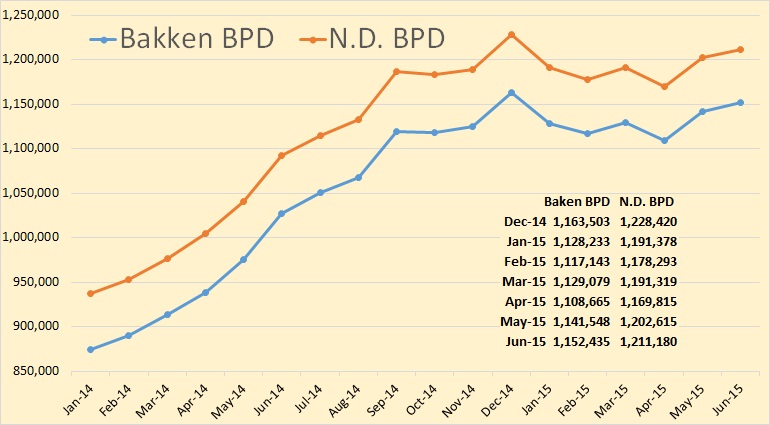

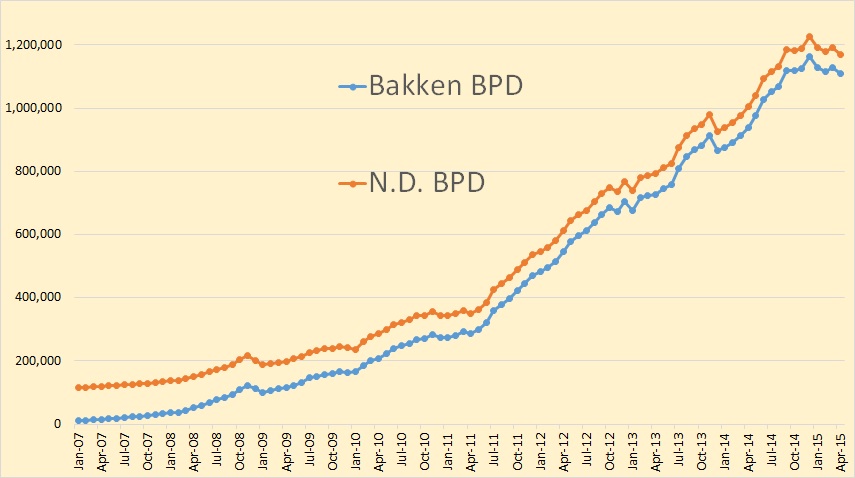

The Bakken Production Statistics and the ND Production Statistics with June production numbers has been published.

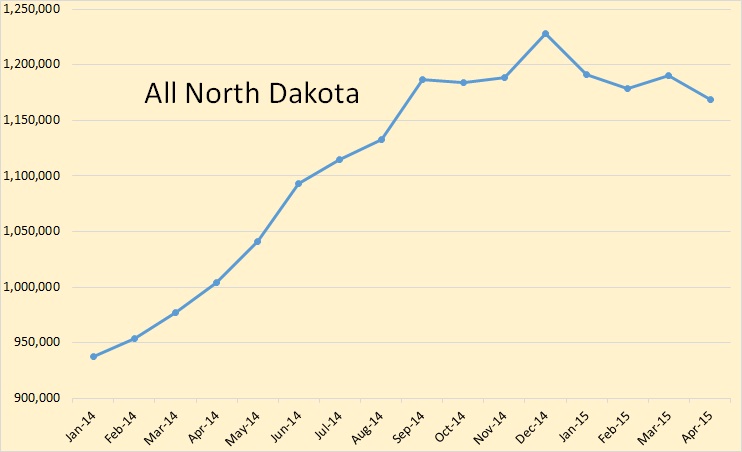

Bakken production was up by 10,887 barrels per day to 1,152,455 BPD while all North Dakota production was up by 8,565 barrels per day to 1,211,180 BPD. Bakken production is still 11,068 bpd below their December high while all North Dakota production is still 17,240 bpd below their December high.