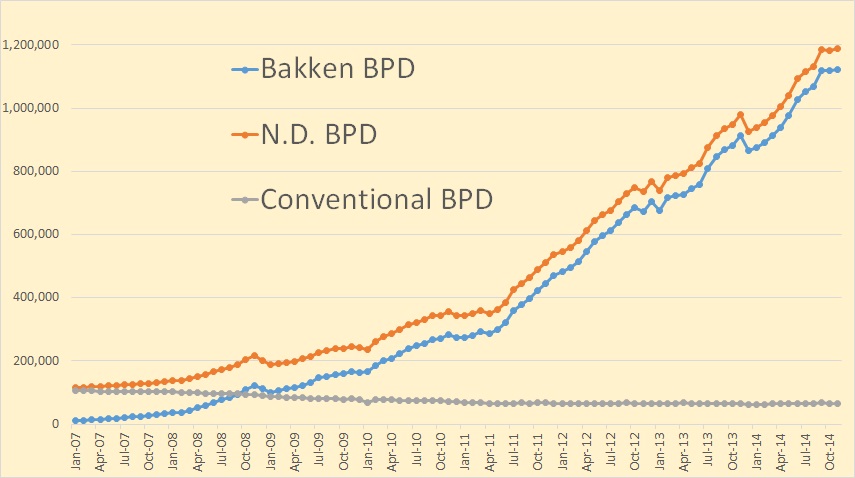

The North Dakota Industrial Commission is out with the Bakken November Production Data and the North Dakota Production Data.

Bakken production was up 5,293 BP/D while total North Dakota was up 3,691 BP/D. Total North Dakota oil production is up 901 barrels per day from two months ago, October production.

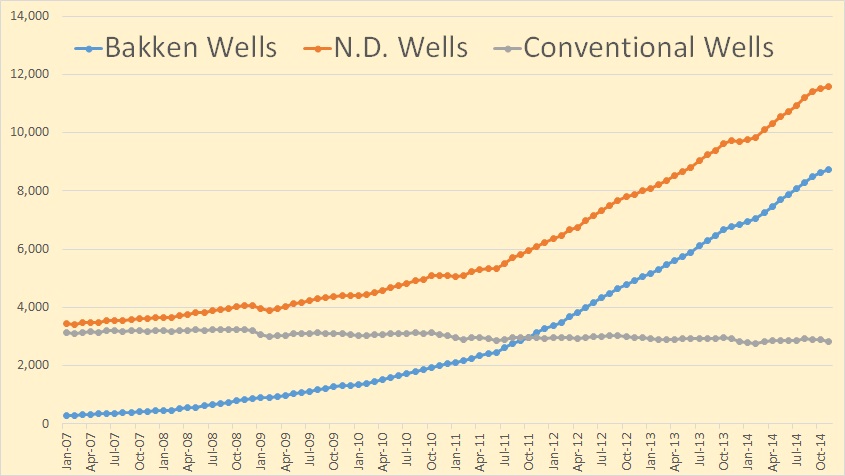

Total wells producing was up by 110 in the Bakken but only up by 63 in North Dakota. That means a lot of conventional wells were shut down.

From the Director’s Cut:

Oct Sweet Crude Price = $68.94/barrel

Nov Sweet Crude Price = $60.61/barrel

Dec Sweet Crude Price = $40.74/barrel

Today Sweet Crude Price = $29.25/barrel (lowest since December 2008) (all-time high was $136.29 7/3/2008)

Oct rig count 191

Nov rig count 188

Dec rig count 181

Today’s rig count is 156 (lowest since Oct 2010)(all-time high was 218 on 5/29/2012)

The statewide rig count is down 28% from the high and in the five most active counties rig count is down as follows:

Divide -62% (high was 3/2013)

Dunn -39% (high was 6/2012)

McKenzie -23% (high was 1/2014)

Mountrail -32% (high was 6/2011)

Williams -28% (high was 10/2014)

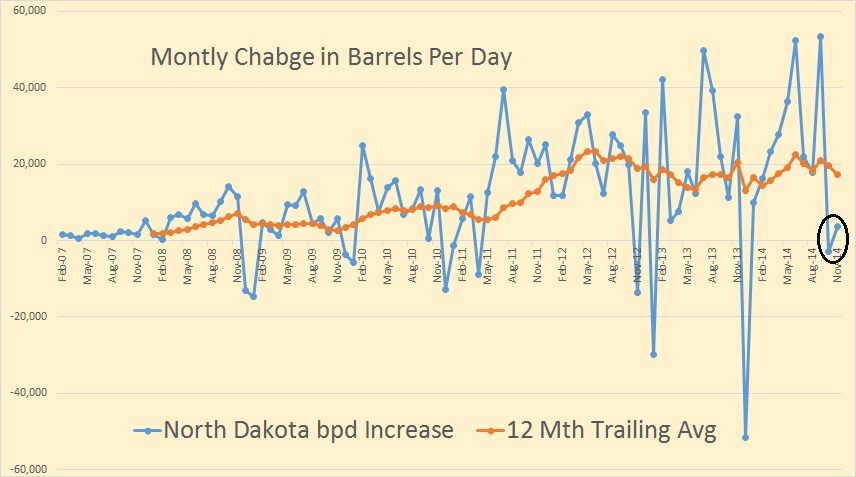

The drilling rig count dropped 3 from October to November, 7 more from November to December, and has since fallen 25 more from December to today. The number of well completions decreased from 145(final) in October to 39(preliminary) in November.

Oil price is by far the biggest driver behind the slow-down. Operators report postponing completion work to avoid high initial oil production at very low prices and achieve NDIC gas capture goals. There were no major precipitation events, but there were 11 days with wind speeds in excess of 35 mph (too high for completion work) and 7 days with temperatures below -10F.

The drillers far outpaced completion crews in November. At the end of November there were about 775 wells waiting on completion services, an increase of 125.

Crude oil take away capacity is expected to remain adequate as long as rail deliveries to coastal refineries keep growing.

Rig count in the Williston Basin is falling rapidly. Utilization rate for rigs capable of 20,000+ feet is currently about 80%, and for shallow well rigs (7,000 feet or less) about 50%.

145 well completions in October led to a decline of 2,790 barrels per day, (revised) while 39 completions in November led to an increase of 3,691 barrels per day. That math makes no sense. But Bakken “wells producing” increased by 110. How did that happen? Bakken “wells producing” increased by 118 in October.

There are now 775 wells awaiting fracking crews, an increase of 125 in one month. What will happen to North Dakota production in the next few months becomes a real guessing game. Nothing can be predicted by the number of active drilling rigs and we have no idea what the fracking crews will be doing.

One thing for sure is production growth has dramatically slowed in the last couple of months, (circled above). I expect that slowdown to continue to get even slower. But because of the huge inventory of uncompleted wells the immediate future of Bakken production becomes a real mystery.

Addendum: The reason “Wells Awaiting Completion” jumped by 125 in November:

Helms: Oil production could decline by third quarter

Lawmakers and oil officials alike are expecting the smaller trigger to take effect Feb. 1 through June. For that to happen, the WTI price must average less than $55 a barrel for a single calendar month.

That will reduce the oil extraction tax from 6.5 percent to 2 percent for a set amount of production, and applies only to wells completed after the trigger is pulled.

That possibility, which is expected my most officials, is leading to an increasing number of wells awaiting completion, as companies wait for the incentives to take effect. Helms said he was “stunned” to hear 775 wells were awaiting completion as of the end of November.

This means there may be a mad rush to complete wells after the the lower tax kicks in on February first.

Note: For those who would like to be added to my new post notification mailing list please post me at DarwinianOne at Gmail.com

340 responses to “Bakken LTO Production, November Data”

Clearly, the (bankrupt) customers are leading the petroleum industry (by the nose, kicking and screaming) into the Promised Land …. absolutely free oil! Time to get your guzzler on …

… right?

Hard to predict how much (how little) absolutely free oil will be made available but teams of government scientists (economists) are certainly working hard around the clock to come up with an answer.

These effects are in place before the real hits start coming. This is November data! The Bakken price was DOUBLE then what it is now.

That guy needs to take a lump sum on his pension money.

Watcher,

Why be so negative. Don’t you realize the FED can print Barrels of Oil? We will never see peak oil with the FED at the helm.

steve

There are phases.

Right now, the Fed could finance increases in global oil production and push the peak upwards. It’s traditional to say to-the-right, but upwards is the correct direction if created money is used to finance increased production higher and higher, because if you are given free money, you’ll hire every one you can to get more oil out, since your primary cost (financing) is being backstopped and the more that comes out, the more money you make (a lot like bigger burgers vs 1970s size burgers, the bigger they are, the more money you make).

When a physical limit is reached, then the nationalization of output arrives as the decline unfolds and capitalism in general has to stop because whatever comes out of the ground will be rationed to grow and transport food. The transport of nothing else will be permitted, or in effect, possible, and thus neither will be capitalism.

Then, soon after, the food can’t be grown or shipped and some new rationing categories will unfold for backhoes at cemeteries.

Watcher,

Have you ever thought that the Fed could Print TRUCKS, DIESEL FUEL, FOOD and ETC. I don’t see PEAK ANYTHING when the Fed is running the show. Don’t you realize a BIG MAC from McFats would be the same quality as one printed by the Federal Reserve?

steve

Yep.

http://www.theguardian.com/technology/2014/apr/01/3d-food-printer-foodini

Steve, Perhaps the FED can get creative and print certificates representing barrels of oil to distribute to the public. Oh wait, That’s what Steve from VA. says dollars are! So I guess if you believe hard enough they truly can print crude. I make a prediction that we still have not seen peak “leadership” psychosis ..some could choose to argue that point though.

Philip,

Excellent points indeed. As I stated above to Watcher, I see no difference in quality of a BIG MAC from McFats, then one printed by the clowns at the Federal Reserve.

Americans have become disillusioned that all we need is MORE PRINTING and everything will be fine. Well, if that is the case, then I say… let’s start with printing more IQ’s. That would really help things right along over the CLIFF.

steve

Well, absent caps, there is some merit in noting that it’s not just the US happy with printing. Pretty much about 85% of Europe is demanding Super Mario buy some ink. He may start January 22, three days before the Greece election. How cool is that?

Watcher,

While you are correct that the NITWITS in Europe are also clever at running the Printing Press, but they can’t hold a candle to the CLOWNS at the Federal Reserve. Well.. then again, we can’t forget about the Japanese and their wonderful way of blowing the YEN off the charts.

Things will continue to get more insane until we wake up one day and see a blank screen with a blinking dash showing the system has totally crashed and is awaiting a REBOOT.

“I’d buy that for a Dollar”

steve

This seems to at least partially confirm what I thought, they are not going to frack drilled wells unless they absolutely have too for some unforeseen reason. I heard another repot on Monday night from a friend of mine who’s son works on the rigs. He said basically as soon as they finish a well they stack the rig. The company he works for is letting the least desirable people go and then moving those they want to keep to rigs that are still drilling but he knows that will not last for long. There is an overwhelming sense of denial in the air but I think life is about to get interesting.

Yup, the cancellation clauses in the drill rig contracts might be uglier than the fracking sand and rail contracts. Those sand and transport suppliers need to tighten that up and put the screws to these guys.

If they can’t pay, have them borrow. If they can’t borrow, you didn’t want to be doing business with them anyway, since the bank knows better than you do.

Hi Watcher,

My guess is the sand business is pretty competitive. If one company won’t provide sand, there are plenty of others willing to grab that business. Rigs are a little harder to come by, not a lot of those can be dug up. But when the lease is up on the rig, if prices are still $35 or less at the wellhead, the lease probably will not be renewed. The lease can also be broken and the penalty will be paid if they run out of room in the sweet spots. Nobody will be bothering to drill in the less productive areas.

Based on the current ND oil price, the only wells worth fracking are the best ones. There are still hedges in place so some wells will be fracked. Unhedged production has no payback for fracking at these prices unless its a gusher. Helms had it right when he said operators were not keen to bring up the big first year well output and get $30 a barrel for it. They all think that if they sit on it for six months to a year they can get $50 or $60 a barrel so if you don’t have to, why frack?

It’s like F-16 assembly lines. If you don’t need them, why build them? Because the guys who know how don’t grow on trees.

So these things will be fracked if that is a consideration. The more likely consideration is the price could be low for years, in which case the lenders are going to be taking ownership of all these companies.

Your last sentence is the one that is exactly right. Which is why they will not lend more money now to frack a new well.

It will be interesting to see what happens if prices do recover. It could become a game of fracking chicken. Some may want to hold out for a better price but as soon as one sand truck rolls they will all have to roll and it may smack the price right back down.

I suspect other oil producers are taking action to reduce activity. They may not have wells with such high decline rates, but in most cases production does go down as activity slows. This means the overall market doesn’t necessarily get forced by the Bakken wells.

Presumably any well that had operating costs equivalent to 50% or more of wellhead revenue six months ago now has no positive, or actually negative, cash flow.

Of course, as I think you noted, the abandonment costs are so high in offshore areas likes the North Sea that a lot of operators may be postponing the day of reckoning and absorbing, for the time being, the negative cash flow on some older fields.

I suspect the shut ins are taking place randomly, for example when electric submersible pumps go out, or a well sands up, they may be allowed to sit for months. I bet the workover rig market is lousy.

Other shut ins are studied a bit before the plug gets pulled. For example, take fields like Rubiales in Colombia. I assume they will cancel drilling rig contracts and hunker down.

Jeff, according to my Niece (Petroleum Eng., Statoil) the biggest hits to new production will be in the Arctic because of high costs and long lead times there. Apparently Norwegians are the biggest players in the Arctic right now so this is probably a good call: This conversation was just ten minutes ago so very current! She reads Ron’s Blog and likes your input.

Doug, 10 minutes ago was $1.50/barrel higher. Try to keep up, please.

Doug, I guess it depends on the time prices stay real low. If we shorten our time horizon, the biggest hits on new production must surely be USA light crudes from tight rocks. I don’t think there are significant ongoing Arctic projects.

Let’s see if we can pump your relative…where are these arctic projects supposed to be?

North Sea operators also lobby for tax breaks:

http://www.theguardian.com/business/2015/jan/15/oil-chiefs-call-for-north-sea-tax-cuts

The UK uses a primitive tax system. They ought to talk to the Angolans.

As a computer guy I have to smile at this. The prices for computer hardware have fallen by half every 18 months since the late sixties.

Oil prices are still much higher than they were when Bush II got into office. Why should there be a tax break?

Computers and similar electronic goods are just about the ONLY things that have steadily declined in price over the last few decades.Everything else that matters that comes to mind has been steadily going up on average-at least everything that comes to mind immediately.

This steady decline in the price of electronic goods seems to have had the effect of causing people who work in the electronics industries to believe in eternal growth and prosperity.

It just doesn’t work that way in other industries.

Now here is a thought that I find sort of intriguing.

Suppose the cost of the chip needed to run a small device such as a phone or tablet drops to let us say one dollar.That sort of chip may never get to be this cheap but let’s say it will for illustrative purposes.

If the electronic guts cost so little then the actual price of electronic goods may start going up eventually simply because the cost of the rest of the device and shipping and retailing etc increase faster than chip prices go down.A chip can’ t possibly cost less than zero.

I believe the prices of some consumer goods have already followed a similar pattern. The cheapest name brand digital watches cost more now than they did three or four years ago in my experience.

At any rate in the non electronics world a government may have the choice of choosing between a lower tax rate and more oil – or between the current tax rate and less oil- maybe even no oil at all.And no oil tax revenue at all.

With the local price at fifty bucks and operating expenses including taxes at sixty bucks including twenty in taxes you get zero oil and zero taxes.

Cut the tax rate to five bucks and with operating expenses falling to forty five bucks you get oil and a little tax revenue.

The really scary thing is when the price falls so low that even a zero tax rate doesn’t allow cash positive extraction.

Then EVERYBODY’s MOMMA has to start paying the oil producers instead of the oil producers paying her.

Ya can’t get by without some oil no sireee.

Gotta have SOME o’ that stinky black slick stuff.

It’s easy to underestimate how fast the price of computer equipment has fallen. Chip prices don’t go below zero, but most of the equipment I was selling in the early nineties cost literally nothing.

For example, nonvolatile storage prices (hard drive space for example) have fallen 99.9999999% since I started.

Components get integrated onto chips because the cost of keeping them separate would be higher — two chips costs a lot more than one.

For example, the Intel 386 was introduced in 1985. It had a quarter of a million transistors and ran on 5 volts. It cost something less than $1,000, not sure any more.

In the mid nineties we were buying a 3V version that ran 4x speed and much smaller SMT style packaging in Hong Kong in bulk for $2. A couple of years later the circuit logic was integrated into embedded systems like CD-ROM drive controllers.

So the product ceased to exist, although the logic was integrated into hundreds of millions if not billions of systems. You need a microscope to see a 80s style desktop PC, and chips are still shrinking quickly.

I read an estimate that over 1,000,000,000,000,000,000,000 (a sextillion) transistors have been shipped. Each one does the duty of the original transistor in the fifties.

Solid state manufacturing started by eating the electronics industry, but it didn’t stop there. Twenty years ago the main industrial use for silver was camera film. The camera and film market collapsed. A whole world of mechanical logic, like carburetors and machine tools is being replaced by chips and actuators weighing much less. Most of the consumer electronics devices of the nineties are just apps today, so despite your claim there is no bottom to the price. Commercially available cars can get 80MPG. New planes do even better per passenger thanks to better design, manufacturing and route optimization. 20 years ago, nobody expected Africa would be able to afford the copper wiring to get telephones — now 800m Africans use dirt cheap mobile technology instead. The real cost of lighting is collapsing. New houses need almost no heating at all around here anyway. Air conditioning may soon go solid state as well. American consumption of newsprint has fallen by 2/3 since the Clinton era. Improved renewables are poised to eat fossil fuel’s lunch in the electricity business. Nobody blinks when solar or wind prices fall 20%.

Computers are at the crossroads of better material sciences and improved design/analytics, but they are only part of the story. Mankind could easily reduce its ecological footprint by half while improving living standards. We could even start undoing the mess we made in the past few centuries. Whether we will before we hit a wall is another question. My guess is that some societies will do better than others.

Basically it all comes down to the ability to produce an oil glut when the world economy is weak and demand is still relatively low. Even after massaging the numbers the US and Europe can only come up with a small gain in the economy. As far as I am concerned, other than a few areas, inflation is still eating that so called growth ( a good portion of which was the oil and gas industry growth in the US). Reality is we are still near zero growth. Don’t let the funny money fool you.

So after putting trillions of dollars into developing oil production in the US, the industry was able to outstrip the demand. Oil was somewhat overpriced anyway and is definitely hung out on heavy debt. Mines experience this effect and shut down for periods until the price goes up. Debt and public investment force continued production or bankruptcy.

Hi. Here are my usual graphs. First the production profile. I have used sales (runs) for confidential months. This tends to give lower initial production. Probably there is a lag between production and sales. So don´t use this data for calculating cumulative production. But the months after that should be more accurate and comparisons between years should be more accurate. So that´s why I used this method.

This time I have included all data points. I used to skip the last one including only January, because it tends to be divert alot with only one moths of data. But it there are some intersting information for 2014. January was actually a rather good month in terms of initial first months of production. But the last data point for 2014 (including only January data) we can see that it is now bellow 2011 and 2013. Also the data point before that (including January and February data) was slightly above the 2012 line using October data, now it´s slighly bellow it. So there are indications that decline rates for wells drilled in 2014 may be higher than the years before it. It´s too early to draw any conclusions, but interesting to note.

Here are the water cut profiles. I was a bit suprised to see that the wate cut for month 0 and 1 for 2014 actually decreased from 47% to 46%. Ron´s 24 hour ip data suggested that water cut should increase. 2014 is still higher that earlier years though. All data points are included here also.

Did total water production decrease?

Lets see. Average oil production for month 0 increased from 290 to 293. So yes, average water production decreased from 257 to 250. But only not confidential wells are included. So it is uncertain.

Here is the one month after first production data for oil production, water cut and gas production. Here we can also see that water cut has decreased.

Hi FreddyW,

It looks like the water cut has increased because the right axis is reversed or do you mean the uptick at the very end?

Yes I mean the last data point.

And finally the Mountrail data. Here production has continued to decrease. It´s now the lowest ever for the period shown.

“So there are indications that decline rates for wells drilled in 2014 may be higher than the years before it.”

I recall this being noticed, that the late graph was declining faster and intersecting previous year lines, and you properly cautioned about the relevant January.

Now, it looks bad. It looks ENORMOUSLY worse with lower price. This can be yet another mechanism of hysteresis — recovery price may be far higher than destruction price.

It’s not enormously worse. The best way to look at it is the cumulative rate versus time.

FreddyW. Something I note is the tail end of 2009 and 2010 wells. 2010 has an uptick, while 2009 drops off sharply to about 25 bopd. It had looked a couple of months ago that these wells would flatten out to around 50 bopd. Do you think that is accurate, or is 25 or less more probable? With nearly 9,000 Bakken/TFS wells, I thought hitting a 4% or less decline at about 50 bopd per well would create a base of 450,000 bopd. My view of EFS is those wells fall off to under 30 bopd in about 4 years. Horizontal in Permian also looks this way to me, although there you have many more zones and therefore tougher to generalize.

I know it is just guessing, but let’s say we look out from now to 2025. What do the wells drilled 2009-2014 look like in your opinion? I am having a tough time understanding how water flood would work in the shales, although middle Bakken doesn’t really look like a shale. Would welcome opinions on this. Seems like whether the 150,000 or so 15,000′-20,000 horizontal wells projected in these fields in next 8-10 will average 5 or 50/bopd is a big deal. I suppose if economy doesn’t have the demand, those wells won’t be drilled. However, welcome opinions assuming they are.

Hi Shallowsand,

I can easily show you what things would look like out to 2025, if you give me some assumptions. How many new wells per month are drilled between now and 2025?

Do we assume that the estimated ultimate recovery(EUR) of new wells remains at the 2009 to 2014 level or does the new well EUR decrease as the sweet spots get drilled up?

If we expect EUR to decrease when does it begin? How quickly does it ramp to its maximum rate of decrease (1 year, 6 months)? What is the maximum annual rate of decrease in new well EUR? With these assumptions I can give you a TRR, where price is assumed to rise enough to keep wells profitable (10% IRR minimum). If you give me some price assumption (real oil prices rise by 5% per year), I can show you output levels that would be profitable based on the assumed oil prices and other underlying assumptions.

In previous posts I have shown scenarios where new wells added decrease to 130 new wells per month by March 2015 and remain at that level. New well Eur starts to decrease in June 2016 and reaches a maximum annual rate of decrease of 7%/year 12 months later. Oil prices rise from $58/b at the refinery gate ($46/b at the wellhead) in August 2015 by 4.9%/year. Some people seem to dislike the endless charts, so I will not bother to post it.

This scenario keeps output pretty flat in North Dakota at about 1.15 mb/d to 1.2 mb/d. If you are wondering what output would look like with no new wells drilled after Dec 2014, that scenario is below.

Dennis, thank you very much for the response. So looks like in 2025 the wells drilled and completed through 2014 are only at about 200,000 bbl per day per your analysis. The number of wells that must be drilled to maintain production long term is staggering. Surprised the market is not taking this into account. Or maybe it is, but is also assuming world wide demand will be peaking soon, which would not be a good thing given no good substitutes on a broad scale in the immediate future.

Also, thanks for the response, Fernando. Wonder if they have a good water source to flood with in ND? Also wonder about these wells long term from the stand point of the lateral

was cut off. from the stand point of the lateral plugging off. Would seem like working over these wells would be very expensive.

Shallow Sand, though there has been some testing with water injection in shale, none were successful. Here is a long PDF on one such test. They found water flooding almost totally useless in shale formations though they did not rule it out completely because they thought perhaps their testing could have been better.

I have read many opinions on water flooding shale and no one seems to think it will work.

EVALUATION OF EOR POTENTIAL BY GAS AND WATER FLOODING IN SHALE OIL RESERVOIRS

2. In our work, although water injection in shale oil reservoir did not have a result as well as gas injection, we cannot conclude that water injection has no potential in the development of shale oil reservoirs absolutely, because we have not optimize the injection process and may factors have not been included in our simulation model.

Miscible CO2 flood is a better option then attempting a waterflood in an unconventional carbonate like the MB and TF.

I would check a huff and puff. I wouldn’t bet much on a sweep process unless you have 200 years.

As you say, the rocks being exploited aren’t shales. They are very poor quality dirty carbonates and silts. The wells were fractured. This means injected water will enter the fractures and bypass the bulk of the rocks. I visualize a little bit of imbibition taking place. But the economics ought to look terrible.

If I owned one of these fields I would try using a two well pilot. After all we did get a surprise when we flooded the North Sea chalk. But it sure looks uphill.

Hi. The last data points for each year contains data only for wells that started production in January. The data is rather noisy, so it gets very unrealiable with only one month of data. So don´t draw any conclusions from it. The last 11 data points for each year does not contain data for all month. So they are subject to change.

This article does a pretty good job of touching on many of the things being discussed here.

http://www.opednews.com/articles/1/Peak-Oil-and-the-Fracking-by-Allan-Stromfeldt-C-Debt_Economy_Energy_Fracking-150112-505.html

Excellent article. I passed it on. Thanks for the link!!

Bottom line is tell me what the best oil futures back month contract should I go long on ….. I think just going with front month won’t make the most.

Somebody ran out of oil and now it’s at 48.53, the tether let loose. Two dollar oil must mean two dollar per barrel price increases.

Up 2.64 at Bloomberg. Bound to change at any moment.

Any kind of wild speculation for the price increase might include a shrinkage in inventories and an increase in demand, the old supply and demand ploy, fall for it every time, never fails. Whoddathunkit?

100 million cars adding twenty-four gallons into the tanks in the past two weeks totals 2 billion 400 million gallons of gasoline. 1.2 billion vehicles adding two gallons on average is still 2.4 billion gallons of fuel, gasoline and diesel. How can the globe trekking jet set travel to Tibet without jet fuel and gas needed to reach the base camp at Mt. Everest? New Zealand needs some tourists this time of year, more jet fuel, more gas, more adventure. Gotta go for the gusto. Might want to squeak in some fishing for salmon. Without oil, you’ll need to find something else to make it all go. Sails and yaks, some gear and food, you might accomplish your goal.

23 gallons of gas in each barrel of oil. All armies, all navies, all air forces, coast guards, all were going to have to have some more, it has to come from somewhere. The merchant marine has to have some diesel for the power plants on the trawlers. Can’t run empty, you’ll be stranded at sea, then the coast guard will have to have a helicopter rescue, more fuel. Fill’er up. Your stomach is empty, you eat, you’re going to live, life is good.

All of a sudden, an additional 55 million barrels have been burned in the past two weeks. Might as well get as much as you can at the low price, it’s probably not going to last very long, you gotta get it while you can, don’t know what you’ve got until it is gone. Those empty tanks are like empty stomachs, when there’s nothing there, nothing works.

On top of that, the Williston Basin production is one million barrels per month lower in November.

https://www.dmr.nd.gov/oilgas/stats/historicaloilprodstats.pdf

Supply and Demand

Those two evil, wicked, mean and nasty devils, the dirty dogs that they are, might be calling the shots, but it is just a guess. Could be all wrong, again, it has happened before.

First, it’s all ecstasy, then agony follows, then ecstasy again, then more agony again and then even more agony again, the misery index must be ebbing from its high, always seeking a low, a never ending quest.

Agony, agony, agony, agony, agony, agony, agony, agony, agony… agony… agony

– Bugs Bunny

If the shale companies are not interested in completing their drilled holes, and they are drilling their holes on borrowed money, then the only reason to drill the holes will be because they can’t get out of the contracts for their suppliers, be that drilling rigs, casing, or other service companies.

If the the delay in completion is by choice, they must be expecting a fast and quick rebound in price.

If the delay is, because they have no other choice, then they are digging themselves one very big hole.

I doubt, many of the shale companies have big enough cash reserves to carry this game on for very long?

”big enough cash reserves to carry this game on for very long”?????????

This question seems to be at the very heart of who survives among the little guys and who gets bought out or sold out.

The price of oil is not going to go back up for a LONG time -as long as it takes the world economy to grow enough to dry up the current glut- unless a whole bunch of somebodies cuts back on actual deliveries.

I use the term delivery instead of production because a few outfits may have ways to store a hell of a lot of oil and can continue producing it. Who these folks might be is hard to say but at different times over the last year or so I remember reading about some HUGE tank farms being built.

At the time I thought the builders were making a bad mistake anticipating business that would probably not be there.

Now I am thinking differently.

All the really big boys started cutting back very heavily on capex well over a year ago. Now the usual explanation is that they could not see adequate justification going forward for investing the money given the high cost of any new production.This is certainly a reasonable explanation- so reasonable that maybe it is TOO reasonable to take it at face value.

IT is ENTIRELY reasonable in my opinion to assume that super major and nationalized oil companies have the very best in house economic expertise that money can buy plus the maximum possible level of intimate communications with OTHER big players – the super banks being the other players I have in mind- plus access to the supposedly secret insider data that is gathered by various national governments thru spying both polite and impolite..

This assertion at first glance might seem sort of farfetched but to take the simplest and biggest two cases- the Saudis and the Russians – it the first case the government and the oil company are one and the same and both the company and the government are the defacto property of the royal family.In the case of Russia the people who own and operate the country for the most part these days are also for the most part alumni of the old soviet government – men who go way back together as apparatchiks and executives with state security agencies.

Here in the US we have what we call the revolving door – the very WORST example being the fact that our supposedly impartial banking regulatory apparatus and government oversight agencies are almost totally staffed by industry insiders. You do not have to be a conspiracy nut to understand that when top a flight executive at a super bank gets a top flight post at THE FED or anywhere else in the government that information does not pass quietly in all directions among people able to keep their mouths shut and their peckers in their pants as well -most of these guys being too old to get in much pecker trouble anyway.

The sort of people I am talking about have OWNERSHIP interests in the businesses they regulate- maybe not in the form of stock but at least in the form of an expected super high paid job back inside the industry once they leave government.

The OWNERS of big banks OWN big chunks of other industries – including the oil industry.I am about as far from a conspiracy nut as it is possible to be but there is no doubt in my mind that when you get to the top and get your stack jack you have ways of letting your managers know that keeping their jobs involves keeping you INFORMED. Regulations be damned.

So -it just might be possible that some of those big storage facilities that I read about in passing belong to people who ANTICIPATED the possibility of a crash in oil prices. If they were wrong they still have the facilities which in terms of conventional thinking will still be useful if unprofitable for a few years – years spent waiting for the economy to grow until the facilities are needed.

BUT – if they very strongly suspected the crash was coming- then they could reasonably anticipate leasing their brand new storage to people with money enough to fill it up with cheap crude – people able and willing to wait on the price going back up.

The price of oil IS going to go back up. The price of any given commodity has NEVER gone down and STAYED down over the long or even the medium term unless demand for it has permanently shrunk.

Whale oil crashed for the long haul because it was DISPLACED by petroleum.

There simply isn’t anything out there to replace oil for the foreseeable future and the potential supply is depleting at minimum rate of around eighty million barrels a day depending on the exact definition of oil.

Maybe all the really big players saw this crash coming. I know hardly anything at all about the history of the oil industry beyond the bare outlines.

But I have spent THOUSANDS of evenings reading history and in particular the history of the nineteenth and twentieth centuries with a favorite aspect of it being war and peace.

By 1937 or so just about all professional military men whose rank was high enough that they were well informed politically believed WWII was baked in. It took most of the political and business leadership a couple more years to believe it since they preferred not to.

The best place for a secret might actually be right out in the open sometimes.

I am NOT actually saying I take these speculations seriously. But I don’t think they can be dismissed with a wave of the hand.

When I commented immediately above that maybe the big boys saw the glut coming I didn’t mean to imply that they expected the price to crash by HALF.

But then the French generals who expected a war with Germany didn’t expect the Germans to kick their butts without even working up a real sweat.

I find very interesting that I have seen hardly any speculation at all from any quarter about the top dogs in the industry suspecting not only stagnant prices but also a possible price busting glut.Maybe I haven’t looked in the right places.

If I remember right I think Shell sold off their fracking interests about two days before the price turned downward.

http://www.wsj.com/articles/big-oil-feels-the-need-to-get-smaller-1414973307

Well, maybe it was a couple days after.

Best to remember that the BoJ is explicitly provided permission to trade in equities and I believe commodities futures too (have to go back and check). If so, the easiest, least threatening-to-normalcy-narrative path is to buy crude contracts and force it up.

Of course, that would be counter to Japanese interests, but they’ll probably do as they’re told.

We found out pretty quick that a minor oversupply of baby formula – more than the collective baby needs – means the price of formula will crash. Mom and Dad will buy more formula- but only if they can get it cheap enough to feed it to the cat.

But this figurative description of oil markets holds only in the very short term. Give Mom and Dad a few weeks or months to think about the cheap price of gasoline and they will decide on that extra trip to Grandma’s house . The guy with the bulldozer may call up a few customers who turned him down earlier and tell them he can trim ten more percent off his last estimate now that diesel is down some.

Some of the young guys with a wife and kids will decide on the v6 model family hauler rather than the four banger.

Everything else held equal consumers are going to start buying noticeably more oil products soon.This may be happening to a large enough extent already to show up in the statistics within the next couple of months.

My own seat of the pants estimate is that some people are already changing their oil consumption habits noticeably. We are crowd animals – and when we see other people having a good time we will do the same.

I am already hearing from acquaintances about how much fishing they expect to do this summer. Fishing is a cheap pastime for me that actually costs me almost nothing. I fish mostly in nearby farm ponds and catch enough to offset the gallon or so of gasoline I burn to get to the ponds.

But I have acquaintances who when they can afford it drive two or three hundred miles one way go fishing any time they can manage three consecutive days off and can come up with five hundred bucks expense money- towing a large boat with a large pickup truck. The boat itself can be counted on to burn thirty or forty gallons in two days.Sometimes more. These guys are going to get in half again more trips this year than they did last year on the same amount of gas money.

Everything else may not be equal though – the economy could have so many other problems that it gets sicker rather than healthier.Some cheap oil vitamins aren’t going to cure debt cancer.Cheap gasoline is not going to fix all the things wrong by any means.

But it will help some people a lot depending on what line of work they are in.

Oooh, Ukraine has been stealing nat gas and Russia just put a stop to it. Cut gas to Europe by 60% via ZH.

Should be able to squeeze a buck or two a barrel out of that hype.

Some German newspapers reported that ZH by mistake used data from an 2009 article. Ather papers picked it up without checking. And so did the oil traders.

I left Santa Cruz, CA on Friday 09 Jan 2015 and drove the 1,550 miles to McKenzie County having been invited to work on a startup of some new saltwater recycling equipment. I arrived on Sat afternoon and have been looking and listening to the rumors, speculations and opinions regarding Bakken oilfield prospects for the immediate future. Here are a few of my observations from a “Boots on the Ground” perspective.

1. People leave -20deg F weather to go back home this time of year.

2. Low oil prices will cull marginal and leveraged outfits who don’t have the reputation needed to continue.

3. Good companies are still hiring workers, and are still turning away work.

4. The “Boom Hysteria” is quite possibly over here, but there is still quite a bit of oil to get out of the ground.

5. Outfits here are betting on rising prices in the next three to four months.

6. The Bakken in January ain’t fer pussies.

O3K, Out.

O3K

Welcome to North Dakota!

Thanks Nick. I’ve met lots of really nice folks trying to get something done under significantly less that ideal conditions.

Anecdotal data remains very important in this environment. Thanks for the observations.

O3K,

Thanks for the info.

I am interested in the water recycling. Is that produced water for fraccing?

If so, I would love to know the quality of water you are producing, salt concentrations etc and what processes you are using.

today’s retail results a miss. And I remember people were adamant that declining oil prices and extra $200 gas savings would boost the economy.

All things are relative Ves, just imagine what the retail results would look like if oil was still $100 a barrel.

Here is 3/4 Smidgeon of tidbit. Retail numbers include retail gasoline sales. So if one sub category isn’t bought then something else is (maybe, or maybe they pay down a student loan), but there is no net goose to the final parameter derived from not spending on gasoline, because that decrease hits the total. There is exclusionary drill down data that will provide some info, but the headline number won’t say anything other than people are getting high paying jobs, or they are not.

Here ya go:http://www.bloomberg.com/markets/economic-calendar/

If anyone cares, Singapore isn’t following suit with the contract expiration spike of this afternoon. Price currently flirting with sub 48.

Gift cards are not counted as sales until they are used. Anyone else besides me give/receive any gift cards??

I heard around xmas time that some godawful HUGE number of giftcards are never cashed in. Hence, popularity.

The money that corporations receive from un-cashed gift cards are subject to the states’ escheat laws. That is, they must be turned over to the states after a period of time determined by each states’ laws.

Cool. But the money is paid to the company. It has to appear as top line, yes? The cost would be later?

I believe it would be at time of sale of card

debit cash

credit unearned revenue

BS items, touches income statement upon redemption

Good catch

Oh and btw, let’s talk about GAAP and non GAAP. Generally Accepted Accounting Principles and that which is imaginary bullshit.

I give you Elon Musk. Non GAAP is supposed to allow companies to exclude special events that occur in a quarter. Like lighting hit a particular machine that is required to make product and since product could not be made until the machine was repaired/replaced, you declare that the decline you’re reporting in sales or earnings do not reflect the reality of the business and was a “special non recurring item”.

Today we have this:

Tesla Motors Inc. Chief Executive Elon Musk told an auto industry gathering the Silicon Valley auto maker will need until 2020 to be profitable on a basis that includes charges and executive compensation.

Uhm ARE YOU KIDDING ME???? He’s calling executive compensation a special non recurring that happens to recur every quarter. God knows what other “charges” there are. Hell, maybe those are the cost of materials to build the cars. Completely non recurring.

THIS is the kind of thing that explains why that GAAP vs Non GAAP chart that ZH splashed a few months ago was what it was. This company isn’t going to make a cent for 5 years, assuming it lasts that long.

Hi Watcher,

Amazon has operated for years without GAAP profits. This is often true of fast growing companies that plow every dime back into the business. It is not possible to run a business without some executive compensation, though I agree that this seems strange as a non-recurring item, I imagine they are referring to bonus compensation, which should not occur every quarter unless a company is doing very well every quarter.

Right – publishing a non-GAAP number along with the GAAP number has become very popular because, they say, “investors” prefer the non-GAAP number to the GAAP number. That would be right if they put the word “stupid” in front of the word “investors.”

However, GAAP screwed up about 15 years ago when they established the “qualified hedge” rules. As a result, virtually no hedging (interest rates, oil costs by users, oil prices by producers, etc.) can qualify as a “qualified hedge.” Thus those swings in whichever leg of the hedge that you own must flow thru the income statement quarterly. So, e.g., if an oil producer, in effect, “sells” its 1st qtr 2017 oil production by selling a hedge contract at $95/bbl and the price in the 4th qtr of 2014 falls to $55/bbl., they have to report $40/bbl of GAAP income for each such barrel sold in the 4th qtr of 2014. If they closed out the hedge on 12/31/14, they would in fact have $40 of income. But, of course if they hold it until the 1st qtr of 2017, then they get their $95/bbl. Say the price in 2017 was $78, that is what they would receive from a buyer, and the hedge would be closed at that point with a $17 hedge gain – $95 total. So, in such a case, I believe that the non-GAAP info is useful. If they hold the hedge, they will disclose that 4th qtr GAAP income includes an “un-realized hedging gain of $40/bbl on x-number of barrels.”

I could see the price of Tesla stock crashing but the company has physical assets and patents worth a substantial fortune – assuming the auto industry remains alive and well. Now that is a big ASS U and ME in and of itself.

My own guess- assuming a moderately healthy economy is that Tesla is going to continue to grow like gangbusters with a big built in advantage of owning near state of the art manufacturing facility and half of the uber battery factory. Tesla has not yet been around long enough to accumulate the sort of deadwood management that afflicts a lot of companies.

Not many people have even seen a Tesla yet in fly over country anyway. I

I will venture a wild guess that the average regular here expects the price of oil to be back around a hundred bucks within a couple of years and that it will continue to go up gradually from that price.

The future of the electric auto is very very bright in my estimation.

There will be another oil price shock – upwards the next time.

I wonder how far a really stripped down car – an honest to Jesus subcompact with NO frills at all would go at a governed maximum speed of forty five mph with a Leaf drive train.Well over a hundred miles for sure. Maybe even a hundred and fifty.

One of the things Leviathan is going to do when the shit hits the fan is to institute very low speed limits.Enforcement will be draconian- for two good reasons. One is that slowing down nets a MAJOR improvement in fuel economy. The other is that the localities town, city, county, states are going to instruct their cops to write tickets as often as possible to get the money.

I have already noticed- as have many other people in this area- that what used to be a friendly warning about a burned out light on the back is an automatic can’t win ticket that costs the county or city about dime or less to write since the court process is mostly automated.

The cop is already on the payroll. So you pay the ticket in advance rather than sit in court for hours.You hand the money to a court clerk who is already there all day every day anyway.She takes you off the docket.

And your wallet has been lightened by a hundred to two hundred bucks depending on the exact locality. This is happening in the town next door probably twenty times a day. It is a small town.

I wonder how far a really stripped down car – an honest to Jesus subcompact with NO frills at all would go at a governed maximum speed of forty five mph with a Leaf drive train.Well over a hundred miles for sure. Maybe even a hundred and fifty.

Are you familiar with the Rocky Mountain Institute? They have been advocating a total redesign of the car for quite awhile now.

http://www.rmi.org/impact_driving_a_clean_future_with_ultralight_autos

posted below…3-D car body printing for electric cars

http://blog.caranddriver.com/made-in-detroit-local-motors-printed-a-car-at-the-auto-show/

Of course, for mass production, I don’t think 3-D printing offers much.

But check out what the RMI is advocating for carbon fiber bodies and the like.

http://www.rmi.org/autocomposites

And this is what they have been doing in the past.

http://www.rmi.org/Platform+Fitness

The key to taking significant amount of weight out of a vehicle without making it smaller is to substitute lighter, yet stronger materials such as advanced composites, aluminum, or lightweight steel for heavier materials. Once the platform is lighter, the engine (or battery) can be downsized while maintaining original performance.

Simply put, every pound removed from the electric vehicle fleet will make electrification easier. Trying to put a battery into a heavy automobile designed to run on an internal combustion engine creates unnecessary challenges. By reducing weight, cars can be designed to run on electricity and reap the multiple benefits of efficiency.

“The Strati is made of 80 percent ABS plastic and 20 percent minced carbon fiber and weighs a claimed 1500 pounds.”

https://localmotors.com/3d-printed-car/

My friends and family have always noted , usually in friendly fashion, that the ONLY four letter word I really try to avoid is WORK. Avoiding as much work as possible is essential to pursuing all the more interesting things in life such as hanging around in garages and drag strips or pool halls.OR libraries.

I am well acquainted in laymen’s and tradesman’s terms with the possibilities involved in building light weight cars.

While whatever can be done in the way of reducing the weight of a car really does make it much more fuel efficient everything else held equal the actual cost of weight reduction engineering is high to prohibitive because of the law of diminishing returns and the high cost of premium or exotic materials. Aluminum is triple the cost of steel. Carbon fiber sky daddy alone knows how much.

A real problem with the RMI approach is that RMI is focusing on promising people they can have their cake and eat it too- that technology is going to enable them to continue to drive cars as large fast and comfortable as todays cars.

There are good reasons for doing this. It is hard enough to get people to even consider unpleasant news- never mind to accept that unpleasant lifestyle changes are unavoidable.

My own thinking is that it just won’t be possible to build very light cars as big as the ones we drive today at an affordable price.

In my estimation the only way we are going to be able to successfully deal with peak oil in terms of automobiles is to take a four pronged approach to building a car.

Light weight is one prong for sure.

Another is a more efficient drive train.It may be that batteries will get to be cheap enough and powerful enough that we can keep on driving cars of the usual size while reducing the weight as much as possible without making a car unaffordable.

The other two are downsizing and lowering speeds.

There is no question that the single best way to reduce fuel consumption is to reduce the frontal area of a car that is going to be driven at moderate to high speeds everything else held equal. Aero resistance is the big eater of energy out on the road once you are up to cruising speed.All the low hanging fruit has already been picked in terms of improving aero design of modern cars. There is not much left to be gained in terms of the SHAPE of a car.

But you can build a low narrow nicely streamlined two seater fore and aft car for no more than any other two seater and it will get awesome mileage even without using exotic materials. It is my belief that the reality of peak oil will FORCE the acceptance of cars of this sort.

The ONE thing that can be quickly and easily accomplished from the technical pov at essentially no (direct ) cost at all is to force everybody to SLOW DOWN substantially. The improvement in fuel economy is simply mind blowing.

Anybody who doubts this can try it some day.

And when the cops start impounding the cars of drivers doing over the new forty mph emergency limit and the public ( make ) works programs include hiring lots of traffic cops … well then people WILL slow down.

It might happen courtesy of an emergency national security executive order from a republican press supported by a republican congress forced to recognize the reality of peak oil one of these days.

All it would take once oil is scarce again is one really important oil exporting country falling to terrorists determined to hurt Satan…Maybe just a few ships being sunk in just the wrong spots.

Damned spell checker changed prez to press on me. Wish we had an edit button.

http://www.bloomberg.com/news/2015-01-14/qatar-shell-scrap-6-5-billion-project-amid-oil-price-collapse.htmlhttp://www.bloomberg.com/news/2015-01-14/qatar-shell-scrap-6-5-billion-project-amid-oil-price-collapse.htmlhttp://www.bloomberg.com/news/2015-01-14/qatar-shell-scrap-6-5-billion-project-amid-oil-price-collapse.html

http://www.forbes.com/sites/brighammccown/2015/01/14/amid-tumbling-oil-prices-alaska-lng-must-go-forward/

Hi OFM,

I would suggest including a teaser quote from your links that gives a flavor of whatever you think is the most interesting part. Otherwise most people will not bother to click the link.

Thanks all suggestions appreciated. And all replies that add to my layman’s insight into the oil business are especially appreciated.

If I ever get my novel published everybody who has helped me will get a thank you on the jacket by name or blog handle.I will most likely finish it – and most likely have to give it away free on the net.

The novelist racket is about like the pro athletic and musical rackets.For every paying job there are a thousand wannabes.

But if it attracts a lot of readers I might make a few new three dimensional friends and maybe be able to leverage these new relationships into something materially useful. They tell me there are groupies for authors too. ;—)

But I fear any that happen to be interested in me will be less than attractive. There is a joke that with the punchline that goes this way.

The martyr makes a disparaging remarks about the esthetic quality of his hard won harem and the reply is ” Why do you think they are still virgins?”

Forget the teaser.

Alaska is ”moving forward on an ambitious infrastructure project to develop and export its North Slope gas reserves.”

This project is expected to run well into the tens of billions.

Here is a link to a description of the LNG project. This should take about 10 years to be ready to deliver the first load.

http://www.arcticgas.gov/alaska-lng-project

Fernando L,

This is the first time I’ve come across a project such as this, in the US, where a state is one of the partners. Is this unusual?

Synapsids, I’m not sure about other states. Alaska got involved in this project because they wanted to have both an export market as well as produce gas to replace dwindling supplies from Cook Inlet.

However, once the state got the idea rolling the North Slope oil companies began to participate.

I think the overall idea is pretty decent. It can also be suplemented with a coal to liquids plant in the Fairbanks area, which probably needs to start up around 2035.

Oh, and I forgot, the concept takes a large amount of CO2 and uses it as injectant for EOR. That project will also require a huge pile of money.

Thanks Fernando.

Where will they get that CO2?

The Sadlerochit main reservoir gas is loaded with CO2.

If the coal to liquids plant you mention gets built they should have plenty of co2 handy if the plant is near the gas fields.

I take it you expect coal to liquids to be a commonplace technology twenty or thirty years down the road.

So do I- unless there are unexpected breakthroughs in other energy industries such as fusion and wind and solar. It seems like a pretty good bet than coal to liquids will be the cheapest bet to make up the shortfall of needed liquid fuels for trucks and aircraft etc.

I really expect battery propelled electric cars and very light trucks to pretty much own the market by then unless fuel cell tech gets to be really cheap.

In that case it might be economical to manufacture free hydrogen using surplus off peak surplus wind solar or nuclear power or to run a fuel cell on natural gas with an onboard gizmo to free up the hydrogen.

It seems I have read about such devices but not recently. Maybe they can’t be made to work or to work reliably and cheaply enough to be practical.

If affordable batteries are not good enough to propel a car just about all day by then – well travelers will get used to the idea of having to take charging breaks along the way on trips.

We got used to sitting in traffic jams. We will get used to battery breaks if we have to.

OR you really might be able to rent a little trailer with a very small diesel and generator mounted in it and hook it on behind to your electric and stay on the road for ten hours at a stretch. Such trailers might be available at just about any large car rental store someday.

“At the end of November there were about 775 wells waiting on completion services”

The average number of net wells additions in the Bakken for January-November 2014 was 172.

I don’t know how many wells are shut in on average per month, but if no wells are shut in, 775 wells waiting on completion services equal 4.5 months of average well additions, even if no new wells are drilled.

Why the number of wells waiting for completion services was rising in late 2014? My guess is that:

– until recently, oil companies were unwilling to early terminate drilling contracts and pay significant penalties

– contracts with frack firms are probably shorter-term and more flexible, than drilling contracts (but that’s only my guess)

– drilling accounts for only about one third, or slightly more, of the total well cost. Meanwhile fracking services account for about one half, and total fracking+completion even more. Oil companies made it clear that they expect fracking cost to decline by some 15-20% due to the glut in the market. Fracking equipment utilizationin the US has grown from 74% in 3Q13 to almost 85% in 3Q14, but will likely fall again this year due to increasing capacity and lower demand. Hence, the pricing power will be in the hands of oil companies and they expect frack costs to fall.

– oil companies expect oil prices to quickly rebound (as we now from they guidance for 2015 and interviews with people like Harold Hamm). So they probably don’t want to spend a lot of money on fracking and completion as long as oil prices remain extremely low and frack prices are still high

Correction: The MONTHLY average number of net wells additions was 172

Alex, Though I know next to nothing of frack services other than what I have read on this and other sites I know that all businesses have their’ break even point after which they just stop providing the service. Just how much cheaper can the frack service providers go until they hit this point? If you or anyone else here can enlighten me on this I would be grateful. I feel that we are in a deflationary spiral as concerns a number of things in our economy and that once at least some products or services cease to be provided you can’t just flip a switch to make then reappear when an up tick in prices occurs. This would be particularly true with a service that requires highly skilled labor willing to work in sub freezing temperatures.

Philip, Halliburton, an oil service firm, with a big share in the frac market, has recently asked his providers to lower prices of equipment and various materials. When oil prices drop, there is usually deflationary trend in the whole supply chain.

Look up prices 5 years ago. That should give you an idea.

Hi AlexS,

I agree with all of the above. In addition one of the oilmen has suggested that waiting to frack the well until oil prices rise makes sense, that leaving an unfracked well for 6 months or so will do little damage to the well, once it is fracked it only will be shut in for maintenance or the well will be damaged. It seems that many companies have made the decision to hold off on fracking their wells until oil prices rise.

good point, thanks Dennis!

“oil companies expect oil prices to quickly rebound”

Whistling past the lender graveyard. They will pitch exploding oil price every time they go to a workout session at a bank, or talk to their HY paper underwriter. This will quickly move well past “natural optimism” of oil drillers into “outright delusion”.

I will add this about the disappearance of skilled workers. There simply weren’t a whole lot of skilled fracking workers as little as three or four years ago compared to today. If they get laid off -which is happening to most of them – they will come back almost for sure given the scarcity of high paying jobs. People who chase the top money in the trades are generally ready to hit the road .

I guess it is a little different in the case of Fracking since the wells are mostly drilled in the same immediate area year after year.

A Fracker might actually be able to buy a house and put his family in it and his kids in local schools but welders and pipe fitters etc expect to work out of campers and hotel rooms sometimes for years at a stretch.If you find a stationary job it is apt to pay a lot less than a temporary traveling job which typically lasts from a few weeks to a couple of years.

Beyond that something tells me that most of the job of Fracking an oil well is somewhat generic in that most of the people are not really doing anything exotic. Driving a truck is driving a truck. Rigging is rigging. If there are fifty people in the immediate vicinity of the well when Fracking is actually happening probably not more than half a dozen of them are actually ”frackers” in the sense that they know how to MANAGE the process. I bet most of the rest of them can learn their jobs in a matter of days or weeks by working alongside an old hand.

When I lived thru a couple of construction busts I saw guys who were general superintendents get laid off- and others who didn’t. They just hung in there and took the pay cuts and went from project manager to foreman all the way back to skilled tradesman.As business picked up they moved back up the ladder very quickly.

OFM,

A lot of people that are going to be laid off in this current downturn, are from the baby boom and was dragged into the oilfield during 70/80s boom. A lot of them will not be going back to work, as retirement beckons.

That is going to be a big hole to fill next time around.

You have a good point about folks who are close to retirement age not coming back. That happens a lot. Even when times are good skilled labor guys in their late fifties have a hard time finding a job.

Guys past fifty just can’t keep up with the younger fellows when the work involves a lot of physical activity.

But I have been hearing about this supposed un met demand for skilled workers most of my life and I long ago concluded this sort of talk is mostly coming from people who are purely and simply running their mouths for reasons involving politics.

When they say they have this huge unmet demand for workers in so and so trade what they really mean is that they want another million men for peanuts wages and that they would gladly hire some for half the going rate.

If the oil industry is making money enough to put millions of dollars worth of sand and water in holes in the ground it will be able to pay men to do the putting. At ten million bucks a well drillers and frackers can afford to pay some old guys to basically just closely supervise new hands.

There will NEVER be a time again when there won’t be PLENTY of young men ready to do even the roughest ,nastiest, and most dangerous work under the most MISERABLE conditions- so long as the wages offered are enough to live well according to red neck standards- fancy new truck for him, nice car for her large newish house within reasonable distance of her favorite mall,bass boat for him, and enough money to send the rug rats to the university the parents never got to attend.

I could go thru the country side near here and get together a hundred guys in a month with hands like hydraulic claws who can RUN -guys who walk walls as they build houses, cut trees close to high voltage wires, operate bulldozers on eyebrow rock ledges on mountain sides, rebuild diesel engines, weld pipe – for sixty hours or more and twenty bucks and per diem enough to eat and sleep.

But the people who SUPPOSEDLY want them want them at twelve or fifteen bucks and half enough per diem to eat and sleep.They are making that where they are if they have work even in this economic backwater.

My deceased brother used to be such a guy. He was offered work many times well away from home – ” road work ” for not much more than he made locally. His standard reply was that he would sooner starve at home.

I was different in that most of the time I did not have a wife and never had kids.Steady work never appealed to me.

So when somebody wanted a warm body at a nuke for a maintenance shutdown I was ready to hit the road for a couple of months. I made eighty G on an annual basis back in the eighties on such jobs.Long hours of course. Seven twelve twenty nine days in a row once. But then I could play around on the farm for a few months and just take it easy.

I never really wanted a new car- never owned one in my life.An old truck and freedom are by far the best deal to my tastes.

Beyond that being an EDUCATED redneck I was able to understand the power of the exponential function as it relates to inflation and leveraged money and leveraged self employed tax free labor.

So I found a couple of other guys with similar backgrounds and we bought an old dirt cheap house once in a while and fixed it up and rented it for ten years or so and rode the boom ALL THE WAY up until we retired.I have collected fifty grand a bunch of times for a month of actual steady work- not immediately of course but over a period of ten or fifteen years as we divided the cash flow and then sold out.

That’s lawyer doctor engineer money with a pickup truck and a load of hand tools.

Good article by Reuters’ John Kemp

Breakeven and shut-in prices for oil wells: Kemp

http://www.reuters.com/article/2015/01/14/oil-shale-prices-kemp-idUSL6N0US33G20150114

On this average measure, the approximate wellhead price for North Dakota’s oil producers was just $38 per barrel on Jan. 12, making production in all peripheral areas of the Bakken play uneconomic and only marginally profitable in three core counties (Dunn, McKenzie and Williams).

For the first time, wellhead prices were no longer high enough to support new drilling in Mountrail, one of the four counties at the heart of the Bakken play.

Breakeven prices are also relatively high in the Permian Basin in Texas as well as in more peripheral shale plays with difficult geology like the Anadarko Basin.

New drilling in many parts of the Bakken, Permian, Eagle Ford and Anadarko plays will therefore stop unless wellhead prices recover.

This is a very good article that managed to negotiate the subject with no hint of positive or negative bias.

YO RON:

Output from existing fields around the world would decline around 9 percent per year in the absence of new drilling or other capital expenditure to increase recovery, according to the International Energy Agency’s World Energy Outlook 2013.

The IEA’s average 9 percent decline rate was calculated by analysing output from more than 1,600 conventional oilfields around the globe. Shale wells, however, exhibit much faster decline rates.

North Dakota’s Department of Mineral Resources estimates output from a typical Bakken well falls 65 percent by the end of the first year, another 35 percent by the end of the second, 15 percent more by the end of the third, and 10 percent per year thereafter.

In a world where the marginal barrel of oil is supplied by shale, rather than conventional fields, breakeven rates are critical to sustaining output levels even in the short term because the industry must keep drilling new wells simply to reduce the rapidly falling output from existing holes.

The remaining text says THIS REPORTER KNOWS HIS STUFF. This article is scrupulously neutral, mostly because he didn’t go making phone calls for quotes from hypesters.

We need to keep an eye on this Kemp guy.

His other recent article

COLUMN-Bakken oil wells and the Red Queen’s revenge: Kemp

http://www.reuters.com/article/2015/01/12/shale-output-northdakota-kemp-idUSL6N0UR2XA20150112

U.S. oil production will be falling by end of 2015: Kemp

http://www.reuters.com/article/2015/01/07/us-shale-drilling-prices-kemp-idUSKBN0KG1Y120150107

It is a very fine article. Well done Mr Kemp.

Output from existing fields around the world would decline around 9 percent per year in the absence of new drilling or other capital expenditure to increase recovery, according to the International Energy Agency’s World Energy Outlook 2013.

In the absence of infill drilling the decline rate would be 9 percent per year. I really don’t think many folks really understand what is going on here. Companies have become more efficient at pulling the oil out a lot faster.

Catton, in “Overshoot” put it something like this, from memory as I don’t have the book with me: It is basically the same thing as if you became more efficient at filling out withdrawal slips at the bank. You can now pull your money out a lot faster. But no new money has been added to your account.

No more oil has been added to the reservoir, they have just became more efficient at getting it out a lot faster. That is one of the reasons that I am absolutely convinced the we are well past 50% of URR and the downside of the curve will be a lot steeper than upside.

I think a plausible estimate for the gross decline rate from existing US oil production may be on the order of 15% to 20% per year.

At 15%/year, in order to maintain current production, we have to replace 100% of current production in about seven years–the productive equivalent of every US oil well from the Gulf of Mexico, to the Eagle Ford, to the Permian Basin to the Bakken to Alaska.

At 20%/year, in order to maintain current production, we have to replace 100% of current production in five years.

Ya, good call Jeff, and we can blame Shale for elevating so far above 9%. Those 65% year 1 smashes moved the total decline rate of the country higher and higher.

Hi Watcher,

For the Bakken as a whole the annual decline rate if all drilling stopped would be about 42% the first year. If we assume this matches the rate for all LTO output in the US and also assume LTO output is 3 of 8 mb/d, and further assume the other 5 mb/d declines at 9%, then US decline with no drilling would be 21% and Jeff Brown’s estimate was on the conservative side (if I understand gross decline correctly).

But it doesn’t make sense to accelerate rates when prices are climbing.

Hi Ron,

Jean Laherrere estimates World C+C URR at 2700 Gb, I believe that estimate is a little low (by at least 300 Gb), but if he is correct the 50% point would be 1350 Gb.

Currently cumulative C+C is about 1250 Gb or 46% of 2700 Gb, it will be 3 to 4 years before we reach 50% (assuming output stays around 76 mb/d for 3 or 4 years). I think you may ignore oil sands production and believe there is only 2200 Gb of conventional C+C (or possibly less), in that case you are correct that we are past 50% of conventional C+C at 57%.

An HL of the World conventional C+C points to 2500 Gb which would put us at 50% at the end of 2014. The hubbert linearization (HL) method of estimating URR has a tendency to underestimate the URR.

It takes more time to increase output from oil sands so I model this separately and use CAPP forecasts as a guide for Canadian oil sands and use Canada as an analog for Venezuela with an assumed 10 year delay relative to Canadian oil sands. Ignoring oil sands altogether (which is not what Jean Laherrere does), would tend to overestimate the rate of decline after the peak.

“I think you may ignore oil sands production and believe there is only 2200 Gb of conventional C+C (or possibly less), in that case you are correct that we are past 50% of conventional C+C at 57%.”

This is poorly worded. I meant that I think you believe that the URR of conventional C+C is 2200 Gb. Conventional means all C+C except oil sands from Canada and Venezuela (which Jean Laherrere calls extra heavy oil.)

According to this chart, unconventional resources are much larger than conventional resources.

http://en.wikipedia.org/wiki/Oil_reserves#mediaviewer/File:Total_World_Oil_Reserves.PNG

Your thoughts?

John B,

One possibility is that the diagram includes the oil shales in the Green River Formation, Utah/Wyoming. There’s no oil there, only kerogen, but they get talked about without that being understood.

Thanks. But I don’t think the Green River kerogen is being included. “Oil Sands” likely refers to Canada. And “Extra Heavy Oil” likely refers to Venezuela.

I guess the real question I have for Dennis, is why his URR numbers for unconventional oil are so low.

Hi JohnB,

Note that the chart you linked to divides oil into 4 categories. The way I define conventional C+C would include the conventional and heavy oil categories from that chart which would total 45%, of remaining URR, the other two categories taken together is what I call unconventional oil and is 55% of the remaining URR (RURR). My estimate is 1250 Gb RURR for conventional and about 500 Gb for unconventional (which is based on Jean Laherrere’s estimate). Jean Laherrere’s estimate of RURR for conventional C+C is 950 Gb. As I mentioned before there are many estimates of oil resources, most of them have conventional resources somewhat higher than unconventional.

Hi JohnB,

There are many different estimates, some of them include the Green River Kerogen deposit which is large but is unlikely to ever produce any oil, unless oil prices get to about $500/b. The processing is very water intensive and there tends to be water shortages in the area. Two doctoral theses one by Steve Mohr and the other by Cristophe McBride give a wide range of estimates for extra heavy oil from oil sands with a low of 660 Gb and a high of 2120 Gb, conventional C+C URR ranges from 2150 Gb to 3950 Gb. If we deduct the cumulative production of 1250 Gb, then the remaining URR is 900 Gb to 2700 Gb for conventional.

Note that the chart shows reserves, so depending on if you use remaining reserves and choose a low estimate for conventional and a high estimate for unconventional would make a difference. The remaining resources of conventional and unconventional are roughly equal, but I think there is a little more conventional that will ultimately be extracted, probably 1450 Gb of conventional and 900 Gb of unconventional would be my guess.

My thoughts are that the whole thing is bogus. They are counting all those OPEC Middle East reserves as real. Once you do that then the whole study goes down the toilet. Because once you start counting phoney reserves then who knows what else you are counting? It means you are just taking someone’s word for it.

I prefer the term “extra heavy oil” for both the Canada “Oil Sands” and Venezuela “Orinoco Oil Belt” hydrocarbon accumulations.

As it turns out the oil properties are similar. The difference lies in the viscosity and gas content at reservoir conditions, and the presence of a large outcrop area in Canada, which is missing in Venezuela (in Venezuela the oil bearing formation subcrops, and forms a wedge between the overlying seal and the underlying basement, although we do have oil on water in the down dip (north) sector).

I think it’s reasonable to state Venezuela’s extra heavy oil resources are overstated. And as far as SEC bookable reserves…they are a lot lower.

If you have any questions feel free to ask.

Hi Fernando,

You have said in the past that the Venezuelan Resources are estimated incorrectly, supposedly proved reserves are on the order of 250 Gb and the USGS estimates technically recoverable resources at 500 Gb in both Venezuela and Canada for a combined extra heavy (XH) oil TRR of 1000 Gb, the USGS also estimates conventional C+C (all but XH oil) URR at about 3000 Gb with remaining URR of 1750 Gb. If we assume that this is inflated due to phantom reserves in the middle east of 300 Gb (estimated by Jean Laherrere), that would still leave 1450 Gb of remaining URR for conventional C+C.

What would your estimate be for Venezuelan XH oil URR be if a government and laws similar to that of Canada was in power in Venezuela?

Dennis, it depends on the timing for the Canadian regime to be implemented. You see, at the current time PDVSA and its foreign partners are using practices which limit ultimate recovery to around 5 to 8 % of original oil in place. The problem (which many engineers have failed to understand) is water influx into the areas being produced . Once water gets to the producing sector the use of thermal methods is practically impossible.

This is something PdVsa either doesn’t understand or doesn’t care to learn. But Rafael wasn’t that familiar with reservoir engineering.

If the new areas are exploited in a similar fashion tgey will ruin the who,e thing. So what’s the timing? Communist dictatorships usually last for a while. In 25 years they’ll have gutted the high graded areas.

Did you mean to say “Canadian regime”, or “Venezuelan regime”?