Since around 2005 many countries have increased their oil production but more have decreased. But the combined production of the United States and Russia have kept the world on a slight uptrend since that time.

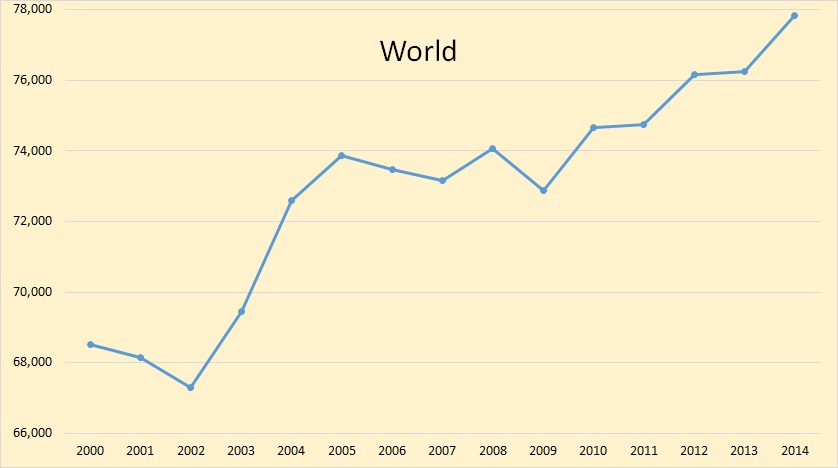

World oil production jumped in 2011, hardly moved at all in 2013 but it was up by more than 1.5 million barrels per day in 2014. And after such a huge gain everyone and their brother were singing “peak oil is dead’. But if you scroll down through the 37 major world oil producers it becomes obvious that a majority of nations have peaked and most of them are in steep decline.

The above chart is EIA data however the next four charts below are JODI data with the last data point February 2015. The data on all charts is thousand barrels per day.

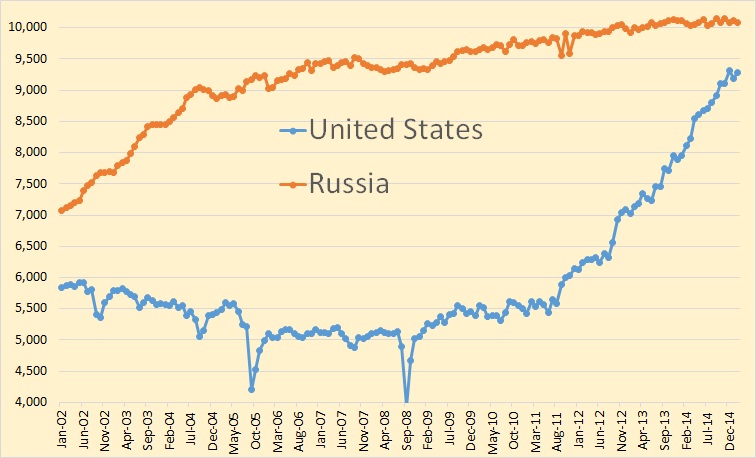

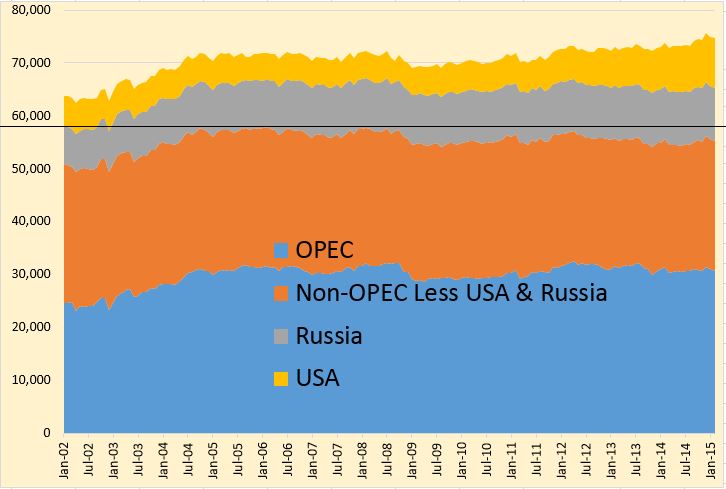

However in the last decade it has been two of the three world’s largest oil producers that have kept us from peak oil, the USA and Russia.

Russia grew like gangbusters in the first six years of this century but has slowed down considerably in the last five years or so while the US, due to the shale revolution, has had four years of dramatic growth.

Using a stacked zero based chart it looks like nothing much has happened since early 2005. And that is correct, the USA and Russia have kept production slightly inching up while the rest of the world slightly declines.

Here we get an amplified view of the World less USA & Russia. The peak was in February 2006 and February 2015 is over 2,600,000 barrels per day below that point.

We have discussed, in several posts, why many of us believe that the USA has peaked, or will peak this year. But what about Russia? Is Russia at her peak also?

I have taken another look at the Global and Russian Energy Outlook to 2040 by two Russian think tanks, The Energy Research Institute of the Russian Academy of Sciences and The Analytical Center for the Government of the Russian Federation that was published last year. I never noticed it before but they actually predict peak oil. On page 35 of this study they say:

Conventional oil (excluding NGL) production will drop to 3.1 billion tonnes by 2040 from the current 3.4 billion tonnes, and the long-discussed ‘conventional oil peak’ will occur in the period from 2015 to 2020. The drop in its extraction will be due to the gradual working-out of reserves of the largest existing fields.

3.4 billion tons per year works out to be 68,000,000 barrels per day and world C+C was about 10 million barrels per day above that number so I don’t know what they are counting, perhaps crude only.

They predict that Russian exports of all petroleum products will peak in 2015. Page 111:

Exports of petroleum products will peak in 2015 and will then gradually decrease until they reach 2010 levels by as early as 2040, mainly due to the decrease in exports of fuel oil and non-marketed petroleum products.

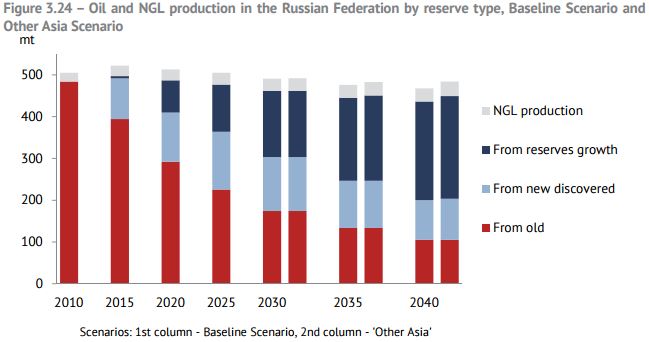

Then on pages 132 and 133 they predict the peak C+C for Russia

In Outlook 2014’s Baseline Scenario, production of oil and gas condensate in the Russian Federation reaches a peak and gradually declines, from 523 million tonnes in 2013 to 522 million tonnes by 2015, after which it continues to decline, right up to the end of the period, to a level of 468 million tonnes. This reduction in production is, for the most part, brought about by the working out of already exploited deposits in the key oil producing regions of the country (in Western Siberia).

They said that Russia peaked in 2013, the year before this document was published, at 10.46 million bpd then decline to 10.44 million bpd by 2015. That is a tiny, almost an imperceptible decline of 20,000 bpd or .2% over two years. They could have said that Russia would plateau in 2013 and remain on that plateau through 2015, which is exactly what has happened… so far anyway.

Here is Russian C+C production through February 2015. It appears now that the peak will be 2014 and 2015 which means that they are at peak right now. The spikes in 2011 were likely caused by the huge Western Siberian wildfires they had that year.

It is interesting to note that both JODI and the EIA reports Russian C+C production at about half a million barrels per day less than what the Russian official web site CDU TEK reports.

Here they have the peak in 2015 but only a slow decline from here on out. Notice that about 60 percent of all Russian oil comes from those very old Western Siberian super giants fields with that percentage declining only very slightly in the future. How can that be? They drilled 8,688 new wells in Russia last year, most of them infill wells in Western Siberia. Do they really expect to poke more holes in those old fields and and continue to get oil from them for another 25 years… or more?

Well yes and no. The chart below shows where they expect all that new oil to come from.

As you can see from the shrinking red column they expect those old fields to decline rather dramatically. But at the same time they expect them to grow. By 2040 they expect fully half of their production to come from “reserves growth”. And they are not bashful in admitting such:

One should point out the significant role that will need to be played by geological exploration during the forecast period, since by 2040 more than 50 per cent of production in all scenarios will need to come from growth in reserves, and final reconnaissance of fields resulting in category C2 reserves becoming category C1.

So those tired old Western Siberian fields will shrink but at the same time they will grow. But in all fairness they will not grow quite as fast as they shrink.

Despite the fall in production in the Baseline Scenario, even at the end of the forecast period the key production capacities of the country will continue to be concentrated in the Tyumen region, with its share accounting for 51 per cent of all crude oil and gas condensate production by 2040 (compared with 61 per cent in 2010).

The Tyumen region, and the areas surrounding it, are the areas in Western Siberia where their oil fields are. So the share of Russian oil production from this region will go from 61% today to 51% in 2040. Because those tired old fields are gonna grow!

Bottom line, USA peaks in 2015 and Russia peaks in 2015 which means the world peaks in 2015. Also many other nations that have increased production over the last few years are also at peak and will be declining soon. And Russia will be declining just a whole lot faster than those two think tanks believe they will. Those old reserves are not going to grow nearly as much as they think they will.

Of course there is a possibility that the peak could actually be in 2014 or even 2016, but I am firmly convinced that we are at peak oil right now. If you have a counter argument I would love to hear it so please post it in the comments below.

I have published a new page, World Oil Yearly Production Charts with annual data charts for all the world’s major oil producers.

_______________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne at gmail.com

”Exports of petroleum products will peak in 2015 and will then gradually decrease until they reach 2010 levels by as early as 2040, mainly due to the decrease in exports of fuel oil and non-marketed petroleum products.”

I can’t quite make sense out of the last portion.

What is (or might be?) an exported non marketed petroleum product?I presume this bit of nonsense is the result of an error in translating the original document from Russian to English.

Otherwise this document has the smell of many I have read over the years involving agricultural issues. It seems to be composed in such a way as to be read by various people in various ways – composed so as to not unduly upset the business as usual apple cart when the general public reads it- but also in such a way that the real message is plain to be seen for eyes that wish to see, eyes that are not afraid to see.

Nobody tells little kids that Mommy and Daddy are going to die and rot. They tell them that someday Mommy and Daddy are going to go to Heaven to live with Grandmas and Grandpas already up there in the clouds, and that the kids themselves will someday do likewise – at some impossibly far distant future time. So the kids are happy and reassured. Any thing more than a year away is unreal to a little kid and anything more than a decade away is unreal to nine hundred and ninety nine adults out of a thousand- until after reaching the age at which their friends and relatives are dropping like flies.

The older one gets, the more he comes to understand the business of reading between the lines of such communications. Powerful Russian officials with intelligent aides at their beck and call will not mistake this report for anything more than a hoped for best case scenario.

There is a folk saying to the effect that a wink is as good as a nod—— which is perfectly true if you are paying attention.

The public in this country does actually in my estimation accept the reality of peak oil in the abstract- and in the concrete too- given the ( mistaken ) caveat that the peak is twenty or thirty or more years down the road – no need to worry about going to die and going to peak oil heaven , plenty of time left to buy TWO or THREE more new six thousand pound beer fetchers.

Put a hundred thousand miles on all three of em!!! Plenty of time to get right with sky daddy in regard to energy sins. !!

We backwoods Baptists joke about getting started sinning on Sunday afternoon and building up to a peak on Saturday night -knowing that we can ( and MUST if one is a believer) get right again on Sunday morning. Serious Baptists plan enjoying life as long as they can and then giving up sin TWO Sundays before their appointment with the undertaker.The second one is just in case – an application of the precautionary principle. 😉

As John Gray has noted, Marx and Hegel, just like Adam Smith, “followed Judaism and Christianity in seeing history as a moral drama whose last act is salvation.”

Morality is not dependent on ‘institution’. It is dependent on the individual.

Kid: “Daddy? Why are there rich people?”

Cae-Dad: “What do you mean by rich? You mean like in spirit?”

Kid: “No-o-o-o-o… Like they have lots of big houses and cars and money!”

Cae-Dad: “Ohhh, you mean those kinds. Well, you see, sweetie, our society allows some people to make more money than other people, working no harder that anyone else. Society then allows those with more money to acquire more land than others. Over time, this creates the dynamic for most, if not all, problems we have in society today, from landlessness, homelessness and poverty, to social unrest, war and civilizational collapse.”

Kid: “Why does society allow that?!”

Cae-Dad: “Corruption. Society uses force to uphold the laws that say that one person with more money can have more land than another with less money.”

Kid: “Why can’t we stop that!?”

Cae-Dad: “Corruption again: This setup is upheld by people with guns and weapons, or access to them, like cops, security guards and military people– people who often don’t understand this basic and very simple immoral core of our society.”

Kid: ” 🙁 ”

Cae-Dad: “Ya; 🙁 “

Morality is not dependent on ‘institution’. It is dependent on the individual.

And just what is it that molds individual behavior?

Two things, heredity and environment. There is nothing else.

A current institution is generally merely a small subset of one’s environment and far easier to transcend than heredity and environment over time.

Environment and heredity generally depend on the laws of physics, rather than the laws of institutional doctrine.

Actually, one thing; environment, which determines heredity. ‘u^

”Actually, one thing; environment, which determines heredity. ‘u^”

In a zen sense this makes just the slightest bit of sense. The river shapes its bed just as the bed shapes the river.

But I have no knowledge of any qualified biologist making such a claim except in this very broadest sense.

Of course the environment of a penguin requires that it have a genome suiting it to its frosty environment. A cow would starve pretty quick , or drown sooner, trying to feed like a penguin – not only does the cow lack the proper body , it also lacks the proper genetically based behaviors.

But generally speaking the claim that environment alone determines everything is bullshit. Heredity suits the organism to the environment but heredity also CHANGES the environment.

Grazing animals change their local environment for instance by (paradoxically to a layman ) promoting the growth of grasses.

Robin: “Cosmic calamity, Batman! It’s an Old farmer mac comment!”

Batman: “Robin, can we just calm down and fight crime without all the drama? Or I won’t take you with me anymore. Sometimes you’re just plain ridiculous… And while I’m at it, why are we wearing our underwear on the outside?”

“In a zen sense this makes just the slightest bit of sense.” ~ Old farmer mac

No, in an Old farmer mac sense this makes just the slightest bit of sense. 😉 <– yellow blob alert!

Actually, one thing; environment, which determines heredity. ‘u^

Caelan, I don’t know what ” ‘u^ ” means. But I hope it was something like a smiley face you were trying to make. Because that has to be a joke. After all even a fifth grader should know that the environment does not determine heredity. That silly crap went out with Lamarck.

I would say in a sense the environment changes what hereditary factors are selected for, and which mutations are favorable

So I do not think it is total nonsense, more just long term musing

And Lamarck is rising, very slightly, with epigenetics, very interesting stuff. There is a book by that name a year or three back that is a fun read

I would say in a sense the environment changes what hereditary factors are selected for, and which mutations are favorable.

The environment can cause different gene expressions but the environment cannot change the genome itself. That is absolutely impossible.

Of course the environment often determines which mutations survive and which do not. But that is nothing but pure natural selection. That is not Lamarckism, that is Darwinism.

Those who think Lamarck is rising simply do not understand natural selection. Learned behavior cannot be inherited.

Ron, seeing as you ratcheted the institution thing to another level, regarding heredity and environment, I thought to click the ratchet yet again it into environment whereby, fundamentally, genes come from it.

LOL, you’re too cute. Yes, a winky face, only turned counter-clockwise from the usual sideways one, in part to avoid the yellow blob that your blog turns the usual ones into. I have been using it and ‘u’ and ^u^ for some time. Of course I could also always use an umlaut: Ü

…How’s your cold by the way?

The environment can cause different gene expressions but the environment cannot change the genome itself. That is absolutely impossible.

Perhaps not the “natural” environment, but reports are that the human genome has already been modified in the lab.

http://rt.com/usa/254965-genetic-modification-human-embryo/

Hopefully they’ll figure out a way to reverse my heterochromatin disorganization.

Kid: Why did the former Soviet Union collapse?

Dad: Because they tried an experiment called communism whereby everyone was paid the same regardless of talent or effort. So, e.g., garbage collectors made the same as physicians and therefore no one wanted to go into the medical profession. Hospitals had huge wards where they had to share needles. It was not good.

Kid “Why did the Soviet Union Collapse?”

Dad ” Because it was a totalitarian state that was controlled by homicidal maniacs.”

Kid “But what about its economic system”

Dad “The homicidal maniacs weren’t very good at economics either”

One famous refugee who manage to escape – leaving his family behind , everything behind , sorry I cannot remember his name famously said

” They pretended to pay us. We pretended to work.” I have zero patience for people who yak about communism and American shortcomings in the same sentence but have never read anything written by people who actually lived under communist governments., or experienced it personally.

Ann Rand had an excellent grasp of the way communism worked in theory and in practice. She did a great job of describing it in the chapter of ” Atlas Shrugged” wherein the workers in the electric motor factory took over and voted in socialism.

They kept increasing the wages and benefits of the lower paid workers ”according to their needs” by means of reducing the pay and benefits of the higher paid skilled workers and management with the end result being all the people who knew how to maintain and run the Twentieth Century Motor Company quit either by choice or necessity, with the company going broke.

Of course the electric motor company story only illustrates the first rotten layer of communist theory.

The rotten core of it is that the people in charge soon position themselves as dictators living very well while the common people suffer.

I find it highly amusing that people who have not read her accuse people who have of being fascists-and accuse her of being fascists.

If fascism means anything at all it means big government being joined at the hip to big business in an extremely foul fashion, with the rich owners and government people running a country as a fiefdom.

That is the exact scenario she put in her book which lead to the collapse of the economy. The real producers were run out of business by the incompetent ones who allied themselves with the government thus getting favorable treatment and subsidies.

For writing a novel that illustrates the evil of fascism she is called a fascist.

Ayn Rand was a psychological deviant who, like all psychopaths, attempted to create a ficticious world and an ideology where her immorality could appear “normal.”

As the Polish psychologist Andrew M. Lobaczewski, who lived 6 years under Nazism and 32 years under Communism, concluded in Political Ponerology:

“It is common,” Lobaczewski adds, for an association or group of psychological deviants to craft

As Lobaczewski goes on to explain, when psychological deviants gain political power (such as Rand’s good buddy, Alan Greenspan),

An absolutely outstanding movie, IMHO, which deals with the obstinancy of human nature is the German film, Napola:

https://www.youtube.com/watch?v=kVL9ZszGhxA

The Gift

“Under capitalism, man exploits man. Under communism, it’s just the opposite.” ~ John Kenneth Galbraith

“What happens when communism comes to the Desert?–

For 70 years, nothing. Then they run out of sand”

The Gift

Russian net exports* have been at or below 7.2 mbpd for seven straight years (2007 to 2013 inclusive, 2014 data not yet available). Based on the 2007 to 2013 rate of decline in their ECI Ratio (ratio of production to consumption), I estimate that Russia has already shipped, through 2013, about one-fifth of their post-2007 CNE (Cumulative Net Exports).

*Total petroleum liquids + other liquids, EIA

No, I wouldn’t call for any peak just yet. News from my buddies out west is the Bakken oil fields are gonna reach record production level in May 2015. Suppose to lower the price at the pump some. All the way up now to $2.79 per at the Valero down the street from me in Enfield, Ct. Still better than last year of course but higher then it needs to be due to all the fleecing and gouging by big oil and big government.

Frank – Regarding “fleecing and gouging” by big oil. What is the price of a hotel room in Las Vegas on New Years eve? What is the price of a beach house in Maine in July? What is the price of a hotel room in Orlando on July 4th. What is the price of a Super Bowl ticket? What is the price of a final four basketball ticket? What was the price of a ring-side ticket last night? What is the price of a World Series game? What was the price of a Kentucky Derby seat at the finish line? What is the price of a ticket within 100 feet of the Indianapolis 500 race finish line?

So – you are right!!!! Everyone price gouges, based upon what “you” want to pay.

Also, higher “than” it needs to be, not higher “then” it needs to be.

Frank would almost for sure gouge the hell out of any customer that comes his way if he happens to be a plumber , mechanic , etc.

But in HIS case he would believe he IS charging a FAIR PRICE.

After all plumbers should be able to drive cars as nice as the cars driven by doctors.

People who make such remarks always believe EVERYBODY is gouging them.

We don’t fleece nor gouge you. We simply charge as much as we can. This generates profits. It’s pretty straightforward.

Yes that is an accurate description. There is a huge gap between what it costs to produce oil and what customers are willing to pay, so there is a lot of play. (Put another way the demand curve levels off at the high end quite a bit.)

Oil companies have certainly been guilty of applying political pressure on governments to ignore the negative externalities of oil consumption. But I think the high prices we saw in recent years (that started when an oilman got himself elected president and started a war against a major oil producing country) were more about panicky traders than some secret cabal oil producers. My guess is that prices fell when traders got numbed to bad news from the Mideast by the Arab Spring.

But as always it’s important to keep in mind there is no single cause for anything in economics.

Mechanical engineers. http://www.imeche.org/knowledge/themes/energy/energy-supply/fossil-energy/when-will-oil-run-out

Economists are predicting that the $200 ceiling will be broached before the end of the year.

I don’t think anybody but Simmons was predicting that…

Back before the price collapse of 2008 I heard all kinds of predictions. A lot of them were in the $200 a barrel range. I thought they might go that high myself. I wuz wrong!

But I learned a valuable lesson. That lesson was that oil prices can only go so high before they start adversely affecting the economy. Then the prices plunge. It happened again just recently. And it will likely happen again.

If oil prices spike they can go a lot higher before they crash. They spiked to $147 a barrel in 2005. But if they go up slowly, or hold a high price for a long time, then they cannot go nearly as high before they crash. $100 to $120 did it last time.

Ron,

For oil price determination, the substitution of oil at high price is also a factor. Ethanol at roughly 2 mb/d is just one factor and came nearly to a standstill in recent years. However the demand for residual fuel oil has been falling precipitously over the last few years. In Europe and North America and even in China demand for residual fuel has been falling by 40% per year – despite rising demand for gasoline, diesel and aviation fuel. Five years ago demand for residual fuel has been almost 15 mb/d – or nearly 20% of the market. Now it is 10 mb/d and in my view it will come out of the market completely over the next five years. This contributed very much to the fall in oil price over the last year. Therefore the oil price will be rising strongly again in a few years, but not over the next two years.

That would make me think the fuel oil is broken and shows up as refinery gain after its hydrogenated?

Ron,

While the oil price crashes of the early 1980s and of 2008 were caused by recessions, which caused demand destruction, the oil price crash of 2014 was different.

Whereas the crashes of the 1980s and 2008 were caused by demand destruction, the oil price crash of 2014 was caused by overproduction.

While the oil price crashes of the early 1980s and of 2008 were caused by recessions,…

Aren’t you getting the cart before the horse? What caused the recessions?

Oil prices were the surely the major cause in 73, 78 and 91, but I would prefer to blame the banks in for the most recent crash.

But as always it’s important to keep in mind there is no single cause for anything in economics.

Ilambiquated says:

I don’t think the human mind works that way. As Tolstoy so eloquently put it in War and Peace, and as a great deal of recent research now confirms that his observation wasn’t too far from the truth:

Oh well, so much for homo economicus and the Enlightenment myth of rational man.

Yes, I agree completely. Humans need narratives.you often here “push chain” arguments: A causes B and B causes C and C causes D therefore A causes D. Makes for a great story, but it’s hard to push a chain.

Well I suppose it depends if one wants to place emphasis on proximate causes or ultimate causes.

Would you agree that the proximate cause of the 1980s recession was Volcker’s monetary policy, the approx. 20% interest rates he implemented?

Would you agree that the proximate cause of the 2008 recession was the popping of a private debt bubble in the West — the private debt bubble in the Anglo/American world and Europe (with the exception of Greece, where the debt bubble was public)?

What were the ultimate causes? What caused the profit crisis for capital in 1979, which in turn caused Volcker to embark on his crusade to destroy inflation in the prices of oil and labor?

What caused the inflaton in the price of oil leading up to 1979? Was the rapid inflation in the price of oil between 1973 and 1981 caused by depletion? Or was it caused by politics, by OPEC (read Saudi Arabia) deciding to curtail supply? What had changed which caused OPEC to have this power, a power which it did not have pre-1970?

What caused the bubble in private debt in the years before 2008? Why was there so much non-productive investment in the Western economies in the years leading up 2008? Why did all the new debt (read money) created in the years before 2008 in the West not result in a concomitant increase in production in the West? In other words, why did it turn out that

?

Hi Ron,

Your argument about oil prices being limited by economic downturns is certainly true in the short to near term of say up to maybe four or five years, maybe somewhat longer.

But I believe that the price of oil certainly can and will approach one fifty or more per barrel in constant money in the longer term- AND that the world will be able to pay this price due to using oil more efficiently.

At one time our primary vehicle on our farm was a full size Ford pickup that seldom got more than ten miles per gallon except it would get twelve on a trip.

Now our primary pickup truck gets in the mid twenties and the car I drive to save gas and wear and tear on the truck gets in the mid thirties.

More efficient vehicles and changing lifestyles will allow us to pay one fifty or more in todays money for oil within a decade or so in my opinion.

This is a very good thing except in the eyes of people who actually WANT the economy to collapse. I personally prefer business as usual to forting up and getting shot at (and eventually hit most likely ) and living on home grown beans and corn bread..

I ‘m getting a little old to be dirt farming with a spade , given that I don’t own a mule or horse or even a donkey.

Now to wander a bit off the topic I am a big fan of Elon Musk and his Tesla cars but I have been reading some horror stories about the cost of repairing one if it is involved in an accident.Some people are claiming you simply cannot get a Tesla fixed except in a Tesla authorized shop and that the price of a very minor parking lot fender ding is ten grand and up. I don’t know if this is true or not.

But at any rate the man and the company are doing a lot in terms of changing the attitude of the public when it comes to electrified automobiles. My great grandparents never thought they would be able to afford tractors and cars when they were young but THEY WUZ WRONG about that. They owned half a dozen or more cars and trucks and two or three tractors over the course of their lives.

Heck, the average European uses 18% as much fuel for personal transportation, which makes $7/gallon (equivalent to $250 oil) entirely affordable. Their cars use 60% as much fuel, and they drive 1/3 as much.

Most Americans live in urban areas that are just as dense as European urban areas. Of course, the US doesn’t have the same mass transit, but we do have hybrids, plug-ins and carpooling (more Americans carpool than use mass transit).

But the entire cultural and physical structure of the US economy, polity and financial system is built upon a requirement for ever-increasing oil consumption.

What will it take to change that cultural and physical structure, and can it be done, or done quickly enough, so as to avoid collapsing the society?

And if the US economic, financial and political order collapses, what will that mean for the rest of the world?

entire cultural and…structure of the US economy, polity and financial system is built upon a requirement for ever-increasing oil consumption.

I’ll grant you that there’s been decades of misinformation that made people think that oil was necessary. That’s not quite the same as a “requirement”.

physical structure of the US economy, polity and financial system is built upon a requirement for ever-increasing oil consumption.

??? EVs can be built in the same factories, drive on the same streets. They start, and turn, and park in the same ways.

They’re sold by the same dealers. I’ll grant you that Tesla is bypassing dealers, and that EV’s low maintenance is a challenger to the business model of dealers, but I think the US will cope with fewer car dealerships.

It has taken 75 years of incessant public relations to instill the car culture and oil culture in the people of the United States.

There’s a great film from the 1939 World’s Fair in NY, created by General Motors, that is instructive in this regard, and shows how the “scientific” methods of mass marketing which were developed in the late 19th and early 20th centuries were used to create the car and oil culutre:

https://www.youtube.com/watch?v=-JFgpxYaeJQ

It’s amazing how much of what the film predicted came true.

The bottom line is that there is so much cultural inertia sustaining the car and petroleum culture that I’m not so sure that it can be turned on a dime.

In addition, all of the infrastructure of the US — suburbs, shopping malls, grocery stores, eight-lane expressways, etc. — was built to accomodate the car and oil culture. How much is it going to replace all that?

Plus the economy and financial system of the United States functions on a model of capitalism which requires never-ending growth. How easy is it going to be to transition to a no-growth economic and financial paradigm?

Car culture isn’t the same as oil culture: EVs work just fine. I sympathize with unhappiness with car culture (I live in a walkable neighborhood, and commute with an electric train), but that’s a separate problem from PO.

The same applies to growth: PO doesn’t mean zero -growth.

“Car culture isn’t the same as oil culture: EVs work just fine.” ~ Nick G

EV’s are part of car culture. Car culture doesn’t work ‘just fine’ at all– ostensibly, a disaster. EV’s in this context therefore don’t work ‘just fine’. Despite this; despite that you don’t own an EV by your own admission hereon (and, if recalled, own a rarely-used regular car); despite that you take the train; and despite that you claim to live in a walkable neighborhood to boot, you continue to want to ‘dump’ EV’s on the rest of us.

The proverbial sleazy car salesman comes to mind.

“I sympathize with unhappiness with car culture…” ~ Nick G

Apparently not enough to abandon the EV PR-sleaze.

“…but that’s a separate problem from PO.” NG

Separate where it’s convenient to be so, like some preaches and practices.

When I talk about the car and oil culture, to my way of thinking they are one and the same. Maybe this song by George Jones will help:

https://www.youtube.com/watch?v=wh5jfvNOwK0

Maybe you were never part of the working or middle class, though, so don’t have any way of understanding how a car becomes part of a man’s ego.

I understand.

Keep in mind: EVs have *better* performance than ICEs. The Tesla 4Wd is the fastest production 4 door sedan on the road.

Have you tried a Chevy Volt in sport mode?

Exactly, Nick G.

Help drive Earth into the ground with the new Chevy Dolt in sport mode. Steal roadkill’s snarl with traffic. It’s sporting.

I’m amazed how around here, some people seem to go into orbit when ‘EV’ is even barely mentioned.

All kinds of bad vibes bounce off the walls, totally out of proportion to the simple facts as I see them.

Sure, I am swimming in the car culture, that’s where I was born and that’s where I am. I don’t like it, and have worked hard to do something about it (urged uber idea decades ago), but still, here I am. I do have a car.

A leaf, an EV, to confess the awful truth. I got it because, despite being bad, bad, bad, it seemed less bad bad than the F150 my good friend bought at the same time.

In my next incarnation, coming soon, I shall construct a better universe, wherein all will be well.

PS, hah, hah. Full disclosure. Just today I went out and bought an old but good F150 for my very hard working soninlaw on accounta he “needed” one for all his farm stuff.

Wimbi, it’s in part about balance and equal time.

As a culture, and as individuals within it, we don’t critically inquire nearly enough about the contexts and consequences in which we do things or advocate doing things. Small, seemingly-inconsequential details, for example, can get pretty big and unwieldy over time, sometimes trapping us.

While some consequences can be supposedly unintended, our often willful negligence where some of them are concerned, makes some cases for unintention terribly flimsy.

It’s amazing how much of what the film predicted came true.

I think what’s amazing is how much of the technology from “Star Trek” that has come true.

Amazon’s “Alexa” functions pretty much the same as the ships computer in the TV series.

http://www.amazon.com/oc/echo/

Hi Glenn,

It will probably require a crisis for things to change. High oil, coal, and natural gas prices will help to spur some of the needed changes but they are also likely to lead to a Great Depression. Hopefully it will become clear to the “man on the street” that fossil fuels are limited and the the rate that they can be produced cannot increase without limit. Once that is understood, things will change, but it will be difficult at best, maybe impossible, but I think not.

The repair cost for any “exotic” six-figure car might be pretty high. If a collision compromises a Tesla S’s “skateboard” vehicle base panel, then a repair might get very tricky, as the battery cells are spread out all through the panel and have thermal cooling circuits. Tesla had problems with road debris bouncing up and puncturing the bottom panel and damaging cells. They ended up retrofitting extra steel plates to reinforce the key areas of the front portion of the panel.

My Chevy Volt was involved in a rear-ender last year. A local body shop made the repair, at “normal” costs and in a reasonable time. With the battery pack configured as a “tee” located in the central core of the vehicle, and reinforced with steel all around, the possibility of the pack being compromised in a non-totalled-level collision are pretty low.

I loaned my car to a friend and she got hit three blocks away driving at 40 km/h. The repair cost shoots up by 4500 € because one single side air bag triggered. I heard they sold three Teslas in Spain, to very rich people. They don’t care about repair bills, I guess.

They don’t care about repair bills, I guess.

I guess they do…

There are no repair bills worth mentioning when talking about a Tesla. If there is a problem Tesla fixes it with a smile at no cost to the customer. Basic maintenance runs about $600.00 a year. Compared to what the average ICE costs in gas alone, that is but a pittance.

“The company [Tesla] reported a net loss for the year [2014] of $294 million, compared with a loss of $74 million in 2013… The company continues to lose money as it builds a market for high-end, all-electric vehicles.” ~ New York Times

this will help them…

http://www.businessinsider.com/tesla-is-officially-in-the-used-car-business-2015-5

Old farmer mac said:

I believe we certainly have to keep that possibility alive.

But the question is: “Can we get there from here?”

And we certainly can’t get there using existing US-style “democratic-capitalism,” which I would argue is neither democratic nor capitalism, at least not capitalism as Adam Smith originally envisioned it.

As the wheels come off of US empire, I’m reminded of what Arthur J. Balfour said of similar time when the wheels were coming off a similar great empire:

No, you weren’t. You were just as lead astray into the use of the wrong kind of value system.

Substitute those 200 dollars to the value generated in the economy. the 147-peak wasn’t that far away. In 2007/8 you got certain smartphones or computers with a certain performance. Look at what you can get now for one and a half barrel. Or remember how much the median worker in a country makes a day to actual paying something (pension funds do not count, they act as a value bumper for public assets in the long run). In Switzerland, that was 200.-/day then and now it is a little bit less, as everywhere. But in the US, wages went waaaay down. The median worker earned then 2 Barrels/day and now probably too. The net effect is much less capital flowing around. The average worker cannot see that with its wallet, but investing companies have trouble as their cash flow or ability to raise capital diminishes. Only those at the fringe of the economy and those not part of societal stuff feel the growing capital needs of the energy sector.

I say if we would look at how many hours it takes to work for a certain amount of oil, coal, gas and agricultural inputs, this is the metric which counts, just like CAPEX was recently put into focus on sites like this.

But $$ are so much more easy to compare, so we take them. At least Dollars are unambiguous to interpret.

I think the reason why postclassical and neoclassical economists settled upon a utility (or price theory) of value, despite all its glaring empirical and logical defects, is because, as Robert L. Heilbroner noted in The Problem of Value in the Constitution of Economic Thought, they “were seeking a less subversive approach to value” than the theories of value formulated by Smith, Ricardo or Marx.

As Heilbroner goes on to note, postclassical and neoclassical economists prefer the utility or price theory of value “because it avoids troublesome considerations of class conflict and cooperation as the fundamental problem of social order, and puts in their place a view of social order as the outcome of individuals contending for pleasure or avoiding pain in an environment of scarcity.”

Hi Glenn,

That is one explanation for a subjective theory of value. The other is that any object can be chosen for an objective theory of value.

We could just as easily have a capital theory of value as a labor theory of value, or we could use steel, cement, bananas.

One only needs to apply a little linear algebra as Piero Sraffa showed, and there are an infinite number of objective theory of Values one could choose. As this is a peak oil blog, the obvious choice is oil or energy as our “source” of value.

This would be no more correct than a labor theory of value or any other objective theory of value.

There’s a great deal of epistemological and ontological anxiety concerning objective theories of value. And unfortunately many of the peak oil tribe cling to instrumental rationality and materialism as if they were a life raft in turbulent waters.

But, as Amitai Etzioni wrote in The Moral Dimension, the fact is that “the position Smith took in Moral Sentiments is not easily reconcilable with the one he took in The Wealth of Nations.”

So in order to solve “Das Smith Problem,” the postclassical and neoclassical economists chose to believe what they wanted to believe of Smith’s writings, accepting whatever justified their policies and convictions, and material interests, and ignorning the rest.

And just look at the hatchet job the objectivists have done on Marx! It’s all part of the drive to put us in that “iron cage” which Max Weber warned of which “imprisons the human spirit and cuts us off from the deepest sources of our being.”

As Susan Neiman explains:

Wittgenstein also blasted objectivism, charging it is not a narrow technical assumpton; it is a world view, a mentality deeply entrenched in our culture that, if left unchecked, shapes itself into the iron cage that Weber so rightly feared imprisons the heart and soul of our civilization.

But, as Daniel Yankelovich laments:

Hi Glenn,

Interesting stuff, my daughter loves Wittgenstein, I am not that familiar with his work. Both objective and subjective positions can be carried too far. For a theory of value as it is done in neoclassical economics a subjective theory of value makes more sense to me. Though there are endless problems with how prices are determined (who is that auctioneer?), how the system moves from one equilibrium to another, and the influence marketing has on consumer preferences (just to name a couple).

From a philosophical perspective, it seems some blend of the subjective and objective makes the most sense. Theory influences how we perceive the world, and our experience and observations in turn influence our understanding or theories of how the world works. A bit of a chicken-egg problem at least in my view (I am no philosopher.)

I think some blend of subjective and objective makes the most sense too. Man may not live by bread alone, but he sure to heck can’t live without bread.

Smith, Ricardo and Marx rejected the utility theory of value because, amongst other reasons, of what is known as the paradox of value (also known as the diamond–water paradox), which is the apparent contradiction that, although water is on the whole more useful, in terms of survival, than diamonds, diamonds command a higher price in the market.

This becomes very important when, for instance, we examine the reasons why people are so hell bent on buying a private automobile, or why they value a sleek, fast and sexy new BMW over a car that will get them from point A to point B in the cheapest, most efficient way possible. One only has to look at the vast amounts of money which people spend on cars to see there’s a lot of the diamond effect going on here, with use value occupying second chair.

And to top it off, marketers know their potential customers. They go to great effort to research people’s buttons, what gets their juices flowing, and to punch those buttons.

Can marketers make riding the subway to work as sexy as driving one’s own flashy, new BMW? Something tells me that is going to be a hard sell with most people.

Trains have chauffeurs – the ultimate luxury!

Would rejecting mind – body dualism suggest rejecting an objective/subjective split as well?

The shift from cars to public transportation is happening among younger singles. They may end up buying cars again when they have kids to transport, but when it is just them and they have convenient access to public transportation (or Uber, for those with more money), they find that they don’t have to bother with parking, insurance, car maintenance, and so on.

Freedom, in some circles, is living without a car, not living with one.

Cellphones have given many people a preferable option for keeping in touch than actually getting in a vehicle and visiting people.

I just read this. It isn’t about cars, but it is about someone choosing to live minimally.

I follow all of that very closely. I have downsized myself considerably and am always looking for ideas about to do even more of it.

I secretly lived in my office for 500 days – Salon.com

Ron Wrote:

“If oil prices spike they can go a lot higher before they crash. They spiked to $147 a barrel in 2005. ”

I think you mean 2008 not 2005. It peak in July 2008.

FWIW: I doubt Oil can spike that high again. 2008 was the peak of the housing\credit bubble. It was much easier for people to borrow back in 2008 than it is today or will be for sometime. My guess is that the global economy can’t tolerate a spike above $125 for anything more than a few weeks before tumbling the economy. That would put a floor on how expensive oil can be drilled. I suspect that the Big Oil firms know this and that is the primary reason why they cut Cap Ex and are no longer drilling for long term, expensive oil projects.

However, monthly Brent prices were only over $100 for six months in 2008, whereas starting in February, 2011, monthly Brent prices were over $100 for 42 months, seven times longer than the six month $100 period in 2008.

And the annual Brent price in 2008 was $97, versus an average Brent price of $110 for 2011 to 2013 inclusive.

That’s a pretty good argument that the 2008 recession was not caused by oil prices: recent oil prices, as a practical matter, have been much higher in the last several years and the economy has not crashed.

Oil hit $147 in 2008, but we didn’t pay the equivalent of $147 at the pump.

Oil also has its largest daily moves in history in July 2008. It spiked and crashed so quickly that the price point of $147 is, in terms of lending valuable economic info, useless.

Jeffrey Brown details why, so I won’t go into it, but just say that average price matters far more than the blip of a one day record.

Brian Wrote:

“Oil also has its largest daily moves in history in July 2008. It spiked and crashed so quickly that the price point of $147 is, in terms of lending valuable economic info, useless.”

Well, July 2008 is when the credit markets started to dry up. In Aug 2008, Subprime began to collapse, and by Sept, Lehman folded, and the price of Oil collapsed with it. By Jan 2009, it bottomed at about $30 bbl. If you recall, a lot of people had open home equity loans (home ATM) which permitted a lot of people to spend money that they didn’t really have. If a large number of people have access to easy credit they will spend it. Recall that lots of people bought SUVs and other large vehicles.

Jeff Wrote:

“hereas starting in February, 2011, monthly Brent prices were over $100 for 42 months, seven times longer than the six month $100 period in 2008.”

Yes, this is why I doubt the economy can tolerate prices above $125 for an extended period. If it could than they economy would have recovered and permitted more drilling and higher prices. Which means that we will “likely” never see Oil projects with break even in the $115 or higher range. Thus putting a limit on ultimate recovery of Oil.

SawDust wrote:

“Don’t be a bit surprised if oil goes above $150 and stays there. Bad economy or not. Currently we are over drilling into a oil glut. We get to a point where we are drilling all we can but into a supply shortage, an ever increasing supply shortage at that. Those who can’t afford $150 will just be priced out of the use of oil. Oil will only be available to those that can afford it.”

I would be very surprised! Perhaps only 10% to 20% of the global population of the industrialized world has incomes that can afford expensive oil. First the poorest will lose out, and so will millions of jobs losses (as whatever disposable income they have vanishes) . The top income earners rely on the bottom 90% of the population to consume to keep thier jobs. Once the economy collapse so will demand. Oil prices will fall to meet demand. I don’t see in any scenerio that prices can remain statically high (excluding high/hyper inflation).

Sawdust Wrote:

“Only reason why oil isn’t +$100 right now is we got too much supply.”

much more likely: too little demand. US GDP growth vanished in late 2014 and continues, China Manufacturing is falling, and Europe is in a permanent recession, and primed for another crisis when Greece defaults (leading to other defaults in the EU)

FWIW: I had expected Oil prices to sig-saz from demand-destruction cycles. As prices rises, the will breach a tipping point that causes the economy to collapse. Oil prices undershoot and make a slow recovery until the next tipping point is breached.

That said, I see lots of instability in the industrialized world. Lots of people are unemployed or underemployed due to the weak economy. Perhaps as soon as the next major economic crisis, I think riots & revolts will become much more abundant. Leading to revolutions that overthrown gov’ts and more regional\civil wars. Even in the US riots are become more common (last week’s in Baltimore for example). When people are no longer willing to tolerate the status-quo they will rebel by rioting or igniting rebellion to overthrown the existing gov’t.

TechGuy said:

This is a perfect example of where, for those in love with theory, that theory trumps factual reality and where the difference between history and specuation — of what has already happend and predictions about what might happen in the future — ceases to exist. (Thank you Kant and all the Fichteans who followed Fichte’s lead.)

Just to set the factual, historical record straight, here is what has already happened:

http://www.api.org/~/media/oil-and-natural-gas-images/gasoline/whatsup-hi-res/world-liquid-fuel-consumption.jpg

Don’t be a bit surprised if oil goes above $150 and stays there. Bad economy or not. Currently we are over drilling into a oil glut. We get to a point where we are drilling all we can but into a supply shortage, an ever increasing supply shortage at that. Those who can’t afford $150 will just be priced out of the use of oil. Oil will only be available to those that can afford it. Demand will fall as those who can’t afford it don’t buy it. But price will probably remain high as the supply is limited and those who can afford it will buy what supply is available. I don’t think demand destruction due to high price will necessarily equate to lower price oil as in the past.

Only reason why oil isn’t +$100 right now is we got too much supply. The oversupply is about 1mbpd or so. Not a huge amount of over supply. Watch what happens to price when we become 1mbpd short and we stay that way for about a year.

Steven Kopits’ (January, 2015) outlook (Prienga):

“Affordability” is the wrong way to frame the discussion. The important thing is that there are better and cheaper alternatives.

Oil just isn’t worth $150 for most applications.

The breakeven point for EVs is about $60: at $150, only fools will continue to buy “gassers” where there’s an EV that will do what they need. There are large categories of the “light vehicle” market where good EVs don’t yet exist, but that’s changing fast. In the meantime, most people really can use a hybrid or a plug-in for most of what they need.

Hi Nick,

It is true that people can use hybrids or just small cars that get good gas mileage, only the Chevy Volt is a very useful plug-in, the range on a Prius plug in is too short to make a big difference (about 11 miles I believe), so the plug-in option is pretty limited. I have refused to drive Chevys (or GM cars in general) since owning a Chevy Chevette when I was younger, by far the worst car I have ever owned. Next car was a Toyota Tercel I got used at 60k and drove until it hit 250k, have owned Toyotas and Hondas since.

A lot of people are turned off by the short range of EVs, so more plug-in options would be nice.

Yep, honda and toyota all the way, but now I have a leaf and am delighted with it. Have a big yellow sign on it:

“RUNS ON THE SUN FOR NOTHING”

Which is somewhat true, ignoring the modest up front cost of the PV.

Also, on the range thing. No problem, almost always the range is plenty, and when it isn’t we can whistle up the honda from the granddaughter and off we go. She likes the leaf better, so is eager to make the trade.

That’s why I keep saying that when the word gets around, EV’s will really take off.

Also, I noticed on Robert Rapier’s blog that the leaf is 25 times as reliable as average, whatever that can mean.

I think there will be a lot of choices.

For instance, I think Ford has two plug-in hybrids.

Hi Nick,

Again I had a bad experience with a Ford as well, my Dad’s car. Coming back to an earlier comment about $60/b for a break even to switch to EVs, you are underestimating the convenience factor of being able to get a 400 mile recharge in 10 minutes when using liquid fuel.

There was not a very big move to EVs when oil prices were over $105/b for three years (2011 to 2014) using twelve month trailing averages of Brent crude. So my guess is that even $125/b may not get the job done, I think we will need to see $150 to $200/b before there is a significant move to EVs, trains, light rail, buses, bikes, blades, car-pooling, walking, and denser living.

Also you have mentioned that in Europe they are paying prices at the pump equivalent to $220/b oil in the US, but there has been very little move to EVs in Europe, though they have far better public transportation.

We really need to get to work on that in the densly populated areas of the US (Boston to Washington) and Southern California and maybe the Bay Area, maybe Chicago and a few other midwestern cities.

I think we will need to see $150 to $200/b before there is a significant move to EVs, trains, light rail, buses, bikes, blades, car-pooling, walking, and denser living

That’s why the “coolness” of a Tesla is important. For as long as we have had cars, they have been sold as something more than just utilitarian transportation. They are sold to make a statement.

I don’t have an EV. I have an 18 year old car that I try not to drive much. When it no longer runs and if I have to get something, it could be an EV, it could be a hybrid, or it could be a subcompact. It definitely won’t be another V6, which I have now. If/when I get another car, it’s got to be one more fuel efficient than what I have now, both for economics and out of concern for the environment.

At any rate, people will make the switch to EVs when driving a big car/truck makes you look as outdated as our grandparents looked when they hung on to their massive Caddies and Pontiacs. Big gas guzzlers will go out the same way polyester leisure suits did. Big trucks and big cars will become “old people” vehicles.

bad experience with a Ford

Yeah, me too. Well, Volkswagen has a plug-in. Heck, almost every car maker has or will have one soon.

underestimating the convenience factor of being able to get a 400 mile recharge in 10 minutes

Wimbi will tell you that’s mostly FUD. Still, a plug-in hybrid will take care of that problem: a plug-in can reduce fuel consumption by 90% – enough for ethanol to cover the rest.

There was not a very big move to EVs when oil prices were over $105/b for three years

It takes longer than that, especially when Fox News and talk radio are trashing them. It takes a while for a variety of models to be available; it takes a while for someone to know someone who has one; it takes a while for silly stories about battery fires to go away; it takes a while for batteries to prove themselves.

For instance, some taxi companies took 6-7 years to evaluate hybrids – now you can’t pry hybrids from their cold, dead hands. UPS and Fedex are still doing trials and pilots. Commercial truck hybrids are still in prototype mode.

there has been very little move to EVs in Europe

That’s happening now. Up till now there’s simply been relatively little need, given how little fuel the average European uses for personal transportation. See Fernando’s comment just below, from Spain.

public transportation. We really need to get to work on that in the densly populated areas of the US

Absolutely. But, that will take a very long time. In the meantime, we can eliminate oil for personal transportation with EVs.

I see Toyota hybrids here, Prius, Yaris, and a larger model I can’t remember. We don’t have any pollution problems, and they don’t save money, but they are “cool”.

You’ve agreed that CO2 is a problem.

In the US, EVs are the cheapest thing on the roads, and hybrids are the next cheapest. What data makes you think they don’t save money in Spain?

SAWDUST said:

To suggest that oil prices have collapsed due to overproduction, and not demand destruction, is a heresy amongst the more doctrinaire elements of the peakoil tribe.

Nonsense. It is not either / or.

Overproduction can cause price collapse. High prices can cause demand destruction leading to price collapse. Both are always at play in the supply – demand oil pricing scenario.

There is no such thing as a peak oil tribe. There are only people who are aware that oil is a finite resource and will soon peak and decline. Then there are those who are aware that oil is a finite resource but deny peak oil is anywhere in sight. Some of this group even say we have hundreds of years wort of oil left. (The abiotic oil fools are such a tiny few that they don’t even count.)

Then there is the third group who make up perhaps 99% of the population, those who have absolutely no idea what the debate is all about and couldn’t care less.

“demand destruction” is an odd phrase. It suggests sacrifice, and a loss of value to the consumer. It suggests poverty.

If I choose a more efficient car, have I “destroyed” demand? Or just gotten smarter and better off?

Ron Patterson said:

Try telling that to the more doctrinaire elements of the peak oil tribe.

Try telling them that there has been no diminishment in global oil demand during the past four years, much less in the last 12 months.

As evidence to substantiate my claim, I would point you towards Gail Tverberg’s latest post and, especially, the comment thread on her blog, Our Finite World:

Gail in China: In Her Own Words and Pictures

We have overproduced right into peak oil. Part of being at the peak is we have as much of a supply as we have ever had and as much of a supply as we will ever get at the same time.

Somebody please post a chart showing me where demand destruction is taking place. Exactly who is using less? We been down this route and demand is steady or growing despite all the negative economic news we see everyday. Demand destruction hasn’t taking place yet. Until i see that the US is using a 1 million or 2 million bpd less than we did YoY. There is no case for demand destruction.

Last time i checked demand has been on a plateau for about 15 years regardless of where price has been during this time. At least here in the US.

Hi Sawdust,

The fact that demand has grown more slowly than before is evidence of demand destruction. If at lower oil prices an increase of 3% in GDP led to a 1% increase in quantity of oil consumed and at higher oil prices the same 3% increase in GDP leads to a 0.5% increase in the amount of oil consumed, then that 0.5% lower consumption is the demand destruction due to higher prices.

The effect of higher oil prices is relatively small, but there is an effect. Likewise we should see an economic boost due to lower oil prices, but that effect is also very small. The fall in prices is mostly due to an excess growth in supply relative to the growth in consumption.

Ron’s contention that it is a bit of both is likely correct, but in this case the larger effect seems to be a relatively fast growth in supply, demand growth did not change all that much. There was an excess supply of about 2 Mb/d in 2014 using EIA output data(93 Mb/d) and OPEC demand data(91 Mb/d). OPEC has a lower estimate for total liquids than the EIA for 2014 (92 Mb/d) with an excess supply of 1 Mb/d, which would suggest an increase in stocks of 365 Mb in 2014.

So for 2014 we are talking about oversupply driving prices down.

Basically true, but economies are what Nassim Nicholas Taleb calls antifragile. Each time you injure an economy, you make it stronger.

It’s a bit like body building. As Arnold Schwarzenegger put it, if it doesn’t hurt, you are doing it wrong. Weightlifting damages the muscles. They react by getting stronger. To injure them again, you have to use bigger weights.

We’ve seen several rounds of intense pain inflicting by oil price spikes since 1970. some countries have reacted quickly, others — especially those with a strong oil producer lobby — haven’t.

Meanwhile technology has improved across the board. The next price spike might look a little different.

Basically true, but economies are what Nassim Nicholas Taleb calls antifragile. Each time you injure an economy, you make it stronger.

That is an interesting thought, though I suspect that Taleb would disagree. Perhaps there are a few economies around that world that might fall into that category but I think most current economies at best might be considered temporarily robust. I think that most economies today are still trapped in a growth paradigm mentality. When growth is no longer physically possible they will crash.

Unlike Taleb’s example of using airliner crashes as examples of systems that are antifragile because we always learn from these crashes and make planes and safety procedures better, in the case of a crashed economy we can at best try to follow a new paradigm but the old growth based system can not fly again.

The US, and Western European economies haven’t been physically growing for about 40 years: home building, steel, cars, appliances, TV, oil consumption….all flat for a long time.

Our growth is non-physical. Manufacturing with improved quality & features, faster, etc., and services: healthcare, communications, entertainment, software, etc.

Drama aside, the economy hasn’t really crashed recently. Rich countries dipped into slight shrinkage for a year or so in the recent crisis, but I don’t think the world economic growth ever fell much under 3% since WWII. Maybe for a year or two. Overall growth has steadily increased since the end of the Cold War.

The countries where growth is occurring has shifted considerably. I think this leads people who grew up in places where growth was high in the 50s and 60s to see things worse than they are.

Hi Ilambiquated,

World GDP growth depends on how you measure it. If we choose the Purchasing Power Parity(PPP) method for GDP growth, you are correct that there have been very few years since 1960 where World GDP (PPP) has been less than 3%.

Rune Likvern has questioned if PPP is the best method for measuring GDP and a did some quick research on this and he is correct that there is some controversy in economics on this point. Some economists argue that market exchange rates should be used because there are many problems with the PPP measure of GDP.

I have noticed that at the IMF they tend to focus on the PPP measure of GDP in their World Outlook reports, it is the measure that is used for GDP in most of the tables in the report. The World Bank seems to use market exchange rates in their database, over the 1990 to 2013 period GDP growth in nominal US $ at market exchange rates was 5.4% on average. Using average US inflation rates over this period (as the measure is in US $) of 2.54% (using US BLS CPI data), the average World real GDP growth at market exchange rates was 2.86% over the 1990 to 2013 period.

Perhaps any economists could comment on whether market exchange rate or PPP is the better measure for determining world GDP growth.

This article is a classic example of confusing proven reserves with URR.

John is talking about this article: WHEN WILL OIL RUN OUT?. And they make a bold statement:

By 2040, production levels may be down to 15 million barrels per day – around 20% of what we currently consume. It is likely by then that the world’s population will be twice as large, and more of it industrialised (and therefore oil dependent).

I don’t think they are confusing proven reserves with URR. I think they are confusing stated proven reserves with actual proven reserves. Which would make the above statement a little optimistic.

I’d say that’s just a casually written, badly researched article. For instance, no one is predicting that by 2040 that the world’s population will be twice as large.

Hi Ron,

Even using the relatively pessimistic estimates of oil resources (2700 Gb of C+C including oil sands at 500 Gb). Output is unlikely to fall to 15 Mb/d by 2040.

Jean Laherrere estimates output at about 40 Mb/d in 2040. Add the XH curve in black to the C+C-XH curve for about 18 Gb/year in 2040 or about 40 Mb/d.

Chart below from Jean Laherrere at link below(page 6):

http://aspofrance.viabloga.com/files/JL_veryshort30May2013.pdf

Chart won’t post so link to chart is below:

https://drive.google.com/file/d/0B4nArV09d398RlZ6eGNCczV0eXM/view?usp=sharing

Note that it looks like over 167 kB files won’t post. Looking at recent charts I have posted it looks like up to 60 kB is ok, I haven’t figured the exact limit, but it is between 60 and 160 kB. If people report the file sizes that didn’t post we can figure this out.

EDIT: I tried reducing the file size to 121 kB, chart still will not post. Also 98 kB in JPEG doesn’t seem to work.

So I have narrowed the range from 60 kB to 98 kB.

Test to see if smaller image fits. Jean Laherrere scenario from above.

gif 37 kB.

Also tried an 81 kB jpeg, same problem too big.

A 69 kB jpeg also did not work, so somewhere between 60 and 70 kB seems to be the file size limit for images.

A 69 kB jpeg also did not work, so somewhere between 60 and 70 kB seems to be the file size limit for images.

Peak graph? 🙂

-Lloyd

Even using the relatively pessimistic estimates of oil resources (2700 Gb of C+C including oil sands at 500 Gb). Output is unlikely to fall to 15 Mb/d by 2040.

I agree. I was just stating that if they had not confused stated reserves with actual reserves then they would have had an even more pessimistic prediction, even taking into account that their current prediction is wildly pessimistic.

I take anyone’s estimate of 2040 oil production with a huge pinch of salt. No one knows what kind of international chaos we may have in the next 25 years so therefore any 2040 prediction is likely to be miles off.

How much of this world production will be available on the export market in 2040? Isn’t this the more important question?

Hi Ed,

That depends on the growth in demand in exporting countries, you are welcome to make that estimate, it requires even more assumptions than I have already made.

Ron is correct that we do not know what things will look like in 2040, or even 2016, in fact.

Ron,

IF some of the following occur then I think the can may be kicked down the road for a little longer.

1. Sanctions against Iran are removed

2. The oil companies finally get their act together in Kazakhstan

3. ISIS is brought under control and Iraq starts a steady increase in production

4. Libya stabilises

5. LTO from countries outside the USA begins. No one forecast the US growth in LTO. Given the cost reductions that US CEOs say that they will be able to make in LTO in the USA it opens the possibility that other countries may be able to produce in volume given a sufficiently high oil price

What you say just goes to show that even the future of conventional oil depends to some extent on geopolitics.

And as far as “the cost reduction that US CEOs say that they will be able to make in LTO in the USA,” if history is any guide to the future I think I would take these claims with a rather large grain of salt. US CEOs have a history of significantly inflating the EURs of shale oil and gas wells.

And while there are undoubtedly some improvements in technology, there are also a limited number of sweet spots on which highly prolific shale wells can be drilled.

Rollo, maybe I should back up that charge against “what US CEOs say” with a bit of history, so you won’t think I’m firing blanks.

The first major shale play was the Barnett Shale, which is located mostly to the north of Dallas and Fort Worth, Texas. Drilling in earnest in the play began in 2000, with drilling activity peaking in 2008.

Operators in the play became incensed in 2013 when the Bureau of Economic Geology at the University of Texas published a study which projected the average EUR from Barnett Shale wells would be only 1.44 billion cubic feet.

An article which appeared in the Fort Worth Star-Telegram at the time (and which I will attach below since it is no longer available on the web) is key to understanding the sort of highly inflated EURs which US CEOs throw around.

As Jim Fuquay, the author of the article explains, the 1.44 bcf figure “is well below many industry estimates of at least 2 billion cubic feet (bcf) of gas and as much as 3 bcf per well.”

Fuquay noted that industry insiders claimed that “While shale wells are known for having production fall rapidly in early years, operators say it also levels out for years or even decades.”

“Indeed, that projected lifespan is one cause of differing estimates on EUR among the various researchers and producers,” Fuquay adds.

“Most producing lives are 40 to 60 years,” said Gregg Jacob, Devon Energy’s business unit manager for the Barnett Shale, Fuquay reports. “That’s one of the reasons Devon expects its 4,800-plus Barnett Shale wells to produce the equivalent of nearly 3 billion feet of gas, natural gas liquids and oil over their lives, he said.”

Fuquay goes on to add that

Fuquay concludes his article as follows:

So now, with the benefit of four more years of production history, how is the the University of Texas forecast turning out?

Below is a graph of the original forecast, and I have penciled on top of it the actual production history for the past four years — 2011, 2012, 2013 and 2014 — from the Texas Railroad Commission’s Barnett Shale Report.

http://i.imgur.com/p682Q4g.jpg

What the graph shows is that production in 2011 and 2012 was higher than the UT study had predicted. But for the last two years decline has not leveled off as the UT study concluded, much less what industry insiders claimed. In 2014 and 2013 y-o-y decline was about 9%.

If this trend continues, then the EURs will be substantially less than what the UT study predicted, not to mention those of the US CEOs.

Here’s the article in the Fort Worth Star-Telegram:

Page 1:

http://i.imgur.com/9sYN3BB.jpg

Page 2:

http://i.imgur.com/3PcM4OX.jpg

Page 3:

http://i.imgur.com/ZNrTbiR.jpg

Page 4:

http://i.imgur.com/mZzO4PN.jpg

Some very good info. You might consider putting it together as a guest post.

What prices did the forecasts assume? Is it reasonable to exclude the effect of very low prices due to Marcellus production?

The decline rate has to be given time to reach the quasi steady state. Physically, it’s impossible for decline rates to be zero. The ability to produce wells at the low gas rate/low decline rate period will depend on liquid loading. Liquid loading is caused simply the amount of water and condensate the well produces, the well design, temperatures, and the production method. This is a really key issue but I don’t see much being discussed.

I take it that some wells produce very clean gas that needs little treatment to be marketable but it seems obvious that even with very high prices there must be a lower limit at which a gas well is simply a money loser.

How low can gas production go in a well before it is simply not worth the trouble of maintaining the production at say a price of five bucks per thousand ?

I know stripper wells can be produced down to less than a barrel a day sometimes when oil prices are up in the hundred buck range. My impression is that the operator turns the pump on and off in such a well , running it only a few hours a week as needed as the oil trickles into the well bore.

OFM

Although your question is directed to gas wells nearing the end of their productive life, a conference call this week by one of the pipeline companies in the Marcellus may show how current economics are affecting gas producers right now.

Apparently Cabot – one of the big Marcellus E&P guys – is going to ‘constrain’ (choke back) production from producing wells,with an industry wide total on the order of 500MMcfd, which is a lot of gas. It would seem that unhedged production is not viable economically.

In a somewhat related vein, the plans to continue to drill and fracture – albeit at a slowing pace – would signal the need to honor (or lose) existing lease agreements. That would be in sync with several forums for PA mineral rights groups whose contributors are saying the ‘time’ – frequently 5 years – is approaching with no retention/producing wells on their properties.

The vast scale in acreage in the Marcellus (much larger than the Bak and EF) is squeezing the operators up there along with the low pricing.

Mac, it depends on the liquid ratio. Gas wells always produce water. If the reservoir is very cold, the gas is mostly methane, and there is no water drive the produced water is negligible. Such a well reaches a limit when the pressure is so low the OPEX to operate the well, the gas compressor and other equipment at the surface exceed the gas revenue.

But a more typical well produces water, and a small amount of condensate. So, either the pressure drops and the gas/liquid mixture can’t reach the surface, or the liquid ratio increases because water enters the well in excessive quantities.

We can get around the problem by pumping the well, using gas lift, soap injection (the soap foams the mix and the foam reaches the surface), changing the completion, and other methods, but it costs money.

I can’t say what’s the lower limit in the USA at say $8 per thousand cubic feet. I’ve worked in overseas areas, offshore, and those wells reached a limit at 2 million cubic feet of gas per day. But those wells have to earn a living carrying platform OPEX. And when the crew flies in by helicopter it sure costs a lot more.

This is one reason why the tight zone fracked wells have such different resource estimates. There’s uncertainty regarding the tail length.

Don’t forget that on average world oil production from all currently wells is decling at 2%/yr, possibly more. At 2%, that is 1.9 Mb/d/yr. that has to be made up before production can increase. Iran and Kazakhstan may just help offset the decline. I’m in Ron’s camp to the extent that it is closer than most observers realize.

A few years ago, ExxonMobil put the decline rate from existing wells worldwide at 4%/year to 6%/year. I’m guessing the 6%/year is more realistic, and probably conservative, given the combination of higher decline rates from smaller conventional fields and from tight/shale plays in the US. In any case, at 6%/year, in round numbers we need about 5 mbpd of new C+C production per year (or a new Saudi Arabia every two years), just to maintain current global C+C production.

http://www.globaltimes.cn/content/898998.shtml

Rollo wrote:

“IF some of the following occur then I think the can may be kicked down the road for a little longer.”

Perhaps not much longer. Lifting sanctions will probably allow Iran to increase production by 1 to 2 mbpd. I very much doubt ISIS/Libya/Yemen, etc problems will go away. They are much likely to get worse. The bottom line, is that there are simply too many young people, that have there entire education based upon a single religion. LTO only works at much more expensive oil, and it does solve a pending shortage with diesel. At best If Air travel was eliminated, it would probably free up about ~10 mbpd for other stuff. That would buy the economy some time, but it airtravel will only disappear after another big oil spike, which will also crush the global economy.

The issue I see, is the world may have a very difficult time handling another financial meltdown. In the West employment is already high, and too may idle hands leads to riot, revolutions and wars.

By the time those events you list start increasing production in a significant way they’ll be needed to plug the decline gap elsewhere.

Well it looks like Russia might have a little bit of umf left.

From an article in the Wall Street Journal:

This is consistent with what the IEA is reporting:

The United States and Saudi Arabia may have thrown down the gauntlet in the geopolitical and geofinancial struggle between the US-aligned powers and the BRICS, but Russia has certainly not demured and has risen to the challenge.

I don’t think there’s any doubt that conventional oil (read “expensive” oil) has peaked.

But there’s lots of expensive oil scattered around the globe, such as Argentina’s impressive shale oil and gas reserves, as well as Venezuela’s massive oil reserves in the Orinoco Basin.

And it is clarion that, in the ongoing geopolitical and geofinancial contest currenty playing out between Russia and China on the one hand, and on the other hand the US and its allies, that everyone involved considers those oil and gas assets to be worth fighting for.

Can or will these fields be developed fast enough to counter the depletion of conventional fields?

Much, of course, depends on what happens in the future on the geopolitical and geofinancial fronts.

Someone is going to get that Venezuelan oil, as it is the last large chunk that has a EROEI that makes sense in this diminished world.