The EIA has apparently stopped publishing its International Energy Statistics. Instead they are now publishing an abbreviated version on their Total Energy web page titled: Tabel 11.1b World Crude Oil Production. Here they publish crude + condensate production numbers for Persian Gulf Nations, Selected Non-OPEC Countries, Total Non-OPEC and World. The “Selected Non-OPEC Producers are Canada, China, Egypt, Mexico, Norway, Russia, United Kingdom and the United States. They have just released their latest data through February 2016.

All the data below is in thousand barrels per day and through February 2016 unless otherwise noted.

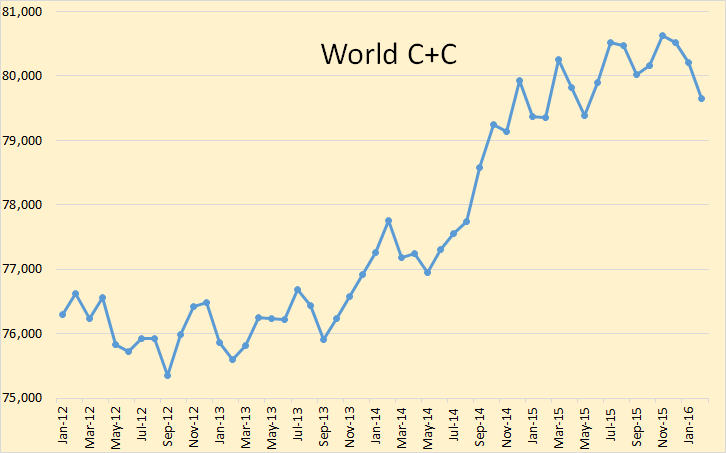

They have world C+C peaking, so far, in November 2015 at 80,630,000 bpd. February production was 79,653,000 bpd, or 977,000 bpd below the peak. World C+C production, they say, averaged 80,035,000 in 2015. Average for the first two months of 2016 was 79,933.000 or 102,000 bpd below the average for 2015.

So with world production continuing to decline, there is little doubt that 2016 production will be well below 2015 production.