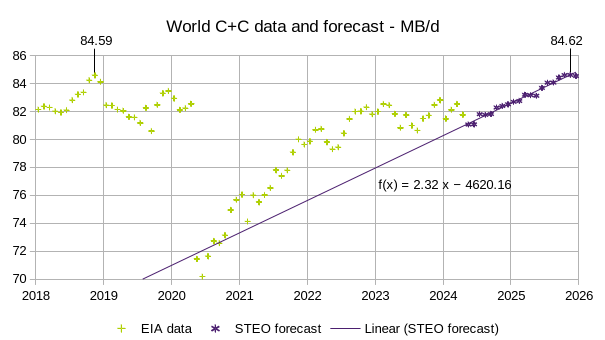

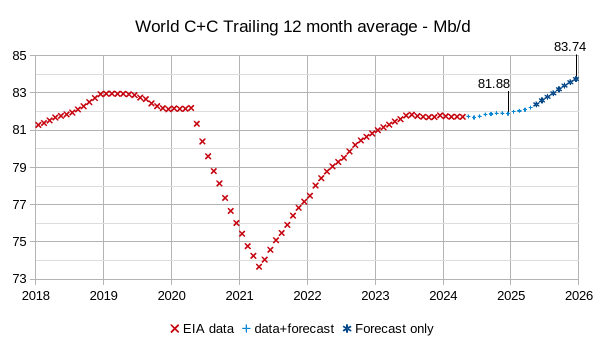

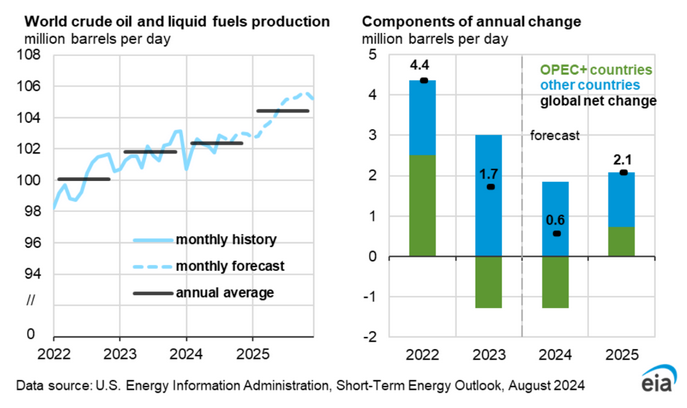

The EIA STEO was published recently, the estimate below is based on data from that report and statistics from the EIA International Energy Statistics. The EIA expects the 2018 peak for annual average World C+C output will be surpassed in 2025. The monthly peak in November 2018 is also expected to be surpassed in November 2025.

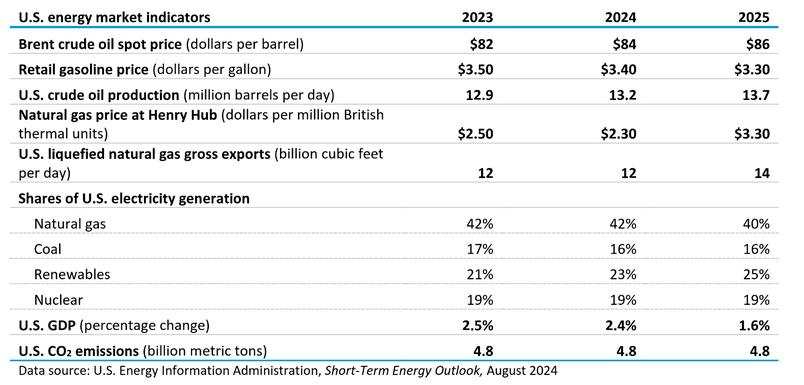

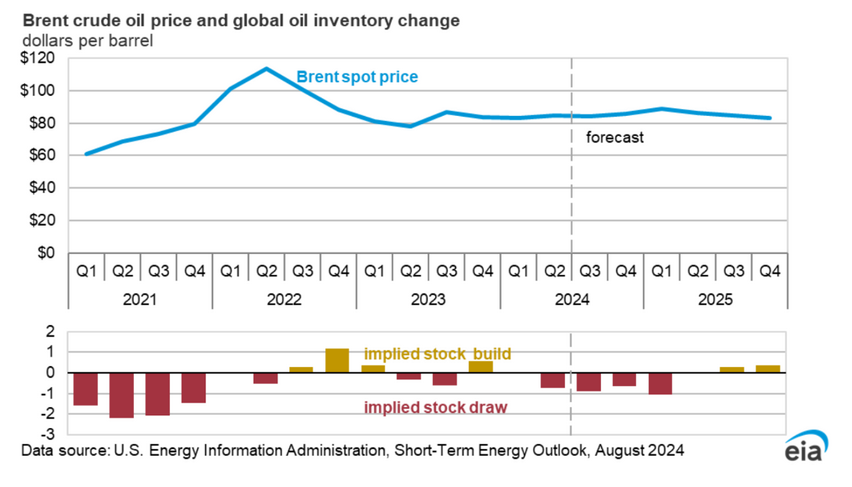

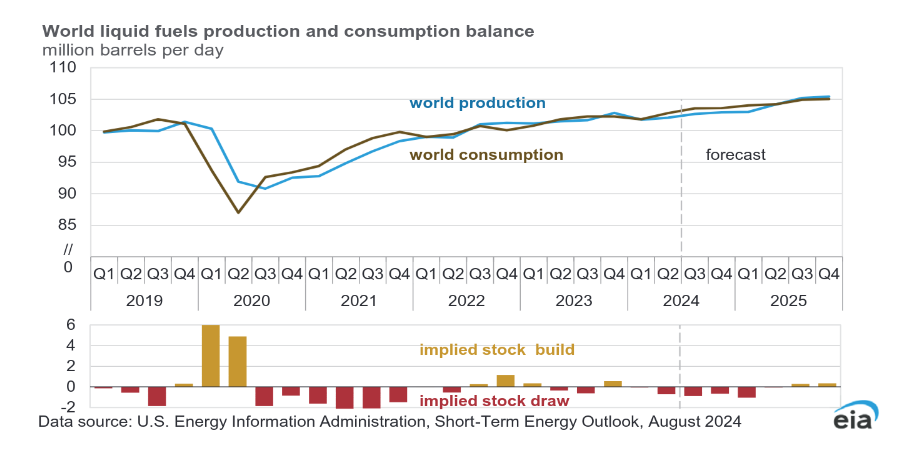

The STEO forecast for annual average output in 2024 looks reasonable, but the nearly 2 million barrel per day increase expected in 2025 looks unlikely in my opinion, especially when we consider the expected Brent average price in 2025 of $86/b.

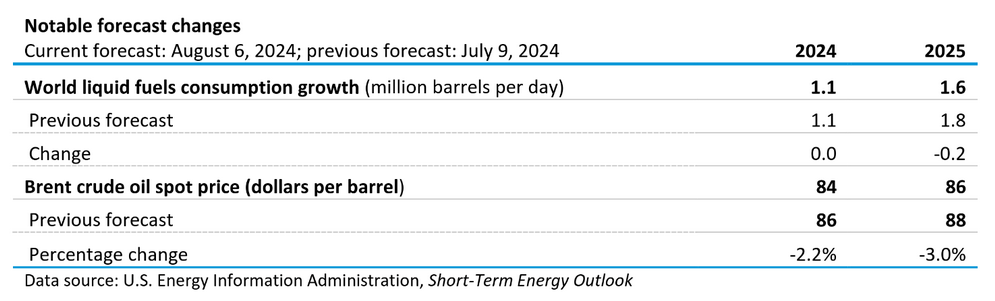

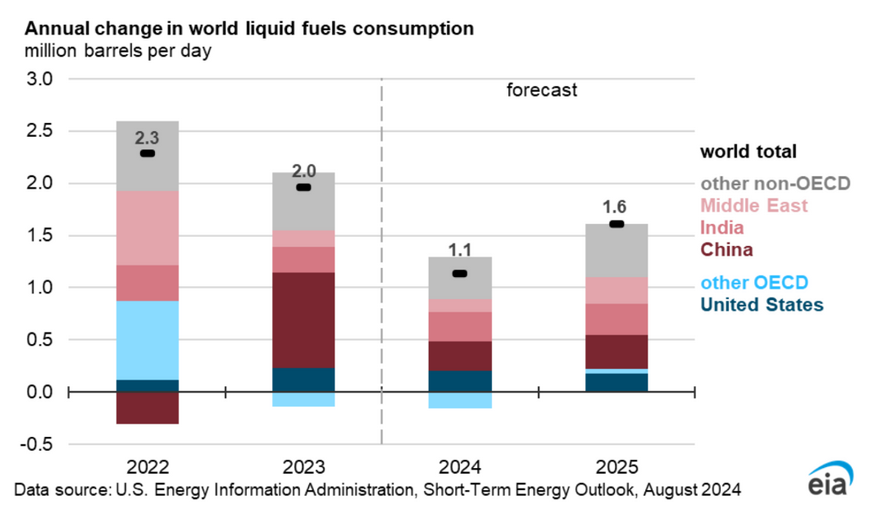

World liquids consumption growth in 2025 and Brent crude oil prices in 2024 and 2025 were both revised lower from last month’s STEO (see table above).

Most of the liquids production increase in 2024 will be NGL rather than C+C output (which was about the same in 2023 as the 2024 forecast). The expected increase in 2025 looks optimistic, probably 2 times too high.

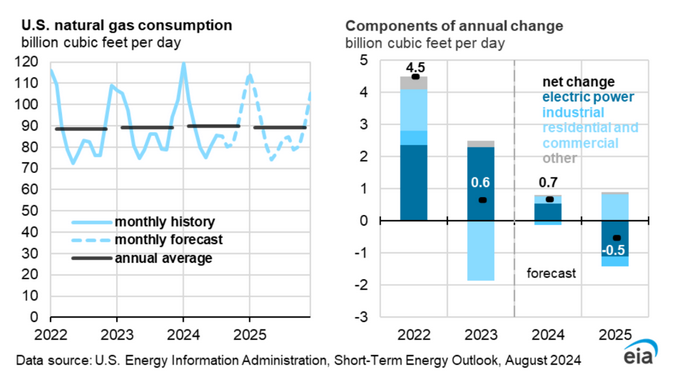

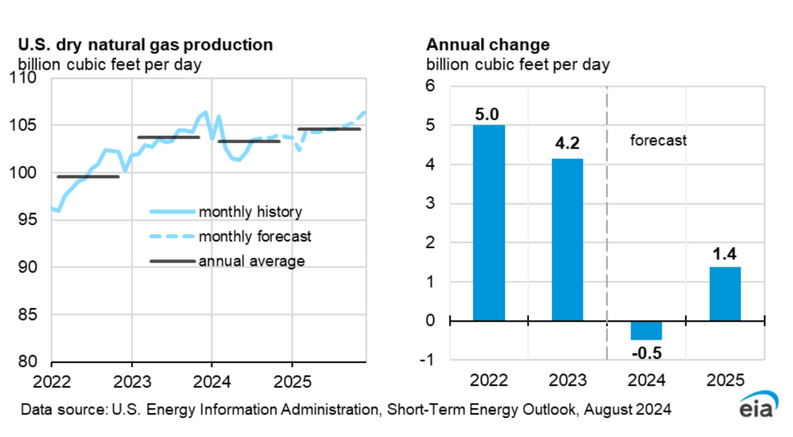

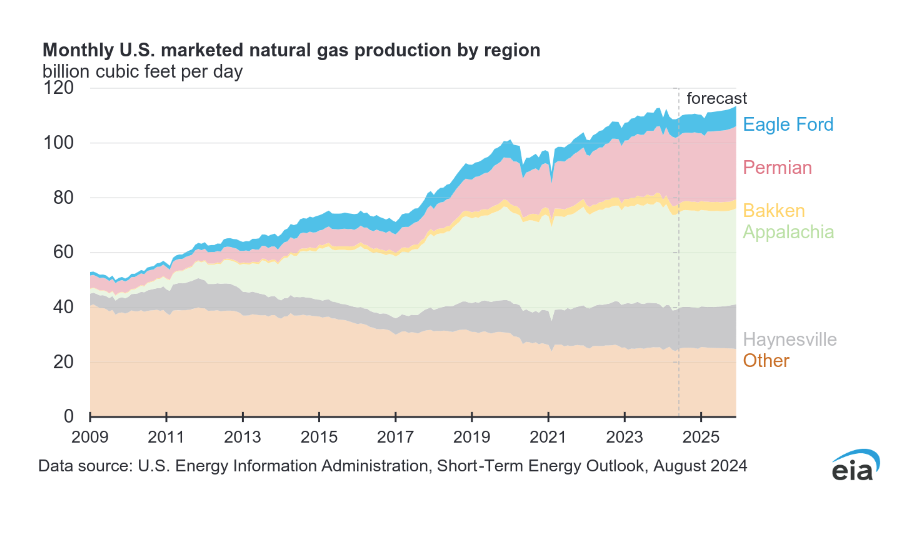

US natural gas consumption is expected to decrease in 2025 due to a cooler summer than 2024.

US Natural Gas production is expected to increase in 2025 as more LNG export capacity comes online.

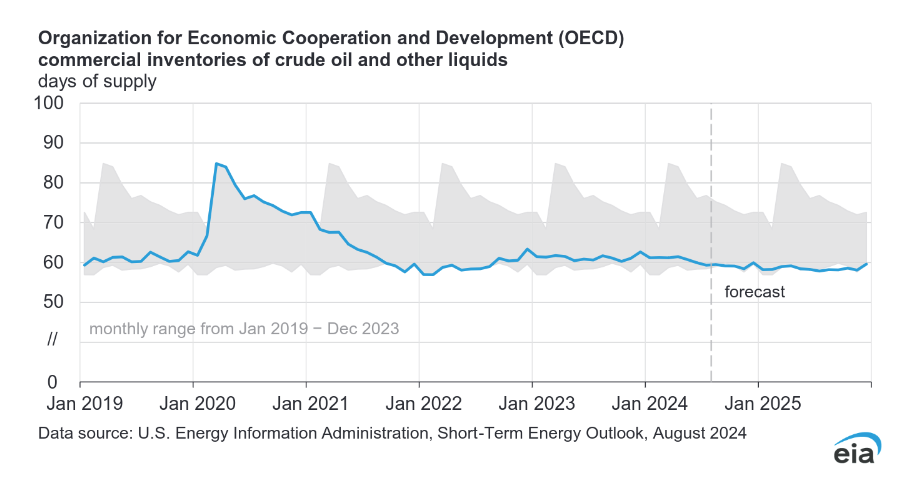

OECD commercial petroleum inventory levels are expected to remain near the bottom of the 2019-2023 5 year average through December 2025.

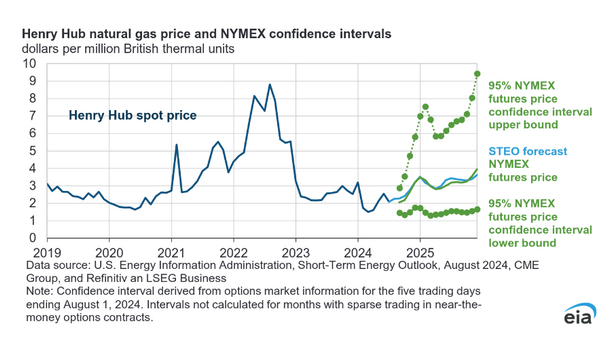

There is a very large potential upside for natural gas prices in the 95% confidence interval more than double the forecast price for December 2025.

Most of the increase in US natural gas output from June 2024 to December 2025 comes from the Permian Basin.

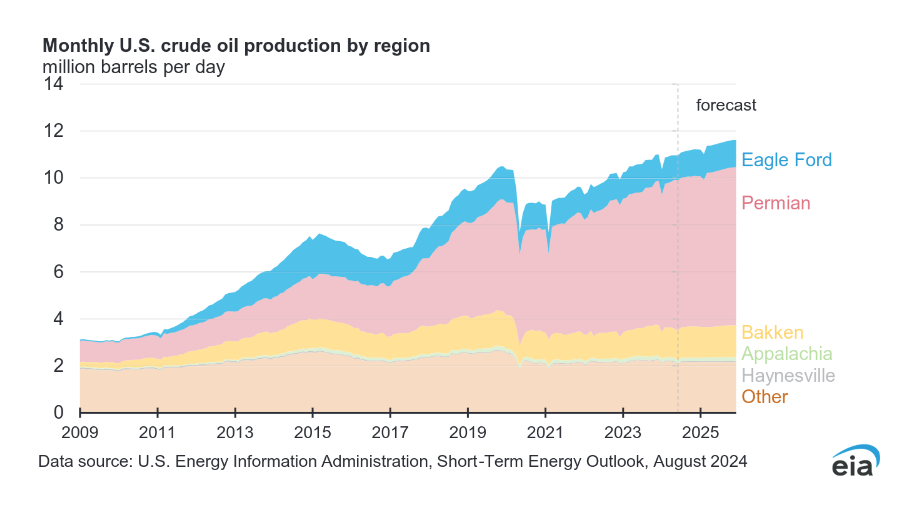

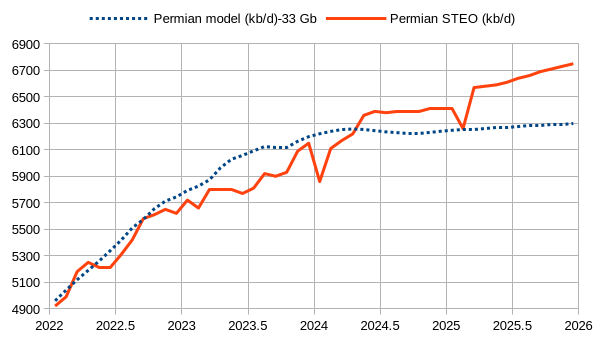

For US crude oil output most of the increase also comes from the Permian Basin and this forecast looks quite optimistic given recent rig counts which predict output through March 2025. If we assume rig efficiency is unchanged and well productivity per foot of lateral gradually decreases at about 2% per year starting in Jan 2025 and that the rig count remains at roughly current level (as of mid-August 2024) for the next 8 months, then we get the Permian Model scenario below. The STEO forecast for the Permian region is shown for comparison.

The difference is about 400 kb/d lower for the model based on my assumptions. Note that assumptions about the future are certain to be incorrect.

Anybody think these numbers are any better than the BLS employment and jobs numbers. If you can overestimate a million workers how about a million barrels. Dont workers pay taxes?

C185,

Government data gets revised several times. The data for the IRS may not be available to the BLS and IRS data also gets revised all the time. Data is imperfect, just the way of the World, we correct the mistakes as best we can and revise our estimates.

Indeed that is true. No data is perfect, and I salute the efforts of those who compile it.

Still, you have to be naive to believe that data isn’t political. It is. It can be massaged to fit an agenda. In this case, all data is massaged to fit the idea that everything is just fine. Keep working, keep your head down, keep invested in the system.

We all know, though, that the smart move is to get what you can and begin to prepare.

SGP,

I don’t buy the conspiricy angle. Any proof of such a claim would be interesting.

The system neutered peak oil talk a long time ago. Dont worry about it.

Predicting the future is hard. But, it looks like a lot of the important oil producing areas will peak and decline around 2030-2035 period. US tight oil, Brazil, the two largest oil and gas fields in Norway, Gulf of Mexico, maybe even KSA. Iran is the only country with a huge potential because it’s been hampered by sanctions for decades. A regime change might be tempting in order to boost exports and move the resources away from China towards the West. China might get desperate enough to start playing international geo political games, though they still don’t have a true blue water navy yet.

Petroslurp: “China might get desperate………”

Perhaps China won’t be too concerned.

https://www.theguardian.com/environment/article/2024/aug/16/china-generating-enough-clean-energy-match-uk-entire-electricity-output

Dennis – Rewind the clock ~12 months, STEO projection for today was 83 mbpd, what makes you think the current projection is any better than a year ago?

Also, 2 years of zero growth, what’s the catalyst to turn this around? Higher oil price?

Demand drives price – price drives production – production yields growth…

I don’t believe it

Kengeo,

The supply will depend in part on demand and the price of oil, to me the 2024 estimate for average annual World C plus C output looks reasonable. As I said in the post the 2025 estimate looks too high, my guess for 2025 is about 82.1 Mbpd.

As to what might turn things around, economic growth might do it, but it depends in part on the speed of the transition to electric transport, some believe it will never occur, it has in my house for personal land transport, but I am the exception not the rule. There have been a lot of plugin sales in China, but the transition seems to be slowing in the OECD of late.

Lots of interesting comments in the STEO post from August 2023.

https://peakoilbarrel.com/steo-and-tight-oil-update-august-2023/#more-45251

https://mishtalk.com/economics/nord-stream-pipeline-blowback-germany-to-stop-all-new-aid-to-ukraine/

Ukraine blew up the Nord stream pipeline.

“The Journal spoke to four senior Ukrainian defense and security officials who either participated in or had direct knowledge of the plot. All of them said the pipelines were a legitimate target in Ukraine’s war of defense against Russia.”

Surely the U.S gave them the greenlight for that.

Maybe. But it was argued that Russia blew it up to give them an excuse to retaliate.

Iron Mike,

Perhaps or not, any evidence, or simply speculation?

I’m suffering Narrative Whiplash….

If true that Ukrainians did the job, then its a good reminder

that countries will generally take dramatic actions when they are invaded, if they are able.

Joe´s on record saying “there will be no Nordstream” a while ago…

https://www.youtube.com/watch?v=xWUuhNd37WI

Mishtalk is a pretty trashy source. What does he mean by “wimpy” anyway?

The German government coalition is in a big fight about spending right now. Lindner has made quite a few claims in recent weeks that don’t reflect the consensus of his colleagues. He in is the smallest party in the coalition and this most recent statement directly contradicts government policy and recent statements by the Chancellor, his boss.

Lindner is acting like he wants be to break the coalition and force an election. He’s also hoping for a few AfD votes I guess. Th problem is that if he succeeds his party will get kicked out of parliament for because they won’t get the 5% minimum vote they need to stay in. So who knows what he thinks he is doing.

Mishtalk trying to claim the Germans are mad at the Russians is just Putin propaganda.

Mish is very center politically. His economic analysis is really good. He used to be a gold standard guy but I haven’t heard him talk about that much in a decade.

He thinks an energy transition to renewables isnt plausible anytime soon. That is probably were most won’t like him.

Post from Novilabs with chart below

https://www.linkedin.com/posts/ted-cross-tx_2024-unconventional-wells-are-on-track-to-activity-7221861495997968384-o5ab/?utm_source=share&utm_medium=member_desktop

Note that the recent increase in well productivity at 90 days when normalized for lateral length (purple line on chart -rhs) does not reach the peak of 2020 so not really best productivity ever, also recent wells have been more widely spaced on average which tends to increase productivity. but it also reduces the number of potential new well locations if wider spacing becomes the norm. Note that the chart below is for all US shale/tight basins, it is not broken out further by basin, it would be interesting to see a similar chart for the Permian basin only which is where most of the growth in LTO output has been occurring.

Some great comments on this post over at oilystuff (link below)

https://www.oilystuff.com/forumstuff/forum-stuff/is-shale-productivity-and-well-preformance-now-trending-up-as-per-novi-https-x-com-josh-young-1-status-1816108148647928294-photo-1

Long term Permian scenario with slower decrease in completion rate leading to higher total wells completed and higher URR. It is impossible to know how quickly the completion rate will decrease in the future, this is one of an infinite number of possible scenarios.

Mr Shellman often speaks of needing to ban crude oil exports from the US.

Let us assume a law is passed by Jan 2026 to that effect and oil producers are given 5 years to reduce output to meet the export ban. For simplicity of modelling I have assumed all of the decrease would come from the Permian basin (this is not a realistic assumption, in practice it would come from all tight oil basins). Below is a Permian scenario tht would roughly meet this condition, but note that natural decreases from other tight oil basins would likely allow greater output from the Permian basin after 2030, but I have not tried to incorporate that into this scenario.

Scenario for US tight oil with assumed crude oil export ban in 2026. The scenario is very rough, but it looks like getting to no exports by 2031 is doable, when starting in 2026, probably could be accomplished faster with a quick drop in completion rate from all tight oil basins.

Not clear this path would be chosen, but technically it is possible.

Somewhat less rough scenario, US crude exports were about 4000 kb/d in 2023 and tight oil output was about 9000 kb/d in 2023 so we need to reduce tight oil output to about 5000 kb/d to eliminate crude oil exports (most of which is tight oil).

Dennis

What impact do you think that move would have on global markets (and the heavy oil the USA still needs to import)?

Old Chemist,

It probably would have little effect, some simple refineries that can utilize LTO might have to shut down, but the products they produce would simply be provided by other refineries. There is some spare capacity from OPEC, about 2 Mb/d, output could be ramped up in Guyana, Canada, and Brazil and it may be possible for Iraq and UAE and perhaps even Saudi Arabia to expand capacity. Oil prices might rise and this might reduce demand somewhat over the long term, possibly speeding the transition to electric land transport.

All of this is speculation on my part, but it seems very unlikely that such a ban would be politically feasible. Just because I think something is a good idea (along with a number of people at the OilyStuffBlog) does not mean it will become a reality.

I understand the rationale behind wanting to ban exports

but until there is an actual shortage of oil products

it is political (and economic) suicide to promote such a plan.

Hickory,

The idea is to conserve oil for future use and import what we need for our refineries, it was us policy for 40 years (from 1975 to 2015) so not a radical idea. Nobody is suggesting tight oil cannot be produced, just that we should produce what can be utilizd by US refineries (roughly 5000 kb/d) and save the rest to be produced later rather than export it.

The idea that we have a lot of tight oil is incorrect, about 29 Gb of tight oil has been produced so far, there might be another 50 Gb at most that might be produced. The US uses about 6 Gb of crude oil per year (input to refineries), so a bit more than 8 years of tight oil supply, if all of it could be used by US refineries, in fact only about 2 Gb per year can be refined in the US (without new refineries or retrofits) so perhaps as much as 25 years of supply with a crude oil export ban.

To me the crude oil export ban makes sense.

Yes, as mentioned I see the rationale.

Not too sure the oil and gas producing industry would be too happy about it, or the producing regions that are used to the economic activity. In fact I think that they’d resent the imposition of restriction on their ability to pay back loans.

I suppose if it was phased in over a decade they might be able to swallow it to some degree.

Hickory,

It would need to be phased in gradually over 5 years, monthly crude export targets with a reduction of 67 kb/d each month for 60 months. I agree it is not likely this policy path would be chosen, politicians tend to think only 2 years ahead.

Dennis, you know my opinion on this… reducing domestic production to “save for the future” could not ever happen. It’s a utopian fantasy that can be debated but it’s an absurd notion in reality. The related individuals, industries, institutions and government are too reliant on the cash flow and tax revenue created by producing oil & gas. The system would go broke unless the lost revenue came from somewhere else in the US gov…. and we know how easy that is. Plus the legal log jam around violating domestic o&g lease contracts would add years of litigation and failure to perform.

Oilystuff seems to hate shale production for some unknown emotional decision. but remember to think for yourself.

Expand the SPR and store. Easier solution.

I don’t “hate” shale production, I only dislike the insane manner in which this valuable natural resource is managed by short-sighted people, who all, by the way, depend on it for personal income, votes and/or power.

Caring about the long term energy security of my country does not seem “emotional,” it seems quite rational, actually. The U.S. did not export oil until 2016 and prior to that everyone in the industry made money, prices were stable for the American consumer, we had actual reserves that could be used to defend our national interests in the event of war and American oil and natural gas created the greatest economic powerhouse the world has ever known.

There were no legal “log jams” regarding OG&M leases during that 116 year period; regulatory statutes regarding overdrilling, pressure depletion, maximizing recovery rates of oil in place and protecting the correlative rights of ALL Texans, not just a few, superceeded all that. Nobody should buy into that excuse, that’s dumb. So, by the way, is taking it out of the ground to “store” it right back in the ground. Fill the SPR, for sure.

The United States is the largest oil consuming nation in the world, consumes 1/3 rd of all the gasoline consumed in the world, yet only has 4% of the worlds proven producing reserves, most of it now from one $9MM, 435K BO EUR Wolfcamp well at a time. We are, nevertheless, the 2nd largest crude oil exporter in the world only behind the KSA with 200 times the reserves.

Exporting the last of America’s hydrocarbon resources will prove someday very soon to be the biggest blunder in U.S. energy policy history. Then all these patriotic proponents of free enterprise will be be long gone, with no answers. Except to go begging to OPEC.

‘Drill, Baby Drill…’ Donald Trump On Oil Extraction In America at RNC 2024, | World News

https://www.youtube.com/watch?v=Q6uV785X-pU

Donald Trump has made clear in his campaign that he supports a significant shift in U.S. energy policy, characterized by a robust emphasis on fossil fuels, extensive regulatory rollbacks, and a scaling back of renewable energy policies. He justifies these changes as necessary to reduce energy costs, achieve “energy dominance,” and boost the competitiveness of U.S. industries by removing the United States from the Paris Agreement on climate change and removing regulations on drilling for oil and gas.

Trump does a great deal of posturing on deregulating drilling, rolling back electric vehicles, stopping energy-based inflation, and energy independence, but his results in achieving this agenda will be mixed. Several of Trump’s oft-repeated statements about U.S. energy just aren’t true, including his boasts about the size of U.S. energy resources and his complaints about energy’s contribution to inflation.

https://www.brookings.edu/articles/trump-has-big-plans-for-climate-and-energy-policy-but-can-he-implement-them/

Mr Shellman,

I agree.

Gungagalonga,

All that needs to happen is a slow down in the rate that new wells are completed, output from tight oil wells will decrease very quickly, perhaps tight oil could be stored in the SPR, though I think traditionally heavier grades of oil have been stored in the SPR, not sure if there is a technical reason for this. Also note that for the Permian Basin if all completions stopped at the end of August 2024, output falls by 3800 kb/d by Nov 2027 (this is not a realistic scenario, it just indicates that it will take some time for output to fall enough to eliminate tight oil exports (unless the tight oil is stored somewhere). US crude oil exports were about 4050 kb/d in 2023 (average for 12 months) and the trailing 12 month average had increased to 4150 by May 2023. In the most recent 12 months about 350 kb/d of crude oil were exported to other North American nations, so eports would need to be reduced to 3800 kb/d to eliminate exports outside of North America (all of recent exports were to Canada, none to Mexico since 2019). We could reach that level of decrease in crude exports by Nov 2027 if all tight oil completions had stopped by Sept 1, 2024. So a minimum 3 year phase in would be needed if tight oil is not stored, unless wells are choked to reduce output (I don’t know if this is technically possible.)

Permian scenario with no wells completed after August 2024.

From Aug 2024 to August 2025 output decreases by about 2350 kb/d for this scenario, about 41%. US tight oil output is about 8600 kb/d in July 2024 based on EIA estimates, so if all tight oil completions stopped after August 2024 and the decline rate for all US tight oil is similar to the Permian this implies a decrease of 3500 kb/d in one year if all tight oil and shale gas completions stopped starting Sept 1, 2024 (some of the tight oil is condensate from shale gas wells).

Thus an all out effort to quickly stop US crude oil exports could occur in about 14 months, by stopping all new shale oil and gas completions after August 31, 2024. We would see a drop of 3800 kb/d, about 44% of all US tight oil output in August 2024 (I assume no change from July 2024 level) by October 2025.

I don’t think this will happen, but it is technically possible.

Dennis and Mike,

Mike, meant to imply you hate shale harvesters, not shale. Hard to hate rock, right? My mistake.

I get where y’all are coming from, but y’all are looking back in hindsight for how a perfect utopian past would have been orchestrated from your perspective about curing a possible future scenario. It’s an academic exercise with a reverse crystal ball, but not one that would have been possible in the slice in time reality of free markets. Humans don’t act like that…. we attack opportunity, which makes us great. Yes, we overshoot at times, but that comes with great progress mostly………Without our domestic production where it is today, billions of $ would not have… and continue…. to flow into the private sector, individuals, tax support for local schools, universities, county coffers, charities and foundations (yes many own minerals), local employment, etc… The benefits have been huge and continue. Harvesting oil doesn’t just get Johnnie to his soccer game, it also grows our domestic world and adds lasting benefits that will persist long after the last drop is pumped.

Magically saying from the beginning of shale that “no, you can’t develop your mineral interest, you have to wait your turn” would never have been possible unless we were a socialist society where the Gov owned all the minerals. We are fortunate to have much of our domestic acreage owned privately by individuals and the private sector and not an oppressive government. This represents what makes America a great place with capitalism, opportunity and freedom…. and freedom to fail on occasion.

I get saving some in the tank for contingencies, but it’s unrealistic to think we should have stalled shale development to bank a psuedo SPR.

Dennis,

Dennis… “All that needs to happen is a slow down in the rate of new wells… if all tight oil completions had stopped by Sept 1, 2024.”. This is a cute series of statements.

Do you honestly think that it would be possible to forcibly shut down completion operations to reduce production on that scale? It would blow the legal lease contract obligations and the budgets of oil companies, service companies, tax rolls, county and state budgets, individuals, etc, etc. Free markets should dictate the direction of production…. drill and sell more oil into strong markets and pull back in weak. Simple free markets work best over time.

Mike… “Exporting the last of America’s hydrocarbon resources…”. Why is the current known shale the last of the resources? Do you know the potential of every molecule of rock that lies beneath our domestic feet? Great plays are still being discovered and rediscovered and exploited daily.

Remember, oil & gas resources are discovered in 4 dimensions…length, width, depth and technology & innovation…. “oil is found in the minds of men”…. Wallace Pratt. We have both seen many examples of old fields thought long depleted only to be revisited and flourish again…. The Cherokee Formation in the Anadarko Basin in OK and now TX is currently accelerating with 1,000-1,500 BOPD completions over a large chunk of the Anadarko.. The Cherokee was vertical spotty completions historically…. but someone had an idea and it’s working. Watch OK production start to rise in the coming months and years as an example of continued US oil production innovation.

I heart US oil production. We rock.

Gungagalonga,

If the US Congress passes a law banning crude exports that is signed by POTUS, noone will need to force companies to stop completion operations, they will choose to do so because they won’t be able to sell their oil and the price of tight oil will drop like a rock because there will be no buyers. Producers will adjust their operations to prevailing market conditions and attempt to maximize profits. If the price of tight oil is $35/bo, the completion rate will quickly fall to nearly zero.

Dennis,

POTUS would never sign that now. On either side. That’s a dead issue politically.

Gungagalonga,

I agree that this policy is not likely to be chosen, it is also unlikely that such a law would pass in the US Legislature.

Maybe wise policies will be chosen for reducing dependence on oil and natural gas by continuing to build out charging infrastructure and improving the speed that new power projects are approved to tie in to the Grid (Texas is the model here as ERCOT does a much better job on this than other US Grid operators).

We should be trying to reduce out reliance on fossil fuel energy which will deplete over time by ramping up EVs (both light duty and heavy duty), high speed rail, public transport, and solar, wind and batteries for electric power as well as improvement in the aging US Grid infrastructure.

I believe this stupid exchange of idealism is why most people with any knowledge of the oil and gas industry post things on social media annoymously. Its self-serving dribble and otherwise embarassing to use their real name in such a way, for instance, as to be able to check their credibility.

This Gunga person is an admitted landman, I believe. Almost all landmen I know are members of the American Association of Petroleum Landmen (AAPL), whom I have given many presentations to over the years. They have a code of ethics that, obviously, don’t apply to unknown names on the internet. That code centers around not misleanding people, nor taking advantage of them. Landmen working the Permian Basin flip leases, reserve ORRI’s, get ahead of lease plays and buy minerals from unsuspecting landowners so they can make money on drilling as many wells as possible, as fast as possible, free and clear of all costs. They make up shit to justify all this, like $70 MM highschool football stadiums all over West Texas using oil and gas tax revenue.

Reservegrowthrulz is the same, an admitted engineer, probably a reservoir engineer, who has a code of ethics to comply with or be called on the carpet. He hides behind a fake name. Nony has nothing to do with the oil business, clearly, maybe he or she is a CPA, or is govenment employee with the DOE…who knows? People like this should be ignored.

I am nobody. I just have 60 years in the oil business spending my own money. I’ve had WI in tight oil wells, am a mineral owner and an overridding royalty owner, but am not afraid to stand up for what I believe in using my own name. I put the future of my country before all else. People insult me all the time using fake names. They are cowards.

Always ask yourself why is this unknown person saying this on social media, what does he or she have to gain, and if they have credibility we should pay attention to, why don’t they stand behind it, proudly. Otherwise its just another dumb ass opinion, or prediction about the future.

U.S crude oil exports are stupid; they benefit a very few, at the great expense of our nation’s long term future. Drill baby drill is really stupid. Its a lie.

None of this is going to turn out like people think. The electricity stuff is a far bigger lie than hydrocarbon scarcity. I suggest people learn to know which end of a horse to walk to. Quickly.

https://www.oilystuff.com/single-post/it-s-a-family-affair

Oklahoma crude oil output. Not much evidence of any increase so far.

Gungagalonga,

Woodford tight oil (aka Anadarko Basin) output from EIA data.

The 2010 USGS assessment for TRR of Woodford Shale Oil is 0.2 to 0.7 Gb for the 90% confidence interval with a meean assessment of 0.4 Gb.

https://pubs.usgs.gov/fs/2011/3003/pdf/FS11-3003.pdf

Since 2011 about 0.36 Gb of tight oil has been produced from the Woodford shale, so the USGS may have underestimated.

A later assessment by the USGS in 2015 has a mean assessment for Woodford Shale at 0.46 Gb (undiscovered tight oil resource) and since Jan 2016 about 0.29 Gb of tight oil has been produced from the Woodford Shale. The F5 estimate was 0.92 Gb, report at link below

https://pubs.usgs.gov/fs/2015/3054/fs20153054.pdf

Dennis, the potential new play in OK is from the Cherokee Fm. Not Woodford…. in response to you post above,

Also, for your post above, this play is in early development as I said before, so it would not be showing up much in EIA or other data. Give it time, big guy. Maybe early 2025, but should be a big impact for OK. Not another Midland Basin, but very nice…. maybe 300-500,000 BOPD eventually, but that’s an on the fly crystal ball guess.

Here is the title from the second USGS study

Assessment of Undiscovered Oil and Gas Resources in the Cherokee

Platform Province Area of Kansas, Oklahoma, and Missouri, 2015

The formation of interest for shale oil in this province is the Woodford. See Woodford Shale Oil (green boundry in figure below from 2015 USGS assessment.) The 90% confidence interval is 0.2 to 0.9 Gb with a mean estimate of 0.46 Gb for undiscovered tight oil in 2015, about 0.3 Gb has been recovered from the Woodford shale since Jan 2016 . Generally USGS estimates have been pretty good, doubtful that URR will be more than 0.75, we may be near peak output now for the Woodford. Much of the energy resource in this province is coalbed gas (about 1.7 Gboe or 10 TCF NG).

Looking more closely at the maps there is a bit of overlap between the 2010 and 2015 assessments, but if we assume two separate areas (2010 study covering more of the western part of Oklahoma and the 2015 assessment covering the eastern part of the state) we could have as much as 0.86 Gb of shale oil from the Woodford (with mean estimates of about 0.4 in the Anadarko Basin Area and 0.46 in the Cherokee Platform Province).

We could further assume that most of the Oil produced so far from the Woodford formation was from the Anadarko area with about 0.36 Gb produced since 2011, this would leave about 0.5 Gb of tight oil in the Woodford to be produced if the mean USGS undiscovered resource estimates are correct. The high point of Woodford shale oil output so far has been about 130 kb/d, so perhaps we might see 140 or 150 kb/d from the Cherokee Platform Province, it seems likely that some of the 90 kb/d that is already being produced from the Woodford is coming from the Cherokee province, I don’t have enough information to make a guess.

Your 300 to 500 kbopd guess (I assume you are not using boe and including natural gas an NGL which is less valuable) seems too high by a factor of 3.

The Rig Report for the Week Ending August 23

– US Hz oil rigs added 2 to 436 and are down 23 rigs from April 19. It is up 9 from 5 weeks ago.

– The Texas rig count was up 4 to 235 rigs and is down 91 from January 2023.

– Texas Permian rigs rose by 5 to 190 while the New Mexico Permian dropped 1 to 100. Not sure where the 5 went. I track Midland and Martin in the Tx Permian and they only added 2

– In New Mexico, Lea added 1 to 51 rigs while Eddy dropped by 2 to 48. Since March 29, the average number of rigs operating in the NM Permian has been 101 for 22 weeks.

– In Texas, Midland added 2 to 20 and Martin was unchanged at 30.

– Eagle Ford dropped 1 to 41.

– NG Hz rigs rose by 1 to 87. (Not shown).

Frac Spread Report for the Week Ending August 23

The frac spread count dropped by 5 to 229 and is down by 17 from one year ago. It is also down by 43 spreads since March 8. Last June 2023 when the frac count was 250, the count dropped steadily down to 244 in the week ending September 1, see chart. I wonder if the drop since June of this year is a seasonal thing.

Reading the back and forth above about US oil exports. The thought that comes to my mind is, why not at least require there to be adequate natural gas takeaway capacity before allowing new wells to go forward.

Instead, operators have been allowed to vent/flare enough natural gas to heat all the homes in several small states. Which has led environmentalists to push for strong methane rules, which then affect us small potatoes people who don’t emit enough gas to light a flare.

What is the argument that all of this gas flaring and venting from US shale is ok?

Shallow sand,

Not clear that there is a good argument. Oil and gas producers might argue that allowing the gas to be flared is good for tax revenues or jobs or that anyone who says producers should not be “free” to do what they want is a Marxist.

There are many that might be convinced by such an argument. Your suggestion makes sense to me.

Another thing that I wonder about is that Mr Shellman seldom mentions the other energy exports (natural gas and coal) that are leaving the US. Perhaps one could claim there is plenty of coal and no need to worry about that, but it is not clear to me that is the case for natural gas.

“require there to be adequate natural gas takeaway capacity before allowing new wells to go forward”

That is very sensible.

And then, just how much nat gas exportation is long term wise?

Hickory,

In my view, it would be unfair to companies that have invested in LNG export facilities to ban natural gas exports, but it would be wise to not allow any new approvals of future LNG export facilities that have not already started construction. Better to leave some natural gas in the ground for future use in my view as the resource that can be profitably extracted is not as large as some assume.

The drain America first policy for oil and natural gas seems unwise.

Unfortunately I think it´s just cheapest for them…

And them pull quite some weight in certain places, as always.

The issue is interesting for several reasons, as Dennis and Hickory debates, LNG seems to be the thing now, so things could change when central Europe needs a lot more NG, due to some local delivery issues.

But I agree, really an obvious thing, for several reasons.

Except for the fact that two major shale gas field in USA have been depleted by 50%. Scientists have hypothesized that they would decline quickly as previously with an other shale gas field.

New posts are up

https://peakoilbarrel.com/opec-update-august-2024/

and

https://peakoilbarrel.com/open-thread-non-petroleum-august-28-2024/

Oilprices are headed down: Brent is now $71 per barrel. Way down from the $84 suggested in the STEO.

I don’t see oilprices going back up to average $86 next year.