The Texas Railroad Comission has released their oil and gas production data for November. As most of you know, the Texas RRC data is always incomplete. Some data is updated immediately but the rest trickles in slowly, sometimes taking many months to years to complete. Nevertheless we can glean some indication of what is happening from what data is reported. That is, if production is increasing, then the incomplete month to month data should be increasing. And it is, but very slowly.

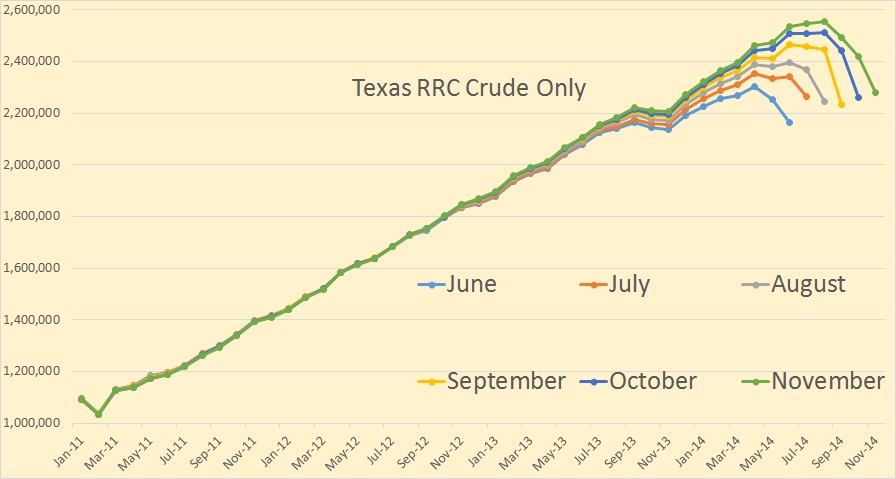

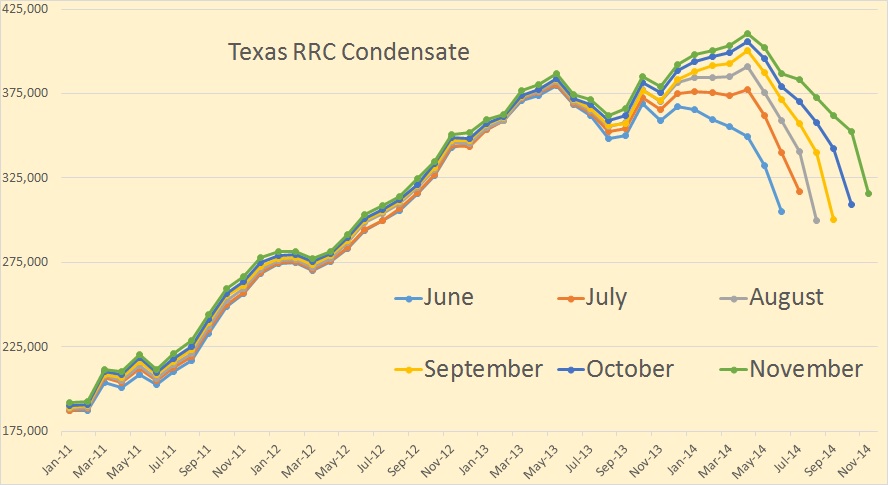

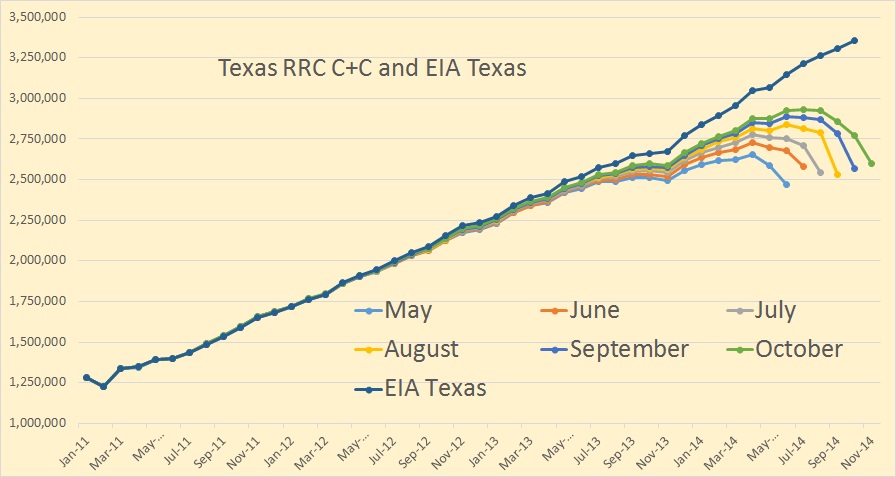

The last data point in all charts below is November 2014 and the oil is in barrels per day.

Texas crude only is still increasing but the increase rate seems to be slowing down.

It is rather hard to tell what condensate is doing but the rate if increase, if any, seems to be slowing.

Combining the two we see a an increase but not quite as great as the EIA seems to believe. The EIA data is only through October. Last month the EIA altered their estimate of Texas C+C and lowered the estimated increase quite a bit. This month they reverted back to their old habits. They have June production up 82 kbd, July up 67 kbd, August up 45 kbd, September and October both up 48 kbd. I believe those figures are all quite optimistic.

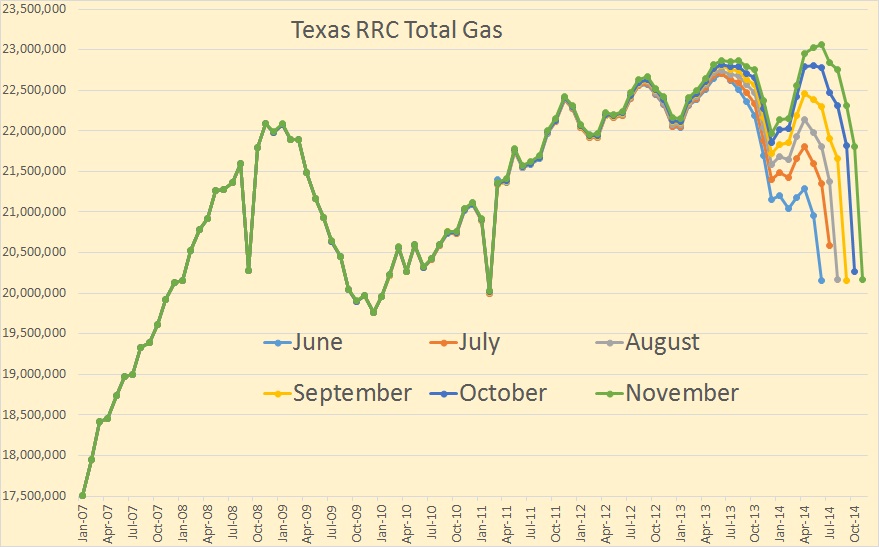

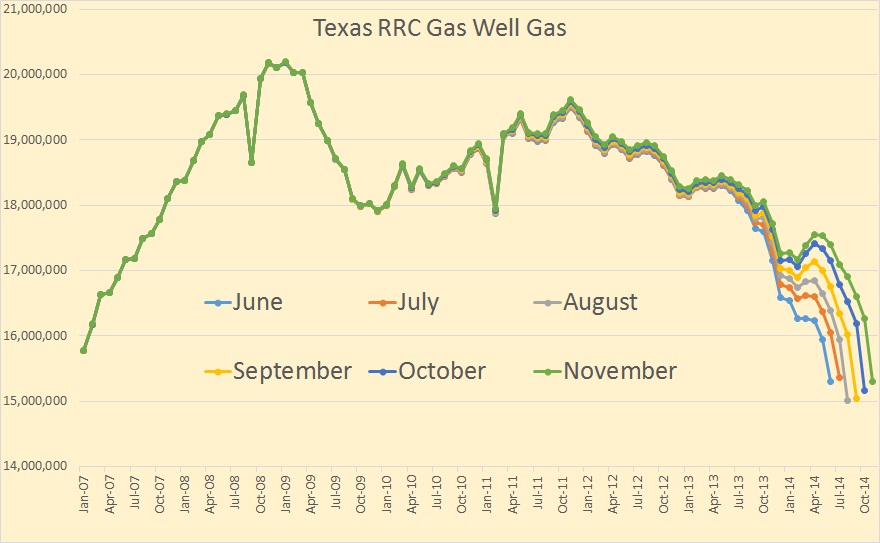

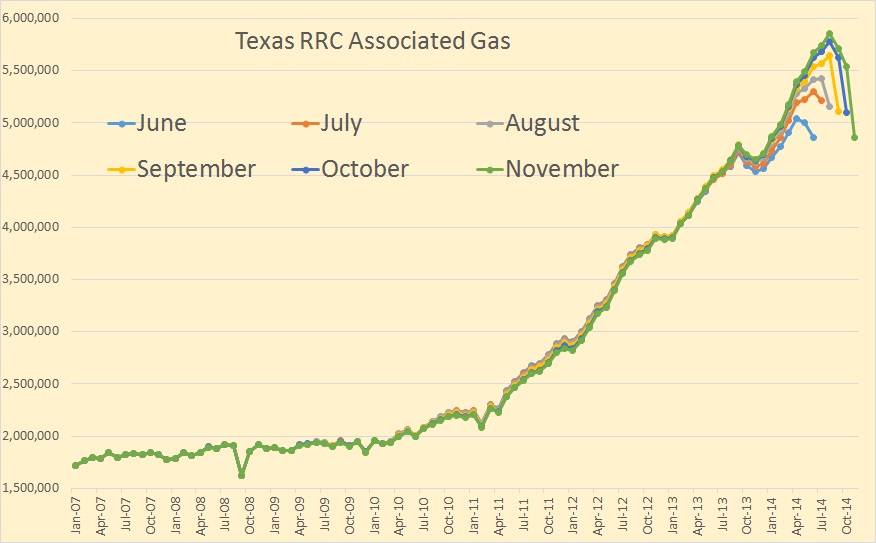

All gas data is in MCF with the last data point November 2014.

Texas gas well gas peaked back in January of 2009 and bottomed out in December of that same year. Then started to increase before peaking again in November of 2011. It has been mostly down since then.

Texas associated gas feinted a peak back in September of 2013 but turned back up again in only a couple of months. Now we seem to have another peak in August 2014. Will it hold? If oil production drops then there is little doubt that it will. Associated gas comes up with the oil. So what happened in September to cause associated gas to drop?

Combining the two we get Texas total gas. Associated gas has kept Texas total gas from peaking… so far. But with both oil and gas prices extremely low it appears we have reached at least another temporary peak in Texas gas production.

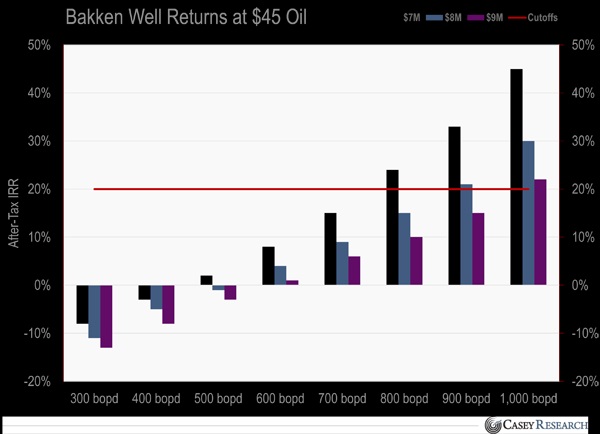

News: The Truth Behind the Bakken: A Mathematician’s Take

Below are two graphs from this link. This article is too long to copy and paste but there is some very good data here you need to read. It puts the Bakken in a different light… if prices stay low.

Thought for the day: Peak oil will be the point in time when more oil is produced than has ever been produced in the history of the world, or ever will be in the future of the world. It is far more likely that this period will be thought of as a time of an oil glut rather than a time of an oil shortage.

Note: For those who would like to be added to my new post notification mailing list please post me at DarwinianOne at Gmail.com

523 responses to “Texas RRC oil and Gas Production Data”

Your thought of the day is bang on. I will pass this on, with the ‘total liquids’ reminder attached.

That quote is correct only if you believe in Hubbert’s symmetrical curve. If you subscribe to Ugo Bardi’s more credible “Seneca Cliff” scenario, then the 50% point is reached well before the peak.

Don, please tell me why the shape of the curve would change what I wrote? I am firmly convinced that Ugo’s Seneca Cliff is exactly what we will see, or more correctly what we are seeing right now. I believe we are well past 50% of total URR right now. And I do mean well past 50%. But peak oil will be the point in time when more oil is produced than has ever been produced in the history of the world, or ever will be in the future of the world. Why would the shape of the curve change that?

For goodness sake, think about it man. The peak will be, by definition, the point when more oil is produced than any other time in history. That is the very definition of a peak. And when we are at the peak, when there is more oil coming out of the ground than at any point in history, there will be every reason to be exuberant, every reason to believe the glut will continue. Theye will very likely be no reason for tha average cornucopian to preceive the coming disaster.

I’m not sure a peak will necessarily be associated with a glut. It could be much worse: demand increases and production can’t satisfy it, which leads to price increases, but the price we need is too high, efficiency/demand destruction AND replacement sources kick in.

I visualize a point when people begin to purchase small hybrids, airplanes and ships move slower, and people move into smaller houses closer to work. And this can be driven by market forces rather than fear of world temperatures.

Does this mental model make sense?

The world is at least another 6 to 8 years away from peak oil. The lack of demand will be the reason because of new transportation efficiencies. Not an inability to produce more affordable oil. By 2030 most new vehicles will not be oil based powered and their CO2 output will be reduced by 90%. These changes to come are already locked in. The technology and cost are not an issue.

The Democrats want you to take your statins and the Republicans want you to eat more fast food. Neither one fixes the cause.

Six years? How? The math didn’t work beyond 2015 with shale operating at $90, mostly because of the decline problems with shale and stagnant at best production outside the US. With shale shut down and all of the good stuff already drilled…yeah, no. Not going to overtake whatever shale peaks at before the drilling moratorium shows up.

There’s a big problem with replacing cheap supergiant fields with all the various hyper-expensive and/or low quality projects around the world.

Yep. Excluding the US, we have not seen an increase in global C+C production, even as annual Brent crude oil prices doubled from $55 in 2005 to the $110 range for 2011 to 2013 inclusive. In other words, the trillions of dollars equivalent spent worldwide on upstream capex only served to keep non-US global C+C production at or below the 2005 production rate.

And if we exclude some plausible estimates for global condensate production from the total global C+C numbers, it’s quite likely that actual global crude oil production (45 and lower API gravity crude) effectively peaked in 2005, while global natural gas production and associated liquids, condensate and NGL, have (so far) continued to increase.

And at the IEA’s estimate for the gross decline rate from existing oil wells worldwide (9%/year), in order to simply maintain current production for 11 years*, the global industry has to replace the productive equivalent of every currently producing oil well in the world over the next 11 years–from the Americas to the North Sea, to Russia to the Middle East.

*At a 9%/year decline rate, existing production would be down to 37% of current production in 11 years, since we would be declining against a falling production level, but I am stipulating a “steady state” production scenario.

What will power most vehicles in 15 years if they are not powered by fossil fuels? Nuclear power and electricity stored in batteries? Or do you envision liquid fuels such as biodiesel.

The future is about the demand side, not the supply side.

http://www.greencarreports.com/news/1096226_breaking-chevrolet-bolt-concept-200-mile-electric-car-to-target-tesla-reports

Today for less $10,000 one can install enough grid tied solar panels that will last more than 25 years to power the average persons transportation needs.

Most of you can’t see the forest because of all the trees.

Really? I live in a tall apartment building near a really nice beach. Do you think I could put the panels on top of the parking garage? All I have to do is get the condo board to let me use the football fields and the tennis courts, right?

With the beauty of capitalism someone else will produce your needed solar energy. I have plenty of room on the roof of my home here in Huntington Beach.

We already have solar power, and very high electric bills. But the solar power here is used as a counterpoint to hydro. When solar goes out hydro picks up the load. Because available hydro sites are limited the solar power penetration is at the top end, and it just takes too much subsidy. Wind is also at the maximum penetration unless they commit to use more gas turbines. But those are too expensive.

Fernando.

Mark Twain said: “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

Solar power in Spain is expensive because the program was mismanaged.

Look at solar with a wider perspective.

I comment a lot about the marketing of oil and the price of it and so forth but generally keep my mouth shut about the actual technical aspects of getting it out of the ground having no expertise in that area.

But I DO have expertise in agriculture and everybody can take this to the bank.

Barring an honest to Jesus REVOLUTION in microbiology such that biofuels can be produced after some new fashion other than raising crops out in the open- biofuels are NOT GOING TO SCALE to the equivalent of more than a very minor fraction of the net energy equivalent of current day oil and gas production.

It is highly unlikely we will ever see biofuels manufactured in quantities equivalent to ten million barrels of oil a day unless by some miracle they can be produced in nice sunny deserts by feeding some nasty water ( sewage would be ideal ) into some sort of green house type of factory that cranks out some sort of microorganism with a high oil content. Now if this sort of thing can be accomplished -which is possible but doubtful- and it can be built out by the hundreds of square miles- biofuels might be the answer to the continuation of business as usual.

My guess is that it would be easier and cheaper by miles to build solar farms and wind farms and use the juice to power up chemical factories and manufacture liquid fuels from co2 and water.

The physical resources needed to grow enough crops to supply both food and biofuel for the business as usual world simply do not exist.

The most important two inputs needed are arable land and clean water both of which are already in short supply and getting significantly shorter on an annual basis.

If the land and water were available we would still be up the creek without a paddle in terms of machinery, fertilizers , pesticides, transportation and so forth.

The people who think organic farming can support business as usual for seven billion people have their heads so far up their butts in terms of understanding the nature of the problem it is pretty much a waste of time even talking to them.

Farms are NOT ecosystems. You remove things from a farm —–they have to be replaced.

Move a hundred bushels of wheat or corn off the premises the macro and micro nutrients have to be replaced. The only way this can be done ON THE GRAND SCALE necessary is with imported manufactured fertilizer while also maintaining the necessary levels of production associated with business as usual.

Some progress is being made in getting by with less fertilizer, pesticide, fuel, electricity, containers,machinery etc. But this is a slow incremental process.

You might as well ask a typical woman in a western country to take up prostitution as to go back to a small time farm lifestyle. It just isn’t in the cards. We will continue to have one or two percent of the people involved in actually growing food in industrialized countries until it is impossible to continue to grow it this way.

Then the fecal matter will be hit the fan.

Given the problems we are looking at involving peak oil, peak water, desertification, loss of farmland to development , growing population , iffy climate etc we will be extremely lucky if we can just maintain food production at a level adequate to prevent mass starvation.

Personally I believe that unless population peaks and declines substantially sooner than the demographers predict starvation on the grand scale is baked in.

There will be no miracle crops that produce sustainable huge quantities of biomass on land that is not also suitable for producing one kind or another of food crop.

There are plenty of pro ag people out there who say this is possible but they are simply lying their asses off or possibly in more charitable terms fooling themselves.

People are notorious for fooling themselves when their salary is at stake.

Anybody acquainted with even the abcs of ecology and agriculture as an industry can understand why.

First off there are no examples of deserts or tundras etc that exhibit high bioproductivity.

IF MOTHER NATURE hasn’t turned a desert or a tundra or alpine landscape into a rip-roaring snorting biofactory even once in the past hundred million years on this planet the odds of farmers- even the kind with doctorates in botany and microbiology and genetic engineering – accomplishing this feat are one in a zillion.

Farming steep mountainsides is simply out of the question except by hand on terraces built at enormous expense or by grazing surefooted animals.

Any land farmed with machinery must be free enough of stone outcroppings wet swampy areas etc to such an extent that machinery can be used. If it is not already highly productive – then water or essential nutrients are not available for one reason or another. Supplying the water and nutrients to such land at low enough cost to use it to grow biomass to burn is out of the question.

Just harvesting and hauling biomass crops to a processing plant is an extremely energy intensive process.

Biofuels will never amount to much in terms of business as usual on the world stage until after we adopt a low energy high efficiency lifestyle globally- assuming we are able and WILLING to adopt such a lifestyle soon enough to avoid going mad max.

A few countries with great climates and lots of land and relatively few people might be able to make a domestic go of biofuels in the medium and near term.

“We already have solar power, and very high electric bills.”

Rat has grid-tied solar, and no electric bills after California started cap and dividend ; B4 that, about $50/year for the grid.

Hey Wharf. Going to Chicago?

Six to eight years away from peak oil? Then you need to explain where this growth will come from? But first you need to explain where the growth will come from just to keep us even as most oil producing countries are now in decline. But we will need enough oil to overcome this decline then enough more to keep growing for six to eight years.

It is easy just to say “six to eight more years”. But when it comes to explaining where all this new oil will come from it becomes a bit more difficult.

Canada, United States and Mexico can all produce more for starters with applied Capital.

Forty-Five years after the United States first peaked. Here we are again!

Where are all the naysayers from TOD today ? The world is flooded with oil and at a lower than recent historic price. Oh, we will consume this excess. It’s the law of mother nature.

i was never too worried about peak oil until I realized exploration wasn’t paying off. This meant oil companies collectively weren’t finding oil to produce in the future. And this trend continues today.

The industry is filling the gap with marginal resources. The bulk of these marginal fields require around $80 to $100 and upwards.

You know, I got the feeling that we have too many innocents who don’t realize we are in a very tight spot.

No need for exploration. I know where you can get another 2 trillion barrels.

http://www.cbsnews.com/news/the-oil-sands-of-alberta/

John B, I’m a petroleum engineer, and I’ve worked a bit on extra heavy oil. Those two trillion barrels aren’t recoverable.

Sure, no offense but there were plenty of people “in the know” that said you couldn’t get anything. They were wrong of course.

When the head of Shell Canada says the estimates could be 2 trillion or higher, I tend to believe he knows what he’s talking about. They are the ones out there producing the stuff now. They are in the best position to know.

I never said or wrote we couldn’t get anything. I did my first heavy oil report in 1978, by then we already had in house steam injection results we could use to prepare pilot field developments.

Question: did you read Shell expected 2 trillion barrels to be produced? Or are you slipping a decimal?

Hi Fernando,

JohnB is confusing oil in place with recoverable resources. In the article he linked to it says there are 175 Gb of reserve but a lot more than that is buried beneath the surface, as much as 2 trillion barrels.

JohnB has jumped to the conclusion that if the oil is there that 100% of it can be recovered. Perhaps you can convince him that it is unlikely that more than 300 Gb will be recovered, and even this amount will likely take 100 years or more to recover. On a side note, I have read that the OOIP for Orinoco is about 1800 Gb, using your 8% estimate, that would imply a URR of about 144 Gb, does that seem to be a reasonable estimate for Orinoco extra heavy? What do you think of a 350 Gb URR estimate for Canadian oil sands?

I am trying to reconcile the 500 Gb estimate by Jean Laherrere for extra heavy oil with the information you have shared with me.

Dennis, the OOIP is around 1.3 trillion BSTO. A birdie told me there were some wells drilled into this volume which found fresh water rather than oil (fresh water and oil look similar in old well logs). So the 1.3 has an error bar of unknown extent.

The recovery factor depends a lot on three factors: whether they use steam or some sort of EOR. The timing for EOR implementation in the high graded blocks they try to produce at the current time (because they are getting water influx, and water kills EOR), and the detailed pay geometry. This means the eventual recovery factor, on a global basis, could be anything between 5 % and 20 %.

As Ron P mentioned the extra heavy pools should be treated separately. It takes about 7 to 10 years to get one of these mega projects to produce from the point we start conceptual engineering.

Hi Fernando,

I really appreciate the information. I model extra heavy oil much differently than lighter oil which I will call C+C less extra heavy, because conventional is used differently by different authors. My model for Orinoco, Canadian oil sands and the combined “extra heavy” oil from both is shown below. It is based in part on Canadian oil sands development to date and Canadian Association of Petroleum Producers (CAPP) forecasts and the assumption that Venezuela will be roughly analogous with a delay.

vertical axis is millions of barrels per day

Ron, I think it comes down to a person’s perception of what it takes to move forward with prospects in deep water, heavy oil, and tight formations.

What I saw reviewing real projects was a fairly large family of prospective investments which needed over say $100 per barrel.

I wouldn’t touch most of the brazil presalt for less than $110 unless it was a smallish four to six well pilot. The heavy oil projects really need an upgrader, or a regular diluent supply, and that’s a bit expensive.

And you know the light tight oil story better than most people. So you know where this takes us. We just need higher prices or else the wheels fall off.

Hi Fernando,

You are much better versed in the real world of the oil industry than me. If oil prices quickly get back to the EIA’s Annual Energy Outlook Reference Case for Brent Crude prices, by rising at say 15% per year until reaching the reference case level and then rising from there along the reference case path, does a URR of 2200 Gb for conventional (no extra heavy included) C+C seem reasonable or does my 2700 Gb guess seem more reasonable? Chart with AEO cases below with real oil prices per barrel in 2014$. (ignore Bak scen case), assume oil prices continue to rise at reference case rate (about 3%/year) or higher (5%)beyond 2040.

What’s your remaining? Or what’s the current cumulative? 1300?

Hi Fernando,

Current cumulative conventional C+C produced is about 1240 Gb ( and 10 Gb of extra heavy for a total C+C of 1250 Gb).

So for the low case we would have remaining conventional URR of 960 Gb, and for the high case 1460 Gb.

I like the high case better. You could push that to 2850-3000 ultimate technical. But that does require we get radical and drill wells all over the place.

Hi Fernando,

I appreciate the input. Thanks!

Hi Fernando,

Just to make sure I am understanding you correctly,

When you say 3000 Gb of technical, are you excluding extra heavy oil? So if you agree that 500 Gb of extra heavy is reasonable (but should be modelled separately) we would have a total world URR for C+C of 3500 Gb?

Just wanted to be sure because sometimes my questions are not stated very clearly.

Oilshale!

Hi Anonymous,

If you are talking about kerogen, that will be very expensive and requires a lot of water which is in short supply near the Green River shale.

One trillion barrels sounds impressive, but if it costs $500/b (2014$) to produce, then we will not produce much of it.

Hi Fernando,

It makes sense to me. In fact it may be the only thing that saves us because many intelligent people are not convinced that the people who are experts on climate change can be believed. It is really too bad that the approach used by tobacco companies for 40 years to sow doubt about the science behind the dangers of cigarette smoking is being used in the case of climate change with the same successful results.

High prices for fossil fuels is the only viable solution to both climate change and peak fossil fuels.

Dennis, there are experts in climate change and there are political scientists who claim they are experts. The whole issue seems to revolve around attribution. And I happen to think many of the famous scientists are full of bull dinky when it comes to issues as climate sensitivity. This has nothing to do with cigarette smoking. Furthermore, we are running out of fossil fuels, which means we will set the breaks due to market forces. This in turn means the end of oil is a bigger crisis than global warming.

Hi Fernando,

There are others with intelligence who disagree with your assessment. Often engineers have very limited understanding of biology and ecology and think they know more than everyone else. The climate scientists that I refer to have hard science backgrounds in geophysics or geochemistry or biology. I don’t put a lot of faith in the analyses by political scientists and economists. Usually engineers use a generous factor of safety in the face of uncertainty, it is not clear why this would not be the case where policy affecting the entire planet is concerned. I agree that peak oil is a problem, the solution to both problems is similar, move away from fossil fuels as quickly as possible.

I’m used to having others who disagree with my opinions. But a call to authority just doesn’t work. I don’t believe the 97 % bs, I think Mann is unreliable, Hansen is old, and so on and so forth. On the other hand I’m ok with Isaac and Zeke. They aren’t political scientists.

Hi Fernando,

I agree that just because someone has a PhD in science does not mean they are correct.

There are a lot more than two scientists in the field of climate science, as I said I have read pretty extensively and although I am not expert, the case seems very solid based on the scientific evidence. It generally is considered wise to err on the side of caution when faced with uncertainty. Perhaps where you studied engineering factors of safety were considered bad practice.

Who are Isaac and Zeke?

Zeke is an energy systems analyst and environmental economist with a strong interest in conservation and efficiency. He was previously the chief scientist at C3, an energy management and efficiency company. He also cofounded Efficiency 2.0, a behavior-based energy efficiency company. He received a bachelor’s degree from Grinnell College, a master’s degree in environmental science from Vrije Universiteit in the Netherlands, and another master’s degree in environmental management from the Yale School of Forestry and Environmental Studies. He has published papers in the fields of environmental economics, energy modeling, and climate science.

http://berkeleyearth.org/team/zeke-hausfather

Stories about global warming pepper the covers of magazines and newspapers on a weekly if not daily basis. But when Isaac Held entered the field of climate studies in the early 1970s, researchers were just beginning to publicize claims that human activities were generating pollutants that could dramatically change the Earth’s climate. Motivated by a desire to understand climate change, Held, now a senior research scientist at the Geophysical Fluid Dynamics Laboratory (GFDL) in Princeton, NJ, has focused on both theoretical and applied atmospheric science. He has explored the scale of cyclones and anticyclones, landscape effects on atmospheric circulation, factors controlling the temperature gradient between the poles and the equator, and overall mechanisms and impacts of global warming.

Held is best known for modeling Hadley cells, which describe the properties of atmospheric circulation in Earth’s equatorial zone. His three decades of research have garnered him numerous awards, and in 2003, Held was elected to the National Academy of Sciences. His Inaugural Article, published in a recent issue of PNAS (1), deals specifically with projected climate change in Africa’s Sahel region, the transition zone between the Sahara desert and the rainforests of Central Africa and the Guinean Coast.

http://www.princeton.edu/aos/people/faculty/isaac_held/

http://www.gfdl.noaa.gov/blog/isaac-held/

http://journals.ametsoc.org/doi/abs/10.1175/JCLI-D-11-00050.1

High prices for fossil fuels is the only viable solution to both climate change and peak fossil fuels.

We know the economics will discourage oil use. Now whether it will be soon enough to make a difference in climate change is another matter. However, at least we do have that. The deniers may not want to pay attention to any temperature research, but they can’t do much about declining quantities of oil and/or prices too high for consumers to buy much oil.

Hi Boomer II,

I would suggest choosing other words that foster civil discussion. Those that disagree with the mainstream view on climate science don’t like the term “denier” which is used as a pejorative. Name calling tends to produce more heat than light.

Really Dennis, “denier” is name calling? How about “stupid shitheads who don’t believe in science”. Now that is name calling.

Agreed. Not sure much is accomplished in either case if the aim is to get someone with an opposing view to listen to what you have to say. Anything else is a waste of time in my opinion.

I see your point. I wasn’t sure how to identify them. I should use “skeptics.”

I believe that skeptic is preferred, though perhaps someone in that camp could correct me.

How about “Chicken Little’s Smarter Brother”.

I’m a skeptic. I’ve seen too much bs coming from both the government and the media not to be skeptic about things. Besides, I spent too much time being there, where it was happening, and I saw it misreported. The first time I tried to correct a blatant lie in a newspaper was in 1979 (LA times). They ignored me, of course. When it cones to the climate warming zingy the best option is to ignore the media and politicians, as well as the more political scientists, like say Mann and Spencer. Dabblers like Cook who wrote the 97% paper are not worth the time.

Your thinking makes great sense.

The problem is that oil supplies may decline faster than we CAN adapt.

While a few people are able to focus on the long term the vast majority of people are followers who think ”they ” will take care of it -whatever ”it” might be. Peak oil, ebola, bad hair day. Whatever.

Adopting a more energy efficient lifestyle overall will take a substantial amount of time. I fear that energy supply in the form of oil in particular will shrink faster than we WILL change our ways.

It might not even be POSSIBLE to change our ways fast enough to deal with the peak oil problem- although I personally believe we could deal with peak oil from a technical point of view.

We COULD mandate all new cars getting forty mpg next year and make it stick and we could build a lot of mass transit instead of more highways. But we WON’T .We COULD mandate much better insulated houses starting a few months down the road. But we WON’T.

The bottom line in my opinion is that is we will not move fast enough on energy conservation and renewables to avoid a truly major world wide crisis.

I realize a lot of my commentary may seem either juvenile or condescending to the folks who comment regularly.

But there are sure to be a non commenting visitors and regular readers who are just now beginning to think about all the things we talk about in this forum. Some of them are probably kids -hopefully at least.

Newbies need a lot of detail that old hands take for granted.

Then there`s 2 billion plus mouths to feed in the next 40 years. Perhaps we`re looking at depleting ground water, decimation of ocean fisheries, soil degradation, more crappy (erratic) weather from global warming, etc. Not to be pessimistic or anything.

Doug, there ain’t no perhaps in anything you’ve mentioned there. It’s pretty much dead certainty! I’ve been watching coral die off for years. There is sea level rise happening in my back yard and severe drought where I was in Brazil. The science is incontrovertible!

we did mandate new cars to get 40+mpg but not until 2018

http://www.c2es.org/federal/executive/vehicle-standards#ldv_2012_to_2025

An AVERAGE FUEL ECONOMY has been mandated.Whether the mandate will stick is another question.

The regulations as written still allow the manufacture of cars that get considerably less than even twenty mpg.

And unnecessarily heavy oversized fuel hog trucks used as cars are still going to be legal.

Hi OFM,

When gas prices are $6/gal in 2014$, do you think a lot of people will be driving pickup trucks when they don’t need one for work? Higher taxes like they have in Europe are the best way forward, in fact Obama should hold out on Keystone and demand a carbon tax as a condition for approving it. Any veto would probably be overridden though, so this would be unlikely to work, he would have to count votes in the Senate carefully, before he persues such a strategy.

Opposing keystone is fairly useless, the gulf coast is supplied by venezuelan crude with identical properties.

Fernando,

I agree. At some point the US should use carbon taxes to speed the transition from fossil fuels, this is just one way to attempt to accomplish that. The republicans want the Keystone XL, democrats want a carbon tax or cap and trade, or some means of reducing carbon emissions, so allow Keystone XL on the condition of some kind of carbon emissions reduction policy.

Newsweek in 1975: “Tornado outbreak blamed on global cooling”

Time in 1977: “How to Survive the Coming Ice Age”

First it’s Global Cooling then Global Warming then Global Climate Change (which of course has been occurring for 4 billion years), seems like the “scientists” who like to claim they know everything are running out of euphemisms . . . LOL 😉

Those that control and enforce all aspects of energy, control the world.

So you need to follow the money of what you are saying; cap & trade and carbon tax, those are pure redistribution of wealth schemes rife with left-wing corruption.

There’s simply no reason to gut and destroy our standards of living with such nonsense anyway as there has been no warming increase in global temperatures for the past 17 years, and counting.

Like most reasonable folks. I am a firm believer in keeping our planet, air, water, environment clean. However, I am also a firm believer in truth and honesty. When liberals and progressives began using Global cooling/warming/change to frame their arguments as opposed to “Clean” it became overwhelmingly obvious their agenda is strictly about unrestrained control and power.

There’s simply no reason to gut and destroy our standards of living with such nonsense anyway as there has been no warming increase in global temperatures for the past 17 years, and counting.

You realize you are posting in a peak oil forum, don’t you?

Our standard of living is going to change because of declining sources of cheap oil.

When liberals and progressives began using Global cooling/warming/change to frame their arguments as opposed to “Clean” it became overwhelmingly obvious their agenda is strictly about unrestrained control and power.

I would think that you climate change deniers could come with a better line of bullshit than that. The vast majority of climate scientist are not in any position of power, they are mostly academics who just want to do good science.

Quoting MSM publications is not the same as citing scientific journals. MSM rags such as Time and Newsweek are looking for “oh-wow” stuff that gets attention and sells magazines; they’ve been telling us that flying cars are just around the corner for 50 years.

Since you call yourself “a firm believer in truth and honesty” (me, too), let me just note that it is NEVER truthful to state as a fact what somebody else’s motivation is. We simply do not know, and cannot know, what another person thinks or is motivated by; of course, we can guess, but we must remember that such guesses are highly error-prone.

I don’t have a problem with a carbon tax. But this should also rationalize the accounts, which requires elimination of subsidies for ethanol, wind, solar, and other renewables. The tax revenue should be used to reduce income taxes.

Hi Fernando,

As long as all subsidies are removed for both fossil fuels and alternatives, I agree with your position on a carbon tax, I believe the revenue should be used to reduce taxes, or possibly improve infrastructure for the power grid, rail, light rail, better urban design, in other words things that might help the transition as fossil fuels deplete. There are some cases where the market does not maximize benefits relative to costs and in those cases, and only those cases there should be government intervention, but it should be minimized as much as possible.

Okay, so most of us here think price of oil will keep rising (even if in fits and starts) so that it becomes increasingly unaffordable for most people.

Now, they have alternatives. If they have money, they can buy more fuel efficient vehicles. If they don’t have money, they decrease driving.

What I am most concerned about is them not understanding why the price of oil puts it out of their reach. If they are told that there is oil, but there are conspiracies to keep them from getting it, then maybe they will choose to get mad rather than take constructive action. That will get them nowhere.

Perhaps there will be a point where Fox News and the like will change their tune, tell the masses the oil is disappearing, and they need to conserve. I’m not expecting to see or hear that any time soon, but maybe when there is little to be gained by anyone by pretending oil is unlimited, the average citizen will accept it as a reality and make the necessary changes.

Decrease driving in an environment that in no way hinders driving? That might take some doing.

http://www.strongtowns.org/journal/2015/1/19/drive-like-your-kids-live-here

Cute sign, though. Hmm, let’s see, elsewhere, Cuomo is dumping most of a $5.4 billion windfall towards helping drivers not pay for higher tolls. Heh. Ah, and finally, the NY DMV revoked the license of Ahmad Abu-Zayedeh. Not sure why that took so many hearings and over 15 months to get done, seems a reasonable step in the wake of a 3-year-old being mowed down by one of you car drivers. Maybe one year negligent homicide charges as well? One can dream…

We COULD mandate all new cars getting forty mpg next year and make it stick and we could build a lot of mass transit instead of more highways. But we WON’T .We COULD mandate much better insulated houses starting a few months down the road. But we WON’T.

I guess by “we” you are referring to America. I wouldn’t be so sure about the rest of the world. The Germans adopted the simple policy of taxing the crap out of energy back in 2000. It has a way of focusing minds on reducing waste, and transfers money to government coffers from energy producers as well.

I also recommend you read up on Japan’s setsuden (electricity saving) policy. They shut down their nukes and replaced half the lost output overnight through conservation. And Japan already used a lot less electricity than America.

http://en.wikipedia.org/wiki/Setsuden

Also the claims that high energy prices will harm the economy are basically absurd. All America needs to do is shift from spending on waste to investing in energy saving and the problem will go away by itself.

Germany has completely destroyed it’s entire energy industry by making the wrongheaded decision to go “green”. You can read about it at US Chamber of Commerce or AEI or Heritage Foundation about how wind/solar has not been able to pay the bills causing “dirty” coal to be bigger than ever in Germany with new coal-powered power plants being built all the time. Plus we in America have read the stories about hundreds of thousands of Germans who have had to suffer from having their electricity turned off because they couldn’t afford the drastic increase in electricity brought on by the “green” schemes (those stories were in 2013 though so probably the number of people who can’t afford electricity bills has risen into the millions by now). The USA most certainly does not need to go where Germany has gone.

http://www.amcham.de/fileadmin/user_upload/Policy/Environment_Energy/2014/1411_EEC_Thesen_Marktdesign.pdf

https://www.uschamber.com/blog/high-energy-prices-has-europe-rethinking-energy-strategy

http://www.aei.org/publication/heres-what-germany-got-for-its-100-billion-euro-subsidy-of-solar-power/

http://dailysignal.com/2013/10/07/generating-german-energy-poverty/

drive at night and charge during the day!

“BMW and Volkswagen on Thursday announced they are teaming up to create nearly 100 electric vehicle charging stations along heavily traveled roads on the East and West Coasts.

The companies are working with ChargePoint, the largest electric vehicle charging network, on the effort. The publicly available stations will be added to ChargePoint’s existing network of more than 20,000 charging spots in North America, and can be accessed by anyone with a ChargePoint or ChargeNow Card, or with the ChargePoint mobile app.”

http://www.pcmag.com/article2/0,2817,2475613,00.asp

Hi Ron,

Could you give us your estimate of World URR for C+C? Jean Laherrere estimates about 2700 Gb. So far the world has produced 1250 Gb of C+C.

A Hubbert linearization(HL) of World conventional C+C (where conventional excludes extra heavy resources) suggests a URR of 2500 Gb, which would be a minimum level because the HL method tends to underestimate the URR.

Chew (see below) reviews unconventional fossil fuels in the paper below:

Chew KJ. 2014 The future of

oil: unconventional fossil fuels. Phil. Trans. R.

Soc. A 372: 20120324

http://dx.doi.org/10.1098/rsta.2012.0324

http://rsta.royalsocietypublishing.org/content/372/2006/20120324

He estimates about 300 Gb from Canadian oil sands and 300 Gb from the Orinoco belt. Fernando thinks the Orinoco estimate should be lower, at about 150 Gb, if we split the difference the estimate roughly matches Jean Laherrere’s 500 Gb URR estimate for extra heavy(XH) C+C.

The USGS estimates about 3000 Gb for conventional C+C URR, if we split the difference between the USGS and HL estimates we would have 2750 Gb of conventional C+C and 500 Gb of XH C+C for a 3250 Gb URR.

We are not well past 50% of World C+C URR, we are at 45% of conventional and 38% of all C+C.

My estimate of world URR would be between 2,000 and 2,200 GB of conventional oil. Counting extra heavy oil and oil sands only confuses things because any increase in production from these two sources will be slow and will not help mitigate the peak very much. You must have had heard the phrase: “It’s not the size of the tank that matters, it’s the size of the tap.”

The decline of the world’s major oil fields

1. The world’s 507 giant oil fields comprise a little over one percent of all oil fields, but produce 60 percent of current world supply (2005). (A giant field is defined as having more than 500 million barrels of ultimately recoverable resources of conventional crude. Heavy oil deposits are not included in the study.)

5. Now, here’s the key insight from the study. An evaluation of giant fields by date of peak shows that new technologies applied to those fields has kept their production higher for longer only to lead to more rapid declines later. As the world’s giant fields continue to age and more start to decline, we can therefore expect the annual decline in their rate of production to worsen. Land-based and offshore giants that went into decline in the last decade showed annual production declines on average above 10 percent.

Sixty percent of the world’s oil comes from fields that are all very old and are either in decline or have been kept from decline by very massive infill drilling as in Russia. But now that party is about to end.

There is just no question that the decline curve in all these fields will be extremely steep. All the new stuff, shale oil, deep water oil and very small fields already have a very steep decline curve.

Dennis, I just don’t pull this stuff out of my ass. I have been studying this for almost 15 years. I have analyzed the output of every major oil producer in the world and I see an imminent peak. If you think production will keep climbing, or plateau for ten to twenty years, then you need to explain where you think all this oil will come from. The coming decline is set in stone, it will definitely happen. But what you are saying is all these vast reserves will be tapped to keep production up or perhaps even increasing.

Where Dennis, will all this new oil come from?

So we hit peak or plateau very soon. What do you think happens next in the US?

Will there be widespread recognition of this and a plan for the future?

Will the “drill baby, drill” politicians acknowledge it or when they claim it’s all a plot organized by someone?

I know some of you expect chaos, as the masses rebel. But others feel that if the decline is gradual enough, people can adjust.

So it seems there are two factors: whether there will be an acknowledgement of peak oil and how peak oil begins to impact the consumer.

Thoughts?

Hi Boomer II,

The peak will only be recognized 5 to 10 years after it has occurred. One problem is that the initial decline will be gradual and people will think that output will go back up in the future. The second problem is that lots of other stuff is called “oil” and that will hide the peak in C+C to some degree. A third issue is that prices will increase and there may be an increase in extraction rates in response which will either slow the decline or possibly keep us on a plateau for a few years.

To me chaos might occur once the peak is widely recognized, in the mean time there will be an economic slowdown.

The one possible thing that might mitigate the economic slowdown is that higher fossil fuel prices might lead to more demand for wind, solar, EVs, public transportation, and other positive infrastructure development (less fossil fuel focused) which might boost the economy and offset some of the drag caused by high fossil fuel prices. This effect may help some, but is likely to require a crisis before it really has a significant effect.

Hi Dennis,

Didn’t the peak in conventional oil already happen 10 years ago?

Where is the chaos, and economic meltdown?

I mean any more than usual.

Hi JohnB,

That depends on one’s definition of conventional oil. My definition is all C+C except extra heavy oil. I think the peak in conventional oil may have been 2014, though the data is not in, and the quantity of extra heavy oil produced is hard to estimate (we have good data for Canada, but not very good estimates for Venezuela).

It is better to just look at C+C output and the most reliable source for this data is the US EIA. I would look at the trailing 12 month moving average to determine the peak and I would not call a peak until we have fallen to 96% of that peak using a 12 month moving average, otherwise we may just be on an undulating plateau. Chart below with World C+C from EIA.

If you subtract tight oil production, then crude oil peaked in 2005.

Most experts consider tight oil “unconventional”.

http://www.eia.gov/todayinenergy/detail.cfm?id=15571

http://www.indexmundi.com/energy.aspx?product=oil&graph=production

Hi JohnB,

There are many experts and almost every one has a different definition of “conventional oil”. I will follow Jean Laherrere who wisely avoids the term all together. I divide oil by API gravity into two buckets, the first bucket has oil with API greater than 10 degrees will be called C+C less extra heavy(XH) or C+C-XH, the second has API gravity of 10 degrees or less and is called extra heavy oil.

How the oil is produced is of little consequence, the properties of the oil are what is important. Once produced, LTO oil is no different from “conventional oil” of the same gravity and sulfur content.

The peak of C+C is what is important, output data on extra heavy oil is hard to find because the data from Venezuela is not very good, so far, we have not seen a peak in the 12 month moving average of World C+C output.

That is true. The exploitation of Bakken tight oil is a secondary recovery phenomena. When the primary approaches fade away one goes to the secondary.

A Bakken reservoir is clearly a different classification of oil.

As an example, one could characterize the uranium found in sea-water as part of the total resource allocation for that element. But we don’t because the effort needed to extract U from sea-water is much more elaborate.

Some logic and rational thought needs to be applied here.

Hi Paul,

LTO is definitely more expensive than other onshore conventional resources.

I think it is much simpler to bracket the types of oil by their viscosity. This has the benefit that on oil shock model can be used for less viscous oil (Laherrere’s C+C less extra heavy), because the speed with which these resources can be developed and extracted is somewhat similar and a second model for the extra heavy oil fro Canadian and Venezuelan oil sands. It would be too much work to separate evry different type of oil and model it separately (deep water, polar, offshore, onshore, LTO, etc.). In addition, the amount of LTO likely to be recovered is on the order of 50 to 100 Gb, more or less a rounding error in the grand scheme, so when I model the World I just roll it in with C+C minus extra heavy.

Hi Ron,

Your estimate of conventional resources is too low. It is at least 2500 Gb. I have also been studying this for a long time, as has Jean Laherrere, I agree that a peak may be here or will arrive soon.

I also agree that a long plateau is unlikely, but I also didn’t think the Bakken and Eagle Ford would produce as much oil as they have when I considered the matter a few years ago.

The USGS and others have estimated conventional URR at 3000 Gb, the oil will come from a combination of new discoveries plus reserve growth. I think 3000 Gb is on the high side but 2600 Gb of conventional C+C would be my most conservative estimate. If the extraction rate from producing reserves remains at about the 2014 level and the World URR is 3000 GB (2500 Gb conventional + 500 Gb extra heavy) World output could look like the following.

Like I mentioned, engineering teams seem to draw up their plans to arrive at an eventual decline factor around 10 %.

I have observed the way they work, and they lay out infill programs, water injection capacity, artificial lift systems, and other items, and then they run economics, and in large fields I’ll be darned if they don’t land back at the same overall shape.

I also found that very aggressive management with a short term outlook drives the project to a higher design peak and much faster declines. They compress field life, overspend on facilities, and make an overall mess out of things. But they get their bonuses.

DC, As you are aware, the Oil Shock model needs a good estimate of discoveries to project future oil production. Laherrere was one of the few sources for discovery and URR estimates, and I could only wiggle out estimates of 2100 Gb from Laherrere in the past.

However, 2100 Gb was clearly a low-ball estimate for a URR according to the oil shock model results and that’s why I upped the estimate to 2800 Gb for what I published.

I remember the time from 2005 to 2010 where I spent a lot of time trying to work a 2100 Gb number for it to make sense, but finally gave up and moved the discovery URR upward.

It is good to see Laherrere going with 2800 Gb for conventional now, as it does seem to make more sense. I blame it on too much reliance on Hubbert Linearization, which is really underpowered as an analysis tool.

FWIW: Perhaps bucketing Oil production by costs would provide a better insight. Even if URR is 2800, I suspect that last 800 Bbbl is significantly more expensive to deliver to the market than the first 1.5 Tbbl oil produced (and to be produced) .Much of that additional oil may never be brought to market. The World has a glut of $300 per bbl oil but is starving for $10 per bbl oil. Economics will prove to be the keystone in future production. I don’t believe the economy can support Oil above $80 for any significant time. For the past 10 years, Central banks have been printing money and have lowered interests to near zero to prop up the global economy. They can’t do that indefinitely.

And in any case, the depletion rate, i.e., the rate at which we consume remaining recoverable reserves, is almost certainly increasing, year by year.

Rather than reserves (which increase as resources are developed) I better metric is recoverable resources, the depletion rate of recoverable resources is definitely increasing if output remains flat, it could level off if output falls, it depends on the decline rate.

“Perhaps bucketing oil production by costs would provide a better insight.” Yes, of course it would. Comparing a barrel of oil from the Barents Sea with one from southern Alberta is totally ridiculous: As is putting heavy and light oil in the same general category. Having stood on an platform in the North Sea and watched the look of disgust on an engineers face as she let expensive heavy oil filter through her fingers, I understand your point.

Hi Doug,

Whether the oil is heavy or light does not always determine cost, there is a lot of light oil which is expensive to produce. The model I use treats the extra heavy oil separately and uses CAPP estimates for Canadian bitumen, and the best estimates I could find (from Jean Laherrere) for Orinoco oil. The Hubbert Linearization method of estimating URR tend to underestimate the URR and this points to 2500 Gb for conventional (no extra heavy oil) C+C. USGS estimates 3000 Gb of conventional, we could deduct Laherrere’s estimate of overstated OPEC resources (300 Gb), and that would leave 2700 Gb of conventional oil.

“Whether the oil is heavy or light does not always determine cost….” That’s pretty obvious when you stick ALWAYS into the equation. How about comparing the percentage of heavy oil projects that have been shelved vs conventional light. BP just blew a bundle on Ugnu (North Slope) and I see reports of heavy oil projects cancelled every day.

Hi Doug,

I do not have any oil field experience so you will have to bear with me. I agree that high cost projects will be shelved, and that extra heavy oil on average is more expensive than the average barrel of conventional oil (where I include all C+C except extra heavy oil in my definition of conventional). My point was that many LTO plays are very expensive and I believe many ultra deep water projects are expensive as well. There are not really a lot of inexpensive wells left to be drilled.

Do you expect that drilling will not continue? I doubt that is the case, the projects will be done if oil companies think they will be profitable, we could probably agree on that, but you often surprise me 🙂

Did the UGnu die?

Fernanda,

“Did Ugnu (North Slope) die.“ No, it didn`t die, it was killed. 🙂

Dennis, “Do you expect that drilling will not continue?“ Come on Dennis, of course drilling will continue. BUT, TechGuy made an excellent point… at least in my opinion. Obviously iffy projects are in jeopardy and by iffy I mean ones of questionable long term economics. The Kazakhstan Kashagan Field is a perfect example: Simple as that.

Hi Doug,

I agree that Techguy’s point that oil will be expensive is correct. I think that his suggestion that 800 Gb of conventional will need $300/b (2014$) to be produced may overstate the case, but you and Fernando may have a better feel for this. My guess would be $150-$250/b to reach 2500 Gb of conventional, but my hope is that $300/b may be closer to the mark, those prices will move us more quickly to other low carbon sources of energy. In my view high prices are a good thing.

Doug L, did ConocoPhillips pokey around with a West S electric heater project?

Fernando, In permitting stage with with first oil in early 2017. Estimated peak production of 9,000 barrels of oil per day. Now called 1H NEWS (Northeast West Sak) Weird name!

I did some work for a presentation to the state government on the electric heater potential. I had a young venezuelan petroleum engineer run a simple mechanistic CMG model, but I don’t recall seeing such rates unless they preheat for a really long time. That BP project sure was a bit problematic. I’m sorry for those guys.

I think focusing on cost to discover and recover is most the most important analysis. For example, I was always under the impression that deep water had high CAPEX, but low OPEX. Some recent posts on this site have indicated that OPEX is also very high.

The fact that many of the projects majors are looking at these days require more than $100 per bbl is a serious problem. Sorry to state the obvious, but if consumption world wide rises due to current lower prices, a shortage could actually occur not too far off.

Hi Shallowsands,

As long as the market is allowed to determine prices, as oil becomes scarce prices rise and consumption decreases. It would be better id the US government recognized the impending fossil fuel scarcity and raised taxes on fossil fuels to speed the transition to alternatives. We will have to wait until the peak is apparent even to Fox News, before this is likely to occur.

I think there’s going to be a panic the day the Saudis announce they can’t raise production anymore.

Yeah Fernando,

That should be an interesting day indeed.

Today on CNBC, some character was claiming that SA may/will increase oil production to 12.5mmbpd. Obviously talking down the price.

Dreams Dreams

Hi WHT,

Jean Laherrere estimates 2200 Gb for conventional and 500 Gb for extra heavy oil, so I was not clear, 2700 Gb is for all C+C including extra heavy oil. HL by my estimate points to 2500 Gb for C+C less XH, but usually this is too low so a better guess would be 2750 Gb of conventional and 500 to 600 Gb of extra heavy oil. Some think this is too optimistic and a few think it is pessimistic, so maybe it is about right. Hopefully oil prices will rise enough that we will leave 500 Gb in the ground.

DC, Thanks for the clarification. If you get about 2750 Gb and I am at about at 2800 Gb, we are pretty much singing the same tune.

I also used the Shell Oil discovery (BOE) estimates as a balance to the Lahererre data, weighing both the pessimistic and optimistic side of what each categorized as conventional crude oil.

I agree that the economic aspects of the lowest-grade or most difficult to extract 500 Gb will have a role in the dynamics of how it plays out.

Hi WHT,

I was under the impression that the Shell data was barrels of oil equivalent, though if we assume that was a C+C+NGL estimate and further assume about 400 Gb for an NGL URR we would have about 3100 Gb for shell. I was also under the impression that your 2800 Gb URR included NGL, but I may not have that right, mostly I think we agree, and the difference in outcome between 2700 or 2800 Gb is negligible. Higher URR estimates of extra heavy oil would change little before 2050, they might slow decline rate marginally, but high prices will be the main thing that moves the world beyond fossil fuel, a gradual increase would make the transition less problematic, but may increase climate issues in the long run. So as fast an increase in fossil fuel prices as possible without economic collapse would be best in my view, probably 7-8% per year.

Dennis, you know my position on OPEC Middle East, North African Reserves. Would you mind telling me what yours is. Just how close is the below chart?

You say 2700 GB of which 1250 has already been produced. That leaves 1450 GB to be produced. So could you fill in the blanks for me?

OPEC remaining reserves__________________

Non OPEC remaining reserves_______________

Of course by reserves I mean economically recoverable reserves.

Just your wild ass guess would be fine.

Hi Ron,

I haven’t really broken it down that way. The World HL of conventional (C+C less extra heavy) crude results in a URR of 2500 Gb. Jean Laherrere did two separate HL analyses for OPEC and non-OPEC. See page 21 and 22 of paper at link below:

http://aspofrance.viabloga.com/files/JL_2013_oilgasprodforecasts.pdf

For OPEC he gets 1200 Gb and non-OPEC 1400 Gb for the World HL he uses too long an interval and gets an incorrect estimate of 2200 Gb. Using 1993-2013 we get 2500 Gb, we will call it OPEC 1250 Gb and non-OPEC 1450 Gb for my 2700 Gb estimate for World URR. There were many estimating a URR of 2000 Gb in 2005, I expect URR to increase to 2700 Gb in the future for conventional C+C. HL in chart below.

Infill drilling is holding up that decline curve and creating a false decline slope. KSA is watering up fast. I think the decline curve will start to steeping in an couple of years.

They have projects to add new wells in undeveloped areas. But the cost is increasing.

I keep hearing there’s a lot of reluctance on their part to ever go above 12 million barrels per day.

They have projects to add new wells in undeveloped areas. But the cost is increasing.

Manifa and Khurais were the last of Saudi’s undeveloped fields to go on line. There are no more. They are still drilling wells in developed areas however. Saudi’s infill drilling program has been underway for well over a decade now.

I guess it depends on how one defines infills. I have a friend working on a field capacity expansion project. But he is limited on what he can discuss. One issue we debated about Aramco practices was the use of peripheral versus pattern floods. One could argue a pattern implementation is “infill”. But I don’t keep track of that work.

On the other hand they have undeveloped light oil field reservoirs near Riyadh? Or are those tapped?

Hi Tech guy,

That is not a decline curve. It is P/Q on the vertical axis and Q on the horizontal where P is annual output and Q is cumulative output. If we assume the 2500 Gb estimate is correct (I think it is too low) and use the oil shock model to estimate future output with the assumption that extraction rates from producing reserves remain close to 2014 levels we can plot the P/Q vs Q and compare with the HL.

The model predicts that the P/Q vs Q will fall below the HL estimate for a time and gradually return to the predicted line. This illustrates part of the problem with the HL method, it fits a line to a curve which is concave up as the URR is approached, this is why it tends to underestimate the eventual URR.

Yes I know an HL curve isn’t a decline curve. but its the infill drilling that has delay declines which is altering the HL curve to be better than it really is. Consider if I have a bucket of water. an punch a few holes in it. As the bucket drains the flow slows as the pressure falls. Left to its own the decline rate rate would roughly match a bell shape. Now to speed up the process I can add a plunger to speed up the flow to maintain the flow artificially. However the real amount of volume present in the bucket is unchanged. HL is presumes that extraction from a field represents a bell curve, but infill drilling has change that to be a mirror of the chi square curve where the downsize slope will be steeper because technology has postponed the natural decline slope. At best Technology may have improved the amount of oil that can be extracted that will have a small influence in URR.

Either late 2013 or early in 2014 I posted some Armaco presentations that showed that the oil column in the Arab-D area had declined to about 30 feet. I recall correctly that back in 2004 that Arab-D oil column was about 400 or 500 feet. Without the massive amount of infill drilling KSA production would have been a fraction of what it is.

Hi Techguy,

If you look at US Lower48 output after the peak the P/Q vs Q plot did not steepen as you suggest except in the short term from 1970 to 1980 (95,000 to 125,000 MMb), I doubt that this will happen for the World either.

DC Wrote:

“If you look at US Lower48 output after the peak the P/Q vs Q plot did not steepen as you suggest except in the short term from 1970 to 1980 (95,000 to 125,000 MMb), I doubt that this will happen for the World either.”

Right, because the declines were not steep and there was still a lot of oil to be tapped. Technology also made advancements during that period, and rising oil processed also helped.

The difference is that world production is still relying on the 10 or so supergiants discovered over 50 years ago. Once the infill drilling has run its course it will impossible to make up for their declines. To add even more pain, these fields are also sources of the cheapest oil to bring to market.

If infill drilling had not been used, the production of all these wells would be considerably less, and would have impacted the HL curve.

The best analogy I can think of at the moment, is that a poor man that has saved for decades can play the part of a rich man for a short period. He can simply burn through is years of savings to appear to be much much wealthier than he really is. After his savings are depleted, The facade quickly disappears. We are likely doing the same with infill drilling.

For remaining resources, OPEC about 750 Gb, and non-OPEC about 700 Gb. This includes future discoveries and reserve growth.

According to Ivanhoe Hubbert did not believe in a symmetrical curve. http://hubbert.mines.edu

Even the curve in Hubbert’s original paper isn’t true symmetrical. He was pretty agnostic as to what the shape would be and there is no real way to predict it because of all the information problems.

The “ten squares” math doesn’t change, though. If you distort it into a plateau via rapid cannibalization of long-tail reserves for current numbers, you will fall fast. I expect that to happen in Russia as they are the poster child for this.

The other variable is OPEC reserves and the degree of lying involved.

The way I try to make sense of Texas RRC’s delayed reporting system is the following.

I take the end points for each month reported and use those to form the slope of production increase or decrease. Using this method the Texas RRC Crude Only graph shows a lessened slope of increased production compared to the complete data in the 2012 region. Essentially it would indicate production is sloping off but not decreasing yet.

This method assumes that the laggards in reporting are all about the same and conversely the timely reporters are similar from month to month. It also assumes that new wells are distributed evenly across the reporting set.

This method shows that the EIA estimate for the C+C could be between 200,oo0 and 300,000 bbl/day higher than reality.

A lengthy article entitles “Shale and Wall Street” was written in Feb 2013. It is amazing how accurate it describes the basic fundamentals leading to the present financial shale problem.

http://shalebubble.org/wp-content/uploads/2013/02/SWS-report-FINAL.pdf

Excerpt from the executive summary:

In 2011, shale mergers and acquisitions (M&A) accounted for $46.5B in deals and became one of the largest profit centers for some Wall Street investment banks. This anomaly bears scrutiny since shale wells were considerably underperforming

in dollar terms during this time. Analysts and investment bankers, nevertheless, emerged as some of the most vocal proponents of shale exploitation. By ensuring that production continued at a frenzied pace, in spite of poor well

performance (in dollar terms), a glut in the market for natural gas resulted and priceswere

driven to new lows. In 2011, U.S. demand for natural gas was exceeded by supply by a factor of four.

It is highly unlikely that market-savvy bankers did not recognize that by overproducing natural gas a glut would occur with a concomitant severe price decline.

This price decline, however, opened the door for significant transactional deals worth billions of dollars and thereby secured further large fees for the investment banks involved. The recent natural gas market glut was largely effected through overproduction of natural gas in order to meet financial analyst’s production targets and to provide cash flow to support operators’ imprudent leverage positions

” Peak oil will be the point in time when more oil is produced than has ever been produced in the history of the world, or ever will be in the future of the world. It is far more likely that this period will be thought of as a time of an oil glut rather than a time of an oil shortage”. Oilgasm.

Oilgasm!

Damn I wish I had thought of that first!

“t is far more likely that this period will be thought of as a time of an oil glut rather than a time of an oil shortage”

That would apply to the 1990’s when the price of oil collapsed. The peak of oil production with the lowest cost was 1999. Since then prices have rise as demand out paced production. Despite the recent collapse of Oil, its still far more expensive than it was in 1999 and we’ll never see the price/supply ratio as we did in the 1990’s. We certainly are not in a oil glut. Consumption as fallen because of price, because customers have purchased more efficient vehicles, decrease in high consumption activities (ie vacation some place distant), or purchase less goods and services.

It’s interesting that most break-even calculations recently quoted on this site seem to imply a return requirement of 20 %. That’s actually a pretty high RoE for most industries. If you’re willing to live with 10 %, break-even price is quite a bit lower. And if you’ve already invested and are stuck with your sunk costs, an ex post 0 % return isn’t so horrible either, because it means you haven’t actually lost money (apart from inflation, which is sort of negligible right now).

Could it be that the lower break-even prices tossed around by other sources are simply caused by different definitions of the concept, i.e. use lower return requirements or profit = 0 (0% return)?

Or maybe those lower breakevens tossed around by sources are to find buyers for positions they or their clients are desperate to unload.

I’d say the odds of that are higher, yes?

Reminds of mid 90’s when Russians were selling fantastic fur coats in Mediterranean just to survive.

I asked “How much, even though who needs fur coat on +30C?” The guy said: “Davai, Davai” (Give me, Give me” whatever you think)

the same like these high cost oil peddling investment schemes at the moment: Give me whatever you think and don’t you worry about breakeven. 🙂

Better example, Greeks buying London real estate in 2011. No inspection. No negotiation. Just Get The Money Out Of Greece.

You are saying it must be some kind of pump and dump. They are pumping something up in hopes of dumping it at a higher price later. I can’t imagine what kind of equities Casey Research, or their clients would be looking to unload by advertising the fact that some Bakken drillers are in deep shit.

I believe some Bakken drillers are in deep shit but I cannot think of any investment that would benefit from this fact. Please enlighten me, just what kind of “positions” are you talking about.

Positions already held.

I would not call it pump in this environment. I’d call it fighting a rear guard action to slow the bleeding as exits take place.

As for specific instruments they might have put clients in who now are looking for the door from, one would guess the big 4 oil services ETFs — OIH, IEZ, PXJ, XES. Some mutual funds have bylaws that specify minimum % holdings in various asset allocation profiles. They may or may not permit ETFs vs HAL or SLB.

But in general, the rationale at the morning meeting would be “get information on wires to slow the bleeding so our clients lose less on the way out”. And then for damn sure get on the phones to out clients and do some hand holding.

Thomas, that’s a pretty good observation. The 20 % IRR hurdle is used as a fairly primitive risk weighting device. A typical approach is to layout unrisked costs, production, prices and taxes. This yields a net cash flow table, which is in turn discounted at 20 % (but the discount factor is lower in larger companies, I have seen some which use unmentionably low factors).

I think the use of a very high discount rate is a mistake. A sounder approach is to use the company’s cost of capital (including shareholder returns), and to risk the other inputs. Given today’s computer power it’s fairly easy to generate multiple runs and generate puts of present value versus ranges of costs, prices, and other variables.

I wrote about this previously because engineers have to optimize field developments. And optimization carried out with a very high discount rate leads to errors. The engineers design wells and fields with very “peaky” rates and extremely fast declines. This in turn reduces the true present value to the corporation.

I have consulted for companies with managers who just couldn’t see how this works. They were raised a certain way, can’t learn to use tools and methods we developed for more powerful computers, and this is why we keep seeing the use of unsound practices.

Based on conversations and discussions I had over the years, it seems European companies are a bit better. Shell and Statoil are very sharp in this area. Petrobras is very good at buying the software they need, but I’m not sure if they use it properly.

And I’m not aware of any USA companies with management which really knows how to use sophisticated risk analysis. The last time I talked to Exxon engineers about this topic they didn’t seem to be too inclined to perform detailed risk runs. But maybe they were keeping that confidential. Exxon types are extremely sharp but tend to share information in slugs. Sometimes they share a lot, sometimes they clam.

AGREED… Peak Oil is Here, the world just doesn’t know it yet.

That being said, here is something a bit OFF TOPIC as Old Farmer Mac likes to say:

Germany’s Bundesbank Resumes Gold Repatriation; Transfers 120 Tonnes Of Physical Gold From Paris And NY Fed

The Bundesbank successfully continued and further stepped up its transfers of gold last year. In 2014, 120 tonnes of gold were transferred to Frankfurt am Main from storage locations abroad: 35 tonnes from Paris and 85 tonnes from New York. “Implementation of our new gold storage plan is proceeding smoothly. Operations are running very much according to schedule,” said Carl-Ludwig Thiele, Member of the Executive Board of the Deutsche Bundesbank.

http://www.zerohedge.com/news/2015-01-19/bundesbank-resumes-gold-repatriation-transfers-120-tonnes-physical-gold-paris-and-ny

While I imagine there are folks here that are SICK & TIRED of me posting about GOLD, I thought this was a notable event as it destroys the silly notion by the less informed mortals that CENTRAL BANKS give a RATS AZZ about GOLD.

We have some very wise Energy folks in here who have made remarks saying that GOLD doesn’t matter anymore…LOL. Well, someone better tell these Central Banks that as they are behaving in quite the opposite fashion.

Furthermore, when PEAK OIL arrives (probably very soon) then GDP growth is impossible. What happens to the theory of NET PRESENT VALUE in a falling energy supply environment??? What does that do to perceived value of Stocks, Bonds, Retirement Accounts and all the other assorted paper garbage?

We certainly live in interesting times….

steve

I use lot of caps because you can’t underline or use italics on this blog. Some people have found a way to make their comments partly BOLD – heavy and dark but not caps. I don’t know how to do BOLD.

I am not personally a gold nut but I do have a little gold in the form of jewelry mostly and intend to hang onto it as an emergency currency.

In times past I would have tried to have a stash of gold but nowadays I maintain a stash of firearms ammunition fertilizer diesel fuel pesticides salt sugar canning jars hardware of various sorts – on and on. If I ever need to BUY a few pounds of beans or flour there is little doubt in my mind I can barter shotgun shells or rifle or pistol ammunition as easily as I could gold- at least in my part of the world.

Gold is magic because it has the legend of universal acceptance behind it. Now if nobody had ever heard of gold and I were to find a ton of someplace the only people who would want it would be physicists and chemists etc interested in investigating the properties of a previously unknown mineral.

With people believing in gold far more fervently than most bible thumpers actually believe in Jesus it lends the aura of incontestable wealth and power to a central bank that possesses it in quantity.

The perception of strength is often times as good as the actual possession of it. A fly that is sufficiently well camouflaged to pass for a wasp is ac safe from most predators and has an enormous advantage over a real wasp in not having to invest in the metabolically expensive weaponry.

People are hardly ever totally rational but most people who understand that gold is not intrinsically valuable for the most part also understand that this lack of intrinsic value just doesn’t matter- so long as most OTHER people continue to believe in the magic of gold.

A country that possesses a lot of gold is a country that also has the the world convinced it is a wealthy country. The more gold the wealthier.Gold builds confidence the way a military parade builds confidence.

But but BUT – gold cannot really be used for money anymore because there simply isn’t enough gold to use it that way in the form of coins.

The solution that bankers invented consists of offering pieces of paper instead of actual gold – each piece of paper theoretically redeemable for a specified amount of actual physical gold. The idea is to print hundreds or thousands or millions of pieces of paper for each real unit of gold – a thousand dollars or euros or whatever for each ounce or even gram of actual gold.

Now as it turned out this system has worked like a charm in lots of places for extended periods of time.

But it has a couple of very dangerous flaws.

One is that it makes it almost impossible for a government to inflate it’s currency while silmantaneously actually backing that currency via redemption in real honest to Jesus gold.

No major modern government to my knowledge has managed to resist the temptation to inflate it’s currency- sooner or later the advantages of embracing inflation simply overwhelm the advantages of maintaining a totally stable currency. The politicians involved are able to reap big short term rewards while putting of paying for those rewards until they are either dead or at least safely retired so they go for the inflation.

Inflated money simply cannot be redeemed for gold – the quantity of gold backing the money is minute in respect to the quantity of the money. So sooner or later the folks foreign and domestic who are in possession of the money insist on redeeming it for physical gold. Impossible. Just flat out can’t be done no siree.

Then there is the problem that gold may and often does appreciate in terms of any currency or all currencies for various reasons. Now if Uncle Sam has gold backed dollars and gold goes UP on the world market then all them there red commie Chinermen and A RABS and dope peddlers and eeverybody else including our FRIENDS will insist on turning in their dollars for Uncle’s gold.

Can’t have that either no siree either way the gold is GONE.

Now eventually the worlds fiat currencies are going to fold one at a time or in bunches or maybe even all of them at once.

When this time comes – when everybody has more or less lost faith in dollars and euros and marks of various sorts – will the Saudi royal family still sell oil for gold ?

I suspect they will to some substantial extent.

Now will UNCLE send the calvary to save their royal asses the way he did when Saddam Hussein got to big for his britches and accept payment in gold- gold that is inedible and can’t be used in any sort of fuel tank either?

I guess Uncle might accept SOME gold but more than likely he will want OIL.