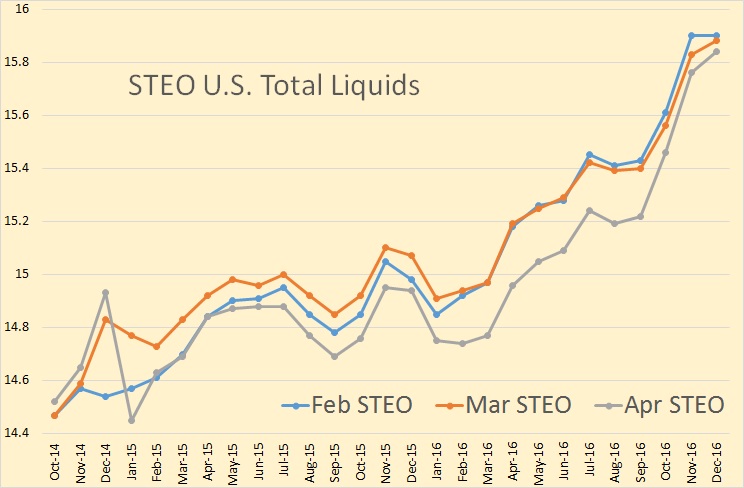

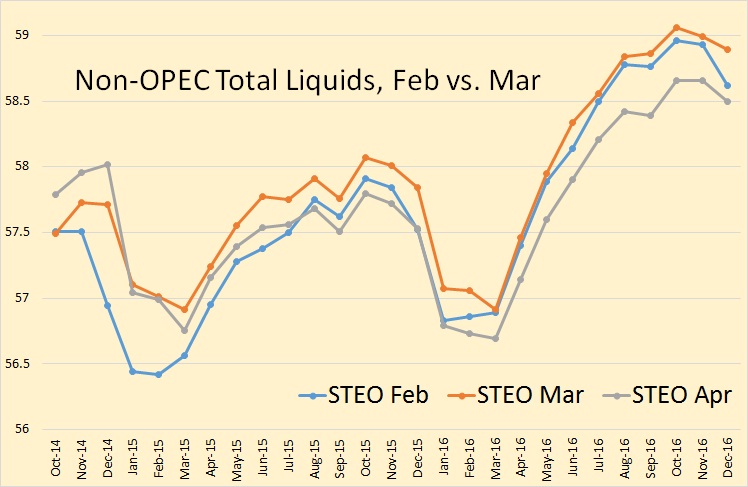

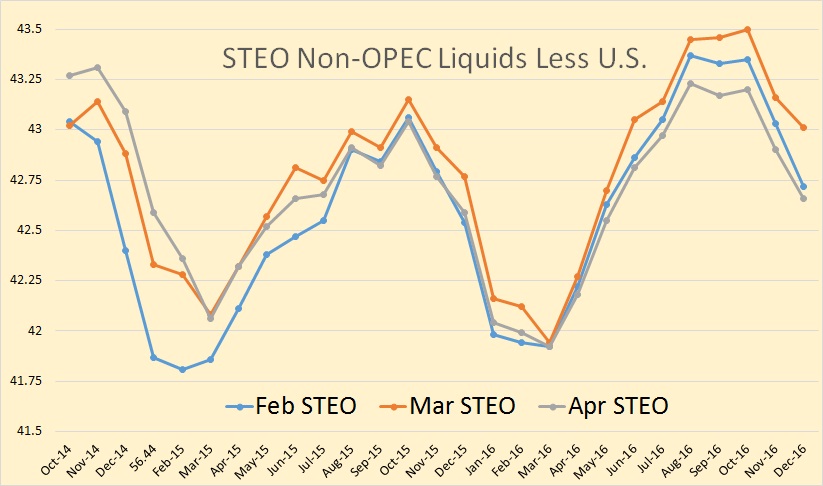

The EIA has released their latest Short-Term Energy Outlook. Below I compare the EIA’s ever changing outlook for future oil production. The STEO charts below are total liquids and are in million barrels per day.

The EIA increased their December 2014 all liquids estimate but dramatically decreased their January 2015 estimate. The EIA now says US total liquids production declined by 480,000 barrels per day in January.

The EIA still believes non-OPEC total liquids production will take off but not until 2016. They have non-OPEC liquids reaching a new high in December but dropping almost one million barrels per day in January and not reaching that December high again until July of 2016.

The EIA’s optimism depends entirely on US production increase returning to the levels it reached in the last three years. Without any US increase they have non-OPEC production peaking in December 2014, so far anyway.

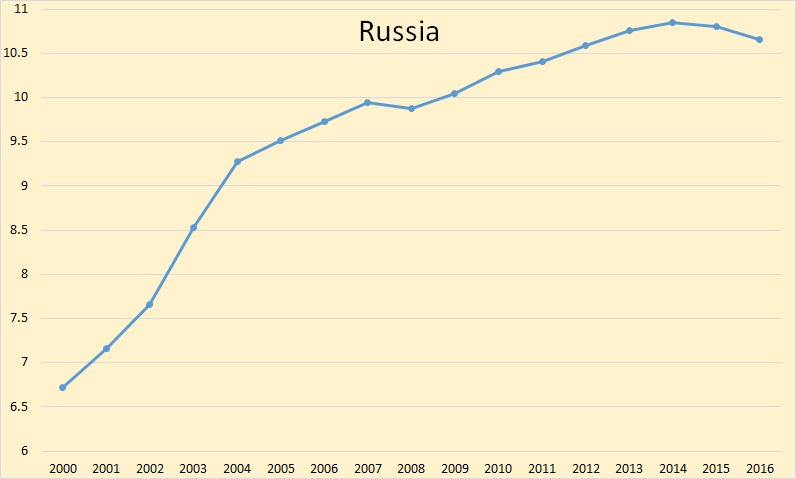

The EIA still has Russia peaking in 2014. Russia, so far, is having a pretty good year, producing about the same as last year, at least according to the official Russian web site CDU TEK

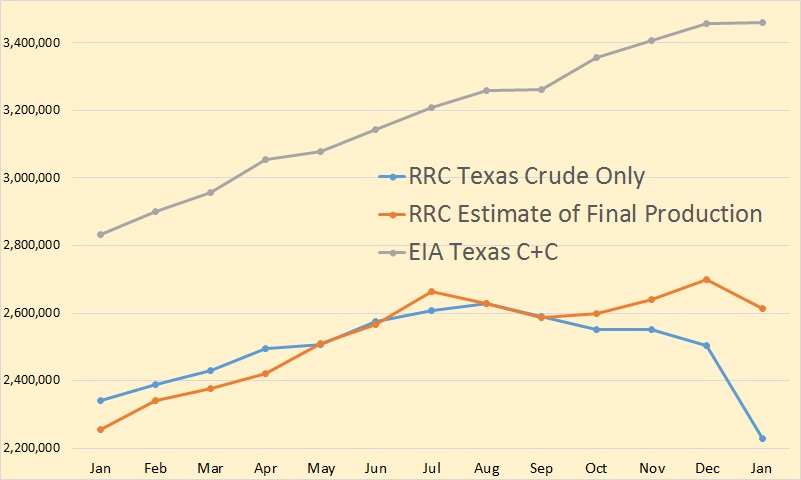

The Texas RRC publishes monthly oil and gas production numbers. However those numbers are always incomplete and it takes several months for the final numbers to come it. It turns out however that the RRC publishes an estimate of the final production for crude oil and gas well gas but not for condensate or associated gas.

The link for this data changes every month so the only way to get the numbers is via Google. So search on “RRC Production Statistics and Allowables for April 2015“. That will get you the January numbers and they will be this, bold their’s:

The Commission’s estimated final production for January 2015 is 81,015,390 barrels of crude oil and 536,271,896 Mcf (thousand cubic feet) of gas well gas.

If you do the same except insert “March” where “April” is in the above example you will get the December numbers. Always search the month three months ahead of the month you want. Anyway you will get:

The Commission’s estimated final production for December 2014 is 83,718,353 barrels of crude oil and 553,215,585 Mcf (thousand cubic feet) of gas well gas.

Gathering the numbers from January 2014 through January 2015, and converting the monthly data to barrels per day, we can compare them with the incomplete numbers and the EIA C+C Texas numbers.

You can see that the Texas RRC believes Texas crude only production has been basically flat for seven months and January 2015 is below the point it was in July 2014.

It is my opinion, and apparently the opinion of the Texas Railroad Commission also, that the EIA is way too optimistic when it comes to Texas oil production.

In Other News:

Record Energy Share Offerings Are a Warning

Yet, given the current profit outlook for upstream firms, I strongly suggest avoiding the exploration and production industry, including oil production master limited partnerships (MLPs), for the foreseeable future.

That’s $10.8 billion in new stock that small and mid size oil companies issued in the first quarter. Understand that is money that never has to be paid back so for the oil companies it is a little like free money. The oil companies, in exchange for this money, give the people shares of the company. So the people who buy this new issued stock hopes the price will double or triple and they will double or triple their investment. However it likely has a far greater chance of going to zero.

And from the Fed: Fed: Oil production to decline 0.7 to 8 percent

“With oil prices at about half their summer 2014 level, will the investment continue to be profitable and boost production?” asked Nida Çakır Melek, an economist in the Regional Affairs Department for the Kansas City Fed.

“Despite highly productive new wells and an increase in the number of wells drilled per rig, U.S. oil production could decline from 0.7 to 8 percent in 2015, due in part to the significant decline in rig counts and depletion in existing wells,” she said.

Down 8 percent? It all depends on what point you are measuring from, the 2014 average or the December 2014 peak. US average C+C production in 2014 was 8,677,000 barrels per day. But production reached a peak in December 2014 of 9,320,000 bpd. January production was already down by 1.45 percent at 9,185,000 bpd.

An 8 percent decline from December would put US production at 8,574,000 bpd. That is quite possible and I would say quite probable by December 2015. But an 8 percent decline from the 2014 average would be 7,83,000 bpd. Not likely an certainly not likely if you are talking about the average 2015 production.

_______________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne@gmail.com

does the eia give any reason why production is apparently picking up at the moment. does not seem to make that much sense or does any other data support this assumption?

In a previous thread I believe I said something to the effect that the EIA did not know its ass from a rotary table with regards to Texas oil and gas production. I stand by that statement.

http://oilprice.com/Energy/Oil-Prices/EIA-Changes-Tack-On-Latest-Oil-Crisis.html

Mike

nicely put 🙂

Aims at keeping prices low to pressure Venecuba, Russia, Iran, etc?

“Our mainstream money system is based on competition, selfishness, greed, individual gain, instead of cooperative values, altruism, good will… The mainstream money system destroys communities. It affects everything in our lives…

Outside the USA, there is a worldwide movement to replace the dysfunctional money system that exists– all the individual national currencies.

One of the biggest hurdles is people’s ignorance of how the mainstream money system works… Mainstream money is issued by banks, and those banks have an agenda… they’re giving a public service in providing a medium of exchange which we all use– we have to use– but at the same time they have a for-profit agenda. And there’s a contradiction there. In fact, if you think about it, the banks issuing money is anti-democratic…

If everybody knew the full facts about how money is issued, how it’s put into circulation, who is issuing it, how they have power and control over the economy, and over individuals’ lives, I think there’d be a lot of very unhappy people around.” ~ Francis Ayley

———

“One way to promote local [‘glocal/trans-local’] spending is to introduce a local [‘glocal/trans-local’/ethics-based?] currency… Eventually, in a period of sufficient upheaval, a money monopoly may be impossible to sustain, then local currencies would be freer to operate… Any initiative which reduces our dependence on national currency in circulation is going to be useful in this regard… Holmgren points out that holding cash under one’s own control, outside of the banking system can greatly increase resilience by reducing dependency on the solvency of middle men. This is very much in accordance with our position at TAE [The Automatic Earth], as cash is king in a period of deflation…” ~ Nicole Foss (my parentheses/emphasis)

———

“…On Thursday, a collective of politically radical coders that calls itself unSystem plans to release the first version of Dark Wallet: a bitcoin application designed to protect its users’ identities far more strongly than the partial privacy protections bitcoin offers in its current form. If the program works as promised, it could neuter impending bitcoin regulations that seek to tie individuals’ identities to bitcoin ownership. By encrypting and mixing together its users’ payments, Dark Wallet seeks to enable practically untraceable flows of money online…

‘This is a way of using bitcoin that mocks every attempt to sprinkle it with regulation’, says Cody Wilson…’ ” ~ Wired

———

”Balkind: Permacredits… propose a way for people to invest in permaculture projects. …In the future, systems like Ethereum will create opportunities to rewrite how society operates. That process will present a historic opportunity for laws to be changed. Will the social justice activists be driving that change or will they be hiding from it?

Schneider: So this is really about power.

Balkind: Whenever we talk about money we’re also talking about power. If we want to focus solely on cryptocurrency, we’re talking about the ability of normal people to take control over money, to make it their own, to use it as a tool to better organize their communities and meet their needs… Cryptocurrency and crypto-contracts go hand in hand—so yes, we’re talking about a lot more than money…” ~ Resilience.org

———

“The Gulf States and OPEC, along with every other institution that holds dollar reserves, is sitting under what James Fallows and others have called the Sword of Damocles: they are damned either way. The issue is further precipitated every time the Fed manipulates the interest rate, creating bubbles and devaluing the currency even further.

Someone has to pay for the subsidized interest rates and that someone is anyone holding dollar-denominated assets. Despite the disdain some foreign politicians and planners in oil state may have for the US government, by pegging rates to the dollar and mandating the use of dollars for petroleum, they continue to prop up a dying fiat system at the expense of their own standard of living.

The only viable solution of solvency and prosperity is a free market in private currencies– a solution without the state and its central planners– one voluntarily determined by market participants.” ~ Tim Swanson

——————

“One response could include an alternative ethical currency or currencies as part of an exit-strategy, even if only initially, given the caveat of how money, as an outgrowth of complexity, can lead to various corruptions and losses of democratic control, and given that global trade systems, as well as the internet, itself, may become increasingly compromised over the course of decline/collapse, thereby rendering some widespread electronic currency forms ineffective.

That said, though, while things last, the rapid adoption of an electronic/software ‘crypto’-currency that ran under the radar through encryption and some kind of piggyback on top of something like Bitcoin’s protocol, such as ‘Dark Wallet’, or something along those lines, would appear to merit serious consideration…” ~ Me, from the ‘Permaea Manifesto’ article (out soon)

Those things writ, it is felt that money, itself, no matter its form, will nevertheless always be a problem, in part, because of vested-interest, power and ethical considerations as well as that…

Money is of course a kind of ‘conceptual/symbolic grid’, (another form of potential control), and, as such, can thusly be manipulated/distorted.

Yada, Yada, Yada- Your complaining about the Fed is simple Republican fear mongering when it’s party is out of power. Most anyone who has taken a macro economics course 1.0 understands the Fed is trying to stimulate the economy by putting money in the hands of consumers with no alternative but to spend it. Once financial fears from the Republican 2008 meltdown have subsided and consumption takes off. The Fed will return to a more normal monetary policy. Most of the world got the shit scared out of them in 2008 from the Republican deregulation and spending. The Republicans refuse to simulate the economy by means of fiscal policy now that they are not in power. So here we sit out of whack for the last six years with congress doing nothing but worthless economic ACA repeal legislation. The Republican’s will have their butts handed to themselves again with their God, Guns and fear constituency in 2016. Mark my words, 4/8/2015.

The Federal Reserve, and other central banks around the world are trying to substitute the cheap energy that enabled the economic growth that we’ve come to expect with quantitive easing and other money printing policies. This is not a partisan issue, it’s merely central planners delaying the inevitable collapse facing a civilisation starved of the cheap energy it needs.

Lady, your comment is utter nonsense.

The cost of an easy money policy from the Fed is inflation of which this country doesn’t have.

Non partisan please, “central planners” is code word for communism in the Republican vocabulary. Just who are these “central planners” you speak of ? The biggest bunch of central planners I can think of is the United States Congress. They manage the largest budget on earth at about $3.9 trillion per year and the Republicans have done everything they can to cut it. Including shutting down the government. You can’t grow a capitalistic economy buy cutting spending. You grow an economy by producing more goods and services from resource which includes labor.

Second, energy is only about 8% of the American economy. That’s half as much as heath care which has sky rocketed as a percentage of the economy over the last 20 years. Energy doesn’t cost anymore today as a percentage of the economy than it did 50 years ago . Fuel mileage is twice as good today as in the 1960’s. Back than the minimum wage was $1.35 and you could buy a new car for $2000, now it would cost you $20,000. Todays quality is far better and capital equipment last far longer. You couldn’t even buy a personal computers 50 years ago.

There is no shortage of low cost commodities in todays economy. The Fed doesn’t need to substitute money for energy(which the Fed can’t do). It needs consumers to rise their demand for goods and services, but they all had the shit scared out of them and their confidence stolen in 2008 and want to sit on larger amounts of cash with less debt. What’s has changed is the American consumers buying habits including it’s government.

“delaying the inevitable collapse facing a civilization starved of the cheap energy” You’ve been reading Gail Tverberg to much. She has been preaching “collapse next week” for five years and has been wrong for just as long. Civilization has always faced collapse. This is nothing new. We will kick this can again though another business cycle and adapt as humans have done from day one. You might even have to get out of you car and walk(that’s not collapse, it’s actually exercise which isn’t going to hurt a lot of Americans).

God bless the crazy Christians

I’m designing a human powered 18 wheeler truck. It will have a really long steel pole sticking out the front end, with attached Kevlar ropes. The Kevlar ropes will have 6 kangaroo hide harnesses. A total of 10 ropes per side will allow 120 persons to pull the truck at 3 kmph. The truck will be followed by two horse drawn carriages with the food and water for the human engines. There will also be 60 hooks on the trucks side to be used to hang the humans when the truck is going downhill. The contingent will be followed by two individuals with shovels who will pick up the feces and debris left behind by my invention.

Or…..you can cut fuel consumption by 50% with existing tech (which is available from the major truck makers, but not implemented yet because the demand is pretty recent). Then cut it by 50% again with rail. Then eliminate it by electrifying the track.

We have cheaper and better alternatives to oil, right now: electric vehicles are cheaper, quieter, cleaner, and have better performance. We need to kick the habit ASAP.

Tesla has a funny story: the owner of a very expensive high performance ICE vehicle came and did a test drive in a Tesla. Afterwards, he drove off, and came back very quickly. He angrily demanded to know who tampered with his vehicle, because it was suddenly noisy and low performance!!

.

Or one of these beauties

http://bakfiets.nl/nl/modellen/cargo+transport+/xl/

Won’t find much gulag labor in the Netherlands however.

Who would have guessed Fernando’s mental word search program of the word “communism” would miss an opportunity to comment nonsense? Everybody

Fernando, my I suggest you research your competition before you invest your life saving.

http://www.greencarcongress.com/2015/03/20150327-dtna.html

I think I can beat it on delivery timing. That’s a prototype, not for sale. I can put my truck together in 36 hours. But it will only be marketable in a country where gulag slave labor is available (that means only communists can use it).

Do ‘wage slaves / debt slaves’ count? No shortage of those in the West!

It’s not the same. This is an important theme in my life: what makes communists so horrible is their fundamental belief that human nature and society must be destroyed to “build socialist man”. They go on to rationalize terror and slavery “because it’s a transitional phase”. I have a tip for you: Istarted being trained in Cuba to become an agent for the regime at an early age, so I know the way they think (or at least the way they brainwash youngsters).

They are very similar to the Taliban who are forged in Pakistani Madrassas, and will destroy and murder because their cause requires it.

Some of you are leftist dabblers, what I consider fairly mild mannered kumbaya my lord types. But the guys at the top know where they are headed. And they don’t really hide it. Read the crap they write and learn your enemy.

Knowing them as well as I do, not too long ago I wrote a about this topic (I turned the communist manifesto on its head).

“The New Poor Working Class Will Destroy the Established Order”

Those who know me from the old TOD days may remember that I have spent my life as a rolling stone spending a little time as necessary doing this and that between short stints on the farm – and that I have spent nearly all my free time reading a lot of serious books rather than watching tv or hanging out in bars or whatever. And about the only people who have had more free time would be the rich folks.

At one time I was very much inclined to right wingish politics and a firm believer that technology would save us, that western style governments would eventually prevail all over the world etc.

But even then I was aware that there are basic physical limits imposed on us by geology , geography, ecology etc. How did I reconcile these contradictory positions?

By a combination of cognitive dissonance and ignoring the limits on the happy assumption that technology would outrun depletion and so forth. At that time climate wasn’t really on my personal radar.

Depletion was far enough away in the ever so distant future that it just didn’t matter to me being a young guy – young guys are not much interested in the distant future.

Now as it happens I being a hard core right winger back in those days at times (At other times I was a long haired hippie with a peace sign on a chain around my neck and a corn cob in mp pocket that would suffice to entertain a small party with one fill of wacky tabaccy , a card carrying ACLU sort of guy) and the sort that loves a hot debate I got into a lot of arguments about the relative merits of socialism democracy capitalism communism etc.

Hard facts such as the fact that there WAS an iron curtain enforced by the old USSR whereas just about anybody from just about anywhere could come and go to anyplace dominated by the so called USA empire convinced me that the people praising communism back in those days had their heads out of sight up their asses – I went to the trouble of reading what august authorities such as the NYT had to say about communism back in the days of Stalin for instance.

From there I moved on and started reading the stuff that I could find written by the handful of people published in the West who escaped from communist societies.

I don’t give a rats ass about PC or about being oh so much more sophisticated than other people , about being on a higher moral plane than others.

FERNANDO has his shit together when it comes to communism and about the way it works. The historical communists – the ones whose names everybody knows – have historically been as bad or worse than any other bad characters in the history of the world and they long ago mastered the art and science of propaganda and mind control to an extent that makes folks like the nazis look almost amateurish by comparison.

None of this is to say that other forms of government or similar governments known by other names are any better today or have been any better in the past or will be any better in the future.

But the fact remains that Fernando has the facts on his side when he says the things he does about communism.

I have some thoughts about why the liberal leaning elite in the USA is reluctant to acknowledge the reality of communism but it would take a while to organize them and this is not really the place for them anyway.

We have a much better human-powered vehicle in Austin: a pedal-powered beer wagon, where the patrons sit and pedal while drinking the beer carried by the wagon … gets at least 3 km.hour, and a good time is had by all.

http://www.pubcrawlerofaustin.com/gallery/

Heh, some people are in deny even in the very year of unraveling. Coal mines are closing around the world, and the price is still falling. Crude prices are way below needed to maintain production rate, and oil inventories are rising 2mb/d in the US.

In over 200 years of industrial age, we never had falling gross energy production. You make mistake of looking at GDP (which includes mining and energy sectors). Look at available money for average people after paying obligatory things.

Gross energy production isn’t falling. Gross Fossil Fuel consumption isn’t even falling.

It would be nice if FF consumption were really falling…but it isn’t. Not yet.

Yes, some people are in denial of the advancements and efficiency gains of the capitalistic free market. Yes, American coal is being substituted with low cost NG and ample low cost Colombian coal that is currently expanding it current production by 25 percent as I type. They have a 100 year supply.

Have no fear, plenty of energy here

😀 😀 😀

The slow-mo nature-wrecking catastrophy of your ‘capitalistic free market’, ay? I second Kam’s laughie faces, although mine are quite laced with some serious bitterness and contempt.

“The Eden that Europeans described when they reached North America was not a wilderness, but a well-managed resource, a complex combination of nature and culture, ecology and economy, a system so subtle and effective that it eluded the settlers who saw only natural wealth free for the taking. The result of this land grab in North America is that only 2% of the land is now wild, its major rivers are polluted, its lakes have caught fire, and its forests are dying from the top down. The tragedy of this commons was that it never really was a commons after colonization, but was surrendered to plunder, privatization, and exploitation in the name of Manifest Destiny and progress.” ~ intelligentagent.com

HI Caelan,

If Chiefengineer takes you for a REPUBLICAN or a Republican mouthpiece I think it is safe to conclude that he knows VERY LITTLE INDEED your philosophy and politics.

Sometimes I have a little trouble figuring out what you’re talking about but if you are a republican mouthpiece I will get my handle changed to OLD FARMER DUNCE.

You can’t stop progress.

Ritual incantations of progress are I suppose a thing for those so inclined, though, I must ask, what progress? The going-to-the-stars narrative seems to have taken a little tumble, given the year a human last escaped from low Earth orbit. Ah, yes, 1972. Bookended nicely by the Nixon Shock and the oil crisis. Right. So, what yardstick now measures progress? A weathervane, perhaps, that points where it will?

Death rates, subdivided by violence vs other causes, are a good measure.

Death rates are very high in small communal hunter-gatherer societies, especially by violence, as the carrying capacity is very low, and population growth is prevented by inter-group war deaths, supplemented by infanticide.

Farming societies do a bit better overall, as the violence is more organized and less part of daily life. Nutrition is more reliable, but much narrower, so tends to be a bit inferior.

Industrial societies do better. Modern society does best of all: infant and maternal mortality is greatly reduced, overall violence is much lower (though world wars in the 20th century were quite dramatic, their death rates as a percentage of the population were smaller).

Overall death rates are continuing to fall, and longevity is continuing to increase, though lately the rate of improvement has slowed down a bit because of over-eating: around the world, mortality due to obesity is about 3x as great as mortality due to under-eating.

NASA’s latest astronaut capsule did leave low earth orbit recently. Hopefully, this will lead to more manned missions.

http://www.dailymail.co.uk/sciencetech/article-2862440/Splashdown-Orion-successfully-lands-Pacific-Ocean-two-historic-orbits-Earth.html

Musk’s Millennium Falcon could possibly bring the cost of spaceflight down dramatically.

http://www.space.com/29065-spacex-cargo-launch-reusable-rocket-test.html

“The modern age is increasingly characterized by despair. Modern society seems out of control and on the brink of numerous irretrievable disasters. The interrelated issues of global climate change, biodiversity loss, overpopulation, and social unrest threaten the very existence of the civilization which most in the industrialized North consider so superior to cultures with simpler technologies.

It is somewhat comforting to realize that the blueprint for survival is contained within our cultural history. Judging from historical accounts of hunter-gatherers, for most of the time humans have been on the planet we have lived in relative harmony with the natural world and with each other. Our minds and cultures evolved under these conditions. Understanding how hunter-gatherer societies solved basic economic problems, while living within environmental constraints and with a maximum of human freedom, may give us a key to ensuring the long-term survival of our species.

But hunter-gatherers are more than interesting relics of the past whose history can give us valuable information about other ways to live. Hunter-gatherers and other indigenous people still exist and still offer alternatives to the possessive individualism of world capitalism. Indigenous people in many parts of the world are at the forefront of the struggle for human dignity and environmental protection… In spite of the onslaught of world culture, many indigenous people are maintaining, even expanding, alternatives to economic man… These alternatives may one day lead us to a new, environmentally sustainable, and socially just economy.” ~ John Gowdy

Hi Caelan,

Shitting outside may be your idea of “the good life”. But it’s certainly not a long term solution.

We need to leave the garden of Eden, and learn how to take care of ourselves before the Sun God gets angry.

Get off your ass if you haven’t and find out about, say what happens to shit once it leaves many people’s homes (and is that sustainable?), and about composting toilets and similar systems.

And then get rid of the shit you’re full of (remove head first of course).

Hi Caelan,

How many people have you convinced to start shitting outside so far?

Are you stipulating that all problems facing society are political in nature? That electing the blue team instead of the red team will magically make new, easy reserves of high quality oil appear in our backyard? Or grant us access to that magical power source that imitates fossil fuels in every way except that it’s cheap, renewable, and doesn’t have a carbon footprint?

This gerrymandered statistic that only 8% of GDP is allocated towards energy does not change the fact that the EROI of energy has decreased over the last few decades. The diminishing returns manifests not just in the electric bill, but systemically, such as in health care.

Of course efficiency is a huge factor in the energy equation, but so is Jevons paradox.

I really hope you’re exaggerating when you state that ‘there’s no shortage of low cost commodities in todays economy.’ Of course there are, all commodities are in finite supply. “But they’re cheap” you may say. Sure, but does that reflect the true cost of its production? Oil only costs ~$50 a barrel atm, so that must mean energy is cheap right? Tell that to the shale industry that could only scrape a positive cash flow in a handful of cases, even when oil was $1oo a barrel.

“Are you stipulating that all problems facing society are political in nature?” Please don’t put words in my writing. “All problems facing society” are not political. I’m saying today’s economic problems of American lowly skilled workers stems from Republican deregulation and tax policy to starve government spending.

Again, “You can’t grow a capitalistic economy buy cutting spending”. The cost of commodities(including labor) is falling because of lack of demand not the lack of resource.

How am I putting words in your writing? I merely asked you a question. The recession is the result of diminishing availability of energy, causing a lack of demand.

ChiefEngineer,

Ok I’ll bite. Firstly Lady Latitude referred to “central banks” not central planners and right now we have ECB, the BOE & BOJ all printing money so the federal reserve is hardly alone. Also note that of the last two mentioned the Bank of England is in a country with a right of centre political alignment & the Bank of Japan is in a country with a far right government. As to American being only 8% dependent on energy, seriously? There is not an economic activity in America or any industrial country in the world witch not almost 100% dependent on energy. Every good produced, everything transported uses energy in some form or other.

Sure, but it’s not hard to reduce oil consumption, then eliminate it entirely.

Go from an SUV at 10MPG to a hybrid at 50MPG, then to an EV at zero gallons per mile.

Sure, but it’s not hard to reduce oil consumption, then eliminate it entirely.

Naw, it’s a piece of cake. 😉

Well, the first 75% really is.

More than 50% of oil consumption is personal transportation – 90% of that can be eliminated really, really easily with extended range EVs like the Volt.

Much of the rest is very straightforward: truck freight moving to rail, asphalt moving to concrete, etc.

The last 25% is somewhat harder, but we’re going to have 20M bpd for a very, very long time – long enough to get those done.

And 100% of oil consumption can be eliminated by killing people who use it.

Kam, you first.

I’ll buy a electric car

Since when is drilling 5 mile deep into the earth in a mile deep of water a piece of cake ? But we do it.

Yes and I’m sure oil-soaked wildlife, etc., appreciate it.

Then you have to deal with all that and with chemicals and labor. Easy peasy.

But of course your bullshit (sorry for offending the bulls and their nice organics) economic-political dystem can conveniently ignore true costs, ‘absorbed’ by nature and community.

Coming up on Macondo’s 5th anniversary, incidentally… Pop the pesticide-residue champagne!

The problem with much of this is embedded in your very moniker; specialization; in-built/engineered myopia. In your case, what with the ‘Chief’ designation, the myopia is presumably of a high level.

CE wrote:

“Second, energy is only about 8% of the American economy.”

Energy is 100% of the economy, energy is used to produce, deliver all goods and services. Energy consumption per revenue in the US fell as the US offshored production to overseas. For instance, Imported steel, fertializer, electronics are not included. Before the US started outsourcing, energy was about 14% of GDP.

CE Wrote:

“The Fed doesn’t need to substitute money for energy(which the Fed can’t do). It needs consumers to rise their demand for goods and services, but they all had the shit scared out of them and their confidence stolen”

The Fed has steadily reduced rates over the past 30 years to “stimulate” the economy. In the process, it just blew a bunch of huge bubbles and created unsustainable debt loads. To “stimulate” the economy any more, the Fed will have to use negative rates, but this is equivalent to setting the house on fire to stay warm.

CE Wrote:

“What’s has changed is the American consumers buying habits including it’s government.”

yes, because consumers can’t borrow anymore. They can only spend their free cash flow (wages minus tax, debt payments, housing, food & energy). The gov’t went on a borrowing bing which took up some of the sack in Consumer spending. Sooner or later even the gov’t won’t be able to borrow anymore even if interest rates stay low. Currently, the Fed gov’t borrows about $1Trillion to keep its doors open.

Consumers spending will only bounce back when the inflation genie gets out. Good wage US jobs continue to be outsourced or being automated, and being replaced by low end service jobs (waiters,bartenders, bartenders, walmart, etc). Job growth is coming from workers being forced into multiple part time jobs as employers cut hours to avoid ACA and other labor regulations. So if one worker switched from one full time job to to two part time jobs, its indicated as job growth.

“The Fed will return to a more normal monetary policy. ”

Nope. Any attempt to normalize monetary policy will crash the economy with spiraling deflation. During one of Ben Bernanke’s Q&A session when he was still chairman a reporter asked him “When will the Fed normalize interest rates”. Ben replied “Not in my lifetime”.

If The fed does raise rates this year it will be tiny (like 10 to 25 basis points) and will eventually cut within 6 months.

The US is beginning to sliding into another recession, Q4 2014 GDP growth was cut to 2.2% (from an estimate above 3%). Q1 2015 GDP is now estimated to be at zero. The Stock market is running on empty as corporate buyback are being tapered (one of the main drivers for rising equities). Corp debt used to finance buybacks has grown to the point corporations are now risking credit downgrades. The strong dollar is hurting US exports and as you said, US consumers aren’t buying.

https://www.frbatlanta.org/cqer/researchcq/gdpnow.cfm

[Fed cuts Q1 GDP 2015 estimate to 0.1%]

The US gov’t can’t afford normalized rates. The cost of interest on 18.1 Trillion @ 5% is about 900 Billion. The US gov’t federal revenue is only about $2T. So about half of the revenue would be needed to just service its existing debt. The result would be the US defaulting on its debt. Interest rates will need to stay low indefinitely. I think after the next market correction, QE will be back and we will have negative interest rates, just like Europe is now introducing. The EU and at least parts of Asia are in a recession. The US economy isn’t an island.

Energy is 100% of the economy, energy is used to produce, deliver all goods and services.

I call this the “garbage-man fallacy”, based on the argument that sanitation workers are the most important group in New York City, because without them the city falls apart.

Energy is essential, but not fossil fuels. We have better and cheaper alternatives to FF.

In fact energy isn’t that important. Information is everything.

For example, it doesn’t matter how much gas you have in your tank, you’ll never get from Miami to Seattle without a map.

Full disclosure: I work in the computer business.

Yes, information is everything.

The romans had lots of coal, but didn’t know it, and didn’t know what to do with it if they did. We have lots of energy all around us – it’s just knowing how to use it that’s key.

“We have lots of energy all around us – it’s just knowing how to use it that’s key.” ~ Nick G

Yes, ethically and truly democratically. Which is, intelligently.

Great remark. They also thought there was nothing of value at all east of the Rhine. It took Saxons like Henry the Lion to unlock the silver mines of Bohemia and Moravia.

Inflation, negative interest rates, bail ins or debt jubilees; makes no difference what the method is, savers will have to pay sooner or later. 95% of our money is only borrowed, after all.

To hell with the Demopublican™ governpimps, their sleazy revolving-door orgy parties and cult wreckonomics.

You can be pimped, tied up with a dog collar, and be whipped if you want. Just leave me out of it. I don’t believe in that religiosity.

Hi Caelan,

I have never lived under anarchy. My guess is that it may be less pleasant than you imagine. You are much more optimistic about the nature of humans than I am.

I may lack imagination in this regard, I was enthralled by the notion of Utopia as a teenager. Alas I grew up.

I was a big fan of the Whole Earth Catalog and remember a lot of optimism in the 1960s and 1970s for new sorts of communities. Lots of communes started and hoped for.

I am all for various utopian ideas, but unfortunately through out history they have tended to be short-lived.

That doesn’t mean I support the current system. But finding the right substitution is not without its challenges.

Caelan, I support where you are coming from, but I want you to create these places, not just talk about them.

First, I am creating those ‘places’ as well as the ‘logistical setups’. Would you believe I even learned new skills/knowledge and uprooted provinces and an old life in the process? I walk the talk even though it is difficult and slow going with all the likes of governpimp/nanny-state suckups/thugs/etc. and assorted zombies walking around and getting in the way. And trying to eat my brains with their asinine narratives/memes/etc..

Second, what are you doing, yourself, about that, seeing as you are advocating it? Do you want a friendly competition in that regard? If so, I’d be up for it and to co-report the progress here. It’s a challenge. Right here, in front of the readership. It’s a good idea, frankly, and perfectly on-topic too. We could even communicate by email if you want and see if we could get Ron to post a mutual article or two that we co-write about our progress/experiences.

Let’s have it, Boomer II. Consider that I have just taken my nice glove off and slapped you in the face with it. ^u^

Second, what are you doing, yourself about that, seeing as you are advocating it?

Not enough to be of much help. I live in a small place. I try to minimize my driving. I don’t buy a lot. But living in a utopian community, I’m not and probably won’t be. There are some co-housing projects near me but they would be more expensive to join than just staying where I am.

Given that I am of retirement age, I don’t see myself leading any movements these days. I have thought about trying to create places where people my age and older can live frugally, happily, and not place a lot of demands on the system. I am worried about my generation becoming a burden.

At any rate, I will continue to follow what people like you are doing, though I probably won’t be a participant myself.

My interests still reflect the spirit of the Whole Earth Catalog. I like all of that self-sufficiency, back-to-the-land, small footprint kind of stuff.

I thought we went through this already, Dennis…

It doesn’t matter. It is not so much I’m necessarily advocating anarchy either. (Then again, we are all anarchists if we really think about it.)

I am advocating ethics, real democratic control, or we have nothing and collapse and/or decline. If you can’t imagine that, or call for it, if you, your narrative or your fetishes are that ethically bankrupt, that’s your prerogative, but, again, leave me and others out of your nightmares/freakshows, your impositions at the business ends of your so-called private security, police and military industrial complex.

You want the nanny state and can’t imagine or call for anything else, any other narrative, and subvert others’s attempts to boot, then feel free to keep your diapers on, one thumb in your mouth, the other in the other end, and continue to writhe around in that orgy. Because that’s what you have; that particular orgy is what gets you sociopoliticultural problems/disasters, declines/collapses and wrecked ecosystems, never mind sore anuses.

Well now I am convinced.

In your ‘government-will-step-in’ quipped reality, ‘convincing’ is a moot point with an embedded government gun in your face. Ironic, given your comment.

Those who make peaceful revolution impossible will make violent revolution inevitable. ~ John F. Kennedy

Ya, guns can be real ‘convincing’.

As per your previous ‘study some economics’ quip, you would seem to do well to ‘study some anarchy’. (In part because anarchy is you, unless you are happy with your pacifier, in your diapers and with your nanny-state.)

“Grown men do not need leaders.” ~ Ed Abbey

Who’s ethics?

Muslims may consider it unethical for a woman to walk in public without being completely covered with a Burka. They may also consider it completely ethical for a blogger to receive 100 lashes for insulting the Monarchy.

Others may completely disagree.

You can rationalize away your questionable so-called ethics until, ultimately, it bumps up against natural constraints. That’s what’s so tragically amusing.

Ethics seem to mean effectively dealing with the global problems we have today and averting collapse. IOW, lack of fundamental ethics may be in large part what leads to collapse. It includes the control over one’s own life. 100 lashings is not democracy, not control over one’s own life, but someone else’s over you.

Here’s a thought experiment for you: Take your ‘100 lashings for insulting the monarchy’ culture for example, and run it as a simulation over time and see what results…

My hypothesis? Yeast in a petri-dish. So we have to transcend our apparent natural constraints and/or trajectories by invoking ethics. Pretty simple, but, good luck!

Speaking of monarchy/oligarchy and collapse and their interrelatedness, I’ll leave this comment with this:

“…all forms of organization, regardless of how democratic they may be at the start, will eventually and inevitably develop oligarchic tendencies, thus making true democracy practically and theoretically impossible, especially in large groups and complex organizations. The relative structural fluidity in a small-scale democracy succumbs to ‘social viscosity’ in a large-scale organization. [Accordingly] …democracy and large-scale organization are incompatible.” ~ Wikipedia

“Why do complex societies become vulnerable to the very kinds of stress which, at an earlier time in its history, the society in question would simply shrug off? Tainter’s answer lies with complexity, itself, and the law of diminishing returns. As a society becomes more complex, greater complexity becomes more costly. The escalation of complexity becomes increasingly difficult to maintain, until it finally becomes impossible.” ~ Jason Godesky

Caelan I generally sympthacize with your sentiments – as best I can tell- since so far as I can tell your heart is in the right place.

But whatever it is you mean by ” true democracy ” I haven’t a clue. If you don’t mean anarchy then you must mean some sort of communal government.

I beg the forgiveness in advance of the majority of the commenting regulars here but I suggest that given the monkey brains and monkey behaviors of our species that any sort of truly communal government is utterly out of the question.

The average man or woman on the street in this world – even in a university town- is so ignorant he or she can be lead around by the nose as easily as a puppy can be lead with a nice savory smelling bit of meat.

What we have in terms of government, especially in western European countries , is probably about as good is it is ever going to get so long as we exist by the billions.

Now if there were to be a die off to the point that we could live in family bands again – perhaps we could have a communal government.

And perhaps the dozen biggest and toughest guys would make all the rest of us wait on them hand and foot.

Hi ofm, nice to catch you again, and bugged that the other one, (my entire comment may be filtered out if their name is spelled out) who seemed to have a working brain, could still not seem to get a handle on some kind of composure.

At least you took yourself out of the equation for a time.

Anyway, yes, the paradox may be that if we as a species can’t get a handle on some kind of composure in our current context, then I fear Mother Nature, like Ron, will be banning some, if not all, of us.

If by some fundamental law of nature, we simply cannot exist sustainably at current levels of complexity, scale and numbers, then discussions and attempts to do so won’t really matter.

Now if there were to be a die off to the point that we could live in family bands again – perhaps we could have a communal government.

Based on what I understand of human history and anthropology, the default system seems to be something tribal, with a leader.

I can’t think of any sustaining human groups where everyone is given equal power. It’s a nice thought, but perhaps humans don’t operate that way. Maybe because in times of crisis, there may not be a time to hold a meeting. So you end up having one person who can decide, on a moment’s notice, what to do and have everyone else follow. That leader may not have the right plan, but having everyone agreeing to listen to one person in times of crisis may be more effective in most cases than having everyone doing what they want without any agreed upon organization.

Now, if you find tune it a bit, you can perhaps have meetings to establish crisis management and when then something happens, everyone knows his/her role and what to do. But I think even with meetings, you end up with someone calling the meeting to order. Now, perhaps you can have a rule book that discusses how meetings are formed, and so on. So you can codify all of this if you want. But if you go back to simpler times, maybe people just decided to recognize a tribal head, or a king, etc.

Once you allow the camels head of complexity into the organizational tent you will get to kings pretty quick and from there to more modern nation states just a little later in biological terms. In historical terms these processes are considered slow, taking thousands of years to get to kings and the a couple thousand more to get to the modern nation state.

Once you allow the camels head of complexity into the organizational tent you will get to kings pretty quick and from there to more modern nation states just a little later in biological terms.

Yes, the bigger the group, usually the more complex the organization. I suppose you can have an empire ruled by just one person and everyone else takes orders.

At any rate, to keep things simple you probably need very small, like-minded groups. But again, seems to me that historically, groups were ruled by the head of the family or the religious leader.

One of the big decisions in the modern history of governments has been how to protect the minority from the rule of the majority. Especially when the minority might not be able to speak or represent itself, like children or the disabled.

“I am advocating ethics, real democratic control, or we have nothing and collapse and/or decline.”

I am not sure direct democracy would work any better than representative gov’t since the people would still choose similar policies. The majority voted for the gov’t they wanted. The only semi-realistic method is to descentralize gov’t so, at least of if a local regional/local gov’t go nuts, you can move out. In the case of a big gov’t, there is no place to move to.

To be honest this is just fantasy talk. The system is locked on autopilot as everyone has their view on how things should be and you can’t change stupid. Don’t believe me? try changing the mind of a Christian to become an atheist or make an Muslim become Christian. Politics is not much different from religion. Most people have “faith” or even political fervor for one party or ideology. Just about everyone that votes wants some form of entitlement from gov’t: Security, Wealth fare, Health care, employment, etc. Trying to convince them otherwise is just a good way to get beaten up or labeled (aka anarchist).

Second, decline and collapse is inevitable. Too many people consuming a finite supply of resources. To believe you can change this would be delusional. Changing the form of gov’t won’t change physics.

Hi Ron,

Notice how as you go back farther in time the RRC final estimate becomes too low, if we go back 25 months. it gets worse and the EIA estimate from 25 months ago matches the RRC data as currently reported almost exactly. A comparison of the EIA’s C+C will always be higher than the RRC’s crude only estimate.

For Texas C+C in Jan 2014 the PDQ gives 2746 kb/d and the EIA has 2832 kb/d, over time the Texas value in the PDQ may continue to increase. The final crude only estimate for Jan 2014 was 2255 kb/d and the current PDQ has 2341 kb/d so the EIA estimate might be 82 kb/d too high, but the RRC final estimate seems to be 86 kb/d too low.

You may be right about current EIA estimates being too high. In March 2014 the EIA estimates Dec 2013 Texas C+C at 2853 kb/d, but the PDQ has Dec 2013 C+C at 2686 kb/d. For crude only in Dec 2013 the RRC final estimate was 2075 kb/d and the PDQ has crude only at 2286 kb/d. In this case the RRC was 211 kb too low and the EIA was 167 kb/d too high. Link to Dec 2013 final estimate below.

http://www.rrc.state.tx.us/all-news/022614b/

Perhaps a good estimate is the average of the RRC final estimate and the EIA’s estimate, but we would need to assume we could apply the production adjustment factor to both crude and condensate to create a final RRC C+C estimate and then average that with the EIA’s estimate.

For Jan 2015 that method would give an estimate of 3234 kb/d of Texas C+C output. I think the eventual data point will be about 3300 kb/d +/-100 kb/d.

A comparison of the EIA’s C+C will always be higher than the RRC’s crude only estimate.

Wow, I had no idea that crude + condensate would be higher than just crude.

Dennis, I showed the EIA C+C because I wanted to show how the EIA sees a constant increase of production every month. The EIA does not produce crude only numbers.

Hi Ron,

The point is that the impression is given that the EIA numbers should be compared with the Texas crude only numbers, look at the chart, obviously the EIA is overestimating.

The RRC underestimates by a similar amount that the EIA over estimates (actually the EIA is a little closer but the difference is small).

The idea that the RRC final estimate is more accurate than the EIA’s estimate in the Petroleum Supply Monthly is not confirmed by the actual data.

Okay, the Texas RRC says Texas crude only was down by 87,000 bpd in January while the EIA says Texas C+C was up by 3,000 bpd in January. Since Texas condensate was likely down in January that is more than a 90,000 barrel per day difference. Time will tell which figure is closer to the truth but I am betting the EIA is the one who is off by a country mile.

Hi Ron,

Yes you may be correct that the EIA number will be high, the RRC final estimate will also be too low. So if we say the difference between the estimates is a country mile (is that like a nautical mile 🙂 ), both estimates will be off by about half a country mile. It is a little difficult to compare because in one case the estimate is crude only and in the other case it is C+C. The EIA estimate will be about 150 kb/d too high, but the RRC final estimate will be 300 kb/d too low, if the production adjustment factor(1.175) is applied to the condensate estimate in the PDQ.

Excellent point and one I’ve been trying to make for months. The longer in time the accumulated graph is, the bigger the “apparent” discrepancy, when in fact, there likely is no difference at all (or very little.)

Much ado about nothing.

But of course! After several months the RRC has the correct data after all the oil companies report their final data. And the EIA keeps revising their data until it matches the RRC data exactly. It could not possibly be otherwise because that’s where the EIA gets their data.

Exactly!!

I have previously tried to give everyone the benefit of 50 years of filing production reports in Texas; how and why it works the way it does. I do not report to anyone other than the Railroad Commission of Texas. The Texas RRC data is the accounting basis in which billions of dollars of royalty and taxes are paid. Those barrels are not estimates, I assure you. Corrections to reports or the occasional filing of a delinquent report to balance sales to production gets done in a matter of a month or so, at the most, or the operator is severed and cannot move oil off the lease premise.

There is one source and one source only for oil production data in Texas.

Mike

Hi Mike,

How do you explain the difference between the final production estimate from 12 months ago and the reported crude output in the Production Database Query.

I know the production gets reported to the RRC, the EIA uses that data to produce a more accurate estimate of Texas output.

What makes you think that the bureaucrats in Texas have a better ability to make these estimates than the bureaucrats at the EIA?

If you look at the data, the EIA estimates over time have been far superior to the estimates by the RRC. Everyone looks at the same data(as reported by you and others to the RRC) and has to guess at the amount of “missing barrels” in the reported data. The fact is that the EIA guesses are more accurate than the RRC’s guesses in their “Final Production estimate”.

Dennis:

1 BO sold = 1 BO produced. The two numbers must balance. Within 23 days of the close of last months business, I get paid for ALL my barrels sold last month. So do my royalty owners, so does the great State of Texas in the form of severance taxes. The accounting for barrels of oil produced and sold in Texas is so precise that a barrel of oil can be reduced by 2/10ths of 1% of total volume for its poor quality (BS&W). That is ultimately accounted for. We are not in the habit of refunding money to each other in Texas based on incorrect barrels of oil sold (produced) that are reported incorrectly to the TRRC or that are delinquent for years at a time. The Texas RRC is the keeper of the accounting. That is precisely why my “bureaucrats” know more than your bureaucrats. Yours deal with imaginary barrels, mine deal with real barrels. I cannot make it more clear than that. All this TRRC vs. EIA hubbub is, in my opinion, ridiculous and I no longer wish to bore people with it.

Mike

Yo Mike, at what point in time for your process is an assay done of the content of your oil? Is it done periodically or just once, or ever?

Watcher, good question. The oil is assayed at the point of sale. A typical “load” of oil is 165 barrels. The operator checks the oil to make sure it meets minimum standards for quality (1% maximum BS&W by volume); if it is good, it gets called in. The crude oil buyer (truck driver) comes out to haul it and assays the oil again going on the truck. His prevails. The buyers wants to buy oil, not water.

M.

So frequent assays . . . of that type. I was more groping towards diesel/kerosene/middle distillate content.

But still, that’s at least a look at it frequently.

Watcher. Every run ticket left in our jars at the tank batteries contains the API gravity as determined by the crude purchaser to the tenth. For example API 34.4. Observed oil temperature is also on the ticket as well as BS & W information,for example 3/10. Opening gauge and closing gauge. Date, time identity of gauger and identity of driver. Operator name and number, lease name and number and tank number. Tank size. Sometimes comments like, “clean tank bottom!”

In our area a gauger employed by the crude purchaser checks the tank first. He says yes or no on if it’s bought. Don’t want to mess with driving a tanker or bobtail to the lease if too much BS & W %. We definitely try to stay in his good graces.

A few days after the end of the month, we receive run statements from the crude purchaser which contain mostly the same info plus price per barrel and gross proceeds calculation. Always check against run tickets.

To a certain extent, wonder if maybe better approach for the EIA would be to have every crude purchaser send them amount of oil purchased each month. They are all heavily automated businesses and really what goes into the pipeline is what matters. Seems EIA would know within less than 30 days how much crude went into the nations pipelines the previous month. Maybe that is big government though? Yikes. LOL!!

Heck, crude purchasers already send this stuff to the states, the county assessors and folks who pay for it like IHS Energy and Drilling Info. Why not just have them send it to the EIA as well, have them add it up and be done with it! This isn’t the KSA for crying out loud! This is the good ole USA where we all need to to know everything including battle plans for crying out loud! LOL!!

For crying out loud, make all the crude purchasers send the EIA the gravity of the oil they bought too! That way we can see if Jeffrey J. Brown is correct.

Given how much freaking speculation there is over in the crude markets, why can’t our government at least compile information in the way I have described? I mean, come on!! Knowing how much goes in the pipeline each month would make it easier to be more accurate on the crude storage numbers, and would also help both our government and the public in figuring out how much oil is being imported.

What revolutionary statistical ideas given we are in the year 2015. Heck, my I phone probably has enough juice to take in an compile the data.

BTW, there cannot be more than a few hundred crude purchasers out there anyway. None of this is rocket science.

Instead we will have to argue till we are blue in the face. I suppose IHS knows all of this information, GS, Citibank, et al, buy it, and then use it to trade while the rest of us plebes try to rely on free public data that is contradictory. Maybe I need to find a class action attorney??

Hi Ron,

I have kept some of the old EIA data as originally reported, the EIA estimates are not perfect, just much better than the RRC “final estimate” which is lower than the data reported in the RRC’s Production Database Query (PDQ). If you look back at some of the data for your charts from 12 months ago you will see that the EIA estimates are far better than the RRC estimates. You have the data just look at it.

In fact your chart in this post shows that you cannot “take the final RRC estimate to the bank”, their final estimates are too low, in every case, from 8 months ago and further back in time.

Another example of data downloaded on Oct 1, 2013. EIA estimate for July 2013 was 2625 kb/d for TX C+C, the Texas C+C output reported in the PDQ on Oct 1, 2013 was 1908 kb/d (1692 kb/d of crude only).

The final RRC estimate for crude only was 1856 kb/d so the production adjustment factor was 1856/1692=1.097.

If we apply the production adjustment factor to both crude and condensate we get 2093 kb/d for TX C+C output. The PDQ estimate for July 2013 is currently 2531 kb/d, closer to the EIA estimate(2625) than the RRC final estimate (as always).

The revisions by the eia are much smaller than the rrc because the initial estimates are far more accurate.

I will guarantee you that the EIA’s estimate of a 3,000 barrel per day increase for Texas C+C for January is nowhere in the ballpark.

Hi Ron,

It is the level of output that matters as a change in output depends on two numbers, Dec 2014 output and Jan 2015 output, so to keep it simple let’s just talk about the level of Jan 2015 output, not the change in output from Dec to Jan.

The EIA estimates Texas C+C in Jan 2015 at 3400 kb/d. If output ended up at 3350 kb/d, that would be about 100 kb/d less than the Dec 2014 estimate by the EIA.

You are talking about changes in output and I am talking about the absolute level of output so that we are talking past each other, it seems.

My argument is that the final level of C+C output in Texas will be pretty close to the EIA estimate, within 100 kb/d and between the Texas final estimate( with the RRC production adjustment factor applied to the RRC production data query).

If you consider an error of 100 kb/d “nowhere near” 3400 kb/d, then you would be correct, I consider an error of 3% better than an error of 10%.

The RRC estimate will be low by 10% and the EIA will be high by 3% for the absolute level of C+C output for Texas in January 2015. At minimum the EIA estimate will be as good as the RRC estimate (the barrels per day that it is high will be equal to the number of barrels that the RRC estimate is low.)

A final thought is that you probably have a lot of this data from older EIA and RRC estimates, just as I do. You can easily prove to yourself that I am correct by looking back at some of your old data. In every case in the past 3 years, the EIA estimates have been far more accurate than the RRC estimates of statewide production for the most recent 2 months reported.

The Texas RRC “final estimates” have been uniformly too low by about 3 times the number of barrels that the EIA estimates have been too high (typically the EIA is high by about 100 kb/d and the RRC is low by about 300 kb/d).

I have given numerous examples showing this, obviously you are not convinced and as Mike has said this is boring. Time will show if you or I are correct about the absolute level of output.

The 87 kb/d fall in output in Jan 2015 may indeed be correct, if output continues to fall at a 2.5% rate for 3 or four months it will be significant. I expect output will level off at 3200 kb/d and will increase back to as much as 3400 kb/d as oil prices climb over the summer, maybe returning to this level by Nov 2015.

So a plateau between 3200 and 3400 kb/d for Texas C+C for 2015 is what I expect for 2015.

This can only be judged in Dec 2017 when all of the RRC data is in, and nobody will remember anyway.

Dennis, you are trying to figure too many angles here. I said, well before the EIA came out with their estimate, that Texas appeared to take a huge hit in January. I made that assessment from looking at the RRC incomplete data, not their later assessment of final numbers or the EIA’s estimate that it was not really that bad.

I stand by that original estimate. We will know in a few months, or perhaps sooner, whether or not I am correct.

Dennis, If I may be so presumptuous as to posit an explanation for the difference between you and Ron, here goes. I cannot recall seeing any explanation as to how exactly the EIA comes up with their estimates but, it appears to me that they have been extrapolating previous growth trends. If this is in fact how they are doing it, each months new data will be x% more than the previous month and as long as the linear growth trend matches what is actually happening, the estimates can turn out really well.

This beaks down when you have a discontinuity such as growth flattening or in fact, declining. If we are witnessing a discontinuity, the EIA estimates will continue to pile on new production at previous growth rates while RRC figures reflect what is actually happening on the ground.

Ron can correct me if I am wrong but, what he has been trying to point out to you is that, even judging by the incomplete RRC data, the growth trend appears to be slowing dramatically. At the same time, while the growth trend in the EIA estimates may have been tempered somewhat by some mechanism known only to the technocrats over at the EIA, they are nowhere near to reflecting the actual decline in growth that the RRC data will eventually show in all it’s glory!

We will all just have to wait and see how this all plays out but, I suspect that in a years time, Ron’s position will be vindicated.

I have seen this all the time with corporate forward looking business plans, projecting growth going forward and saying shit like, “We expect to earn 6% more revenue for the next financial year based on (insert reason here) and over the next five years should experience growth in the region of (insert WAG here)%”. Then you have some event like a war or a new disruptive technology or an unexpected increase/decline in the price of some commodity or the other and you can throw that entire projection in the toilet!

As has been said many times before,“Past performance is no guarantee of future results.”

Alan from the islands

Hi Islandboy,

Maybe you are correct, note that the EIA sees the same data that we see, and may very well see the discontinuity that Ron sees, that may be why they have Texas output basically flat in Jan 2015 and why I have suggested they may revise this downward. For the two previous months the EIA estimated output had increased by 50 kb/d, the most recent estimate had an increase of only 3 kb/d so the EIA sees that something has changed.

Another factor that may mess the EIA up is the RRC’s change to all digital reporting, this will make the data behave differently than in the past and should make the RRC data more timely within 6 to 12 months.

That may figure into Ron’s thinking, I don’t know. In fact Dean’s methodology may give us the best guess. He estimates 3300 kb/d for Nov and Dec and 3160 for Jan 2015. I still like 3300 kb/d for Jan, but 3250 kb/d is probably better based on Ron and Dean’s analysis.

Output will definitely be between 3000 kb/d and 3440 kb/d for Jan 2015, if it is between these at 3220 kb/d and we define a 220 kb/d error as nowhere near correct, then both the RRC and EIA will be nowhere near correct for Jan 2015 C+C output for Texas. We will know in 12 to 24 months.

This link is not directly on topic but since oil has so much to do with climate, climate IS discussed here often.

http://www.resilience.org/stories/2015-04-03/how-long-can-oceans-continue-to-absorb-earth-s-excess-heat

This article is longer than most dealing with the subject in the msm and goes into some detail.

Another great read, although more pertinent for the last thread:

http://dark-mountain.net/blog/rivershift/

Disclamer: Dark Mountain has published some of my work.

The Law of Diminishing Returns

Part one of a four-part video series. Released in conjunction with Afterburn: Society Beyond Fossil Fuels.

Is modern society hitting the point of diminishing returns?

In this brand new short video released today, Richard Heinberg explores how — in our economy, the environment, and energy production — we may well be. When previous societies have hit similar limits, they often doubled-down by attempting ever more complex interventions to keep things going, before finally collapsing. Will this be our fate too? And is there an alternative?

http://www.postcarbon.org/the-law-of-diminishing-returns/

Mac, thats a climate change panic inducing piece. If you want to get into ocean temperature change issues you should try loading the Argo buoy data on your Google Earth software. Google has a deal which allows you to obtain the location and measurements from thousands of buoys.

What I do is take the buoy temperature and salinity plots and mount them in panels to make my own cross sections. This allows me to study what goes on by looking at actual data. It’s also useful to understand heat capacities as well as salt water densities/specific volumes.

I should add that if an article includes the cockamamie Hiroshima bomb analogue then it should immediately be discarded. That’s a low brow technique invented by the SKS ignorati who make propaganda for a living. The best way to understand energy uptake is to look up and understand the actual figures.

For example, if you want to estimate the energy uptake in the upper 300 meters of the ocean you can use the Levitus et al data, work out the slope in joules per year, change it to watts per m2 using the oceans total surface area.

http://data.nodc.noaa.gov/woa/PUBLICATIONS/grlheat12.pdf

Very informative research letter Fernando. However, saying it’s not a global emergency does not change the realities. It’s a global emergency since our civilization is so overbuilt and so precariously perched on the very things that caused the predicaments.

“We have estimated an increase of 24 1022 J representing

a volume mean warming of 0.09C of the 0–2000 m

layer of the World Ocean. If this heat were instantly transferred

to the lower 10 km of the global atmosphere it would

result in a volume mean warming of this atmospheric layer

by approximately 36C (65F). This transfer of course will

not happen; earth’s climate system simply does not work

like this. But this computation does provide a perspective on

the amount of heating that the earth system has undergone

since 1955.” Nothing scary there.

I wonder how much soil and rock heating anomaly has occurred in the continents. The atmosphere is the lowest mass and exposed directly to space. Rock, soil, biomass and freshwater are all more massive than the atmosphere by far. With so much more soil being exposed directly to sunlight due to agricultural deforestation, how much heat is being stored in the ground?

I would think that increased evaporation in farm fields would cool the ground, moving the energy to atmosphere and then somewhat to the ocean through rain, conduction, convection and infra-red irradiance.

Luckily we also have the melting polar ice to absorb energy, though that is a one off.

Too bad the GLORY launch failed and destroyed our chances to understand atmospheric aerosol distribution and properties in detail.

Yes screw those thousands of phd scientist and thousands more grad students who compile the data from thousands of instruments on land, in the oceans, and in space and confer with each other on an ongoing basis. Any schmoe with a computer can do it better.

Jef, I happen to be adult, educated, and wise. I’m also very curious. This makes it impossible for me to turn into a groupie, a follower of anybody or anything. I don’t care fir any political parties, and I prefer to do things my way. If you prefer to have blind faith then that’s up to you.

SO hows your “faith” in gravity doing.

You act like my kids when they were 5 through 16, you simply have to be oppositional regardless of the facts.

My faith in Gravity? I assume you mean Eisnstein’s idea that gravity isn’t a force but a property of space time which distorts due to the presence of mass?

General relativity is an incomplete idea. It fails to deal with quantum effects. And it has led to the introduction of “dark matter” to account for observations. Thus far we can’t find dark matter (this is why it’s said to be dark).

My hunch is that dark matter doesn’t exist, and that observations are explained by the fact that gravity is imparted by tiny things (call them the particles which define space time properties) which happen to have anisotropic behavior. If they find dark matter I will recant. Otherwise I prefer my solution to theirs.

Is your curiosity satisfied? Would you rather discuss something about the oil and gas industry? That’s my real strength.

Otherwise I prefer my solution to theirs.

LOL!

I’m starting to come around to OFM’s theory that most of what you say is an attempt at sarcasm but I think you need to work on your delivery a bit more…

When are you going to publish your grand theory of everything based on you knowing more about anything and everything in the entire universe, than any of us mere mortals ?

La Grande Théorie Unifiée de Tout de Fernando Leanme

Now available at Amazon.com for $14.95

Limited time offer. Hurry supplies won’t last!

Fernando’s perspective on the nature of dark matter is the general position of many Astrophysicists.

He is not conveying some radical personal belief.

The term “dark matter” often confuses laymen because the title suggests we know of this concrete, tangible thing, but just haven’t found it. This is completely false.

Observations show that there is significantly more gravity around the periphery of galaxies than there should be according to our current understanding of physics via Special Relativity. The term “dark matter” is merely a place holder for the “extra” gravity.

Astrophysicists will readily admit that “dark matter” is likely an artifact of our model (Relativity), and will simply vanish once a Unified Theory comes about. Dark matter is most likely an indicator that our current model isn’t perfect; dark matter likely isn’t an actual physical thing floating around in space.

It doesn’t mean Relativity is WRONG – Newton didn’t prove Kepler’s Laws to be false he simply refined them; Einstein didn’t prove Newton’s Laws to be false, he simply refined them; a Unified Theory won’t prove the Laws of Relativity or Quantum Mechanics false it will simply refine them.

It is not audacious to say that Einstein’s Laws of Relativity were lacking in completeness. Einstein himself was very outspoken on the fact that Relativity is simply a stepping stone. It yields complete gibberish on small scales, and is therefore, by definition, not accurately reflecting the realities of the physical universe.

Dark matter (and dark energy) are just symptoms of an incomplete model, not actual physical “things” out there in the cosmos. Astrophysicists readily and happily hypothesize this as the “origins” of dark matter. The fact that our current models don’t sufficiently explain the physical universe is extremely exciting to Astrophysicists, and they embrace it.

The best way of thinking about dark matter and dark energy in relation to General and Special Relativity is that these laws break down both on very small scales (quantum level, black holes, singularity), at very large scales (edge of galaxies having “extra” gravity i.e. dark matter), AND very, very large scales (universe as a whole expanding faster than Relativity predicts i.e. dark energy).

Putting it this way reveals that Relativity is really only accurate on a specific scale, but it is astonishingly accurate on that one scale. Fortunately for us it is at the scale of stars and planets that it is impeccably accurate thus allowing us to use GPS (w/o Relativity your Google Maps would be off due to speed, mass, time dilation), send probes to Mars, and even rendezvous with comets 10 years and billions of miles after launch.

The thing is, people completely misunderstand this reality. Yes, Einstein’s Theories of Relativity are impeccable at describing the physical universe at this specific scale, but no physicist deludes themselves into thinking this means it is accurate, and therefore true, for any and every scale larger or smaller.

Relativity describes a segment, a small part of the total spectrum of the physical universe. It happens to be the part of the spectrum we most need described for our activities (like GPS and exploring our solar system), but this is still a very limited scale in a lot of ways, and it is by no means anywhere near a Unified Theory that accurately describes all scales faithfully.

I obviously can’t speak for Fernando, but hopefully that helps elaborate on why Fernando is not being audacious in any way, shape, or form on his hypothesis regarding the nature of “dark matter”.

Fair enough!

The Modern Concept of Matter – Frank Wilczek

https://www.youtube.com/watch?v=q63CnyBu3nQ

Brian, that’s about right. It’s not like I think it’s turtles all the way down.

maybe we could change the snark detectors to look for WIMPS?

My problem is that when ever I see the government stepping in to “help” us, it always costs us more in taxes and lost freedoms down the road. I don’t “hate” the phd scientists and grad students you mention, but I sure don’t want to see any of my taxes fund their research. If climate change is so important, I say let the private sector step in to fund the research and find solutions. Outside of military operations, government should only have a spectator role.

“…but I sure don’t want to see any of my taxes fund their research.” ~ M.Marcellin

Why stop there?

I don’t want to see governpimps.

Never mind our funding of anything through them and by taxation-by-force.

It doesn’t work, and worse– including scientific research in that context– and is not ethical.

No emergency? Well maybe there is and maybe there isn’t…

I’ve been diving on coral reefs for almost 38 years and I have been witnessing more and more coral bleaching in the last decade. I think we have reason to be quite worried. There are many many stressors affecting the health of coral reefs. Warming oceans is definitely one of them. Here’s another link from NOAA .

http://oceanservice.noaa.gov/facts/coral_bleach.html

Warmer water temperatures can result in coral bleaching. When water is too warm, corals will expel the algae (zooxanthellae) living in their tissues causing the coral to turn completely white. This is called coral bleaching. When a coral bleaches, it is not dead. Corals can survive a bleaching event, but they are under more stress and are subject to mortality.

In 2005, the U.S. lost half of its coral reefs in the Caribbean in one year due to a massive bleaching event. The warm waters centered around the northern Antilles near the Virgin Islands and Puerto Rico expanded southward. Comparison of satellite data from the previous 20 years confirmed that thermal stress from the 2005 event was greater than the previous 20 years combined.

So back to the link you provided and a chart from it using the Levitus et al data. You don’t see a problem?

Thanks, too, for the Richard H./Resilience.org video, Fred, (which was shared with others).

Richard seems to make things as simple and as easy to understand as possible and that’s the idea. To get the message out, it needs to be as understandable to as many as possible.