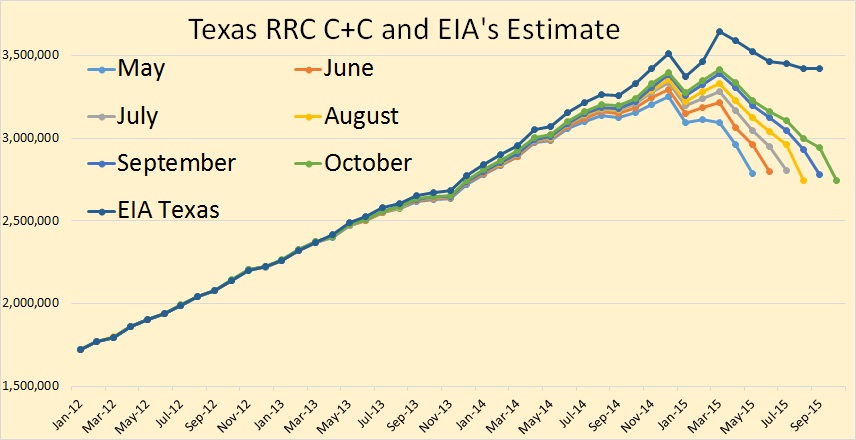

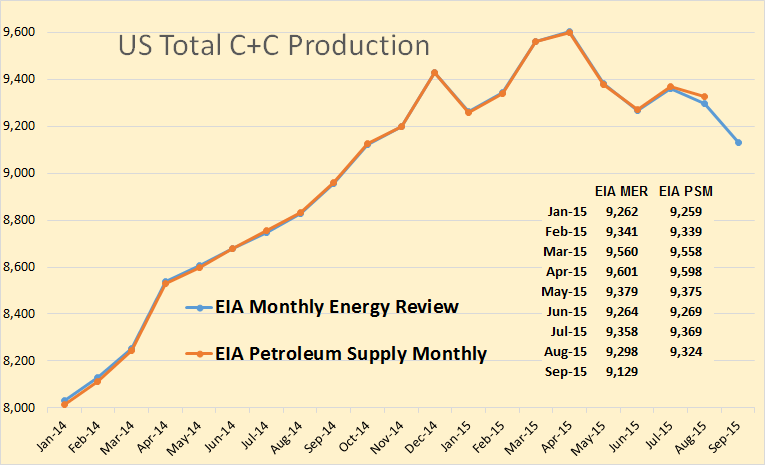

The Texas RRC Oil and Gas production data is out. All the RRC data below is through October 2015 and all the EIA data below is through September 2015.

Important: All the Texas RRC data is incomplete, especially the latter months. They will be revised upward as the Texas RRC gathers more data. The EIA data is what the EIA expects the final data will look like.

The RRC Crude + Condensate data for October shows a slight decline in October. The EIA says Texas C+C was flat, August to September.