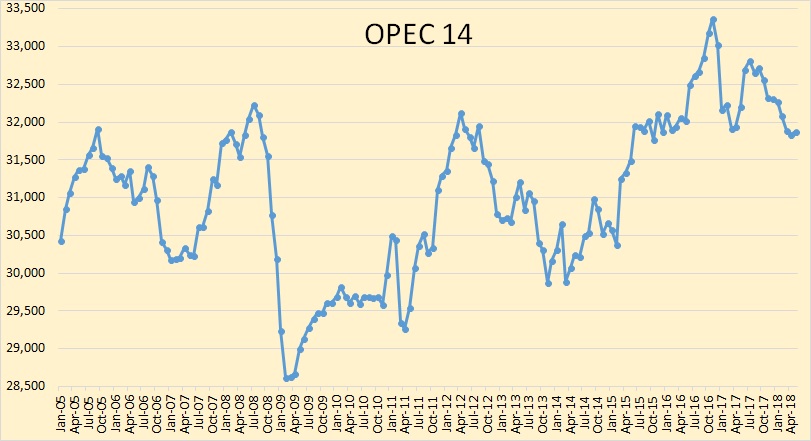

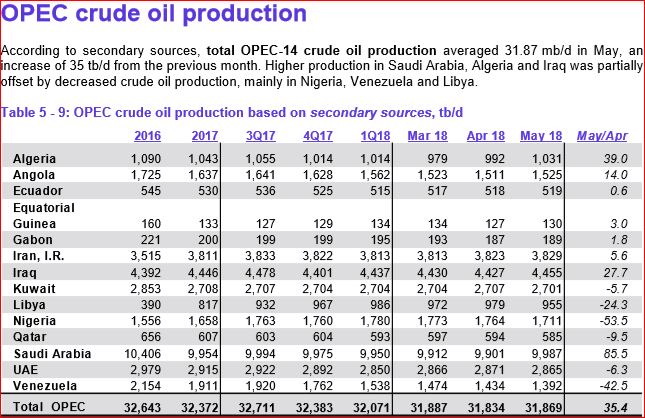

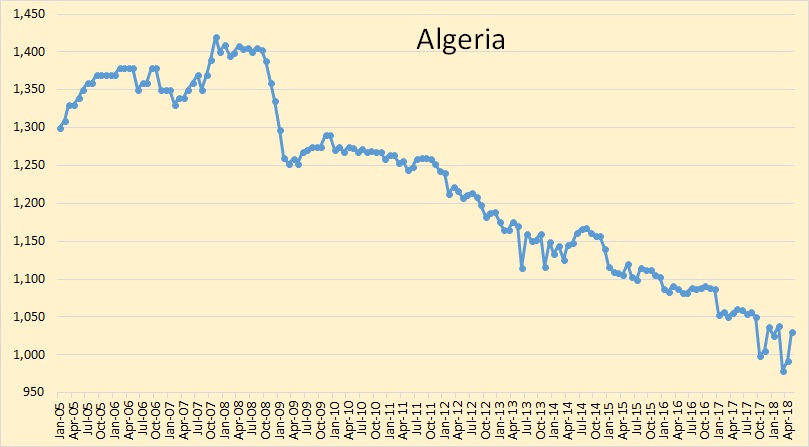

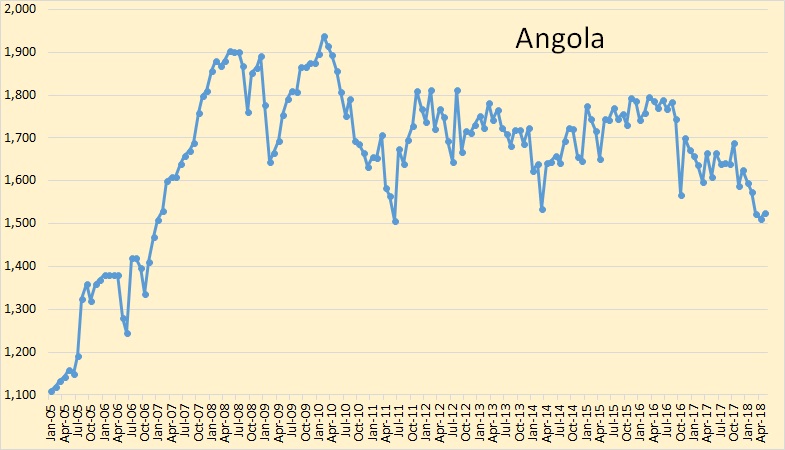

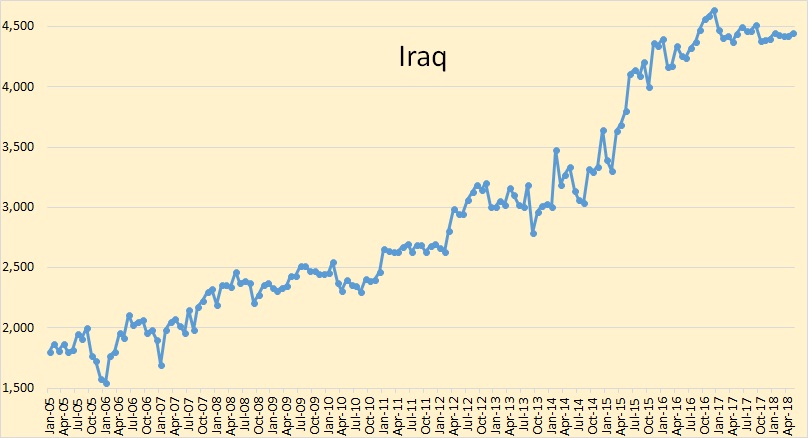

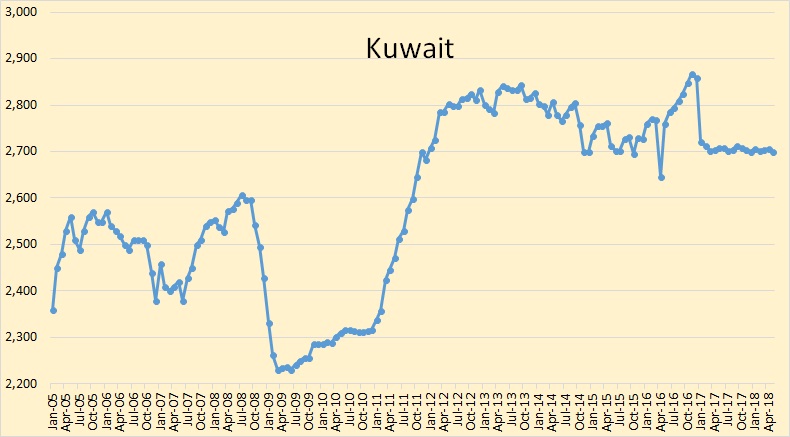

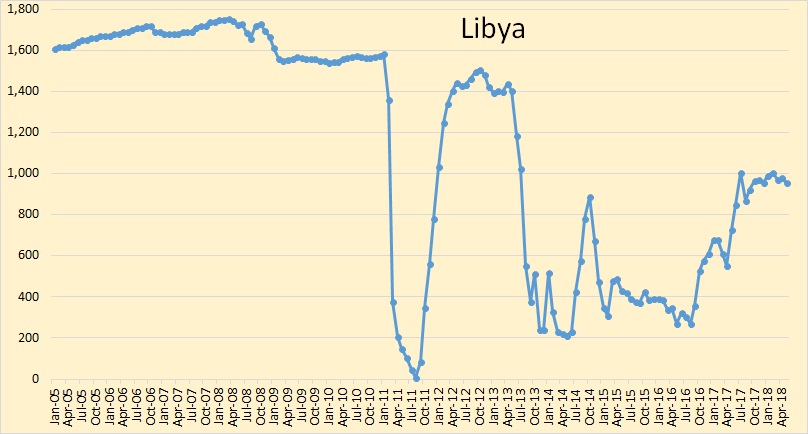

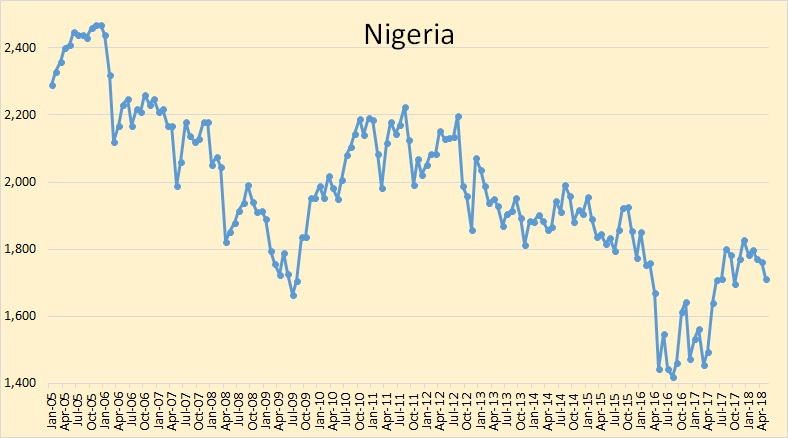

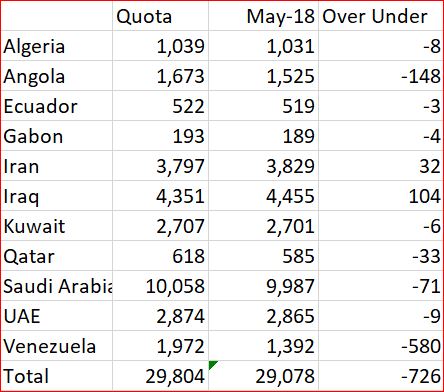

All OPEC data below is from the OPEC Monthly Oil Market Report. All OPEC data is in thousand barrels per day and is through May 2018.

OPEC 14 Crude oil production was up 35,000 barrels per day but that was after March production had been revised down by 32,000 bpd and April production was revised down by 89,000 bpd.

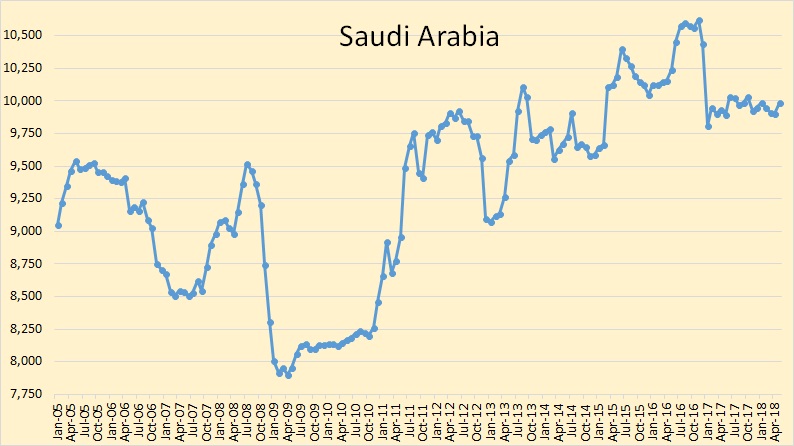

Nigeria’s April production was revised down by 27,000 bpd and Saudi Arabia’s April production was revised down by 58,000 bpd.

Nigeria’s March production was revised down by 26,000 bpd and their April production was revised down by 27,000 bpd. And still their May production was down by 53,500 bpd.

Saudi Arabia’s April production was revised down by 58,000 bpd. Their March production was unrevised.

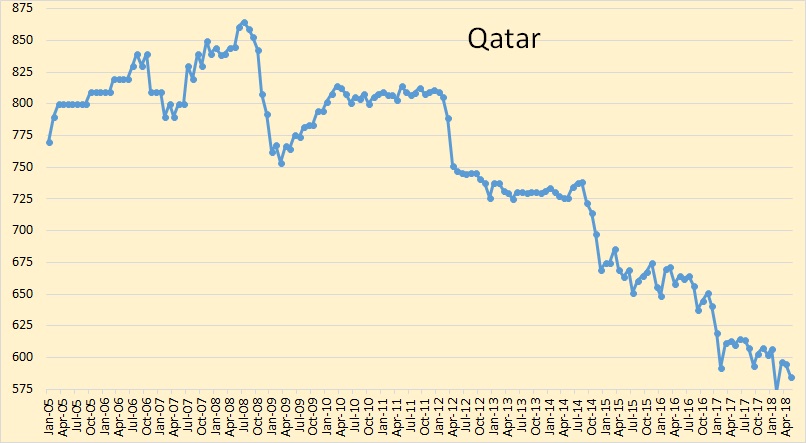

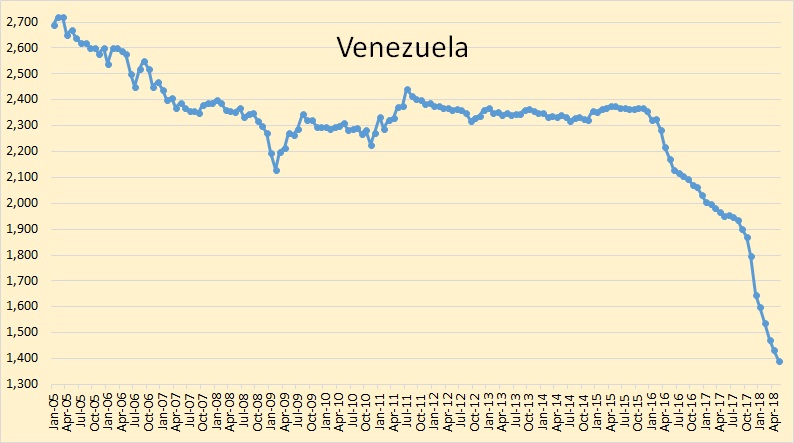

Venezuela’s collapse continues.

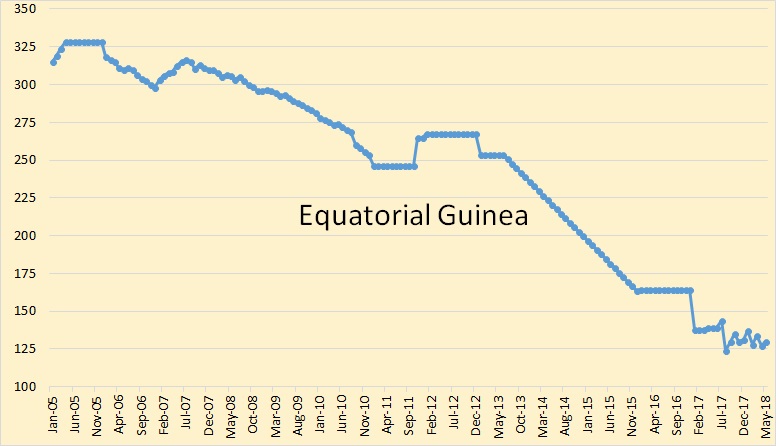

Equatorial Guinea was not a member of OPEC when quotas were set. Libya and Nigeria are not subject to quotas due to political problems in those states.

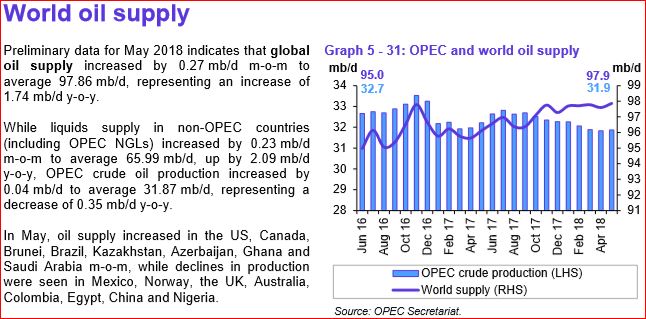

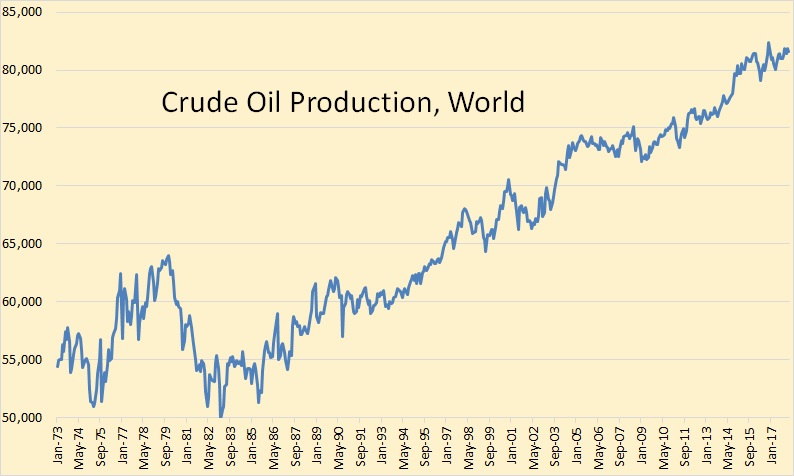

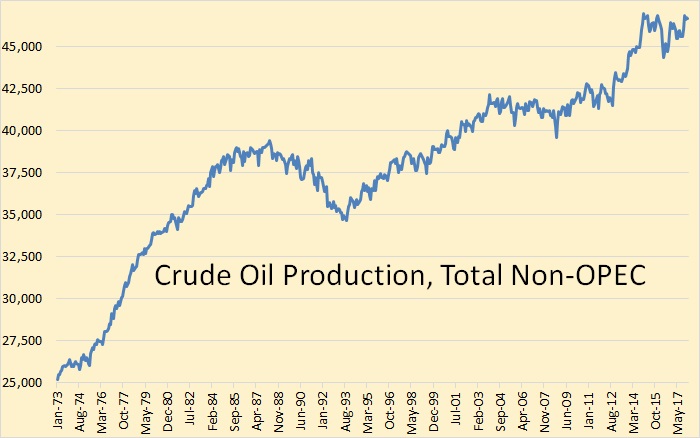

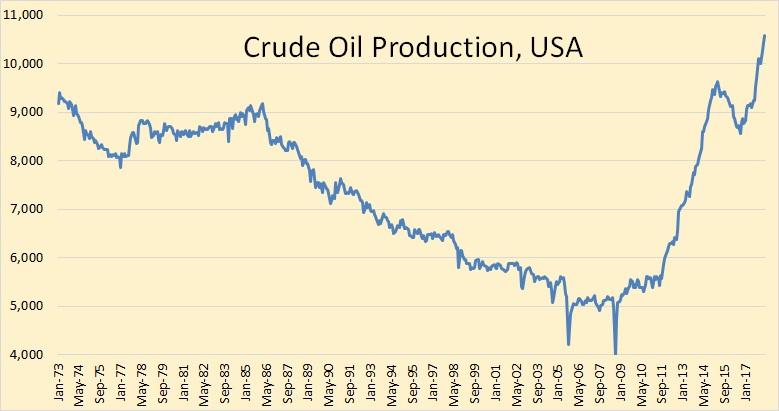

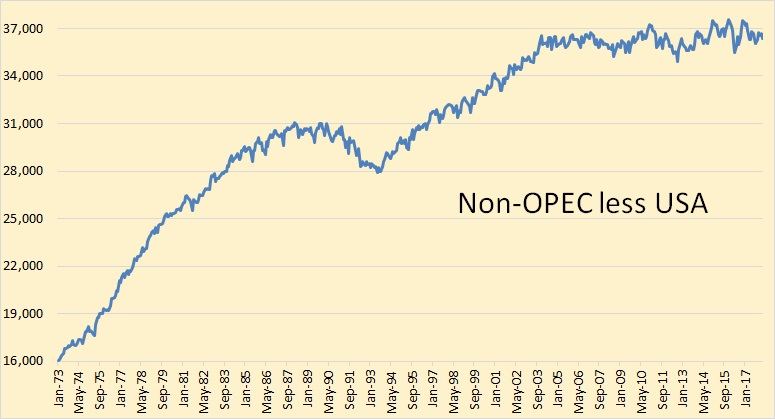

Some folks asked for data going back further than I have been posting. So I have posted below, USA, World, OPEC and Non-OPEC data going back to 1973. All data is in thousand barrels per day and it through February 2018 except USA data which is through April. All data below is crude + condensate.

World oil production, since the early 80s has been increasing steadily except for two brief pauses. One in the late 80s to early 90s and again from 2005 to 2010.

The dip you see in Non-OPEC production, late 80s through early 90s, was caused by the collapse of the Soviet Union. Non-OPEC peaked, so far, in December 2015. The spike you see, 2012 to the present, is entirely due to US shale oil production.

This is OPEC crude + condensate according to the EIA. The OPEC MOMR does not report condensate as its production is not counted in the quota system. The highest peak on this chart is December 2016. That was OPEC preparing for quota cuts. But as this chart shows, there were no real cuts at all.

This graph shows the dramatic effect shale oil has had on US production. This graph does not show the first peak in 1970. The second peak in 1986 was when Alaska’s Prudhoe Bay peaked. The current peak here is April 2018 and is an all-time high.

Non-OPEC less USA has been on a bumpy plateau for the last fourteen and one-half years. When shale oil peaks the US peaks and Non-OPEC peaks. Then the “call on OPEC” will be to save the world.

We have to discuss Saudi Arabia

(a) Aljazeera Interview with Mamdouh Salameh

In video min 16:15

“Sooner or later Saudi Arabia will need the world to deal with them and help them. The diversification program you referred to is not going to achieve much shortly.When you talk about Saudi Aramco which is main source of income they are talking about the IPO which is the initial public offering of selling 5% of Saudi Aramco, not the productive assets of oil, but different assets for $100 billion. That is not going to happen and I will tell you why. Because the Saudis have valued the IPO at more than $100 billion dollars. _*That cannot be right because based on the proven reserves they have (17: 14) many organizations including Wall Street Journal and the World Bank and many other analysts said that the value could be based on smaller proven reserves. Saudi Arabia says it has proven reserves of 268 Gb. My research shows that this is between 80 and 90 Gb and many other experts also agree with that. If you base your IPO value on that smaller reserves I think the value of the IPO is between 50-75 billion dollars. Still Saudi Arabia with the rising oil prices it does not have to sell any percentage in Aramco. It does not need the money financially with the improvement of oil prices.That’s why I say the IPO is not going to happen.What will happen in diversification is on concentrate (=focus) on adding value to your oil exports. Instead of exporting crude oil export as refined product, more petro-chemicals. Saudi Arabia could within the next 2-3 years dominate the petro chemical industry in the world and become the major producer and exporter. Furthermore, they can use even 5% of their oil revenue to expand full production. That’s an important part. Saudi Arabia imports more than 30 billion dollars for food firstly coming from the US”

https://www.aljazeera.com/programmes/insidestory/2018/06/drive-modernise-saudi-arabia-wrong-turn-180610170726544.html

(b) https://oilprice.com/Geopolitics/International/Can-Saudi-Arabia-Prevent-The-Next-Oil-Shock.html

In this post

Iraq war and its aftermath failed to stop the beginning of peak oil in 2005

http://crudeoilpeak.info/iraq-war-and-its-aftermath-failed-to-stop-the-beginning-of-peak-oil-in-2005

there is a table with 97 Gb cumulative production and 231 Gb original reserves for Saudi Arabia as calculated by PFC Energy for end 2003

Since then Saudi production was around 48 Gb. So we have 145 Gb cumulative and 231-145= 86 Gb remaining, within the range Salameh mentioned in the above interview

This was a hot topic a decade ago. Everybody looking closely at KSA knows that the official reserve figures are overstated. By how much is more the question that requires expert knowledge and intensive study given the lack of detailed recent data. The 80-90 Gb guess is probably a good one. This notion of reserve capacity is difficult to grasp and I think KSA is conserned about the real production capability being exposed when Mr.Trump asked politely if they could increase production (if he did). Key details about such things as production per field, water cut and number/types of wells would be welcomed. And this kind of information is more or less required if investors are to pay huge money for a tiny piece of Saudi Aramco.

Are big fields like Ghawar more suited to exotic recovery improvements. I haven’t seen news on Ghawar since The Oil Drum and Matt Simmons.

Ghawar doesn’t need exotic recovery, it’s a huge field with 34 APIoil and no nasties, and good reservoir properties. Water flood is giving them 70% recovery – they have the best reservoir models, real time seismic, the ability to drill wells for production, injection and inspection wherever they like; it doesn’t get much better.

So is it possible that it can have a cliff in production, from hero to zero as a pop saying is going.

FWIW: Ghawar has been using advanced Oil recovery for over a decade. Ghawar is using Horizontal drilling as the remaining Oil column has shrunk between 30 feet and 10 feet (depending on the drilling sites), SA has also been using CO2 injection in some parts of Ghawar, since I think around 2007-2009 period (but I cannot recall the actual start date).

I posted Here some links to SA Annual tech briefings that SA had posted on their website. However those may no longer be available. When I checked back in December they were gone, but it possible they were updating the website at the time. The Tech briefings had a lot of engineering information on new ways SA was creating and using new technology for extraction, locating trapped oil in pockets, etc. From what I read in these briefings, SA left no stone unturned looking to maintain production levels.

But the question said exotic, not advanced. I’m not sure horizontal drilling counts as either as it’s been around since the 30s and really expanded with Troll in the 80s and 90s. They did pioneer intelligent completions / maximum reservoir contact wells but they are not uncommon now, and they probably could have achieved the same, at higher cost, just with more drilling. As to CO2 I thought that was being tried to boost recovery even more and hadn’t made much impact yet – seems more likely to work on heavier oil.

“But the question said exotic, not advanced. ”

Horizontal Drilling, CO2 injection and other wiz-bang methods is about as close to “exotic”. Or did you mean using exotic dancer to appease the gods to deliver more Oil?

“As to CO2 I thought that was being tried to boost recovery even more and hadn’t made much impact yet ”

They are trying everything! It would surprise me that SA is using frack drilling in some special regions where the rock isn’t very permeable. The only thing SA likely hasn’t done *yet* is deploy witch doctors and exotic dancers.

None of those qualify as exotic.

CO2 works better when the reservoir conditions and fluids allow for a miscible front to develop. Heavier crudes are usually shallower and this may make it easier or harder to implement. It depends. However I have seen work done in a very cold heavy oil reservoir where the CO2 worked very well in a model.

I’m not sure what’s defined as exotic nowadays. The Saudis could try flooding with fresh water plus detergents and that should get them a few percent extra recovery. But they’ll have to bring water from India.

So the question is how much is left, when the remaining colums are under 30 feet (and this is 10 years ago)?

They then have to activate their reserve fields soon to maintain production.

Should be no problem since they have constant reserves since more than 30 years of more than 200 GB 😉 .

Given that they export a lot of chaos among the neighbors, it is also a mater of time since this kind of overproduction will affect closer to the “factory”

Production vs export capability.

At what stage in each of these, do export limitations affect production? The first, I can take wags, based on the fact there is a lot of data. The US increase for a year and a half is limited. But Permian producers are amazingly short sighted, and keep pumping. Still, I see production at, at least, half a million barrels short of projection through 2019. Constraints are the pipelines and port export capability.

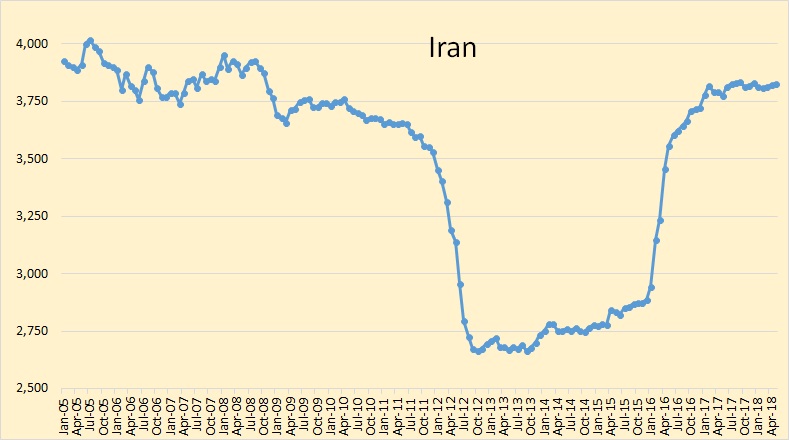

The other two, I have less data on, and my wags wouldn’t come close. They are Venezuela and Iran.

Venezuela is struggling to get half their production exported, due to losing the Caribbean operations to Conoco. Their production is dropping, but how much faster will their production drop due to storage?

Iran is still a question mark, but lack of interest by insurers, refineries, and shippers don’t bode well.

The call on OPEC now sits at somewhere over one million barrels, now, for the next year and a half. And growing. That doesn’t even consider demand for 2019. Just to keep it about the same as 2018. How demand for 2018 matches production is still very much of a question. We already know Iran’s stance on cooperating with OPEC. Now add this one:

https://oilprice.com/Latest-Energy-News/World-News/Iraq-OPEC-Shouldnt-Heed-Calls-To-Boost-Oil-Production.html

Not everyone agrees that OPEC (Sauds) have that capability:

https://oilprice.com/Geopolitics/International/Can-Saudi-Arabia-Prevent-The-Next-Oil-Shock.html

I find it amazing (same comment as last OPEC post), that nobody apart from you picks up on the downward revisions!

Well, nowhere in the MOMR does it say that the production numbers have been revised. What I do is compare the last two months numbers with the current numbers on an Excel spreadsheet. That’s the only way to find out who has been revised and by how much.

EQUINOR SEES BREAK-EVENS SLASHED FOR JOHAN CASTBERG

“Norwegian energy company Equinor said Tuesday its Johan Castberg field could be profitable so long as the price of oil is about $35 per barrel.”

https://www.upi.com/Equinor-sees-break-evens-slashed-for-Johan-Castberg/3851528807963/?spt=slh&or=2

MORE OIL FOUND IN NORWEGIAN WATERS OF THE NORTH SEA

“A Norwegian government regulator said Friday it confirmed an oil discovery was made in untested waters in the central part of the North Sea. The Norwegian Petroleum Directorate, the nation’s energy regulator, confirmed a discovery was made by Equinor in a wildcat well, one drilled in an area not previously known to contain oil or natural gas.”

https://www.upi.com/Energy-News/2018/06/08/More-oil-found-in-Norwegian-waters-of-the-North-Sea/2551528455982/

About 20 mmbbls in an area with no available hubs – that’s going to need some high prices or more neighbouring discoveries to be developed. The bigger story is that, as marginal as this is, it is still the best oil discovery announced in the last few weeks.

Hmmm, seems like I was highly scoffed at when I postulated a future with continued fossil fuel burning, due to cheaper and more advanced methods of recovery. This has already come true in several areas and is sure to keep going. Scoff back at my scoffers.

I just revised my CO2 concentration pathway, assumed a huge increase in future oil and gas reserves, plus a slight increase in coal, and my model says CO2 will not reach 600 ppm by 2100. Market forces limit how much we can produce. This means the IPCC work to limit emissions is hardly worth it.

EIA STEO estimates that U.S. crude oil production averaged 10.7 million barrels per day (b/d) in May, up 80,000 b/d from the April level. And forecasts 11.4 million b/day in December 2018.

https://www.eia.gov/outlooks/steo/

600k additional from the Permian by December? No doubt that is possible to produce, but what are they going to do with it after it comes out of the ground? Or, the other 400k they have by mid year 2019? Ok, I have never maintained that the elevator went all the way to the top with EIA economists.

Consumer confidence must be high in China still.

China auto sales rise 7.9 percent in May as electrics surge

Associated Press – Tue Jun 12, 4:08AM CDT

BEIJING (AP) — China’s auto sales rose 7.9 percent in May from a year earlier as purchases of electric and gasoline-electric hybrid vehicles more than doubled to 102,000, an industry group reported Tuesday.

Sales of SUVs, sedans and minivans rose to 1.9 million, according to the China Association of Automobile Manufacturers. Total vehicle sales, including trucks and buses, rose 9.6 percent to 2.3 million.

Year-to-date sales rose 5.1 percent to 9.9 million, rebounding from 2017’s annual growth of just 1.4 percent.

Sales of electric and gasoline-electric hybrids rose 126 percent over a year earlier. Through May, sales of electrics and hybrids rose 142 percent to 328,000.

https://www.barchart.com/story/news/load-more-stories/385676/china-auto-sales-rise-79-percent-in-may-as-electrics-surge

“Sales of SUVs, sedans and minivans rose to 1.9 million”

What about hatchbacks, combis, and cabrios? Let me teach you – everything under 3.5 tons, engine above 500 cc, and with four wheels, is a car.

when you look at the stark numbers its hard to have any solace in a couple of Tony Seba charts or non-stop articles about an EV revolution. Anyone that was waiting for the Chinese to bail out the world vis-a-vis peak oil (or even climate change) needs to meet Gadot.

To be rich is glorious. And China is filled with millenials and gen-xers that are hyper-obsessed with status symbols like fancy cars.

Through May, sales of electrics and hybrids rose 142 percent to 328,000.

That’s as good as anyone could expect. Exponential growth always looks a little unimpressive in the short run, because the absolute numbers aren’t that large.

Casual (popular) forecasters commonly guess too high in the short run, and too low in the long run.

China sold more the 28M new cars & light trucks in 2017. It’s the biggest market for vehicles in the world. EV & Hybrids was 1% of total sales & I would bet 80% or more of the 328K were hybrids. Nobody is buying EV’s

Nobody is buying EV’s

Apparently you do not understand the meaning of the word “vehicle”, hint, it doesn’t necessarily mean a gas guzzling SUV, PU or even a Tesla Model S or a Jaguar I-Pace. And you don’t seem to understand the exponential function either… There are currently 7.6 billion humans on the planet and they are just getting started with the transition to EVs! That includes electric bicycles, scooters, buses, trucks, trains, ships, ferries and even electric aircraft for mass transport.

https://www.statista.com/statistics/255662/sales-of-electric-bicycles-in-china/

This statistic represents the retail sales of electric bicycles in China from 2010 through 2020. In 2015, some 14.35 million electric bikes were sold to customers in China. The country is the most important market for electric bikes worldwide.

And purely for your entertainment:

https://www.youtube.com/watch?v=WrKfqIB-xCU

Fully Charged Live 2018 – Short Highlights

The Wall Street Journal had two related articles this weekend.

1. Silicon Valley is investing heavily in several electric scooter rental companies. Getting around in urban areas by scooters you can grab and then leave anywhere is popular with people living and working there.

2. People who buy SUVs and trucks are finding that their vehicles are often too big to fit into parking lot spots.

2018-06-12 (Reuters) The precise level of spare capacity available depends in part on how it is defined.

The Paris-based International Energy Agency (IEA), which bases its figures on oil production that can be brought onstream within 90 days and sustained for an extended period, estimates OPEC’s spare production capacity was 3.47 million bpd in April, with Saudi Arabia accounting for roughly 60 percent.

The U.S. Energy Information Administration (EIA), which defines it as production that can be brought online for 30 days and sustained for at least 90 days, put OPEC’s spare capacity at 1.91 million bpd in the first quarter.

Consultancy Energy Aspects said Gulf OPEC members would likely add less than 1 million bpd immediately, rising to about 1.5 million bpd in three to six months.

https://www.reuters.com/article/us-oil-opec-capacity/opec-will-squeeze-oil-buffer-to-historic-lows-with-an-output-hike-idUSKBN1J811H

The limit in Saudi, I am sure, is water injection and produced water handling capacity, not the wells or the reservoirs. They can’t significantly increase production without adding at least twice the amount of new oil in water injection (water cut is over 50% and oil shrinkage is around 20 to 30% I’d guess). I think spare capacity is likely to be highly seasonal so they can increase supply for power generation in summer and I’d guess recent increase is due in part to the Khurais expansion starting up, though I haven’t seen an announcement. I don’t see how EIA can come up with independent assessments of spare capacity so they are taking whatever they are told or simply extrapolating from data that could be 10 or 20 years old.

“The limit in Saudi, I am sure, is water injection and produced water handling capacity, not the wells or the reservoirs. ”

Its Horizontal Drilling and redrilling them when the water column exceeds the well height. They perodically have to redrill horizontal wells as the water column rises above them. When Ghawar was first drilled it had an oil column of about 2000 ft. Now its between 30 ft & 10 feet Also lots of oil that gets trap in pockets as water column rises, and the have to target those pockets with new wells.

I think not, it’s a lot cheaper to add a few more production wells than to add a couple of million barrels of high pressure water injection capacity (topsides facilities and the wells needed to inject it), and they are particularly careful to control their water injection to ensure they keep an even water contact, that’s why they have the sophisticated models, 4-D seismic and inspection wells, where they can. They have the best control of the sweep of anywhere in the world, which is not to say they don’t get any surprises. The drilling of new oil wells is to maintain current production, not to increase it, that is why I said water handling is the limit, and part of the issue is that as the water cut increases they can’t maintain voidage replacement with current capacity – therefore they drill a new well rather than increase water injection.

Hi George,

Would maybe about 600 kb/d of spare capacity for KSA sound roughly correct then? Basically this is just bringing output back to the previous peak in Nov 2016.

I don’t know. What do you define spare capacity to mean? They have been continuously drawing down stocks for a couple of years I think, is that just to meet their OPEC commitments or because they can’t do anything else? Has Manifa water injection capacity, and hence production, been, or will be, limited by the pipeline corrosion issues. Do they do all their maintenance in winter so they can crank up in summer? Has Khurais expansion started up yet?

None of that changes the fact that the ultimate production limit is water, not the reservoir or wells or pipelines. It almost always is with mature water flood fields, if theirs no limit to where you can drill new wells – i.e. what spare capacity they have is limited in the water systems (note to produce 1000 bpd of stock tank oil with water cut 50% and oil shrinkage factor of 20% requires about 2200 bpd water injection, usually at very high pressure, plus the well to inject it).

George Kaplan,

I am assuming three things.

Water injection that has already been built as of Nov 2016 will continue to work, Khurais has not started up yet as there would be news on that, and that KSA can bring output back to Nov 2016 levels (about 600 kb/d higher than May 2018 output).

Any or all assumptions may be incorrect.

“I think not, it’s a lot cheaper to add a few more production wells than to add a couple of million barrels of high pressure water injection capacity (topsides facilities and the wells needed to inject it”

Water injection isn’t the problem, its water cut. The don’t need to inject more if they keep the water cut stable. In order to keep the water cut, they have to perodically drill new wells to keep the wells in contact with the Oil column. Over time the Water column push up on the Oil column (ie Oil floats on Water). All the CapEx/Opex goes into drilling to keep in the Oil Column Zone as well as add new wells to tap oil trapped in pockets. As the Oil column continues to shrink and and as the water column become increasing contact with the cap rock its going to required more and more drilling to maintain production.

My guess well know when SA starts running into problems when we start to see the rig count increase and the production dropping over a period of a couple of years.

“The drilling of new oil wells is to maintain current production, not to increase it”

SA cannot increase Oil production much. They are working on extracting the remaining cream (oil column) floating on a see of water. Increasing production would just increase the water cut and also increase trapped oil that would later be more costly to extract. The only way SA can increase production is to tap new fields or increase drilling for oil trapped in pockets. But at some point these options will vanish over time as it will be increasing more difficult to squeeze more oil out, like trying to squeeze trapped toothpaste out of a depleted toothpaste tube.

But this can’t be right because it makes so much sense that I understand it.

I didn’t say water injection was the problem I said it was the limit to increasing production. It is. Water cut is the problem that leads to decline unless they keep drilling new wells.

Two ways that increasing water cut is a problem are: 1) you have to inject more water for the same amount of oil, which they don’t have, 2) you have to treat more produced water, which they don’t have capacity for. Exactly what I said above. The third is that it reduces overall well flow and, more so, oil flow; but that is easily got round if it easy to drill new wells, as is the case for Saudi, even the offshore fields, which are shallow. That also solves the first two problems because the individual field and overall country water cuts are held steady.

The limits on surface facilities are much more expensive and long term (5 years at least) to get round, but it could be done, therefore it is wrong to say that the only way to increase production is to tap new fields.

(ps – I worked on water flood oil fields, including some minor studies for Saudi, for at least 15 years through my career, the water is a bigger influence on the design and operation than the oil.)

That all together sounds like it’s completely senseless to keep some spare capacity for fields like this.

This capacity will cost billions, hold back for not much. A big oil storage is better there for satisfying demand peaks or temporary supply losses.

Reserve capacity is cheap to have when you are in primary recovery of a conventional (giant) field.

The only illusion of reserve capacity would be in fields with tertiary recovery would be to postpone maintainance for a few months to get that 5% more production.

Did I understand it right?

Some spare is always needed, just to maintain production during maintenance or unplanned outages. Sparing doesn’t postpone maintenance, it means maintenance can be done without taking the plant offline, or at least not for too long, so you get maximum returns on your investment (when plants are taken down for major turn arounds it is to do work on items for which there are no online spares).

Depending on the maturity of the field there is also always different amount of sparage in the different project components – e.g. the wells, compression, power generation, oil processing, export capacity, water injection, water processing – the limit is the component with the least amount of sparage.

In Saudi also, at least for the heavy fields, they have been known to rest them completely for a time, this allows the water contact to settle out and avoid excessive coning, which provides a much better sweep of the oil and higher recoveries (I don’t think any where else has that luxury).

So when someone says “we have spare capacity” it can mean almost anything from 2×100% pumps on a particular duty to an entirely unused, ready for action oil field.

From a modern capitalist approach with everything just-in-time and the next quarterly statement being all important then excess sparing wouldn’t please the shareholders, but Saudi designed facilities with 50 year life times, so it might be different.

From looking at their recent production profiles, which seem to go up when they report a new start-up and then decline, and stock draws, which have been consistent since January 2016, I find it hard to believe they have a large amount of “real” spare capacity – i.e. that’s easy to bring on line and that doesn’t alter any of the performance of the fields over the long term or compromise planned maintenance schedules – but I can’t say for sure. And, as I’ve said, the limit to expanding production (that means beyond just using up the spare) is almost certainly with the surface facilities for water, so it’s likely that is also the part with the least spare capacity.

Thanks George.

It sounds like you believe they might be able to maintain a plateau of 10 Mb/d for many years, if they just drill more wells as needed. Though I may not be understanding correctly.

There’s the big question. Once the horizontal wells are at the top of the reservoir then you can’t drill any more and once the water contact hits them, even with intelligent completions, then the decline will be fast (but even that is relative, huge fields take longer to decline than small ones). There was a report in the Oil Drum some time ago that indicated that a lot of Ghawar wells were near the limit but nothing much seems to have happened since to indicate this turned into a problem, but then Saudi has a lot of other fields. On some of their offshore fields they are replacing all the wellheads to add ESPs, that usually means they have run out of new well options. Their rig count is declining, but maybe jus because they are drilling much more productive MRC wells.

It’s the difference between the size of the tank and the size of the tap (or for water injection more like the size of the vent that lets air in to stop the tank collapsing under suction). Might only know what’s going on well after the fact.

Indeed there is much that we do not know about KSA.

2018-06-12 – CARACAS/HOUSTON (Reuters) – Venezuela’s state-run PDVSA and partners have halted operations at two upgraders that convert extra-heavy oil into exportable crude and plan to stop work at two others, according to six sources close to the projects, a move aimed at easing the strains from a tanker backlog that is delaying shipments.

https://www.reuters.com/article/us-venezuela-pdvsa-crude/venezuelas-oil-upgraders-to-be-halted-amid-export-crisis-sources-idUSKBN1J82FX

As I said above, the article points out that if they can’t relieve the bottleneck; they will be forced to slow or shut in production.

2018-06-12 (Argus Media) So far in June, the outlook for Venezuelan production is grimmer. Venezuela was producing about 1.5mn b/d at the start of May, including roughly about 800,000 b/d in the Orinoco oil belt and a combined 700,000 b/d in the company’s eastern and western divisions. But output in early June has dropped to 1.1mn-1.2mn b/d, according to three PdV officials.

https://www.argusmedia.com/pages/NewsBody.aspx?id=1697240&menu=yes?utm_source=rss%20Free&utm_medium=sendible&utm_campaign=RSS

Bigger drops coming, soon.

I agree with his take, mostly. At this level of confusion, and lack of money and personnel capital, it’s not fixable.

https://oilprice.com/Energy/Energy-General/Venezuela-Wont-Have-Enough-Oil-To-Export-By-2019.html

The basic problem is the General he put in charge did not understand Maduro’s command. He thought Maduro said oil production needs to decrease a million barrels a day.

They are losing workers especially the technical managers, don’t have money for spares and are going to shut down to repair (I note it says repair not just maintenance for two of them) and restart all four of the most difficult operations in refining, all at the same time. These are high temperature fluidised beds with some pretty horrible waste product (highly viscous, toxic coke in heavy oil residue sludge which can block pipes and burners and corrode all sorts of stuff). Shutting them down fro extended periods is not always a great idea at the best of times. Planned maintenance for such things is usually phased so only one is down at a time to ensure all the planning and purchasing can be completed and the experts are available to go to each plant in turn. The plants need catalyst replacement which costs money, and tends to be more frequent if the plant isn’t in very good condition or isn’t being operated optimally (the operators need to be well trained). Be interesting to see how long it takes and how many come back, it’s quite possible the best case will be cannibalising a couple to keep the others going.

As to: “If PDVSA cannot alleviate the shipping bottleneck, the company and its joint ventures could be forced to slow or temporarily pause production at some Orinoco Belt oilfields,” that is already happening: they have dropped over half the rigs and might be down to none by September at current rate, without new wells and workovers heavy oil can decline pretty quickly.

Good article in NYT about Venezuela’s oil industry collapse.

https://www.nytimes.com/2018/06/14/world/americas/venezuela-oil-economy.html

Houston, 11 June (Argus) Plains All American Pipeline, a prime mover of crude around and away from the Permian, reiterated last week that there is not enough trucking capacity to address skyrocketing production, and potential rail slots are limited.

With most material pipeline capacity additions a year or more away, Plains said the logical solution is slowing output

https://www.argusmedia.com/pages/NewsBody.aspx?id=1696409&menu=yes?utm_source=rss%20Free&utm_medium=sendible&utm_campaign=RSS

That’s really kind of funny. The takeaway professionals have to tell them, “come on guys, put a brake on it. It can’t be moved.” Note, the article stated that the pipeline company said production is already slowing.

Wonder if EIA will finally read the memo?

Also, it may result in more little fish, being eaten by the bigger fish.

Energy News, you constantly amaze me with your finds of information. Everything is extremely pertinent.

The next 3 or 4 months for EF and Bakken might be interesting – they’ve both been steady or slightly declining with no pick up in drilling or, I think, permitting even as the price has risen, and the initial well production and ultimate recovery look to be declining on recent wells. If Permian is closed off I wonder if the operators will bother to move back to these.

State of North Dakota came out with a new presentation a few weeks ago showing revised predictions for Bakken oil output. They now have production likely reaching 1,900,000 BOPD within the next decade while the best forecast offers better than 2,200,000 BOPD.

https://www.dmr.nd.gov/oilgas/presentations/WBPC052418_2400.pdf

Yeah, I think they will. You just won’t see growth just overnight from these areas, and the ones who had good areas in these, never left. EOG, Conoco and others are still doing their thing. Growth will mainly show up the first and second quarter of 2019. Maybe some the last quarter of 2018. My guess. It just won’t ramp up like the Permian, EIA predicts a bunch, but they are smoking some strong stuff. They believe in teleportation of oil to the coast, and further teleportation to VLCCs off the coast.

That not everyone believes the EIA is evident in the huge, many billions of dollars, losses in stock value of the “Permian pure play” companies recently. EIAs and IEAs fairy tales are coming unraveled. About the only section of the investment community that still believes them, is that percentage of adults that still believe chocolate milk comes from brown cows. What they are still unsure of, is how much excess capacity OPEC now has.

Wild guess on the 22nd. OPEC releases non-opec from the agreement. Increasing OPEC, at this point, will involve disintegration of OPEC, which it really is, anyway. But, a modest increase may hold them together for a little while. Although, for the Sauds part, I don’t know why they would, except to keep up the illusion.

IEA monthly oil market report for June is out.

Selected extracts from the report follows.

About the market in general:

Rapidly rising prices in recent months have raised doubts about the strength of demand growth, and we have modestly downgraded our estimate for 2018. Prices are unlikely to increase as sharply as they did from mid-2017 onwards and thus the dampening effect on demand will be reduced.

About Non-OPEC production growth:

We think that in Texas by end-2019 there will be a net 575 kb/d of additional pipeline capacity beyond our earlier number, albeit with most of it coming on line in the second half of the year. In the meantime, capacity will likely remain tight but production will still be able to grow strongly, by 1.3 mb/d this year and 0.9 mb/d in 2019. Our non-OPEC growth for 2019 includes a modest increase from Russia reflecting a possible contribution to compensating for lost production from Iran and Venezuela.

About OPEC production:

To make up for the losses [from Venezuela and Iran], we estimate that Middle East OPEC countries could increase production in fairly short order by about 1.1 mb/d and there could be more output from Russia on top of the increase already built into our 2019 non-OPEC supply numbers. However, even if the Iran/Venezuela supply gap is plugged, the market will be finely balanced next year, and vulnerable to prices rising higher in the event of further disruption. It is possible that the very small number of countries with spare capacity beyond what can be activated quickly will have to go the extra mile.

As usual I disagree with their views, it seems like they have a stance that the market will be in balance no matter what.

https://www.iea.org/oilmarketreport/omrpublic/

They now have an estimate (“scenario”) of market balance in 2019. All assumptions are not available in the public version. Deficit (stock draw or call on Saudi et al.) is between 1-1.6 mbd assuming lower exports from Iran and Venezuela. However, current decline in Venezuela looks worse than I think they assumed and IEA continues to assume N America shale oil on full throttle. 2019 is shaping up to be interesting.

(sorry for cross post)

The most likely trend for Venezuela is surely that it hits zero exports (or maybe total production at worst) sometime in 2019, not that it flattens out or, more miraculously, starts increasing again. Brazil is likely to take longer, and therefore have a lower peak, to ramp-up its planned Santos FPSOs. Kazakhstan looks decidedly peaky (or plateau-y, except in the past they’ve always shown decline after a peak); Tengiz expansion is in 2020 but I think initially it just extends the plant plateau. North Sea will be declining until J. Sverdrup. Nigeria and Angola are definitely showing signs of the big declines you get when deep water FPSOs hit end of life, and not much drilling there showing yet.

It would be interesting to know how they factor in decline rates (which are accelerating); in-fill drilling (which must be running out of the best prospects); and short cycle developments of new discoveries (few to none of those at the moment). If they are using predictions based on 2005 to 2014 experience the models are going to be a long way out, but what data is available to do something better?

BP Statistical Review of World Energy 2018

https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

U.S. Petroleum Balance Sheet, Week Ending 6/8/2018

http://ir.eia.gov/wpsr/overview.pdf

Saxo chart summary https://pbs.twimg.com/media/DflCAkpX4AAGGjK.jpg

A draw of about the same overall size as last weeks build, due to big increase in total products supplied, which is up +3.3 million barrels per day from last week.

This week’s domestic crude oil production estimate incorporates a re-benchmarking that raised estimated volumes by 55,000 barrels per day.

https://www.eia.gov/petroleum/supply/weekly/

https://oilprice.com/Energy/Crude-Oil/OPEC-Lifts-Non-OPEC-Oil-Production-Growth-Forecast.html

OPEC predicts an increase of 130k barrels in 2018 that will be teleported out of the Permian.

The bible is out. A few surprises.

India’s oil consumption growth was only 2.9%. Derives from their monetary debacle early in the year. We should see signs of whether or not that corrects back to their much higher norm before next year.

China consumption growth 4%. Higher than India. Clearly an aberration.

KSA consumption actually declined fractionally, which allows Japan to still be ahead of them in consumption.

US consumption growth 1%. So much for EV silliness.

BENGHAZI, Libya, June 14 (Reuters) – Libya’s Es Sider oil port was shut on Thursday due to armed clashes nearby and at least one storage tank in the neighbouring Ras Lanuf terminal was set alight, an engineer in the area said.

https://www.reuters.com/article/libya-security-oil/update-2-clashes-shut-libyas-es-sider-oil-port-ras-lanuf-tank-on-fire-engineer-idUSL8N1TG1L6

Photo on Twitter: https://pbs.twimg.com/media/DfpGCWwWAAA2wUj.jpg

Drop in the bucket to what is happening right now. US will be about 500k less than their (IEA’s) expectations into 2019 due to transportation constraints. George thinks Venezuela will approximate zero by 2019, as do others. Give them the benefit of doubt and say a one million decrease from 1.6 at the beginning of this year. IEA is still using production vs export capabilities, which has to change. Europe’s refineries have largely stopped buying Iran’s oil, as has India. That’s 1.1 million that has to be sold elsewhere, or not. On shipping, insurance, and financing that is not affected by the restrictions. I count 2.6 million into 2019 that is not on IEA’s plate. Yeah, as said above, 2019 is going to be quite interesting, most of which we will see the end of 2018. None of this takes into consideration any increase in demand for 2019 that is over the US production projection for 2019 (.9). nor any shortage carried over from 2018. Yeah, we should be hunky dory.

In the investment world, we will still be watching EIA weeklies, to determine what is happening in the rest of the world for awhile. So increased cognitive function won’t happen soon.

250kbd – not shabby when it’s for longer than a few days. A quarter of the Opec reserve capacity, or all the russian reserve capacity.

Without fracking, the world would be in deep sh*** already. With e technic not advanced enough and 150$+ oil – and more economic problems and instabilities.

“Without fracking, the world would be in deep sh*** already.”

Are you kidding? Why? We can’t car share, build vehicles that get 80 mpg or better, can’t conserve, can’t innovate? There is nothing better (sadly) than economic stress to make fast and lasting changes.

Let the oil go up to $150. All the countermeasures have been developed, in a decade we would be well on our way to not needing oil ever again. Sure the military and some specialized vehicles or systems might need to burn some oil but 90 percent of the demand would be gone in a decade. Bring those prices up and keep them there. Things look ready now for a permanent transistion.

Here in the US we are so wasteful, we would hardly know the difference if we cut demand by 50 percent. I cut my use of gasoline for transport down to 10 percent already. Didn’t die or anything like that. Many people could cut theirs by 50 percent or more with existing technology. With some planning and minor lifestyle changes, down to 30 percent.

Businesses would go EV or hybrid with natural gas.

It’s very dangerous to the oil industry to let the price rise. It’s no longer a kidnapped world, it’s merely a matter of changing production to different types of vehicles and heating systems. Oil lost out in power generation, it will lose out in transportation if prices go high for very long.

Sorry, not buying that.

People who can afford it will continue wasting gas – and US people have lots of money or credit cards. Some will have to scale back, of cause.

The break comes in developing countries, where the “Arabian spring” was triggered by high fuel prices, among other reasons. Or in other countries when the goverment can’t keep up fuel subsidis. Modern cities, even in the 3rd world, need gas to function.

This means public transport and goods transport, not private cars!

Buying smaller car is an option for developed countries, including China.

Other things: Lybia – with higher prices, the war between war lords for the oil perhaps heats up more – more weapons available.

Nigeria: More oil price – more money to get from government, so blow up more pipelines.

Venezuela: The decline started already at 100$+ due to socialistic waste, so no change here.

Irak: Perhaps more money for IS & co by selling oil – so less production and more war.

Iran: More money -> more weapons to shoot out the proxy war with Saudi Arabia.

Russia: More money -> no really need to increase production, just earn.

And so on… we need a transition, but not a chaotic one.

Just reading the existent system now. Dependence upon oil is by design and design can now change. Economic stress is the only way to hasten the transistion.

If Iran wants to spend it’s oil money on war instead of energy transistion, then it will end up back on camels in the long run. Same with some other countries.

If the people of a country are more interested in war and destruction than helping themselves, that will end badly. Same goes for the US, or any other big country, if it keeps trying to run the world.

Venezuela is an example of bad leadership, nothing else.

People and governments often end up where they are aiming.

You don’t understand, that this “wasting” of oil, and other energy sources IS the economy. When your car burns more gas – people in oil extracion, and refining have jobs, and oil exporting countires have revenue to employ it’s citizens, and these citizens then buy iphones, etc.

Oil can only be scaled down, when other energy source takes over.

The root of all employment in the world is using of energy sources. More energy used worldwide, means more purchasing power of the population. It’s true since hunter-gather times.

Europe begs to differ. A number of European countries have twice the GDP/energy of the US. The whole world has been increasing GDP/energy used for many years.

“Oil can only be scaled down, when other energy source takes over.”

Efficiency and systems management has already scaled down the use of oil, otherwise we would be using more than twice as much now.

Meanwhile, other energy sources are and have been taking over from oil for many years. From electric trains to electric power, electric cars, gas heating. This trend will only accelerate as oil becomes more expensive and more volatile in price.

Yep, it’s scary for some. Two days work for a few guys or less puts enough PV on a house to supply it’s power and the power for an EV. Maybe another day or two for maintenance over the next 20 to 30 years. That is all the work that is provided.

Another day or two to put in a battery backup system. Not much work there.

However, not to worry. There is a huge amount of work over the next few decades designing, installing new energy systems. Houses and buildings need refits to be better insulated. Water systems will have to be changed. Everything will change, meaning lots of work. Probably too much, so automation will play a big part.

After that, who knows.

Are you suggesting that we should buy oil we don’t need, as charity to Texas and Saudi Arabia?

That’s an odd claim for “somebody” pretending to be Polish. Are you saying Poland doesn’t have an economy? Because the last I heard it was booming without an oil industry.

“Why? We can’t car share, build vehicles that get 80 mpg or better, can’t conserve, can’t innovate? There is nothing better (sadly) than economic stress to make fast and lasting changes.”

An 80 mpg vehicle is called a motorcycle. I don’t expect many people to commute to work in the middle of winter on a motorcycle. Nor can I see granny going to the grocery store on a motor-bike. There are limits to improvement: You cannot squeeze blood from a stone. Law of diminishing returns: further efficiency improvements are much smaller and much more expensive to implement.

A lot of oil is consume to transport goods to consumers. That salad you bought at your local grocer, likely traveled 1200miles in a refrigerated truck. Pretty much everything you consume includes materials, parts that are manufactured in distant locations.

Most Westerners are now dead broke. They carry high amounts of debt, and have managed to avoid going homeless because Central Banks dropped the interest rates to nearly zero. Since then People have been increasing there debt and at some point rising interest rates & increasing debt will trigger another crisis. That said, dropping the interest to near zero probably won’t work the second time since when the next crisis starts rates will be significantly lower than during the 2008-2009 (ie law of dimishing returns applies to interest rates too)

“Let the oil go up to $150. All the countermeasures have been developed, in a decade we would be well on our way to not needing oil ever again”

It won’t be sustainable. Recall that in 2008, Oil prices peaked at $147/bbl and it triggered the biggest global recession since the Great Depression. Gov’t turned to Money printing (ie QE) to avoid a deflationary spiral. If Oil Spikes near $150/bbl is going to trigger another global crisis. Which will lead to more war, Civil wars, revolutions, & rioting. Recall that during 2009-2012, Developing world gov’t collapsed, and there were widespread riots in Europe (UK, Spain, Italy, Germany, etc).

“Oil lost out in power generation, it will lose out in transportation if prices go high for very long.”

Oil was never a major source for generating Electricity. Coal was, but that been outpaced by NatGas. The think is that NatGas is much more valuable to use for spinning turbines. Its used for heating and DHW in urban areas since it does not release emissions like Coal & Oil would. I cannot fathom the costs of retro-fitting every home & business when NatGas depletion hits.

It took the work about 140 years to build the economy and infrastructure which is dependent on fossil fuels. Any transition off fossil fuels is likely to take nearly as long.

I am taking that rant to my garden to help plant growth.

Tech guy said:

“An 80 mpg vehicle is called a motorcycle. I don’t expect many people to commute to work in the middle of winter on a motorcycle. Nor can I see granny going to the grocery store on a motor-bike. There are limits to improvement: You cannot squeeze blood from a stone. Law of diminishing returns: further efficiency improvements are much smaller and much more expensive to implement.”

No they are called hybrids and EV’s and they are real cars not motorcycles, though EV motorcycles do much better.

Techguy said:

“It took the work about 140 years to build the economy and infrastructure which is dependent on fossil fuels. Any transition off fossil fuels is likely to take nearly as long.”

You are long about 100 years on that one. Most things already depend upon electricity, we already have the tech needed for the transistion which is in progress around the world.

You think oil is going to last 140 years? Make it 30 to 40 and some people might believe you on this site.

BTW oil prices did not trigger the global recession, it was a banking failure due to an 8 trillion dollar housing bubble bursting, a stock market descent and the resulting loss of wealth causing a big cutback in consumer spending, then the largest loss of jobs and cutback in business investment since the Depression.

It took the work about 140 years to build the economy and infrastructure which is dependent on fossil fuels. Any transition off fossil fuels is likely to take nearly as long.

Why would that be the case? There are many examples of leapfrogging over previously existing technology. Third world countries without the existing infrastructure of land lines went straight to smartphones in about a decade.

Today’s Millenials think very differently about transportation than the old guard. My own son does quite well without owning a car. He is a university student and has a job. If he needs to commute he takes public transport or if necessary a ride sharing service like Uber or Lyft, he has a smartphone and that’s all he needs.

BTW an 80 mpg vehicle is not a motorcycle, that’s completely obsolete technology. Because there some are European Millenials who came up with this:

https://www.youtube.com/watch?v=9QVBIiOcIds

Solar-powered car (4-seater) by Solar Team Eindhoven

Senior communities have embraced golf carts.

In urban areas, people are using electric scooters.

For some lifestyles, using vehicles that are low maintenance, don’t require expensive fuels, don’t require insurance and state and local fees, and can be parked or ditched easily are more convenient than owning or operating a traditional vehicle.

The transportation market may further split into the SUV/truck owners and the small electric device users.

As the small electric market expands, and communities become more accommodating to their users, a tipping point may be reached.

Devoting expensive real estate to parking lots doesn’t always make financial sense.

Know what? You’re right! Everything is solved. EVs will save the world! We’ll be driving EVs to Infinity and Beyond.

Why don’t You two go on a worldwide celebration! You should be awarded the Nobel Prizes for Physics, World peace, Chemistry, and economics.

We all bow to your great wisdom!

kumbaya! Now Ron & Dennis can shutdown POB since its really all pointless.

Of course EV’s aren’t about to save the world from oil depletion, demand outstripping supply of crude oil, and the economic catastrophe that a massively overgrown population will experience from the shortfall of energy.

But that is all the more reason to adopt EV’s as quickly as our economy can do it- because when peak oil becomes apparent, you sure as hell still want to be able to get around, and to market. The more folks and businesses with EV’s/hybrids at that point, the more functional the economy will be. Certainly that holds true for your local community and family.

I saw a guy driving through the city streets the other day- his vehicle was an electric trycicle that was about as big as a van. It was hauling 4 electric bikes in a rack, and then a separate cargo trailer behind it for tools and such. He was going to next stop on his route, servicing the electric bikes that Ford has put out for rent around the city in huge racks. Maybe this kind of stuff isn’t happening in your town, but it is starting to in hundreds of others. Better than doing nothing while peak oil gets closer. btw- Ford is planning to have battery power in most of their vehicles within 4 years-

“DETROIT (Reuters) – Ford Motor Co (F.N) will significantly increase its planned investments in electric vehicles to $11 billion by 2022 and have 40 hybrid and fully electric vehicles in its model lineup, Chairman Bill Ford said on Sunday at the Detroit auto show. ”

https://www.reuters.com/article/us-autoshow-detroit-ford-motor/ford-plans-11-billion-investment-40-electrified-vehicles-by-2022-idUSKBN1F30YZ

Ford is exiting passenger cars. its going to focus on light trucks and SUVs:

https://www.investors.com/news/ford-motor-exiting-passenger-cars-more-trucks-suvs-new-lineup/

Cars are becoming unaffordable. Average US auto loan is now over 6 years. Subprime autoloans are avg. close to 10 years. Personal transportion is dying a slow death as the costs for personal vehicle ownership is slowly becoming unaffordable for all but the top 10% of the population. Ford is switching to focus on the high end market which is affordable by roughly the top 10% of the wage earners. GM & Crysler\Fiat are focusing on debt to fuel autosales, which will lead them into default again when the next recession hits.

Instead of EVs, public rail transportation should have been the focus as well as increasing freight trains instead of trucks to move goods. EVs are a dead end. The USA could have spent the the past 10 years adding more rail to support passenger and freight. As energy prices rise, and demographic problems grip the economy, their won’t be any resources available to increase rail transportation.

Rail is the most efficient transportation system available and it can be powered by fossil fuels or electricity and isn’t dependent on batteries. It also avoids wasted energy not getting stuck in a traffic jam.

No way will EVs ever obtain any significant numbers compared to fossil vehicles. Perhaps hybrid will increase, but these are still dependent on fossil fuels & EVs are still dependent of natGas power plants. If there was ever a signifcant transition to EVs the Grid would need a massive investment to permit large numbers of EV to be charged.

I think that most people will end up holding on to junkers when they can not longer afford to by new vehicles. They simply drive considerable less, until they are no longer able to drive at all. Something like 90% of all new personal vehicles use auto loans. Delinquency rate for subprime auto loans are now at a 22 year high.

I recall that 5 to 7 years ago, The cornucopians here\TOD believed Wind and Solar would dominate grid power generate by now. They projected that current trends in growth would increase for the forseeable future. It didn’t happen. Today most of new grid power generation is coming from new NatGas plants, which for the time being is the cheapest source (even beating coal).

Well stated TechGuy.

I can’t disagree

Except that none of that is realistic.

For instance, car prices are rising because people are willing to pay more. You can still buy cheap new cars…but no one is buying them.

I don’t remember anyone here 6 years ago saying Wind and Solar would dominate grid power generation by 2018.

And you might want to take a look at the latest post: http://peakoilbarrel.com/eias-electric-power-monthly-may-2018-edition-with-data-for-march/#comment-642876

for stats on new capacity for natural gas vs wind & solar.

Could be the first sign of things kicking off again – wasn’t the chap who was supposed to be holding it together reported as having a stroke some time recently?

Saudi Arabia – Manifa – I’ve not seen anything more recent but this article from last year suggests that they’re building a new water injection system in parallel with the original corroded one, while still producing oil.

KHOBAR, Saudi Arabia, July 20 (Reuters) In August, service companies are expected to receive tender documents to bid for work related to laying a new pipeline to replace the one hit by the corrosion, but is still in use, other industry sources said.

https://af.reuters.com/article/africaTech/idAFL5N1KB6G7

Whatever happened to Jeffrey Brown? (ELM)

World desulphurization capacity is at 60%, with another 3.9 million b/d of capacity being added by 2021

OPEC World Oil Outlook 2016. Capacity by process and region

At the global level, today’s refineries are increasingly ‘complex’ – that is, more refineries today have more secondary processing per barrel of primary distillation capacity than was the case in the past. The trend has been for most new large refineries to be built with high levels of upgrading, desulphurization, octane and related supporting capacity from the outset. Recent examples include new refineries in India and Saudi Arabia. Thus, base levels of secondary capacity are now substantial. As a percentage of crude (atmospheric) distillation capacity, vacuum distillation stands at an average of 38% worldwide, upgrading at 41%, gasoline octane units at 19% and desulphurization at 60%.

http://www.opec.org/opec_web/en/publications/340.htm

US EIA 2017 Table 1. Desulfurization capacity is 17,621,484 barrels per stream day

https://www.eia.gov/petroleum/refinerycapacity/refcap17.pdf

Futures prices for 3.5% sulphur fuel oil

https://pbs.twimg.com/media/DfsLIiBW4AALxhu.jpg

Isn’t another factor for the IMO rules that the shipping industry has decided to switch to marine diesel, rather than desulphurised bunker oil. I don’t know why – maybe they thought it would be more readily available; so they could switch back if it turns out not to be.

Yes “thought it would be more readily available”. No doubt they prefer fuel oil as it costs less than diesel (gasoil) and their fuel systems are designed to use it. I guess the story is that, so far, there isn’t enough low sulphur fuel oil available.

George

I suspect this is the thin end of the wedge. I can only comment from the perspective of the trucking industry but when the legislators turned there sights on us some years ago sulphur was the first target. But very soon oxides of nitrogen were also included. Thus moden truck engines are now all electronically monitored and controlled, catalytic converters, particulate filters and exhaust gas after treatment (adblue) are all in common use. Non of which work atall well with bunker fuel.

I guess regulators don’t like heavy fuel oil all together. Too much metals, NOx in addition to high natural sulphur content if the feedstock has a decent amount of sulphur in it. Some crude oils have low enough sulphur content to not need further treatment, for example some Algerian/Nigerian crude types and some of the tight oil as well (e.g. Eagle Ford). It is usually more the case for the high API crude though. It doesn’t solve the problem as some refineries have a strategy buying low sulphur oil even today.

Found an article where the authors think the refiners have the following options:

• Investing to reduce the sulfur content of produced fuel oil to continue serving the bunker fuel market. Investments in process options should be carefully evaluated based on differentials in pricing of low-sulfur fuel oil (LSFO) vs. HSFO.

• Exiting the fuel oil market completely. Many refiners are considering implementation of bottom-of-the-barrel upgraders to produce more low-sulfur distillates, including marine diesel.

https://www.ogj.com/articles/print/volume-116/issue-4/processing/study-evaluates-refiners-options-to-meet-2020-bunker-fuel-sulfur-rules.html

For the second option investing in delayed cokers seems to be a good idea (that was what Exxon did in Rotterdam). It is a costly investment, but must be worth it given diesel prices at the moment.

If all refineries chose to exit the fuel oil market I can’t help thinking this will create some problems as what was bunker fuel oil before now ends up in a range of distillate products and some (maybe 5-10%) could also end up as gasoline after cracking. So it is difficult to replace bunker oil with marine diesel 1:1.

It is also kind of worrying that marine diesel as an alternative is a lot more expensive than bunker oil. This is an inflation trigger for the global economy and a hurdle for the shipping industry.

Maybe the world economy will be so far in the tank by 2020 we’ll be seeing general deflation amid low demand for fossil fuels.

There sure seems to be a lot of factors pointing to a rather hard landing for this long business cycle (10 years is a really long boom period). The central banks have a tendency to print money when things go wrong; or use the low interest weapon if they have it. Where all this will end up is difficult to predict just because of how complex it is.

To be more precise, after some reflection, what I fear is more stagflation. A rare historic incidence which combines inflation with negative economic growth. That is what happens when pouring money into an economy with scarce resources where oil is one of them. What is coming is typically not like 2008-09 just because black swans are everywhere, and higher inflation is the surprise coming forward in my opinion. Prices for fossil fuels will stay pretty high in such a scenario, e.g. with the decline rates for oil overall rising steadily. Which I think is a good thing due to the energy transition that has to happen. I think it is realistic that we can come up with a halfway of a solution for our energy problems and that it is good enough to secure a decent standard of living (or maybe halfway decent or okish ;-)) long into the future. But not an affluent one and it will be highly country specific. Unless some kind of technology breakthrough is coming, but that is certainly a long time project.

At the same time, a lot of shipers are investing in two fuel engines (nat gas and fuel oil) to comply with sulfur rules

2018-06-14 (RBN Energy) Cushing Pipelines Filling Up And The Impact On Price Differentials

U.S. production has been growing consistently and demand for crude at the Gulf Coast for exports and refinery inputs will remain strong. With no new projects in the works to transport additional crude volume from Cushing to the Gulf, space on Marketlink and Seaway should remain a valuable commodity, at least until several new pipes are built out of the Permian to the Gulf. . And if those two lines remain full, pipelines and production further upstream of Cushing could start to see differential swings as well.

https://rbnenergy.com/oklahoma-breakdown-cushing-pipelines-filling-up-and-the-impact-on-price-differentials

That’s a very interesting look, and something I have been wondering about for awhile. Cushing is not filling up, now. It is at a very low point relative to the past few years. Still, an almost $8 discount to MEH means MEH is only a coulpla bucks less than Brent. Which I view as very positive for demand. Most of the Eagle Ford goes directly to MEH, involving only transportation costs and whatever other arbitrage they throw in. So, Eagle Ford is getting the best rates, as of now. That traveling from the Permian to Cushing, are subject to two big discounts before sale. According to the article, it may have a delay in sale, too. Stuff coming from north, and from Okla. have the same constrictions to MEH. But, they have some other alternatives to MEH, at least. Cushing would have been completely overflowing without the 300k a day pipeline to Nashville opened last year. I read they are looking at other re-works to get it to East Coast refiners. All the new pipelines I read about from the Permian are headed to the Coast, not Cushing. I haven’t read about any new lines from Cushing to the Coast. But, if there is demand, we may be hearing about it soon.

A new one from Mr. Likvern

https://fractionalflow.com/2018/06/14/the-powers-of-fossil-fuels-an-update-with-data-per-2017/

It has an odd emphasis on debt. It’s true that debt is a claim on the future. But…everything is a claim on the future. A mortgage is, and so is a lease with promised rent payments. Bonds are, but so are stocks with dividends.

He implies that rising debt is *necessary* for economic growth, but doesn’t make that explicit. It’s a key assumption that’s not spelled out, perhaps because it’s not supportable.

And this idea that debt pulls forward energy consumption is odd. You can’t borrow energy from the future- it’s either physically here today or it’s not.

Finally, he make some dubious criticisms of renewables-am I right in my vague memory that he denies climate change?

Hello everyone.

Recently I have been lurking around POB due to other pressing engagements, but the comment from NickG prompted me to respond.

…

Troll alert!

First of all Nick G do you have courage enough to introduce yourself by your full given name?

1.” It has an odd emphasis on debt. It’s true that debt is a claim on the future. But…everything is a claim on the future. A mortgage is, and so is a lease with promised rent payments. Bonds are, but so are stocks with dividends.”

Mortage is DEBT!

How is (all) rent payments DEBT?

Are dividends DEBT?

2. ”He implies that rising debt is *necessary* for economic growth, but doesn’t make that explicit. It’s a key assumption that’s not spelled out, perhaps because it’s not supportable.”

If NickG had taken the time to read my article before commenting he would have found that figure 6 shows how world total debt grew from 2002 to 2017 while figure 1 also shows development in world GDP. To help him; figure 6 shows world total debt grew by $131 Trillion and world GDP by about $35 Trillion for the referred period.

NickG, please explain how economic growth is facilitated.

3. ”And this idea that debt pulls forward energy consumption is odd. You can’t borrow energy from the future- it’s either physically here today or it’s not.”

DEBT pulls forward demand/consumption, also for energy.

4. ”Finally, he make some dubious criticisms of renewables-am I right in my vague memory that he denies climate change?”

NickG, show where in my article that I make some “dubious criticisms of renewables”?

NickG, I resent your thinly veiled comment (rather attempt to smear) regarding what I mean or not mean about climate.

I demand NickG either provides evidence supporting his comment or retract the comment in full.

Rune,

I’ve been here and on TOD for more than 10 years – I think its quite clear that I’m serious about this stuff, and not interested in creating unnecessary, personal, unsupported arguments (which I think is what you were suggesting).

Yes, I challenged your article quite strongly, but…that’s because I disagree with it, quite strongly.

So, there’s a lot of material here for a very long discussion. let’s limit it to one issue at a time, and start at the end: do you agree that climate change is anthropogenic, primarily caused by fossil fuels, and a very serious risk to humanity?

I never discuss matters related to climate in the public.

And my article was not about climate, it was primarily about energy. In other words you are trying to discuss something that is not related to my article…that is what trolls do.

No, you did not challenge my article, you simply revealed your ignorance.

I am still waiting for your explanations and documentation.

And btw why do you, NickG (still waiting to learn your full given name) not have the courage to take your comment to my site?

Rune,

“No, you did not challenge my article, you simply revealed your ignorance.”

Yes, that pretty well sums it up.

Well, I find it useful to know, when discussing biology, whether the person agrees with the theory of evolution.

Similarly, when discussing energy, I find it helpful to know the person’s views on climate. That’s not trolling – it’s pretty basic when it comes to energy. And, sadly, I find that people who defend fossil fuels, and makes dubious criticisms of renewables, almost all of the time don’t accept the scientific consensus on climate. I can’t think of a good reason not to discuss climate – such discussions do attract comments from climate denier trolls, but you can delete them on your own blog.

Okay, I guess that’s enough on climate – readers can draw their own conclusions from your unwillingness to discuss it.

Now, let’s go to the off-topic things that you’ve offered: I don’t give my name for reasons that I can’t discuss, and because it’s irrelevant – authority doesn’t matter. Only good logical arguments, and evidence matter. On the internet, you can be a dog, and it doesn’t matter – the question is, does what you say make sense? Why don’t I go to your site? I don’t know – I don’t really see a reason to. POB uses the time I have available for such things, and I don’t have time to go to more sites to engage in long arguments – I have enough of them here.

So…let’s tackle one more topic – the first one, debt, looks good. You said:

Mortage is DEBT!

How is (all) rent payments DEBT?

Are dividends DEBT?

I didn’t say rent payments or dividends are debt. I said that they’re claims on the future. If you sign a 5 year lease, you’ve made a promise to make those payments, just as if you’d signed a 5 year mortgage note. Similarly, people who buy stocks are getting the promise of dividends: they’re a claim on the net profits of the company. And a claim that’s enforceable in court.

So, if a country’s housing stock is shifting from rental to owned (e.g., apartments are converted to condominiums), then debt will rise, but does that mean anything? Not at all. The “claims on the future” are no greater than they were before.’ Similarly, if corporations are shifting to financing capital investments through debt rather than through stock issuance, it doesn’t mean anything at all about the “claims on the future”.

Does that help?

NickG, you are still way off in the wilderness relative to the content of my article.

”Now, let’s go to the off-topic things that you’veoffered: I don’t give my name for reasons that I can’t discuss, and because it’s irrelevant – authority doesn’t matter.”

NickG, your reply is what to be expected from a troll.

Again I urge you to provide references to my official stances on climate. Alternatively retract your statement.

Nick wrote;

”Only good logical arguments, and evidence matter.”

Yes, hard facts, data and logic matters.

So where did you apply those in your initial comment directed towards my article?

Hint, reread your initial comment which was designed to create doubt without providing for an alternative explanation.

ON THE SUBJECT ON DEBT.

Have the world’s debt/credit grown in recent years?

(Note I provided documentation for this from several sources in my article and my point was about the growth in stocks of the worlds currencies and you provided a non relevant reply.)

NickG, I will give it to you straight. Your comments/replies reveal you are a financial illiterate.

Rune,

It looks like we’re still have to talk about Climate. I regret that it has upset you so much, but I can’t imagine how we can ignore it. I think we can all agree that if Climate Change is as important as the IPCC suggests, that it’s a very large cost for fossil fuels. Also, almost all world governments are shaping their energy-related public policy with Climate Change in mind. That means that Climate Change has to be a very large factor in any analysis of energy costs, and the relative growth of fossil fuels and renewables.

So, whether one includes Climate Change is important. It’s highly relevant to the accuracy and realism of any analysis or projection of our energy future.

So…do you include Climate Change in your analyses and projections?

Nick, not to worry. Growth based on a declining energy system is a fatal direction. Fossil fuels, besides their many horrible present consequences, have no long term future. Thirty to 100 years at most and declining during that period. To even try and compare fossil fuels to solar and wind energy which has an unlimited timeline is just silly. Continuing to base a civilization on FF technology and use is deadly in the near term.

The total useful energy available from solar and wind is vast compared to the total useful energy available from fossil fuels and the timeline of FF use is a mere point compared to the timeline for solar and wind energy availability. With a limited amount of energy and an extremely short timeline, FF are not comparable to soalr and wind power.

FF use is a dead end. Solar and wind are continuous sources over geologic time.

I see no point in the discussion considering the current state of technology and knowledge.

Unless of course it is to point out that FF is a large economic drain on the system and the funding should be shifted to developing a long term energy system.

There are other sources not yet tapped:

Geological energy – or fusion energy.

But both require more time to be developed in a safe and economic way.

The next source is water power (already tapped but can be advanced – wave energy) and bio mass energy (problematic but possible as a gap filler).

Bio mass has the advantage to be storable just like a heap of coal – so it can bet a good gap filler with little extra cost.

The problem facing any energy source other than solar is that solar is going to be free during the day in a decade or two. That makes investing a chump’s game.

Solar is already the cheapest form of energy. If prices for solar equipment fall at 10% a year for the next 15 years, they will hit 20% of current prices.

For reference, prices fell by about 25% last year, and are expected to repeat that this year. The switch from polysilicon to monosilicon is expected this year, so panels should produce a lot more energy as well.

We are nowhere near the bottom. Whether or not you believe solar can supply all our energy needs, it’s hard to deny that selling energy at a profit is going to be much harder in the 21st century than it was in the 20th century.

Maybe we will stop investing in things so much and invest more into ourselves and the natural world. Bringing the world back toward life could be the best investment we have ever made.

I found Rune’s article very relevant to the world we live in today; debt affects financial systems, the price of hydrocarbons and its use in the future, even how alternatives to hydrocarbons can be developed going forward. I note Rune did not post his article on POB, someone else did, and did so under discussions related to petroleum.

The criticism the article received is simply directed at the author, not the topic, and is an effort by the same 2-4 individuals on POB that always try and control its content and otherwise promote their irrational, radical agenda against all hydrocarbon use, starting tomorrow. If you see no-point in discussing fossil fuels anymore, then don’t. Stay on the non-petroleum side of the tracks to discuss ice and rail on Trump. And since when does one have to declare one’s position on climate change before offering insight into oil and natural gas issues critical to the near term future of the world? That’s some pretty narrow minded stuff.

Does that help, Nick?

Some people who post comments here are desperate for pushing their vision of a future that ‘works’, smoothly and cleanly, without coal and oil. All of their comments are in support of trying to convince all readers that this can happen, if only they agree. Pleae ‘drink the coolaid’, they say.

I am sorry to say to them that it is merely wishful thinking. Worth working towards certainly, but a massive depression and demographic chaos is already baked in the cake, with a very high degree of certainty. This is due to the combination of a massive global debt accumulation peaking at the same time as fossil fuels (within the the next 7 years) Catastrophic, imho.

GF, sounds to me like you might just be one of those so called financial illiterates. 😉

Jeez, next thing you know you’ll be trying to convince people that physical laws trump neoclassical economic thinking… Good luck with that!

Maybe you need to post that youtube video of Jeremy Rifkin’s talk on the third industrial revolution, here on the Petroleum side of POB, not that I think it will change any of the deeply entrenched views of anyone on this side of the aisle.

I’m sure things will be much better when we have 9 billion people vying for the limited resources of an overheating and dying planet circa 2040. /sarc!

I now see more than 5 cars when I walk the paved roads near me. It’s absolutely horrendous.

I have seen traffic jams at the 4 way blinking light stop in the town center, sometimes involving up to 6 to 8 cars stopped at once. What a nightmare.

I find it hard to imagine what will happen here when there are lots more people in Africa.

Hi Rune,

China’s debt to GDP to the non-financial sector is only about 160%, so there is likely room for growth in Chinese debt. For the US the Debt to GDP has stayed pretty consistent ay 250% from 2010 to 2017 based on BIS data.