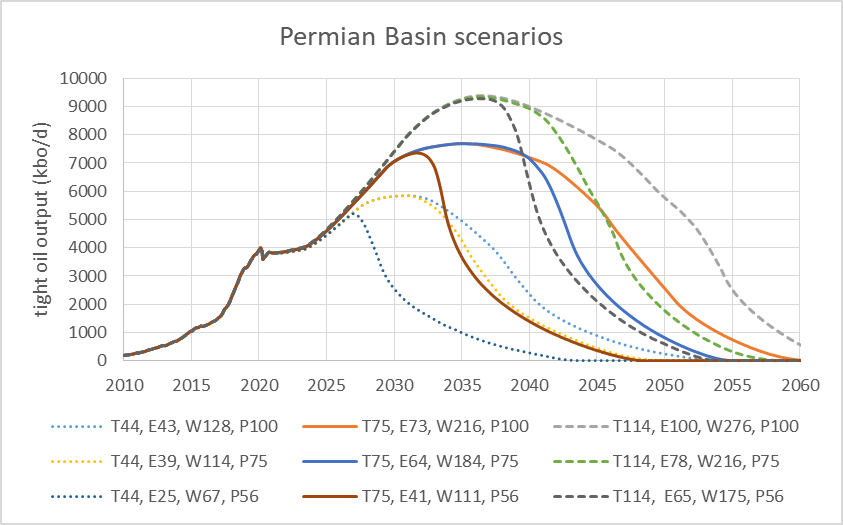

The future of tight oil output in the US will depend in large part on future development of Permian Basin resources in Texas and New Mexico. I have developed nine scenarios for future Permian basin tight oil output based on 3 levels of technically recoverable resources (TRR) and 3 different future oil price scenarios. These are summarized in the chart below.