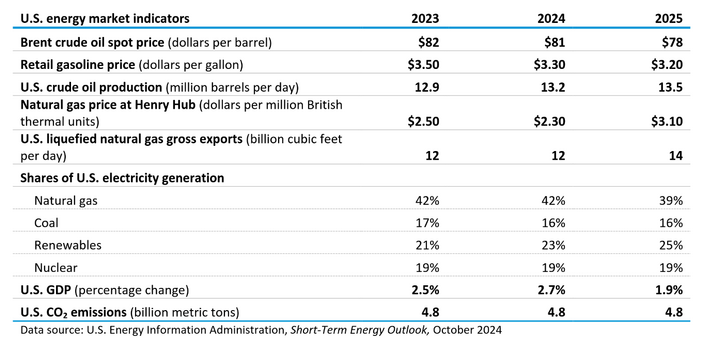

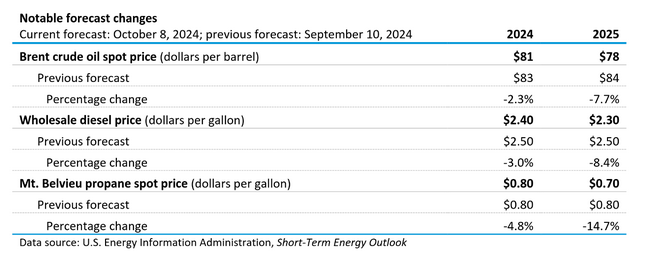

The EIA STEO was published recently, most estimates for Petroleum liquids and crude oil output have been revised lower compared to the estimates in September’s report.

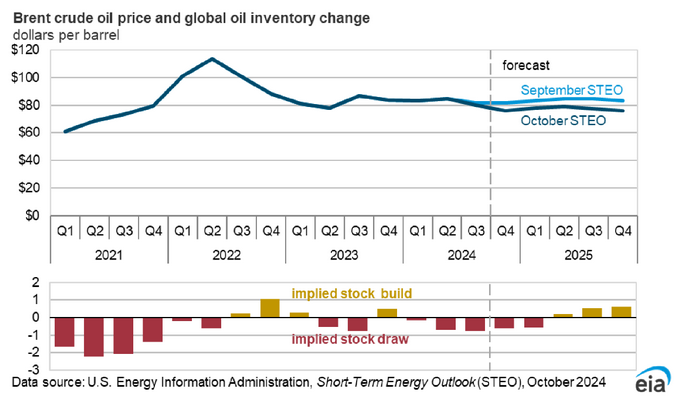

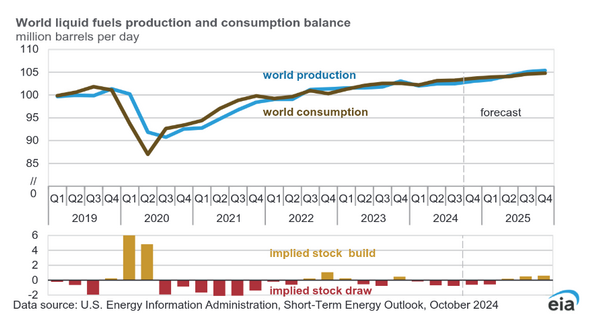

The EIA expects World petroleum liquids output to increase significantly more in 2025 than it did in 2024 despite its forecast for falling oil prices in 2025. In 2024 World liquids output is forecast to increase by 500 kb/d, but in 2025 the increase is expected to be 4 times larger at 2000 kb/d. Seems doubtful that the increase will be that large if the oil price forecast of $78/bo (nominal dollars) for Brent is correct.

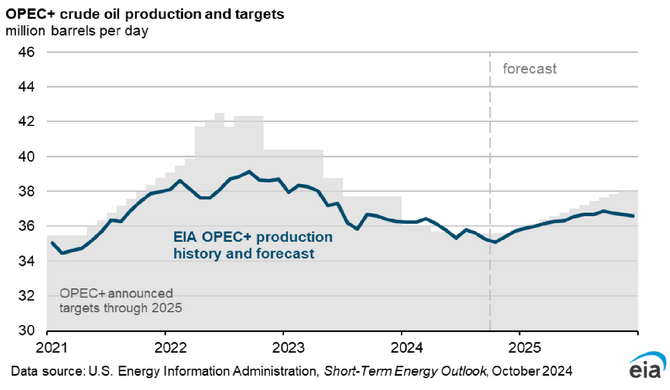

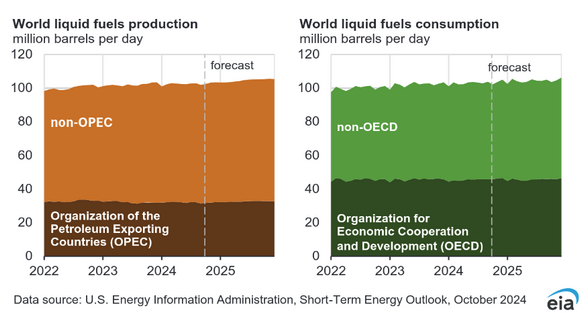

This forecast for OPEC+ output seems optimistic for the low crude oil prices that the EIA expects in 2025.

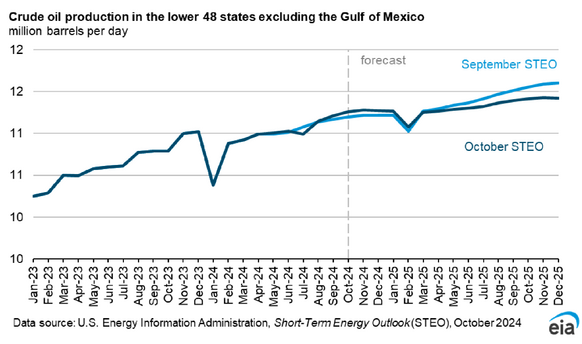

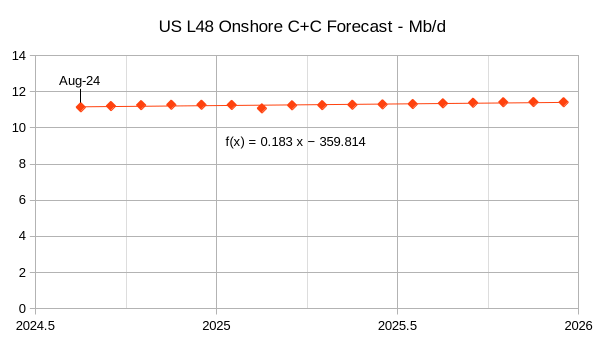

The forecast for US L48 onshore output has been revised lower than last month’s forecast, but the higher output growth in 2H2025 seems optimistic based on the oil price forecast.

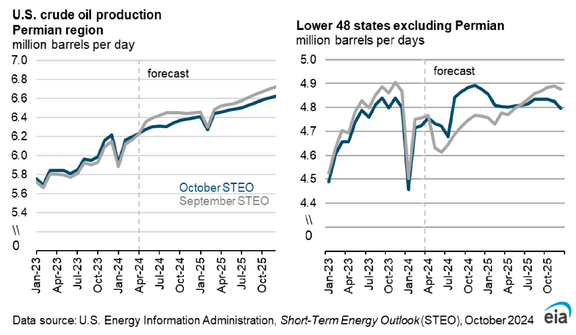

The non-Permian forecast for L48 onshore output looks optimistic especially for the second half of 2024.

The EIA forecast for World production and consumption suggests a stock draw from 2024Q1 to 2025Q1, it is not clear that the estimates and forecasts are accurate given the relatively low oil price level for most of 2024 and expected lower prices in 2025. I think the consumption estimates in 2024 are too high and the production forecast for 2025 is also likely too high.

The zero scaled charts above show the relative output shares for OPEC and non-OPEC and the consumption shares for OECD and non-OECD nations. Much of the forecast increase in output comes from non-OPEC producers and again it is unclear why output would increase more strongly in late 2024 and 2025 compared to the previous 2 years when oil prices are expected to be lower. Liquids consumption is expected to continue its slow but steady growth, but this misses the increasing share of plugin vehicles which may lead to slower consumption growth in the future.

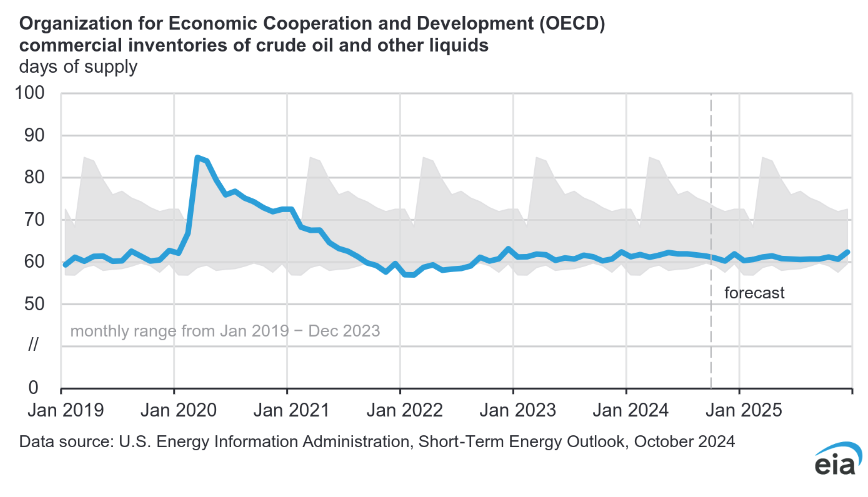

OECD commercial inventories are expected to remain near the bottom of the 2019-2023 average.

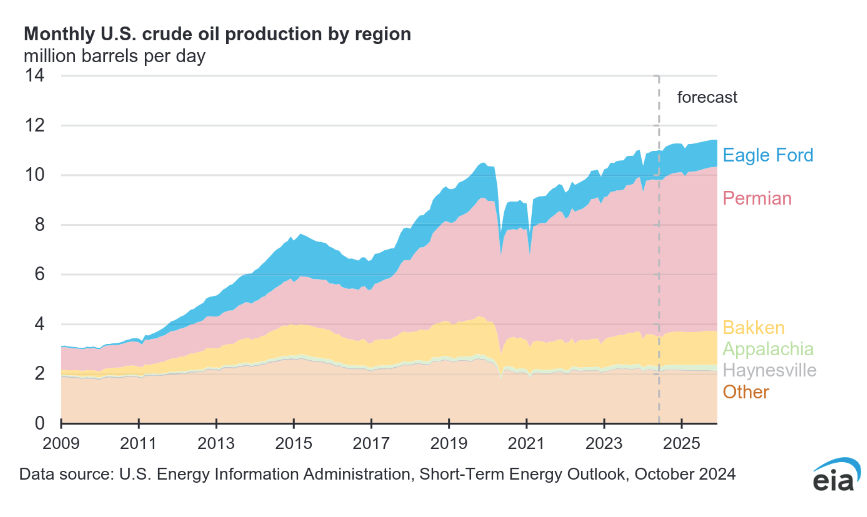

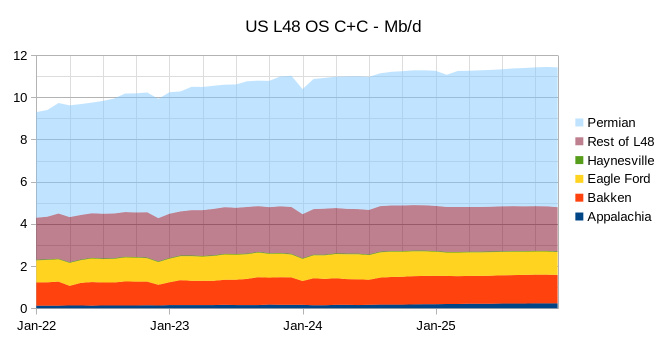

Most US L48 onshore C+C output growth since 2022 has come from the Permian basin and this is expected to continue through 2025, but at lower rates of growth in 2024 and 2025 compared to the previous 2 years.

From Jan 2022 to Dec 2023 there was a small increase in non-Permian L48 onshore C+C output in the US, after 2023 output for non-Permian is relatively flat. The slowdown in overall US L48 onshore output is apparent in the chart above.

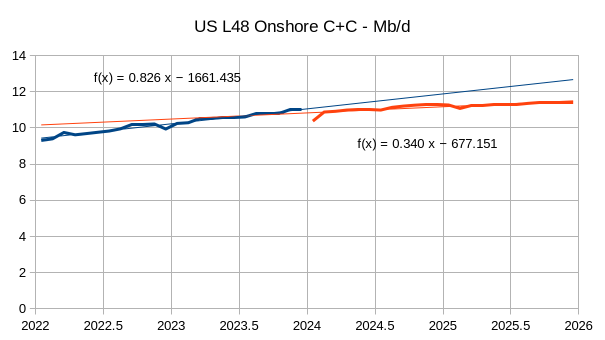

The chart above gives a more precise indication of the slower output growth in 2024-2025 compared to 2022-2023, roughly 2.43 times slower growth in the later period. Much of the increase in 2024 and 2025 occurs from Jan 2024 to July 2025, for the August 2024 to December 2025 period US L48 onshore C+C output only grows at about 183 kb/d per year as shown in chart below.

91 responses to “Short Term Energy Outlook, October 2024”

Another great piece by Mr Shellman, linked below.

https://www.oilystuff.com/forumstuff/forum-stuff/breaking-even-is-breaking-bad

Well of course. That’s just media silliness.

Most everyone uses NPV. Which can still be wrong*, but is the normal calculation for any corporation.

But most newsreaders don’t know how to break out the Excel and build a simple project NPV model. Even for simpler (than oil/gas) projects like investing capital for a more efficient commercial HVAC system.

Heck most reporters are English majors who would cavitate if they had to calculate a discounted cash flow. Like they don’t even remember from algebra two, how to handle exponents.

Add onto that, that service cost inflates/deflates booms/busts. So it’s not just “cope” that you see breakeven oil prices drop during a recession.

There’s also a more subtle effect occurring where the posited project population changes during boom or bust. Obviously if I’m only drilling the sweetest of sweet, the breakeven is lower. And to the contrary with going out to the fringe in a boom. There is no static list of projects that are in some statistical thermodynamics micro ensemble, for theoretical consideration. And companies will have their own intuitive consideration of what projects are “up for discussion”.

So, yeah, the breakeven is sort of interesting. And nice that the Fed does their survey of it. But it’s very hard to extract strong inferences from the survey. People are wont to say this means “running out of sweet spot” or “technology getting better”. And of course, both effects to occur. But there’s a lot of confounding variables (see above).

I guess you could have some sort of “oil breakeven” within the NPV discussion. Like just doing Excel goalseek on a project to see what drives the IRR to 10%. But even then, having accounted for cost of capital, you still have confounding factors of service cost in/de-flation as well as intuitive subtle changes in possible projects up for consideration.

———-

*Wrong primarily for two reasons: (1) oil/natty price uncertainty and (2) production uncertainty. /(Point (2) can somewhat be mitigated by drilling lots of wells and getting statistical results across the projects.)

The media is basically stoopid, sort of like you, Nony; it buys into “corportate” definitions, revised definitions, 2 plus 3 = 9, non Gapp cole slaw …like YOU just wrote. Forget the $400 plus billion the U.S. tight oil sector has already lost, send me a link to “media” discussions about how the U.S shale sector is going to pay back its remaining $150B of debt before it runs out of good locations to drill, or, better yet, that AND how the tight oil sector is then going to plug, abondoned and decomission 180.0000 HZ wells and the land that they are on, much less a trillion dollars, minum, of infastructure ? The media never talks about that, just me.

Here is something that has probably never occured to you since you know nothing about oil and gas anyway; when the asset (well) is depleted that asset becomes a liability, as is all the stuff associated with that asset downstream for miles. There is no PP&E to sell to cover that liability. “Depleted” means it is not longer generating revenue to cover P,A&D costs. I am trying to understand what the NPV of a revenue stream from a producing asset (well) has to do with covering its ultimate liability; there is no way you even begin to explain that.

By SEC filings I believe less than 20% of all this liability is set aside and then only by the biggest corporations. The other 80% is coming from where, exactly? Because the beginning of the end is at hand…

https://www.msn.com/en-us/money/other/new-permian-oil-pipelines-unlikely-to-be-built-say-top-operators/ar-AA1sROwU?ocid=BingNewsSerp

I try to make things simple, so people won’t automatically believe what Corporate America says about itself. NPV, like breakeven’s, is part of the slight of hand; its only when people with a shred of business since use real dollars going out v. real dollars coming in that they see the problem. The wonders of the tight oil phenomena are not going to seem so wonderful when the bill on these liabilities come due.

Thanks Mike.

NPV is counting your chickens before they hatch.

Yeah, the dirty secret of the oil industry is its propensity to walk away from liabilities, after pocketing all of the profits.

Does the USA have more abandoned wells, than the rest of the world has wells in total ?Probably.

The abject irresponsibility of the entire industry is shameful but as long as folks are pocketing untold wealth, dumping all of the decommissioning on the proletariat is the ground that the fossil fuel industry and its profits is based upon.

Apologies to the handful of who who have a shred of ethics, but the numbers don’t cast a good light on the rest of you. Future generations will generate tomes on the injustice of it all.

Texas and New Mexico output using EIA data from July 2022 to Juy 2024 (25 months).

If we consider Permian and Eagle Ford region output (which covers most of Texas and New Mexico’s C plus C output) and the forecast by the EIA from August 2024 to December 2025, along with EIA estimates from December 2023 to July 2024, we find output increases annually by 227 kb/d over the December 2023 to December 2025 period for these two regions (Permian and Eagle Ford).

I am not sure if you can read this article as it is behind a paywall. I have sent links to a few private individuals and each of them have been able to read it.

Here is a quote.

“Analysts are now beginning to project what could be the ultimate, slow-motion bust after U.S. shale peaks and producers increasingly look elsewhere to drill”

https://www.wsj.com/business/energy-oil/they-are-basking-in-americas-oil-boomand-preparing-for-the-big-bust-2844dd76?st=crBRBc&reflink=desktopwebshare_permalink

It worked for me.

Thanks for the link!

Thanks Seppo, nice piece. Output will not continue to increase for much longer in Lea County, New Mexico (the focus of the article linked) in my opinion. There are some who believe peak has already arrived there, I don’t agree with that assessment (as of July 2024), but we may be close (maybe 12 to 24 months in the future).

Chart below has 3 year trend in New Mexico C plus C output, trends often change, I expect the future trend will have a a smaller average annual increase in output.

To compare with earlier chart for Texas and New Mexico which covered 2 years, the New Mexico data for past two years has an average annual increase of 169 kb/d (roughly 39% of the total TX and NM average annual C plus C increase over that period was from New Mexico).

Great article Seppo, thanks. Folks in Hobbs are really starting to worry. They have lived through a boom and bust before and know what it is like.

“We’ve taken the big jump, and now it looks like it’s beginning to level off,” Low said. “I’m kind of wondering if we’re hitting the peak.”

A onetime oil worker and son of a drilling superintendent, Low budgets conservatively, advising elected officials with models that include oil prices far below their current value and a plunge in production similar to the pandemic. “You don’t know how long the boom is going to last and you don’t know how long the bust is going to last,” he said. “And how low is the bust going to go?”

Dennis

I was hoping that the August New Mexico data would add some clarity to what is happening in Lea County. Unfortunately there was a significant updating of their oil production data starting in January 2023. Typically there would be a minimal 1 kb/d or none that far back.

So I think the August projection is wrong in terms of the actual production. However note that August is only 12 kb/d higher than May, which I think continues to signal a peak/plateau within the next 6 months.

As an aside. Texas data for August has also gone through a massive update. Did I once read where you said that Texas updates/reviews its old data every August.

Ovi,

I don’t think I have said that. What happens in August is that the EIA publishes the Petroleum supply annual and at that time the Petroleum Supply Monthly estimates are synced with the State Data, in th case of Texas, the EIA data is matched to the RRC data about 15 months back so roughly Feb 2023 for the most recent Petroleum Supply annual (when most recently reported month would have been May 2024). The RRC updates its information monthly, some months the adjustments are larger than others, but this seems to be random.

I have no idea when the peak will occur, my WAG remains 2027 or 2028, in the mean time I expect the annual rate of increase will gradually fall and eventually will become negative around 2028.

Note that there have been other periods where output has been flat for a few months followed by increased output, so I am less convinced there will be a plateau, especially if oil and natural gas prices start to increase. If prices remain subdued due to over supply of fossil fuels, then you may be correct.

Dennis

Thanks for clarifying the updates info.

Ovi,

I double checked this and I was only partially correct. The petroleum supply annual, volume 2, updates monthly data for the previous year from January through December, so for the report released on August 30, 2024, the monthly data for Jan 2023 to December 2023 was updated. Older data may also get updated, but it is not clear when this occurs, we would have to keep a copy of the database on July 31 and then compare when it is released at the end of August. I have never done that, maybe I will try it in 2025 if I remember.

https://www.eia.gov/petroleum/supply/annual/volume2/

I actually have the data from the PSM for July and August 2024. The data only changes for the most recent two months for the July 2024 file and then for the months from Jan 2014 to December 2021, none of the data from Jan 2022 to March 2024 changes. Not really clear how it works as I look at it more closely.

It seems looking at the 914 comp-stat-oil spreadsheets that the EIA updates Texas data to sync with the Enverus data from May to May of previous year so for 2023 data files I have they match up May 2021 to May 2022 and June 2022 to May 2023 the 914 estimates are used as the “final estimates”. That is the best I can guess. It is not a very transparent process.

Investigated further and it looks like the updata may happen in July for the PSM. Unfortunately I don’t have a copy of the PSM data from July on my hard drive but have copies from June and August. The update might happen in July or maybe August, but there is a clear difference between the June and August data as shown in chart below. For most other months the differences are usually only in the most recent 2 or three months.

The June estimate was on average 0.35% lower than the updated August 2024 estimate over the Jan 2022 to Jan 2024 period.

Can’t keep growing with the current rig count. Not possible

LTO Survivor,

Perhaps, but the Permian basin rig count has been at about 300 for about 12 months and output has continued to grow in the Permian region, I expect the lower rig counts since early 2023 (rig counts fell from April to September 2023) will lead to slower increases in the future, but output may still increase. Check back in a year and we will see. Chart below shows most recent 18 months and the STEO forecast for next 18 months for Permian region.

I think rig count is only one of many parameters as most know here, there´s also number of fracs (not growing) in combination with DUCs (more important in the short term in my view), lateral lenght, yield per foot/yard/mile of frac etc.

As I have said before, a truly multivariable analysis. But with the rig/frac numbers posted below I have a hard time seeing US extraction increasing much in the near term.

You can make it into a gift article and send it to people.

rgds

Yes, that is what I did and sent it to the group. I was wondering if there is a limit on how many readers can open it. It was an experiment on my part.

New post on my website

Non-OPEC 10 oil production plateau ended 2019

20 Oct 2024

https://crudeoilpeak.info/non-opec-10-oil-production-plateau-ended-2019

Watch out Russian oil production in a war economy (conscriptions, focus on military industry etc.) Web links in above post

Matt

15 years ago every one of the 80 million vehicles sold used diesel or petrol. Next year 15 million new vehicles will have batteries. Not only are the number of ice vehicles falling globally but the new ones tend to be far more efficient then the 50 million old ones being scrapped each year.

OPEC plus has cut 2 million barrels per day of production yet oil prices are below $90.

Peak oil simply does not matter any more.

A global recession hits the market in 2018:

https://en.wikipedia.org/wiki/Automotive_industry

Of course Peak oil matters. Hybrid vehicles are a Potemkin village.

SCEPTIC —

Not sure who the czar is in your analogy.

Be that as it may, it’s important to realize that electrification is more than just flipping a switch from a purely mechanical machine to an all electric one.

Take fuel injection. This technology has replaced carburetors. Carburetors are an mechanical miracle, a sort of mechanical computer really, but they can’t compete with electronic sensors and computers controlling electric pumps. In a sense, cars are already electric.

One big problem for manufacturers is the prevelance of antiquated 12 volt electricity systems. The lower the voltage the thicker the wire you need, which is why cars need so much copper. Also low voltage system lack the umph to do serious mechanical work.

48V systems open the door to innovations — drive by wire instead of power steering, including 4-wheel-drive steering, active suspension instead of shock absorbers, electric regenerative brakes instead of power brakes, electrically actuated valves instead of a camshaft, and starter motors strong enough to move the vehicle, which would top up or partially replace the output of the combustion engine. Also much smaller wire harnesses.

Each of these electronic computer controlled systems would reduce the weight and improve the performance of the vehicle. 12V is ubiquitous, so 12V components are cheap and have a lock on the market. This is slowly changing.

Meanwhile cars are slowly adapting centralized computer systems to replace the hodgepodge of incompatible computer systems we see in every vehicle now.

The larger point is that even if you believe that battery electric vehicles will never take over the market, it’s clear that cars are getting more and more electric all the time. Electrification is pretty much inevitable, and one of the results will be improved efficiency in cars, and reduced role of traditional mechanical solutions. ICE vehicle fleet size has already peaked, so a decline in oil demand from this key sector looks unavoidable.

“One big problem for manufacturers is the prevelance of antiquated 12 volt electricity systems. ”

Which points to cars actually being hybrid-electric for more than 100 years. EVs dominated in 1905 because cranking a mechanical engine was dangerous – a backfire could break your arm. Then starting the motor was electrified…

“The lower the voltage the thicker the wire you need, which is why cars need so much copper.”

True. Though copper is mostly not essential: aluminum could be used. In fact, electric motors can be built with aluminum windings – copper not needed. In so many ways, it is unrealistic to say that there are elements whose scarcity is a barrier to Net-zero.

I’m glad cost is a non-factor. Hell, let’s just use gold for everything electrical.

“cost is a non-factor”

Precisely the opposite: the cure for high prices is…high prices.

For example, copper is roughly $4/lb, and aluminum is roughly $1.20. As a result, aluminum is nibbling away at copper demand. If the difference widens a lot, you’ll see this substitution accelerating.

https://en.wikipedia.org/wiki/List_of_countries_by_motor_vehicle_production

The electric engine does not replace the combustion engine car – because it is not possible. There is a recession in the car market.

And there will be a global recession very soon.

The Czar is the public, in front of whom illusions are placed.

Sceptic,

In my case all my vehicles are currently BEV. It can be done. It is also not possible for man to fly or walk on the moon.

Dennis,

I see no logical connection between “In my case all…” and “It can be done”.

We are talking about parameters at the level of the global economy.

Many people will no longer have a vehicle. This is what the global vehicle market shows.

So yes, peak oil matters.

Sceptic,

The long term future is likely autonomous evs, so yes there will be fewer vehicles. Peak oil was expected to be a problem due to lack of transport, this is not likely to be a problem so peak oil is also not likely to be a problem imho.

It will be cheaper in the future to not own a vehicle, simply call an Uber as robo taxis will be ubiquitous.

Dennis,

I live in Europe – many people are now giving up on cars because it becomes too expensive.

There is a real economic impoverishment. And that’s just the beginning.

“It will be cheaper in the future to not own a vehicle”..

Yes, and this is exactly the result of the peak.

The end of your sentence is just positive thinking: “Don’t worry, there will be a technological solution”.

It will hurt.

Now we are just at the beginning of the descending plateau. In the middle of the descent, it will be much harder.

Sceptic,

Cost per mile travelled will fall over time, fewer vehicles powered with oil may be a good thing for the health of the ecosystem. Transitions can be difficult, tax policy to flatten the distribution of income can help with wealth inequality, but this is more of a problem in the US than in Europe.

Hi Sceptic,

something for you.

https://www.peakoil.ch/media/files/the_end_of_oil_covered_230920.pdf

Dennis, AV’s will arrive but are unlikely to displace much of current private vehicle ownership for the many reasons we discussed before. Most individuals that currently own private autos will still need private to exist and for independence. Human Uber/Lyft drivers will be severely displaced.

Gungagalonga,

Human driven vehicles may be about as common in the future has the horse and buggy are today. There are still a few, but are rather uncommon. In the future the very wealthy may continue to own their own private AV, they might even choose to have a specially made EV with a steering wheel and brake and accelerator which they can hire a driver to sit in the ” drivers ” seat, but the AV would probably be much safer. The wealthy may be free to do as they wish at least on private roads. For public roads they may have to pay a lot for a license allowing them to put others on the road at risk.

@Berndt

Thank you for your text. Very interesting. In my opinion, one aspect is missing: debt. It is the management of debt/energy that determines the political choices of the most powerful countries, which hold the main currencies. That’s why the crash can be sudden (ca 2025-2030 in my opinion), because everyone lies little or a lot about the debt.

The old world of coal and oil created an economic system based on theoretically infinite growth of energy. Because this old world is built in parallel on a theoretically infinite growth of debt. This model cannot last with one of the two legs cut off. At some point, the giant will fall.

Peak oil was yesterday. Flat growth today. Don’t worry… But recession is tomorow. And we are going to enter the real debt peak and the fiat money crisis the day after.

The risk of war can also increase in connection with this global crisis.

Because war is the oldest method of hiding real problems.

For the rest, I agree with your conclusion: the future belongs to balanced systems.

But only after the giant dies.

For now, it is better to live in the countryside – away from very big cities.

Dennis, first, thanks as always for the great work on the STEO, etc. Much appreciated.

On the subject of private car ownership mostly going away, I have to continue to disagree.

Here are a few examples of individuals that will resist letting their private car go away:

-Any plumber, AC/Heat service folks, craftsman, electrician, etc… etc…

-Any mother or father of children under the age of 16.

-Any mother or father of kids who play sports.

-Anyone who likes to go camping and off roading in a rig they put together

-Anyone wanting to express themselves with their car (sports cars, big trucks, low riders, etc… etc…) Have you seen the Port Aransas, TX beach at spring break????

-Anyone in a hurry who wants to jump up and go immediately and not wait for an AV. We are an impatient society and giving up the luxury of travel independence will be received well by most.

-Anyone who hunts and fishes.

-Anyone that has a vacation home to close to fly to… think lake house, ranch, farm, coast house, river house, etc. Going there with all the gear for the weekend.

-Anyone who wants the security of moving their human body independently when they want to. Why are Generac’s so popular in many places? Because humans want the Secuity of keeping the lights on. What happens if the AV system goes down? Private car ownership gives travel security in the same way.

The above are easy examples, but there are many more. Humans are vane and different people and like to have their own unique style and to express it…. In an extreme example, the big tire old truck vs. the convertible Mercedes owner. The big truck guy might like to have his gun tucked under his seat and always a copenhagen dip cup to spit in in the consol… while the convertible Mercedes person wants to get tan and cruise around at their leisure going to tennis. Look around and watch the driving humanity be active and really observe if most could run their daily lives without private car ownership. Not just exist, but live. I have and it’s fascinating how reliant we are to have a mobile extension of ourselves in a private car, whether human or algo driven.

Just my random thoughts.

@Dennis and Gongagalonga

Looks like you are talking about what the SAE labels as Level 5 autonomous technology.

Is there actually some clearly defined path towards achieving this? I’ve not seen any compelling case that there is.

T Hill.

The simple path towards level five autonomy is starting in a small geographic area and gradually expanding.

https://waymo.com/blog/2024/08/expanding-destinations-for-san-francisco-and-los-angeles-riders/

Highway trucking is another simple entry point.

https://kodiak.ai/?gad_source=1&gclid=EAIaIQobChMIv7nln7WoiQMVYEP_AR2gUgTYEAAYASAAEgKmgPD_BwE

GGGG,

It will start at the edges: families with three cars will shift down to two, and teenagers will decide that cars aren’t so cool and will rely on Travel As A Service. Generational change of that sort is already clearly happening.

https://www.foxbusiness.com/media/fewer-young-people-choosing-buy-drive-cars-seeking-avoid-financial-burden-report.amp

Nick G. Did you read my rambling post?

My teenagers all drive Tahoes and a 4 Runner. They love them and get great joy from independence and weekend adventures. Latest one was at Big Bend testing the offroad “creep” option on the 4 Runner, which worked great. You don’t appreciate what you are up against here. Private cars are an extension of humanity, just like horses for centuries before.

I will say that my oldest does enjoy Taas when he and his buddies go out for a night that they shouldn’t be driving. This is where Taas will reside, much like the yellow cabs in Manhattan.

But thanks for your opinion and all the great detail to support it.

GGGG,

I agree that it is a complicated issue. I think it’s very difficult to predict. Things may evolve differently for urban and rural folks, for instance. TAAS is certainly a better fit for urban areas. Of course, they include roughly 80% of the population.

Personally I think it’s astonishing how much we all spend on cars now, and the risks we take:

“Motor vehicle crashes are the leading cause of death for U.S. teens.”

https://www.cdc.gov/teen-drivers/risk-factors/index.html#:~:text=Motor vehicle crashes are the,young drivers on the road.

Gungagalonga,

Perhaps behaviors will change as the cost per mile for TaaS falls to 25% of the cost of privately owned vehicles. I agree for trades people owning a vehicle will make sense, for the example of second homes, we are talking about fairly wealthy people and they may continue to own a personal vehicle. For me personally, not a lot of stuff goes from home to lake, the lake stuff is at the lake house. TaaS would work when AVs exist, it will likely be 10 years or maybe 20 where I live.

I agree Gunga…

Most people are going to be very slow to give up personal transport and control. Certainly me and all the people I know.

Urbanite settings will get gradual adaption however. I have heard very positive reports from visitors to SF with Waymo. If it really works in SF, it can work in a lot of places. 2030’s.

Hi Hickory,

Sometimes we guess right, sometimes not. What did you think about smart phones when you first saw one? A friend was an early adopter and got one of the early iphones in 2007 so I saw it in person, I would never spend that much on a cell phone… not something I would use, I thought to myself at the time.

My guess is that AVs will be much the same and will be everywhere in 20 years. Old guys like me will be slow to adopt, but the rest of the world may move faster.

I do now have a smart phone (not an iphone, but much the same product), got my first one in 2013, so it took me 6 years to recognize its utility.

Love to see people keeping the robotaxis faith after all these years of abject failure.

Can’t wait for my flying car robotaxis too. Any day now…

Right about one thing though. Owning a car won’t be a thing for most people. Fortunately, biking and scooters have only grown in popularity as carbrain goes into terminal decline, thankfully.

There is a huge problem with the entire TaaS concept that is never addresse by the proponents, that being peak hours.

It’s the time when everyone needs to get to work and back home. Mums drop kid/kids at schools and head off to work, then someone has to pick up the kid/kids on the way home from work..

This all happen at the same time and is why cities traffic is clogged at the same times every day. To have enough TaaS available for these peak times, would mean most are sitting idle most other times and they would very quickly cease being a cheap alternative.

The usual response is that businesses will have to become more flexible with work hours etc, but that ignores the real world when businesses operate during business hours so that they can contact and engage with other businesses when there are actually people there!!

If businesses everywhere all had staggered hours of operating, then a lot of efficiencies we’ve gained in the modern world disappear, workplaces would have to be heated or cooled a lot more etc..

Everyone that proposes this type of nonsense assumes we can have one great change because of peak oil, and the rest of the system will operate exactly the same as today.

It’s simple thinking about a complex multi-faceted system, where there are feedback loops all over the place being affected at the same time. TaaS can work to a minor scale, probably replacing taxis, ubers, lyft, and perhaps for some inner city dwellers with lots of public transport as another option, but totally take over from private ownership autos, forget it…

Hideaway,

That would indeed be a problem if nothing changes in the future. Society has changed throughout history, this is likely to continue and exactly what those changes will be is unknown. Assuming there will be no changes in the future is the least likely scenario. BAU has never been a realistic option, except in the sense that never really has been a BAU or that BAU has always been change at random rates over time.

Dennis you missed the point about efficiency. Going to any type of system of staggered hours for ALL businesses would be way less efficient than the current 9-5 of which financial markets are only open 10-4 here, anyway. sure people can ‘trade’ 24 hours a day, but all the volume of exchange, and deals are done 9-5..

The arm wave of ‘things might change’ because they have in the past, while very, very true, but for very different reasons than you are thinking of, is just a cop out.

If anything the ‘system’ as it operates will try to become more efficient, saving money, but businesses don’t care how employees spend their money, it’s the business costs that count, in becoming more efficient.

You are so divorced from the real world, where you see minor changes happening in the background, all in an environment of growing fossil fuel use, and think when there is a major change to declining fossil fuel availability, something we haven’t had in the last 200 years, that everything will tick along as normal and we’ll use a lot more machines built only by fossil fuels!!

Car dependency isn’t an inevitable feature of modern life. It’s more a flaw in city design.

Despite all the romantic descriptions of driving mentioned here, car dependency is more about sitting in endless traffic jams, pointlessly driving miles to get to locations that could be around the corner, and an enormous financial burden. It is also a major cause of death and injury, killing more than 40,000 people a year in America alone.

With young people losing interest in driving, and the growing senior citizen population less and less able to drive, car travel is set to decline in coming decades. Cities across America are reacting by promoting infill construction, reversing the white flight of previous decades and saving themselves costs by reducing sprawl.

Sceptic

I live in Europe – many people are now giving up on cars because it becomes too expensive.

Car per capita has been increasing steadily for year. Got any data to back your claim?

https://ec.europa.eu/eurostat/de/web/products-eurostat-news/w/ddn-20240117-1

https://www.acea.auto/files/ACEA-report-vehicles-in-use-europe-2023.pdf

https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Passenger_cars_in_the_EU

A 6.7% increase in EU-registered passenger cars since 2018

1. I’m not sure what the links you are talking about are, or why/how we should “watch out”. (Not even a disagreement–just don’t understand what you are saying.)

2. That Russia graph looks interesting. Anything special happen in early 2020 to make them drop like that? And then come roaring back. But then kinda taking another hit in 2022 and not getting up to 2019 levels. Anything special happen in early 2022? Oh well, I’m sure it’s just geology-driven changes. ;))

Dennis and Matt, and Ovi…thanks for the work on all this.

The delicate balance holds for now, it appears.

In the 2024 update the UN is still projecting the addition of 2 billion higher population level by the time of peak, in about 50 years. [10.3 B in 2085]

Hickory,

I prefer estimates by Professor Lutz

https://iiasa.ac.at/staff/wolfgang-lutz

https://www.ageing.ox.ac.uk/people/view/71

Chart below is one of his estimates, scale is billions of people, estimate is every 5 years starting in 1950 and extending to 2100, peak for this scenario is 2050 to 2055 at 8.65 billion.

I sure hope he is right with this scenario.

I’ll put my reply to non-oil thread

Thanks for the work Dennis

You’re welcome Schinzy, thanks for checking in.

https://www.latimes.com/environment/story/2024-10-18/another-refinery-shuts-down-in-california-what-happens-to-gas-prices

There’s nothing like a real scenario to show that oil can be substituted with green tech. I guess with Chinese $15k ev’s this might be possible in LA. A fourth the oil can be used for power. In the short term with an off peak charging system? Can it be done w/o massive grid change?

Being a lousy gambler I’ll take the big under for now.

Think it’s possible short term , Carnot/hideaway ?

https://www.youtube.com/watch?v=03MM0hKGlSc

5 minutes

The (Next) Gulf War is coming

10-12 million barrels of crude at risk (maybe 20).

Assessed as 1 in 4 chance over the next few months by a professional geo politicist.

Another reminder that oil is not a reliable source of energy.

The cost of supply insecurity is a real and very large cost.

People don’t call their oil supply models “shock” models for nothing.

For those with USA oil export concerns, that is addressed as well.

Per the Commentator:

American oil exports will be immediately cutoff, and California will suffer the most as they get their oil from the middle east.

This would exacerbate the problems for the rest of the world.

Could you expand on that? The EIA says that the US imports most from Canada and Mexico, and only roughly 5% of the US crude refinery input comes from the Persian Gulf (860k/day).

Zeihan said it not me. Watch the video.

I read the transcript (I generally don’t watch videos). As I feared, it’s general, without numbers or sources. So, I went searching.

It looks like about 20% of California’s oil comes from the Gulf:

https://www.energy.ca.gov/data-reports/energy-almanac/californias-petroleum-market/foreign-sources-crude-oil-imports

That’s higher than the 5% for the US overall, but it’s not quite at the level of $10 gas, as he suggested. An aggressive program of carpooling and working at home would handle it.

California’s reliance on middle eastern oil + an OIL spike because of a war in the middle east is why you get $10 a gallon.

Andre,

He seems to be saying that the US would be an island of lower prices, because he assumes the US would stop oil exports.

I don’t think either of those ideas makes sense, but still they’re not consistent with the $10 a gallon idea.

$10 in California. Not the whole USA.

I’m not agreeing. That is what he says.

California would be competing with China to get oil which is the biggest importer from the middle east ( which is what I think he is saying ).

With all due respect to the very well-informed, articulate Peter Zeihan, the scenario he promulgated would have about as much chance as a fart in a whirlwind. I don’t have much doubt that at some point–probably after the American election–Israel will take out some vital structure in Iran, and that could well be Kharg Island. But the U.S. is watching the Persian Gulf like a hawk, and if Iran even thinks about doing major harm to Saudi Arabia they will be suppressed promptly.

No matter how enthusiastic one is about renewable energy and the coming nuclear energy age, it is important to remember that the ready availability of crude oil is still paramount in industry. Mr. Zeihan does say that what he outlines is only a 1 in 4 possibility, but he didn’t finish his thesis: the part where American (and allied) forces put down any interruption of the flow of crude oil.

Zeihan thinks the USA is slowly pulling out of international affairs as it does not benefit from being the world’s police officer.

He thinks USA shale is endless….That is what he gets wrong IMO.

Not to mention that each step of the escalation is irrational: Israel would know that Iran would regard an attack on their primary oil export route as a major casus belli. So far everything between Israel and Iran has been theatre.

In turn, an attack by Iran on KSA would make no sense as a response to *Israel*.

Wow Nick ….. “So far everything between Israel and Iran has been theatre.”

For once I agree fully with you. Every Iranian counterattack, to being attacked over the last couple of years has come with prior warnings to the US, who promptly warned Israel as the Iranians expected them to. Lots of bluff and blunder by both sides up to present, mostly for home audiences without being a full scale attack by either. It appears neither side wants full on war, but does want to appear ‘strong’ for their own people.

I forecast weeks ago, on another forum, that there would be no counter from Israel prior to the US election, plus I still think it will only be a ‘measured’ response, so not to risk all out war.

https://www.youtube.com/watch?v=jJTw3SzrlQM

Zeihan on the Joe Rogan Experience….

2 hours

If you post on Peak Oil Barrel and want a comprehensive of where things are going you must watch this.

Why Russia invaded Ukraine? Russia will collapse and they know it? Once Russian oil is shut in it will never be reproduced again? We have an Agricultural crisis and we have to make tough choices? Renewables? Nuclear? Uranium? Potash? Lots of people are going to die? Demographic crisis? etc etc etc etc etc…

Get Ya Popcorn Ready!!!

The idea that if we had self driving cars, then only a fraction of the cars used today would be needed does not take into account when cars are needed.

If travel was staggered equally throughout the day then a fraction of vehicles would do the job. The reality is nearly everyone wants to travel to work, school etc for 2 hours in the morning and return during a 2 hour period at the end of the day. Many people would not want to be alone in a car with someone they do not know.

Most people who can car share, do so already, so self driving cars will not help in rush hours.

Can you imagine needing a taxi during the busy holiday periods to go camping or the beach. Prices would be exorbitant if you could get a driverless vehicle at all.

https://www.youtube.com/watch?v=c6xGgzs2szQ

5 minutes

Zeihan is revealing some interesting oil info.

In this one…

1) He reveals his misunderstanding of USA Shale. Would love to see Mike Shellman correct him.

2) He explains why if Russia loses production it will never get it back.

3) I think he or someone on his staff may be reading this site.

I am a huge fan of Zeihan, these are relevant oil posts and he isn’t perfect at predicting the future like everyone else.

He (or someone on his staff) even says ” I’ll go get the popcorn and you grab the sodas” — see my comment above “Get ya popcorn ready” Posted days before the newsletter was released.

Is he reading this site???

From newsletter today:

“My crystal ball is working overtime trying to figure out what the future of oil prices will look like. You’ve already heard one of the scenarios, but here’s another POTENTIAL way this could play out.

The Saudis could get frustrated with other oil producers not cutting production, and flood the market with oil. We’re talking 3 million barrels per day, which would drive prices down below $50 per barrel. This would have an outsized impact on higher cost producers like Angola, Venezuela, and Nigeria.

These countries could face economic instability because of this, but they’re not getting the worst of it. The Russian oil fields are hard and expensive to operate, should production drop during a price war, it may never recover. Oh, and the US will be fine thanks to low-cost shale production.

Okay, I’ll go get the popcorn and you grab the sodas.“

ShallowSand has often commented that finding qualified labor in the oil industry is difficult.

Zeihan says Russia has the same problem, their petroleum industry has lost its labor force.

@3:50

Why do I even try? Many of the climate change blogs have a keyword block on “peak oil”, and so whenever I try to link back here, my comment disappears.

Surprised by the ignorance of this commenter:

https://www.realclimate.org/index.php/archives/2024/10/unforced-variations-oct-2024/#comment-825917

I should have saved my comment before submitting, maybe I will try again later.

So I tried again to link back to POB with no success. I have posted 100’s of comments at RealClimate.com over the years, mostly on climate modeling topics. The comment always appears with a “pending moderation approval” line, but not in this case. All I stated was:

The comment simply disappeared, which in my experience means it got filtered out,

This is nothing new. There are very few active climate science blogs. One I also comment on is andthentheresphysics.wordpress.com/ (aka the ATTP blog). This one is owned by a guy that obviously doesn’t want any mention of peak oil by me, and he has a moderator named “Willard” that will delete the mention with a condescending warning. So I never mention peak oil.

Climate science is terrified of something.

Paul it would be intersting to not name the blog in the comment.

Dennis,

I gave your suggestion a try and it looks like it went into moderation, which is good.

Paul

This one is owned by a guy that obviously doesn’t want any mention of peak oil by me, and he has a moderator named “Willard” that will delete the mention with a condescending warning.

Perhaps the prospect of an imminent, permanent decline of cheap oil coming on during a vaunted expensive “Green Transition” is too much to contemplate. One precludes the other.

The Rig Report for the Week Ending October 25

– US Hz oil rigs dropped by 4 to 427 and are now back down to the July 24 count of 427 rigs. They are also down 32 rigs from April 19 and are at their lowest count since January 2022.

– The Texas rig count dropped by 5 to 234 and it is the second week in a row that the count dropped by 5.

– Permian rigs were down by 3 to 283.

– Texas Permian rigs dropped by 4 to 191 while the New Mexico Permian rigs added 1 to 92.

– In New Mexico, Eddy was unchanged at 43 while Lea added 1 to 49.

– In Texas, Midland was unchanged at 24 while Martin dropped 3 to 26. Martin is down 5 from 5 weeks ago.

– Eagle Ford was down 1 at 39.

– NG Hz rigs added 2 to 85.

Frac Spread Report for the Week Ending October 25

The frac spread count increased by 1 to 239. It is also down 36 from one year ago and down by 33 spreads since March 8.

Attached is a comparison of Colorado’s oil production as reported by the EIA (green) and Colorado (red).

Is the difference between the two in the last few months due to a reporting lag in Colorado? For July Colorado is 12 kb/d lower than the EIA. August production as reported by Colorado is down by 9 kb/d to 425 kb/d.

Ovi, the EIA reports crude oil and lease condensate as crude, while the Colorado Oil and Gas Commission separates them out. In basically all the shale basins that I’m involved in, Colorado included, the condensate fraction is growing. Like with the Permian, this different methodology is going to skew the numbers, which are then rectified further down the transport chain–usually at the plant. As with the TRRC, the EIA eventually adapts the Colorado state tally, so at some point these become the same. This situation, which has been reasonable up to now, is likely going to pose a problem in the near future, because the condensates are API 65 and up, and they’re getting too plentiful to blend in with the crude and keep below API 50 (West Texas Light). The usual practice with some operators is to whiff off the lightest fractions, which leaves a better blend except for too much naphtha, as well as the prevalent heavier chains in the area, frequently propane and butane. Everybody wants to be an oilman, nobody says they’re a condensate man, yet it seems headed that way.

Gerry

Thanks. The Colorado site just says “Oil. I wasn’t sure if that included condensate. They also produce a lot of water. In August water production was 671 kb/d or a WOR of 1.58.

Ovi,

I think Mr. Maddoux may be incorrect, the Colorado “oil” data is crude plus condensate. According to the Colorado State website it takes about 2.5 months after the end of the month for oil volumes reported to be complete. This seems to be exactly what we see. Also note that for 2023 the 914 estimates were less than the ECMC (Colorado’s oil and gas agency).

So yes there is a reporting lag supposedly of about 2.5 months, but in reality it is more like 6 to 8 months for the data to be complete.

New posts are up

https://peakoilbarrel.com/opec-update-october-2024/

and

https://peakoilbarrel.com/open-thread-non-petroleum-october-28-2024/

Brent price is currently at $71. I find it hard to imagine the price going up to average $78 in 2025.

Can we expect that the november STEO will put the expected Brent price at $76 or even $74?

Or should we expect that the conflict in the Middle East really gets out of hand and make the price go back up a few bucks?