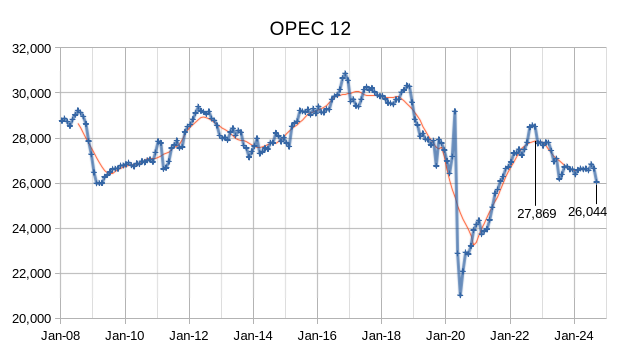

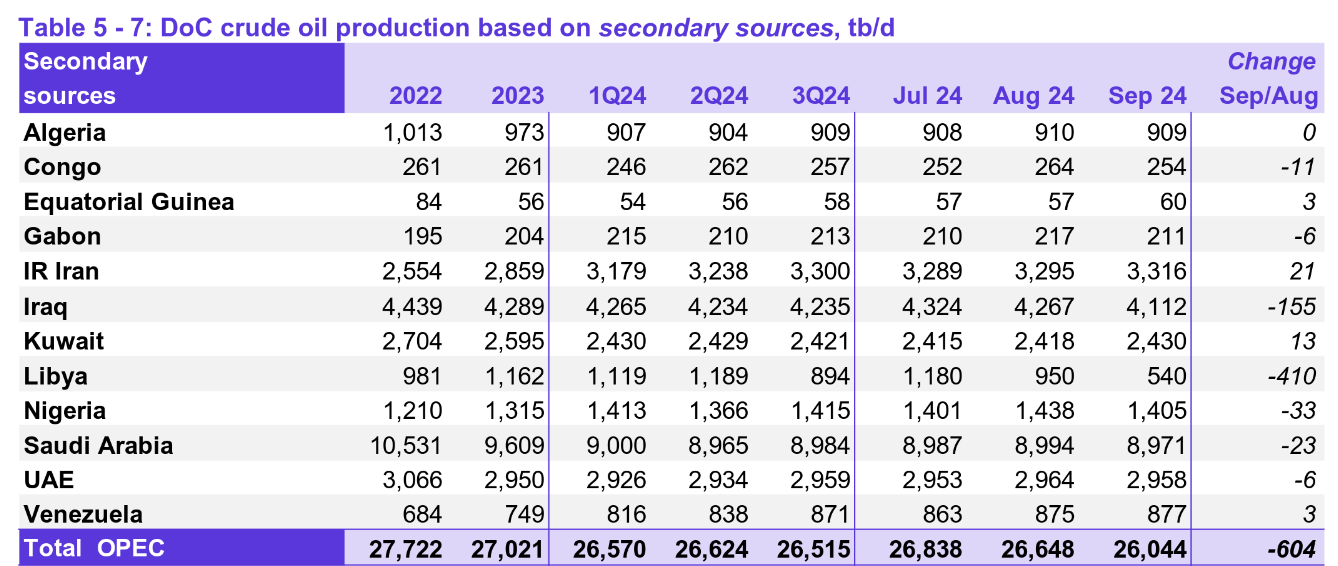

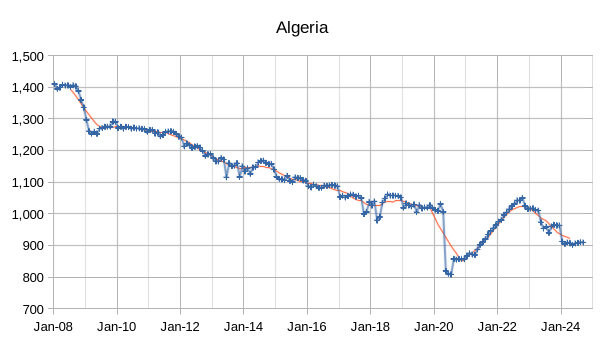

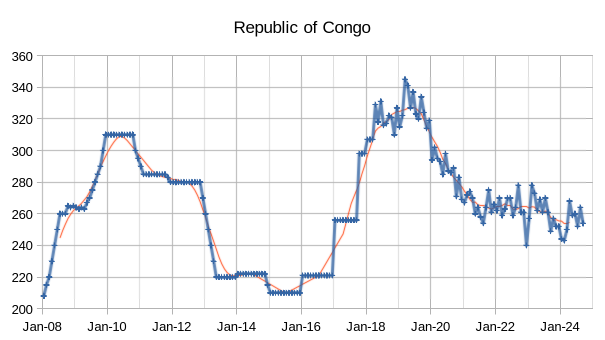

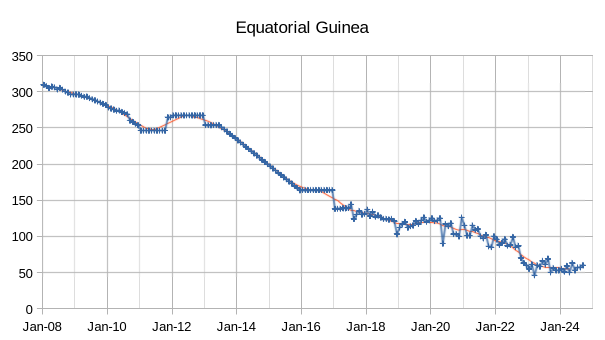

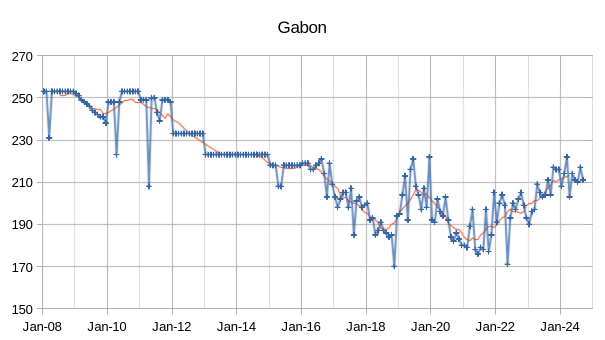

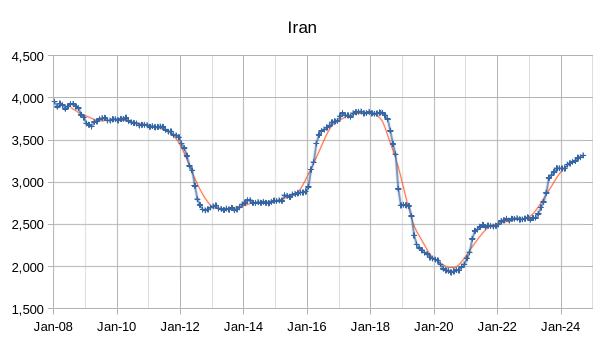

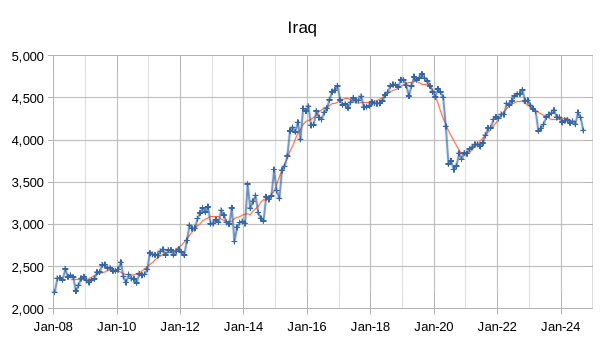

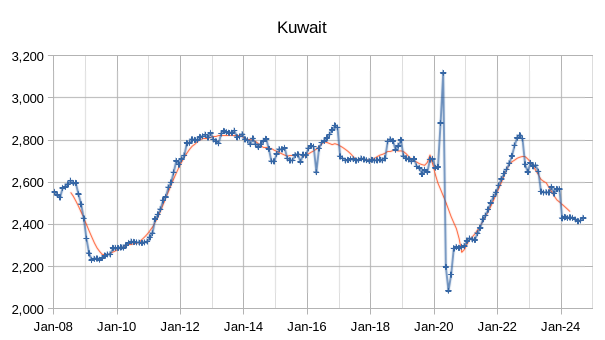

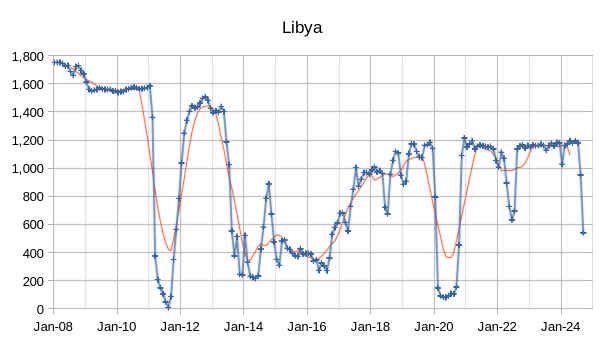

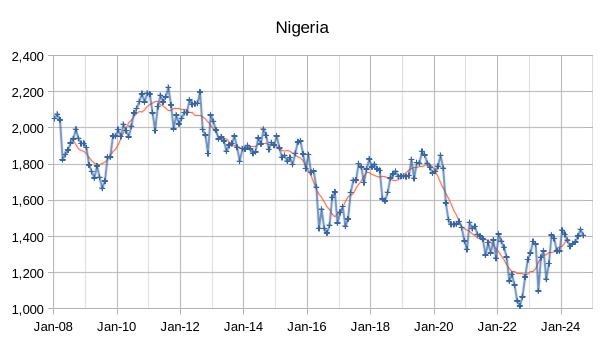

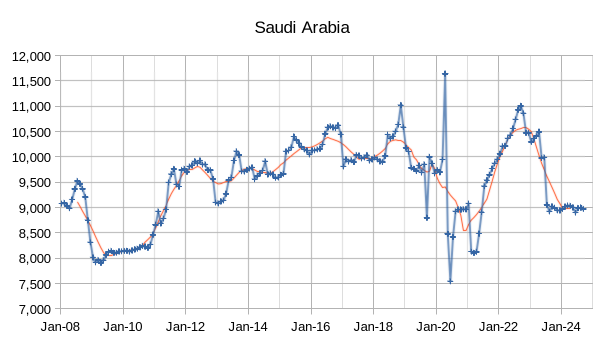

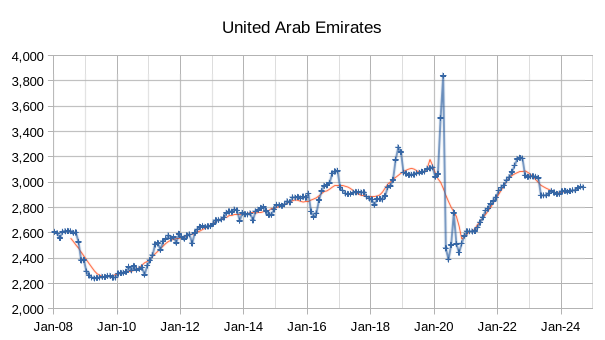

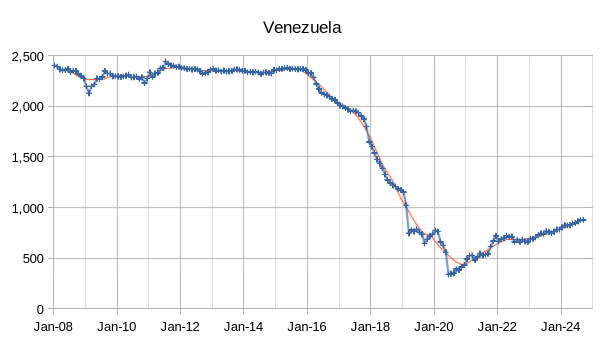

The OPEC Monthly Oil Market Report (MOMR) for October 2024 was published recently. The last month reported in most of the OPEC charts that follow is September 2024 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In the OPEC charts below the blue line with markers is monthly output and the thin red line is the centered twelve month average (CTMA) output.

Output for August 2024 was revised higher by 60 kb/d and July 2024 output was revised higher by 54 kb/d compared to last month’s report. OPEC 12 output decreased by 604 kb/d with most of the decrease from Libya’s political turmoil(410 kb/d.) Iraq decreased by 155 kb/d, all other OPEC members had small increases or decreases of 33 kb/d or smaller, with the net decrease being about 39 kb/d for the other 10 OPEC nations.

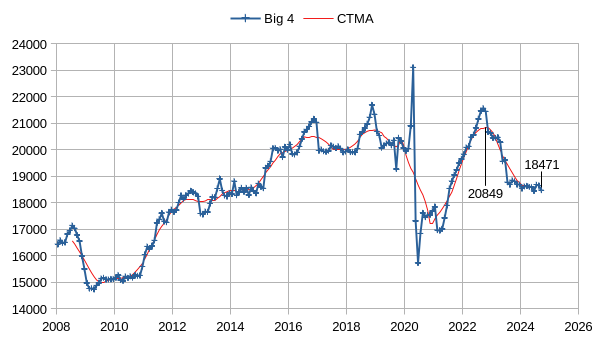

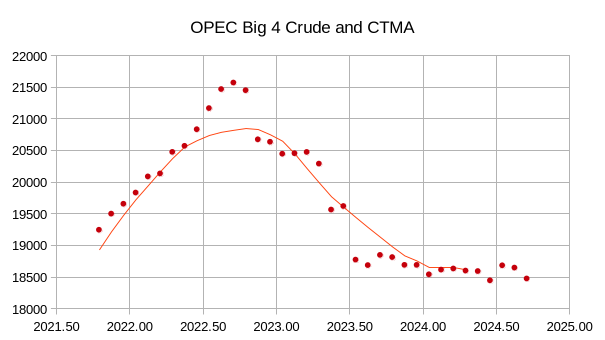

The chart above shows output from the Big 4 OPEC producers that are subject to output quotas (Saudi Arabia, UAE, Iraq, and Kuwait.) After the pandemic, Big 4 average output peaked in 2022 at a centered 12 month average (CTMA) of 20849 kb/d, crude output has been cut by 2378 kb/d relative to the 2022 CTMA peak to 18471 kb/d. The Big 4 may have roughly 2378 kb/d of spare capacity when World demand calls for an increase in output.

The chart above shows the same data as the previous chart over the past 36 months (October 2021 to September 2024).

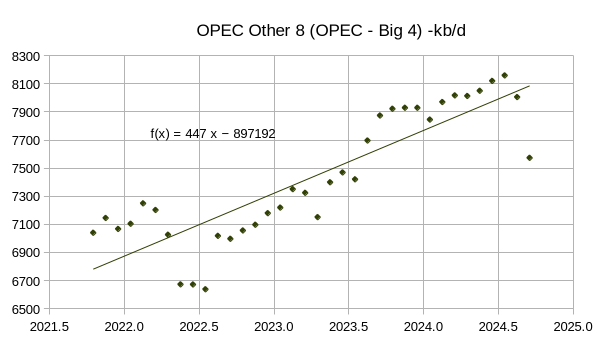

Crude output from the Other 8 OPEC producers (those not part of the Big 4) has risen at an average annual rate of 447 kb/d for the past 36 months. About 410 kb/d of this increase has come from Iran and Venezuela, so the 6 remaining OPEC members have seen an average annual increase of only about 37 kb/d over the past 3 years, essentially flat output. If we assume Iran and Venezuela are close to maximum output levels under the current international sanctions regime, then the Other 8 OPEC nations are likely to have relatively little increase in output in the future.

Over the next 5 years or so I expect World Supply of C+C will be adequate to meet demand, given continued increases from Argentina, Brazil, Canada, Guyana, and Norway along with spare capacity of over 2000 kb/d from the OPEC Big 4. In addition we will likely see reduced demand due to the transition to electric land transport. Oil prices will tell the tale of whether peak oil supply or peak oil demand hits first.

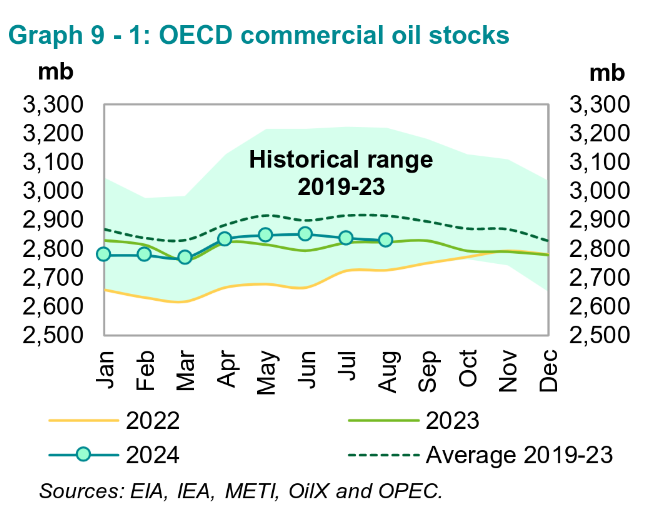

OECD commercial petroleum stocks are close to the 2023 level which is about 86 Mb/d below the 5 year average.

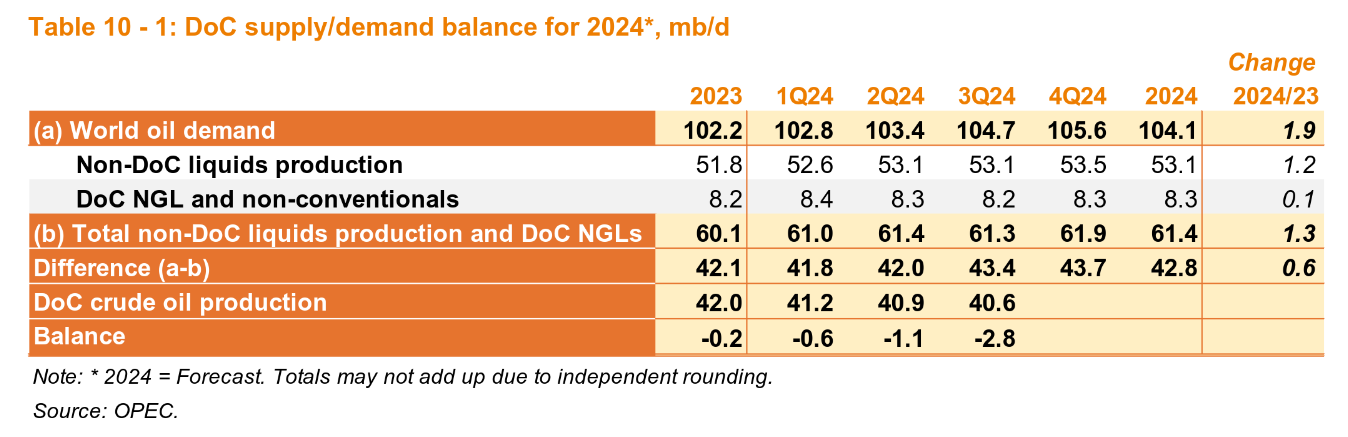

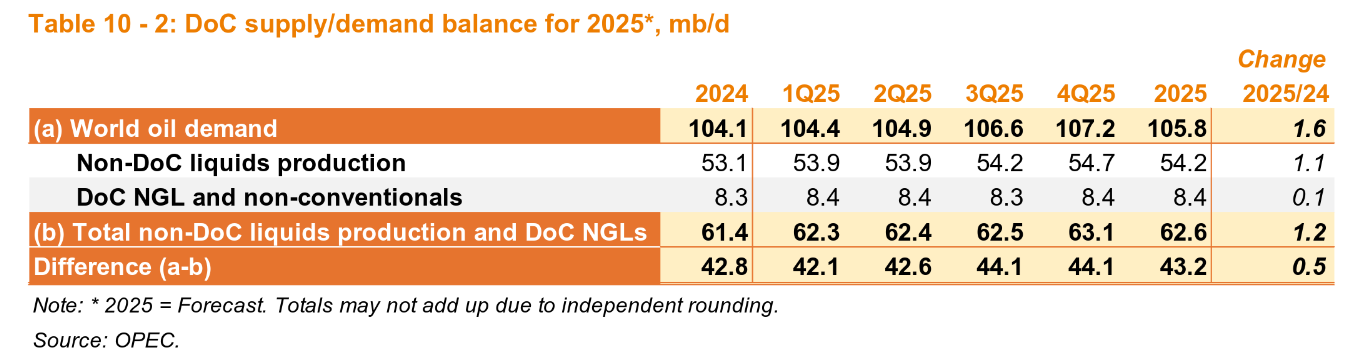

World demand estimates have again been revised lower than last month’s estimate with 2024 demand falling by 100 kb/d and 2025 demand falling by 200 kb/d, I expect in future months we will see further revisions to lower demand estimates as the OPEC demand estimates are significantly higher than EIA and IEA estimates. The EIA expects 2024 demand to be 103.06 Mb/d and 2025 demand to be 104.35 Mb/d. The IEA expects demand in 2024 to be slightly less than 103 Mb/d and in 2025 it expects about 103.9 Mb/d, almost 2 Mb/d less than the OPEC estimate for 2025.

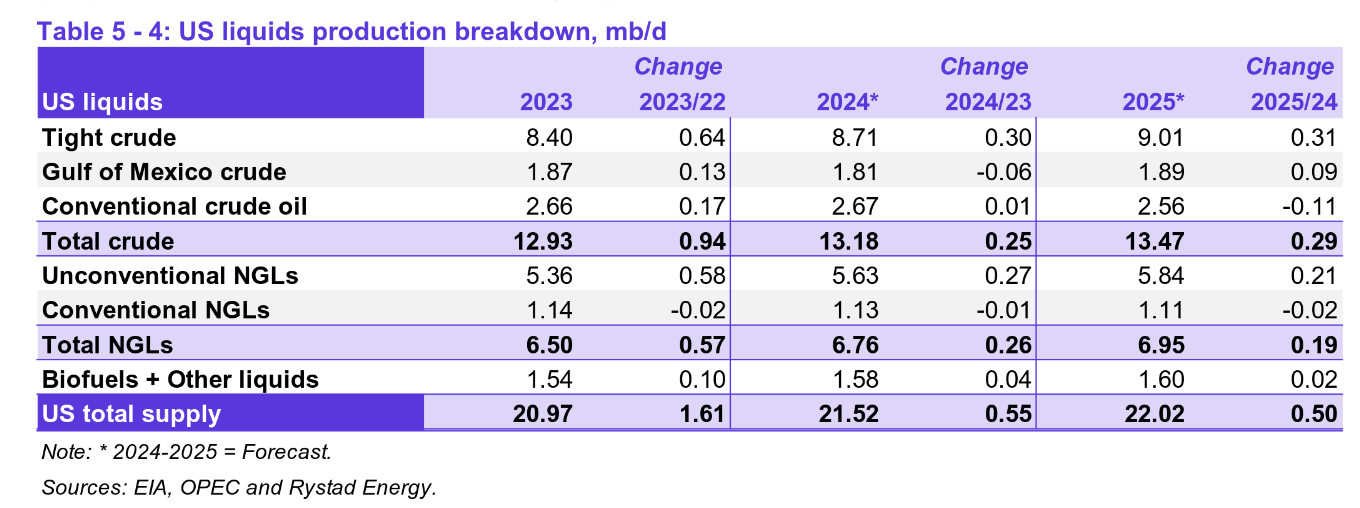

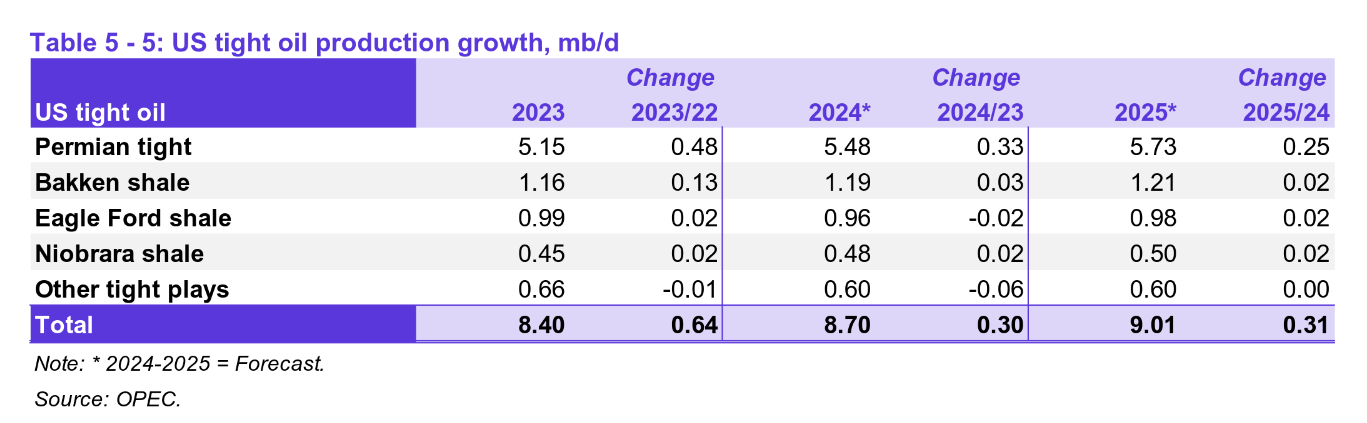

In 2024 OPEC expects about 45% of the US increase in liquids output will come from C+C and in 2025 about 58% of the increase in US liquids output will come from C+C, with the balance from NGL, biofuel, and other liquids increases. Tight oil provides 120% of the C+C increase in 2024 and 107% of the C+C increase in 2025.

The Permian basin provides 110% of the tight oil increase in 2024 and 81% of the tight oil increase in 2025 and is responsible for most of the projected increase in US C+C output over the 2023 to 2025 period.

151 responses to “OPEC Update, October 2024”

If oil supplies are forever adequate, what was the point of the whole peak oil discussion from the 2000s until the present day?

Did we just waist a significant proportion of our time studying and documenting a problem that isn’t really a problem?

I mean, understand peak oil, and have for a long time, but this is just waiting for godot now.

SGP99,

In 1998 nobody thought EVs were viable, that was an incorrect assumption, also almost everyone thought that higher oil prices would be a disaster for the World economy, the experience of 2010 to 2014 (average Brent Oil Prices about $115/bo in 2024 US$ with 3% average World real GDP annual growth) showed that was also a bad assumption.

High oil prices led to greater fuel efficiency anf the development of BEVs. Also high prices allowed resources that were thought to be too expensive (such as tight oil and extra heavy oil) to be developed profitably. Though many question if tight oil as in industry will ever earn decent profits over the entire lifecycle, it probably works at $120 per barrel, but not so much at $70/bo.

SGP99 said “what was the point of the whole peak oil discussion from the 2000s until the present day?”

There was the motto that came out of the DailyKos blog in early 2000s called “document the atrocities”. The observation was that there always seemed to be a memory hole when it came to an event that came and passed, so that later others could do historical revisionism of the data and to clean it up to make whoever is in power look good. So this blog is doing quite a service in documenting in detail how the data changes over time. I’m sure that in the future, AI tools will screen scrape this site and incorporate it into its knowledgebase.

And the memory hole definition itself I think came from Orwells 1984 novel, where history is changed by keystrokes and the “old” truths are put in the garbage shute.

For my own reference, I have saved quite a few old PoB posts, and there are also some TOD posts I have saved. Hopefully a bit over the top but you never know…

“High oil prices led to greater fuel efficiency anf the development of BEVs”

Price incentives certainly were important. Also necessary was good public policy. The California CARB pushed hard for EVs, which induced GM to create the EV-1. The Clinton administration pushed for hybrids, which created the Prius. These were foundational.

Nick,

Good policy can help. Not sure if we will be getting much of that, it depends in part on election results. Much of the US population is unaware of the coming environmental crisis, we seem to be the frogs in a gradually warming pot.

When we are aware the temperature is too hot it will be too late for action.

I agree.

Good leadership matters. Few people have the time to become policy experts. They depend on media, their friends and those individuals they trust.

The oil industry and related industries have fought change, in part by dominating the Republican Party and its media arm Fox. A prominent part of the oil industry is the Koch family, which has been a large, long term negative influence.

Other billionaires have been involved, including Thiel, Musk and others. Oddly, billionaires are often really misled by an echo chamber of misinformation (most of which comes from their sphere of influence, of course).

A good book: Oligarchy by Jeffrey Winters

Push back against electric truck mandates in California

https://x.com/BlindFaithBook/status/1851282444940689881

All I can say is : what do you expect?

Not clear what you mean: who’s the “you” in your question?

You’re nitpicking Nick. Let me reword his statement for him and he can correct me if I am wrong.

“All I can say is: What should we expect?

Well, I’m still not clear what’s meant.

This is an editorial in the WSJ. The OpEd page in the Journal has always been crazy right wing, and under Murdoch’s ownership this has only gotten more unhinged.

So, yes, that’s what I’d expect from the WSJ. Is that what Paul meant?

Nick,

What I meant by that is that it would be expected that they would attack the most challenging aspect of adoption. Not e-Scooters, not e-Carts, not e-Bikes, not e-Vs, not e-Trains, not e-DeliveryVans. but they draw the line at e-TankerTrucks and that’s enough to paint the entire plan in doubt. So California laid down a challenge, and big deal that they may have to rethink logistics — at least they aren’t mandating e-JumboJets.

Thanks, Paul. Your thoughts make sense.

Modern battery development got its start in mobile electronic devices, far from the energy sector. As the technology improved, batteries spread to more and more mobile devices, including two-wheelers and now cars, which I guess are mobility devices.

This is in line with a point I have made several times here, that oil is not a good source of energy and can’t compete with coal or gas. Oil is much too expensive. But it is a great way to store energy in a moving vehicle. So it is no surprise that its competition should come from the world of mobile devices.

Oh dear. Those high oil prices were only possible because of massive money printing which continues to the very day. It creates a gigantic asset bubble.

I am interested in another problem: what will the economic effects of peak oil be? If you go to this page: https://ourworldindata.org/grapher/primary-energy-cons?tab=chart&country=~OWID_EUR you will note that Europe’s primary energy consumption peaked in the 1990s. My conclusion is that Europe’s economy over the last 30 years exemplifies how the world economy will react once peak oil is past, which in my view will signal peak world primary energy consumption. I think one salient characteristic of the European economy over the last 30 years is its de-industrialisation.

Schinzy,

I think it makes more sense to look at the World and not at individual regions as goods are exported and imported. If we look at the natural log of World fossil fuel consumption from 1965 to 2023 in order to see how rates of growth have changed over time, we find about 0.9% average annual growth from 2010 to 2023. For 1983 to 2009 the average annual rate of growth was 1.9% and from 1965 to 1979 the average rate of growth was 4.1%.

The World economy is becoming more efficient in the use of fossil fuel energy and also some fossil fuel energy is being replaced with solar, wind, hydro, and nuclear power.

Growth in World real GDP per capita has been pretty steady from 1975 to 2023.

You prove that growth has become sluggish with the decline in energy growth. With the peak, it will be a net recession afterwards. Productivity gains do not allow the trend to be reversed. Added to the unmanaged growth of debt (public and private), a monumental financial and social crash is ahead. The question is how long people will believe in the “miracles” of the economy and its promises of a bright future thanks to technology and credit. Maintaining this system will always be more painful for the population. It is time to return to basic needs – food, shelter, heating, relationships of trust, solidarity. After all, human beings have lived for hundreds of thousands of years differently than in the last 200 years. The last 200 years have been the anomaly created by the maximum exploitation of all our fossil energy sources. This is not sustainable and everything that depends on it will collapse. The first thing that depends on it is the economy of debt and the trust in perpetual economic growth.

Abandoning this religion does not mean going back to caves, but returning to simplicity.

Sceptic,

Natural log of Real GDP per capita for the world in 2015$ at market exchange rates to measure rate of growth. The average annual rate of increase of real GDP per capita from 1970 to 2023 has been 1.56%. So it is only the rate of growth in the use of fossil fuel that has slowed as we use fossil fuel more efficiently and raplace fossil fuel with other sources of energy.

Dennis,

You have to add the debt growth in your graphs.

Sceptic,

As long as the debt can be serviced it is not a problem. Debt to GDP is what matters, for the OECD there hasn’t been that big a change and basically there has been greater access to debt for all nations, but particularly non-OECD nations.

Data from

https://data.bis.org/topics/TOTAL_CREDIT/data?data_view=table&rows=BORROWERS_CTY&cols=TIME_PERIOD&filter=TC_BORROWERS=C^UNIT_TYPE=770^TIMESPAN=1960-01-01_2024-03-27

The data is % credit to GDP for the non-financial sector at market value for emerging economies, advanced economies, and all economies that report data to the Bank for International Settlements (sometimes called the Banker’s Bank).

Based on this data debt is not much of a problem at the World level. Note that Japan’s debt to GDP has been over 300% since 1998 and is currently close to 400%, I think 400% is likely too high, but up to 300% for the World is probably a level that can be serviced. For advanced economies for the most recent 4 quarter average it is 261%, less than the level of the 4 quarters of 2010 (263%). For all economies the number has risen as emerging economies have gotten better access to credit markets.

As the debt is growing much faster than GDP, it is obvious that it will not be sustainable in the long term, and very quickly in the event of a recession.

To pay the interest on a debt that is growing so quickly, strong growth and good perspective is needed. Without abundant and cheap oil, growth will be very weak, without perspective for investors.

And you don’t mention the state debt, which has also increased very significantly over the last 20 years.

With such levels, states will be unable to invest, except in a big war.

The price of gold is a good marker of the ongoing debt crisis.

https://goldprice.org/gold-price-history.html

Current price can be explained by the lack of perspective in the global economy.

Sceptic,

That debt shown in the chart is total public and private debt for non-financial corporations, governments, households and non-profits (it is total credit to the entire non-financial sector of the economy and includes government debt). Debt is growing slightly faster than GDP overall, from 2010 to 2023. Debt to GDP has been relatively flat for advanced nations, there was a tick up during the pandemic, but debt to GDP for advanced nations was lower in the most recent 4 quarters than the 2010 average (which means debt grew by less than GDP).

Think of it this way, banks will approve mortgages at debt to income levels of about 330%, for an individual with a decent credit score, no reason why debt levels at 250% (for all reporting economies) relative to GDP (or national income) would be a problem.

Debt at current levels is a non-issue.

On recessions and their effect see 2020 and 2021 where debt to GDP rises and note how it then falls as we come out of the recession. As to energy shortages, note the low price of oil which suggests the World is currently well supplied with oil. Demand for oil is growing slowly and as land transport is electrified it will grow even more slowly and by 2028 demand will start to decline. Peak oil is likely to be due to lack of demand rather than lack of supply, same will be true for coal and natural gas by 2040 as solar, wind and batteries continue to grow.

The price of gold tells us about the supply and demand for gold, it tells us nothing more than the price of wheat or apples.

What debt crisis? Current yield on 10 year US treasury bond is 4.29% and was at 3.63% in mid September ( a real rate of 1.63% if inflation were at the Fed target of 2%). These are not high interest rates (I focus on the US as this is where I live.)

Public debt is the most significant debt, because it is the debt that keeps the system alive during a serious crisis. And it is growing very fast, much faster than the GNP – which means big crisis or war.

Private banks can decide whether or not to lend to a private or to increase the price of money, which makes the loan less attractive. If private debt is falling proportionately in our context, it is because the economic outlook is too bad to take risks. Banks have already anticipated the recession. They limit private loans. They don’t trust.

Public debt is here to avoid the worst, but very soon the States will not be able to support the servicing of the debt in bad economic situation, without real growth.

https://www.investing.com/rates-bonds/u.s.-1-month-bond-yield

The historical curve shows a very bad situation, as in 2007-2008. But the level of public debt is now much more serious than it was in 2008!

For the low oil price in our peak context, it is also a clear sign of global recession.

The economy is shrinking. This is not the electric car.

SCEPTIC —

It’s important to keep in mind that about three quarters of private debt is real estate debt. The debt increases along with transactions in increasingly expensive real estate.

Rising real estate prices and the associated increase in private debt are in no way associated with burning fossil fuel. It’s mostly just a bubble.

In other words, Debt is increasing thanks to a variety of non-energy cause. These include nimbyism, as seen in the mess California in particular but American cities in general have gotten themselves into. Another cause is the East Asian disease where governments have allowed real estate speculators to dominate the financial sector, which led to the de-industrialization of Hong Kong, the long slump in Japan, and the present crisis in China.

Both the American urban crisis and the current Chinese slump are the result of households putting all their money into the real estate bubble instead of investment to improve productivity (or return value in some other way). None of this can be related to burning fossil fuel in any meaningful way.

The whole fossil fuel = debt idea is a canard. There is no connection between energy and debt.

Alimbiquated ….. ” The debt increases along with transactions in increasingly expensive real estate.”

So why is real estate getting more expensive?? Why isn’t more than enough being built cheaply?

The answer is that the costs of energy and materials to build houses and everything else are getting much more expensive because they are scarce and it’s taking more energy and materials to gain access to everything needed to build.

We didn’t have a massive bubble in real estate in the ’60’s because there was plenty of cheap energy and cheap materials to build it all. We then over the next decades outsourced all the heavy industry to cheaper labour and energy countries while making ‘building’ a major local industry, which required population growth to enable it, and still does.

Without the rising real estate market the debt markets couldn’t grow like they have to bring forward production of energy and materials through huge debt in those areas as well. How much did the shale patch borrow to fund all the fracked wells? By dragging forward in time the use of lower grades energy and material resources with debt for everything exploding, it’s allowed GDP numbers to be fudged in such a way as showing growth, with higher prices of many things.

It’s all connected, real estate is not separate from energy, or mines, it’s all part of the system of civilization that has to keep growing by any means, including creating new debt out of thin air to bring forward investment in accessing all energy and materials for all the different parts of the system.

HIDEAWAY —

So why is real estate getting more expensive?? Why isn’t more than enough being built cheaply?

Real estate is land. Building land is possible (ask the Dutch). Be that as it may, land prices are going up for the reasons I described — it’s basically a bubble.

For example in American cities most land is exclusively reserved for single family homes, often on quarter acre lots. Homeowners oppose any changes to this because they fear that increasing the number of housing units in the city could reduce demand for their own homes, cutting into their savings. This is ultimately down to the fact that real estate is seen as a financial investment.

As a result, land use is hopelessly inefficient. This in turn is the cause of decaying infrastructure, because sprawling cities have higher costs per person, as well as time and energy wasted in traffic, as people are forced to travel long distances to do anything.

The cost of building is not the problem at all.

“The whole fossil fuel = debt idea is a canard. There is no connection between energy and debt.”

Most people through the use of energy earn money to repay debts. Most people have no income whatsoever without the use of energy.

Without energy banks aren’t going to make loans to most people.

Money supply is based on counterpart risks. Banks don’t create new money via loans if the risk goes up. Bank reserves on FEDs balance sheet don’t translate into commercial banks making loans.

Most people and businesses use energy to produce taxable income. Without the use of energy taxable income would fall off a cliff.

Without a growing energy supply the risk of making loans into the economy goes up.

There is absolutely a close connection between energy and debt. If energy supply shrinks so will the supply of debt.

The cause of decay is entropy, everything suffers from it, there is no stopping it. You could have over 9.8 billion quarter acre blocks in the USA alone, there is no shortage of land…

It seems you want regulation to stop sprawl, but even cities with high density rates have suffered from real estate bubbles. It’s because the debt machine must go on to produce growth in the entire system, that seems difficult for you to understand.

Cities offer economies of scale compared to the same population outside cities, with savings of both materials and energy, plus the growth of complexity that comes from growing cities. We might ‘save a bit more by going denser, but cities develop their own denser inner areas given market forces.

If energy and materials were as abundant and cheap as the green/renewable narrative states, then none of the entropy would be a problem, but it clearly is. The problem is not people spread out too far, it’s overpopulation and gaining access to declining resources of all types that manifests itself as growing debt in your eyes.

The smaller cities of the ’60’s still had suburban sprawl, but because energy, particularly oil was cheap and we were mining much higher grades of all resources, none of it was a problem as it was always cheap to keep the maintenance up on everything as there was always more with the rapid growth.

Cities will continue to decay, debt will continue to grow until it can’t when we turn from energy and material growth to decline. If you think the decay is bad now, just wait until we are in rapidly declining oil availability to see fast decay. It’s what we get for ignoring all the warnings over many decades and decide human hubris about technology saving us from clear overshoot..

First qtr 2008 GDP was 3.8%. Second qtr 2008 GDP was 3.9%. So GDP was actually accelerating right before SHTF.

GDP doesn’t tell you anything about the health of the economy.

ALIMBIQUATED

What cities are you even talking about? The good ‘ol American quarter acre? That ship has sailed out of view and fallen off the map. All the major US cities I know are in infill mode and you’re lucky to get a small slice of a quarter acre. Any older thing on a quarter acre is likely to get bowled and replaced by 2-4 units, more if they go tall or can acquire neighboring properties.

So, in a sense, I agree that land is a contributor to housing cost. But it is clearly also the build. Have you priced a new build with a contractor lately?

Further, you say debt is increasing because of increasing cost of real estate. And yet, why wouldn’t debt be increasing because of increasing cost of energy. When I was a teen you rocked up to the filling station with literally a dollar in your pocket and squeeze 4 gallons into the old Corolla. You could run for a while on that. I know round me it’s not uncommon for people to be burning four hundred a month. Why would more expensive RE affect private debt, but more expensive energy, not?

HIDEAWAY —

It seems you want regulation to stop sprawl, but even cities with high density rates have suffered from real estate bubbles.

NO, I want to end the legislation that causes sprawl. e.g. parking minimum, restrictive use based zoning that bans corner stores etc.

Also sprawl is not related to real estate bubbles.

That said, I think there should be limits on greenfield building, but for environmental reasons, not economic. One big driver of forest fires in the Western US is running power lines above ground through the woods.

Power lines should be underground. If it’s too expensive raise the price of electricity to reflect the real cost of the grid. In the 19th century coal powered trains spewed sparks that set fire to crops. Farmers objected, rail companies ludicrously maintained it wasn’t their problem. Electricity utilities are acting the same way to this day.

one salient characteristic of the European economy over the last 30 years is its de-industrialisation

Not even remotely true.

Besides Airbus, I would say de-industrialisation is definately happening in Europe. VW is just the canary, many more will follow. Cheap energy is generally a good thing for industry, but that´s gone.

But in Airbus case that´s mainly because the main competitor managed to screw their own things up massively. Also I don´t think Detroit is doing that great currently either…

Lap

The destruction of heavy industries has been going on for more than 30 years.

https://www.tandfonline.com/doi/full/10.1080/03071847.2023.2250389#d1e116

Many of the areas where shipbuilding was the main industry are now terribly run down, empty factories and other buildings with broken windows and crumbling facades. So sad to see.

Then Thatcher and her type believed that industry should be able to compete with any country. Regardless of how disgusting the standards were in factories in countries like China or India.

It is impossible to compete against £5 per day factory workers

https://www.reuters.com/business/energy/losing-hope-rescue-some-european-solar-firms-head-us-2024-04-15/#:~:text=The%20plant%20in%20Freiberg%20in,they%20are%20in%20financial%20difficulties.

In that instance, it’s a mix of energy/resources/labour increasing in cost AND the Tendency of the Rate of Profit to Fall, hence the neoliberal reforms of Thatcher and Reagan leading inevitably to offshoring.

If we tried to reverse the move to service economies in the West, we’d have a bloody hard time. Germany was one of the last bastions of such a model with good worker compensation. Anyone check in on them since someone blew up Nord Stream?

The tapping into the global markets and bringing in of a couple billion Chinese and Indian workers has meant we have no other avenues down which capital can reduce costs (hence the AI craze too, given all other tech hat pulls lately have been total flops). There isn’t another planet with exploitable workforces to offshore to, nor new cheap and abundant and easy to access resources either.

We played ourselves burning the planet to create a world nobody likes. Excellent move.

You are correct.

Let me say it this way: industrial production before the oil crisis in the 1970s characterized wealthy countries with high living standards. Since then, industrial production has been stagnant or growing very slowly in wealthy countries, but increasing in countries with low wages and/or increasing energy consumption. Thus the proportion of European industrial production in the world industrial production has been decreasing. The effect of the Russian sanctions has been a collapse of European industrial production: 15% was shut in in 2022. I do not believe this production will ever return to Europe unless energy consumption increases. As a proxy of industrial production, here is a look at car production in various countries from 1950 to 2022: https://transportgeography.org/contents/chapter1/the-setting-of-global-transportation-systems/automobile-production-world/

industrial production has been stagnant or growing very slowly in wealthy countries

That’s mostly because consumption of industrial goods has been stagnant. People only need so many houses, cars, washing machines, etc.

That’s why the old idea that “economic growth can’t go on forever” is irrelevant: there’s no need for infinite growth in hard goods. In the US and Europe we need better cars but not more cars. We need better health care, but not more hospitals.

Don’t think the economic system and those that run it will be too happy with that state.

Nick

The consumption of goods has not been stagnant

In 1994 Chinese exports amounted to $100 billion, last year it had grown to $3,550 billion. Bought by Europe, The U.S. etc. All those goods instead of being made by those countries employing their own people were shipped in. Millions of workers who had good incomes are now on minimum wage and reliant on state top up.

There are many peaks. Each peak has consequences. Look at the oil peaks in Libya, Sudan, Yemen and Syria. They are all failed states with geopolitical ramifications in the Middle East and the global trade. I have posts on my website crudeoilpeak.info on these countries

I believe that almost everyone severely underestimates the risk of disruption to international trade in basic goods like oil, copper, phosphorus, food.

What percent of the world economy function is dependent on importation of raw materials, processed and manufactured goods?

For example, we could wake up one day and find that

-Iran pushed Israel too far, and that the Kharg export terminal was destroyed in response.

-Or that China made its big move on Taiwan.

-Or that trump went ahead and ignited a brush fire trade war that quickly grew into a full forest inferno.

The covid pandemic was just a small taste of what the risk to international trade is.

Unpredictable. Uninsurable.

I’d say the governments of the US, China, EU, Japan, Korea, Iran, KSA all are acutely aware of the risks of major disruptions in shipping and trade. That’s why conflicts are so often theatre for domestic consumption.

Russia seems to be an exception. They seem to be living in a pre-industrial world where theft through empire was the key to prosperity. Very sad, for them and everyone.

OPEC+ down 560 Kbpd.

Click on graph to enlarge.

Russia Crude Only down 28 Kbd to 9,001,000 barrels per day.

Click on graph to enlarge.

https://www.youtube.com/watch?v=c6xGgzs2szQ

I’m going to post this one again.

@3:50

Russia’s oil industry is toast. And they know it.

Their Petroleum Engineering schools ended in the 1980s

The Americans, Britts, French have left.

These are VERY VERY difficult mature well to produce that FREEZE over if not taken care of and are in MELTING PERMAFROST.

global warming caused the Siberia permafrost to melt

—Peter’s knowledge about crude oil is just as good as the global warming general public

Oh I forgot…

The Ukraine is actively trying to destroy their infrastructure!!

“global warming caused the Siberia permafrost to melt”

No shit!

Is this including the “dark” hydrocarbons going through Kazakstan, India, possibly China etc.?

(even Europe is getting some NG at the moment, even without NS2)

There are rumours that those “unaccounted” flows are quite significant so might paint a slightly different picture.

I don´t really know, but the attendance list at BRICS 2024 was longer than I expected so might still be some fuel left there.

Anyway, as always a good job by Dennis and the PoB crew!

This does not represent sales or shipments. It is an estimate of production made by several companies, what OPEC calls “secondary sources. The estimate includes oil used for domestic consumption. I would guess it is pretty close.

I have just done this post:

Russian oil quota history December 2018 – June 2024

31 Oct 2024

https://crudeoilpeak.info/russian-oil-quota-history-december-2018-june-2024

Great Work Dennis!

Andre

Thanks Andre.

Crude oil slammed in biggest one-day percentage drop since July 2022

Benchmark crude oil futures fell Monday in their largest one-day decline in more than two years after Israel’s weekend strikes on Iran avoided energy facilities and ease worries of a wider war that could disrupt global supplies.

Oil futures’ sharp slide weighed on the stock prices of oil-related companies, making energy (NYSEARCA:XLE) the S&P 500’s worst performing sector in an otherwise upbeat session for stocks.

APA Corp. (APA) was the day’s biggest loser on the S&P, -4.5%, and Diamondback Energy (FANG) closed -3.6%; several big names, including Exxon Mobil (XOM), Chevron (CVX) and Marathon Petroleum (MPC) fell to multi-week lows before paring losses.

Separately, the Department of Energy said it is seeking to buy up to 3M barrels of oil for the U.S. Strategic Petroleum Reserve as prices fall further from its $79/bbl target acquisition price.

Front-month Nymex crude (CL1:COM) for December delivery closed -6.1% to $67.38/bbl, and front-month December Brent crude (CO1:COM) also finished -6.1% to $71.42/bbl, the largest one-day percentage decline for both benchmarks since July 12, 2022.

Dennis.

I sure hope you don’t buy anymore Tesla’s, or support Elon Musk in any other way. He ran an ad calling VP Harris the “C word.” He is unhinged.

Aren’t there other EV’s that don’t support such a crazy, dangerous person?

It’s a tough question. Tesla has done a great deal of good. Musk has done a fair amount of harm. Do we hurt one to punish the other?

The Washington Post has done a great deal of good. Bezos has done some harm by refusing to allow the Post to endorse. Do we cancel our subscription to punish him? I’m thinking not.

What do you think?

I have admit, on an emotional level…I’m not as enthusiastic about buying a tesla as I used to be…

Shallow sand,

I probably won’t buy another Tesla, Musk does seem pretty deranged of late.

I many countries there will not be enough sustainable power supply for tens of millions of EVs

Certainly true Matt, sustainable or unsustainable power sources .

Add to that the escalation in electricity demand of other types like data centers (cloud/crypto/AI/surveillance/military,medical and finance operations] and AC….it adds up to big demand.

The tailwind behind the electric generation industries in all of its forms is just massive.

Consider how much more air conditioners people are deploying in an attempt to survive fossil fuel warming.

If only there was a way to capture the radiants from the sun and use it someway useful…

Preferably in this case would be if it would be efficient at the beneficial, needed times.

One could hope at least, it would surely reduce the need for fossil fuel electricity generation.

EVs do not require continual power for charging.

On an individual basis that is of course true.

Yet on a widespread basis EV charging is a 24/7/365 variable load.

Systems need to be employed proactively to handle all of this pending growth in electricity demand.

Hickory,

In general there are periods of high and low use for electricity. Most vehicles can be charged during those low use periods, if most individuals make this choice (and TOU rates incentivize this behavior) then it will be true in general.

Yes – there is major synergy between EVs and renewable electricity.

Charging can respond to pricing or utility signals. Heck, iPhones can charge that way.

And as battery life becomes longer it will be feasible to use EVs to back up the grid.

Chinese ones? Oh, yeah. The tariffs.

I’d just… move beyond cars entirely as they’re a massive waste of valuable resources and a blight on the environment.

But I hear you get death threats in the US for saying such.

https://www.oilystuff.com/forumstuff/forum-stuff/oily-stuff-political-endorsements-for-2024

God help us all. The fear, and hatred the left has over one human being is…pathetic. I have never seen anything remotely like it in 18 election cycles.

It suggests to me that nobody in American anymore is strong enough, or capable enough to withstand a stupid presidential election. They all want government to help them, to make their lives better, easier, and more like their neighbors. Half the election cycles I went thru in my life did not end up like I wanted; I got smarter, worked harder, and survived.

This is not the most important election of your lives, its just another presidential election. If you want a better life, get your lazy, urban, internet driven lives to work, quit blaming everybody else for your failures and above and beyond all else, get hating. Stop spreading fear. It is destroying the country.

Piss off Dennis Coyne. I hope to never read another world of your shit, ever. You did not know anything about oil and natural gas, ever. Why anybody reads your shit is beyond me.

Well, then you have to stop hating Democrats. Which by the way all manner of blowhards have been doing for a very long time.

Fair enough? It doesn’t just work one way. You don’t get to say “stop being deranged and hating Trump” while being deranged and hating Democrats, or excusing those that do.

Bad manners Mr Mike.

We have this shit here in Germany, too.

The left and green have gotten more and more woke and communistic in the last years, splitting the community more and more.

Media is on a crusade against right, without viewing the pink elephants in the room – so they produce even more right wing voters from fed up citizen’s.

Free handouts to everyone able to say “Asyl” and the slow decline of wealth adds to it.

So we get more right wing voters with every new bill from the government.

This will eclipse next year hear when the government election will be.

We have this shit here in Germany, too.

No Eulenspiegel, you HAD this shit in Germany. Germany 1933: From democracy to dictatorship And if Trump is elected his election will take the USA to the same sad end. He has already promised that if he is elected, we will not have to vote anymore. Of course, not. He will not allow us to vote.

Let us hope Trump is not elected again. If so, then what happened in Germany may happen in the USA. At least Trump will try desperately to make that happen.

You shock me Eulenspiegel. I would have thought a German would have recognized a Fascist.

Ron,

Unfortunately those on the right set up these false equivalencies. Harris lies too they say, she didn’t say Biden was too old to serve a second term, that’s just the same you see as Trump lying about winning the 2020 election and inciting an attack on the capital with those lies. They say this stuff with a straight face, they may even believe it. Trump lies so much they just discount the outrageous things he says, it seems only the center and left take what he says seriously or half the nation is deranged, it is a bit unclear to me.

“she didn’t say Biden was too old”

My wild ass guess is that when the Biden campaign set up an early debate. The campaign had a plan for Kamala to be Biden’s successor for this election. The timing and management of the Harris campaign has been excellent. The Republicans were caught off guard and didn’t have years to smear her.

One more wild ass guess, Kamala is going to ride a blue wave to the White House.

You can’t compare this crazy white house storming af this mob with the fachists.

At this time 33 they had already an armed private army of 500.000 thugs, while the Reichswehr was 100.000.

Imagine this alone. They also have killed hundreds already in the election time.

This shit was a magnitude bigger than things today.

Fortunately.

Also for example Putin is only a pocket version of Stalin or Adolf. Fortunately.

Eulenspiegel,

Not the White House, the Capitol where Congress was certifying the Election of President Biden on Jan 6, 2020.

The point is simply fascist tendencies by Trump, his talk of the enemy within and suggestion of using the military to round up civilians, sounds a bit ominous. People in the Republican party don’t take it seriously, but those who know the history of fascism (which is more familiar to German students of history) would see these warning signs more clearly.

Of course Trump says the riot at the capital was a lovefest and that the Police Officers that were being beaten just like that kind of thing, I guess. They were just touring the Capital according to Trump.

Some of us do not look forward to saluting a new Fuhrer. Things turned very quickly in 1933 in Germany, hopefully we don’t see the same in the US, there are many paramilitary white supremacists in the US such as the Proud Boys that are standing back and standing by in support of Trump, many of them were at the capital on Jan 6, 2020.

Trump of course blames it on the left “the enemy within”, much like Hitler who blamed Communists and Jews for all problems in Germany.

Eulenspiegel, all revolutions start small, though this tempted revolution by Trump was not all that small. If he is elected, he will continue his attempt to become a fascist dictator. He will arrest any and all TV personnel who criticize him. He will close down any TV or radio station that dares to critize any of his attempts to rule America with an iron fist. Dictators are his heroes.

What really baffles me is he has told all Americans what he intends to do. He is so transparent. Why, why, why do so many people admire this very obvious wannabe dictator? How can so many people be so goddamn dumb????

Ron,

My guess is that Trump lies so often that most don’t believe anything he says. People are not very smart or they aren’t paying attention. Lots of his supporters say they think a businessman in the White House means the economy will be better, lots of folks focus on the economy and know little about civics. Unfortunate, but perhaps that’s the explanation.

Also some are afraid of “the left”. I think both the far left and far right are to be feared, the center is fine with me.

There are 378 millions firearms in USA. That will not be the same than in Germany but a civile war.

Eulenspiegel —

The original Eulenspiegel was clever, you are not living up to his name. You certainly aren’t funny.

The CDU under Merkel opened the gates to asylum seekers without strengthening the system to deal with them, not the Socialists or the Greens.

“Woke” is a 1990s word for urban black Americans realizing they were being screwed by poorly governed American cities, and has nothing to do with Germany. Fox highjacked the word when they realized that even their dumbest viewers were getting tired of hearing them rant about the “libs”. It is irrelevant to German politics and invoking it just shows you are out of touch.

You say The media are against the right, but where did you get this “woke” bullshit from? Get a grip. You were spoon fed that lie by Rupert Murdoch and you swallowed it whole.

Where you see a human being, we have something else.

Ohh… and pick your choice, all comes from uncertainty, the best we can do is to model with the best available data. There is got be a direction for evolving, otherwise you can visit the Mayan and Roman ruins, decay is all but certain.

Dennis, thank you for your hard work!!!

The context for the criticism:

“did not know anything about oil and natural gas, ever”

Reading this paper yesterday https://archive.ph/QVddY#selection-943.0-979.311:

To me, this is interesting stuff. Laplace had likely never set foot on an ocean vessel.

Several years ago, I asked Dennis to be a co-author of our book Mathematical Geoenergy — a book filled with analysis that credentialed geologists, geophysicists, climate scientists, and meteorologists would frown upon, because we’re not in the Earth sciences clique. Just remember, that at one time everyone was a Laplace.

Paul Pukite,

Laplace was exceptional, I am no Laplace, you have had some amazing insights, I have simply built my models using those and the work of others (who have asked that I not use their name.)

Thanks Mr Shellman,

I have learned a lot from you, best of luck. Obviously I know much less about producing oil and gas than you.

I can accept that there are differences of opinion. You seem to be fearful of immigrants and the left. I am not fearful of Republicans, I just don’t think a former president that is a poor loser and decides to incite an attack on the Capital is a wise choice for President, but 47% of the nation disagrees with my point of view. Most democratic nations with advanced economies choose their executive by popular vote, the US antiquated system gives unequal representation not only in the Senate (which confirms Judicial appointments so this influences the Judicial branch), but for the President as well based on a compromise to help slaveowners in the Southern US. Most democracies that chose an electoral system initially later dropped it for a popular vote.

Some day the US might become as enlightened, I am not hopeful I will see it in my lifetime. The rule is rather simple, one person, one vote.

Dennis Coyne is doing a fantastic job. I was very fortunate to have him take over this site. And Ovi is fantastic also. And anyone who thinks these two guys are not doing a great job can just piss off.

I just got around to reading this stuff this morning and found the website post you linked to has been deleted. I wonder why.

There are two choices we will have this coming Tuesday. We can choose love or we can choose hate. When politicians turn to hate we need to throw their ass out. And do it at the ballot box, not the way Trump wants to do it, by throwing them in jail. But if any man tries to overthrow our government with violence, that is TREASON. Anyone who commits treason against our government does belong in jail.

No Ron, We are all very fortunate to have Dennis manage POB.

Thank you, Ovi, Dennis and Ron

Ron,

Thanks, Ovi does better work than me imho.

I agree about Trump, but Trump is very slippery, he didn’t commit any violence, he simply encouraged others to do so, but he will say he was kidding or being sarcastic or some such nonsense.

Hopefully Trump will be held to account, but I am not that optimistic.

Strange that Mike Shellman put a link to his post here and then decided to delete it. It was there yesterday and he was aggravated that I expressed a different opinion on his forum in response.

Dennis

You do all of the hard work of carrying this site with your great models and constantly answering our viewers comments. I really don’t know how you manage to do it all.

Thanks for all of your hard work.

Thanks Ovi,

I think your posts are better than mine, thank you, not sure this site would survive without your contribution.

Dennis does not deserve to be smacked around by Mike, no matter how insightful Mike’s comments are. Pitiful way to conduct oneself.

Mike B,

Mr Shellman’s comments are very insightful, it is ok, differences of opinion are expected.

His comments will be missed by me and I imagine many others. He has said he will no longer comment here and has asked that I not comment at his blog.

He is still welcome here.

I guess I started this with my Elon Musk comment.

I’ve never been a fan of Musk. The guy has benefitted financially more from US government handouts than any other human in history.

Now that he is on Trump’s side, all the people who generally bitch about government handouts think Elon is the greatest thing since sliced bread.

Same goes for stripper well operators support of Trump. Unregulated shale drilling seriously harmed our way of life. 2015-2020 were bad years. The beginning was Obama, who is no fan of the industry. I have pointed out his lies about percentage depletion here in the past.

But 2017-2020 was Trump. The one thing Trump did was with methane emissions. But instead of passing some common sense legislation to help us, he just stalled it, which allowed Biden to bring it right back.

Trump says drill baby drill. He wants $40 WTI. Not seeing how that helps stripper well operators. Now that Musk is giving Trump tons of $$, I suspect if Trump wins the oil industry will really get stabbed in the back.

I don’t see either Presidential candidate as an ally of stripper well operators.

Shallow sand,

What were the lies about percentage depletion by Obama?

What are the government handouts Tesla has received? In some cases there have been loans which have been repaid, also subsidies, available to any other EV maker, local tax incentives which are a normal thing granted to many large businesses. SpaceX has many government contacts which pays for their services, these are not handouts or subsidies.

Musk is an ass, but the subsidies claim is similar to tax breaks given to oil and gas companies, they are laws that are passed by Congress and signed into law by the President.

Dennis.

Obama classified percentage depletion as a Big Oil tax break.

I think we discussed this awhile back.

Not maybe a big lie given where we are at in 2024.

Shallow sand,

Do Big Oil Companies not get the percentage depletion allowance? I can’t remember the specifics.

Percentage depletion is limited to 1,000 BOPD (or 6,000 mcfpd) per taxpayer.

Got it, thank you.

So Big oil gets this tax break, but it is a very small part of their total output and is not important for them, it is really a tax break for small businesses. Thanks for the clarification.

In a nutshell, what was the nature of the disagreement between you two? This is a blog for those interested in peak oil, so what could possibly have precipitated such animosity?

Mike lashes out at anyone who suggests that we can and should move away from oil.

I get it – he’s protecting his career, and his community.

But when ExxonMobil agrees as corporate policy that Net-zero is practical and necessary, isn’t it time to acknowledge that change is coming?

Mike B,

Mr Shellman supports Trump, I expressed my surprise given Trump’s history, he does not like it when people disagree with him especially at his blog. I thought I was polite, just pointing out that Trump incited an attack on the Capital and has made many comments suggesting fascist tendencies or something along those lines. The post was deleted by Mr Shellman so I don’t have an exact quote of what I said, I think an opposing opinion infuriates Mike.

When I read Mike’s comment he says stop spreading fear, that is what Trump has been doing. I am pointing out the fact that Trump is saying many things consistent with the fascist playbook. I don’t think Fascism is consistent with US values, unfortunately 47% of US voters don’t seem to see it the way I do. It is depressing.

Ah, it was about politics. I thought the dispute was rooted in oil because of this line:

You did not know anything about oil and natural gas, ever.

Too bad he’s gone. He has made some amazing observations.

Mike lashes out at anyone who suggests that we can and should move away from oil

And against anyone suggesting we already are moving away from oil, though it is obviously the case, for better or for worse.

I guess everyone is entitled to their own theories about where the world is headed, but denying what is going on now or inventing your own facts is contemptible.

My animosity toward’s Dennis Coyne is deep, indeed. It stems from ten years of listening to him argue, criticize and essentially dismiss real life experience, be it mine, or LTO Survivor’s, or Rune Likverns, or Tool Push; he always felt he knew better than anyone else because of, numbers. He single handledly ran off every one on this blog that knew anything about oil and natural gas because he is a control freak. He is accusing me of the same thing he is MOST guilty of.

I don’t know that he has ever had a job in his life, he has admitted that he has never run a business, or made a payroll; he thinks he is smarter than my entire industry, 140 years old, because of a couple of piss-ant degrees. His narcassism exceeds that of Donald Trumps four fold.

I don’t rail on people that disagree with me about oil and natural gas; that is stupid. I argue with engineers and geologists all the time about oil exports and the need for conservation. Anybody that has read my stuff for the past 10 years knows that.

I believe in a reasonable, rational, affordable transition to reneweable transportation fuels; always have. I disagree, vehemently, that we should end fossil fuel use ASAP. You guys have miss-timed all this grossly. You will never take responsibility for the stupid things you’ve said about fossil fuels because you post anonymously and you don’t have the guts.

A week ago I made a post on my personal blog as to whom I voted for, and why. I did not suggest that anyone vote the same way I did, I simply wanted MY readers to know that in spite of the criticisim of Trump about drill baby drill, I voted for him anyway. And why. My post was an “endorsement” of hard work and hope, that the American dream was still alive and well. I put up a photo on my post of a large family in S. Texas, a young family with many mouths to feed, working hard. Living the Amercian dream.

Dennis Coyne, full of hate and anger about politics, seized my post as an oportunity to vent political dung heap. In other words, he came over into my front yard, and took a big shit on my driveway, because he thought he could persuade me, in Texas!, and my readers, he knew better than all of us. That he was intellectually and morally superior. He says he was “polite” because he does not know the meaning of the word. He has, actually, the manners of a goat. Its a Yankee, New York, N.E., West Coast thing. Not a middle America thing.

Fuck him. Most of you liberal weenie necks would have done the same thing if you were me, and the pages were turned, its just that you don’t have the courage. You all hide behind fake names and hurl insults. You are cowards. Say what you must about me, insult everything you can about me to make yourself “feel” better. That is what you do. That is all you can do, actually. You have no real life experience, you can only rely on the…internet. I am sorry.

Happy fall, y’all. Happy Thanksgiving.

God BLESS America.

Mr Shellman,

Can you find an example of where I have insulted you? I don’t think I have.

I have learned a lot from you and I thank you. Best of luck to you and your family in the future.

Note that I do not consider asking a question as an insult, I have asked lots of questions over the years, that is how I learn. I apologize if my questions have offended you.

Ms Shellman is asking that we conflate their make believe ‘god’ with the felonious rapist fascist Trump. Reasonable rational oppression and subjection of women, mass deportation of legal residents, domestic military suppression of dissent, ‘legal’ prosecution of political opponents, Mike is all in and all for it.

Mike is very reactive, anger as a substitution for more nuanced feelings, projecting his frustrations and inadequacies onto others, as his ilk do.

I’m happy I beat Ron to post about how silly and defeating it all is, folks arguing for their own demise and crowing their support for the basest dumbest most corrupt con men who would fleece them of every penny without a moment of hesitation.

“A Special Monologue for the Republican in Your Life”

This is all for you Mike with love, HB

https://www.youtube.com/watch?v=Oy0zq8YzY9w

“@Gonzo-Sammy

4 days ago

I am one of the millions of Proud Republicans who early voted Kamala !! 💙❤️

@jhunz23

4 days ago

Both my parents are lifelong Republicans in FL, and neither are voting for Trump this election. I am also a registered Republican in NC, and I will be voting all blue this time. It is my belief that the Republican party needs to be handed a loss so severe that they never flirt with wannabe dictators like Trump ever again. It’s time to cut out the rot!”

It’s going to be a Blue Wave- HB

I share your sentiment…., but

Mike Shellman answered my questions regarding how shale oil was stored and settled for in Texas back in 2017-2018. He has integrity and that is why I value the open door policy from D. Coyne. Mike Shellman is a welcome in my book.

When it comes R. Likvern, he is propably a very smart person. He could see that in Norway, we had a couple of aging gigant fields with the new ones not quite making up for it in the overall picture. It turns out it was not so much a problem after all and the big hint is that technology played a big role. And just pretty recently the equivalent of energy secretary in Norway said we actually have to explore more. Why not the last decade? There are reasons to believe in a very long oil tail for Norway, and always have been.

And that extrapolates to the global situation. D. Coyne makes realistic mathematical models, and he is very good at doing it. The result is always a further postponement of the peak. As long as the global economy keep humping along the picture could go on.

Best of luck down in Texas by the way! You have a lot going for you.

Thank you; Kolbenih. I appreciate that. I wanted to help. Nothing less.

I spent 10 years of this forum trying to teach people something about oil and natural gas and pretty much all I got was grief for it. I wanted to help by building understanding in my industry and trust in it. I butted heads with statistical nitwits and “highly educated,” internet experts who just just a few years ago did not what that black splotch was on the driveway under their cars, but thought they were smarter than a half century of real life experiece.

Again, thank you.

We’re going to need a lot of luck in Texas, actually. We are running out of water, out of oil, have so much natural gas we burn the shit out of it up flare stacks, and slowly but surely are being overrun by meatheads from California, like Huntington Beach and Got2Surf. Californians are are now everywhere, sorta like fireants. Or nutria in Louisiana. What exactly, are they running from? And if Texas is so bad, why come here. Idaho is much nicer.

There are so many illegal immigrants in Texas now, since four years ago, ones daughter has a better than good chance of having her throat slit than not it she is out with friends for the evening. You think they care, Californians? They want to make it a law in California if you steal less than a thousand dollars of stuff from a store you won’t even get arrested.

By the by, everywhere I surfed in Californy the past 6 years I get sick from all the feces in the water.

I NEVER, ever, injected politics into my wish to teach people more about oil and gas. Your mediators did, and their cohorts, Into everything. They cannot take a dump in the mornings without politicizing the moment.

um, now which politician is for love? I’m confused.

I only visit here for oil news and stats not political opinions.

In the very early days of the peak oil movement, there were scenarios that peak oil would collapse societies. Do we see this happening now in the US? After all, the conventional crude oil peak started in 2005.

Matt,

The US is not collapsing yet, Wall St Journal editorial page claims the US economy is doing fine.

If Trump is elected perhaps the collapse begins, that might be what Russia and China are hoping for.

Russia is collapsing now. China will be following shortly. Especially if there is a conflict in the Middle East that disrupts oil exports.

Canada is in the best position IMO (especially getting the 900 billion dollar a year USA military for free).

The USA will be financially collapsing in the short term:

Medicare .2.2 trillion and growing at 9% per year.

Interest on debt 1 trillion

The USA has to borrow money to pay the electrical bill at the Capital Building.

enough said.

If Shale starts dropping buckle your seat belts.

However, the USA will rebound ( oil tankers go to USA or bottom of the Ocean ) albeit at a lower standard of living.

Canada (oil, resources), USA, South America will be isolated from the rest of the world and trade resources. Australia may be included in there as well (20% of worlds coal reserves, natural gas, rare earths, uranium, etc)

Microchips are another risk.

Do we see this happening now in the US? After all, the conventional crude oil peak started in 2005.

No, peak oil alone will not collapse civilization as we know it. It will be only one contributor. And it will not even be “Peak” oil, but the lack of petroleum products, several years after the peak. And the fact that a lot of today’s oil is not conventional has nothing to do with it. Non-conventional oil is just as useful as conventional oil. Crude oil is crude oil no matter whether it is conventional or not.

Also, we have some other resources now. Both wind and solar will help soften the collapse but will not prevent it. But primarily it will be the destruction of our eco-system that will do us in. We are destroying the planet, but it is happening so gradually hardly anyone realizes it.

But not to worry, the super predator known as Homo sapiens will survive. Not billions but at least a few million.

Nice comment Ron,

“hardly anyone realizes it”

I like it when people put numbers to things like this. For me, I’m thinking this means maybe about 2 to 5 percent. In my world when I talk to people, I think the number is higher. Maybe closer to 20 to 30 percent. Mostly I think people don’t focus on it because they feel there is nothing they or anyone can do about it and the consequences aren’t going to effect themselves.

“Not billions but at least a few million”

Isn’t this just the cycle of life. In the beginning we start out in diapers and need others to survive. If we make it to aging out, we find ourselves in diapers and requiring help to survive. Humanity has advanced into different earth environments we couldn’t have survived without human development. I think we will retreat into environments our current technology at that time can support. Canada might want to start building a wall early.

Ron … “No, peak oil alone will not collapse civilization as we know it. It will be only one contributor. And it will not even be “Peak” oil, but the lack of petroleum products, several years after the peak.”

I couldn’t have stated it better, thanks.

I see it as feedback loops of lack of petroleum products, accelerating the decline in oil production, and every metal and mineral production, which feeds back to accelerate the decline in production of everything.

What’s another word for accelerating decline? Collapse…

The few millions of humans that survive I also agree, providing we don’t kill off all the fauna larger than a rat. We need Vitamin B12 that we can only get from meat/animal products/fish or some fermented foods. Without it we send ourselves to extinction…

With the overfishing, ocean acidification and pollution we’ve sent into the oceans, there might not be many fish surviving us either..

Matt, the rapid pace of societal change and increasing dependence on fossil fuels increases the risk of collapse. Political discord, famine, and epidemic, seem most likely to initiate a collapse. In my view the US is currently at heightened danger because of our political differences. Hopefully, the heat will be turned down after this election.

DCLonghorn,

I also wish the political rhetoric would be turned down. Unfortunately I have been hoping for this since 2015, at some point Trump will leave the scene, it is surprising he has had so much support from Republican leadership as his views are antithetical to traditional conservatism.

I wish Bush had the balls to speak up.

I never liked Bush (or his dad, but Barbara was cool for saying, “Why should I waste my beautiful mind on something like that?”), but I get it:

Bush doesn’t want to endanger his family.

Mike B,

Although I didn’t vote for either Bush for president, either of them would be a far better choice than Trump in my view. At least his daughter Barbara (grandaughter of Barbara Bush and daughter of George W and Laura Bush) has been campaigning for Harris.

https://www.independent.co.uk/news/world/americas/us-politics/barbara-bush-kamala-harris-campaign-b2637651.html

lol at thinking the Democrats are “left”.

Only in America, I guess, where Hitler would be a tad too left for incumbent politicians (because he cared about infrastructure and animal rights, probably).

I will make this a separate post, because all stripper well operators should take notice of what Musk said very recently.

Musk has been very vocal against government spending. So a fellow business owner called him out on all of the government subsidies his companies have received.

Musk responded that oil & gas companies get way more subsidies than EV companies. He was the one who brought up oil & gas.

Look for Trump to repeal percentage depletion, at Elon’s suggestion, if Trump wins and makes Elon his “government efficiency tzar.”

Elon Musk’s primary concern is Elon Musk. It is really strange to see oil producers supporting Musk, thinking he is some ally.

The only reason many of the strippers are still pumping around the LA area is that it will cost too much to clean them up if they get shut down. People actually believe they are producing something, instead of being there to avoid a business expense.

https://www.propublica.org/article/cost-of-california-oil-cleanup-exceeds-industry-profits

“It Will Cost Up to $21.5 Billion to Clean Up California’s Oil Sites. The Industry Won’t Make Enough Money to Pay for It.”

Does this include midstream and downstream, or just upstream.

It costs a tremendous amount to decommission oil refineries.

However, CA does have a lot of urban upstream production and I suspect that costs a lot more to P&A than in rural locations.

Musk proposed cutting federal spending by about one third. Because SS, Medicare & DOD are off the table, that would mean cutting most agencies by 80%.

An extraordinary disaster.

———————————————

I do not understand how people can only ask “what’s in it for me”. Does no one think about what’s best for the country???

“SS, Medicare & DOD are off the table,”

I think we’d all be naive to assume that. Depends who has control of the federal Executive and Legislative branches of government.

“Tesla and SpaceX CEO Elon Musk said he wants to cut at least $2 trillion in federal spending if Donald Trump is elected president”

Heard a song tonight titled- “The best Democracy money can buy”

although I’m not sure about the accuracy of the word ‘best’ in that phrase.

Why Is Musk Spending Over $100 Million Supporting A Trump Presidency??

Easy… he wants Trump to give him CARTE BLANCHE on his SpaceX Starship Enterprise In Brownsville, Texas.

I don’t believe people realize the Musk SpaceX Starship Mars Colonization Boondoggle. SpaceX Starship is taller than the Saturn V Rocket.

Musk wants to build 1,000 of these Starships and GET THIS, launch each one 3 TIMES A DAY. That’s 3,000 SpaceX Starship launches a day.

What kind of Energy & Infrastructure would be needed to LAUNCH the equivalent of 3,000 Saturn V Rockets… EVERY DAY??

Because Musk wants to be able to access the Methane on Mars for fuel for return trips, he is switching from RP-1 Kerosene Rocket Fuel to Methane, or LNG… LOL.

How much Methane would it take for Musk to launch 3,000 SpaceX Starships a Day??

150 Bcf/d of natural gas, or 1.5X the total current amount of U.S. Natural Gas Supply.

steve

“Musk wants to build 1,000 of these Starships and GET THIS, launch each one 3 TIMES A DAY. That’s 3,000 SpaceX Starship launches a day.”

I had read that it’s equivalent to the daily use of natural gas of the USA. I had tweeted this before and now can’t find it because the twitter search function is useless these days.

This is close

https://skeptics.stackexchange.com/questions/52538/will-spacexs-fleet-of-rockets-triple-the-entire-united-states-demand-for-methan

It’s a pretty safe bet that Musk’s Martian dreams will never happen. We don’t have the energy unless we pave the Sahara with solar or build 50,000 nuclear power plants or whatever scifi fantasy feels good to you.

One big problem with Mars is that there is nothing of value there. Not even air. Another is that it is insanely far away, and it’s steeply uphill all the way. In fact the only attractive thing that I can think of is that MARS looks like WARS and the STAR WARS movie franchise got a lot of scifi fans excited back in the day. People get confused easily.

I mean, why not the moon anyway? It’s worthless too, but Mars is about 150 times as far away. Makes no sense to want to go to Mars.

Attempting regular (well once every few years, when the planets approach each other) traffic between Earth and Mars with chemical rockets is unlikely to go anywhere. By the time we build the energy infrastructure to make it happen, new tech will probably have superseded the idea. Kinda like how the first aerial circumnavigation wasn’t by hot air balloon.

I’m all for sending Musk, Trump and any of his fans and/or billionaire friends on an all expenses paid, one way ticket to Olympus Mons. Anyone wanna chip in?

Why Is Musk Spending Over $100 Million Supporting A Trump Presidency??

Easy… he wants Trump to give him CARTE BLANCHE on his SpaceX Starship Enterprise In Brownsville, Texas.

I don’t believe people realize the Musk SpaceX Starship Mars Colonization Boondoggle. SpaceX Starship is taller than the Saturn V Rocket.

Musk wants to build 1,000 of these Starships and GET THIS, launch each one 3 TIMES A DAY. That’s 3,000 SpaceX Starship launches a day.

What kind of Energy & Infrastructure would be needed to LAUNCH the equivalent of 3,000 Saturn V Rockets… EVERY DAY??

Because Musk wants to be able to access the Methane on Mars for fuel for return trips, he is switching from RP-1 Kerosene Rocket Fuel to Methane, or LNG… LOL.

How much Methane would it take for Musk to launch 3,000 SpaceX Starships a Day??

150 Bcf/d of natural gas, or 1.5X the total current amount of U.S. Natural Gas Supply.

steve

And he has big aspirations for his brain implant device (NeuraLink), humanoid Robot Optimus, Starlink global satellite internet service, and autonomous vehicles.

His next stop is a private military force. His political support goes to anyone he believes will provide the smoothest path to his project of domination.

A great example of how one person can be brilliant is some ways, and an absolute simpleton (putting it gently) in others.

‘we have the best democracy that money can buy’

914 is out:

https://www.eia.gov/petroleum/production/

US up 200 to new record 13.4 MM bopd.

*TX up 100

*NM up 60

(round numbers)

OH crosses 100+

MT matches KS

Anyone know how much the USA is still importing after all the balancing out of the numbers?

I would have said 5 or 6 million, but then you have the things like refinery gain and importing and exporting of oil-related products. Still, and even though this allows headlines like ‘USA produces more oil than ever before’, I believe we are net importing at least a few million barrels? I don’t imagine that number is reported officially as such anywhere, cause why would they?

DJ:

We’ve been a net exporter, in nominal terms, since 2020.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MTTNTUS2&f=M

If you strip out propane as a “product”, it becomes pretty close to par. (And I would probably agree with that change, or to weight the products by $ value.)

Still, even with the definitional issues, it’s impressive. Just looking at apples to apples (same definition), we were importing 12 MM bpd in late 2000s. Now it’s a little under 2 MM bpd net exports. A reversal of 14 bpd. How many of the writers at TOD predicted that?!

How does a 14M swing come on the back of 9M of tight oil?

How much do I need to spoon feed you, DJ? You could have looked up the net imports yourself, for instance! Oh…and YOU’RE WELCOME!

FWIW, propane (I already alluded to) is another 1.5 in the numbers.

Not sure the rest –maybe increase in refining capacity or other products or decrease in consumption. Anyways, why don’t you do some analysis, yourself?

Oh, I see what you did there. The first chart you linked to is OIL (13M) as the footnote says, crude oil plus lease condensate. Whereas the second chart, showing the net exports of -2M, is OIL plus PRODUCTS. The USA still imports somewhat over 6M barrels a day of OIL. That makes sense. I thought the charts were displaying the same thing but they’re not, so useless to compare the two.

Still, I agree that it’s an impressive swing, just not as impressive when it’s the “plus PRODUCTS” you’re talking about. i.e. if you’re going to strip out Propane, which you agree is reasonable, then you’d agree it’s reasonable to strip out all NGLs and you’re way back into net importer territory. Which is what I expected.

I’m not an expert by any means. I just like to go over the numbers from time to time as a sanity check. You might spoon feed some of those numbers to yourself while you’re at it. If you’re going to put yourself out there as knowledgable, that sort of stuff should be on the tip of your tongue.

Long video on water disposal challenges in Permian basin (47 minutes) at link below

https://youtu.be/E0WImM0l3rA

The video Dennis mentions above is by Christine Guerrero, a petroleum engineer. She makes the case that future development of the field should be guided by finding a home for the wastewater to be produced. We are currently injecting around 20 million barrels of wastewater back into the basin daily.

Record Texas Earthquakes:

8/16/1931 Presidio Cty 5.8

4/14/1995 Brewster cty 5.7

11/16/22 Reeves cty 5.4 Possible mainshock of 881 earthquake swarm

11/8/2023 Reeves Cty 5.2 Possible mainshock of 278 EQ swarm

12/8/2023 Martin 5.2

7/9/2024 Fisher 5.1 Possible mainshock of 69 swarm

9/17/2024 Martin 5.1 Possible mainshock of 50 swarm

3/26/2020 Reeves 5.0 Research paper identified injection water as cause

There are over 50 4.0 to 4.9

There are over 250,000 wells in what has become a sesmically active basin, and many of them are old and leaking from one formation to another. This is a horrible situation for West Texas. Whether the RRC will be able to continue to turn a blind eye towards this mess, I don’t know.

The referenced paper may be long, but it is very insightful. Please take alook.

The Rig Report for the Week Ending November 1.

– US Hz oil rigs rose by 3 to 430. They are down 29 rigs from April 19 and are up 3 relative to their recent lowest count of 427 on July 24th.

– The Texas rig count was unchanged at 234.

– The Texas and New Mexico Permian rigs were unchanged at 191 and 92 respectively.

– In New Mexico, Eddy and Lea were unchanged at 43 and 49 respectively.

– In Texas, Midland added 2 to 26 while Martin added 1 to 27.

– Eagle Ford added 1 to 40.

– NG Hz rigs added 1 to 86.

Frac Spread Report for the Week Ending November 1

The frac spread count decreased by 7 to 232. It is also down 38 from one year ago and down by 40 spreads since March 8.

US August Oil Production at Record high

US production rose by 195 kb/d to 13,401 kb/d, another new record high. The major gains came from Texas 99 kb/d and NM 57 kb/d.

It is amazing how US production keeps on rising with both the Rig and Frac counts near record lows.

The funny thing is that shale is more productive than people give it credit for. Sure, it has high decline. But you get relatively high rates to start with. And it ends up being higher production per rig than was typical pre shale.

It’s even more stunning if you look at natural gas.

https://en.macromicro.me/charts/39429/us-natural-gas-production-vs-rig-counts

During the “Peak Gas” crisis of 2008ish (anyone remember that?), we had 1400 rigs drilling for gas.

Now we have less than 200 drilling for gas. And we’ve doubled the gas production! Sure, there’s some “ass gas”. But that still doesn’t explain the stunning amount of growth with the small amount of rigs.

The fact is that critics obsess on the decline rate. “Hey, did you know that shale wells decline fast?” (No duh…I know that…y’all have repeated that for the last 15 years.) But what matters is the total EUR delivered. And it’s monstrous for shale gas wells. They are hyoooge!

Nony,

What matters is profits, natural gas doesn’t make much at current US prices.

https://www.eia.gov/todayinenergy/detail.php?id=63506

excerpt:

U.S. natural gas production from shale and tight formations, which accounts for 79% of dry natural gas production, decreased slightly in the first nine months of 2024 compared with the same period in 2023. If this trend holds for the remainder of 2024, it would mark the first annual decrease in U.S. shale gas production since we started collecting these data in 2000.

Nony,

Rig count is not a great metric, a better metric might be rig horsepower or feet drilled.

The wells are more productive because the laterals are longer.

The EIA article below gives some numbers.

https://www.eia.gov/todayinenergy/detail.php?id=52138

The weighted average well length has doubled from 2010 to 2021 (last year covered by article) from about 7500 feet to 15000 feet.

You are correct that horizontal wells are more productive, this expected due to their nature. By 2021 nearly all drilling in the US was for horizontal wells, 81% of wells completed and about 95% of footage drilled.

Found more recent data at link below

https://www.eia.gov/totalenergy/data/browser/index.php?tbl=T05.02#/?f=M&start=200001&end=202409&charted=14-17-15-16