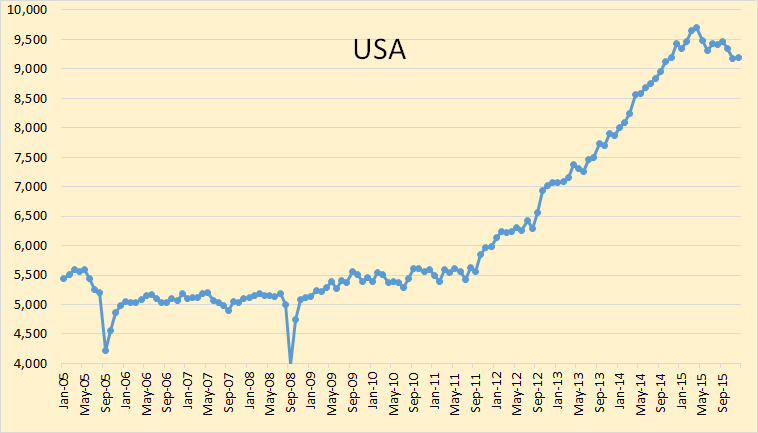

The EIA’s Monthly Energy Review just came out. They have the U.S. production numbers through December along with World, OPEC C+C, Non-OPEC and selected Non-OPEC nations through October. All EIA data is in thousand barrels per day.

Notice: When I use the term “peaked” below, I am referring to the most recent peak, not the all time peak and not necessarily the final peak.

United States C+C production peaked in April at 9,694,000 bpd and has dropped half a million barrels per day by December to 9,191,000 bpd.

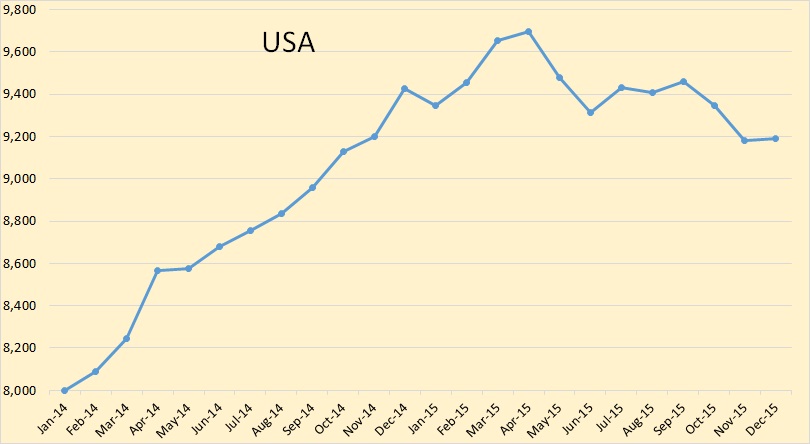

Here is a 2 year chart of US production that gives an amplified look at what is happening. November and December production is now below November 2014 production.

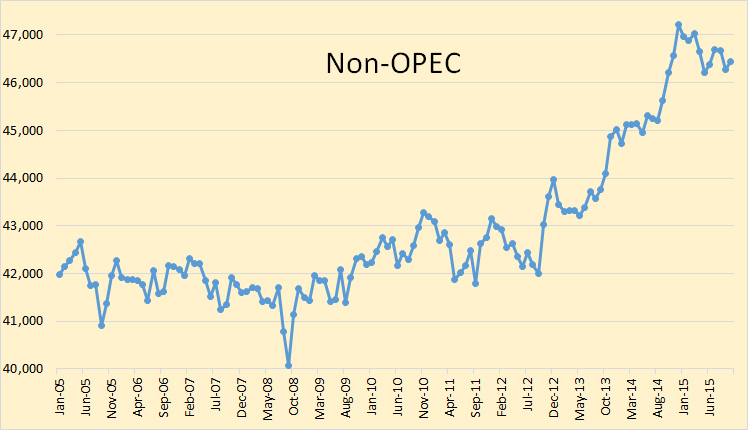

Non-OPEC C+C peaked in December at 47,207,000 bpd and dropped 763,000 bpd to 46,444,000 bpd by October. The above chart, I believe, clearly shows that Non-OPEC production is in a downward trend. There is little doubt that this trend will continue for the next year or so. The question is how far will it drop before an increase in prices brings back enough upstream investment to turn production back around? And how long will that take?

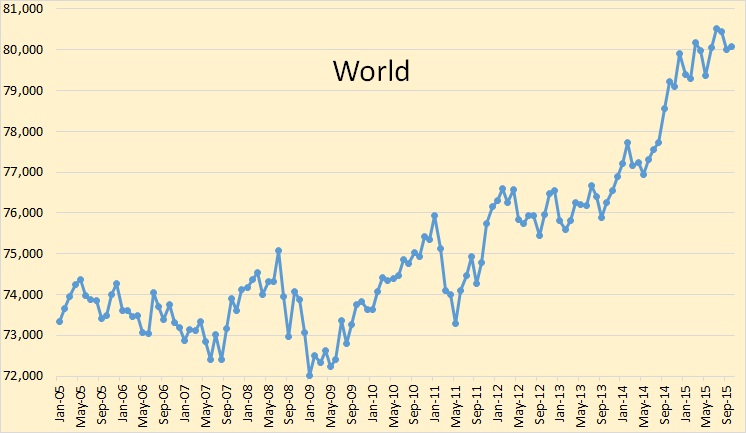

World C+C production peaked in July at 80,531,000 and by October had dropped 461,000 bpd to 80,070,000 bpd.

Russia peaked in January at 10,246,000 bpd and in Octber was down 106,000 bpd to 10,140,000 bpd. Russia appears to be on a plateau, likely before a slow decline that begins in 2016.

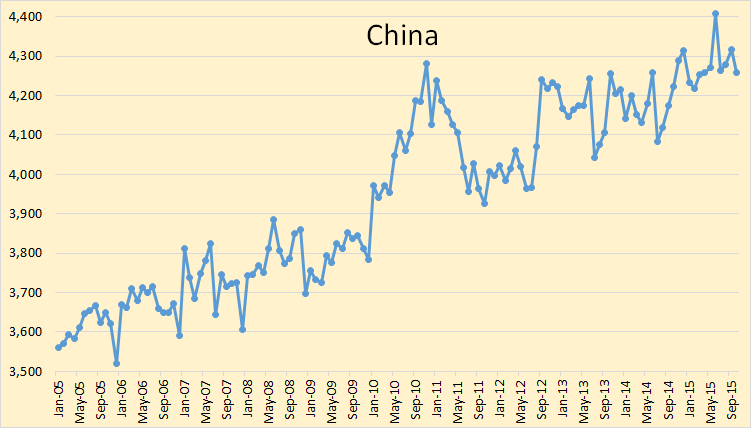

China peaked in June at 4,408,000 bpd and production in October stood at 4,259,000 bpd.

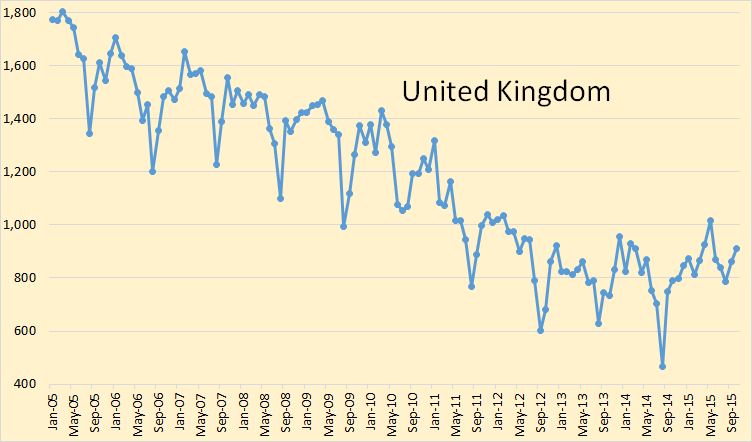

The United Kingdom has been on a plateau of about 800,000 bpd for about three and one half years but in October had production up to 912,000 bpd.

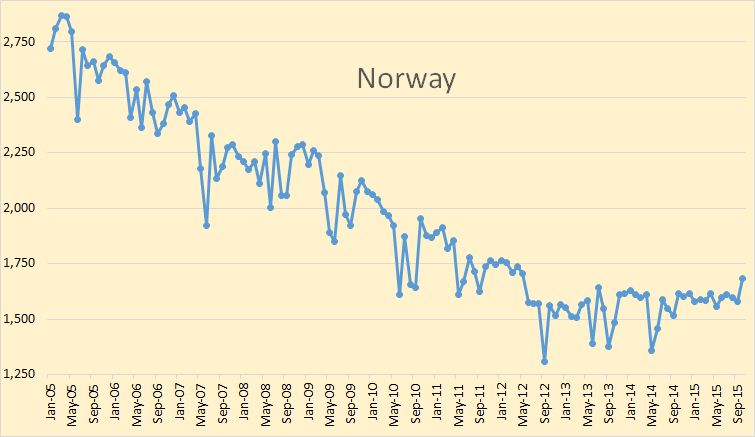

Norway, like the UK, managed to halt its decline about three and one half years ago and has been on a plateau of around 1,600,000 bpd since then. They had a gain of 104,000 bpd in October to 1,685,000 bpd.

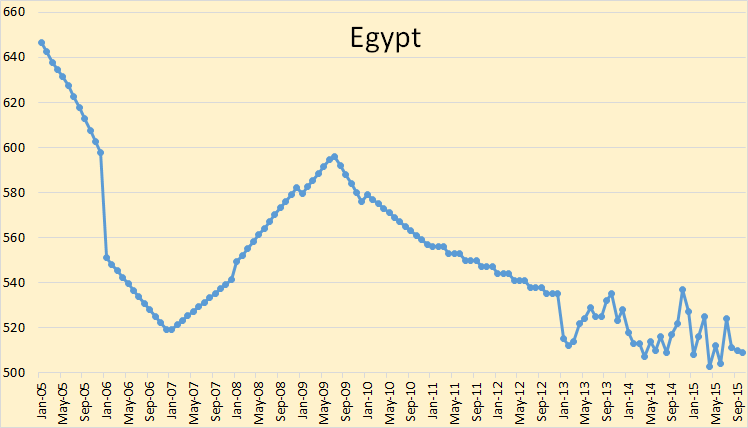

Egypt is in steady decline. In October their C+C production stood at 509,000 bpd.

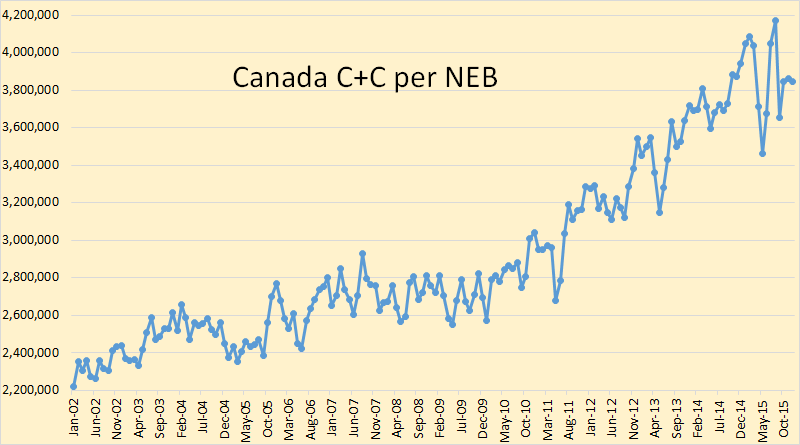

For Canada I am using the data from Canada’s National Energy Board. Their numbers are through December and were upgraded just a couple of days ago. The data below is in barrels per day.

Canadian production peaked in August but things have not gone so well since then. The decline in April, May and June is something that happens almost every year but the decline in September was an anomaly.

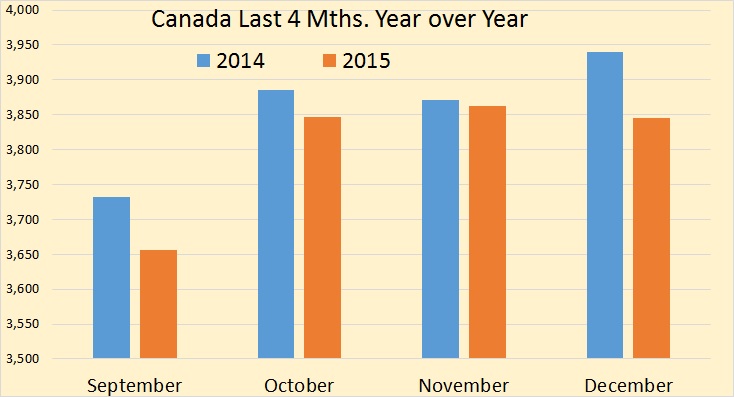

Canada, for the last four months, has declined in year over year production. And since they had record production in January, February and March, that trend will continue for at least for three more months. The data in the chart above is in thousand barrels per day.

Ambrose Evans-Pritchard and Daniel Yergin come to some startling conclusions. Bold mine.

Wealthy predators eye US shale firms

The question is whether even US shale can ever be big enough to compensate for coming shortage of oil as global investment collapses.

“There has been a US$1.8 trillion reduction in spending planned for 2015 to 2020 compared to what was expected in 2014,” said Yergin.

Yet oil demand is still growing briskly. The world economy will need seven million more barrels a day by 2020. Natural depletion on existing fields implies a loss of a further 13 million barrels a day by then.

Adding to the witches’ brew, global spare capacity is at wafer-thin levels – perhaps as low as 1.5 million barrels a day – as the Saudis, Russians and others produce at full tilt.

Yergin said those hoping for a quick rescue from Opec were likely to be disappointed.

I am of the firm opinion that the vast majority of oil production prognosticators are under estimating the effect of natural depletion of existing fields. Even countries that are increasing production, or are on a production plateau, like Saudi Arabia, Iraq, the UAE, Iran, Russia and others, all have serious depletion problems. Failing to account for this decline when you make your prediction will likely cause a serious error.

Gail Tverberg’s blog, Our Finite World, published the following chart last week. But the chart was originally created in 2014 by Alliance Bernstein and may not reflect today’s cost as some costs have dropped in the last year. The term “breakeven cost” refers to the cost to produce a barrel of oil and has nothing to do with a country’s budget.

I do not understand why they thought US conventional was so expensive. However it is interesting to note that Canadian Oil Sands is the most expensive oil in the world.

Nevertheless there is reason to believe that this chart just has production costs way too high. Eyeballing the chart it looks like they have Nigerian cost per barrel at over $60. But this article has a different figure: Oil crash: Nigeria producing at $5 per barrel loss.

LAGOS — As oil prices continue on the downward slide, Nigerian oil firms may be producing at up to $5/barrel loss, as average production costs for independent and marginal field producers is between $30 and $35/barrel.

399 responses to “Is Non-OPEC Beginning Serious Decline?”

Oilsands firms may be forced to cut production as danger of negative bitumen prices looms

The danger for oilsands companies is the price of bitumen falling below the price of diluent, “so your costs exceed your revenues from selling the blend,”

http://business.financialpost.com/news/energy/oilsands-firms-may-be-forced-to-cut-production-as-danger-of-negative-bitumen-prices-looms?__lsa=509c-f4ce

LOL

http://www.thebeerstore.ca/beers/moosehead-lager

The real existential risk is the price of oil falling below the price of a case of Moosehead. 😀

http://bedstuybeer.com/Bed-Stuy-Beer-wholesale-prices.pdf

http://www.wine-searcher.com/merchant/2713?wine_id_F=4796374

Note that the price for a case of Lonestar beer is $23-$26. So, don’t be surprised if WTI falls to that price range (absent a world war and resumption of QEternity^2). 😀

Well, the oil price seems to be creeping back up, so we won’t have to brew/distill our own just yet, but it might be prudent to give it some consideration.

Meow Mix

Part of the decline for Canada in September and October was a Maintenance shutdown at the Hibernia offshore platform.

http://www.cnlopb.ca/pdfs/graph_hib.pdf

Canada might have further reduction this year because of the tragedy at Nexen’s SAGD facility which means about 50,000 bpd is off line indefinitely.

Note also – not shown in the charts – but Mexico has started declining again after a plateau period and Brazil might be falling short of expectations given the economic, corruption and labour problems at PetroBras.

Also Syncrude was totally shut down for due to a pipe burst at the end of August. That took 320 kb/d off line for all of September.

“Russia peaked in January at 10,246,000 bpd and in Octber was down 106,000 bpd to 10,140,000 bpd. Russia appears to be on a plateau, likely before a slow decline that begins in 2016.”

Oh yes, the EIA doesn’t know exactly how much oil is produced in the U.S., but they surely know better than the Russian Energy Ministry what are production volumes in Russia.

As regards the future, I agree that Russia is on a plateau, with potential +/- 1-2% annual fluctuations around 2014-2015 average levels.

Russian crude and condensate production (mb/d)

source: Russian Energy Ministry

Alex, the EIA depends entirely on other sources for its Russian oil production reports. This is very similar to OPEC’s “Secondary Sources”. The EIA and JODI, for the last three years or so, are extremely close with their Russian production numbers. They both report numbers well below what the Russian Oil Minister reports. And they both often report a monthly decline in production when the official Russian numbers report an increase in production.

Is it possible that there is some political bias in those reports by the Russian Oil Minister?

Just asking.

Hi Ron,

Not any more likely than political bias by the EIA or NEB, imo. I think EIA numbers for the US are pretty good, NEB’s numbers for Canada are best and the Russian Energy Ministry numbers for Russia would be best.

Dennis, I do appreciate your input but sometimes you just try way too hard to be fair. 😉 What motive would the EIA or the NEB have for fudging the numbers? And which way would they fudge them if they did?

A perfect example: If you go to OPEC’s MOMR and check the production numbers for each OPEC nation, you will find two different sets of numbers. One set will be from “Secondary Sources” and the other set will be from “Direct Communication”. The direct communication numbers, for several countries, is always off by several hundred barrels per day. For others the two sets of numbers are relatively close. The difference is some have a motive for fudging the numbers, others do not. And also, secondary sources, such as Platts and others, is almost always more accurate than the numbers produced by direct communication with the country itself.

Also Dennis, I must ask, and this is very important, does the EIA or NEB have a reputation of producing propaganda? Does the Russian Government have a reputation of producing propaganda?

Now I do fault the EIA in some of their numbers. But they do not fudge the numbers deliberately. But due to budget restraints or lack of a good data source they sometimes just seem to insert a number. But there is no malicious intent here. They don’t have a good number so they just use the last good number they had… again.

As to those Russian numbers. JODI, when they reduced Russia’s numbers significantly a few years ago, was highly criticized for doing so. (They just brought them into line with what the EIA was already reporting.) They said they had several sources for those numbers and stood by them. Now the JODI numbers and the EIA numbers still vary but not by any significant amount. Prior to that adjustment JODI had been using Russia’s direct communication numbers.

Bottom line, I trust the EIA’s and JODI’s “Secondary Sources” far more than I trust Russia’s “Direct Communication”.

Hi Ron,

You may not have noticed, but the Soviet Union no longer exists. 🙂

AlexS is very sharp, if the Russian Energy ministry was fudging its numbers he would be aware.

I have no evidence that the Russian Energy ministry is fudging any numbers and to assume otherwise is a mistake in my opinion.

I agree the OPEC numbers based on direct communication may be fudged, there is no auditing of OPEC data.

The Russians report in metric tonnes rather than barrels or cubic meters so the output numbers depend on the appropriate average density of the oil.

The difference between US and Russian data may be a matter of how C5 is reported, in the US C5 produced in the field is counted with crude and C5 produced in a natural gas processing plant is considered NGL.

This is a strange distinction unique to the United States. In Canada all pentanes and pentanes plus are grouped together regardless of where they are produced, perhaps Russia does the same.

If so, it is the US EIA which is not accounting for C+C properly rather than the Russians, so I am being both fair and logical if my guess is correct.

I don’t know Russian so I cannot read the Russian Energy Ministry website. Perhaps AlexS can comment on how pentanes( and C5+) from natural gas processing plants in Russia are reported. Are they included in C+C output numbers (similar to the way Canada reports its data)?

Dennis, the difference is far more than just pentanes from natural gas wells. The EIA shows Russian production declining in August, September and October of 2015. Alex’s chart shows Russian production increasing sharply in August, September and October of 2015. There is no way pentanes from natural gas wells could account for that.

When one agency says production is increasing sharply and another says it is declining, then…..??? Well, you tell me. And please don’t tell me it is all caused by C5 from natural gas wells.

And the difference, in October, is about 600,000 barrels per day, up from about 450,000 bpd just a couple of months earlier.

Hi Ron,

It might explain some of the difference, but for the same reason you would trust Canada’s NEB to know Canadian output better than the EIA, I would trust Russia’s Energy Ministry to know Russia’s output better than the EIA.

As in most things the truth is unknown.

but for the same reason you would trust Canada’s NEB to know Canadian output better than the EIA,

Dennis, the EIA uses the NEB data. That’s where they get their Canada data. The EIA Canada data tracks the NEB exactly, but slightly below it. There is something that the NEB is counting but the EIA is not. I have not figured out what that is but any rate the difference is too small to be concerned with. I only use the NEB because they have two months more data, (December), than the EIA, (October).

I would trust Russia’s Energy Ministry to know Russia’s output better than the EIA.

Oh, of course he does. I have never questioned what the Russian Energy Minister knows. I only question what he reports.

Denis, as we discussed I’m researching the inputs for a spreadsheet I’m preparing to estimate a pretty rough forecast.

Based on what I see it could be possible for the USA to return to the previous crude plus condensate peak production, but the main us potential seems to be very light crude and NGL. Since I’m not going to account for NGL I may be a bit off.

The only other long term sources I can see are the Canada and Venezuela heavy oils, the Brazil deep water, Iraq, and some shale production in the Former Soviet Union.

The Tverberg Venezuela costs are understated if the crude is to be produced to recover more than say 6 % recovery factor. Once they develop the fields to have their target 20 % the costs skyrocket because they have to generate steam and add butane to it.

Anyway, I’ll keep on researching and playing around with the spreadsheet. Will let you know what I see in a few weeks.

Fernando,

Thanks. I look forward to it.

Hey Fernando,

Hopefully you’ll share your forecast with the rest of us 🙂

Many posts ago you mentioned you could see the world getting to 100 million barrels per day if we had $200 a barrel oil.

Would love to see you model that scenario to see where that 200 oil is coming from.

On another note, as Ron says, you should try to be one of the 1 billion survivors after overshoot.

Based on Fernando’s long term projections it looks like the Americas are the place to be with Canada (IMO the best spot to be), Venezuela and Brazil having the best long term oil prospects.

Also, USA has the best coal reserves if it gets to CTL.

There will be hard times everywhere, but in Canada you’ll atleast be able to drive to the liquor store and have lots of food to eat.

If the AMOC (Atlantic meridional overturning circulation) continues slowing down, you won’t want your grandchildren to be on the east coast..LOL!

thanks!

Ron,

Is it possible that there is some political bias in those reports by the EIA and JODI?

Just joking.

In fact, I try to avoid conspiracy theories if there are simpler explanations.

In this case a do not see political bias from any side. Rather, there are different definitions and methodologies.

I had several times commented on Russian oil production in the past months, but as you are raising this issue again and again I probably have to set up somewhere a FAQ section.

In brief:

It seems that the EIA and JODI are classifying most of Russia’s gas condensate production as NGLs.

This is because only lease condensate is included by the EIA in C+C output, while most of condensate in Russia is processed at gas and condensate processing plants (GPPs), where acid and sulfur components are removed, lighter hydrocarbons (ethane, propane, butane) are separated, condensate is stabilized and processed. Most of these plants distil petroleum products (gasoline, jet fuel and diesel) directly from condensate, while part of stabilized condensate is supplied to conventional oil refineries, petrochemical plants and for exports. As such, I do not understand why a product which consists of C5+ hydrocarbons and is liquid at standard pressure and temperature is defined as NGLs rather than condensate just because it is treated at gas processing plants. But this is the EIA’s methodology and JODI apparently follows its classification.

IEA has a different definition of condensate and NGLs. Thus, according to JODI, Russian average NGL production in January-November 2015 was 727 kb/d; and according to the EIA it averaged 757 kb/d in January-October. For comparison, the IEA numbers show Russian NGL production at only 340 kb/d in 2015.

The IEA oil production statistics include C+C+NGLs, however in their recent monthly Oil Market Reports (from May 2015) the IEA is also mentioning C+C production for Russia. These numbers are very close to the data provided by the Russian Energy Ministry. Note that the IEA works closely with Russia and they know the situation in Russian energy sector better than the EIA or JODI.

Estimates of Russian petroleum liquids output (mb/d)

The IEA’s C+C numbers (from the text of the Oil Market Report) are roughly the same as Russia’s Energy Ministry’s.

They use the 7.33 barrels/ton ratio for the Russian oil, similarly to several other western sources

JODI data almost perfectly follows the trend of the Energy Ministry’s numbers

We can find the EIA data for Russian petroleum liquids in:

– Short-Term Energy Outlook, January 2016: total liquids production. The numbers for November and December 2015 are forecasts, for earlier months – estimates.

– Monthly Energy Review: crude + lease condensate production. Estimates to October 2015.

– International Energy Statistics [http://www.eia.gov/cfapps/ipdbproject/IEDIndex3.cfm?tid=50&pid=53&aid=1]

Here we can find a detailed breakdown: crude + lease condensate; NGPLs; other liquids (none in the case of Russia);

refinery processing gains and total liquids supply.

C+C numbers are the same as in the Monthly Energy Review;

Total liquids production data is the same as in the STEO.

But all the numbers are only up to June 2015.

I have tried to “model” the EIA numbers for the whole period to December 2015.

We have the EIA forecast for total liquids supply to December;

Refinery processing gains are assumed to remain at 20 kb/d, as in the past 2 years;

NGPL production is assumed at the same levels as in the August-October (755 kb/d)

Then we can calculate the C+C numbers for November and December.

As we can see, up until July the trends in the EIA numbers and Russian official numbers coincide, but from August

they go in opposite directions. I think the EIA is just late to update their estimates, compared with the other agencies.

EIA petroleum liquids estimates for Russia vs. Russian Energy Ministry C+C production data

Alex, I am not a conspiracy theorists either. I do not believe there is any conspiracy concerning Russian oil production. Also, I do understand that there are different definitions of exactly what crude plus condensate consist of.

Alex, I have no problem with any of this shit. What I do have a problem with is this, you wrote:

I had several times commented on Russian oil production in the past months, but as you are raising this issue again and again I probably have to set up somewhere a FAQ section.

I did not raise the issue Alex, you raised the issue! First, in your comment you quoted me:

“Russia peaked in January at 10,246,000 bpd and in Octber was down 106,000 bpd to 10,140,000 bpd. Russia appears to be on a plateau, likely before a slow decline that begins in 2016.”

Then you replied:

Oh yes, the EIA doesn’t know exactly how much oil is produced in the U.S., but they surely know better than the Russian Energy Ministry what are production volumes in Russia.

So obviously Alex, it was you who questioned the difference between what the EIA reports and what the Russian Energy Ministry reports. Nothing, absolutely nothing in my posts even mentions the Russian Energy Minister, or CDU TEK, or anything else reported by Russia. I would have been completely satisfied with completely leaving their estimates out of the picture. And that would have been that had not you brought up the subject.

So please don’t accuse me of “raising this issue again and again” because I did not do that, you did.

And I can promise you, I will not raise the issue in the future either.

Hi Ron,

I believe AlexS has shown fairly conclusively that the EIA data for Russia and that of JODI as well suffer from exactly the problem I brought up.

This has been discussed several times in the comments, you have chosen to ignore it. Note that the difference between the EIA and NEB numbers are also explained by the different way that the EIA and many other nations report pentanes and pentanes plus.

The difference between the EIA and Russian Energy ministry data is that the EIA is reporting crude only for Russia and not C+C, the data from the IEA Monthly Oil Market report shows this rather definitively.

A more accurate data set would use the Russian data in place of the EIA data for Russia for C+C, in my opinion.

Dennis, I did not choose to ignore anything. I did not bring the subject up of the difference between the EIA and the Russian data for Russian production in this thread. Alex did that!

I have no desire to further discuss the difference between the EIA data and the data presented by the Russian Energy Minister. We have beat that dead horse until there is nothing left but a greasy spot on the ground.

For my data and charts I present on this site I will continue to use the EIA, NEB, JODI and the OPEC MOMR. I don’t have access to any other Russian data other than the daily CDU TEK site. But that is a daily input that sometimes skips a week or more with their reporting. I tried tracking it for awhile but it was just too erratic. So I just gave up.

So on this site we have the EIA, JODI, NEB and MOMR. That is it. If that is not enough then I am just really damn sorry. When I report Russian production it will be either the EIA numbers or the JODI numbers. If you don’t choose to believe those numbers then please feel free to find some numbers that you like better.

Hi Ron,

Well if you wanted a better estimate for Russia you could use:

http://minenergo.gov.ru/en/activity/statistic

You would simply substitute the better numbers for Russian output, just as you substitute the NEB data for Canada.

I did this below for Jan 2013 to Oct 2015 as I only have data for Russia back to Jan 2013.

Hi AlexS. It would be nice to have a link to the source of that data. Looking at the discrepancy to other datasets I work with, I would guess it is not reporting exactly the same products. The EIA C+C dataset is pretty restrictive (as it should be), for instance, it only includes fossil products that are stable in liquid state at the surface.

Cheers.

Luís,

The source of data is Russia’s energy ministry’s website:

http://minenergo.gov.ru/en/activity/statistic

The numbers are in tons per months. I am using 7.3 barrels/ton ratio to convert into b/d.

Condensate is included, but not NGLs.

More detailed data by each company and by each subsidiary of large vertically integrated companies is available in the CDU TEK (a Russian analogue of the EIA) website, but it’s not free.

http://www.riatec.ru/en/catalog/operative_data/section.php?SECTION_ID=117

These detailed numbers are republished in a number of Russian oil&gas industry journals (also not free).

Detailed monthly and annual averages in kb/d are also published by Energy Intelligence (paid site)

http://www.energyintel.com/pages/login.aspx?fid=art&DocId=913740

But they are using 7.33 conversion ratio, so their numbers in kb/d are slightly higher than mine.

The notion that any western government, agency or corporation can be trusted with any sort of claim regarding anything Russia-related is absurd. This is especially so in the case of the most strategic commodity on the planet.

Hi AlexS,

If we substitute the Russian Energy Ministry data for the EIA Russian data, and use the NEB data for Canada, we get the following chart. The red dashed line is the centered 12 month moving average.

Interesting that takeovers thus far seem focused on unconventional….Suncor bought COS and talk of shale…can conventional producers be far behind?

Gail’s chart on Canadian costs are off:

They vary all over the map as to capital financing and age of plant.

Syncrude pegs losses at up to $10/barrel as oil prices collapse

Canada’s largest synthetic crude project is not likely to shut down operations, its biggest owner said on Wednesday, even as a company…

Oil sands defaults to increase: Portfolio manager

Canada’s largest synthetic crude project is not likely to shut down operations, its biggest owner said on Wednesday, even as a company presentation showed it is losing about $10 for every barrel it produces.

Syncrude Canada Ltd, a joint venture project in northern Alberta at which mined oil sands bitumen is upgraded into refinery-ready synthetic crude has a break-even production costs of $46 US a barrel, according to a presentation from Siren Fisekci, vice president of investor and corporate relations.

Meanwhile, the cost to produce Syncrude’s fully upgraded oil is even steeper at $50 US a barrel once interest payments, administration, insurance and other costs are added in, according to the presentation at the EnerCom Oil and Gas conference in Denver, Colorado.

http://www.bnn.ca/News/2015/8/20/Top-Canada-oil-sands-project-unlikely-to-close-even-if-its-losing-6-a-barrel.aspx

I have started a website in which I would like to provide an interactive presentation of US shale oil production : shaleprofile.com

It just got launched, and is very basic, but the interactivity may make it interesting to those interested in the Bakken.

Interesting site Enno.

It would great to see charts of production per well over time. My own analysis has shown Bakken per well productivity has been dropping for a good few years. More wells to produce the same amount of oil is not a good sign.

Thank you Andrew.

Note that when you click on the 3rd analysis (well quality over the years), you can change the 4 filters to zoom into the well production over time for small sub groups (e.g. the production profile of wells of a single company in specific counties/fields/formations) . I do aim to include individual wells as well as an analysis in a future update.

Enno, I looked over production for several companies. Interesting to see how they approached 2015 differently. I suspect if all had taken EOG’s approach in the Bakken, prices would not be so low now?

Shallow,

Probably it would have made some impact yes. But they had the cash, they got rich drilling fast, and they had many incentives not to let production drop, unlike actual owners..

Thank you, Enno,

I’ll be a frequent visitor to your website

Meanwhile, here are excerpts from an article in Platts’:

“When North Dakota oil production broke above 1 million b/d for the first time in April 2014, many expected that the 2 million b/d threshold would be breached in relatively short order.

Now, rather than striving for 2 million b/d, state officials are hoping to maintain production above 1 million b/d.

And there are indications that a significant drop in Bakken supply may already be underway.

While Lynn Helms, the state’s top oil regulator, called recent production numbers “quite a surprise” amidst market shifts largely unsupportive of domestic production, he indicated the relative success would be short lived.

While North Dakota supply has remained steady amid falling prices, it’s unclear what has happened since the end of November as prices began their steady dip below $40/b and, eventually, $30/b, a pricing environment where Helms believes the majority of Bakken producers cannot survive.

“We cannot sustain production at sub-$30/b prices,” Helms told reporters following the release of the latest state supply data.

Helms believes that WTI spot prices will need to average roughly $50/b in order for current production to be maintained. If prices return to the $30-$40/b range, production will likely stay above 1 million b/d, but will likely stay just above that level and will fall steadily, by about 10,000 b/d each month, if prices do not climb above $40/b in the near term, Helms said.”

http://blogs.platts.com/2016/01/26/north-dakota-oil-supply-crash/

Thanks Alex,

You are one of the most informed (and unbiased) commenters on this board, and I highly appreciate your feedback.

Currently, with sub-50 rigs drilling in ND, less than 70 wells per month can be drilled. As we have seen no proof so far that wells are significantly better than before, I belief it is highly likely that we are on a long-term trend towards a lower production level in ND (I estimate roughly 900 kbo/d based on 65 wells/m), until prices significantly move up again. It’s a slow process that will play out over 2-3 years, although I expect the biggest impact in 2016. This is only based on currently available info, and this outlook should of course be constantly adjusted with the rapidly changing rig count, oil prices, operating conditions, new well performance and lag times.

A potential major factor may still be how fast DUCs will be depleted, but as of yet there are no signs of that having an impact. I guess that sheer momentum will spread most of its impact out over many months.

Enno

Congratulations and best wishes with your new website.

If the annual (eventual) subscription fee is, say, current WTI, I’d sign up. You put in a lot of time with this stuff and I certainly appreciate the effort.

Re the 2016 DUCs … I just double checked Continental’s 2016 capex projections, released the other day, and they plan on Bakken DUCs INCREASING from current 135 to 195 at end of 2016.

Go figger. Oklahoma DOCs, presently 35, are projected to be 50/at year end.

Lottsa variables and rationals (sp?) with this stuff.

dclonghorn

You are justified, I think, to be skeptical of the high EURs.

All these guys seem to post high to very high EUR numbers.

One example, Continental just projected 1.8MMboe EURs for some of their Oklahoma wells. Outside of numerous Appalachian Basin natgas wells, I’d never seen oil-waited wells even remotely expected to produce that high.

Thanks Coffeeguy, you will be most welcome.

Amazing site. I can’t imagine the amounts of data entered to build it. Thanks for allowing access.

You’re welcome dclonghorn.

Enno, Your site is truly amazing. It allows me to do a little fact checking when I see a producer make a claim that seems doubtful. For instance, CLR has just come out with a press release where they have decided to cut their 2016 drilling budget by about two thirds. They imply that they are being conservative and don’t really have to make the cut now because their Bakken EUR’s are around 850,000 boe. Such BOE would also include some gas volumes, but my understanding is its primarily oil. The well quality over the years button shows that 2011 has the best cumulative curve of any year so far, with about 200,000 bbl cumulative average through 5 years with production down to 20, 428 year (56BOPD) in the last 12 months. It obviously not even in the same ballpark as a 850,000 BOE EUR. Thanks again.

Exactly dclonghorn, and thank you. This is exactly how I was hoping the site will be used for.

And I belief it is even worse than is indicated, because:

– in this data the refracked wells are still included

– as Ciaran has shown in his projections, the cash flow is starting to become negative (with oil around $60, and other reasonable assumptions) at about 12 years on production or so, for the average well.

I understand there was some Canadian production that was interrupted by massive forest fires in western Canada during spring 2015. Perhaps that played a role in the Canadian decreases at that time. I believe Cenovus Foster Creek was evacuated, as was probably other area operators like CNRL.

I saw Gail’s chart on her site and qdoubted the numbers there. Perhaps she is including Alaska and Gulf in the column “US Conventional”.

Several years ago, on the Oil Drum some folks were doing very detailed analyses of KSA fields, particularly Ghawar. Is anyone looking at Ghawar these days or was all of that data a one time thing. What was said at the time, and I think is still true, is that if that field ever falters there will be panic everywhere.

Okay, it is not Gail’s chart. The chart was originally created in 2014 by Alliance Bernstein and may not reflect today’s cost as some costs have dropped in the last year. I clearly stated that in the text of my post.

Yes, the chart is wrong. That was my point in posting it. Costs have come down, in some cases rather dramatically. I would estimate at approximately half those reflected in the chart. But that is just a wild ass guess.

You would think that KSA would be concerned about getting every dime out of dwindling Ghawar…only way to do that is to collaborate with Russia and Iraq on cuts. Iran will need time to ramp up and cannot be expected to hold back…but may have a hard time finding money for infrastructure.

KSA looking to do a deal with Russia smells like capitulation.

That chart with Canadian oil sands cost at over $100 is way off.

One of, if not, the biggest players here is Suncor. As of Q3 2015, their operating cost per barrel is $27.

(source:http://www.suncor.com/pdf/2015-Q3_Suncor_QuarterlyReport_English.pdf)

Oil sands operations have been steadily decreasing their costs, and they still have room for further improvements.

But to be fair, the above example is only operating cost and doesn’t look at capital expenditure.

For that let’s look at Fort Hills – this is the major project currently under construction. The capital costs, capacity and project life is all publicly available information via google. I have to estimate some numbers, but I’ll try to error on the conservative side.

Total estimated construction cost: $13.5 billion (wow that’s a lot!)

Daily capacity: 180,000 barrels

Annual capacity: 60 million barrels (these plants run 24/7/365, but I rounded down by 5.7M to account for down time)

Estimated life of the project: 50 years

Total barrels produced over it’s life: ~ 3 Billion

Let’s say that oil stays at $70 for the next 50 years just to keep things really simple.

Let’s also say that their operating cost is $30 per barrel and stays there, although that’s probably a bit high.

That leaves $40 profit on every barrel produced (less any transportation costs, exchange rate, etc.)

3 billion barrels x $40 profit = $120 B profit – $13.5 capex = $106.5 BILLION NET PROFIT on this project.

And remember, this is assuming oil stays at only $70!

Canada is going to be a major player going forward. They have the 3rd largest deposit (the largest of any stable first world democratic country). One of the worlds largest oil companies is very bullish on Canada (http://business.financialpost.com/news/energy/exxon-mobil-corps-defiant-outlook-predicts-canadian-and-venezuelan-oilsands-output-will-quadruple-over-next-24-years?__lsa=47f4-3f1a)

“He said shale companies had put up a much tougher fight than expected and were only now succumbing to the violence of the oil price crash, 15 months after Saudi Arabia and the Gulf states began to flood the global market to flush out rivals.”

With regards to the above, this is BS. Saudi Arabia didn’t flood the market, the US did. Saudi Arabia just maintained production. So many media commentators fail to understand this. Look at the data.

And Saudi net exports (total petroleum liquids + other liquids) fell from 9.5 million bpd in 2005 to 8.4 million bpd in 2014 (EIA data except for 2014 BP consumption data).

Yergin is clearly a shill for shale. He’s smart enough to know when what he is saying is wrong.

Fair enough, but just what is he saying that is wrong? You failed to point that out. Please do.

Ron,

As per Andrews statement and quote of Yergin from above comment.

“Saudi Arabia didn’t flood the market, the US did. Saudi Arabia just maintained production.”

I feel D Yergin wishes to construe the information so as to paint US LTO as a victim of ‘violent’ Saudi market maneuvers. His choice of words is clear. He does not wish to inform. He wishes to unfurl moral exhortations and to sell stories to hopefull investors i.e. The valiant US LTO is under attack from violent Saudis. But not to worry. We shall over come.

As Jeff points out, Saudi exports are decreasing.

He’s a shill. He’s pumping up the investors.That’s my take on him anyway.

For what it’s worth; I think KSA knows they’re peaking. They saw it coming. This price plunge is a psychological operation, so to speak, to strike fear into any future investors who might wish to invest in KSAs competitors.

While it is true that I am a Hard-Crash Peak Oil Doomer I find his 13 million barrels a day decrease from existing production by 2020 a little rich. If KSA, Iraq and a few others (Brazil, Venezuela?) fall off a cliff, and I’m not ruling that out entirely, then yes, perhaps.

Really now? I think you are being overly dramatic. I believe Yergin is just telling it like it is, or like he thinks it is anyway. He may have it wrong but if he does it is just because he is mistaken. I do not attribute any malicious intent in his prognostications.

If you notice the quotation marks in the article you should notice that the 13 million barrel per day decline is not his projection but that of Ambrose Evans-Pritchard. And I think it is spot on. Hell, it could be even more, closer to 15 million barrels per day by the end of 2010 anyway.

Perhaps I am overly dramatic. Yes, I’m certain I am. Yergin just seems suspicious to me. Thanks for clarifying the source of the 13 million prediction.

Minus 15000000 by the end of 2020!

Buckle your chin straps!!

Ron, Jimmy,

I share the suspicions about Yergin as he has a strong agenda to support shale. The big disadvantage of shale is the high decline rate which is at least 5 times higher than conventional and the low economics of scale (production per well) which is 100 times lower than wells in Saudi-Arabia. It is also nonsense to buy assets from shale as the assets (producing wells) of shale companies become close to worthless over a very short time span due to the high decline rate of existing wells. The Quicksilver bankruptcy has shown that investors just got 12 cents on the invested dollar. So, the challenge for shale is to find enough dumb money, which is ready to loose everything all over again. This is the only way how shale can maintain its production level. However, the recent huge collapse of the bond market for shale companies shows that investors are smarter than many believe.

Whether it is malicious or not, Yergin is terrible on shale. The graph is quite right and Yergin is wrong – it is shale’s overproduction (due to capital misallocation by Wall Street thanks to zero interest rates) that has caused the supply overshoot.

Yergin is also wrong about ‘resilience’ – he’s one of the main cheerleaders for the ‘technological innovation’ meme. Never mind that the data shows that they are just accelerating production (and even Harold Hamm has said this recently, though it passed mostly without comment in the media). Never mind that shale cos lost money at $100. Never mind that the reason North Dakota production grew in Oct and Nov 15 was that WLL and CLR opened the chokes on their old wells, proving their desperation for cashflow.

He could just be wrong on this, but the thing that makes me suspect an agenda is that he is one of those people along with Ed Morse of Citi (Citi has some shale bonds on its books) who calls it a ‘swing producer’. I mean, even Wikipedia knows that a swing producer is low cost and produces at will. Art Berman has conclusively refuted this nonsense elsewhere.

This is a guy that won a Pulitzer writing about oil and he apparently doesn’t even know the basic definitions of his trade? Doesn’t seem likely – so adds some weight to the idea he might be purposefully talking it up.

I do find this “Saudi Arabia flooding the market” narrative highly annoying when, according to the graph SA production doesn’t appear to have varied as much as plus or minus a million barrels per day, while the US has increased production almost 6 mbpd and spent a small fortune doing it to boot.

The US has increased oil production by 4.7 mb/d from 2008 average to April 2015.

Saudi Arabia has increased production by 950 kb/d between November 2014 (when OPEC decided not to cut production) and June 2015.

It is clear that LTO was a game-changer for the global oil market, but Saudi Arabian production undoubtedly contributed to the oil glut in 2015.

That said, the US and Saudi production have been on decline since May and July 2015, respectively

Hi AlexS,

If we add US and Canadian production increases from mid 2008 to May 2015 (using centered 12 month averages), it is about a 5.7 Mb/d increase, the World increase in C+C (using EIA data) was about 6 Mb/d, so only 300 kb/d came from the rest of the World. This estimate would be a little different if we used Russian and Canadian data, but I haven’t done that calculation.

Dennis,

From 2005 to 2014, all of the growth in global C+C output came from North American unconventional sources: LTO and oil sands.

Apparently, in 2015 the contribution of conventionals was bigger thanks mainly to additional supply from Iraq and Saudi Arabia and slower growth in LTO and oil sands

Alex – nice chart.

What’s the data source(s)?

sunnnv,

EIA Annual Energy Outlook 2015;

EIA International Energy Statistics;

Canadian Association of Petroleum Producers. Statistical Handbook for Canada’s Upstream Petroleum Industry

I posted this some months ago along with the graph (included below).

I am dying to see how high the oil price rebounds.

The chart is dated November 2014 and is based on data collected several months before that.

Since then, most of those countries have cut their budget spending and some of them have devalued local currencies, which has significantly reduced the oil price needed to balance the budget.

It is clear however that at $30, $40 and $50 all of them run fiscal deficits.

Thanks for the clarification, AlexS. Indeed, it is imagined they have.

My prediction, $65 average price over the next 12 months, doesn’t look like crazy if we look at that chart.

Hi Fernando,

You have made that prediction twice, so I am assuming you are serious.

One big strike against that forecast is I agree (and I usually miss badly on oil price forecasts). For example last year around this time I claimed that oil would be about $75/b or higher by Jan 2016, so I am now being a little more conservative and suggesting $65/b by Dec 2016 ($65/b for the year might be unlikely). The simple scenario below would need oil prices to rise to $96/b for the Dec 2016 average price, just to reach a $63/b 2016 average oil price. So for me $52/b for the 2016 average price and $74/b by December 2016 (average price) seems more reasonable. In the chart below I show the higher ($63/b average 2016 oil price) scenario.

You take ~$30 what it is and ~$100 what it was per barrel and you average those two to get ~$65 what it will be.

Hi Caelan,

Yes that’s right, I just don’t think $100/b in Dec 2016 is very realistic, but I am probably wrong again. Fernando knows the oil industry, I do not.

I am being a little facetious of course, but not too much.

“I am dying to see how high the oil price rebounds.”

Caelan, please don’t…you won’t be able to see…

Joking, of course.

Be well,

Petro

Well then I’ll leave it to you and you can tell me how high it went once you, yourself, cross the threshold.

Anyway, I might still be around for Fernando’s $65/b year-average forecast.

But for some other things, I think hell will have to freeze over first.

There is a ,000 missing on the World Chart

It is missing from all the charts. The data is in thousand barrels per day. I thought that was a given. At any rate I have made that clear in the text of the post.

Typo ? “World C+C production peaked in July at 80,531,000 and by October had dropped 461,000 bpd to 80,070 bpd.”

Hi Robert Wilson,

Thanks, I noticed that as well and have e-mailed Ron, he will correct it when he gets a chance. The 80,070 bpd for World C+C in Oct 2015 clearly is missing three zeroes and should be 80,070,000 bpd.

Here is a link to an indepth analysis of the Venezuelan oil industry.

http://www.eia.gov/beta/international/analysis.cfm?iso=VEN

It will take a while to read it, but worth it.

Transparency International has Venezuela down as the most corrupt country in the western hemisphere, and one of the worst in the world.

I doubt the Maduro regime is going to be able to keep the oil flowing much longer, assuming Maduro and company remain in power.

It is probably not possible to make even a good educated guess as to how long it will be before Venezuela settles down, and capital and people to restore the oil industry begin to flow into the country again, but it seems doubtful to me that Venezuela can even hold production more or less steady much longer. And getting production up again might take years.

That info is a bit outdated in part, some of it is wrong. For example, Total wasn’t forcibly taken over. Total’s Jusepin block was expropriated, because Total didn’t wish to take a 40. % interest in the proposed joint venture, they wanted 49 %. Pdvsa was adamant and simply nationalized.

Total kept the 40 % in the heavy oil block, and is one of the most supine foreign partners.

Look at this blog post about the number of ships coming into Venezuela’s ports

http://devilexcrement.com/2016/01/28/introducing-the-puerto-cabello-non-baltic-index-pcni/

Hess Corp. announced Fourth quarter 2015 production today.

BOEPD increased from 362K in Q4 2014 to 368K in 2015.

HOWEVER.

All of the below are in terms of BOEPD for Q4, 2014 and 2015

Crude oil in 2014 was 241K. In 2015 DROPPED to 233K.

Natural gas liquids was 32K in 2014. INCREASED to 40K in 2015.

Natural gas was 89K in 2014, INCREASED to 95K in 2015

Furthermore, there was a substantial drop in US crude oil production Q3 to Q 4. 152K to 141K. That is a big quarter over quarter drop. Can someone with better math skills than I annualize that one?

I think these numbers should be of particular interest to Jeffrey J. Brown, who is constantly pilloried by the CC crowd, as he has dubbed them.

Further, there are many others here who I am sure will take note of the increasing GOR (Rune, are you still out there?)

I further note that the product mix for Continental Resources was 70% oil 30 gas and NGLs for 2014. It went 65/35 in 2015 and company guidance for 2016 is 60/40.

Will be interesting to see what other companies report in the next 30 or so days.

“The world economy will need seven million more barrels a day by 2020. Natural depletion on existing fields implies a loss of a further 13 million barrels a day by then.”

The current price crisis has just made sure we do not get those extra 20 million barrels in 5 years. The shit is going to hit the fan real soon. We will not make it to 2020 without a global crisis that will make the Great Financial Crisis of 2008 look like a picnic. I just can’t see any way renewable energies can prevent it.

“I just can’t see any way renewable energies can prevent it.”

Nor do I, although I am strongly in favor of building out renewables as fast as we can.

Anybody who owns oil in the ground imo stands an excellent chance of getting a VERY high price for it within a decade, if he can hold on to it that long.

I also favor a serious build up of renewables, but in a non-centralized way. And we should build installations capable of lasting for a very long time with very little maintenance and independently from the grid. People should understand that these are palliative measures, as there is no cure for the energy tsunami that is about to hit us in a short time.

We might see high oil prices temporarily, but as our economy gets destroyed by imbalances, our capacity to pay for goods or resources is going to be seriously compromised.

Couldn’t agree more, sadly.

I agree with you, but I sure wish I had photovoltaics all over my roof when things get ugly.

Unfortunately for me, I get quite a big dose of afternoon shade from a big forested hillside.

Build a Barn or a PV Carport.

If one is sufficiently convinced that collapse is immanent, one strategy might be to sign a PPA with SolarCity or Vivant or similar. Your roof, their panels, add on some storage and a grid cut off. When the global economy collapses, unlikely they will come around to pick up their hardware. Free power!

Doesn’t help with the mountain of shade problem though.

Javier…wow!

…did I read you before more “optimistically” than I should have, or did you recently have an “epiphany”?!

In any event…”welcome” to reality.

Be well,

Petro

Hi Petro,

I have been of this opinion regarding resources for a very long time, but I became conscious about the immediacy of the approaching energy tsunami due to Peak Oil in September 2014, when the oil price crisis started to develop and I saw the painting on the wall. At that time I was walking the Camino de Santiago, 750 km by foot in less than a month on my own. I had plenty of time to think things thoroughly all the way to the damning inevitable conclusion. It was fitting that I ended the trip at the arches of the Portal of Glory of Santiago’s cathedral were the apocalypse and the last judgement are represented.

I am very optimistic about the climate, and deeply concerned about the ecology. We are going to need to rely a lot more on biological resources and they are in quite bad shape.

On the economical and energy issues I find that I agree with you almost completely. I think I am quite misunderstood because I don’t buy the climate scaremongering that has become so popular lately and is a hot political issue that blinds a lot of people into partisan postures at both sides, suspending their critical reasoning.

I look forward to your posts, specially when they are not too cryptic 😉

I’d appreciate it more if you could elaborate on your theory Javier. What approaching tsunami? Do you mean surplus energy or a restriction of energy?

Hi Dave,

My view is that Peak Oil has taken place in 2015 and future production is going to be seriously compromised by current oil price crisis. A new global recession within the next 5 years (probably as early as this year) is going to worsen the situation. As a result a feedback will be stablished that will contract the economy and reduce its energy needs, while creating an affordability problem. Our oil usage will decrease, our electricity usage will decrease, the energy transition to renewables will not proceed adequately, and our civilization will start a simplification process that will be extremely painful. The cheap plentiful oil that we are currently enjoying is equivalent to the sea retreating before a tsunami. It makes people feel safer and advance in the sea while they should be running to a more elevated position.

Well said Javier, and I fully concur.

“will start a simplification process that will be extremely painful.”

10 words that say 7 billion things.

Hi Javier,

Electricity consumption may decrease, due to slower growth and/or greater efficiency, but lower oil supply won’t have that much of an effect because very little electricity is produced with oil.

Oil output will not decrease so quickly that maintenance of the electric power system cannot be continued, the lower oil supply will mostly reduce the oil used for personal transportation, eventually the oil market will adjust so that the oil price reflects the marginal cost of production at whatever level World demand for oil settles at where the supply matches demand.

Whether natural gas and coal can provide enough electricity to power society is unknown. Society may well simplify rapidly , or the demographic transition will allow a slower transition to a simpler lifestyle.

Hi Dennis,

I see you still don’t get Peak Oil, Dennis. It is not only less oil that we get. The entire economy goes into contraction, so it uses less energy, it needs less energy, and that includes less electricity. Obviously this has all type of nasty side effects. This also means no new renewables, something that almost nobody is capable of seeing despite it is taking place just in front of everybody’s eyes.

Spain is not the World.

Spain is above the average of the world and had the protection of being inside the EU.

The world is going to do worse, not better, when the time to reduce its global primary energy consumption arrives.

Hi Javier,

The reason for the decline in primary energy consumption is the decline of Spain’s economy.

For the World, there has been no problem up to 2014, based on data from the Statistical Review of World Energy.

Exactly. Peak Oil is manifested through economic decline. Now you are starting to get it.

Hi Javier,

First not all energy is in the form of oil, so if you mean peak energy, that is not yet upon us.

And you have cause and effect reversed, economic decline is the cause, less energy use the effect. If Spain had the ability to control its own economic policy like the UK, Switzerland, and Norway, it would not have taken so long to recover from the GFC.

Joining the Eurozone was only a good idea when economic times were good.

Hi Javier,

Part of the reason for declining Primary Energy use is declining real GDP, but there has also been a decrease in energy intensity (energy per unit real GDP) especially since 2004. See 2 charts below.

Spain’s Energy intensity has decreased by 17% from 2004 to 2014. Energy is being used more efficiently so that more is being produced with each unit of energy. Energy intensity is MJ of primary energy per GDP in constant 2000 Euros.

Andrew Bacevich: Six National Security Questions Hillary, Donald, Ted, Marco, etc., Don’t Want to Answer and Won’t Even Be Asks

http://www.tomdispatch.com/blog/176095/

== quote ==

Energy Security: Given the availability of abundant oil and natural gas reserves in the Western Hemisphere and the potential future abundance of alternative energy systems, why should the Persian Gulf continue to qualify as a vital U.S. national security interest?

Back in 1980, two factors prompted President Jimmy Carter to announce that the United States viewed the Persian Gulf as worth fighting for. The first was a growing U.S. dependence on foreign oil and a belief that American consumers were guzzling gas at a rate that would rapidly deplete domestic reserves. The second was a concern that, having just invaded Afghanistan, the Soviet Union might next have an appetite for going after those giant gas stations in the Gulf, Iran, or even Saudi Arabia.

Today we know that the Western Hemisphere contains more than ample supplies of oil and natural gas to sustain the American way of life (while also heating up the planet). As for the Soviet Union, it no longer exists — a decade spent chewing on Afghanistan having produced a fatal case of indigestion.

No doubt ensuring U.S. energy security should remain a major priority. Yet in that regard, protecting Canada, Mexico, and Venezuela is far more relevant to the nation’s well-being than protecting Saudi Arabia, Kuwait, and Iraq, while being far easier and cheaper to accomplish. So who will be the first presidential candidate to call for abrogating the Carter Doctrine?

Show of hands, please?

Why bother? US Middle East foreign policy is being scripted by the Israel Lobby. The USA is on its way to being a quasi colony.

Funny (but not too bright)

Drilling forecast chopped for 2016 under ‘lower for longer’ price scenario

The report comes at what would normally be the busiest time of the year in the Canadian oilpatch as frozen ground allows heavy equipment access into swampy backcountry leases. However, after an extended break for rig crews at Christmastime and a less than robust winter ramp-up, the rig count has actually been declining.

Hi Ron,

“I am of the firm opinion that the vast majority of oil production prognosticators are under estimating the effect of natural depletion of existing fields. Even countries that are increasing production, or are on a production plateau, like Saudi Arabia, Iraq, the UAE, Iran, Russia and others, all have serious depletion problems. Failing to account for this decline when you make your prediction will likely cause a serious error.”

This is a very important point. Thank you !

Even assuming 5% decline on average that’s additional 5Mb/d that somehow need to be found and then extracted to keep world oil production flat (other things equal). And “oil glut” adherents are salivating non-stop about possible injection of 0.3 Mb/d from Iran in mid 2016. We are probably slowly approaching a very interesting times, when “peak oil” will show its ugly face again and this time without any compensating factors like the US shale boom.

But there is an additional important factor: now after learning the current lesson all oil producing counties will double or triple efforts to create own refineries and chemical plans that use oil as an input. That will eventually take some oil from world market. http://abarrelfull.wikidot.com/refinery-projects-to-be-completed-in-2016

– Saudis are already doing that (http://www.wsj.com/articles/new-mideast-oil-refineries-could-stir-up-fuel-market-dynamics-1423431483 )

– Iran probably will be next to Saudis in the level of investments in refining facilities. Talks have been held so far with Japanese and Korean firms to invest in Iran’s renovation and improvement of oil processing facilities. Isfahan and Bandar Abbas refineries will get $1.2 billion each to upgrade and enhance products.

Managing director of National Iranian Oil Refining and Distribution Co. (NIORDC), stated that despite the declining oil price, the construction of oil and condensate refineries in Iran will not come to a halt … (http://www.iranoilgas.com/news/details?id=15328&title=Iran+will+not+halt+building+refineries+). Iran & Spain also plan joint oil refinery at Gibraltar (http://theiranproject.com/blog/2016/01/19/iran-spain-plan-joint-oil-refinery-at-gibraltar/ )

In Russia Bashneft plans to launch sulfur production line at the Ufa Oil Refinery by 2017. Volgograd Oil Refinery, one of the four major refineries operated by LUKOIL, is undergoing expansion and upgrades to increase its production capacity, while meeting the Russian Government’s recently tightened fuel specifications. Russia Rosneft also plans to increase refining capacity soon. Russia will also built build the first oil refinery in Uganda https://www.rt.com/business/233159-russia-uganda-oil-tender/. Russia is dependent on the West for catalysts, refining equipment and gas turbine parts, meaning refinery modernization needs the access to Western expertise.

– Iraq set a goal of increasing refining capacity to 1.5 million bbl/d. Iraq has plans for four new refineries as well as plans for expanding the existing Daura and Basrah refineries (EIA, http://www.eia.gov/beta/international/analysis.cfm?iso=IRQ)

If we assume about 80 Mb/d for output then 5% decline would be about 4 Mb/d each year.

There will be some continued investment in drilling new wells, an assumption of zero investment in the oil industry is not a good one, so realistically decline might be 2 Mb/d. There are also long term projects that already have huge sunk costs which will go forward even at low oil prices, so decline in 2016 is more likely to be 1 Mb/d than 2 Mb/d. When oil supply becomes short, oil investment will gradually ramp back up and stem any further decline and may eventually increase output by 1 to 3 Mb/d above 2015 average oil output levels.

Three different scenarios are presented below, based on a URR of 3400 Gb (production through 2300) with cumulative output of 2900 Gb by 2100. Note that through Dec 2015, estimated C+C cumulative output is about 1280 Gb, clearly beyond 2015 we do not know future output as it will depend on the world economy and oil prices in the future which are unknown. The low and medium scenarios are consistent with a 2015 peak in oil output and the low scenario has annual decline rates of less than 2% per year through 2100. The high scenario peaks in 2023 at 83 Mb/d and the peak annual decline rate is 2.02% in 2090 and falls to 2% in 2100 and 1.67% in 2150.

Dennis,

“There will be some continued investment in drilling new wells, an assumption of zero investment in the oil industry is not a good one, so realistically decline might be 2 Mb/d. There are also long term projects that already have huge sunk costs which will go forward even at low oil prices, so decline in 2016 is more likely to be 1 Mb/d than 2 Mb/d.”

I agree. Actually the decline of production might be even smaller due to “Great Condensate Con” (GCC). But my point is that the reduction of capex now create qualitatively new environment: “un-creative destruction” environment for “raw” oil exports so to speak.

With money becoming tight for oil industry (at current oil price level) and redirection of capex on creation of new refineries and chemical plants as well as increased domestic consumption in Asia, I think that the decline in oil exports (not production, but exports) in 2016 will be larger then the decline in oil production and larger then EIA forecast. That’s about it, as for my forecasting capabilities 😉

In view of this effect there a secondary phenomena that can happen: rumpling up investment in case oil prices became “more normal” might well occur with the usual lag of around 18 months and exports remain declining for a longer period then production, while the demand for transportation and internal consumption by chemical industries in oil producing countries and Asia stimulated by low oil prices will continue to increase continually.

So with an appropriate trigger event during the those hypothetical 18 months there can be an oil price spike. Quite violent price spike because the system a whole (aka neoliberal economy) is not stable and move of oil prices up might well be amplified by Wall Street in the same manner as the current move down.

In other words, certain preconditions now were created for an oil price spike far above usual “fair” $70-$80 level and may be for setting a new record. Whether it materialize remains to be seen.

The GCC is a nothing burger like the ELM.

I am not convinced that the oil exporters will increase their consumption a lot as their economies will be hurt by lower oil prices, less GDP growth will result in less oil consumption growth. So the decline in net exports will not change markedly from what it has been since 2005, with the possible exception of Canada and Norway, but this might be offset by increases by Iran and Iraq.

I wouldn’t count on a new build refinery in Gibraltar. That’s Spanish territory stolen by imperialist englishmen. The long term plan is to have two million Limeys move to Andalucia and use them as hostages to help the Gibraltar takeover. Once Gibraltar is dealt with we can expand its territory by adding 200 km2 and converting it into Western Hong Kong. ?

Funny (but not too bright)

Shallow sand,

Looks like about a 28% annualized decline for HES U.S. oil production. Applied to the entire U.S. that will put us under 7 million by next january. Wow!! And HES just reduced capex another 25% I believe.

Kellyb,

I share your view about a decline of shale production. As the year over year growth rate has been an excellent forecaster for the production increase in Texas, it predicts now a massive decline over the next months (see below chart). The recent collapse of the bond market for shale companies certainly will accelerate this trend.

Hi Heinrich,

Dean’s estimates for Texas output are much better than the RRC estimates for the most recent 18 months, the right had side of your chart (after May 2014) should be ignored.

Dennis,

Only time will tell what will be happening over the next months. We are all human beings (including yours truly) and nobody can ignore something in advance. A significant reduction of US supply is necessary for a turnaround in the oil price. Any resistance towards a supply reduction will just increase the pain and damage to producers and the US economy.

Hi Heinrich,

I agree, US output needs to fall.

I also agree it will fall, but not quite as quickly as implied by the Texas RRC chart (the incomplete data gives an inaccurate picture). US output might fall as much as 2 Mb/d from the April 2015 peak, hopefully that will be enough to bring the market back into balance (along with decline in Canada).

I also agree the future is hard to predict, but so far your oil price predictions have been much better than mine. What do you think of recent EIA price predictions (in the Jan 2016 STEO)? Too high, too low, or just right?

Dennis,

EIA oil price predictions have been and are too linear. The oil price will be in my opinion much more volatile than predicted in the STEO2016. Depending on the consequences of the recent bond market crash, it is important to observe the reaction of the companies. BHP has for instance canceled any rig in Fayetteville and Haynesville. I guess the production cuts are coming now very quickly. As soon as the year over year decline (in my above chart) turns around, prices will go up again. I expect huge swings in the oil price as the leverage in the oil market is now enormous (very low net exports are now available). The next price rise could be ferocious and could go up in a very short time period. The oil bull is just eliminating the weak hands until the run starts again. It is a much better strategy to get out of the way now and start investing again later.

Heinrich,

Very interesting. Thank you !

I came to similar conclusions. See http://peakoilbarrel.com/is-non-opec-beginning-serious-decline/#comment-557682

likbez,

What is in my view important is that the time of a stable long term price band width as we have seen it over decades, is over. There is simply too much leverage in the system – on the downside as well as the upside. As consumption of oil influences very much global current account balances – and thus changes capital flows and currencies in a huge way – the system is unstable. The shale boom stabilized somewhat currencies, yet created a massive imbalance in the bond market. So oil will go down as long as something breaks (in this case it is in my view the US high yield bond market) and then it will go up in the other direction again. So, no – we will not get a stable ‘fair price’ of oil of around 60 USD/barrel for a long time. As soon as the market turns around we will shoot up way above 60 USD/barrel. Shale changed the oil market for sure, but it created also volatility.

Increased volatility in price is surely coming; as unsustainable lows [for producers] reduce forward supply and push up price only to hit a weak demand response. Sure we’ve seen some steady demand return in US and continue in China, but given the price signal that looks fairly muted, and will prove, under price stress, to be weak. So I suggest that recent marginal consumption rise will be able to be shed fairly quickly in times of higher price.

Marginal demand in mature economies [and China is maturing fast] looks to be ‘induced’ by supply availability at a lower price; if we are around peak supply, we are clearly around peak demand too. The recent bounce in US consumption [or ‘demand’ if you must] followed lower price, so it isn’t some quantity without which western civilisation will fall. Please note I am talking about recent increases in consumption, not the bulk 90%.

All price action indeed takes place at the margins; of supply and consumption.

Gonna be messy, with many competing theories in MSM. And price volatility is a difficult environment for attracting investment.

Hi PatrickR,

At some point OPEC will realize that the price volatility does not serve them well. Hopefully high cost producers will be cautious about thinking that OPEC will bail them out if they overproduce in the future and a little more discipline will be shown in the oil industry. Lenders might also be a little less willing to lend in the future after they have lost their shirts.

I agree however that volatility is the most likely scenario with oil swinging from $50 to $150 and back in annual cycles(or less), not a great investment climate (as the cycles will be highly irregular).

Hi Kellyb,

The decline rate is steep at first and then moderates, there are a lot of DUCs that are still waiting on completion so a 500 to 700 kb decline over the next 12 months is about all we will see, even if the average oil price remains between $40 and $50 per barrel for 2016 (average price for the year).

If we see the annual decline you suggest, oil prices will not remain under $50/b for the year and the higher oil prices may slow the decline rate as investment will increase at higher oil prices.

I have a couple of questions for any of you’ll oil men:

1. What happens when all these shale wells drilled over the last 6 years decline down to stripper well status? Are they more likely to get sold or recompleted? Do any of you’ll own shale stripper wells?

2. Is the gas decline in a shale well proportional to the oil decline? Say you have a shale well that on IP produced 65% oil and 35% gas. Seven to 10 years later when that well is down to stripper well status will the gas output still be the same proportion or do the oil and gas decline at different rates?

Great Question. Well or deposit a Red Head, Blond or Brunette?

Your second question makes no sense. 65% and 35% proportion of what? Boe?

If you go back to previous Bakken Ronposts, the comments usually have some oil and water production analysis, but not much gas numbers. By the way, the oil/water ratio is a better question, since water disposal expense can define shutdown date.

To clarify let’s say when new the well produces 100 BOE per day 65 bbl oil and 35 boe gas. 65/35. Does the ratio stay relatively steady over the life of the well or does gas decline at a different rate?

Don’t think anyone is focused on it, mostly because until recently the gas was often flared rather than captured.

The contrasting scenario would be the gas well funded by NGL production from it. NGL funds the operation and it will shut down when the NGL revenue can’t fund extraction of the gas.

The gas to oil ratio increases over time (because the crude “boils” in the reservoir and that gas moves better than a de gassed crude). The ability to produce the well will depend on the completion tubulars and other equipment, the reservoir, and prices. I bet they’ll be shut in to repressurize and then get produced 3-4 days a month.

Natural re-pressure recovery or from Pumps ?

so much for if you build it, they will ride….

“For almost a decade, transit ridership has declined across Southern California despite enormous and costly efforts by top transportation officials to entice people out of their cars and onto buses and trains.

The Los Angeles County Metropolitan Transportation Authority, the region’s largest carrier, lost more than 10% of its boardings from 2006 to 2015, a decline that appears to be accelerating. Despite a $9-billion investment in new light rail and subway lines, Metro now has fewer boardings than it did three decades ago, when buses were the county’s only transit option.

Most other agencies fare no better. In Orange County, bus ridership plummeted 30% in the last seven years, while some smaller bus operators across the region have experienced declines approaching 25%. In the last two years alone, a Metro study found that 16 transit providers in Los Angeles County saw average quarterly declines of 4% to 5%.”

http://www.latimes.com/local/california/la-me-ridership-slump-20160127-story.html

To be fair, why would people ride PT when:

– Gas is cheap.

– Negative social stigma and cultural conditioning against PT.

– Advertising and infrastructure encouraging mass car use.

Now if oil prices increased and gas became expensive… Remember, people are inherently lazy so you’d have to make catching a bus easier than driving to work to see a significant shift. In the current price environment the motivation to change is not there. It will happen eventually though when necessity starts to dictate it for more and more people.

The worse times get, the more society goes downhill, the greater the incentive for ( excuse my elitist language and attitude ) respectable people to avoid mass transit.

I am very much a large, somewhat menacing looking white guy, occasionally mistaken for an undercover cop, or out of uniform cop, in times gone by, and it never bothered me much to ride a bus, once in a while, with the riff raff.

But my ( second) wife would rather have walked to work than ride the bus- and she was and remains a life long card carrying liberal democrat, although she is no longer my wife.

Mass transit can help a hell of a lot, and I am in favor of building it, but it is not going to solve our social troubles. The ONLY WAY people such as the members of this forum will live in an urban environment is if it is a wealthy enough environment to keep the REAL lower class out.

I attribute fifty percent of STARBUCKS success to the fact that the riff raff can’t afford to buy anything at Starbuck’s prices, and thus don’t stop in.

Incidentally I KNOW about riff raff due to living in close proximity and am occasionally mistaken for riff raff myself since I am apt to go to town wearing throw away clothes ( saved for one time wear doing a nasty job ) and do not hesitate to use the motherxxxxxx word freely when I run into one of my many acquaintances among the real riff raff. Otoh, I have also been mistaken for a minister when visiting sick friends at a hospital. LOL

Mass transit will be widely adopted in this country only at such a time as it is forced on us by the steel toed boot of necessity in our collective backside.

In the city of Richmond, a small house a long way from a bus line is apt to sell for MORE than one ON a bus line, everything else comparable.

I leave it as homework for the reader to come up with the explanation.

There are extraordinarily powerful forces at work that will in my opinion drive the decentralization of business of all sorts away from downtown environments, and out where businesses and residences are in better geographic balance. A lot of former business space is apt to be converted to residential space, thus solving the transportation problem nicely for a person who lives up,and works down, in a city center.

Autonomous electric cars and wind and solar electricity , backed up with gas, will enable the ones of us who have decent incomes, to continue to commute either alone or with a couple of compatible fellow citizens.

Buses suck. Rail, is amazing and no, it isn’t just “riffraff” who find light rail appealing. Rail is also electric. And fast. And punctual. Ever been to NY? Chicago? Tell me only riffraff rides the El to Wrigley. It is a pretty interesting story how General Motors and the IC industry collectively conspired to choke commuter rail in thirties and forties and replace it with buses in this country. A story that was actually proven in court and resulted in damages but of course it was too late to affect the outcome. The problem as you point out, is buses, not public transport.

Two Starbucks that I know of have suddenly closed down and I’m betting it won’t be long before a third one in mind, essentially in the middle of a parking lot, follows suit.

Their prices are so ridiculous– especially if you remove their drinks’ stabilizers, syrups and ices (not much left of the drink)– that their model seems to depend on the frivolity that surrounds the ‘Oil Party’ that will never come again.

People in the future will wonder and wonder about this time, about how strange, dreamlike, contradictory and bizarre it seemed, yet that many of the time took for granted, for normal; such as grabbing overpriced fluid concoctions for the privilege of hanging out in a seating arrangement or patio overlooking living-rooms-on-wheels and strips and acres asphalt.

Meanwhile, ” ‘Zombie Ships’ – Why Global Shipping Is Even Worse Than The Baltic Dry Suggests”

“What was life really like back then, Great-Grandpa? …Why, at the edges of towns and cities, are there all those strange large-and-boxy empty buildings surrounded by some kind of thin tar-and-stone amalgam surface? Were these artifacts of some sort of religious importance?”

Apparently investing large amounts of money into public transport and then doing major service cuts is a great method to reduce ridership. If the service will not take a person to the place they need to go, when they need to go and at a reasonable price, the person will find alternative methods or just move away.

The major problem with buses is they deal with the same traffic problem as cars, so ridesharing and car ownership is a no brainer if the service becomes problematic. Trains have the problem of only going to certain places and then the buses must take over from there. If bus schedules are reduced, the chain is broken.