The EIA publishes what they call a Drilling Productivity Report in which they claim that each rig is getting more productive, that is each rig produces just a little more oil each month than it did the previous month. But over the long haul, I find that the exact opposite is true. In every place in the world, each rig produces a little less oil every year.

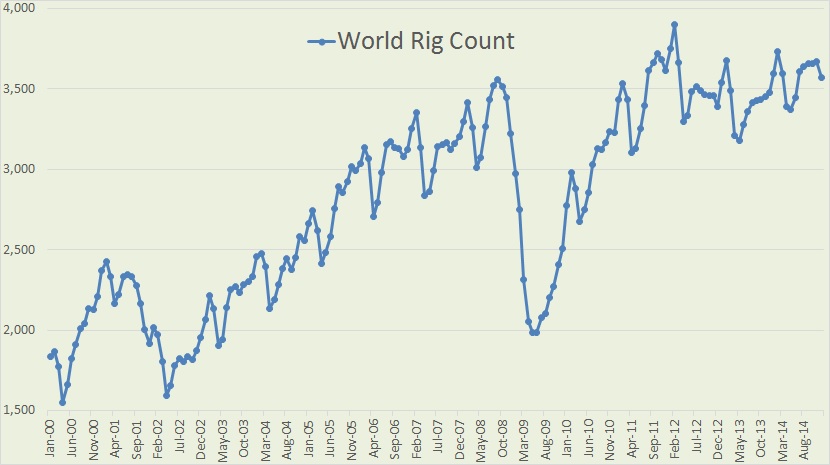

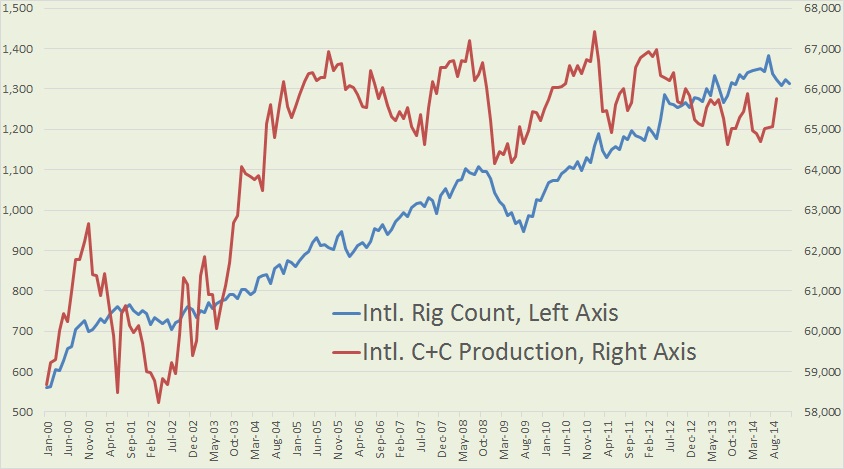

Baker Hughes publishes monthly their International Rig Count where we can find the world rig count back to 1975. However I only looked at the last 15 years and found some surprising results.

The last “Rig Count” data point on all charts below is December 2014. Also, very important, the rig count includes rigs drilling for gas as well as oil since Baker Hughes does not break down international rigs down to either gas or oil. They just give us the total rig count.

The last price collapse we had, in late 2008, the rig count dropped by over 1,570 between September 2008 and May 2009.

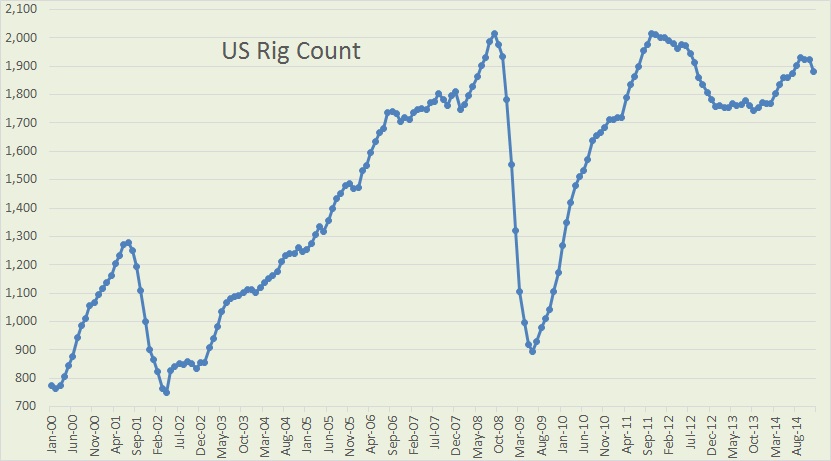

1,114 of that 1,570 rig count decline in 2008 and 2009 came from the US alone. That was the number of rigs dropped by the us between September 2008 and June 2009.

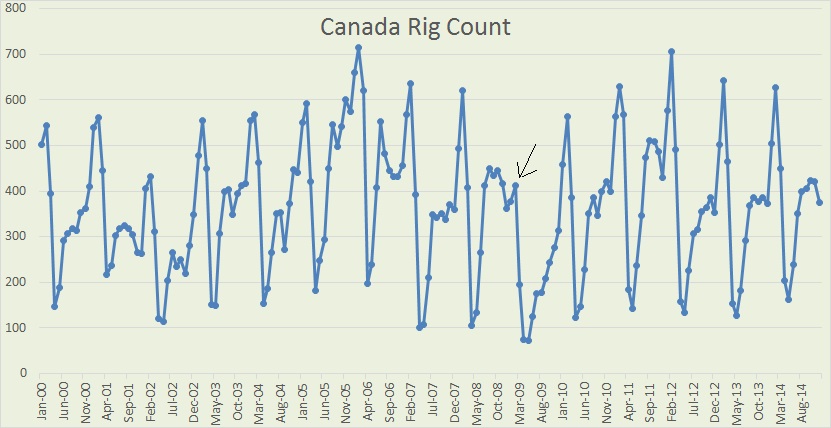

Looking at the first graph up top, World Rig Count, you will see a strange saw tooth that bottoms out every April or May. That is entirely due to the Canadian Rig count.

The Canadian Rig Count tops out every February and bottoms out every April and May. The only year in the last 15 years when this did not happen was during the price crash, February 2009, (arrow). I have no idea why the Canadian Rig Count tops out during the dead of winter and bottoms out during the spring thaw, but perhaps that, the thaw, has something to do with it. I hope some kind Canadian will clue us in on why this happens. At any rate, to my knowledge, this is the only country in the world where has this strange oscillation happens.

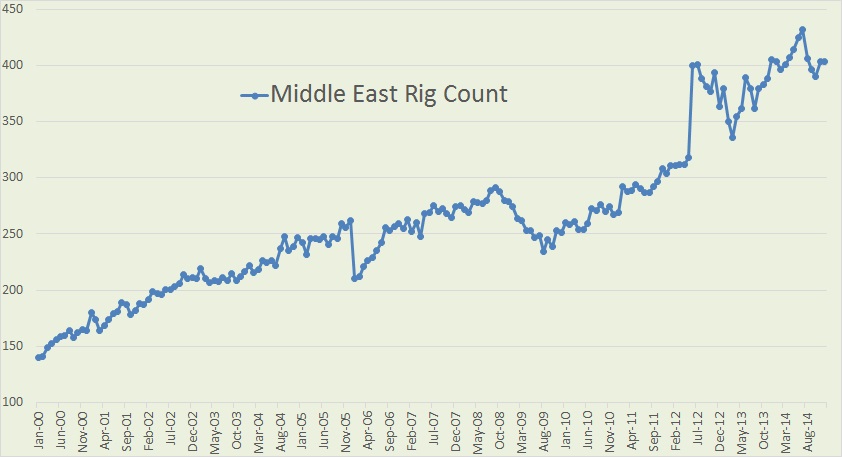

The Middle East Rig Count has gone from 140 to over 400 in 15 years. About half of this increase has come from Saudi Arabia.

Here I have overlapped the International Rig Count with International Crude + Condensate production. International, in this case, is everywhere except the US and Canada. The point here is that an almost constant increase in the rig count since 2005 has not yielded any increase in production. It is the perfect example of the Red Queen syndrome, it takes more and more wells to stay in the same place.

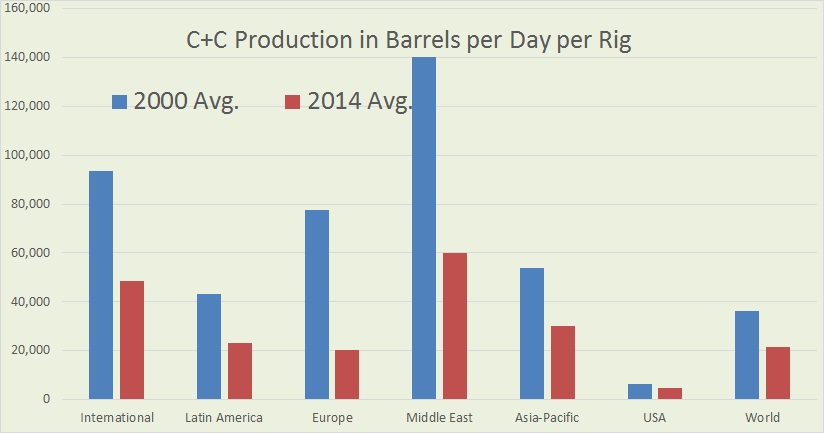

An overlay of production with rig count however does not give a true comparison between rig count and production. That is because the scales are not equal and therefore no true comparison can be gleaned from such a chart. But they can be compared with simple math. That is you simply divide the average daily production for that year by the average number of rigs for that year.

This is production per rig, not production per well. Basically this chart compares what a rig did for you in 2000 as compared with what a rig is doing for you today. Look at as a worldwide Drilling Productivity Report. The EIA says rigs working in US Tight Oil fields are getting more and more efficient. This is due to longer laterals, more fracking stages , more wells per pad and so on. However rigs, overall, are getting less and less efficient. This is due to the fact that the vast majority of rigs worldwide are simply engaged in infill drilling of old wells. So it is only natural that each well will yield a little less oil than the last one.

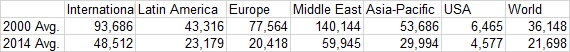

Below is the data that produced the chart above. The data is barrels per day per rig.

The USA produces 4,577 barrels per day for every active rig while the Middle Ease produces 59,945 barrels per day per rig, down from 140,144 in 2000. Well the reason is we in the USA just don’t get nearly as much oil per well as they do in the Middle east. In Saudi, for instance, they drill these long horizontal wells in their supergiant fields, many of the wells MRC, Multiple Reservoir Contact or Christmas Tree wells. Then around the periphery of the field, every few hundred feet, they put a water injection well. And they pump millions of barrels of sea water, every day, into the reservoir. The water sweeps the oil to the well lateral and they produce thousands of barrels per day per well.

Recent data on Saudi Arabia is rather hard to come by but in 2010 they had about 3,270 wells, counting half those in the neutral zone, and they produced about 9.5 million barrels of oil per day. That puts Saudi average production at somewhere between 2,800 and 3,000 barrels per day per well.

At about the same period of time, 2010, the US had about 510,000 wells producing an average on 10.5 barrels per day per well. Today about 400,000 of those wells are stripper wells producing an average of 1.8 barrels per day.

You must read this article.

U.S. Shale Boom May Come To Abrupt End

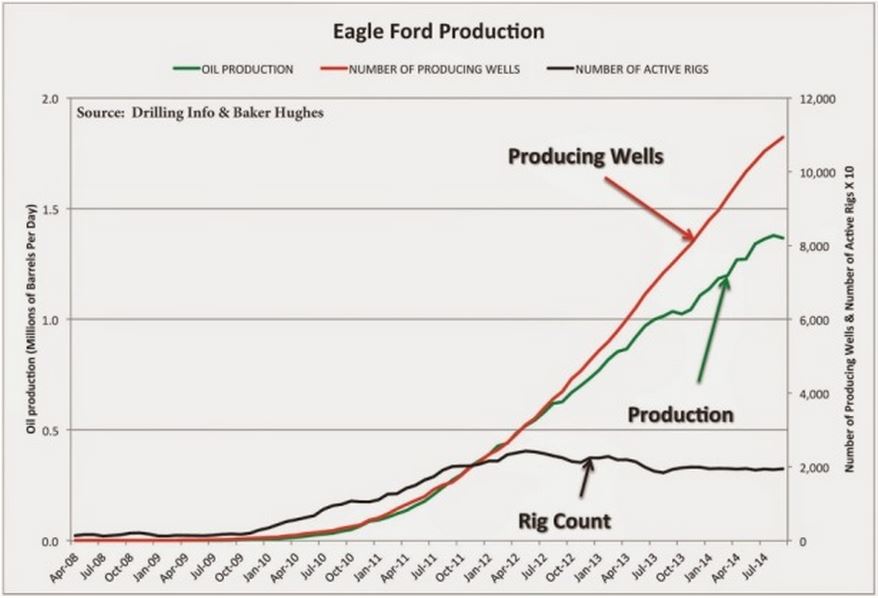

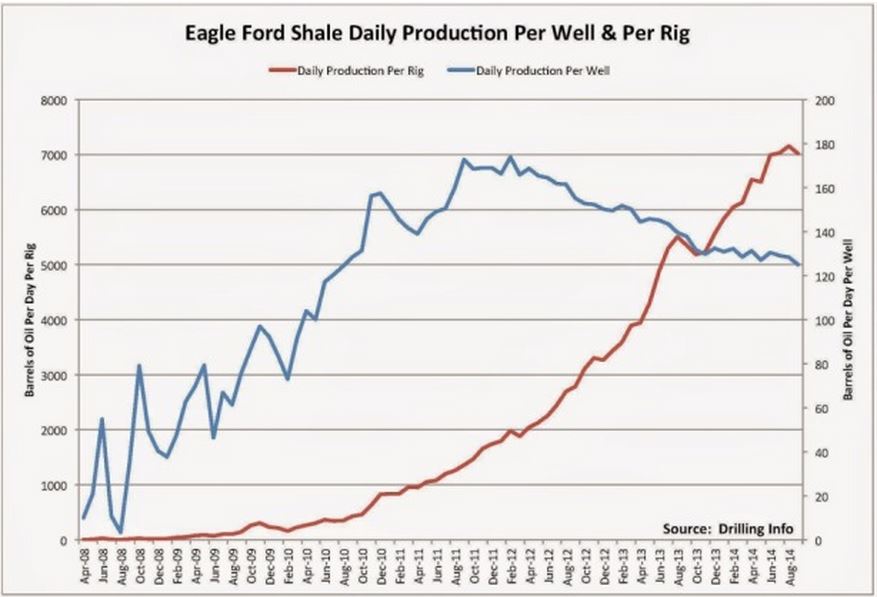

Rig productivity has increased but average well productivity has decreased. Every rig used in pad drilling has approximately three times the impact on the daily production rate as a rig did before pad drilling. At the same time, average well productivity has decreased by about one-third.

This means that production rates will fall at a much higher rate today than during previous periods of falling rig counts.

Well productivity is falling. It has already fell by one third. That is the same thing I have been telling you folks for months now.

Note: My posts are irregular, usually every three or four days but at different times of the day. Whenever I put up a new post I send an email notification of such. If you would like to be put on that list, or removed from it, post me at DarwinianOne at Gmail.com

563 responses to “Worldwide Drilling Productivity Report”

” The Canadian Rig Count tops out every February and bottoms out every April and May.”

The reason is in may (spring time) there are road bans. With road bans you can’t drive on the road with heavy vehicles. In the winter everything is frozen. It is just prohibitively expensive to repair gravel roads.

Exactly. Spring brakeup = mud and trucks (weight restrictions) are banned from many secondary and almost all gravel roads. In fact, owing to unusually mild weather in southern BC, trucks have already been banned from many areas (winter logging is the norm here).

Record cold winter followed by a record warm one in southern BC?

Our daffs and other bulbs up about 6-8″, while I watch unending snowmagedddon back east. Chickens dropping an egg/each every day. We are at 50+ deg. north. On Friday I pick up my new motorcycle. I can hardly sleep I’m so excited. Ski hills are sucking wind, though. Oh well, my family quit skiing about 15 years ago. I remember popping the wallet for about $100 bucks each, and thought as I froze my ass off on a swinging chair lift, “this really isn’t as much fun as it is supposed to be”.

To add to that, even asphalt roads get ruined during spring thaws. As the bed under the roads thaws, it can do so unevenly. Heavy loads compress thawed portions more than frozen portions, causing cracking, and then water flows in, refreezes, cause more cracking, and then it’s pothole city.

The EIA’s Drilling Productivity Report shows (or attempts to show) the new-well productivity per rig.

If I’m understanding things right, your rig productivity measure mixes together the production from old wells and new wells. Is that right?

Yes of course. It’s basically crude oil production per rig in use. All it really shows is that they are taking more and more rigs to produce the same amount of oil. It does not show how many new wells are drilled each month or year. Also, the Baker Hughes international index does not distinguish between rigs drilling for oil from those drilling for gas.

OK, thanks.

The only way I can think of this could not be rock solid evidence of peak oil getting close would be that drilling rigs have been drastically downsized in terms of capacity – which is certainly not the case according to remarks make by the hands on guys in forums such as this one.

They all say that newer rigs are much faster finishing a well than older ones and that there aren’t very many – if any- really old rigs in service anyway.

Somebody who works in the field may know if old rigs from the US and Europe get shipped to places such as Africa where they are put to use. I suppose if you bought one cheap enough you could run it profitably in a low labor cost environment.

The question would then be how much local skilled labor you can get- and use – cheap as opposed to guys working far from home and Momma and kids who expect to get paid their usual rate plus EXTRA for being lonely and MORE EXTRA for maybe getting shot at occasionally.

Old farmer, old rigs get treated the same everywhere. I’ve seen poorly maintained rigs owned by state oil companies. They also tend to lease substandard rigs because their officials can be corrupt.

But overall rig efficiency seems to be lower in some countries due to union practices, high heat and humidity, very low temperatures, or remoteness. Many years ago I worked on a rig located in the middle of nowhere, a truck with critical equipment was re routed at a village bacause the local cops didn’t want it in town, the truck driver got lost, and then spent several days trying to get back to the rig. That doesn’t happen in the USA.

Hi Old Farmer Mac,

We don’t know how many of these rigs are drilling for oil. In the US natural gas is very cheap, but that is not true everywhere in the World. See my comment near the bottom of the post, rig efficiency in terms of energy per rig per year has decreased, but sometimes this occurs as energy prices increase and a lot of rigs get used inefficiently in the chase for cashing in on high energy prices, this also happened in 1981 when international rigs were at their high point of 5600 rigs, since 2000 the highest number of average rigs in a year has been 3600 rigs (and no single month above 3700 rigs since 2000), in 1981 they hit 6000 rigs in the high month.

Dennis, I think in likely that the percentage, worldwide, of oil rigs versus gas rigs, remained pretty much the same over the years. Sure the percentage would change as the price oscillated with the price. But I don’t see any dramatic changes in oil rigs versus gas rigs. But there has been a dramatic change in percentage in the US. The oil rig count has increased dramatically while the gas rig count has dropped, which really makes my case.

If anything I would expect to see the same trend worldwide, but not nearly as dramatic as in the USA.

Click on RalphW’s link below.

“don’t know how many … drilling for oil…” What?

http://www.bakerhughes.com/rig-count

The pretty picture shows oil in blue, gas in red, geothermal in green.

If you download the spreadsheet under “Historical Rig Counts”

if has several sheets.

Current Weekly Summary

US Count by Basin

US L & OS Split by State (land and offshore)

US Oil and Gas Split

US Count by Trajectory (i.e. directional, horizontal, vertical).

…

be sure you look at the right sheet.

Of course “oil well” and “gas well” are somewhat slippery definitions, depending on state rules, etc. , but they should be pretty close.

I think if you look at the last 5 years US only, you will see improvement on a per rig basis in the last few years. This is mostly due to improvements in steering significantly reducing drill time for US horizontals.

I find that hard to square. In 2000 4/5 of all US rigs were drilling for gas. Now at least 3/4 of them are drilling for oil. That is at least a three fold increase. Oil production has not increased threefold.

US rig count split between oil and gas

http://www.euanmearns.com/wp-content/uploads/2015/01/us_rig_count_2jan15.png

Off topic but the only kinds of industrial plant I can think of that MIGHT be getting down scaled workably is nuclear power. A lot of people seem to believe that relatively small modular reactors might be practical and work better than large big ones.

Wind turbines keep getting bigger and scaling down a solar farm would not make it work any better.

Any body know of any other major industries that might be moving to smaller equipment ?

A small gas peaker power plant might be more practical than a bigger plant but it wouldn’t likely burn gas any more efficiently or cost less per kilowatt of capacity.

Maybe somebody builds smaller, lighter oil and SLOWER rigs that work better in remote areas -at least for drilling exploratory wells in places that don’t yet have very much in the line of roads or rail. IF so there would be only a very few of them and this would not change the average output per rig enough to even bother taking it into account.

Small gas power plant. Not more efficient defined as electricity out per unit energy fuel in, but a hell of a lot more USEFUL overall if doing the obvious- take the “waste’ heat and use for something useful.

That’s the whole idea of multiple small power scattered all around to enable greater over-all usefulness. Totally obvious, but as usual around here, not done.

Of course, you can do that with a big power plant too- IF you put it into middle of a city, and not, as we do , out in the boonies where nobody who counts can see, smell or be killed by it.

PS. I am having real fun making a REALLY small power plant that burns trash and runs a Honda. That’ll show, ’em, bygod.

The trash burn part runs great. Now for the Honda. Tough luck, honda. sorry ’bout that.

What do u do with trash ash and what Is your hydrocarbon emissions? What portion of your trash is plastic and what happens to the chlorinated hydrocarbons??

Eventually, same thing that happens to them in the European trash to power plants. They go to the trouble of freighting our trash to their cities. They are happy with the result. Why just them? Better we do it.

Present- I am in the process of finding out. Can’t believe what I leave of the complex molecules at 700C is worse than what happens to them if they leave here as trash.

Lots of ideas for waste heat with this technology: electrical storage,

http://www.isentropic.co.uk/

“Of course, you can do that with a big power plant too- IF you put it into middle of a city, and not, as we do , out in the boonies where nobody who counts can see, smell or be killed by it.”

The problem is cost and access. It can be prohibitively expensive to purchase land to install a plant in a downtown city. Access can be a problem to bring in heavy service equipment because the local gov’t don’t want heavy vehicles moving during business hours, since they can interfere with traffic.

Another issue is that to make use of the waste heat, steam pipes need to be run to connect to all of the buildings, which isn’t cheap.

The best option (in my opinion) is to install small co-generation gas turbines in large buildings. The would produce produce there own power and meet heating and domestic hot water demand. However they are’t terribly useful during the summer which heat isn’t needed.

FYI: Most Gas fired plants are combine cycle, which they gas turbine exhaust is used to produce steam to run steam turbines.

In my opinion using NatGas for baseload generation is folly since NatGas is extremely useful fuel, since it widely used for domestic heating in large commercial buildings. NatGas is also feedstock for agraculture chemicals and a large number of other commercial products, plastics, varnishes, etc. Its a waste to burn for electrical generation.

Better to use windpower for roughly half your power needs, solar for perhaps 10-30% (depending on the optimal cost mix), hydro where possible and natural gas for a relatively small remainder.

What happens when there’s no wind for a week?

What happens when there’s no wind for a week?

Why is this a problem? I am assuming that most places that already have gas or coal-fired power plants will still have them. Whenever you do use wind, that is less gas or coal you will need to burn. Has anyone suggested that wind and solar will totally replace gas, coal, or nuclear power plants?

In that case wind won’t deliver half the power needs.

Realistically, it’s possible to run hydropower as a counterpoint to solar, and gas turbines as counterpoints to wind. But this costs a ton of money. And gas will run out.

I’m trying to figure out what to do when we run out of fossil fuels.

I’m trying to figure out what to do when we run out of fossil fuels.

We will likely cut way back in how we use energy. But by doing that, some alternative energy technologies may be sufficient. There are parts of the world where electricity doesn’t run all the time. They make do.

If European and American cities no longer have reliable electricity all the time, they would adjust.

Batteries and pumped storage would work well to match supply and demand for daily (diurnal) variation, but the sensible storage option for seasonal wind/solar lulls is “wind-gas”.

People get hung up on the capex of batteries and pumped storage, but using those for seasonal storage is like driving a M1 tank to work – they only make sense for diurnal storage where the capex is amortized over thousands of cycles.

Overbuild wind/solar production by, say, 25% above the average demand, and use the excess to electrolize seawater and store the hydrogen underground. http://en.wikipedia.org/wiki/Underground_hydrogen_storage

That makes the storage incredibly cheap, and the conversion efficiency is relatively unimportant because you’ll only need to draw about 5% of consumption from storage*. Higher efficiency is still valuable, but minimizing capex is much more important than maximizing efficiency.

“wind-gas” is the solution, and other forms of storage are just red herrings.

Germany is planning to convert hydrogen to methane (via the Sabatier reaction (CO2 + 4H2 = CH4 + 2H2O)) to take advantage of existing methane-based systems. This may make sense in the short term, but it requires a source of carbon. That raises costs, and in the longterm isn’t necessary (unless we want to invest in pulling CO2 from the atmosphere. That would be a good idea, but it’s a separate project, and it’s significant cost shouldn’t be considered part of the cost of creating a stable, 100% renewable grid). Similarly, if there’s quite a lot of surplus windpower, it might make sense to synthesize hydrocarbons for niche applications like long-distance transportation. But, I suspect that’s far in the future – for quite some time we’ll have enough liquid fuel, as an extended-range electric like the Ampera/Volt reduces the onboard hydrocarbon by 90%.

This is a theoretical exercise. It will be tough to synthesize hydrocarbons more cheaply than finding them in the ground, and it will be a while before we completely eliminate fossil fuels for that last 5% of generation. Why are synthetic liquid fuels expensive?

You’d have to build so much wind that there’s a lot of excess production with zero value. And, there are other costs besides energy:

The NREL study below finds a capital cost of $1.32 per kilo of H2, which is about equivalent to a gallon of diesel. That’s at 97% utilization: if you’re using stranded wind then utilization will depend on the percentage of the year that prices are rock bottom low. It will take a while for that percentage to rise to 20%, and even then synthetic fuel would cost 5x$1.32, or $6.60 (before taxes).

Here’s a reasonably straightforward, simple quantitative analysis, with cost estimates for large-scale electrolysis units, including capital cost and conversion efficiency.

Brief summary of H2 cost from electrolysis (2004); they came up with $1.32/kg capex, $.37/kg for opex, plus electricity ($/kWh x 40kWh/kilo of H2). Assumes 97% utilization, 40 year life for most of system. Target electrolytic efficiency is 78%.

Capital costs costs *highly* dependent on size of unit.

http://www.nrel.gov/docs/fy04osti/36705.pdf

summary for: http://www.nrel.gov/hydrogen/pdfs/36734.pdf

Has anybody seen anything with more recent information on capital costs and efficiency?

*Storage will always be the last resort – many other strategies are much cheaper, and will be exhausted first: supply diversity; long distance transmission; Demand Side Management;, etc, etc. Seasonal storage will only be needed in the distant future when fossil fuels are completely phased out, and in the unusual event that all renewables are low for an extended period in a large geographical area. This might be a 3 week period in January where all supply is 1/3 of demand, so that the equivalent of 2 weeks (4% of annual consumption) is needed.

On the prairie going a week without wind would be like the ocean going a week without waves

Well, yes. Lack of wind shouldn’t be a problem in areas with wind.

I was just pointing out that not having wind 24 hours of the day seems to be a solvable problem. There are backup and dual systems.

1) That’s what the “natural gas for a relatively small remainder” is for.

2) Wind never goes away completely: “no wind for a week” really means, at worst, maybe 5% of faceplate production. Well, that’s 16% of the average production (at 30%), and if you overbuild wind by 50% (the US grid is overbuilt by 250%, right now) then it’s 24% of average expected production. So, wind is down by 74%.

3) If you use wind for 50% of your kWhs, and you lose it for 2% of the year, that’s a base of 1%, and a net loss of .74%. If you supply that with very cheap peaker single cycle gas turbines, that’s mighty cheap.

It’s so easy for the rich. Do you think this proposal will work in Jamaica?

Yes.

It would be far, far cheaper than their current oil generation.

This is why Jamaica will use coal. They can’t afford wind and solar beyond a certain value. Most of what I read about renewables lacks solidity. I’ve had a long career preparing or reviewing project proposals, and I can’t see anything I would approve. And we do see a lot of green Mickey mouse engineering which fails to acknowledge the green opposition to palliatives and solutions. Take pumped storage. Here in Spain they would object to projects, glue themselves to roads as the scream asking for magic solar power solutions. We are dealing with irrational people, some of them are really nuts, it’s a leftist/green version of the Islamic Army. They can’t even sit down to discuss things rationally. And now we got some advocating law breaking behavior.

Well, short term thinking may well prevail in Jamaica.

It’s easy to burn the forests around you, then wake up to deforestation.

It’s easy to burn coal with no pollution controls, and wake up to widespread asthma in your children.

It’s easy to become dependent on expensive fuel imports, and wake up to utilities unable to pay their bills, and requiring state subsides that the state can’t afford.

Oil, gas and coal company investors and employees (and retirees) will fight the transition as long as they can…

US costs

“The United States’ reliance on coal to generate almost half of its electricity, costs the economy about $345 billion a year in hidden expenses not borne by miners or utilities, including health problems in mining communities and pollution around power plants, a study found.

Those costs would effectively triple the price of electricity produced by coal-fired plants, which are prevalent in part due to the their low cost of operation, the study led by a Harvard University researcher found.

“This is not borne by the coal industry, this is borne by us, in our taxes,” said Paul Epstein, a Harvard Medical School instructor and the associate director of its Center for Health and the Global Environment, the study’s lead author.

“The public cost is far greater than the cost of the coal itself. The impacts of this industry go way beyond just lighting our lights.”

Coal-fired plants currently supply about 45 percent of the nation’s electricity, according to U.S. Energy Department data. Accounting for all the ancillary costs associated with burning coal would add about 18 cents per kilowatt hour to the cost of electricity from coal-fired plants, shifting it from one of the cheapest sources of electricity to one of the most expensive.”

“…The estimate of hidden costs takes into account a variety of side-effects of coal production and use. Among them are the cost of treading elevated rates of cancer and other illnesses in coal-mining areas, environmental damage and lost tourism opportunities in coal regions where mountaintop removal is practiced and climate change resulting from elevated emissions of carbon dioxide from burning the coal.

Coal releases more carbon dioxide when burned than does natural gas or oil.

The $345 billion annual cost figure was the study’s best estimate of the costs associated with burning coal. The study said the costs could be as low as $175 billion or as high as $523 billion.

“This is effectively a subsidy borne by asthmatic children and rain-polluted lakes and the climate is another way of looking at it,” said Kert Davies, research director with the environmental activist group Greenpeace. “It’s a tax by the industry on us that we are not seeing in our bills but we are bearing the costs.”

The estimates came in the paper “Full cost accounting for the life cycle of coal,” to be published in the Annals of the New York Academy of Sciences.”

http://uk.reuters.com/article/2011/02/16/us-usa-coal-study-idUKTRE71F4X820110216?rpc=401&feedType=RSS&feedName=environmentNews&rpc=401

I don’t know if anybody is moving to smaller equipment, but in my case I’ve directed project planning teams to break the project down into smaller components. This allowed us to fabricate indoors and truck to site assembled components. In some cases we also consider whether the local labor force can execute better and cheaper if we reduce sizes. There’s also a potential for more bidders in smaller size.

So, in some locations I’m definitely for smaller kits. This is very obvious for some facilities in locations such as Alaska’s North Slope, a South American jungle, or a platform in some offshore locations.

“I don’t know if anybody is moving to smaller equipment”

Smaller equipment will have lower output power. While multiple smaller units can be ganged, the maintenance costs increase with the number of units installed. Efficiency also falls when operating smaller units caused by compounding losses (friction, load transfer/transmission, etc). However, in some cases its just not cost effective to install big units in remote locations, or places with limited space.

I wasn’t referring only to motors. My comment applies to plant kit.

The windmills that I have seen in the Texas Panhandle since the 1930’s were not too large.

For nuclear news 2 to 3 times per week see http://www.hiroshimasyndrome.com/fukushima-accident-updates.html

Depends on what you mean by smaller equipment.

Assembly robots in the electronics industry are getting smaller and smaller because the things they assemble are getting smaller. You need a microscope to see a surface mounting robot at work, but it moves so fast you don’t see much.

There is also a major movement to reduce the total floor space needed in factories for a given process such as the assembly of a certain product. Japanese kaizen practices routinely reduce floor space by 50%-75% when they are first introduced. Part of this is redesigning machines to take up less space. In the car industry it means improving production quality to reduce the space required for rework — repairing cars that were built with incorrectly.

It is also common practice to improve flexibility, meaning reducing the output volume that can be produced economically. For example, print runs of printing presses have fallen dramatically in recent decades. That is “smaller” in another sense.

Hybrid engines are common in large vehicles like trains, ships and hydraulic equipment. Currently they are being adopted in passenger vehicles. That’s an example of similar equipment being downscaled for a different market.

EV motors are a lot smaller than infernal combustion engines – that’s the Tesla has both aback and front trunk (frunk).

Regarding small nuclear designs, I came across a Nuclear 2MW “portable” design, used as power supply for “Project Iceworm” in Greenland in 1960… efficiency of about 20%, not so good. It is a good read. Seems like they gave up trying to build them in 1970.

I have been fooling around with NOT grid solar, PV and thermal…. 24 V PV with pressure water storage and min batteries for well system, homemade 24v dc well pump(refuse to pay $1400 to yuppie scum solar vendors), no inverter…(can still throw a switch to grid for 120V pump that I left in place… cya….lol) and thermal for hot water heat for house… home built and design, still working on bugs and “load management”. So far both systems appear to be cost effective if I don’t consider my time invested.

Gas peakers get less efficient when they get smaller, old FERC PURPA rules a lot of the CoGen’s got a little over 45% with low grade steam from the back end of the steam turbine going to a host. Those were between 50 to 80MW… the little ones didn’t work both efficiency and financially, you couldn’t finance them.

I have been wondering if we will see a increase in smaller farm(ers) and food production as we go down the back side of the peak.

We have a couple of local small scale farms trying to build a go of it right now. They just can’t compete in price with the big markets, although many in our valley are patronizing them to ensure their survival. We now use a local mechanic for the same reason, mainly because I just don’t have the testing equipment to work on our car anymore. Most of us grow, hunt, fish, our own food. The new farms are sustained up by a spouse with a conventional town job. The mechanics wife also works in town.

There are a lot of good reasons to expect small farms to make a comeback on the way down. How many new small farms and where will depend on geography , climate and local economic conditions.

I can see it happening NOW to a small extent where I live. Nobody ever managed to grow potatoes of any sort in this immediate area cheaply enough to compete in trade until the last few years. Folks in other places with land and weather better suited could ship them here cheaper than we could grow them and sell them wholesale. So everybody who farmed small scale and gardened had a potato patch but no body raised more than a few bushels.

In the last few years the cost of trucking has risen fast to the point that local guys can raise potatoes now cheaper than the far off competition can GROW AND SHIP to this area so potato fields are getting to be a common sight.One of my relatives raises a thousand bushels or more to sell at his farm market.

I cannot think of a single SMALL farmer in this neighborhood who has been able to consistently earn a respectable living from his farm. An off farm job is just about an absolute necessity . Folks with capital enough to operate with five or six hired hands on a scale big enough to keep those hands busy year around are making it farming without outside income in a few cases. There are very few of that sort in this area. That much land and machinery puts you well into the millionaire class and getting it farming is out of the question. Marriage and inheritance are the usual means of acquiring so much farm land locally.

A few folks got farm welfare loans at extremely low interest rates many years ago that allowed them to buy large tracts of land. The ones that managed to make the payments did so by working a second or third shift job in town and driving the same old pickup truck for twenty years. They are mostly all millionaires now except for the ones who fell into the booze and younger woman traps.

My richest relative is a multimillionaire several times over as the result of owning a farm purchased this way. He and his wife took turns working in town to make the payments. This farm has probably never generated enough cash for two people to live modestly in any given year but it includes a lot of very scenic ridge top land with dynamite mountain views and town gets a little closer every year.

OFM Wrote:

“There are a lot of good reasons to expect small farms to make a comeback on the way down.”

I am not so sure on that:

1. Gov’t regulations are leaning on small farmers in favor of Big Agra. I see lots of regulations that seem to be intended to drive the small farmer out of business.

2. The Average age of of US farmers is close to 60 years. Young people are leaving farming.

3. Labor saving machinery is best suited to large farming operations as the equipment is usually expensive and the farms need to be large to make full use of the machines capabilities (ie it doesn’t make sense to own a ridable lawn mover with a 240 inch deck to mow a 100 sqft. lawn).

This report pretty much states that smaller farmers are disappearing and the remaining farms are getting bigger.

http://www.agcensus.usda.gov/Publications/2012/Preliminary_Report/Highlights.pdf

FWIW: I think I am part of the 0.001% that is switching from a Tech career to agra. Mostly because I see that the future will be very bleak and I prefer to eat than stave 🙂

Younger farmers are NOT leaving farming. In fact the number of small farms, beginning farmers, and young farmers is growing in many areas. You just won’t see it in your super market. They are doing CSA’s, Farmers Markets, and on Farm sales. One of the mistaken conceptions of beginning farmers today is that they will fail due to an inability to “feed the World”. I doubt that is a goal of most of them. I think an off farm income is fine. It is a statement about the financial world we live in today, not the one we might wish for. To me it makes little comment on one’s contribution to agriculture. If you are farming well, preserving soil, limiting inputs, and making healthy food I hope and believe you will continue to grow in number, and provide food for those around you.

The economies of scale and the burden of compliance with an ever growing number of regulations definitely work against the little guys.

The big boys ”own ” the industry for now and will continue to own it for a while yet.

But when things start falling apart – and things ARE eventually going to get worse instead of better with resources peaking and population still growing- some things will work in favor of little folks.

One of the first ones is that regulations will be increasingly ignored. Anybody who doubts this will change his mind if he spends a few months of his life working and living with the underclass.

Selling a few eggs or a little milk or some home butchered meat or home canned veggies is pretty much against the law.Folks sell these things already as well as barbering and styling hair without a license. I know a dozen people who make part or all of their living doing various sorts of work that can be done legally only with a contractors license which they most assuredly do not have.

A lot of land is going to be available in very small or small tracts that cannot be worked any way at all with large machinery. A field less than ten acres in size is utterly out of the question when it comes to raising grain for instance with large modern equipment. You just can’t move it cheap enough and quick enough from one field to the next especially if it is more than a couple of miles between fields.

Such land will be and is generally available today dirt cheap in terms of rent and millions of people own such tracts of farmable land.

The little guy has it all over on the big fella in one respect. He can efficiently cut out ALL THE MIDDLEMEN and use a large portion of his output to feed his own family and friends without the burden of paying income taxes and bookkeeping and so forth.

A California farmer with a hundred acres of green beans or onions can’t eat even one thousandth of one percent of his output which he has to sell wholesale- meaning he gets if he is lucky maybe on average twenty five percent of retail price.

My Momma used to grow and dry or can enough green beans to last us year in and year out with green beans on the table once or twice every week.She probably sold twenty five additional bushels most years at twice the high volume wholesale price- which was still only half the retail price.

Now here is a KEY point about her market gardening. It was not that she made a lot of money. Far from it. She could have made three or four times as much and more dependably working in a textile mill.

But she made SOME money and between what she MADE and what she SAVED by being a stay at home farm MANAGER wife my parents did about as well or maybe better than if she had taken any outside job she had a shot at.

The savings went WAY beyond just food. She made some of our clothing and patched it all. Never spent a dime on babysitters. Helped with the firewood and cooked on a wood burning range some of the time to save on electricity. Always hung out the laundry. Found a hundred ways to save a dime here and there.

Convenience food to Momma meant a DEAD chicken- we used to raise fifty at a time and drop everything else and kill chickens for a couple of hours and freeze them.

When you are not collecting welfare and aren’t making enough money to live well if you have grit and determination you find ways to spend your time bootstrapping your own living standards.

When a family with access to a few acres of land is unable to find enough paid work to make ends meet they will take up farming to help bring the ends together.However much they make is that much more and if it is only the equivalent of two thirds of minimum wage per hour invested it is still a LOT better than nothing.

The big boys will own the big fields of grain and the big orchards far into the future.I actually expect big time farming to survive as long as industrial civilization lasts.So long as a single man can grow a thousand acres of wheat or corn more or less all alone with the exception of hiring some help during harvest season wheat is always going to be too cheap to bother with raising ten or twenty bushels for family needs unless the family has close to zero cash income with which to buy wheat.

But folks who are willing to work for hard for only a little money can make a few thousand bucks working a few acres of land with old cheap small equipment. Depending on location as little as a couple of acres can be enough to pay a lot of bills. Right now flipping burgers is still a better option for most folks but burger flipping jobs are going to be VERY scarce eventually.

In my opinion there will be tens of millions of people in this country within the next few decades who will gladly take up this lifestyle because a few thousand bucks is a fortune if you are otherwise flat broke and out of work.

And they will find markets for what they produce NOT because it is chi chi for the well of city and surbanite woman or metrosexual to shop for fresh food generally sold at HIGHER prices than supermarkets but RATHER because other people who are not farming will buy in quantity to save money.

As late as fifty to sixty years ago my Mom who was responsible for most of the marketing (another critical job on a small farm) had at least twenty five regular long term customers who came back year after year five or six times a year as the various crops matured and bought in quantity. It was not unusual to see a family car loaded up with as much as a thousand pounds of produce of various sorts dragging it’s bumper leaving our driveway. Guys who ran small stores came with pickup trucks and left with bumpers dragging with fifty bushels of apples in our own custom made ( on the place ) wooden crates and ran specials on apples for canning and storing in cool basements and on back porches.They always brought the boxes back. I still have close to a thousand of them we made in the fifties which have been used several hundred times times each but they are about worn out now.

Those carloads of produce were canned and frozen by the working class women who bought them to feed their own families for the next year.

Women these days have plenty of employment opportunities and can afford to buy at supermarkets and don’t usually want to be bothered with ” tomato canning day” or ”peach canning day”. Anybody with a good job can make more than he or she can save this way by just working more hours.

When people start getting short of money and opportunities to earn money they will rediscover these old survival skills and strategies.

This is why I believe small farms are going to come back. They will come back because they will be one of the best opportunities for a lot of people to maintain a reasonably decent living standard in an economic environment with fewer and fewer employment opportunities.

Peak oil – more generally peak everything – is going to be all about employment problems.

Attractive young women without better options are going to be willing to ” take up ” with old farmers again.

It’s too bad I am already too old to live to see that aspect of the return of the small farm. 😉

I live in an area with lots of small organic farms. They sell to members who get a certain amount of produce and/or milk each week. They sell to local restaurants. In some cases they start restaurants and use their own produce.

Yes, and “locally grown” protects small farmers as well.

The only way out for farmers is to find niches where consumers are willing to spend more. That is why things like “organic” and “locally grown” “no GMO” etc etc should be welcomed with open arms.

It’s basic marketing: Get big, get a niche or get out.

Along with all of these local organic farms is a thriving Farmer’s Market that is held two days a week for about six months of the year.

The foodie culture that is booming among the young professionals and among the affluent is allowing small farms to grow unique products and sell them directly to their customers. Another thing that is part of the mix is farm tourism (e.g., pumpkin patches, summer camps for kids) and hosting dinners at the farm.

”Member ” farm operators in my area have generally found themselves in court for selling milk.

The regulatory authorities rightly look on such ” memberships” as subterfuges intended to get around sanitary regulations. Ditto processed meat.

It behooves anybody planning to operate a membership scheme to get some legal advice.

Not too many small farmers – meaning family operated farms- are going to have the time and money needed to run a market or a restaurant.

The relatively few that I know who make a go of farm markets actually buy most of what they sell from other local farmers or have it shipped in.

Anybody who thinks a couple of people can have ten or twelve different kinds or produce on hand all summer in a farm market without buying most of it has zero experience in actual truck farming.

If you have a couple of people who can STAY in the field you can have a reasonable shot at keeping your store stocked with a few things that grow well in your area for most of the growing season.

Stores on farm or off must do a certain amount of business to be viable. You can only grow crops in certain minimum quantities and succeed commercially.

A casually operated road side stand may do ok with a very limited inventory but a serious farm market needs a substantial volume of produce in order to justify paying somebody to run it.

Unless you have full time employees and a good bit of land you will necessarily buy most of what you sell at a farm market.

If you buy tomatoes in mid June in a Va farm market – and such markets do have tomatoes mid June – then they were shipped in from points south -at least three or four hundred miles south .

Local farm markets have peaches from South Carolina four weeks before our local peaches are ready. But at the tail end of the season sometimes we can send some of ours south since the South Carolina crop is sold out.

All farmers know this but hardly any of their customers know it.

My daughter is good friends with a farmer who does sell milk to members, so I know it is done around here.

Most of the memberships involve produce, though. The members support a local organic farm and get a share of each week’s produce.

As for growing their own products to see or buying them from elsewhere, I have seen both. I drive past the farms daily, so I can see what is in the field. I can also see when lots of pumpkins suddenly turn up for a pumpkin patch that wasn’t a patch before.

At any rate, since I can see from the road what is in the fields, who is working the fields, what signs go up for what is for sale, who sells at the farmer’s market, and so on, I have a pretty good idea of what is growing, who is growing it, and what gets trucked it.

I live in a very affluent area, so the working organic farms do have local people who will support them. Outside the immediate town, there is lots of open space, organic farms, horse ranches, and so on.

Eggs are another popular item you can buy from quite a few local farms. In fact, in some cases, it’s just someone with a big backyard with a bunch of chickens and they sell the extras to people in the neighborhood.

Oh, the peaches. They are trucked in from another part of the state (which is famous for their peaches). Same with cantaloupe. Those come from another part of the state, too. I think in some cases the farmers who grow them in the western or southern parts of the state haul them into our part of the state themselves and then sell them at the Farmers’ Market. In other cases, local farmers who maintain big food stands sell the products. But they don’t claim the peaches and cantaloupes are theirs since people want the peaches and cantaloupes from the parts of the state known for growing them.

At any rate, I wouldn’t say there is much of a con going on where I live. The people who buy these products often go to the farms themselves to see what is there. I live in a place full of food connoisseurs. If you have ever watched the show “Portlandia” (I don’t live Portland, by the way), you see people in restaurants asking the name of the pig they are about to eat and want to know under what conditions the pig lived. 🙂

interesting little thing going on where I live. located in the middle of about 25 producing oil wells.

http://futurefoodsfarms.com/Future_Foods_Farms/Welcome.html

Ron, that’s very insightful. I think we need to separate the rig drilling efficiency and new well productivity. New well productivity is down.

But rig efficiency does in general trend up. Except in times when business is booming, we end up with inexperienced personnel, and this slows down rig operations. I believe this may have been happening, in some operations I can’t mention, in which I’ve noticed unusual mistakes I would say are caused by poor quality engineers and supervisors. I’m free to mention Venezuela, where personnel quality really dropped in 2003. But this also happens elsewhere.

As regards well quality, common sense tells us that if we drill wells in a high price environment we can afford to drill poor wells. However the trend doesn’t exactly follow oil price because industry costs also went up very fast in the last 15 years.

In conclusion, your observation is spot on, and it makes a lot of sense.

“The USA produces 4,577 barrels per day for every active rig while the Middle Ease produces 59,945 barrels per day per rig, down from 140,144 in 2000.”

I read a month or so ago that a very large majority of CAPEX in 2013 went to the American shale oil industry. I can’t remember the exact number and I’m in too big a hurry to search for it, but it was a significant majority of CAPEX going to frack that greasy liquid out of the ground across the great USA.

From my point of view, it is ONLY the 59,945 barrels per day being produced by the ME that keeps this financial freak show we call the “global economy” on the road. And in that freak show, the 4,577 barrels per day produced by the USA is the main attraction — clowns, jugglers, high rope walkers, cannon ball daredevils and ticket scalpers.

Amazing how we have come to this. I don’t see a happy ending to this story, sad to say.

We just need a really popular birth control pill and a cheap battery.

That distills it down to the absolute essence of the problem! Well said.

The Nissan Leaf has the lowest cost to own and operate of any US vehicle.

We already have a cheap solution.

How much cheaper than a Honda Civic, $18490 MSRP – 39 HWY?

Cheap? With or without any consideration of the carbon?

There are two prices for a car- out of pocket to get it, and out of your grandkids’ life to run it.

Which are you counting??

If you don’t count both, you flunk the accounting test.

Why just grandkids? Should the accounting ignore the infinite series of great, great great, great great great … grandchildren. What percent of the world’s billion plus and growing car population will evolve to electric. Will the coal, nuclear, gas. biofuel mix change. Things do change. I recall a controversy about four decades ago about building additional oil storage tanks next to the power plant on the coast near Ventura CA. At that time much of the electricity was generated by burning petroleum

http://www.eia.gov/tools/faqs/faq.cfm?id=427&t=3

Of course you take a stab at ALL the costs, but real soon, you come to the point where you say “we will, for the purpose of this analysis, ignore higher order effects” And then you toss in a guess of how much that was. Like maybe 0.5% of the stuff you have a good handle on?

SOP

Richard Heinberg over on Resiliance, talking about renewable future, says

small car (35 mpg) 138 grams/pkm -mfg+direct fuel+ indirect fuel

electric car (pv) 50g/pkg.

And I got my Leaf and the PV to run it for LESS than the most common vehicle around here- f150 + some fanciness. which, Heinberg numbers say would be around 300 g/pkm.

That’s 6 to 1 in favor of Leaf +pv.

Wimbi wrote:

“Cheap? With or without any consideration of the carbon?”

Leafs are carbon powered since +75% of US power is generated from fossil fuels. Depending on where your power is generated from, you make be burning coal in your leaf. Just because you can’t see it burning carbon doesn’t mean it isn’t.

The Grid can’t tolerate a EV economy. The grid is already struggling to meet demand during the summer months and won’t take too much more during the summer to push it over. That said I very much doubt consumers will be switching over to EV. Perhaps EV owership will increase by few more percent, but that will be it.

I suspect that rolling blackouts will become much more frequent in a few years. The new EPA regulations (forcing the closure of just about all coal fired plants by 2024) is going to make electricity much more expensive so that the decreased production caused by shutdowns can be offset with decreased demand. Coal generation will be largely replaced by NatGas, which will go up in cost do to the increased demand. Better install an extra 15 to 20 KW of panels for your leaf, and find a night-shift job (so you can charge the leaf during the day)

The German grid has become more reliable, even as they added wind and solar power.

They are building 10 new coal plants, and have ended big renewable projects.

http://phys.org/news/2014-01-germany-eyes-swift-renewable-energy.html

http://theenergycollective.com/robertwilson190/328841/why-germanys-nuclear-phase-out-leading-more-coal-burning

Exactly! I keep telling people that nothing will really be done to stop global warming. The welfare of today will always take precedence over the welfare of tomorrow.

It looks like the decision to go with coal plants was made quite awhile go and was made to phase out nuclear rather than renewables. While this still means there are now going to be more coal plants, we should at least keep in mind the reason for them. From the article:

Investment decisions for these power plants were made in 2005-2008. …

In the year 2000 the government of Gerhard Schröder announced that all of Germany’s nuclear power plants must close by 2022, and this was passed into law in 2002.

They…have ended big renewable projects.

Where do you see that in these articles??

The Phys org articles is full of inaccuracies.

Merkel took the surprise decision in 2011 to scrap nuclear power for renewables in the wake of the Fukushima disaster

The decision was made in 2002 or 2003 by the Red/Green coalition. Merkel tried to roll the decision back a few months before Fukushima but it only partly stuck.

Generous state incentives for solar, wind and biogas that have driven up prices, now among Europe’s highest, would be trimmed from this year

This contains several inaccuracies.

Wholesale prices are among the lowest in the world, often negative. Prices to large consumers are also very low.

Only the household prices are high, and this is mostly driven by high taxes. The high prices are not an unintended consequence at all. They are intended to incentivize conservation.

“Trimmed from this year” is nonsense. Subsidies for building solar ended in 2004 (not sure about wind) and the feed in tariff (which began in 1991, not 2011) has been falling steadily since then as well.

Didn’t bother to read your second link but coal consumption fell in Germany in 2014.

There has been a lot of talk about coal plant construction, but total capacity is falling. The decision to phase out older less efficient plants was made in the 90s.

That’s what we call a greenish urban legend. Germans are hooked on coal, and their power grid stability is highly unstable.

The German System Operators disagree.

Do you have a source for that?

Here’s a couple of things to read. When you read the guardian article you will see a quote from Eldrup about Danish wind power. He’s deceitful. The only way they manage grid stability is by exporting.

https://www.allianz.com/v_1339677769000/media/responsibility/documents/position_paper_power_blackout_risks.pdf

http://www.theguardian.com/environment/2012/feb/10/grid-blackout-threat-renewables

Fernando,

If you want to contribute to the general understanding, and advance a productive debate rather than simply appear obstructionist, then it’s desirable to extract quotes from any articles or sources you find, in order to highlight the relevant information. You shouldn’t force readers to dig for the information you’re providing.

The only way they manage grid stability is by exporting

What’s wrong with exporting? The French make their grid “stable” by exporting nuclear power at night, and importing power during the day. It only makes sense to optimize your operations using imports and exports as one very useful tool.

Nick, everybody wants to export surplus wind. I think you just need to do a tabletop exercise and imagine every European nation trying to generate 40 % of the electric load using wind power. The cost to do it and avoid huge blackouts is humongous. I realize to many of you this is a mental exercise, but there are engineers trying to figure this out for real. Thus far, it’s impossible. The EU emissions goals can’t be achieved with current technology. The effort would be so costly it would wreck their economies.

everybody wants to export surplus wind.

Of course – that’s the point. Wind turbines output correlation is very roughly proportional to distance: get far enough away (certainly possible in Europe) and one country’s wind output will be high, and another’s will be low, and vice versa.

One wind turbine has a very high ratio of variance to mean output. A wind farm has a lower ratio. A country’s ratio is substantially lower. A continent: much lower.

The cost to do it and avoid huge blackouts is humongous.

How do you know? I (and many others) have done simulations, using real hourly wind output and grid consumption data, and found the opposite.

http://www.sciencedirect.com/science/article/pii/S0378775312014759

Excerpt from the abstract:

“Our model evaluated over 28 billion combinations of renewables and storage, each tested over 35,040 h (four years) of load and weather data. We find that the least cost solutions yield seemingly-excessive generation capacity—at times, almost three times the electricity needed to meet electrical load. This is because diverse renewable generation and the excess capacity together meet electric load with less storage, lowering total system cost. At 2030 technology costs and with excess electricity displacing natural gas, we find that the electric system can be powered 90%–99.9% of hours entirely on renewable electricity, at costs comparable to today’s—but only if we optimize the mix of generation and storage technologies.”

And from the conclusion:

“At 2008 technology costs, 30% of hours is the lowest-cost mix we evaluated. At expected 2030 technology costs, the cost minimum is 90% of hours met entirely by renewables. And 99.9% of hours, while not the cost-minimum, is lower in cost than today’s total cost of electricity.”

and

“We find that 90% of hours are covered most cost-effectively by a system that generates from renewables 180% the electrical energy needed by load, and 99.9% of hours are covered by generating almost 290% of need. Only 9e72 h of storage were required to cover 99.9% of hours of load over four years. So much excess generation of renewables is a new idea, but it is not problematic or inefficient, any more than it is problematic to build a thermal power plant requiring fuel input at 250% of the electrical output, as we do today.”

Tech Guy, I’ve noticed your coments on this page and you appear to me to be a tad uninformed.

Either yesterday or today someone posted on article on windpower installations in 2014 inceasing by a factor of six.

In 2014, the US had it’s second straight year of record solar PV installations, adding more PV capacity in two years than had previously ever been installed! That’s right, in the last two years, US solar PV capacity has more than doubled!

Utility scale solar PV has quadrupled over the past two years so a sizeable chunk of new solar PV was installed by utilities.

Why? LCOE for new utility scale solar PV is now below Natural Gas peaker plants for the mid day peak demand period.

Between 2013 and 2014 three significant solar thermal (CSP) plants have been commissioned in the desert southwest; The Solana, Ivanpah and Crescent Dunes Plants. IIRC all three are larger than 200MW, with Crescent Dunes and Solana having the ability to store enough heat to operate for at least six hours (IIRC) after cessation of solar input.

Much of your negative comments may have been true three or fur years ago but, things are changing fast, very fast. Who would have thought that utilties would ever choose solar PV over gas peaker plants to satisfy the mid day peak. As it is, this wil work particularly well in the desert southwest, where most of the large scale solar PV action is, when it comes to staisfying the mid day peak with heavy air conditioning loads. The electricity supply/demand situation in the southwest is gonig to be very interesting this summer. I guarantee it.

Background information on all of the above can be found by visiting/searching the following web sites;

Renewables International

solarserver.com Solar Magazine, News

North American Clean Energy Magazine, Soalr News

I’m not saying that any of this is a silver bullet but, things are not nearly as bad as you make them sound. If we can hold things together just a little bit longer, maybe things might actually start looking up , like maybe we might just be able to star thinking about contemplating renewable powered economies.

Alan from the islands

“In 2014, the US had it’s second straight year of record solar PV installations, adding more PV capacity in two years than had previously ever been installed! That’s right, in the last two years, US solar PV capacity has more than doubled!

Utility scale solar PV has quadrupled over the past two years so a sizeable chunk of new solar PV was installed by utilities.”

There are a few very large PV farms that are gov’t essentially gov’t funded. Some utiltities are adding a few megawatts (nameplate cap) , just enough to make friends in gov’t. They have no plans to replace large baseload, fossil plants with PV or Wind. They are also not building large storage systems, which dwarf the costs of PV/Wind farms.

PV installs have slowed considerably:

http://www.greentechmedia.com/articles/read/Five-Things-You-Should-Know-About-the-US-Utility-Scale-PV-Market

Don’t confuse a 1 GW baseload plant with 1 GW of nameplate PV capacity. Most people believe that 1 GW of PV panels can replace a 1 GW coal plant. it can’t even come close.

” That’s right, in the last two years, US solar PV capacity has more than doubled!”

Doubling from one drop to two drops in the bucket isn’t very much. If I have a penny in my pocket and I add a $10 bill, I could say my savings are growing by 1,000% Still that $10.01 bearly buys me lunch.

PV/Wind is just another fade, like the tech stocks in the 1990’s or the housing bubble in 2000’s. With in 5 years it will be end up as another bust.

I warned people in the past about bubbles, the 90’s tech bubble, the housing bubble, and most recently the shale bubble. Everyone keeps on telling me I am wrong and don’t know what I am talking about. Some how, I managed to be right, again and again. Just maybe I’ve done a pretty good job on researching the facts as well as communicating with insiders.

wonder what these guys are thinking…

http://www.buffalonews.com/business/prospectus/solar-energy-building-a-new-industry-in-wny-from-the-ground-up-20150123

I followed yor link and I’m not quite sure it supports your argument. A graphic showing the 2014 Q1 capaciity additions beiing about half of the 2014 Q4 additions with 2013 Q2 being even less, does not tell the whole story. In fact Figure 2.11 further down directly contradicts your assertion that “PV installs have slowed considerably:”.

In the sidebar at the Greentech Media web site was a story that spoke to the three largest utility scale projects in the US, at 550MW, 550MW and 579MW. These must be the “few very large PV farms that are gov’t essentially gov’t funded.” A little tip: don’t link to web sites that are basically green energy news/advocacy sites when trying to put a negative spin on renewables.

As far as “Don’t confuse a 1 GW baseload plant with 1 GW of nameplate PV capacity.” goes, see my comment to the story Was 2014 the turning point for the Energiewende?at renewablesinternational.com, (no 8. at the time of this post) for an explanation of just how clear I am on that point.

As far as your penny analogy goes, if you end up with 100 or even 50 pennies in you pocket because you were collecting pennies and a pick-pocket passes through your group of people and takes everybody’s paper banknotes, guess who just might end up having the most cash in the group?

PV and wind are not fads. They are making an increasinngly relevant contribution to the energy mix of some countries. There are places in the world that will depend entirely on whatever renewable energy capacity they have installed when oil becomes scarce/prohibitively expensive.

I don’t understand you. Are you trolling?

Alan from the islands

PV/Wind is just another fade, like the tech stocks in the 1990’s or the housing bubble in 2000’s. With in 5 years it will be end up as another bust.

Would you be willing to place a wager on that? Just curious, as fossil fuels become more expensive and difficult to extract do you really believe solar and wind will be just a fad?!

Of course, wind and solar will have booms and busts.

Railroads had a boom and bust after the Civil War – it was part of the Long Depression of the 1870’s.

Electrification had a boom and bust after WWI – it contributed to the Great Depression of the 1930’s.

Telecom and Internet had a boom and bust recently.

That didn’t mean they weren’t major, successful industries – they were a victim of their own success!

Alan, it seems you need to mosey over to Germany and spend a couple of weeks talking to people.

I read an incredible amount of nonsense about the German grid, but since I’m in Spain I get a little bit of a local european flavour.

The new EPA regulations (forcing the closure of just about all coal fired plants by 2024) is going to make electricity much more expensive so that the decreased production caused by shutdowns can be offset with decreased demand.

Weren’t the days of coal-fired plants numbered anyway? Seems like the economics of natural gas, plus local communities preferring a cleaner energy source, were going to doom coal fired plants as it became time to replace/upgrade older plants.

The coal plants won’t close. The EPA plan doesn’t really exist. By the time they put states’ input into the mix the EPA will back off. These things run in cycles. By 2020 they’ll realize the USA doesn’t have as much cheap gas as they expected.

The EPA plan doesn’t really exist. By the time they put states’ input into the mix the EPA will back off.

And how do you know this?

Because the EPA plan is now requesting proposals by state governments. These take time. The time schedule will be stretched by lawsuits from all sides. And as we all know a basic premise is to use natural gas as the workhorse. But by 2020 gas prices will be a lot higher.

Fern wrote:

“The coal plants won’t close. The EPA plan doesn’t really exist. By the time they put states’ input into the mix the EPA will back off. ”

This is incorrect. There already have been numerous closures in 2014 and 2015 isn’t much better. Since Demand for electricity is declining, Its just easier to decommission them, then fight to keep them running. The Gov’t, states and the EPA were hoping that power the power companies would build new NatGas Plants or renewables to replace them (ie create jobs, borrow more money). But they are choosing not to. At this time there a very few new plant projects that have been announced. Although six more Nuke plants may be shutdown in 2015 or 2016 (no decisions made yet). The costs to maintain many of the older Nuke plants are just becoming too costly and there is a lack of nuke workers since thousands are beginning to reach retirement age. The Bottom line, the US is rapidly losing plants much faster than new plants are being built. I expect that electricity prices will more than double (nationwide average) in the next 5 to 7 years. Rolling backouts will be increase during the summer months. Power companies use to keep the older plants around for the peak demand months, but since most of them were older coal fired plants, they are dismantling them.

http://www.commdiginews.com/environment/closures-threaten-24-percent-of-us-coal-fired-electric-power-plants-13407/

http://www.sourcewatch.org/index.php/Coal_plant_retirements

http://www.cnsnews.com/news/article/barbara-hollingsworth/lost-electricity-generation-capacity-7x-higher-epa-estimates

http://instituteforenergyresearch.org/topics/policy/power-plant-closures/

“ERC has admitted that, “Since January 2011, the introduction and implementation of several environmental regulations combined with increased natural gas availability has contributed to the closure of nearly 43 GW of baseload capacity.”[8] NERC has shown concern that the closures will cause electricity reliability problems.

According to their 2013 Summer Reliability Assessment, some areas of the country have not been able to build enough generation capacity to meet recent load growth. A major reason for this is uncertainty surrounding environmental regulations.[9] Because of these deficiencies, some areas will see their generation reserve margins fall below target levels that can jeopardize power reliability. According to NERC, “Insufficient reserves during peak hours could lead to increased risk of entering emergency operating conditions, including the possibility of curtailment…and even rotating outages of firm load.”[10]”

“By 2020 they’ll realize the USA doesn’t have as much cheap gas as they expected.”

By then, it will be too late as the US economy collapses. The closures happening now will drive up costs, causing consumers to cut back and industrials to move offshore. This will create a feedback loop as job losses increase. To add insult, they won’t be able to just refire up shutdown plants because the power companies are dismantling the old plants to avoid taxes and regulatory costs to keep them mothballed. The EPA/state/Fed rules are set up in to force the power companies to dismantle the older plants.

On the other side of the World, China and India continue to build new Coal, Nuke and NatGas Plants. Perhaps they are expecting to grab the remaining US industrial production when the US powers down. Law of unintended consequences: Since India and China have almost no regulations on their plants, Global pollution will increase. US production moves overseas and consume power from the dirtiest plants instead of the reasonably clean power plants of the US. Consumption of electricity in the US is far cleaner than it is in China. Bad US regulation has increase global pollution by kickstarting industrial development in Asia.

TechGuy wrote:

The Grid can’t tolerate a EV economy.

Not true. According to this study, the majority of US cars, and light trucks can be charged at night with existing spare capacity.

http://energytech.pnnl.gov/publications/pdf/PHEV_Economic_Analysis_Part2_Final.pdf

Junk & hogwash:

1. The do not discuss the impact of increased grid load (especially during the summer when demand for electricity and gasoline is high).

2. They discuss about building a lot more coal and NatGas plants.

This article is written to target the cost savings and it focus on a couple of small markets, presuming that electrity costs do not rise. The model is based upon that all drivers will need less than 13Kwh per day when in real world its closer to 20 Kwh/d for EVs. It does not provide any simulation or models on how the grid would accommodate the extra demand, especially on a national scale. It just discusses cost savings.

Look, the US consumes about 3/4 of the entire grid in any given day for transportation (29% for transportation, 40% for electricity). So for the US to switch to a pure electric system, the grid will would have grow by more than 50% of current capacity. Two: there is insufficient Lithium for a such a large build out. Well before EV cars become the normal for new car purchases the cost of Lithium will become prohibitively expensive.

And the big conudrum: At night, there is no PV generation. so what is the source to charge them overnight? just wind? The article you posted relies on NatGas, Coal and Nuclear. BTW: The plant they included in the analysis: San Onofre nuclear power plant, is being decommissioned.

None of you guys have any real world analysis and you constantly ignore the details. Bottom line: It “ain’t” happening! Better have Plan B!

So for the US to switch to a pure electric system, the grid will would have grow by more than 50% of current capacity.

But who is suggesting a pure electric system? Seems like most solar/wind people are saying that the more electrical generation that can be done with solar and wind, the less fossil fuels will be needed. Then they have been used where they are truly essential rather than just burned up because no one wants to change anything.

And the more transportation that is switched to electric, the less oil is needed.

I meant to say, “Then they can been used where they are truly essential rather than just burned up because no one wants to change anything.”

The old “Insufficient Lithium” argument.

How do you explain all the Lithium power tools and cell phones? Is that a different kind of Lithium?

And you must think all the auto manufacturers ramping up EV production, are just stupid to have not thought of that first.

EV production is doubling every year.

Doesn’t the Tesla have a 500-600kg (1100lb – 1320lb). That’s gotta contain a heck of a lot more lithium than your average cell phone or laptop battery. Just saying…

*battery weight.

I for one will hazard a guess that the price of entirely non recyclable gasoline and diesel fuel will be a ten times bigger problem than the price of lithium.

Dunno. Check where lithium reserves are found.

It is true that the grid is overloaded at times and at places but in general it is still robust – witness the notable rarity of outages other than ones caused by storms.

I can’t see any reason why the grid will not be upgraded as needed. The upgrades will come after a few repeated large scale outages change peoples minds about paying for the upgrades.

Electric cars are going to rule the road eventually if the economy doesn’t croak first. Batteries are getting cheaper and oil is getting – long term- more expensive.

I am old enough to remember when tv sets and radios and power tools and such were REPAIRED. Not anymore – new ores are so cheap you just junk an old one when it finally dies.

Battery powered cars are going to eventually be so reliable and so cheap to maintain that nobody will want to buy a car powered by gasoline any more except maybe for long trips.No radiator fuel pump cat head gaskets timing belt rod bearings starter motor transmission fuel tank etc etc to give problems.

JUST ONE big old battery to worry about and an electric motor with only three or four NON RECIPROCATING moving parts and a gear reduction to the driving wheels. With a new or refurbished battery there is really no reason for an electric car to EVER wear out.It might rust away.

Why should we assume the grid will not be upgraded to handle charging electric cars by the tens of millions ?

Coal will be cheap for a long time to come and wind and sun will always be free except somebody will undoubtedly figure out a way to tax both.( sarc)

Nukes may make a big comeback as well.

As a matter of fact a grid upgrade will make wonderful sense since most cars will be charged at night and most cars will not even need a full charge every day anyway. Charging at night is going to be a great way to make good use of base load power plants than are other wise idled back due to low nighttime demand.

And the more electric cars the merrier when it comes to making good use of intermittent wind and solar power which can be fed into all those hungry batteries with a smart grid and time of use pricing to encourage the electric vehicle owner to charge as often as possible when wind and solar farms are cranking it out.

Personally I have no problem envisioning ten parking spots in every large parking lot with a 120 volt plug available to put some juice in employee’s cars while they are just sitting there all day.

After the first ten spots are in regular use the second ten spots will get plugs too.This sort of perk will suit a lot of drivers better than a small raise while also being cheaper on the employer.

Even today while gasoline and gasoline cars are still somewhat cheaper to run on average than electrics there are very good reasons other than climate to get away from oil. Burning domestic coal and building wind and solar farms is much better for the economy than buying oil from people who hate our guts and are eventually going to run out of oil to sell anyway.

If I were younger I would install a large solar array and buy an electric car now in the expectation of EVENTUALLY saving enough on gasoline and repairs to make this choice a no brainer.

Here’s what I used to do with my saturday science kids.

I took apart a briggs lawnmower engine– every one of those greasy big, and smelly easy to loose little parts, and spread them out on a 4 by 8 sheet of old plywood. Lots and lots of little parts of unknown function, each one vital or it wouldn’t be there. Briggs did not waste money.

Then I took apart an electric motor from a battery powered lawnmower, and put it out on another sheet of plywood, including of course the battery, wires and charging plug.

then I let the kids just look at the two piles of stuff, and talk about them among themselves. They did.

I said nothing.

Years later they told me that there was no further need whatsoever to convince them that IC engines were way more complex than electric motors, and had countless more ways to crap out and not do their job, whatever that was.

Wimbi,

Yeah, I like the same idea with the ingredients list for butter and margarine.

Large gas turbines are simpler than large SUV gasoline engines. Then we hook them up to generators and voila, electricity!

Hi Robert,

The answer depends on future gasoline prices, nobody knows these, but my guess is that within a year gasoline in the US will be back to $3.50/US gallon and rising. Electricity prices may rise as well, but at a slower rate, those with enough PV to meet their needs will have their electricity rates locked in for 25 years, replacement panels will likely be much cheaper. The Leaf will last much longer than the Civic and if you don’t mind driving an old car will probably still be going in 25 years with one battery replacement after 10 to 15 years, depending on miles driven per year. The electric motor will last, suspension and body may fall apart after 15 years.

For those that own a Leaf, does the car seem to be built to last, does 15 to 20 years with 12k per year sound reasonable based on experience to date?