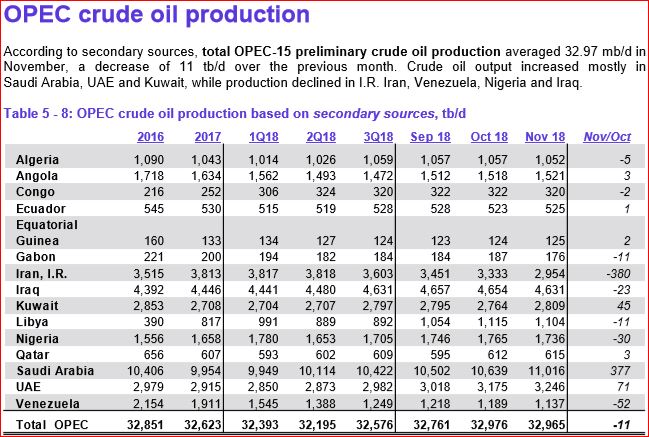

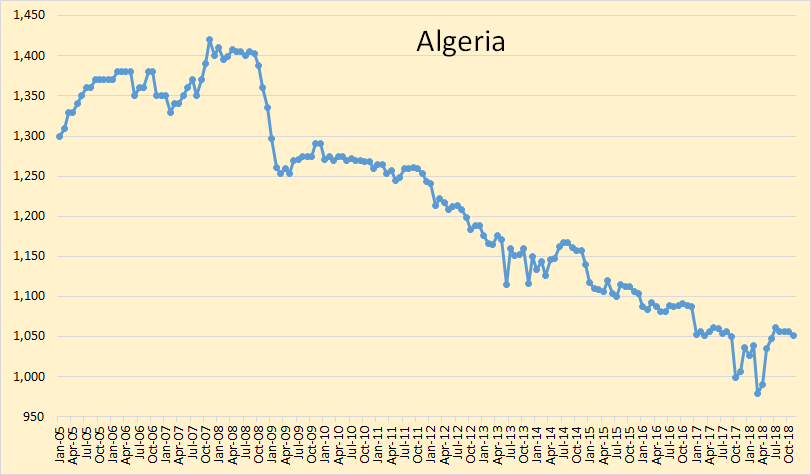

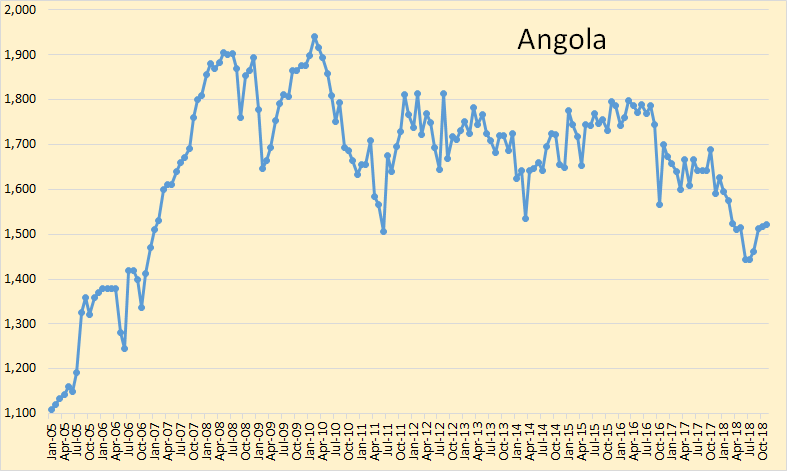

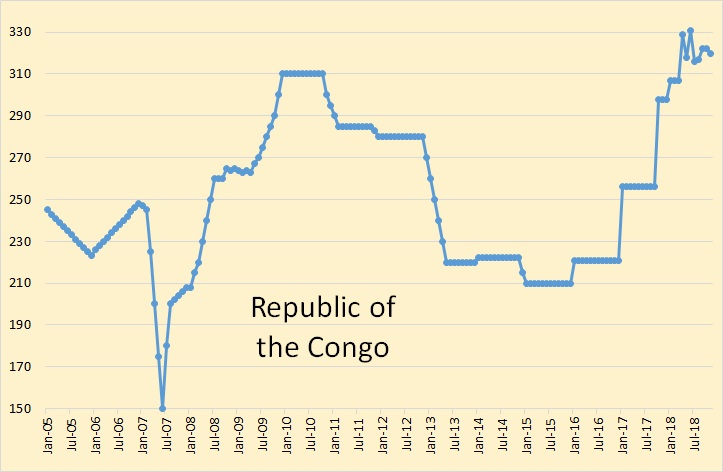

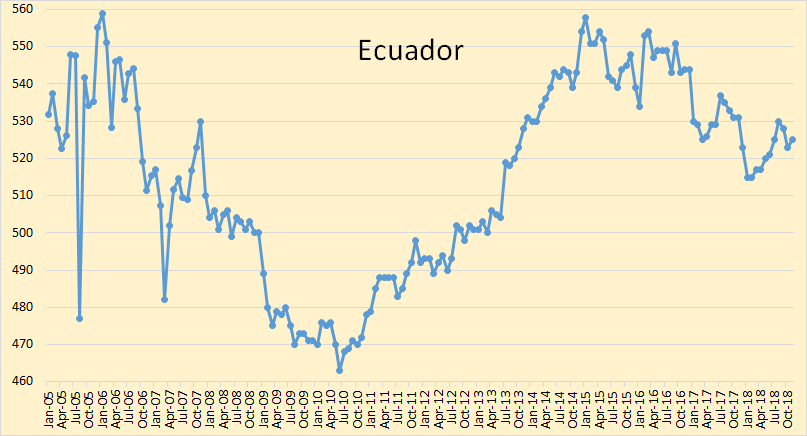

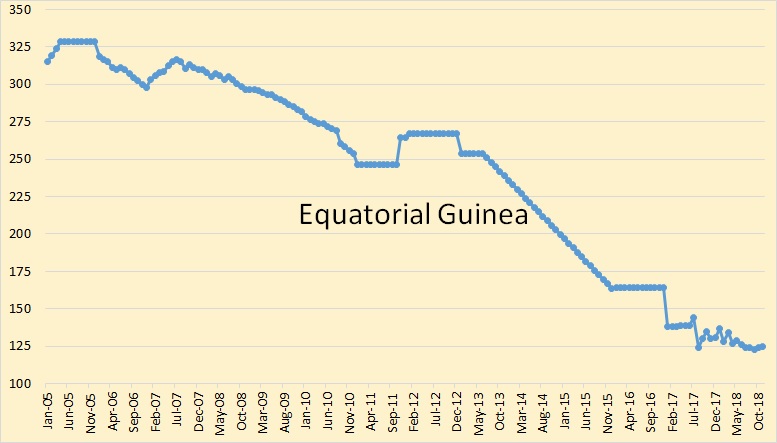

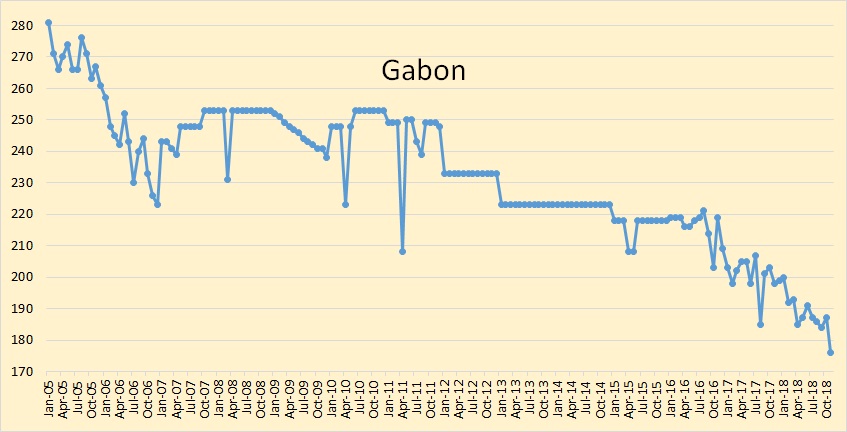

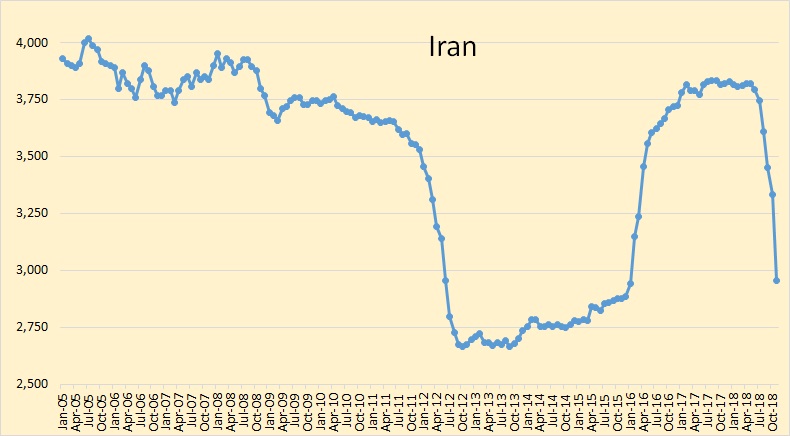

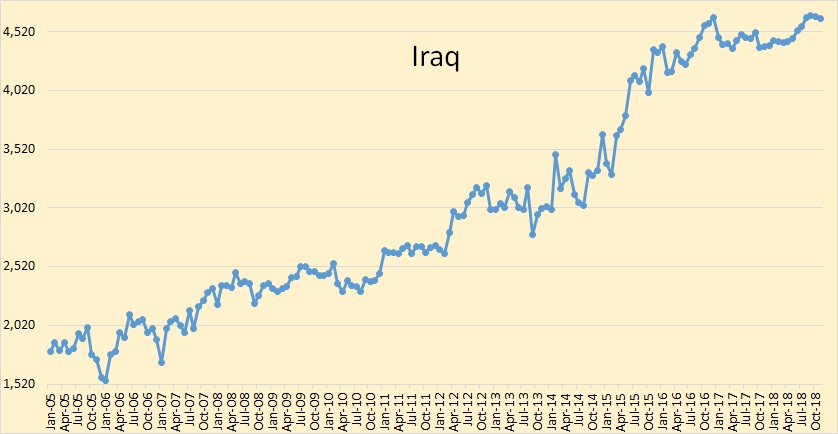

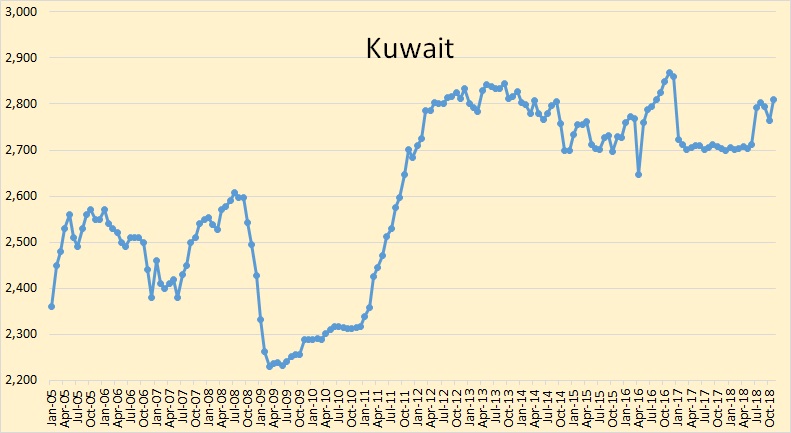

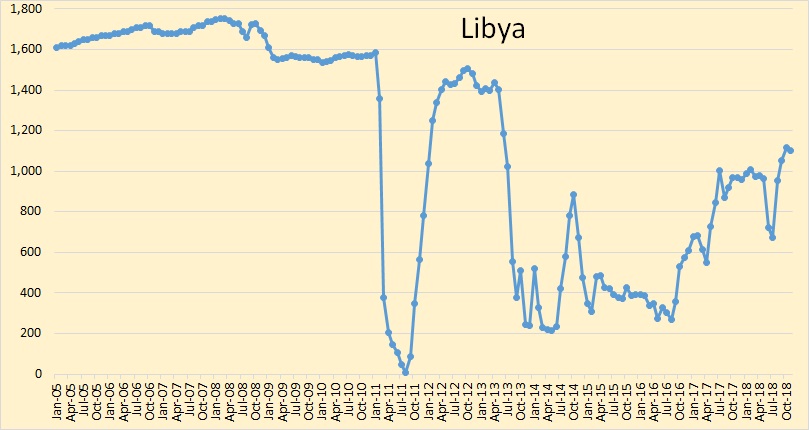

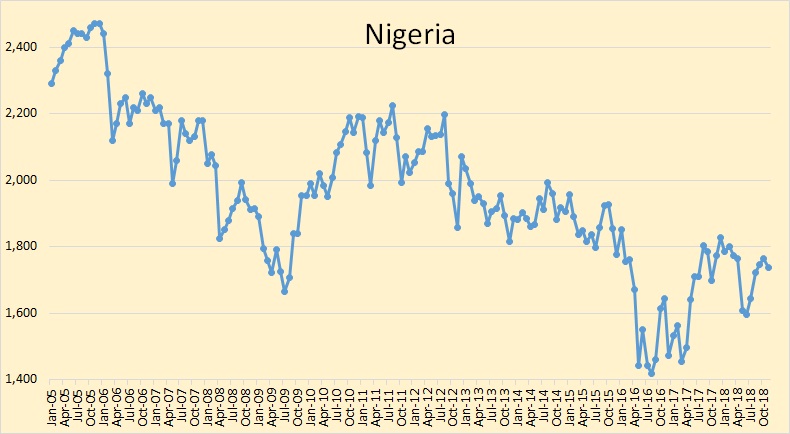

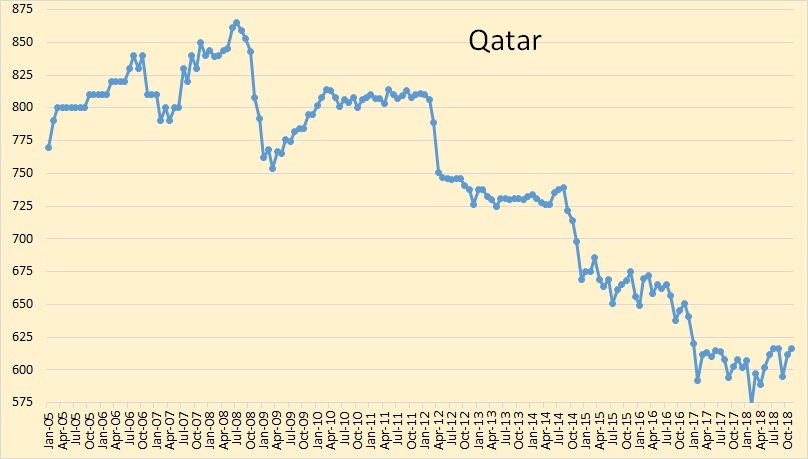

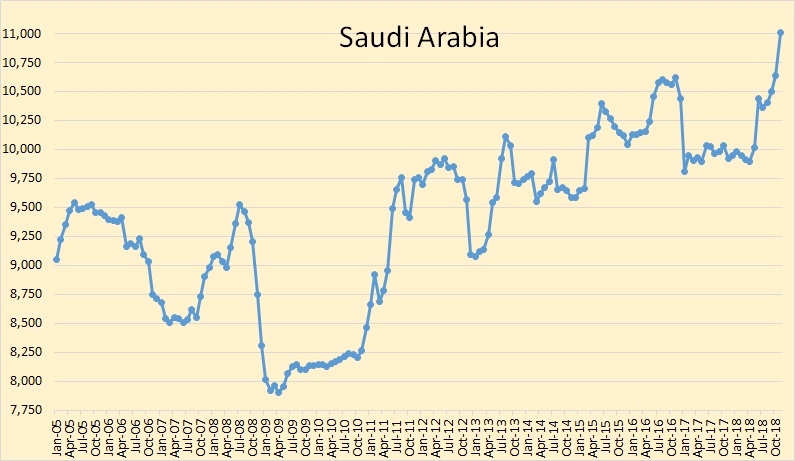

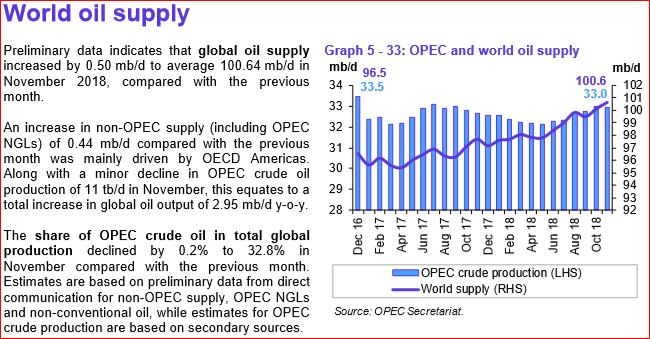

All the below OPEC data is from the latest OPEC Monthly Oil Market Report. The data is in thousand barrels per day and is through November 2018.

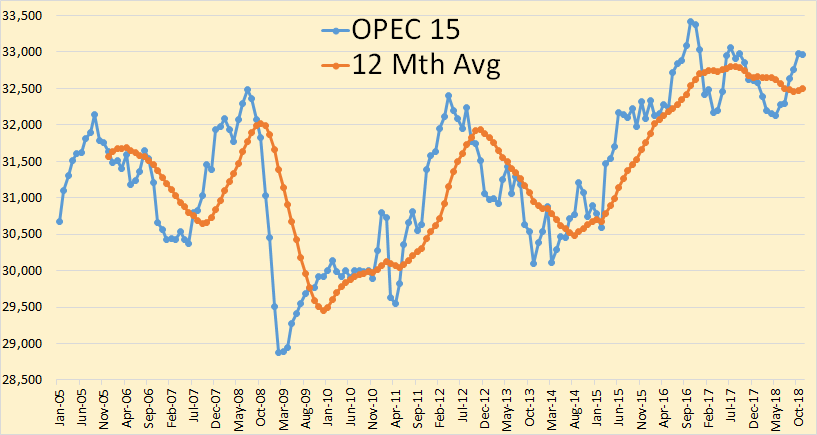

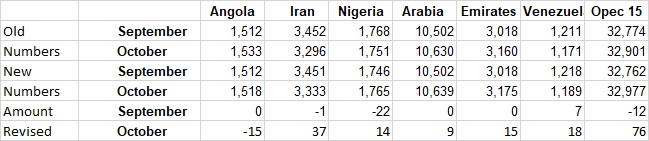

OPEC 15 was down 11,000 barrels per day in November but that was after October production was revised upward by 67,000 bpd.

OPEC production was 32,965,000 barrels per day in November. The revised October numbers, 32,976,000 was an all time high.

Above are the major revisions. All other revisions were in the low single digits.

Qatar will be leaving OPEC at the end of the year.

Saudi Arabia reached an all-time high of 11,016,000 barrels per day in November. They are positioning for cuts beginning in January.

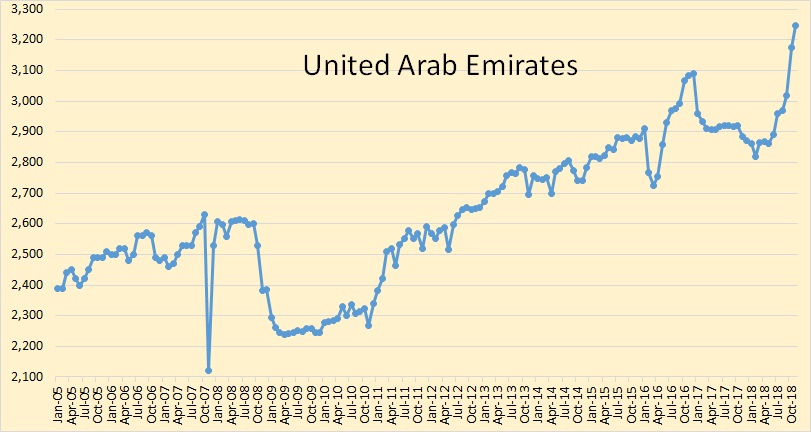

The UAE also reached a new all time high in November.

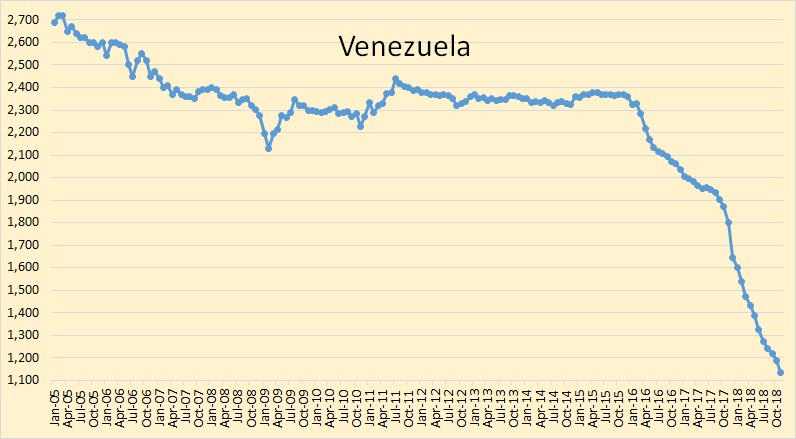

And the Venezuelan decline continues. When will they drop below one million bpd? May?

World oil supply, (total liquids), has finally topped 100 million barrels per day according to the OPEC Secretariat.

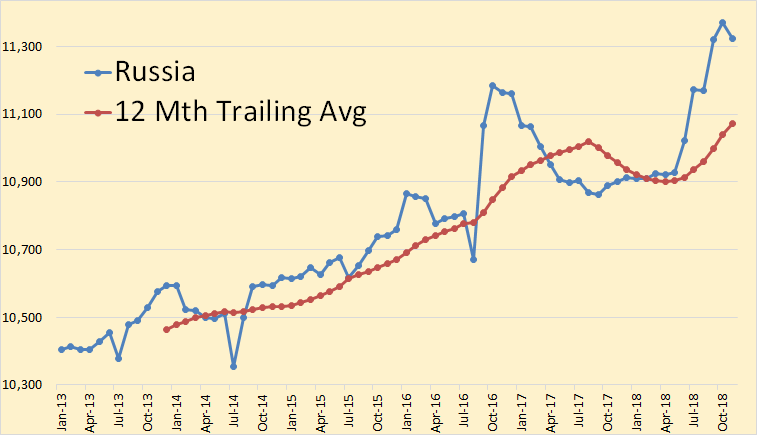

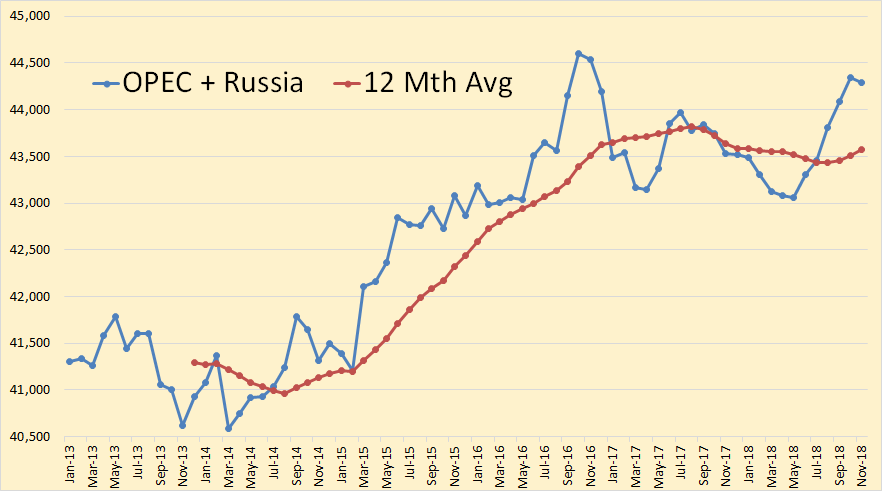

If Russia does cut 400,000 bpd, they will be right back to where they from May 2017 through May 2018. The Russian data is through November 2018.

OPEC + Russia peaked, so far, in 2016. The 12 month average peaked in 2917.

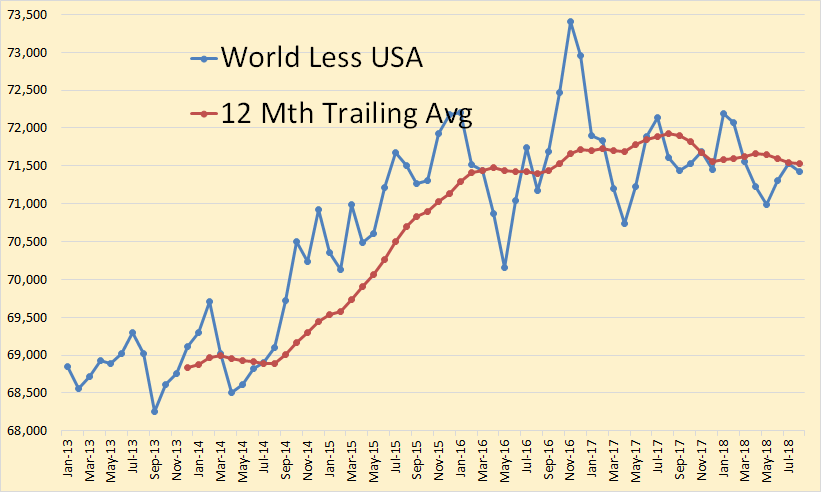

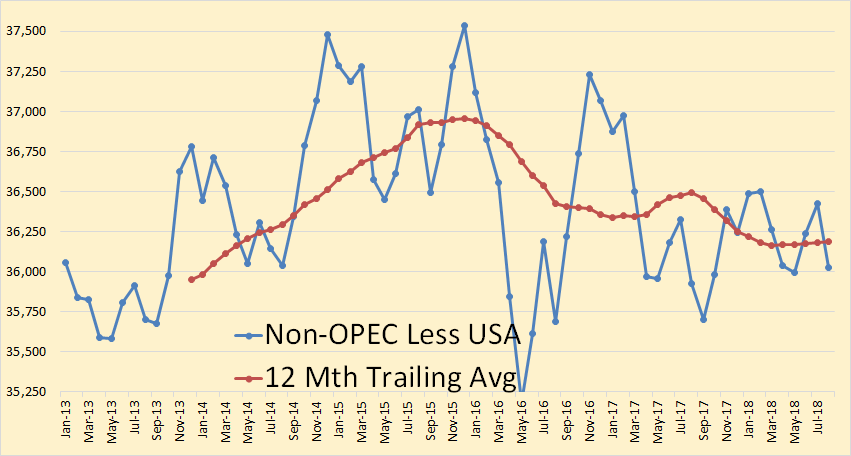

World oil production outside the USA has very likely already peaked. The data for the two charts below is through August 2108.

World less USA peaked, so far, in 2016 while the 12 month average peaked in 2017.

And it is far more likely that Non-OPEC less USA peaked in 2015. Even the recent increase from Russia will make little difference. Monthly production is down 1,511,000 bpd from the peak while the 12 month average is down 765,000 bpd from the peak.

The future of US Shale Oil Production

USA conventional oil peaked in 1970. It is US shale oil that keeping peak crude oil at bay.

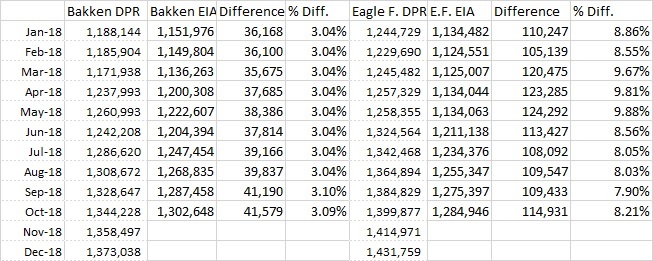

The data I use below is from the EIA’s Drilling Productivity Report. Their data is always projected a few months ahead but their historical data is accurate. Well it differes in a few percentage points from the data issued by the EIA’ Monthly Report. Example below:

Notice that the DPR Bakken data, through August, is always exactly 3.04% higher than their Monthly Report. Their Eagle Ford data DPR averages about 8.5% higher. I think the difference is the DPR includes all oil in the basin, conventional + shale. However, below I use the Drilling Productivity Report data because they give the monthly decline rate while the Monthly Report does not.

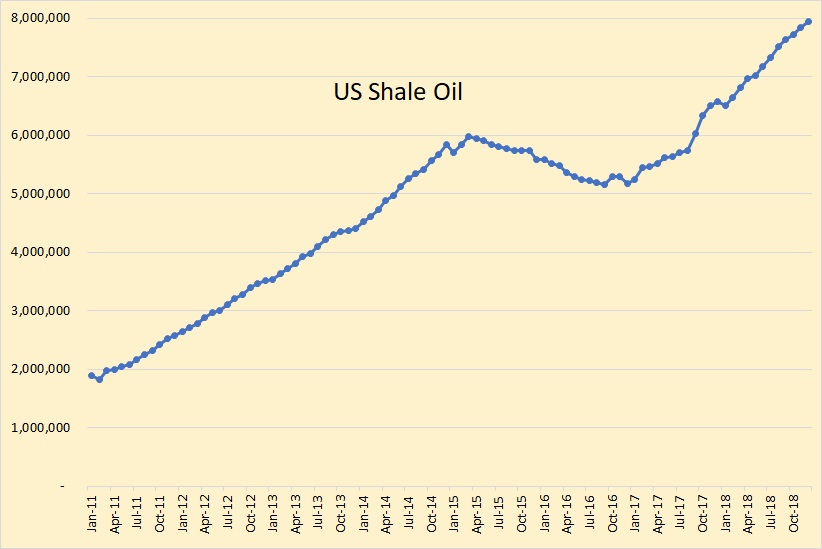

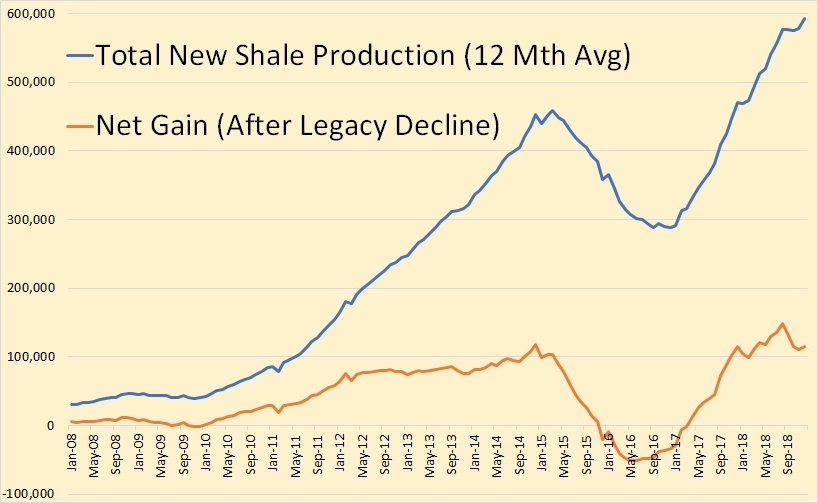

The above data is from the EIA’s Drilling Productivity Report and is through December 2018. Obviously the last few months are estimates. It is for all shale basins and is in barrels per day.

Definition: Legacy Decline. The total decline in production of all wells other than new wells drilled this month, or the last month in which data is posted.

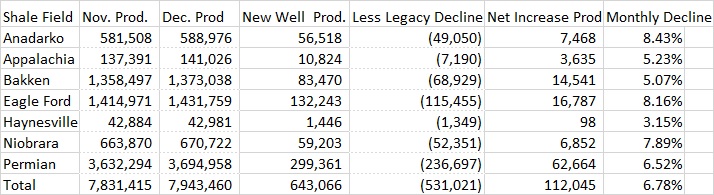

This is the decline rate the EIA is predicting for December 2018. The decline rate for total shale production is 6.78%. This is even more alarming when one considers that the DPR also includes all conventional oil in these basins.

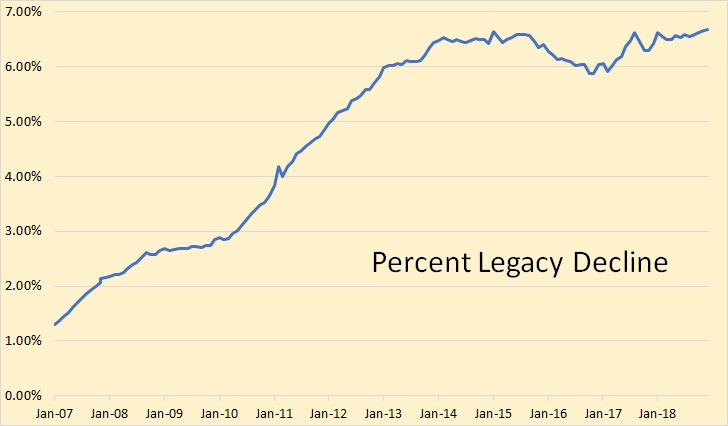

The percentage decline rate increased as production increased but seemed to top out at about 6.5 percent per month.

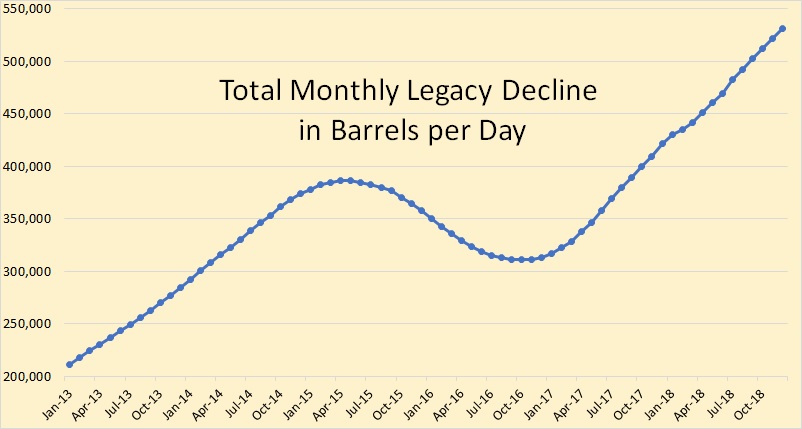

Since legacy decline is holding at about 6.5 percent, then the more oil produced means more decline in production. Currently, legacy decline is just above 500,000 barrels per month. This means that if production is to be increased by 100,000 barrels per month then new wells must produce 600,000 barrels per month of new oil.

The above blue line is production per month for all new wells, averaged for 12 months. The red line is total net increase in US shale production per month, also averaged for 12 months.

The more shale production is increased, the more production must be increased just to stay in the same place. Though there may be new oil produced in shale basins for two or more decades, I don’t think new well production can stay ahead of legacy decline for more than a couple of years.

Good post Ron, thanks.

I think that is a good analysis. Too bad we have to rely on EIA data. Unfortunately, it’s the only game in town. For most people. I personally think shale will be mostly flat from Sept 2018 to the fourth quarter of 2019. Per RRC data, and Schlumberger. I don’t think the sticking point is currently the pipelines in the Permian. It is how much that can be loaded on ships. We had a 350k bpd pipeline added the first of Nov. to Cushing. Production has not increased from what I can tell, but discounts are way down. My additional source of information is reading articles from the Midland newspaper. It’s the only one that covers the small producer, and basically the main news is the oil in the Permian. And decline rates can get higher. Spot on about increasing activity to increase production. Treadmill has a steep incline.

Saudi Arabia keeps on surprising. Maybe they have some sort of wormhole connected to an all oil planet.

Aren’t they releasing barrels from storage to pad their numbers though?

Sshhhh! You could wind up as part of a nitate experiment in some embassy flowerbed.

If they cut in December or January, you might be right

6.7% per month? 80.4%/yr? This seems high for decline. There is enough age on some of those wells that the plunge should have started to level.

Seems really hard to believe that a cessation of drilling would take output down 80% in one year. OTOH if that was 6.7%/year, that seems low for so many shale wells vs conventional in the total.

It’s “only” 58% decline per year – you have to calculate it exponential, not additive.

It does level off some when it approximates stripper status. And E is correct, the annual rate per well is much higher than 6%.

It averages about 6.5% and the percentage drops off as decline sets in. The percentage dropped to 6% in late 2015. It would have continue to drop if production had continued to drop. The highest decline is from wells less than one year old. Older wells have a much lower decline rate.

Mine decrease at over 60% a year with over a three year history of seven wells on six different 640 acre lease areas, and they do better than most in my county, but whatever, EIA is the yin and the yang. If you bother to pull various production reports by lease, you may change your mind. But, you have to consider new wells they add to the lease area. Historically, it starts to level off at around 3k a month. Of course, that’s off the RRC site, so it has to be suspect when compared to EIA “data”, that reportedly gets their data from drilling info, who gets their data from RRC.

I use data from shaleprofile, which gets its data from RRC. Take the well profiles vs number of wells completed per month and the model matches output data pretty well. Completions would need to fall to under 280 for output to be flat.

Don’t look now, but production is down a little with over 480 completions.

Guym,

Not based on the data from shaleprofile, not sure you have Permian Basin tight oil data. It is possible conventional production is down, also you have suggested in the past the completion data is not very accurate. According to shaleprofile there were 332 Permian completions in August 2018, in June there were 394 completions. That data might also not be completely accurate, it seems to be revised over time as RRC data is updated. July was 349 completions.

My understanding is that your September estimate is preliminary, In August completions were pretty low, but my guess is that you don’t have Permian horizontal well output data.

Enno Peters uses RRC data, and he shows Permian output increased in August.

See https://shaleprofile.com/2018/12/04/permian-update-through-august-2018/

Horse patootie. RRC data does not show it increased. I seem to be a minority of one on this blog, who does not think Texas production is increasing. That is if you don’t count RRC or Schlumberger. On the other hand, that seems good enough company.

From a post by EN on 12/4/2018

https://pbs.twimg.com/media/Dtma6J1XQAAG2cl.jpg

A post from the last thread that is an update on Schlumberger by kohl

http://investorcenter.slb.com/phoenix.zhtml?c=97513&p=irol-presentations

In it, he sees completions start to flatten in the third quarter, and decline in the fourth, showing up as reduced production in the first half of 2019. I have production down for Sept, but on an average, I believe it will be close to flat Aug through Dec.

Look at shaleprofile.com. I was talking about Permian basin not all of Texas.

If you don’t believe Enno Peters, fine.

I think his data is great, the best by far and directly from RRC.

Schlumberger is predicting decreased activity as in completions. That is what shaleprofile shows. The point is that through August Permian output is up even though completions are down. Just look at shaleprofile.

As to output decreasing, or flat in 2019, in the Permian I will have to see it before believing. The data for well profiles and completion data suggests Permian completions will need to decrease quite a bit before we see flat output. To about 280 new wells per month in the Permian basin.

Chart below shows my model compared to data for Permian basin, I am pretty confident in the model, but future completions are unknown. The model is through August 2018, completions 394 in model (done before I had Enno’s data which often is revised up later). Click on chart for larger view.

Enno’s work is good, Texas did not increase in August, maybe the Permian did. As for seeing before you believe, that’s not unusual, actually pretty normal. I feel the same way, but I give a little more weight to Schlumberger expectations than yours. I’m sure you can understand that.

Guym,

Fair enough. I interpreted Schlumberger differently than you. They said the falling activity level will show up in the first half production for 2019. You interpret that as a decrease in production, but it could also mean a decrease in the rate of increase from 2018. We will have to wait to see if your interpretation is correct. (He did not say “reduced” production, he said it would “show up” in first half 2019 production numbers. We interpret “show up” differently, you see reduced I see a slower increase, not clear from the presentation.

Chart below shows a model (new wells on right axis) which shows why I think output is not likely to decrease and even flat output seems unlikely (though I forced the model to flat output by dropping completions in 2019). Click on chart for larger view.

You seem to think that shale wells can remain at the same completion rate and not decline. I can’t argue with someone who believes the world is flat. If the completion rate goes down, production follows. Hence, there is no mystery of what the guy at Schlumberger was saying.

I really see production Aug 2018 to Sept 2019 as close to flat. My concept of flat over that long of a period would be Plus or Minus 300k bpd, allowing for other production. Permian will probably not drop, overall. But, that’s just a guess, and I am usually wrong.

Guy,

At some completion rate output falls. The model demonstrates that the completion rate needs to fall to under 300 wells completed per month for output to be flat in Permian basin. If oil prices remain at 50 to 60 per barrel it is possible output will be flat in Permian.

I am highly skeptical that oil prices will be at current levels in May 2019, more likely is 70 to 80 per barrel.

I never get oil prices right, but your guess on prices might be similar, if so we can’t both be wrong. 😉

Guym,

I believe the Earth is not a perfect sphere. Do you agree that the Schlumberger presentation does not say output will be “reduced”?

I tweeked the previous scenario to match what you think will happen. Time scale changed to end in 2025. Notice that output was increasing in 2017 when the completion rate averaged around 175 new wells per month. Currently around 290 to 300 wells per month must be completed to maintain flat output, if well completions slowly increase to 500 new wells per month (see chart) and then remain at that level for until 2045, output will eventually peak in 2033 at about 5500 kb/d. Chart can be enlarged by clicking on it.

Guym

One final comment on Permian basin output.

From June to August the well completion rate fell from 395 to 325 for Permian basin horizontal oil well completions while output increased. At some point completions might fall to the critical level where output decreases, currently that level is about 285 horizontal oil well completions based on the data from shaleprofile which is gathered from the RRC and New Mexico.

This assumes the average well profile is unchanged from the average 2017 Permian well.

As I mentioned in 2014, it’s better to drill but leave wells uncompleted until prices rise again.

Fernando,

Thanks. Yes probably best not to complete many wells when prices are too low, many tight oil operators don’t seem to follow the advice of their petroleum engineers (I am assuming your advice would be standard petroleum engineering practice).

So the legacy decline rate is reported as 6.x% per month for month 1 of wells. Odd.

Odd way to report. Surprised it’s not the legacy decline for the whole field averaged, which would include wells beyond 1 month age. Been looking at these steep curves for years, and how they flatten out over time, but never really thought about how they quote legacy decline.

Wait a minute, that doesn’t make sense. Gonna have to hunt down the definition of legacy decline as they calculate it.

And did:

“How should the legacy decline rates be interpreted? How can they be translated into well-decline curves or decline rates?

The legacy production change is the change in total regional production from one month to the next, excluding production coming from newly drilled wells. Production from a well typically declines over time, as pressure from the formation around the wellbore is depleted. In the absence of new wells being drilled, the group of all existing wells in a region will decline in production from one month to the next. As such, the DPR separates the wells in a region into groups of newly drilled wells and existing, or legacy, wells, measuring the production levels separately. Each month, the group of newly drilled wells from the prior month is moved into the group of legacy wells, and a new group of newly drilled wells is measured. It is important to note that as the number of wells moving into the legacy group increases, the legacy production change tends to become more negative; i.e., greater total production declines from month to month. This method does not translate directly to what many people traditionally consider well decline curves or decline rates.”

That says they add new production from wells that become legacy wells each month because they were new the previous month. So this legacy decline rate always has 1 month old well production being added to the total and that will lessen the decline rate reported. It is really a NET decline rate of the field, given new(ish) production added, rather than an average of the declines of all wells of the field.

So the legacy decline rate is reported as 6.x% per month for month 1 of wells. Odd.

No, I never said anything like that. The overall decline rate is 6+% decline rate. The newer wells have a higher decline rate and the older wells have a lower decline rate. Therefore the decline rate declines when there are fewer new wells or less production from new wells.

The legacy decline rate is the total decline rate. It is just that the decline rate of new wells cannot be measured because their initial production is what is produced the first month. Their decline rate cannot be measured until you know their initial production.

There is nothing strange about the term “legacy decline”. It is just the difference between new well production and total production. If new well production was half a million barrels per day that month, but total production only went up 100K barrels that month, then legacy decline was 400k that month.

It is really that simple. Don’t try to make it difficult.

No, read their definition. It’s not simple. They are not averaging the decline rate of all wells.

They are computing additive production and adding additional wells’ production each month as those wells become older than 1 month — and comparing to previous.

It somewhat says wells younger than 1 month are what is growing overall production.

No, read their definition.

Got a link for that definition? The definition up top is my definition. I apologize if it is confusing.

It’s not simple. They are not averaging the decline rate of all wells.

They are not averaging anything. They just measuring total production for a field. Subtracting that number from last months total production gives you total monthly increase, or decrease. Then if they have total new well production, just subtract total increase, or decrease, in monthly production from total new well production, that will give you legacy decline.

All I did was reverse that process. I added total increase to legacy decline, (as a positive number), that gave me total new well production.

Guys.

Go look at shaleprofile.com.

Huge amount of total output is from 2017-18 wells.

At $269 per month, I really can’t afford it.

Ron,

There is a free part.

https://shaleprofile.com/blog/

Ron.

The free part is pretty good IMO.

shallow sand,

Agree 100% Enno Peters blog at

http://www.shaleprofile.com is the best site for tight oil data I have seen by far.

Possibly the only thing that Mike Shellman and I would agree on 🙂

Dennis, I don’t often get a chance to agree or disagree with you on oily matters because you are always trying to interject “science” and statistical analysis bullshit into everything. EVERYTHING! Life is not like that, and neither is the oil business. I think you might be mule-lipped to know how few people give a rats ass what you THINK is going to happen 35 years from now and how tired everyone gets of hearing the same ‘ol crap all the time about TRR and how rising oil prices are going help your models come true. About oil economics, you know nothing. Sorry; you’ll get over it.

And here is the deal about the oil and gas business that you don’t know, and can never understand, nor would I expect you to understand: to have relevance IN it involves a long, slow process of listening and keeping your mouth shut. Of learning. You find your place in it the old fashion way…you EARN it. I am old school; I have broken bones, put good men in body bags, have cracks in my face and blisters on my hands, been on the verge of living under a bridge but always found a way because, in part, I learned from others who knew more than I did. I listened. I never had the audacity to argue with people who knew more than I did until I had the experience to argue with them. Sitting at the computer all day don’t get it done.

Its not just you, Dennis; the internet is full of limp-dick oil analysts right now and everybody can’t wait to prove to others how smart they are about things they don’t even understand. Never even SEEN before, much less understand. I like people who…work. With their hands. And their own money.

Other than that, you seem like a nice fella, I love Maine (nice brookies there, but way too many black flies) and I never allow politics to interfere in my judgment of others, like most people do. Its a miserable way to live to hate and be angry all the time…over political idealism, or allowing one human being, Trump, for instance, to take root in your soul so deeply you cannot think of anything else in life other than hating him. He’s an idiot; my advise to life’s whiners is out smart the son of a bitch, then get off the internet and mow the grass.

Its your blog, carry on.

Mike,

Much of what I do I have learned by listening to you, interesting lecture.

I have worked as a pool builder, roofer, carpenter, and millwright.

So despite what you think you know about me, you don’t know me at all. Most of my injuries have occurred playing sports, aside from one vehicle accident.

I appreciate learning from you, but feel free to ignore anything I have to say.

Interesting that you didn’t even agree with me about Enno’s blog, sorry you feel that way.

Dennis.

I think the frustration of a small business oil producer should be obvious.

My family and I have pretty much decided producing oil in the US is not a real business anymore. How can one have a real business when there are so many fixed costs, that do not change much, with the price of the product sold moving up and down like a yo-yo? Add to that at least 50% of the voting public thinking what you are doing is evil. It is now much more preferred that one grow harvest and sell cannabis so people can get high, rather than produce oil for gasoline, diesel, plastics and the numerous other daily used consumer products.

You have done a lot of construction work, so I am sure you know the feeling when there is a recession and work drops way off. At least you might get some sympathy in that situation. Farmers get a government payment. Oil people get laughed at.

We basically lost $20 a barrel in the blink of an eye. In our case, that is over $100K per month of income loss. This after 2015-17, where the price was less than half what it had been 2011-14.

Take the family out here that is living on 20 BOPD, doing all the work themselves. Selling 600 BO per month. That family just saw a $12,000 hit to the top line. The expenses didn’t change except for fuel, which has fallen some. Probably less than $1,000 per month savings there.

Imagine what would happen if the boss walked into the tech campus of a firm in Silicon Valley and said everyone was taking a $12,000 per month pay cut immediately. Would be a lot of knashing of teeth.

Now imagine the pay cut was pretty much in conjunction with an erratic President, supported almost 100% by the industry, ironically, who erroneously thinks .30 a gallon lower gasoline prices will be a boon to the US economy. With the alternative being a party openly hostile to the industry, who cannot differentiate between small business owners with small footprints and corporate titans who make no money on the product, but make billions off the corporate largess. We are all terrible polluters who need to get hit with a carbon tax and made to jump through environmental testing hoops despite we are emitting less than the tiny amounts of methane we were emitting 30 years ago.

It is incredibly frustrating.

Shallow. Thanks for explaining how it looks from where you stand.

As much as I hate to think this way, it raises the idea that the government should have a price stability mechanism in place that shields producers from the volatility of the dysfunctional market. Maybe gets updated every 6 months depending on market conditions or something like that. I’m sure everyone would hate it.

Maybe the government should even have a longrange an energy policy. Like a ten yr plan. I know…crazy thinking.

Shallow sand,

I was just re-reading Mik’e comment, I would have to shovel the snow off my lawn, before mowing. 🙂

I have not worked in construction very much since I was a young man, some carpentry work helping out a friend whose partner was injured for a half a year when I older.

In any case, I feel for you guys and am hoping for higher oil prices. At low oil prices tight oil will not do well, nor will oil sands, or deep water offshore.

Not sure what can be done about the volatility. I simply think a carbon tax makes sense so we transition to alternatives because oil output is likely to peak by 2025, perhaps 2030, if USGS mean estimates are correct and oil prices rise as I assume.

Note that an oil price scenario between the AEO 2018 low oil price case and reference oil price case (average of the two scenarios) would mean that at current well cost, the Permian Basin would never become profitable. This is what Mike Shellman has been saying all along.

I would comment that neither he nor I know what the future oil price will be.

Just as I do not know it will be high, he does not know that it will be low.

The future is unknown. On that perhaps you would agree.

That’s why I often present several scenarios. Below are scenarios I use for Oil Prices, the med/low scenario results in failure for the Permian basin (if it were a business it would be bankrupt under that oil price scenario), for the medium oil price scenario or higher it succeeds if well cost remains 9.5 million per well in 2017$.

Click on chart to make it bigger.

Shallow sand,

Seems strange to me for someone to lash out at me because oil prices have fallen. Does it seem that I am cheering for lower oil prices?

I think I have been pretty consistent in my expectation that oil prices will increase at some point and in fact what I think would be best to bring about a gradual transition to other forms of energy as fossil fuel gradually depletes.

I also have been consistently wrong about oil prices going up, but clearly I have no control over oil prices.

I have nothing against oil producers and have never intentionally said anything to disparage oil producers, especially smaller companies. I don’t particularly like the fact that Exxon-Mobil tried to mislead the public about climate change, much like Tobacco companies with the dangers of cigarette smoking.

Small oil producers had nothing to do with that in my view.

Despite what Mike believes I have a pretty good handle on oil production economics thanks to the work of Rune Likvern and comments by you, Mike Shellman, Fernando Leanme and others.

I do a discounted cash flow analysis for net revenue over the life of the well, those wells with a positive discounted cash flow over there operating life are assumed to be completed. I use the AEO reference case for my price deck and use constant dollars for the analysis and a “real” annual discount rate of 7%, which is the same as a 10% nominal annual discount rate at a 3% annual rate of inflation. This is standard economic analysis that I am sure you and Mike are familiar with. Mike has complained that I use constant dollars, doing the analysis in nominal terms changes nothing, I just prefer constant dollars, it is the way economists are trained to think.

Mike – You take great pains to always tell us how much experience you have, but as far as I can tell you haven’t got the faintest idea how 98% of the oil and gas industry works. It is based on hard science and mathematics: thermodynamics, probability, materials science, structural statics and dynamics, some of the most sophisticated programs and fastest computers in the world etc. When those things are ignored and decisions are based on “trust me, that’s how we did it last time” people die. Taking pride in near miss accidents and injuries is absolutely the worst approach and will, rightly, severely limit someone’s future career options, even in the least rigorous companies. Hard won lessons have, thankfully, mostly purged your type of thinking from the industry and it is now one of the safest around. As for using ones own money and labour – I’d really be interested to see a sole trader build and operate a multi-billion dollar development, which is where by far most oil and gas is produced, on their own from scratch – it is simply impossible, that’s why capitalism is so popular.

Shallow Sand speaks the truth for a lot of us small producers who have been around for decades. It’s an artificial world where a 1% oversupply of crude is termed “awash” in oil and where the “oversupply” crashes the price. My family and I hang on for the sake of our few dozen employees and on the (probably irrational) hope that Saudi Arabia and operators in the Permian can’t keep borrowing money forever. For four years, starting in 2014, we cheated by wearing out trucks, dozer tracks, power tongs and every other piece of equipment we own. This year we paid the piper and spent $800,000 (every bit of extra cash we harvested at $70 oil) replacing equipment and buying some tools for the shop–except for the few thousand dollars I spent on new cameras for the shop and a couple other defense items. I figure when the college students with the worthless degrees find that the internet doesn’t work anymore, and they’re cold in the winter, the first thing they’ll do is wish for global warming, and the second things they’ll do is show up at my shop demanding a safe warm place. I want to be ready.

Dennis, I don’t often get a chance to agree or disagree with you on oily matters because you are always trying to interject “science” and statistical analysis bullshit into everything. EVERYTHING! Life is not like that, and neither is the oil business.

So let me get this straight, every endeavor that I’m aware of, if one removes the science and the statistical analysis one is left with pure bullshit! Except for the oil business. Ok, good to know! Carry on!

Cheers!

Well, to me that would be very understandable. The third year is small potatoes to the first two years. EIA’s “legacy decline” has always seemed to come from outer space, to me.

Shallow sand,

Yes for all of the US almost 2/3 of output is from wells that started producing in 2017 and 2018.

Also 2016 wells produced 1567 kb/d at the start of 2017 and 614 kb/d at the beginning of 2018. So a fall of about 61% in a year. About 9,000 wells were completed in 2017 to keep output rising (data from shaleprofile.com), in 2018 through August about 6000 new tight oil wells have been completed. If completion rate decreases as it did in 2015 and 2016, output might decrease. It would probably need to fall to 50% of current completion rates for a decrease in output.

Well, that vindicates my 60% decline from my wells, lol. I thought they were decent upper tier two wells, so glad to hear they are not underperforming to the average.

Ron I pasted from EIA.

https://www.eia.gov/petroleum/drilling/faqs.php

scroll a bit

The newest (1 month+) wells dont have a previous month in their data. They add that production. It’s a net calculation, not an average of all well declines.

It will understate what it would be if they averaged all declines (including those newest (1+ month) declines.

Rephrasing, assuming I understand them . . . they look at all wells and compare it to previous month, but wells just coming into the data that are 1+ month old . . . their production does not have a previous month to compare to, so that production is purely added. The whole field will show decline EXCEPT for those newly added wells — even though those wells did decline from the prior month which is excluded from the data.

They are reporting a form of net legacy decline. I guess what they SHOULD do is wait a month so there is a previous month to compare to for the new wells, but I’m sure that will be convoluted with constantly noting that no matter what they do, some wells will have no previous data.

Or perhaps compute the decline rate for every single well in the field and average them together. This way the newest wells don’t get their production into the overall calculation.

Ok, it takes production from boundaries, not plays. Anyone have any idea how many plays are in the Permian and Eagle Ford boundaries, including conventional? Bunch. Permian is close to 1 million in conventional, still. Almost all of that is not in the Wolfcamp, Sprayberry, or mostly where they are currently drilling. Apples and GD oranges, again.

Total decline of all wells and average decline per well are the same number by simple algebra.

Excellent post, Ron. Curious what the other posters think will be the 1st major US shale play to peak. Eagle Ford or Bakken I would think. Not sure where Niobrara and the Anadarko are in relation to those 2. The next few years will be very interesting indeed.

My guess is Eagle Ford, then Bakken, not sure what’s next.

Update to EF model with assumed TRR of 12.5 Gb and using AEO 2018 reference oil price scenario. Well cost in 2017$ assumed to be $6.7 million on average. URR is 8.8 Gb, secondary peaks in 2018 and 2027, but previous 2015 peak is never approached.

So in effect, Eagle Ford play is past peak. Bakken will be next, probably within a year or two.

Yeah, seems highly unlikely at best that Eagle Ford will ever regain its high. Even the EIA forecast – notorious blue sky that it is – only gets it back to 1.5 million bpd. And that on a theory of producers shifting from Permian due to logistical constraints in the latter.

It’s a mature area, only so many decent spots to drill.

Chart for revised US LTO scenario.

Hi Dennis,

Thank you, and Ron, for the generous good work.

Your LTO scenario assumes that drilling continues at present rate, and so debt issuance, low interest rates and goldilocks oil prices continue. Or, couldn’t a severe recession, or higher interest rates completely crash the LTO ponzi scheme? Might this then render much of tight oil cost prohibitive for……….ever?

BloomingDave,

The LTO scenario assumes the rate of well completion increases until about 2025 and then starts to decrease as sweet spots get drilled up and average new well productivity decreases.

My scenario assumes oil prices gradually increase to the point that tight oil companies can pay of their debt and I assume an annual interest rate on the debt of 7.9% (until it is paid off).

A recession like the GFC would make my scenario wrong, but in the past 120 years there have been only two period where World Real GDP decreased in any calendar year (Great Depression and GFC), so these events are not frequent and probability is low that there will be another such severe recession in the short period of 2010 to 2025 (a 15 year period rather than the usual 60 year period). So the scenario is my best guess and may be wrong.

Permian Basin output for Medium ERR scenario with 400 well completions per month (same as Oct 2018) until 2040, 106,000 wells drilled from 2019 to 2040. Output peaks in 2030 at 4800 kb/d.

I do not think this is a realistic scenario, simply presented to show what happens if completion rate remains constant at today’s level. The EIA’s DPR model is not very good in my opinion.

In other sources US growth is more 1.9 mb/year, source is Rystad:

https://oilprice.com/Energy/Crude-Oil/OPEC-Came-Up-Short-Heres-What-They-Should-Do.html

Looks like the USA is supplying half of the world soon at these growth rates.

As far I know Bakken is still pipeline limited the next time, so no growth from there?

So it falls most to GOM, Eagle ford and Permian, which can grow without pipelines?

EF does not have pipeline problems, but it is not going to grow at $55 or less oil price. If prices rise to $80, yes. But, the price will need to be consistent for a good long while. GOM has hit its high back in August according to SLa and George. We won’t have much, or any growth in the first half of 2019, no matter what the hype is, unless prices spike.

Guym,

At $80/b to $100/b from 2019-2025 do you think the Eagle Ford could surpass its previous peak? I think not, but it’s your neighborhood so you would know better than me.

If oil prices rise fairly quickly, before the Permian can gear up, then it is possible for it to come close. Otherwise, probably not.

Thx guym

Dennis, attached are four EIA projections for C+C from 4 previous STEO’s. While all previous ones showed increasing crude production for on-shore lower 48 states out to end 2019, the latest projection, Dec 2018, shows a peak in July 2019. Any thoughts on the cause, financial, geological…? Clearly this means that after July 2019, decline rates are exceeding new additional production for the on-onshore lower 48.

Ovi

Not sure what that is based on perhaps expected port and pipeline constraints.

Generally the STEO is not very accurate so I ignore it.

If the AEO 2018 reference case oil price is correct (I expect it will be low) ans the USGS mean cases for tight oil are correct then we will be likely to see 9 Mb/d of tight oil output by 2024. So the 2019 plateau in the STEO will be a temporary pajuse in the increase.

I will keep watching their outlook to track how it evolves. One can hope that their methodology is improving.

Thanks.

Hey maybe they are correct.

Future is tough to predict.

Excellent analysis Ron Patterson. I really enjoy your monthly production updates and especially the analysis of various import aspects of the oil industry that is often added after the production charts.

I understand the big declines in legacy production are a characteristic of shale oil, and with overall production growth there will come a time when production from new wells cannot keep up with the decline from the legacy wells. What I wonder also is how good are the economics for drilling all these new wells. I am not close to the numbers , but my suspicion is that the economics are not that good. Nevertheless the shale oil industry ploughs on and continues to set new highs month after month.

Thanks, Ron. From my website:

6/12/2018

Qatar peak oil

http://crudeoilpeak.info/qatar-peak-oil

On the French fuel protests:

28/11/2018

European oil consumption after North Sea Peak Oil

http://crudeoilpeak.info/european-oil-consumption-after-north-sea-peak-oil

tl;dr

BP says Europe consumption up each of last 4 yrs

Prices down after EIA reports a smaller draw of 1.2 million. Lol, the past two weeks total stocks are reported down by over 15 million, including SPR, and net imports are up over a million barrels a day this week. That glut is having some big time affect on inventories, isn’t it? ?

I have debated pulling the trigger on symbol USO…. looks to be an easy 30 to 40% return in 12 to 18 months. I thought we were energy independent? 🙂

I’m in leaps for USO for Jan 2020. The only worry I have is that the discount for WTI could go up at year end 2019 when the oil can’t get shipped out. Still, overall it should get higher, but I am notorious for being a lousey investor.?

I have my eye on it–

But haven’t pulled the trigger.

What is behind the drop in Iranian production over the past year. Did I miss something?

Sanctions imposed by US on Iran.

Wow. I would have thought there were enough countries to be willing to buck that. They must be hurting and more than a little P.O’ed.

Iranian oil was replaced by extra oil produced by Saudi Arabia and Emirates. The sanctions however, won’t make the Iranians fold to US neocons, who seem to control Trump via Bolton?

By the way, I expect Venezuela’s production to drop below 1 mmbopd in January, because Maduro’s presidential term ends on January 9, and on the 10th Venezuela is likely not to have a government recognized by USA, Colombia and Brazil. Maduro is scared there will be some sort of humanitarian intervention and requested help from Putin, Erdogan and the Iranians. A few days ago two Tu160 bombers landed at Maiquetia, but the word I got was that Putin was pulling them out tomorrow night unless Maduro starts handing oil over. Meanwhile the Iranians announced they will be sending three warships to help defend Venezuela (sounds like BS), and the new Brazilian president, Bolsonaro, reached an agreement with a state governor who runs the region bordering Venezuela to put it under federal control, to enable the feds to handle the flood of Venezuelans fleeing into Brazil.

Inside Venezuela there’s a small amazonian tribe rebellion against the regime, they closed the Canaima national park, and tribe elders declared a couple of sites used by the Venezuelan army were fair target for native fighters. The rest of the country is in the usual chaos, with a higher crime rate making it difficult to move overland from town to town.

In the USA, the prosecutors who are tracing the chavista mafias money are getting cooperation from those already jailed, and there’s confirmation that hundreds of millions was stolen and put into US, European, and other investments and bank accounts. The latest kingpin to be indicted is named Gorrin, and it seems he was given money to buy the Globovision TV, to turn into a nominally opposition media while following a regime script. Gorrin fled the US and his whereabouts are unknown.

Wait. What? Maduro was just re-elected to a 4 yr term this past April.

Depends on which planet you are on.

Maduro’s current term expires on January 9, 2019. The regime scuttled the National Assembly, and created a “National Constituyent Assembly” or NCA. They say this Assembly has superpowers and sits above Maduro, the Supreme Court, the State Attorney, and the National Assembly.

The NCA, which is illegitimate, called for elections ahead of time, and Maduro was “re-elected” in illegitimate elections, several months ahead of schedule. But the previous term is still running. Approximately 42 nations have already stated that come January 10 Maduro will not be president. About a month ago Maduro requested that about $500 million worth of Venezuela’s gold held by the Bank of England be sent to Caracas, but the bank refused because it thinks Maduro is looting everything and the regime will likely collapse.

I don’t think this is the type of blog where I should write extensively about what goes on. December production is on schedule to average 1.1 million bopd, but I expect January production will be lower than 1 mmbopd, even though the current trend puts it at 1.06 mmbopd.

I don’t have a good idea about what will go on in early January. I do know Colombia moved 4600 men from an elite reaction group into Catacumbo, and is making sure it has secure lines of supply from Cúcuta into Catatumbo. This is very interesting because there are three points where the border can be crossed fast and without hassles in the dry season, which has just started, and Catatumbo is one. The other one which looks attractive is Guajira, and the US Navy sent an LSD vessel there a few months ago. They landed a small group of Marines, who proceeded to take soundings and soil samples, and drilled water wells. So if the US is going to back Colombia and Brazil from a land site, it’s possible they’ll do it from the Colombian side of Guajira, where LSDs and other vessels can approach within two miles of the coast.

Fernando Leanme,

Thanks for this, as always.

Most nations were allowed to continue to import without sanctions from US, they were granted waivers by US, this supposedly will change in May. Allies such as Korea, Japan, and Europe cut back on imports, even China and India, I think.

Recent drop in oil price was in part in response to more nations being granted waivers than expected by the oil market.

except that much of the price decline took place before there was any hint of either a waiver announcement or a waiver discussion.

Rumors can drive prices, lots of leaks at White House.

Thank you Ron for the great post again.

Here is a probable confirmation of Russia’s oil peak in 2018-2019 as you have predicted before:

https://ibb.co/JW1j4sf

To avert 2°C global increase fossil fuel use needs to decline at about seven five to percent per year. That is just about the natural decline rate for mature oil fields, so effectively no more developments can be approved without catastrophic results somewhere. I think the evidence is mounting that after 2°C we will hit some form of runaway which will lead to hot house earth and the change will be much too fast for us to be able to adapt, which will mean the end of civilisation and maybe humanity. Therefore any new oil well could be considered the one that went over the tipping point and caused mass starvation etc. Yet no regulatory regime in the world is stopping approval of developments, in fact many are actively trying to accelerate investment from private companies. German has a word for all this, as for most things: Lebenslüge – the lie you have to tell yourself to live your life.

There’s no evidence for a “runaway” temperature increase. But there’s plenty of evidence for a fanatical, repressive, and irrational movement which ties world average temperature to the need to implement communism.

Those commies are remarkable, aren’t they? They’ve managed to rid the Arctic of 95% of its old ice, flood the US with record rainfall events, set fire to Australia, and break the back of the jetstream. They boogie, them commies.

If we are uncritical we shall always find what we want: we shall look for, and find, confirmations, and we shall look away from, and not see, whatever might be dangerous to our pet theories. In this way it is only too easy to obtain what appears to be overwhelming evidence in favour of a theory, which, if approached critically, would have been refuted.

Whenever a theory appears to you as the only possible one, take this as a sign that you have neither understood the theory nor the problem, which it was intended to solve.

For it was my master who taught me not only how very little I knew but also that any wisdom to which I might ever aspire could consist only in realizing more fully the infinity of my ignorance.

That’s Karl Popper, a man who was not only cleverer than you, but cleverer than you can even imagine.

Popper is way over-rated.

“‘Popper is way over-rated.”, says the man with zero credibility.

The likes of Kaplan think they are card-carrying atheists. But they need to believe in something otherwise their meaningless lives would feel shallow, hollow, depressing and purposeless. I recommend Nicholas Wade’s “The Faith Instinct”.

Lose the fear– it is crippling you.

“Ad hominem (Latin for “to the person”, short for argumentum ad hominem, is a fallacious argumentative strategy whereby genuine discussion of the topic at hand is avoided by instead attacking the character, motive, or other attribute of the person making the argument, or persons associated with the argument, rather than attacking the substance of the argument itself.”

https://en.m.wikipedia.org/wiki/Ad_hominem

Or it could be that Archie is just a fuckwit and best ignored, at least until public opinion (aka mob rule once things get bad enough) decides some of these a-hole deniers need to pay some recompense for fucking things up so badly for the rest of us.

Disaster Communism and Other Opportunisms

And then there’s ‘disaster capitalism’, which doesn’t necessarily make the disasters, such as anthropogenic climate change (ACC/AGW), any less real or valid.

There may be relatively-little evidence for ‘runaway temperature increase’ now, but then, evidence can be hard to glean at certain points along exponential curves…

In any case, our species has, of course, many concerns besides ACC/AGW, which makes things appear to be shaping up toward a perfect storm.

I much prefer when the climate BS is kept to the non petroleum thread.

I much prefer it when the anti-science BS is kept off this forum.

Hey Dan, you good with anti-Commie rants?

I much prefer when you shut the fuck up, but we can’t have everything.

Hello, what is of paramount importance is the total free cash flow generated by shale oil producers at any given price of oil. Any idea on this? At the average Q2’2018 price of 68$, 2/3 of producers had negative cash flows so the situation is probably worse off in Q3’2018. As per the FRED, effective high yield rates in the US went from 5.5% to 7.5% in the space of one year. Also equity prices are decreasing which impacts gearing and the ability to raise financing. To summarize, lower oil price, higher rates and tighter financing constraints will weaken even further cash flow generation, balance sheets and ability to drill at such high rates. So my scenario is for WTI to bottom between 40$ and 50$ and to slowly but surely creep up as production figures decrease during the course of 2019 and 2020. Shale oil is a by-product of easy monetary policies which are being withdrawn.

Correct analysis. In a nutshell, if prices remain where they are many tight oil producers will be toast.

Lol, you got that right.

Guym,

Occasionally I get things right. 🙂

Regarding my small oil business rant above.

Small business is a tough place, not just in the oil industry, but all over.

I think of the grocery store owners. Those guys had a pretty good thing going in small towns 30 years ago. Now they are gone if there is a Walmart nearby.

Same with department stores. The mall in a mid sized town nearby is halfway a ghost town now.

Capitalism can be brutal. But it doesn’t seem that another way has proven to be a better idea either. We tend to take freedom for granted in the USA. We are very lucky we have the freedom we do have.

I don’t know that price controls are a good idea. I don’t know what the answer is to market volatility. We benefitted from getting into oil when no one wanted to touch it, and really did well from 2005–14. Since then, not so good, but maybe our time will come once more.

Overall, shouldn’t complain. Just trying to give a unique perspective. Also trying to let everyone know that there are a lot of hardworking small business owners in upstream oil and they aren’t the terrible people some make them out to be.

Everything in the media these days is very urban centered and also very East Coast dominant. So different perspectives from different regions is always good, I think.

!! Runners-up for Quote of the Year !!

from above:

“Shale oil is a by-product of easy monetary policies which are being withdrawn.”

in a way kinda 🙁

https://www.zerohedge.com/news/2018-12-11/real-implications-new-permian-estimates

“Now, I know FOR A FACT that American energy dominance is within our grasp”

and it keeps getting more better

“Reilly stressed, “Knowing where these resources are located and how much exists is crucial to ensuring both our energy independence and energy dominance.””

Pretty Powerful results for just a by-product!

Was it JH Kunstler that pointed out that “energy dominance” is kinda kinky?

shallow sand,

I always look forward to your posts. I think there’s nothing more important here, and that’s a high bar.

Syn. Thank you for the kind words.

Shallow Sand,

You and Mike are a big part of the reason this blog is worth reading. Nice to have a variety of viewpoints and differences of opinion.

Shallow Sand

Neo Capitalism or Creditism might be better terms to describe our current monetary and economic system. When central banks can issue Credit and lend it to their pets by the billions and when those corporations go under they just issue more Credit to the corporations that take their place. This is not Capitalism where companies and individuals produce something valuable and return a profit that they can then reinvest as Capital.

This current economic system is destroying the sources of wealth and valuables. It encourages burning down the house to stay warm. I used to dream of being a big farmer but more and more I feel lucky when I see the stress and fear that so many of the bigger farmers are dealing with.

I appreciate your great contribution to this site. I’ve learned so much from your comments. They’ve increased my confidence that this shale business would not be here if it were not for the biggest ponzi scheme to date. And that the peak of Oil production per Capita that was reached in 1979 will never again be topped in my lifetime even with all this fraud on its side.

Some great musings from Charles Hugh Smith

https://www.oftwominds.com/blogoct18/zombies10-18.html

Farmlad.

The size of farming operations and the debt they are taking on is mind blowing.

A large farm in our neighborhood recently took delivery of the largest new JD combine with a new corn head and bean head. I was told the total price was $1.2 million.

I don’t know how most farmers sleep a night. Heath insurance running $2-3K per month. Low grain prices for the fifth year in a row. Interest rates rising.

I guess it has always been this way. Many panics in the 19th century. Most of those involved huge swings in commodity prices.

The East Texas oilfield opened during the Great Depression. Some sold oil for 5 cents a barrel.

The world is in a commodity down cycle. I assume history will repeat itself.

I do wonder if we will see farmland prices sink more. Land prices have dropped quite a bit in the fringe areas. Not as much in the strong areas. Have to think rising interest rates will take their toll on land prices as long as grain stays low.

shallow sand,

Your perspective is much appreciated. I continue to hope for higher oil prices as that is what will allow us to get through the energy transition.

Dennis.

The only thing we know for sure about future oil prices is that we have no clue what they will be in the future. Lol!!

I know why you model prices. I also understand why your models frustrate Mike.

As we have seen, if prices closely correlated with US oil production, your models might make some sense. However, US oil production has apparently increased substantially despite low prices and many, many wells being drilled and completed that are not profitable when all costs are included.

I think it is fascinating to see that almost all of the publicly traded oil service companies are in big financial trouble despite the unprecedented amounts of upstream capital being spent in the US lower 48. Many are trading below the 2016 and 2009 lows.

Nabors is the largest US onshore driller. Stock price is 1/4 if what is was in 1979 NOT adjusted for inflation.

Weatherford International is a huge service company. Likely going BK based on shareprice.

One would think these companies would be thriving.

Watcher gets attacked here quite often. I don’t agree with all of Watcher’s posts. However, I do agree that things seem messed up.

I talk to the guys in the field, like Mike, who actually get the oil on their gloves. I go over the shale numbers with them, because they assume it is wildly profitable. Once we talk numbers, the common response is, “So it’s just a huge promotion?”

Funny thing on SA. Discussing Whiting. Look at their stock price chart. 1 for 5.5 reverse split doesn’t help. But, new CEO apparently thinks they can afford a luxury box at Denver Broncos games and can afford team building exercises two time zones away.

Shallow sand,

The economics do not pencil out at low oil prices on that point I agree. The prices I assume simply use the EIA AEO oil price reference case, which may well be wrong.

My models assume eventually oil prices will need to rise or there will not be enough oil produced. This is based on the assumption that oil companies can only lose money for so long before they go out of business because they cannot make their loan payments. In a medium/low oil price scenario, that is what happens.

As a result oil supply falls to a level that does not satisfy demand at the lower oil price level, then oil prices get bid up as there are too many customers chasing too little oil. I know you know all this, as it is basic econ 101, but in the long run it is the way a free market works (at least in theory).

If we want to throw up our hands and say we have no clue, that is always an option, but less interesting from my perspective.

I personally am at the throw up hands point.

The pundits are all saying shale is profitable at $50 WTI. Of course, the companies aren’t generally getting $50. More like $30s or low $40s. Hedges could be helping some.

There are still a lot of rigs going. Still a lot of frack crews going. Maybe that will tail off as contracts expire and are not renewed.

Companies keep producing oil through BK these days.

Shallow sand,

Doesn’t make a lot of sense at less than 60 per barrel at well head. I doubt it can continue more than 6 months at current price levels.

Many pundits know even less than me. 🙂

Oil consumption might head down.

This one on recession.

https://www.newsweek.com/recession-2020-cfo-economy-market-crash-general-motors-verizon-trump-2019-1255426

This one on automation.

https://www.nytimes.com/2018/12/13/opinion/robots-trump-country-jobs.html

I predict oil consumption will start falling in the early 20s. Here’s my argument:

There are about 1 bn cars on the road. Cars have a life expectancy of 14 years, so 71 m are scrapped every years. 81 m were sold last year, so the number of cars on the road is grows by about 10 m, or 1% per year.

This year about 4m EVs and hybrids were sold. Like EVs, hybrids burn almost no oil. Growth is about 70% / year. If it stays at 50% for a few more years, which seems likely, we get 6 m in 2019, 9 m in 2020, and 13.5 m in 2021.

So in 2021 the number of combustion engine cars will start falling, albeit very slowly. But there’s more. Most cars park 90% of the time. The biggest advantage of EVs is gas savings, so heavily used vehicles — taxis, ride share vehicles, fleet vehicles — will be replaced first, and they consume much more than the average car.

EDIT: For example, if EVs are used four times as heavily as ICEs, and they hit 0.5% of the total market, then demanded quantity of oil would be down 2%.

I don’t know about EVs plus Hybrids, but the total number of EVs on the road, in 2017, is just under two million.

But my bone to pick with you is you expect the exponential growth rate to remain constant at 70% per year. No, it just does not work like that.

The exponential rate will automatically drop off as the number of EVSs increase. Of course the numbers will continue to increase, but when the numbers get into the 10s of millions, the exponential growth rate will be nowhere near the 70% mark. That is just not a good way to make a prediction.

Worldwide number of battery electric vehicles in use from 2012 to 2017 (in 1,000s)*

They had EV’s in 1016 and 1017? How far we have fallen. 🙂

“The exponential rate will automatically drop off as the number of EVSs increase.”

Which is why I use a logistical equation in my graphs, not an exponential.

BTW, Tesla production went from 27,000 cars per quarter to over 80,000 cars per quarter in one year ( 3rd quarter this year).

Their new rate is about 400,000 per year and will probably cross 500,000 per year very soon.

Those are all BEV.

I agree, Ron.

My guess for maximum added electrics to the total vehicle fleet per year is probably about 30 to 40 million: I would further guess this might happen around 2033.

My basis for this is that I think electrics will last twice as long as ICE cars: hence, factory capacity should be about half that of our current production. I also think that if we get to driverless cars on a wide basis, they will kill the incentive for vehicle ownership (barring those in rural areas and special cases like tradesmen). There is not much difference between public transit and a driverless car; this will depress demand despite rising population.

Of course, the world could (and probably will) end first, but as a thought experiment, it’s not unreasonable.

Ron,

Of course you’re right about 70% growth being a passing thing. But I expect it to run a few years in the mid double digit range.

The main problem now is battery shortages. Every EV that is being seriously marketed has a half year or year waiting list, but a lot of battery production is coming on line.

https://twitter.com/tsport100/status/988436366932365313

This site predicts 1.1 TWh battery production by 2028.

https://www.visualcapitalist.com/battery-megafactory-forecast-1-twh-capacity-2028/

That puts a damper on my calculation, because at 70 KWh per car battery, that’s only enough for about 15 million cars. The shorter term outlook of tripling by 2023 means about 24% growth, based on this site’s claim that current capacity is 220 GWh.

China, which is responsible for practically all vehicle sales growth, is planning a sevenfold increase in EVs by 2025, which means increasing sales by a third each year. The are building battery factories like crazy, and I fully expect them to overshoot their targets as much as they overshot their solar targets. They planned 105 GW by 2020 in 2015, but have revised that to “up to 270 GW”.

So call me crazy but I think 20-30m EVs and hybrids a year by the late 20s is realistic. Again, that’s about 30% annual growth.

The main reason I think it is true is that electricity is much cheaper than gas per mile, and electric cars will soon be cheaper to buy than combustion engine cars as well. We’ll see.

“This year about 4m EVs and hybrids were sold. Like EVs, hybrids burn almost no oil. Growth is about 70% / year. If it stays at 50% for a few more years, which seems likely, we get 6 m in 2019, 9 m in 2020, and 13.5 m in 2021. ”

EVs burn coal & NatGas since most of the Grid power is produced via coal & NatGas. You analysis of EV growth is flawed, since it does not account that the majority of vehicles are financed, and most new cars have long term loans. What is likely to happen is consumers by far fewer vehicles as the costs or vehicles becomes un-affordable. Its difficult to buy a new car when you still paying off the loan of the old one. EVs are usually more expensive & come the next recession many manufacturers will likely exit the EV market or reduce investment. I would expect EV sales to collapse by the early to mid 2020’s if not sooner if there is another global recession in 2019.

Most official agencies (IEA, OPEC, EIA) projects a peak of US shale oil around 2025. From what I read on this esteemed forum this seems like a reasonable expectations, however, US shale oil will cease to be a market moving factor once its growth rate slows to 500K or below, with this in mind, does anyone have a projection on when will US shale production growth slow to such level? Based on my own work I see this happening in the 2021/2022 time frame, but would welcome the board input.

My guess would be 2019/2020.

For sure. But, it will probably pick up some after that, too little, too late.

Well, if “making money” had been a criteria for shale, ever, then 2014 would have been the peak year.

Not because that was the peak year of making money, but by then it was abundantly obvious that they hadn’t and really never would.

Sure, some operators could have picked up some pieces for pennies on the dollar and made a few bucks, but I mean that collective half a trillion of debt and equity already on the bonfire that could not be paid back under any rational scenarios.

Crazy what thin-air money printing can accomplish, isn’t it?

Chris,

The economics works in the Permian at the AEO 2018 Reference case prices, debt gets paid back about 2027 in my medium ERR scenario, mean USGS TRR and AEO reference price case. After 2027 cumulative net revenue in 2017$ (not discounted) is about 300 to 400 B 2017$. Assuming real annual interest rates of 7.5%. When oil prices are lower (average of AEO 2018 reference and low oil price case) the economics does not work.

To me the AEO 2018 reference oil price scenario looks quite conservative, my expectation is that oil prices will be higher than that scenario through at least 2035.

>Crazy what thin-air money printing can accomplish, isn’t it?

The low interest rates of recent years are a byproduct of globalization and the huge improvements in efficiency in recent years. As technology improves, it’s getting easier and easier to produce the goods and services consumers want. Furthermore, better transportation, communication and financing are allowing vast numbers of workers to enter the job market worldwide, pushing down wages and increasing profit.

At the same time the economy is dematerializing, as teenagers lose interest in cars and spend all their time on mobile devices that consume much fewer resources.

So more and more capital is being created, but there is less and less need for it. As a result, interest rates are nearly zero.

The real question facing mankind is what to do with all this money. A moon colony? A giant war? Reversing global warming? Ending disease? Mass restoration of the ecosystem? Health care and education for all? The American answer seems to be to pepper the continent with oil wells that deliver little or no ROI.

alim- ” low interest rates of recent years are a byproduct of globalization ”

Well, I don’t see the world like that. The interest rates are low because the worlds growth is very fragile and higher rates would push growth to stagnation.

The implications of which version you believe are huge.

Yeah. I see Asia as a gigantic deflation machine. Hundreds of millions of people streaming off the fields and into the factories, offering their labor at rock bottom prices. And when they run out it will be Africans.

Added to that, learning curves seem to be speeding up, and material things are shrinking down to nothing.

People raised in the 60s and 70s worry about inflation, but I don’t see how it could possibly happen under a halfway sane government.

“People raised in the 60s and 70s worry about inflation, but I don’t see how it could possibly happen under a halfway sane government.”

The Inflation rate in the US in 1979 was close to 12%. It wasn’t until the Volker crushed it with 14% interest rates. The issue is that since then, the Bond market has been in a bull market. Bond prices keep on falling, fueling more & more debt. However when at some point Gov’ts get into too much debt, and start printing money, and eventually inflation takes off, even in a high debt economy. Odds this will probably happen in the 2020s since sometime between 2022 & 2024 it will take every tax dollar just to pay the interest on US treasuries & entitlements (no money for defense, education, roads, etc). At that point the gov’t will just start printing money to cover the difference. Its likely most of the industrial world will follow the US’s example (just like the did with interest rates). So then you have entire global economy following Robert Mugabe’s economics.

Joseph,

Much depends on the price of oil. If we assume the aeo 2018 reference oil price scenario is correct, the increase in US LTO output falls to 500 kb/d in 2022, peak is 2024 at 9 Mb/d of US tight oil output.

Lower prices might lead to a lower peak, but it might be later. URR will be about 60 Gb in the AEO 2018 reference Oil price case, a lower oil price scenario would lead to a lower URR and higher oil prices might increase URR, range would be 50-70 Gb.

Thank you all, much appreciated.

Joseph,

I mistakenly used Permian URR above , for all US tight oil the mean will be about 85 Gb with a range of 70 to 100 Gb.

Currently, legacy decline is just above 500,000 barrels per month. This means that if production is to be increased by 100,000 barrels per month then new wells must produce 600,000 barrels per month of new oil.

If US new oil production is indeed increasing by 600,000 barrels/day per month, this is a mind-blowing number — 7.2 million barrels/day per year. Has new oil production ever increased by this much anywhere else in the World?

It’s just a completely other kind of business.

With a conventional giant, you set your productive wells, and then set injection wells, infrastructure, gas plants, reinjection infrastructure. So you invest double digit billion $ in above the ground infrastructure.

In shale it’s more about drilling many wells, with a less sophisticated infrastructure above the ground.

Conventional fields have constant drilling, too – new injectors, creaming, side pockets. But this is not new production, it maintains production.

Least but not last – the crazy drilling in shale is only to mainain production, too. A conventional field you tap complete, and then mainain it. A LTO field you tap slice by slice.

Do we have a computation of what % of total US oil production is from wells < 1 year old? Or even < 3 mos old.

Watcher,

Go to shaleprofile.com to get an idea. In August 2018 roughly 25% of US C+C is from wells which started producing in the first 8 months of 2018.

Look at just the Permian on Enno’s fine sight. If you focus just on the oil. +50% of all current Permian production came online during first 8 months of 2018. Legacy decline for 2017. Take a long hard look at that as well. Combine what 2017 and what 2018 legacy decline will be. How do they complete enough wells during a calendar year to overcome this legacy decline is my question. Also compare 2017’s legacy decline to the years before it. You’ll see that legacy decline is accelerating.

The infrastructure is there.

Say you just stall – ever drilling rig will drill it’s holes, every completion team will frack it, no growth or reductions here. Every rock has the same quality. Every well lives 10 years before it gets plugged

You produce let’s say 300 wells a month

Then you’ll see even growth over 10 years, every year less. So you have 300 1 month old wells, 300 2 months old wells, 300 3 month old wells …. up to how many months you are doing this. The growth is determined by the oldes well here – that’s what your produce more than the month before.

Until you start plugging – then you are in equilibrium.

When the rock starts getting worse without the technic being able to compensate, you start declining – or have to drill more.

I don’t think we’re there, yet.

What does stall mean. You say stall and then you say keep drilling.

HHH,

As Ron correctly said, higher completion rates lead to higher legacy decline. Currently there are around 350 horizontal oil completions per month in the Permian, if it falls to less than 290 per month, output will decrease.

I was looking for total US, which would be more than just shale. Some drilling elsewhere, surely.

But probably most is shale. Big % is dependent on recency.

Pretty much all increase in output is from tight oil, perhaps a bit in GOM, but that will probably be flat to down going forward.

Watcher,

Completion data like what is found at Enno Peters site is usually only found in proprietary databases, even if someone had access to that data they are not allowed to share it.

I don’t have access to that data so do not know yhe answer to your original question.

Peak will definitely not be 2018.

https://www.reuters.com/article/us-usa-oil-eia-outlook/us-expected-to-end-2018-as-worlds-top-oil-producer-eia-idUSKBN1OA21D

Also there is spare capacity in Saudi Arabia, and Russia will increase oil production for another year or 2.

Canada can still increase production and so can Brazil, Kazakhstan, Iran and Iraq can produce more, Nigeria could produce more if the pipelines stop being blown up.

https://www.forbes.com/sites/michaellynch/2018/06/29/what-ever-happened-to-peak-oil/#4e13c394731a

It has been a long long wait for peak oil, anything on the TV?

Best guess is peak oil is when peak US LTO is. US LTO will go down faster than conventional fields once the limit is reached, so no possibilities to replace it from conventional production. Especially when Russia is in decline when this happens.

^This. I agree.

Depends

If the world decides things are bad enough they will allow Iran to produce the 4MMbl it can. That would stave off peak for another 2 years. If all the Independents could operate freely in Venezuela they could produce another 3 million barrels per day. That could be done but probably will not be.

American sanctions could be lifted and US technology could produce the vast shale oil in Russia. It all depends on how desperate people get. And they will get desperate.

The most likely peak will be around the timescale Dennis has propositioned.

Yea you could be right. It is very hard to tell.

I am still inclined to think that the shale oil production in Russia and probably in Argentina et al. needs high oil prices. (again i could be wrong)

Not sure how that will occur in a world where GDP growth seems to be steady declining. But again who knows.

Everyone who has looked at the Bazhenov shale situation thinks it is only viable in very high prices, if then. There’s no infrastructure and no local labor in that part of Siberia. This is nothing like the Bakken or Permian.

That’s ignoring the politics and geology questions, both of which are considerable.

Iron Mike,

World real GDP growth has been pretty steady at about 3 to 3.5% per year from 2010 to 2017. See IMF chart at link below (click on chart button)

https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/WEOWORLD

Dennis

The GDP growth does not take into account the debt that has been used to boost that GDP.

A government that has no debt can use all it’s tax revenue to pay for schools, roads, police etc.

A government saddled with debt, must first honour the debt repayments. If it does not, it ends up like Greece.

The United Kingdom has to pay £48 billion to service it’s debt. That is $ times as much as what it spends on all the police forces.

The debt robs tax payers of services they should have, such as elderly care and safe neighborhoods. Police funding have been cut and cut.

https://fullfact.org/crime/police-funding-england-and-wales/

The rich in nice areas are the last to care about these things but eventually the people will simply have enough.

The debts occured paying not just for wars

https://www.thebalance.com/cost-of-iraq-war-timeline-economic-impact-3306301

https://thevietnamwar.info/how-much-vietnam-war-cost/

but paying for hundreds of thousands of mentally and physically injured men.

https://www.uswings.com/about-us-wings/vietnam-war-facts/

The arms manufacturers did very well along with the share holders and politicians who became non exec directors.

When a government borrow a hundred billion in order to pay wages and build roads, that is not real GDP. It is fake GDP which will be pay for with higher taxes and lower growth in the coming decades.

The rich are the first to defend this perverse situation because they benefit at the expense of the rest.

Hugo,

There can be too much debt and too little. Probably not as much of a problem as you believe. The debt was needed to get us out of the GFC. I agree that Government debt should be reduced where possible.

Private debt is not really a big deal, on a World basis it is money we owe ourselves, assuming no interplanetary lending. 🙂

Dennis

As I said, the rich will say it’s fine cos they are the beneficiaries of the debt which enriches the top and impoverishes the bottom

Hugo,

Also note that the rich hold most of the debt, so if it is defaulted on it hits them most.

A simple solution is to raise taxes on the wealthy in order to pay down government debt, also military spending could be reduced and that money could be used to pay down government debt. Also note that for many nations the interest rate on government debt is pretty low so not a lot of incentive in those nations to reduce government debt.

In addition, nobody wants higher taxes and very few want lower government spending, so government deficits remain a problem. So far it has been manageable, if debt grows faster than the economy, it will be a problem in the future.

Proper policy is to reduce debt during a boom so it can increase during a recession.

Greece’s problems (which have mostly been solved) are caused by the fact that the government owed the debt to foreigners. Obviously poor governance is a problem in Greece, but the low savings rate (by consumers and businesses) is the key problem.

There is no real reason to keep government debt low, as a matter of fact. It’s a myth created by a famous example of bad Excel calculations.

https://www.bloomberg.com/news/articles/2013-04-18/faq-reinhart-rogoff-and-the-excel-error-that-changed-history

It is important have good governance however, and for the government to invest sensibly. For example, America has problems maintaining its infrastructure because it is so poorly designed. The general feeling is that more should be spent, but actually less should be spent more wisely.

https://www.strongtowns.org/journal/2018/8/22/the-more-we-grow-the-poorer-we-become-td9nw

alimbiquated

Greece problems have mostly been solved. Are you kidding!!

https://www.euractiv.com/section/economy-jobs/news/greeces-unemployment-falls-under-20-after-7-years-of-bailout/

https://www.euractiv.com/section/economy-jobs/news/greeces-unemployment-falls-under-20-after-7-years-of-bailout/

https://www.thebalance.com/what-is-the-greece-debt-crisis-3305525

As a theoretical peak based on a lot of data that I assume Dennis model is based on, 2025 may very well be the peak. But in reality I think it will be different. With these kind of frequent showers of low oil prices experienced the last 4 years, offshore and places where cheap financing are not appropriate will suffer and building up for example Iran, Iraq, Libya, Venezuela, Syria and Kazakhstan will take too long time and not meet the demand in time. Add to that landlocked areas with potential that take even more time to develop. I know for a certainty that the oil and potential is there given investments. And then there is the shale oil potential worldwide which I do not know too much about, but assume will be expensive anyway. Due to politics intervening with the markets too much, we have built ourselves a time gap for supply scaricity and recession. A lot of potential areas screaming for higher oil prices, but not getting it. Nothing about this in MSM, nevertheless doesn’t mean it is wrong until proved otherwise.

I guess spare capacity and inventory globally can be stretched, but would it not be very visible after a while? (too high oil prices and recession due to debt bubble being a big concern)

kolbeinh,