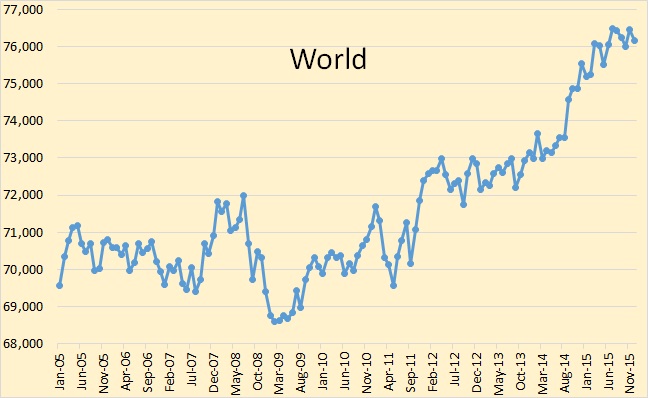

The JODI Oil World Database came out a few days ago. The data is through December 2015. The JODI C+C production numbers differs somewhat from the EIA numbers. The JODI OPEC numbers are crude. Also there are a few very small producers that do not report to JODI so their numbers will be slightly less than the EIA. But otherwise they are pretty accurate.

Also, JODI, for some reason, does not count all of Canada’s oil sands production. So for Canada I use Canada’s National Energy Board numbers instead.

The JODI C+C numbers, for Non-OPEC, will average about 2.4 million barrels per day less than the EIA. This is largely due to some countries not reporting to JODI. But these countries only have small changes in their overall production so would have little effect on any of my charts or calculations.

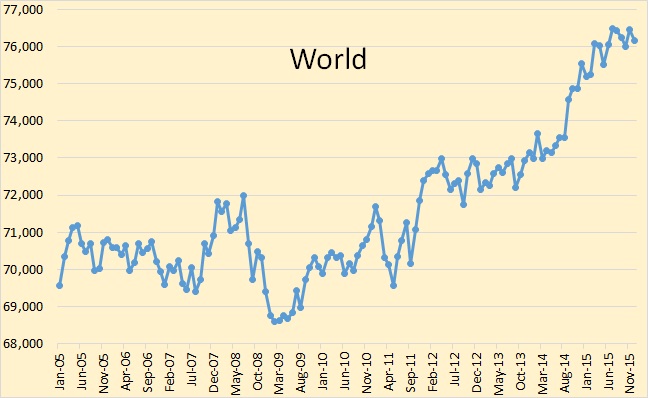

According to JODI, world crude oil production peaked, so far, in July and has declined by 339,000 barrels per day.

Read More