Note: Please post only extinction event comments below.

The Sixth Extinction

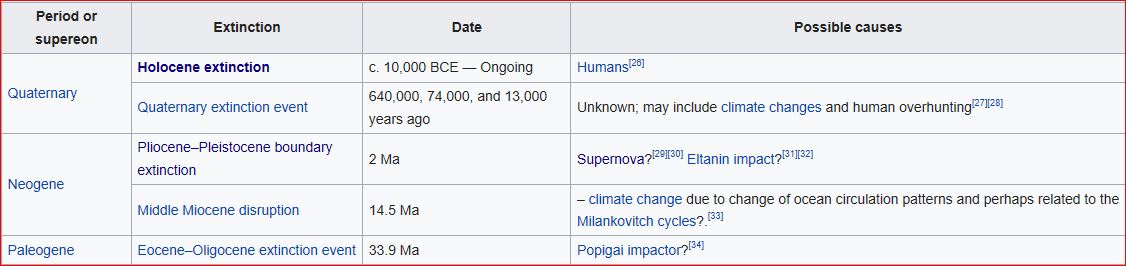

There have been five major extinctions in the earth’s history and twenty lesser extinction events. They are all cataloged by Wikipedia here:

And here, below, are all the extinction events since the KT extinction.

The event 2 million years ago was, of course, the start of the ice ages. However, there is some who say that it was ushered in with an asteroid impact.

Pliocene-Pleistocene boundary: did Eltanin asteroid kickstart the ice ages?

I am not prepared to comment one way or the other on this bit of news. However, their explanation for the Quaternary extinction event is interesting. There were three events which they say the causes were unknown but may indicate climate change or overhunting. Really now? Let’s look at the first two dates.

640,000 years ago. This is the exact date that geologists and volcanologists estimate the Yellowstone supervolcano erupted.

74,000 years ago. This is the exact date that geologists and volcanologists estimate the Toba supervolcano erupted.

One would think that if there were two spikes in the extinction rate at the exact same time two super volcanos erupted, that they just might put two and two together and figure out that these two supervolcano eruptions had something to do with it. The Toba eruption almost wiped out the human population leaving, by some estimates, less than 10,000 humans alive.

And now the extinction event of 13,000 years ago has been explained. It was actually 12,900 years ago. It is all explained in this Nova presentation The Last Extinction . An extraterrestrial meteorite or asteroid impact was the culprit. Thanks to GoneFishing for the link.