The Cornucopians are exuberant, they believe that collapsing of oil prices dealt the death knell for peak oil. An oil glut, they say, is what we have, not peak oil. But an oil glut is exactly what we would expect at the very peak. After all, that is what peak oil is, that is the the point in time when the world produces more oil than ever in history… and the most it ever will produce.

I am of the firm conviction that the world is at the peak of world oil production right now, or was at that point three or four months ago. I think history will show that the 12 months of September 2014 through August 2015 will be the one year peak. Whether the calendar year peak is 2014 or 2015 is the only thing still in question, or that is my opinion anyway.

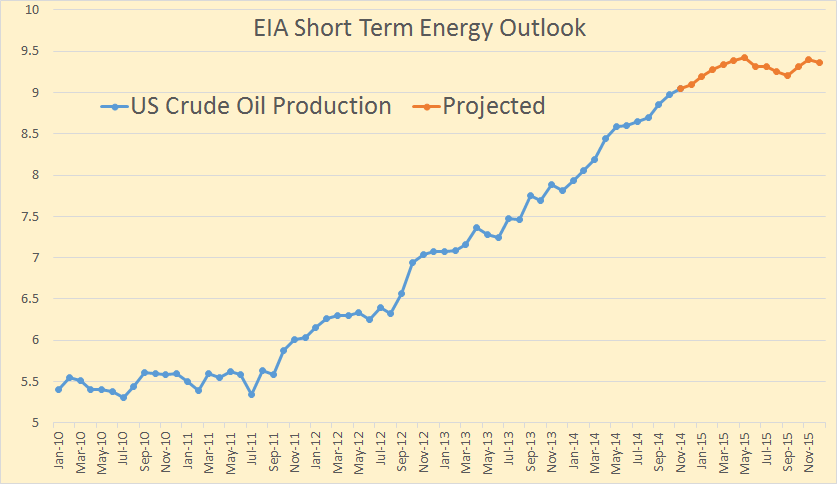

The EIA says, in their Short Term Energy Outlook says US Crude oil will peak, at least temporarily, in May 2015.

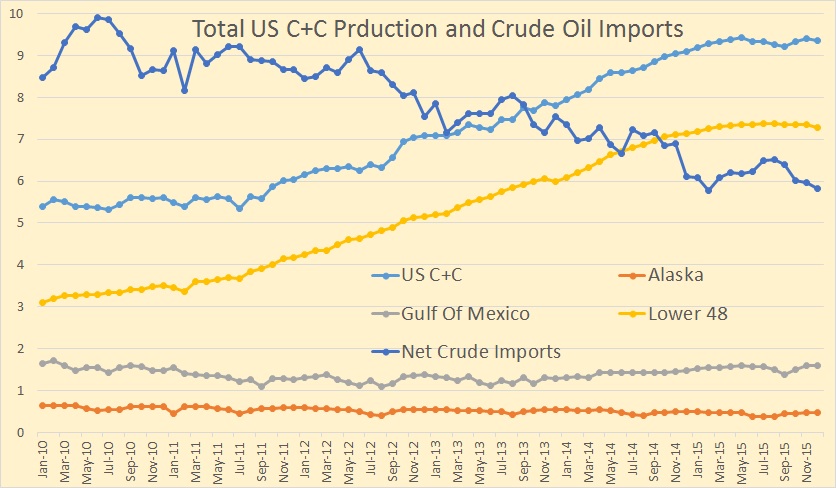

Looking at the area breakdown for total US production:

This chart includes net US crude oil imports. Notice how they expect crude oil imports to bottom out in February of 2015 at 5.78 mbd then increase to 6.71 mbd in August before declining to 5.82 mbd in December.

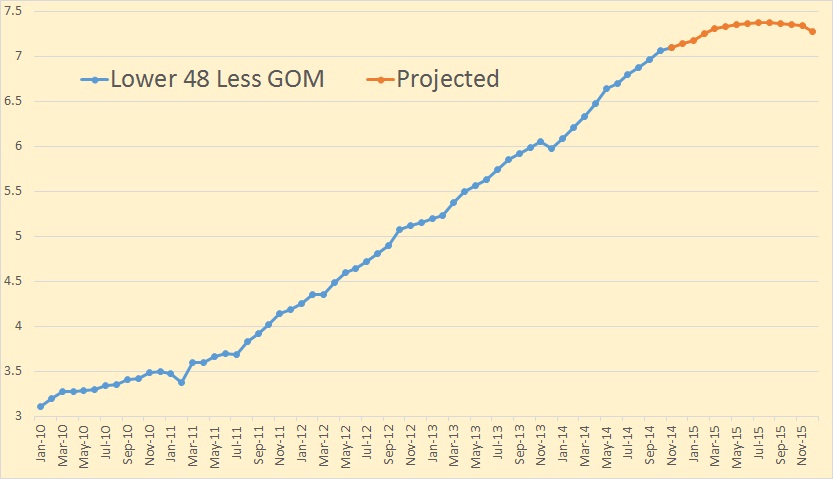

Lower 48, excluding the Gulf of Mexico, peaks in July and August of 2015 at 7.47 mbd, according to the prognosticators at the EIA, before starting a slow decline to 7.28 mbd in December.

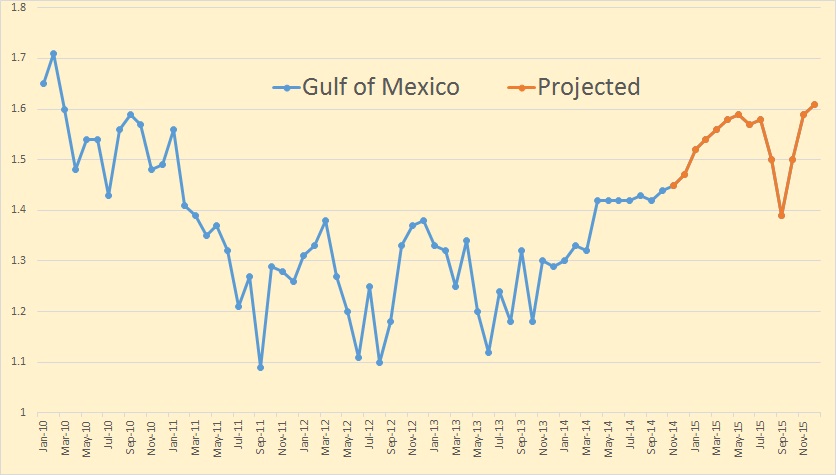

The dip you saw in the first chart came from the projection of the GOM production. I have no idea why they are expecting that dip in August, September and October but I suppose it has something to do with the hurricane season. But if they can predict what will happen to oil production during the hurricane season they are good, really good.

However they are predicting GOM production will increase by 170,000 bpd by December of 2015. I don’t really think that is going to happen. However the EIA has come off a lot from their earlier GOM production, or seems to be leaning in that direction anyway. They originally had GOM production at over 2 million barrels per day by 2016.

The new Short Term Energy Outlook is due out Tuesday. I will report on any changes in the EIA’s outlook then.

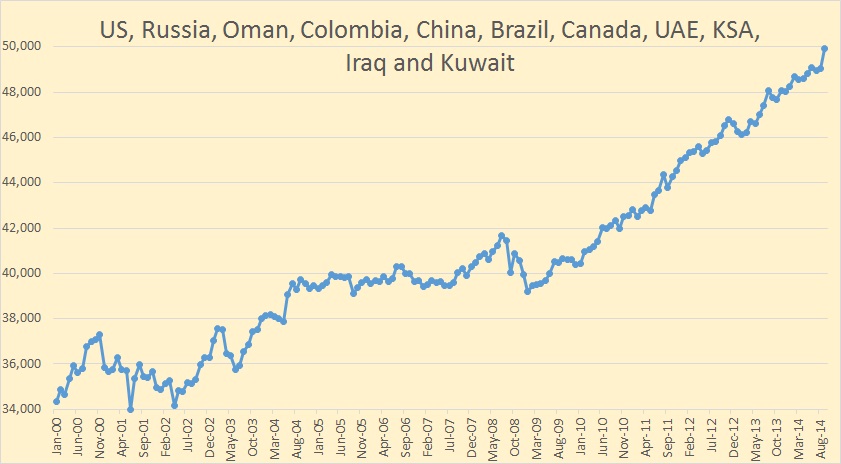

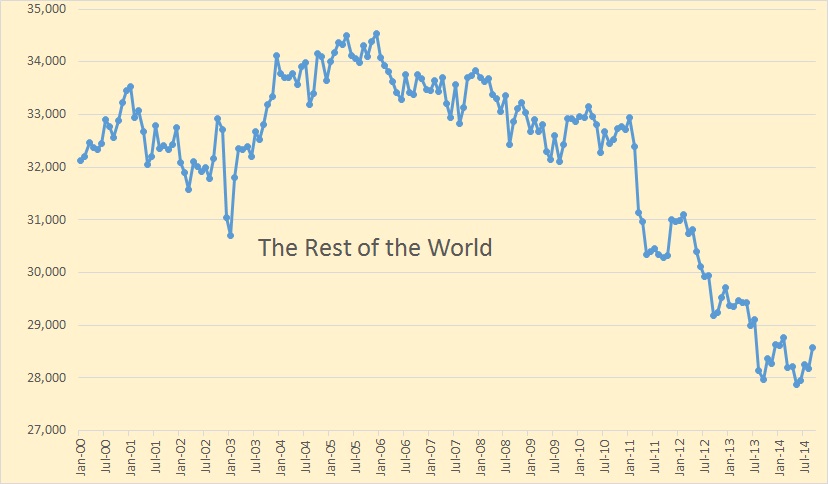

But looking at the rest of the world, data for the two charts below is in thousand bpd with data through September 2014.

Here is where all the growth has come from in the last five years. The combined production of these 11 nations are up about 10.7 million barrels per day since their low on January of 2009. All these nations, with the possible exception of Brazil and Iraq, will have reached their peak on or before the summer of 2015. Of course if the price increases again then the US and Canada will again start to increase production. But even in here their rapid production growth is over. Any increase after the price rise, if it happens, will be at a much slower rate.

The rest of the world is down and going lower. Of this group only Kazakhstan has any hope of increasing production very much and Kazakhstan will not see anything until 2017, if then.

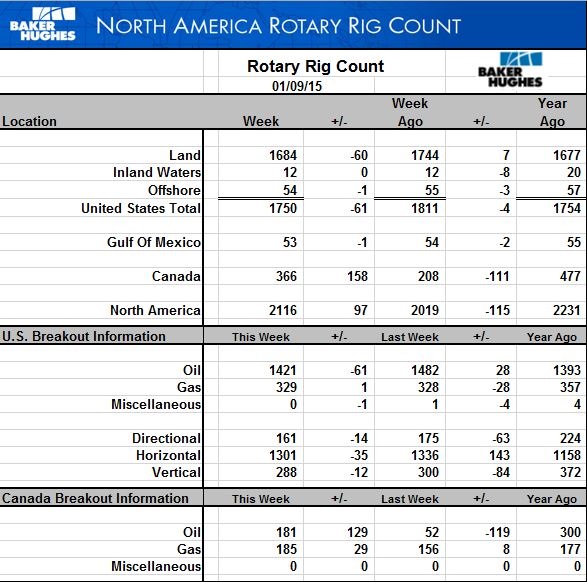

The Baker Hughes Rig Count is out.

Canadian rig count was up 158 to 366. That still leaves it down 25 rigs from the 391 it was at two weeks ago. I have no idea what is going on there.

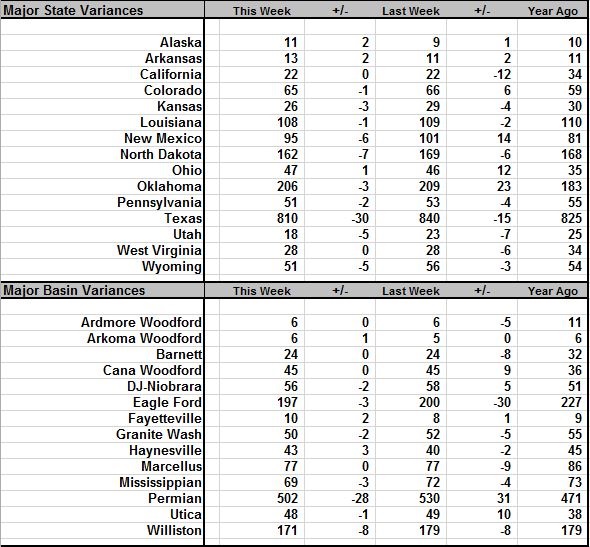

But the US oil rig count was down 61 from one week ago. It now sits at 1420, down 188 rigs from the high of 1609 back in October. The Permian suffered the largest loss, down 28 rigs this week.

In other news: Lynn Helms says it takes at least 140 rigs to keep production flat.

At least 140 rigs are needed to maintain October’s production level of 1.2 million barrels per day, the most recent figure available, Helms said. Based on a survey of the Bakken’s top producers, he expects the rig count to drop to 150 by July 1 and to as low as 125 rigs by the end of the year if depressed oil prices persist.

I believe that figure is a little optimistic but it’s his job to be optimistic. In the short term it is fracking crews, not rigs that will determine whether production goes up, down or stays flat. From my reading of new wells coming on line, November looks to be flat to down, December looks pretty good and January is starting out pretty bad.

Note: I send an email notice when I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com.

Hello,

I just put up the post

Are Mountrail’s Sweet Spots Past Their Prime?

http://fractionalflow.com/2015/01/09/are-mountrails-sweet-spots-past-their-prime/

More analysis of Bakken LTO.

“The linear fits show that wells started in 2012 were poorer than in previous years.”

That will be worth debate here.

I’m afraid the debate will not reach a conclusion because :

“Measurements from actual data showed that the smoothed month over month legacy decline varied between 5 – 6%.”

This proving wrong is going to be the big monkey wrench thrown into correlation analysis.

Bankrupt companies cannot continue to sell oil from already existing wells. They will be semi padlocked awaiting litigation. Simply that, metaphorically. What this will do is make the legacy decline rate steepen for the very old wells. On a graph they will slam down to near zero with just a handful escaping the padlock and the rest simply stopped, awaiting a very long court queue.

These aren’t a bankrupt department store that asks for court protection from creditors. They can’t go on selling inventory until the shelves are empty. The inventory is collateral on the loans that have driven them into bankruptcy. It will take time for a judge to decide who can do what. They can’t just file and still send their guys out to the wells to load up trucks. The bondholders own that oil the day they file for bankruptcy.

I have the impression that wasn’t the case in previous oil price crashes.

Do you have any support for this idea that oil company financial problems will mean capped wells? Sources, links, etc?

The best link would be finance.yahoo.com and the going yield on HYG.

Past oil price crashes are not informative in the new normal of high yield funding. Besides which, would not past oil production during those crashes be the links you want?

Hi Watcher,

Several people with knowledge of the oil industry much better than yours have repeatedly said you are wrong on this, and they are correct.

Your knowledge of bankruptcy proceedings is severely limited, based on your comments.

Watcher, I think the bankruptcy trustee will operate the wells via a contract operator if they are profitable to operate. Wells could be shutdown for a short period of time during a transition. Also, will the BK’s be liquidations or reorganizations? That could make a difference. If OPEX is higher than the oil price, they would likely be shut in. Again, the BK in shale will result primarily from debt incurred from CAPEX spent drilling and completing the wells. I have seen wells shut down, but those were primarily strippers whose OPEX or LOE was higher than the crude oil price, think 1998.

I doubt they will all be padlocked.

As I said, padlocks are metaphorical. These are LLC, not corporations. The bankruptcy judge makes the call on how assets are distributed, and he can’t do that until the case comes to court.

They are going to be inundated. And the lenders are not going to have any incentive in going fast if fast doesn’t provide them, rather than the LLC, and advantage. Largely, LLCs dissolve when they file. Then distribution of assets is even more difficult to arrange among creditors — none of whom want to operate an oil well.

Watcher, I don’t think it will go down that way, but I won’t shed too many tears for the companies if you are correct. Will feel bad for the employees though.

DC Wrote:

“Several people with knowledge of the oil industry much better than yours have repeatedly said you are wrong on this, and they are correct.”

Watcher is likely correct. Those that are in the oil industry haven’t seen this amount of over leaverage since the 1980s and finance had changed a lot since then. The issue is that contractors are going to get stiffed for sure and they aren’t going to come back to work, until the invoices get settled. Once a driller falls into bankruptcy it’s going to take time for the Bean counters to figure out who is rightfully owed money. There will need to be court hearing and meeting with creditors before money gets paid. Until a full audit is performed by a bankruptcy firm, no one is likely to get paid. That’s just the way it is!

There is also a possibility that the creditors will shut in wells and wait for oil prices to recover, so they have a better opportunity to recovered as much loss capital as they can.

In Jan 2009 Oil priced bottomed at about $30 bbl, by June 2009 they bounced back to about $70. It would be foolish not to shut-in and instead sell at a steep loss. If I recall correctly, during the plunge in the 1980’s wells were shut-in.

In about 6 to 8 months, prices will likely rebound. The only reason not to shut-in is if your over leveraged and grasping for cash flow to pay those bond coupons that are coming due. I am sure a few drillers will do that in an attempt to wait out the plunge. Unfortunately they were already insolvent before oil prices started to collapse. They would have gone bankrupt anyway, just at a later date. The price collapse is just pulling forward the date of their demise. The smarter management teams will walk away and save themselves grief of trying to bailout a sunken ship.

In the oil business things have a tendency to roll downhill. This means the players involved react to crises to maximize their own value. This of course is driven to a large extent by expected future prices.

So now we need to ask ourselves, what does the futures market say about prices in 2016? 2020? Can anybody put up a graph, and we can chit chat about the implications?

As to Mr. Leanme’s question, above:

There is not one CEO, prospect geologist, land man, roughneck, completion engineer, division order analyst or well gauger in the world wide oil industry right now who does not believe that the price of crude oil will find a bottom soon and start it’s relentless march back up to 8o dollars a barrel over the next 12-18 months. Futures strip outs and a 4th grade knowledge of worldwide production declines, net export factors, and the prospects for ever increasing hydrocarbon demand, strongly point toward the fact that oil prices will go up. It is inevitable. Wind, sun and corn, in spite of the rhetoric, won’t help you fly the kids to Disneyland next summer.

What are the implications of rising oil prices? They are that while some people sit at a computer all day envisioning how the shale oil industry is going to fail, of bankruptcies and government bail outs, of padlocked wells and over 3 million barrels per day of LTO production vanishing into thin air…there are lots of very, very smart people out there figuring out a way to survive. And they will survive. My kind of oil industry (conventional) is not going away and the shale oil industry is not going away either, not entirely. It will be different as a result of this correction in prices, but it is not going to fail completely. Shale oil was never the answer that America needed anyway, but it will play a role in our energy future. That’s a damn good thing. I am still mad at the bastards (I cannot stand the abundance/technology bullshit that still, to this day, gets slung against the wall,) but hey, my kids and grandkids need the nasty stuff those guys are wringing out of all that crummy rock.

If you want the shale oil industry to fail, for self serving reasons, to perhaps be right about peak oil production theories, to have something to waste away the days by on a computer, seek professional help immediately. There are pills to take for that sort of stuff.

Things are getting tough out here in the oilfield right now, its time for me to get tougher. I’ve been thru this price thing a bunch of times; I am not going to lose one stinking BOPD if I can hep it, no sireee. But this is going to be my last post for awhile.

I drive thru the biggest shale oil field in the world almost every day. I have been in the exploration and production business for a half century. I have done everything in it you can imagine, then some. I know what I am looking at. I know how long rigs stay on locations, how long it takes to drill shale wells. I have gotten daily drilling reports, I know what shale wells cost, and why; I have watched my royalty checks from shale wells get smaller and smaller over the years. I sure as hell know about decline rates and EURS based on IP’s and type curves that don’t, in the long run, end up anything like shale oil companies say. I know how to make money in the oil business. Most of the crap the shale oil industry feeds folks on the internet is worse than crap. When I read that stuff I always feel like I need to go take a shower. These days I see vacuum trucks lined up at water disposal wells 8 deep, rig iron stacked back in the woods, good men going to the house, or the beer joints, out of work. Worried. I ask people who I have known and worked with over 50 years, that work in the shale patch, what the real deal is.

What I have found is that most people on blogs don’t want to know what the real deal is. They don’t want to listen to folks who have been there, and done that, or that are doing it now. They would rather read about it in a “link” and speculate about it. If its on the internet, it must be true, they think. People who use to not know what that spot was under their car on the driveway are now oil “experts.” They don’t want to hear, or read things that do not fit into their unique perception of reality. That’s a mistake. There are some smart people on this site that want you know the real deal. Pay attention.

The oilfield is a very fluid environment that changes every day. The manner in which it can adapt and adjust to extenuating circumstances is unlike any other industry in the world. How most of you envision this is all going to shake out for the shale oil industry won’t be anywhere close to the real deal. Y’all can keep guessing about it but give the folks out here actually doing it, some credit. It ain’t the pizza business.

Thanks.

Mike

Ron, I am in touch with Rune; if you and/or Dennis have a question for me, please give Dennis my email address. I am good with that. The data is important.

Keep a bind on it!

M.

Kaffee: “I want the truth!”

Col. Jessup: “You can’t handle the truth!”

https://www.youtube.com/watch?v=5j2F4VcBmeo

Mike. Gonna miss your posts. I need to tone it down myself. Think I need to quit reading the shale BS also and focus on staying afloat. Hang in there.

Mike, we value your input on this site. We also value the input of all other true oilmen on this site. I only wish there were more. I never discount the word of an oilman.

Hi Mike,

It has been a pleasure learning from a pro! Thanks.

I am with Ron. Learning from you and others with real world oil field experience is great, I apologize for coming across often as a know it all.

Relative to you, Fernando, ManBearPig, Doug Leighton, Rune Likvern, and Ron I know little.

I appreciate your patience and willingness to correct me when I am wrong and to answer my endless questions.

“When I read that stuff I always feel like I need to go take a shower.” ~ Mike

Yup, and my skin’s pretty damn dry these days.

(I should stockpile Oil of Olay before its price rockets back up or it goes in terminal decline.) ‘u^

Mike,

Thanks for all you’ve given us. I’ll look for your return.

Mike,

I hope my comments didn’t tick you off and that’s the reason your going to cut back on posting. I presume, that you need to spend more time on running your business. If I did say something that ticked you off, I am sorry. I just posting my views on various topics. I usually read all your post since they are the most valuable. As you stated its people with their boots on the ground that have the most valuable information.

I think the price collapse absolutely sucks and is unfair. I absolutely appreciate the hard work of people like you and your crew. You group is some the hardest working people in America, and I can certainly relate to your point of getting pissed off when people start getting joyful over collapsing prices. I don’t like to see hardworking people lose their jobs, especially in such an important industry as yours.

My fear is that this price collapse is going to have a long term problem as capital investment disappears and doesn’t come back for a long time. As I stated, investors are very reluctant to jump back in, having gotten burned. I suspect that your running a sound and tight ship and you don’t need to rely on cheap credit to drill. if that is the case than I am sure you will bounce back in a year or less. I hope you end up being able to use the price collapse to locate some bargains, so when the prices do bounce back, you’ll come back stronger.

Best wishes for you and your crew. Please thank your crew for me. I really appreciate their hard work and commitment to help keep the economic running.

Hi TechGuy,

Well I appreciate your posts, and thrig’s too, among others.

(Was that you about the 40 suns around the planet bit? It’s sobering.)

Ron’s world peak prediction here is just plain scary… so close…

Thanks for your help in understanding the industry. I will look forward to your return. Keep safe.

NAOM

I’ve learned a lot from reading your posts and wish you and yours the best as you try to deal with current circumstances.

Stay strong man. I’ll try to hold down the fort with the few other industry guys we have here until you return.

Mike,

Sorry to see you go, you have been a breath of fresh air. It has been great to see others confused by our conversation, as I am often confused by theirs. Smiles.

Remember there are 3 handles on the slips, so don’t go too far.

See you around a rotary table somewhere.

Pusher

Mike,

I too am a producer of 30 plus years. Your comments are spot on. Over the next several months the USA, and perhaps the world, will see how far away America is from energy independence. Like you, I will still be here to pick up a few crumbs as the fallout matures into a wholesale reevaluation of shale plays, particularly oil, and gas may follow. I don’t about your experiences, but I’ve seen horizontal drilling and massive frac jobs prove to be technically successful, but the economics appear to fit better for government owned reserves rather than private or public owned companies. The Saudis, and their partner(s) in this effort to accomplish their objective(s), may achieve their goals, whatever they are, sooner or later. Unfortunately, I believe one objective has less to do with market share and more to do with technology. It is painful to think they, and others, will eventually adopt our technology to enhance their own EUR’s.

Best of luck, Mike. Perhaps we will get acquainted at a spud meeting one day.

My post will appear here on POB at a later date, likely within a couple of weeks.

There are a lot of moving parts in LTO dynamics. Some wells are temporarily shut in for some reason, then brought back.

To me going forward the dominant factor dictating future LTO extraction developments will all be about financial dynamics. This appears to be the part poorest understood as debt allowed for fast growth in LTO extraction. When debt no longer turbochargers growth the dynamics work in a powerful way in the opposite direction.

This will also affect the points you list.

Rune, talking about financial dynamics, I noticed there’s an industry practice amongst smaller outfits to model investment economics using a very high target rate of return. They don’t apply risk and seem to be somewhat optimistic.

My experience is that such practices lead to poorly optimized development plans. In real life the internal rate of return is lower, this means present value for later year cash flow is higher than estimated.

What do you think, am I pointing out something real? Are they using IRR as high as 15 to 20 % to optimize their pad, equipment and well layouts?

Fernando,

With few exceptions I have not seen the assumptions smaller companies use for their economic evaluations. I have seen prospectuses where I found some of the assumptions with a clear positive bias and no sensitivity runs.

A common feature from some of the more recent developments of conventional reservoirs have been too optimistic estimates on recoverable reserves (thus flow), development costs (CAPEX) and as of now on price trajectories leading to the owners taking considerable write downs some time after production was started. Risk was understated.

Some have speculated that some of those involved in the early development phase (prior to the development being sanctioned) engaged in something close to wishful thinking (or worse) to help the development pass the hurdles and thus earn their bonuses.

Those making development plans are humans with all that entails.

Increased (debt) leverage has been a common feature for the more recent developments. This works fine as long there is profit growth, but if something goes south (flows, prices etc.) it destroys equity and borrowed capital at a very fast pace.

To me the point above appears poorly understood, because companies that experiences write downs have their balance sheets impaired. Then add lower flow of profits and it finds itself in a vicious struggle to “target financial performance” (repairing its balance sheet) and they also have less debt carrying capacities.

If oil prices remains subdued those companies remaining in the game will not have the same CAPEX capacities as they had on the way up (little remaining space on their balance sheets to take on more debt and at the other end you may have burnt investors afraid to come out in the water again).

This is an important point I sense is missed by most analysts. Most analysis I have seen assumes the companies will continue to take on more debt as there is no tomorrow. They are in for a big surprise.

In the shales, I do not expect a beautiful deleveraging to take place….. it will be an ugly one.

The thing is if too optimistic assumptions are used to make the development (either conventional and/or shale) appear financially attractive the book keeping rules will at some point in time force the truth out in the sunlight.

I think the truth is their return on average capital employed over the years (if they live long enough to have a record). Just keep your eyes open for hurdle rates or discount factors they use in their pv presentations.

I guess we do agree, they are optimists who use high hurdles to cover their behinds. And this means their plans aren’t really optmized. This in turn means they could probably do better using smaller amounts of sand per individual frac job and cutting well costs. Just a hunch.

Rune, you state correctly that the Parshall is about 300 square miles. As of October, 2014, there are 340 producing wells.

As you know, the Drilling Spacing Unit (DSU) in ND is 2 sq. miles (1,280 sq. acres). The Parshall thus now averages about TWO wells per DSU.

Rune, you must be aware of plans to place 12,16,24, or more wells/DSU. (EOG is floating plans to place 8 wells in each bench of MB, TF1-3, totalling a stunning 32 wells from EACH mega-pad).

As the Parshall, along with the Sanish, is recognized as the most productive area in ND, much more future output would be considered reasonable.

I appreciate all the work you contribute, while maintaining a longtime contrary stance.

so, let me see if I get this straight…, they drill a well in a two mile long by half mile wide rectangle. The spacing between wells is a half mile…..the two outer wells in that four tine configuration are 3/4 mile away from the pad center. So they got to drill directionally to step out 3750 feet, making the turn to drill at least a horizontal mile. And they expect to pump these wells with what? Rod pumps? Or do their engineers expect the wells to flow for a long time? What’s the water cut behavior in this Parshall area?

Fernando, virtually none of the numbers/layout that you described is congruent with what is happening in the Bakken. While I could suggest you refer to many of the E&P companies’ web sites for historically accurate operational info, they seem to roundly demonized by many on this site.

The ND DMR site offers numerous highly informative presentations that clearly describe much of what has occurred up there these past several years, including well layout/density.

Coffeguyzz, I was referring to the “EOG is floating plans…” statement. If they are planning 32 well pads they have an ambitious layout.

I have led teams laying out pads and wells for a few years, or served as consultant for companies preparing these plans, so I’m familiar with the problems involved. And I wonder if EOG engineers understand the implications of having wells turn that way, to later try to put a pump inside with decent run lives.

Do they really publish their detailed pad layouts for these 32 well pads, or are they in the cartoon phase?

Fernando,

I work offshore so i am used to much closer spacing, 2.5 to 3m. Obviously we use gyro for positioning. Do you know what spacing is required where gyro is not required?

As these pads become higher density, they may have to give up the luxury of being able to work over the well next to the one they are drilling and get really compact.

Toolpush, as you know when we work offshore the wells are located in the lower deck, and the rig sits on a deck sitting far above the wells. The costs are a lot higher, this forces us to have a much tighter spacing between wells.

In Arctic areas we seem to drift to 8 meter centers. And on cheap onshore land they put them far apart.

What I found when cost optimizing large pads is that an 8 meter center works fine. This is simply caused by the number of drilling rigs available and our ability to produce offset wells inside cages. This of course depends on the well. Drilling and producing is very feasible when the wells produce heavy oil or with lots of water.

I know you understand these topics, I’m just making sure the exchange provides readers with the proper background.

Fernando, “cartoon phase” … I like that.

While I cannot speak for the competency (or lack thereof) for the engineers at EOG, I can direct you to see an actual photo of a surveyed, staked out 32 well pad – the 30F – that Whiting is readying in their Retail area in the Niobrara. It can be seen as slide #14 to be found in their 11/14 presentation ‘Redtail Investor Update”. Slide #21 has different configurations re placement/layouts of both 16 and 32 well pads. This presentation also includes info on the Bakken, with Whiting now being bigger in many respects than Continental.

Push, if you are inclined to access the aforementioned presentation, you may see a lot of technical info regarding well design, rock characteristics, frac’ing particulars, and other detailed stuff. All to be found at whiting.com, investor updates.

Highly readable data for pro and novice alike.

Thanks! That Niobrara presentation is very good. I’m still wondering if the EOG layout requires a very widely spaced set of tines. I think they’ll have problems if they try to pump those wells. I guess they need to check their pumping system in a simulation to see what it does to tubing wear.

Coffeeguyz,

I/we focus on the hard data and the story these tell.

The companies are in LTO extraction to make a financial profit. Period.

I have done a lot of work looking at productivities for both Middle Bakken and Three Forks, and so far I have not seen the improvements in productivity that was held out. I have followed the hard data for close to 3 years. And I document the results, do not throw out claims.

You refer to a company floating plans. The key word is floating.

Further up I alluded to that going forward the developments will now be set by the financial dynamics created by high leverage when it meets a collapsing oil price…..”and no one saw it coming”.

The companies will be constrained on 2 fronts;

1) Reduced cash flow will limit their funding abilities for new wells. There could of course be investors that would continue throw more money their way while the oil prices are low.

2) Profitability of the wells. LTO extraction is front end loaded and low oil prices dictates high flows from wells to make these profitable. With WTI around $50/b, a well needs to flow around 120 – 130 kb during its first year to come out clear.

So far around 10% of all the wells in Bakken have had such a productivity or better.

The Parshall DSUs are 640 acres, or 1 square mile. That was one of the first areas in the Bakken to be discovered, and the standard at the time was one mile horizontal laterals, so 640 acre DSUs were reasonable. Once the operators got their feet wet in the Bakken, so to speak, they began preferring two mile laterals in 1280 acre DSUs.

Wes, thanks for the input. So, at 300 sq. miles for the Parshall, and one sq.mi/DSU, we have bout 300 DSUs. Presently there are 340 wells. Reasonable to expect many more wells/increased production potential from this sweetest of all sweet spots?

It would be reasonable to test placement of a long horizontal covering the area between four half wells, which if successful would theoretically allow 150 additional Middle Bakken locations.

Is Three Forks highly over pressured in the Parshall area?

Fernando, Mike Filloon has written numerous articles on these topics on Seeking Alpha. Just the other day he wrote a rather brief but informative piece discussing the varying pressure differentials throughout both the Bakken and TF and how they would likely impact companies with their particular acreage.

I can’t find it. Is it paywalled?

Fernando, no paywall, but they may require some kind of ‘registration’. It has been quite awhile since I went through the process, so I cannot recall, but I know I did not pay.

Over time, I have found the Seeking Alpha sources to be highly informative, but still containing more than a few biased shills. Reader beware.

Filloon and Richard Zeits seem knowledgeable. Mr. Patterson has posted on there as well.

Hi Ron,

Thanks for keeping the lights on after TOD shut down. IMO, Hubbert modeled production of low cost, high EROEI conventional oil. Hubbert did not model high cost, low EROEI forms of oil production like shale fracking, nor ultra deepwater offshore oil, nor tar sand mining to make synthetic oil. In this sense, I still maintain that Hubbert’s peak in conventional oil was a decade ago in 2005.

Yes, WTI and Brent are uneconomically cheap now. That is in part due to western strategic planners using derivatives to manage oil futures markets as weapons of mass destruction in a geopolitical struggle – primarily with Russia – but any damage inflicted on Iran and Venezuela is welcome as well. It is even possible that due to national security interests, money losing US shale production might be rescued by the Fed or Treasury buying fracking debts at par and forgiving them. From the NSC point of view, if it cost another trillion dollars on the Fed balance sheet to bloodlessly topple Putin and install someone more to their liking, it would be a bargain. Obama has already dropped hints in that general direction.

Check out the latest from Steve St. Angelo, oil demand did not drop in 2014, a great contrast to what happened in 2008: RECORD GLOBAL OIL DEMAND: Even As The Price Of Oil Declined:

http://srsroccoreport.com/record-global-oil-demand-even-as-the-price-of-oil-declined/record-global-oil-demand-even-as-the-price-of-oil-declined/

Why didn’t “western strategic planners” “manage oil futures” when the price hit $147/barrel, and western economies were driven into recession?

I don’t believe anyone has the power to control the oil price like that.

Ok, you are most welcome to join me at the big poker table at the NYMEX sometime. Price is set in the derivatives market, but has at best a tenuous connection to the physical market. Fortunes are made daily by taking the other side of the trade versus people who think the markets are an honest price discovery mechanism for physical goods.

I made a moderate amount of money in years gone by from selling sugar, orange juice, lumber, gold, natural gas, oil, and silver despite not actually having any of the above to deliver. The Fed’s balance sheet is over $4 trillion at the moment. With that kind of money, and the ability to make more out of thin air, one can push any market in any direction desired. The only game left in town in to figure out what the Fed wants and hitch your wagon to that star. Stocks have gone up since 2009 because the Fed wanted that to happen, no other reason.

I agree with you that oil prices are set in the derivatives market. I think the root cause is that large gap between production costs and the pain point where demand destruction begins, as well as the inflexibility of demand. (The last two are closely related.)

But that does not prove that the price is controllable. The derivatives market has plenty of players as well.

Price is set in the derivatives market, but has at best a tenuous connection to the physical market.

Spoken like a man who hasn’t a clue as to what really controls oil prices. Oil prices are set by supply and demand with at best a tenuous connection to the futures market.

I like this analogy: Picture a boat pulling a water skier. The skier can make wide swings to the right and to the left of the boat but his long term path must follow the path of the boat. He cannot release the boat and take off on a path of his own.

That is the case of the price of oil on the futures market. The futures market make wide swings above and below the path that supply and demand dictates. But the price on the futures market can never just release supply and demand and take off on a path of its own. If that happens and the price swings too high, a glut soon happens and the price comes plunging back down. But if the price swings too low, demand goes up and production goes down and soon the price swings back in line with supply and demand.

The idea that the price of oil is not ultimately connected to supply and demand but is controlled by the futures market instead is truly absurd. Prices fell because of 1) an oversupply of oil and 2) A decline in demand caused by a deepening recession in many parts of the world. Number 2 was likely the primary cause of the decline. The price of oil did not fall because of a glut of sellers in the futures market.

I have to agree with Ron on the SUPPLY vs DEMAND forces in determining price. However, I believe (AS STATED IN MY LINKED ARTICLE ABOVE), the U.S. sanctions as well as the U.S. forced European sanctions on Russia, plus the breakdown of the Ukrainian economy, destroyed EXPECTED IEA DEMAND of 94 mbd by Q4 2014.

Furthermore, the strong U.S. Dollar as a result of falling oil prices is destroying revenue from oil producing countries that also impacts economic activity negatively… slowing consumption.

Again, the expected global oil demand was supposed to be 94 mbd as global production is 94.1 mbd. However the decline to 93.5 mbd in Q4 2014 caused a glut… which I believe was due to the U.S. Govt intervention in Ukraine and Russia.

I just listened to an interesting interview which stated that France, Germany, Ukraine and Russia heads of Govt are meeting in Kazakhstan this month to discuss dropping the European sanctions and working on a diplomatic solution to the current problem.

Thus, we have Europe basically giving a MIDDLE FINGER to the U.S. Govt’s Hawkish Military policy against Russia.

I believe the U.S. Govt and Economy experience some serious headwinds in 2015.

steve

Steve,

Pease help me here:

You wrote: “global production is 94.1 mbd.”

However, Patterson has global oil production at about 77 mbd.

http://peakoilbarrel.com/eias-world-production-numbers/

We are talking over 20% difference.

Steve is counting total liquids which includes bottled gas, (NGLs), biofuels such as ethanol and palm oil and refinery process gain as well as C+C. But even here he is a little high. The EIA says all that came to a total of 93,451,162 barrels per day in September.

Crude oil plus Condensate came to 78,493,816 bpd in September. I only deal with oil, not all that other crap that the EIA and Iea throws in there to make it look like the world is producing a lot more oil than it actually is.

Thanks Ron.

It’s also useful to look out for “boe”, and remember gas prices are quite variable. I have seen gas sold at $0.60 per MMBTU booked together with 34 degrees API crude oil. It really swelled the boe figures.

I am one hundred percent with Ron. The ONLY way a commodity price can be controlled to any serious extent is to control the supply and distribution of that commodity.

This has been well established and unquestioned as fact in marketing more or less forever. People with various schemes to sell are out there in recent times trying to convince the world it ain’t so but it IS.

Users have a certain amount of influence on prices by substituting alternate products or just cutting back on things they deem too expensive.

But real price control- to the extent it is possible – depends on controlling supply and distribution.

I have yet to see any argument to the contrary that is not based on smoke and mirrors thinking that can never be clearly delineated.

Just who are these magical financial warriors who are able to insinuate themselves between the biggest and baddest great white shark corporations in the world such as Exon or Mobil or Saudi Aramco and their customers and rake off unearned profits??

How do they do it? Where along the money trail do they extract their cut?

Now the overall economy can be and is stimulated or damped down by the shenanigans of central banks and big banks. But this is not the same thing as controlling the price of a given commodity.The most that could be said of this effect is that as the economy in general rises or sinks commodity prices generally follow the trend.

So long as there is a decent amount of competition in the business of supplying oil the supply will basically be determined by the costs of the last standing marginal high cost producer- on average. The price will oscillate above and below this level but not too far and not too long.Ron’s ski boat analogy is perfect.

There is MORE that too much competition for customers right now in the oil business. It is about as cutthroat is it can get. Some of the suppliers are going to close up partially or totally before long – as soon as they can manage it in a business like fashion.

It will take a few months for this to happen and a few months more for the excess supply in the distribution system to get used up and then prices will go up again.

I had a professor who likened price supply and demand to three bugs circling a light with the light itself moving slowly – such as the light on a slow boat moving around in a harbor. The light itself is the economy in this descriptive scheme. The supply and demand bugs like each other and fly close together. The price bug steers clear of the other two as best it can so that if you know where any one of the three is you have a pretty good idea of the location of the other two.

Oil prices are set by supply and demand with at best a tenuous connection to the futures market.

Do have any evidence for this claim?

) A decline in demand caused by a deepening recession in many parts of the world.

I don’t think world economic growth was lower in 2014 than in 2013. Also consumption of oil has been growing pretty steadily since 2008. Why would price crash now?

Oil prices are set by supply and demand with at best a tenuous connection to the futures market.

Do have any evidence for this claim?

Supply and demand is recognized as the price setter of all commodities. It’s just common sense. However if anyone claims that something else sets the price of commodities then the burden of proof lies with them.

Supply and demand dictates the price, never one alone.

So you would say that gold prices are also set by supply and demand?

Considering how much bad economics there is around, and radical disagreement about basics, I would be careful to invoke “common sense” to justify economic claims.

No, the price of Gold is set by marketing hype – and an irrational expectation that owning paper claims on gold (that may or may not actually exist in some vault) will serve as a hedge against inflation.

But unlike Crude, Gold is not ‘consumed’ to facilitate the day to day operation of the global economy. Over 50% is used for jewelry, another 34% is used for holdings and investments, and a small portion (12%) is used by industry. If the industrial use could ‘only’ use Gold AND was an essential component of operating the global economy, and world global oil production came to an end, all the gold previously mined is STILL available to be applied whereas all previously mined Crude is now in the atmosphere and/or ocean as carbon dioxide.

Pick a different analogy based on something that is needed – but doesn’t exist after it is consumed (like, maybe, wheat or rice..or any other food stuff).

Some other remarks:

A recession is defined as falling economic output. You claim there is a “deepening recession”. Are you claiming economic output is falling worldwide? Or even that a significant proportion of the world economy is shrinking?

Another point is that I would expect consumption of oil to track economic output, not economic growth. Do you agree with this?

On the other hand, I guess oil prices may be sensitive to economic growth, but consumption.

There was a significant slowdown in global oil demand growth from 1.23 million b/d in 2013 to 0.67 million b/d in 2014 (as per IEA).

There was no absolute decline in demand, unlike in late 2008 and 2009.

However, in contrast to 2008-09, in 2014 there was a significant (+ 1.9million b/d) increase in non-OPEC liquids supply (incl. NGLs, biofueles and processing gains), large part of which came from the U.S.

Combined with slowing consumption, this sharply reduced demand for OPEC crude. Yet, OPEC didn’t reduce its output, which led to the current supply glut.

(Furthermore, there was a temporary increase in Lybian oil production from 0.2 to 0.9 mb/d, although this dropped again by the end of the year).

The situation was exacerbated by the rise of the US$ exchange rate vs. global currencies (which is inversely correlated with the price of oil) and, to some extent, by expectations of an increase in the interest rates in the U.S. All this caused panic selling by financial investors. But I completely agree with Ron that supply-demand fundamentals, not speculation, was the primary reason for the current sharp drop in oil prices

Damn MicroHydro, I was going make the same comments. You beat me too it. Right on. Net energy from liquid fossil fuels peaked in 2005 as Hubbert forecasted. The stuff called barrels today ain’t the same stuff.

Micro,

As I have periodically noted, in my opinion is quite likely that actual global crude oil production (45 and lower API gravity crude oil) effectively peaked in 2005, while global natural gas production and associated liquids, condensate and NGL, have (so far) continued to increase.

In any case, when we ask for the price of oil, we get the price of 45 or lower API gravity crude oil, but when we ask for volumes, we get the volume of crude oil plus some combination of condensate + NGL + biofuels + refinery gains.

Economists would argue that we are seeing a classic case of substitution, i.e., more reliance on less desirable condensate and NGL as the production of actual crude oil production stagnated, and they would be correct, but that’s not the issue. The Cornucopians claim that there is no possibility of any kind of peak in sight, and this assertion, based on the data, would appear to be flagrantly false in regard to actual global crude oil production, e.g., the “Texas Tea” portrayed in the “Beverly Hillbillies” TV series.

“Black Gold, Texas Tea”

https://www.youtube.com/watch?v=QtvTE3m5jpM

“November looks to be flat to down, December looks pretty good and January is starting out pretty bad.”

Sounds right. November would be shock, and “surely this will fix itself in the next few days”, and then December “okay, it’s epic disaster, but a decent person doesn’t fire anyone just before Christmas”, and then come January, WHAMO!

I’m a long-time lurker here (and previously at TOD). Don’t have much to contribute, so I don’t. I live in NW Montana. After the housing bust, lots of guys with strong backs and weak minds left here and headed to the Bakken, leaving their families Behind. My wife, in her work, has contact with a lot of these guys, so I hear stories second hand. One guy told her yesterday that rigs are “being laid up like cordwood in the boneyards.” (kind of a mixed metaphor there.) Several others have said they’ve gotten their pink slips, and are going on unemployment ($4000/mo, so you can only wonder what they had been earning). They are still either in denial or just ignorant – they all say it will snap back quickly. But there is a sense of fear- most all of them are making payments on new $50,000 diesel pickups, and maybe a boat and a winterized trailer. I’m only surprised that we aren’t seeing a faster drop in the rig counts. Interesting times ahead.

In a world of broadly complicit obfuscation, day to day anecdotes are valuable.

I’m only surprised that we aren’t seeing a faster drop in the rig counts. Interesting times ahead.

Another One Bites the Dust

https://www.youtube.com/watch?v=rY0WxgSXdEE

I agree Ron, especially with the Bakken and Eagleford. Net cash flow per barrel for the drillers is down 60% per barrell. For a variety of reasons, most owe a lot of money. So, the banks see the cash flow. They want to ensure that they will be paid back. So, my forecast for this year in those 2 areas is 50% fewer wells for 2015 than in 2014. I am assumming a gradual increase in the WTI price back to $80 by year end. But, even with that, the drillers (and bankers) will be smart enough not to start many new wells in the Bakken from October of 2015 until March of 2016 because winter problems can cause increased costs, and the price trend, even if up as I think, will not be in place long enough to have the confidence to drill (with borrowed money). Therefore, with respect to the Bakken (and possibly the Eagleford), 2016 production I think will also decline again 20% from 2015. But, more wells drilled in 2016 than 2015 if prices are there.

At current prices, new wells in those areas will take 3 years to pay out, leaving very little production for profit over an extended period of time. As a retired accountant, I just think that it is going to be an easy call not to drill until prices recover significantly. At that point, not enough good places to drill fast enough to get to a new peak.

I guess the key question could be whether nuclear, wind and other renewables are competitive with oil at $150 per barrel and gas at $10 per MMBTU. If other forms of energy can’t compete then we can go for a while. Maybe peak in the early 30’s?

Great question Fernando,

The competitive status of alternative energy may well depend as much or more on social and political decisions as it will on nuclear , wind, solar and other technologies.

Barring lucky but not too likely technical and engineering breakthroughs the bean counters probably have a fairly good handle on how fast the cost of wind and solar will come down- assuming their assumptions about economic conditions turn out to be good ones.

But about all economists have managed to prove about predicting the future of the economy is that they are not very good at it !!!!

Personally I expect wind and solar built in good spots to be economically competitive based on fuel cost savings alone within a decade-keeping in mind that a solar or wind farm completed in say 2025 is going to be competing with gas and SOME oil ( Oil is fungible on a world wide basis and the folks in Sand Country are going to go with a hell of a lot of solar if it means they can profitably sell the oil they are burning to run air conditioners etc) as generation fuel for until 2o55 at least. With refurbishment a wind or solar farm will last indefinitely and replacing the stuff subject to failure is will probably not cost more than half as much (half is a wild ass guess on my part ) as a scratch farm.

Predicting the future is a fools game unless you attach so many caveats that it takes all day to read them.

Here are some reasonable jumping off scenarios to use as starting points for a brainstorming or bullshitting discussion of what might happen.

The price of oil stay holds for a few years at a stable low price with the consequence that battery electric and hybrid car sales are slow to glacial. The business as usual establishment is lined up with the oil auto airline building industries and business as usual politicians gut spending on renewables subsidies and even on basic research .The actual cost of renewables continues to fall but much slower than expected due to less economy of scale.

Little is accomplished on the efficiency and conservation fronts due to complacency and behind the scenes pressure from our friends the Koch Brothers and their ilk.

In ten years – or maybe twenty- the prices of oil and gas spike sharply with horrible economic and political consequences ranging from lots of unemployment to outright energy wars.

Another scenario

Oil goes back up within a year or so and within a year or two the price spikes sharply with the consequence that electric and hybrid cars sell as fast as they roll off the assembly line. This could set the stage for bankers, labor unions, entrepreneurs, job hungry political localities and every Tom Dick Harry and Tina Debbie Henrietta to buy into the NEXT BIG BUBBLE- during recent decades we have seen the bubbles grow and burst or mature in computers pharmaceuticals automobiles housing you name it- There could be a huge rush into renewables.

This in turn might result in solar farms being built in cloudy rainy Scotland and wind farms built in my area where the wind resource is almost as marginal as Scottish sun.Hundreds of billions could be wasted.

Or it might result in the wind farms being built where they should be – on the high plains of our mid west where the wind is very dependable and the technology of long distance transmission being scaled up to affordable levels.Ways could be found to balance consumption with availability – these ways might be sort of expensive but there is nothing technically tough about installing more insulation and more thermal mass so houses can serve as thermal storage as an example.

Pure chance is going to play a huge role.If there is a major nuclear accident that results in not just a large scale evacuation but a few tens of thousands of people dieing in the short term my guess is that nuclear power will be down and out for decades- until some body somewhere manages to build and demo a new reactor design that just won’t melt down and they manage to convince the world it CAN’T MELT DOWN.

If there is no new major nuclear accident within the next ten years I expect a hell of a lot of reactors will be built- barring the economy getting so bad that they can’t be financed.They may or may not be economically competitive. Aircraft carriers and armored divisions are not economically competitive but countries feel a LOT safer when they have these things.

Another possibility

The prices of oil and gas rise steadily but not too fast as the result of depletion and growing population on the one hand with efficiency and conservation measures on the other keeping the prices from breaking the back of the world economy.The renewables industries grow steadily. People trade in or scrap 2015 cars for 2040 models that get twice the mileage but pay twice the price for gasoline as well.

Oil furnaces are obsolete and new guys in the hvac trades don’t even bother to learn how to service them. It’s all gas and heat pumps.

(The 2040 car will probably be a lot smaller or a plug in hybrid if not a pure electric)

There will be countless feedback loops popping up between each and every major occurrence on the political ,economic , engineering, and geological fronts.

The only FOR SURE prediction I am willing to make is that the next couple of decades are going to be interesting times. 😉

Nuclear power is pretty much fated to fall over the next 30 years or so due to a version of the Red Queen.

Construction stopped almost completely for over thirty years. The fleet is aging, and one by one the existing plants are disappearing. A lot of plants will have to be built for the industry to even maintain current output in the coming decades.

Decommissioning the existing plants or extending their lifetimes is going to be expensive and technically difficult. That will provide plenty of fodder for opponents of nuclear power as well.

Also the cheap Russian uranium (taken from warheads) is running out.

New plants are being built, but it is hard to imagine growth in output.

I agree that the future of nuclear power is questionable on the grounds of fuel supply but it is my impression after reading all I can find on the subject that since so little uranium goes such a LONG way in a power plant that it will be possible to mine low grade ores successfully for a very long time .

This would in essence be about the same thing we are doing now in mining low grade oil.Expensive but maybe not so expensive as to be out of reach if used wisely. It may be possible to extract uranium from sea water economically at some point , or alternative methods of mining it might be developed.Beyond this there is no question whatsoever that breeders work. If it comes down to choice between fast breeders and a general lack of affordable electricity I have no doubt that the naked ape will opt for the electricity regardless of the risks of weapons proliferation and runaway reactors.

There is no doubt current day fast breeder designs are dangerous but there is also no doubt the designs can and will be improved substantially if they are put into commercial production.

The only thing that scares me more than a big new fleet of nukes is the lack of them. As dangerous as they no doubt are the flip side of their utility is in my estimation just as great. A country with plenty of electricity is not so apt to go to war to seize another country’s coal or gas fields.Environmentalists withe their hearts in the right place all to often fail to pay any attention to the lessons of history.History ain’t over -not by a LONG SHOT.

I think bankers are a bigger problem than environmentalists. No company can have a risk as big as a nuke on its balance sheet unless the government is willing to bail it out.

Nuclear advocates (mostly engineers) will tell you that the likelihood of an accident is small, but that is beside the point. As long as the possibility of a meltdown is there, only government can finance nuclear power.

Another problem is that the payoff time for nuclear plants is very long — sixty years for new plants is sometimes cited. And that is after construction is complete, so add another 10-15 years.

So from the point of view of a central planner nuclear power might seem like a good bet. But in a free market the current technology isn’t really viable from a financial point of view.

The long payoff time also means that governance issues are an additional risk. For example, China is building a lot of nuclear power right now. China seems very good at running big complex projects, but what happens if there is a civil war in 40 years?

Governance is often an issue in the short term as well. Building a nuclear plant in Pakistan or Nigeria, both of which desperately need more electricity, doesn’t seem like a great idea. For one thing bill collection and grid maintenance are spotty at best.

In other words, our central planner needs to feel confident his plans will work and be in place a long time.

So Ilambiquated do you think non-environmentalists have done a good job so far?

Not sure what you mean.

All these things you point out are precisely the things that scare me so badly about HAVING nukes._Slow to build, very expensive to build up front, questionable maintanencce over the long haul, weapons proliferation…….There is a lot not to like about nukes.

But as steady flow of juice that keeps the water and sewer and the lights on is for all intents and purposes essentially priceless.

Nukes are not likely to shut down because of trade embargos or war unless they last a very long time.A recently refueled nuke can run for months at a time without an hour of downtime.

OFM,

No one is mentioning disposal of high-level nuclear waste.

If the Thorium Angel really does come to visit us we could do a fair job of using it, perhaps, but I’m not holding my breath. As for burying it, for the US it would be as safe to shoot it into the Sun (awfully expensive, though) unless you can talk the Minnesota congressional delegation into allowing a depository there; not holding my breath on that one, either.

The thing that I find staggering when you stop to think about it is the hubris involved in believing that any civilization is capable of dealing with nuclear waste. It is the time scales involved. There is no civilization on the face of the earth that is as old as the time scales that we are implied when we consider how long we will be responsible for this garbage. How can we make that commitment, put that burden on the future, a future that we have no conception of?

Yup. Hubris. Worth watching:

http://www.intoeternitythemovie.com/

Technology expands exponentially. More in the last 100 years than the previous millions. So within 100 years, I expect that it will not be a problem at all.

Clueless, you haven’t a clue. Technology creates problems, it does not fix them. Technology created nuclear power. Nuclear power was a solution. The chief cause of problems is solutions.

I remember when Danny Hillis came up with the idea of a clock that would last 10,000 years and made a complete fool of himself.

http://longnow.org/clock/

Nuclear storage is for longer times

Long term storage is a hell of a problem -I should have mentioned it but just forgot – and no edit button.

But just as it seems certain that we will burn every ton of coal and drop of oil we can put our monkey paws on it seems pretty likely to me that we will pursue the nuclear option if the renewables option does not work out. In composing these particular comments I was thinking it terms of the next decade or two.

Once coal and oil and gas supplies are really short and electricity is really expensive – with renewables not having shouldered the load – most countries will opt for nukes if they are still capable of building them.

The prospect of a major accident – maybe one chance in a thousand any given year in any given area with a few nukes in the area- is going to be viewed as a trivial risk compared to not having lights and water and sewer and refrigeration and phones etc.

If renewables don’t scale up nukes are a dead sure bet over the long haul.

I like your third alternative. NG will act as the bridge fuel in countries where it is abundant. It already is replacing coal in US. Others will jump slowly but surely to renewables.

I read the british have been burning trees to meet their renewables goals. If I had assurance this policy will last I would buy me a chunk of jungle in Colombia, cut it up and sell it to the British. Afterwards I would plant it with sugar cane to make ethanol to sell to the Germans.

That has been the fate of the massive rain forests in SE Asia. Palm oil plantations to make mandated biodiesel for EU market. Its been estimated that cutting the forest releases as much co2 as the biodiesel will replace from fossil fuel in 70 years. Ecological and environmental devastation in the name of saving the environment. Exit the old man of the forest.

Wind, Solar, Nuclear, etc. don’t really compete that much with oil directly.

It’s mostly the alt vehicles that compete with oil. CNG, Biofuel, battery electric, Hydrogen, etc.

This is true in the US. However, electricity does compete with oil in Europe and East Asia, where electric trains compete with ICE vehicles both in the freight and passenger market.

Fernando Wrote:

“I guess the key question could be whether nuclear, wind and other renewables are competitive with oil at $150 per barrel and gas at $10 per MMBTU. If other forms of energy can’t compete then we can go for a while. Maybe peak in the early 30’s?”

The issue is that the economy can’t afford $150 bbl. It can’t really afford even $100 bbl. Only Central banking money printing has prevented the global economy from falling into the greatest depression. The bottom line is that consumers can’t afford an economy dependent on renewable power systems, and money printing can’t continue indefinitely. Soon or later the problems will catch up. My guess is that perhaps they can postpone a global depression for the next five years, maybe stretching it as long as ten years. Its also very likely that WW3 will happen before a severe depression begins. The US has put the world on the road to WW3 with its policy of destabilizing the middle east and is now working to against Russia.

The way I see it the economy can stand high prices. The prices I quoted are seen in Europe at the retail level (we pay huge taxes on liquid fuels, and electricity is burdened by renewables subsidies and fuel taxes).

I read a comment that renewables don’t compete with oil. To an extent they sure do. And if they don’t do so fully the question becomes to what extent they can penetrate the market to carve out a piece of the market, thus causing peak crude and condensate.

I don’t agree that whether renewables can compete is a bean counter issue. Renewables just lack the technical attributes needed for large penetration. In spite of the propaganda and the outright lies we read about what goes on in Germany the bottom line is that the solar and wind programs they have aren’t feasible. And if the Germans can’t afford it then the bulk of nations definitely can’t.

I don’t have the answers, I’m just pointing out this isn’t simply an oil industry issue, the renewables’ high cost will impact the timing for crude oil and condensate peak.

In spite of the propaganda and the outright lies we read about what goes on in Germany the bottom line is that the solar and wind programs they have aren’t feasible. And if the Germans can’t afford it then the bulk of nations definitely can’t.

Fernando, when you make a comment about something in the oil business I’m pretty sure you actually know what you are talking about from first hand experience and I therefor I’m pretty sure I don’t have to second guess the information that you provide.

Having said that I can’t say the same about your comment above. I have family in Germany and I do visit on occasion. One of my siblings works for a large German global software company that is involved with developing smart grid technology used to integrate many different sources of energy.

Have you ever heard of IRENE (Integration of Regenerative Energy and Electric Mobility.) Check out this link, maybe it will help give you a slightly different view on some of the things that are actually happening in Germany and Europe that aren’t yet on the radar of many of us living here in the US

http://blog.rmi.org/blog_2014_11_06_small_german_town_becomes_testing_ground_for_smart_grid

Fred, I visit China and Japan and I have a sister who has a PhD in microbiology who used to work at Harvard Medical research. Do you think that makes me an expert in oriental medicine?

LOL! Probably not but claiming Germany’s alternative energy program is just a bunch of lies without some solid evidence to back up your statements doesn’t do you much credit either. All I’m saying is I have been there and know some pretty smart Germans who are doing things that seem to be working.

Did you check out my link to IRENE?

Try this

http://www.dissentmagazine.org/article/green-energy-bust-in-germany

http://www.economist.com/news/europe/21594336-germanys-new-super-minister-energy-and-economy-has-his-work-cut-out-sunny-windy-costly

http://www.spiegel.de/international/germany/high-costs-and-errors-of-german-transition-to-renewable-energy-a-920288.html

What I find in parallel to the links above is a large body of watermelon literature which apologizes for this failure, by blaming anything to a conspiracy to investors’ stupidity and backwardness, to society’s inability to understand that communism will solve energy problems. In other words, from an objective engineering and economic point of view the german policy is a failure, but it’s supporters have nearly religious beliefs, tend to be extreme leftists and seem undeterred by the destruction their ideas cause.

The stated goals of the Energiewende were to decrease energy consumption by raising prices, decentralize energy production, reduce or end nuclear energy production, reduce carbon dioxide output and make renewables cheaper. All these goals have been reached.

You may not like these goals, but that is a different question.

Your first link is a pro-nuclear rant, blaming renewables for the demise of nukes. Maybe the nuclear industry ought to look in the mirror and see that it’s not so blameless for the high cost and unresolved waste issues (nor are the politicians who rushed to close the nuclear plants).

And it’s dated, using 2012 data.

The new Merkel government decided to sell out to the coal miners to get their governing coalition, then got whacked in opinion polls, now they’re spinning things.

The blather about the extreme cost of electricity in Germany leaves out the fact that Germany enacted high taxes some years ago to drive down electricity consumption.

http://www.dw.de/german-electricity-price-is-half-taxes-and-fees/a-17849142

And industry is exempt from the renewables levy, and benefits from the decline in wholesale prices caused by renewables.

Since wholesale prices are lowering, conventional generators are hurting, and “apologizing for failures…” by blaming renewables, or like E.ON, seeing the writing on the wall, and splitting off the old fossil fuel side.

http://www.reuters.com/article/2014/12/01/us-e-on-divestiture-idUSKCN0JE0WJ20141201

http://www.bloomberg.com/news/2014-12-01/eon-split-to-fortify-german-green-energy-transformation.html

“watermelon literature” huh – so anyone who accepts the reality that fossil fuels are limited and that we’d better get sustainable is a communist?

What exactly is the failure?

The German grid is among the world’s most reliable.

http://spectrum.ieee.org/energywise/energy/the-smarter-grid/germanys-superstable-solarsoaked-grid

Who, beside the capitalists who gambled their investments in coal and nuclear and lost, are being destroyed?

E.ON’s Stade nuclear plant got shut down in 2003 (a year before it “had to”) because the state of Lower Saxony started charging people for use of river water, (can you say “no more externalization of costs”?), and it couldn’t compete anymore.

http://www.eon.com/content/dam/eon-content-pool/eon/company-asset-finder/asset-profiles/stade-power-plant/kernkraft-decommissioning_Stade_en.pdf

How about that promise that nukes were “too cheap to meter”? Yeah, I know, the technical guys didn’t make that promise, only the high muckety mucks did – but that’s what sold the public on the peaceful atom.

Thank you!

have you stayed in a Holiday Inn Express?

Not in Germany >;-)

Only when I went to meet with other spies. We use their excellent facilities to meet and avoid being detected by Smersh and MIB.

Within the quest to maximize profit is

“…the very incentive structure that would inevitably create the state or some institution that performs the same functions as the state (for the state protects the privatized commons with violence, protects the rich from the poor, allows corporations to avoid liability, and the state applies ‘the law’ selectively which makes those who control the state exempt from the state’s laws). When market economists use the term ‘Efficiency’ they are speaking of cost efficiency, which is a phrase that really means ‘maximize profit at every level of production’. This really translates to ‘maximize profit’ at the expense of resource efficiency and technical efficiency and human needs whenever possible. Underlying our current ecological crisis is an outdated hierarchical socioeconomic structure. Cost efficiency/economic growth are better measurements of ecocide than resource efficiency. It might be resource efficient for us to give everyone on the planet a clean energy supply/houses/clean food free of monetary charge but that does not maximize profit, and under capitalism profit must be prioritized above human needs. The problems aren’t the microcosms of corruption we see, but socioeconomic hierarchy itself. However the microcosms of corruption often help to reinforce/accentuate the system that created such corruption.”

Nuclear: very roughly 8 cents per kWh. Wind: around 7 cents. With Transmission and Distribution of about 5 cents, that’s about 12.5 cents per kWh.

EVs use about 1/3 kWh per mile (.2 per km). So, they’ll cost about 4.1 cents per mile.

Oil at, say, $3.30 per gallon and 22 MPG (the US fleet average) costs 15 cents per mile.

4.1 cents is a lot cheaper than 15 cents.

Try building an EV, from ore extraction, plastic interior, tires, etc. using electricity. Try building additional nuclear plants without diesel. What’s the premium to buy an EV over ICE? Cheaper? Really? When’s the breakeven?

Mining is a common concern. Much mining, especially underground, has been electric for some time – here’s a source of electrical mining equipment. Caterpillar manufactures 200-ton and above mining trucks with both drives. Caterpillar will produce mining trucks for every application—uphill, downhill, flat or extreme conditions — with electric as well as mechanical drive. Here’s an electric earth moving truck. Here’s an electric mobile strip mining machine, the largest tracked vehicle in the world at 13,500 tons.

Plastic consumption can be made more efficient by reducing packaging and redesigning structures to reduce density while maintaining strength (human bones are a good example: they’re hollow, and even the tubular structures are mostly empty space internally); other materials (glass, metal, cardboard) can substitute; and it can be recycled to reduce virgin material needs by 99%.

Even now, much plastic is made from natural gas and coal. Industrial chemistry can produce very simple hydrocarbons from any source of hydrocarbons, and build them into any compound our heart might desire. Various kinds of feedstocks would work. Some are more convenient or slightly cheaper than others. Whatever fossil fuel is convenient will work; biomass will work just fine, or hydrocarbons can be synthesized from seawater, atmospheric CO2 and renewable electricity (air, fire and water!).

Tires only have a little bit of oil in synthetic rubber: http://en.wikipedia.org/wiki/Tire_manufacturing

Finally, the Nissan Leaf is the cheapest vehicle on the road to own & operate: check Edmunds.com Total Cost of Ownership.

Cat and all the others do sell electric drive trucks, but all if them have Diesel engines powering the drives

The trolley assist you show does exist but I think is only used in a handful (armful?) of the 30,000 trucks running in the world

If there were enough EVs and Hydrogen vehicles on the road, biofuel production could be diverted to heavy equipment like loaders, and farm tractors, etc.

Toyota is now open sourcing it’s Hydrogen Vehicle technology.

http://www.gizmag.com/toyota-opens-fuel-cell-patents-to-drive-hydrogen-society/35453/

We all know what happened after IBM open sourced it’s PC tech.

Now we need a way to make hydrogen and handle it safely.

It is true that not many mining trucks have trolley wires for their electric motors but that is mostly because diesel fuel is still cheap. A really big truck can easily use as much as four or five hundred gallons of diesel in a day if it runs continuously and such expensive trucks are run around the clock if possible.Just one truck can easily burn well over a quarter of a million dollars worth of fuel in a year.Running it on electricity can save as much as ninety percent of the diesel bill.

If the haul road is a long one and the mine needs a lot of trucks the trolley lines are going to get built if the electricity is available.In my opinion it will be in a lot more places in the future than it is now. A few dedicated wind turbines could power a whole bunch of these trucks for twenty years- any day or night the wind is blowing of course. If it is not then they will still run on diesel- which they do anyway at both ends of the trip.

It occurs to me that we might actually see automated long distance trains at some point in the future- whereby a trucker could just drive his rig on one of a string of flat cars headed from Norfolk to LA along with a few other guys and dog her down and crawl into the sleeper and wake up a third of the way across the country doing a steady eighty mph – with that little train running itself by trolley wire under the eye of railroad controllers working more like air traffic controllers .

A self driving train ought to be a lot easier proposition than a self driving car.

OFM,

You are on track, the Australian Iron ore and coal mines have been or are planning driverless train use for a while now.

Of course mining trains with dedicated tracks are the easiest, as there is no other incidental traffic to deal with.

As for getting away from using diesel, in mining operations, LNG seems to be the first option and is in current use.

hhpinsight.com

A self driving train ought to be a lot easier proposition than a self driving car.

However, trains are already much more efficient in terms of labor costs than cars and trucks, because a single train replaces hundreds of cars or trucks. So self-driving trains don’t add much value. I doubt much will come of the idea.

It is true that no more than three or four guys operate most trains and that one or two would suffice except for union rules and such.

But the real value of self driving trains is not going to be mostly in the labor savings in my estimation. It will be in getting them organized and running them closer together on the tracks without traffic jams. ”Incidental traffic” on the rails themselves will cease to be much of a problem with one big well integrated computer system managing hundreds of miles or even thousands of miles of track.Standardization can be nearly perfect and any upright monkeys messing around can at least be well trained and well screened monkeys running on glucose rather than ethanol.

I can visualize individual cars having their own electric motors and batteries and wireless controls – the batteries being only large enough for switching yard and siding maneuvers- with such cars one guy sitting at a control console in a tower could run a whole yard all by himself.Probably ten times as fast as it can be done now with a large well experienced crew.

A dozen or a hundred such cars would not even need a locomotive.They would be able to propel themselves.

Most people do not realize just how autonomous railroads in the US at least are in terms of managing their own affairs. They buy electricity from utilities but they do not have to answer to building inspectors or utility authorities etc concerning their work. If they want to string trolley wire they don’t even have to apply for a construction permit.They have their own cops.With guns.

This sort of motor will be built right into the wheels of the train cars. The tech is already here and already commonplace.Considering how much it is going to cost to run trucks in the future and how much trouble and time is involved in switching cars in and out these days the technology will be competitive imo.

Trains can take back most of the last couple of hundred miles that belong to the trucking industry these days with this sort of technology. Just about any car can be delivered economically to just about any siding this way.

They could build zip lines over the tracks that

could double as electrical distribution. A step to Toto’s Spider Web Rings.

About have of rail transportation is electric. Trains typically have a separate electricity system.

http://en.wikipedia.org/wiki/Railway_electrification_system

Gee, what could go wrong with driverless trains?

Planes can fly themselves too, including landing and takeoff.

Would you fly in one?

Trains have a few more implications than a big conveyor belt, and even a belt fucks up and needs monitoring and shutting down. If we have got to the point where marginal efficencies relative to cost are necessary to maintain profitable operations, then maybe it is time to shut it down. Personally, I like the law in Oregon that requires a gas jockey to pump your gas. It keeps the kids working and gets their foot in the door of work. Or, Oregon could go self-serve, tell them to stay home and increase taxes to pay them a welfare stipend or put them in free community college.

regards

Many passenger planes are landed in low visibility by autopilot, depending on visibility. Plenty of self driving trains in England already too, on the underground. The robots are coming it would seem.