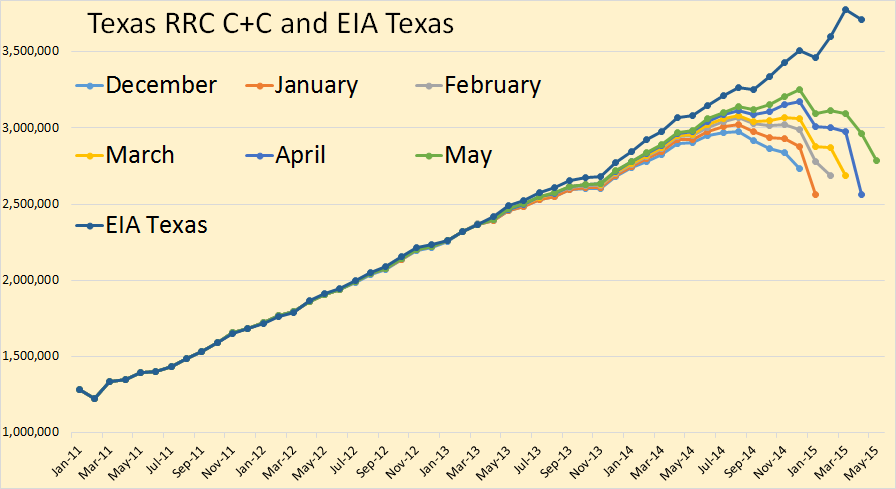

The Texas RRC Data is out. All RRC data below is through May. The EIA data is through April.

There appears to be an increase in Texas May crude oil production. You will notice that the EIA has departed from their usual practice of just estimating Texas C+C production up about 50,000 bpd for every month for the last six months or so. They have a new method or estimating Texas production which is explained in the first link below the charts.

That new method has Texas C+C production down 64,000 barrels per day in April. The May Texas production data will be out on July 31, in the Petroleum Supply Monthly.

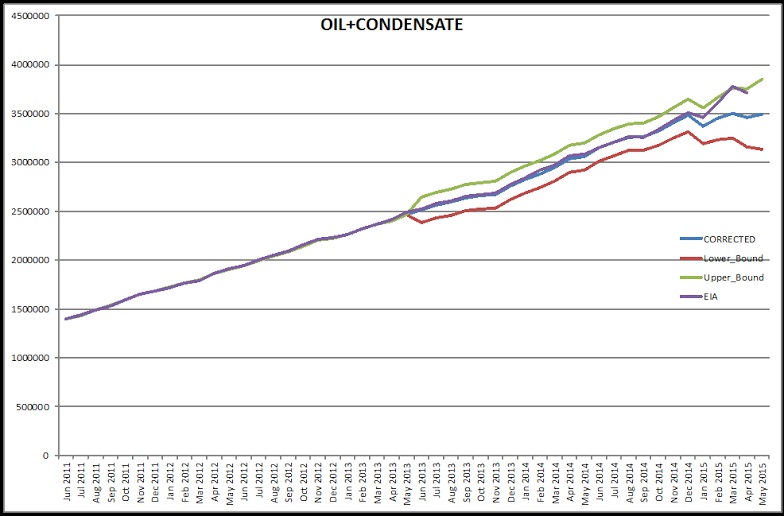

Dr. Dean Fantazzini has calculated what the data wil eventually look like and given us the 95% confidence bounds. He has Texas C+C basically flat since December.

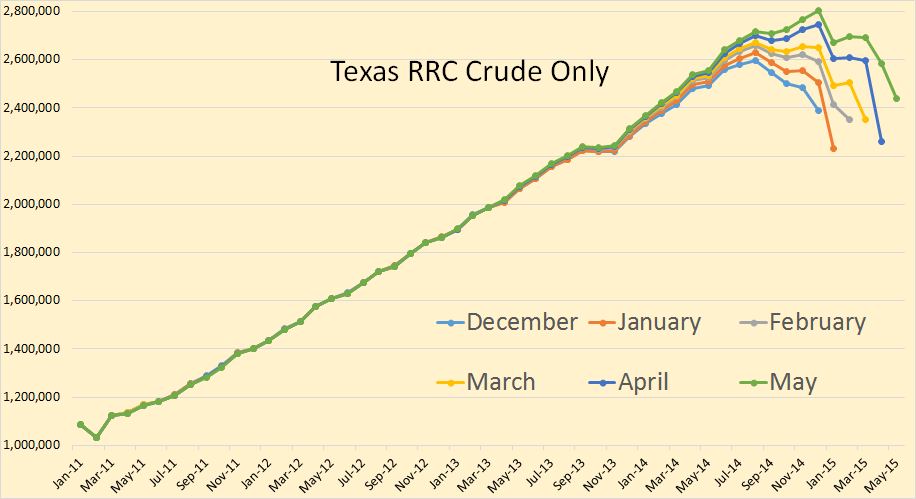

Texas crude only appears to have had a very good gain in May.

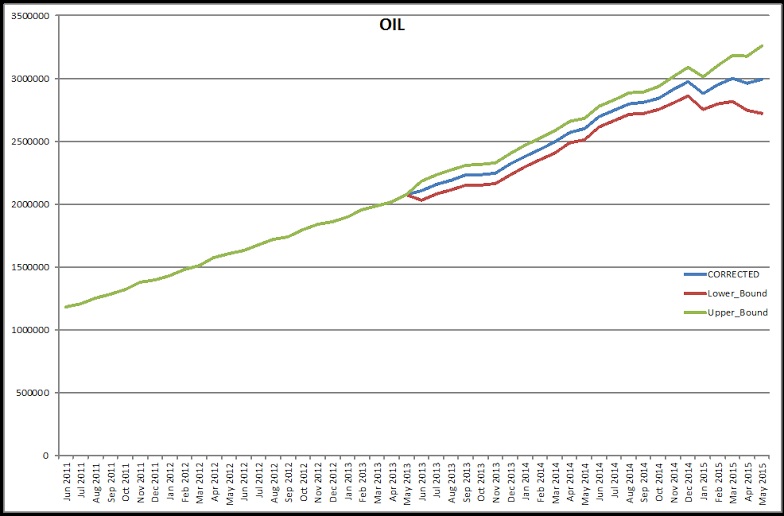

Dr. Fantazzini has Texas crude only showing only a very tiny gain since December.

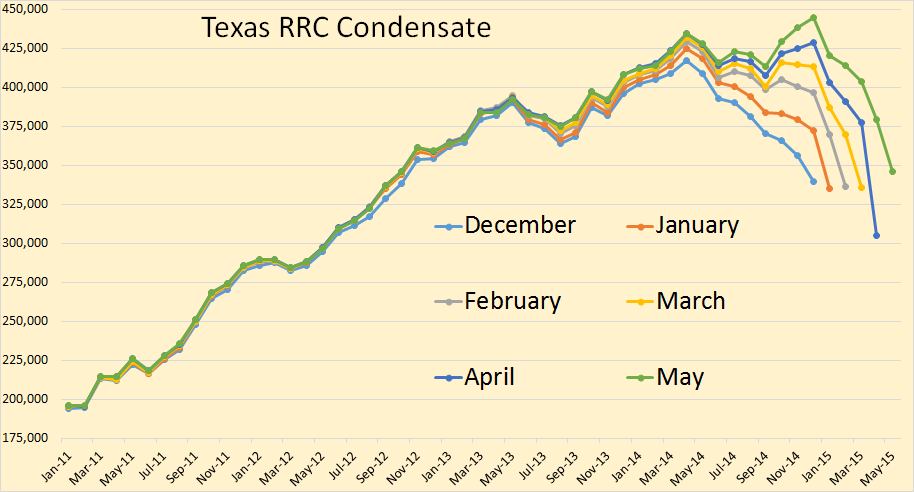

Texas Condensate was up slightly in May but not nearly as much as crude.

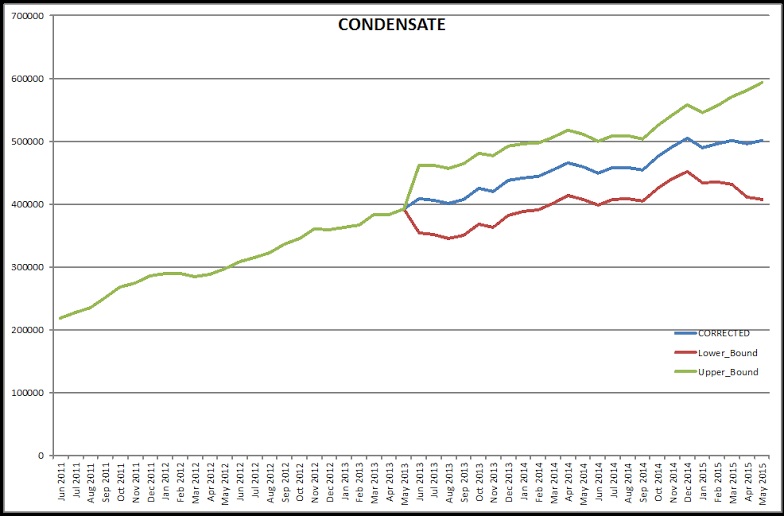

Dr. Fantazzini has Texas condensate flat to slightly down since December.

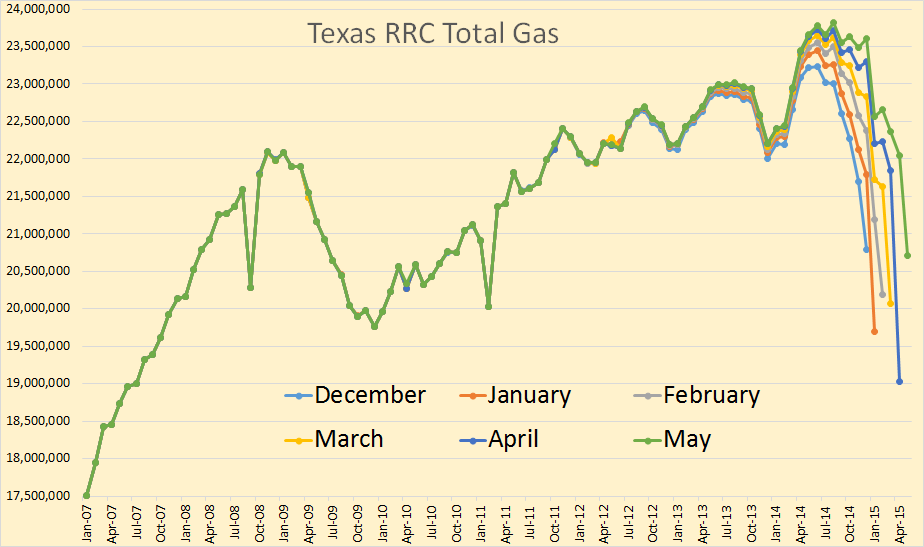

Texas total gas was also up in May over the last few months.

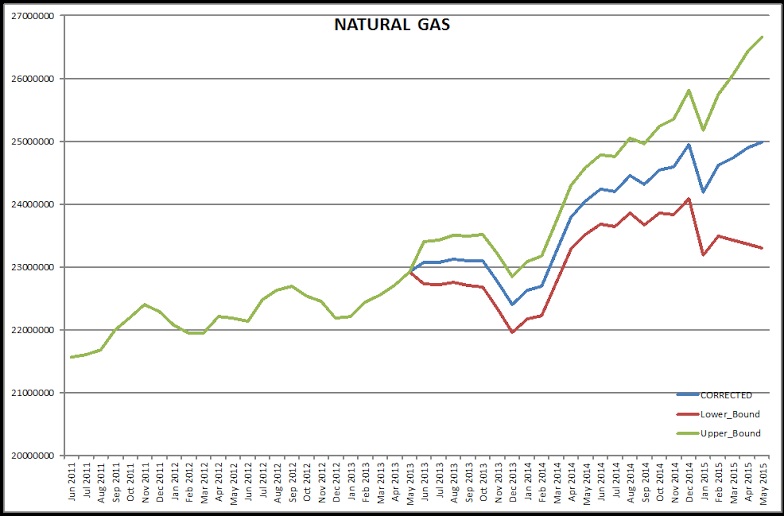

Dr. Fantazzini has Texas total gas making a new high in May but only slightly higher than the December peak.

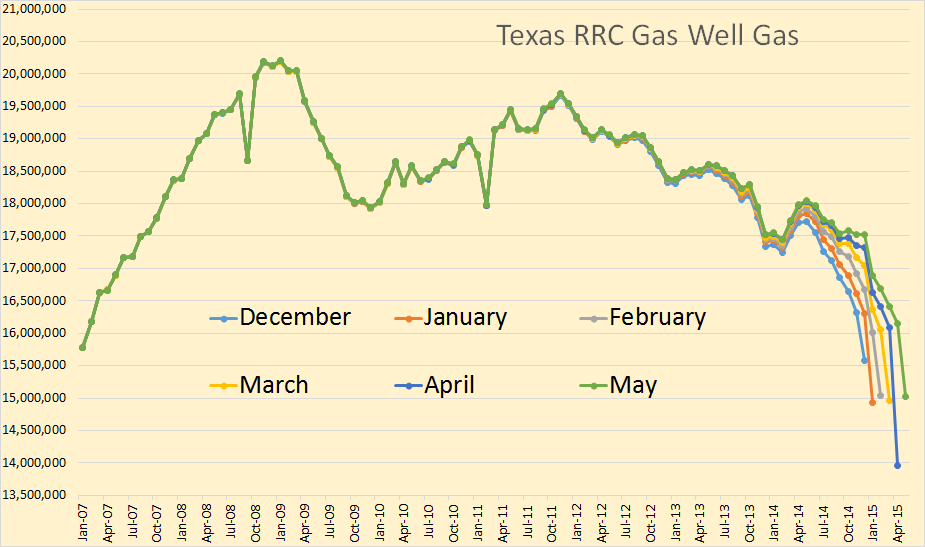

Texas gas well gas was up in May but it still appears to be below the level reached in December.

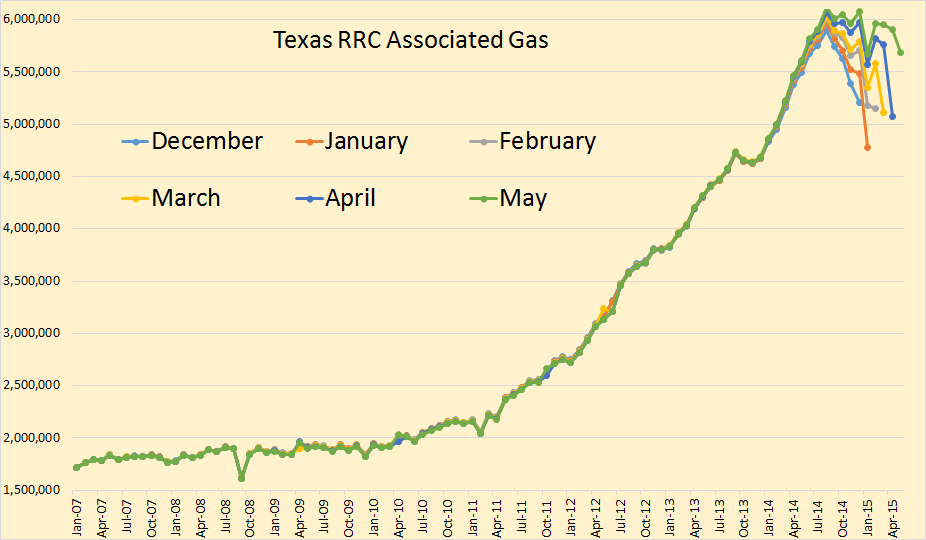

The biggest gain of all appears to be in associated gas, or what the RRC refers to as casinghead gas.

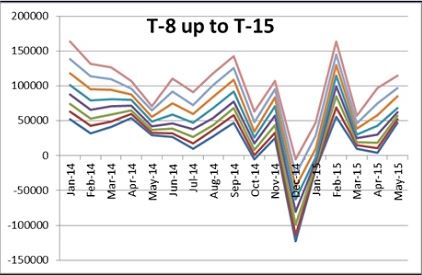

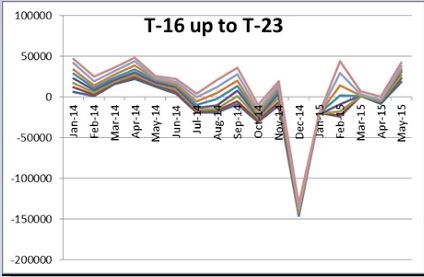

The following three charts are also from Dr. Dean Fantazzini. I don’t quite understand them but his definition is below.

I also attached a plot about the dynamics for the oil (only) correcting factors. As you see, in the last two months, the factors for the closest months T and T-1 have jumped a little: my impression is that in the last two months the RRC is trying to increase the amount of oil data processed. Interestingly, this is not happening for condensate and natural gas, instead.

Below is part of the explanation of how the EIA is now calculating Texas Crude plus Condensate production, hoping to get better accuracy than in the past. If this really interest you then you should click on the link and read the whole article.

How much oil does Texas really produce? The EIA now says it has a better way to count

HOUSTON — The U.S. Energy Information Administration is trying to make its oil production estimates faster and more accurate. That will mean going around Texas’ top industry regulator and straight to the producers to get the numbers.

Recent price swings in crude oil markets have necessitated the shift, said Gary Long, an EIA petroleum engineer, as production has swung faster during the downturn than it did at any point during the long buildup of the shale oil boom.

“We were basically just using a ruler and adding 50,000 (barrels) a day, and that worked pretty well for a while,” he said. “But after the downtown and the talk of the (production) rollover… we thought ‘Our methodology isn’t going to see that.’”…

Accordingly, the EIA has been experimenting with going straight to producers to get its production data. The process would resemble how the group arrives at its natural gas data, Long said.

The top 80 percent or so of producers by the amount of crude they pump would report to the EIA how much they produced across the state. That data would then form the backbone of a production estimate by the EIA, whose analysts would estimate the rest.

“We actually started surveying operators or producers,” Long said, saying that the next monthly estimate may be made using the new methodology if all goes well. “That data has started coming in. We’re looking at it, we’re evaluating it.”

The Fracking revolution has ended any talk of peak oil?

Arizona congressman: We need new energy policy, now

The energy world we live in now was unthinkable just a decade ago. Policy back then was shaped by talk of peak oil and fears of increased reliance on Russian or Middle East imports. President Bush used his State of the Union address that year to push Congress for legislation to reduce environmental oversight and expand domestic drilling. As I remember it, the mood in Washington could best be described as frantic.

So much has changed since then. Domestic development is now booming so fast that Big Oil has set its sight beyond our shores and wants to end the export ban. The underground fracking revolution has ended any talk of “peak” production.

But this next one is even better. Peak oil and global warming are both fading bogyman myths.

Will brutal commodity selloff derail Fed interest rate hike?

Yesterday, WTI got smacked around again, breaking apparently weak support at $50 and briefly dipping to $49 and change before closing barely up once again. WTI has strengthened somewhat this morning, up at $50.87 bbl., a positive jump of 72 cents or slightly less than 1.5 percent on the morning, as of 11 a.m. EDT.

That’s scarcely encouraging, however, given a market that greatly fears a tidal wave of Iranian oil, which may or may not happen anytime soon. Elsewhere, given the continuing, fairly steady rig count in U.S. shale ranges, the bogey man of “peak oil,” like global warming climate change, seems to be one of the many fading myths of our time, at least for the next 10-20 years or so.

And Dan Yergin says we will reach Peak Oil Demand… in the 2030s.

Cheap Oil and Amazing Cheap Energy: The World According to Dan Yergin

There will be worldwide peak oil demand. We think it’s going to be in the 2030s.

Kemp: North Dakota Oil Well Completions Slow Sharply

No new well completion reports have been filed in North Dakota since July 10, the longest gap this year, according to daily activity records published by the state’s Department of Mineral Resources (DMR).

Completions, rather than wells drilled, provide the best guide to short-term changes in output, since operators can always delay completing a well and putting it into production, either because they are waiting for completion crews to be available or to wait for better prices.

Completion is usually defined as a single operation including the stimulation and testing of a well as well as the installation of surface production equipment (“Dictionary of petroleum exploration, drilling and production” 2014).

North Dakota’s regulators consider a well completed when the first oil is produced through wellhead equipment into tanks from the ultimate producing interval and after the well has been cased.

“In no case shall oil or gas be transported from the lease prior to the filing of a completion report unless approved by the (DMR) director,” according to state rules.

Completions reported to the DMR are published in its daily activity reports. The number of completions reported each day is volatile because operators have some discretion about when to file their forms; there are indications that operators often file a clutch of reports for related wells at the same site at the same time.

If the slump continues over the next few days, it could be a sign that shale producers are deferring putting more wells into production to save cash and wait for better prices.

But the slump did not continue. Today, July 22, there were 28 “Producing Wells Completed” and 9 “Confidential Wells Plugged or Producing”. That brings total wells brought on line in July to 62 putting us on track for a total of 87 wells for July. That is still way below the number required to keep production flat.

_________________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne at gmail.com .

610 responses to “Texas RRC Oil & Gas Production”

Ron – For the life of me I don’t understand why you gave Javier a platform for spewing his personal opinion wrt climate change. There is nothing even remotely accurate about his “beliefs” and comments. If you believe that you need to provide fair and balanced opinions then I suppose next you need to do a feature post on how Abiotic Oil will provide all the oil we will ever need.

This just in;

Ocean Temperatures At Record High

Of all the excess heat that results from people’s emissions, 93.4% goes into oceans. Accordingly, ocean heat has strongly increased over the years.

http://arctic-news.blogspot.co.nz/2015/07/ocean-temperatures-at-record-high.html

Jeff, Javier has had his say but you are correct, it is time to do something about all this denial shit. I am beginning to believe these people should be ignored, not argued with. I am going to start deleting denial crap unless they make a logical argument that makes sense.

As I keep pointing out, if they just stuck to pulling out research and let people discuss it, that would be one thing.

But they always throw in the political stuff because they are convinced there is an intentional, worldwide effort to mislead the world with climate data. It’s not the climate data they appear to be interested in. It’s the political stuff that seems to be the basis of their beliefs.

I agree. It’s fine to draw attention to especially interesting articles and pass this on to potentially interested people. Personally I doubt ANYONE here is qualified to analyze and critique scientific papers on AGW. I have over 800 papers on pulsar research (going back to 1968), a degree in Engineering Physics, and have followed this subject religiously for 47 years and I am not remotely qualified to critique the science. Too much of this so called debate on AGW is grandstanding that takes up a lot of space in Ron’s Blog.

Too much of this so called debate on AGW is grandstanding that takes up a lot of space in Ron’s Blog.

Since this is a Peak Oil forum, seems to me it is only relevant to the extent that policy changes oil consumption. And so far it doesn’t appear to be doing so.

Now, we could be discussing whether natural gas should be the energy source of choice for power plants, but again, right now coal is getting phased out because it is dirty, and natural gas is being used more, whether or not it contributes to CO2 in the atmosphere.

Seems like our focus here is more on resource depletion than on the environmental consequences of resource consumption.

I had assumed that the consensus had long been that denial per se was to be ignored.

Myself, I had hoped to see the energy expended here in futile refutation be redirected to potential solutions to the so well-documented depletion of cheap ff’s, and it’s possibly catastrophic economic and climate effects.

http://phys.org/news/2015-07-solar-power.html

http://www.resilience.org/stories/2015-07-22/solar-desalination-could-be-a-game-changer-for-california-farms

I had assumed that the consensus had long been that denial per se was to be ignored.

I won’t respond to a new questionable post on the assumption that once it generates responses, it’s hard to delete.

I have sometimes weighed in after others have done so, primarily to redirect the conversations so that we don’t waste time with them. As I keep pointing out, the lifestyle changes some people fear will be forced upon them because of GW are coming anyway because of economics and resource shortages. The way the world uses fossil fuels is changing and will continue to change. Talking about political conspiracies may make them feel like they are fighting the “good fight” but in reality they have very little control over the changes that are coming. If anything, refusing to adjust will make the changes that more disruptive when they happen. Going from relatively plentiful oil to much less and more expensive is going to be harder if no one has planned for it.

Boomer. No offense meant. Thanks for all your good comments.

Oh, I didn’t assume your comment was directed at me.

I was just saying that I, too, avoid commenting on some of the more trollish posts, but if they end up generating a thread that won’t be deleted, I may say something.

Boomer II,

We should accept this as the general standard in this forum. It is truly a great idea.

Climate change discussions are highly relevant given that they focus on potential impacts of major policy events, and how they may affect oil demand. There is no need to fill the comment section with debates about the origin of climate change.

Inevitably, the upcoming global summit on climate change policy will be mentioned and discussed because it will be a major headline. All regular contributors to this site should keep their focus purely on how quickly future demand forecasts can change in light of whatever agreements result from the Paris Summit.

The Hirsch Report in 2005 is very prescient in this matter. If this years summit yields major progress, and preliminary agreements between the U.S. and China indicate it will, there will be a legitimate impact on future demand.

A combination of global policy agreement and the natural trend in costs regarding battery costs, EV tech, PV, and wind could combine to make the near future much less terrible – at least relative to what it would have been.

In 2010 how many of us would have thought that 2015 would be a year when oil prices averaged $50-$60 barrel without a concurrent global economic catastrophe?

We’re really straddling the line between the Hirsch Reports analysis:

10 years of lead time developing alternative tech (EVs and renewables) could allow us to scrape by after hard times.

0 years of lead time would create system wide failure.

In 2008 we came so close to the edge of the abyss. It is, frankly, amazing the global financial system didn’t collapse.

Is 2015 just like 2005? Are we legitimately much closer in the development of EVs and renewables now than then?

We clearly are, but are we even yet in a phase where we can truly say we’ve spent a single year trying to transition? Not really.

We’re getting close, and a strong global agreement could push us into a true transition.

The most fascinating and mind consuming topic is really “how close are we to starting a thorough transition?” Given a stable global economy, and the progress in relative costs of batteries, EVs, PV, and wind, we’re close to a turning point.

But the second the economy goes sour due to an oil crisis will any of it have mattered? A genuine peak event would halt even the strongest transition in its tracks.

There is a threshold whereby two radically different futures exist for the next 30 years.

Before that threshold of transition is genuine, truly frightening global financial collapse.

After that threshold is, granted, a lot of economic pain, but, like in 2008, the system holds together and transition ensues.

We’re so close to that threshold that a binding global climate change policy could be the thing that sways us from one reality to another. Regardless of climate change’s reality, the results of the Paris summit will have a significant impact on what side of that threshold we find ourselves.

I cannot commend you enough for making the prescient point that climate change discussion matters in this forum; it matters to the extent that global action on climate change influences our future in regards to peak oil. Discussion should be limited to that topic, and should not sway into debate of what is causing climate change (or whether or not it is even happening for that matter). There are forums for that, and this is not one of them.

I must agree that when the subject is climate science we must leave the details to climate scientists – when the details are about the ACTUAL SCIENCE itself. When it comes to heart surgery we must leave the details to heart surgeons. Ditto just about any really involved subject.

But climate science does not exist in a vacuum in the sense that it can be done in a lab and the experiments can be easily and cheaply duplicated.

Climate science right or wrong depends to a huge extent on the assumptions built into it when it comes to FORECASTING the future.

The forecasts are based on politically determined assumptions. There is simply no way to deny this basic fact. ANY action taken on the basis of these forecasts are politically determined and there will be winners and losers on the vast scale depending on what actions are taken – if any.

Personally I believe most of the people who do not believe in forced climate change and post comments here are actually capable of thinking for themselves – and ARE thinking. ( Some are obvious trolls of course.)

Their problem is not that they are incapable thinkers but that they are simply scientifically illiterate. A cursory , mile wide quarter inch deep layman’s knowledge of the sciences MUCH worse than useless when it comes to evaluating climate science. You can USE a computer and fly on a jet and yet be literally illiterate when it comes to the physical sciences.

Such people simply do not understand the nature of peer review not just over the short term but over the long term as well. They believe everybody is somewhat dishonest and out to get what he can , from their lawyer to their doctor to the man they vote for to their own kids.

So it is no wonder at all that they believe climate scientists are frauds. A cursory, shallow layman level knowledge of the sciences is quite enough for them to convince themselves that fraud is involved. For every fact supporting change it is very easy to come up with one supporting natural variation- if you do not understand the subject in some depth.

Let us not forget that NOBODY has ever gone broke overestimating the ignorance and stupidity of the public. I personally know some graduates of VERY well thought of universities who are scientifically illiterate. You can graduate from just about any university excepting one such as MIT or Caltech taking only one so called “survey” course in the sciences. Such a course is just about equivalent to reading a couple of incomprehensible books and immediately forgetting them.

I have only contributed my opinion when there was an ongoing discussion about climate change. I have never brought up the issue since I respect that this is a blog on oil. I do not come to the blog to convince anybody about climate change, I come to learn about peak oil, but I have little to contribute about that since the level of expertise on oil related matters is very high and I don’t usually like to say something when I have little to contribute.

You have posted several times on climate change so I don’t take any responsibility for “spewing my personal opinion wrt climate change” as if everybody else wasn’t doing the same.

It is fine with me if there is no discussion on climate change in the blog, but I would think very poorly if the goal is only to have a one-sided view on climate change and dissenting views are discouraged. But of course it is your blog, so it’s your say.

Probably not a good idea to head on into a Mosque and ask if anyone would like to hear your testimony about Jesus.

Javier, your views are complete crap and you have to know that they are vastly different than those of any respected climate scientists. All you are doing is tossing useless noise into the forum here. There are a vast variety of views that are debated in climate science. Your views reflect none of them.

Thank you for your opinion. I am in the company of such great minds as Freeman Dyson and climatologists with long and fruitful publishing records like Roy Spencer, Richard Lindzen, Judith Curry, Ole Humlum, Fred Singer, Willie Soon, Nicola Scafetta, Friedhelm Steinhilber, Ilya Usoskin, Henrik Svensmark, Sami Solanki, Roger Pielke Jr., Fredrik Ljungqvist, Craig Loehle, Ján Veizer, Zhengyu Liu, Robert Knox, Nic Lewis, John Christy, David Douglass, David Evans, Felix Fitzroy, Bjorn Stevens, and Joanna Haigh, just to cite some of the researchers whose results and/or conclusions clearly contradict key aspects of the IPCC represented model of climate change.

My views are a lot more shared in the climate scientific community than you are prepared to accept.

I lol’d when I saw Willie Soon’s name, got undisclosed fossil fuel company backers?! Yep!

You should see if you can get on their payroll too.

“I am in the company of such great minds as blahbla”

A rebel! With a brilliant idea! See also: crackpot.

Now, as to the leavings of your gish gallop, hmm, ah, yes. Roy Spencer, of “Remote Sensing” fame, whose article that “blow[s] a gaping hole in global warming alarmism” (heh) was refuted inside three days. The editor of “Remote Sensing” resigned, agreeing with the critics of the paper. Ouch. Well, if you want to fly the Spencer albatross, I guess you could drop that name.

Lindzen, lindzen, lindzen. ‘This attitude has strong backing from Richard Lindzen, Professor of Meteorology at the Massachusetts Institute of Technology, who describes Exxon Mobil as “the only principled oil and gas company I know in the US.”‘ — http://news.bbc.co.uk/2/hi/business/6595369.stm

Principaled contributions to his wallet, doubtless. Wasn’t there some sort of gulf blow-out involving Exxon? The only principled oil and gas company. Indeed.

Judith Curry is flying a Zero in the Great Marianas Turkey Shoot. https://tamino.wordpress.com/2015/07/03/judith-curry-responds-sort-of-v2/

Singer? Another bling boy for the Heartland money pump.

Willie Soon, too soon!

Nicola Scafetta seems much in tune with the Music of the Spheres (Kepler rebooted as “Tides from Jupiter” for their purported influence on temperatures terrestrial vis-a-vis the Sun), but flunks the Shapiro-Wilk test.

… this being the point of such gish gallops, is that there is a huge dirty laundry list to slosh through, which is probably why denialists spout them, bear with me here. Mead. Must brew more mead …

Friedhelm Steinhilber, Ilya Usoskin, Henrik Svensmark, Sami Solanki? Too Soon to tell if this sunny obsession of yours will pay off. Actual climate scientists appear dubious. Henrik in particular thinks rays play a major role in warming, expect for the up-and-to-the-right march of temperatures, set against a decline in cosmic rays. Fail. Oh, he’s a measure-from-the-monster-1998-el-nino Shaq Attacker. Stats fail.

Roger Pielke… oh, the junior one. Smackdown. http://www.whitehouse.gov/sites/default/files/microsites/ostp/critique_of_pielke_jr_statements_on_drought.pdf

Fredrik Ljungqvist. Uh… some Milankovitch work that “agrees well” with the work of Mann et al (2008). Nothing, ah, revolutionary here. Can I get a roll on the percussive drum? Thank you.

Craig Loehle. A Heartland-of-the-unabomber-ad-fame expert who has “never received money from fossil fuel interests” which is an interesting claim given the funding Exxon has forked over to this expert’s employer. If Susie gives it to Mallory who gives it to Craig, it’s not from Susie. QED.

Why is the isotope geologist Ján Veizer in this list? Oh, Heartland expert.

Zhengyu Liu, working on “The Holocene temperature conundrum.” Okay, a scientist doing science, probably the best find among all the other lint and chaff you’ve strewn here. Notably, his work does not “change the evidence of human impact on global climate.”

Robert Knox, the Harry Potter actor… or… ?

Nic Lewis? Ah, Curry’s wingman in the aforementioned Turkey Shoot.

John Christy. Didn’t he sign the American Geophysical Union’s warning about humand-caused warming?

David Douglass. I can only find “Climate forcing by the volcanic eruption of Mount Pinatubo” (2005) which has racked up 0 citations. Publish or perish, David, publish or perish.

David Evans. Looks like an electrical engineer? Or there’s some emeritus Biologist from Florida… ?

Felix Fitzroy calls for a “green new deal” to place more emphasis on climate change mitigation (rather than GDP). Okay, that’s great. Who will pay for that? And what does it have to do with climate science?

Bjorn Stevens looks like a solid cloud scientist, but yet and still and again I’m not seeing anything that would upset the apple cart.

Joanna Haigh appears to have garnered some fuss over a rejected paper, rejected due to “both factual errors and an overall assessment.” Well, shucks. Better luck next time?

Yet despite your wise arse phrases these people are scientists working for research institutions and doing and publishing science that you are probably not even capable of understanding much less judge. Whether they are right or wrong is not up to you to decide.

Yes it is for us to judge. We can read. The science literature will reflect the respect with which they are held. The entire list includes no one that is both respected and published with anything that will be the slightest problem for the consensus on global warming.

Mmm. A more cogent rebuttal would have mentioned the error made by Tamino, but if an easy pitch like that sails on by…

“…and doing and publishing science that you are probably not even capable of understanding much less judge.” ~ Javier

Javier, while I have not been paying too much attention to your take on the climate change issue, it seems to me that science is about understanding and making it understandable to everyone, not just an elite clique of scientists.

I love popularization articles like this one:

http://dailycaller.com/2015/07/22/expedition-to-study-global-warming-put-on-hold-because-of-too-much-ice/

Fernado, your appreciation of a mostly anti-science site such as the Daily Caller is precisely why people should have reason to question anything that you have to say about science. If you want to understand what is real then you have to have an epistemology that actually yields knowledge of the real. Do you care about what is real or do you just delight in attacking those who do care about what is real? Your delight in the Daily Caller is polemical extremism that should not appear here.

I can understand how some retired petroleum engineers and the like may be pressed to somehow ‘align’ in their mind what they have spent their entire careers helping to possibly do (cook the planet).

Perhaps it’s a bit like an especially-icy Arctic year to somehow ‘align’ with especially-ice-free ones.

You don’t think it’s funny to have a research vessel researching global warming suspend its trek because it’s running into too much ice? I laughed when I saw it, it reminded me of the similar vessel stuck in January 2014 somewhere off Antarctica.

Sure it’s amusing on some level… but given my attitude about governpimps (the ship is nuclear powered, etc.) and the wealth of, often infernal, irony and contradiction that’s out there, it’s like the same old joke over and over again.

“in·fer·nal

inˈfərnl/

adjective

1. of, relating to, or characteristic of hell or the underworld. ‘the infernal regions’

synonyms: hellish, nether, subterranean, underworld, chthonic, Tartarean…

satanic, devilish, diabolical, fiendish, demonic

‘the infernal regions’

2. informal

irritating and tiresome (used for emphasis).

‘you’re an infernal nuisance’

synonyms: damnable, wretched, confounded;” ~ Google dictionary

Heaven Hell

Javier, Thanks for proving my point with your list. Singer is senile bloviator saying nothing that can be published for decades. He speaks only to gullible right wingers who like to listen to crackpot nonsense. Dyson has no climate credentials at all. Spencer is a profound incompetent who was given satellite data to process and then proved that he could not understand how to do that. He is now asserting that science is proving young earth creationism. Lindzen is a competent meteorologist who actually got published in cloud science. His most salient paper looked at a particular area of the south Pacific. Virtually every subsequent paper looking at his claims has demonstrated that he was quite wrong when we look at cloud dynamics world wide. Lindzen not being a climate scientist is unfamiliar with paleo-history and the long term climate forcing mechanism that drive it. His major theory has been thoroughly debunked but he is likely the best that you have on this list.

Javier, it is like evolution, that is evolution is a fact, the matter is settled. All opposition to evolution is religious or political. I no longer argue with creationists because I know they deny science, they blame the teaching of evolution on politics. That is just dumb. I now just ignore them because they do not deserve my time or attention.

But I still talk about evolution because it plays such an important part in life on earth. I dismiss the deniers but I am still free to discuss the science.

Likewise with global warming and climate change. It is a fact, the jury is in and the matter is settled. The opposition to the science is political. But I, and anyone else, is still free to discuss the science because it plays such a very important part in the future of life on earth.

This blog will continue to discuss global warming and climate change because of the very dramatic effect it is having on our lives and the lives of every other creature on earth. But this blog will no longer be a platform for the political deniers of science to voice their politics and pseudo science.

Ron, you are so right. Evolution has such vast complexities that are becoming increasingly visible. It is a true pleasure reading a writer who can make those nuances visible to a layperson. The passionate philosophical debates on evolutionary science are also quite interesting. I do love debating and discussing those complexities with others. Evolution would be more than a bit off topic here. However, the world of energy is most relevant here. I presume that over 98% of those who come here are like me and support your move to keep the discussion to the real science around energy. It is just like evolution in having much interesting complexity and differences of opinion that are critical for humanity. We just need a modest reduction in the noise that does not deserve our time and attention.

Thanks Ron, I utterly agree.

Perhaps you can get some help from some of the posters to act as moderators, to ease your burden.

There is a deep link between evolution and energy. Successful species maximise the use of the energy available to them. Populations expand and contract in response to this available energy. and the Human species is no different. Therefore discussing evolution in this context is relevant to the peak oil debate.

Hello Ed.

Great comment. You are talking about the Maximum Power Principle. I’m not sure that has ever been much discussed here. It really should be.

“That theory, as it is expressed by the maximum power principle, addresses the empirical question of why systems of any type or size organize themselves into the patterns observed. Such a question assumes that physical laws govern system function. It does not assume, for example, that the system comprising economic production is driven by consumers; rather that the whole cycle of production-consumption is structured and driven by physical laws.”

~Howard T. Odum

Well, animal populations do. But they don’t have contraceptives, or insulation.

Most of the world has reduced it’s fertility below the replacement rate, voluntarily. That wouldn’t be predicted by the MPP.

The OECD has plateaued in terms of production and consumption of new cars, homes, washer/dryer’s, TV, etc. That wouldn’t be predicted by the MPP.

“Well, animal populations do. But they don’t have contraceptives, or insulation.”

Dream on. Humans are just like all animals. Contraception and insulation don’t really make any difference at all. You are just telling yourself a story.

“Most of the world has reduced it’s fertility below the replacement rate, voluntarily. That wouldn’t be predicted by the MPP.”

Yes it would. The fertility rate was not reduced voluntarily. The fertility rate is determined by available net energy. There is less available energy per capita, therefore, less reproduction.

“The OECD has plateaued in terms of production and consumption of new cars, homes, washer/dryer’s, TV, etc. That wouldn’t be predicted by the MPP.”

Yes it would. There is less available energy per capita, therefore, less consumption.

The fertility rate is determined by available net energy. There is less available energy per capita, therefore, less reproduction.

What data suggests to you that there is less available energy per capita??

Animal population growth rates are limited by food availability and death rates. Humans have more food per capita than ever – obesity is a growing problem around the world. Death rates, and especially infant mortality rates, are falling around the world. This looks nothing at all like an animal population hitting food limits.

Hey Nick.

I do not want to entertain this discussion on this level.

———-

The Maximum Power Principle is one of the most important breakthroughs in the understanding life and evolution on this planet. It is foundational science for understanding our current energy dilemma. I am sorry, but if you don’t understand it, you are ignorant. If it does not inform your views, then you are just wrong.

http://jayhanson.us/loop.htm

“Today, when one observes the many severe environmental and social problems, it appears that we are rushing towards extinction and are powerless to stop it. Why can’t we save ourselves? To answer that question we only need to integrate three of the key influences on our behavior: biological evolution, overshoot, and a proposed fourth law of thermodynamics called the “Maximum Power Principle”(MPP). The MPP states that biological systems will organize to increase power generation, by degrading more energy, whenever systemic constraints allow it.

Living organisms are required by the Second law of thermodynamics (a law like gravity) to deplete (dissipate) available energy (exergy) in order to survive and reproduce. In the discipline of open system thermodynamics, living organisms are called “dissipative structures” because they “dissipate” energy.

A dissipative structure is a thermodynamically open system which is operating out of, and often far from, thermodynamic equilibrium in an environment with which it exchanges energy and matter. When dissipative structures occur, they are required by the Second Law of thermodynamics to enhance local energy gradient dissipation.

Originally formulated by Lotka and further developed by Odum and Pinkerton, the MPP states that biological systems capture and use energy to build and maintain structures and gradients, which allow additional capture and utilization of energy. One of the great strengths of the MPP is that it directly relates energetics to fitness; organisms maximize fitness by maximizing power. With greater power, there is greater opportunity to allocate energy to reproduction and survival, and therefore, an organism that captures and utilizes more energy than another organism in a population will have a fitness advantage.

The best way to survive in such a milieu is not to live in ecological balance with slow growth, but to grow rapidly and be able to fend off competitors as well as take resources from others.

Not only are human societies never alone, but regardless of how well they control their own population or act ecologically, they cannot control their neighbors behavior. Each society must confront the real possibility that its neighbors will not live in ecological balance but will grow its numbers and attempt to take the resources from nearby groups. Not only have societies always lived in a changing environment, but they always have neighbors. The best way to survive in such a milieu is not to live in ecological balance with slow growth, but to grow rapidly and be able to fend off competitors as well as take resources from others.

To see how this most human dynamic works, imagine an extremely simple world with only two societies and no unoccupied land. Under normal conditions, neither group would have much motivation to take resources from the other. People may be somewhat hungry, but not hungry enough to risk getting killed in order to eat a little better. A few members of either group may die indirectly from food shortages—via disease or infant mortality, for example—but from an individual s perspective, he or she is much more likely to be killed trying to take food from the neighbors than from the usual provisioning shortfalls. Such a constant world would never last for long. Populations would grow and human activity would degrade the land or resources, reducing their abundance. Even if, by sheer luck, all things remained equal, it must be remembered that the climate would never be constant: Times of food stress occur because of changes in the weather, especially over the course of several generations. When a very bad year or series of years occurs, the willingness to risk a fight increases because the likelihood of starving goes up.

If one group is much bigger, better organized, or has better fighters among its members and the group faces starvation, the motivation to take over the territory of its neighbor is high, because it is very likely to succeed. Since human groups are never identical, there will always be some groups for whom warfare as a solution is a rational choice in any food crisis, because they are likely to succeed in getting more resources by warring on their neighbors.

Now comes the most important part of this overly simplified story: The group with the larger population always has an advantage in any competition over resources, whatever those resources may be. Over the course of human history, one side rarely has better weapons or tactics for any length of time, and most such warfare between smaller societies is attritional. With equal skills and weapons, each side would be expected to kill an equal number of its opponents. Over time, the larger group will finally overwhelm the smaller one. This advantage of size is well recognized by humans all over the world, and they go to great lengths to keep their numbers comparable to their potential enemies. This is observed anthropologically by the universal desire to have many allies, and the common tactic of smaller groups inviting other societies to join them, even in times of food stress.

Assume for a moment that by some miracle one of our two groups is full of farsighted, ecological geniuses. They are able to keep their population in check and, moreover, keep it far enough below the carrying capacity that minor changes in the weather, or even longer-term changes in the climate, do not result in food stress. If they need to consume only half of what is available each year, even if there is a terrible year, this group will probably come through the hardship just fine. More important, when a few good years come along, these masterfully ecological people will/not/grow rapidly, because to do so would mean that they would have trouble when the good times end. Think of them as the ecological equivalent of the industrious ants.

The second group, on the other hand, is just the opposite—it consists of ecological dimwits. They have no wonderful processes available to control their population. They are forever on the edge of the carrying capacity, they reproduce with abandon, and they frequently suffer food shortages and the inevitable consequences. Think of this bunch as the ecological equivalent of the carefree grasshoppers. When the good years come, they have more children and grow their population rapidly. Twenty years later, they have doubled their numbers and quickly run out of food at the first minor change in the weather. Of course, had this been a group of “noble savages who eschewed warfare, they would have starved to death and only a much smaller and more sustainable group survived. This is not a bunch of noble savages; these are ecological dimwits and they attack their good neighbors in order to save their own skins. Since they now outnumber their good neighbors two to one, the dimwits prevail after heavy attrition on both sides. The “good” ants turn out to be dead ants, and the “bad” grasshoppers inherit the earth. The moral of this fable is that if any group can get itself into ecological balance and stabilize its population even in the face of environmental change, it will be tremendously disadvantaged against societies that do not behave that way. The long-term successful society, in a world with many different societies, will be the one that grows when it can and fights when it runs out of resources. It is useless to live an ecologically sustainable existence in the “Garden of Eden” unless the neighbors do so as well. Only one nonconservationist society in an entire region can begin a process of conflict and expansion by the “grasshoppers” at the expense of the Eden-dwelling “ants”. This smacks of a Darwinian competition—survival of the fittest—between societies. Note that the “fittest” of our two groups was not the more ecological, it was the one that grew faster. The idea of such Darwinian competition is unpalatable to many, especially when the “bad” folks appear to be the winners.”

~Jay Hanson

(End part 1)

Well, you said above:

“Populations expand and contract in response to this available energy. and the Human species is no different.”

And, we have seen that this is just not so.

Most of the world has reduced it’s fertility below the replacement rate due to greater affluence and availability of life choices other than child-bearing. The rest of the world’s fertility is falling very fast.

Food per capita is expanding to the point that’s it’s unhealthy. Infant mortality is falling, adult death rates are falling, and longevity is increasing.

And, extra-somatic

Nick is more correct in this conversation.

That is a bogus comparison. You are using the false analogy fallacy and the guilt by association fallacy.

That creationism and disagreement with catastrophic human global warming theory are a false analogy can be demonstrated by the long list of active scientific researchers that are publishing dozens of relevant papers in important peer-reviewed journals challenging crucial aspects of IPCC established AGW theory. Just to cite some of them: Roy Spencer, Richard Lindzen, Judith Curry, Ole Humlum, Fred Singer, Willie Soon, Nicola Scafetta, Friedhelm Steinhilber, Ilya Usoskin, Henrik Svensmark, Sami Solanki, Roger Pielke Jr., Fredrik Ljungqvist, Craig Loehle, Ján Veizer, Zhengyu Liu, Robert Knox, Nic Lewis, John Christy, David Douglass, David Evans, Felix Fitzroy, Bjorn Stevens, and Joanna Haigh.

You wont be able to provide a similar list of current scientist questioning key aspects of evolutionary theory.

Your second fallacy is to try to associate people that disagree with catastrophic human global warming theory with creationists so they are guilt by association. No such association exists.

Time and nature have been disproving CAGW for the last 15 years when warming has barely progressed and climate sensitivity and hence the consequences of warming, has had its average value reduced. This trend is likely to continue and even accentuate over the next two decades. I understand that you don’t like to have your core beliefs challenged.

I am prepared to place an intellectual bet against you on climate change evolution for the next 15 years subject to annual review. Are you as sure that the world is going to continue warming as I am that it is not?

“You wont be able to provide a similar list of current scientist questioning key aspects of evolutionary theory.”

Actually Roy Spencer is quite firmly in the intelligent design camp, so there’s at least one name which would appear on both lists. Which I guess just goes to show what idiotic company you’re keeping.

As I’ve said elsewhere, I prefer to ridicule you than to engage with you, as I find it both more entertaining and just as constructive. You idiot.

At the risk of being ridiculed, I have what I think is a nuanced perspective.

There is no question that the planet has been warming since the end of the previous ice age, and most especially since the Maunder Minimum in the 17th century.

There is unquestionably warming associated with the urban heat island effect from deforestation, paving over grasslands, watersheds, and erecting structures of concrete and steel.

These effects have coincided with the First and Second Industrial Revolutions, the so-called Green Revolution since the 1950s-60s, and the human ape population accelerating from a growth rate of ~0-0.4% for most of our species existence to near 2% in the 1970s and a near halving of the rate since then to date.

Surely the 600% increase in the number of human apes since the onset of the Industrial Revolution has had AT LEAST an incremental effect on atmospheric warming over the past 60-100 to 150 years.

But allow me to invite participants to examine the Gleissberg (Jovian orbit), Seuss/de Vries, and Hallstatt cycles (planetary alignments and the possible effect on solar equatorial forcing, solar magnetic effects, and sunspots, as well as geophysical forcing on the Earth’s crust and possible effects related to underwater volcanoes and associated ocean warming) that are largely unknown and certainly not factors discussed as part of the “debate” about atmospheric and ocean warming.

Note that the previous two convergences of the Gleissberg and Seuss/de Vries cycles were in the late 18th and early to mid-19th centuries, late 16th and early 17th centuries, and late 13th to early 15th centuries.

Consult the historical record for the climate conditions in Europe, Asia, and Mesoamerica at the time, and note the occurrence of mega-drought conditions that might have caused the collapse of the Maya and Anasazi civilizations, and perhaps the west African empires of Mali and Songhai.

The larger inference is that there are likely to be natural solar and geophysical forces manifesting IN ADDITION TO the effects from human ape population overshoot of the finite planet Earth. How much human activity is ACTUALLY affecting atmospheric and ocean temperatures beyond the implied natural effects are a subject of inquiry for me.

But perhaps more importantly, what can be done in the near or intermediate term to make a difference, if any, short of a dramatic decline in human ape population over the current and next generation?

In this context, I suspect that it is too late to make any difference for the current and next generation even IF the incremental warming is primarily caused by human activity.

But IF we see a period of lows in average sunspot maxima over the next 2-3 solar cycles (20-33 years) not seen in 200-400 years AND a “pause” in the increase in warming, it might well be that the effects of warming already having occurred (ice melt, sea level rise, etc.), including mega-drought conditions in CA and the US Southwest, are already entrained and will manifest in undesirable, if not catastrophic, ways for a generation or longer hereafter.

Anyway, I hope that makes sense and avoids the typical reprisals from those inclined to be motivated by ideology and politics.

The universe/multiverses is/are teaching and I’m still learning (so far). 🙂

Do you have magnitudes (delta W/m2 at TOA) for these cycles and references I can look up. Thanks.

BC,

The natural effects of changes in solar energy inputs and the various orbital cycles the Earth experiences are the foundation of climate science.

Our sunspot records actually go back to 1610. Shortly after making the first telescope Galileo Galilei began recording sunspot activity. We have no records before that time, but we have a strong grasp of solar activity cycles from those 400 years of records.

You are entirely correct that the Little Ice Age occurred during an extended period of little to no sunspot activity. It is accepted science that is used in calculating the influence of solar activity – by means of sunspot activity records. This is a central aspect of climate calculations.

Climate scientists start with solar activity. It is the very first piece of information that is considered because it informs total solar output during any period. From there the Earth’s various cycles of tilt, precession, etc. are used to determine the total solar influx to Earth’s atmosphere over time.

Given the natural cycles of the Sun and Earth we SHOULD be in a period of global cooling. All the data we have confirms this; there is zero doubt. The data on Sun activity and Earth’s cycles are well recorded, and climate models accurately predict global average temperatures in the past – including the Little Ice Age.

Using the data on solar activity and Earth’s natural cycles predicts temperatures faithfully – until the 20th century when a growing anomaly in predicted temperatures appears. This is the very foundation of climate science.

When all natural cycles are considered (including geological records of volcanic activity, which geologists have highly accurate records of) the Earth should be in a cooling trend, but instead it is in a warming trend that deviates further and further from where global temperatures SHOULD be as time passes.

We’re only 14 years into 21st century – 13 of those years are the warmest on record, and 2015 is already the single warmest year on record. This is occurring when the planet should be cooling.

The mystery was to figure out what is causing temperatures to be so radically different than solar activity and Earth’s orbital cycles would predict.

The only hypothesis that accurately explains this temperature anomaly is the increased concentration of greenhouse gases in the atmosphere.

The science of greenhouse gases is quite simple and easy to measure – every molecule in existence has a specific, non-changing spectrum of EM waves that it absorbs, and every molecule has a specific, non-changing spectrum of EM waves it emits. These are the physical properties of molecules, and it is why pure gold is always gold no matter where it came from.

A greenhouse gas is any gas that does not absorb EM waves in the solar spectrum. So solar energy passes right through because the molecule is physically incapable of absorbing it. That solar energy passes through the atmosphere and IS absorbed by the Earth’s surface. Those solar EM waves are re-emitted as infrared energy (another kind of EM wave).

Greenhouse gases absorb infrared EM waves. This is why they’re called greenhouse gases – they are incapable of absorbing EM waves in the solar spectrum, but do absorb infrared EM waves. Thus making them like the glass pane of a greenhouse – solar energy passes through the glass and is absorbed and re-emitted as infrared energy inside, but glass absorbs infrared waves, so energy comes in and is trapped.

You can literally go out, buy yourself a spectrometer, and measure these properties of various molecules yourself.

Anthropogenic climate change is based on this:

We have strong, accurate records of solar output and total solar influx to Earth over time. Using that data accurately predicts Earth’s past temperatures with extremely high accuracy. Starting in the mid-20th century a growing anomaly in temperatures arises that natural cycles do not account for.

To explain the anomaly numerous variables are tested -volcanic activity, albedo, pollutants, and many other causes are fully tested. When everything is taken into account there is still a significant temperature anomaly.

Conveniently, molecules have defined physical properties for what EM waves they can absorb and emit. Some are colloquially referred to as “greenhouse gases” due to the fact that they can’t absorb solar EM waves, but do absorb infrared energy – like a glass pane in a greenhouse. It just so happens that the concentration of one of these greenhouses gases has increased RAPIDLY (on a geological timescale), and the temperature anomalies occur as this happens.

Even more conveniently, past changes in temperature are also accurately explained only by considering the atmospheres concentration of greenhouse gases in the past.

That is why the science is so compelling. Every single factor is taken into account, and data for solar activity, Earth’s cycles, volcanic activity, temperature, albedo, pollutants, and greenhouse gas concentrations are thorough and verified through several different sources to ensure their accuracy – from ice cores, tree rings, composition of geologic layers, isotope analysis, and more.

What climate skeptics don’t understand is that the historical data used is incredibly strong and accurate, and every factor they cite as an explanation is ALREADY TAKEN INTO ACCOUNT. Every possible thing that can impact global temperatures is included. It is not a question of “is it this factor or that factor” it is EVERY factor.

In a pie chart of the various factors impacting the temperature anomaly that began in the mid-20th century the strongest one, by a very, very large margin, is the rising concentration of greenhouse gases in the atmosphere.

Hopefully this helps put it into context, or at least provides you with some illumination on the subject.

Often it isn’t fully laid out for people, so they default to skepticism, which is quite healthy if you ask me. That skepticism is eliminated when the whole process is laid out… or so I hope.

You wont be able to provide a similar list of current scientist questioning key aspects of evolutionary theory.

No, because evolution has been around longer, so we’re at a different point in the “evolution” of scientific and social debate. We’re perhaps very roughly at the point evolution was in 1920, around the time of the Scopes trial.

Ron, why can’t evolution be the unfolding of creationism. why does it have to be either/or. I don’t believe in the virgin birth or the resurrection of a dead man but I was raised in a catholic school for 12 years and they taught both evolution and creationism. For me it all boils down to one simple question, where did the information in our DNA come from. Now here on this physical earth of ours we know that information comes from conscious activity. Now is it possible that this information just popped out of nowhere. Sure, that is possible but the more logical conclusion is that it came from conscious activity.

“…where did the information in our DNA come from…” The same place that the DNA came from to form frogs, spiders, worms, slugs and chimps: Since we’re basically the same as chimps maybe you could ask them, or Fred.

Since we’re basically the same as chimps maybe you could ask them, or Fred.

I’ll defer to both the chimps and bonobos, we seem to be a mosaic of both and we share roughly 98.6% of our genes with them 🙂

http://goo.gl/VivKmp

Two African apes are the closest living relatives of humans: the chimpanzee (Pan troglodytes) and the bonobo (Pan paniscus).

As for the origin of DNA and information it contains…

Here’s a pretty good reference, despite it being about 15 years old.

http://www.ncbi.nlm.nih.gov/books/NBK6360/

Or if you prefer you can always go to the Discovery Institute. 🙂

http://www.discovery.org/articleFiles/PDFs/DNAPerspectives.pdf

Fred,

Saw your comment below about The Great Disconformity, increased mineral concentrations, and the evolution of shells and other mineral dense structures.

That you for posting it!

I had never heard about that, and it is an utterly fascinating hypothesis.

Afterall, the atoms Earth organisms are composed of just so happen to be the most common available (minus inert noble gases – looking at you Helium and Argon).

It makes a good hypothesis that long-term increases in the mineral composition of ocean water would open the possibility of evolving features that utilized them.

It’s pretty well understood that the Great Oxidation event allowed for the evolution of aerobic bacteria. A new element/molecule became abundant, and life inevitably found a use for it.

Great article everyone should read. For those who skipped over it:

http://io9.com/5903330/toxic-oceans-created-the-greatest-explosion-in-biodiversity-earth-has-ever-seen

For me it all boils down to one simple question, where did the information in our DNA come from?

It evolved. You need to say that real slow so it sinks in..

It eee–voollllved!

Origin and Evolution of DNA and DNA Replication Machineries

Sure, that is possible but the more logical conclusion is that it came from conscious activity.

An where did that conscious activity come from?

Enough already. I had already said that I refused to argue with a creationist anymore. And so-called “intelligent design” is just another form of creationism.

I will discuss this no further. Bye now.

Ron, I clearly stated that life evolves. It is the origin of life that is in question. And that simple little theory that you linked to, who’s to say that that process wasn’t designed. It is an answer that I will probably be searching for until the day I die. But if you found it than good for you.

And that simple little theory that you linked to, who’s to say that that process wasn’t designed.

But who designed the designer?

I am intrigued by the theories of the origin of the universe, and we can push our knowledge back to the beginnings of the universe, but I’m not sure we’ll ever figure out what came before the beginning? Was there no beginning? If so, what does that mean?

Even if one believes in God, where did God come from? If he had no beginning, what does that mean?

Also, given the number of stars in the knowable universe and the long history of the universe, humans are such a tiny part of it and we, as a species, probably won’t be around forever. The end of homo sapiens is likely part of the natural progress of things. In the greater scheme of the universe, I don’t think we matter much. At any rate, in terms of time and distance, human scale is of no consequence.

Boomer II,

“…what came before the beginning?”

Steven Hawking once said that to ask that is like asking what is located one mile north of the North Pole. “It’s a meaningless question.”

He has a point, I guess.

So some evolutionists went to God and said, God, we don’t need you anymore. We can take some dirt and go to the lab and create life. God says, that’s fine, now get your own dirt.

Most people simply aren’t aware of the fact that it took 3.3 billion years of evolution on the microbial level before the first multi-cellular “macro” organism appeared.

86% of life’s evolutionary history was just microbes.

All the cellular complexity inside of us happened at an infinitesimally slow pace. 3.3 billion years of evolution, and all we had to show for it was still just… microbes.

Only after that foundation was built over 3.3 billion years did the very first multi-cellular “macro” organism appear.

It doesn’t help that our brains are incapable of genuinely comprehending “3.3 billion years”. It is literally 100% impossible for anyone to truly grasp how long 100,000 years or 1 million years is, much less 3.3 BILLION.

We can “understand” 100,000 years as a concept; however, we cannot truly comprehend the unfolding of such an insanely LONG time frame.

Once you get to 3.3 billion years… Well, no wonder people find life’s complexity impossible. They simply have no grasp of how infinitely long that timeline is.

I cannot truly grasp it either, but I understand the idea of 3.3 billion years well enough to ask “what took life so damn long to evolve the first Sponge?!” instead of some peoples ignorant question “How could something as complex as a human evolve after ‘only’ 3.8 billion years?”

3.8 billion years. And all we got was humans!

Look at a side-by-side picture of E. coli and a human and it SEEMS amazing, but only because the eternity of time between them is not fully comprehended.

3.3 billion years and all you get is Sponges. That is terribly, terribly inefficient considering how ungodly long that time frame is. But, that’s the nature of random mutation and natural selection.

Some people think evolution is just too darn incredible to be true. I’d say it happens so damn slowly that it is better seen as underwhelming.

Very nicely put.

When compared to infinity, a few billion years isn’t that long at all.

Quantum equation predicts universe has no beginning

http://phys.org/news/2015-02-big-quantum-equation-universe.html

A few billions years or so in the context of infinity is maybe sort of like pressing the fast forward or backward button or even clicking on the next song. Maybe our universe is just the ‘next song’… of an infinite album of songs.

I Look Like I’m From Space

Of course, we’re all from space and so we all look like that… Right? ^u^

MudGod,

I am 100% on the same page. I’m only hoping to express the reality that 3.3 billion years might as well be eternity.

We are incapable of comprehending infinite time; we are equally incapable of comprehending the scale of 3.3 billion years of time.

In terms of physics 3.3 billion years is s momentary flash compared to “infinite”. In terms of experiential understanding 3.3 billion years is just as nebulous as infinity.

Physics gives us the defined number, but relating the magnitude of that number is impossible. Even an accurate conception of its length is a diminishment of its true reality.

3.3 billion years! It doesn’t even make sense once you really dig into what even 100 million years of time is.

We cannot even comprehend a single lifetime. From when we’re conceived to our first cogent memory 3 years later. Every job, every shift, every date, every purchase, every mundane moment. THEN we sleep for 33% of it, so 33% of a 77 year life literally doesn’t exist in terms of experiencing time.

One lifetime seems “short” because our brain prunes memories. Our hard drive space doesn’t change, but the accumulation of experience doesn’t relent.

It is a biological limitation that every year goes by “faster and faster” as we age. This has nothing to do with time itself. It is 100% a reflection of our brain pruning old memories as new data comes in. The result is a feeling of “time passing more quickly” as moment to moment experiences are refined to the most important (neurologically, not literally) and everything else is deleted (i.e. forgotten).

This is why comprehending 3.3 billion years is, literally, neuro-anatomically impossible.

It is neuro-anatomically impossible for us to comprehend the length of our own lived and experienced lifetime. It is well established science that each year feels shorter because we have a finite hard-drive and over a lifetime we experience far more than can be stored.

It is no different than having a 1 TB hard-drive and trying to store every years great movies on it – give it 20 or 30 years and you’re going to be forced to delete previously “important” movies to save new “important” movies.

1500 movies come out every year. You save 3. You forget 97% of movies, but at over time even that 3% retained that are “important” must be trimmed. You forget how much you loved Young Frankenstein. There;s no conscience moment that it happened, but it did.

Comprehending the entirety of even a single lifetime is, unequivocally, biologically, impossible. That is a life we technically live, but its totality is only comprehended through experience, which is limited by neurology.

Comprehending 100,000 years when we’re verifiably incapable of comprehending our own lifetime?

We need not venture to a timeline of 3.3 billion years when we know we are not equipped to comprehend our own lifetime.

This isn’t philosophy; this is well documented science.

Hi Brian,

Excellent comment though, being picky, I have one small reservation. Comprehend has two meanings: Grasp mentally and understand. We cannot mentally grasp large numbers however they are certainly something we understand. Every day I do calculations involving 10 to various powers and comprehend (understand) the result. Obviously you do so yourself.

“Apparently Earth is 4.54 billion years old. That seems awfully recent in a universe that’s only apparently 13.77 billion years old, don’t you think? Why should our planet be, eerily perhaps, as old as almost exactly a third (4.54 x 3= 13.62 billion) of the age of the entire universe?…

Given the question about life on other planets, maybe it is indeed very early in the process and we may be among the first.” ~ Tribe Of Pangaea- First Member

“…we are probably one of the first planets with intelligent life. [with maybe intelligence being kind of so-called or relative or something] First you had the big bang, then you had lots of cosmic evolution. Then lots of stars had to form, burn, and then go super-nova in order to form the heavier elements. So it probably took a good 7 to 8 billion years until there were enough heavier elements to even make life possible. Our planet then formed and life started. It took some 4.5billion years to evolve us. Any other intelligent life out there (which is probably extremely rare) probably hasn’t been around much longer than us. And even if they are out there, it is no surprise they haven’t mastered long-distance space travel given the near impossible physics of it.” ~ speculawyer

Ronald Walter; happy belated moon landing.

In a Nick G/Jacque Fresco world, perhaps Mars would be well-colonized by now (with Tesla rovers ‘n’ stuff) and in the process of being terraformed.

“…we are probably one of the first planets with intelligent life. First …..

Well many hundreds of billions of planets formed out of heavier elements at pretty close to the same time ours did… so….

Sure, although that might make things relatively sparse even at a few hundred billion and what with those extinction events that almost wiped things out here.

And then there’s that myth of progress thing.

And those inherent drags on the what-is-possible.

Yes!

Cosmologically speaking, several solar lifetimes were needed to produce enough heavy elements for rocky planetary systems to exist.

That being said, the universes earliest stars were massive and short-lived.

We may be among the first intelligent life in our galaxy; no need to go universal since we have 200 billion stars in the Milky Way alone.

Also, we may not. As Ron pointed out, billions of other solar systems in our galaxy are of the same age and atomic complexity.

Even more importantly, billions of star systems in our galaxy are billions of years older, but still composed of the same enriched remains of several generations of older stars.

Case in point, the Earth homolog announced by NASA yesterday, Kepler 452-b, is 1.5 billion years older than Earth, yet is revolving around a star equivalent to the Sun in its composition.

Brian,

The Milky Way is 13.2 billion years years old. It has been forming stars (and their planets) all that time. So, rocky planets with life potential have been in our galaxy for a long long time. Human existence is trivial (time wise) so another planet with “intelligent” life would as likely be more “evolved” as less evolved. Unless some galactic god of goddess decided otherwise.

Brian Rose,

About the 2 billion years when life remained prokaryote (bacteria and archaea: single-celled, without a nucleus):

Look into Nick Lane’s new book The Vital Question. He makes a strong argument that what made more complex organisms possible comes down to a large increase in energy available per gene, as a result of that endosymbiotic engulfing, by an archaeal cell, of a bacterium. The engulfed bacterium set up shop within the archaeon and became a specialized generator of cellular energy, passing most of its genes to the archaeon and retaining primarily what it needed in its new role–leaving it smaller. Smaller meant that the cell could host a large number of these mitochondria, as they now were, and the energy production could allow much larger, and more complex, cells than prokaryote energy production could support. Thus the eukaryote scale of organism became possible, sponges and all.

He makes a good argument that this endosymbiotic event only happened once.

Synapsid,

The endosymbiosis of mitochondria is frankly the single most important event in evolutionary history.

Evolution of a nucleus? A landmark moment we use to segregate entire domains of life.

Evolution of chromosomes? Incredibly important.

Endosymbiosis of mitochondria? Likely the biggest event in evolutionary history.

There is not a single eukaryote that doesn’t have mitochondria. Well, more accurately, even the very few eukaryotes that don’t have mitochondria have the ribosomal remains of having had mitochondria, but having lost them.

Makes you wonder. Is it the nucleus that defines a eukaryote or the mitochondria?

Separating DNA into its own compartment allows for far greater and more precise translation of DNA into RNA. Without that adaptability and precision you cannot produce the differentiated variety of cells needed for macroorganisms.

However, that segregation and precision have costs. Energetic costs. Without a powerhouse that evolutionary strategy cannot be maintained.

Endocytosis of mitochondria by eukaryotic cells is much like how coral works, but much more intimate.

Hands down the biggest “How likely is this?” part of evolutionary history. Yet without it we would not have… us. Or any macro-organism for that matter.

In each of the cells in my body there are hundreds of mitochondria. Alien cells, dividing independently inside my own cells, all containing their own DNA.

We’re eukaryotes… with hundreds of prokaryotes living independent lives INSIDE every single one of our cells. It’s intriguing to say the least.

For 3.3 billion years single cell organisms evolved more and more complexity. But there are a limit to how advanced a single cell can be. You will approach that limit asymptotically. 1 billion years, or 10, not much difference. The limitation lays in the single cell concept.

The breakthrough come with multi cellular organisms. And that super-important step can happen first when sufficiently advanced cells are formed (eukaryotic cells) and then we must wait a long time for a series of random events will create a multi cellular structure. I guess a few billion years is what it takes.

And for what it is worth; 10 000 years is what I can wrap my head around. I call it a myriard, the “seconds on my evolutionary clock”. 100 000 years is ten times of that.

Wow, we have some really intelligent life on this blog. Thanks for your time and contributions to this discussion. Now I have a Masters in Environmental Science and believe strongly in evolution so why would I even consider Intelligent Design as a valid scientific theory. Well it’s because I have a daughter who sees spirits. And not only her but some of her cousins and one of her teachers also sees these same spirits. So in my search for answers I come across this book called The Scalpel and the Soul written by a neurosurgeon Dr Allan J. Hamilton. A book I recommend for anybody who is terminal or has a love one that is. So now I ponder the origin of life, something even Darwin didn’t have an answer for. Now I am no cellular biologist or physicist so I don’t quite understand everything in this discussion but in regards to the age of the universe, if energy can neither be created nor destroyed, how could there have been a beginning or an end. And if consciousness is energy well then…

So now I ponder the origin of life, something even Darwin didn’t have an answer for. Now I am no cellular biologist or physicist so I don’t quite understand everything in this discussion but in regards to the age of the universe, if energy can neither be created nor destroyed, how could there have been a beginning or an end.

I am more interested in theoretical physics than religion, but I still realize there are concepts we as humans don’t understand and may never understand.

I have pondered the idea that our reality is just someone else’s dream. Or that there are multiple universes not necessarily all operating on the same physical principles. And so on.

Currently I find that theoretical physics more awe-inspiring and thought-provoking than any religion or spirituality I have come across, and I anticipate that will continue to be the case. However, part of that awe involves realizing there are unanswered questions.

Mudgod

Spirituality has been described as an individual’s recognition of the existence of a non-physical reality. (Religion being a social/cultural expression of same).

Faith may more precisely be viewed NOT as believing in something you do not know to be true … rather it is trusting in something you do not yet understand.

Those with intimate experiences with things of a spiritual nature would understand.

MudGod, surely you must realize that any theory that posits a supernatural being must, by definition, be a religious theory, not a scientific theory.

Mr. Patterson

Before he went insane, was institutionalized, and was electronically lobotomized via electroshock therapy, Robert Pirsig was able to employ his staggering intellectual prowess to identify just how Reason obtained its self-appointed position at the apex of human qualities. He used the scientific method throughout to arrive at his conclusions.

His work was presented in the classic “Zen and the Art of Motorcycle Maintenance”.

JW,

Very well said.

Look at a diagram of a eukaryote with all of its organelles, cytoskeleton, innumerable transport system… I mean even the “simple” process of mitosis is an incredibly elaborate and awe inspiring dance.

By the time we got to single celled Eukaryotes 98% of the evolutionary work was done.

If Eukaryotes are like the Taj Mahal, then Prokaryotes are a mud-brick hut. But even Prokaryotes, simple as they seem, did a lot of the fine tuning that allowed for Eukaryotes to come about.

We share 55% of our DNA with E coli. If we had the DNA of our actual common ancestor with E coli we’d find that it is much higher than 55% since E coli has been evolving just as long as we have.

But, at a bear minimum, we can say that 55% of what we are is left over from billions of years ago. More accurately, the genetic foundation that underpins our cellular activity and structure was so well refined by the time our Prokaryotic ancestor came about that no amount of selection could refine it further. The concrete was poured and dried; 55% of the work was done, and we weren’t even a single celled Eukaryote yet.

In that 3.3 billion years of microbial evolution a LOT happened. If we saw what the first “life” was I’m positive it would saddle the line and only qualify as proto-life. Like a duck-billed platypus it’s not quite a mammal; it’s a proto-mammal.

Going from whatever that proto-life was, through the RNA World (if that is indeed how things unfolded, which I think likely), to the first DNA organism (call it a proto-prokaryote), to eukaryotes.

3.3 billion years is an eternity, but you are correct, we should not downplay the fact that those microbial years did 98% of the work. Then, macro-organisms did a few finishing touches.

His work was presented in the classic “Zen and the Art of Motorcycle Maintenance”.

I read that book back in the late 70s. I don’t remember a lot about it however. I do remember that I loved it.

Mr. Patterson

A very brief passage from ZMM that may address a great deal of the underlying tensions displayed on this blog, the hydrocarbon field, and much of today’s societies in general …

“The Buddha, the Godhead, resides quite as comfortably in the circuits of a digital computer or the gears of a cycle transmission as he does at the top of a mountain or in the petals of a flower. To think otherwise is to demean the Buddha – which is to demean oneself”.

Fascinating insight.

Ron,

It depends on what you mean by climate change.

Every reputable scientist believes in co2 causing global warming. But there is a great deal of debate as to the sensitivity of temperature to the amount of co2.

If sensitivity is on lower end then increasing co2 will not do much harm, it may even do some good. If on higher end there will be problems.

Very reputable scientists disagree about what the sensitivity is.

The ipcc models have predicted higher sensitivity but actual observation does not match the models. It could be we just need to get more observations or models are incorrect.

Time will tell.

The IPCC models didn’t accurately predict how much energy the oceans would absorb, and that did make them too sensitive.

It is a bit nerve wracking that the loss of sea ice, permafrost, ice sheets, and glaciers has happened FASTER than models predicted.

This means sea level rise will likely be more rapid and severe than predicted.

There is less surface warming than predicted, so you’d think there’d be less ice loss than predicted… But the opposite happened.

So surface warming predictions were too sensitive, but sea level rise predictions were not sensitive enough. If anything that is a far worse outcome.

I wish the model were correct – we’d have more warming with less disaster. Instead what is unfolding is less warming with more disaster.

In my eyes potential sea level rise is the least manageable and most costly long-term impact of climate change.

Brian, I hope you are right about sea level rise being the most costly. My fear is that the impact on agriculture will be the most costly. The natural result of big declines in agricultural productivity will have waves of population decline with the associated social dysfunction and wars that logically must occur with anything that dramatic.

Everybody says sea level. The other stuff is mostly hype. And they project using RCp8.5. Other than sea level and having an AC unit fall on your head you should be fine.

Acidification of the seas might be a bigger problem than rising sea levels.

My own seat of the pants guess is that by the time rising sea levels result in truly major disruptions the population of naked apes will be falling off substantially for reasons both fair and foul.