This is a guest post by Ian Schindler (Schinzy).

The views expressed do not necessarily reflect the views of Ron Patterson or Dennis Coyne.

Introduction

This work is preliminary. It is a preview of part of a paper I am writing with Aude Illig. There are three main reasons I am making this post. The first is as a public service. There are many people reading this blog who are directly affected by oil prices and who have to make decisions based on future oil prices. Having a model to understand the dynamics of oil prices is of use to them. The second reason is that some people reading this blog model oil extraction. These models either omit price considerations or make assumptions on them. Our model is a large improvement on these assumptions so it should improve their extraction models. The final reason is that I consider the quality of the comments on this blog to be high. I believe that the feedback I get from this post will improve the quality of the final paper. Indeed, Dennis Coyne has already provided valuable feedback after previewing the post. This study has been a humbling experience. Get ready to throw out everything you thought you knew about oil prices.

The model does not by any means explain all oil price variation. What is remarkable is that with only one data set, it explains so much. Many factors may affect the price of oil. This model provides a base to which other variables can be added to find what explains oil prices.

I was asked to write a chapter titled “Strategies for an Economy Facing Energy Constraints” for a book last year which I wrote with my daughter. I do not think the book will be published but the chapter may be of interest to some. I have posted the pdf file on line and will refer to it often [2].

I prefer the terminology of Turchin and Nefedov to the term “peak oil”. Because oil is a finite resource, it will have a growth phase, a stagflation phase, and a decline or contraction phase. Turchin and Nefedov characterized these phases in agrarian civilizations [3]. The phases of oil extraction have similar characteristics. I believe that the growth phase of oil ended around 2005 and that the stagflation phase ended towards the end of 2014. The sign that the stagflation phase ended was the drop in oil prices.

The Cost Share Theorem from neoclassic equilibrium theory says that oil and food are not very important in economic production because their cost shares are small. Our price model is consistent with the opposite view: that oil extraction has been extremely important in economic production. In [2] computations show that the dynamics of the cost share is the indicator of importance in an economic production function. In particular, the cost share of important factors have negative derivatives, that is they shrink during periods of economic growth, and grow during periods of economic contraction.

An Empirical Model

George Box said that all models were wrong, but some models are useful. Our goal is to use historical oil extraction data to explain oil prices. If one can explain a large part of oil prices with this data, it can be used to understand what made oil prices move in the past. One can then make predictions with the assumptions that, at least short term, past conditions have not changed too much. If the predictions do not match future prices, this is also information. It means that some past condition is no longer verified. The model can help to determine exactly what condition is no longer verified.

We used price and extraction data for crude, condensate, and NGL from BP’s 2015 Statistical Review because the extraction data goes back to 1969 (actually 1965, we were also looking at cost share and our data set for GWP only went back to 1969). We wanted to include price shocks of the 1970’s.

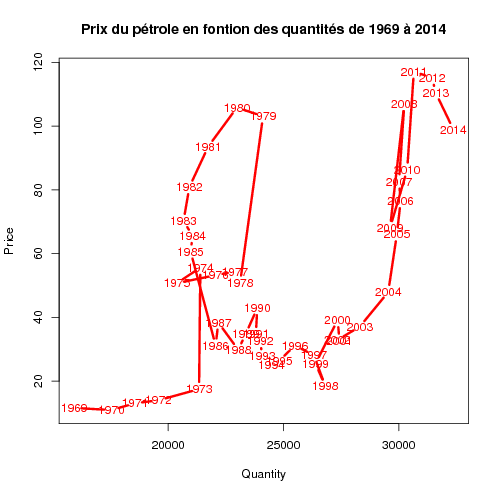

By p(t) and q(t) we will denote the price of oil and the quantity of oil extracted (in barrels) in year . The data immediately give us a model for the price of oil. It is the average price for the period. Clearly this is not a good model because there are large variations from this average value. What could cause these variations? From Figure 1, one sees that quantities cannot explain price because p is not uniquely determined by q, in other words several prices correspond to the same quantity produced. So we attempt to use autocorrelation: we attempt to explain p(t) as a function of q(t), q(t-1), q(t-2), etc. It is well known that the more variables one uses, the less robust the model is. When we say robust, we mean that the reliability of the model for predicting future prices is impaired with too many variables. For example if we used all the variables q(t-k), k=1, … 44, we could explain all the variation from the mean, but the information would be useless for predictions because we would have been too greedy. There are other factors that effect price such as the weather, strikes, earthquakes, interest rates, financial bubbles, etc. that are not included in the extraction data. Better predictions are made from fewer variables and a fit which is not exact.

Figure 1: Price vs quantities

We define

Dq(t) = q(t) – q(t-1) (2.1)

DDq(t) = q(t)-2q(t-1)+q(t-2) (2.2)

Note that Dq(t) and DDq(t) are the discreet first and second derivatives of q(t) with time step h=1. The vectors q(t), Dq(t), and DDq(t) span the linear space generated by q(t), q(t-1), and q(t-2) so our methodology is equivalent to using the latter variables. We prefer the former variables because the results are easier to interpret with these variables. I will discuss the following model:

log(log(p(t)))=a + bq(t) -cDq(t)+dDDq(t) (2.3)

where a, b, c, and d are positive constants determined by linear regression (a priory it was not known that they were positive, this was determined by the regression). After reviewing this post Dennis Coyne generously shared his EIA data from 1960. We get a much better fit with the EIA data which only includes crude and condensate production and no NGL so we will use it for the paper.

Equation (2.3) is equivalent to

p(t)=exp(exp(a+bq(t)-cDq(t)+dDDq(t))) (2.4)

The reason that the best linear regression worked for the log(log(p(t))) is because the dependency of price on these variables is non-linear. Linear regression tests for affine functions. The log flattens large values. The log(log) really flattens large values and it was a great surprise that this model gave the best fit with the data we used. This corresponds to the inelasticity of oil prices. That is, small changes in supply provoke large changes in price.

The R output for the regression is as follows:

Call:

lm(formula = log(log(Price71)) ~ Quantity71 + DQuantity71 + DDQuantity)

Residuals:

Min 1Q Median 3Q Max

-0.25737 -0.08838 0.01609 0.08395 0.26496

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 8.955e-01 1.299e-01 6.895 2.62e-08 ***

Quantity71 1.944e-05 5.098e-06 3.814 0.000464 ***

DQuantity71 -1.412e-04 3.667e-05 -3.852 0.000415 ***

DDQuantity 5.847e-05 2.821e-05 2.072 0.044717 *

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.1269 on 40 degrees of freedom

Multiple R-squared: 0.4115, Adjusted R-squared: 0.3674

F-statistic: 9.324 on 3 and 40 DF, p-value: 8.45e-05

Adjusted R-squared is 0.367 means that the model explains 36.7% of the variance from the mean taking into account the number of variables. In other words a large part of what is normally called demand is determined by the offer, and it’s first and second derivatives. Frequently demand is estimated by economic growth. Oil price is strongly correlated to GWP. Thus three years of oil extraction can give a good estimate of GWP. This is strong evidence that oil extraction has been a major determinant in economic production. This is much more reasonable than to imagine that GWP this year somehow determined oil extraction this year, last year, and the year before.

The intercept is the coefficient a, Quantity71 b, DQuantity71 -c, and DDQuantity71 d.

Interpretation

If extraction is constant for two years, then Dq(t)=DDq(t)=0. In that case the model reduces to

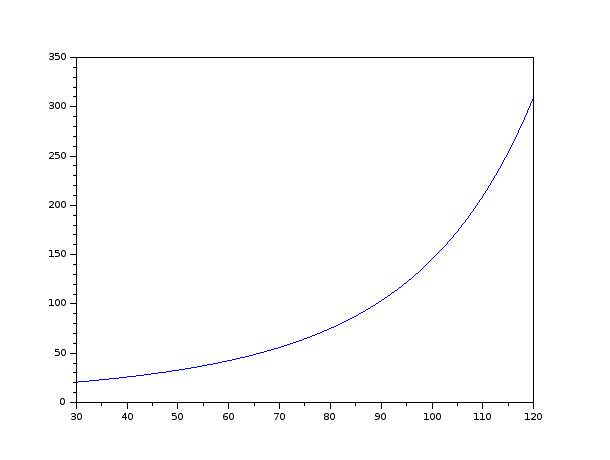

p(t)=exp(exp(.8955+1.944*10^(-5)q(t))) (3.5)

We call this the basic price formula that predicts the price if extraction is constant. Note that the basic price is an increasing function of quantity. This is another indication that oil extraction is a very important part of economic production because it indicates that the price divided by the cost share is increasing indicating super-linear scaling in GWP [2, Theorem A.1.1]. In Figure 2 we graph the basic price as a function of quantities. Because the exponential is such a fast growing function, one must be careful extending the model to extraction levels much larger than current levels.

Figure 2: The Basic Price vs Quantities

Suppose Dq(t) is a constant so DDq(t) =0. Then and the model becomes

p(t)=exp(exp(.8955+1.944*10^(-5)q(t) – 14.12*10^(-04)Dq(t)))(3.6)

Note that the coefficient of Dq(t) is about 7 times larger than the coefficient of q(t) and of opposite sign. Thus gives a much larger price signal than q(t). The signal goes in the opposite direction of the change but it only lasts for a year. One might understand this as follows: a rise (fall) in extraction influences the economy much more next year than this year. Imagine that an increase in extraction levels occurred the first of the year. The economy is using a certain quantity of oil at the basic price and suddenly on the first of the year an extra million barrels a day is delivered. In order to unload this extra oil, the price must drop. It takes a while to figure out what to do with the extra oil, but by the end of the year it is sorted out and someone is using the oil to get some work done. This produces economic growth and thus if the same quantity is produced the next year people will be able and willing to pay a higher price to continue using the same amount of oil. Thus the price rises.

Example 1 If extraction is constant at 80 mbd the basic price is

p(t)=$75. If q(t)=80, q(t-1)=78, and q(t-2)=76 then Dq(t)=Dq(t-1)=2 and DDq(t)=0. Then p(t)=$49 because extraction is rising. If q(t)=80, q(t-1)=82, and q(t-2)=84 then Dq(t)=-2 and DDq(t)=0. Then

p(t)=$120 because extraction is falling.

Dependence on the second derivative is more subtle. The second derivative is negative at local maximums and positive at local minimums so that the second derivative will mollify the price change caused by the first derivative. This explains why peak extraction is frequently associated with low prices. A minimum in extraction will thus be associated with relatively high prices. Economically this factor can be interpreted as follows: it takes two years for the economic growth (contraction) produced by an increase (decrease) in extraction to take hold. The first year it is rather fragile and easily reduced (increased) by a drop (rise) in extraction.

Example 2

1. If q(t)=80, q(t-1)=78, and q(t-2)=80, then extraction reaches a local minimum at q(t-1). We compute p(t)=$70 rather than $49 as in Example 1 with the same increase in extraction from 78 mbd.

2. If q(t)=80, q(t-1)=82, and q(t-2)=80, then extraction reaches a local maximum at q(t-1). We compute p(t)=$81 rather than $120 as in Example 1 with the same decrease in extraction from 82 mbd.

3. It is interesting to note that if q(t)=Aρ^t with ρ=(1+r) and the growth rate r in a reasonable range (0<r<.12) then p(t) is an increasing function of q(t). For example if q(t)=80(1.02)^t, then p(3)=$58.3<$60.8=p(4), thus increasing production at a constant rate produces increasing prices. However this price is lower than the basic price at the same extraction quantity which is $87.6.

In Figure 3 we plot the fitted model with the actual data with the model’s prediction for 2015 (based on an increase of 2.2 mbd from the last data point of 92 mbd in 2014). Note that the model does not do well with extreme prices, either high as in the 1970’s, 80’s, and from 2005 to 2014 or low at the end of the 20th century. This is because the model is adjusting to average prices and so will in general be between the observed price and the mean. In Figure 4 we plot the fitted model and the vs the actual price with the EIA data provided by Dennis Coyne.

Figure 3:

Fitted model with BP data discussed

Figure 4:

Fitted model with EIA data from Dennis

For those interested in using the model produced from EIA data, a=0.779552, b=.009443, c=0.058792, and d=0.023649.

Scenarios

The growth phase of oil extraction was characterized by increasing prices well below the basic price of each level of extraction due to short term price signals resisting growth. The high prices during the stagflation phase of extraction can be explained by lower growth in extraction. Thus the short term signals are weaker and prices are closer to the basic price. With production of 92 mbd, the basic price in 2014 was $110/barrel.

We outline 3 possible scenarios for the contraction stage of oil extraction. We assume that peak extraction is 95 mbd which gives a basic price of $120.

- The first scenario is a steady decline in oil extraction. If extraction falls at a constant rate of 1% per year from 95 mbd, then q(t)=95*.99^t, from which we compute q(2)=93 and q(3)=92. We obtain p ^(2)=$145and p ^(3)=$140. Thus the price is high but decreasing. As extraction continues to decline, higher priced extraction will eventually be priced out and closed. This will lead to a faster decline in extraction, lower prices and thus a negative feedback cycle. This corroborates a phenomenon described in [3]: stagflation occurs because the civilization has reached the carrying capacity of the land. Peasants leave the countryside for the cities as they can no longer make a decent living in the countryside even as food production stagnates.

- The end of the stagflation period is characterized by civil war among the elite class [3]. If one equates the oil extraction industry with the elite class, the 2014-2015 price war can be seen as the beginning of a civil war among the elite class. Well financed expensive production (such as fracking) can keep production high to eliminate lower price competition (conventional) in the mistaken belief that lower extraction rates mean higher prices. Eliminating this competition initially creates higher prices due to higher decline rates, but faster decline in extraction quantities leads to faster declines in the basic price which will lead to a faster overall decline in oil extraction.

- A Seneca cliff [1] can be imagined if for example a sudden drop in non OPEC production coincides with war in the Persian Gulf. If extraction rates fall precipitously and remain low for two years, the ensuing drop in prices will decimate the extraction industry and a recovery will be highly unlikely.

Note that in all three scenarios, price considerations from the model speed the rate of decline in extraction.

Conclusion

The model presented supports the thesis that a large part of economic production is generated by increased extraction. The big surprise is that prices increase with extraction levels. The most powerful price signals come from short term effects lasting no more than 2 years. It is hoped that this model will aid modelers, policy makers, and investors understand the dynamics of the contraction phase of oil extraction. Modelers can now estimate the price of oil from their extraction numbers. From the price, investment in oil extraction can be estimated which will lead to more reliable estimates of future oil extraction. The model can also be used to assess climate change mitigation policies. If a policy results in prices significantly below predicted values, it can be considered successful. The model might also be useful in predicting financial bubbles. We believe that our methodology can be extended to extraction of other fossil fuels and sources of energy.

Bibliography

1

Ugo Bardi.

The Seneca effect: why decline is faster than growth.

Blog, 2011.

http://cassandralegacy.blogspot.fr/2011/08/seneca-effect-origins-of-collapse.html.

2

Ian Schindler and Julia Schindler.

Strategies for an economy facing energy constraints, 2015.

http://www.math.univ-toulouse.fr/~schindle/articles/2015-chapter.pdf.

3

Peter Turchin and Sergey Nefedov.

Secular Cycles.

Princeton University Press, 2009.

Interesting paper – I like the analogies with the agrarian analyses in the Secular Cycles book, and civil wars being replaced by price wars. With hydrocarbons (especially oil) replacing manual labour since the industrial revolution this appears entirely applicable, but I’m sure there are counterarguments – e.g. what would be the modern equivalent of ‘peasants moving to the cities’?.

The model doesn’t seem to do so well over the last 5 years, which is probably of most relevance. Do you think a one year time step is good enough in the high volatility environment that we appear to be experiencing – maybe quarterly data would give better fit given the relevance of first and second derivatives?

The model does not completely explain oil prices because there are factors which are exogenous to the model. My personal guess as to why the model does not do well over the last 5 years is that quantitative easing caused financial bubbles that inflated the price of oil from 2009-2013 and that currently those bubbles are deflating so that the model will overestimate the price of oil for a couple of years as all those bubbles get sorted out.

Would not such exogenous influences tend to increase in a contraction phase as the elites seek to return to growth BAU, or if that proves impossible to protect their hegemony at any cost? So the bubbles wouldn’t deflate steadily, but instead move to some other form of distortion.

“…what would be the modern equivalent of ‘peasants moving to the cities’?.”

An entire generation living online?

Could be – or the whole adult population reduced to debt slaves and addicted to anti-depressants and prescription pain killers?

“e.g. what would be the modern equivalent of ‘peasants moving to the cities’?.”

Solar power, wind power, and batteries (including electric cars). Growth industries, growing very very fast. They can’t train solar installers fast enough.

Peasants left agriculture and went to find industrial jobs.

People will leave the oil industry and the dependent-on-oil industries and move into the industries which are *not* dependent on oil. (Yes, oil will still be used for some plastics and lubricants, but do you realize how *little* oil is used for that? It’s marginal.)

I’m just a visiting layman to the site, but at first glance I would like to make a measured comment. I believe there are more variables than what the model includes, although it was very interesting. I did not see included the effect of propaganda by the industry or those with vested interests. Investment hypes. Refinery limitations. CAFE changes. Population and demographics, certainly slower effects but are there, nonetheless.

In my own limited opinion I believe that if personal transportation was finally returned to ‘transportation’, as opposed to identity and self-worth (“Just have to have that advertised Lincoln or the new BMW series”), if safety requirements were reduced for automobiles (complex designs, air bags, increased structural weight, climate controls, etc) the lowering weight factor of automobiles would produce a huge reduction of fuel useage, thus lowering prices and affecting extraction rates. It is a big jump to forecasting that rising extraction means rising prices. Isn’t price just a lagging indicator?

How necessary is Civil Aviation and air travel? Could there be a rennaisance in rail travel and a slower way of life? How about free mass transportation in walkable cities? Tolls and limits to parking in major cities?

What I found most interesting was your dates and titles, particularly Stagflation as opposed to the Undulating Plateau.

I was thinking this morning of my 1st year university psychology classes this morning and I have no idea why? It was brutal. But it was interesting to experience a class that tried to complex its study of human behaviour into a science, much like economics does. Energy, itself, is life. And how cannot it not be in one way or another? Then surely the understanding of extraction, prices, and trends will be just as mysterious and complicated as people and human behaviour? Even still, as we approach a Senaca Cliff we do not live in a planned and controlled economy to the extent of someone being able to actually do something to mitigate costs, energy use, or extraction rates. I believe it will be a collective WTF moment as society starts to really fall to pieces. And then there are those pesky shareholders. They need a story, maybe a lie, to keep their hand in. Unless, oil production is one day deemed to be vital enough for Nationalization, and we know how well that can work.

Thank you for this interesting post.

respectfully….

When we began this study my hunch was that a great deal of the price of oil was contained in the quantities extracted along with it’s first and second derivatives. In short, I believe that a lot of those factors you mention above are somehow contained in the extraction rate and it’s first and second derivatives. What linear regression does is compute, if there is a function of the type in Equation (2.3), what the “best” coefficients are. It also gives some idea of whether or not the variables explain the variation. It is now the job of economists to find a theory as to why the equation worked in the past to explain the price as well as it does.

You mean commerical aviation, not “civil aviation”. Commercial aviation is transport of paying passengers, domestic or international.

Yair . . .

Just flicking through this very long thread again and, being an uneducated old bush bloke I believe I may have a different take on our problems.

I have no understanding of many of the concepts mentioned on this site.

Folks go on and on about energy necessary to travel but when I fly in over a large city I look at all the buildings cheek to jowl and I work with and know pipes and pumps and I think that one of the largest problems in the future will be maintaining sewerage systems and pumping and treating shit.

The first large engines ever built were specifically designed to pump sewerage in a London with just a few million people and I believe certain modern cities in the Middle East have no sewerage systems and rely on thousands of tanker trucks to transport waste into the dessert every day . . . I seldom see this problem mentioned.

Cheers.

How does this model handle consumption efficiency growth (e.g., moving from 12 MPG to 50 MPG) and substitution, e.g., replacement of ICEs with EVs?

Nick G

Those factors you mention, such as efficiency growth and government mandates will make permanent changes in the demand for oil in a stepwise fashion. I have always assumed that oil production demand will be down to synthetic chemicals, plastics and lubricants by 2035.

I doubt if many people here believe that oil production will not fall over the next 20 years anyway, so replacement and efficiency will be even more in demand.

I came up with a possible answer to this question last night. I would call this model the BAU price model because it explains prices of the past. If civilization decides to preempt the fall in oil extraction by increasing investment in energy transition initiatives, this model could well overestimate the price.

the BAU price model because it explains prices of the past.

It doesn’t explain the past. Prices crashed in the 1980’s in large part because demand crashed. In particular, the US reduced consumption by almost 20% from 1978-1982 despite a (slightly) growing economy. It did so with substitution.

Prices crashed in 2015 – that would not have happened if consumption had been higher. Consumption would have been 10M bpd higher if the US government had not mandated increases in CAFE efficiency over the 1976-2015 period (despite much higher industrial production and overall GDP), and 2M bpd higher if consumption had not fallen in the US from very roughly 2006 to 2014 (despite higher GDP & industrial production).

Prices are a function of supply AND demand.

“Prices are a function of supply and demand.”

That’s not what the empirical evidence says.

That’s an extraordinary statement, and it needs a great deal of evidence. A statistical analysis which finds a fairly weak correlation between production levels and prices doesn’t begin to support that statement.

After all, if both supply and demand dictate prices, then it seems pretty obvious and intuitive that there would be a 50% R squared between production (aka supply) and prices. Demand can be expected to account for the other 50%. Life, of course, is never quite that simple or easy…

Have you absorbed the historical evidence I referred to above? Does it seem at all possible that oil prices could have crashed if consumption was 2-10M bpd higher???

With one data set (EIA C & C data from 1960) and 3 variables the model has an R^2 of .67, that is it explains 67% of the variation in price from its mean. The standard deviation is the square root of the variance, so it explains about 80% of demand (well not exactly it’s the log(log) of demand). I agree that there are other factors influencing demand. But I find truly remarkable that so much of demand is contained within these three variables. I do not think you can understand the dynamics oil prices without

understanding why so much of demand is somehow contained in these three variables. In any case these three variables is where I focus my attention to understand the dynamics of oil prices.

p(t)=exp(exp(.8955+1.944*10^(-5)q(t))) (3.5)

One thing I know for sure is that if I start having nightmares of high school algebra II and calculus again. It is because of this post.

Current demand is subject to decisions that were made 10, 20, 30 and even 40 years ago. If it were me, I would track the ratios between GDP, oil consumption and production cost using forecasting smoothing techniques. Then add back in a standard deviation for market randomness and information time lag.

Now I’m going to go out and get my cardio on a bike ride. Hoping I can get those equations out of my head. But than again, that’s just me. More than 2 standard deviations from the norm.

The purchasers of oil products, fuels in particular are captive consumers, they have few alternatives other than some system changes that will result lower use.

That is changing now and has been changing for a while. Efficiency and alternative energy are two of the big factors effecting demand and price.

Long ago it was steam trains, electric trains and trolleys, now the trolley systems are gone, but they are being replaced by electric vehicles and high efficiency vehicles, which free the consumer and makes it an open market once again. Electric trains still operate and may grow in use, another factor eating into oil demand and causing price fluctuations.

Both geology and technology are placing other dynamics in the cost of increasing oil production. The geology of shale oil forces the use of extensive and expensive technology. Enhancing production in existing oil fields increases the cost of production. Ocean drilling is getting deeper and more expensive. New oil production is generally more expensive. So as the world tries to produce more, costs to producers go up.

As consumers seek efficiency and alternatives, price must go down to compete. Eventually, competition will not be possible since the easy cheap oil discoveries are just about gone.

I said this below, but it fits here as well:

Two thoughts:

How many variables (including variations and transformations of those variables) did you test? 50 years isn’t really a very large or robust data set. If you tested dozens of variables, then there is a very high chance of simply finding spurious correlations.

2nd, have you tested a very simple model of demand’s impact on price: GDP growth vs price changes? Or an extended set of variations similar to the transformations you tried for production?

Also, you said: ” The standard deviation is the square root of the variance, so it explains about 80% of demand (well not exactly it’s the log(log) of demand). ” Are you sure it’s ok to describe it that way? I would have stuck with 67% of variance as “explaining” price variation.

In any case, this model makes sense to me. I have the feeling that it enhances my understanding of price phenomena. I haven’t seen anything better.

With respect to norms, the variance is the square of the L^2 norm which is our standard idea of distance. R squared is a ratio of variances, thus of the square of distances. It is not the same thing as the ratio of standard deviations, but taking the square root gives a an idea of how much distance is explained rather than how much distance squared is explained.

xxxxx

“Prices are a function of supply and demand.”

That’s not what the empirical evidence says.

xxxxx

The theory of supply , demand, and resulting price is CORRECTLY interpreted and applied as a SNAPSHOT of a moving world, a motion picture world.

Any COMPETENT instructor teaching economics , anybody who is not an idiot of one stripe or another, makes this ABSOLUTELY CLEAR within the first couple of days of study of supply and demand.

Such an instructor tells his students that in the real world, there are such things as price wars, cartels, monopolies, oligopolies, rationing, subsidies, punitive taxes, substitution, actual war, and other factors that muddy the waters.

Such factors include the inability of producers to make rapid changes in response to changes in price, in some industries. Oil is one such industry.

There are plenty of reasons, that have been discussed in some detail over the last year in this forum, why oil producers cannot, or in some cases, refuse to cut production in response to a decline in price, especially over the short to medium term.

Let’s not forget that the oil industry is one of the slowest moving behemoths, probably THE slowest moving of all industries, when it comes to lead times, contractual obligations, political entanglements etc.

Most oil is owned by and produced by governments, and we all know governments are rather slow and dim witted when it comes to rapid change, needed or not.

MY lived thru some very bad times in our own industry, twice, when prices were below costs for several years in a row.We hung in there, ate the losses, and eventually made them up. Many of our competitors gave up, some after two or three losing years in a row, some others only after a second losing streak.

The reason the survivors stayed in was that we estimated the cost of abandoning our orchard operations was too high, and that we would lose our asses, trying to sell in such a bear market. In a nutshell, we were going broke if we quit, but we had a shot at surviving by hanging on. So we hung on, and sure enough, the price of fruit went up again.

A lot of oil sellers are desperate enough for cash to sell at an overall loss, on a day to day basis, so long as producing and selling generates SOME cash.

None of these factors prove that there is any thing wrong with the theory of supply and demand determining price.

Sometimes producers can respond quickly. Folks who sell hot dogs on the sidewalk can double production in a day or two, if it’s worthwhile, by hiring a helper, or quit anytime they decide they are in a losing business. It would take me six to eight years, minimum, if I were still working, to double my production of fruit, other than by buying out a competitor.

If I were still working, and losing money, it would take at least three years for me to abandon any significant amount of production. I would sacrifice a few older or sickly trees is all. What I WOULD do is cut back on planned future expansion, or replacement trees.

Note that I was a family operator, and one or two horse family business operations are just about the most nimble of all businesses when it comes to expansion or contraction..

WHY, in view of actual prevailing conditions, should we EXPECT oil producers to cut back production sharply, except in cases where they are actually losing cash short term by producing?

It took me a while to understand my own rhetorical question, because I was under the impression that day to day operations comprised a much large portion of the costs of producing oil than is actually the case. Apparently only a rather minor fraction of world wide production is under water in terms of cash flow, even at thirty to forty bucks.

And even producers who are cash flow negative may be in such circumstances that shutting down would cost them more than continuing to produce.

ALL this sort of thing is taken into account in a technically literate discussion of the theory of supply and demand.

The take away bottom line is that a year, or even two years, is not necessarily enough time for oil producers to RESPOND to changes in price to a substantial degree.

Sometimes I wonder if I am the only regular in this forum who actually took a serious basic course in economics.

Sarc light blinking, I am not trying to insult anybody but rather point out that the theory of supply and demand is consistent with the current price of oil without having to bend it even the slightest bit.

“Sometimes I wonder if I am the only regular in this forum who actually took a serious basic course in economics.”

Really ? Be carefully you don’t fall off that pedestal. You might hurt your ego.

I put the sarc like blinking in the wrong place,a line or two down.

But anybody who actually did take a real university course in econ will understand just how many people, even in a forum such as this one, have a truly piss poor understanding of the law of supply and demand. I would guess that even in this forum considerably less than a quarter of us could pass a first year econ final exam.

I could not pass a first year calculus final, now,half a century later, nor could I pass a first year chemistry final, between having forgotten some of the chemistry and the some of the necessary math.

But I did at least take the courses.

Econ is simpler, and easier to remember, but hardly anybody except biz majors takes econ. I happen to be one of the rare exceptions.

For instance there are PLENTY of people in this forum who insist that traders control the price of oil. They never actually explain how though, except in terms of smoke and mirrors. The smoke is in their own eyes, and they are blinded by the mirrors.

Oil is cheap right now because there is more oil coming to market than the end users want at a higher price. So the price has fallen to the point that the market absorbs all the oil being produced, minus any very minor amount that is being put into storage by the producers themselves.

The price will go up again when one of two things happens, or more probably, a combination of the two.

Producers will EVENTUALLY cut back production, so that less oil comes to market, and or end users will be willing to buy at a higher price in order to get as much as they need and want.

It really is that simple. Even a dumb farmer semi educated at a so called cow college can understand that if producers are trying to sell more than end users want, the price crashes until either producers cut back , or until consumption increases.

It took me quite a while to understand just how long it would take the folks in the oil industry to cut back. The process is no more than just well started even now.

An ocean liner is as nimble as a hummingbird compared to the oil industry.

Understanding this stuff is as simple as falling off a log.

Baseball and other sports are easily UNDERSTOOD, but actually predicting who will win and lose is tough to impossible. There are too many constantly changing variables, and some random variables as well.

Likewise, Nobody should expect to successfully apply supply and demand theory to PREDICTING the price of oil , because both supply and demand are affected in random ways by many different variables, and successfully quantizing all of them is impossible. There are too many and they change too fast.

re: “It took me quite a while to understand just how long it would take the folks in the oil industry to cut back. The process is no more than just well started even now.”

Kicking and screaming until the cash to produce runs out, and the loan tap dries up. Until then, they have to have cash flow, any kind and any amount.

Oil companies make investment decisions based on a price forecast. The price forecasts I have seen come in very diverse shapes. But most of them aren’t constant, and very seldom use the current price.

I’ve made this comment several times to help you understand that behavior is dictated by expectations plus the perceived ability to get the money to spend. In other words, a lot of what goes on is based on perception of what’s going on, and what the future will be.

The law of supply and demand works perfectly. I just don’t know how to use it to understand the dynamics of oil prices.

What’s the goal? An understanding of historical price changes, or a reliable predictive model?

The first is pretty easy. The first place to start is with understanding history. For instance, the reasons behind supply and demand changes. If you don’t know the real, historical details of how those have behaved, you have nothing.

The second…..Well, if you can do it, you’ll be rich. Seriously. It depends on political decisions and events, technical changes, etc., etc. These are very, very hard to predict. For instance, the only people that I know of who predicted the LTO boom were old fashioned analysts that were derided in PO circles as cornucopians. They had faith that higher prices would draw forth more supply, and they were right. I admit I didn’t expect it: I thought supply would be stagnant, and prices would stay high.

Forecasting is very hard, especially about the future.

I only recently learned about the historical (1950s-1960s) Texas state government policy to set a floor on oil prices (propping up the price). Very important fiactor historically…

“For instance, the only people that I know of who predicted the LTO boom were old fashioned analysts that were derided in PO circles as cornucopians. They had faith that higher prices would draw forth more supply, and they were right.”

The thing is that there are TWO possible reactions to higher prices:

(1) More supply — expensive supply comes on line

(2) Reduced demand — people start using existing supply more efficiently, or switch to alternatives/substitutes.

I really expected the switch to substitutes to happen sooner. The switch to substitutes *did* happen for home heating, and for a bunch of industrial processes, and for electrical generation. Transportation fuels have been very stubborn — I expected the switch to be a lot faster. Cars & trains have been cheaper to operate on electricity than on gasoline/diesel when figuring just ongoing costs since the 1970s, and cheaper when figuring Total Cost of Ownership since the 1990s, but apparently the retooling of the economy is slower than I expected.

The essential thing is personal and institutional resistance to change.

Car companies don’t like EVs: it makes individuals’ company and sector-wide institutional knowledge obsolete. They dramatically reduce maintenance costs, which are the majority of dealer revenue.

Oil companies hate EVs, for obvious reasons.

A less obvious factor, but which is immensely important: the Koch brothers, whose “oil oligarch” father founded the John Birch society, have single-handedly, dramatically, distorted US politics in order to prevent change.

I guess I’m not a regular, but I have a very extensive economics background at this point. I only took three semesters in college, but the amount I’ve studied since then is massive.

Each market is different. It’s complicated because

demand in time period 1 affects price in time period 2+

price in time period 1 affects demand in time period 2+

supply in time period 1 affects price in time period 2+

price in time period 1 affects supply in time period 2+

demand in time period 1 directly affects supply in time period 2+

supply in time period 1 directly affects demand in time period 2+

Naive equilibrium analysis as in Econ 101 won’t teach you a thing; the markets are never in equilbrium and never even approach it.

Oil’s an interesting market.

— it has exchanges. In most markets, the seller is a price-setter and the buyer is a price-taker — buyers respond quickly to price, changing demand, while sellers respond slowly to changed demand, changing price slowly. In a smaller group of markets, the buyer is a price-setter and the seller is a price-taker — sellers respond quickly to price, changing supply, while buyers respond slowly to changed supply, changing price slowly. In an exchange, neither side sets the price. This means that price adjusts fast always, making for high fluctuations.

— it is extremely slow to increase supply. Oil exploration takes years.

— it is extremely slow to *decrease* supply. You don’t want to turn off the oil pumps and let the machinery freeze up.

— it is extremely slow to decrease *demand*. People have to replace their gas-guzzlers with alternatives, which takes years.

— it is relatively fast to increase demand.

Now, the basics:

Supply responds to price, but supply is only brought on line if the price is *expected* to exceed production cost of new production. Supply is only reduced if the price is *expected* to cause unending losses.

Demand responds to price, and again it responds mostly to *expected* price. Demand is mainly driven by the price and quality of *alternatives* (substitutes) relative to the price of oil; so a shift of the oil price past a critical alternative price causes (eventually and slowly) a complete shift in the economy, as people and firms retool. (This happened when firms retooled from other fuels to oil; it happened again when they retooled from oil to gas; it happened when people started driving gasoline cars instead of using horses, electric cars, or steam cars; it is happening as people replace them with electric cars.)

If you’re trying to use supply and demand to understand the oil price, naive equilbrium theory is no good — the key is to understand the actual reactions to each shock, and *how long they take to propagate*. How long it takes from the crash in the oil price before the frackers shut in all their wells. How long it takes from the high point in the oil price before companies manage to mass-produce electric cars which are price-competitive with gasoline cars (it’s mostly a matter of economies of scale — the electricity is already cheaper than the gasoline at $20/bbl oil and 14 cent/kwh electricity).

Great posts OFM and Nathanael!

Indeed the multiplicity of lags and delays in responses, together with the mind-numbing complexity of semi-independent market places, including direct sales from producer to refinery, sales from governments to other end-user states via private contracts of variable duration and price, production and sales from the big fuel companies to their service station chains where they set the price on the sign at the gate to reflect the public impression of the price of benchmark crudes regardless of their internal costs etc etc all the way down the rabbit hole…

The overall complexity of the markets (free and otherwise) and the timing and extent of their responses to publicised price data which may have nothing to do with their own cost of production or processing makes the idea of obtaining useful predictive outputs from a simple four variable model seem (at the risk of being unkind) somewhat naive.

Schinzy, your model is not that flash at ‘predicting’ the past is it, as there are unexplained divergences of a scale which makes the tool unhelpful as a predictor even of past actual scenarios.

And what is the ‘price’ anyway? How much oil actually gets traded at the price of Brent or WTI?

Your effort is commendable (as others have said you would be rich if you got it working reliably) but I have done enough modelling to know the dangers of getting the right answer for the wrong reasons or of re-aggregating a highly disagregated reality in an attempt to make some sense of it.

The real world of commodity trading generally and of key resources like energy in particular is subject to so many pushes and pulls, that us folk at the end of the pipe can only be grateful that there is still something dripping out at our end!

How much of the current price war is driven by the fear in several governments that if they stop throwing bread to the masses their own heads will be stuck on the railings tomorrow? How does your model reflect those sad realities?

Predicting the price tomorrow? Frankly I would follow OFMac’s educated guesses ahead of your:

lm(formula = log(log(Price71)) ~ Quantity71 + DQuantity71 + DDQuantity)

Do I have any positive contribution to make to your hard work? Sorry, No. Its all too hard for me to get a function around with any chance of sensible real meaning. I compliment you on the way your equations seem to give some insights into the way your variables interact. That is useful.

But good luck, anyway!

One of the problems with using historical models to make predictions is that when disruptive technology comes along this type of model may have errors that are hard to adjust for.

Many believe that Light Tight Oil (LTO, also known incorrectly as shale oil), is only a high priced flash in the pan, that will quickly die. Over the past few years both of these assumptions are proven to be quite wrong.

The EIA on Sept 24, 2015 came out with an updated report under “Analyisis & Projections” called “World Shale Oil Assessments”

This analysis places the U.S. LTO resource potential at 78.2 billion barrels. A detailed breakdown can be seen by clicking on “US” in the

table.

The U.S. analysis is a bottoms up analysis taking (1) the area of potential, (2) well spacing, (3) EUR per well to determine what they call the “Technically Recoverable Resource ” (TRR). When doing a Peak Oil Analysis, these is what the ultimate recoverable is.

It should be noted that EURs can change quite a bit so for example for the Bakken they sub divided it into 41 subregions.

The other piece of the disruptive technology is the cost of production. Over the last few years this has come down much more than many believe. The lower costs can be seen in two ways.

The first place is in the EIAs monthly “Productivity Report” which shows that rig production in barrels per day per month, for the last five years, in the Bakken has gone from 100 to 230, and in the Eagle Ford it has gone from 100 to 300. This equates to a major reduction in costs.

The second way lower costs can be seen is what ROR the oil and gas companies are expecting. For example EOG is estimating that their ATROR for five different plays is 30% at a WTI price of $40. Just a few years ago the threshold price of LTO was throught to be $80 to $100.

Since the EIA analysis is based on current production, changes in EURs and future areas of derisked production are not included. For example the Permian, and Three Forks have zones that have little production history and are not included. Also plays that are just opening up, like the Unita, which has 1.2 trillion barrels of OOIP, is just now seeing horizontal wells with good results being drilled in zones that has never see this type of drilling.

The beautiful part of this model is that it does not take extraction cost into account. Whatever the cost of extraction, based on what is extracted, this model gives you the price.

With respect to LTO extraction, in my opinion the big revolution is that because of high initial flow rates and short investment cycles, LTO extraction has introduced boom bust economics to oil extraction. In terms of the price model LTO extraction could bring on a faster decline in oil extraction by scaring investors away from longer cycle extraction projects such as deep water. Can LTO extraction replace all other types of extraction? If extraction levels decrease, the model says the base price will decrease as well. This will accelerate the contraction phase.

The beautiful part of this model is that it does not take into account

extraction costs at all. Whatever the technology or extraction

cost, as a function of the quantity extracted, this model will

give you the price.

With respect ot LTO, in my opinion, the big revolution is that

because of high initial flow rates and short investment cycles,

LTO extraction introduced boom bust economics to the oil

extraction industry. This could bring on a faster sharper

contraction phase by scaring investors away from longer cycle

investments such as deep water. The model says that if

extraction rates fall, so does the base price. I do not believe

LTO can replace all other forms of extraction. If these forms of

extraction produce less due to decreased investment, the

contraction phase will be precipitated.The beautiful part of this model is that it does not take into account

extraction costs at all. Whatever the technology or extraction

cost, as a function of the quantity extracted, this model will

give you the price.

With respect ot LTO, in my opinion, the big revolution is that

because of high initial flow rates and short investment cycles,

LTO extraction introduced boom bust economics to the oil

extraction industry. This could bring on a faster sharper

contraction phase by scaring investors away from longer cycle

investments such as deep water. The model says that if

extraction rates fall, so does the base price. I do not believe

LTO can replace all other forms of extraction. If these forms of

extraction produce less due to decreased investment, the

contraction phase will be precipitated.

I believe that what has happened in this cycle in the oil market is that an increase in U.S. production from LTO of one million barrels a day for four years caused the S/D balance to shift to over supply.

The difference in this cycle, making it longer and deeper than expected is the Saudi change in response.

From 1999 to 2013, each time there was a dip in price the Saudis cut their production by an average of 1.5 million barrels a day. This happened five times.

In 2013 as prices started down they started to cut production, but then something changed. As prices went lower instead of cutting production they increased it by over one million a day.

Was it to punish Iran or Russia. I don’t think so. I believe it was to slow down the runaway freight train of US LTO production. I believe that they understand the potential of this new resource to change the oil market.

The Saudis recongnized that LTO production growth was a product of cheap and plentiful financing. They set out to pop the bubble and they have. The bankruptcies are piling up. LTO economics are overstated. The wells will not produce anything close to what the companies claim. LTO could come back if the banks and debt investors are dumb enough to lend to the companies. My guess is that any debt financing will have much higher costs and tighter covenants. Borrowing for 10 years unsecured at 4-5% probably won’t be coming back.

I believe that $100 plus oil prices was the real fuel that fed the growth in LTO production. At that price a very good ROR was made and fund were provided.

Over the past couple of years very high gains were made in productivity, which can be seen in the EIA’s productivity report. The net effect is the breakeven price of LTO has been greatly reduced.

As in every other oil price cycle we have seen funds will come in when oil prices are high enough for a good ROR. I believe that threshold has now dropped to around $45 depending on which play.

The question that needs answering is what was the effect of cheap funding?

The LTO oil boom was the result of companies making a nice return at $100+ oil. At that price range production increased at a rate of one million barrels a day for three years.

If the cost of funding was say 3 to 5% higher what would have been the results?

Companies would still be making money, and they would also be borrowing, but the amount borrowed would have been lower.

At a lower amount of borrowing, production growth would not have been one million per year. One estimate that growth would have been around 750 kbd.

So after three years, U.S. Production would have been 750 kbd lower than it was.

At that growth rate world production would have stayed in balance, prices would have stayed in the $100 range, and the Saudis would not have ramped up production by 1 to 1.5 million a day.

So IMO the net effect of cheap money was to grow production more than the market could use and then crash prices.

In either case, with or without cheap money, the LTO boom would still have happened.

I believe that $100 plus oil prices was the real fuel that fed the growth in LTO production. At that price a very good ROR was made and fund were provided.

It was simply the situation in which Wall Street needed a place to dump money provided by Fed and shale came quite handy.

According to Art Berman, during the 5 year period (2008-2012), Chesapeake, Southwestern, EOG, and Devon spent over 50 billion dollars more than they took in. Such a great profitability.

Most of the companies you talked about are Nat gas production companies. We are talking about LTO.

But Art only talked about what was spent. If you look at LTO what was gotten was in increase in production of about 4 million barrels a day of production. That is a rate of 1,460, 000,000 barrels a year.

That generates sales at $100 oil of $146,000,000,000 per year.

Art Berman talked about what these companies have spent (capex) and what they got (operating cashflow).

During the whole period of the shale boom, shale companies’ capex significantly exceeded their operating cashflows.

That doesn’t mean that all that cash was “burned”. Operating cashflow is what they get from today’s sales. Capex is what is spent on tomorrow’s production. Given that until recently production volumes were rapidly increasing, that partly justified cash overspending.

Not only your calculation is wrong, but it looks like you do not even understand that the hangover for banking industry and seduced by WS propaganda, or way too greedy, or way too stupid investors in shale just started.

Among banks exposed to energy, French Crédit Agricole might have the most difficult “morning after” ( $29.8bn credit exposure to energy).

According to FT investors in energy worldwide lost more than $150bn in bonds, and more than $2tn in equities.

Such losses are not quickly forgotten and some heads already rolled. More to follow especially in pension and mutual funds with such an exposure. Those who survive will be more cautious. Much more…

http://www.ft.com/intl/cms/s/0/d48b1922-eadd-11e5-bb79-2303682345c8.html?siteedition=uk

That means that when oil prices rise, Ponzi financing will not be available like in “good old times”. Even obtaining speculative financing (“evergreen loans”) might be difficult.

Now please answer a simple question: “Where survivors of shale bust find money for “carpet drilling” if and when oil price cross, say, magic level $80 at which shale companies operations can be profitable ?”

They do not have their own funds to finance “carpet drilling”. Everything was done on borrowed money. So at best this might be a “dead cat bounce” followed by price decline that could well wipe the survivors of previous slump.

You need “very high” prices to induce the level of greed at which money will be freely flowing into shale again.

Or may be you think a new generation of oil/energy investors will discount possibilities of the second price crush and “go all in”, repeating the same mistake? that can happen but generally you need at least 5-7 years for forget lessons of the previous crash. After that Ponzi can be played again.

Moreover along with “peak oil” we might have “pick idiots investing in oil/energy” as well. Way too many people were burned. Now they understand that this is a game for big boys and if you can’t buy a tanker of oil, it is extremely stupid to invest your hard earned money in oil futures. In other words the next five-seven years shale industry will have hard times, no matter to what level oil prices recover.

I copied and pasted this comment in at least 15 times before it appeared. I guess that’s why it repeats. The funny part is that it does not include the last paste.

Oil and gas is the biggest industry in the world. There is not a close second. It has gone thru many up and down cycles. The current down cycle is nothing new.

The decline rate of the world’s oil production is estimated to be around 5 million barrels a day. The world needs new production of that much to replace natural production declines. Demand is also on average is increasing by around 1.5 million barrels a day.

The seeds of the next up cycle in oil prices has been planted and watered, as the cuts in cap ex budgets will cause a production short fall with respect to demand. This may happen much sooner than many expect.

As the price goes up the ROR will get better and better money as has always happened money will flow into oil and gas projects.

How does the model explain a 75% fall in the price of oil when the alleged overproduction was at most 3%?

It does not. The model does not use overproduction as a variable.

The best test of a model is to see how well it performs against reality. Figures 3 and 4 do not show a very good correspondence between the proposed model and reality, especially after about 1990. Furthermore, an R-squared around 0.4 is not particularly strong. The majority of variance is not explained by the model. This is a real issue and likely explains why there appears to be weak correspondence between the model and reality–enough of the variance is not being captured for an accurate forecast. You have to work harder and try to bring other variables outside of price and quantity into the model, e.g. a more sophisticated multivariate regression model.

You appear to be aware of this and have spent some time discussing models and over-fitting (i.e. the addition of variables can elevate the possibility of false positives). However, this does not mean that the addition of a few more variables will not help–they could. There are tests for over-fitting that provide some means for helping to assess potential problems with over-fitting. The Akaike Information Criterion (AIC) comes to mind.

The idea that price would be correlated with extraction rates, even over the short term, does not necessarily follow mainly because price could potentially be influenced by many factors including geopolitical ones. I suspect a better model would look at the physical basis of the problem, in other words focus on the extraction process and the operation of an economy thermodynamically. But even in this case the model would likely not be perfect because price may not always reflect the physical reality since price has a human-psychological component.

I see no evidence in this draft to support this statement: “Oil price is strongly correlated to GWP.”? At a minimum, this statement needs a reference.

Of course, this quote from Nicola Tesla is of relevance: “Today’s scientists have substituted mathematics for experiments, and they wander off through equation after equation, and eventually build a structure which has no relation to reality.” Always keep in mind what a model is–an approximation of reality at best. I do applaud your basic approach, but sometimes greater complexity may be needed. It certainly would be prudent to explore a more complex model and see how it works relative to simpler models and also reality.

-best

With the C and C data from the EIA from 1960, R squared is .67. But even with an R squared of .37 compared to other price forecasters I think the model does a great job.

What’s going on is that your model is eliding out (ignoring) a short term dynamic in order to capture the medium-term dynamic.

Short term, high production leads to low prices and low production leads to high prices.

But medium term, high production -> low prices -> higher demand -> higher prices, and low production -> high prices -> lower demand -> lower prices.

The key point here is that the initial-reaction short-term price changes are *not* sticky, but the demand changes are “sticky” and last for years. High demand is due to people buying gas guzzlers which they will keep for 10 years or more. Low demand is due to people ripping out their oil heating and putting in electric heating, which will last for 20 years or more.

This is why your model is working as well as it does.

Tesla’s comment does not apply to this model as it is based on

empirical evidence, and thus reality.

The fit from this model relies on three variables from one

data set. If you can do better, I am very interested.

Two thoughts:

How many variables (including variations and transformations of those variables) did you test? 50 years isn’t really a very large or robust data set. If you tested dozens of variables, then there is a very high chance of simply finding spurious correlations.

2nd, have you tested a very simple model of demand’s impact on price: GDP growth vs price changes? Or an extended set of variations similar to the transformations you tried for production?

I would attempt to build a better model when I am paid to do it, and not before. This kind of stuff should not be given out for free.

I find the R^2 of 0.67 more interesting. An R^2 of 0.37 is rather low, though I suppose if it is better than anything else out there then I can see some rationale for using the approach. The results (Figures 3 and 4) show that the model is having a hard time capturing real price trends, especially after 1990. It makes me wonder if the addition of one more variable–outside of the data you are using–might make a significant improvement. There seems to be some room for a big jump in your R^2 value.

I believe that Tesla’s comments does apply though I understand where you are coming from. All models run into the same problems wether-or-not they are empirically based. You can derive as many equations as you like via statistical methods, but in the end if they are not reflecting reality–the data that reflect what actually happened–then they need to be refined.

Finally, I need to make a correction to my statement: The AIC is useful to evaluate model strength between different models that use maximum likelihood approaches (e.g. Poisson or negative binomial regression). In your case you used a form of linear regression, so a coefficient-of-determination is your main criteria for model strength. Other methods are required to determine over-fitting, and in fact it can take a lot of work, thus the general rule to only include as many variables as you need. I am getting rusty.

Edit: After reading other comments, it seems like others are homing in on reasons for error in the forecast of oil prices, such as changes in the way oil is used in industrial societies. Also, I see that you adjusted price for the change in the value of the dollar over time–this may not be necessary since oil prices themselves are known drivers of inflation (e.g. 1973-74 and 1979-80 oil shocks–at least on price inflation). It might be interesting to see the results without adjusting for the devaluation of the dollar over time. Just a thought.

-best

Using nominal oil prices and a log model from 1902 to 2005 we get the following. The log log model doesn’t work on nominal oil prices less than $1.

To use the model with low prices, it can be altered slightly to do the regression. If there is just one log, you can use the regression:

log(p(t)-p_min+1) = etc

where p_min is the minimum price in the series.

With the log(log) model you have several choices. For example:

log(log(p(t)-p_min+e))

I was able to do a log-log model on nominal oil prices by adjusting the price curve up by $0.4 for all years (40 cents added to the price in every year from 1900 to 2014), then 40 cents is subtracted from the model price.

Regression on 1902 to 2005 has r squared of 0.67. Nominal prices from 1992 to 2015 shown in chart below. This is for those that don’t believe the inflation adjustments. Model price is $278/b in 2015.

Quite interesting. I don’t know how to explain this.

The model above is not correct.

I transformed nominal price incorrectly. When done properly as Schinzy suggested the ln(ln(Price)) should not be less than zero over the range of the regression. Model below is correct for regression on 1902 to 2010 with R squared of 0.93. The 2016 price at 79 Mb/d C+C output is $69/b. Chart below gives the low and high 99% confidence interval for the model (dotted lines.)

You make sense. I did not expect an R squared higher than .4 because I assumed our variables did not account for everything. Einstein said that even if you have a model that explains everything you can observe, you don’t know the model is correct because you can’t look inside nature to see if you are correct. I think the model should be judged by its usefulness.

I am with Nick in that there are many variables left out of the model, that is the nature of the modeling biz. Any model should be interpreted as including in the very name of it the term ” every thing else held the same or equal”.

One pitfall of this model , at least in the context of the short to medium term time frame, is to be found here. It would be good at this point to include the caveat that this statement applies only in the long term to prevent misunderstandings.

“Well financed expensive production (such as fracking) can keep production high to eliminate lower price competition (conventional) in the mistaken belief that lower extraction rates mean higher price ” emphasis.

I don’t think there is a single person who posts here on a fairly frequent basis, with the possible exception of watcher, who will argue that if some oil producing nation, or combination of nations, were to reduce extraction ( which MUST equal production since production IS extraction) say five million barrels a day , that the price of oil would not shoot up substantially and quickly. Even a production drop of just a million barrels a day would soon result in a significant rise in price, unless it is counteracted by a decline in demand due to economic weakness.

In terms of the “very biggest ” picture, it is reasonable to assume that higher production must require higher prices, because the marginal barrels that are produced are high cost barrels. The economies of scale that usually apply in manufacturing or agriculture or retail commerce do not apply in the oil industry, at least not right across the board.

Even in agriculture, the price of a crop must go up if the only way farmers can produce more if it is to bring marginal land into production. Our family farm land is marginal, in terms of climate and topography, compared to Washington state, meaning we need a higher price than Washington state apple growers. We can compete though, because our shipping costs to eastern markets are a lot less.

There seems to be an assumption made by many people that oil production and prices can decline together, and I will not argue that this cannot or will not come to pass.

As production declines, the use of and demand or desire for oil could and might decline even faster than production, due to a weak economy, or to increasing efficiency of the use of oil, or changing lifestyles, or the widespread adoption of electric cars, etc, or any combination of all these factors plus several more.

But while I can easily see this scenario coming to pass, I don’t think it is by any means a water tight scenario.

Production might decline as the result of political, geological, or economic factors FASTER than the overall economy can adapt to using less oil. In my opinion, this is probably a more likely scenario.

There is certainly plenty of oil that will be produced at forty bucks a barrel, for some years to come, enough to run the world economy, IF it declines to the point all the airlines go broke, most people have to give up driving and cars quit selling, people have to give up potato chips for potatoes they cook themselves, etc etc. I really doubt the economy will decline to that point anytime soon, lol.

The end users of oil could and would pay a hundred bucks or more each for let us say ninety percent of current total oil production. How long it might take that price to bring about a recession is an open question of course. It might not even result in a recession, if we were to adapt fast enough. ( Not likely but maybe not impossible. )

The question in my mind is this .

In the short to medium term, how far could oil production decline without the economy seizing up due to a lack of liquid fuel to power our transportation system? In my opinion, the answer is not a whole lot. Four or five percent would play hell with the price of gasoline, plane tickets, truck freight, etc, because the price of liquid fuel is HIGHLY inelastic, at least in the short to medium term.

Does anybody think we can adapt to a low liquid fuel economy or lifestyle in less than a decade or two, without experiencing extreme hardship ?

I am a big believer in the electric automobile, but I really doubt we could get the electric portion of the world automobile fleet up to even ten percent in less than a DECADE.

As Nick and Paulo point out, there are tons of possibilities to be taken into consideration in thinking about the need for and the use of oil in the coming years.

There are TONS of things most people can and will give up, as a matter of necessity if not choice, before they give up driving. I could get by without my cell phone, if it comes down to really needing another five gallons of gasoline a month at ten bucks, or ten gallons at five bucks. I know plenty of people who are supposedly “hard up” who think nothing of paying a buck and a half for ten ounces of sugar water when they stop for gasoline. When they are tired and worn out on payday they are apt to buy take out fast food for dinner. The gasoline retailer is going to win out over the fast food joint. When things get tough, a lot of convenience stores that sell gasoline will close, because their customers will leave off the soft drinks and chips , which bring in more profit than the gasoline itself.

If somebody will finance them, millions and millions of third world farmers who still depend on muscle power will gladly buy a small tractor. Ya only have to feed a tractor when it is actually in use, and that means tractors are infinitely cheaper to use than draft animals, under almost any circumstances, so long as you can get fuel and parts, even at exorbitant prices. This extra demand for oil even at two hundred bucks, meaning eight buck diesel fuel, would be entirely justifiable on rational economic grounds.

In the USA, except for the small portion of us who live where we can get by without a car, we MUST continue to drive, and to drive almost as much as we do today.Most Europeans who drive today are not in a position to give up driving, although a lot of them cut cut back a lot, due to being able to take mass transit at least part of the time.

Only a fool would contend we can cut back sharply on driving , in the short to medium term. Our homes are located too far from our jobs and the places we have to go on a regular basis, and there is nothing much that can be done about it, short term, other than carpooling, and not a hell of a lot in the medium term, meaning the next decade or more.

” ALL MODELS are wrong, but some are useful. ”

I think this one is useful, but my guess is that half the comments will be made by folks who overlook the assumptions, lol.

“Only a fool would contend – – -”

I live on a dead end road. At end of road, some mobile homes peopled by appalachians with 4 kids. Also pa and grandpa and a couple of others, presumably the ones growing weed.

I tend to spend time near the road and see the traffic. At around 4 pm 4 big school busses bring the 4 kids home separately from school to the same door! Each kid all alone. Ditto in morning.

Then, at lunch time, I see maybe 3 of the people go in in their loud junkers and then go back in, all close in time and each all alone.

In bad weather, lots of laments on this or that junker having one or another serious illness, causing compromises to be made, usually missing work.

So, as long-time energy engineer, I think – couldn’t we make some sort of better arrangement that would serve all these folk better and cost less fuel and weed?

GolDangIt! Can’t thinka nuthin’.

Hi Wimbi,

I think the reason you “Can’t thinka nuthin’” is because you have been smelling a little to much of that burning weed. Here is an idea for you to ponder. The kids each get an uber app for their cell phone paid for by the school transportation department. Then uber invests in solar energy and google self driving EV’s. Then the kids could smoke too and from school safely.

Hey XT, think it possible I might have intended a little sarcasm.

Sarcasm? Forbid it Almighty God! Surely no one here is so primitive.

Except maybe XT.

“I refuse to be a member of any club that would accept me as a member”

Sarcasm – “Then the kids could smoke(weed) too and from school safely.”

I know how to play your game. I even gave you a give away line. Surely you know how to play your own game.

Dang it, Wimbi,

Sarcasm aside,

I can’t think a nuthin’ either, at least not anything that will work in the SHORT or NEAR TERM, other than the steel toed boot of necessity connecting hard with the collective backside of society.

Most people are in the habit of living from day to day, paycheck to paycheck, without thinking about the long term, or even next month , and getting them to change their ways is a task that would give pause to a god.

Let’s just be honest and face up to it, most humans are strongly opposed to doing any more thinking that absolutely necessary to survive physically without being hungry or cold for the next few hours or days. That is damned little thinking, in the case of your neighbors and many of mine.

I have lots of neighbors and acquaintances that would be right at home at the end of your road. Some of them are close enough kin that it would embarrass me if I were the sort of guy to give a shit about my social status.

And if it is damned near impossible to get individuals to change their ways, how much harder would it be to get your local gridlocked government to change ITS ways, considering it is composed of people each one mostly interested in protecting his own turf?

For now, the obvious and dirt simple explanation as to why your neighbors and mine and just about all the rest of us yankees of all social classes will continue to drive boils down to this.

Driving allows us to live WHERE we live, the way we WANT to live, the way we can AFFORD to live, a damned sight cheaper than the alternative of moving and changing our ways.

I live in an old but pretty decent farmhouse on a couple of acres in a resort quality area ( I can walk to the boundary of a of national park) in terms of natural beauty, peace and quiet, etc, that I couldn’t rent out for more than six maybe seven hundred bucks. ( My farm is not contiguous to the family home .)

In northern Virginia, my house and grounds would rent for not less than six thousand a month. God only knows what it would go for in some other hot markets, but it would go for well over ten thousand a month in the Silicon Valley.

Getting something comparable any place I could take mass transit, at least any place I have ever lived or visited, including the Big Apple, would cost me three or four or more times more than it would cost me to own and drive a decent new car and live farther out .

Your neighbors can’t AFFORD to move. Most of us can’t afford to move.

Any and all talk about walkable neighborhoods, mass transit, biking, etc is just pure bullshit, in the context of the SHORT TERM, and not much better than bullshit in the middle term out to five or ten years.

Bike lanes, mass transit, etc cannot be expected to come into being in significant quantity any faster, and that is a super optimistic estimate. A few miles worth of mass transit takes YEARS to build. Bike lanes are wonderful, but they aren’t going to sprout like mushrooms in a warm spring rain, barring a miracle.

Your neighbors will give up their cars ONLY when the cost of them rises so high they simply CANNOT pay it any longer.

There will be many tens of millions of old cheap cars around for another couple of decades at the very least. Even ten dollar gasoline in one that gets thirty or more mpg will be cheap, compared to the alternative of doing without that car.

I have an eighty year old neighbor who lived seventy years like every DIME was precious to him. He drove the same pickup truck twenty years, wore his boots until they fell apart, still burns wood to save on electricity, etc.

He eats mostly beans and corn bread.