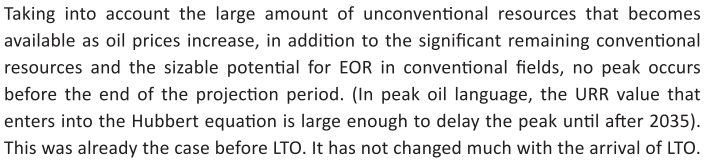

I was going over the IEA’s World Energy Outlook 2013 and noticed a few things you might find interesting. Exactly what is their opinion on Peak Oil? Here, cut and pasted from the report.

Got that? The URR is great enough to delay any peak until after 2035. Here is one of their graphs that indicate how much they think is left, coal, gas and oil.

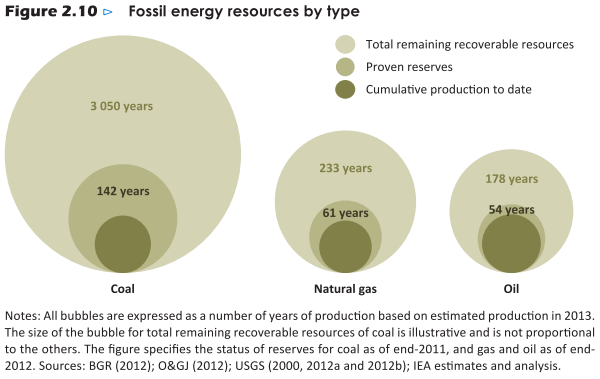

Okay 54 years of proven reserves. That puts the peak out to well past mid century. Likely well past 2100 if you count those remaining recoverable resources. And just who has all this oil?

2.2 trillion barrels of conventional crude oil resources. However only 1.7 trillion barrels of that has a 90% probability of being recoverable. Of this the Middle East has the lions share, 971 billion barrels of resources with a 90% probability of recovering 813 billion barrels of that.

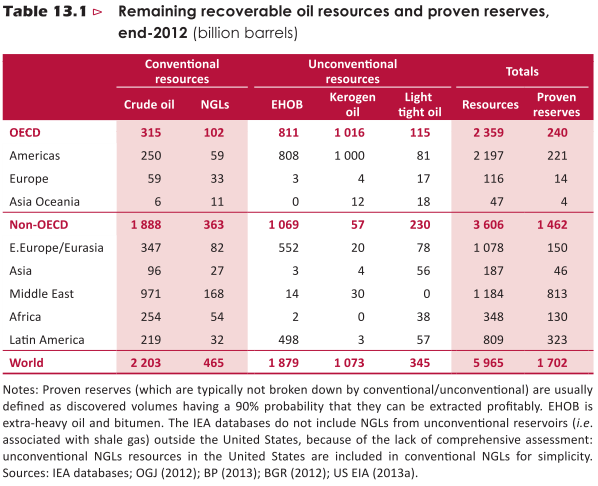

The Middle East, of course, mostly OPEC. And if you count the four OPEC countries of Africa and the two in South America, the vast majority of the world’s oil reserves are in OPEC nations. In fact OPEC claims 81% of all the proven reserves in the world.

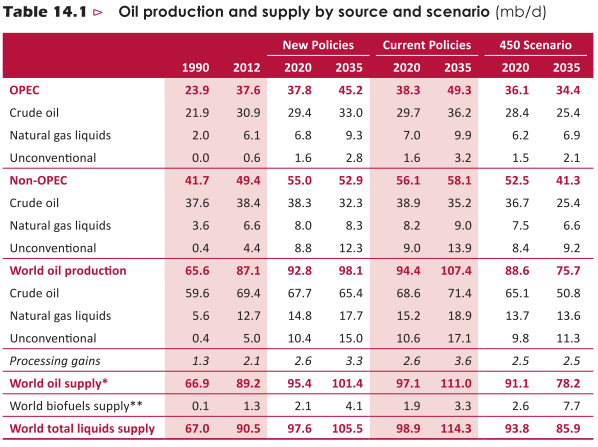

So with 81% of the world’s proven reserves what is the IEA expecting from OPEC in the future?

A word of explanation is needed here. New Policies Scenario: A scenario in the World Energy Outlook that takes account of broad policy commitments and plans that have been announced by countries, including national pledges to reduce greenhouse-gas emissions and plans to phase out fossil-energy subsidies, even if the measures to implement these commitments have yet to be identified or announced.

450 Scenario: A scenario presented in the World Energy Outlook that sets out an energy pathway consistent with the goal of limiting the global increase in temperature to 2°C by limiting concentration of greenhouse gases in the atmosphere to around 450 parts per million of CO2.

Current Policies is business as usual. Or, basically, we will keep on doing what we are doing. Which is of course exactly what will happen. However what the IEA sees as happening, above, is not exactly what will happen, far from it.

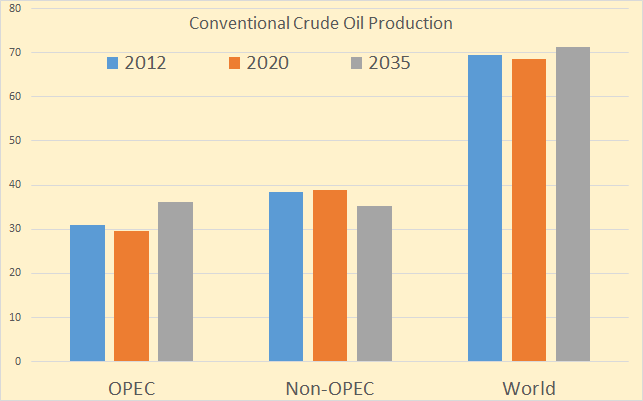

So, looking at Conventional Crude Oil Production in 2012, 2020 and 2035 we find this. All data on all charts below are in million barrels per day:

Well hell, OPEC production will be lower in 2020 than it is today. And non OPEC production will be lower in 2035 than it is today. But not to worry, total conventional crude production will be up 2.9 percent in the 23 years between 2012 and 2035.

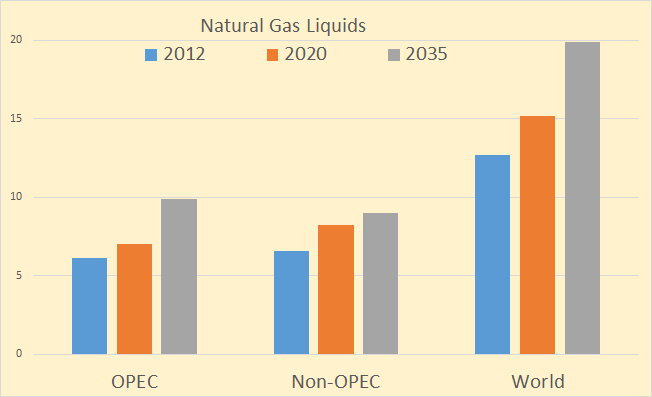

But they are expecting Natural Gas Liquids to increase by almost 57 percent.

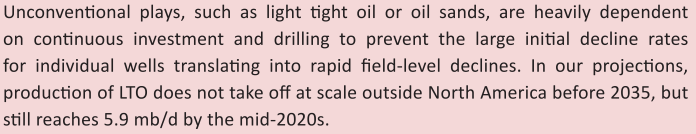

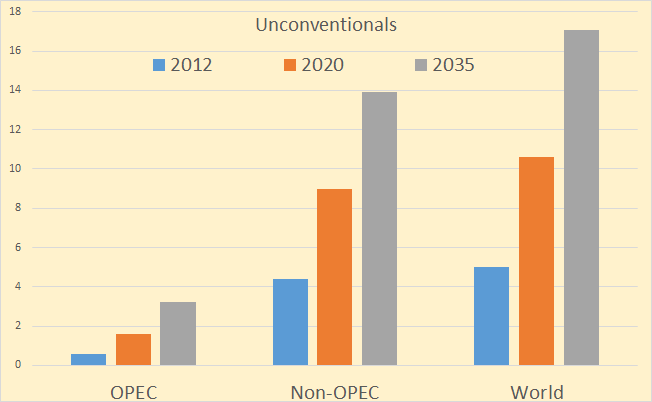

And let us not forget about Unconventionals. What are Unconventionals?

Unconventionals, Light Tight Oil and Oil Sands increase from 5 mb/d to 10.6 mb/d in 2020 to 17.1 mb/d in 2035. That is an increase of 242 percent in 23 years.

Note: If you would like to be added to my email notification list when a new post is posted please email me at DarwinianOne at Gmail.com.

Ron,

I guess this is a dumb question but here goes anyway: Will burning all that coal, gas and oil be a bad thing for the planet? Or do these guys not build global warming fears into their thinking?

Doug

Ron,

Got to love the 450 Scenario on limiting Global Temperatures from reaching 2C. Simply amazing how grown adults actually delude themselves into believing this garbage.

After spending a month pouring over all the new climate data, a simple analogy hit me. When I used to be a bartender in college, we would get groups of amateurs that would come in a drink up a storm. They would be celebrating some event and within a hour or so… do 3-4 shots. Not including the drinks they were sipping on.

Unfortunately, any amateur who was not used to drinking was already screwed… just didn’t know it yet. While they were feeling good for that first hour or so, by the time those 4 shots kicked in by the next few hours.. they were WHITE in the FACE and sick as a dog.

This is precisely what’s taken place with our climate. We BLEW carbon in the atmosphere so fast (like doing alcohol shots), that the system is now reacting to it all. I imagine we are heading into a RAPID HEATING, and there’s no stopping it because the damage was done years ago.

I have this strange feeling that the world will wake up in the next several years on the subject of climate change when MSM won’t be able to delude the public as weather events go haywire.

steve

Steve,

Maybe we should just aim for 6 degrees C. Hell man, screw the booze, we could have methane breathing, bubble watching parties while sunbathing on Arctic shores. Remember, don’t get all negative on us now.

Doug

Doug,

LOLOL…

s teve

“Well hell, OPEC production will be lower in 2020 than it is today.”

That is the one compelling issue in the article. If OPEC output will drop over the next 6 years (to 2020), there is no imaginable mechanism for that to turn around in those particular countries to generate an increase by 2035.

Unless . . . they add countries.

Watcher,

Which countries do you think might do the trick?

Doug

Not really the point — I was alluding to how the OPEC majors are about as well seismically mapped as you can be and so how do you acknowledge decline for 6 yrs and then imagine growth for 15. Iraq is going to grow some over the next 6, but it’s not going to them carry the ball for all others in the next 15.

But as for who might join OPEC, obviously Canada.

Watcher,

“so how do you acknowledge decline for 6 yrs and then imagine growth for 15” Obviously you don’t. You’re talking to the choir here man; don’t take me seriously. The whole thing is stupid beyond belief! Besides, if they manage to squeeze that much extra oil out of the Canadian tar sands (which they won’t) it won’t require Natural Gas for heat, the air temperature will be adequate by then.

Doug

Current extraction is dependent on high prices. The same high prices are unaffordable and are causing the bends around the world … a world built assuming -$20 crude into the distant future.

All that infrastructure is now stranded and credit is taking a beating. How much of a beating? Japan is staring into the abyss and China’s loan-shark economy is deflating.

When China goes into recession all that fancy ‘fracking’, blue-ocean and tar-sands nonsense will be under very deep water. When the ‘savior oil’ gets shut in, there is no $20 oil left to be put into use. It’s all gone.

Steve, Thumbs up.

However, what keeps my up at night, is the danger of third world war. As economies fail, there will be politicians standing on their soapboxes screaming bloody murder and blame everyone else except themselves. They will target foreigners, ethnic groups, and nations. They will rally the masses to go to war with promises and lies. The world can survive 6C 10C or even much higher temperatures. It cannot survive after its been turned into radioactive slag.

I 2nd the thumbs up for Steve. But I don’t think ‘the world’ – if by that we mean global human industrial society, or anything like it – can survive 6C, let alone 10C. We are toast in so many ways…

I strongly encourage all readers to watch the BBC documentary on the Permian Extinction event. You can access it via YouTube. Compelling evidence supporting the view that the extinction event resulted from two temperature spikes of 5ºC each; the first caused by volcanism in the Siberian Traps, the second resulting from catastrophic release of methane from sea floor methane hydrates.

Dennis:

Would be good to have a post just on EF.

Also, perhaps interesting to compare some of your projections to others (if they exist). IEA/EIA, CERA, Hughes, analyst reports.

I have compared my LTO scenarios with the EIA AEO 2013, other sources require guesswork, reading numbers off of charts and putting them in a spreadsheet and such. If you would like to do it, feel free, I can provide spreadsheets with my scenarios to save you some work, but I am unwilling to pull together many different future scenarios, often the latest reports are behind paywalls and I am cheap.

I did a Bakken scenario with USGS F95, F50, and F5 TRR and then used my usual economic assumptions (7% discount rate) with two different price scenarios (on the chart right axis). The dashed lines are the low price cases and the solid lines are the high price cases. ERR varies from 4.3Gb to 11.4Gb (1953 to 2073 output) for the 6 cases. Chart below.

Thanks, I’ll go look at AEO 2013.

The problem with many of these forecasts is that they don’t break out Bakken, Eagle Ford and so forth. You can check out the following:

http://peakoilbarrel.com/when-wil-us-light-tight-oil-lto-peak/

The scenario presented in that post is exceedingly optimistic in my opinion. I created the other LTO scenario out of thin air, I would be quite surprised if the LTO in the US from plays other than the Bakken and Eagle Ford reach the levels in my “other LTO scenario”.

If they could find a way to frack the high clay sediments, that would be a lot of extra barrels, no? (Or somehow otherwise get the oil from them). I have no idea how to do that or if anyone figures it out. But was just thinking that could be a place for research.

Hi Nony,

Think about clay that has not hardened and hitting it with a hammer, would you expect a lot of fractures?

I KNOW that it doesn’t fracture now because it’s a bunch of gooey clay. 😉 The question is…how could we. Or is there some other methodology, non-fracture related to get the oil.

I have no solution and it may be insoluble. But if you could figure it out, it would be amazing, no? Just total goofey brainstorming, but use some mechanical spikes (not hydraulics). Chill it and then fracture it? Dissolve the clay? I really, really don’t think any of those goofy ideas would work or that there is any simple solution…I was just throwing it out as a cool material science problem.

Pencil pushers, geologists, and EOR will allow for greater oil and gas production over time. Welcome to the Profit Lab.

The main variable that the peak oil crowd forgets is Capitalism. As prices go up stripper wells become valuable again, spacing patterns increase with the additional cash flow, and EOR technology comes about to make formerly unprofitable resources profitable. When we were briefly at $148 dollar oil I was reading articles of shut-in wells being brought back on-line to enjoy in the profit taking.

The second thing the peak oil crowd forgets is that good management cuts costs. This allows the strongest to survive if the price of oil goes too low and creates even bigger profits when the markets eventually rebound.

The third and final thing the peak oil crowd forgets is fishing for the worst of last years data to make your point means simply that you are illogical and those you lead are the same. The same can be said of the Chicken Little “warmists” still pushing their “manmade climate change” political and economic agenda in spite of all the evidence showing that warming stopped 16 years ago.

As it has been said by others we are not drilling for oil as much as we are now mining for oil. Technology is always going to improve and always be the game changer by continually increasing the amount of proved reserves.

In some lab right now someone is likely trying to create the strongest yet cheapest proppant to improve production while chemical engineers are working on better fluid dynamics to improve fracs. Right now frac pressures are 8000 to 9000 PSI with schedule 120 pipe. Someday someone is going to invent Schedule 160 pipe and increase the pressure more. Some other game changer is out there too. The nitrogen frac, the tri frac, the larger bore frac, The sonic frac, who knows?

The oil is there and as long as Capitalism prevails it will come our way.

OK, so western Europe is not capitalistic, because oil production is dropping there there 🙂

Here Here! The EIA is a major government organization. How can one think that they are wrong all the time? They certainly have evidence for their model of the world, and it is the most likely way things will pan out. As Ron says for the EIA summary: “No peak until sometime after 2100”.

Don’t worry, Be Happy.

FunnelFan,

Well, according to Dave Demshur, CEO of Core Labs, he believes Global Peak Oil Production will be 2014-2015. Core Labs analyzes drill results from the majors and 100’s of small oil and gas companies throughout the world. If anyone has a good idea of what is taking place in the oil industry, Core Labs is more qualified than most.

I guess you didn’t watch Steve Kopits presentation which he provides data that oil companies need $100, $120 and some $130 to make free cash flow. Management can’t cut costs anymore because all that’s left (for the most part) is low quality, high cost garbage oil. And the market can’t afford high priced oil. So X-NAY on increasing profits.

I see you are still going by OUTDATED CLIMATE DATA. Can’t blame you, most people regurgitate the old stuff over and over again. Arctic is heating 4-6 times the global average. And I don’t know if you heard, but the warming didn’t stop… IT JUST WENT INTO THE OCEAN.

It looks like our buddy and pal EL Nino maybe coming back for some KICKS & GIGGLES, which means it will release the captured HEAT back into the lower atmosphere. If this is the case… we get warming in spades. God hath a sense of humor.

Lastly, the so called 1 trillion barrels of OIL SHALE in the west is another way of deluding simpletons. Shell and Chevron pulled out of their Oil Shale projects as they realize.. can’t make shareholders happy by PRODUCING OIL AT A LOSS.

Maybe more Americans wake up as the Oil Production Gauge starts to head below HALF.

steve

Steve, you’re forgetting, “as long as Capitalism prevails it will come our way”. Who are you to quibble with such powerful logic?

Doug

Doug,

Heavens no…. not me.

Ah… the hell with the environment and all the birds, animals and fishies. I got my money on that FunnelFan capitalism.

Steve

Core Labs CEO thinks we may have arrived at peak oil

He estimates planetary oil production in 2014, 2015, and maybe 2016 to be at the peak level we shall ever be able to generate. When asked about future oil independence here in the US, he just smiled — and added “no chance”.

I grew up in a time when we all believed in ever better times thru technology.We sucked it in with our Mother’s Milk. I still remember the “better days thru better ways” motto from 4H with a smile.

I majored is agriculture at a major university and we were trained to have a technocopian mindset and I had one for most of my adult life.It was easy to believe because I plowed a little with a mule a boy- the mule was my grandfather’s last one and we kept it for sentimental reasons and plowed a few garden furrows with it every year even though our little mountain farms were mostly mechanized by the time I was old enough to reach the pedals on a tractor.

It was easy to believe because those were the headiest of the glory days of the Green Revolution and so far as we were concerned Borlaug was seated pretty close to God.

But we ag guys are basically scientists in the way we work and think and we are necessarily generalists because our lab is the real world where things have to work not only in theory and in the enclosed research building but also in the real world of dollars and cents and rain and wind and sun and depleting natural resources ranging from oil to phosphate rock.

And being generalists most of us got at least some minimal training business and economics.

There is a thing we refer to as the law of diminishing returns.I can grow three hundred bushels of corn on the same acre my great grandfather got thirty or forty by putting in enough effort and resources but it is uneconomic to do so.

Contemplation of the law of diminishing returns and the basic principles of biology that underlie agricultural science has forced me into giving up my cornucopian mindset.

People who are seriously studying energy issues these day are believers in the law of diminishing returns but they refer to it with new words. They speak of energy returned on energy invested. (Sometimes if they are businessmen they may use the phrase energy returned on investment meaning– to them–cash or money invested.This results in some confusion at times in the popular press.)

Those of us who have seriously studied this matter and believe peak oil is a real likelihood in the near to medium term do not doubt that there is a potentially large enough resource of oil in the ground for production to rise for several more decades at least.

But we do understand that while technology may make it possible to recover this oil technology the price of recovering it may well be prohibitive.

Nobody doubts that flying and swimming cars are possible but the cost of building them remains prohibitive more than a century after the invention of the car and the airplane.

Each time we go to a lower quality resource in the ground the cost of recovery necessarily increases barring a real technological revolution.We are now digging vast pits hundreds of meters deep and hauling up the stone in giant trucks and processing many tons of it using up a huge amount of energy and manpower and machinery to get one paltry ounce of gold.

There is a hard limit on how expensive oil can get before it gets to the price the last or marginal barrel is simply unaffordable because we aren’t ever going to be able to pay gold prices for oil.

A hundred years ago the energy return on oil was about a hundred to one. The energy return on tar sands oil may be as high as five or six to one at best and getting that oil to market consumes huge amounts of machinery and manpower that used to never be needed at an oil field.

A typical fracked well consumes many times the materials and energy it takes to bring in a conventional well. This runs up the price of fuel and trucks and pipe and diesel engines and all the other inputs for everybody else that uses these same things for other purposes.

The increase in the price of oil due to the amount of oil that is needed to frack a well is probably too small to even be calculated but a doubling of the price of it in the short term would break every for profit airline in the world.

Now is it possible that aero engineers can double the fuel efficiency of aircraft and thus offset a doubling of fuel costs? Maybe. Maybe not.

BUT it is extremely improbable that they can do so in say five years and no doubt it is impossible to replace the current fleet of aircraft in less than ten to twenty years.

My personal opinion is that history and depletion are going to outrun the technology of oil recovery like a fast freight by passing a tramp. This does not mean that the technology will not continue to improve or that it will always be impossible to recover all that hard to get at oil.

Oil is so valuable a resource that I have said many times I can more easily afford twenty dollar diesel fuel than I can afford to give up my tractors and go back to horses and mules. Some will still be produced when it costs three or four hundred dollars a barrel to get it out of the ground.

The amount we can get out of all the old legacy fields world wide is declining at about four percent annually and the unconventional oil industry has about the same chance as a snowball on a hot stove of growing fast enough to offset the decline of conventional oil because nobody has discovered any truly significant amount of new conventional oil that can be had at current prices for decades now.

The unconventional industry is starting from too small a base in comparison to the conventional industry.

Another doubling of the price of oil will break the back of the world economy and oil production will peak if for no other reason than that the world cannot afford it at the price of marginal production.

Technology is enabling us to increase the efficiency of energy use as well as it is increasing our ability to get at unconventional oil but efficiency can be increased only so fast.We can’t just scrap our existing infrastructure and replace it overnight or even in a decade or even in two decades. It will take over a decade even under the most optimistic assumptions to turn over the automobile fleet.

A simple analogy is that the economy is on the way to the hospital due to oil troubles.There is not too much doubt the technology ambulance can get the patient there –eventually- but maybe not before the patient dies enroute.

And the hospital itself may have the technical expertise to save the patient but lack the resources to do so.We can afford a heart transplant here and there as a society.

But suppose it becomes possible to grow a new heart for every old geezer in the country for a thousand bucks in a heart lab and it still costs mid six figures for the transplant operation?

I can raise apples buying twenty dollar diesel fuel and it won’t break me or the economy because I raise a hell of a lot of apples with just one gallon of diesel.

But the tourism industry wouldn’t last twenty four hours with twenty dollar gasoline and jet fuel.

Peak oil is not a matter of new technology so much as it is a matter of time and depletion and costs.

Mac,

Thanks for the wisdom. It mirrors my own observations of the biomass side of farming.

The concept of marginal cost is something that I have found is very difficult to communicate to people. One of the reasons that the developed world has gone into so much debt is that the marginal cost of maintaining our societies has risen dramatically. As the easy and cheap to develop was exploited, the new resources that are brought on line to expand capacity cost many times what the original resources cost.

The explosion of debt has masked the fact that our current life style and continual growth actually costs more than we can afford. Falling interest rates has allowed the charade to continue for quite awhile but eventually, we will have to live with what can be funded by cash flow. It will be a rude awakening for the developed world.

Woody

With the dual miracles of fracking and horizontal drilling and vast unexplored and untapped sources, like in Asia, the price of oil is not going to go much higher, if any, for a loooong time. Even if it ever actually does, there is always going be oil recoverable at some price.

Alternatives to oil will never work without obtaining inefficient and wasteful government borrowed money subsidies that are just giveaways to leftist special interest groups. This is why Capitalism is the only proven sustainable path forward. Think about it, the only obstacle right now to enjoying cheap and plentiful energy over the next several generations is current government policy. If the government would get the heck out of the way of both extraction and refining, the USA could go from importing nearly half of its unrefined and refined oil to becoming an energy exporter in less than a decade.

Funnel,

Which energy would that be? Not from fossil fuel, Right?

FunnelGuy, have you looked into the effect of Bernanke-style Capitalism on oil fields in Oklahoma that are empty? I have never done that. It would be a good study.

FunnelGuy wrote:

“. If the government would get the heck out of the way of both extraction and refining, the USA could go from importing nearly half of its unrefined and refined oil to becoming an energy exporter in less than a decade.”

Lets suppose you’re right about recoverable resources, which is incorrect, since oil recovery costs worldwide are soaring, even in the least regulated regions of the world.

Socialism and neo-collectivism is now the dominate political movement in Western civilization. In the US, both parties (GOP and DNC) are socialists, they just subsidize different groups. The US is deep in debt and has unfunded liabilities of over 200 Trillion. 26% of all federal revenue is used to pay just the interest on the 17.5 Trillion while interest rates are at historic lows. More than Half of all US household are dependant on gov’t subsidies (food Stamps, Social Security, Wealthfare, Medicare, and Medicaid). There is no way your going to convince a single household to give up their subsidies and return to a traditional capitalism system. There is no way the US is going to dig itself out and there is no way any Washington is going to surrender its power and turn over the reigns back to capitalism. Real capitalism is dead, its now in the hands of the socialists centered around nepotism and capitalism isn’t coming back anytime soon, if ever. To get back to capitalism, will require another round of revolution (ie 1776) and another global war to address the global economic imbalances.

Before you assume that you know more about oil production and capitalism then the rest of the blog members, please take the time to read through all of the the articles posted that contain technical analysis using real data and the comments directly related to them to fully understand the gravity of the situation. Its very rude to make wild assumptions with no data or evidence to support your faith.

FunnelFan,

“…the USA could go from importing nearly half of its unrefined and refined oil to becoming an energy exporter in less than a decade.” The trouble with these tongue-in-cheek comments is someone always thinks you’re serious and a ton of useless dialogue ensues; yes, it happens to me all the time. My advice would be to insert one of those cute little round yellow smiling faces following this kind of “commentary”.

Doug

I used to be a believer in capitalism. I’m just not sure what it means when money is printed whimsically on a global scale by the Fed, the PBOC, the BOJ and assorted and sundry others.

Which is why it’s shaky to think about oil output being dependent on the number of printed pieces of paper created.

Though if you embrace that concept it does make sense. Yes, if oil were priced at $50,000 per 42 gallon barrel and society was somehow configured to endure that, you probably could get natural gas from Titan and GTL it to oil for use. That point is that yes, economics is correct, if the price of something is high enough it will be produced for consumption.

Odds seem pretty high, though, that whereas some US strippers come online at $140, they don’t add more than a few hundred thousand bpd. The world burns 85+ million bpd.

I would like to hear more of your input about fracking logistics, particularly as regards above ground traffic jams by the trucks.

BTW, in a cost perspective, why has no one unionized those truck drivers?

Truck drivers are among the most individualistically oriented people still around.Most of them aren’t interested.

And unions really work- can really work – when the people who might want to be in them work in large numbers for a given employer that can be struck and forced to accept a union.

This does not apply to government employees at all of course.

There is no way to strike a thousand small trucking outfits. If a handful go out, the rest fill in the gap in a heartbeat.And most of those small outfits are family operations to start with.

If you get run over by local small time pizza delivery guy the restaurant insurance pays and if that is not enough the restaurant which is probably a corporation goes bankrupt .

The owners and managers will be making pizza right along with a new name and address in a matter of weeks. Strike a trucking company with a hundred trucks and it will disappear in a few weeks and be reborn in a few months at the longest under a new name with most of the same old customers.

Relations between customer and industry in trucking are very much on a personal basis between the buyer and the person he talks to when he needs a truck for a week or every night for a year driver included.

The only thing that really matters is the credibility of the man who answers the phone at the trucking company.

A few of the bigger companies are unionized from back in the days when routes were regulated and basically the property of whichever company had the regulatory lock on them.But they aren’t doing so well over the long haul in a deregulated environment.

If all that were real there would be no Teamsters.

This is one hell of a lot of union dues not being collected. Surprising they aren’t up there recruiting.

My Daddy was a Teamster for fifty years on a second and third shift job and being a rolling stone I have been a member at various times of some unions myself.

There are many companies that are unionized that own and operate a relatively small number of trucks as part of their own business operations and a lot of those drivers are unionized. But while they are truckers they are not part of what is usually thought of as the trucking industry – the primary business of which is actually running trucks hauling goods for hire for other companies.

There are some unionized trucking companies of course but the business is cutthroat in the extreme and paying union wages and bennies is almost impossible. There is not much a union can do to work with the management to increase efficiency the way it can in some industries such as electrical by running training programs and having a number of guys ready and waiting at the union hall for a short term but very high wage high skill job.

If you want to learn to drive a truck you can have a cdl in a matter of six or eight weeks. It takes at least a couple of years of full time work at increasing skill level and that much more in class room time to become a qualified electrician.

I learned the basics on the farm when I was twelve or so but big for my age and able to reach the pedals and my formal training consisted of riding in a truck a couple of days as as observer and then two days as the driver with the regular driver riding with me. Then I got an appointment at DMV and took the test and walked out with my license – this was about forty years or more ago.

I have mentioned that I am a rolling stone before this.I always worked at something different whenever I could and that was most of the time when I wanted to work.Having a lot of paper work such as a cdl and a pesticides applicators permit and certification to operate a forklift opens doors. Getting this stuff is as easy as pie if you are literate.

Trucking is a highly responsible job in terms of not having an accident but the skill level is trivial except for parking and backing in tight quarters. Getting good at that takes some time like any other physical skill such as playing an instrument .

But anybody with good eyesight and good depth perception can learn to do it.I never got to be very good at it myself compared to the guys who drive for years on end but I always managed

with people laughing at me sometimes for taking too long.All the jobs I ever had driving were short term ones associated with big construction projects but we had a couple of big trucks on the farm in times gone by.Most serious farmers do because it is cheaper over the long run than hiring your hauling done and you can’t ever count on hiring a truck on short notice during busy seasons in farm country.

Teamsters score a win against “sharecropping on wheels.” But will the trucking industry really change?

By Lydia DePillis, Wonkblog, March 22 at 9:44 am

The point is unionizing the enormous amount of trucking in the LTO fields. Not about unions in general anywhere else.

I wanna see what happens if well development prices go up instead of the unanimously presumed down.

“The oil is there and as long as Capitalism prevails it will come our way.”

So, either oil is infinite or Capitalism is toast.

Or you missed the episode of Sesame Street “brought to you by the numbers Finite and Infinite”.

:^)

“all the evidence showing that warming stopped 16 years ago”

Wow. Just wow. Any other words would clearly be wasted…

Ron, thank you for reinforcing my conclusion that the EIA is just a hack organization. Every time I read something like this I try to see if there is an possibility that they are right, I give them the benefit of the doubt that they may know something I don’t, and every time I end up shaking my head at the obvious deception (not ignorance, not carelessness) that is being put forth. And put forth with the imprimatur of a government agency staffed by experts. This report will no doubt be cited time and again by those who wish to believe that there is no looming energy crisis. But that’s what people want to hear. So be it. We are fools.

“It’s easier to fool people than to convince them that they have been fooled.” Mark Twain

Calhoun,

This was the IEA not the EIA. IEA website is http://www.iea.org/ where IEA stands for International Energy Agency. EIA website is http://www.eia.gov/ where EIA is the US Energy Information Administration.

They may both be hacks, I like the information coming from the US EIA, though budget cuts are making the data less timely and the estimates poorer, it is the best we have, not perfect by any means.

Dennis (or anyone),

Do you have any reason to believe data coming from the EIA is inaccurate? For example, would there be any reason to question, for example, that North Slope oil production for Jan. 201x averaged 555,000 barrels per day if that were the number provided in their monthly report(s)?

I ask because (1) I assume the reports are spot on but (2) if they’re not the whole Peak Oil discussion becomes suspect or complicated beyond belief. I do know actual shipments sent down the TAP are subject to rarely discussed variables. For example, complications stemming from water cut treatment availability on rigs, temperature requirements to flow in the pipeline, marketing issues in California, balancing needs among producers, taxation matters, etc. However, to my mind, none of this matters in the mid term: oil is produced, reservoirs decline, profits (or losses) ensue. But I really want to believe the EIA numbers — they matter. I’d like your opinion on this.

Doug

Doug, I have no reason to doubt the EIA on US domestic production. They usually do get the very latest numbers, the numbers that they must estimate, quite a bit too high. But eventually they must lower them to what the oil companies and individual states actually report. That’s why their revisions are usually lower than their original numbers.

As far as the Alaska numbers go, I think they reflect exactly what the state reports to them. And it is quite easy to measure what comes through the pipeline. So the Alaska numbers are likely always accurate and up to date.

The numbers from Texas are the most inaccurate because the Texas RRC is very delinquent in reporting their data. That is likely because the oil companies are also delinquent in their reporting practices.

But I really don’t trust the EIA as far as international data is concerned. Oh they are accurate concerning Norway, Mexico and other countries that report their production numbers. However a lot of nations do not report their data and the EIA just guesses. It is those guesses that I don’t trust. I think they choose to err on the high side. And they usually do.

Ron,

Thanks, That’s more-or-less what I’ve always assumed.

Hi Doug,

I agree with Ron on the domestic numbers, on the international numbers he is correct that the EIA’s numbers aren’t perfect, but I think he would be hard pressed to point to a better source, the JODI data is not very good, BP is ok, but it pretty much matches the EIA data. I think the IEA data is worse than the EIA’s, and OPEC gives pretty good data, but again it doesn’t seem all that different than EIA data.

The International EIA data is definitely not as good as the domestic data, on that Ron and I agree. I still think that overall the EIA data is the best we’ve got, but like all data it is imperfect.

Dennis,

Another thanks. I can sleep knowing domestic production is more-or-less as stated. As for the Arabs I suppose their numbers are sort of OK too, if you’re not talking reserves.

Doug

Dennis, I did not say there was a better source of data than the EIA. For non OPEC there definitely is not. See the below chart for Algeria, EIA and the OPEC MOMR. Now Algeria produces a lot of condensate so there is likely room for a lot of difference. But Algeria has never had those long periods of virtually no change in production like the EIA says they have.

The EIA is just not very good for OPEC and that makes the rest of their numbers for non-OPEC suspect.

Hi Ron,

Which Algeria numbers are you charting from the OPEC report, there are two different sets. As you said, there is the difference in crude vs crude plus condensate.

What is more important to me is OPEC as a whole.

If you compare OPEC crude+ NGLs and nonconventional with EIA C+C+NGL which are the only two numbers which can be directly compared, the number from OPEC is 2141 kb/d higher than the EIA estimate for the third quarter of 2013 (using the secondary sources number). So you are complaining that the EIA is underestimating OPEC output? I think it the OPEC estimate which could easily be questioned, why are they overstating their output by 2 million barrels per day?

EIA 3q 2013 OPEC C+C+NGL=35.8 MMb/d

MOMR 3q 2013 OPEC C+C+NGL=37.9MMb/d, MOMR secondary sources number was used for crude.

I only chart “secondary sources”. The “direct communication” have only been posted for about a year so there is no way I could post those.

But: Here are the figures I get in kb/d for 2013. The EIA numbers are the average for the first 10 months. OPEC Crude Only average for 2013 was taken directly from the MOMR

OPEC Crude Only 2013

The data does not include process gain, only crude, NGLs and other liquids.

But the difference is 152 kb/d not the over two million you came up with.

But my complaint is the EIA data, for several nations, never changes for many months at a time. Look at Algeria in my chart. Does that look realistic? No, they are just guessing.

I have no idea how you came up with 37.9 mb/d. I could not find that figure anywhere in the MOMR.

Hi Ron I took the 3rd quarter numbers from MOMR Crude+NGL(and non-conventional) and compared it to the EIA’s 3rd quarter numbers.

The EIA sometimes estimates output, when they think it hasn’t changed a lot, they leave the estimate the same, big deal. They are still the best data source by far, IMO, though the budget cutting in Washington, especially the big cut in 2011 for the EIA budget has certainly not improved the data coming out of the EIA, we probably agree on that point.

On the EIA 3rd quarter numbers I included only crude plus condensate and NGL (C+C+NGL), I did not include other liquids.

So my comparison was third quarter 2013 from MOMR to third quarter 2013 for EIA C+C+NGL.

EIA third quarter 2013 OPEC

c+c=32.2 MMb/d

ngl=3.6 MMb/d

c+c+ngl=35.8 MMb/d

MOMR (I think I mistakenly used the direct commumication number, my mistake, sorry) 3rd quarter 2013

crude 30.4 MMb/d

NGL 5.8 MMb/d

crude plus NGL=36.2

and the direct communication number is about 37.9 MMb/d.

The OPEC and EIA totals are pretty much the same, with EIA slightly lower than OPEC (0.4 MMb/d).

The EIA is much less focused in international data, when the shale boom starts to reach its peak (2014 to 2017 is my guess), the EIA may once again start to pay more attention to international energy data.

MOMR (I think I mistakenly used the direct commumication number, my mistake, sorry)

A good practice to follow is when you get numbers that look impossible, they probably are, so go back and check again before posting.

Those “direct communication” numbers are impossible, especially for Iran and Venezuela. They both have a political ax to grind and grossly overstate their production numbers. The EIA, to their credit, ignore those numbers.

Hi Doug,

Ron said:

“They usually do get the very latest numbers, the numbers that they must estimate, quite a bit too high. But eventually they must lower them to what the oil companies and individual states actually report. That’s why their revisions are usually lower than their original numbers.”

In the case of Texas I have been following EIA and RRC data pretty closely since Dec 2012 and so far, the EIA estimates have been pretty good, maybe this will change in the future. I am referring to the data in the Crude Production data found at the link below:

http://www.eia.gov/dnav/pet/pet_crd_crpdn_adc_mbblpd_m.htm

A chart of TX C+C in kb/d from the EIA downloaded in Jan 2013, Mar2013, Aug2013, and March 2014 is charted below, the downward data revisions have been pretty small over the last 14 months.

Dennis,

Thanks once again, that’s actually encouraging. This may be (probably is) a dumb question. When you look at EIA Gulf Coast production, is that Texas, or some other state, oil? In other words, who gets the taxes from oil and/or gas produced in the Gulf? Being a Canadian US Federal vs State is kind of a mystery to me; actually it’s a total mystery to me.

Doug

Doug,

There are no dumb questions in my opinion. Though some answers are better than others. (This answer is really a guess, so not very good.)

I am not sure what you mean by Gulf Coast Production. There is PADD 3 Federal Offshore, is that what you are referring to?

If so, those areas are controlled by the Federal Government and I believe that no royalties are paid and any taxes would go to the Federal government. I believe the leases are bid at auction and there may not be any production taxes, just the normal corporate taxes, but I am unsure about this, maybe Ron knows, he knows a lot, probably more than me [on that point we might even agree 😉 ]

Dennis wrote: If so, those areas are controlled by the Federal Government and I believe that no royalties are paid and any taxes would go to the Federal government. I believe the leases are bid at auction and there may not be any production taxes, just the normal corporate taxes, but I am unsure about this, maybe Ron knows.

No, I do not know. But I would bet my bottom dollar that you are dead wrong on this issue. There is no way that BP only pays corporate taxes on oil they recover from US territories in the Gulf of Mexico. Call it royalties or call it a “per barrel tax” but they pay something other than normal corporate taxes.

Think about it. If for some reason BP had a huge disaster… now don’t laugh, that could happen. 😉 And because of the huge cost of this disaster they would show a loss on all US operations. Then they would pay nothing at all because they had no profits.

Hey, let’s research this thing and see who is closer to the truth. Perhaps someone reading this already knows the answer. If so, please reply.

I will defer to someone wiser than myself, as I said Ron knows more than me.

Dennis,

I disagree, it’s a dumb question. What I refer to MUST be Federally owned, by definition! I guess Alaska may somehow be an exception? In Canada, everything involving tidal water is owned/controlled by the Feds but sometimes they feel guilty and toss a few crumbs to the closest Province. No idea what PADD 3 means.

Doug

Ron/Dennis,

OK, I’m ‘way beyond my depth so hereby withdraw from this discussion. Except for one question: Is it possible when Alaska joined the union the state somehow kept some (taxation) rights to offshore territory? You guys seem to have a complex system w.r.t. state vs federal jurisdiction.

Doug

I will hazard a guess here that the definition of ” Gulf Coast production” is not a well defined term but that in most cases it is intended to mean the shallow water production in state waters of all the states that touch on the Gulf. It may or may not be meant to include any shallow water production in federal waters if there is any.

It may or may not be intended to include land based wells near the coastline.

BUT this is only a guess based on my impression from reading various articles about the oil business and the economy.

The same term”Gulf Coast” is used to refer to farms a hundred or more miles inland in the farm news.

I do believe it is a very poorly defined term that may mean almost anything depending on who is using it.

Mac, Thanks for the thoughts.

What got me going on this is the EIA monthly production report entitled: “Federal Offshore Gulf of Mexico Field Production of Crude Oil” which comes out monthly and I suddenly realized that I don’t know what that means. Now you mention shallow water possibly not being part of the bigger picture. Think I’ll just admit ignorance and move on.

Doug

It varies by state, but natural resources close to shore (3 or 4 miles) are controlled by the state. Outside of that would be federal. The Feds like all mineral rights owners gets a share of the revenue.

Non-OPEC oil production by region from 2000 to 2014

This is one of the more interesting graphs I’ve seen recently, if only because of it’s format. Wish they had one just like it for OPEC. In any case, the message is clear – if not for unconventional (i.e. expensive) oil from North America and Russia’s 90’s comeback (peaking soon, if not already), the past ten years have been been pretty poor for Non OPEC production. In my opinion, we are now reaching the great inflection point — infill drilling, tertiary recovery, capital intensive LTO, and tar sands are all reaching their limits for papering over the depletion of the aging giants which have supplied us for decades.

On the other hand, there’s always kerogen.

The chart is “Total Liquids”. That is it includes Natural Gas liquids or what I like to call “Bottled Gas”. They call it oil, I call it gas. For instance they show Asia and Oceania still increasing when they actually peaked in 2010 and have declined almost half a million barrels per day since then. Here is what Asia and Oceania looks like when you don’t count bottled gas. The data is from the EIA, Crude + Condensate.

Absolutely correct, thanks for the clarification. Once again the NGL component clouds the reality.

Here’s a chart for World C+C+NGL using EIA data, the barrels of NGL have only 70% of the energy of an average barrel of crude so they have been discounted by 70%( ie 1000 barrels of NGL are converted to 700 barrels of oil equivalent(boe).

Chart below is a 12 month centered moving average of World C+C+NGL in MMboe/d from July 2000 to May 2013.

And for those who prefer a zero scale chart.

and a final chart with annual data from 1982 to 1999 added.

Note from 1992 to 2012 (20 years) output increased by 17 MMboe/d. If the linear trend since 1982 continues for 20 more years at the same rate of increase, we will reach 100 MMboe/d of C+C+NGL output by 2033, not too far from the IEA 2035 New Policies Scenario.

Personally I doubt we can maintain this linear rate of rise, but if prices rise enough we may be able to get to 90 MMboe/d of C+C+NGL and maintain a plateau for 10 to 20 years.

If the rise in real oil prices stays at a 5 to 6 % annual rate of increase (vs, the 12% rate of increase in real oil prices since 1998), then a world wide economic crash might not ensue.

The high real oil prices would then encourage substitution of electricity (from wind, solar, geothermal, and nuclear) for liquid fuels, along with some natural gas (until that starts to run short, probably 10- 15 years after the decline of oil output).

People respond to prices. Gasoline at $7/gallon or higher with carbon taxes will make people rethink their vehicle choices and demand better public transportation in densely populated areas.

Dennis,

I know the very good reasons for not using zero-based charts unless the data themselves go that low, and I agree with them, but, you know, that zero-base that you give sends a message that has an impact for me. Thanks for including it.

Synapsid,

Your welcome. The zero based chart is dramatic, but I agree with Ron that it makes it hard to see the changes in output over time, which is what we are trying to track.

I also agree with your point that it shows more clearly how slowly output has been rising since July 2000.

Is There No Limit To Human Wastefulness?

The Kingdom Tower Begins Construction on April 27th to Become World’s Tallest Building

Other sustainability features including natural air cooling from the top of the tower due to the arid environment of the region such as the Burj does in taking in the cooler air from the top of the building to use in the air conditioning of the tower. The condensation from the system will also be recycled for irrigation and other uses through the building.

Sustainability features!?!? Clearly, that word has lost all meaning.

Meanwhile, the press reports this crazy logic:

Saudi Arabia will rely mostly on fuel oil to run power plants when annual demand peaks this summer, enabling the country to burn less of its crude and keep more for export, according to consultants Energy Aspects Ltd.

Hooray! KSA gets to burn expensive imported refined fuel oil so they can export more lower value crude! No wonder they can afford to waste money on pointless buildings. (Actually the building has a very big point at the top!)

Calhoun, there is something very wrong with this story. The authors are using the wrong term. They are saying “fuel oil” when they should be saying “bunker fuel”. True both are fuel oil but they have totally different meanings in Western language terms.

Saudi gets a lot of bunker fuel from its refineries but not enough so they must import more. Bunker fuel is the sludge left over when all the good stuff like gasoline, diesel and kerosene have been removed. It is what ships use in their boilers. It is the favorite boiler fuel worldwide where a liquid fuel is required. And it is a lot cheaper than the fuel oil a lot Westerners use to heat their homes.

Ron, The Shoaiba power-desalination plant is an oil-fired complex in Saudi Arabia on the coast of Red Sea. This is the world’s largest fossil fuel power plants and the world’s third largest integrated water/power plant. There they do say it uses fuel oil but you are correct, it is in fact bunker oil — by our definition. Apparently it will be converted to gas at some point, after pipelines are built.

Doug, this is a subject that I know something about. I worked for five years in Saudi Arabia and two of those five years I worked at the Ghazlan Power Plant just north of Ras Tanura. That was Ghazlan 1. Ghazlan 2 was built long after I left in 1985.

All Saudi power plants, and evaporation desalination plants, as opposed to reverse osmosis desal plants, can use either gas or oil, they do not need to be converted. They do use different burners. When they are burning oil they have spray heads that telescope out into the center of the boiler. But when they are burning gas the gas is injected right from an orifice in the wall of the boiler.

At Ghazlan we burned gas at least 90% of the time. Mostly we burned methane but occasionally would burn ethane. The oil burners however would burn anything. Usually we burned bunker oil but could burn straight unrefined crude. Once we burned naphtha. That was a product of the refinery and I guess they had more of the stuff than they could sell.

But we never burned fuel oil, which is basically kerosene. Kerosene is far too valuable a product to use as boiler fuel.

Ron,

I was there a few years back for a plant opening at the invitation of Siemens and was told their systems can burn pretty much anything, by design. It seems the Saudis really do want to fuel turbines with gas as much as practical but often oil (in some form) is “convenient” and after plastic bags, bunker fuel must as close to rubbish as you can get. Anyway, thanks for the info update. It’s refreshing indeed to get facts first hand.

Doug

In regard to the remaining supply of post-2005 Cumulative Net Exports (CNE) from Saudi Arabia and the (2005) Top 33 net oil exporters, the question is not whether we have depleted the volume of post-2005 CNE, the question is, by how much?

My contention is that the actual rates of depletion in remaining post-2005 Saudi and Global Cumulative Net Exports of oil are vastly higher than almost anyone believes. Four graphs follow, including a new graph for Saudi Arabia.

Export Land Model

Following is a graph showing normalized values (year 2000 values = 100%) for “Export Land,” a simple mathematical model which assumes a production peak in the year 2000, with a -5%/year rate of change in production and a +2.5%/year rate of change in consumption. At the production and net export peak in the year 2000, the ECI ratio (ratio of production to consumption) was 2.0, or consumption was equal to half of production.

The Export Land Model (or ELM) demonstrates that given an ongoing production decline in a net oil exporting country, unless they cut their consumption at the same rate as the rate of decline in production, or at a faster rate, the resulting net export decline rate will exceed the production decline rate, and the net export decline rate will accelerate with time. Furthermore, if the rate of increase in consumption exceeds the rate of increase in production, a net oil exporter can be come a net importer, prior to a production peak, e.g., the US and China.

Six Country Case History

Following is a graph showing combined normalized values (year 1995 = 100%) for the Six Country Case History (Indonesia, UK, Egypt, Vietnam, Argentina and Malaysia). These are the major net oil exporters, excluding China, that hit or approached zero net oil exports from 1980 to 2010. Note that even as their combined production rose by 2% from 1995 to 1999, they had already shipped, by the end of 1999, more than half of their combined post-1995 CNE (Cumulative Net Exports).

Note that estimated post-1995 CNE, based on the seven year 1995 to 2002 rate of decline in the ECI ratio, were 9.0 GB. Actual post-1995 CNE were 7.3 Gb (billion barrels).

Saudi Arabia

Following is a graph showing normalized values (year 2005 values = 100%) for Saudi Arabia. The first three lines are actual data. The fourth line, Remaining post-2005 CNE by year, shows the estimated values. Estimated Saudi post-2005 CNE, based on the seven year 2005 to 2012 rate of decline in the Saudi ECI ratio, are about 56 Gb.

I estimate that Saudi Arabia has already shipped a little more than one-third of their post-2005 CNE, in only seven years (through 2012).

(2005) Top 33 Net Oil Exporters

Following is a graph showing the normalized values (year 2005 = 100%) for the Top 33 net oil exporters in 2005 (countries with 100,000 bpd or more of net exports), which I define as Global Net Exports of oil (GNE). As with the Saudi graph, the first three lines are actual data. The fourth line, Remaining post-2005 CNE by year, shows the estimated values. Estimated (2005) Top33 post-2005 CNE, based on the seven year 2005 to 2012 rate of decline in the Top 33 ECI ratio, are about 530 Gb.

I estimate that the (2005) Top 33 Net Oil Exporters have already shipped about one-fifth of their post-2005 CNE, in only seven years (through 2012).

One final note about “Net Export Math.”

The model and the empirical case history show that the rate of depletion in post-export peak CNE (Cumulative Net Exports) exceeded the rate of decline in the post-export peak ECI ratio, i.e., the remaining cumulative supply of net exports fell faster than the rate of decline in the ratio of production to consumption.

This implies that the rates of decline in post-2005 Saudi and Global post-2005 CNE exceed their respective rates of decline in their ECI ratios.

The seven year (2000 to 2007) exponential rate of decline in Export Land’s ECI ratio was 7.8%/year. The seven year (2000 to 2007) exponential rate of decline in remaining post-2000 CNE from Export Land, i.e., the exponential rate of depletion in post-2000 CNE, was 43.0%/year.

The seven year (1995 to 2002) exponential rate of decline in the Six Country ECI ratio was 2.7%/year. The seven year (1995 to 2002) exponential rate of decline in remaining Six Country post-1995 CNE, i.e., the exponential rate of depletion in post-1995 CNE, was 26.0%/year. (Based on the seven year, 1995 to 2002, rate of decline in the Six Country ECI ratio, the estimated Six Country post-1995 CNE depletion rate was 17%/year).

The seven year (2005 to 2012) exponential rate of decline in the Saudi ECI ratio was 4.9%/year. The seven year (2005 to 2012) estimated exponential rate of decline in remaining Saudi post-2005 CNE, i.e., the estimated exponential rate of depletion in post-2005 Saudi CNE, was 6.6%/year.

The seven year (2005 to 2012) exponential rate of decline in the (2005) Top 33 ECI ratio was 2.0%/year. The seven year (2005 to 2012) estimated exponential rate of decline in remaining Top 33 post-2005 CNE, i.e., the estimated exponential rate of depletion in post-2005 Top 33 CNE, was 3.4%/year.

I tried finding that report, but it is paywalled. 🙁

I would actually be interested in the report itself, not just “why peakers disagree”.

What report? Nony, you need to click on the “reply” button right under the post you are replying to, not just start typing in the “Leave A Reply” box at the bottom of the page.

But Why do peakers disagree? That depends on what points they disagree about. No person earth likely agrees with any other person on earth on everything. So the point of contention is very important. So if you will give me the point you think peakers mostly disagree on then I might give you an opinion. Then again I might not. 😉

I’m referring to IEA World Energy Outlook 2013, the subject of your headpost. The report costs 150 pounds. I couldn’t find a free copy online.

There is a superb article up at Wired today about coal and carbon capture and storage.

I have never seen a better one.

http://www.wired.com/wiredscience/2014/03/clean-coal/

Mac,

Agreed, very interesting. I spent about seven years is China and, to a degree, keep abreast of stuff going on there. It really bugs me to continually hear: “China is crap”. For every engineer trained in America 20 graduate from Chinese universities and there is a strong Chinese presence in every significant school in the world. Furthermore, the average engineer in China is as capable as the average one here in the west. Another fact people seem to ignore, or not be aware of, is that most leaders in Asia are engineers as apposed to lawyers. I’m prejudiced in this matter but in my mind engineers are schooled in the idea: do it once, do it right; lawyers aren’t. Having said that I would be the last person alive to say there aren’t huge problems in Asia, huge beyond comprehension. But, there are also a vast number of capable people working toward solving problems as well. The article you have cited is an excellent example of this. Thanks.

Doug

Doug, I think you are being overly sensitive to any Chinese criticism. Nowhere in the article did anyone say that “China is crap”. The article was highly critical of China’s continued increase of coal use. And I think that criticism is justified. The article, otherwise, actually praises China:

Nowhere is the preeminence of coal more apparent than in the planet’s fastest-growing, most populous region: Asia, especially China. In the past few decades, China has lifted several hundred million people out of destitution—arguably history’s biggest, fastest rise in human well-being. That advance couldn’t have happened without industrialization, and that industrialization couldn’t have happened without coal. More than three-quarters of China’s electricity comes from coal, including the power for the giant electronic plants where iPhones are assembled. More coal goes to heating millions of homes, to smelting steel (China produces nearly half the world’s steel), and to baking limestone to make cement (China provides almost half the world’s cement). In its frantic quest to develop, China burns almost as much coal as the rest of the world put together—a fact that makes climatologists shudder.

That being said, I think China’s leadership, the Chinese Communist Party, actually deserves a lot more criticism than it gets. They are corrupt to the core and, I believe, they are leading China down a path that can only lead in its ultimate financial collapse. They are building, with borrowed money, millions of office buildings, office space, apartments, malls and whole cities, that no one will ever occupy. But they must keep building and keep borrowing or the economy will collapse. So they do.

Ron,

Just to clarify, the China-is-crap comment stems from people I meet, in general, and not anything to do with your Blog.

You are correct regarding corruption, but it’s goes far beyond the Communist Party, who are guilty as charged. I can say, without ANY exaggeration: NEVER once have I attended a meeting in China, (Indonesia or several other places) where money wasn’t being handed out in envelopes between people for God knows what: for everything I guess. It’s THE way-of-life and those involved have no conception of the self destructive process it is. This is probably the biggest problem Asia faces and the scale is beyond belief.

Doug

More and more ethane being rejected into natural gas (heating/power) because there is not enough North American petrochemical demand for it and it’s hard to export:

https://rbnenergy.com/changes-in-longitudes-ethane-exports-to-europe

Wonder if anyone would comment about these very disturbing graphics.

By the way, this is my first comment. Hope these links works properly. Can’t wait to hear your comments!

And I guess I can ‘safely’ say for all of us that are no commenting: Thanks for this great site. Amazing work and commitment on informing all of us, here. We appreciate.

Please, lead on:

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=A103600001&f=M

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MGFIMUS1&f=A

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MGFEXUS2&f=M

First graph: the refiner’s don’t do retail anymore. Not enough money and the liability of leaky storage tanks at gas stations became too great. Refiners sell more to wholesalers now.

Second graph: with the shale bubble the Barely Crude Oil that is being produced has a proportionally large gasoline fraction. Lots of BCO times a bigger fraction means lots of gas being produced.

Third graph: flip side of the second graph.

Just my somewhat informed take. Others may be able to offer a better informed reasoning.

Naw, you hit the nail on the head Aws. Refineries are just getting out of the retail business. And refineries here in the USA are producing a lot more gasoline but selling it wholesale and exporting a lot more of it.

So, see if I got it right:

US gasoline wholesale peaked in 2005 [see link below] at around 344.106

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=A103700001&f=M

Would anyone know why EIA stopped collecting/reporting wholesale gasoline in 2006?

Also, I wondering if US gasoline production/consumption is declining faster than conventional oil… even that US has shale oil, if that should be called oil. And, perhaps, some Canada’s tar [oil] sand.

And of course, US’s remaining conventional oil.

Hmmm. Before I forget: Thanks for the wholesale heads-up!

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WGFRPUS2&f=W

This is the relevant Gasoline chart.

I just watched “The Usual Suspects”. Cool screen name.

Another chart with 53 week centered moving average of net refiner and blender finished gasoline output EIA weekly data 1982 to 2014 chart below.

Rate of increase has slowed since 2007.

I realized that the US imports some gasoline (and we export as well and we don’t have data over the entire 2007 to 2013 period on gasoline exports). So I found consumption data for gasoline from the EIA:

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MGFUPUS2&f=M

I downloaded the excel file so I could smooth out the seasonal fluctuations with a 13 month centered moving average. US gasoline consumption has decreased since 2006, so there has been some reaction to increased prices (though some of the reduced consumption may be due to reduced economic activity).

I read my chart incorrectly, the decrease has been since 2007 not 2006.

The following only covers 1973 to 2013 the fall in consumption looks more dramatic on this chart, otherwise same data as above.

That chart is for total US consumption. In the last 40 years population has gone up by nearly 50% so per capita consumption is falling more steeply than that chart shows.

Hope this link works.

http://iansurbanblog.blogspot.co.uk/

Failed to embed image in page. Follow link and scroll down .

Drought drives up female slaughter rates

stockjournal.com.au, 24 Mar, 2014 07:20 AM

Stumbled on this indirectly from above article…

Peter Whip: Climate champion

Meat and Livestock Australia

I guess they are catching up down under or should I say adapting to changing conditions because I don’t know anything about raising cattle there other than it requires strategies for hot and dry.

But we were teaching breeding heifers as young as possible fifteen or more years ago in this country when I was working as an agriculture teacher in a rural high school.

It is a very profitable strategy so long as the heifer doesn’t die on you giving birth.High birth weight calves grow out faster and cheaper so you breed mature cows to bulls that father that trait.But a low weight calf is more profitable given that it is born to mother up to a year younger than usual.(Some cows must be rebred , they don’t always catch.)

Modern farming is about spreadsheets to an extent that surprises most people.

Modern everything is about spreadsheets to an extent that surprises most people. I know this is what is happening behind the scenes at the organic farm that delivers my grass-fed steak at an affordable price, but this sub-thread just gives this non-farm-boy the willies….

More confirmation of Jeffrey Brown’s oil export model:

http://www.bloomberg.com/news/2014-03-25/russia-s-black-sea-oil-flows-declining-as-baltic-cargoes-gain.html

Oil & Gas Journal: Financial questions seen for US shale gas, tight-oil plays

http://www.ogj.com/articles/2014/03/financial-questions-seen-for-us-shale-gas-tight-oil-plays.html

This, Jeffrey’s link above, is quite interesting.

“While most of the companies that have made write-downs are not quitting, many players in this industry have already noted that the revolution is not as technically and financially attractive as they expected,” the analyst writes.

According to the Energy Aspects analysis, total capital expenditure nearly matches total revenue every year, and net cash flow is becoming negative as debt rises. Other financial indicators “add to concerns about the sustainability of the business,” Sandrea says.

Below ground, he says, rapid production declines and low recovery rates, despite technical improvements, remain problems in many plays and might worsen as operators move into increasingly challenging acreage.

Unless financial performances improve, capital markets won’t support the continuous drilling needed to sustain production from unconventional resource plays, Sandrea suggests, asking, “Who can or will want to fund the drilling of millions of acres and hundreds of thousands of wells at an ongoing loss?”

Ron and Jeff,

I think you’re forgetting something: “The oil is there and as long as Capitalism prevails it will come our way.” And, for the record: I don’t know how to add those little yellow faces!

Doug

Pieces of paper are not going to get in the way of preventing starvation.

If societal collapse looms from . . . whatever . . . the government will decree by executive order that in some way profit is achieved. No one in Congress or anywhere else will act to stop such a thing and the Fed will provide whatever money is needed for the trucks to roll.

Rational thought about price and economics ceased to be operative in 2009.

Replying to myself to be more clear.

If companies are leaving LTO because it costs too much, then oil ouput will plummet and it’s VERY likely that this can’t be tolerated in a post Taper economy.

And so it won’t be tolerated. If output falls to 600K bpd, you will have the interesting event of Democrats advocating giving money to oil companies to maintain trucker employment, and perhaps Republicans objecting to it as another manifestation of government corruption of capitalism.

Smiley faces. Just do it the old way, a colon, :, a minus sign, -, and a close one of these thingies, ), I cannot spell it even with my spell checker. 😉 A semicolon gives a winking smiley face. And the program automatically converts it to a yellow smiley face. At least it works for me but I don’t know if this is something that only works for administrators. But it doesn’t matter. Even doing it the old way we know that it is a smiley face.

Hi Doug,

Just a semi colon followed by a right parenthesis or colon followed by a right parenthesis will get you 😉 or 🙂 you need to leave a space on each side of the thing for it to work with no space between the colon or semicolon and parenthesis.

I suppose the cornucopians expect to make it up on volume rather than making a profit per barrel. Sarcasm light ON.

I read a piece on an economics site a few days back about peak oil being nothing to worry about since if all else fails it is possible to manufacture oil out of coal and we have plenty of coal.

And this is actually technically true in both respects- it can be done and we have coal enough to do it for quite some time -if the economy can support the necessary price.

That seems very doubtful to me but on the other hand I am neither an engineer or an accountant and have no knowledge of such matters other than whatever rough estimates I have read.

But it seems the Chinese have built a modern coal to liquids plant or maybe two or three of them so they are evidently of the opinion that if they want enough synthetic liquid fuel to run their economy they better at least have a sound experience based estimate of the cost of manufacturing it.

I will venture a wild axxed guess that if the coal and labor are both cheap the cost of synthetic gasoline and diesel probably aren’t going to be more than twice the cost of the ordinary kind all things considered at this time .

And in a few years- given the likelihood of peak oil- it may be that coal to liquids may be cost competitive if the economy doesn’t collapse first.

Everything depends so much on how fast the price of oil goes up that it is impossible in my opinion to more than guess and speculate about such matters.

But while the cheap oil based western economic model is a doddering old man threatening to wind up in a nursing home anytime or actually keel over dead a developing economy such as China might be able to handle another doubling in the price of oil if given time.

The Chinese government is powerful enough to redirect development into mass transit and energy efficiency in a way that is totally out of the realm of political reality here in the US.

And while those of us trained mostly in finance and business administration and banking and economics may think the collapse of their banking industry will destroy them it won’t- not necessarily.

It just means the people who are supposedly rich right this minute are not actually rich. So far as I can see the Chinese don’t owe much of any consequence to any other country.Not in comparison to their accounts receivables at least!!!!!!

Look at their situation as if they were all in a life boat with plenty of food and water but they get to playing poker and a handful of the people wind up owning all the food and water.

That handful aren’t going to eat and drink it all by any means whatsoever. The rest of the people on the boat may tolerate their having a larger share but over the side they will go once they try to hog it all. Or alternatively, into the cooking pot assuming there is any fuel on board to cook with.

The vast tracts of empty houses in China aren’t going to sit empty forever. Only an idiot could believe in such foolishness. The super inflated prices of those houses will deflate like a childs toy balloon and they will be occupied by people who can then afford to live in them.

Every body who worked on building them in any respect at all got a living out of the building of them in real time in the sense that they had a roof over their head and clothing on their back and food in their belly while the building was happening.

Nobody has actually lost anything except a fortune in markers he could have spent on something else if he had been wiser. But people with fortunes are seldom so foolish as to lose every last dime so that they starve. They are going to wind up older and wiser and still in most cases wealthier than they were when the boom started because most of them at that time had nothing at all beyond the clothes on their back and their skills and work ethic.

They will still have the work ethic and the skills and they will be considerably wiser to boot if not as young as they used to be.

Money ain’t nothing but a marker once you understand the reality of it.

IF you don’t see it look at what Hitler accomplished in well under a decade in a country that was absolutely busted in terms of conventional thinking.Of course what he did accomplish didn’t do either him or anybody else any good but the point is that he did succeed in putting every body to work and increasing production in a way that was believed to be impossible and is still believed to be impossible by most observers.

Ivy League professors are as perfectly capable of ignoring inconvenient facts as backwoods preachers.

Too bad it was mostly war materials and war skills.

But the point is that he did it without much of anything in terms of a finance and banking sector.He did it with real three dimensional tools and raw materials and people.

NOT MONEY.

If the Chinese can double their energy efficiency they can afford coal to liquids. And given time they may be able to pull it off. We can too but it will take us a lot longer because we will not change our ways until circumstances force change on us whereas the Chinese are most likely to be proactive as they deem it necessary.

Assuming they don’t miscalculate.

BUT at least they are calculating.

We aren’t.

From what I can put together, the price point for CTL will be around $150/brl. which will end up forming a cap for all competing forms of energy. Renewables and nuclear have a relatively small window of financial feasibility.

That is ”close enough for government work” to my guess as to it costing twice as much as conventional oil.

Hi Woody,

I have seen much lower estimates (around $70/barrel) for CTL, where did you see the $150/barrel figure? I searched but I couldn’t find such a high estimate anywhere. I assume that is $150/b in 2013$ (a real oil price), is that correct?

DC,

The $150/b is a rough number I put together based on reading multiple reports from government and industry, observations of how existing and planned GTL and CTL plants have done, and watching where industry puts its money.

At $70/b I would think you would already see a lot of CTL plants in countries with coal reserves and balance of payment problems and/or week currencies. Other than South Africa, due to the embargo, you don’t see much going on yet with CTL.

The CTL price point is important in the renewable energy area as it will dictate what types of projects are ultimately cost effective, at least without regulatory interference.

Woody

DC,

The $70/b cost you sight may represent the capital and operating costs of a model syngas conversion plant that doesn’t include the cost of the syngas itself. Whether using coal imported to the plant or syngas from gasifing an in situ coal seem there is a cost for the raw material for the plant.

If there was really a 70/bbl opportunity, would think capacity would go in. I guess there might be worry about prices dropping preventing a huge capital asset being built, but think someone would go ahead…like even a coal company.

I am not sure those empty Chinese cities will ever be filled. Cities need an economy to support them. All the cities in the uk were abandoned when the Romans left. No food, no cities.

Well, the Chinese will live in them temporarily at least.

For what it is worth I expect them to have an empire similar to our own and to be able to project force in their own corner of the world in the same way we do to protect their interests – which will include ownership of millions of acres of prime farm land in many places outside China’s borders. Likewise shares in oil fields and mines of many sorts, oil refineries, hydroelectric plants, etc.

They are buying all these things legally and when the time comes they are going to feel justified in defending that ownership.I doubt if there will be anybody in a position to stop them from doing so.

They will not have a starvation problem within the next few decades unless the climate gets too crazy. They may not be getting as much meat as they want but they have proved in the past that you can live on a bowl of rice and an egg and a little fruit and some local veggies.

They have either already built the worlds most ambitious water systems in terms of moving a lot of water a long way.

And the government is authoritarian in a good way in some respects such as making sure of long term basic needs if for no other reason than that is the best way to assure its own survival.

That should read ” They have already built some of the worlds most …. ” and have more under construction.