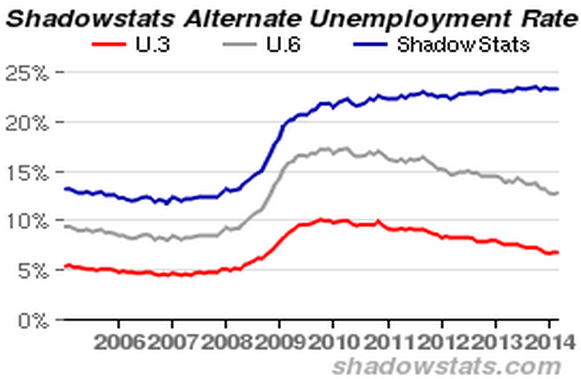

There has been considerable debate lately on what effect the supply and price of oil is having on the economy. It is, to my mind, a lot more serious than the vast majority of economists believe. In fact one can just look at what is happening today to see the effect of a constrained oil supply and high oil prices. Just look at the unemployment rate:

Real unemployment is double what it was in 2007. And it is creeping higher.

If you have not watched Oil Supply and Demand Forecasting with Steven Kopits then you have missed the best and most informative video that has come along since this whole debate started over a decade ago. I have just finished watching it for the third time. This time I made notes.

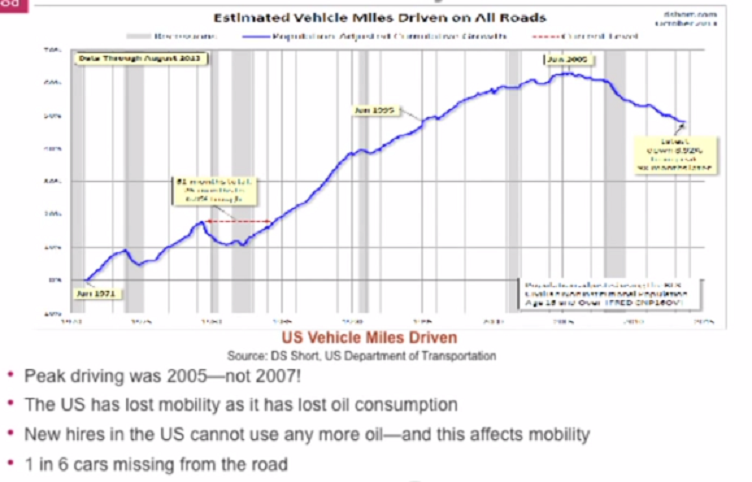

Kopits makes it very clear that oil is a binding constraint on economic growth. Of course that is obvious to most of us but you would be surprised at how many economists deny this. But for starters a few charts from Kopits video:

This is a direct result of the high price of oil.

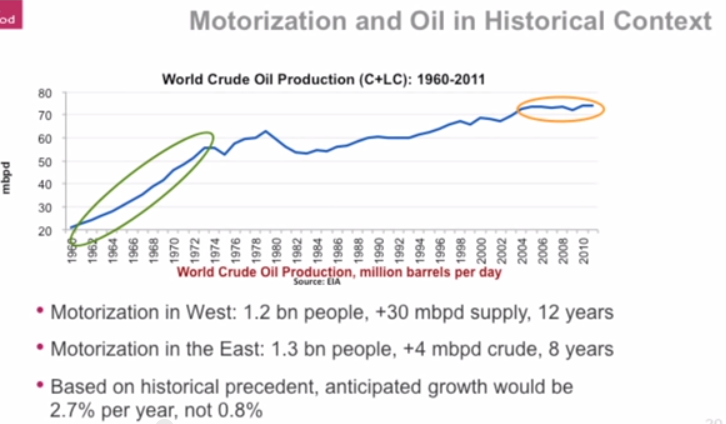

And the difference between the motorization of the West and the Motorization of the East.

The obvious reason for the difference was supply constraint. The oil was just not there therefore the supply could not grow.

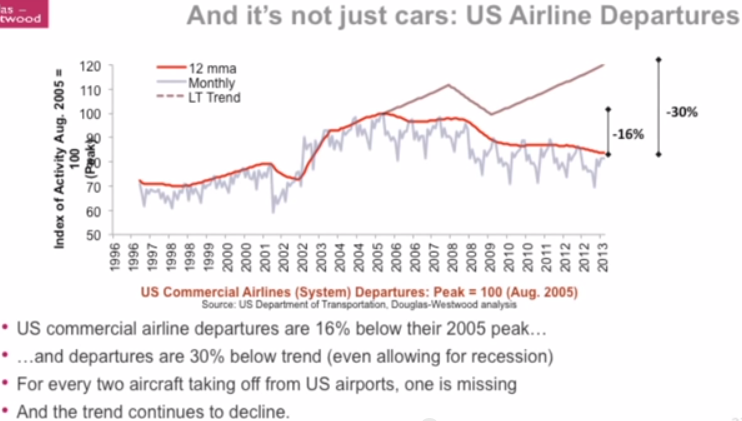

Air transportation was affected by supply constraint even more than road transportation.

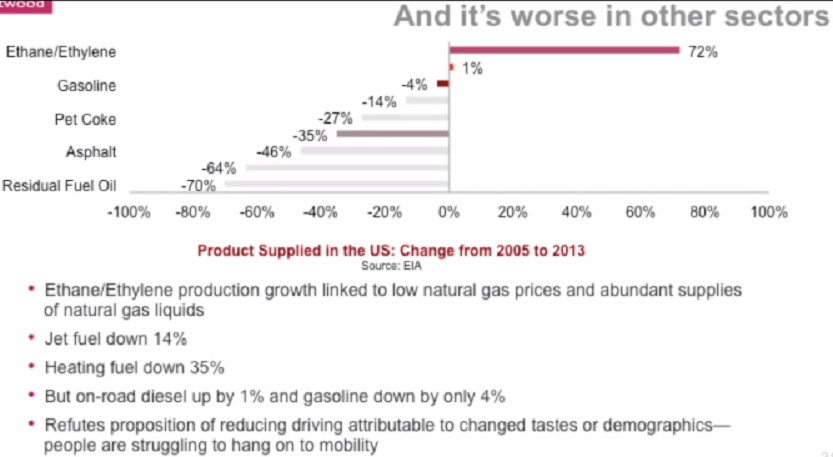

But we are hanging on as best we can to our mobility while cutting more drastically in other areas.

People are switching to natural gas where they can but hanging on to their driving habits as best they can.

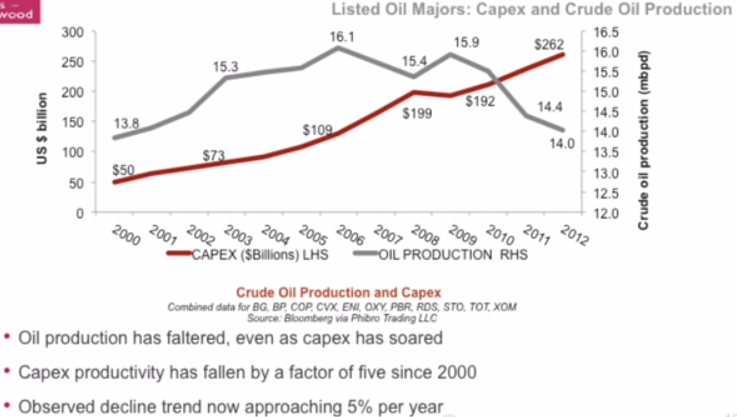

And it’t going to get a lot worse. Kopits: “Oil company profits have lagged because costs are rising faster than revenues. E&P capex per barrel has been rising by nearly 11% per year. Brent prices have been largely flat. A number of projects have consequently been deferred, cancelled or return for re-evaluation.”

I must add here, what is happening to the majors is also happening to the national oil companies as far as new oil is concerned. Their old giant fields will continue to pump oil at a few bucks a barrel but new exploration and drilling cost are rising just as fast for them as it is for the majors. For instance Aramco boosts drilling in seismically tough Red Sea.

Aramco is seeking reserves in anticipation of global economic growth and increasing demand for oil. The Red Sea is two kilometres deep in places with a 7,000-foot thick salt sequence which can distort seismic images, according to the magazine.

Just looking for the oil will cost them billions, and many more billions to produce it if they find any, which is a very big if.

Kopits: “In a demand constrained model: Price = Marginal Cost.

In a supply constrained model this is not the case. The price increases to a point where the marginal consumer would rather do with less than pay more. They will not recognize your marginal cost. If your cost continues to rise your consumer will not recognize it.”

Understand he is talking about the marginal consumer here. Every consumer has a price limit. If you are in the top 10% income bracket then your marginal price is very high. But for the masses there is a limit.

Kopits: “Oil majors are very slow to understand what is happening because they don’t use supply constrained forecasting. So that’s made them inherently optimistic. They say ‘Oh prices will rise’. But they are not rising. They don’t know why they are not rising. But now they are in a position saying ‘Oh we must sell something because our investors want dividends’.

Conclusions:

Demand-constrained models dominate thinking about oil and demand, supply, prices and their effect on the economy.

The data have not supported these models in recent years; the data do fit a supply-constrained model.

A supply-constrained approach will not be applicable if China falters, US short term latent demand is sated, and oil supply growth is robust.

For a supply-constrained model to be valid, oil must be holding back GDP growth as an implicit element of model construct.

If the supply-constrained approach is right, then GDP growth depends intrinsically on increasing oil production.

Without such increases, OECD GDP growth will continue to lag indefinitely, with a long-term GDP growth rate in the 1-2% range entirely plausable, and indeed, likely.

In turn, if this is true, then current national budget deficit levels and debt levels will prove unsustainable, and a second round of material and lasting adjustment will be necessary.

Okay then, just how high can prices go in 2013 dollars before the marginal consumers start to cut back on their consumption. This of course would not only halt the price rise but also be felt in other sectors of the economy. Well I would say we are at that point right now. In fact we are always pushing on that point. Every time prices rise a little some consumers cut back, and their cutting back affects other sectors of the economy.

But of course if the supply were to start dropping by say one or two percent per year, or higher, then prices would of course go higher. But the economy would suffer the consequences. And those consequences could be a killer.

Ron,

Great post. Glad you condensed Kopits work including the additional graphs. This supply constrained model best describes the situation we are currently experiencing. Only gets worse from here on out.

Lastly, the collapse of the Petro-Dollar will more than likely increase the percentage of those American Marginal Buyers who can’t afford high priced oil. The slow demise of the Petro-Dollar is taking place currently, but I imagine it will pick up speed in the next several years.

steve

People require energy to keep on living, we must have it. If there is a reduction in the amount of energy available, some will starve. The growth of the human population must co-relate to the growth of coal and oil production, as peak energy occurs soon after will be peak people.

I do believe that energy is the true capital.

Going like Old Ari.

Here in South East Wisconsin, one can start the Winter with heat and not pay for it all Winter long, but it all comes to an end on April 15th.

From The JT: Disconnections begin today for customers behind on their heating bills

As of Tuesday, about 5,000 to 6,000 customers were behind on their bills and had made no arrangements with the utility, We Energies spokesman Brian Manthey said. The utility does not track numbers by county.

We Energies has about 1.1 million electric and about 1 million gas customers, Manthey said, and many are customers for both. “The number of customers is similar, but the amount they owe is up, by maybe 10 to 15 percent” because of the extremely cold, long winter, he said.

Given the especially rough and collapsing economy in South East Wisconsin, the effect will be multiplied many times as those who can’t pay are forced to make difficult choices. Part of this is why property values are collapsing, and the difference between assessed value, for taxation purposes, versus market value, what you can sell the property for, and becoming widely divergent. Also, lots of small businesses in the City are closing – they couldn’t pay their energy bills this Winter, and their customer base had no money to shop.

Further, these financially wiped out people will have damaged credit. That limits credit expansion and their ability to get a job. And how does WE Energies make up for the loss? It must be placed on the backs of those who can pay, which further stresses the system, increases the costs, and the debt death spiral signal grows faster.

Then, people without hope and $$$ , when or if they do get into legal trouble, become yet another cost for Society. Wisconsin has a HUGE Prison Industry. How will those future promised retirements and benefits be paid, when Wisconsin has made every one a “criminal” and unemployable? This is why I believe that Societal collapse will come very, and unexpectedly quickly. The Shark fin model.

Fascinating perspective. People are going to be hurt, there’s no way around that. It starts with a few but eventually the pain spreads and then what? If next winter is anything close to this winter, there’s going to be huge problems because the NG storage is likely to lower as the heating season begins.

Looks like it’s the beginning of the end of large-scale centralized government and that it is far more vulnerable to oil issues than some realize– except maybe gov’t, itself, hence the phony ‘delusion’.

JH Kunstler keeps saying that he voted for Obama twice, and yet at the same time harps ceaselessly about gov’t delusion. I doubt it is anything of the sort. I am also unsurprised by news out of Ukraine.

As for predictions, I see much more global anti-gov’t sentiment (as it continues cutting services to stem decreases in the black blood flow through the arteries and so forth), which may leak into all other forms of gov’t, too, such as local. Sentiment has its own momentum, and when some are mad, they can take it out on others.

A ‘pension’ may very well come to mean more like having the adult kids back at home, and/or an anethesiologist/surgeon who knows a bit about wild medicinals for a friendly neighbor. And maybe some gold and a garden around the house…

Ron, or anyone in the know; how should one inquire about one’s junior gold mine shares of a company that was apparently bought by another and maybe another after that? Would the shares still be valid after about ~25 years?

Nah.

The BLS has agenda. Shadowstats has no budget.

Both unreliable.

Just who the hell is BLS? That acronym appears nowhere else on this post or in any other comments… so far. If you are going to use acronyms that do not appear in the post or anywhere else please tell us who they are. But I don’t give one flying fart if they do have an agenda. I have an agenda, does that mean that I am unreliable? I also have no budget. Does that also mean that I am unreliable?

You make no sensible argument whatsoever. In fact you do not make any attempt at an argument. You just claim that if a person has an agenda, or that they have no budget, then they are unreliable.

I personally know hundreds of people with an agenda that are very reliable. Of course also know just as many people with an agenda that are unreliable. Bottom line, having an agenda has absolutely nothing to do with whether they are reliable or not?

Ditto for having no budget. How on earth can the amount of money in your budget have an effect on your reliability. Saying they are unreliable is just not enough. You must back up that claim with some kind of logical argument. You posited no argument whatsoever.

Surely Watcher, you can see the fallacies in your line of reasoning. Try to do better next time.

Bureau of Labor Statistics

Watcher,

Perhaps you would be so kind to point to a site with reliable statistics, that would surely be a welcome addition to the debate.

Ron,

Nice post. Thanks!

There aren’t any.

The rationale is BLS has its agenda that transcends party to report numbers favorable to . . . whoever is allocating budget that year. Lots and lots of discussion on their site about this. They are self aware, and there is always justification for choices made in sampling (y’all did know it’s just 1 week of a given month?) but the choices always result in improvement of the reported data.

The agenda is systemic.

John Williams has no budget. He is a bit more famous for his CPI alternates, but his alternative U numbers have attracted attention now, too. As for his CPI alternates, he has no budget to take samples. He makes a choice of alternate methodology and the taps in to raw BLS or Commerce data and tweaks them according to his design. Pretty shaky.

“The BLS has agenda. Shadowstats has no budget.Both unreliable.”

Its likely that neither (BLS or Shadowstats) is correct, but considering the cratering Labor force participation rates, its probably not too far off from Shadowstats estimates.

Ron Wrote:

“You just claim that if a person has an agenda, or that they have no budget, then they are unreliable.”

The BLS does have an agenda, which is to promote data that backs up gov’t claims that incumbents use to get re-elected. Shadowstats does not have the manpower or resources to produce accurate information. John Williams too often makes claims that hyper-inflation is around the corner which reduces his creditability. John would better serve the public but simply providing reports and data and perhaps future models instead of making predictions (in my opinion).

There is a lot of evidence that the BLS “manufactures” its data. consider that it constantly revise its data as the current released data always provides rosier data. If you look at the data corrections the BLS produces its always much worse then the original release. The BLS also constantly adjusts their Birth-death model and since the corrections are always for very old data its simply ignored.

I think if someone can find some data on Social Security receipts it would provide a realistic employment figures. I found these which show declines since 2008 but it they are not current:

http://www.justfacts.com/images/taxes/social_insurance_taxes-full.png

http://taxprof.typepad.com/.a/6a00d8341c4eab53ef0167616ec7ba970b-500wi

I don’t think using Gov’t revenues is a good measure as they have started increasing taxes, adding fees and charging more for gov’t land leases.

Ron Wrote:

“But there has been very little automation of American jobs in the last twenty years or so. What has destroyed far more jobs than anything else has been outsourcing of jobs to China, India, Bangladesh, and a few other places”

I can provide some basic examples of automation in the US: The Internet and Print. The Internet has decimated print (newspapers, magazines, etc) as well as advertising. The Internet has also change consumer commerce as a large number of consumers choose to shop on-line instead of going to the mall or other brick and mortar stores. US manufacturing is also leaning very heavy on automation as machine automation removes large number of humans from the process. Software automation is about to replace many office jobs as new software tools are becoming intelligent enough to displace human workers. In the past 7 years Call center automation software has probably reduced the number of call center personnel by 10 %to 25%.

If jobs were never outsourced to China and India, there still would be fewer manufacturing jobs. Jobs are moving to China and India because: Few or no environmental regulations and dirt cheap labor is below the costs of automation machines. That said, the rising costs of moving goods across the pacific and inflation in Asia, is causing US business to rethink Outsourcing to Asia. Right now some manufacture out of China to Mexico:

http://www.usatoday.com/story/news/world/2013/03/18/manufacturing-mexico-china/1997883/

Of course one can make the strong argument for the increased effort for automation as a means to cut costs as profit margins get squeezed because of rising energy prices. Pre-2008 businesses used to send out roving armies of salesmen to pitch their products. They used to fly on planes to rack up tens of thousand of air-miles. Now most sales meetings are done using WebEx\Goto Meeting or other remote conferencing tools (at least in my personal experience). Web conferencing tools is also another software tool that lead to fewer jobs, as a single salesman working out of the home-office can probably handle at least twice the number of sales calls of traveling salesman.

“If jobs were never outsourced to China and India, there still would be fewer manufacturing jobs. ”

That’s pretty much the story. You can get really controversial by saying it’s the low IQ jobs being erased. That’s 1/2 the population (by definition IQ 100 is the half way point).

The 45 yr old ladies that used to collect tolls at that San Fran bridge lost their jobs when barcode scanners scanned bumpers of cars that were going to use the bridge. 45 year old toll collectors do not then go back to software engineering school to get the “new jobs”. They go on benefits. For life.

And . . . they don’t drive to work anymore consuming oil.

I’m gonna offer up rebuttal and then shoot it down.

A lot of internet work is now done and is part of GDP. The automation of work has destroyed jobs for about half the population so many of those don’t have to drive to a job. This, decline in miles driven do not have to derive from oil scarcity.

But in counter rebuttal, stuff does have to move, even if people do not, and that burns oil. The Baltic Dry Index has been in freefall for a long time.

The automation of work has destroyed jobs for about half the population so many of those don’t have to drive to a job.

Automation did destroy a lot of jobs a few years ago. But there has been very little automation of American jobs in the last twenty years or so. What has destroyed far more jobs than anything else has been outsourcing of jobs to China, India, Bangladesh, and a few other places. Every time I call support for some electronic piece of equipment I have I get to talk to an Indian.

This, decline in miles driven do not have to derive from oil scarcity.

Nothing is all or nothing. No, not all lost jobs are the result of oil scarcity. But a huge amount of jobs, not lost to outsourcing, are the result of the high price of oil. And it is not just the loss of jobs, it is the never getting of a job after college or high school. If you do not own a car then you cannot get to a job you might get if you could afford one.

Don’t wanna be provocative, but the high price of oil generated a lot of jobs.

Don’t know if anyone has computed a net.

“Don’t wanna be provocative, but the high price of oil generated a lot of jobs.”

I highly doubt you can back that assertion up with any reliable data! So until you can and actually show us the numbers I’ll consider that to be pure provocation.

Apparently you either have an agenda or don’t have a budget. Perhaps both!

And just to throw this out there, what exactly do you think is the main underlying cause of social unrest across the globe as exemplified by what is happening in the BRICS, hint, it isn’t a massive increase in job opportunities brought about by the high price of oil! Either put up or stop pulling things out of thin air…

Dood, you really need me to post a North Dakota employment link?

Watcher,

High oil prices are good for all oil producing areas/regions like North Dakota, where shale oil has generated many good paying jobs and brought high employment.

Based upon your logic high oil prices should thus be good for all economic activity.

Turns out it does not work like that in the real world,

http://www.zerohedge.com/news/2014-04-20/gas-prices-hit-13-month-highs-prompt-macro-concerns

This, decline in miles driven do not have to derive from oil scarcity.

Could it be an affordability issue?

A lot of internet work is now done and is part of GDP.

So what explains the steep decline in US petroleum consumption starting in the midst of last decade?

Any links to studies that proves that the growth in internet work (tele commuting) accelerated the decline in US petroleum consumption as of the midst of last decade?

Re affordability, the theory would be scarcity pops price.

As for links, I am a link. I probably read it somewhere, which doesn’t make it true, though not for memory reasons . . . one hopes.

Re affordability, the theory would be scarcity pops price.

Does said theory say anything about growing prices forcing demand down which then becomes an affordability issue for a growing number of consumers.

Petroleum products are by many in the western world considered a necessity.

I am a link

Point is that what you present may be your opinion and does not offer anyone any chance of independently checking out what you present.

Ya, I’ll post a link if it’s handy. Otherwise, I can be ignored.

Oddly, maybe consumption goes up with price. re: Bakken trucks. They wouldn’t be rolling if price didn’t justify drilling.

“Oddly, maybe consumption goes up with price. re: Bakken trucks. They wouldn’t be rolling if price didn’t justify drilling.”

Exactly, the trucks in Bakken are rolling as they are part of profitable activities.

Are all consumers employed by Bakken activities?

Oddly, maybe consumption goes up with price. re: Bakken trucks. They wouldn’t be rolling if price didn’t justify drilling.

I am troubled that I did not see a smiley face by that comment. What percentage of the 76,000,000 barrels per day do Bakken trucks consume?

I actually laid that out a few Ronposts ago for a single well to take a first step at EROEI.

It ain’t much. I think it was 600 barrels for the year.

The shadowstats data is not good, the bureau of labor statistics is much better.

Some of the reduction in miles driven may be due to higher prices, so the Sunday drive for something to pass the time is substituted by reading a book. Kids passing the time by driving around in their cars is substituted by kids chatting online or playing online games. The baby boomers are getting older and older people drive less. And as Watcher suggested, some jobs can be done from home.

Online meeting software has made business travel less necessary and higher airfare has reduced the numbers of people who can afford air travel. Also older people (baby boom) find air travel difficult and there are a greater number of older Americans. Note that Kopits shows that older americans buy cars, the point is that they do not drive very much so VMT(vehicle miles travelled) decreases when there is a greater percentage of older drivers.

Stuff still has to move, but a lot more of the long haul freight is being moved by rail which is much more fuel efficient.

Baltic Dry Index doesn’t profile rail. Still in freefall.

The Shadowstats guy raised good points. He’s one guy so he doesn’t have staff to moderate him.

The one thing that raised my eyebrows the most about what he pointed out was that when the past and current BLS chief honchos were interviewed they VERY AGGRESSIVELY defended their organization against . . . and accusation that was never made.

They said things like — our culture at BLS is so pure there is No Possible Way any political party influence could ever be allowed to change what we report.

That was never accused. The point was systemic, not partisan at all.

From Copits:

“Oil majors are very slow to understand what is happening because they don’t use supply constrained forecasting. So that’s made them inherently optimistic. They say ‘Oh prices will rise’. But they are not rising. They don’t know why they are not rising.”

That’s because supply and demand graphed, cross at a pressure price point in which greater price reduces demand. That point of intersection like you say Ron is not for the top 10% income producers but for the general public, a homogenized threshold reflecting what 100% of the people in the economy can handle at a given flow rate.

All these years of the ascent in oil production we were under the pressure price point, but now we have hit that ceiling, incentive for exploration is falling off and not far behind will be the descent from peak. This dynamic is why many think in terms of a shark’s fin descent rather than catabolic.

Saw a rumor floating that he got fired when that vid got popular. Anyone know?

No he did not get fired, he did get laid off. I think they closed the New York office for economic reasons. I saw something from him the other day however and he has a new job. I did not save the link though.

Good.

The conventional assumption is the oil sector costs will continue to rise … and the other sectors will carry on as if nothing at all is happening. Unfortunately, when oil is constrained, the other sectors are adversely affected, customers cannot repay loans or borrow (same thing) and the amount of available credit is diminished. This turns around to adversely affects the drillers who are unable to borrow from their customers’ lenders. The customers fail, the drillers follow and soon enough there is no more oil.

Everything is tied together, all look to go down with the sinking ship. The bankrupting process is underway right now, the ability of customers to afford petroleum is diminishing fast, under everyone’s noses. Today’s price = an oil shock! Soon enough, the price needed by drillers will be the price that torpedoes the waste-based economy … then it is game over.

People also don’t understand … petroleum that is unavailable b/c it is unaffordable is permanently off limits. Shortages do not allow petroleum customers to become richer.

Several oil companies have announced reduced CAPEX (CAPtial EXpenditures) for the near term and several are heavily loaded with debt that was assumed in a bid to bring more expensive oil to the market. The reality is that some of the discoveries requires a higher oil price to meet companies’ requirements for return.

Some of the companies have deferred their exploration programs in the Arctic.

A recurring theme is CAPEX reduction, increase of dividends and defer (volumetric) production targets.

So we will soon find out (as in start to experience) what is now being baked into the cake.

http://www.reuters.com/article/2014/04/19/russia-northkorea-debt-idUSL6N0NB09S20140419

It is hard to say exactly what is on Mr Putin’s mind and what it is he wishes to accomplish but it seems clear enough that he does not want to depend on the West for customers and that he has intentions of selling to Asian customers to the extent he can.

One thing is for sure. You can bet he has an excellent intelligence staff and that he is uncommonly intelligent personally.It takes more than just luck and connections go get where he is.

Such a man is not easily fooled or distracted by fools with academic credentials but no common sense or knowledge of the physical sciences.

I take it as a given that he understands that all the government and business debt that the world is drowning in is not going to be repaid except maybe in severely depreciated (INFLATED) money and that he is not interested in accepting a lot of dollars or pounds if he can avoid doing so. If he does he will exchange them for hard goods in short order.

The Asian countries aren’t yet saddled with the sort of debts we have here – I ‘m talking about pensions and old age health care and so forth in particular.

Furthermore they are in a position to provide the Russians with anything we can from cargo ships to nuclear reactors to automobiles. Most people don’t seem to realize it but the Russians are excellent engineers and perfectly capable of building just about anything for themselves from trucks to spaceships but they don’t yet have the capacity to manufacture consumer goods as fast as they can consume them.

Money is a very handy thing when trade gets complicated and lots of different suppliers are involved but in the case of let us say the Russians and the South Koreans no money is really needed. The Koreans will take oil and the Russians will take Korean industrial and consumer goods.

The sweetest part of such deals from Putin’s point of view is that the Asian countries are not squeamish the way we are about a few little military adventures or bribes..So Putin will have his trading partners and in the same move be able to poke a stick in the eyes of the US and the western European countries.

It won’t be easy building a pipeline thru North Korea but Putin may very well do it. This would suit the North Koreans in that they can thumb their nose at the west and get a little oil to boot out of the deal.

My estimate is that the odds of the western countries doing anything really significant about the annexation of Crimea are slim indeed.

We aren’t going to put any troops on the ground where a fire fight could escalate into a nuclear war and even if we did we might very well find out as the Germans did that the Russians are not easily pushed around especially in their own backyard.

They aren’t any better than we are at winning a fight when they don’t know who the enemy is but if they get into fight with NATO they enemy will be perfectly obvious.

We may have somewhat of a technological edge but they are ” there fustest with the mostest” and that is a generally an overwhelming advantage in and of itself.

I have a book around here someplace by an American general who was intimately acquainted with Russian military equipment before he retired and his evaluation of their tanks for instance was ” they can do everything you want a tank to do.”

A Russian soldier said this about the whole thing. ” Germans are funny fellows,coming to conquer Stalingrad in shiny leather boots. They thought it would be a joyride.”

The reason this works is North Korea pays its bills now. They ship coal for oil, and don’t burn much of either.

FYI S. Korea has one of the biggest LNG terminals in the world in Inchon.

Ron, great post! I’ll post some additional graphs below.

Dennis, thanks for posting the new charts under Ron’s previous post. I’m moving the discussion here so that you can see it.

It appears that our exercises have the following differences:

When using log linear regression, my exercise shows that oil spending relative to world GDP would keep rising (given the assumptions) and your exercise shows that oil spending as % of world GDP would first rise and then tend to decline.

Our log linear regression results are different. My exercise shows that an increase in real oil price by 1% would cause a decline in oil intensity by 0.19%. Your exercise shows that an increase in real oil price by 1% would cause a decline in oil intensity by 0.37%.

Part of the differences may be caused by I used 3-year trailing averages and you used 3-year centered averages. Say, for the data point 2010, I used average real oil prices in 2008, 2009, and 2010 and you used average real oil prices in 2009, 2010, and 2011. Here is a question, if the purpose is to explain oil intensity in 2010, then it seems real oil price in 2011 should not be among those variables that help to explain the behavior in 2010.

In any case, let’s consider how the oil spending share is determined:

Oil Spending as % of GDP = Oil Spending / GDP = Oil Consumption * Oil Price / GDP

= (Oil Consumption / GDP) * Oil Price = Oil Price * Oil intensity

Thus,

The Growth Rate of Oil Spending as % of GDP

= The Growth Rate of Oil Price + The Growth Rate of Oil Intensity

Both you and I assumed postive growth rates of real oil prices in the future. Thus, so long as real oil price grows more rapidly than oil intensity declines, oil spending as % of GDP should have positive growth rates. That is, it should tend to rise.

Despite differences in our regression results, both of our regressions produce results that imply the elasticity of oil intensity relative to real oil price is less than one. That is, for 1% increase in real oil price, oil intensity will fall by less than 1%. Thus, given these regression results, rising real oil prices should always lead to rising oil spending as % of GDP.

But in your exercise, oil spending relative to GDP only rises to a certain level and then decline. I wonder what other variable or assumption in your exercise is accounting for the decline of oil spending share.

The above is for Dennis Coyne

In my scenario, prices rise at a faster rate than GDP rises.

So lets say real oil prices rise by 10% per year, but GDP rises by 2.5% per year and oil intensity decreases by 0.4 % for a 1 % rise in real oil price. Under that scenario oil intensity would be decreasing (-4%) faster than GNP is rising (2.5%). I agree on the trailing prices, though one could argue with efficient markets that businesses have perfect knowledge of next years prices. Personally I think such arguments are silly (I would pick up that $100 bill, if we came across it.)

I am going to redo the analysis using World bank data, BP prices and so forth (and trailing 3 year avg prices). I will post a link to the spreadsheet when it is complete.

Note that I am changing the rate of increase in price over time (it is not fixed in my analysis). I assume as oil spending gets above 5.5% of GDP, GDP growth slows to 2%, and that as peak oil arrives (over the 2020 to 2030 period) real oil prices tend to rise more quickly, eventually oil spending gets back to 5% of GDP or less and I assume real GDP growth picks up to 3% and that the rate of increase in prices moderates to 4%.

More on this later when the analysis is complete. Also of interest would be to compare US, Italy and Germany to the World.

Thank, Dennis. I look forward to that.

I notice that in your explanation, real oil price is stilling growing more rapidly than oil intensity declines (I get the part your oil consumption is falling).

So long as real oil price grows more rapidly than oil intensity declines, it’s a mathematical intensity that oil spending as % of GDP has to rise. So I am still wondering why your oil spending as % of GDP falls after it reaches 5.5%. In other words, in your model, after oil spending hits 5% of GDP, do you assume that oil intensity falls much faster than 4% (or your assumed pace of real oil price growth)? And if yes, what’s the reasoning behind it?

I think I see what may be confounding me.

You assume because we have a log-linear relationship between oil intensity and real oil price level (trailing 3 year average), that the % decline rate in oil intensity should remain constant at some fixed percentage.

This will only be true if prices increase at a linear rate.

In my model I assume prices increase by 6% per year (or even 7 %) which is an exponential rate of increase in price.

Under those conditions (a fixed percentage rise in prices) the rate of decrease in oil intensity (the absolute value of said decrease) will become larger because each year the step up in price will be larger due to the exponential nature of the price increase.

This is the reason that the % rate of decrease in oil intensity gets larger over time, the rate is not fixed due to the exponential increase in the real oil price.

Dennis, thanks for the reply. I still find myself in disagreement with you. I understand you’re talking about exponential growth of real oil price. But given the statistically observed relationship between real oil price and oil intensity (under the log linear assumption), I still cannot see how oil intensity can decline more rapidly than real oil price rises.

I wonder if you’ve mistakenly applied the decline rate intended for oil intensity to oil consumption.

I’ll post an example below my OECD charts.

Well I will create a simple example on a spreadsheet.

The log linear relationship is between real oil prices and oil intensity natural log of oil intensity vs real oil price.

If we have real oil prices increase in a linear fashion (for example the price increases by $10 each year), then your assumption that oil intensity will decrease by a constant percentage (about 4% in the example above) each year would be correct.

If my scenarios assume that prices increase by 3% per year, that is not linear it is exponential.

Just try it on a spreadsheet. You will see that I am correct.

“The Red Sea is two kilometres deep in places with a 7,000-foot thick salt sequence which can distort seismic images, according to the magazine.”

Halite has a velocity of meters/sec. Other ‘ites” mixed in can be as slow as 3500 m/sec and of course you don’t know it’s there.

The pictures are expensive as hell and halite Reverse Migration and reflection processing is apparently pretty new. This smells like the Saudis are gambling a bit.

err halite 4500 m/sec

The people who own the new seismic technology have pricing power and no mistake but on the other hand they can price it only so high before a customer such as Aramco can just decide to go with the older stuff and take a bigger chance on a few exploratory wells.

I wonder how long it will be before the technology becomes widespread. It is not likely that patents will protect it when the Russians and the Chinese get their hands on it.. I suppose a lot of it is still hush hush and only the people who are doing it know how it is actually done. The equipment is probably all one off custom made in secure shops and most likely depends as much on computer programs written to interpret the data as it does on the data itself.

But the biggest possible secret of all about this technology – the fact that it exists and it works- couldn’t be kept secret because then it would be worthless unless it were invented and used exclusively in house by some particular oil company.

The point here is that once it is proven to work then anybody else who wants to reinvent it knows without a doubt that success is definitely a possibility.

The old Soviet Union knew without a shadow of doubt for instance that an atom bomb could be built from the fact that we used a couple on Japanese cities.Without that knowledge they might not have been willing to invest very much into atom bomb research at all and thus failed in building them.

What I am saying is that there will likely be competition in the new seismic technology sooner than most people would guess.

I may be very wrong but my guess is that once you have the equipment and know how to use it the actual cost of making the searches is probably very modest indeed in relation to the possible payoff.

The equipment will be cloned if it can’t be bought and programmers are affordable by the gross if you are an oil major.

The equipment is nothing. Some seismometers and recorders (as well as the occasional boom underground). As usual in the New Normal the companies trying to make money on this are all computer folks pimping their algorithms. If you were a tenured academic trying to get free office space at your univ’s industrial park, you’d want your business to be 90% software, too.

This smells like the Saudis are gambling a bit.

Actually, just coming to the retirement party.

The graph belows shows the relationship between the annual growth in world oil consumption (measured in million barrels per day) and world economic growth rate (%) for the period 1981-2012.

For the period 1981-2012, linear regression produces the following result:

Change in Oil Consumption = -0.929 + 0.552 * World Economic Growth Rate

R-square is 0.518. It says that an increase of world economic growth rate by 1 percentage point was associated with an increase in world oil consumption by 552 thousand barrels per day. With zero economic growth, there is an “autonomous” tendency for world oil consumption to fall by 929 thousand barrels per day per year. With a “normal” world economic growth rate (3.5%), the implied growth of world oil consumption is 1 million barrels per day per year. With zero oil consumption, the implied world economic growth rate is 1.7 percent.

For the period 2001-2012, linear regression produces the following result:

Change in Oil Consumption = -0.595 + 0.461 * World Economic Growth Rate

Compared to the regression for 1981-2012, in this regression, the slope is slightly less steep but the negative intercept is much smaller.

R-square is 0.591. It says that an increase of world economic growth rate by 1 percentage point was associated with an increase in world oil consumption by 461 thousand barrels per day. With zero economic growth, there is an “autonomous” tendency for world oil consumption to fall by 595 thousand barrels per day per year. With a “normal” world economic growth rate (3.5%), the implied growth of world oil consumption is 1.02 million barrels per day per year. With zero oil consumption, the implied world economic growth rate is 1.3 percent.

If we take the above results as face value, it would suggest in the post-peak oil world, world economic growth rate is likely to be 1.3-1.7 percent or less.

The following graph looks at the period 2001-2012 only. Over the 12-year period, world oil consumption grew in 10 out of 12 years and declined only in 2008 and 2009.

Hi PE,

Have you done any future projections that involve serious proactive oil conservation efforts on the part of the large oil consumers?

I realize that regulatory efforts and incentives are baked into the cake in terms of what has happened in the past and what is likely to happen in the near term or at least the very near term.

Any new laws and regulations will take at least three or four years to have much effect barring wartime laws which could have a major effect in a matter of weeks.

It is my opinion – for what it is worth- that oil prices are going to go up sharply in the near future barring a collapse of demand due to the end users being unable to afford it.

It seems very likely to me at least that it will not be too long before a lot of new regulations are put into place in most countries to reduce the consumption of oil – this happening in addition to whatever reductions are brought about as the result of market forces of course.

Almost everybody thinks I am a nut case for saying that a serious gas tax is a possibility in the United States but then most people thought I was deluded when I was saying a decade ago that gay marriage was in and pot prohibition was out within the easily foreseeable future. Ditto socialized medicine. (Anybody who does not recognize Ocare for what it is- socialized medicine in short pants- is as politically naive as a child and not paying any attention at all to history.)

Countries that are importing a lot of oil are going to go broke fast unless they find ways to reduce the bill and once it is impossible to kick the can down the road any longer they will do something proactively about cutting oil imports.

Of course modeling oil consumption taking such proactive activities into account would involve making unsupported assumptions as to what regulations and incentives will be put into place.

My premise is that developed net oil importing countries have been going increasingly into debt, from real creditors and from accommodative central bankers, trying to keep their “Wants” based economies going, as the supply of ANE* fell from 41 mbpd in 2005 to 35 mbpd in 2012.

Chart showing total global public debt versus the GNE/CNI ratio from 2002 to 2012 follows.

*Global Net Exports = Top 33 net exporters in 2005, EIA data, total petroleum liquids + other liquids

CNI = Chindia’s Net Imports

ANE = Available Net Exports = GNE – CNI

Thanks for the comments. No, I’ve not done projection of oil conservation efforts. Although the historical relaitonship between oil consumption and GDP should reflect historical conservation effort.

Right now, transportation accounts for about 60% of world oil consumption. Industry accounts for 30% (including 15% as chemical inputs). Agriculture and other account for 10%.

Liquid fuels can be made from biomass, coal, or natural gas. But each involves severe limitations and high environmental costs.

Chemical inputs cannot be electrified.

Industrial and agricultural uses mostly have to do with heavy equipment using diesel fuels and cannot be easily electrified.

Within transportation, about one-third has to do with sea borne transportation, air borne transportation, or freight transportation on roads, and cannot be easily electrified.

Passenger transporation on roads (1/3-40%) is the part that can be electrified with comparatively less difficulty. But even the electrification in this sector is slow.

If overall energy efficiency improves, oil consumption will decline proportionately. But so far energy efficiency grows at about 1% a year worldwide and about 2% a year for OECD countries (though part of the “efficiency improvement” in OECD countries simply reflects capital relocation to developing countries), not sufficient to offset economic growth (3-4% world wide, 5% or more for non-OECD countries).

Thanks .

I expect electrified autos to become a lot more popular a lot sooner than most folks think they will once oil supplies get really tight.

Let us suppose for instance that (when not if ) gasoline is rationed a few years down the road and the ration is not enough to satisfy the well heeled owner of a gas hog suv.

If he were to buy a pure electric or plug in hybrid for his wife or children or part of his own driving needs he would be able to drive his Belchfire Special and tow his boat to the lake a lot oftener than otherwise.This man would not be buying his electric car because it runs cheaper but because it allows him to spend more in total on personal transportation.

I can’t really see any reason why cargo ships cannot be built to run on coal since oil has gotten so expensive..I know bunker oil is about the cheapest oil around but I don’t know of any reason why it can’t be upgraded in the same fashion as tar sands oil into gasoline and diesel fuel probably at about the same cost.

Take a look at modern ships. They are bigger than ever and for a wild guess at least three times bigger in terms of cargo capacity than the last of the ships that ran on coal well over half a century ago now.

The bigger a ship gets the less power it needs to maintain speed per ton of displacement and there is a joke in the industry that the shipyards will eventually do away with the usual engines and just hang a couple of outboards off the stern as the ships keep getting bigger.

Given that it is actually possible to run a large diesel engine on powdered coal it might become economical to build reciprocating ship engines to run on coal before to much longer.But maybe a more likely solution to the high cost of bunker oil would to build new ships powered by coal fired steam turbines of the sort used in electrical generating plants. Such a propulsion system would no doubt take up more space than a conventional diesel engine but the bigger the ship the lower the cost of the space in terms of lost cargo capacity.

When you get down to the nitty gritty it seems that there aren’t many products available that aren’t substantially subsidized in one fashion or another. Speaking as long time observer of human nature and politics I see no reason at all to expect this to change-quite the contrary.We are hooked on subsidies like a far gone alcoholic on his booze- most of the subsidies coming for now in the form of debts that cannot be reasonably expected to be made good.

We may institute programs across the board that result in the scrapping and replacement of older residential heating and cooling systems on the taxpayers dime.

We have had one cash for clunkers program and there will probably be more of them in the future.

For now we are still hooked on building new airports but in a couple of decades or less we may see some commercial airports bought out and closed.

We already have substantial subsidies in place for the wind and solar power industries and I believe they will be maintained and actually increased over the long term rather than phased out – although they might be temporarily frozen in the US in the case of a republican take over of Washington.( There are a lot of republican owners of wind and solar businesses and a lot of republican office holder in states where these are already serious industries.)

All in all I think there is a good case to be made for the pace of energy efficiency growth to pick up substantially.

For what it is worth in my opinion the rate of growth of wind and solar power may actually accelerate soon since it seems likely that both industries will reach actual dollars and cents cost parity (without considering pollution costs) with coal and natural gas within the next decade at the longest and considerably sooner in places with good wind and or solar resources.

Paradoxically this may not result in the end of subsidies but their continuation as various states and localities compete for the jobs and eventual associated tax revenues to be had from landing such investments.

What do you get if you do this for the OECD?

I will work on that

This link is to a long article that goes into considerable depth about central banks and the problems they are dealing with -or trying to at least- these days.

I found it well worth the time to read it.

http://www.spiegel.de/international/business/central-banks-ability-to-influence-markets-waning-a-964757.html

This is in response to Dennis’s suggestion to look at the OECD oil consumption in relation to economic growth.

A linear regression for the 1981-2012 period yields the following result:

Change in Oil Consumption = -0.918 + 0.425 * Economic Growth Rate

See the graph below. R-square = 0.498. With zero economic growth rate, there is an “autonomous” tendency for oil consumption to fall by 918 thousand barrels per day per year. With each increase in economic growth rate by 1%, oil consumption tends to rise by 425 thousand barrels per day per year. With a 3% economic growth rate (if economic growth were to be sufficiently strong to start reducing unemployment rate), oil consumption needs to rise by 357 thousand barrels per day per year. With zero oil consumption, the implied economic growth rate is 2.2 percent.

Now consider the more recent years. A linear regression for the 2001-2012 period yields the following result:

Change in Oil Consumption = -0.879 + 0.387 * Economic Growth Rate

See the graph below. R-square = 0.740. With zero economic growth rate, there is an “autonomous” tendency for oil consumption to fall by 879 thousand barrels per day per year. With each increase in economic growth rate by 1%, oil consumption tends to rise by 387 thousand barrels per day per year. With a 3% economic growth rate (if economic growth were to be sufficiently strong to start reducing unemployment rate), oil consumption needs to rise by 282 thousand barrels per day per year. With zero oil consumption, the implied economic growth rate is 2.3 percent.

For the period since 2001, OECD economies have become somewhat less oil dependent than in earlier years. For the period 2001-2012, OECD oil consumption had significant positive growth only in 2003, 2004, 2005, and 2010 and was basically flat in 2001 and 2002. In other years, OECD oil consumption declined.

However, even for OECD countries, economic growth rates needed for lower unemployment rate would still require significant positive growth of oil consumption and when annual oil consumption decline exceeded 1 million barrels per day, the declines were associated with catastrophic economic conditions (such as in 2008 and 2009).

Fantastic data, and data presentation, by both PE and DC. Shows the enormous challenge ahead, it is so clear that improving our energy efficiency needs to become the central campaign of our civilisation, time for a real conscious effort. At least it has been improving despite no policy to achieve it, albeit slowly, or rather policies that subsidise waste.

It would help enormously if we would stop subsidising the lifestyles of the cheap oil Motordom era:

http://www.nytimes.com/2014/04/17/opinion/americas-urban-future.html?_r=2

After all as Keynes said: ‘ The difficulty lies, not in the new ideas, but in escaping from the old ones’

Well said.

Interesting work Dennis & PE.

This is to follow up earlier discussion with Dennis on how log linear relationship between oil price and oil intensity affects oil spending share of GDP.

Definitions: Oil Intensity = Oil Consumption / GDP

The following numerical example might help to illustrate where I and Dennis disagree.

Suppose through empirical data, we observe the following relationship between oil intensity and real oil price

ln (Oil Intensity) = -3 – 0.5 * ln (Real Oil Price)

This is of course equivalent to:

Oil Intensithy = (e^-3) / (Real Oil Price ^ 0.5)

e^-3 = 0.0498; it follows that:

Oil Intensity = 0.0498 / (Real Oil Price ^ 0.5)

Imagine that for period 0, real oil price = 1, therefore oil intensity = 0.0498; if GDP = 100, oil consumption equals 4.98, and oil spending equals 4.98% of GDP

Now let’s assume for period 1 to 50, GDP grows by 3% a year. Real oil price grows by 1% in period 1, 2% in period 2, and so on … until period 10 (this is to illustrate Dennis’s assumption of accelerating growth of real oil price). Starting with period 10, real oil price grows at the fixed rate of 10% per period until period 50. For each period, oil intensity will be calculated based on the above formula. After knowing GDP and oil intensity, oil consumption can be calculated. After knowing GDP, oil consumption, and real oil price, oil spending as % of GDP can be calculated. The following are some of the results:

Period 1:

GDP 103; Real Oil Price 1.01; Oil Intensity 0.0495; Oil Consumption 5.103; Oil Spending = 5.00% of GDP

Period 5:

GDP 115.9; Real Oil Price 1.159; Oil Intensity 0.0463; Oil Consumption 5.362; Oil Spending = 5.36% of GDP

Period 10:

GDP 134.4; Real Oil Price 1.702; Oil Intensity 0.0382; Oil Consumption 5.129; Oil Spending = 6.50% of GDP

Period 50:

438.4; Real Oil Price 77.023; Oil Intensity 0.00567; Oil Consumption 2.487; Oil Spending = 43.70% of GDP

Notice that by period 50, both oil intensity and oil consumption are much smaller than period 0, nevertheless oil spending is extraordinarily high exactly because of the rapid growth of oil prices.

Dennis, this mathematical discussion may have led us away from the real discussion.

Remember in the graph I posted (for the relationship between real oil price and oil intensity), while falling oil intensity was associated with rising real oil price for the period 1999-2012 (and in fact, rising oil spending as % of GDP rose during the period) , both oil intensity and real oil price fell during 1981-1998 (and not surprisingly, oil spending as % of GDP fell during this period as well).

At least in the short run, I think the coming data are more likely to favor your scenario (even though I still think I have the mathematical argument on my side). In the next two or three years, I think we’re likely to see more or less constant real oil prices in combination with declining oil intensity (and declining oil spending share). This is because rising real oil price is not the only factor that could drive down oil intensity. Since 1980, the “autonomous” decline of oil intensity has been about 2% a year. Empirically, this has been far more important than the oil intensity decline “induced” by rising real oil price.

But I do think (or speculate) that once the US shale oil boom comes to an end, we are likely to return to a situation similar to 1999-2012. Real oil price will again grow rapidly, more than offsetting the decline of oil intensity and leading to rising oil spending share. But oil spending share will not rise forever. At some point, the global economy will be broken. Global recession will bring down oil prices as well as the oil spending as % of GDP.

We will find out.

Since GDP has become a fairly manipulated number, oil intensity might be better reflected against a more measurable subset of GDP that reflects actual dollar transactions without the imputed fluff.

Well, film libraries are made of plastic (until digitized), so maybe there’s oil relevance.

But that is tiny amounts of oil compared to driving every kid to school. Strong correlation between increasing urbanisation and rise in daily use of Transit and Active movement and therefore continued plunge in VMT (vehicle mile travelled) and therefore decline of oil use in private transport. Remember vMT peaked in, yup you guessed it, that year 2005, and has continued to fall every year since, recession or not.

Moving to a walkable neighbourhood, or getting that metro or light rail line built takes a long time… This is the reason transportation fuel use is considered inelastic, or hard to change, but slow to change is not the same as impossible to change.

These trends are only just beginning. The great auto age is ending before our eyes, but of course it’s hard to see. Just like when it began; everywhere you looked you’d mostly see horses…. With change it’s the trend that matters (same with renewables- look at the trend; just starting to ramp up). Then stay alert for tipping points.

Speaking of tipping points…did you see this?

12 Reasons Why New Zealand’s Economic Bubble Will End In Disaster

New Zealand’s economy has been hailed as one of world’s top safe-haven economies in recent years after it emerged from Global Financial Crisis relatively unscathed. Unfortunately, my research has found that many of today’s so-called safe-havens (such as Singapore) are experiencing economic bubbles that are strikingly similar to those that led to the financial crisis in the first place.

Though I will be writing a lengthy report about New Zealand’s economic bubble in the near future, I wanted to use this column to outline key points that are helpful for those who are looking for a concise explanation of this bubble.

Yup. Well all bubbles end in disaster. Or correction, if you’re feeling dispassionate. So it’s circular; if it’s a bubble, it’ll pop.

Calling bubbles is a big industry now, this one relies on which ideas you accept as supporting prices in various markets. And the thing about NZ is that it is so small that outside influences have huge effects. Weirdly some parts of our economy often bounce when the big world corrects because of statistically insignificant flows of capital [from the big economies POV] seeking a haven here have large effects on such a small market.

Is the property market overvalued? Yes by any historical measure compared to incomes and rental rates. But if you had pulled out of say the inner Auckland market and gone into cash anytime this century you’d be seriously out of pocket now, and this fact keeps everyone in. Also we have no Capital Gains Tax, nor Stamp Duty, or other levers that governments use to calm residential property over-investment. It’s nutty but the tax system incentivises buying and keeping homes instead of investing in the productive parts of the economy. The more left wing Opposition Party is promising a CGT but then they’re not popular with the property owning class and not in power.

Put it this way; I’m aware of the numbers but I’ve not sold up and gone renting…. The economy here is growing and inflating, we don’t have negative real interest rates like the UK, US, and Japan so cash isn’t [yet] more powerful than assets.

Right now China’s switch from importing hard commodities [iron ore, coal] to soft [food] is causing our little engine to overheat a bit. Suddenly we’re getting more love from our biggest trading partner than Australia is…. which is causing the exchange rate to keep rising; perhaps that’s even more of a bubble?

But the short answer is that this guy is a bubble fanatic. In essence he’s saying China’s gonna pop, so then Australia’s gonna pop, so NZ will pop. If you accept the first idea as a fact then yes I agree; both Aus and NZ are now highly entwined with China as suppliers. We’re at the other end of the Chinese game from Europe and the US, the other end of the supply chain. But there’s nothing fresh or interesting in this view, he looks like a big self promoter to me. I ain’t following him on Twitter like he clearly so wants, much better insight here on this site.

Hi pe,

I misunderstood the definition of log linear.

my relationship was Nat log of oil intensity vs price so an exponential decline in oil intensity vs real oil price.

I don’t think trying to relate growth rates works well, data is too noisy.

Hi PE,

I realize upon checking the internet that some people refer to a log-log plot as a log linear relationship but it is a little confusing because there are others who refer to a semi-log plot as a log linear plot so I now see the source of my confusion. I was doing a semilog plot of natural log of oil intensity vs real oil price and you were doing a log- log plot, I don’t think regressing growth rates on growth rates is the way to go because these are quite noisy.

I also think using Kopits idea of oil efficiency makes more sense (reciprocal of oil intensity) and just using a plot of oil efficiency vs real oil price makes the most sense though the curve should bend over time maybe use a square root of oil price or something like that as the efficiency gains are not unlimited.

Pe i agree with that assessment, but am more interested in what happens next.

After recession has hit consumption of oi decreases but prices will recover and substitution will begin in earnest.

thanks for the great work you have done here.

Thanks a lot for the replies. I enjoy your work a lot.

Hi PE,

If the relationship is log linear, you are correct, I do not think a log linear relationship is likely to be the correct specification, I think the oil intensity will decline in an exponential fashion relative to the price increase so that an exponential rise in prices (say 3% per year) will cause oil intensity to fall by an increasing rate. This is the reason we get different results. I believe that increased prices will eventually lead to greater oil efficiency as other forms of energy substitute for oil.

Will the price mechanism accomplish this process smoothly with no recession? I doubt it.

Will the recession be permanent? I doubt that proposition as well, but clearly this is a minority view of those that think peak oil will soon become a reality.

Even at the “low” rate of 1% yearly decline in oil, extended out 30 years the exponential function would eliminate about 25% of available oil, so from 85mbpd to just 63. At a 2% decline, those 85 would fall to just 47 over the 30 years. This prompts some concerns regarding electric vehicles or other hypothetical road-reliant replacements for the internal combustion engine: where will the asphalt for the roads come from? How will it be manufactured, transported, and made roady?

Tar sands and move it by train or let roads revert to gravel.

Also there will be less use of cars electric or otherwise more busses subways and trains and less airline travel and more long haul freight on trains or ships.

It seems the link to the presentation’s pdf file is broken, is there any way to make it available again? Thanks!

I have sent you the file as an attachment.

Ron

Sorry, my post was returned. Your email address you used does not exist. If you will post me at DarwinianOne at Gmail.com I will send you the slide deck as an attachment.

Ron