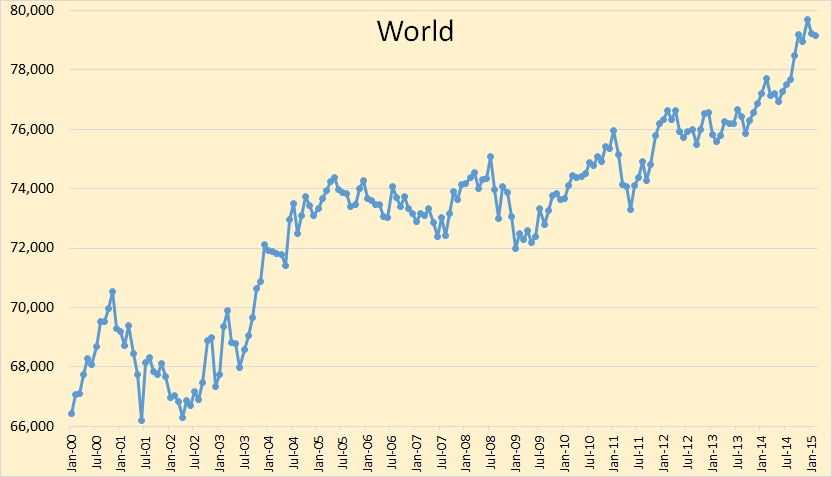

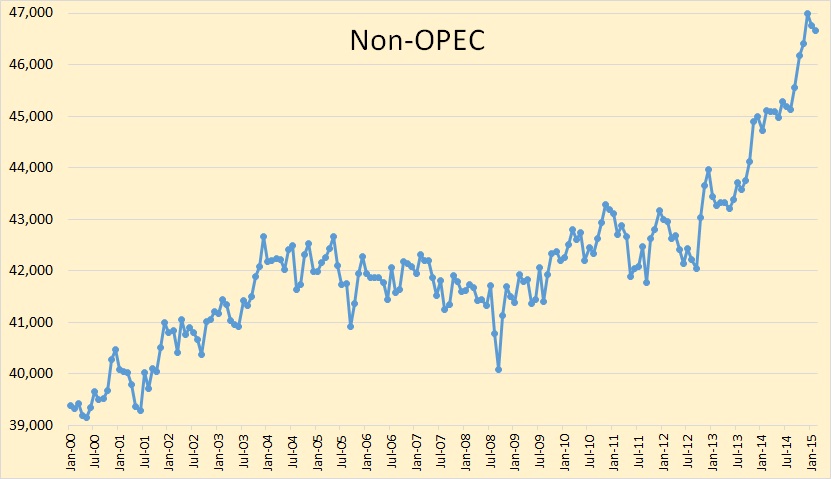

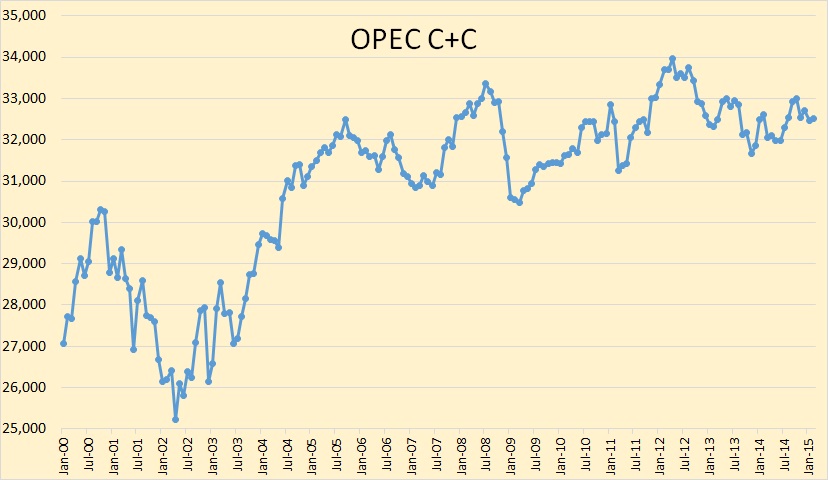

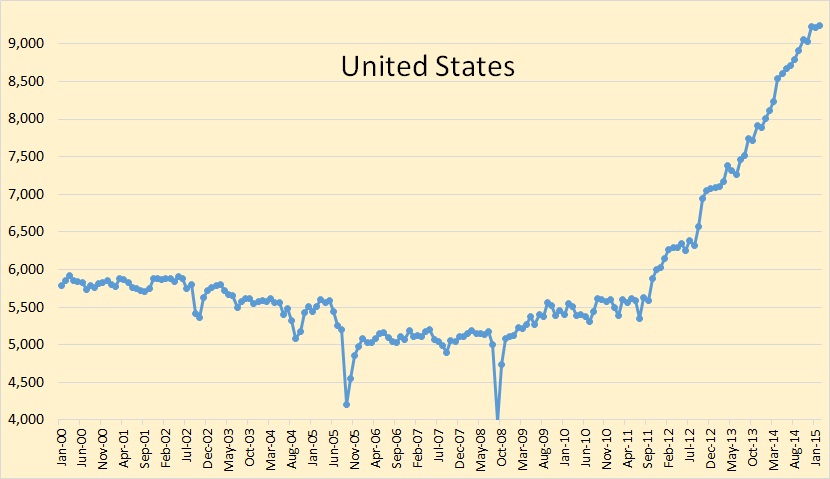

The Eia has finally updated their International Energy Statistics with data through February 2015. All data in the charts below are Crude + Condensate and is in thousand barrels per day with the last data point February 2015.

World C+C dropped 477,000 bpd in January and another 65,000 bpd in February for a total decline of 542,000 bpd. World C+C stood at 79,160,000 barrels per day in February.

Non OPEC C+C declined 244,000 bpd in January and another 100,000 bpd in February for a total decline of 344,000 since December. Non-OPEC C+C production stood at 46,656,000 bpd in February.

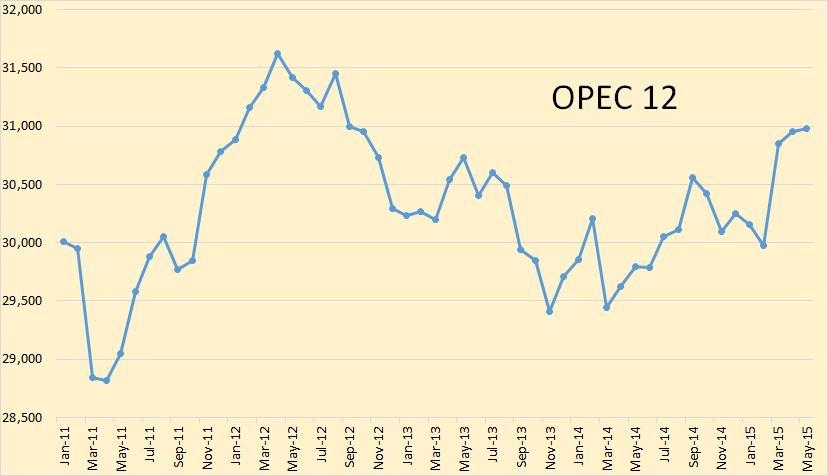

OPEC C+C, in February 2015 stood at 32,504,000 bpd, down 1,451,000 bpd from its peak in April 2012. However according to the OPEC MOMR their crude only is up 1,000,000 bpd from February to May.

According to the EIA’s International Energy Statistics US C+C production, in February, stood at 9,238,000 bpd. It was down 14,000 bpd in January but up 24,000 bpd in February for an increase of 10,000 over those two months.

An interesting point here is while US C+C was up 10,000 bpd from December to February, US total liquids were down 297,000 bpd. That was because over that two month period they have NGLs down 20,000 bpd, refinery process gain down 150,000 bpd and other liquids down 136,000 bpd.

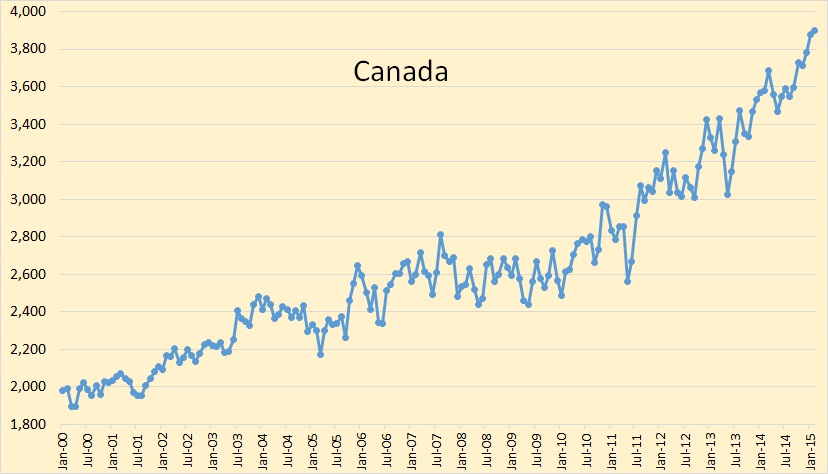

In spite of the huge rig count decline in Canada the EIA says they were up 99,000 bpd in January and up another 22,000 bpd in February. Canada’s C+C production stood at 3,901,000 bpd in February.

China, after reaching a new high in December fell 83,000 bpd in January and another 14,000 bpd in February. China’s C+C production, in February, stood at 4,218,000 bpd.

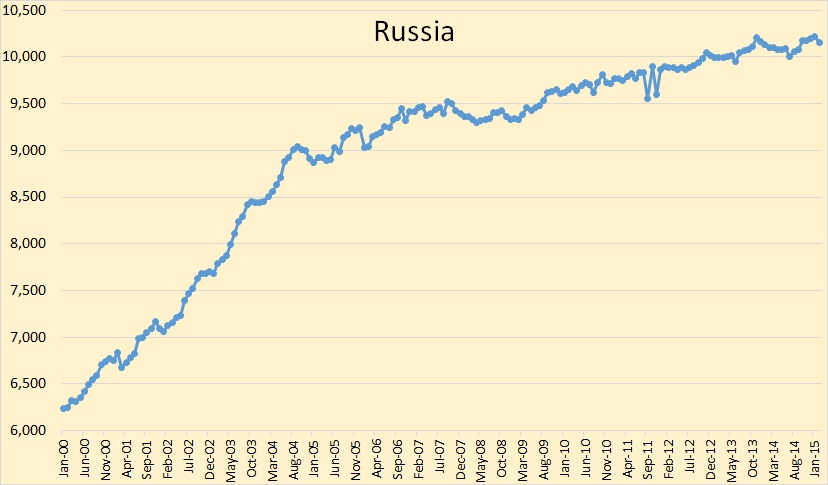

Russia’s C+C reached 10,220,000 bpd in January, barely topping the 10,209,000 bpd of November 2013. Their C+C production however dropped 70,000 bpd in February and stood, at that point, at 10,150,000 bpd.

The page Non-OPEC Charts has been updated with charts of all non-OPEC producers.

There has been a lot of discussion on this blog lately as to whether US crude production, in the last few months has been up or down. The EIA’s Weekly Petroleum Status Report has us production soaring in 2015, reaching new highs almost every week. However the EIA’s own Drilling Productivity Report has shale oil, the source of almost all US production gains, peaking in April with an increasing decline in May, June and July. And reports from individual states seem to indicate that the decline started even earlier.

Platts has Eagel Ford was down 8,000 bpd in April and down another 6,000 bpd in May. And we know from the NDIC Stats that North Dakota production in April was down almost 22,000 bpd in April and down alomost 60,000 bpd since peaking in December. Platts however says Bakken production was basically flat in May, up a mere 650 bpd. Accurate to 10 bpd? I seriously doubt that.

I am betting that when the June data finally comes in that it will show crude oil production in the US has seriously declined since December 2014. And it is likely Canada has done likewise.

This chart of OPEC crude only production through May. They have increased production by 1,000,000 bpd since February but they are all pumping flat out to achieve that.

I am now more convinced than ever that 2015 will see the peak in world crude oil production. I have very closely studied the charts of every producing nation and my prognosis is based on that study. I see many nations in steep decline and most every other nation peaking now, or in the last couple of years, or very near their peak today. These include the world’s three largest producers, Russia, Saudi Arabia and the USA.

Many other nations are at or have reached their peak in the last few years. These include other producing giants such as Kuwait, the UAE, Brazil and China. Other non giants are peaking or have recently peaked include Colombia, Oman, and India. Only Canada, and Kazakhstan have any real upside potential and I am not too sure about Kazakhstan.

I know many will point to Venezuela but that is just not going to happen. Venezuela does have vast potential but also have vast political problems and a history of confiscating foreign assets and paying them pennies on the dollar. So don’t expect anything but a slow decline from Venezuela for the next decade or so.

492 responses to “New International Energy Statistics.”

I think we will see that the EIA is doing the same thing that other “Deep Captured” government agencies are and that is cooking the books to create the utopia that central planners want us to perceive. The problem for the EIA and other Foxes guarding the Hen House is that long term truth will come out and there will be serious concequences for their misinformation campaign. Depletion, destruction of risk capital and growing demand from artificially low gasoline prices and loss of confidence in fiat money and the central planners (IMF Fed etc) will ensure much higher prices for crude long term.

I think that is pure nonsense. The EIA is doing the best they can at a very difficult job. They disagree among themselves and different groups report different figures. But after a year or two they all agree and report exactly what the states report to the EIA. Except for offshore federal agencies reporting for the Gulf of Mexico and offshore California, the EIA is entirely dependent on the individual states for their data. And they report exactly what the states report to them.

I don’t believe there is any “Central Planners” as you refer to. And I have no idea what you mean by “Deep Captured” government agencies. Who the hell are they?

Seeing deep conspiracies in the government seems to be a very popular view among a some people. I am not buying it. The simplest explanation is the most likely explanation. Things are pretty much the way they seem to be. I don’t buy any of those silly conspiracy theories. There was no flying saucer crash near Roswell New Mexico, the moon landing was real, Cheney and Bush did not plan 9/11, the Alaskan antenna farm called HAARP is for observing the aurora borealis and jet contrails are ice crystals, not “chemtrails”. And the US Government is not engaged in some deep conspiracy to hoodwink the American people into believing in what your favorite conspiracy theory says they want us to believe. All stupid conspiracy theories are that, stupid conspiracy theories, and nothing more.

Much as I’m loathe to dip my toe into this debate, you may recall this story from back in 2009 from a very reputable British newspaper:

Key oil figures were distorted by US pressure, says whistleblower

Exclusive: Watchdog’s estimates of reserves inflated says top official

http://www.theguardian.com/environment/2009/nov/09/peak-oil-international-energy-agency

Not only oil data, but climate data suppressed also:

http://www.ibtimes.com/new-zealand-scientists-complain-gagging-over-climate-change-issues-1978914

Thanks for sharing this Marcus 6/24/15 oil is getting killed today on a 4.93mm bbl draw today on stocks. This is an example of supply demand not driving price but rather HFT and Central Planning.

All short term swings in the futures market price of oil is driven by market sentiment. All long term trends are driven by world supply and demand.

Oil is a fungible commodity. (Google it if you don’t know what that word means.) Oil is traded on the world market and the price is not dictated by anything but supply and demand.

The OPEC Basket Price changes day to day but not during the day. It is driven entirely by supply and demand. So called “Central Planning” in the US would have no effect on the OPEC basket price yet the long term trends of both are the same with the OPEC basket price trading very close to WTI and about three to five dollars, on average, below brent.

Ron, Over 1,800 American architects and engineers say that the government´t version of 911 is pure crap. No theory. Just a group of professionals with technical educations.

Take the time to look. ae911truth.org

Amvet, take your stupid conspiracy theory crap somewhere else. This is not a conspiracy theory blog.

Please! Nobody reply to this post. I don’t want to hear any more 9/11 crap.

I concur!

Check out shadowstats.com for a full directory of US government lying about the US economy!

There are no lies. There can be systemic errors, but no one gets up to go to work each morning with an intent to lie for such a modest salary.

The systemic errors can be considerable, however, and a few may even have agenda. The agenda likely is bipartisan.

yer funny. no lies. Still hunting for those lost “weapons of mass destruction”, are we. Hilarious!!!!

Shadowstats have been promising hyperinflation for the last 5 years or so, and yet the cost of a membership hasn’t changed once in all that time.

hyperinflation is here. looked at the stock market lately?

Everyone else measures inflation by looking at the price of goods and services, and where I’m at that hasn’t changed much in recent years.

The stock market is up because corporate profits are at record highs.

Not likely. Has our government suffered for doinghe 911 attack? ( ae911truth.org )

That analysis is right.

That analysis is bullshit!

Ron you should go down the rabbit hole a little further and I promise you will get your eyes open to the misinformation that I speak off. Why do you think banks have been fined billions and billions of dollars (paid to the state) while no one goes to jail Ron? I really don’t care if you believe me or not and appreciate your good work but I have been witness for this for decades and watched it get worse and worse. You should look up “Deep Capture” and check it out for yourself.

Don, I understand where you are coming from. And I agree with a lot of it. There are a lot of crooks on Wall Street and high frequency trading is just another way of stealing. It is basically legalized front running and it should be outlawed.

The problem with the SEC is under funding, over work and incompetency. They are not crooks in cahoots with the traders. That is the bullshit I am talking about.

Also the lobbyist write most of the laws passed by congress. They wrote the Medicare law that says the government cannot negotiate the price medicare pays for prescription drugs. They must pay the price the drug companies ask. That is robbery.

The problem is Congress depend on donations from large companies and powerful company men like the Koch Brothers. Congressional elections are an auction an the candidate with the most campaign money is usually the one that gets elected.

But that does not mean career, unelected, workers at the EIA, or anywhere else in government are in cahoots with Wall Street crooks or anyone else to fudge the data. That is the bullshit I am talking about.

The problem is Don, that you see how lobbyist are buying congress and you assume that means every government employee, even people at the EIA who have no connection to lobbyist, are crooks cooking the books. That is bullshit.

I don’t have all the answers Ron and would love to believe that the SEC was just underfunded but I don’t. But i do know that if you work for a government agency and buck the system you are out, period. I agree with many things that you are saying about lobbyist, front running etc. But now things are unraveling so that their only choice is to let them unravel or cook the books. 93 million Americans out of the work force and unemployment continues to drop (Please). Gibson’s Paradox (Larry Summers & Bob Rubin) is the game plan of the elites and it says that if you can keep interest rates at close to zero (HFT) and keep gold suppressed (HFT) that you can then print as money as you like (and therefore be like God). They know that Gibson’s Paradox (zero interest rates) is choking the US economy but are putting the elites and the banks ahead of the American people.

Ron, Did you consider that the reports written by honest employees are often edited by political appointees ???

The US gov’t works the the big banksters promoting their short oil position. Their propaganda outlets include Bloomberg and others. They never challenge the EIA production data. Anyone can compare Texas RRC and North Dakota data to see the data disparity between the EIA and the original source information. The EIA has promulgated their US oil production growth for 6 months now. Will they admit they are lying, ever?

That’s right Joel

“The path to growth is gradual but the road to ruin is rapid.” – Lucius Seneca, Roman philosopher

Good God, has it come to this. Everyone in the government is lying and on the take? They are all a bunch of crooks? Well let me make my position very clear right now. I don’t believe a damn word of that.

The EIA are just people. They are often wrong… and some of them are incompetent. But that does not make them crooks.

Hi Ron,

Again I agree 100%, the EIA does the best it can with the limited (as in incomplete) data it gets from the states (for the most recent 12 to 24 months).

I take that back, I agree they are not crooks, but I do not think the people working at the EIA are incompetent.

Get real Dennis, I did not say “the people working at the EIA are incompetent”. Read my statement again and quote me correctly the next time you quote me. I said:

and some of them are incompetent.

13,814 people work for the Department of Energy. I could not find out how many of them work for the EIA but I would guess about a thousand. Out of that many you are bound to have a few incompetent souls. It could not possibly be otherwise.

And I could give you examples Dennis. Remember I have been tracking EIA data for well over 10 years now. Just one example, the EIAhas been giving Venezuela’s C+C’s production at exactly 2,300,000 barrels per day for 33 straight months now. Platts, and several other agencies, gives a far more accurate estimate of Venezuela’s production. They could easily check them all and make an educated guess instead of saying their production has not varied one barrel per day for almost 3 years now.

Now Dennis, tell me again that some of them are not incompetent.

I think that different groups in the EIA responsible for statistics and forecasts on US oil production should have better communication and coordination between themselves.

The whole system of reporting by oil companies and gathering and processing of information by state agencies should also be improved.

As regards EIA international oil statistics,

they are indeed quite poor. Better to use other sources

My personal contact w/ EIA is very small. Occasionally I email a technical question. They come across as being pleasant, reasonably competent.

I observe the EIA tends to offer a ‘positive’ message. They often ‘stretch’ their analysis (such as reporting refinery volume gains as ‘new fuel’). Their databases have become harder to use. They tend to follow the implicit directions/meet the public relations desires of the fuel industry, to cater to them, much like other reporting agencies such as BLS. This makes sense b/c the agency must deal with the fuel types every day = Stockholm syndrome.

Because the EIA is not regulatory there is no backscratching/deal making as are found in other US agencies such as DoD, DoJ, SEC, etc. These agencies have become outright criminal: creatures do not get jobs at these agencies unless they are on the take.

In a perfect world, fully half of the Pentagon would do serious time in penitentiary for accepting bribes/offering kickbacks; the other half would be fired for incompetence. 50/50 crook/incompetence ratio is typical for Federal operational/regulatory bodies.

My dear ol’ was a government lifer (CIA, FBI, DoJ) and I live in DC metro area … a government company town. There are no real secrets … the corruption is far worse than Dr. Don suggests. Far, far worse.

I observe the EIA tends to offer a ‘positive’ message. They often ‘stretch’ their analysis (such as reporting refinery volume gains as ‘new fuel’). Their databases have become harder to use. They tend to follow the implicit directions/meet the public relations desires of the fuel industry, to cater to them, much like other reporting agencies such as BLS. This makes sense b/c the agency must deal with the fuel types every day = Stockholm syndrome.

But look what happens when government agencies offer a negative message (e.g., climate data, EPA, OSHA). If a government agency says what some people don’t want to hear, politicians threaten to shut it down.

There can be a ” Read between the line message ” extracted from such apparent errors as Venezuelan production being listed as dead constant.

That message could be that the agency has to publish SOMETHING to meet it’s own rules but that the data is no good and should be ignored. Think wink wink.

I have seen this sort of thing happen in jobs I have been on. If something essential is unavailable because somebody dropped the ball, the boss figures out a way to substitute something else he can put his hands on and everybody just overlooks the discrepancy.

I have seen gravel used to make up a shortage of fill dirt when there was a stockpile of paid for gravel handy even though fill dirt costs a lot less. All the bosses managed to overlook a few loads of gravel being dumped in a place that called for fill dirt.

This sort of subterfuge can more easily managed than changing the rules or strictly complying with them.

Printing nothing, leaving a blank spot, would upset too many anally retentive bean counters upstairs someplace in the energy department. The computers would spit out error messages due to a lack of an entry in that cell in the spread sheets etc.

I am not saying this IS the correct explanation but rather that it MIGHT be.

There is plenty of ”wink wink ” to go around these days.

At the risk of posting this on my iPhone and no idea where in thread we are at….I’ll chime in.

People who can write complex mathematical models, use very complex software and have decades of domain experience in areas like oil production are either extremely expensive consultants or they will be working in the money making part of the business. They are extremely rare and will not work for peanuts.

Forecasting in many industries is a regulatory requirement not something businesses or governments want or care to spend money on.

They do it because they have to. They will get fined if they don’t produce something.

The kid that just graduated college may be the only person that understands the software to create the model. And that kid might be the only person with the time to produce the results.

Seen it with my own eyes.

Friend, somewhere in storage I keep a booklet showing a ten year forecast of Iran’s oil production, released in September 1979. I used it to educate my bosses about what I call discontinuities.

However, I will add that we do have very complex models which try to predict future performance for up to 30 years. When I was supervising the engineers running the models I didn’t bother with the details (I didn’t know the pull down menus), but I knew more about the model’s guts than most people. And I didn’t allow new engineers to start learning the forecast model until they had at least two years’ exposure to our reservoir models.

I made one exception to this rule, with a young man who wanted to prepare a basic model for his thesis. But he was number two in his class and I wanted to give him unique skills to help him move out of Venezuela.

I don’t know about all other companies, but I’ve observed that the better candidates to become forecast modelers are engineers with field, reservoir engineering, and facilities projects backgrounds. Teaching them the commercial side is fairly simple. But a commercial type can’t grasp the oilfield or a large project.

Another data point: I believe the people running long term forecasts for Exxon are all experienced engineers who receive commercial training on the job (I worked with them in joint projects several times).

Hi Ron,

I stand by my statement that I do not think that some of the people at the EIA are incompetent. You can say that, we do not always agree.

Edit: To be clear I am saying that I do not think that any of the people at the EIA are incompetent. I think their resources are limited and they are doing the best they can.

The data from Venezuela is not very good, but for 2011 to 2014 (annual data) the C+C+NGL estimate by the EIA matches BP’s estimate fairly well (the EIA average for those 4 years is 1.3% lower than the BP estimate.)

There is no perfect data, maybe there are conflicting estimates from different sources on Venezuelan output and the average over 2011 to 2014 is 2500 +/- 200 kb so the 2500 kb C+C estimate simply reflects this uncertainty.

And I stand by my statement that no outfit in the world can have more than 100 employees and not have even one incompetent person on their payroll. And there are far more incompetent people at the top of the ladder than at the bottom. I think that may have become a serious problem at the EIA. That is the Peter Principle. I think it should be renamed “Peter’s Law” because it always happens.

I would bet that you have never heard of The Peter Principle

Underfunding of agencies that provide statistics seems to be a pretty deliberate strategy on the part of some industries. They want to cripple the power of government agencies to regulate them. So, they fund elected representatives, and induce them to reduce funding for both statistical and regulatory agencies.

Those agencies therefore don’t have the manpower to collect the data needed to develop good regulatory policies, or the manpower to actually enforce them.

Hi Ron,

No I had heard jokes about the crap floats to the top. My reading of the webpage you linked to would suggest that nearly every employee that has remained in their position for 4 years or more is incompetent because they would have been promoted if they were competent. So basically only recently hired or recently promoted people in any organzation are competent according to my reading of the Peter Principle. Do you really buy that?

Dennis, when The Peter Principle first came out in 1969, it stayed on the New York Times nonfiction top ten list for many weeks. I cannot do it justice in one paragraph so I won’t try. But yes I buy it.

The link is to the book, not the article. The book is still in print and a new edition comes out every few years. It explain a lot about why things are so screwed up. No, not all top positions are filled by incompetent people but enough of them are as to explain why things always go wrong.

Dennis, if you just think for a minute about all the companies that have gone out of business because of stupid mistakes by their CEO, you will understand The Peter Principle. I worked for one such company for 10 years, Digital Equipment Corporation. The CEO thought mini computers would never replace large mainframes and refused to even consider making them.

But I can name others, Circuit City did not even start selling computers until Best Buy had overtaken them and they were near bankrupt. Then they tried the same thing as Best Buy but way too late. And I could name others. Think of K Mart, Big K, W.T. Grants. They did not even see Sam Walton coming until it was way too late. They could have done the same thing Sam did but were just too incompetent to see what was working until it was too late.

Hi AlexS,

Where do you think the best “free information” is available on International C+C output? BP is good, but is only annual data and includes NGL in oil production data.

If one uses EIA NGL data (the only such data available for free that I know of) to get an estimate of C+C output from the BP data, it agrees pretty well with EIA data.

All other agencies that offer free data such as the IEA and OPEC follow only total liquids for World output.

The JODI data is incomplete and pretty painful to work with to get an estimate of World output.

The EIA data for C+C World output is the best we have available. If you want to follow total liquids, you could use other sources, but I have no reason to assume those sources are any better.

Dennis,

Yes, the EIA is the only source of data on C+C, NGL and other liquids production for all countries. And you get this data in excel format. But, unfortunately, in some cases this information is not accurate.

So if you can get the numbers for a particular country from other sources (national agencies, JODI, etc.), I would prefer those alternative sources. The IEA data is also useful, as most countries do not produce large volumes of NGLs, and the share of NGLs in their total liquids output is fairly stable.

Hi AlexS,

Too much work for me, how do we know how much NGL various countries produce (from the EIA? and can you believe those numbers).

How do we know which numbers are correct?

The EIA data is fine, there is no perfect data.

Dr. Don: The banks “lost” about a trillion dollars in home loans. But, who got the money that the banks lost? Your neighbors who borrowed more than there home was worth and then who were unable to pay it back, got most of the money. But, the bankers did not get up and go to work saying “how can I bankrupt my bank and lose my job? I know, I will just give away money to homeowners who will not pay it back.”

No, they got caught up in the idea that in a couple of years that the house would be worth more than the loan, so there was no problem in their delusional eyes. In the meantime, the commission income from the loans helped them personally. And the US government asked JP Morgan to buy Washington Mutual and bail them out. So they did and then the US government fined the JP Morgan bankers for the excessive loans that Washington Mutual made. And, Bank of America bought out Countrywide Financial, and then B of A bankers got fined for the bad lending practices of Countrywide. If you married someone and it turned out that they had committed a crime before the marriage, do you think that you should go to jail for their crime?

But the key thing to remember is that most of the money that the banks lost, was money that went directly into the pockets of homeowners.

Clueless ,

Sometimes you flat out nail an important point that everybody else seems to miss entirely.

It would be immensely helpful if every body who chatters on endlessly about debt would try to think of it in the same way a chemist or physicist thinks of a physical process…

Money or assets are NOT ACTUALLY lost -except in a nominal sense – when a debt goes unpaid. In reality what happens is that the OWNERSHIP of the assets or money involved is defacto transferred to the debtor by the creditor.The debtor gains. The creditor loses. The number of chips on the table remains the same.

This is painting very fast with a very broad brush of course. The loss is real enough to the creditor and the gain is apt to be fleeting for the debtor- but when a debtor lives high on the hog and goes broke, the courts cannot retrieve the good times. They are gone as surely as the fishing trip took last year, as surely as the fine meals charged up at nice restaurants with the gold card.

When an entire segment of a society lives on excessive debt, the people on the receiving end get richer, the people on the tax paying end get poorer. I know many people who get government pensions and bennies who have done easier, less stressful jobs for less hours than the people who pay those pensions – out of true productive work.

I have a good friend who has been paid a couple of million bucks over the years to serve as a ”housing advocate” for poor people in the city of Richmond. In that entire time he has never created or contributed to the creation of a single square foot of decent affordable housing- whereas I myself at different times for short periods worked for less than half the money on a per day basis without benefits– actually renovating run down houses.

My personal attorney is a good friend and usually charges me peanuts in the form of beer and steaks for dealing with minor stuff such as a real estate closing. But his typical client pays thru the nose for the same service. There is not really any justification for his being able to charge so much- his gofers do just about all the work involved in routine cases.

My dentist apparently nets about four hundred bucks a day for supervising three hygienists who do nothing except clean patients teeth -EACH. This is on top of what he earns himself of course doing actual dental work.

It’s a darwinian world folks. Some of us are winners. Some of us are losers.

The people who get away with not paying debts are winning, at least temporarily.

Of course some assets do remain in the case of bad debts. The house can be foreclosed, the car can be repossessed. But the fast broad brush tells the true story as surely as the wheels of justice grinding slow but exceeding fine.

Most people don’t understand money creation and destruction. Just to summarise. 95% of money out there is just a set of numbers stored on some leger somewhere on a computer nowadays. Money is created whenever a bank makes a loan, buys an asset, pays for goods and services etc. Money is destroyed (deleted) when loans get repaid and interest payments are paid. Banks try to balance their books unless the money supply needs expanding or contracting. The government usually does this through the setting of base interest rates.

If a debtor cannot pay back a loan, they go bust, then the creditor has to take the hit. If that creditor can’t pay it, they go bust and their creditor takes the hit etc. all the way down the line to the lender of last resort – the central bank. Ultimately central banks can engineer inflation whereby the currency gets devalued along with debts and savings. Eventually debt/GDP comes into line. PS I’m with Ron with this; all these conspiracy theories are doing my head in. Sloppy and lazy thinking in my view.

Ed, If you have not read “The Creature from Jekyll Island” about how John D. Rockefeller and J. P. Morgan founded the private Federal Reserve to control our economy for the benefit of the banking cartel, I can recommend it.

Clueless – That response was truely clueless.

The banks didn’t go bankrupt and few to none lost their jobs over the mortgage bust. Where did the money go? back to where it came from…thin air. And guess what the banks got the house and the home owner, your neighbors, got kicked out and their credit rating trashed.

Yes they knew full well when they woke up an went to work in the morning that it would eventually crash but they also knew that they would not get hurt and would in fact make money either way it went and that is exactly what happened.

few to none lost their jobs over the mortgage bust.

FWIW, a lot of people lost their jobs in the financial industry, after the credit crunch.

I recommend Griftopia – Taibbi

https://en.wikipedia.org/wiki/Griftopia

I’m not sure if the money always went to the borrower. Who does mortgage money go to, if you buy a house? The seller, not the borrower.

I’d say it often went to the developer who built the house on spec, and sold it to someone who couldn’t afford it.

The buyer who could not really afford the house nevertheless enjoyed living beyond his means for some period of time – So in a very real sense he consumed some of the money.

AND when a foreclosed house is eventually sold, if it sells for much less than is owed on it, then the buyer gets the difference in real concrete goods- assuming he can afford the house.

Mother Nature really does not give a flying you know what about efficiency and conservation.

It helps to think about business in the same way to a certain extent.

Business is usually thought of as a win win proposition, both buyer and seller gaining but this is not necessarily true at all times.

A hell of a lot of business is conducted on a win lose zero sum basis. The goods and services simply change ownership rather than DISAPPEARING into some unknown dimension. Of course consumable services and goods do disappear – but into the known dimension of history.

Nick is dead on. The SELLER gets the money when a mortgage is created. It matters not a whit to the seller what happens to the house or the housing market five minutes after closing. The seller has the money.

The lender is on the risk hook and assumes the risk on the basis of hoped for future profits.

Bad debts in very large part simply mean the defacto change in ownership of physical assets or fiat money.

Anybody who understands the conservation of energy and mass in basic chemistry should have no problem understanding what I am getting at. Every thing winds up SOMEWHERE, nothing is DESTROYED.

Anybody who understands the conservation of energy and mass in basic chemistry should have no problem understanding what I am getting at. Every thing winds up SOMEWHERE, nothing is DESTROYED.

In terms of the very wealthy, I don’t think it matters if they can’t collect on some debts or if some of their assets decline in value a bit. If they have more wealth than they can spend and, even after some declines, they still have more wealth than they can spend, what their net worth is on paper doesn’t matter much.

The buyer who could not really afford the house nevertheless enjoyed living beyond his means for some period of time – So in a very real sense he consumed some of the money.

Perhaps. But, I don’t think I’d say the buyer “enjoyed” this living. It was usually a disaster, involving misery, foreclosure, ruined credit, loss of investments in the house (downpayment, decorating, moving costs, etc).

AND when a foreclosed house is eventually sold, if it sells for much less than is owed on it, then the buyer gets the difference in real concrete goods- assuming he can afford the house.

The buyer pays the market price. They don’t get anything for free. Of course, that market price may be below the market price for a similar looking home because the buyer is taking the risk of buying something that probably has been trashed.

Over half of the borrowers in the housing bust were people who lived in a house for several years that increased in value. Then they “refinanced” and took all of the equity out of the house. Took the money and bought new cars, boats, vacation trips etc. Then, when the bust arrived, their new refinanced mortgage exceeded the value of the house. But, they had spent all of the money that they took out. In many cases, they had no money invested in the house at all after the refinancing.

Thank you Clueless for saving me the trouble of replying to Nick.I was about to get out a smaller brush but you saved me the trouble.I have known many people over the years who have done exactly as you have just explained.

My attorney told me just a couple of months ago he borrowed MORE on his house – so far he has borrowed about four or five times the original purchase price. The key to this is that he bought it thirty or forty years ago and has been borrowing in a rising market ever since.

There are PLENTY of people who live well beyond their means on easy credit, with driveways full of new cars and boats and the house full of new stuff to the point just about every dime coming in is due in payments the day it arrives.

They manage to hang on, mostly,so long as they don’t lose their jobs or get sick but every year I hear about one or another losing control.

What this boils down to is people with substantial incomes having no more FREE CASH FLOW than Walmart clerks living on beans and cheap coffee.

Sometimes this sort of person has assets which are protected from creditors and the courts by various means. One that works pretty well in this state is to have some property not pledged as collateral in the husband’s or wife’s name with that spouse not cosigning.

Now as to a person buying a foreclosed house paying market price – sometimes yes, in principle yes , but nobody I ever knew who bought such a house thought he was paying as much as he would have paid for a similar house in a similar location.

In the sense I meant, if the buyer gets a house that cost a hundred grand to build say ten years ago, for only say eighty thousand , with labor and materials up in price since then, he captures the embodied value of that labor and material.

He gets to LIVE in the house and CONSUME the value of the time element involved even though he might never realize a cash profit. Value can be measured in more ways than one.

Sure. I was talking about the other half of the borrowers: the ones who bought at inflated prices, or bought something they couldn’t afford. In those cases, it was the seller who got the money, and the buyer was left holding the bag.

It’s worth also remembering that many people who were left “underwater” stuck with the loans (both purchase and HELOC) instead of walking away. They may have consumed based on assumptions that were wrong, but they were and still are paying for that consumption.

PS Ron I don’t believer in any of the crap you mentioned so sorry not to fit your stereotype.

Perhaps but those who believe in one conspiracy are most likely to believe in others as well.

If I understand the Guardian piece says reserves were inflated (which I would say was designed to keep oil prices low if anything) but the latest figures seem to indicate we are hitting a peak which has been interpreted as a conspiracy to inflate prices in the long run (have I got that right). They seem to be completely opposite strategies, and I can’t see EIA have the competency to carry through either of them. Who actually benefits from either position – inside traders?

A price direction desired would be agenda.

A very good example is what is happening with Greece right now. All this morning there was talk of encouraging progress and Greece capitulating. Then the Euro markets closed. And out came German statements that the Greek proposals were insufficient.

Oil price direction is an uncertain agenda. There is a mixture of opinion on which direction is desired. This yields conflicting data.

“That analysis is bullshit!”

You seem upset. If it’s bullshit, why would you respond in a way that makes you seem upset about it?

The analysis is nothing but conspiracy theory bullshit. Dr. Don is saying that the US Government has a central planning agency that dictates to the EIA. And they are demanding that they must cook the books. Implying that everything the EIA publishes is lies dictated by the central planners. That is pure conspiracy theory bullshit.

Conspiracy theory bullshit always upsets me. I really cannot explain why. Perhaps you can psychoanalyze me and tell me why conspiracy theory bullshit upsets me so.

Mr. Patterson

You have always struck me as one with impeccable integrity.

For a host of reasons, I refrain from engaging in anything other than oil/energy related issues on this site.

However, the fact that two individuals carrying current, valid “Company” IDs, driving a “Company” registered vehicle, were apprehended a few weeks back crossing the border in El Paso with over a thousand pounds of cocaine – due to the vigilance of the local Minutemen, might prompt one to ponder ‘stuff’.

Haven’t heard of this? Mmmm …. Mebbe it’s just a tin foil hat kinda thing.

(Journalist Gary Webb – who committed suicide by firing two bullets into his head, must be spinning in his grave).

Coffee, what in the hell are you talking about? We were discussing silly idea that there some “central planning agency dictates everything the EIA does or publishes”. And you bring up an incident where two men driving a company vehicle, were caught with crossing the border with a thousand pounds of cocaine.

I don’t really see the connection there? But I am sure there is one and I am just too blind to see it. But whatever it is I agree with you. I would be afraid not to. 😉

I’m not American but even I know what the “Company” is…

I did a quick search on the story above and got this:

http://worldnewsdailyreport.com/two-cia-agents-arrested-by-minutemen-while-crossing-mexican-border-with-1300-pounds-of-cocaine/

Ron I think the truth is in the middle. I understand your rejection of what I will call the grand conspiracy: you know, the trilateral commission, the council on foreign relations as guiding hand for the world, and on and on. You read this stuff when you’re a teenager and it is appealing, but later on it doesn’t hold up. Like trying to go back and read Siddhartha after a certain age.

And yet there are larger forces than affect us all. Corporate, political, the power of the media in the public arena. A few examples of things that raise the eyebrows, some echoed upthread:

inflation – what is counted and how. John Williams has some of this right. I have tracked a number of personal inflation statistics for many years – from the cost of a newspaper to a movie ticket, six pack of beer, electricity, insurance – my own personal inflation basket, if you will. Most items going up by between 5-10% per year, year after year, while the official stat was 2% and below.

oil and gas – the decision to start reporting the oil sands in world reserves; the decision to start reporting total liquids instead of crude.

The changing calculation of GDP.

Unemployment – the way not-in-labor-force is used. The way people (millions) were shunted onto disability rolls and out of the unemployment stat. Just look at the way the telephone survey is done. Calls go out one week of the month. If you’ve worked one day in that week, you are counted as employed for the month. If you worked (unpaid) in a family business, you are counted as employed. Everything possible is skewed to count people as employed instead of the opposite, to where if you are a poor couple on the bones of your ass, and you decide you have a lawnmower, you’re going to start a landscaping business, you print up some flyers at Kinko’s and you get a few gigs at $25/lawn that month you’re employed. And you’re wife who went to the Kroger and put flyers under windshield wipers, she’s employed too.

financial reporting – just like a decision on what oil to record as reserves, comes a change in reporting on the national debt. Henceforth we will only report the “public debt” and hence it can still be recorded as less than 100% of GDP. Hell, we don’t even have to update the debt figures any more. For the second extended period the DTS doesn’t even have to get updated (because we’ve hit the limit and are practicing “extraordinary measures”), until some point down the track when another trillion or so $$ will pop onto the radar.

Any of these are complex topics, but the nut of it is that you’re right. If you’re some mid-level functionary in the BLS, or the DOE, or the Treasury, or the CBO, you’re just doing your job with the framework you’ve been given. Not reporting the national debt this month, okay, mate, we’ll turn ‘er loose when congress reauthorizes the limit. Oil sands are now reserves, okey dokey, let’s remake this table and get it recalculated in time for the next IEO.

Maybe that first year, a few of us raise our eyebrows. Oil sands, really? But then we accept it and it becomes the status quo. Working one day in the month = employed. Really? Hedonic adjustments to recalculate inflation. Really?

Since it’s an energy blog I’ll wind up on that. If you heard tomorrow that kerogen was going to be counted as proven reserves you’d probably choke on your coffee. But why not? It’s just a bit of a leap, and we’re already counting bitumen… Why shouldn’t we just count coal for that matter. It’s oil too.

Decisions get made that defy close inspection. And it makes people clamour over conspiracy. But most people are just doing their jobs the best way they know how.

Hi Ron

The monthly energy review has US c+c at 9.4 Mb/d in April. Can you define what you mean by a serious decline by June?

What output level do you expect in June?

Dennis, the Monthly Energy Review has US production up, February to March, by 163,000 barrels per day. That is beyond all reason. I would consider it a serious decline if it is down by 200,000 bpd, in June, from from its December high. But if it is down by a single barrel from December then that will mean the EIA’s Weekly Petroleum Status Report is almost 400,000 bpd too high. And it will mean my guess is twice as close to the actual number as the EIA Weekly Status Report.

Hi Ron, I ignore the weekly status report, those numbers are often bad and never revised. So if I am understanding you correctly, you think 9227 kb/d in December(from Monthly Energy Review) will be the high point and that production will fall to 9030 kb/d by June 2015, is that right? Or do you think that currently US C+C declined to 9100 kb/d in April(since December) and will fall another 200 kb/d to 8900 kb/d by June?

I will be surprised if we see output below 9300 kb/d in June, but maybe it will be between 9000 and 9300, say 9150 kb/d, if so that is a pretty small decline over 6 months (about a 1.6% annual decline rate). If output declines as you predict, oil prices will rise followed by US C+C output.

On the near term World C+C peak, I think we will see a temporary peak in 2015 at around 79 or 80 Mb/d (for the 12 month average) by Sept 2015 as you have predicted. If oil prices recover as monthly World C+C output continues to decline in 2015, then a plateau or possibly even a slight rise in output is possible. I think the plateau scenario is more plausible for a year or two with a slow decline through 2020 ( to about 78.5 Mb/d).

It depends on oil prices and how the World economy responds to the recognition of peak oil (which the mainstream media is unlikely to accept until 2025, even if my scenario is not too pessimistic, and most here will think it far too optimistic.)

Dennis, I meant 200,000 bpd below the December numbers. However I am not all that confident of those it will be 200 k below December. I do believe the numbers will be below December however.

I don’t see a plateau after the peak in 2015. And that applies even if prices do recover. Remember I called 2015 the peak well before the price collapse. And I am sticking by that prediction. I see only a slight decline in 2016 but increasing by more than 2% in 2017.

Hi Ron,

You might be right about the peak, but unless oil prices stay low and/or the economy falls apart very quickly, I am confident that the decline will not be as rapid as you predict. We will get to a 2% annual decline (or higher) when the World depression (or worse) arrives in 2030+/-5 years.

Prior to that annual decline will be under 1% until 2020 and under 2% until 2030 (unless the depression has arrived by 2025), when the depression hits annual decline rates will rise due to low oil prices and a lack of aggregate demand for all goods and services.

We will get to a 2% annual decline (or higher) when the World depression (or worse) arrives in 2030+/-5 years.

Really now? You are predicting a World depression in 15 years, + or – 5 years. I wouldn’t make such a prediction. Oh I think there will be a World depression, likely in just a few years. But the seeds of that depression are happening right now. 25 to 30 nations are already “failed states” and that number will rise. But my point is the recession will gradually increase intensity and it will be difficult to point to the exact date it began.

But the decline rate, I think by the mid 20s it will be above 3% average. There will be some years it will be less and some more but it will, by then, be greater than 3%.

Hi Ron,

If your predictions about the economy are correct, your predictions about oil decline may be correct as well.

If the World economy continues to grow at 2 to 3% in real terms on average until 2025 (as it has on average for the past 10 years or so), would you still expect an average rate of C+C decline of 3% by 2025?

There are all kinds of potential scenarios for an oil shock which could cause a sharp decline in oil output, such as a major war in the Middle East or the start of World War 3, I don’t think those are predictable.

Another possibility is a spike in oil prices (a rapid increase in prices such as a 100% price increase or more in one year) which could lead to a severe recession which is also difficult to predict.

Once peak oil is reached we both see the economy slowing down and oil output falling, you see it happening more quickly, I think the process will unfold more slowly. The economy will attempt to adjust to higher oil prices and growth will be reduced by the resulting economic disruption, eventually there will be a financial crisis which will cause a depression.

Hopefully the lessons that J.M. Keynes taught us will be relearned.

Hi Ron,

You said,

Really now? You are predicting a World depression in 15 years, + or – 5 years. I wouldn’t make such a prediction. Oh I think there will be a World depression, likely in just a few years. But the seeds of that depression are happening right now. 25 to 30 nations are already “failed states” and that number will rise. But my point is the recession will gradually increase intensity and it will be difficult to point to the exact date it began.

You say you wouldn’t make such a prediction, and then you predict that there will be a depression in a few years.

I guess your main point is you think things will gradually get worse and worse, that may be what happens. I think things will get worse without most people recognizing it (much like the lead up to the financial crisis), then there will be a “Minsky moment” where a financial crisis occurs which is likely to lead to a depression. I like the symmetry of a 100 year cycle so maybe a stock market crash in the third quarter of 2029, followed by a 10 year depression (assuming that we choose austerity as the proper course of action).

If economists relearn Keynesian economics, perhaps the depression will be shortened to 5 years. These WAGS could be wrong by at least +/-5 years for the start date as well as by +/- 5 years for the duration of the depression.

Hopefully I am wrong and there will be no depression, but at minimum a recession will follow peak oil within 10 years.

Dennis, what I mean is it will not be something that just happens one day that was not there the day before. Something is gradually happening, and I am not sure I would describe it as a depression.

It is, and will be, monetary problems but a lot of other things also. I believe the next ten to fifteen years will be a lot different than the past ten or fifteen years. But it will not come suddenly, or at least I hope not.

It is a little like the weather we are having right now. We have never had weather like we are having right now. So dry in California, flooding in Texas and the middle of the country, and droughts all over the world.

Reservoirs, both above and below ground are going dry, not just in the West but in a lot of other places in the world. The world is slowly losing its ability to feed its people. But it is happening so slowly no one is noticing.

Thousands of immigrants are streaming out of North Africa every day. They are trying to escape the failed states of Africa. Places like Italy are trying to absorb all they can but now they, and other European nations, are turning them away. There will soon be starving hoards on the beaches of Southern Europe.

That is what is happening right now Dennis. And it is ramping up so slow few seems to notice. But to borrow a phrase from Robert Kaplan, it is the coming anarchy. And there is no way to stop it.

It may, or will, be anarchy turned inside-out; from the innards of the state back to the outside. Anarchy doesn’t equal chaos. Only by State-anarchists does it. Of course it does if you lose your internal anarchy against the external, the majority. But that’s what happens when the forced stasis of the State im/ex/plodes.

Failed State seems almost a tautology, and the way some speak, it is as if the State is desired/necessary; the crowning glory of civilization. Well, ‘crowning’ (oligarchy/monarchy) sure…

There is some distinction made between the State and civilization, but in any case, I suspect a difference in kind where BAU EV’s, renewables, roadways, skyscrapers and whatnot become bizarre, out-of-place ‘stranded assets/ghosts/abandonments’ in an exergy world that changed from a grape to a raisin.

(Behold, a thought experiment where someone tries to build out something relatively small-scale, like, say for their home and surrounds, and each time they build an element of it, they disable a part of their body, so their buildout becomes increasingly harder until they are completely disabled or dead [‘raisined’] and so their buildout becomes useless as their little world changes from a grape to a raisin.)

This system that some of us are looking to smooth transition to, again, is unethical: BAU/crony-capitalist plutarchy. Roll that around in your mind. Hold it close to your heart. It is not the kind of system you look to for that kind of thing, but you are doing it anyway and talking about it on here. And you are (suggesting) playing Russian Roulette with the rest of your– and my– world and planet to boot. You know who you are.

So there are not only problems from various technical/technological, strategic, financial, political, ecological, etc., standpoints, but also from ethical ones. As you sleep soundly at night, with a clear conscience. Clear, but corrupt.

25 to 30 nations are already “failed states” and that number will rise.

Do we know whether that number is higher than it was 20 or 40 years ago? I’d be really curious to see a real analysis over time.

Id like to see a failed state list. I can’t think of 30.

The 25 Most Failed States On Earth

This list only has 25 and does not include Libya. But the list is 2 years old. I think I could come up with four more, other than Libya.

not to mention the US of A

but then again I guess you think everything is hunky dory still.

The list isn’t accessible, nor is the criteria link.

Ron,

Two thoughts:

That list is just a ranking of countries from best to worst. There’s not clear dividing line that says a country is “failed”. Some of those are just poor.

Which leads to the bigger point: how do we know things are getting worse? Many of those countries were even poorer 25 or 50 years ago. Most of them are in Africa, and Africa as a whole is growing economically, and has been for decades.

Nick, just poor is not a definition of a failed state.

Failed States

Failed states can no longer perform basic functions such as education, security, or governance, usually due to fractious violence or extreme poverty. Within this power vacuum, people fall victim to competing factions and crime, and sometimes the United Nations or neighboring states intervene to prevent a humanitarian disaster. However, states fail not only because of internal factors. Foreign governments can also knowingly destabilize a state by fueling ethnic warfare or supporting rebel forces, causing it to collapse.

How do we know things are getting worse? Are you kidding? Where was ISIS 10 years ago. What about Syria? Or Libya? Or Ethiopia? Or Eritrea? And what shape was Greece in just a few years ago. Is the world debt increasing, both public and private? Will that debt ever be paid. If private debt cannot be paid people go bankrupt. And private debt is increasing exponentially.

And that is just the economics. What about ecologically. Well, let’s not get into that. I would have to write a book and tell you how that has gotten worse in the last few years… and last few decades.

That definition is too broad. A civil war doesn’t mean much unless neither side wins. In Somalia, one side has been about to win (twice) and the USA intervened (twice). So that’s a failed state sustained in a failed state by USA foreign policy. I think Syria may be similar.

On the other hand, I’d say Haiti is a failed state.

If Somalia is not a failed state then there is no such thing as a failed state and never will be.

There is no one or two sides in Somalia. Somalia is ruled by warlords, each with their own territory.

That being said, there is the Global Policy Foruf definition of a failed state, then Wiki has a similar definition, then we have the Fernando definition. I have no idea what that is but I think I will stick to the Wiki or the GPF definition.

Ron, Somalia is a failed state because on two occasions the side that was about to win was rolled back by USA interference. These civil wars can have pretty nasty actors, but the eventual end point isn’t necessarily “failed state” unless outside interference stops one side’s victory. In Somalia’s case the two would be winners were the Habr Gidr led by Mohamed Farah Aidid (of black hawk down fame), and the other case was the Al Shabab Muslim militias.

http://www.bbc.com/news/world-africa-15336689

One could argue Al Shabab is a Bush creation. In 2006 the Islamic Courts had taken control of Mogadishu, and the USA financed an Ethiopian invasion.

This Muslim courts were eliminated and a tougher, nastier and much more radical offshoot emerged in southern Somalia. And they won’t go away as long as the USA is financing an invasion force of African Christians which props up a puppet government.

Fernando, Somalia is a failed state regardless of the cause. Your assessment that it was “caused by the USA” questionable, but regardless that is beside the point.

And your assessment that Somalia would be a successful state if one warlord had just been allowed to annihilate the other is laughable.

That’s how states have been built. You call them warlords, they call themselves clan leaders.

Try reading a detailed Spanish history to see how Spain came to be. It was built by warlords who called themselves “King”.

Every state is a failed state.

Saying which states are failures is just splitting hairs.

http://finance.yahoo.com/news/global-oil-production-substantially-lower-175257546.h

For more information – please !

I made this point myself weeks ago here in this forum.- that the mass media are swallowing a phony definition of oil hook line and sinker..

I suppose we shouldn’t expect any better. Advertising supports the msm and the editors and reporters can’t afford to piss off their advertisers to too great an extent. And they can’t afford to piss off their OWNERS to any real extent at all.

There is hardly any such thing as an INDEPENDENT newspaper or magazine anymore. Just about all of them belong to some sort of corporate conglomerate or institutional fund of one sort or another.

The small number of people and organizations that are publishing the truth are drowned out.

I want to add to my 12:15 comment that I agree with Ron that the official statistics are off in the short term by significant amounts but that the long term statistics are very reliable.

So I am not buying into the conspiracy theories being debated here so far today- not to any substantial extent at least.

There need be no ACTUAL conspiracy for the msm media to just gradually change the definition of oil from what used to be more or less universally accepted by both industry AND media to a new ” don’t worry , be happy” definition that supports the business as usual scenario which in turn keeps the advertisers and owners happy. It keeps Joe and Suzy Sixpack happy too.

I am still hoping to invent the new word or phrase that will make me famous which describes this sort of thing. It LOOKS like a conspiracy and it has all the outer hallmarks of a conspiracy- but it lacks the main ingredient- the players involved getting together secretly and forming and executing a plan.

I do believe that the larger central banks have far more power than most people realize and that they are far more under the influence of the big corporate banks than is generally recognized by the public.

The fact that the managers of the large banks all escaped going to jail and even getting fired when caught cheating on the grand scale tells us all we need to know about how powerful bankers are.

Furthermore anybody who bothers to investigate will quickly discover that the regulatory agencies which supposedly regulate the banks are staffed almost exclusively at the top levels with former and to be again big bank executives and or megarich folks.

Incidentally I forgot to mention earlier that after hanging out in this forum and the old TOD etc so long I can’t even remember who to credit with first pointing out the discrepancy of the definition of oil. Jeffrey Brown for sure wrote about it earlier than most others but he may not have been the first one .

Mac,

I think most people and businesses not directly involved in the production, refinement, or sale of crude oil just aren’t that interested in just what counts as oil.

Most people are concerned about price – the price at the pump, the price to fuel a fleet of trucks, the price to manufacture petroleum-based products.

I agree with you on your other points. The era of local muckrackers, well-funded investigative journalists, and truly independent news is at an end. The major media conglomerates control most of them. There are still a few independent magazines and newspapers, or freedom enough that they might as well be independent. The rise of the internet has replaced analysis and journalism with a flood of confusing, often contradictory information; information that is more likely to confuse and demoralize than inform and empower.

Those who aren’t concerned about the details may find themselves trying to fill up a tractor trailer with ethane.

If you use half the cargo space to mount a pressurized fuel tank and rearrange the route so as to have half a day to fill the tank I suppose you could run a tractor trailer cross country on ethane. 😉

Hopefully we won’t be running trucks long distances very often in the future. The trailers will be loaded on flat cars and pulled from city to city by fully electrified locomotives powered by wind ,sun, coal, and maybe some new nukes.

Long distance trucking is a dieing industry barring the invention of a miracle battery or a miracle biofuel. I am now comfortable with the idea that battery electric cars can and will mostly displace the ice car and that they will do so over the next decade or two barring a fast collapse of business as usual.Cheaper batteries and more expensive gasoline virtually guarantee this transition.

ICE cars built twenty years from today will most likely be downsized and lightened, and the engines and drive lines sufficiently improved, so as to get close to double the miles per gallon of current day cars. If engineering smaller, lighter and sufficiently fuel efficient cars to keep the wheels of BAU turning proves impossible then Leviathan will step in to solve the fuel shortage problem in other ways.

One way might be to impose a universal much lowered speed limit. Dropping down fifteen or twenty mph does WONDERS for fuel economy in a modern car.This would of course have the additional effect of encouraging less sprawl and more localization of jobs and shopping etc.

Long distance trucking is a dieing industry

Yeah, I think trains are the future of land freight.

barring the invention of a miracle battery or a miracle biofuel.

Don’t forget, there’s a difference between “optimal” and “viable”. You could certainly put an affordable 6 ton battery in a 40 ton truck. It would reduce capacity by 15%, but it would give you a good 750 mile range. You’d have to swap batteries at “gas” stations, but for a fleet application like this, that wouldn’t be a big deal.

Similarly, there’s little doubt that we could produce synthetic fuels from renewable electricity for less than $10/gallon. That’s probably not competitive with electric trains, but it would work if desired for reasons of route and scheduling flexibility.

Really? How would that work?

Hi Fernando, If you mean how it would work in the sense of manufacturing the fuel, I don’t have any real idea. But maybe wind and solar power will get to be cheap enough – eventually – that it could be done for ten bucks.

Doubling or tripling the cost of fuel to run a truck can be a killer or a minor problem , depending on what you are hauling and how far. Paying an two or three hundred bucks a day to deliver small high markup items by the thousands to convenience stores would mean the delivered cost of a candy bar would go up only a penny or less .

The price of a load of gravel delivered a good way from the quarry would go up substantially.

I really do believe in peak oil myself and believe that I have a good shot at living to see well off people driving super small plug in hybrid cars that get two hundred or more miles per gallon equivalent between a small but powerful battery and a lawn mower sized diesel engine.

A two seater fore and aft arrangement is going to be the hot seller in a couple of decades.Most of the buyers will run most of the time on the battery.

IIRC somebody has a Volt with twenty thousand miles on it already that has used well under a hundred gallons of gasoline so far, given that the car is used for local deliveries and is plugged up whenever he parks it at the store.

Seems to me it’s more practical to make hydrogen and leave it as it is to feed a fuel cell? airplanes can be fueled with biofuels.

I think we got too many weird ideas being floated around which represent rather inefficient steps.

In the very long term it will make sense to produce *some* liquids – maybe 15% of what we produce now, for aviation, long distance water freight, seasonal agriculture, a little personal transportation.

These people claim 70% efficiency, which is pretty good. Might make it a little more widely useful than otherwise.

A pilot plant in Dresden has started production of the synthetic fuel Audi e-diesel using water, CO2 and green power—i.e., power-to-liquid (PtL). After a commissioning phase of just four months, the research facility in Dresden started producing its first batches of high‑quality diesel fuel a few days ago. (Earlier post.)

http://www.greencarcongress.com/2015/04/20150421-audi.html

http://bravenewclimate.com/2013/01/16/zero-emission-synfuel-from-seawater/

I think pretty near everybody here is missing two dominant facts re future.

1) Biggest. Fossil fuels are poison, and soon something is gonna jam that bad tasting but inescapable fact down our collective throats so hard we won’t be able to spit it out. Then, big changes in pricing, and ff’s are history.

2) There are HUGE opportunities in efficiency and sustainable energy sources that we are ignoring because we don’t have to look at them–yet.

When we do have to look, we will see. Then, ff’s are history.

And, personal guess. All of above will happen far faster than anyone here thinks– but me, of course.

And, I am starting to think, the Chinese.

And over there, Amory Lovins and offspring. BTW, his bunch are in a conspiracy with the Chinese.

I think demographics and a shift in money/power will hit a tipping point and renewables, distributed generation, and energy conservation technology will be the hot trends in DC.

Fossil fuels and everything tied to them is last century. These are not growth industries.

Mac, I think ethane would be loaded and stored in the liquid phase at a very low temperature. But I’m not proposing ethane. I meant that one does have to worry about what kind of molecules are coming out of a well.

I got it and that is why I put on a smiley face.

Now as to whether you can build an affordable low temperature fuel storage system that will withstand the vibration and shocks and so forth and still last a good many years mounted on a truck – that is a tough one. Maybe it can be done.

Most of what I read indicates that simpler large pressure tanks are more apt to be practical- and there is plenty of room on trucks for them if the intended cargo is dense or heavy. Think steel , concrete, lumber.

A very large fuel tank or tanks would be a big problem if the truck is needed to haul potato chips or other light high volume cargo.

Such tanks could be standardized and switched out pretty fast at truck stops using fork lifts or dedicated lanes with automated switching machinery. This would eliminate the time lag involved in filling one on the truck and also eliminate the need for very large storage tanks on the truck stop premises.Small interchangeable tanks could be efficiently filled on a steady basis.

Don’t forget batteries: they’re already cheaper than oil. Charging time is the problem for trucks, but this kind of swapping would fix that.

Well, I was thinking of an 8000 psi working pressure tank kept at 35 degrees F. That keeps ethane as a liquid. Like I wrote, it isn’t very practical.

Demand might be higher than previous estimates as well:

Sorry – I messed something up there and I don’t have an edit option.

Both links give a “page not found”. You have the same edit button everyone else has.

Not for the first post I don’t I do for the second- I got a message saying I’d posted twice which might have done something to the edit function. Can you delete the string please?

I deleted both links which didn’t work. I cannot delete a post after it has been replied to.

Link to the original article in oilprice.com by Kurt Cobb:

http://oilprice.com/Energy/Crude-Oil/Global-Oil-Production-Substantially-Lower-Than-Believed.html

Ron,

Yes, there is a great deal of fraud taking place in the top banks… mostly U.S. banks. Seems as if the United States ranks number one in the world for the amount of fraud, corruption and crime taking place in the largest banks in the world. I recently wrote an article on this: http://srsroccoreport.com/must-see-chart-major-bank-fraud-adds-up-to-a-lot-of-silver/must-see-chart-major-bank-fraud-adds-up-to-a-lot-of-silver/

Turns out that the top banks paid more than $128 billion in fines and settlements since 2008. Thus, the fines just paid by these banks could pay for total cumulative world silver mine supply from 2008-2014.

BLANK OF AMERICA (that’s correct, its BLANK of America), was awarded first place by paying $61 billion in fines, while JP Morgue’n came in second, by coughing up $31 billion and CitiCorpse, dead third with $10 billion.

The amount of leverage in the U.S. and Global financial system is way beyond anything sustainable. I imagine when the FAN FINALLY HITS THE SH*T, there will be no plan B like there was in 2008.

steve

The trust horizon with the current system based on accounting fraud is almost gone.

Even the bewildered herd knows something is wrong.

Dave,

This is true, indeed. My wife and I sold our business back in 2006 and moved out west in 2007 to a small ranching community as I knew the system was going to fall apart. And fall apart it did. What I and most in the precious metal community didn’t realize, is how long they could prop up the markets with Trillions of Dollars in currency swaps and monetary liquidity.

What will be an even more surprise is the rapid speed in which the system implodes. Who knows how it unfolds, but it won’t be pretty.

I go to the local truck stop to grab a bite where the farmers and ranchers meet for coffee. I sit in a table next to them and listen. One old guy said, “There’s no more gold left in Fort Knox, the damn Chinese got it all.” I almost cracked a laugh when I heard that. Then went on to say just how screwed up everything was and the Dollar was going to be in real trouble.

Again… Farmers and Rancher….LOL.

steve

I was a intellectual, but I’ve come to realize I’m actually a very well educated farmer.

Just returned from a trip to Montana.

It was a eye opener. Fat, well armed people, watching Fox news and eating off the industrial food system.

Even the boys riding fence had a belly hanging over the belt buckle.

But the fishing was good, the people friendly, and they all have a story as to what is wrong– even if the myths needed a bit of critical thought.

Fat, well armed people, watching Fox news and eating off the industrial food system.

I think government has done far more good than bad, so I fall to the left of center.

But I have grown so tired of the complaints that I have been making a dare while Obama has been in office (since to some people he is the anti-Christ).

I dare the anti-government folks to end all Federal government contracts, all Federal government jobs, and all Federal entitlement programs.

It will never happen. The economy would collapse and no politician would ever push for it. The politicians who say they want to cut the government money are generally just doing so as political theater. They say it, but don’t really mean it. But I dare them to actually do it.

People generally seem to want the money going to other people to stop, but they don’t want the money they receive to stop.

And if you want to save the Earth, then killing the American economy is one way to do it. Take away everyone’s money and the big houses and the big cars and the industrial farms and most everything else goes away. In other words, the “kill the government” types (and there aren’t any, really) are closet environmentalists.

But if there are conspiracies, you might want to at least coordinate them.

On the one hand, we have people saying the amount of available oil has been inflated. So therefore we don’t need to worry about running out of it.

On the other hand, we have people saying climate data is wrong to convince us to use less carbon energy sources.

Now, since this is a peak oil forum, I’d say most people here believe oil will become scarce pretty soon and therefore there is no particular reason to commit fraud to get us to use less because the reality will hit us soon enough as it is.

Inflating oil reserves so that we’ll continue to use more of it doesn’t seem to make much sense. But perhaps the powers-that-be know we’re running out and they are amassing their wealth so they can protect themselves from the masses when society falls apart.

I’m not given to conspiracy theories because I think it takes too much coordination on a huge scale to pull them off. And I rarely see the logic in why there would be a conspiracy to do something in the first place. I think we get enough bad policies just from the nature of politics-for-sale. No need for the extra step of a conspiracy.

Reference Venezuela: Investment are very negative, oil production is likely to drop. The black market rate is close to 460 bolivars per USD. Bloomberg’s announced they think there’s a 40 %+ probability of bond default in 2016. Inflation is running at over 100 %. Foreign reserves are down to $12 billion USD. The government owes over $15 billion in unpaid bills (not bonds, bills such as the money they owe to food and spare parts suppliers). They are trying to sell refineries and whatever they can move to cover the shortfall.

Airlines are canceling service to Venezuela. Food shortages continue, medicine shortages are acute. Corruption seems to prevail, crime has escalated, education is a disaster (now they are excluding high school students with straight As from entering university, if they come from the wrong family background (meaning from families opposed to the regime)).

They seem to be losing some friends, but latinamerican governments have demonstrated they are not worried about human rights abuses or the destruction of democracy. The international left seems to be a little less prompt to support the Maduro regime, but quite a few continue to show pretty good moral flexibility.

I voted for Obama. My vote was dictated by McCain when he started singing “Bomb Iran” and picked Sarah Palin for VP. I had consulted in Alaska and heard first hand about her record. As for other elections, after seeing the way Bush blundered with full GOP support I decided I couldn’t vote GOP. And I’m probably going to hold my nose and vote for Hillary (yuck). But I’m willing to vote for Rand Paul, I suppose.

I voted for Obama also, twice.

I wrote in ELMER FUDD in my ballot. Wonder how many votes he got.

steve

Be honest now, is this why messages that explain the conservative viewpoint on certain matters don’t go through? I wouldn’t hold it against you, it’s your blog and you can have a leftward bias on it if you want.

But I’m not leftist. I just dislike the GOP. They are terrible. By the way, my comment appeared in the wrong place. I was answering a comment somebody made about Obama. I don’t think Obama does a good job, but McCain would have been worse.

Russell, Bullshit! Yes I do delete some comments, about one every two or three months. I delete people who say things like: Global warming is a communist plot and everyone who says it is real is a communist or other shit like that. If something sounds like it is from an absolute idiot then I delete it. The last post I deleted, before today, was about three or four months ago.

Then today I deleted a post from some idiot who said: anyone who voted for Obama should have it tattooed on his head so we would know who fundamentally transform America into a socialist place I can’t recognize anymore.

I do not suffer fools gladly.

Edit: And that’s why Fernando’s post appeared in the wrong place. I deleted it just as he was responding to it.

Relax, I was just pointing out I don’t usually jump in explaining my voting record. I answered the guys comment because I thought it was pretty extreme.

“Then today I deleted a post from some idiot who said: anyone who voted for Obama should have it tattooed on his head so we would know who fundamentally transform America into a socialist place I can’t recognize anymore.”