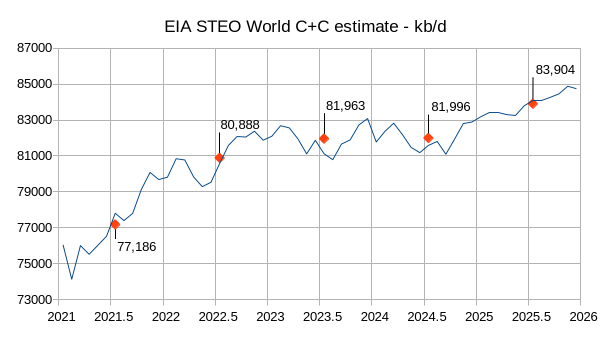

The EIA STEO was published recently, the estimate for World C+C output from September 2024 to December 2024 in the chart below is based on crude oil estimates in the STEO for World minus US C+C output and the ratio of the STEO crude estimates and C+C estimates from the EIA’s International Energy Statistics for World minus US C+C output for the most recent 12 months (September 2023 to August 2024).

In my view the estimate for World C+C annual output in 2025 (83.9 Mb/d) looks optimistic, I expect World C+C will average about 82.5 Mb/d in 2025 about 500 kb/d higher than the 2024 estimate, which appears reasonable.

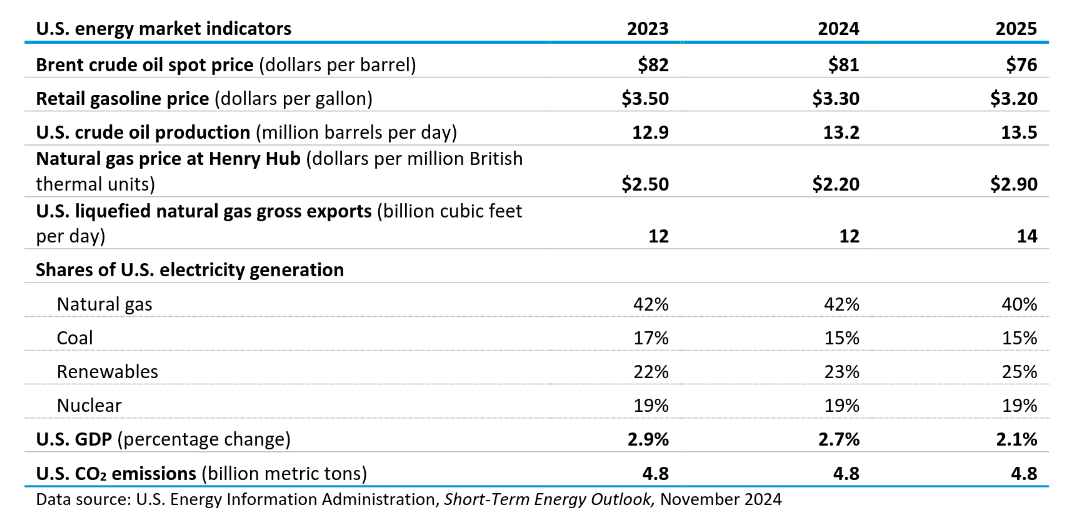

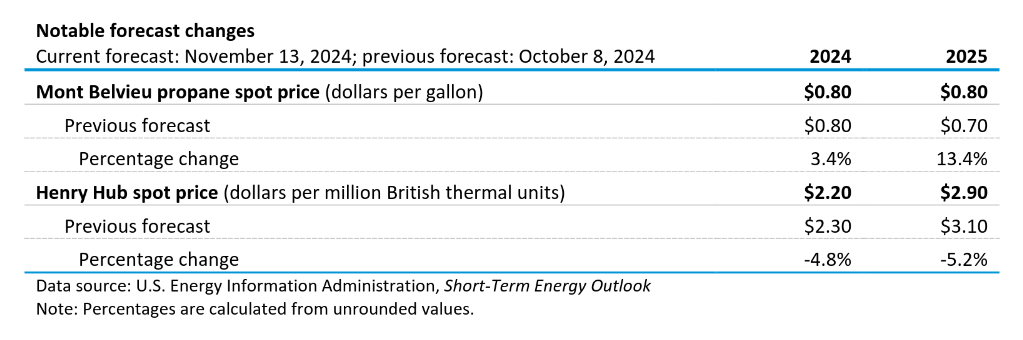

US crude oil forecasts for 2024 and 2025 are unchanged from last month, but Brent Oil price for 2025 has been revised lower by $2/b from last month’s STEO and Henry Hub natural gas prices have also been revised lower in 2024 and 2025 compared to last month, US GDP growth in 2025 has been revised to 2.1% from last month’s estimate of 1.9%.

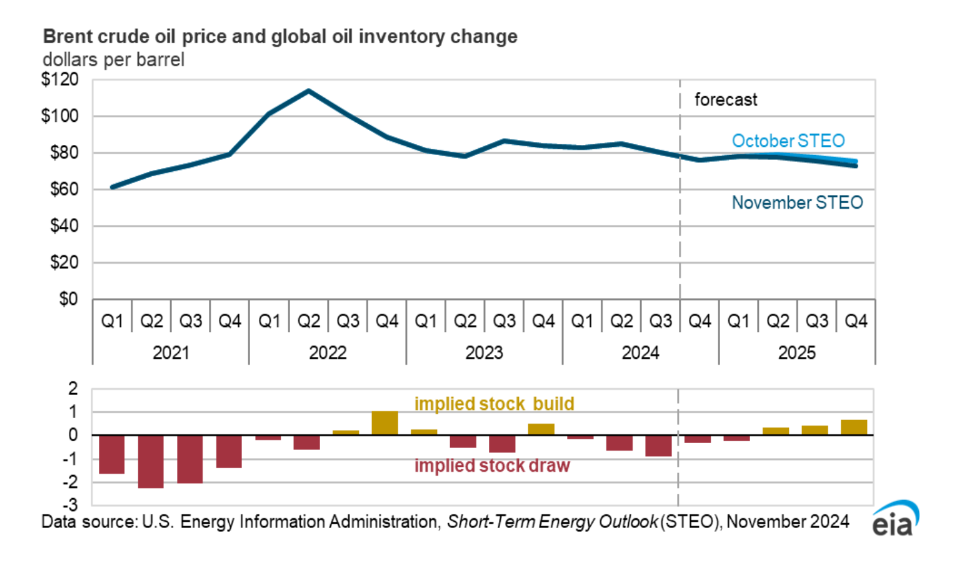

World petroleum stocks are expected to fall in 2024Q4 and 2025Q1 and then build for the rest of 2025 based on current EIA estimates. Brent prices are slightly lower in the last 3 quarters of 2025 compared to the October STEO estimate.

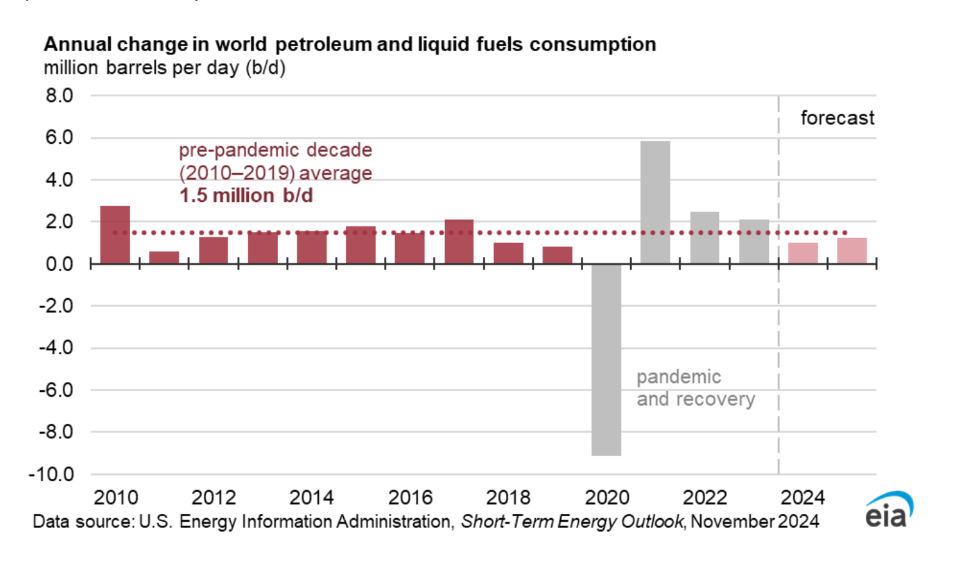

From 2010 to 2019 World petroleum consumption (includes NGL) increased at an average annual rate of 1.5 Mb/d, in 2024 consumption is expected to increase at 1 Mb/d and in 2025 at 1.2 Mb/d, below the recent historical rate (excluding pandemic and recovery period up to 2023).

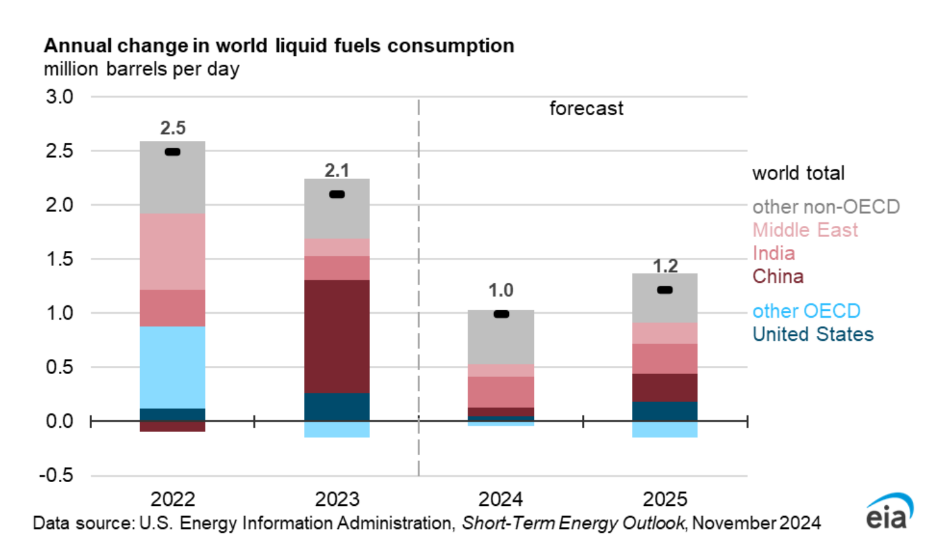

This chart gives more detail on which parts of the World have been responsible for petroleum consumption increases and the expectations for 2024 and 2025.

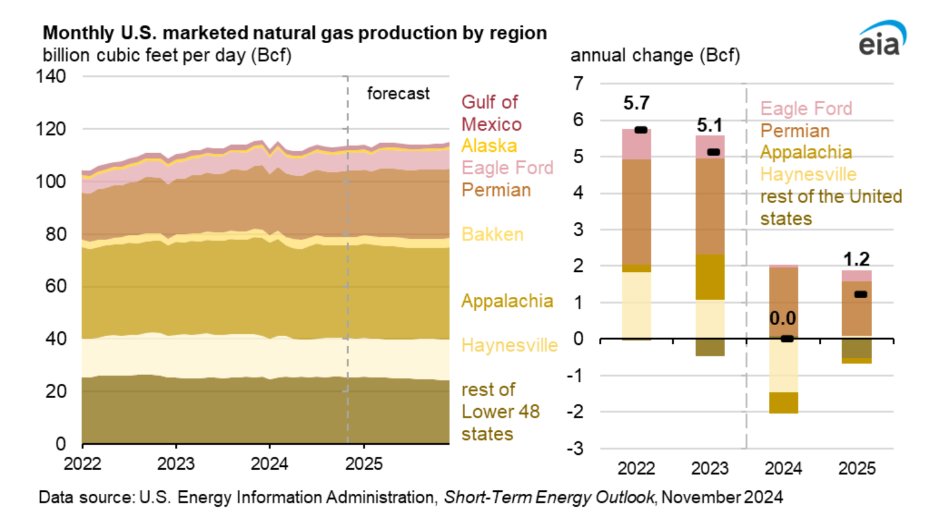

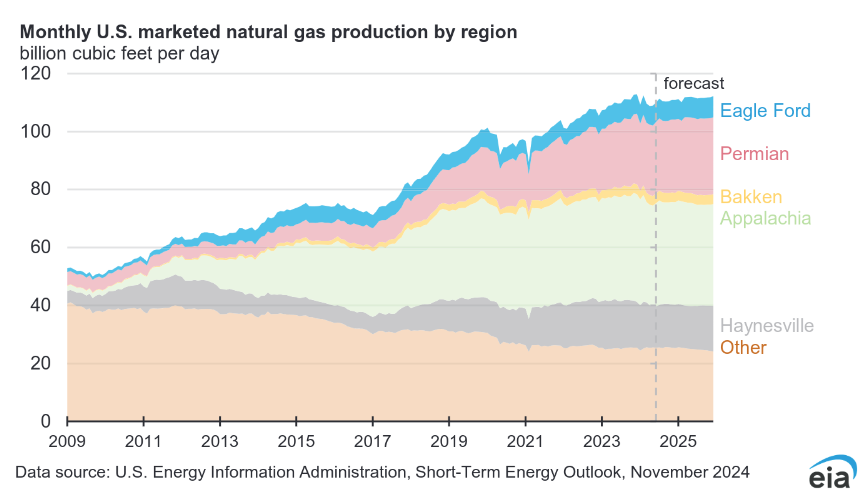

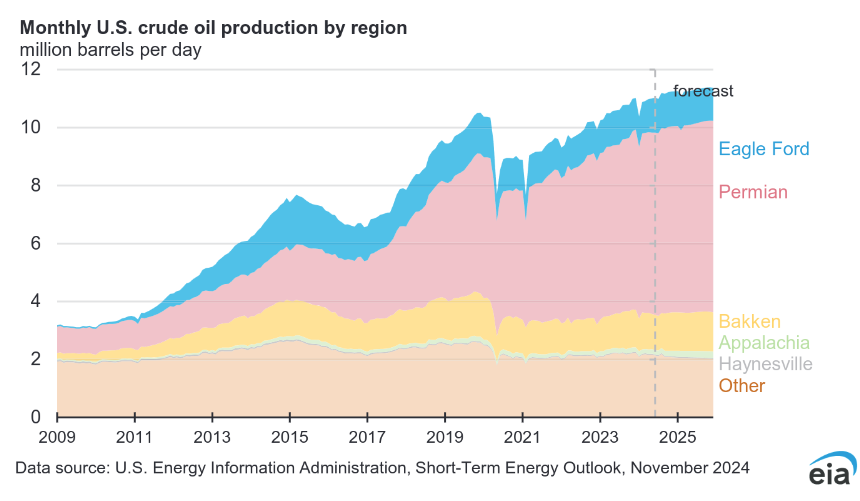

US natural gas output grew rapidly in 2022 and 2023, but no annual growth is expected in 2024 and growth in 2025 is expected to be nearly 5 times smaller than in 2022 (21% of the growth rate in 2022). Most of the growth in 2025 is forecast to come from the Permian Basin.

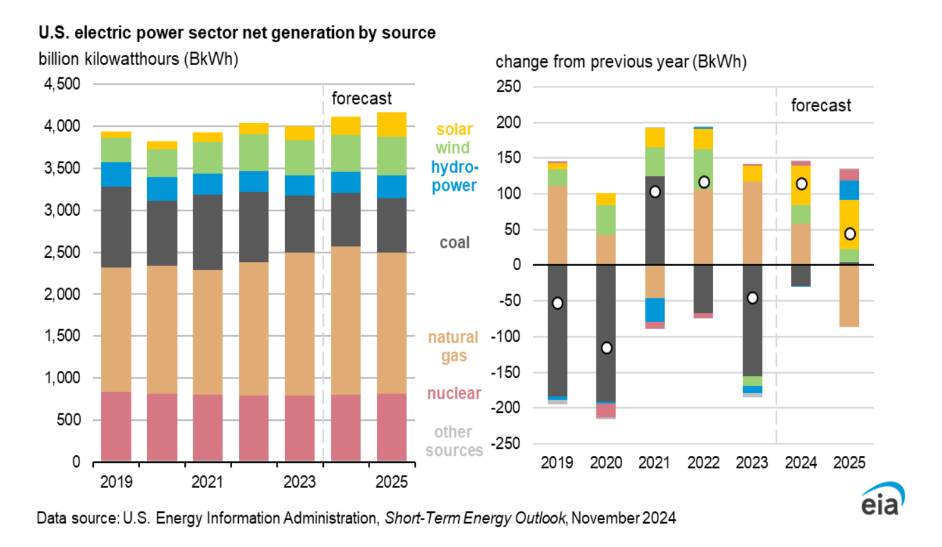

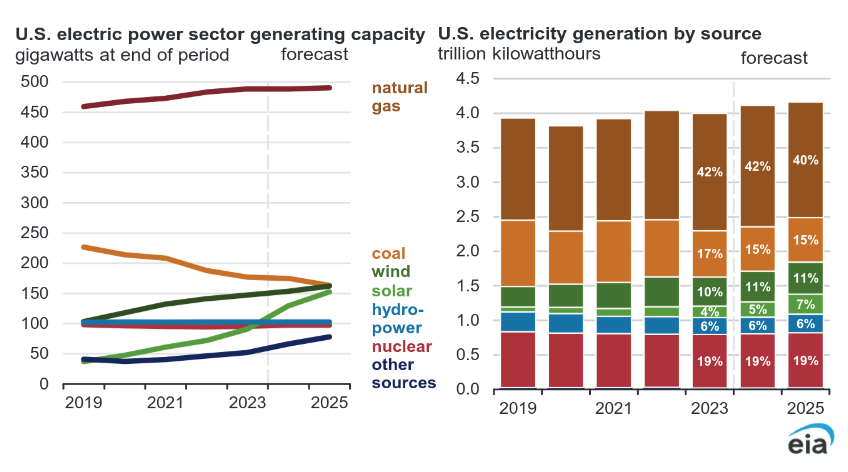

US electricity generation is expected to increase by 3% in 2024 due to a hotter summer than 2023 and by 1% in 2025.

From the STEO: We expect natural gas and solar power to be the largest sources of growth in U.S. electricity generation in 2024. Natural gas use for power generation has risen this year as a result of relatively low fuel prices, while solar is powering more generation as U.S. generating capacity grows. We expect U.S. natural gas generation will grow by 3% in 2024. Slower growth in U.S. electricity demand and higher natural gas prices in most regions next year is likely to reduce generation from natural gas, which we expect will fall by 5% between 2024 and 2025.

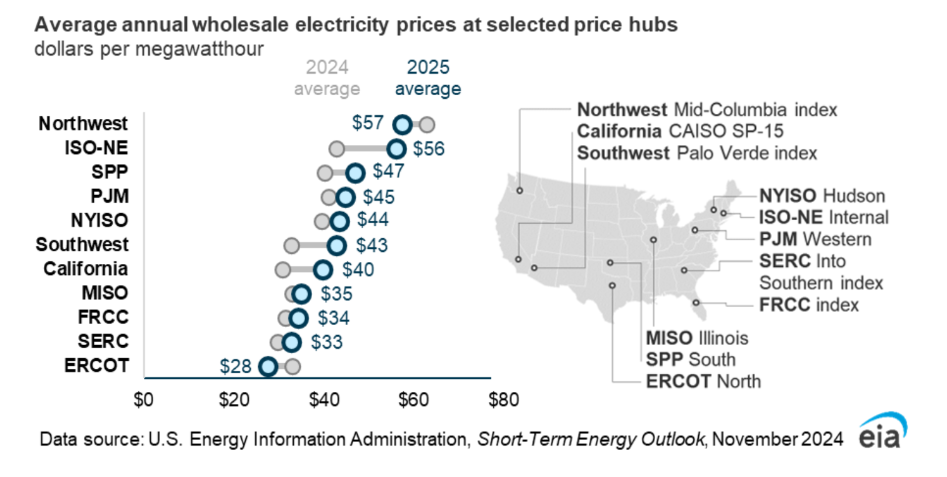

Higher natural gas prices in 2025 are expected to increase annual wholesale electricity prices in most parts of the US. In the Northwest more hydro generation than 2024 causes prices to drop a bit from 2024. In Texas expanding output from solar generation allows prices to drop further from their already low levels, leading to the lowest prices by a $5/MWh compared to the next lowest price region.

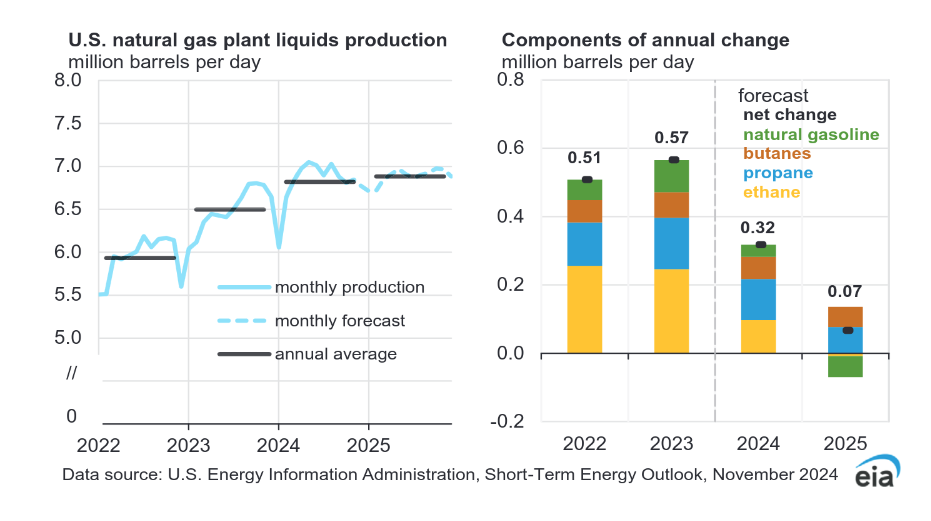

NGL output grows more slowly in 2024 and 2025 compared to 2022 and 2023 due to slower growth in natural gas output.

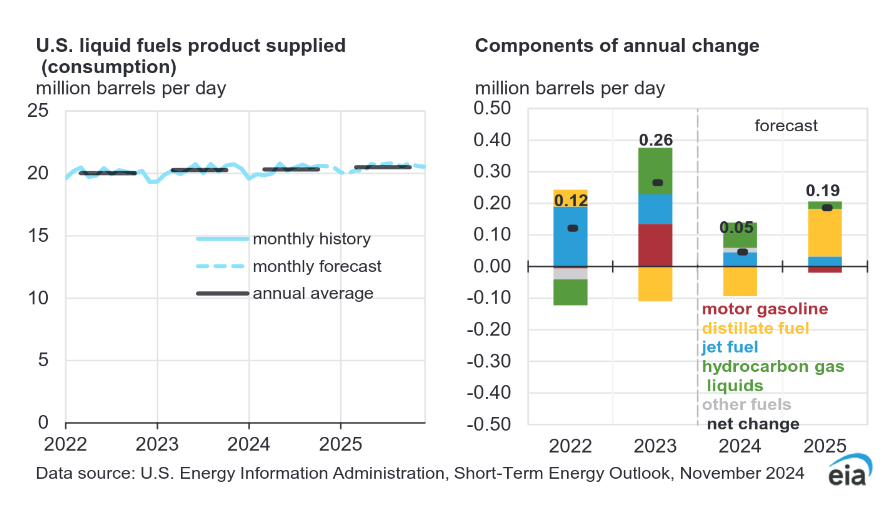

US consumption of liquid fuels is nearly flat in 2024 and in 2025 almost all of the growth in consumption is from increased distillate fuel use (aka diesel), the annual growth rate in liquid fuel consumption in 2025 is under 1%.

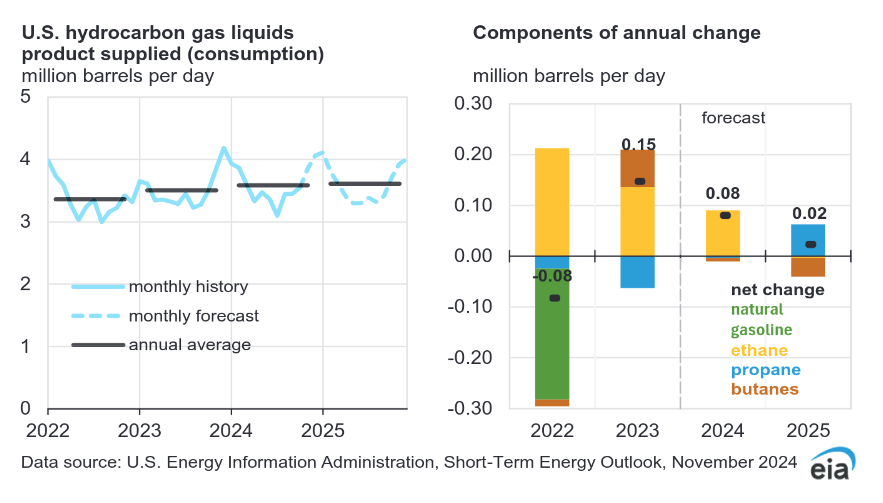

The increase in hydrocarbon gas liquids(HGL) in 2024 accounts for all of the increase in liquid fuel consumption in the US, but in 2025 is only about 10% of the total increase in liquids consumption.

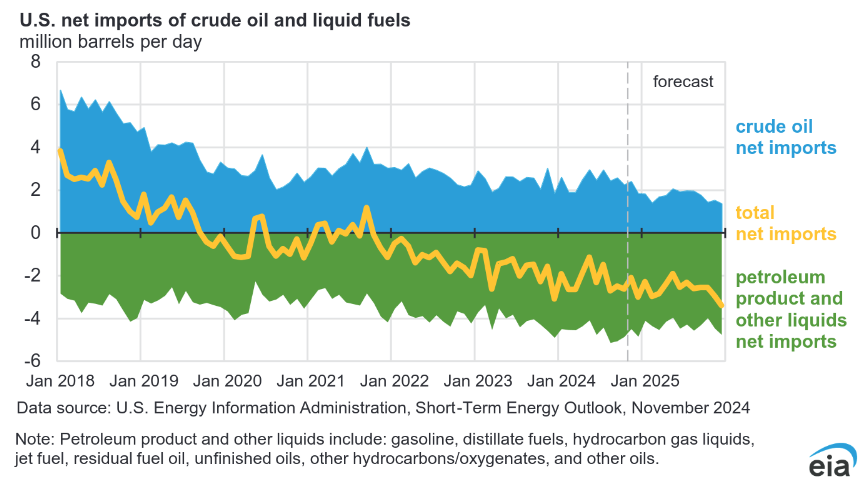

The US continues to be a net importer of crude oil, most of the net exports are HGL.

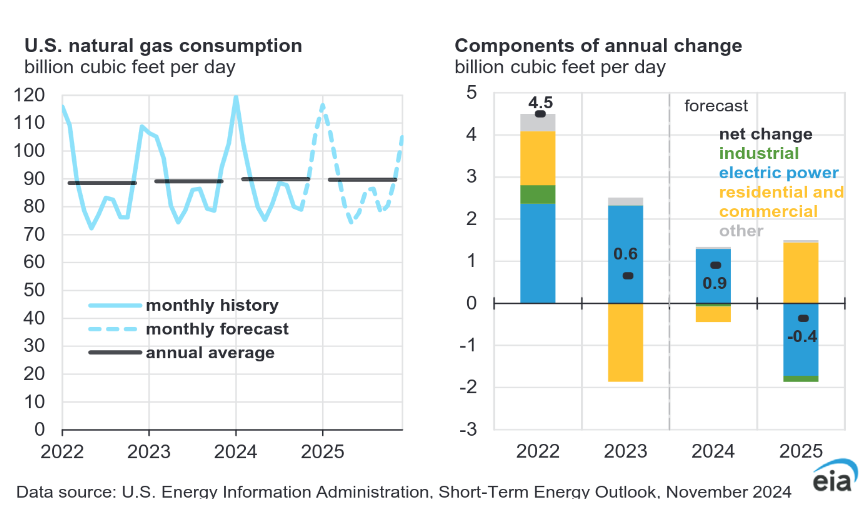

US consumption of natural gas has been relatively flat in 2023 and is expected to be flat in 2024, despite strong increases in natural gas used in power generation in those 2 years. Higher natural gas prices in 2025 is forecast to decrease natural gas fired power generation and lead to an overall decrease in natural gas consumption (only a tiny decrease of half a percent).

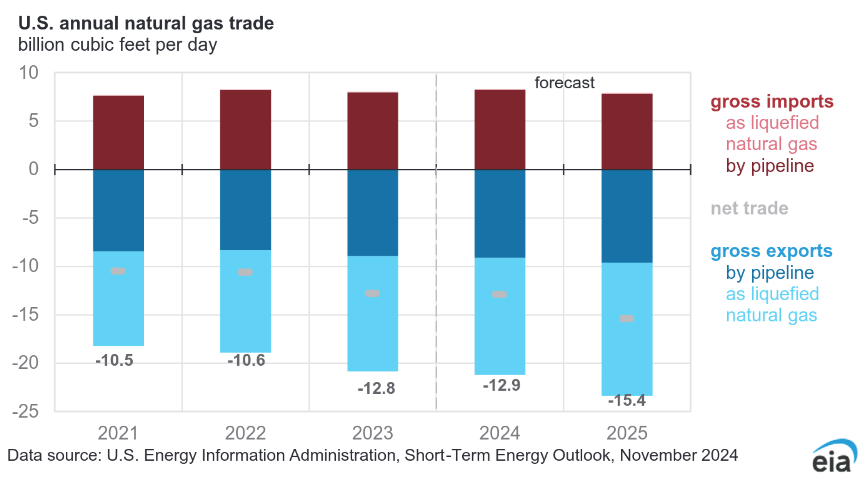

The increased US natural gas output is forecast to lead to higher exports of natural gas with nearly a 50% increase in exports over the 2021 to 2025 period.

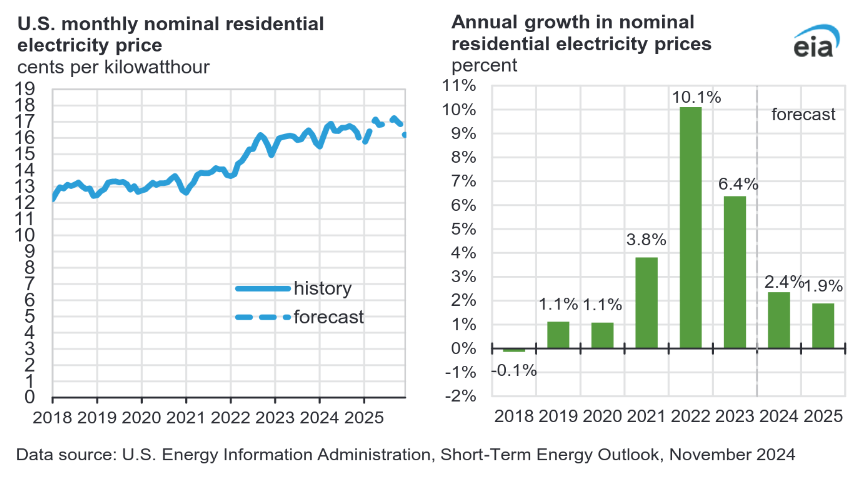

Electricity prices are forecast to increase more slowly in 2024 and 2025 compared to the 2021 to 2023 period.

Electricity generation (right side of chart above) for coal is expected to decrease from 17% in 2023 to 15% in 2024 and 2025 and natural gas power generation is expected to fall from 42% in 2024 to 40% in 2025. Wind power generation increases from 10% in 2023 to 11% in 2024 and 2025 and solar power increases from 4% in 2023 to 5% in 2024 and to 7% in 2025. Nuclear and Hydro power remain at 19% and 6% respectively for the 2023 to 2025 period.

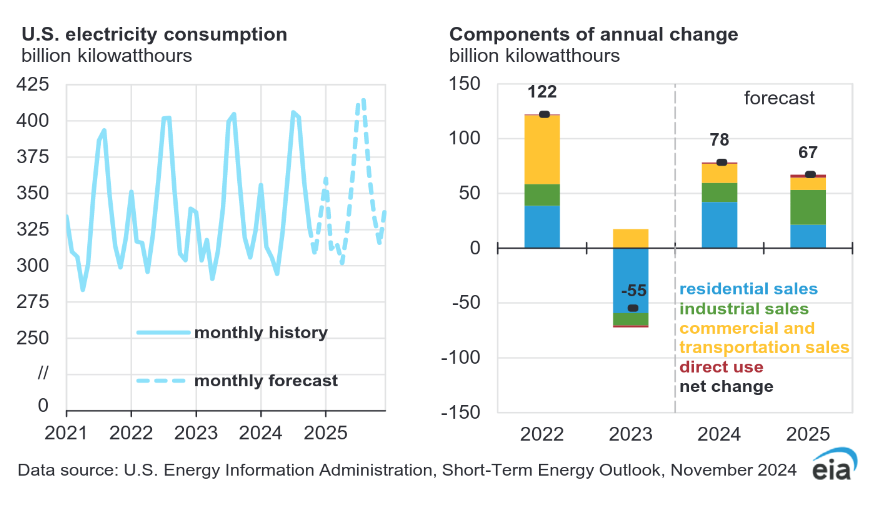

US electricity consumption fell by 55 TWh in 2023 and is expected to increase by 78 TWh(1.9%) in 2024 and 67 TWh(1.6%) in 2025. Note that this is higher than the average annual rate of growth from 2005 to 2023 of about 0.27% per year for US electricity consumption. Perhaps data centers and EVs are expected to lead to higher electricity use.

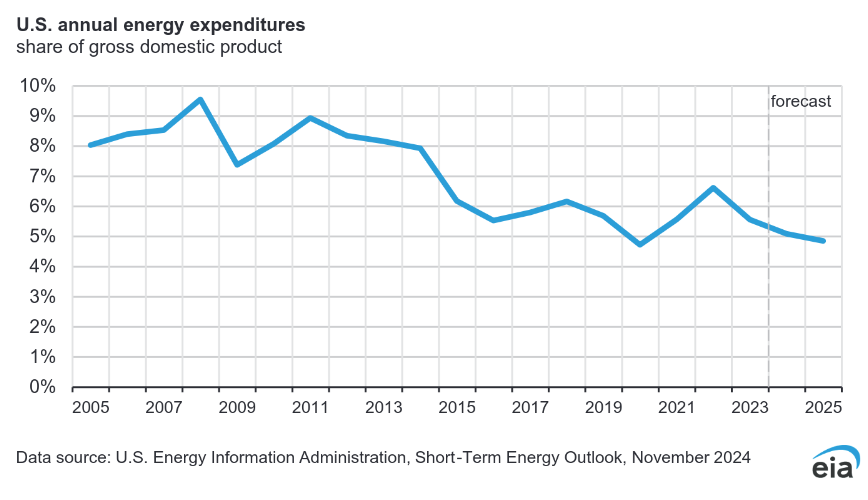

The share of US GDP spent on energy is expected to continue the decline that started in 2008.

Natural gas production is expected to be flat over the forecast period from Sept 2024 to Dec 2025.

US L48 output excluding GOM is expected to increase more slowly over the forecast period than over the previous 15 months. This is mostly due to a slower increase in Permian basin output than in the past 15 months.

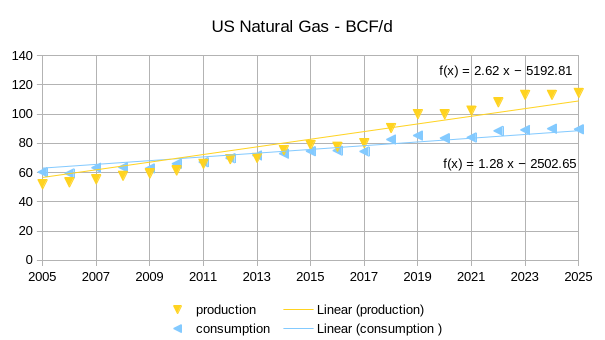

US natural gas production has been growing more quickly than US natural gas consumption over the 2005 to 2025 period (including forecast for 2024 and 2025 from STEO), the excess since 2013 has been exported. Notice the slope of the production curve becoming flatter since 2023, this may not allow further increases in US exports of natural gas in the future, unless US natural gas consumption starts to decline.

205 responses to “Short Term Energy Outlook, November 2024”

“Notice the slope of the production curve becoming flatter since 2023, this may not allow further increases in US exports of natural gas in the future, unless US natural gas consumption starts to decline.”

I think the story is the reverse. Prices are low. That’s what’s stopping gas from growing. And we are exporting everything we can. (But you can’t just open an LNG facility on the spur of the moment.)

There is a huge amount of very rich dry gas shale. And lots of rigs available. It’s just not worth mobilizing rigs into gas plays, given the prices.

Only too obvious that charts can only tell you what has happened and not what will happen.

https://www.aogr.com/web-exclusives/us-rig-count/2018

Who knows how much gas will be produced when the gas rig count goes back to over 200.

Loadsofoil,

I agree, also the last two points on that last natural gas chart are forecasts by the EIA, those forecasts are often wrong and are revised monthly. The most recent EIA long term forecast for US natural gas was published in October 2023 (IEO 2023). Chart below compares that with data from 2005 to 2023 and STEO forecast for 2024 and 2025. The future is unknown, guesses is all we have. The chart is for dry natural gas output for the US.

Legend reversed in chart above, sorry. Corrected chart below.

Hi Dennis I recently sent you a email on the subject of lars and his net export math. I don’t wanna seem demanding but do you think you could get back to me sometime after Thanksgiving?

Jacob,

See your email, sorry I missed yours.

Nony,

Excellent point. I looked at the natural gas data a little more closely and if we ignore the STEO forecast for 2024 and 2025 we find the dry natural gas output grew at an average annual rate of 4.2% from 2005 to 2023 while total dry gas consumption grew at an average annual rate of 2.3% over the same period.

I wonder if there will be a bit of a conundrum in the future over the right natural gas price. It has to be high enough so producers can make money, but low enough that LNG exports can be profitable. It will be a difficult needle to thread. I agree there is a lot of potential natural gas resource, the question is how much of it is an economically recoverable resource. I think it will be less than many optimists believe.

Carbon prices will probably be the main driver of natural gas prices for the consumer. In Europe and East Asia, carbon emissions are likely to get more expensive in the near future. This makes the conundrum even more problematic.

My new post:

US crude exports 2014 – August 2024

19 Nov 2024

https://crudeoilpeak.info/us-crude-oil-exports-2014-to-august-2024

This article includes a link to a video by

Sal Mercogliano, a maritime historian at Campbell University and author of the youtube channel “What’s going on with shipping”. It’s worth watching. He has 5 recommendations for the new administration to improve US shipping

1. Nice post. I like how a lot of what you do is just process the overall data and visualize it, versus only showing data that supports a particular point.

2. I remember arguments with Big Orrin in 2017-2018. He said that nobody would use US crude. That didn’t prove right.

3. The idea that nobody wants light sweet is kind of silly. Sure there has been some light on light competition between US and Africa. But light sweet still gets a price premium versus medium sour (and even more versus heavy sour) in all regional markets. Even the US, which is closest to the problem. But also Europe…and definitely Asia. The market has handled this just fine.

I mean refiners live in this world of looking for the cheapest cargo and trading off value versus price. So a $2.00 price premium shrinking to $1.00 means something to them. But producers live in the (traded) WTI world. And daily swings of a dollar or more are totally normal. So they really, really, really don’t care where the crude ends up. Just what they get at Cushing (or Houston or Rotterdam). And the long, slow, partial shift of medium sour to light crude is not an issue for the producers. They are much more affected by price gyrations from OPEC, recessions, wars, war jitters, oversupply, fires in Alberta, hurricanes in the GOM, etc.

The whole “too much light sweet” is such an example of a little bit of knowledge being dangerous. I remember Rusty Braziel saying that if the market really preffered medium sour, he’d build a plant to dump sulfur and asphalt (which are incredibly cheap) into light sweet oil.

4. Imported WTI (the actual West Texas Intermediate oil, not the financial surrogate from Cushing) is now the key source of supply for setting Brent price. Like it’s an official part of the crude that goes into Brent price nowadays, not just a traded alternative.

5. The Canadian ATL refineries can process medium sour (e.g. Persian Gulf just fine. If they are doing US light grades it’s because of economics. They were mostly doing Basrah, prior to the US shale boom. They are pretty nimble and shift sources based on economics and access the global markets via sea. They have the facilities to handle desulfurization/hydrogenation and medium to heavy API (visbreakers or cokers).

Curious about the electricity generating GW capacity and electrical generation (TWh x 1000) by source. “Other sources” has over 60GW capacity right now and will be nearing the capacity of nuclear by mid-2025, but shows no production of TWh in the adjacent bar graph. Why?

Joe Clarkson,

Capacity is a less useful number as some types of generation operate at 95% capacity and others at 25%. For that reason I focus on generation rather than capacity, I ignore the left side of that chart.

OK, I agree that capacity is not as important as generation, but am still mystified that the “other sources” capacity, all 60-75 GW of it, has no generation at all.

Conventional dry natural gas output in the US declined at an average annual rate of 5.84% per year from Jan 2010 to Dec 2019, pretty much all increase in US natural gas output in the future will be from shale gas. The chart below looks at the natural log of shale gas output in the US from Jan 2007 to August 2024, the slope of the output curve indicates the annual rate of growth. From Jan 2021 to Dec 2022 the rate of growth was about 7% per year, but the most recent 24 months (Sept 2022 to August 2024) there was a slight annual decrease of 0.27%. Higher natural gas prices might fix this problem, but it is unclear what long term price is needed to lead to a long term investment in more LNG export capacity and what long term US demand will look like, the bet on LNG export capacity looks like a risky proposition as low natural gas prices may lead to a lack of natural gas supply.

The report linked below from April 2024 expects an oversupply of LNG for World Markets, this points to lower levels of US LNG exports due to lower LNG prices on World markets and lack of profitability of further LNG export capacity expansion.

https://ieefa.org/resources/global-lng-outlook-2024-2028

North American LNG export capacity is expected to increase by 13 BCF/d from 2024 to 2028 with 9.7 BCF/d from US, and 2.5 BCF/d from Canada, and 0.8 BCF/d from Mexico. See link below for more detail.

https://www.eia.gov/todayinenergy/detail.php?id=62984

Article below gives some insight on near term LNG prospects for US, it will be interesting to see what happens to Henry Hub prices over the next 4 to 5 months.

https://boereport.com/2024/11/20/us-lng-exports-primed-to-jump-as-price-arb-to-europe-opens-wide-maguire/

Natural gas price futures have been heading higher of late, $3.44/MCF at Henry Hub as I write and $14.45/MCF at TTF (Netherlands). The spot price for Henry Hub natural gas averaged $1.79 per million BTU (1.037 MCF = 1 million BTU) for week ending November 15.

Scan here now and then.

Item one, the World Statistical Report quotes US natural gas reserves at about 12.7 trillion cubic meters. This is well into the shale era and it would be nearly impossible for that number to not include an estimate of shale gas.

Production, or consumption, is just under 1 trillion cubic meters per year. So yes, that’s 12 years. The folks at BP or that new outfit that they’ve outsourced to do have a caveat on all of their reserves numbers saying that they are in the process of reevaluating methodology, but those numbers are not a new departure from previous presumptions, and indeed have increased since fracking. So 12.

As regards Trump’s impact on production, there is a fundamental problem with pretty much all assessments of what is coming in the new administration. If folks do not live in red areas they don’t generally understand what just happened. The campaign was not about issues. It was about push back against the coastal contempt held towards fly-over country, it was about anger concerning the persecution and prosecutions, and it was about warmongering.

Somehow the Democratic campaign did not survey the populace as to how compelling their issues were in forming attitudes. Right up until the last days they remained confident that white women were motivated primarily by abortion. This was never true, and it was measurably never true. It was a very badly researched campaign. The dangers of believing one’s own propaganda.

Probably the most powerful reality for the new administration’s oil policies is the degree to which Elon Musk has embraced Trump. Musk lost his aura of left-wing hero when he bought Twitter and erased its censorship, and that put Tesla at great risk. Were he still a left-wing hero with no embracing of Trump, absolutely no reluctance would exist in the new administration to wipe out all EVs. With Musk now a major player in the administration, measures will be taken to save Tesla from policies that erase government pressure in favor of EVs. Something clever will take place that provides Tesla with an overwhelming advantage over all of the competition because efforts will be made to wipe out that competition via policy. Anyone who is expecting the new Chinese EVs to have a path inward to the US can rethink their thinking.

What was unthinkable a year or two ago when Hybrids became ascendant, perhaps now is thinkable. A Tesla hybrid.

Perhaps the most intriguing possibility is ANWR exploratory drilling. One would expect a lot of it, and maybe outright government subsidized. When it shows nothing there, the impact on not just administration thinking, but everyone’s thinking about oil is going to change.

Watcher – While I might not disagree with most of this, you left out the most compelling part. Lalala was simply not electable (no primary) and vast majority of Americans did not want to hear her cackle laugh for the next 4 years. Add to that the fact the administration tried to keep senile joe running when it was crystal clear he had no business. Also, there is a longstanding tradition of switching back and forth between the parties, now to complete the cycle the stock market will take a 30+ percent haircut for next couple years…

Vast majority? Did you look at the results?

Kamala Harris won more than 74 million votes, or 48.3% of the vote. This was not a blowout for Trump, it just appears that way because of the electoral college, the way we shade states (red or blue).

It was a close election. Trump has now won 2 of 3 elections, one popular vote, and has never broken past 50% of the American population.

I mean, it’s just not true to say that Trump is even close to 55 or 60 percent of the people.

My biggest point is that the election had very little to do with Trump, it could have been a better or worse republican running against an unelectable Dem, same outcome. Can you imagine if the R candidate was moderate and more centrist? It would have been an absolute landslide. Dems found someone liked even less than Hillary, I think this is a watershed moment that may take a very long time for the party to recover from (if at all). Dems are licking their wound and asking, why are we so dumb? For the record, I’m neither R/D…can’t wait to see 3rd/4th/5th parties come into existence…

Watcher —

Good to see you back. I miss not seeing your frequent posts.

Doug, the most interesting thing in the world of oil in recent years is the failure of Ukraine oil consumption to grow. Tanks, personnel carriers, mobile missile carriers . . . scurrying about to and fro . . . and in terms of consumption, utterly overwhelmed by population fleeing to Europe.

239K bpd pre Covid. 204K 2023.

Propaganda issues no doubt, but that has to be millions gone to live elsewhere.

1. Shale gas (and gas overall) has a long history of slowdowns when price goes low. Look at 2012, 2015, 2020, etc. 2020 was the recession of course. But earlier slowdowns, were really weather related. But in all cases, it was a demand/price crash slowing growth. NOT GEOLOGY. Not “using up the resource”. Not “Peak Gas”. Demand slumped because of a warm winter (which is hard to predict) and then inventory got full and price dropped and rigs dropped. In some cases even shutins of producing wells.

You can see a previous example of worrying about a temp slowdown here:

https://cassandralegacy.blogspot.com/2013/07/the-shale-gas-revolution-is-it-already_7.html

Or here (on this very blog):

https://peakoilbarrel.com/collapse-of-shale-gas-production-has-begun/

But in each case, production recovered after the glut got worked down.

Now…if prices get very high (and future strip also high) and production slows down…then we actually done run out of shale! But that’s not happening and I doubt it happens for decades. There’s a lot of the Haynesville left to drill and other gassy plays like the Eagle Ford or Ohio Utica or even the Woodford in OK and TX. (Huge amount of Marcellus left also, but it is sort of capped by the successful efforts to limit egress pipelines.)

2. On LNG: there’s a big scrunch factor when building an LNG terminal. It’s a lot of money and you have to commit years ahead of time. And you are competing versus Qataris and new projects offshore in Africa (which have very cheap sources of gas, cheaper than Henry Hub…but building the facility can be more expensive!).

It’s a very different market from oil, where the external market is much larger than the internal market. So only so many projects (around the world) can go forward. In oil, you drill it and dump it on the market. In LNG, you need to line up customers ahead of time and win the bid rounds versus other projects. (In US gas, you can drill and dump gas on the HH market…but that’s not LNG export, that’s just local production.)

https://www.youtube.com/watch?v=_SYcFAvc7HQ

(Don’t need to watch whole video…just see discussion from 3:00 to 10:00 on difference of oil and LNG).

LNG costs money (wastes gas, essentially) to do the liquefaction and keep cold during transit. It’s massively inefficient versus pipelines of course, but is the reasonable solution for places like Japan or Hawaii. But in a non-war world, Europe would get gas from Russia by pipe…it makes economic and even environmental sense versus the waste of liquefaction.

3. But it also doesn’t help when the administration in power does things like this, either:

https://www.reuters.com/business/energy/biden-pauses-approval-new-lng-export-projects-win-climate-activists-2024-01-26/

It’s not just the actual projects held up, it’s also knowing the capriciousness of the federal government can stop you from shipping. Who wants to build a 40 year asset, if there’s a possibility that President AOC shuts it down in 2032. It’s a risk premium that has to be added onto the economics.

P.s. Use of a log scale makes the recent increase look more plateu-ed than it is in the real world.

See here for a linear chart (and all gas, which is what matters economically…when you buy it you don’t put a little gold sticker on all the shale molecules):

https://www.eia.gov/dnav/ng/hist/n9070us2A.htm

Nony,

I agree prices will influence output, yes a natural log chart shows how the exponential rate of growth has changed over time. Here is the Shale gas on a linear scale, I have not claimed there is no more shale gas to produce, only that recently production growth has slowed compared to the recent past (2017-2020). Do you see a big increase over the past 25 months? I don’t see it.

The president did not stop LNG exporters from exporting, he held up the approval process for new LNG facilities. The biggest risk for LNG exporters will be overcapacity and potentially falling natural gas prices due to slowing demand for natural gas.

Shale gas output increased by a factor of 5 from 2008 to 2017 and by about 1.66 from 2017 to 2024, that’s the point of the log chart.

Jan 2021 to Dec 2022 the OLS linear annual average increase in shale output was 5.5 BCF/d. From Sept 2022 to August 2024 (using 24 months to reduce seasonality) the OLS linear average annual decrease was 0.2 BCF/d for shale gas output.

Nony,

Another factor to consider is that a large piece of shale gas output comes from the Permian Basin, as that basin starts to run out of tier one and tier 2 drilling locations the Permian is likely to peak and then decline, probably decline begins by 2029 and perhaps as soon as 2027 (my guess is 2028), shale gas output from the Permian may start to decline around the same time.

You suggest there is plenty of shale gas left in Marcellus, Utica, Haynesville, and other shale gas focused basins. I agree there are technically recoverable resources, but I wonder if much of it will be profitable to produce. The chart below divides shale gas production into tight oil focused basins (Permian, Bakken, Eagle Ford, and Niobrara) and all other basins (which i call shale gas focused). The chart covers the past 36 months (Sept 2021 to August 2024). This includes 2022 when natural gas prices were relatively high and over the entire period natural gas prices were not very high (monthly average Henry Hub Spot price was $3.99/MMBTU).

Nony,

Here is a chart with total dry natural gas and shale gas, all of the increase in natural gas output since 2007 has been from shale gas, that is the point, conventional output has been decreasing since 2003. From 2007 to 2024 conventional NG output fell by about 24 BCF/d. Shale gas is where the action is.

US non-shale natural gas gross withdrawals. From 2009 to 2023 the average annual rate of decrease was about 5.4%.

Nony,

Regarding current underdeveloped sources of natty …

Western Haynesville continues to shine as Comstock reports on an ongoing basis.

The App Basin’s Upper Devonian formations were estimated to hold ~100 Trillion cubic feet economically recoverable resource by Gregory Wrighstone a decade back. The ~60 then-developed unconventional wells were estimated to have EURs of 1 to 3 Bcf over their lifetime. Consequent production from these – and an additional handful – Burkett, Genesee, Geneseo, et al wells have resulted in numerous units producing in excess of 4/5(+) Bcf cums already.

Should Pacific Coast Mexico LNG plants expand/be built, the Permian ass gas could become a highly profitable LNG product for the Asian market. (This could unleash the staggeringly huge potential of the now-dormant Mancos B).

Rusty Hutson’s Diversified Energy continues to vastly improve operating procedures for their tens of thousands of stripper wells. These approaches could have a big trickle down effect on smaller operators’ viability should they implement these hardware/technical advances.

Coalbed methane is still there, but unattractive at these low prices.

Heck, methane is PRODUCED – and recovered – every frickin’ day at RNG plants throughout the country (Pennsylvania just opened another one recently).

With all your sharp, economically sensitive analysis, Nony, I offer you this to ponder …

When it becomes widely accepted that low cost natty will be the norm far off into the future (from a strictly supply focused perspective), the entrepreneurial spirits will arise. While you dismiss natty (LNG/CNG) for wid(er) spread use in transportation, I believe you will be found incorrect. The price spread between liquids (diesel and petrol/gasoline) versus natgas alternatives is way too large for the market to continue to ignore.

So, yes, we live in a world with ‘permanent’ low cost natgas in North America. This realization is apt to manifest in further applications of this wondrous resource … power generation and transportation being two of the most prominent.

Coffeeguyzz,

If natural gas prices remain low, not much of it will be produced. Many of the high resource estimates come from a period when natural gas prices were higher in the US (back in 2008 the annual average spot price was $8.86/MMBTU nominal for HH spot price or $12.90. MMBTU in 2024 $). At $2.50/ MMBTU we won’t see a lot of production growth. The Haynesville has has a good run from 2017 to 2023, not clear if it will recover with low HH prices.

Marcellus, Haynesville and Utica from Jan 2018 to Aug 2024, not much growth since Jan 2023. About 5% growth per year (2.1 BCF/d annual rate) over the period on the chart.

Data from https://www.eia.gov/naturalgas/data.php

Hi Dennis:

About that chart showing not much growth since January 2023, I heartily agree, its because the futures, and most other gas prices went from good to subeconomic within about a month.

According to the Moore Research Center chart natural gas dropped from a robust 6 in December 22, to mostly 2’s in January 23. There hasn’t been a sustained rally over 3 since. When the natural gas producers can hedge out somewhere in the upper three’s gas production will start rising. Producers are restraining gas production now because of lousy prices.

https://www.mrci.com/pdf/ng.pdf

DCLonghorn,

I agree low natural gas prices caused output to fall. Futures prices have risen recently, but it will take a few months (4 maybe?) to see how the market reacts. Supposedly the LNG exporters need about a $11 spread between HH and TTF to export profitably to Europe. So this would imply TTF at about 15, if HH is at 4, note also that the EIA expects that as natural gas price increases US demand for natural gas will fall, so the natural gas market may become more dependent on international prices and long term contract prices for LNG exporters. In addition a lot of new LNG capacity is expected over time which may drive international prices lower as over capacity in LNG drives prices lower.

We may be approaching a situation where only associated gas from tight oil producers is profitable over the medium to long term.

I wrote a long post but the SpamAdmin deleted it . 🙁 Probably for too many hyperlinks…i.e. too many sources!

Oh well…serves me right. Won’t bother with that…stick to unsourced chat style comments. And not waste my work.

Nony,

Keep the links to under 5, then if you need more just do another comment.

Also, he can create his own blog, write something there, and then link to it.

Nony,

Alternatively you could save any comment with more than 3 links to a word processor in case it gets caught by the spam filter, I think it catches anything with more than 4 hyperlinks, but it might be 3. I restored your comment.

Dennis – Your shock models adapted to monthly world production. Since production is below 83 mb/d, do you believe something less than 2,500 Gb is reasonable?

Kengeo,

The chart below shows the parabola you have fit to the June 2020 to July 2024 data, as is clear this is not a good model for the general World C plus C data set. The World C plus C URR is not likely to be as low as 2500 Gb and it may well be that 2900 is also too low, it may be 3100 Gb or perhaps higher, it will depend in part on demand for liquid fuel.

Does the parabolic model you have created look reasonable in your view? It is only wrong by 80 Mb/d for 2015 and it continues to negative values before 2015 and after 2032. Maybe go back to the drawing board.

My best guess would likely be around ~2000 Gb, so roughly dropping ~4 mb/d annually for next 15 years.

2025-77 mbpd (~150 Gb)

2030-57 mbpd (~130 Gb)

2035-37 mbpd (~100 Gb)

2040-17 mbpd (~80 Gb)

2040 to 2060 (long tail, 130 Gb)

URR for conventional is 2,000 Gb, other unconventional deposits will never amount to more than ~10-15 mbpd, they will likely be the long tail after ~2050.

URR for economic oil is likely only 1750 Gb or so, this is what brought the 2004 peak oil event and when the term unconventional oil became a buzzword.

Also, I think a much much steeper drop from 80 to 60 mbpd could be possible, something as drastic as 10-15 mbpd over the course of 4-6 months, many different scenarios could have this result.

All it would take is a roughly 25-30% reduction from US, Russia, and Saudi Arabia…

Price could drive production down or other factors…

Long-term, gradual drop in production would actually be a good thing…a 2 mbpd annual decrease would likely be about as close to perfect as possible…

Kengeo,

Anything is possible, the planet could collide with a large asteroid, or we could have a nuclear holocaust. The biggest annual decrease historically was 6132 kb/d in 2020 over the period from 1973 to 2023. So you are thinking about 5 times more than that, I disagree strongly that is likely except in the case of a planetwide catastrophe such as WW3 or a something at the level of the Permian era asteroid event. The likelihood is small, but remains possible.

Kengeo,

Here is your model in chart form with 4% decline after 2039 and where I assume average output in 2024 will be 82 Mb/d with output decreasing by 4000 kb/d each year for 15 years.

I do not think this is close to being correct, just putting it out there for people to see.

Kengeo,

A decline of 4 mb/d annually for the next 15 years would be a disaster, but it wouldn’t surprise me very much. I don’t expect it to happen though.

This although I remember the regularly written comments by ROCKMAN on theoildrum website. About how agressive secondary and tertiary crude oil recovery techniques deplete oilfields very rapidly. Good before Peakoil happens….not so good thereafter.

I don’t pay too much attention to the hypothetical crude oilproduction graphes.

Geopolitics, etc. will make those smooth graphes not very relevant. For a guess they are ok

We agree, both 1750 Gb and 3500 Gb are both very unlikely , somewhere in between (2650 Gb) plus or minus 15-20% seems more plausible.

Given current production of 1450 Gb, and 1P reserves of 450 Gb, seems a low estimate would be 1900 Gb

Using Rystads latest estimate for 2P reserves would yield nearly 2200 Gb for a reasonable estimate of URR. This is 20% less than 2650 Gb. Average of 1P and 2P URR is 2050 Gb. This is very close to my best guess if 2 Tb. This is implies that 2/3 of conventional oil has been produced, leaving only 0.5 Tb left.

Kengeo,

Keep in mind that the definition of proved reserves is that there is a 90% probability that reserves will be larger than the proved reserve estimate at present. Reality is that it is probably more like a 99% probability when contingent resources, reserve growth and discoveries are taken into account. The 2P reserves would supposedly have a 50% probability that reserves would be larger, if we ignore contingent resources, reserve growth and discoveries, reality is probably on the order of a 75% probability that URR will be larger than 2P reserves plus cumulative production (about 2240 Gb). I would put the 1 sigma range (roughly a 70% probability the URR will be in this range) as 2700 to 3100 Gb with 2900 Gb being my best guess (with 50/50 odds of URR being higher or lower than this) maybe a 50% probability of URR being in the 2800 to 3000 Gb range, with 25% probability it is lower than 2800 Gb and a 25% probability it will be higher than 3000 Gb. Conventional will be around 2750 Gb +/- 250 Gb in my view.

Fascinating misunderstanding of statistics and reserves Dennis. A reasonable range is between 2 – 2.4 Tb, best estimate being 2.2 Tb.

Your math:

90% -> 99%

50% -> 75%

So let’s correct your numbers:

3 Tb / 174% =1.724 TB

1.724 Tb x 140% =2.4 Tb

Reminder on 2P definition: Midpoint scenario of recoverable resources, often considered the most realistic estimate for planning and forecasting.

1P = 1.9 Tb

For 75% likelihood-2 Tb, we can estimate as follows:

99% – 1.8 Tb

95% – 1.85 Tb

90% – 1.9 Tb (1P) – (10% URR is lower)

80 – 1.95 Tb

75 – 2.0 Tb

70 – 2.05 Tb (30% URR is lower)

60 – 2.1 Tb

50 – 2.2 Tb (2P) Best Estimate

40 – 2.3 Tb

30 – 2.4 Tb (70% URR is lower)

20 – 2.5 Tb

10 – 2.6 Tb

5 – 2.9 Tb (95% likelihood URR is lower)

1 – 3 Tb (99% likelihood URR is lower)

And please don’t forget that Laherrere believes 2P shouldn’t be taken seriously as it’s overly optimistic and likely plain wrong.

Kengeo,

Laherrere’s estimates have increased over time as 2P estimates are the best estimate at the present time under an assumption that no contingent resources become reserves in the future and that there are no further discoveries, I understand statistics quite well. You also misinterpret Laherrere’s analysis in my view.

My analysis takes into account the potential for future reserve growth and discovery, an analysis that ignores the fact that there are about 500 Gb of discovered contingent resources and that there is likely to be technological development in the future that lowers costs, making even more resources viable along with ongoing discoveries.

USGS estimated conventional resources to be about 3000 Gb in 2000 and unconventional resources might be 500 Gb, so I would put the upper limit at about 3500 Gb (99% probability URR will be lower). I would put the minimum at about 2500 Gb (when we take all resources into account and technological change, discovery and reserve growth) where there is a 99% probability URR will be higher than 2500 G. Note also that despite people thinking my estimates are too optimistic, historically I have been too conservative.

Your reasonable range is not very reasonable simply because you fail to understand reserves and resources. Keep in mind that 2PC is about 1200 Gb (this does not even require any discovery or reserve growth, this is the engineering best estimate of discovered resources). Add 1500 GB of cumulative production and we have 2700 Gb for a best guess URR under an assumption of no new discovery, no reserve growth and no further technological development(none of these are reasonable in my opinion).

Note also that for the Rystad estimates from 2017 to 2023 the 2PC estimate remained the same while about 30 Gb were produced annually over that period. The combination of reserve growth and new discoveries over that period was on average about 30 Gb per year. You seem to think this will end starting in 2024, I disagree. Perhaps the average level will be less over the next 10 years, say 20 Gb per year on average. That gets us to a URR of 2900 Gb as the reserve growth plus discovery occurs, or lets say it is 10 Gb per year on average over the next 20 years, we still get to 2900 Gb.

Another thing to consider is we know URR can’t be less than 1500 Gb as we have already produced that amount, that is the floor. There is a lot of room above 2900 Gb and much more than 2900 Gb could potentially be produced, I am not so optimistic that I think it cannot happen, but I am hopeful that my guess of 2900 Gb is roughly correct. I would prefer that your guesses were correct from an environmental perspective, but I am just not that much of an optimist.

Dennis –

To summarize, a conservative estimate of remaining oil uses 1P plus 100 Gb for a total of 2 Tb – this uses pessimistic assumptions about reserve growth, undiscovered resources, and technological advancements.

A Best Estimate uses 2P of 2.2 Tb

A moderately optimistic estimate is 2.4 Tb (75% confidence level meaning URR is likely lower, but not by a lot). However, this requires significant future contributions from reserve growth, discoveries, and technological advancements. While not the highest possible estimate, it reflects a scenario with relatively favorable conditions for oil recovery.

From

https://www.spe.org/en/industry/petroleum-resources-classification-system-definitions/

Contingent Resources

Contingent Resources are those quantities of petroleum which are estimated, on a given date, to be potentially recoverable from known accumulations, but which are not currently considered to be commercially recoverable.

It is recognized that some ambiguity may exist between the definitions of contingent resources and unproved reserves. This is a reflection of variations in current industry practice. It is recommended that if the degree of commitment is not such that the accumulation is expected to be developed and placed on production within a reasonable timeframe, the estimated recoverable volumes for the accumulation be classified as contingent resources.

Contingent Resources may include, for example, accumulations for which there is currently no viable market, or where commercial recovery is dependent on the development of new technology, or where evaluation of the accumulation is still at an early stage.

Reasonable time frame is typically 5 years.

Determining whether a contingent resource can be classified as reserves depends on it being classified as “commercial”.

From 2018 PRMS (pages 6-7): https://www.spe.org/en/industry/reserves/

2.1.2.1 Discovered recoverable quantities (Contingent Resources) may be considered commercially mature, and thus attain Reserves classification, if the entity claiming commerciality has demonstrated a firm intention to proceed with development. This means the entity has satisfied the internal decision criteria (typically rate of return at or above the weighted average cost-of-capital or the hurdle rate). Commerciality is achieved with the entity’s commitment to the project and all of the following criteria:

A. Evidence of a technically mature, feasible development plan.

B. Evidence of financial appropriations either being in place or having a high likelihood of being secured to implement the project.

C. Evidence to support a reasonable time-frame for development.

D. A reasonable assessment that the development projects will have positive economics and meet defined investment and operating criteria. This assessment is performed on the estimated entitlement forecast quantities and associated cash flow on which the investment decision is made (see Section 3.1.1, Net Cash-Flow Evaluation).

E. A reasonable expectation that there will be a market for forecast sales quantities of the production required to justify development. There should also be similar confidence that all produced streams (e.g., oil, gas, water, CO2) can be sold, stored, re-injected, or otherwise appropriately disposed.

F. Evidence that the necessary production and transportation facilities are available or can be made available.

G. Evidence that legal, contractual, environmental, regulatory, and government approvals are in place or will be forthcoming, together with resolving any social and economic concerns.

…

2.1.2.3 To be included in the Reserves class, a project must be sufficiently defined to establish both its technical and commercial viability as noted in Section 2.1.2.1. There must be a reasonable expectation that all required internal and external approvals will be forthcoming and evidence of firm intention to proceed with development within a reasonable time-frame. A reasonable time-frame for the initiation of development depends on the specific circumstances and varies according to the scope of the project. While five years is recommended as a benchmark, a longer time-frame could be applied where justifiable; for example, development of economic projects that take longer than five years to be developed or are deferred to meet contractual or strategic objectives. In all cases, the justification for classification as Reserves should be clearly documented.

Dennis –

Wishful thinking can only take a person so far.

Here’s the fatal flaw in your argument:

Peak oil (conventional) is now 8 to 20 years in the rear view mirror. For Conventional URR of 1.6 Tb we would have expect a peak on or near year 2000 at 68 mbpd, actual was very close to that value.

For 1.8 Tb, peak in 2007 at 72 mbpd would be expected and was observed.

Now for the next value of 2.2 Tb, a peak of 78 mbpd should have happened but did not (was 70) – >10% too low.

For 2.4 Tb, 2025 peak expectation is 90, but actual is looking like ~64 mbpd. 40% too low!!!

You can continue this (forecast).

2.6 Tb – 2030 at 95 mbpd, actual will be ~52 without significant changes. This is 80% too low.

2.7 Tb – 2033 at 98 mbpd, if 46 then this will be 113% too low…

By time we make it to you high estimate of 3.4 Tb, peak year is 2050 and conventional production is 115 mbpd, if 23, then this is 500% too low…

You need to focus on the oil that matters…focus on the data points that matter.

My guess is you will make up some interesting rationale so you can hold on to your overestimates…

Kengeo,

Peak conventional was 2016 at cumulative output of about 1273 Gb. The rise of unconventional output made conventional producers such as OPEC restrict their output. My URR estimate is for conventional and unconventional output. I generally do not assume that peak is required to occur at 50% of URR, it seldom does. Why do you think a polynomial fit to data tells you anything, it doesn’t.

We will see how it plays out, I hope you are right, but think you are not.

Kengeo,

Where are you getting these peak values? Not clear you are correct on those. For a conventional Hubbert model fit to EIA data with URR of 2500 Gb I get a peak in 2016 at about 73.9 Mb/d, just slightly above the actual peak of 73 Mb/d. Note however that in the real world output does not follow a logistic curve. So as far as what data matters, that is never very clear and any model will be only a rough approximation.

Kengeo,

Hubbert curve for World C plus C based on HL for 2000 to 2019 EIA data, URR about 3000 Gb. Peak is 2024 at 81.7 Mb/d.

It is likely 2024 World C plus C output will be about 82 Mb/d, so this is roughly correct for 2024.

Hubbert Model (3000 Gb URR) and EIA data for World C plus C.

Longer term Hubbert Model (3 Tb) and data 1900-2100.

Slightly higher URR estimate of 3.2 Tb leads to peak of 82.5 Mb/d in 2027 for Hubbert Curve, compared with EIA data through 2023 and Shock Model forecast through 2029.

This is how a Hubbert curve is done properly.

Dennis – For that to occur (3 Tb), conventional production would need to be 25 mbpd greater than it currently is…

Can also verify by looking at OPEC and Russia. Together they account for 39 mbpd, falling by 2.5% annually. Conventional oil production decline will continue its march down, losing 1.5 mbpd annually.

US shale will continue along its plateau for several more years, entering 15% annual decline by 2030 at the latest. 2030 production will be at most 75 mbpd.

Kengeo,

The Hubbert curve is for conventional and unconventional production, currently unconventional output is about 12.7 Mb/d (2023 tight oil and oil sands output), total C plus C was about 82 Mb/d in 2023, conventional about 69 Mb/d. You might be forgetting about extra heavy oil output from Canada and Venezuela (API gravity of 10 degrees or less) which was about 4 Mb/d in 2023, this is added to tight oil output of about 8.7 Mb/d in 2023.

Kengeo,

Various Hubbert curves, note that cumulative production at the end of 2023 was about 1500 Gb, currently OPEC plus is limiting their collective production by about 2 Mb/d and has been limiting production for most of the period from 2019 to 2023. There is also increasing output from Argentina, Brazil, Canada, Guyana, and Norway expected over the next 5 years at least.

Dennis

Not sure the Hubbert concept really applies to the Canadian oil sands, where product transport capacity and water limitations play a big role in how the resource is extracted, while geologic factors are minimal.

Old chemist,

Resources that are limited will tend to deplete over time, I generally model these separately (unconventional and conventional resources), but was attempting to simplify.

For all resources there are many factors at play including product transport capacity and water is certainly an issue for any oil play as sometimes there is water drive involved in secondary recovery and there is almost always produced water to deal with.

The Hubbert concept has been applied to coal by Laherrere and Rutledge, not sure why it could not be applied to oil sands or any limited resource.

In this case the resource I am considering is crude plus condensate in all forms (conventional and unconventional).

Hubbert curves, slight variation

For chart above URR, Peak output and peak year

We could use your low estimate (2000 Gb) for the bottom (with at least a 99% probability that URR would be higher),

I would still use 2900 Gb as my best guess and 3800 Gb as the high end estimate with a 99% probability that URR would be lower. My 70% confidence interval would be 2700 to 3100 Gb and 95% confidence interval of 2300 Gb to 3500 Gb.

Kengeo,

Cumulative production through the end of 2023 was 1500 Gb, so maybe 1950 Gb for a very low end estimate, I would say a 99% probability the URR will be higher given the reality that contingent resources exist ( about 500 Gb) and reserve growth and discovery are very likely.

Always like these URR discussions, as much for what they leave out, as they include..

The underlying assumption is that current size and complexity of the background system continues to operate ‘normally’, to gain access to these reserves. The ‘normality’ we are assuming is a system of growth in the background, including size, energy use and complexity.

The assumption is false, as we lose ‘normality’ when overall energy extraction starts to decline, leaving less energy for every activity on average, including maintenance of existing complexity.

A lot of the remaining theoretical URR will remain in the ground as we lose the complexity to gain access to it, so it’s a misnomer in the first place. URR can and will shrink.

Hideaway,

If things play out as you assume they will, you may be correct and URR would be smaller, difficult to anticipate technological progress leading to greater efficiency in energy use. You assume energy use will contract, I also make that assumption, the difference is that I see a lot of inefficiency that can be removed from the system, my guess is that you do not.

Dennis you continue to do the hand wave of technology will save us, while ignoring physical laws of the universe, in this case the law of diminishing returns. All the ‘easy’ as in ‘cheap’ technological improvements were made decades ago, now every improvement is massively expensive and has smaller returns.

All that technology improvements do is allow greater energy inputs, to produce the technology that allows a bit more of whatever resource to be extracted. More technology is greater complexity of the entire system and is a common theme throughout the physical universe as complex systems grow.

The hand wave of lots of inefficiencies, without explanation of exactly what it would take to rid ourselves of these inefficiencies, as in the full accounting of energy inputs to produce whatever solution, is actually nonsense, as they would have already happened if a cheap enough solution was available.

When civilization is on the energy downslope we lose size and complexity so the ability to gain access to the remaining oil will be greatly compromised as it relies on all the modern complex technology to remain in place.

Energy per unit of real GDP for World continues to decrease and rate of population growth is slowing. Those are facts that you ignore.

Dennis we are still adding around 70,000,000 people per year to world population, which last time I looked meant still growing, so increased size complexity laws still apply, it’s a fact and I don’t ignore it, you do…

Real GDP is a man made construct to be whatever people want it to be. By leaving out asset price inflation from official inflation numbers, we never get ‘real’ inflation to adjust GDP to get ‘real GDP’. Any competent understanding of economics would know this, yet it evades just about every economist, because they want things to look better than they really are for the median person/family in the developed world where the median person/family is materially worse off over the last 5-6 decades.

You totally avoided the law of diminishing returns and the size complexity laws and went off in a tangent. These are physical laws that are inescapable. Thinking that some man made construct (real GDP), to get around reality, is an explanation is foolish.

If size or energy use, start to decline, then the complexity crashes in a chaotic way, as per universal laws!!

Go and do a bit of research on size complexity laws that have been discovered in various different sciences, all independently of each other, instead of trying to be an economist that thinks physical laws of the universe don’t apply to us!!

Hideaway,

Many well respected demographers (Wolfgang Lutz and others) expect World population is likely to peak before 2060. After that we will see fewer people and when population decline reaches 1.5% which the real GDP per capita growth rate, then real GDP growth reaches zero, if population decline rates increase to more than 1.5% then real GDP for the World decreases, also as the World becomes wealthier real GDP per capita growth rates may also approach zero or even fall.

HIDEAWAY –

Any competent understanding of economics would know this, yet it evades just about every economist

I’m not crazy. I’m the only sane one. The rest of the world is crazy.

Hideaway,

I mentioned the law of diminishing returns, which you seem not to understand.

See

https://en.wikipedia.org/wiki/Diminishing_returns

The law states that the marginal returns of increasing one factor of production while all others are held fixed (ceteris paribus) will see eventually decreasing returns. So what does a producer do? They increase other factors of production as needed so the output is optimized. If a factory is at optimum capacity and more output is needed, another factory will be built, also sometimes process improvements are devised that can increase capacity.

Dennis, for once could you look at something in scientific terms instead of economic terms?

https://content.wolfram.com/sites/13/2018/12/21-3-2.pdf

https://ecologyandsociety.org/vol7/iss3/art3/

“Systems grow relatively rapidly at first because they have not yet acquired any impediments to growth. Indeed, we may suppose that the rapid growth rates of immature systems best represent the universal urgency toward equilibration. However, we then notice a decline in the growth rates of older systems. There seems to be a law of diminishing returns for growth, and in ecological systems this is revealed as a limitation on diversification. I have proposed (Salthe 1993) that the limit to continued growth of any kind is imposed by information overload, because it is being loaded into a finite locale that is no longer growing.”

You can also look at any mining operation on the planet, they need to increase energy and material use to gain the same quantity of metal or mineral as in the past, it’s a law of diminishing returns due to lower ore grades on average, we used all the easy to get stuff first, same with oil, gas and coal, we have falling EROEI which is another form of the law of diminishing returns.

How is it the real world escapes your perception? Are you so overtrained in economics you can’t see the forest for the trees??

Dear Alimbiquated, how about you educate yourself in these fields for a few years before making comments about it’s only me..

Perhaps you could look up the work of Prof William Rees, or Prof T Garrett, or Prof T Murphy, or Prof S. Michaux, or Prof J Tainter, etc, then get back to me about how all these people are incorrect…..

Hideaway,

The law of diminishing returns is a concept in economics, often misapplied by others. As I said you do not seem to understand the concept. Mines get depleted over time obviously, that is not the same as the law of diminishing returns. EROEI will fall as resources get depleted also not the law of diminishing returns.

Hideaway consider that as peoples/countries find oil products or nat gas less affordable or accessible they will use what supplies they do have more carefully. Progressively so.

What does that translate to in action?

The uses that are most optional will get gradually weeded out by pricing mechanisms or government rules.

There will be increasing incentive to make do with less- better engines, better insulation.

And a higher fraction of the combustion will be directed toward production of non-fossil energy generating mechanisms that will in effect act as fossil fuel age extenders- hamburger helper if you prefer. And this can go a very long way in stabilizing energy availability as the population peaks and then enters the decline phase.

I know that you believe that the utilities of the world greatly overestimate the net energy output from all of these mechanisms like hydro, nuclear, solar, wind, geothermal. I see it differently, with the world utilities having a front row seat on this interplay. Their viability depends on understanding it and making correct long term decisions to navigate the scenario.

Just watch what they are doing…what mechanisms they are deploying. That will show you exactly what has the best net energy output/capital ex. Its the proof in the pudding.

[of course governments also impose some direction on these industry decisions for various reasons such as national energy security, domestic job/industry support, pandering to voting constituents, or environmental damage control]

Hickory, going for more ‘essential’ uses of resources instead of all uses of them defies how we’ve developed our industries and economies..

For example consider high end computer chips, which take great complexity to produce at scale. they are used mostly in discretionary gaming consoles and say special sensors in horizontal oil rigs. If you limit their use and ban gaming consoles, the demand for these chips crash. Why wouldn’t the company making them go bust due to lack of sales and production of the chips needed for horizontal oil rigs become unavailable, so ending the complex operation of drilling horizontally.

It’s just an example of how the unravelling of complexity by rules or competition will work in a chaotic way when either size or energy use decline work their magic of universal physical laws on the complexity we’ve created.

A clear look at history of civilizations finds they all collapsed because of an internal energy depletion, while trying to maintain their complex hierarchy. Whether it was climate change, increased salinity, or invasion by outside forces, it all comes back to less food, animals, trees and slaves, the energy sources of those civilizations, diminishing, leading to their collapse.

Our current civilization is magnitudes larger than any prior one and relies upon 6 continent supply chains to maintain the complexity while we are still growing in size and complexity.

You concentrated upon what ‘utilities’ would do, yet we have an entire complex system of civilization. What use are utilities that rely upon complex supply chains if there is no food reaching cities due to other complex systems breaking down as in fuel and fertilizer to farms relying upon complex machinery??

It’s an entire deal, all at once when energy or size starts to decline, chaotic feedback loops effect every internal complex system leading to collapse.

The perfect example of size complexity laws in action are in stars, where the larger the star the more spectacular the unwinding of the complexity internally. Small stars don’t go supernova, large ones do.

I do agree with you about much of that. Collapse conditions to level of disorder and decline that we see in places like Haiti have a strong likelihood of becoming much more widespread over the next 3 decades. No one should be smug enough to think that their region is immune to loss of civil society or prosperity since profound disorder and poverty can appear quickly, triggered by a pretty long list of factors.

Hideaway,

Society is not based on physical laws alone, it is understood using knowledge such as sociology, psychology, and economics. Society is not a biological organism or a software engineering project, making assumptions about software complexity or biological complexity and how these might apply to social systems is quite likely to lead one astray.

Nothing in social science is ever clear cut, no repeatable lab experiments are possible. Any understanding of how society works once understood by many will lead to changes in behavior as actors use this knowledge to game the system and will lead to a new system where the old rules no longer apply.

As soon as you understand a social system, the system changes and requires going back to the drawing board.

The law of diminishing returns applies to a single input where everything else remains fixed, nothing ever remains fixed and the law never applies in general.

Dennis, I have never read a more complete lack of understanding of how our systems work, than this reply of yours…

Giant ant colonies, are social structures and follow the same size complexity power laws, and biological systems as well as urban centres all follow size power laws, perhaps you should look into a lot of work by prof Geoffrey West on what he calls scaling power laws of cities and corporations.

Basically it doesn’t matter if there are social systems involved or not, the size complexity rules apply and because we require the high complexity to do so much of material, energy and food gathering of the modern world, when the size or energy inputs fall the system collapses fairly quickly.

Basically the bigger the system the harder the fall. The largest stars collapse the fastest, the largest civilization the world has ever endured will also collapse much faster than prior small ones. Social interactions have no influence over physical laws.

Your argument about social systems is akin to working around the laws of thermodynamics because you don’t want them to apply to you.

Hideaway,

Not really familiar with complexity analysis, my guess is that there are a variety of opinions within the field.

A sample work at link below.

https://link.springer.com/article/10.1007/s10699-023-09917-w

I get a little lost in the mathematics at definition 6 on page 1164 of the pdf, I have not learned beyond basic multivariable calculus, differential equations and statistics, I am not familiar with set theory, topology and such that advanced mathematicians would be familiar with.

Dennis it’s not analysis of complex systems, it’s size and complexity physical laws you need to look up, which has been discovered in several separate areas of science independently of each other.

Which is why I specifically mentioned Prof Geoffrey West’s work, or perhaps Georgiev with size complexity laws in stars.

It’s not about the complexity itself, it’s the physical laws that govern all growing complex systems, hence the relationship and importance of size.

Hideaway,

The two are connected and many of the people that look at this stuff are physicists and mathematicians (which the author of the article is). If you are going to try to extend the analysis to the World you need to go beyond simple physical laws, you need to look at the entire picture which includes both physical and social science and philosophy. Your focus is too narrow.

Also rules of thumb like the bigger they are the harder they fall while intuitive, intuition often leads us astray, like the thinking that heavier objects fall faster than light objects, which seems true in practice but is wrong in general (say in a vacuum which applies to most of the universe).

Also keep in mind civilizations are social structures, obviously physical laws are important, social interactions are also important in understanding the rise and fall of civilizations. Civilization is not fixed it changes over time.

Dennis the physical laws of the universe are those that have allowed us to create this civilization, and will be the same ones that end it. All the social, philosophical stuff are just man made constructs, which are subsets of what the physical laws of the universe allows.

You discuss these concepts like an economist who thinks money solves everything and we can replace every physical aspect of our existence without limits, in a finite world.

Everything we need cannot be replaced by a substitute, as per economist thinking.

If you believe substitution to be true, then please explain what humans can replace oxygen with, to breathe. I believe that no social or philosophical thinking will overcome this physical law…

Hideaway,

I am not arguing that there is a substitute for everything, but in some cases one form of energy can be substituted for another, aluminum can in many cases be used as a substitute for copper as a conductor, wind, solar and batteries can replace coal and natural gas used for producing electricity, and heat pumps can replace natural gas or oil boilers for heating buildings and water. I have university degrees in both physics and economics, I am well aware of physical laws and am familiar with some social science as well.

Why is it that systems become more complex do you think? If there were no advantage the larger more complex systems would not be able to compete with less complex systems. If complex systems lose any advantage that complexity confers the systems will adjust to a more efficient size and complexity, you assume for some reason this cannot occur, I disagree. Social systems are adaptable and constantly changing, there are not fixed social laws as there are physical laws, social laws and norms are devised by humans and are adapted as needed.

Yes physical laws are fixed, though note that out understanding of physical laws changes over time and technological and engineering progress allow advances that in centuries past would have been laughed at as the imaginings of a dreamer. Jet flight and smart phones come to mind and even the ease and speed of land transportation realized today would have been unthinkable 200 years ago.

Dennis systems don’t become more complex unless they grow, hence the relationships between size and complexity of systems. The bigger the system the more complex it becomes..

The growing complexity helps solve problems withing the growing system, and as such allows the system to become more efficient. As I’ve previously explained look up the work of Prof Geoffrey West to learn more about this. There are power laws throughout nature where a system double the size needs only a 75% increase in energy and materials, or thereabouts. Human settlements correspond to the 85% power law for every doubling in size of the physical settlement. It’s more efficient.

An Elephant is much more complex than a mouse with many more branches of internal networks, and especially brain neuron size and function, but as it’s a million times the size of a mouse it only uses 750,000 times the resources (food, water) of a million mice because of the efficiency gains in it’s huge complex size.

Hideaway

I’ll apologize in advance for not yet taking the time to dig up your G. West reference material. I will do so, but would like to ask a clarifying question first if I could.

You note that … “Human settlements correspond to the 85% power law for every doubling in size of the physical settlement. It’s more efficient.”

I read this as indicating that a doubling of population size and/or built environment somehow only requires 85% more incremental resources/energy. Is that your intent here?

Hideaway,

You noted that … “there are power laws throughout nature where a system double the size needs only a 75% increase in energy and materials, or thereabouts. Human settlements correspond to the 85% power law for every doubling in size of the physical settlement. It’s more efficient.” You cite Geoffrey West as your source for this.

In short, I’m skeptical at best.

It appears likely that the underlying primary source for this is:

Bettencourt, Lobo, Helbing, and Geoffrey B. West (2007) Growth, innovation, scaling, and the pace of life in cities. PNAS, vol. 104, no. 17, 7301–7306

The authors note the well know power law relationship of many physiologic characteristics with body mass. That is well established. However, they then suggest that there is a quantifiable metaphor with cities and population. Not “size of the physical settlement” as you note. Population.

They do not provide good support for their data sources, either in the paper or in the linked source material. They claim that their conclusions are “being shared by all cities belonging to the same urban system and sustained across different nations and times.” However, their timeframe appears to be centered very tightly around the year 2000, with the majority of data coming from the US with a smaller leavening of data from China and Germany.

They have a serious boundary value problem to start with. I know you are familiar with the work of Rees, as you have cited him here. I would suggest that his work on ecological footprints is much more fundamental and representative of reality.

It is also hard to see how a data set for what is essentially a single point in the human experience is supposed to provide a valid basis for such a conclusion across all cities, populations and times.

They go on the show a number of power law exponent values representing this supposed power law relationship with population. The two in the 85% range you note are for ‘length of electrical cables’ (0.87) and ‘road surface’ (0.83). These two look like they are only for some ill-defined data set from Germany for 2002, and their approach to the analysis is flawed from the start.

Nope, not buying it from what they show.

Hi T Hill,

Firstly, when I was discussing size of human settlements, it was always population size, nothing else and there has always been a saving in materials and energy, ergo efficiency by having a larger group and specialization, plus in all the internal networks, just like any organism.

However I also agree that in modern times no town or city is in isolation by itself in the modern world, which is a weakness in their arguments, but no reason to throw a huge amount of research out the window. I believe the relationships they have discovered would have been far better as separate entities many hundreds or even thousands of years ago before we humans set up networks of trade.

In the modern world, we have 6 continent supply chains with huge quantities of goods being transported across the planet and many networks that make any town or city reliant upon others for parts of their existence.

As you would no doubt understand a quick look at a paper to “buy it” or not will never give a full understanding of the overall situation. There are also many scientific papers discussing the same phenomenon of size complexity laws in other social animals like ant colonies, or wasp colonies, plus research into storm complexity related to size, and again separately star size complexity physical laws. Just because you don’t like the implications of such a law of nature, doesn’t mean it should be rejected.

Hideaway

You note that “… there has always been a saving in materials and energy, ergo efficiency by having a larger group and specialization, ergo efficiency…”. This is a common assumption. Proof is harder to come by, and in fact research shows mixed results on this point. One thing that West and his colleagues do get right is that cities tend to concentrate wealth. Wealth tends to increase consumption (to a point), resulting in the use of more materials and energy. Your assumption is particularly in question if we use a physics based definition of efficiency as the ratio of the output energy to the input energy and consider more than a single narrow aspect of cities.

I’m probably as susceptible to confirmation bias as anyone, but when I said I didn’t “buy” it perhaps I was being too informal. I noted acceptance of the biological power laws. I don’t accept the attempt by West & co. to develop similar relationships for the built environment associated with cities. To be more specific, one fatal flaw in their work is their boundary conditions and the use of Metropolitan Statistical Areas as city boundaries. For a thought experiment, imagine drawing an impenetrable wall at the MSA boundary. For their conclusions about ‘length of electrical lines’ or ‘road surface’ to be valid, the city must be able to function without these features outside of that wall.

West and co. do not present a “huge amount of research”. I’m throwing out their conclusions because of underlying problems with it and other research that points in different directions. It’s not about liking the results or not.

And thus begins and extensive back and forth between Dennis and Hideaway.

I summarize it as: Dennis: Efficiency! Hideway: Not!

I have been listening to a number of podcasts about AI and what is in store from us, ranging from Meh to We’re all gonna die. So I had chatGPT open at the time, and ever curious I asked chatGPT whether AI would produce more oil for us.

What followed was an extended and fairly nuanced answer, which indeed captured in its first two sentences both of these positions. “AI itself cannot directly produce more oil because oil production relies on physical extraction from geological formations. [Hideaway] However, AI can significantly enhance the efficiency and yield of oil production processes through various applications: [Dennis]”

It then went on to outline the ways in which AI will affect oil production.

Duanex,

The oil resource is limited, on that I agree. The disagreement (mostly with Kengeo) is the correct number. Rystad estimated about 1500 Gb of remaining resources as of Dec 31, 2023 (published in July 2024), cumulative production at the end of 2023 was about 1500 Gb, this leads diectly to my 3000 Gb estimate which happens to be what the USGS estimated for conventional oil URR back in 2000, unconventional is likely to be around 200 Gb minimum (this includes both tight oil and extra heavy oil which has API gravity of 10 degrees or less) which gets us to 3200 Gb based on the USGS estimate. My guess is 2900 to 3300 Gb (to account for some potential reserve growth as technology and knowledge improves over time).

Several Hubbert curves, the curves between 2.5 and 3.5 Tb seem to fit best for data from 1990 to 2023.

Hi Denis and others! The more I see historical world production curve, the more I think Hubert curve can only be applied until 1970-1975. After that period, the growth is linear in an attempt to still increase production while fighting against natural decline. The production being flat for about 10 years now, we may foresee a deep decline in the coming years.

The production curve will not be symmetrical as in Hubert curve as technology helps to kind of anticipate today a future production. A bit more like negative binomial distribution.

Hi Chris,

If we use data from 1896 to 1975 to fit a Hubbert curve we get a URR of 12 Tb, if we do a fit on 1896 to 1980 the URR falls to 3 Tb. So it does not work out as you expect.

Dennis clearly one of the stupidest graphs you have ever drawn. If you had extended the peak and roll over from the actual prior to 1970’s graph and matched it with known discoveries, the peak would have been around 30 years earlier and much, much lower.

We know statistically that the inflexion point on the way up is around 1 standard deviation in time away from the peak, and the distance to 2 standard deviations to the left can be calculated from existing data by the percentage of the total production under the curve.

The simple reality is that we were undergoing a normal distribution curve prior to 1973, and have had a linear increase ever since.

This huge change came because the US with unbridled capitalism allowed the fast depletion of the valuable resource, while OPEC decided to gain a greater share of their resource by hiking prices. The world suddenly woke up to limited resources, improved efficiency, and made substitutions for oil use.

The natural curve we were on, changed to only a linear increase from that point and has been on this linear increase ever since, until we hit physical limits where we can’t increase future production at all. I agree it’s most likely sometime in the near future.

We have already crossed the point where the natural increase in the prior to 1973 gaussian curve would have peaked and rolled over, probably by around 20-25 years, and it would be on the downslope now, just as conventional C+C actually is!!

The point we are approaching is where the from that natural curve would reach 1 standard deviation on the right hand side of the curve when the acceleration to the downside increases.

The linear increases in oil production since around 1973, greatly reduced the natural rate of oil use in the late ’70’s through to around 2000’ish, which would put peak further into the future and of course made all peak oil predictions of the time look silly.

The chart Kengeo put up at 11/26/24 at 11.34 am is far closer to what you should have drawn here, in reply to Chris. I do not take Chris or anyone else here to be a fool, but your chart above is treating him as one which is ridiculous.

This above chart clearly shows you don’t want to use the actual numbers from before that 1972-3 period as the basis for any curve, because it would give results you don’t like…

Hideaway,

Just fit the logistic to the data as I said. The curve used is not a Gaussian, it is a logistic.

Chris said we should use the data to 1970 to 1975, that is what I did, used data from 1896 to 1975, the curve charted is the result. I agree it is ridiculous, that was the point which I though could be left unstated for the intelligent readers here. The problem with such an analysis is there are many different results that are possible. Yes growth was exponential for many years and switched to linear growth after the oil shocks of the 70s and 80s.

A logistic curve has fat tails, the early tails on the left of your logistic curves do not fit the reality of what happened prior to the mid ’70’s, not remotely close. A gaussian fit is far, far, better, as it matches the data…

Since the mid ’70’s we have had a linear increase in C+C, so it doesn’t fit any curve at all!!

Taking the existing curve up to the mid ’70’s into the future using all known parameters of normal distribution curves and the discovery of oil up to that point (which is well over 80% of all discoveries), gives us a picture of what would have happened without the sudden change to a world realising oil was limited.

The really nonsense bit is that most people in the peak oil world try to make the linear aspect of oil growth conform to a curve, when it clearly doesn’t, while ignoring the actual data that did confirm to a normal distribution curve..

As I stated earlier, Kengeo’s curve that hits peak in the year 2000, looks far more accurate than most, with current high production of C+C dragging future use into the present…

Hideaway,

The logistic fits fine over the 1896 to 1973 period. Here is data vs logistic.