Comments related to petroleum production in this thread please.

Author: D C

Open Thread- Non-Petroleum, September 27, 2018

Comments not related to petroleum in this thread. Thank you.

World Coal 2018-2050: World Energy Annual Report (Part 4)

A Guest Post by Dr. Minqi Li, Professor

Department of Economics, University of Utah

E-mail: minqi.li@economics.utah.edu

September 2018

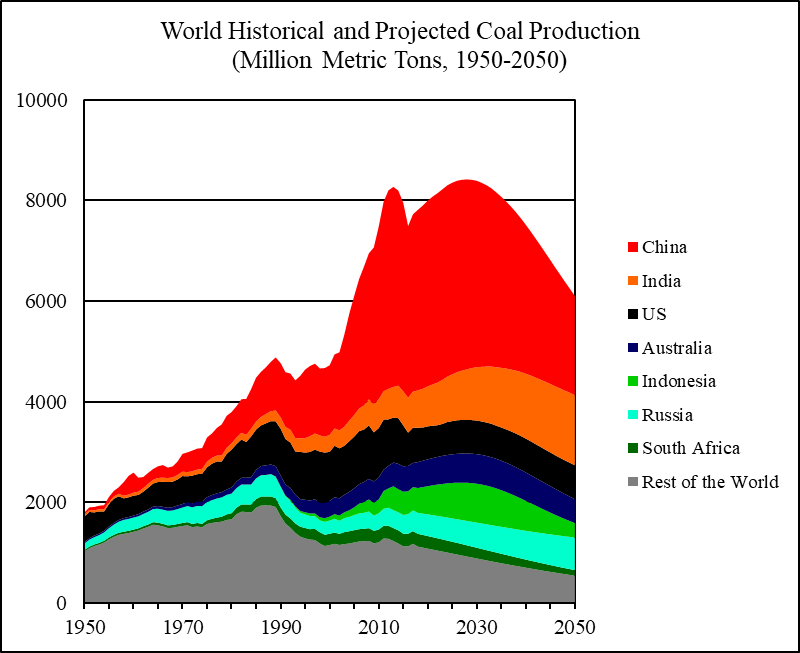

This is Part 4 of the World Energy Annual Report in 2018. This part of the Annual Report provides updated analysis of world coal production and consumption, evaluates the future prospect of world coal supply and considers the implications of peak coal production for global economic growth.

This report uses Hubbert linearization to evaluate a region’s ultimately recoverable coal resources where a Hubbert linear trend can be meaningfully established, that is, where a clear downward trend of the annual production to cumulative production ratios can be identified and has been established for at least several years. Otherwise, this report uses alternative sources to establish a region’s ultimately recoverable coal resources, such as official reserves, official projections, or estimates made by energy research institutions.

Figure 14 World Historical and Projected Coal Production, 1950-2050

Figures are placed at the end of each section. Read More

Open Thread Petroleum, Sept 20, 2018

Comments about petroleum production and related subjects here please.

Open Thread Petroleum, August 28, 2017

Comments related to oil and natural gas should be in this thread.

Thanks.

Non-Petroleum comments should be placed in the Electric Power Monthly thread.