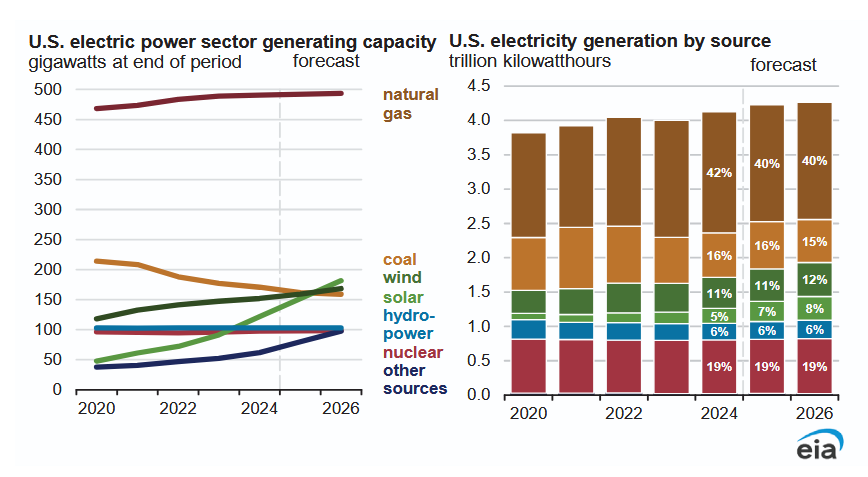

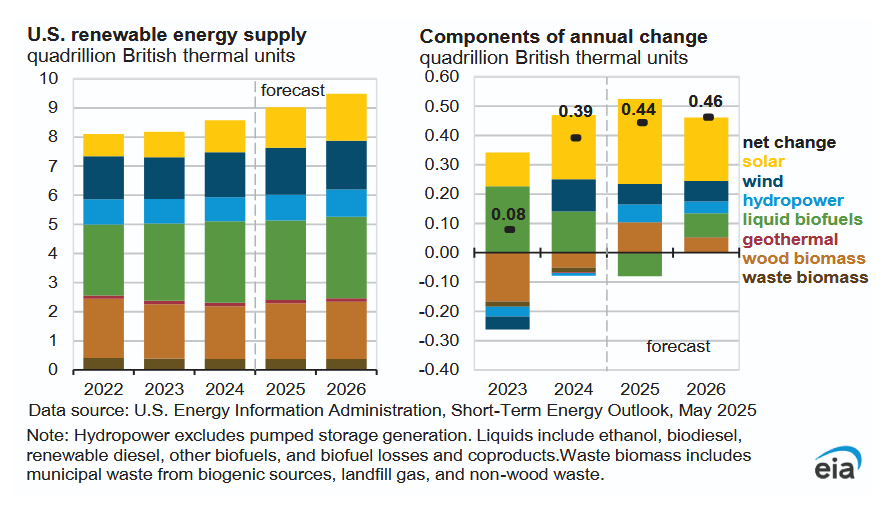

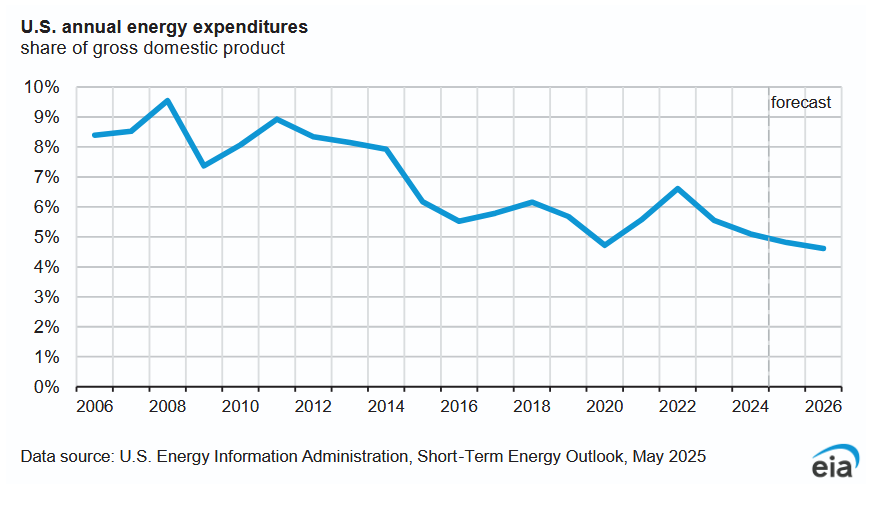

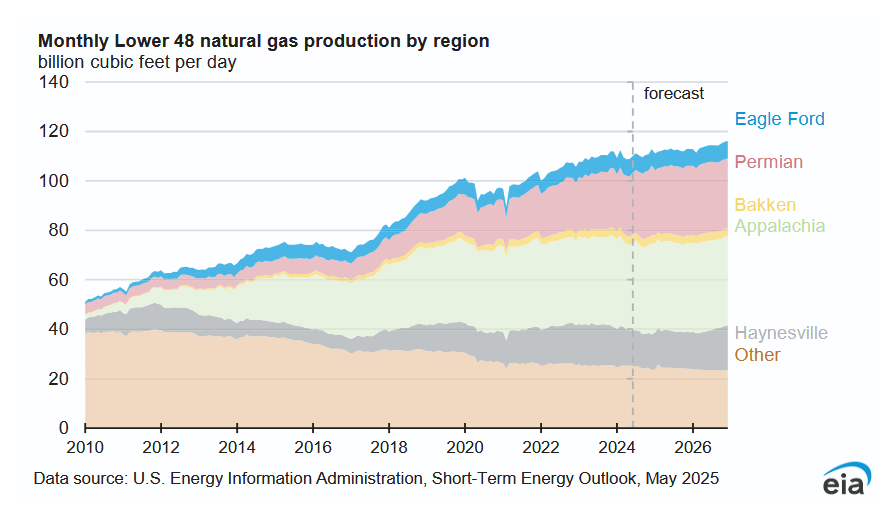

The EIA Short Term Energy Outlook (STEO) was published recently. A summary in chart form.

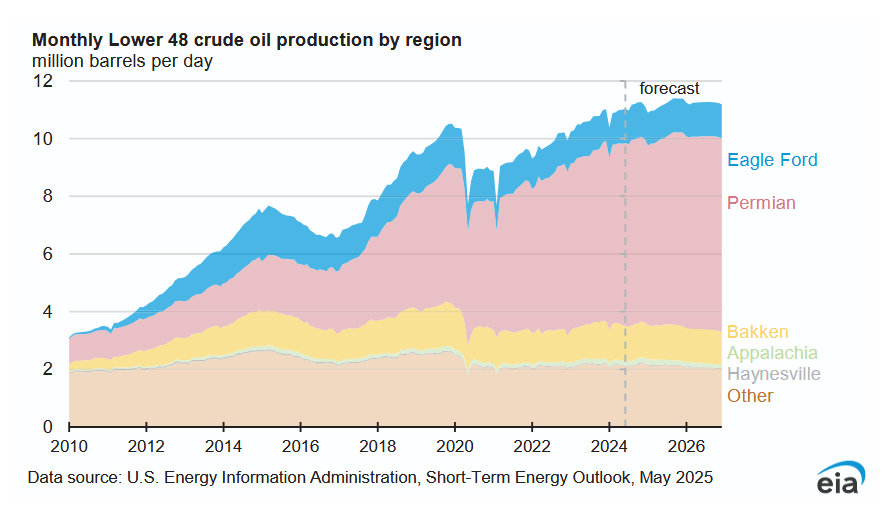

A brief comment on this last chart. I agree with Ovi that the STEO forecast for US Lower 48 C+C output looks optimistic. My guess is that output will be relatively flat from April to September 2025 and then will decline due to low oil prices in late 2025 and in 2026.

153 responses to “Short Term Energy Outlook, May 2025”

I’m curious what people think of the two tax benefits for domestic oil companies: depletion allowances and intangible drilling costs.

Large companies, who use accrual accounting, typically allocate capital costs over the life of the investment. Sometimes government allows them to accelerate depreciation in order to promote a favored industry, or compensate for external social benefits not otherwise accounted for (e.g., national security needs for oil production in wartime).

My understanding is that depletion allowances & intangible drilling cost deductions are this kind of thing, and they’ve been controversial ever since they started in the 1920’s, even though depletion has been limited to small companies for several decades. Are they reasonable? Excessive? Completely unwarranted?

You need to differentiate between cost depletion and percentage depletion.

Percentage is on allowed on the taxpayer’s first 1,000 BOEPD. Percentage depletion doesn’t relate to actual expenses incurred in drilling the well.

Cost depletion does relate to the actual intangible costs of the well.

Okay, let’s talk about intangible drilling costs. Is this a fair description?

Intangible costs:

Labor: Wages for workers involved in the drilling process.

Fuel: Costs of fuel used to power drilling equipment.

Repairs: Costs of repairing drilling equipment.

Supplies: Costs of various supplies used during the drilling process.

Site preparation: Ground clearing, drainage, and other site preparation activities.

Consulting fees: Costs for professional services like geological survey

Tangible costs:

the costs of the drilling equipment and machinery, such as the drilling rig itself.

So, the next question is how large IDC (intangible drilling costs) are?

Online sources suggest about 70% of drilling costs are IDC.

“According to the Committee for a Responsible Federal Budget, this makes 60% to 80% of total drilling costs tax-deductible.

This is one of the largest tax breaks available to the oil industry. Repealing the deduction would save U.S. taxpayers an estimated $13 billion between 2024 and 2033, according to estimates by the Joint Committee on Taxation.

It also reports that it is a rare case of a tax deduction that can be taken in its entirety in the year the costs are incurred. Most similar corporate tax breaks are spread out over five years.”

https://www.investopedia.com/terms/i/intangible-drilling-costs.asp

Does this sound about right?

I have just published the 2nd part of my post on a potential oil supply crisis in East Asia during a possible military conflict around Taiwan, seen with Australian eyes

Australian Diesel imports update January 2025 data. Preparing for surprises in the Strait of Taiwan (part 2)

https://crudeoilpeak.info/australian-diesel-imports-update-january-2025-data-preparing-for-surprises-in-the-strait-of-taiwan-part-2

I, for one, appreciate your work Matt M.

Being an Australian helps I suppose.

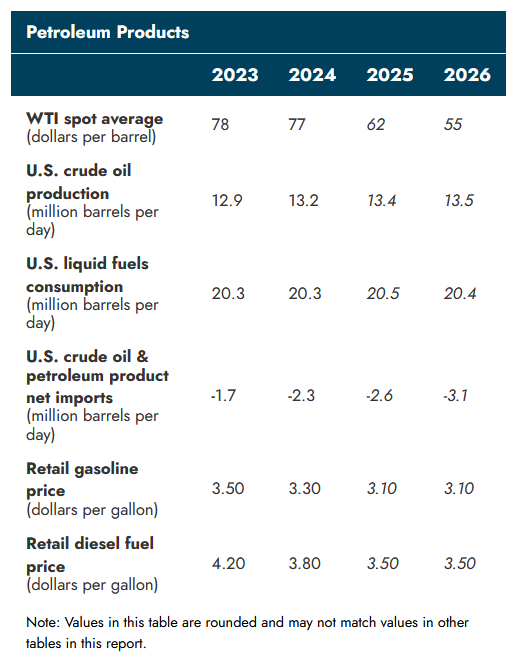

Is it just me, or have gasoline prices not fallen much? I see the STEO sees them barely budging despite a steep drop in Brent/WTI.

SS

I think you are right. The average price in 2024 was $3.30/gal. Attached is the AAA gasoline price. It is roughly 15¢/gal lower than last year’s average but down 40¢/gal from one year ago. I have been checking this page for the past month or two and I keep seeing a fairly steady price bouncing around $3.15/gal as the price of WTI has dropped.

I think the refiners have figured out that $3.15/gal makes Americans feel good and the refiners are probably make a slightly better ROI.

Gasoline should be about $2.65 if we compare it to 2018-2019, when oil prices were in the same ballpark.

It should be about $.22 more to address the stagnant $.184/gal for 32 yrs. Then maybe another 15 cents for public transit upgrades. Then another $2 over a decade to change behavior and type of vehicles on the road.

But what the heck let’s do a HUGE import tax instead and crush consumer demand.

The increase in total liquids production is great news for more than a billion people who have been able to move to using LPG in cooking and heating.

https://www.iea.org/reports/a-vision-for-clean-cooking-access-for-all/executive-summary

2 billion people who eat food cooked a wood burning stoves don’t care what global crude oil production is. Being able to buy LPG which is a vital product of the oil and gas industry is everything to them.

It has been calculated that for about 0.1% of global wealth, all flared gas and NGLs could be processed and distributed cheap enough to eradicate solid fuels use.

The illness and deaths prevented would lift millions out of poverty.

https://www.who.int/news-room/fact-sheets/detail/household-air-pollution-and-health

Give an argument as to how valid it would be to replace the classic stove/range/oven with dedicated electrical appliances such as microwave/hot-air-fryers/rice makers/slim-pizza-skillets. Saving space is not an issue because storage is used by the space a massive range took. This is for a small family unit – not for big parties.

That’s the premise — how does DeepSeek respond?

Replacing a classic stove/range/oven with dedicated electrical appliances (microwave, air fryer, rice cooker, pizza skillet, etc.) can be a valid and efficient choice for a small family, provided cooking habits align with the capabilities of these appliances. Below are key arguments supporting this setup:

1. Efficiency & Energy Savings

Targeted Cooking: Smaller appliances heat up faster and use energy only for the specific task (e.g., air fryer for roasting, rice cooker for steaming), whereas an oven/stove wastes energy preheating and maintaining large cavities.

No Wasted Space: A full oven is often overkill for small meals, whereas an air fryer or microwave handles small portions efficiently.

2. Faster & More Convenient

No Preheating Needed: Air fryers, microwaves, and skillets reach optimal temps in minutes, unlike conventional ovens.

Easier Cleanup: Many countertop appliances (like rice cookers and air fryers) have nonstick, dishwasher-safe parts, while stove cooking often involves multiple pots/pans.

3. Versatility of Modern Appliances

Air Fryers → Can roast, bake, and even “fry” with little oil (replacing an oven for many tasks).

Microwaves (with convection) → Can steam, reheat, and even bake simple items.

Rice Cookers → Often double as steamers or slow cookers.

Induction Pizza Skillet/Single Burner → Can sear, sauté, and even make flatbreads without a full stove.

4. Space Optimization (Despite No Storage Constraints)

Even if storage isn’t an issue, removing a bulky range opens up counter space for meal prep or other uses.

Modular appliances allow only the needed devices to be out at once (e.g., store the rice maker when not in use).

Potential Downsides to Consider

Large-Batch Cooking: Roasting a whole chicken or baking a big casserole may be trickier (though some air fryers and multi-cookers can handle this).

Simultaneous Cooking: Making multiple dishes at once may require juggling appliances (whereas a 4-burner stove + oven allows more parallelism).

High-Heat Searing: Some electric skillets/air fryers don’t sear as well as gas burners (though induction skillets come close).

Final Verdict: A Smart Choice for the Right Household

If your small family:

✔ Primarily cooks simple, small-batch meals (stir-fries, roasted veggies, steamed rice, reheating leftovers).

✔ Rarely needs to bake large dishes or host big dinners.

✔ Values speed, easy cleanup, and energy efficiency over traditional stove versatility.

Then yes, replacing the range with dedicated appliances is a valid—and possibly superior—option. However, if you frequently sear steaks, bake lasagnas, or cook multi-component meals, keeping at least one high-power burner (induction) + a compact oven (like a Breville Smart Oven) might be a better compromise

Good thoughts.

An induction cooktop is very cheap – as little as $50 in the US and probably cheaper in developing countries – and uses very little power.

Combine an induction cooktop, a little bit of PV and a relatively small battery and you have a clean and cheap solution. Far cheaper, cleaner and more reliable than butane, kerosene, LPG, etc.

To many people, the thought of eliminating gas stoves is nearly equivalent to banning guns. Really has nothing to do with logic, but a reactionary mindset. Next is the 110 volt range, which eliminates the step of rewring

https://apnews.com/article/climate-energy-gas-methane-pollution-emissions-stove-3facc7cc5390b97129dba4cd051206cc

From the article:

“Then there are the health benefits of cooking with electricity. Gas stoves, which 47 million Americans use, release pollutants like nitrogen dioxide that has been linked to asthma and cancer-causing benzene.

“You wouldn’t stand over the tailpipe of a car breathing in the exhaust from that car. And yet nearly 50 million households stand over a gas stove, breathing the same pollutants in their homes,” said Rob Jackson, an environmental scientist at Stanford University and lead author on a study on pollution from gas cooking.”

Nick

Why don’t you give a lecture on your wisdom

https://glpgp.org/

Giving them your wisdom and knowledge on solar panels costs. Meters required for each house to power cooking and lighting. How much battery storage required during rainy season? Cost of those batteries.

Cost of electric hob.

How long would it take a household to save all that money when they have an income of $2 to $3 thousand per year.

https://en.wikipedia.org/wiki/List_of_countries_by_GDP_(PPP)_per_capita

Perhaps run it past here. Would be really interesting.

Then I could let charity I know where they are going wrong.

“Meters required for each house to power cooking and lighting. ”

Not needed for non-grid homes, which is most in places like Aftrica.

“How much battery storage required during rainy season? ”

How much kerosene or LPG do you think can be afforded by people with a household income of $2-3K per year? Maybe a liter or two per week in a kerosene lamp, which gives enough light for a child to do homework for an hour or two?

“Cost of those batteries.”

About $100 per kWh – probably you’d want 1-2 kWhs.

“Cost of electric hob.”

A single induction cooktop, in volume, about $50.

And a 400W PV panel might be $120, in volume.

So, a onetime expense of maybe $400, which typically is paid over time at an expense substantially lower than kerosene or LPG.

Lighting, of course, would cost less than 25% as much.

—————————————————

I took a look at the charity. One of the participants is the Climate and Clean Air coalition. Here’s what they recommend for Household Energy:

“Extend electricity infrastructure

Replace traditional cooking with clean-burning modern fuel and cookstove technology, such as solar, biogas, electricity

Eliminating kerosene lamps

Replacing lump coal with coal briquettes for cooking and heating

Replacing wood stove and burners with pellet stoves and boilers”

So, this is a combination of electrification and incremental improvements in FF efficiency and cleanliness.

I can certainly see a role for LPG here, but I would expect it would be secondary and temporary.

Usual load of garbage from you Nick….

“About $100 per kWh – probably you’d want 1-2 kWhs.

“Cost of electric hob.”

A single induction cooktop, in volume, about $50.

And a 400W PV panel might be $120, in volume.

So, a onetime expense of maybe $400”

Now explain exactly how this setup works, based upon the cheap 2000w induction cooktop, running off 120V or 240V AC actually works, or did you leave out a lot of important, expensive details, like inverters??

You’re a fool if you buy the cheapest gear as it wont last long, and is inappropriate for most who know nothing about how electronics work.

As I’ve built/own several solar/inverter/battery systems, I can tell you need to multiply the cost by a magnitude to come close to a simple reliable system that will run a cheap induction cooktop in winter after a couple of cloudy days…

Which in essence means you know absolutely nothing about what you pontificate over..

Nick G

Just showed how ill informed you are.

Hideaway,

Could you provide detailed quantities and costs for your suggested setup?

Keep in mind this is a low-cost, simple setup, probably for a remote location in Africa, and something that would be packaged by a large charity with volume buying power?

Hideaway,

Yes, I didn’t break out the cost of the inverter. PV panels are going for around 10 to 12 cents per watt in Pakistan, so I’d guess that my 30 cent estimate will include that.

https://jbms.pk/solar-panel-price-in-pakistan/

About 285 Pakistan rupees to one US dollar, so 27 per watt is 9.5 cents per watt.

You might also want to present the cost of the liquid fuel option: cost of the stove, daily cost of the fuel…

Nick, you are the one that made the claim of how cheap it could be without any evidence at all. How about you back up your claims with actual numbers from the real world and an actual example….

You miss simple realities like induction cooktops will have a surge of power on start up. A 2000W induction cooktop will require between 3,000W-4,000W as a surge to start, which means that your solar/inverter/battery system has to be able to handle this surge load, or it will all get damaged very quickly or simply fail to operate.

Good quality, low frequency inverters, can mostly handle surge loads, cheap high frequency inverters usually cannot. Low frequency inverters are more expensive than high frequency inverters, because of the materials they are made from. Then there is the charge controller. Either built in for better quality inverters or separate equipment to accompany the cheap nasty inverters.

All inverters use electricity in their operation, at night when no electricity is being produced from the solar panels. This means higher battery storage, plus allowance for cloudy days, means extra storage.

Then there is the board it’s all mounted on (fie proof), copper cable, plus switches/circuit breakers to make whatever system is built safe on both the DC side (solar panel generation, battery storage) and the AC side (120V/240V AC) of the electrical system.

Then there is the need to keep the system in as dust free environment as possible, as good quality inverters have cooling fans with filters that can clog up with too much dust and overheat if not protected from dust shortening their operating life.

As I stated earlier, you are talking about things you have no idea about. A simple cheap LPG burner is way better and cheaper to operate over the long term for billions of people..

I fully accept the reality that it’s not close to sustainable to run these fossil fuel appliances for much longer because depletion will make the fuel cost too high.

However as depletion kicks in the cost of building all these electrical systems will also explode higher, because we make all this electrical stuff with fossil fuel energy. Plus all the extra materials it would take becomes impossible in a world of lower ore grades requiring more energy to produce, right when net energy availability is declining.

Paul

It is difficult to understand the ignorance you display in your comments.

I am working on a high pressure 100Bar coffee maker that deliver the similar massive fracking fluid and proppant to crack coffee nuts to get the best shale essence out of coffee beans.

Great idea but how many people can afford to pay a hundred grand for a coffee bean fracker?

one way to revive Starbucks against simple coffee vendors

Yup, my great grandfather went from draft animals to a tractor. How much longer will millions be lifted out of subsistence living?

Leeg

A tractor did not just fall out of the sky. Industrial countries firstly needed honest leadership at all levels and this was hard won over centuries. So many have died standing against dictatorship or corrupt government that would just take what they wanted.

Once good governance is in place, a country like America could use its vast resources of iron ore, coal, gas and oil for the benefit of all. America still burns vast amounts of coal which it has been doing for 150 years.

A barrel of oil has the equivalent of a man working all year, and the U.S uses 14 million every single day. The coal the U.S. burns is the equivalent of the manpower of a billion people. The gas even more.

https://en.wikipedia.org/wiki/List_of_countries_by_GDP_(PPP)_per_capita

Many countries have no oil, coal or gas. They have wood and are using it to the detriment of the entire planet. As the forests go so do all the animals and other plants. So the global water cycle gets disrupted. Which will kill us all.

Saving the planet involves sharing resources.

Many countries have no oil, coal or gas. …Saving the planet involves sharing resources.

Sharing would be very good, but…it’s not really happening. Instead, dictatorships and corrupt governments in Russia, KSA and Texas exploit their customers.

Sunshine, on the other hand, is distributed widely to (literally!) people’s backyards and roofs. It’s cheaper, cleaner, easier and the wide distribution discourages corruption. Just look at the happy customers in Pakistan and China.

Terrible response Nick. Tell me specifically how Texas exploits their customers, I’m assuming selling oil.

Molecules are sold at their free-market value and standard measure in Texas. Texas often sells at a lost, but that doesn’t win accolades when that happen now does it. Do you think $62 oil is party time?

So, what are you really talking about here Nick? You clearly don’t live in my beautiful state but hate it.

Sigh.

I don’t hate Texas. But…

‘Tell me specifically how Texas exploits their customers, I’m assuming selling oil. Molecules are sold at their free-market value”

Do you remember the Texas Railroad Commission? For many decades it restricted production to keep prices up, right? Is that generally considered a free market?

No Nick, the TX RRC regulates production limits to help preserve reservoir conditions to eventually help produce the maximum cumulative production from that reservoir. They aren’t increasing or decreasing well density to regulate pricing.

The TX RRC has very little direct influence on world crude prices in my opinion and probably doesn’t want it.

The TX RRC has very little direct influence on world crude prices

Well, as someone else just noted, the TRRC imposed “production allowables” led to a 28 year period of stable WTI prices, up to about 1973. That period only ended because OPEC took over and prices jumped well above the nicely stable TRRC price.

Again – is that a free market?

Nick, I’m done… you have nothing to add. Time to “sigh” again.

Gungagalonga

Love Texas or hate it, but there is no question that the uneven distribution of fossil fuels around the world has led to significant “rent-taking” over the past century. It is also undeniable that renewables resources are much more evenly distributed.

This is one of the key reasons why renewables are set to cut profits in the energy industry. The other is the fact that renewables are free at the margin, making price wars much more brutal to suppliers.

So fasten your seat belt. As renewables spread, energy business profits are bound to fall.

Alim.

Agreed that renewables have and should continue to erode oil and nat gas demand for energy, but over a long time… especially nat gas. We probably have a couple generations of continued use here, especially with the current headwinds for the renewable industries.

However, that was not my point to Nick. Nick wrote that Texas was in the same group as Russia and KSA and guilty of “exploiting” the world via the Texas RRC controlling production to raise prices. I disagreed with his statement as it is ludicrous.

Your response to me is a different discussion topic. From what I see, renewables are currently getting hammered by the investment community and dumped. Easy funding is drying up for renewables and nat gas is finding its way into everything energy and tech as an easy abundant source for a quick hookup… for a while anyway. Things will swing another way someday so i don’t disagree that renewables will gain significant energy share over decades. As many have said here before on energy sources… it’s all hands on deck as the world needs everything it can get its hands on right now.

“Sunshine, on the other hand, is distributed widely to (literally!) people’s backyards and roofs.” – Nick G.

No. Sunshine is vey unevenly distributed. In Britain, Ireland, Norway, we get a fraction of the sun the Spanish or Italians enjoy. We are further north and “enjoy” cloudier skies while Romans and Madrilenos have horizon to horizon blur skies through summer. And within for example Britain, drier south eastern England has mare abundant sun than the rain sodden West Highlands of Scotland. I doubt whether Washington and Oregon is as sunny as California or Texas, or Tasmania compared to Perth Australia My house faces due south and has no trees nor buildings around it so I generate the maximum possible electricity with this orientation. My neighbours are not so fortunate in and it is not worth their while to fix solar panels to their rooftops.

I agree. I think everyone would.

The point is that sunshine is far more evenly distributed than FF. Every country has some, and most have enough for it to be a primary resource. This is very different from FF.

A country like Germany only has moderate insolation (aka sunshine), but having a domestic low-carbon resource is sufficiently compelling that they are relying on it rather than importing from Spain or Morocco.

You can hate Texas all you want, Nick. We all feel pretty much the same about people like you.

https://www.oilystuff.com/forumstuff/forum-stuff/nick-g

You need to control your emotions Mike Shellman. They cloud your thoughts.

Seriously, this is a somewhat down-to-earth technical blog, but nearly every time you post it’s some weird emotional outburst.

Keep in mind that the tech bros figured out years ago that the best way to control people’s behavior is to play with their emotions. You’re setting yourself up to be somebody’s dupe.

Another excellent post by Mr Shellman at link below.

https://www.oilystuff.com/forumstuff/forum-stuff/u-s-shale-oil-pdp-reserves

Lots of great stuff at oilystuff.com

Thank you, Dennis. I appreciate that.

The allegation against Texas as being as “corrupt” as Russia and the KSA was insulting to me and should be to anyone. It was stupid. The three decades the Texas RRC prorated oil production were good decades for the entire country. Oil prices were low and stable.

As to Texas not “sharing,” that too was stupid. With Russian sanctions Texas is now the 2nd largest crude oil exporter in the world, second only to the KSA. That comes at horrendous financial and social costs to our State…and to our Nation.

As to my “emotional” stability and being duped by malicious people, please let me be very clear: America does not have the remaining, affordable hydrocarbons to be selling them, below costs, to Europe or anywhere else. Particularly natural gas. To get thru an affordable, rational transition to renewables and AI, we will need every MCF of gas we have left.

Exporting the last of our nation’s remaining hydrocarbons will prove, soon, to be the biggest blunder in American energy policy history. We do NOT owe cheap oil and gas to the rest of the world. It is anything BUT cheap.

Texas as being as “corrupt” as Russia and the KSA

Ah, now I see the problem. That’s not what I meant. I really don’t think they’re comparable. I do think there’s a good, worthwhile discussion about oil exporters, market management, and the effect of oil concentration on income distribution and governance, but that seems have gotten lost. So, one more time: I don’t think Russia and KSA are comparable to Texas – good lord, no.

This is a problem with short-form discussions like this. Someone says something which isn’t perfectly phrased, and someone else gets upset.

I should have phrased it better, and others ideally should have asked for clarification before going over the top.

Thank you Mr Shellman.

Agree in full.

Tech Bro: you chose to post anonymously; I assume for a reason. Perhaps you don’t want folks to know what credentials you actually have as you post on this “somewhat” technical blog. Are you German? Because you are very critical of American politics, our energy policies, how we manage our remaining natural resources in America… it is, in fact, pretty obvious you don’t like much of anything about my country. Where are you from, exactly? Or is that a secret too?

Are you a recipient of, or do you in anyway benefit from, U.S. oil and LNG exports sent to your current place of residence, below financial and social costs? In other words, as unemotionally as I can be, what gives you the right to bitch and/or criticize America to the extent you do? Anonymously, it is safe, I know, but what exactly is your beef against my country? Citizen? Ex-patriot?

Industrial countries firstly needed honest leadership at all levels and this was hard won over centuries. So many have died standing against dictatorship or corrupt government that would just take what they wanted. Once good governance is in place, a country like America could use its vast resources

So, the industrial revolution happened because of honest leadership? I generally agree that good governance is very valuable, but I haven’t heard this exact theory before. Do you have a source? Or could you expand on this idea?

Nick

I did not say the industrial revolution happened because of honest government.

Stop twisting words it is a disgraceful tactic.

With good just laws and protection, investors could invent and hold the patent allowing them to make a living creating valuable things that benefited people. In countries plagued by corruption and chaos there were few inventions.

The greatest number of patents has been in countries with the strongest legal systems.

https://hal.science/hal-02929514/document

Japan is very telling once a decent democratic government was installed by MacArthur

“I did not say the industrial revolution happened because of honest government.”

I don’t know why you’re unhappy – that seems like a reasonable summary of your first comment. Further, I would agree with that argument: innovation (like the industrial revolution) will certainly be encouraged by honest and non-corrupt government.

But, I haven’t seen research on the topic – I’d love to see some. I’ll take a look at the study you provided.

So how much longer do you think millions will be lifted out of subsistence living with fossil fuels? I use a 28 hp tractor. I know the work a few gallons of diesel can do.

Loads

Saving the planet involves sharing resources.

True, but it is a mistake to think that developing countries will follow the same path as developed countries. Telephones are a good example of this. Blanketing Africa with land lines was never going to happen. But Africa has a billion or more mobile phones now. In fact more Africans have phones than have electricity.

Energy demand in poor countries is likely to grow slowly, because poor people don’t have the money to buy energy hungry devices. Traditional energy sources will not be abandoned at once.

On current tech, electricity consumption spreads first for lighting, then mobile phones, then entertainment (TVs etc), then basic cooling (fans) then cooking and heating, then refrigeration. In tropical and subtropical countries most of this can be supplied by off-grid solar.

Other more expensive devices like air conditioners and washing machines come later, because they are too expensive. Dreams of massive exports to poor countries will always be limited by their very poverty.

Alim

I have not assumed that.

I am dealing in facts. 2.2 billion people globally burn wood and other solid fuels.

Over 5 million die each year from breathing in the smoke. Charities are helping people change to LPG.

The reason charities are doing so is because they know that solar panels, inverters and enough batteries to provide reliable cooking and lighting for each small village is vastly more expensive.

Fact 1 billion people have more from solid fuel to LPG over the last few decades. Not sure if this is skipping the west’s development pattern.

Fact they want the 2.2 billion who are destroying the forests to stop. Fact the 2.2 billion can’t afford solar panels.

The poorly informed Nick G thinks they can. The charities that have been helping for the last few decades know better.

The wealth of the poorest 2.2 billion amounts to 0.25% of the global wealth.

The forests that were a carbon sink are now becoming a net contributor.

https://www.scientificamerican.com/article/forests-are-losing-their-ability-to-hold-carbon/

Do you understand how it will impact you?

Thanks loadsofoil. I come here to learn something new, and you do post some interesting source material. Appreciated.

Chevron to lay off 200 Permian workers, all in Midland

“On May 16, 2025, Chevron notified the Texas Workforce Commission (TWC) of its anticipated workforce reduction of approximately 200 employees in Midland, Texas, in accordance with the WARN Act.”

Chevron added in the WARN letter that the layoffs are permanent and the employees do not have bumping rights or are represented by a union.

This could be related to the peaking in Midland county.

https://www.khou.com/article/money/business/houston-business-journal/chevron-to-lay-off-workers/285-1cfc7170-a3cf-4f3d-9b94-2addce2a5137

https://www.msn.com/en-us/news/world/venezuela-held-an-election-for-an-oil-rich-region-the-main-problem-is-it-belongs-to-another-country/ar-AA1FsCee

Venezuela elects new Governor for Guyana.

https://uk.news.yahoo.com/venezuela-shadow-war-over-oil-000000940.html?guccounter=1&guce_referrer=aHR0cHM6Ly9kdWNrZHVja2dvLmNvbS8&guce_referrer_sig=AQAAAM7jg5F-QZ90BCvLxoq_WzhLYO1YbkyMRNdGkgRabHVsDOBmviF3V4yJPMiBrXQHF6QlEK2RMIA_UWe0GlDS5gwXZPxKtsr96nUzWfW45tyeNzkS8Dz5p6ZINlm39kQMUYdvclWe9ZALjMGGZD7bkZbw9hnxZhLPMpsO1qmJA3Uc

Venezuela conducting shadow war on Guyana.

https://www.bloomberg.com/news/articles/2025-05-28/us-issues-limited-license-for-chevron-to-continue-in-venezuela

Chevron booted from Venezuala. Trump issues limited license extension for minor maintenance.

Please note…Trump’s first Secretary of Defense was General Jim Mattis.

General Mattis team wrote the infamous “US Military Peak Oil in 2015 Paper” that can be GOOGLED online.

I speculate that Mattis briefed Trump on Peak Oil and realised Trump didn’t care.

It’s not going to affect him, and he can buy assets on the cheap!!

Mattis resigned during Trump’s administration.

I would not be giving Venezuela to the Russians & Chinese if I cared about Peak Oil!!!!

Drones (air, land and sea) with lots of electric and smaller ICE engines will replace large ICE powered conventional weapons. Probably saving over a third of the military FF use in the next couple of years?

https://www.youtube.com/watch?v=YBrPeGWD3Nc

Trump doesn’t attend security briefings. He already knows what to do!

This is insane!

The global oil industry produces more than crude oil and condensates.

It now produces 20 million barrels per day of other things that it sells at a good profit.

There are already a billion plus customers who buy LPG and another 2 billion more that charities and governments are trying to help get access to this cleaner fuel.

https://t20ind.org/research/promoting-the-use-of-lpg-for-household-cooking-in-developing-countries/

Dennis dismisses NGP liquids as not as important as C&C has no basis for people.

The lpg market is worth $180 billion and can look forward to at least another billion new customers in the coming years.

LPG is the next best thing to electricity for cooking and heating when electricity is simply not available or too expensive.

https://blogs.worldbank.org/en/opendata/1-18-billion-around-the-world-are-unable-to-use-electricity#:~:text=In%20a%20newly%20released%20paper,2020%2C%20according%20to%20official%20data.

Loadsofoil,

Oil (in liquid form at room temperature and atmospheric pressure) is mostly used for transportation, LPG is used mostly for cooking or heating. I think the oil as C plus C should be the focus of peak oil, but certainly the LPG is useful. Note that most of the LPG is a by product of natural gas production. Note that in 2023 average consumption of ethane and LPG was about 14.7 Mb/d based on data from Energy Institute. Liquid fuels consumed in 2023 averaged about 67.3 Mb/d. Note that less LPG will be used as it becomes more expensive especially in areas where electricity is available as electric cooking and heat pumps will likely be cheaper.

In areas where electricity is not available, I agree LPG is much healthier than wood or coal and will be used if it is a cheaper and more convenient option.

Below is a WAG for Natural Gas (Gross Gas minus reinjected gas), Dry gas output roughly 90% of this estimate in 2023. Peak for Gross minus reinjected in 2030 is 166 TCF per year, if we assume dry gas remains at 2023 % in 2030 peak dry natural gas is about 150 TCF per year in 2030 vs 143 TCF per year in 2023.

Dennis

LPG is more than a byproduct, it is a product with over a billion customers.

Oil is important for transport but with electric cars it is no longer as important as it once was. In fact if you are correct and gas peaks around 2030 and with it LPG. we will be in a situation where transport is under pressure from oil production falling by 7 or 8 million barrels per day by 2035 and 1.5 billion people finding their source of cooking and heating becoming more and more scarce.

As per the article above there are 400 million people close to electricity supplies but they can’t afford it.

When 2 billion people have only 0.25% of the global wealth they never will be able to afford it.

Approximately 2 trillion per year is required to provide clean energy and water to the 2/3 billion who do not have these basics. Without this investment deforestation will continue and mass migration will get so much worse.

I don’t see much hope without a complete change in how the world works politically and financially.

EOG just bought out Encino making for an extraordinarily powerful operation in Ohio’s Utica.

Total acreage now north of one million acres (1,100,000), contiguous acreage (super important in the App Basin) almost a half million acres in the core, extremely efficient midstream infrastructure.

With Ohio’s oil output showing a 61% increase YOY, this new setup could easily double the state’s current production in a few years’ time. (914 is out later today).

With West Virginia’s natgas output recently exceeding Louisiana’s – and closing in on Alaska’s – hydrocarbon production in the Appalachian Basin continues to boom.

The torrid pace of new data center buildout in the area – coincident with several on-site natgas fueled power plants – ensures a robust increase in future production. (This, along with tentative moves to build 2 new pipes to/through New York state).

Dennis will be revising his projection charts 24 months from now.

Appalachia Rising!

Edit: 914 just released.

Louisiana increased about a Billion and a half cubic feet per day in just one month. Wow. Guess those Haynesville boys are letting her rip. The Mountaineers will likely never again surpass the Bayou state in the natty rankings.

Combined output from PA, WV and OH (Appalachia) from 914, gross withdrawals in million of cubic feet per day.

Pretty flat since 2022, perhaps that will change, we will see. The increase since Jan 2022 has been about 1.4% per year (annual increase of 0.522 BCF/d).

“The torrid pace of new data center buildout in the area – coincident with several on-site natgas fueled power plants – ensures a robust increase in future production”

On social media site such as BlueSky, there’s an explosion of mentions of Jevons Paradox.. It seems that they are understanding how increased supply of fuel is meaningless. Crowing about a meager discovery will never again filter down to the typical consumer.

Thanks for the handy STEO charts Dennis.

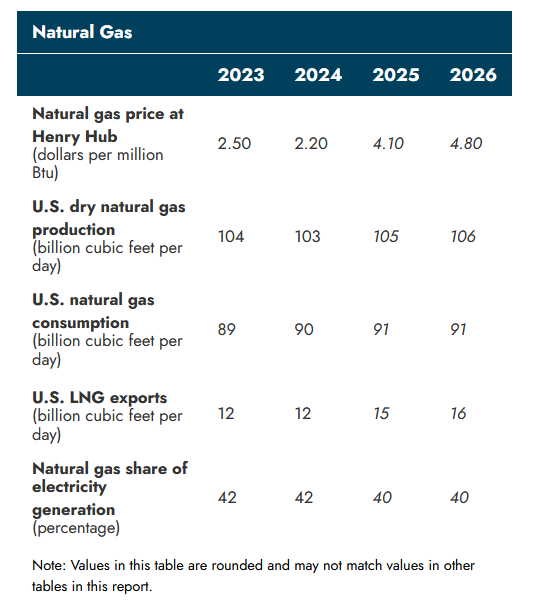

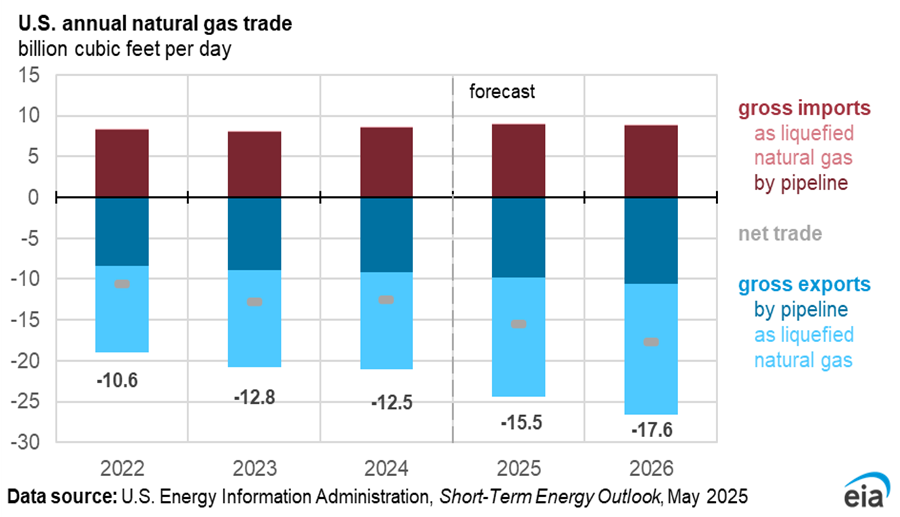

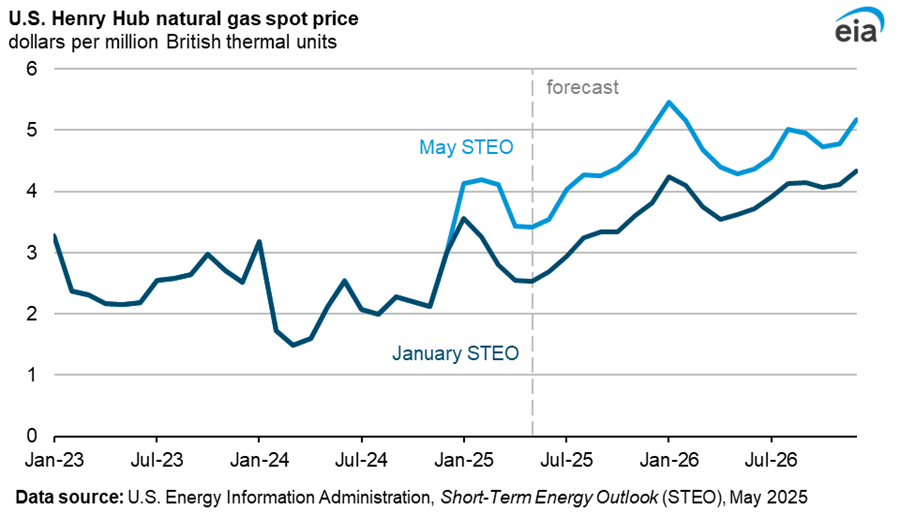

I’m beginning to wonder if anybody at the DOE is aware of the fact that NG output is now flat to down across most shale plays (by number)…and that the US is busy building out data centers like its an existential crisis (with NG as the only viable near-term energy source for electricity) and has another 14 bcf/day of LNG terminals under construction.

I have my doubts…

I’m well aware that (much) higher NG prices will solve the problem (for a while) but the issues of domestic inflation and long-term national security would have me telling the LNG proponents to go pound sand. I dunno, maybe leave something for future generations to play with?

Chris,

I agree exporting both oil and natural gas is not good policy. US citizens will look back on these decisions in a decade and say,

What were they thinking?

I imagine high natural gas prices may lead to some data centers being built near wind or solar resources (or places like Texas where both are available) as long term availability of gas is in question.

For US shale gas I have the scenario below as my best guess. It will be wrong.

Dennis —

All kinds of ideas about powering data centers are in the air. One I haven’t heard talked about much is reusing the waste heat from data centers, but it has been done before. This could be used for district heating, for example, saving a lot of energy in other sectors.

In view of that, it probably makes more sense to have the data centers near where the excess heat is needed than near the source of fuel, if fuel is easier to transport than heat.

Here’s an even more exotic idea: Data centers in space. The idea of huge solar arrays in space has been around for some time. It isn’t very realistic though, because there isn’t any convenient way to get the electricity back down to Earth.

So why not use the electricity in space to power orbital data centers, and beam the data back down to Earth? Data is much easier to transfer than energy.

Mr. Martenson,

The just-released 914 shows the highest ever natty production on record (over 130 Bcfd).

The increasing natgas production from ‘oil’ wells will ensure ever increasing natty production from existing producers with minimal new investments.

If you may have noticed, there are several hundreds of trillions of virtually undeveloped natgas resources throughout the US and Canada that are dormant largely due to THE lowest average Henry Hub pricing ($2.21) of all time for 2024.

Not to worry about energy scarcity as the long anticipated roll out of the Small Modular Reactors is about to arise. This should enable all the electric car lovers to recharge their vehicles to their heart’s content, no longer fretting about those terrible, terrible occasions when the wind don’t blow and the sun don’t glow.

Coffeeguyzz,

Keep in mind that the volatile natural gas prices are part of the reason a lot of resources have not been developed, the resource must be profitable to produce and sell or it remains in the ground. This also applies to oil and much of the tight oil resource may also not be profitable due to oil and natural gas prices that are too low, The assumption that associated gas is nearly unlimited fails to recognize some basic facts on the ground.

Maybe SMRs will save the day, for now they are quite expensive, perhaps as they ramp up, costs will come down.

US gross natural gas annual change in trailing 12 month average (TTMA), for most recent 12 month average there was a 0.46% annual increase YOY. This is likely due to the low price in 2024 for natural gas.

That’s the ourobouros. First (now), the gas price is low and discouraging drilling and extraction (by a lot, 3 dollars /mcf vs 12 dollars/mcf cost price for extraction in the big plays of shale gas). If the consumption increases, the price will rise and the extraction will resume. But the high prices of energy will slow the economy and create a glute of gas causing prices to fall and drilling and extraction to decline further. And so on, Better to have other sources of energy and a regulated price of electricity.

Longer term look at US Gross gas during the shale gas era, very variable growth rates.

“The just-released 914 shows the highest ever natty production on record (over 130 Bcfd).”

I’m not too impressed with the gross withdrawals of wet gas. I only track dry marketed gas. Reinjected gas? I’m not interested. Flared gas? I don’t care. LNG’s parading as NG? again, I don’t care.

On that basis, dry marketed gas through the first three months of 2025 is ever so slightly above 2024 and 3% above 2023. So…bouncing along dead flat until further notice.

2025 3‐month YTD 9,502

2024 3‐month YTD 9458

2023 3‐month YTD 9,213

[Table 1]

(link: https://www.eia.gov/naturalgas/monthly/pdf/ngm_all.pdf)

Editorially, I deplore the way in which the EIA has taken to mashing all sorts of things into being either “oil” or “gas” when they are really NGL’s which have a totally different use and a completely different market and disposition.

NGLs have a higher value than dry gas, in general. So, if you strip it out, you are discounting something worth more, not less. On the other hand, yes, I agree about flaring, reinjecting being right to exclude.

But dissing on NGLs (in gas) is kind of strange. Like I totally agree with the peaker horror at “boe” where gas is counted as oil, on a BTU basis, since the dollar value is much lower. But it’s actually the opposite story with NGLs in wet gas.

[Also…it’s kind of hypocritical the horror that peakers have at BTU basis for BOE…but then they want to say higher BTU (but lower priced) barrels of tar sands crudes are worth more the LTO.]

If you look at NGLs on their own (since you don’t want them counted with gas), it’s actually an incredible story…even more stunning than the rise of oil or dry gas.

E.g. here is propane:

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=M_EPLLPA_FPF_NUS_MBBLD&f=A

“But dissing on NGLs (in gas) is kind of strange.”

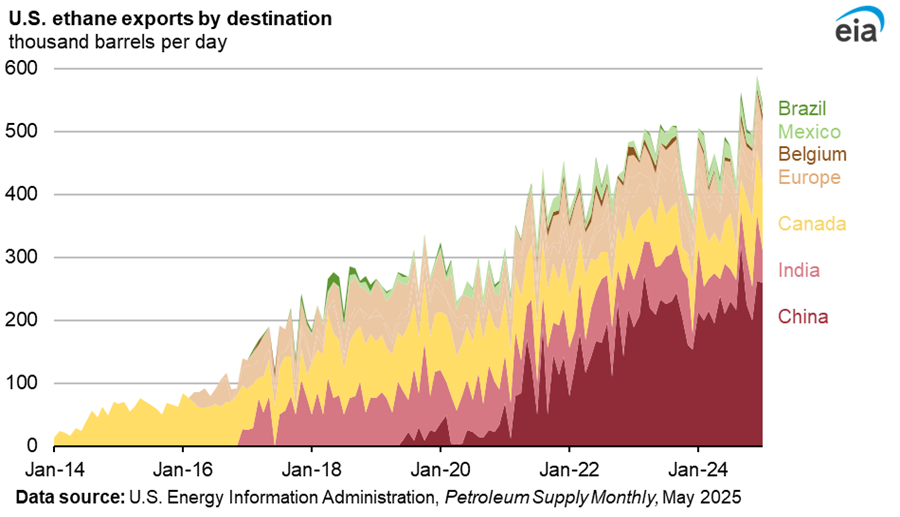

Not to me. Dry Gas is what goes into electricity turbines and is compressed into LNG. Ethane, propane and butane are separated and sold to entirely different parts of the economic chain.

If you are trying to determine if there’s a supply shortfall or abundance for, say, LNG, you have to use dry gas only. If you are trying to determine what it means for the electricity grid to go from 43% reliance on NG to 52%, you need to work with the dry gas numbers.

From a wellhead $ perspective? Sure, count them up, but not from an economic downstream perspective, which is where I spend most of my time.

Chris

You obviously don’t view the world as interconnected, which it is. The oil companies sell everything they make. Just concerning yourself with gas because it makes electricity is so America centric. So very Trump.

The value of those products is over $200 billion, wow that is some big ignore.

Food is shipped all over the planet and every form of energy is involved in growing that food. Fertiliser, irrigation which is becoming more costly, harvesting, packing, refrigeration etc.

People are no longer willing to sit and die of hunger or thirst and they are starting to overwhelm the areas that are still reasonably productive.

Over 300 million people moved in 2024 from their home countries to another.

https://news.un.org/en/story/2009/01/288882

This issue is overwhelming us, financially, housing schooling etc.

Only developing these countries to be places where people thrive is the cure.

Which means people like you need to realise no man is an island. That the world is highly interconnected and problems are spreading rapidly.

Maybe you think you will be the last man standing.

US March Oil Production at New High

Biggest contributors were NM, 100 kb/d and Texas 50 kb/d.

Also US C plus C 12 month average output also at a new peak of 13295 kb/d.

I think we will see a monthly report of 14 million BOPD in 2025.

If you all have yet to digest yesterday’s 8-0 Supreme Court’s decision involving the buildout of the <100 mile long train tracks out of the Uinta Basin, be prepared for many significant developments to arise from this important ruling.

Although the Uinta boys may be 3 or 4 years out from rail loading their product to market (currently using hazardous, expensive trucking), the wider national infrastructure developments may finally be freed from absurd obstructionist ploys meant to de-rail (pun intended) a wide array of much needed facilities.

About time.

Coffeguyzz,

Are you an attorney or tech specialist with experience in the NEPA process for infrastructure projects? Involved in a number of projects with an EIS? Would be interested in hearing more insights if so.

Also, please share some of the ‘many significant developments to arise’ from this ruling. What developments?

The way I read it, direct project impacts are still on the table right?

The 914 for MAR is out: https://www.eia.gov/petroleum/production/#ng-tab

Just barely another record for oil. Also fair to just say it’s bouncing around on a plateau.

NM was the biggest driver of the increase oil production, with a 100ish bopd gain. OH hit a new record. LA and MT are far behind, but also had gains last month.

Gas is interesting, up ~3 BCF/d, to a new record. (And AK was flat, slightly down, so “real” gas production.)

LA was the biggest driver of new gas, up a BCF/d on it’s own, which is huge for a single state. There are massive amounts of gas (and available at reasonable prices too) in the App, but that is mostly stranded as new egress pipelines have been blocked by anti-FF types. Consequently the App produces to fill the existing pipes and local demand and after that, more production just blows out the diff versus HH. In contrast, LA feels HH pricing and has good access to Gulf petrochem buyers as well as LNG export.

Coffee: EOG acquiring Encino is interesting. They are sort of the company with the best OH oil acreage, despite EOG’s typical touting of their own stuff. So…now they really have it.

US Marketed Natural Gas trailing 12 month average, Gross Gas includes natural gas that is reinjected, other gas, and natural gas that is vented or flared. I believe marketed gas is the more interesting metric and also prefer 12 month average output because output is very uneven for natural gas with a lot of month to month variation.

“I believe marketed gas is the more interesting metric”

Absolutely agree on that.

Also note that by 2030 the LNG additions underway will create another 14 bcf of demand by 2030. In essence, the same conditions that gave us the run from 2020 to now have to be in place between now and 2030.

It’s a non-zero risk that the right combination of prices and new take-away capacity do not arise to allow supply to meet the demand. Which is to to say nothing of the data center demand.

Looks like an awesome story. Doubled over the last couple decades. So much for David Hughes and his “Peak Gas” lecture from 2008!

Also…if you’re stripping out the NGLs, need to list them separately as their own story. And it’s a kick ass story!

Nony,

Marketed Gas includes the wet gas, Dry Gas has the NGL removed. Yes a big increase due to shale gas.

Here is what conventional dry gas for the US looks like with a guess at future output after 2024 (6% average annual decline rate from 2008 to 2024 assumed to continue in the future).

US Dry Natural Gas has doubled while NGL output increased by a factor of 3.5 since 2008.

US Dry Gas (included all natural gas, conventional, shale and coal bed methane) Scenario. peak in 2028 at 41.14 TCF per year or 112.4 BCF/d annual average output. URR for this scenario is 2250 TCF.

Nony,

Here is the EIA AEO reference case from 2008 for US natural gas data from page below.

https://www.eia.gov/outlooks/archive/aeo08/aeoref_tab.html

Many underestimated future shale gas output in 2008, the future is much easier to predict after it has occurred.

The EIA reference scenario was low by more than a factor of 2 in 2024 (AEO 2008 at 54 BCF/d vs actual output of 110 BCF/d in 2024.)

AEO 2008 Reference case for Dry Natural Gas compared with EIA data (annual average output from 2006 to 2024). Note that this chart has different units from previous chart (TCF/year vs BCF/d).

Here is the AEO 2011 reference cases for US C plus C and dry natural gas (right axis in TCF per year.)

AEO 2025 reference case for US C plus C and dry natural gas.

My guess is that the forecast after 2030 is very optimistic actual output is likely to be considerably lower than this EIA reference scenario.

This will help the shale patch… (NOT!!) ….

“We’re going to bring it from 25 per cent to 50 per cent the tariffs on steel into the United States of America, which will even further secure the steel industry in the United States.”

The doubling of steel levies — to take effect on June 4 — could further push up prices for a metal used in housing, vehicles, and other goods.

The price of steel products has increased around 16 per cent since Trump became president, according to the US government’s producer price index.”

https://www.abc.net.au/news/2025-05-31/trump-steel-tariffs-double-to-50-per-cent/105361374

All those drill pipes and casings that are imported.

What does Trump expect, new industrial processes will start up in the USA based on artificial price hikes that could be again reduced to zero tariffs by the next administration in 3.5 years time??? Or is he just trying to bring on world economic collapse a bit sooner than would have otherwise have happened??

No sane business is going to make a long term decision to build new production of anything based on possibly very short term tariffs.

is he just trying to bring on world economic collapse a bit sooner than would have otherwise have happened??.

A lot of people are asking that question: he seems determined to do everything possible to harm the world economy (with a particular focus on harming the US’s economy and international power).

Adolf Trump is not very smart.

Malice or incompetence?

The classic question…

it is not just A Trump who is trying to sabotage the economies.

It is lots of the voters and especially the extremists like Navarro, Bannon and Fox everyday.

However extrmeme, it really shows the urgency of industrialization in US, whether the old steel/metal/medics/chip/ship/phones….. or new AI. Like the Trump 1st term, his trade war with China became the legacy for Biden only tweaked up a lot more.

Unlike other 100% imported goods, the 50% hike in steel tarriff will not increase the steel pipe price by 50%, it will just give domestic steel pipe supplier a much needed price break and hope Japan/Korea/EU could invest in US steel manufacturing ASAP.

Rig Report for the Week Ending May 30

The rig count drop that started in early April, when 450 rigs were operating, continues and hits a new recent low.

– US Hz oil rigs dropped by 4 to 426, 1 rig lower than the previous July 24 low of 427.

– New Mexico rigs were down 1 to 81 while Texas also dropped 1 rig to 229. Texas Permian was unchanged at 186 rigs

– In Texas, Midland was unchanged at 24 while Martin dropped 1 to 25.

– In New Mexico, Eddy added 2 to 44 while Lea dropped 3 to 37. Lea is down 13 rigs from the end of February while Eddy is down 1.

– Eagle Ford was unchanged at 37.

– NG Hz rigs were up 1 to 82.

Frac Spread Report for the Week Ending May 30

The frac spread count rose by 4 to 190. It is also down 63 from one year ago and down by 25 spreads since March 28.

For Chris:

1 of X:

Consider an analogy in precious metals mining, where it is common to have ores that have gold, silver, and copper in them. You seem to be saying that you only care about the gold and the copper and ignore the silver. That’s just sort of strange, since it’s an incredible silver (NGL) growth story, even more so than either the gold or the copper. Why care about gold and copper and ignore silver?

Also, strange that you equate losses or recycle of natural gas with an admixture of a MORE valuable coproduct. It’s like equating the silver in a copper/silver mixture with sand/water/losses to tailing, etc. I mean, yeah it’s literally “not copper”, but a lot different sort of “not copper” as the losses and sand.

2 of x for Chris:

The reason why the EIA reports wet gas and C&C is that these are the actual production streams at the pad. Continental Resources doesn’t “produce” propane or Y-grade or NGLs.

At the lease, there is a device called the 3 phase separator. It is a MECHANICAL separation. You get liquid water out the bottom, liquid hydrocarbon (C&C) out the middle, and gaseous hydrocarbon (rich gas) out the top. Think of the separation funnel in organic chem class…mechanical separation.

The NGL gets separated at BIG, heavy metal processing plants. It’s a part of the petrochemical industry. It’s “midstream”. CLR doesn’t produce NGLs in the same manner that they don’t produce kerosene. (That’s a refined product, from the refinery.) Think of the distillation column in organic chem class, that’s a thermal separation.

EIA didn’t “stick the NGLs in the gas”. Either physically or actuarially. It was there to start with!

Note that C&C actually still has a few percent of propane and ethane inside it. That’s not some sneaky Republican shale producer game to hold the peak oilers down. It’s just the way oil and gas have worked since the beginning.

Hydrocarbons have an incredible co-solubility (like dissolves like). So, you have to run a process using temperature (fractional distillation or cryogenic fractionation) to separate out the various “cuts”. There has ALWAYS been a part of the refinery (the top of the distillation column) that separates out the light ends. As well as pots and kettles to further separate and proce the light ends. This is ChemE101. Or maybe 201. Or 301 at the most! 😉

And neither EIA nor the producers stuck the light ends in the crude. Even relatively heavy crudes have a noticeable fraction of light ends, requiring a part of the refinery to deal with them.

https://www.e-education.psu.edu/fsc432/content/light-ends-unit

I mean heck, if you want CLR to report dry gas (and NGLs, or even the “purity products” like propane, ethane, etc.), you might as well ask them to report diesel/jet/kerosene. But they are not in the mid/downstream business. It makes no sense to ask them that…it’s not even their data.

3 of x for CM:

There is nothing magic about methane for gas turbines. You could run a power turbine on propane. It’s actually a higher energy density fuel. The reason it is not done is because the propane is more valuable elsewhere (as a chemical feedstock or as a more easily transported [lower pressure cylinders] heating/cooking gas). Not because it wouldn’t work.

Heck…look at the classic LM2500. It (typically) runs on kerosene…JP-5!

https://en.wikipedia.org/wiki/General_Electric_LM2500

It looks like a 50% tariff on treated tubular steel such as that used in the oilfield would tack on an extra 10% to the cost of each well, so a 10,000′ deep conventional well would cost $500,000 more to drill and a big horizontal well would cost an extra million. This won’t stop new domestic oil and gas in its tracks but it will certainly lead to an earlier demise for those shale companies operating with high debt loads from paying excessive amounts for leases of dubious quality.

I’m not sure anyone knows what the president has in mind. It appears to be preservation of old, traditional factories that supplied him with I-Beams for NYC construction and are at risk of becoming dinosaurs, as well as putting a thumb on the price of crude oil, even if a deal has to be made with the devil. His Energy Secretary, Chris Wright, a fracking guy, is in favor of opening up Alaska, but also building out SMR’s, in the interim using NG to spin the turbine at utility plants and exporting the excess as LNG.

This has been a transactional president from the beginning. I don’t actually know a single person who thinks that tariffs are a good idea, either for America or for the world. U.S. Steel had a monopoly at one time, and if your business wanes when you have a monopoly, there is something badly wrong.

Speaking of which, Exxon, John D. Rockefeller’s Standard Oil of 1870, has withstood the nuances of every presidential administration since just after Abe Lincoln and poor, alcoholic Andrew Johnson who took Mr. Lincoln’s place. Exxon is a survivor. Living off the vast income from its other holdings, including the riches of the Stabroek Block off Guyana, Exxon can afford to drill right through this debacle, losing money on each well until it has basically outlasted every other operator in the Permian Basin. At that point the new iteration of the erstwhile union of “Exxon Mobil—-Saudi Aramco” can pretty well set the global price of oil. This sounds Machiavellian, and it is, but it’s about the only explanation for the deliberate deconstruction of the shale oil industry (which was already doing a pretty good job of that on its own).

not sure anyone knows what the president has in mind. It appears to be preservation of old, traditional factories

Trump stated aim is the pursuit of jobs that China doesn’t want anymore.

Maybe the only purpose of the tariffs is to allow income tax reductions for the very wealthy.

Don’t assume Trump has a plan.

He is a narcissistic bully. Not a chess player.

He only cares about himself.

He has an inability to feel empathy.

He wants to bully people and have people feed his fragile ego.

But deep down he is a coward.

Vallourec built a seamless steel tubing plant in Youngstown some years ago to save shipping costs from Germany. But they still import the steel.

Gulf of America output is projected to rise from 1.8 million barrels per day (bpd) to 2.4 million bpd by 2027

https://oilprice.com/Energy/Crude-Oil/US-Offshore-Oil-Production-Set-To-Jump.html

Gulf of Mexico, to most Americans.

Haha yeah, I can’t find the place in the constitution where it says the president has the right to rename geographic features.

There’s a Chinese saying, “指鹿為馬” call a deer a horse. It involves the famous schemer Zhaogao. He was chancellor to the second Qin emperor. Once gave the emperor a deer, saying it was a horse. When the emperor laughed and said it was a horse, Zhaogao asked each of the ministers present in turn whether they thought it was a deer or a horse.

Later, the ministers who said it was a deer were arrested and executed. The emperor didn’t live very long afterwards either.

To upstanding subjects of the kingdom of Trumpistan, it doesn’t matter whether it’s the Gulf of Mexico or the Gulf of America. It doesn’t matter if Biden was really assassinated in 2020 and the Biden we know is only a clone (as Trump claims). It doesn’t matter that climate change is real, tax cuts increase the deficit, Trumpcoins are a scam, and Putin is a criminal intent on destroying America. What matters is loyalty to their god king.

You saw this behavior in Germany in WWII as well. One supposedly talented general after the next bled his army dry when the war was already lost, then committed suicide to avoid capture. When asked why, it was because they swore an oath to the Führer. Nothing matters in this kind of political system except loyalty to the Supreme Leader.

What happens after Trump goes? Does the Gulf of America revert to being Gulf of Mexico, or does the name stick? And what about “Red White and Blue Land?” Are publishers of maps and atlases currently changing the names to accord with Trump’s fantasy, and will they keep publishing the names into the future?

Mike,

The Gulf of Mexico will remain the Gulf of Mexico despite what Adolf Trump says.

Does anyone actually know how much oil, gas and coal we should be burning by now.

https://climateandeconomy.com/

Vis a vis the predicted emergence of SMR’s for clean, enhanced electricity delivery, I would urge any interested party to read through the process from mining uranium ore to milling into yellowcake all the way to production of fissile material and then, once the bulk of the energy has been expelled to turn a turbine, the recycling of plutonium and the ultimate disposal of nuclear waste. The intrinsic sink of hydrocarbon energy into the development of another form of energy, deemed cleaner, and the manifold risks and hazards inherent to this process on a global scale make the use of fossil fuels for electricity seem downright clean and safe.

And that leads me to a possible solution to simplify a dirty job–at least to get started. Every country that possesses nuclear weapons has stockpiled several times more than they need to create a nuclear holocaust. Many of these nuclear warheads are laughably obsolete. The ideal solution for nuclear fissile feedstock is to dilute the weapons-grade uranium down to energy-grade, a retake on the old Megatons to Megawatts program. Certainly, Russia and the U.S. could easily save back their newest nuclear warheads while providing ample feedstock for the budding new SMR program.

GERRY,

While there has been much Fanfare and optimism regarding SMR technology, when we dig into the details, it just won’t scale to the level we need before Fossil Fuels take the EROI dump.

https://news.stanford.edu/stories/2022/05/small-modular-reactors-produce-high-levels-nuclear-waste

Furthermore, studies show that SMRs create 2- 30X the level of nuclear waste (10X being the average) compared to typical larger conventional nuclear power plants. This isn’t just the nuclear fuel, but all the parts in the SMRs that become radioactive. Manufacturing lots of small SMRs will create a Shit-ton of radioactive equipment-parts waste that the proponents overlook… as have every other scientist and engineer who ignored Joseph Tainter’s work on the COLLAPSE OF COMPLEX SOCITIES.

https://www.youtube.com/watch?v=G0R09YzyuCI

At some point, humans will stop DELUDING themselves that there is a PLAN B, C, or Z to continue infinite growth on a finite planet.

Maybe when humans start ingesting enough micro-plastics as they find in seagulls guts, we will realize we F#CKED things up much worse than the Energy problems we face.

But then again… watching the ORANGE CLOWN SHOW in Washington DC, maybe not.

steve

Thanks for your response and the professor’s youtube and the Stanford article. They were informative.

My only rebuttal is that humans have, through cunning, derived a sophisticated society but still function with a primitive digestive system. In other words, they are used to shitting wherever the urge hits them and hiding the waste from sight. In order to preserve a certain way of wife or in many circumstances climb up the next rung of the ladder, they will give in to the notion that nuclear waste is a messy but necessary part of modern life.

Artificial Intelligence was not my idea. I think in general it’s a horrible idea that will waste untold millions of human souls by taking away their jobs. However, AI is coming very fast. All you have to do is ask your search engine a question and you get an answer within seconds. The number of people going into tech is probably greater than those learning a trade. In AI, deep neural networks simulate the human brain in learning on many different levels (nodes), each of which triggers another node with its own exponential array of possibilities at that level, and keep going–they call it machine learning but in its best form is more like the brains of da Vinci, Einstein, Musk and Stephen Hawking all doing their best work in a jam session. This AI is going to get better, not worse. AI is soon going to run our national defense systems, and, God forbid, should we find ourselves in a multi-front war (which we will), the level of sophistication of our AI is going to determine who is the winner.

From the simple use of robotic AI that we all now use right on up the chain to Pentagon decisions and reactions to geopolitical events is going to require unheard-of amounts of electricity. I wrote about this a few years ago in a small book on the coming electricity shortage called “Sparks Fly.” The more I researched it, the more frightening it became. AI alone will soon have the power that used to run our homes and businesses. Bill Gates and the Google boys understand this; that’s the reason they’re revamping old nuclear reactors. Our Secretary of Energy Chris Wright is on record that he favors SMR’s. I imagine the president will agree with him.

Maybe I’m being melodramatic but I believe we’re heading for an electricity shortage around the world the likes of which we’ve never contemplated. Everyone is under the illusion that electricity is clean; therefore, why would you use anything else. That’s precisely the reason all these multi-billion-dollar LNG trains are going in, and why foreign countries are trying to invest in them–despite the fact that the NG supply could fall short of their voracious appetite. I look for NG to hit $5/tcf by the end of 2026, and keep going until this data center demand equilibrates. Along the way, as NG falters or becomes too expensive, the sharp elbows scuffling for AI supremacy will turn to nuclear. And it will happen faster than we are thinking.

Mr. Gerry,

AI will have all of the knowledge that we humans have accumulated. Will definitely be smarter using it.

But we humans are not inherently intelligent, we only move on forward after experiencing setbacks, like the thinning of the ozone layer and many other things. Don’t expect us to see the consequences in advance.

The Sixth Extinction is well under way, if that is a big enough setback. LOL

“AI will have all of the knowledge that we humans have accumulated. Will definitely be smarter using it.”

Only someone that has never programmed neural networks or machine learning (AI) could say this.

AI is not intelligent or conscious. It is a very powerful pattern matcher.

If the patterns are wrong or they change. It completely sucks!

Where is my self-driving car? Elon promised them in 2017???

GERRY,

I also appreciate your detailed reply. While the proliferation of AI will continue in the years ahead, the downside is AI’s fundamental diminishing returns predicament.

AI is based on the massive churning of energy through super-AI chips. Chips for AI or Data centers last between 3 and 5 years. Thus, using AI Technology to solve Complex Infrastructure Problems is similar to using a stronger Drug to offset weaker Drug or Drug that has lost its potency.

Of course, this is a simple analogy, but AI only works when the Complex Global 2,500-mile semiconductor Supply Chain remains intact. I label the Semiconductor Fab Plant as the head of a 2,500-mile complex supply chain snake.

If anyone studies the complex Semiconductor Fab Plant, you will find it has it’s own onsight complex gas fabrication plant to refine gases to super-high quality. Semiconductors are not more efficent today, because we have omitted the 50 years of time-binding the education, trial & error advancing technology and the massive energy and capital consumed during this entire 50 year period.

AI will likely mark the pinnacle of our complex Global High-Tech Economy.

steve

SRSrocco, I spent my entire career as a computer hardware engineer. Actually I am not a degreed engineer, but that was my title. Computer chips don’t wear out. They can degenerate if allowed to overheat, or to operate at too high a temperature for long periods. But if the cooling system is working properly, a chip should last for decades. They just don’t wear out.

Ron,

Speaking with people in the industry and doing research, the data suggests AI or Data Center Chips last between 3-5 years.

Among the 5 AI chip designs that are at least as new as the NVIDIA V100, the median lifespan from release until final use for frontier training is 3.9 years. For these newer chip designs, lifespans range from 2.3 to 4.5 years. In contrast, older AI chip designs generally saw shorter lifespans.

AI chips, particularly datacenter GPUs, tend to have a shorter lifespan of around 4-5 years, primarily due to the immense power consumption and heat generated by these devices. The extreme heat load causes significant stress on the delicate semiconductor chips, potentially leading to accelerated degradation and failure. Additionally, the rapid advancements in AI algorithms and the increasing complexity of models require newer, more powerful hardware to keep up.

https://www.extremetech.com/computing/data-center-ai-gpus-may-have-extremely-short-lifespans

steve

Steve – I think the chips can last longer, but they are replaced earlier due to economical obsolescence…they essentially become too expensive to run compared to the newer offerings on the market. I’m sure there’s a lot more to it than that, but at the core it’s about saving money with newer models…

Steve, then it’s all due to overheating. Silicon and germanium are elements that don’t wear due to electrical currents passing through them. But overheating can obviously break or deuterate the contact between them.

Even the last-gen Hopper GPUs were quite greedy with their 700W power envelope. That’s a lot of power and heat to run through delicate silicon, which undoubtedly reduces the lifespan.

They obviously have a cooling problem. Heat can destroy anything.

So it’s really a depreciation time, not a wear-out time. Agree with Ron that chips don’t wear out unless the fan or coolant fails and causes it to overheat. And even in these situations there is usually an automatic shutoff (leave your phone in the sun to see this in action).

Export Land Model

An observation developed by geologist Jeffrey Brown and Sam Foucher.

An example of the observation. The United kingdom, in round figures, at its peak produced 3 million barrels per day and used 1.5. It was able to export 1.5 million barrels per day. Enough to supply the needs of Greece, Portugal and Poland.

In 3 short years it could only supply half of their need and in 3 more years could not even meet its own needs.

This is the canary in the coal mine, which should have spurred all importing countries to electrify all public transport and make it so widespread that people would not have to buy cars. That was 25 years ago.

The world does not run on 84 million barrels of oil. It runs on less than 40 million barrels of net exports.

China, India, Europe and a hundred other importing countries all compete for only 40 million barrels.

https://www.energyinst.org/__data/assets/pdf_file/0006/1542714/684_EI_Stat_Review_V16_DIGITAL.pdf

It’s all very well talking about Chinese electric cars but look at the consumption.

If peak oil happens in 2029/30, world exports will decline by a quarter in just 6 years.

Could the U.S. consume 5 million barrels per day less in that time? Not a chance. Every single vehicle sold would have to be fully electric by 2028 to get close to that rate of oil consumption decline.

The only thing that has prevented the world experiencing this turmoil is U.S. shale. Increasing oil production by 6 million barrels per day by drilling a vast number of wells. The best areas have nearly all been used up, so a decline will start to happen soon.

India and otherS fully intend to take their share of what will soon be a sharply diminishing resource.

https://www.petro-online.com/news/fuel-for-thought/13/global-data/india-is-poised-to-take-the-lead-in-upcoming-crude-oil-refinery-ventures-across-asia-until-2027/61256#:~:text=Within%20India%2C%2035%20upcoming%20refinery,are%20in%20the%20commissioning%20stage.

I think OPEC spare capacity will be gone in 3 years. That is when the fun will really start.

Loadsofoil,

Is there a shortage of crude oil or its products in the UK? If so it is news. Prices adjust to allocate scarce resources in general.

Dennis

That is not. Not net exports. Not net imports.

Kindly post your sources so we can have a look. Thanks.

Dennis I really don’t think you actually understand what peak oil is. Other than a rather superficial level of posting the same graph a thousand times.

Post the data let’s have a look.

Loadsofoil,

Correct it is imports of crude plus condensate, I did not say it was net imports or net exports, the title of the chart says pretty clearly what is covered.

using EIA data from 1980 to 2018 from https://www.eia.gov/international/data/world

For the World Imports are equal to exports. Energy Institute data was used for 2022 and 2023 for crude and an estimate was made using % crude to petroleum liquids imports in 2018 and 2022 and extrapolating between 2018 and 2022 to estimate using energy institute data from spreadsheet at link below

https://www.energyinst.org/statistical-review

Net exports are more difficult, but here is an estimate based on top 48 net exporters of crude oil in 1999 based on EIA data for 1980 to 2018.

Note that if you want to continue to be welcomed here try some politeness. Or go elsewhere to find something interesting from someone worth reading.

The export land model is flawed, the assumption that consumption levels are not affected by higher prices that would occur if there are shortages is not a good one and is a fundamental assumption of the export land model.

Interesting piece on net exports by Euan Mearns (from 2017).

https://euanmearns.com/peak-oil-exports/

Dennis

I try and make valid comments and you often come back with disrespectful, condesending replies such as.

“Loadsofoil,

Is there a shortage of crude oil or its products in the UK? If so it is news.”

I did not ask you to comment on my post.

EIA post on US tight oil and Permian Basin

https://www.eia.gov/todayinenergy/detail.php?id=65404

Chart below illustrates that since mid 2020 most of the growth in US tight oil output has been from the Permian Basin. US C plus C output growth since 2010 has been mostly from tight oil output increases and since July 2020 about 89% of the increase in US C plus C output has been from Permian Basin tight oil output (2154 kb/d from Permian Basin tight oil and 276 kb/d from US C plus C that is not Permian Basin tight oil).

Dennis – I have not followed the forum as close as I should, could you post your latest/greatest world model? Any significant tweaks or changes been made recently? Thx

Also, is 2023 (December) the post Covid peak? Is there some reason it might be higher this year, maybe Nov/Dec?

Kengeo,

If OPEC increases supply by 2200 kb/d this year, the Dec 2023 level will be surpassed.

Not sure what the last guess is that you saw. My most recent Oil Shock Model from April, don’t think changes are significant since December or so.

I wonder if there are countries now who have economic activity curtailed by oil product shortage due to lack of available supply at current pricing or geopolitical factors?

I’m pretty sure there are a bunch of countries who would buy much more if they could afford it, especially in Africa.

If we look under the hood there are going to be many countries, and regions within countries that come up very short on supply as time rolls on. The projected population (demand) drop lags oil supply drop by something like 3-5 decades. Roughly 1 generation lag I think.

That curve has a wide array of price/demand/prosperity speculations and unknowable variables built in, accompanying all the geologic/technological/geopolitics factors.

Pretty wide band of variability, growing with each year.

Hickory,

I agree the future of oil output is highly speculative, this is my guess and it is certain to be wrong, my expectation is actual output will be lower by as much as 20%.

No doubt there are people everywhere who would like more stuff at lower cost, there is no doubt a higher proportion of people who need more in less developed nations.

The curve is more of an oil supply curve which simply assumes demand will be as large as supply and that prices will adjust to make this a reality. The curve beyond 2024 is speculative as future demand is unknown.