The EIA just released its latest Drilling Productivity Report which is a report on all major shale plays in the U.S. All the data below, unless otherwise noted, is in barrels per day.

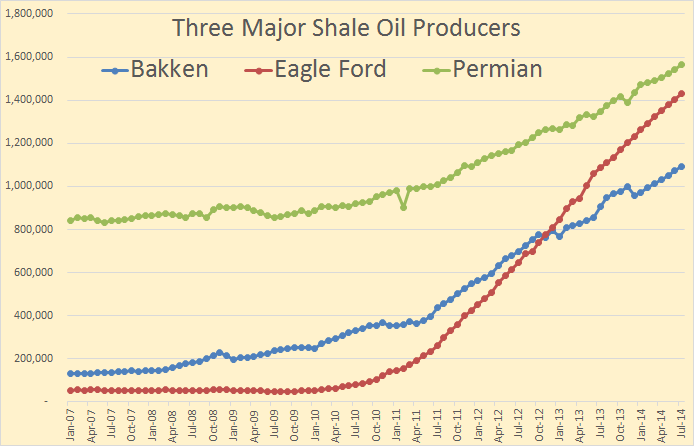

The EIA includes the Permian production as shale or light tight oil production. No doubt some tight oil is produced in the Permian but I think most Permian oil is conventional oil.

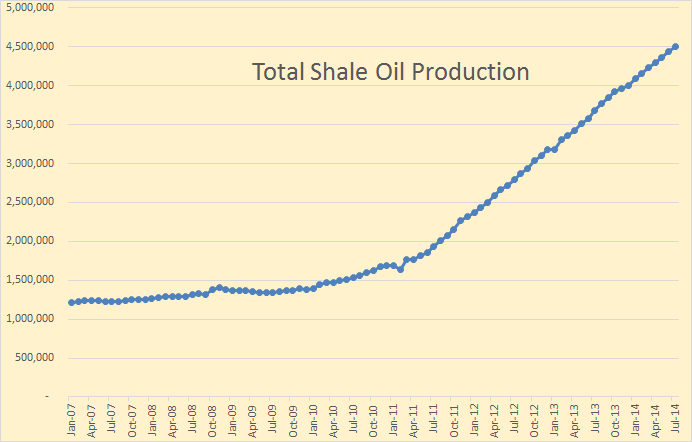

Total shale oil production from all six shale plays. However I believe perhaps one million barrels of this is conventional production.

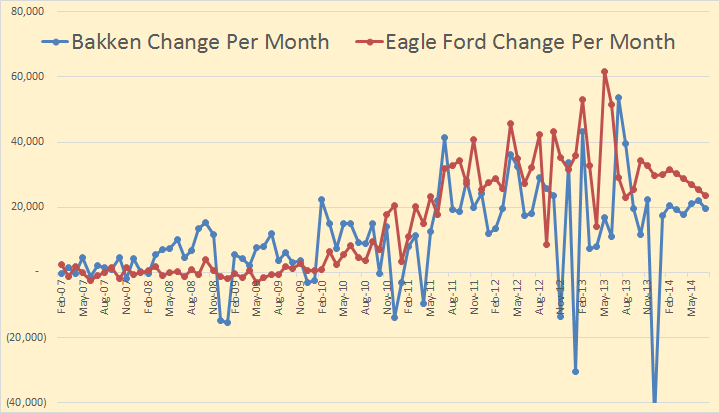

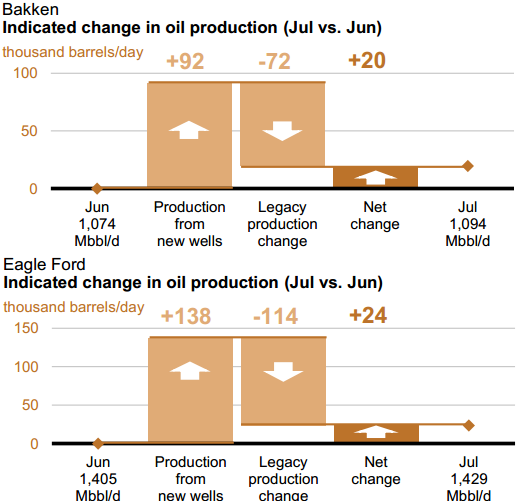

This chart is interesting as it shows what the EIA expects the Bakken and Eagle Ford to do in the next few months. The last seven months of the Bakken and the last nine or ten months of Eagle Ford. They are expecting the Bakken to continue to increase at about 20,000 barrels per day per month but they expect Eagle Ford’s increase to decline from about 35,000 barrels per day to about 23,000 barrels per day per month.

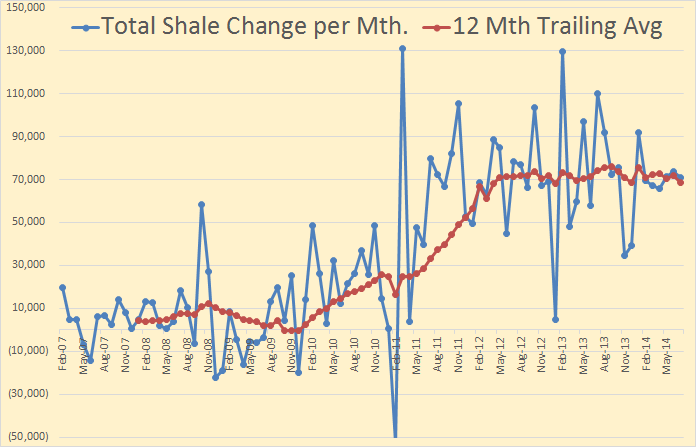

The above chart shows the combined amount amount of increase or decline per month for all six shale oil areas. Note that the last seven months or so are mostly the EIA’s estimate. As you can see it is mostly increase and that increase is averaging out to be about 70,000 barrels per day per month. That works out to be about 840,000 barrels per day per year. That is LTO or shale oil only. Production from the rest of the U.S. would have to be added to or subtracted from that amount.

Last year the U.S. increased production by about 960,000 barrels per day. This year I believe total U.S. production will increase by about 750,000 barrels per day, however I need a few more months of data before I can make a really educated guess.

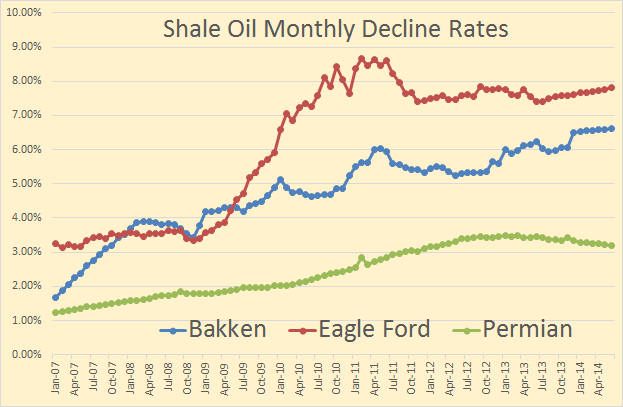

This is the most important part of the story, shale oil decline rates. As you can see the EIA says Eagle Fore is declining at about 7.75% per month and the Bakken is declining at a little over 6.6% per month. And notice the EIA has decline rates rising, not falling. They say the Permian is declining at about 3.2% per month. That is because, in my opinion, the Permian is mostly conventional oil.

But this is why the production of Light Tight Oil will slow dramatically in the coming months. As production increases the more the amount that declines every month increases.

As you can see from the above two charts almost all of the increase each month is already being eaten up by the decline. Of new Bakken production each month over 78% only replaces production decline. And of total Eagle Ford production almost 83% is needed just to replace the decline that month. That percentage will increase as production increases. But of course if production increased by the same amount each month and the decline rate percentage stayed the same, then they would never reach zero increase but would just get a little closer to zero each month.

However with they would definitely, sooner or later, not just reach zero increase but actually start to decline. As they move further and further away from the sweet spots or drill wells closer and closer together, production per well will fall. At that point production will start to fall. And if they have a bad weather month, as they did last December, then production will drop dramatically.

Another Bakken web site of interest: Bakken Shale, News, MarketPlace, Jobs

They publish news stories and rig count stats. Today they have links to seven stories including the three below.

May 26, 2014 Bakken Shale Rig Count Stays Flat at 182

June 2, 2014 Bakken Shale Rig Count Decreases by Five to 177

June 9, 2014 Bakken Shale Rig Count Decreases by One to 176

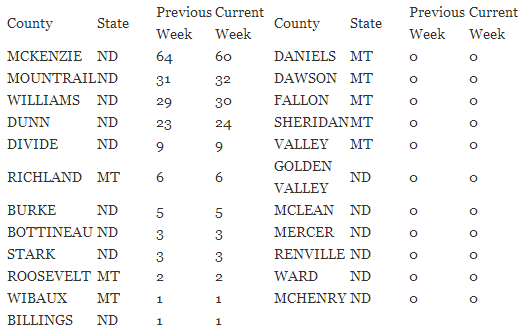

All the articles point out that rigs moving in and rigging up are not counted. The May 26th and the Jun 2nd article put the “moving in and rigging up” number at 16 rigs. However the June 9th article said that number was 12. So even if you count the rigs moving in and rigging up, the number of rigs seem to be dropping. I think the Lynn Helms, in his “Director’s Cut”, includes rigs “moving in and rigging up” in his count. But I will compare that with what is reported at this web site when the North Dakota data comes out in a few days.

That chart comes from the last article linked above. The total comes to 176 rigs, 167 in North Dakota and 9 in Montana.

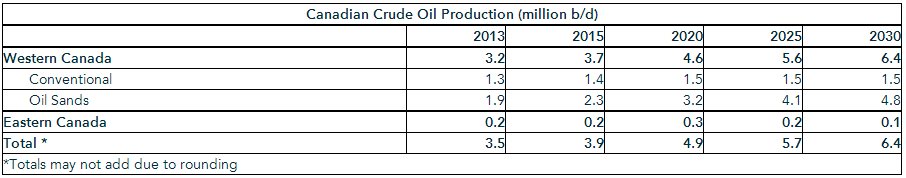

In other news: Canadian oil industry body cuts long-term production forecast

In its annual forecast, the lobby group for the country’s largest oil and gas companies, said total Canadian oil production would rise to 6.4 million barrels per day in 2030, compared with 3.5 million bpd in 2013.

That forecast was about 300,000 bpd, or 5 percent, lower than the one CAPP made last year.

And I fear they have further reductions in their forecast ahead.

142 responses to “The EIA’s Drilling Productivity Report and Other News”

More great analysis, Ron. In other other news, the weekly NG storage report from EIA continues to paint a troubling picture. As of May 30, storage still hasn’t reached the MINIMUM level of the past five years. Will stocks get back up to normal levels? That would require an extraordinary production rate over the next five months — might happen, but might not. So a lot will depend on just how hot the summer is and just how cold next winter is. But I’m expecting NG supply to be tight and significantly higher prices on the way.

What is becoming clear is that the growth rate for shale oil is no longer increasing exponentially; the production curve has now straightened out. The next step will be for it to bend down slightly, then more and more as the peak approaches.

Since the bulk of increased tight oil production has been in just the last three years and it took less time than that for the production curve to reach the region of simple arithmetic increase, the peak is probably not much later than three years from now and could well be sooner. Of course, the production curve slope may begin increasing again, but looking at the rig count and the finances of the shale producers, I doubt that it will happen without a dramatic increase in oil price.

Joe C Wrote:

“What is becoming clear is that the growth rate for shale oil is no longer increasing exponentially; the production curve has now straightened out. The next step will be for it to bend down slightly, then more and more as the peak approaches.”

I think once it peaks it may spell doom for most shale drillers. I suspect they can only borrow as long has they can show growth. Once they can no longer expand production its hard to believe that they can continue to borrow large sums. I did a little investigating work into Continential resources (CLR). During the past 4 quarters CLR has borrowed an average of $208M per quarter, with an average quarterly profit of about $880M. For the financials, it appears that CLRs profits have flattened out already (at least for the past three quarters). I think they only way the can postpone the peak is if they can find another and better sweet spot.

“More great analysis, Ron”

Absolutely!

People should be paying more attention to Iraq. ISIS is out to counqur that whole country. And they’re succeeding.

http://www.jpost.com/Breaking-News/Insurgents-in-Iraq-overrun-Mosul-provincial-government-headquarters-355829

Picture guys who train and fight as well as Americans but are so extreme ideologically that al-Qaeda cut ties. You want to be a foreign oil company when they show up?

Baghdad (who may be behind this) is depending on 250K bpd out of that region, but negotiations have been slow. Iraq does have an modest Air Force that could be doing *something*, if headquarters wanted something to be done.

This story smells like Baghdad would like that government replaced. Or maybe someone else wants that oil to flow.

These are the same guys Baghdad Shia government is fighting in Fallujah, for info.

A quite recent Maliki interview :

http://www.france24.com/en/20140308-france24-exclusive-interview-iraq-maliki/

Baghdad’s army got crushed, ISIS now has all of Mosul and all of the army’s equipment:

http://mobile.nytimes.com/2014/06/11/world/middleeast/militants-in-mosul.html?referrer=

http://m.us.wsj.com/articles/militants-seize-provincial-hq-in-mosul-city-iraq-1402387098?mobile=y

Overall this is a big deal. If oil flow out of Iraq gets smacked, the price will spike.

Tony Hayward (ex bp CEO, associated with a Turkish company) is very involved in Kurdistan also.

Many other hot spots

Iran official identifies Diego Garcia as potential second-strike target of war

http://www.uskowioniran.com/2014/06/iran-official-identifies-diego-garcia.html

Egypt’s lost power

http://webapps.aljazeera.net/aje/custom/2014/egyptlostpower/index.html

Iraq is so far falling a little short of the optimistic scenario that Stuart Staniford outlined in 2010:

http://www.theoildrum.com/node/6101

Political literacy is a must when analyzing Renter Oligarchies.

Especially ones where the population reportedly was going to greet us with flower pedals and joy.

haha 12.

That Hill guy should speak up re: oil fields that are shut in are irreparably damaged. I have heard nothing at all about this for Iraq, which was pumping and then got shut in.

Definitions:

GNE = Combined net exports from (2005) Top 33 net exporters, total petroleum liquids + other liquids

ANE = GNE less CNI (Chindia’s combined net imports)

ANE fell from 41 mbpd in 2005 to 35 mbpd in 2012. Note that Iraq and Libya combined accounted for 10% of ANE in 2012 (3.5 mbpd of net exports).

If we assume that the 2002 to 2012 pattern shown on the following graph holds for 2014, my point is that a substantial decline in net exports from both Iraq and Libya would come predominantly out of the ANE volume.

Things could get very “interesting” if political unrest spreads to Saudi Arabia, but from what I have read, Saudi Arabia is in a metastable situation, in that it appears to be stable, but it is inherently unstable.

You may recall that reported Chinese net oil imports are up by a double digit margin year over year, possibly at least in part due to them building up their crude oil reserve.

The “Chindia” ELM

What has happened is clear. What will happen is less clear, but here is what we have observed since 2005. In terms of simple percentages, GNE fell by 3.5% from 2005 to 2012, while ANE fell by 14% from 2005 to 2012, due to Chindia’s continuing increase in their consumption of GNE.

China buys 22 million cars a year (more some years). They don’t junk old ones because these are the nouveau riche.

22 million X 20 miles (less than the US norm) per day / 25 mpg =1760000 gallons per day / 42 =

420Kish bpd added to China consumption each year just from cars.

Given that most consumption increases there is from diesel, odds are this number is quite low — unless everything bought is a diesel car, which . . . can’t be given GM’s sales numbers.

Meaning, 420K is the absolute lowest increase in Chinese consumption even remotely conceivable. Nearly double that is likely.

750K bpd out of 10.4 total consumption maps nicely to the 7ish% GDP rise they claim. You want to know what they will burn in the future? Compound 7% forward.

And India:

Domestic car sales 2013 1.8 million cars. 14 million scooters.

1.8 million X 15 miles per day / 35 (smaller cars) mpg / 42 = 18K bpd

14 million X 15 miles per day / 100 mpg / 42 = 50,000 bpd

0.7 million commercial vehicles X 25 miles per day / 15 mpg / 42 = 30K bpd

Total added yearly consumption 18 + 50 + 30 or about 100K bpd from this weak year of car sales.

Out of their total consumption of 3.8 million bpd = about 3% increase.

Watcher is posting some scary numbers, and the real situation is probably worse than his numbers suggest.

The cars will probably be driven more miles than he suggests if the roads needed to drive them more get built.

And the figure given for the driven mileage of commercial vehicles strikes me as way too low and the estimated fuel economy as being way too high unless ” commercial vehicle” in India is defined very differently than it is in most countries.

You, sir, read between the lines.

I very purposely picked numbers somewhat absurdly favorable to make the point.

There will be no gentle transition. There will be devastation.

The fuel use for transport is going up quickly as you state. But China in the early 2000’s was still building oil power stations. I used to pass one under construction from Hong Kong to the mainland in 2003. They have slowed up on fuel oil use, but this is a balancing factor with the increase of transport fuels.

The US Natural gas situation seems interesting to me. After reading the latest on RBN Energy, everything is going to be rosy next year and onward.

https://rbnenergy.com/in-the-curve-evolving-trends-in-natural-gas-forward-curves

I know the Marcellus is a very productive area, but also from RBN again, it appears all gas pipelines running anywhere near the Marcellus, is being reversed to take gas north to Canada, west to Chicago, and South to LA. and Florida. Not forgetting the LNG plants being built.

https://rbnenergy.com/they-long-to-be-close-to-you-the-marcellus/utica-push-to-reverse-gas-pipelines

It seems like the Marcellus is going to supply 2/3 of the US gas market all by itself, as no other shale plays, except when gas is co-produced with oil, is coming to the party to help out. At least not at the current price of $4.50+.

I do realize the Marcellus is currently pipeline constrained, as the spot price in Pa. is less than Henry Hub, but to what extent and how fast can it be expanded to supply such a large demand. In the article is states 9 billion cubic ft per day take away capacity will come online in the next few years. Something tells me the price is going to have to rise to encourage other areas to help with all this growth, or someone is going to be a little cold one of these winters. I just can’t get my head around the fact that all the so called smart money is betting otherwise on the futures market.

As they say time will tell!

My usual natgas comments follow. Note the 20% decline in Louisiana’s natural gas production, from 2012 to 2013. And over the same time frame, Gulf of Mexico natural gas production fell by 13%.

No chance of increased NatGas production anytime soon. NatGas Rig count is hitting rock bottom. Looks like another crisis and much higher prices needed:

http://l2.yimg.com/bt/api/res/1.2/E6heLwoyax9g1xHt9_6cHQ–/YXBwaWQ9eW5ld3M7cT04NTt3PTYxNA–/http://marketrealist.com/wp-content/uploads/cache/2014/03/2014_03_31-US-Nat-Gas-ST/120080631.jpg

Full Article:

http://finance.yahoo.com/news/why-2014-natural-gas-rig-200806528.html

Gas-Turbine Sales increasing by 15% for 2014 because of new CO2 regulations:

http://www.ccj-online.com/axford-expects-2014-gas-turbine-orders-from-us-owners-to-increase-by-15-over-2013-worldwide-he-sees-a-5-decline/

Eggs, one basket. Great Plan! /sarcasm

TechGuy,

To be fair the Marcellus is pipeline constrained, rather than drill rig constrained. How long this lasts after all the new pipe capacity comes on line is the question. Once the take away capacity catches up with production capacity, then it will be over to the drillers. Will the rigs be available? You would expect a price increase would be required to make this happen. Will they be able to keep up production while keeping prices low?

The thing that really strikes me is how, geometrically opposed the players in the market have placed their money. To us here, it looks like a slow motion wreak happening before our eyes, but the people with the money can’t see it, or say otherwise.

It looks like a real high stakes game of poker as to who is correct.

Just to add a little flavour, New Mexico is considering putting a moratorium on fraccing, as our friend Mr Crammer on CNBC was just spouting. Now that could really cramp the shale fraccing boom!

Fracking is not particularly risky or dangerous vs conventional production. Period.

OTOH there is considerable merit in the perspective of burning everyone else’s first and being able to defy behavioral prices specified by exporters in the future. As has been mentioned Russia should be demanding cessation of alternative energy research as a price addendum for its oil and gas, and a future militant govt in KSA could demand customers convert to Islam.

So in that context production restriction has a valid point.

Watcher Wrote:

“Fracking is not particularly risky or dangerous vs conventional production. Period.”

Except when drillers dump spent fracking fluid into ground water in order to save money or to avoid hauling it off site to be properly disposed of. And there is the link between earthquakes and fracking. So far fracking hasn’t triggered any confirmed major earthquakes yet, but it certainly looks at lot like playing russian roulette.

All kinds of illegal acts can be widely harmful. Nothing special about fracking in that regard.

Nothing special about fraccing, but if they shut it down, it shuts down the shale plays.

Now that will be special.

Yup, it will be saved to avoid the non monetary prices imposed later.

Note that the EIA shows that marketed natural gas production from Texas, Louisiana and the Gulf of Mexico (GOM) all fell from 2012 to 2013. Their combined gas production fell from 12.0 TCF in 2012 to 11.1 TCF in 2013, a net decline of 7.5% in one year. This is the net decline, after new wells were added. The gross decline from existing wells in 2012 would be much higher.

The TX + LA + GOM region accounts for about half of US natural gas production. So, currently increasing production from the other half of production, including the Marcellus, has so far kept us on an “Undulating Plateau” in natural gas production.

Well, not quite. The imperative to go fast in shale means there’s no time to lay pipeline to a new, dying shale well and so a HELLUVA lot of gas is getting flared. A price change would likely elevate that particular production.

Meaning, specifically, the Eagle Ford shale, which would change those TX numbers.

Maybe all that gas is out there and MAYBE it can be gotten to market at something approaching current prices —— but – and this is a VERY BIG BUT- I personally can’t see any reason why this might be true other than wishful thinking.

I have to buy some lumber and steel and copper wire and hire the services of trades people occasionally -even after a lifetime as rolling stone of a craftsman I can’t do everything.The prices of everything I must buy have doubled or even tripled over the last couple of decades. In some cases they have quadrupled or gone up even more than that.I can sell scrap steel for what I used to pay for new steel.

That gas is not going to come to market at a cheap price- IF it can be brought to market at ANY price the economy can stand— especially considering that the wells are mostly going to decline at a ferocious pace.

Ewart: Rising costs lower oilsands outlook

“It is material enough to send a message that costs and competitiveness are getting tighter,” said Greg Stringham, vice-president oilsands and markets at CAPP. “It’s a variability of forecasting and I wouldn’t want to read too much into the signal it’s trying to provide, but it is down.”

The CAPP forecast is released each June.

This year it comes two weeks after French oil company Total announced it would delay its $11-billion Joslyn North oilsands mining project given the rising costs in the sector. Joslyn was expected to be in production by 2020.

Not only are we facing a rapid decline in U.S. & World oil production, we are also witnessing a rapidly increasing melt of the worlds glaciers. Looks like the Jakobshavn Glacier in Greenland lost 10 cubic kilometers (size of Manhattan) in just one month.

You have to see this video of the largest recorded Glacier Calving event in history:

https://www.youtube.com/watch?v=hC3VTgIPoGU&feature=player_embedded

It took 100 years (1901 – 2000) for the Jakobshavn Glacier to retreat 8 miles. However, it retreated another 9 miles from 2000-2010.

Once a lot of the ice is gone, the world gets warming in spades.

steve

WOW!

I thought Steve was referring to what Neven and his band of sea ice observers recently reported… It just gets worse.

Steve, thanks for the opening to add Neven’s post to the mix.

Jakobshavn calves a(nother) big one

I was too focused on the “Chasing Ice” video that I misread that you were reporting on the recent calving. Anyway, it did give me a chance to post Neven and Espen’s GIF.

Adding CO2 to the air will increase the amount of heat retained, there is no escaping that. But when that amount of heat is divided by the mass of the air, there isn’t much of a temperature spike. No climatologist has ever used thermodynamics to make a theoretical estimate of true temperature increase because THERE IS NO THEORETICAL BASIS. Looks like the extra CO2 has produced an extra half a degree. So be it, I think we can all live with that. Only the far-left socialists and globalists

eager to implement there worldwide wealth redistribution scheme under the guide of “climate change” are running around screaming that the world has warmed too much. Give me a break!

Argue all you want, but first show me the physics, just in case I missed something. No one ever does the math on CO2 heat retention from absorbing IR.

Dear Thomas,

I don’t think that the main issue is that CO2 in the air would increase the temperature of the air (much), the issue is that it leads to a general increase in temperature of everything below the air (earth itself), as the earth loses its ability to cool off via irradiation.

Sort of like a greenhouse, right? Anyway, think I’ll go with the 97% plus climate scientists’ view(s) at least until Thomas demonstrates why they’re all wrong. Meanwhile all that ice just keeps melting and melting and melting.

They are just trying to sell books, get grants and destroy capitalism!

One more time:

No evidence that peer review improves anything.

Are you discounting everyone of those 2257 peer reviewed articles?

I discount almost everything at all times.

I now understand how you think. : )

So, you don’t want the evidence confirmed and checked?

Hi Thomas,

I am pretty sure that the geophysicists, such as Myles Allen at Oxford (amongst many others) understand the thermodynamics a little better than you do.

For a simplified model see http://contextearth.com/2013/10/26/csalt-model/

Man’s impact on climate is negligible compared to the sun, volcanic activity, earthquakes, tsunamis, and other geological events. You people pushing the climate change agenda have other motives. Call it an altruistic endeavor to save mankind, but it is not hard to figure out it really is all about income redistribution. The plan is to alter our energy generating methods and tax all energy uses well beyond today’s taxes. Like all income redistribution schemes, the very rich will not be impacted. The very poor will get large subsidies, with the man in the middle PAYING for it all.

Absolutely, our real purpose here is to get more taxes out of the middle class. It’s sad to see our Grand Conspiracy exposed but we’ll just have to bite the bullet and find another cause. You were so clever to figure this out. I only pray that we and our families are not all burned at the stake.

Yes, it’s true – we’re all communist witches who hate freedom.

Stephen,

LOL… you stole my favorite line. The only thing I can add to this serious discussion is the understanding that HUMANS can do no wrong. Of course climate change is due to the SUN, VOLCANIC ACTIVITY, THE STARS or maybe the trillions of roaches giving off methane.

What we do know… is that HUMANS aren’t responsible for doing anything wrong. It says so in the Bible.

steve

I used to have a colleague who would pop his head into my office everyday before heading to class and say, “Off to stamp out ignorance.” Unfortunately, the internet spreads ignorance like wildfire. Peak oil, climate change, nuclear proliferation, religious fanaticism are all threats to our civilization. But no threat makes me bemoan our condition and despair for my child and his future more than ignorance.

Best,

Tom

Dear Sir,

You are making an ad hominem argumentation

https://en.wikipedia.org/wiki/Ad_hominem

I hope this may benefit your future reasoning.

Enno,

I assume you are talking to me. I really have no idea what you are talking about. Perhaps the layout of this blog makes it difficult for you to know what I am responding to. My comment was in response to the following statement made by CDN:

Man’s impact on climate is negligible compared to the sun, volcanic activity, earthquakes, tsunamis, and other geological events.

This, sir, is an ignorant statement. In fact, without human contributions due to the enormous amount of entropy we are currently adding to the biosphere, the average global temperature would likely be in a cooling phase over the past few decades due exactly to the factors he noted. Anthropogenic influences are significantly overwhelming natural factors.

See about 8:30 into the following video:

https://www.youtube.com/watch?v=9CKNHpVUJKk

So, to be clear, my comments were in no way an ad hominem.

Best,

Tom

Tom,

I was responding to CDNs post, not yours. My post would have been indented if it was.

Thanks Enno,

That certainly makes more sense.

Best,

Tom

Thanks for posting the CSALT model. It does indeed look like CO2 (at least as a proxy) is a significant factor in climate.

Is the data available to see how the CSALT model would do for the medieval warm period in which it looks like a large part of the US west was in multiple 100 year droughts”>

It looks like I messed up with the link. It is http://www.ldeo.columbia.edu/res/div/ocp/drought/medieval.shtml

Hi Oldtech,

The CSALT model depends on data that does not go back to the medieval warm period with very good accuracy.

We have proxy data which gives a rough estimate of temperature (with better coverage for the northern hemisphere) and carbon dioxide data, so we could look at the effect of carbon dioxide alone, but this misses the other effects of aerosols, solar effects, length of day, and the southern oscillation index during earlier periods. The model works best over the period from 1880 to the present.

I have played around with the model and included several periodic functions that correspond with various orbital parameters of the sun, moon, and the giant planets. I used periodic functions of 27, 20, 9.1, 8.85, 8, 7.3, and 2.46 years along with the CSALT data.

See http://contextearth.com/2013/12/06/tidal-component-to-csalt/

and

http://contextearth.com/2013/12/02/orbital-forcings-in-the-csalt-model-explain-the-pause/

and

http://contextearth.com/2013/12/18/csalt-model-and-the-hale-cycle/

and

http://contextearth.com/2014/01/11/the-cause-of-the-pause-is-due-to-thermodynamic-laws/

So the periodic functions were those that are based on planetary, lunar, solar, and other seasonal cycles that were statisistically significant to the model over the 1880 to 2013 period.

The NOAA land-ocean temperature with a 12 month centered moving average is compared with the CSALT model with the 7 sinusoidal periodic components mentioned above also with a 12 month centered moving average for the model. A chart of the 1960 to 2103 period is shown below, but the entire period from 1880 to 2013 matches the model pretty well.

Hi Oldtech,

I missed one of the periodic functions included in the model, it is a 5.3 year cycle added the others mentioned above. For the entire 1880 to 2013 period the 12 month centered averages of the model vs NOAA land ocean global temperature data is shown in the chart below.

Oh goodie, climastrology!

To be compared with this thermodynamic model

http://web.archive.org/web/20091124213247/http://tamino.wordpress.com/2007/10/03/two-boxes/

yielding this result

http://tamino.wordpress.com/2013/02/23/once-is-not-enough/

Occam’s razor can be very very sharp….

The solar magnetic flux is a major factor in climate change. There are very clear correlations between solar activity and climate change on earth – the evidence is much better there than between CO2 and climate change. Besides, as the IPCC acknowledged last September, there has been no global warming in 16+ years (they stated 15 years as the report was sealed in 2012). NO MODEL PREDICTED this hiatus in warming. Models are five times the observed temps. That’s a fairly significant margin of error that the left-wing warming activists just flat out refuse to acknowledge.

Really?

10 warmest years on record (°C anomaly from 1901–2000 mean)

Year Global[66] Land[67] Ocean[68]

2010 0.6590 1.0748 0.5027

2005 0.6523 1.0505 0.5007

1998 0.6325 0.9351 0.5160

2003 0.6219 0.8859 0.5207

2002 0.6130 0.9351 0.4902

2006 0.5978 0.9091 0.4792

2009 0.5957 0.8621 0.4953

2007 0.5914 1.0886 0.3900

2004 0.5779 0.8132 0.4885

2012 0.5728 0.8968 0.4509

And this was in a ENSO La Nina, when we should not have been getting warmer,

Really scary, as it looks like we are headed the other way.

If the current emerging El Nino is strong, more stored ocean heat will be released into the atmosphere.

I’m gonna have to go get a count of % comments on the global warming blogs devoted to proppant types and totals per Bakken well.

Just to be sure there is numeric symmetry.

Forget symmetry–

What you really should be looking at is the Southern Oscillation Index (SOI)— it needs to cooperate.

You do know this was a lie, and was created in a studio the Queen Of England owns in San Bernardino California.

That is one scary glacier calving. The scale is phenomenally large and all in just a little over one hour. It looked like a scene from the movie Monolith Monsters (1957) except highly accelerated.

I wonder if previous civilizations had a similar, yet reverse, effect with advancing glaciers during the ice ages and then the same effect as they melted. On land it would cause extreme flood events, blockages then releases of streams of rivers. One can see the scouring that the last glaciation did as it formed gorges and waterfalls across portions of North America. I live just north of terminal moraine, which is dotted with sand and gravel quarries.

The fact that the latest human version “grew up” during the receding glacial period is often forgotten. We are now witnessing a further receding of glaciers, though not nearly as vast as occurring in the previous 50,000 years. This one may push us to a near ice free world, but I wonder if it will only put off the next glaciation by 5,000 years since the orbital deviations will still be in effect.

The consequences of reducing CO2 back to pre-industrial levels would mean facing a world descending toward an ice age and all the chaos that would cause. People are astounded by the Little Ice Age effects, yet a full Ice Age has a much greater effect on climate, hydrology and life and who knows how fast the temperatures would change.

Will future technology save our butts?

Dr. Morris Adelman And Peak Oil Theory

Oil is not ‘inexhaustible’, as Dr. Adelman liked to say, but it remains extraordinarily abundant. And yes, that even applies to the Monterey Shale formation. Despite the protestations of today’s cultish purveyors of Peak Oil theory, 40 billion barrels of oil did not magically disappear because some guys in Washington DC decided to change a mathematical calculation.

The oil is still there, and billions of barrels of it will ultimately be produced because, as Dr. Adelman knew, the inevitable, unstoppable advance of technology will make it so.

He is saying that the Monterey Shale holds 40 billion barrels and we will recover every drop of it because future technology will figure out how. But even the most optimistic reports put the oil there at 15.4 billion barrels, now downgraded to .6 billion barrels. And though there has been some new technology in the oil patch it was primarily the high price of oil that made the Bakken and Eagle Ford shale recoverable. It was the price of oil that made deep water oil recoverable, and even higher prices were needed to make deep water sub-salt oil economically recoverable.

High prices has made it economical to drill in tiny fields that hold only a few million barrels. High oil prices were the reason we saw an undulating plateau beginning in 2005 rather than a steep decline. But high prices have only bought us a bumpy plateau, not soaring oil production.

But now we are looking at the decline beginning within the next few years. New miracle technology will not arrive in time to save our butts. Believing that new technology will save is the same thing as saying “science will think of something”. Science cannot perform miracles and I don’t believe in magic. The EIA says there are 600 million barrels of recoverable oil in the Monterey Shale but I doubt very much of that will ever be recovered.

Every time I see a post like this I want to go the Mike Rupert way . Connecting the dots over the last 10 years with the 3 E ( Energy,Economy,Ecology) collapse has got on my nerves . The only reason I live is because I have been thru the five stages (denial,anger,bargaining,depression,acceptance) . I tell to all those who will listen that my victory is going to be “bitter sweet “. Sweet because I will be correct, bitter because it will effect all my loved one’s (son,grandson,daughter,granddaughter,brother,sister,wife friends etc etc ) . But,what can I do ? Nobody listens , I continue my rants and at the same time doing a lot of travelling to see the sights before the “black gold” runs out and I kick the bucket .

What can you do? How about using a bit less of that “black gold” rather than saying there’s nothing you can do, might as well burn as much of it as I can before it’s gone?

Honestly, this is the equivalent of all of us realizing we’re running out of money and deciding that the only thing we can possibly do is go around telling everyone that we’re running out of money and then spending as much as we can.

Frankly, I wouldn’t be too inclined to listen to someone telling me about how we’re running out of oil who’s response to that is to burn more of it before they die. Why should I listen to someone telling me about a problem who’s response to it is to do their damndest to make it worse? I wouldn’t trust the advice of such a person.

If we’re running out of oil, then one thing all of us can do is work on getting by with less of it. That won’t fix the problem–the problem isn’t going to be fixed, because it’s a predicament rather than a problem–but it would make the future a little less worse. And that’s something. It sure as hell is something more than purposefully making it worse.

And in learning to get by with a bit less, you’ll actually have some skills and wisdom to possibly help your loved ones with as crunch time hits. Again, that’s something, no?

People who think they know better than all of the equally smart far better informed oil major scientists crack me up. Most informed people in the industry knew Monterey wasn’t adding up. Occidental tried to arbitrage that and got clobbered.

There’s a reason no one bothers with extreme technical difficulty resources. When you have real world economic constraints, it doesn’t matter. Doesn’t matter if Monterey is $180 break-even or $300, either.

We can’t run what we have on garbage resources.

ISIS jihadists have just captured Iraq’s biggest oil refinary in Baiji (150,000 BPD)

Watch how fast it becomes acceptable to negotiate with terrorists if they manage to take over the country.

“If we torture the data long enough, it will confess.”

I googled it and found only this:

Maliki seeks state of emergency after ISIS seizes 2nd-largest Iraqi city

Iraqi Prime Minister Nouri al Maliki urged his parliament Tuesday to declare a nationwide state of emergency after militants from an al Qaida offshoot seized control of a large swath of Mosul, Iraq’s second largest city, in a humiliating sequence of events that saw Iraq’s U.S.-trained security forces abandon their posts and weapons and flee…

A resident of Tikrit, the central Iraqi city that was Saddam Hussein’s hometown, said government workers at the nearby Bayji refinery, Iraq’s largest, were handing over their official vehicles to administrators for fear they’d be killed for them if militants made it into the area.

It don’t look like there is a lot of hope for those U.S. trained troops defending Iraq. 😉 Seriously it looks like Iraq is headed for a lot of turmoil and civil strife. I doubt that they will ever reach 4 million barrels per day. They produced, in April, 3.3 million bpd. The idea that they would reach 12 million barrels per day has to be the joke of the century.

http://investmentwatchblog.com/iraq-update-isis-jihadists-have-just-captured-iraqs-biggest-oil-refinary-in-baiji-150000-bpd/

Could be a very “interesting” year, especially if the unrest spreads to Saudi Arabia.

As noted up the thread, I would suspect that declines in net exports from the Middle East will be disproportionately absorbed by net oil importers other than China & India.

Russia. Decline in Russia would make this a very very ‘interesting’ year.

Declines can be voluntary and probably will be and maybe should be.

The thought “let’s save it for our own people in the future” may hit a lot of places at the same time.

Poor Japan. They have no chance at all.

http://www.nytimes.com/2014/06/11/world/middleeast/militants-in-mosul.html?_r=0

“Having consolidated control over Sunni-dominated Nineveh Province, armed gunmen were heading on the main road to Baghdad”

“The Iraqi army apparently crumbled in the face of the militant assault, as soldiers dropped their weapons, shed their uniforms for civilian clothes and blended in with the fleeing masses. The militants freed thousands of prisoners and took over military bases, police stations, banks and provincial headquarters, before raising the black flag of the jihadi group Islamic State of Iraq and Syria over public buildings. The bodies of soldiers, police officers and civilians lay scattered in the streets.”

Yes, yes, but is the oil still flowing?

I am only guessing, but the two biggest factors in a army’s efficiency are usually logistic supplies and morale.

If you have run out of bullets, no point in holding on to your gun. If you haven’t been paid for 3 months because of corruption in the chain of command, your propensity to risk death for your CO declines rapidly.

ISIS is reported to have 5000 fighters. They have just overrun a city of over 1,000,000 people. I don’t think the army put up much of a fight.

Would you? These guys are much better and harder than the Iraqi army, and they don’t take prisoners. If you unit is falling apart because its losing, it pays to be the fastest and let someone else end up on LiveLeak as an example.

These guys will hit the oil fields and other refineries if they can. Its a good way to collapse the government, since the government is entirely dependent on oil revenues.

Well, let’s presume these folks have brains.

Cutting off oil would generate the sort of military response from outside that they don’t want. So their optimal plan is to keep the oil flowing, but maybe intercept payment for it and fund themselves.

Once they take Baghdad, then they really are sitting pretty and demand all sorts of things from their customers — like mandatory Islamic education in primary schools of customer countries.

It is clear that the (Shia) Iraqi army has decided to ignore the politicians and withdraw to their heartlands without a fight.

Kirkuk now owned by the Kurds. The ISIS have not overrun the refinery, the locals talked them out of it. The army is making a stand short of Baghdad , where a Shia holy shrine was in peril.

Iraq is now 3 countries. The West will just have to adjust to the real politic and renegotiate oil supplies. Oil up a dollar on the news.

Patrick,

The link below by Andy Hamilton fits pretty well with what you’ve been saying for awhile now. Seems like a balanced view of the New Realty: I don’t know if the “Green” part is valid but you’d as good a handle on that as anyone.

Doug

Come on Doug; surely you’d have picked me for a Guardian reader from way back!

Yes, so far they are down 100kbpd since December. That makes 2% per year decline.

Jeff Brown Wrote:

“Could be a very “interesting” year, especially if the unrest spreads to Saudi Arabia.”

For you!

http://www.bbc.co.uk/mediacentre/worldnews/2014/our-world-saudi-secret-uprising

I think that Saudi Arabia can accurately be described as “metastable,” in that it appears to be stable, but it is inherently unstable. A good book on Saudi Arabia:

http://www.amazon.com/On-Saudi-Arabia-Religion-Lines/dp/0307473287

In any case, in 2010 Syria + Libya produced a combined 2.2 mbpd (total petroleum liquids + other liquids, EIA). The EIA shows that their 2013 fourth quarter combined production was down to 0.4 mbpd, a decline of 82% from 2010.

In 2013, according to the EIA, combined production from Iraq + Saudi Arabia was 14.7 mbpd. In 2012, their combined net exports were 10.9 mbpd.

If Iraq and Saudi Arabia were emulate the civil wars in Syria and Libya, their combined production would fall from 14.7 mbpd to about 3 mbpd, presumably eliminating their net exports.

In 2012, Global Net Exports of oil (GNE) were 44 mbpd, and Available Net Exports (ANE, the volume of GNE available to importers other than China & India) were 35 mbpd.

Nafeez Ahmed in the Guardian has been putting together some useful articles (though some may think his boosting of renewables is wishful thinking):

http://www.theguardian.com/environment/earth-insight/2014/jun/10/inevitable-demise-fossil-fuel-empire

“Wishful thinking”, yeah. Well, there is a presumption of a transition from FF to renewables, and to some extent that will certainly occur, but will it be enough to actually make a full fledged transition in which BAU continues? Renewables does not replace a densely energized liquid, oil, transportation of various modes, from ships, planes, tractors and big rig trucks. Also the German’s with their Energywiende reached 13% renewables and hit a wall due to intermittency of energy supply causing distribution problems. So how do we go to 100% renewables? And worse yet, how do renewables create more renewables, and if so, then how do we get 2-4% GDP annual growth?

Hi Perk Earl,

There will not be BAU, that would be what exists with plenty of fossil fuels.

There may be a transition to renewables and clearly it will not happen overnight, but fossil fuels will not decline to zero output overnight either. As the supply of oil declines, oil prices will increase and oil will be used more efficiently.

The intermittency problem of renewables is solved by overbuilding capacity and building HVDC to enable more efficient movement of power across the grid, batteries and fuel cells and some natural gas can be used for backup.

A university of Delaware study showed how 90% of the Northeastern United States electricity could be provided by renewables by 2030.

See http://www.sciencedirect.com/science/article/pii/S0378775312014759

the full paper can be downloaded at the link above.

Transportation will need to move to rail, light rail, buses, and electric or hybrid cars.

And no it will not be easy, and I would not call this BAU, it would be a logical response to our predicament and it will only begin as the decline in World crude plus condensate output falls to 4% below the 12 month moving average peak. If we are currently at peak (about 76 MMb/d of C+C), that would be about 73 MMb/d of World C+C output, when we get to that point (or before) prices will rise, economic crisis may result, but governments may start to take action (as OldFarmerMac has suggested).

Very possibly this is wishful thinking, but lots of seemingly impossible events have occurred (landing a man on the moon comes to mind), smart phones (to an 18th century person) are also rather magical. The future is pretty difficult to predict.

“There may be a transition to renewables and clearly it will not happen overnight, but fossil fuels will not decline to zero output overnight either. ”

No reason for an oil supplier to zero oil output provided to an importer — provided the importer agrees to suspend all terrorist activity — which is defined as those activities associated with investigating renewables. That is terrorist activity.

It’s just absurd to presume that a supplier wants to fuel his own destruction. The obvious requirement is that no further research takes place if you want oil. If you want to do that research, find another supplier — one who is insane enough to fuel his own demise.

I very much fear what I think you may be implying. Should several even small exporters decide to limit by say 10 or 20% to assure a longer lasting supply for themselves that this would cause supply distress to importers and should one or two larger exporters do such we would be revisiting the Arab oil embargo of ’73 only maybe …permanantly. I suppose this will have to happen if not by forethought by domestic consumption. Hard to keep the masses peaceable if you try to lower the per capita energy consumption of people who use much less than Westerners. Thank God for the need for revenue.

Hi Watcher,

OPEC fears renewables. Their response in the past has been to keep supply up so low prices will snuff out renewables. If they restrict supply and prices spike, this tends to make renewable energy more competitive and as it scales up prices may fall to the point where oil is uncompetitive even when OPEC pumps full out to try to reduce price.

Is there any compelling evidence that any exporting nations have attempted what you are suggesting (no renewables or you won’t get oil)?

Brazil’s oil power dreams in disarray

Brazil’s giant state-owned oil company, Petrobras, is in tough financial shape, with profits down 30 per cent in the first three months of the year and its stock market value less than half what it was when the company went public in 2010. Production problems in Petrobras’ oil fields have forced the country once again to import oil, at an average rate of 793,000 barrels per day in the first quarter.

Making matters worse, the company faces corruption allegations. A former executive has been jailed and faces charges of money-laundering. Brazil’s Congress has opened an investigation.

Meanwhile, the world is not standing still. The US is moving closer to energy independence, largely because of a revolution in natural gas production from hydraulic fracturing, or fracking, the controversial process of injecting water and chemicals into deposits deep underground. Mexico is about to open its long-closed petroleum sector to international investment, and countries such as Colombia are ramping up oil exploration and production. The opportunity to woo customers who are seeking new sources of oil during the sanctions on Iran already has been missed.

“Pre-salt looks like it is going to be less of a bonanza than Brazil thought it would be,” Peter Hakim, president emeritus of the Inter-American Dialogue, a policy centre in Washington, told McClatchy.

Also at stake is Brazil’s promise of energy independence, the health of its overall economy and the personal savings of many Brazilians who invested in Petrobras.

Americans also have a financial stake in the company, though many may not realise it. The US pension funds that hold bonds or stock issued by Petrobras are some of the United States’ largest: the California Public Employees’ Retirement System, the California State Teachers’ Retirement System and the New York City Employees’ Retirement System.

Others include the State Board of Administration of Florida, the Washington state Public Employees’ Retirement System and the South Carolina Retirement System. Those investments came when Wall Street and Brazil were euphoric about the pre-salt discoveries, which Luiz Inacio Lula da Silva, then Brazil’s president, likened in 2007 to a “winning lottery ticket” and Brazil’s “passport to the future.”

“Production problems in Petrobras’ oil fields have forced the country once again to import oil, at an average rate of 793,000 barrels per day in the first quarter.”

I think Brasil has always be a net importer oil. I maybe proved wrong but not by much. They have traditionally exported heavy oil, and importing light oil for which their refineries are designed for. The good news it the sub salt oil is light oil, so they should be able to now refine their own oil as their traditional heavy oil produced from their older deep water fields decline.

Surely there are no limits to the wonders mankind’s ingenuity can unleash. Hydrocarbons – oil and nat gas – are in vast unlimited supplies and all we need is the development of technology to enable exploitation of the resorces. You’ve just got to believe. Faith will move mountains. “Oil is not ‘inexhaustible’, as Dr. Adelman liked to say, but it remains extraordinarily abundant. And yes, that even applies to the Monterey Shale formation.”

And floating around in solution in the oceans are immense vast abundances of gold. There is enough gold to pay off every country’s national debt probably ten times over. The only problem is figuring out how to get it. Have faith. Remember – there are no limits to mankind’s (or America’s) ingenuity and technological advance. Soon, we’ll get at that gold and all humanity’s problems will be solved.

Likewise, we will get at the oil and gas to by technological advance. And then we will be able to populate the planet ten times over; and pump out carbon dioxide from the atmosphere into outer space; and refrigerate Greenland and Antarctica; and restore all the millions of extinct species to the world ecosystem; and mine Jupiter’s moons for hydrocarbons; and put an end to tectonic plate movements and end earthquakes and plug volcanoes; and resurrect the dead……………. We must have faith in our own ingenuity.

Ozymandias.

Mike,

As I’ve pointer out before, that “ocean-of-gold” is is a TRR (resource). I’ve already staked it and I’m looking for quality investors. Dennis will no doubt invest a few hundred grand in the initial offering. If you’re interested…………….. [Surely I don’t need a yellow face here?]

Doug

We shouldn’t exaggerate: At about 10 parts per quadrillion the Earth’s oceans hold roughly 15,000 tonnes of gold: Not really enough to pay every country’s national debt ten times over but for my small venture capital company……..

Exaggerate? Moi? Technological advance depends on capital investment and if you want the investment, you need to tell the truth to the suckers – er sorry I mean far seeing risk taking venture capitalists – that there are boundless unlimited vast abundant infinite resources to be got so long as you have the vision to exploit them.

In any case, NOAA say there are 20 milion tonnes of the stuff floating around. 5 kilos per human being.

Well yes, whatever. Now if you make your check out to fantasy gold unlimited I’ll see it gets deposited in the appropriate a/c.

Hi doug,

Let me know how much is economically recoverable.

I have pointed out many times that we start with a trr then figure out how much is profitable to produce. If the trr is zero, the err is zero, but a large trr can also result in an err of zero, it depends on prices and costs.

Dennis,

“If the trr is zero, the err is zero, but a large trr can also result in an err of zero, it depends on prices and costs.” PLEASE, cut me (us) some slack here. After all, we’re not kids in your grade five classroom. I don’t pretend to be an expert on anything but I do have a few degrees and 35 years of professional experience (not even close to recent I admit).

The reason for my TRR shot is valid – there’s far too much credence given to these “resource” numbers (NB recent Cal shale fiasco). Don’t get me wrong, I (usually) appreciate your input but you’ve got to give the rest of us credit for some intelligence, not much, just a little. [yellow face]

Doug

Hi Doug,

The undiscovered TRR estimates by the USGS are usually pretty reasonable, in fact their 2008 Bakken estimate and 2011 Eagle Ford estimates were too low.

EIA estimates by consulting firms with little knowledge of geology should be ignored (Monterrey fiasco).

Proved reserve numbers always end up being too low in the US unless prices crash.

[…] der älteren Quellen wieder aufgefressen. Das ist selbst nach den offiziell verfügbaren Zahlen so. Nach ein paar Jahren ist die Förderrate auf zehn Prozent ihres anfänglichen Niveaus […]

One more falls:

http://www.bbc.com/news/world-middle-east-27800319

Things seem to be spiraling out of control.

“As many as 500,000 people fled Mosul after the militants attacked the city. The head of the Turkish mission in Mosul and almost 50 consulate staff are being held by the militants, Turkish officials say.”

haha 500K refugees. Let’s see Baghdad feed them.

One does wonder where these guys are getting gasoline for their machine gun equipped pickup trucks.

The Brits said they aren’t going to act. Obama won’t either. Bottom line here, someone is going to have to do a Libya with fighter jets or these guys will mow down Parliament, kill Maliki, install their own guys and then SPRINT to the camera and announce democratic elections in just 6 months, and during that 6 months most oil will flow and all proceeds go into their own pockets to fund weapons and global terrorism.

Then after they feel confident, demand Islamic conversion of customers, demand Iran become Sunni, maybe resume the Iran/Iraq war (that will cost about 5 mbpd from global supply), or maybe just throttle back production for posterity.

The overall winner? Anyone who is energy independent — aka Russia.

I do not know if ISIS will try to take Baghdad. That would be a sure fire route to civil war and oil production collapse.

They are being encouraged to accept that they have the Sunni heartlands under control, that they have effectively destroyed the nation state called ‘Iraq’ as set up by the British in 1919, and they can now settle down and form a government and civil service.

I do not think the US will give Malaki the fire power he needs to retake the territory.

I do not rule out limited special force operations, but they are of course not openly reported.

It may be a little late to stick my two cents worth into the current climate discussion here but never the less:

Beware of oversimplification in such discussions.

The public is not so well informed by a long shot as the regulars here.

When someone says that natural forces have many times the effect of man’s activities on the climate they are making an easily proven statement– depending on the time frame implied or ignored as the case may be.Over the long term volcanos and orbital variations are no doubt more important than oil and coal and gas can ever be.

So in responding to people who believe that man has only a minor influence the proper response is that this is true- compared to natural variations over geological time. You may also need to explain what geological time means.

The actual amount of co2 we release in comparison to the amounts nature generates and recyles is trivial, well under one percent of the total IIRC.One really big extended volcanic event really could release many times as many tons as we are responsible for as the result of burning coal.

Any body who doubts this can search “Deccan Traps”.

But this does not mean the climate scientists are wrong. It just means that if you expect to convert anybody from a doubter to a believer you must take time to explain that what they believe may well be true but that the situation is more subtle or nuanced or complicated.

A good way to explain the current global warming situation which takes a while to read or listen too but which is intelligible to most laymen follows.

Suppose you follow the fortunes of a hypothetical man thru his life. There will be times when he is in bad trouble financially, and times when his income is increasing rapidly.He can go bankrupt or he can wind up rich depending on his luck good or bad.There will be both times he is ”running in the hole” and times he is getting ahead that last for extended periods such as getting thru college and his middle years when his kids are grown up and his income is at its max.

Some of the time- maybe even most of the time – his income is likely about the same as his expenditures. In this case his finances can be described as being” in equilibrium ”for as long as his income and expenses remain in balance.

Now if he gets a raise- and he saves it all – the amount saved can grow to an impressive nest egg over time. Likewise if he starts spending more than he is making it is possible for him to wind up very deep in debt.

Now we humans do not not live in geological time. A decade is an eye blink and a century is not even a yawn. A thousand years is a yawn in geological time.This planet is sure to experience more ice age and more hot house periods over millions of years.

NOW IN TERMS of our human time scale the planet is in a basically balanced or equilibrium situation in terms of green house gases on its own account AT THIS TIME.

It would indeed probably be getting ready to mostly freeze up again in the northern hemisphere within the next couple of thousand years or so if it weren’t for us.This freeze up would be a repeat of the last ten or so ice ages on a more or less regular schedule. They don’t call this period we live in an interglacial for nothing.

(It may well freeze up anyway because in that length of time the co2 we release may well be washed out of the atmosphere anyway)

But we ARE dumping co2 into the air at a tremendous rate and this is like saving money in terms of saving the heat that arrives here from the sun.The co2 traps the heat. It is as simple as that.This extra heat ain’t money and we can’t get rid of it by spending it.

And the amount of heat that is being trapped from day to day is increasing all the time and the total amount of heat energy stored in the oceans and land and atmosphere is growing all the time.

IF WE WANTED this heat the co2 effect would be like getting a raise and saving the money.The heat can accumulate fast enough to change things drastically on a human time scale.It IS accumulating fast enough to change things a hell of a lot within our own lifespans.

Unfortunately we don’t want the extra heat because we are best adapted to our current conditions.

If we are dealing with a typical doubter we have a chance of converting him to a believer if we take the time to explain in some detail why he is MOSTLY right but wrong in his conclusions.But if we insult him right away we don’t have a snowballs chance on a hot stove of making a convert.

well said OFM. I am going to try to use your approach.

And therein is the real problem. It seems the collective consciousness has an inherent inertia when it comes to recognizing and acting on information that doesn’t resonate with what everyone believes to be true. There is inertia in the collective mind when it comes to grasping the nature of global warming. We see it at work in our societies now, especially in the United States it seems, but also increasingly dominating in Canada and Australia where conservative (how appropriate the term) governments and sentiments deny the connection between CO2 and warming, let alone climate chaos.

If our collective mind were capable of the same kind of anticipatory learning that individual brains demonstrate then we would have heeded the early warnings. From the Wikipedia article on global warming:

We knew in the sense that some individual minds had seen the causal relation and had even worked out what the cue signal would tell us. Had we acted anticipatorily to that signal we would not be in the current situation. We, as a species, would have taken preemptive action to avoid the current crisis. But, of course, we didn’t.

The reason is that the vast majority of human beings are at best minimally wise. They don’t learn from their experiences. They do not have the scope of thinking to take in the whole world and for long time scales. For them such phenomenon are basically incomprehensible. And since they are in the majority and occupy the so-called leadership positions in society the collective mind is the most inert component of all.

Real control requires feedforward, causal associative learning, and the power to overcome inertia. The governance systems of societies have none of these in any meaningful way. Governance should steer our societies away from danger. Instead they seem to be willing participants in steering us right into the maw of destruction.

The small fraction of people on this planet who actually do have feedforward and have learned causal models of how the world works collectively have no power. Because of the inertia in the collective consciousness not even the power of words seems to have any effect. This mighty ship of civilization will crash into the reef of collapse without even a hint of starting to turn.

-George

“It may be a little late to stick my two cents worth into the current climate discussion here”

That’s not possible on an oil production blog. It can only be too early.

Some links:

Rune’s new post:

http://fractionalflow.com/2014/05/20/central-banks-balance-sheets-interest-rates-and-the-oil-price/

regarding crude export from the US:

http://www.oilslick.com/commentary/?id=4084&type=1

” Yergin claims ending the ban on exports would allow the U.S. to sell its highly rates light sweet crude on the open market and that would drive down the price of heavy sour crude we buy from other countries.

The first point that should make his report suspect is that it was paid for by Exxon, Chevron and Halliburton. Any report that big oil funds has got to be suspect. They would not be paying for a report that said ending exports would reduce oil prices. They have a vested interest in seeing oil prices move continually higher. ”

🙂

We need to be careful in passing judgement on questions such as this one.

While I do not believe that the effect of allowing our light oil to be exported would move prices enough for the movement to be noticed above the noise of ordinary day to day and month to month oil price fluctuations the argument may hold water to some extent.

More oil on the market of any sort can at least theoretically drive down the price of oil in general.

BUT I cannot see any way this would work to the advantage of the public.

It might be very much to the advantage of the owners of the exported oil and somewhat to the advantage of the owners and operators of refineries processing imported heavy crude.

The reason I make this argument is that if a business major or business man reads this blog he may very well believe as a result of any training he has in economics that exporting our light crude would be a good thing for the economy.

I think it would be a good thing only for the owners of the light crude and possibly the owners of domestic refineries.If there is any savings to be made in the energy used to run the refineries and ship the crude and finished products that savings will be captured as additional profits by the owners.

Nevertheless such savings are probably at least potentially real if I understand the argument.We need less light crude and more heavy crude whereas the rest of the world mostly needs more light and less heavy.Swapping light for heavy can probably save a little energy and a little money on each barrel involved.

If you happen to handle a hundred thousand or more barrels per day that little bit per barrel could add up to real money pretty damned quick.Even just one buck a barrel made or saved would mean an extra million bucks on the bottom line every ten days for hundred thousand barrel a day company.

Vermont House Uses Only Half a Cord of Firewood

In Ripton, Vermont, this fuel-stingy replica of Chris Corson’s Maine Passivhaus was heated last winter by a small wood stove

Posted on Jun 6 2014 by Martin Holladay, GBA Advisor

http://www.cga.ca/wp-content/uploads/2011/02/Chart-1-Natural-Gas-Storage35.pdf

From Energy Evidence… energyevidence.com

http://www.energyevidence.com/blog/NOVAGasFlows.pdf

Looks like we have a problem.

The eastern two thirds of North America should hope for an El Nino.

From Brad Plumer at Vox.com,

What sort of weather impacts does El Niño have?

Warmer, drier winters in the eastern and midwestern US: El Niño’s effects in the United States don’t usually kick in until winter — and the phenomenon is usually associated with drier, warmer winters in the Midwest and East Coast. That often means less snowfall, though it depends on the shape of El Niño.

Meanwhile, in India the monsoon is a bit late:

http://thinkprogress.org/climate/2014/06/10/3447153/heatwave-india-riots/

For some it will be a blessing… others a curse.

Funny how those who can least afford it get the short end of the stick. The impacts of climate change will play out in a similar way. You can imagine those most affected getting angry… Arab Spring angry.

By the way the temperatures are getting hot in the Middle East!

People here can sometimes get too excited by the news.

“In Washington, State Department spokeswoman Jen Psaki said the United States believed that the Baiji refinery remained under control of the Iraqi government.”

The refinery is actually defended by a British security group Restrata. see http://www.restrata.com/cst_details.php?cstid=6

I have seen 3 large military helicopters flying low and fast over my (UK) village in the last 2 days. My mind has visions of special forces urgently training for a mission in a wide, flat country.

I think some people are getting a little nervous about Iraq, WTI currently up $1.60 to $106, and Brent up $1.88 to above $111.80.

I don’t know if there has been any news breaking developments.

Well we’ve had this amazing three years of stability, or rather a ‘stuck’ oil price: couldn’t go up, couldn’t go down. What I think we’ve really found is a very solid floor at ~100. There was lots of talk of lower prices by serious players but it has proved impossible [marginal barrel etc]. So now the upside pressure is both structural and [Shale optimism waning, Russia, Saudi failure to bump up] and now event driven: ME drama. Boo-ya. Is it off to a new level this time, or is this just the reef fish of the markets expressing themselves…?

Here’s your “Cheerful” thought of the day

On Good Morning America this morning (on ABC), they quoted an unnamed US intelligence official who said that after reviewing the intelligence data on Iraq, “It makes one want to kill oneself.”

“12.10 Iraq’s parliament has failed to reach a quorum, officials told AFP, preventing it from voting on a request to announce a state of emergency to deal with the major jihadist offensive.

A senior government official told AFP only 128 of 325 MPs attended, and another official confirmed a quorum was not reached.”

http://www.telegraph.co.uk/news/worldnews/middleeast/iraq/10892299/Iraq-crisis-al-Qaeda-militants-push-towards-Baghdad-in-sight-live.html

I hope this is not because they have taken the last plane out of town. Things don’t look good.

WTI 106.

I got $5 says SPR release threat is imminent.

Hey Watcher,

There is plenty of oil at the moment, they are just arguing how much people are willing to pay for it.

If Basra is disrupted, then all bets are off.

Basra, one of the last places on Earth with $5 a barrel oil.

“I hope this is not because they have taken the last plane out of town. ”

Brings back memories of the fall of Saigon. Pretty interesting parallel here, I suppose. Saigon fell a couple of years after the US finally withdrew from Vietnam.

Iconic image of people desperately trying to get on one of the last, or the last, helicopters leaving the US embassy in Saigon:

Just religious civil war to the death in a major producer that is the real great hope for future demand…

Even if ISIS doesn’t take southern territory or send people running for choppers in Baghdad – yet – this is absolutely the end of a lot of expansion talk. The government is falling apart.

How is the estimate that Iraq oil production will reach 10mbpd looking now? Most of the production has been from the south where infrastructure was more complete but there is a lot of oil in the north(about 1/2 of production came from north before U.S invasion) and this 10mbpd figure depends on developing it. Which was never realistic in the frist place.

Iraq Update: Kurds Take Kirkuk, Al Qaeda Surges Toward Baghdad

h**p://www.zerohedge.com/news/2014-06-12/iraq-update-kurds-take-kirkuk-pipeline-threatened-al-qaeda-surges-toward-baghdad

In broader terms (via RanSquawk):

The situation in Northern Iraq continues to deteriorate as the extremist ISIS/ISIL group took control of Mosul and then moved into Tirkit, which was later recaptured, in the north of Iraq which is near the Ceyhan-Kirkuk pipeline, which carries 1.6mln bbls per day. ISIS/ISIL forces then seized the Baiji refinery, the main refinery in Iraq, from Iraqi forces. (BBG/RTRS)

Iraqi forces and militants have now clashed in Ramadi, 100km from Baghdad, as ISIL extremist forces push towards the Iraqi capital. (BBG)

However Iraqi Oil Minister Luaibi said US planes may bomb North Iraq and denied ISIL took Baiji refinery in the North. The oil Minister also said Iraq average crude exports 2.6mln bbl/d, Iraq crude production 3.166mln bbl/d, Kirkuk production 167,000 bbl/d and Iraq has stored oil products and won’t increase imports. (BBG/RTRS)

Washington has vowed to boost aid to Iraq and is mulling done strikes amid fears that Iraqi forces are crumbling in the face of militant attacks. (RTRS)

Juan Cole, someone who has exceptional insight on Iraq, has posted this:

http://www.juancole.com/2014/06/promises-modern-history.html

This really may be the Kurds’ best chance so far. They and the ISIS are both Sunni so neither is going to hesitate to capitalize on Shiite weakness (read: government weakness) in Iraq.

On the offchance that this blog post has not been posted yet:

http://blogs.platts.com/2014/05/01/oil-majors-costs-prices/

It seems to agree with analytical approaches we’re probably all familiar with and that the cheap stuff is gone.

Rgds

WP