What is Reserve Growth?

BP: In general, a portion of a field’s probable and possible reserves tend to get converted into proved reserves over time as operating history reduces the uncertainty around remaining recoverable reserves: an aspect of the phenomenon referred to as ‘reserves growth’.

Wiki: Experience shows that initial estimates of the size of newly discovered oil fields are usually too low. As years pass, successive estimates of the ultimate recovery of fields tend to increase. The term reserve growth refers to the typical increases in estimated ultimate recovery that occur as oil fields are developed and produced.

Basically the U.S. Security and Exchange Commission have stringent reserve booking requirements for oil companies. As a result early booked reserves of any given field is very conservative. Also, any company would much rather have reserves too low and increase them later than have them too high and have to decrease them later.

But would this not mean that fields of national oil companies, and especially fields that were discovered and developed in the Former Soviet Union have different reserve growth rates than fields developed by publically traded oil firms. The answer is yes and the USGS admits that is exactly the case.

In this publication, Reserve Growth in Oil Fields of West Siberian Basin, Russia, the USGS tells us all we need to know about Reserve growth in West Siberia.

ABSTRACT

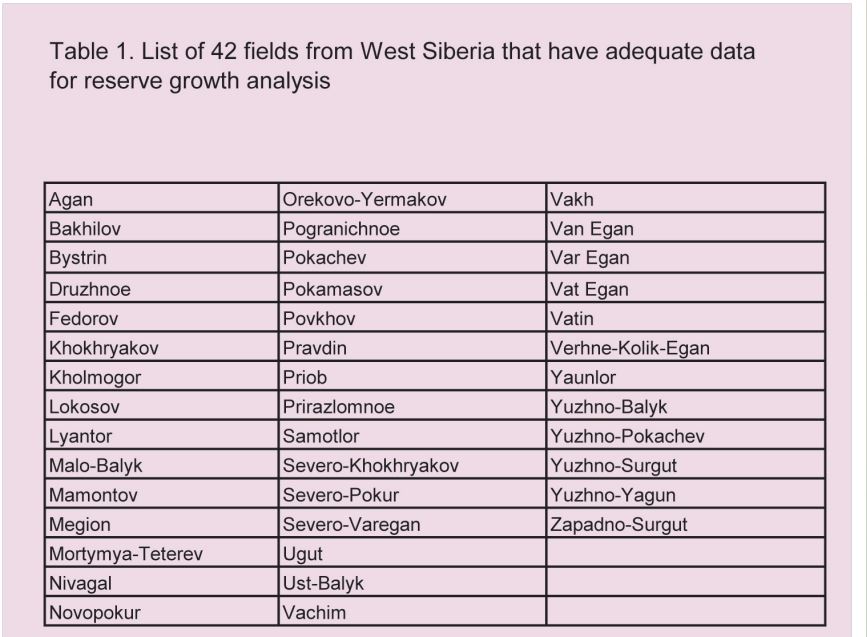

Although reserve (or field) growth has proven to be an important factor contributing to new reserves in mature petroleum basins, it is still a poorly understood phenomenon. Although several papers have been published on the reserve growth in the U.S. fields, only limited studies are available on other petroleum provinces. This study explores the reserve growth in the 42 largest West Siberian oil fields that contain about 55 percent of the basin’s total oil reserves.

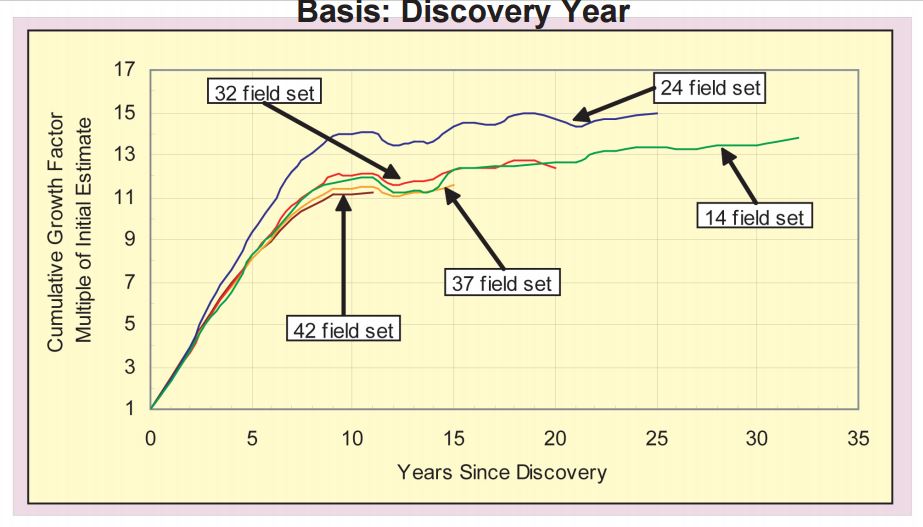

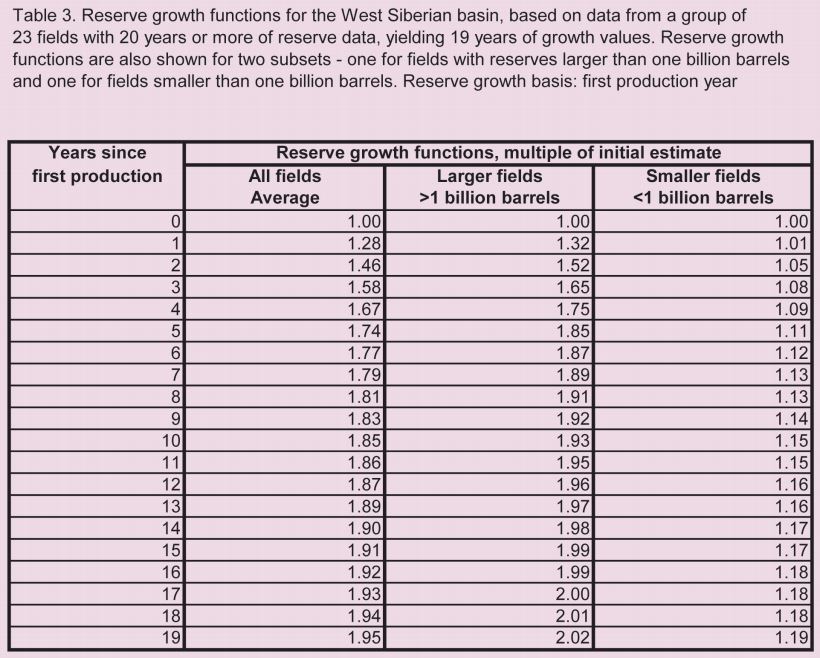

The West Siberian oil fields show a 13-fold reserve growth 20 years after the discovery year and only about a 2-fold growth after the first production year. This difference in growth is attributed to extensive exploration and field delineation activities between discovery and the first production year. Because of uncertainty in the length of evaluation time and in reported reserves during this initial period, reserve growth based on the first production year is more reliable for model development. However, reserve growth models based both on discovery year and first production year show rapid growth in the first few years and slower growth in the following years. In contrast, the reserve growth patterns for the conterminous United States and offshore Gulf of Mexico show a steady reserve increase throughout the productive lives of the fields. The different reserve booking requirements and the lack of capital investment for improved reservoir management and production technologies in West Siberian fields relative to U.S. fields are the probable causes for the difference in the growth patterns.

Four of the five largest fields in Russia are located here in West Siberia, Samotlor, Priob, Lyantor and Fedorov. 61% of Russian production currently comes from Western Siberia. Russia’s second largest field, Romashkino, discovered in 1948, is located in the Volga-Ural Basin and is also in serious decline.

An important point: Total reserve, which is the same as estimated ultimate recovery, is defined here as the sum of cumulative production and the remaining reserve of A+B+C1 categories as of the date of reporting.

That is, all reserves reported in this report are total reserves or URR, not just remaining reserves.

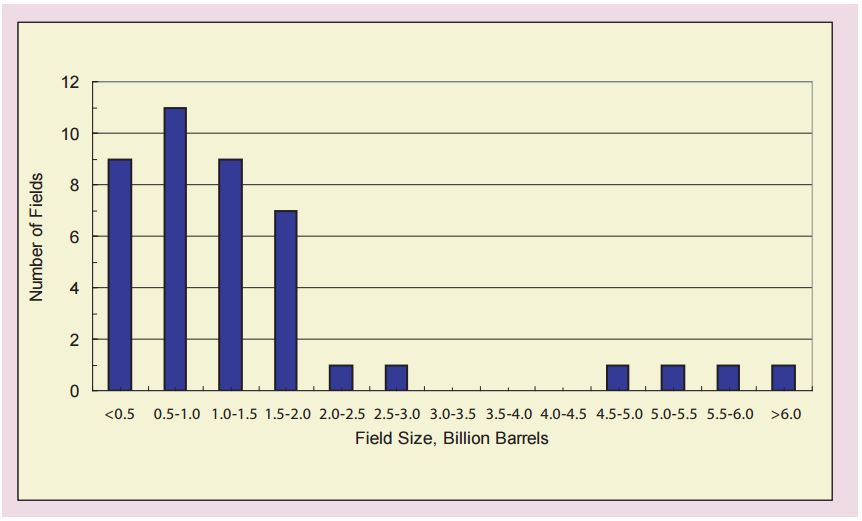

Figure 2. Field size distribution of 42 oil fields in the West Siberian Basin: The mode field size is 0.5-1.0 billion barrels. The distribution is skewed to the right, implying fewer fields with increasing field size.

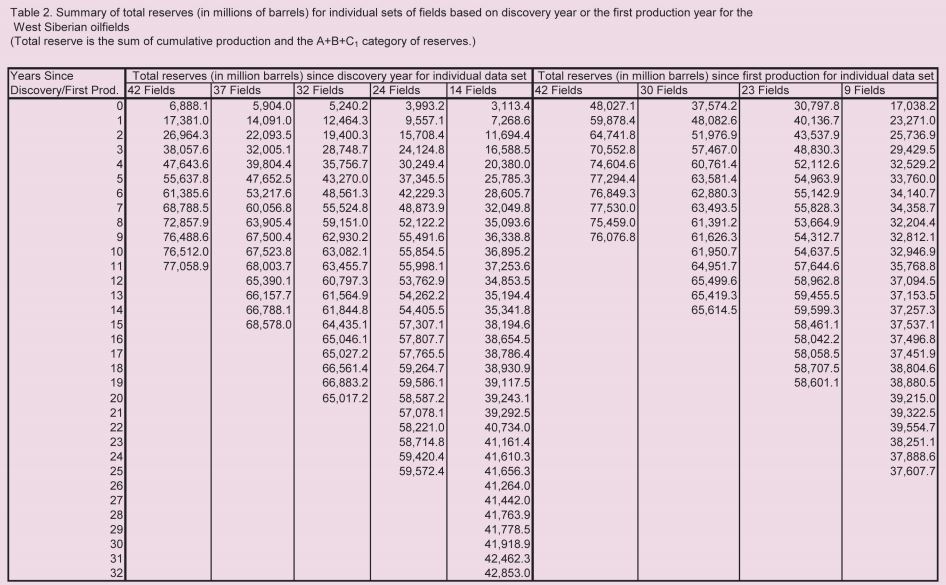

Table 2. Summary of total reserves (in millions of barrels) for individual sets of fields based on discovery year or the first production year for the West Siberian oilfields. (Total reserve is the sum of cumulative production and A+B+C1 category of reserves.)

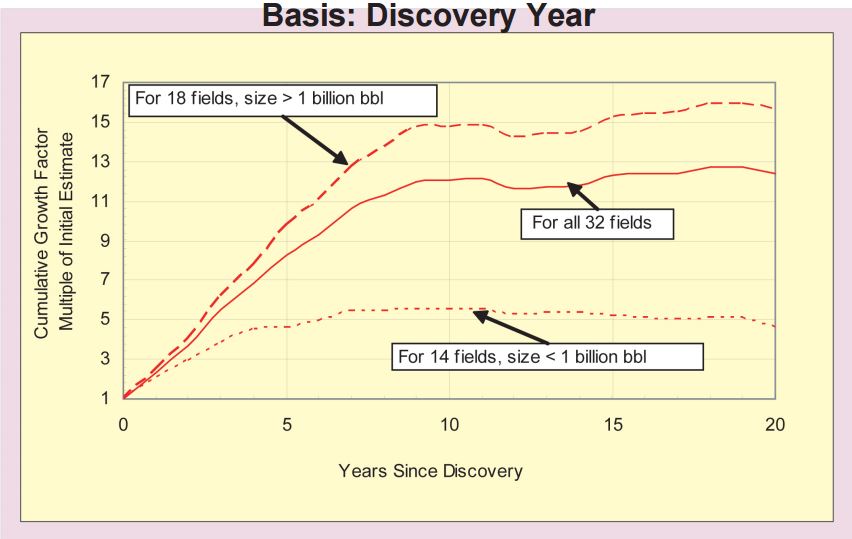

Figure 3. The number of fields in each of five sets ranges from 14 to 42, with the corresponding duration of the reserve record for fields in individual sets from 32 to 11 years since discovery (Table 2). The reserve growth ranges from 11- to 15-fold over a period of 11-32 years; most of the growth occurs in the first 9-10 years.

Figure 4. A set of 32 West Siberian fields, with each field having at least 20 years of reserve record since discovery shows overall growth of 13-fold, while its two subsets – one for 18 fields with sizes larger than one billion barrels and one for 14 fields with sizes smaller than one billion barrel – show different growths.

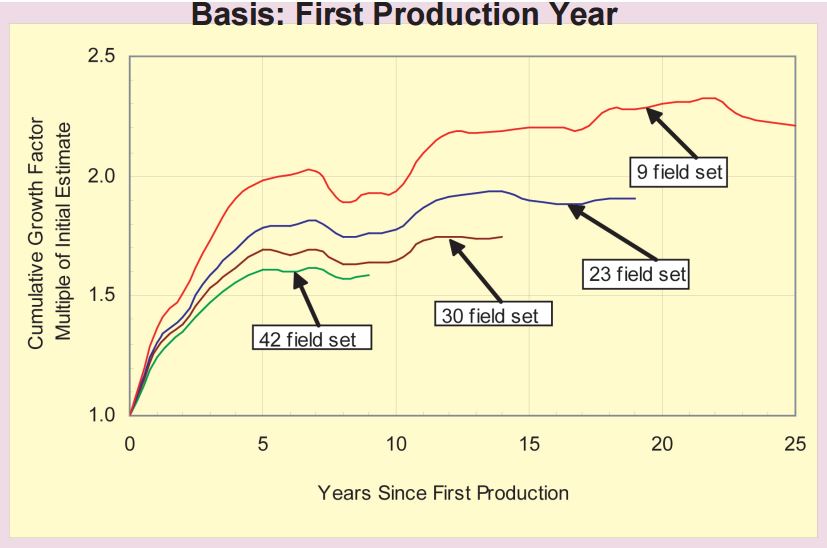

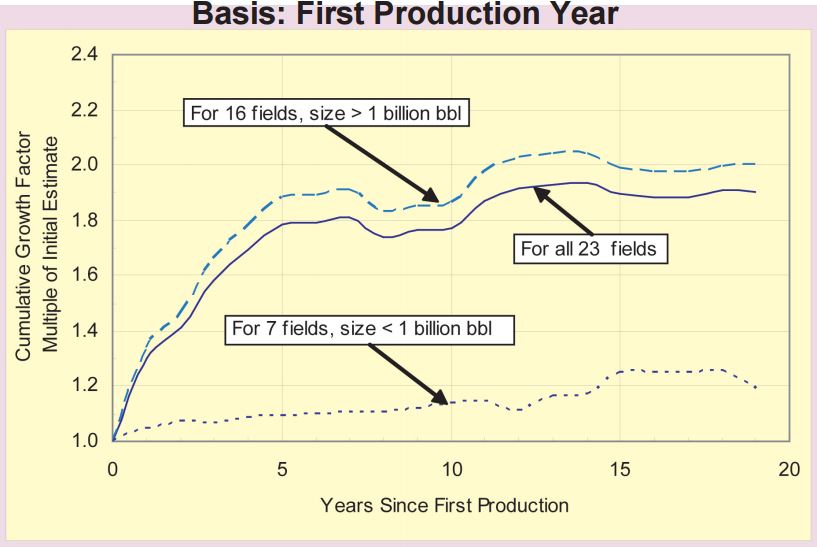

Figure 5. The cumulative growth curves for four sets of fields are plotted. All 42 fields with each field having at least 9 years of reserve record since the first production; 30 fields with at least 14 years; 23 fields with at least 19 years; and 9 fields with at least 25 years of record (Table 2). Reserve growth for individual sets varies from 1.6- to 2.3-fold.

Figure 6. The set of 23 West Siberian fields with 19 years of reserve record since the first production shows an overall growth of 1.9-fold, and the two subsets of the 23 fields – one for 16 fields with sizes larger than one billion barrels and one for 7 fields with sizes smaller than one billion barrels – show different growths, with large fields showing the most growth.

Small fields with less than one billion barrels have hardly any reserve growth at all.

Notice that most reserve growth happens in the first 9 to 10 years and after 17 or 18 years there is hardly any reserve growth at all.

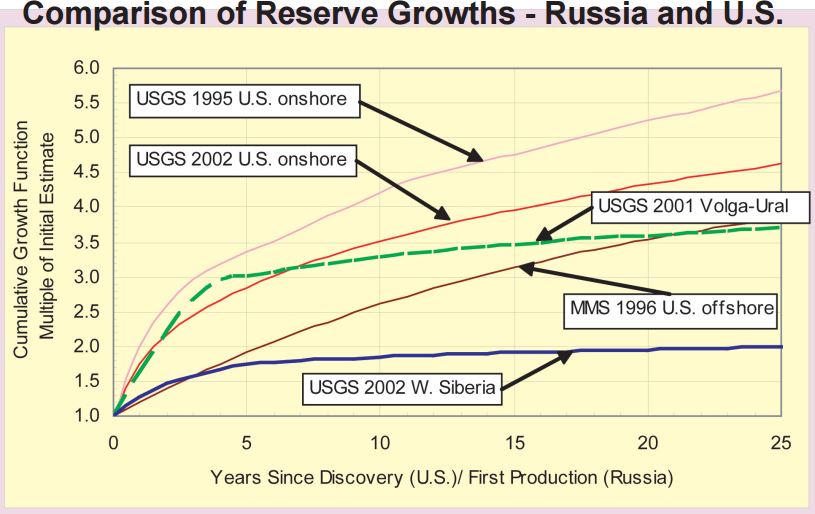

Figure 9. Curves (models) for the West Siberian and Volga-Ural provinces are based on the first production year and for the U.S. fields based on the discovery year.

This is perhaps the most telling chart of all. Fields in Western Siberia have just about ceased all reserve growth.

CONCLUSIONS

1. West Siberian Basin reserve growth is similar to what has been reported for the North Sea fields; production start-up date is the basis for both the analyses.

2. All models show rapid reserve growth in the first five years, but the West Siberian models show much slower growth in the following years compared to the models for the U.S. fields. Slower growth in West Siberian fields is caused by different reserve booking requirements and probably by insufficient investment in improved production technologies.

3. The West Siberian model, using the year of first production, predicts potential reserve growth ranging from 270 to 330 million barrels, or 0.34-0.42 percent per year over a five-year (1998-2003) period, compared with 0.51-0.58 and 0.72-0.79 percent per year predicted by two models for U.S. onshore fields over a five-year (1996-2001) period.

My Conclusions

Had the Western Siberia oil fields had the tiny reserve growth this report predicted for 1998 to 2003 period it is lone gone now. All those fields are in decline now and have been in decline for a few years now. But Russian production has not yet started to decline. New fields have kept production up. Vankor, and three nearby fields now produce almost half a million barrels per day. However Vankor will likely start to decline next year.

So it is very likely that with the peaking of even Vankor, and with the declining of all those old fields in Western Siberia, Russia will start to decline in earnest. Russian oil production will not get any help from reserve growth in Western Siberia. Old dying fields, like old dying men… do not grow.

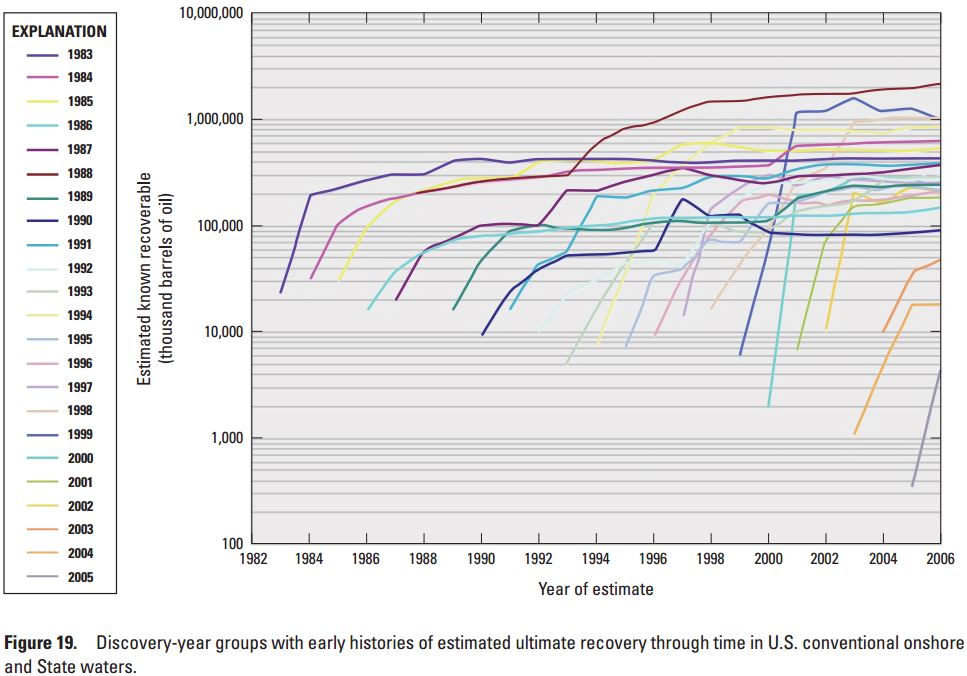

A report on US Reserve Growth

The two charts below are from a 2013 USGS publication: Reserve Growth of Oil and Gas Fields—Investigations and Applications. This report is all about reserve growth in the United States. I would suggest that all who are interested in reserve growth in general, and US reserve growth in particular, take a look at it.

The chart above is on a logarithmic scale so it is a little hard to figure actual reserve growth. But the most important thing to take away from it is that most of the reserve growth is in the very first few years. Also notice in the above chart that the more recently discovered fields are getting a lot smaller.

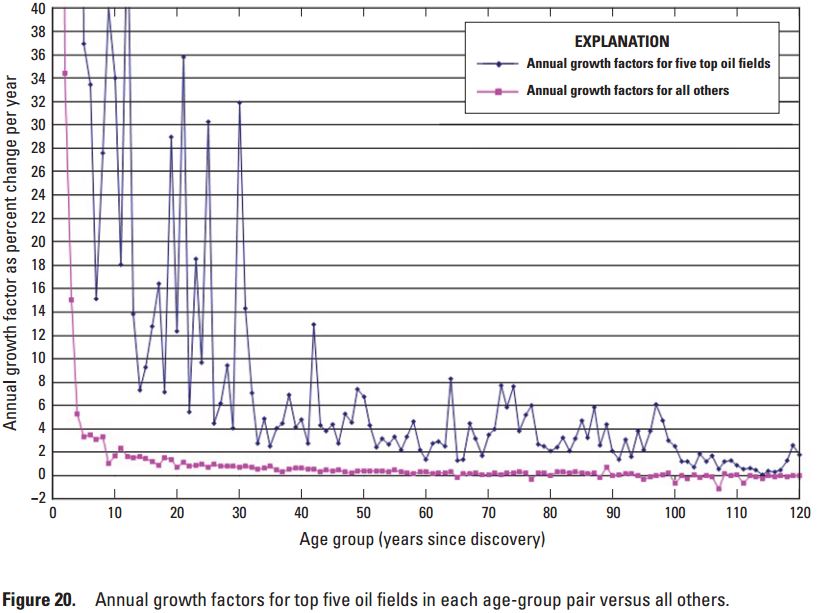

In the US, the top five fields have considerable reserve growth. The rest of the group, after the first five years, have almost none at all. It is obvious that companies have a tendency to ramp up small fields to their actual reserves far sooner than they do their larger reserves.

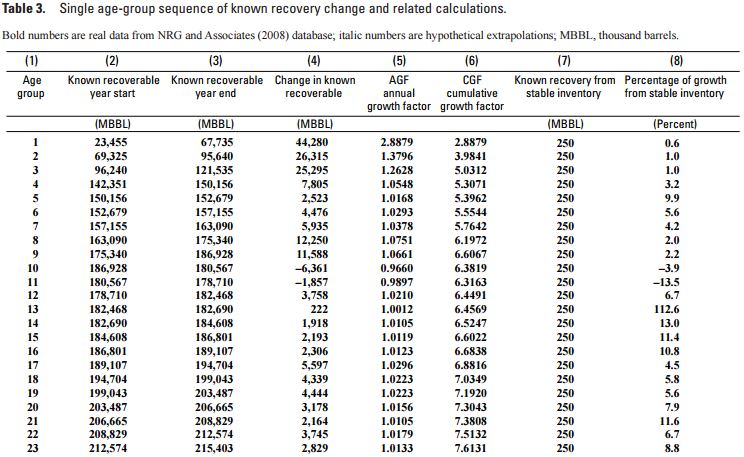

And be sure to take a look at Table 3 It gives conclusive proof that reserve growth is something that happens to young oil fields. Old fields, even those in the US, if they grow at all, grow very little. And sometimes they even shrink.

_______________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne at gmail.com

Ron: The Russian fields have a unique exploration/appraisal/development sequence. I worked on a project meant to “prepare” one of those giant fields you list for development approval, so I´m fairly familiar with the way the Russians did it.

The Soviet system had a large disconnect between the exploration and early appraisal phase (carried out by a separate exploration organization), and the eventual set up for approval by what I´ll call “The Commission”. This means the reserves would grow slowly as the fields were appraised, but the final number introduced into the official books was the result of a development proposal, an official document which required the use of “accepted” development patterns and recovery factors.

Neither the reserves nor the development plan submitted for approval had much economics input. To make matters more complicated, the teams preparing the proposal were isolated from the field organizations (which had separate field facility construction, operations, and drilling structures). I don´t want to get into the details, some of which changed over the years (and which I learned by working with Russians who advised me on how to prepare documents for use by their commissions).

In conclusion, the Russian reserves, as booked when the field went on stream were established following diktats and rules which ignored economics to a large extent. What kept those reserves from being booked down was the tendency for oil prices to increase, as well as the technology we imperialists brought in during the 1990´s and 2000´s (a lot of the work we did was shamelessly copied, sometimes it was stolen, we wasted a huge amount of time and money trying to get in, and a lot of that involved a fairly stupid approach: we gave knowledge away for free).

Fernando,

Please correct me if I am wrong, but I understood one of the major reasons for reserve growth/production increase, once the Russian fields were opened up to western technology was the introduction of gravel packing and sand control. I understood the Russians had a hell of a time sand control, and would produce until the well sanded out then abandon.

I also heard a few funny stories where ESPs were suppose to have been installed into wells, and when the western companies went to work them over, they found no ESP on the end of the tubing Apparently it was easier to make quote with no pump on the end to slow you down, lol. Not sure if it affected production much or how wide spread, but it does illustrate some of the conflicting goals in the Soviet system?

For those who don’t understand oil field jargon, ESP is electrical submersible pump.

Tool push, we found all sorts of problems. Russians are really smart, but they had very little knowledge about economics, were tied up in knots by a surreal bureaucracy, and the culture rewarded very submissive behavior towards superior.

This seems to be a natural outcome of communist dictatorship. My dad was an MD in Cuba, and my mom ran a children’s hospital department. They reported the same problems and the imposition of this behavior by communist party apparatchiks.

I saw the same problem in Venezuela as the Cuban presence and way of thinking began to be imposed. The Chinese too suffer from this problem, but they have sent hundreds of thousands of management or senior personnel to study abroad, so at least they realize they have it, and they overcome it in part by being smart and using very structured logic.

The Russians suffered from huge problems all over the place. They had no idea of how to run oilfield operations to optimize downtime, they rewarded heavy oil production, vented a huge amount of rich gas, drilled like turkeys, killed and maimed the workforce, and had very little exposure to computers and commonly used software. Their down hole tools were shoddy, they didn’t know how to do a clean completion, and on and on and on.

But they learned pretty fast. Ten years after the fall of the Soviet Union they were performing much better. But I wouldn’t let a Russian company operate offshore anywhere in the world.

This seems to be a natural outcome of communist dictatorship.

This problem is 100s of years old. The authoritarian/submissive peasant culture is ancient, and very, very hard to change.

Yes. We could say communist autocracy enhances the atavistic and repressive aspects of human nature. But I don’t see college and high school professors advocating a return to medieval times. They do advocate communism quite openly and are very repetitive teaching this message in our local public schools. On the other hand we don’t see right wing or hyper religious brainwashing (which I also consider a serious threat).

They do advocate communism quite openly and are very repetitive teaching this message in our local public schools. On the other hand we don’t see right wing or hyper religious brainwashing (which I also consider a serious threat).

This sounds like stuff being put out by right wing media. While as a group educators then to be more liberal than conservative, they aren’t teaching communism unless it is the topic of the course or they are exploring various economic systems.

And there are definitely examples of right wing and religious teaching in classes. Stories come up regularly.

There’s no need for me to document all the examples, but your view of the American educational system is not based on fact.

But I keep coming back to this. The US has been “fighting” communism for a very long time. We’ve spent a lot of money to do so.

What exactly do you think the US is supposed to do that it hasn’t done for a very long time? Do you want the military to be stronger? Do you want to establish a police state so that we know even more about what everyone is doing? Do you want every citizen to take a pledge that they are not communists?

How much money do you want the US to spend and how many freedoms should we give up to fight communism to your satisfaction?

I believe Fernando is talking about Spain which is where he currently lives unless I am mistaken, rather than the USA, although he lives here part time , or used to, as best I can tell.

It is very common for teachers in any country to promote their own political agenda. I know, I used to be a teacher myself. There are a million ways to do it , some blatant , some subtle.

Okay. If he is talking about Spanish schools, I know nothing about those and can’t comment about them. And sure, I wouldn’t be surprised if there is more communist sentiment in some European locations than in the US.

I took a class in Madrid once, taught by the mayor. If I recall correctly, he was a communist.

Of course, that was soon after Franco, and Franco could radicalize anyone…

This place is a little weird. The Center Right controls the community, but schools are taken over by communists. I work with high school students helping them with electronics and programming projects, so I get to hear the incredible loads of bs and pure lies they get from their teachers. I give them counter arguments, so it’s getting pretty interesting.

“Russians are really smart, ….”

Have produced many world chess champions.

Cuba produced more chess world champions than Russia on a per capita basis. But I don’t think we are unusually smart.

Personally I think intellectual horsepower is about equally distributed among all people all over the world.

But some societies tend to push people into certain intellectual pursuits. If you have little or no money and few opportunities to spend that little bit, and limited access to books and libraries etc, then you are much more apt to take up a game such as chess than somebody living in a place with more and more varied intellectual and recreational opportunities.

Once the game is popular in a given neighborhood this popularity will be self reinforcing.

So while TALENT may be equally distributed, probably five or ten times as many Cuban kids percentage wise play chess compared to American kids.

We Yankees will probably always dominate a sport such as basketball at the olympic or professional level because it is so popular here and we are so numerous.

But if the game were to become as popular in China or India as it is here …. teams from those countries would probably dominate.

I don’t agree. Face it, West Africans dunk much better than white folk, Eskimos are shaped like medicine balls, and Finns are terrible at break dancing.

Hi Fernando,

In case you have not noticed American professional basketball players can pass for West African ninety five percent of the time on the basis of a quick photographic comparison.

Probably no less than four or five million young black guys in this country play basketball on the street and in organized leagues every day. Since basketball is very popular here but is not very popular in Africa we will continue to dominate in basketball.

Russia and Cuba will continue to dominate in chess so long as chess remains extremely popular in these countries as compared to other countries.

If the Chinese ever take up chess en masse forget about ever seeing a Russian or Cuban champion from that point forward beginning about ten or fifteen years later.

It’s just a numbers game.

If the Russians are as bad of operators as what you and toolpush say they are — as backward and incompetent — and there is a “lack of capital investment for improved reservoir management and production technologies” as the USGS says, then it seems like there is a lot of room for improvement here.

There could be a lot of upside potential in the West Siberian oil fields.

Glenn,

My comments up above refer to the pre 1991 times. Some 24 years ago. You may have noticed Russian oil production had increased a significant amount since then. So yes you were correct, there was a potential for large production increases. The trouble is most of those easy gains have been made, so either find more oil, or production has the potential to fall.

Toolpush says:

“My comments up above refer to the pre 1991 times. Some 24 years ago. You may have noticed Russian oil production had increased a significant amount since then”

You are wrong. Oil production was rising until late 1980s. It started to decline in Gorbachov’s times and plunged during the so called “liberal reforms” in the 1990s. It recovered over the past 15 years, but is still below the Soviet time record

Russian oil production (incl. NGLs)

Source: BP Statistical Review of World Energy

No kidding. The Soviet peak had a youthful Samotlor and other West Siberian fields. The climb to 10 mm bopd in recent years was due to western know how and higher oil prices. Or are you claiming soviet technology was equal to ours? Even today they remain behind us.

To “ours”?

What a touching testament from someone who is apparently oblivious to how the oil business works.

The transnational service companies who own and control this technology have no totems, taboos, crosses, steeples, mosques, races, armies, flags or nations. They will work for anyone who has a checkbook.

AlexS

OUCH!

Knockout punch!

It looks some folks in this neck of the woods allow politics to take factual reality and turn it on its head.

AlexS

I have taken your graph and indicated on it the changes of ruling regimes in Russia. As one can see, the correlation between politics and oil production is unmistakable.

Glen,

Thank you for making my point

Soviet period, found easy oil but could not produce for very long and were in steep decline before attempted coup.

Yeltson, chaos, no support from anywhere

Putin, Stabilization, access to western technology, increase in production!

Glenn Stehle,

thanks for that

toolpush,

The rapid growth of the Soviet oil production in the 1970-s – early 1980s was indeed due to the development of Samotlor and other fields in West Siberia discovered in the 1960s. In normal conditions, this growth would be followed by a long plateau, but in fact production dropped due to disastrous “reforms” and terrible mismanagement of the oil industry and the whole Russian economy during the 1990-s.

The rebound since 1999 was mainly due to improved management, although the use of Western technologies obviously played an important role. As regards the contribution of oil prices, I should note that the most rapid growth occurred between 1999 and 2005, when oil prices were not as high as more recently.

AlexS,

They say a picture is worth a thousand words, and I’d say that’s true of one coming out of Moscow this morning, included below.

On the left is Venezuela’s president Nicolás Maduro. Venezuela has the world’s largest oil reserves. In the center is Russia’s president, Vladimir Putin. If we combine oil and natural gas, Russia is the world’s largest oil and gas exporting power, surpassing even Saudi Arabia. On the right is Xi Jinping, China’s president. China is the world’s largest industrial power.

As the NY Times reports this morning, there are lots of new energy deals in the works:

China has also loaned Venezuela tens of billions of dollars, and says it will continue to do so in the future:

Oil, geopolitics and geofinance are all connected at the hip, and exploring the interplay between the three, and especially how peak oil affects the interworking of the three, is for me at least as interesting as all the colapsnik theorizing of the neo-apocalytists.

***Well as frequently happens, I couldn’t get the photo to post, so here is a link to it

http://i.imgur.com/WEQ5Es2.jpg

And this photo, when juxtaposed next to the one above, shows just how much things have changed since the 1990s:

Alex,

The drop in production started in 86/87, while the soviets were in full control and no hint of coups. So you are saying it was the Soviets that mismanaged the fields?

I believe my little stories up above about sand control and ESP would have me agreeing with you.

The lack of a long plateau for these super giant fields also fits my story of sand control issues.

The Yeltson years were just waste, and I think we will all agree on that, but the drop in production was well on it way before Yeltson turned up in Moscow on his tank at the White House.

As does this photo:

http://i.imgur.com/v5mTQHE.png

My comments refer to what we found in the 1990’s in the former Soviet Union. They’ve improved a lot, but it takes a couple of generations to change things like safety culture.

Fernando,

I think a few folks, are having a hard time splitting the difference between the soviet regime and the Russian government, and are unwilling to take the word of people that actually worked in these areas?

I think I’ll take AlexS’ empirical evidence over your and Fernando Leanme’s anecdotal evidence.

The proof, after all, is in the pudding.

And needless to say, anecdotal evidence is one of the most useful rhetological prescriptions in the spin doctor’s medicine bag.

Hi Glenn,

The Russians themselves believe that out put in Russia will peak soon. Ron has references expert reports that say as much. Do you note the change in slope on AlexS’s chart? Russian output may not have peaked yet (data is often revised, and different data sources often do not agree), do you believe that it will never peak? I think they may be able to maintain a plateau for a couple of years if oil prices are high an then there will be a slow decline. There is the possibility of an LTO surge at some point, but I doubt it will happen as quickly as the US ( and maybe not at all). Remember that an extra 30 Gb out of a total resource of 2800 Gb does not move the needle much.

Don’t put too much faith in EIA resource estimates(remember the Monterrey LTO estimates?), the USGS is much better.

Are you arguing that only geology determines when peak oil will occur?

I would argue it’s a little bit more complex than that. Here are four factors which I think are important when it comes to determining production rates, reserves and reserves growth:

And, while I’m pretty sure we’ve reached peak conventional (read “cheap” oil), I’m not touting that as sure truth.

For instance, what would have happened if the neocons would have pulled off the Iraq War as they had planned? Iraq ostensibly has massive untapped conventional oil reserves which could have been brought on line, completely changing the global oil supply picture:

For me, there’s a little bit more going on in the world than the “intellecutal snobbery” and “creeping expertism” of “the culture of technical control,” as Daniel Yankelovich put it.

Yankelovich laments that “The dominant mind-set of the culture stresses information, not judgment,” as if information, without judgment, is enough.

And then when you get the information wrong, as Fernando Leanme and toolpush do, then the situation is just hopeless.

Glenn, that Iraq has that much oil and will produce 8 million bpd is more than just a myth, it is the biggest crock of shit that mainstream media ever bought into.

Ron,

That very well may be true. But then it may not be true.

When the National Energy Policy Development Group (NEPDG), also known as the “Energy Task Force,” drafted the National Energy Policy (NEP), commonly known as the”Cheney Report,” back in 2001, it relied on studies conducted by the Department of Energy.

The Cheney Report included a map which shows oilfields, pipelines, tanker terminals, and refineries, and includes eight “blocks” for exploration near the border with Saudi Arabia. Iraq has been proven to have the second-highest amount of oil reserves of any nation in the world, next to Saudi Arabia. And, this is without exploration of the eight blocks near the Saudi border—a vast area that is at least one-third of the country—which could make Iraq number one in terms of proven reserves.

Here’s a link to the map included in the Cheney Report:

http://i.imgur.com/7JJt7uY.jpg

As far as I know, the political situation in Iraq still remains unstable and these blocks still remain unexplored.

Hi Glenn,

No I have never said that only geology will result in a peak, there are many factors, the primary ones are geology and the price of oil which is determined by the interaction of income, politics, and technology develoment and its application. Actually nobody that commonly posts here at peak oil barrel has ever argued that the peak will be determined solely by geology.

What you will not hear me arguing is that oil output can continually increase until 2040 and beyond and that that there are no geological or economic contraints. Resources are not unlimited.

Dennis Coyne,

I left out one very important factor: technology.

In the end though I do agree that geology will have the last say. (Geez! I’m beginning to sound like Bertrand Russell’s Free Man’s Worship now: “…omnipotent matter rolls on its relentless way. For man…it remains only to cherish ere yet the blow falls, the lofty thoughts that enoble his little day, proudly defiant of the irresistible forces which tolerate for a moment his knowledge and his condemnation…, the world that his own ideals have fashioned despite the trampling march of unconscious power.” In repentence I’ll have to do three Hail Marys tonight to Immanuel Kant to ask him for his intercession.)

But in the interregnum, which I don’t know how long will last, these other factors will come into play.

Hi Ron,

My takeaway from the second USGS paper in your post is very different. While it is true that for most fields the reserve growth occurs over the first few years after production, the more interesting point is that only a very small percentage of US oil and gas fields are responsible for most of the reserve growth.

From the paper(page 24):

Of all oil fields discovered prior to 1982, 256 (3.1

percent) accounted for 75 percent of gross oil reserve growth

between 1982 and 2006.

and (p. 27)

Reserve growth ultimately ceases when the

final field within any given group changes from having an

inventory profile to a PRR approaching 0.

The”inventory profile” is a situation where reserve growth is equal to output so the the remaining reserves remain stable, the point is that this cannot continue forever, eventually these high reserve growth fields will reach their geological limit. No estimate is offered for when this might occur, but the author seems to caution against the myth of infinite reserve growth.

Thanks Ron, a very interesting paper.

Reserve growth stops when we can’t find anything else we can do, and the field performance doesn’t justify any more increases (I’m referring to proved plus probable or P50).

There are some odd ball cases. For example, let’s say you have an offshore field producing a water drive reservoir, the estimate recovery factor to the economic limit is 56 %, and you can’t justify drilling nor sidetracking. If oil prices are more or less steady you may see reserves go up a teensy bit at the end as you keep producing the field below the economic limit just to avoid incurring the abandonment costs.

Hi Fernando,

When you suggested 25% reserve growth, was that 25% of total reserves or 25% of remaining reserves?

Dennis, remaining reserves. I think the figure is dropping for two reasons:

1. Fields are getting older. As you know, it’s hard to find reserves in older fields. I can go over the reasons why this happens but I suppose they are evident to most readers.

2. An increasing fraction is found in OPEC, former Soviet Union and other nations with a more aggressive approach than the SEC imposed definition.

For example, I know Venezuela’s reserves are in trouble (remember the bit I wrote showing reserves at changing prices?). I also believe Iraqi and possibly other Middle East reserves are already booked to the max.

Hi Fernando,

What is your take on OPEC reserves? From my perspective we don’t really know what has happened to OPEC reserves since 1980, when they were probably 1P reserves based on SEC regulations.

Perhaps you have access to databases that show something different.

How does the UK compare to the US regarding the approach to reserves? For the UK, since peak, the ratio of 2P to 1P has been about 1.75, an there has been significant reserve growth over the 1999 to 2013 period, based on remaining 2P reserves.

25% seems pretty low, given that the US (based on an estimate of 2P reserves using the UK 2P/1P ratio and excluding new discoveries) reserve growth from 1977 to 2006 was about 75% of remaining 2P reserves.

My takeaway from the second USGS paper in your post is very different.

Different from what? Everything you stated was exactly what I stated. Most reserve growth occurs in the first few years. Only a small number of fields is responsible for most of the reserve growth. (figure 20.) And reserve growth ceases in old fields.

You have just made my case. Thanks.

Hi Ron,

You said the following about the second paper, specifically:

And be sure to take a look at Table 3 It gives conclusive proof that reserve growth is something that happens to young oil fields. Old fields, even those in the US, if they grow at all, grow very little. And sometimes they even shrink.

If that seems like what I said, then we don’t speak the same language.

Yo said: While it is true that for most fields the reserve growth occurs over the first few years after production, the more interesting point is that only a very small percentage of US oil and gas fields are responsible for most of the reserve growth.

Which are two points that I made very clear in my post.

And everything in the paper points to the fact that reserve growth declines with age. That is the one point you seem to want to deny the most.

I think we speak the same language.

Hi Ron,

I think we are talking about different papers, you linked to two papers, I was referring to the second paper, which says that about the majority of fields (that reserve growth happens early), the important point is to look at that minority of fields which behaves differently and is the main point of the paper. Did you read the whole 2nd paper, it is actually much more interesting than the first as it covers ground I was not aware of, the first paper was pretty standard stuff and was not surprising or new to me.

Fernando says

as well as the technology we imperialists brought in during the 1990´s and 2000´s (a lot of the work we did was shamelessly copied, sometimes it was stolen, we wasted a huge amount of time and money trying to get in, and a lot of that involved a fairly stupid approach: we gave knowledge away for free).

In the U.S., we put billions of dollars into improving the technology of shale oil. But when shale oil is over, you will come to us with their technologies. Why should we reinvent the wheel a second time. 🙂

Exactly. I play chess. Most company managers play poker.

As previously noted, Russian net exports, after showing a strong increase, e.g., increasing from 5.0 mbpd* in 2002 to 7.2 mbpd in 2007, have been flat to down since 2007 (at or below 7.2 mbpd, through 2013, the 2014 data are not yet available).

Their ECI Ratio (ratio of production to consumption) fell from 3.7 in 2007 to 3.2 in 2013. At an ECI Ratio of 1.0, net exports = zero.

*Total petroleum liquids + other liquids, EIA

This is off topic but will throw some light on the way the CHINESE government functions. I am about as far from a commie or socialist as anybody but nevertheless I do recognize that a COMPETENT authoritarian government, one run by and advised by scientifically capable advisors, can in some cases get things done in a hurry that just don’t get done at all by a democracy – or at least , get delayed in a democracy until the point of crisis.

The Chinese government is obviously competent viewed from just about any point of view – internal stability, maintaining itself in power, economic growth , etc. It is true the country is very badly polluted and has gargantuan resource problems, but no other government would likely have done any more any faster to solve these problems.

Read this link from Fernando’s personal blog for insight.

I cannot vouch for the accuracy of any particular detail since I am only poorly acquainted with Chinese history but he obviously understands a great deal about the internal workings of the Chinese government.

And whatever the Chinese government does is going to have an enormous impact on the peak oil issue and the fossil fuel resource issue in general as well as the environmental issues.

http://21stcenturysocialcritic.blogspot.com/2015/05/sons-of-heaven.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+21stCenturySocialCritic+%2821st+Century+Social+Critic%29

For what it’s worth, I thought readers of this blog might find this interesting, found at Yahoo Finance via Oilprice.com:

The Return Of Peak Oil – Worrying Signs From U.S. And Russia

“Since around 2005 many countries have increased their oil production but more have decreased. But the combined production of the United States and Russia have kept the world on a slight uptrend since that time.”

Sound familiar? It should, since it is the opening sentence of Ron’s previous lead post. Yup, that lead post is reproduced in it’s entirety on the Yahoo Finance web site, which cites Oilprice.com as it’s source. Over at Oilprice.com the article can be found at the following link:

http://oilprice.com/Energy/Crude-Oil/The-Return-Of-Peak-Oil-Worrying-Signs-From-U.S.-And-Russia.html

At Oilprice.com they have a short bio on our esteemed host and the same page that hosts the bio also has a list of other articles by Ron and lists him as a “Contributor since: 24 Oct 2014”. So while Ron’s articles have been appearing over at Oilprice for a few months now, this is the first one I’ve seen picked up by Yahoo Finance, a web site I consider to be a fairly mainstream financial news source and my financial news site of choice.

Since I think we can all agree that this site is not a place for the “happy news” and the msm generally tends not to favour the “doom and gloom” found in these parts, I find this interesting. Is it that, since the overwhelming deluge of happy stories about abundance and American energy independence, has given way to the reality of falling rig counts, massive layoffs in the oil patch and boom towns going bust, there is now a search for the truth?

Island boy

No.

USGS said:

Ron Patterson said:

Let me play devil’s advocate here.

Don’t we need more information before we can conclude that “Old dying fields, like old dying men… do not grow”?

What sort of recovery methods have these fields in Western Siberia been subjected to? Only primary recovery? Secondary recovery? Tertiary recovery?

As the graph below of historical oil production from the Wasson San Andres Field shows, the oil production rate was greater during secondary recovery than it was under primary recovery.

Under primary recovery, it peaked at 50,000 bopd.

But under secondary recovery, it peaked at more than 3x this, at more than 150,000 bopd.

So it seems like more information about these fields in Western Siberia would be needed before any conclusions can be drawn as to what their future production potential, and reserve potential, is.

► Well, I couldn’t get the image to appear as part of the comment, either in jpeg or gif format, but here is the link to the graph:

http://image.slidesharecdn.com/gccsi-fundamentalsofeor-english-140710025222-phpapp02/95/webinar-fundamentals-of-co2-enhanced-oil-recovery-english-12-638.jpg?cb=1404994507

Glenn: when we look carefully at the plot you linked, we can see the primary peak took place when the U.S. was the world’s top oil producer, and Texas used production controls. The second peak took place in the 1970’s, when prices increased and OPEC implemented its boycott, etc etc.

I have spent years reviewing water flood and EOR projects. With very few exceptions, secondary recovery projects fail to take a field to an earlier peak. The exceptions are associated with badly mismanaged fields, or a major discontinuity such as a government change which introduces lower taxes or other reforms.

Regarding Russia, I suggest you read the comment I wrote above.

What you say might have a small grain of truth to it, but it is obvious from looking at the graph that peak primary production, under Texas Railroad Commission (TRRC) proration orders, occurred in 1946 at about 50,000 bopd.

Furthermore, it can also be seen by looking at the graph that primary production declined on a straight-line curve from 1946 until 1963, at which time secondary recovery was initiated. In 1963 primary production had declined to only about 10,000 bopd, or in other words, surely way below what was allowed by the TRRC.

If secondary and tertiary recovery had not been implemented, then primary production would have proceeded along that linear decline curve, and this field would have been out of business a long time ago.

But, thanks to secondary and tertiary recovery methods, the Denver Unit is still, even to this day, making almost 25,000 bopd. We’re talking more than 50 years after secondary recovery began, and from a starting point of only 10,000 bopd, with a 150,000 bopd peak in between.

There has been and will be far more oil recovered from this unit using secondary and tertiary methods than what would have ever been recovered using only primary methods.

And as far as your claim that the peak in primary production in 1946 was caused by a TRRC proration order, can you show me what the TRRC allowable was in 1946?

The Denver Unit was developed using fairly primitive techniques, when the state was under proration. This means it was never developed under primary as it would have been developed under 1970’s conditions.

I have 40 years engineering experience in the oil industry. Let me make a suggestion: grab the reservoir properties at initial conditions, introduce them into a nodal analysis program, and estimate initial well rates at 200 psi flowing tubing pressure (assume you have 7 inch casing and 3 1/2 inch tubing). Divide the ooip by area, multiply by 80, that’s your ooip per 80 acre unit. Assume 15 % recovery factor. Estimate the total number of 80 acre units. Multiply the number of 80 acre units by the IP per well at 200 psi back pressure. That’s your field potential under primary.

Fernando Leanme said:

And from what you, toolpush and the USGS are saying, so were the oil fields in Western Siberia.

If this is true, then there might be a great deal of potential to greatly increase production from those fields, just like there was in the Wasson Field.

It is true. If you wish I can explain why I used the term “primitive”. Russian fields are a bit different. It’s hard to generalize in such a vast nation.

One problem I see in Russia is the environment, which is much tougher than west Texas. The other problem is the lack of cheap CO2.

Dont embed pictures, post links. Life is easier.

The Wasson was developed on 40 acre spacing, not 80 acre. As Fernando stated, the reason for the low primary peak was the low production quotas from the RRC. The peak in the mid 70’s was the max economic rate the field could produce under secondary production. The peak of the Denver Unit plus the other 6 units in the field (there used to be 7 total, not sure how may there are now) was something like 250 mbopd. A rule of thumb I’ve always seen for San Andres fields in the Permian is 15% +/- 3% for each phase of production. The Wasson also has a >1BBO TZ/ROZ which is currently being CO2 flooded as well. The EUR that I have seen for the field as a whole is 2.1 BBO from the main pay or 52% or OOIP, with 14% of that being tertiary.

MBP, I suggested 80 acres to account for the well sequencing. My guess is that, if we had been planning the development with Woody Craig’s SPE monograph on Waterflooding the field would have been designed to produce 200,000 BOPD, and water injection would have started within the first five years of field life.

Hi Ron,

Great job!

One thing that is different in this analysis is the use of “total reserves” rather than remaining reserves.

If we use remaining reserves the growth is much more significant.

As a simple example, the USGS in 2000 published a World Petroleum Assessment where Technically Recoverable Resources of conventional oil (which excludes extra heavy oil from Canada and Venezuela) was estimated at roughly 3 trillion barrels, of this total about 600 billion barrels was expected to be reserve growth, 550 Gb was newly discovered oil (not yet discovered), 850 Gb was cumulative output, and about 1000 Gb was proved plus probable reserves.

In this case remaining reserves are 1000 Gb and total reserves are 1850 Gb, and if the 600 Gb estimated reserve growth was correct of we use remaining reserves, reserve growth would be 60% and if we use total reserves reserve growth is only 32%.

Also using Jean Laherrere’s 2013 estimate for World 2P C+C less extra heavy oil(XH) reserves of 850 Gb plus cumulative C+C-XH output of 1100 Gb, we have total reserves of 1950 Gb. Let’s bump up Jean Laherrere’s discovery estimate by 20% to 300 Gb, if we add this to 1950 Gb we get 2250 Gb for total expected oil reserves, my guess for eventual C+C-XH URR is 2800 Gb so there would need to be 550 Gb of reserve growth which is 24% of 2250 Gb.

For the USGS estimate a similar calculation would give 600 Gb/2400 Gb=25% reserve growth.

A more detailed analysis would take reserves added to producing reserves from the oil shock model and an equation similar to that derived in the poster (using Western Siberia as a conservative estimate for the World) to estimate future reserve growth. In that case I would reduce the shock model to the 2200 Gb estimate of Jean Laherrere to see how the reserve growth plays out.

Dennis, we do use remaining reserves. We use remain reserves + cumulative production. That is what total reserves are. Remain reserves began to decline when the first barrel was produced. And remaining reserves decline with every barrel produced.

My point of this post is: “Reserve Growth is something that happens in the first decade or so of newly producing oil fields. There is some growth after that but it is so little it can largely be ignored. Or at least that’s what the USGS data shows.

Hi Ron,

And my point is that even a small amount of growth can make a big difference over time.

In fact if you use the 5th through 19th year (flat) estimate for Western Siberia (all data) and apply it to 2000 Gb for 30 years you get 300 Gb of reserve growth, if the curve is extended to 70 years the total reserve growth is 500 Gb.

This does not mean there will not be a peak, the reserve growth will just help reduce the rate of decline in overall oil output.

This also makes me wonder if Fernando meant growth in total reserves when he suggested 25% reserve growth, if so I agree with that estimate. (A comment by Fernando in the last post concerning reserve growth.)

Hi Ron,

The EIA has fairly detailed reserve data. I estimated 2P reserves by multiplying proven reserves by 1.75 based on UK reserve data (which gives both 1P, 2P, and 3P reserves).

I deducted new discoveries from each year of data from 1977 to 2013 so that only reserve growth is shown in the reserves from 1977 to 2013. The cumulative average growth rate from 1977 to 2006 is about 1% per year, this period was used to eliminate the gain in reserves from the LTO plays from 2007 to 2013. Even though 1% per year does not sound like much it adds up to 61 Gb over 30 years.

Hi All,

In the table above and in the comment I mislabelled the Annual Growth Factor (AGF) as the cumulative annual growth rate. This right hand column is analogous to column 5 in table 3 at the end of Ron’s post. The 61 Gb of total reserve growth from 1977 to 2006 is on an initial total reserves of 170 Gb, so about 30% reserve growth over a 30 years period. On average the fields in the US are not very young, so even though old men don’t grow taller (they often gain a little mass), old oil fields do seem to grow.

Old oil fields don’t grow and young oil fields don’t grow. What grows are estimates of recoverable reserves. And those estimates are highly regulated by the U.S. Securities and Exchange Commission.

Guidelines for the Evaluation of Petroleum Reserves and Resources

U.S. Securities and Exchange Commission (SEC)

Historically, the agency that has had the most influence in setting standards for external reserves reporting has been the U.S. Securities and Exchange Commission (SEC). With the agency’s widespread influence, the SEC definition of proved reserves has become the standard used by most publicly held companies for external reporting purposes. The SEC definition for proved reserves is as follows:

At first there is a great deal of uncertainty as to how much oil can be recovered from any given field. But as time passes estimates as to recoverable reserves get more accurate. Most upgrades of reserve estimates are made in the first few years after a field is brought on line. As the years pass increase in proven reserves, known as “reserve growth” become less and less. After decades of production and after a field goes into decline, increases in proven reserves become so small they can largely be ignored.

This applies only to publically traded oil companies. Reserve growth has been shown to be far less pronounced in national oil companies. In fact, OPEC countries will likely have no reserve growth at all but will have “reserve shrinkage” instead.

Hi Ron,

There are databases which I do not have access to that give the proved plus probable reserves, which oil companies have but are not required to reveal on the 10-k (though they are now allowed to do so as long as the proven reserve data id provided and used in the balance sheet).

EIA has all the data you need.

You do not have access to these databases but you think I do?

Nothing in either of the papers suggests that there is no reserve growth for the national oil companies. In fact many of the largest fields in the World are produced by the national oil companies and they are likely to have considerable increases in the estimated total reserves over time.

In fact if the declared reserves of OPEC nations are 2P reserves since reserves increased in the 80s, then the reserve growth has been modest in OPEC relative to US reserve growth.

Dennis pleaseeeeee. Do not even insinuate that I even suggested that national oil companies have no reserve growth. Russian oil companies, for most of their existence were national oil companies. Some of them still are. Three fourth of my post was stressing the fact that their reserve growth was primarily in the first ten years.

I have never, ever, ever stated that national oil companies have no reserve growth.

Really Dennis????

Hi Ron

read the bold part of your comment above where you said opec reserves would not grow.

Dennis, OPEC reserves are grossly overinflated. Saudi claims 265.8 billion barrels of reserves, Iran claims 157.8 billion barrels of reserves, Iraq claims 144.2 billion barrels of reserves, Kuwait claims 101.5 billion barrels of reserves, the UAE claims 97.8 billion barrels and the combined claimed reserves of all OPEC are 1,206 billion barrels.

If you think these reserves are going to grow then I think you are delusional. So let me repeat what I said above with a slight alteration:

OPEC countries will have no reserve growth at all but will most definitely have “reserve shrinkage” instead.

Hi Ron

if some large old oil fields in opec nations behave like the few (3%) oil fields in the US that are responsible for most of the reserve growth in the US you may be incorrect.

Excluding Orinoco reserves OPEC reserves are about 950 Gb if we add nonOPEC reserves we get about 1300 Gb of 2P reserves. If Fernando’s reserve growth estimate is correct that would be 300 Gb of reserve growth for the world.

Dennis, if you really believe that OPEC “just might” actually have 1,206 GB of reserves then you know absolutely nothing about the history of OPEC, why their reserves are inflated, or the historic, “proven reserves battles” that have been going on within OPEC ever since the mid 80s. And they are still going on. Iran and Iraq are still trying to “one up each other” in the ongoing “OPEC proven reserves battle”.

But if you truly believe that OPEC just might have that over 1.2 Trillion barrels of reserves, then I am truly disappointed with your knowledge of OPEC history and how OPEC actually works.

I know mainstream media has an excuse for believing that OPEC proven reserves nonsense but you don’t. You should know better.

Dennis,

Remember that in the ’80’s OPEC reserves suddenly increased a lot, after the allowed oil production was coupled with their reserves. The more reserves they stated to have, the more oil they could export. That makes those suddenly increased claimed reserves very suspect of course.

Hi Han

If 1980 reported OPEC reserves were 1P reserves and OPEC nations switched to 2P reserves for their reports by 1990 this would have raised reserves by a factor of 1.75. The small increase in reserves since 1990 if extra heavy oil is excluded is lower than US reserve growth over the same period when we use 2P reserves for the US reserve growth estimate.

Also Han, those reserves have not decreased by a single barrel since they were suddenly increased. In fact they have usually increased by a little each year.

For every barrel pumped out of the ground another barrel suddenly appeared to replace it. So they have “magic oil”. A new barrel appears in the reserves every time one is pumped out.

Hi Ron,

Reserves have been pretty flat in the US as well, and we have been producing oil in the US for a much longer period.

Now you might argue that this is because proven reserves are what is reported in the US. We can estimate 2P reserves by multiplying proven reserves by 1.75. From 1988 to 2006 reserves decreased by 10 Gb, while 41 Gb of oil was produced over those years. So about 31 Gb of reserve growth occurred on initial 2P reserves of 46.6 Gb in 1988 or a 66% increase in reserves over 18 years. If OPEC 2P reserves were 755 Gb in 1988 and these reserves grew by a similar percentage(60%) and we subtract 1988-2006 OPEC output of 190 Gb we get 1000 Gb of OPEC reserves, reported OPEC reserves were about 930 Gb in 2006, so OPEC reserves grew by about 48% over this period, considerably slower than US reserve growth.

Apologies for being off topic:

Alberta conservative Govt wiped out in yesterday’s election. This would be akin to Rick Perry losing a Texas to Jennifer Warren. I simply cannot believe it and am very heartened by the result.

Those of us out west in BC used to joke that Albertans were taught that Earnest Manning (Social Credit….right wing) actually put the oil under the ground. The right wing coalition under Social Credit and PC has ruled Aberta for over 50 years, culminating in wasteful scandals at the same time the recent oil price decline set in. Some changes were implemented and a snap election called for a so-called mandate. However, I believe the electors were offended by being taken for granted. They spoke with their ballot and decided on change.

This has HUGE implications for the Oil Sands and how revenues unfold.

http://www.cbc.ca/news/elections/alberta-votes/alberta-election-2015-results-ndp-wave-sweeps-across-province-in-historic-win-1.3062605

That’s amazing!

Have you seen the series of posts published by the Canadian blog, The Progressive Economics Forum, which charges that Canada’s conservative governement was plunging the country headlong into a staples trap?

This passage from Gordon Laxter, author of one of the posts in the series, sums up the theme explored by the series quite succinctly:

Once I saw some aerial photos of the massive operations in the Canadian tar sands, I was shocked at what was being done. If this is what getting oil out of the ground has come to, the sooner we wean ourselves away from oil, the better.

Glad to see that Canadians, too, are deciding they’ve had enough.

If I am wrong about my interpretations of the tar sands and the election, please correct me. I am speaking as an American who doesn’t know all the details.

The oil sands will continue to be produced. Use google maps and locate Edmonton and Fort McMurry.

Use google maps and locate Edmonton and Fort McMurry.

What does that have to do with my comment? I don’t get your point.

I think Glen summed it up nicely with his comments. Well said.

Yes, that’s what I got. The election is a signal that some Canadians are rethinking their ties to oil.

The oil sands will continue to be produced. Use google maps and locate Edmonton and Fort McMurry.

I don’t get what Fernando is saying with the above comment.

Boomer

There are a couple of tiny outfits operating in Utah right now that claim to be – get this – ‘washing’ the hydrocarbons out of the oil sands there using D-Limonene based solvents (fast orange type stuff).

As preposterous as it may sound, they claim to actually be producing hundreds of barrels a day with a cost under $30 per.

Dunno bout that, but it sure is intriguing.

I doubt if Canadians are “rethinking their ties to oil”. It’s More likely, they are reeling from a loss of income, due to the declining oil price.

I’m pretty sure a Left Wing Government is not going to fix the problem, any more than the Left Wing Government in Greece fixed their debt problem.

It’s More likely, they are reeling from a loss of income, due to the declining oil price.

And what happens in the US when the price of a resource goes down and there is major environmental damage to obtain the resource, some citizens decide it isn’t worth the damage and it is time to rethink it. Perhaps that is what is happening in Canada. Why rape your country’s land if it isn’t helping you out anymore?

John B says:

But that’s what being caught up in a staples trap is all about, being completely vulnerable to the boom and bust cycles of primary materials production.

The area is huge. Sort of glide over it and locate the disturbed area. It’s actually tiny. Most of the oil will be produced using horizontal wells.

I think Alberta will benefit if they slow down development to allow for costs to come down. There are also technical needs to fine tune the steam injection. And they could use a couple of upgraders.

The area is huge. Sort of glide over it and locate the disturbed area. It’s actually tiny.

So the tar sands mining won’t be expanding? That’s good to know.

But the process itself is disturbing because of what it takes to squeeze petroleum out of the dirt. If that’s what the world needs in order to feed its oil appetite, it seems to me a sure sign that we’re scraping the bottom now. And if we don’t need tar sand oil, maybe it isn’t worth going to all the trouble to get it.

http://www.pembina.org/reports/oilsands-metrics.pdf

Yes, it does disturb the surface. But the in situ should never disturb about 7 to 8 % of the land surface. And it’s not all disturbed at the same time. My guess is that at peak it may take up 3 % of the total surface.

There are two types of Oil Sands operation. Mining and SAGD (Steam Assisted Gravity Drainage). Clearly the pictures you see are from mining. The majority of the oil sands are at depths that are not mineable.

Attached is a picture of a SAGD site (It will not post, says not found). Until I figure out how to make it post, the site looks similar to a ND LTO site and is very similar operationally since it has a small footprint. SAGD uses two horizontal holes, one on top of the other. The steam is used to liquefy the bitumen so that it drains into the lower hole. It is then pumped to the surface. All new oil sand projects use SAGD because there are no new surface mineable oil sands. The aboriginal people found this stuff on the surface and used it to waterproof their canoe’s made of birch bark.

What you don’t read in the press regarding the mining operation is that once the bitumen is separated from the sand, the cleaned sand is used to refill the hole. The companies are required to return the site to a habitable form for wild life.

These are the photos I saw.

Glad to hear that this doesn’t take up much land, isn’t typical of what is being done now, and will be cleaned up when finished.

Canadian Oil Sands Flyover – Business Insider

What OVI described is typical for in situ. I think there’s a lot of propaganda and distortion going on. I don’t think a SAGD pad can be said to be pretty. But it’s not a junkyard, and it’s definitely better than a stripper or biker bar.

Obviously coal mining has been an ugly process for a long time, first with underground mines and then with strip mines.

I suppose what bothers me about tar sands, aside from whatever environmental damage might be done, is that there is so much required to turn it into useable oil. In my mind, that’s a bad sign. If this is the future of oil, I think we’re in trouble now for us even to be needing to get oil this way.

In other words, tar sand shouldn’t be considered a way to preserve BAU. It should be considered a way to transition to alternatives as soon as possible.

As I mentioned, I think a SAGD site and an LTO site in ND and Texas are very similar. The one big difference is that there is tons of date on the carbon foot print of an oil sands site because they have to pay $15/ton of carbon they produce. Not much similar info on Texas or ND.

Interesting pics.

Though some of them – related to coking – have wrong/misleading captions.

“After it’s coked, the oil is ‘cracked’ to break the heavy parts down into lighter…”

Coking is a cracking process. Heating any oil to coking temps causes some of the carbon to agglomerate out of the molecules, causing molecular cleaving and leaving hydrogen to cover the dangling bonds on the (now smaller) oil molecules left over.

http://en.wikipedia.org/wiki/Petroleum_coke

“Cracked, coked and lighter, what’s left gets send to a tower like this,

where inside it’s hotter at the top than the bottom,

forcing dense material down and lighter petroleum products up”

Sigh – the caption is over a quad delayed coker.

Hidden in the lower part at 4 large tanks (“drums”) that the coke deposits in.

The lattice structures above hold the water jet rig used to cut the coke out after a coke drum is full. (it’s a batch process, thus delayed coking units always have 2 or more coke drums.)

http://en.wikipedia.org/wiki/Delayed_coker

Looks like they burn some of the pet coke (petroleum coke, as opposed to coke made from coal) in their power plant – a few pics before, a conveyor leads up into the green building by the big smokestack – pet coke usually has a lot of sulfur in it – stinks when burned.

More on coking:

College guy: lots of pretty drawings, some pictures:

http://inside.mines.edu/~jjechura/Refining/06_Delayed_Coking.pdf

Industry guy: two black and write drawings, rest is text:

http://coking.com/wp-content/uploads/sites/2/2013/11/DelayedCokingFundamentals.pdf

The “hotter at the top…” is backward from how distillation columns work, it’s hottest at the bottom, and things go up until they reach a level where they cool and condense, then that fraction is drawn off.

http://en.wikipedia.org/wiki/Oil_refinery#The_crude_oil_distillation_unit

Better drawing of the innards of a distillation column at:

http://en.wikipedia.org/wiki/Fractional_distillation#Industrial_distillation

But otherwise, neat pics.

I supervised a combo field development and upgrader engineering concept study, and I had them give me options to use the coke to generate steam and power. We had a gasifier option, captured the CO2, assumed we could sell it to older oil field operations. We also had a plant enriching the air feed and generating a nitrogen stream we assumed we could sell to inject in older gas/condensate fields. The coke gasifier was the weak spot for the whole complex. I don’t think that thing will ever be built, but it sure was nice to look at the drawings.

What Alberta’s shocking election results could mean for the oil sands – Vox

Russia’s oil production was 43,83 million tons in April 2015, or 10.67 mbd using 7.3 barrels per ton conversion rate. That was another monthly (post-Soviet) record. Production in January-April was 175,233 thousand tons, or 10.66 mbd, up 1.2% from the same period of 2014.

The joint study by the Energy Research Institute and The Analytical Center for the Government of the Russian Federation said last year that Russian oil production had reached a peak at 523 million tons in 2013 and would gradually decline to 522 million tonnes by 2015.

In fact, Russia’s production was 526,8 million tons in 2014 (10.56 mbd).

It is true that production is increasing at a very slow rate, but it is not declining.

On Vankor field:

“Rosneft’s Vankor Oil Output May Start Declining Next Year

http://www.rigzone.com/news/oil_gas/a/137901/Rosnefts_Vankor_Oil_Output_May_Start_Declining_Next_Year

VANKOR OIL FIELD, Russia, March 30 (Reuters) – Oil output at Rosneft’s Vankor deposit, a driver of Russia’s recent oil production growth, may start declining next year, a top company official said, underlining the challenges of production in far-flung regions.

Russia, one of the world’s top oil producers, is tapping oil at a pace of 10.65 million barrels per day, a post-Soviet record-high, thanks to a ramp-up at Vankor and other new fields.

“(Vankor’s) oil production will stay at the plateau of 22 million tonnes this year, while next year it may decline slightly,” said Alexander Cherepanov, the chief engineer of Vankorneft, a Rosneft subsidiary which is developing the field.

… Vankor …has initial recoverable reserves of 476 million tonnes of oil and gas condensate,

Total reserves at the Vankor cluster, including Vankor and nearby fields, are estimated at 876 million tonnes.

Rosneft had originally envisaged Vankor to reach peak output of 25 million tonnes a year (500,000 barrels per day) in 2013. It will now do so in 2019 – and only with the help of three other nearby fields acquired with the $55 billion takeover of TNK-BP two years ago.

The fields, Suzun, Tagul and Lodochnoye, will be launched within the next few years with Suzun seen starting production by the end of next year. ”

And there are other undeveloped fields in the Vankor cluster

More definitional stuff.

Now oil fields can define “further development” as being geographical expansion. Add some nearby fields and call it part of the central one, and the central one grows its output and punch your fist into the air in celebration at just what amazing things new technology can achieve.

Speaking of definitional stuff, Watcher, how do you like this one: “reserve impairment.” Can anyone graph reserve impairments, interest rates on rolling over indebtedness and shale oil CEO blood pressure?

http://247wallst.com/energy-business/2015/05/06/how-chesapeake-earnings-overcame-a-5-billion-charge/

Reserve Impairment. haha Like “Right Sizing” vs “Down sizing”.

That’s the first explicit description of the 1st day of month averaging required that I have seen in a quarterly. Should be even lower June 30.

And let’s have a look at what GAAP and non GAAP translates to:

The oil and gas exploration and production company posted adjusted diluted earnings per share (EPS) of $0.11 on revenues of $2.76 billion. In the same period a year ago, the company reported adjusted EPS of $0.54 on revenues of $5.05 billion.

and in the next para:

The company’s took a $4.976 billion impairment charge on its oil and gas properties, largely resulting from significant decreases in the trailing 12-month average first-day-of-the-month oil and natural gas prices as of March 31, 2015, compared to December 31, 2014. After offsetting items, the company’s total net loss amounted to $3.78 billion, or $5.72 per share.

11 cents a share earnings vs $5.72 per share loss.

In their defense this is better than almost all other non GAAP games. This is a non cash loss. It should define collateral, but even that may not happen. And that loss may not happen next quarter (or it might).

As opposed to companies that pay executives money and pretend that is a non recurring event.

Any new developments in Russian shale oil? The newest one at Google News is this item from February: Russia’s Gazprom Neft says drilling results at Bazhenov positive

KLR

I thought two directionals were successfully drilled and two more horizontals with 600′ laterals were going to be attempted by this summer, but I cannot find any source for those recollections (hallucinating?).

Along the way, though, came across an excellent, timely article (April 28, 2015) in Asian Oil and Gas magazine describing the current status of the Russian oil industry.

Nice counterpoint to the discussions in this thread.

In fact, Gazprom Neft has several tight oil projects, all at very early stages of development

“Gazprom Neft Advances Shale Oil Projects

THU, MAY 7, 2015

http://www.energyintel.com/pages/eig_article.aspx?DocId=885448

Russia’s fourth-largest crude oil producer Gazprom Neft is moving on with shale oil projects at home despite Western sanctions that ban shale oil technology and equipment exports to Russia.

The oil arm of state-run Gazprom said on May 6 that the first exploration well was drilled in the deeper Bazhenov formations of its Archinkoye field in the Tomsk region. The move is part of a federally funded project to establish a R&D base in the Tomsk region to test technologies needed to tap hard-to-recover and shale oil reserves.

…….

Gazprom Neft is actively moving ahead with unconventional projects in Russia despite Western sanctions. Earlier this year the company received first shale oil flows at the Yuzhno-Priobskoye field in West Siberia, while it is also developing the Palyanovskaya area of the Krasnoleninskoye field in the Khanty-Mansiysk region. Shale oil development is also carried out at fields licensed to Salym Petroleum Development (SPD), a 50-50 joint venture with Royal Dutch Shell.

Sources told Nefte Compass that Gazprom Neft is also proceeding alone with shale oil within the Khanty-Mansiysk Oil Alliance (KMOA) joint venture, also with Shell, in which the Anglo-Dutch major was forced to freeze its activities last year because of sanctions.

Gazprom Neft Deputy General Director Vadim Yakovlev said last month that KMOA — which holds three licenses in the Khanty-Mansiysk district of West Siberia — would now focus on conventional reserves, although sources say Gazprom Neft hopes that Shell, which is now a “dormant partner,” will finally find ways to revive the JV’s initial aim of exploring and developing shale oil reserves “

Alex

Good info, thanks for posting.

With all the politics involved, I wonder if Schlumberger’s offer to ‘frac for free’, with billing to be taken out of future production would make sense for Gazprom.

coffeeguyzz,

Did Schlumberger really made such an offer?

Alex

Yes, just a week or so back at their quarterly earnings report, or possibly at CERA week?

The CEO came on fairly strongly that Schlumberger now has a suite of tools, techniques, designs that they feel can significantly enhance returns for both fracturing and, especially, re-frac’ing. All they need are wells in which to show their stuff and, with all the confidence in the world, they won’t even charge upfront for much of the work.

It sounded kinda ‘salesmanship’ type approach to me, but, hey, what’s an operator got to lose?

If Schlumberger started doing this and was successful, could have big time ramifications. (Lottsa drilled, unfrac’d wells out there) …

coffeeguyzz,

It seems that oil companies are somewhat sceptical about refracking.

“U.S. shale oil firms say refracking not the best path in downturn

http://www.reuters.com/article/2015/05/05/usa-oil-fracking-idUSL1N0XW1UX20150505

Refracking, the practice of fracking an oil and gas well a second time, is still too unpredictable to rely on as a way to slash costs and increase output during the oil price slump, top U.S. shale oil executives said on Tuesday.

Oilfield service companies, including Schlumberger and Baker Hughes, have touted refracking as a cheap way to revive output from existing shale wells.

But executives from producers say the refracking technology, while promising, remains tricky. “We have not tried any refracks. Our outlook on that is that it is really technical,” said Bill Thomas, CEO of EOG Resources Inc. “We believe that just drilling a new well, and kind of starting fresh … is probably the preferred way to go.”

Output from a new well can be easier to forecast than output from refracking.

“Right now we see that (refracking) as a good forward option,” said Chuck Meloy, the outgoing head of U.S. onshore exploration and production for Anadarko Petroleum. “We’d like to see the technology improve and get enhanced some and make it more predictable.”

Oilfield services companies, which have laid off thousands of employees and seen revenue plunge after a 50 percent collapse in crude prices since June, have talked up refracking because it would allow producers to save money on drilling, normally about 40 percent of the cost of a new well.

Pullbacks by producers will likely lead to a drop in U.S. crude production this quarter, according to government forecasts.

In Schlumberger’s first-quarter results report, Chairman and CEO Paal Kibsgaard said the company expected the refracking market to expand.

“This is quite a significant market opportunity,” he said on the company’s conference call. He added that Schlumberger was prepared to “foot the entire bill for the refracturing work, and then get paid back in production.”

Alex

The results have been mixed, but there have been at least several hundred wells re-frac’d in many different shale plays.

BHP and Marathon are doing many. In the Bakken, well results for Marathon increased almost ten fold to 10,000bbl/month on the few that I’ve seen.

Some of the early gas wells have achieved near original IP’s after refrac’ing.

Still lots to learn, I guess.

http://www.cnbc.com/id/102652027

US crude inventories fall by 3.9 million barrels

Oil prices extended gains and hit new 2015 highs as U.S. crude stocks fell last week for the first time since the week ending Jan. 2, while gasoline and distillate inventories rose, data from the Energy Information Administration showed on Wednesday.

Crude inventories fell by 3.9 million barrels in the last week, compared with analysts’ expectations for an increase of 1.5 million barrels.

Crude stocks at the Cushing, Oklahoma, delivery hub fell by 12,000 barrels, EIA said.

Gasoline stocks rose by 401,000 barrels, compared with analysts’ expectations in a Reuters poll for a 867,000-barrel gain.

Oop! They forgot a little bit of what I would call valuable information.

http://ir.eia.gov/wpsr/wpsrsummary.pdf

U.S. crude oil imports averaged over 6.5 million barrels per day last week, down by

905,000 barrels per day from the previous week. Over the last four weeks, crude oil

imports averaged over 7.2 million barrels per day, 5.0% below the same four-week period

last year

So imports of crude were down 6.3 mmbo for the week with storage down 3.9 mmbo. If imports were kept the same we would have had an build in inventory, rather than a fall. The writers of the articles didn’t think this was a relevant bit of information to be included? Very strange, unless this information affected their story line of course.

The recent increases in US imports, seems to have been from the Saudis. The current drop may also mean the Saudi aggressive exporting, maybe coming to an end?

down by

905,000 barrels per day from the previous week

And thus, reduction in consumption. By . . . a lot.

Production still increasing, per the latest from Texas.

And yet price is rising. Maybe . . . just maybe the Euro going from 105 to 112 and the GBP doing similar things reversed the yardstick for a while and maybe . . . just maybe this is more important than anything else.

0.9% first look Q1 GDP does not bespeak consumption gain, and yesterday’s trade balance report says that number is too high and will revise down. Q2 estimates are being chopped daily as data arrives.

That reduces consumption. But a weak US economy also erodes the dollar.

Look at which effect was dominant. What a coincidence. When you measure something in dollars per barrel and the numerator isn’t constant, how can you think a dollar independent analysis will say anything.

Edit . . . make that 1.13 as of a few minutes ago. Somehow printing 1 trillion euros is anti dilutive, apparently.

In euro, oil is decreasing since the maximum of yesterday (maximum since December 5). I also think oil price variations are very correlated to euro/dollar exchange rate. This is a major contribution.

Watcher,

Euro movement is just a short squeeze. Profits are being booked as all those short Euro’s exit their trades in anticipation of a Greek deal. Profits are also being booked over in the bond market as there is no need to own German bunds yielding next to nothing if Greece gets a deal.

This shouldn’t last. Give it a few day or so after the deal is reached. The ECB still has negative interest rates and is actively printing. Where the Fed is still in positive interest rate territory and is not actively printing. Only way this turns into anything more than a short squeeze is if FED changes coarse an says no interest rate hikes and more QE is on the way. Which is a possibility given some of the recent data coming out the US.

With a Greek deal in place it will be a risk on atmosphere. That’s dollar positive as Yen weakness will continue. USD/JPY has the ability to move all markets. Some more so than others but other currency pairs in particular. If China throws in the towel an unleashes their own QE which is something thats probably going to happen. That will move USD/JPY to 150.00 and send EUR/USD below parity with the dollar. I look for oil to somewhat breakdown it’s correlation with the Euro in this scenario. I don’t see oil being pulled down by the same magnitude. FED would be forced to act in such a scenario so it wouldn’t last long.

Hi toolpush,