A Post by Ovi at peakoilbarrel . com

All of the oil production data for the US states comes from the EIAʼs Petroleum Supply Monthly. In addition, information from other EIA offices is provided to project future US output. At the end, an estimate is made for the decline rate in the L48 conventional oil fields and an analysis of a few different EIA reports is undertaken.

The charts below are updated to October 2019 for the 10 largest US oil producing states (>100 kb/d).

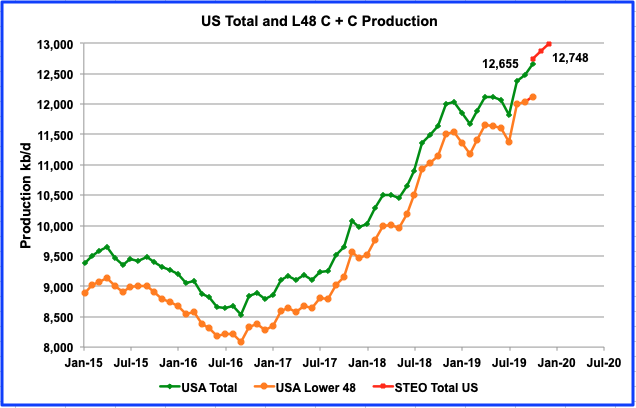

U.S. oil output continued to increase in October 2019. Production reached a new high of 12,655 kb/d, an increase 171 kb/d over September and 55 kb/d higher than estimated by the December Monthly Energy Review (MER). However it is 93 kb/d lower than the 12,748 kb/d estimated in the December STEO report. This could be an indication that the January STEO report will again lower US production estimates for 2020.

Read More