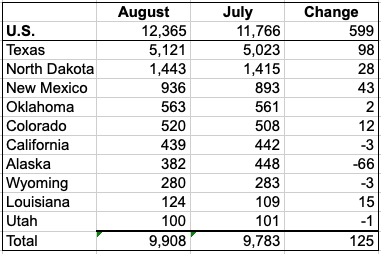

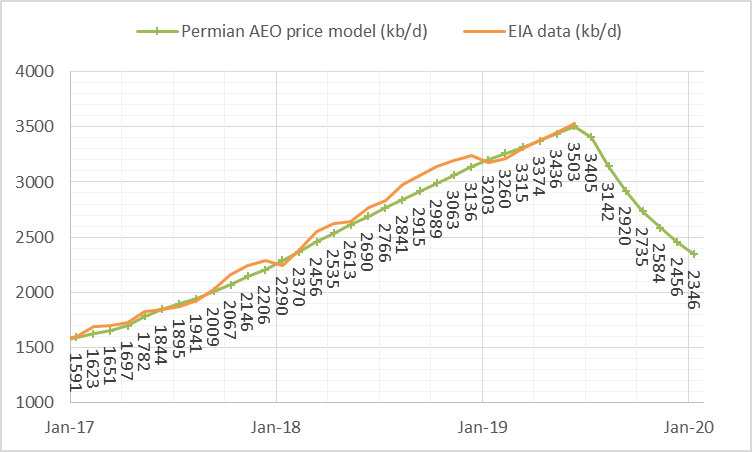

All of the oil production data for the states comes from the EIAʼs Petroleum Supply Monthly.

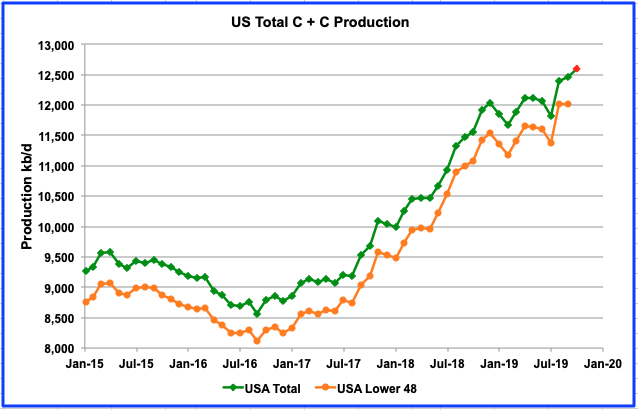

The charts below are updated to September 2019 for the largest US oil producing states (>100 kb/d).

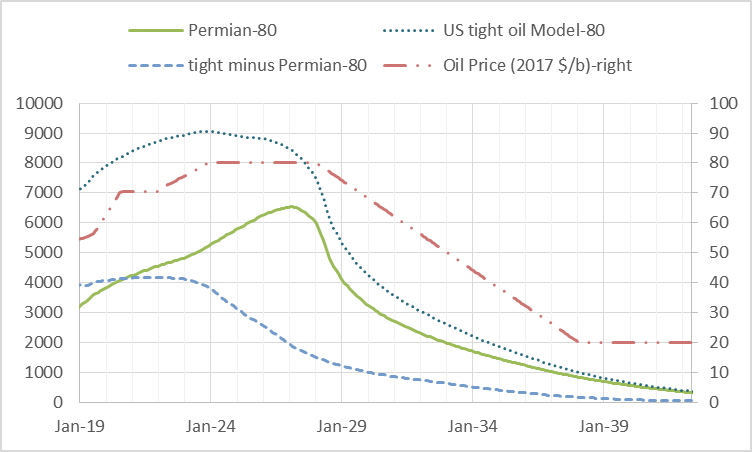

There continues to be much speculation and information pointing to a potential slowing of US oil production. However the latest production data from the EIA continues to point higher, albeit at a slower rate.

Read More