I need to tell you of a very special talent I have. I have the very unusual and rare ability to find, to ferret out if you will, the blatantly obvious. I mean if it is as plain as the nose on your face, I am going to figure it out. What shocks me is that this ability is so rare. What is happening to our earth and our species is so obvious it is mind blowing.

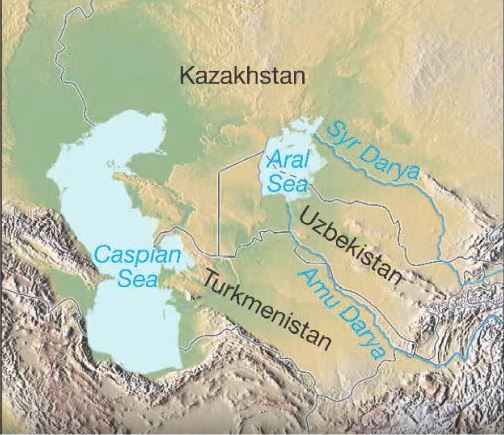

I could give you thousands of forest disappearing, deserts expanding, rivers drying up, water tables dropping, top soil disappearing, species going extinct, ocean fish disappearing, pollution and plastic waste killing sea birds, and on and on and on. But I will start with one example that exemplifies what is happening to the entire world, the Aral Sea.

What has been happening to the world can be exemplified by this short 3 minute video on the Aral Sea: The Aral Sea story.

The Aral Sea was once the fifth largest inland sea in the world. It supported a huge fishing industry. But that was before they dammed its tributaries to irrigate cotton fields.