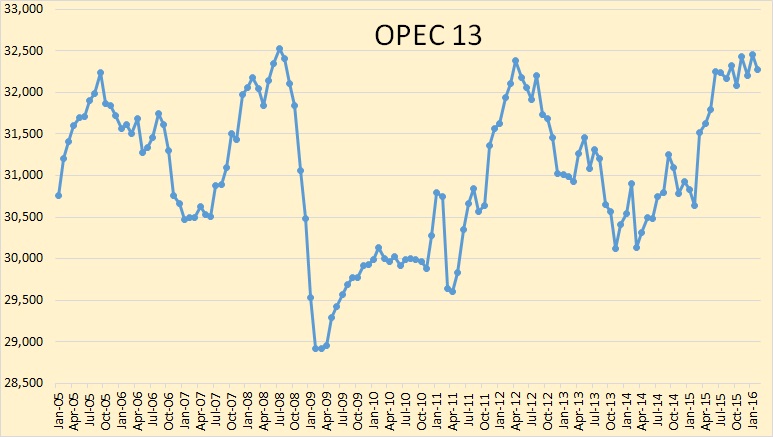

All charts are through February 2016

The OPEC Monthly Oil Market Report just came out. The charts are “Crude Only” production and do not reflect condensate production.

Also the charts, except for Libya, are not zero based. I chose to amplify the change rather than the total. OPEC is now 13 nations with the the addition of Indonesia.

All Data is in thousand barrels per day.

OPEC production was down 174,800 barrels per day in February

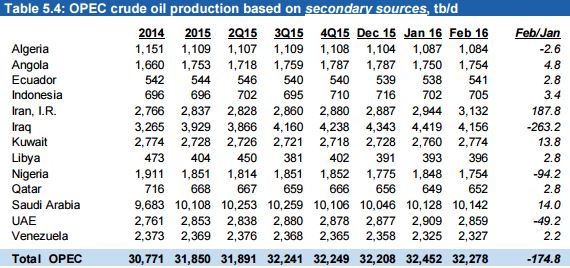

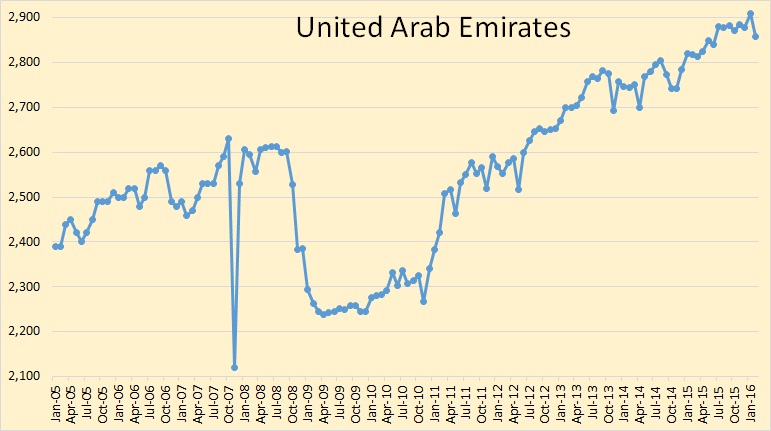

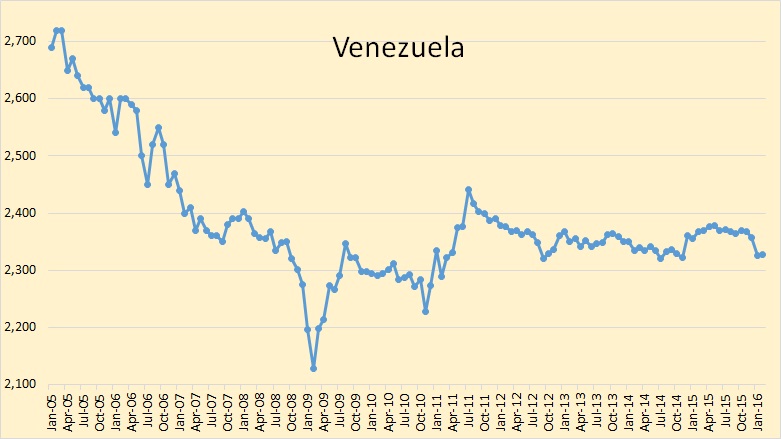

OPEC uses secondary sources such as Platts and other agencies to report their production numbers. These numbers are pretty accurate and usually have only slight revisions month to month. The big gainer in February was Iran. The big losers were Iraq, Nigeria and the United Arab Emirates.

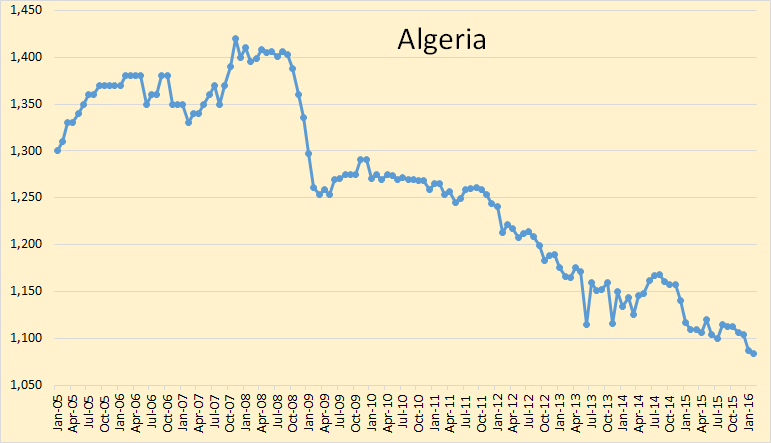

Algeria peaked in November 2007 and has been in a steady decline since that point.

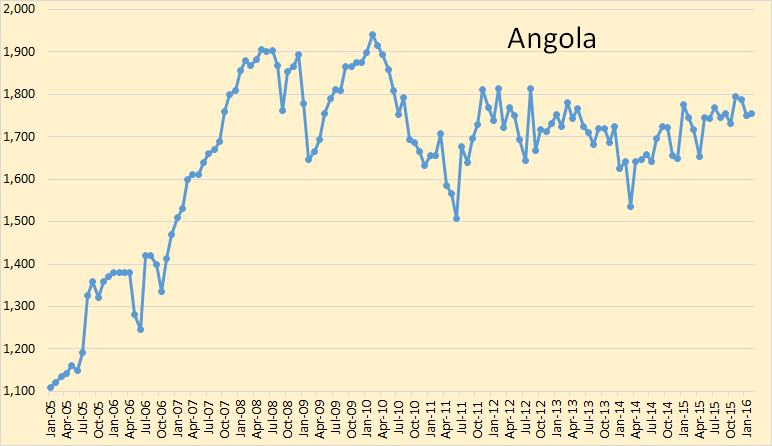

Angola has been holding steady since peaking in 2008 and 2010.

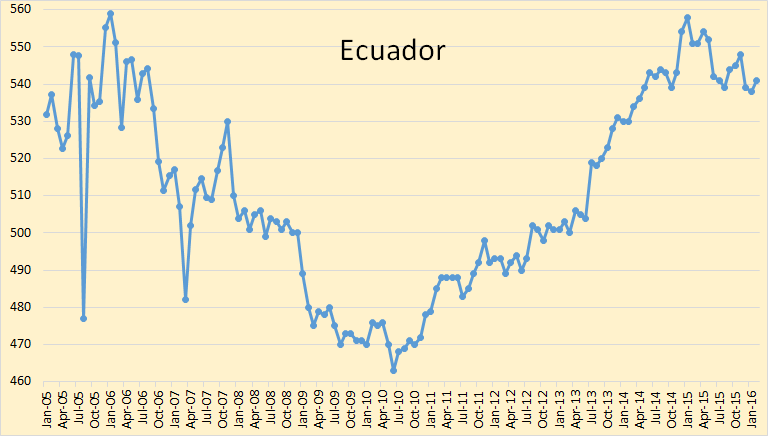

Ecuador appears to have peaked last year. It is likely production will be down, but only slightly, in 2016.

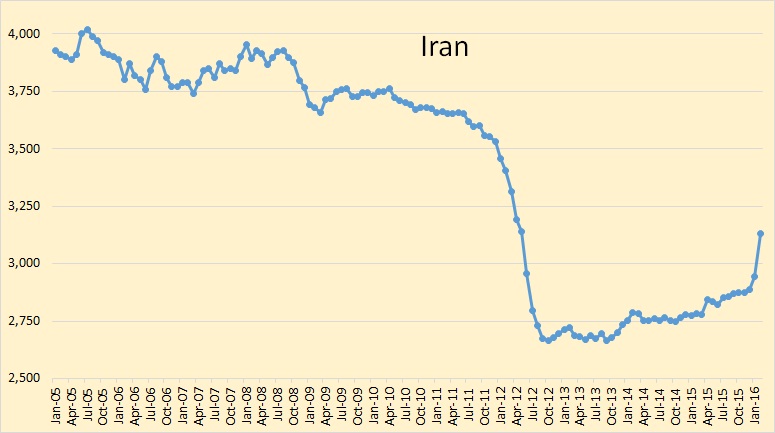

Sanctions were just lifted, in the middle of January, on Iran. Their production was up 187,800 barrels per day in February to 3,123,000 bpd. I expect their production to be up by from 500 to 600 thousand barrels per day by year’s end. However I believe Iran will be the only OPEC nation with any significant production increase in 2016. Most other OPEC countries will, I believe, be flat to down slightly.

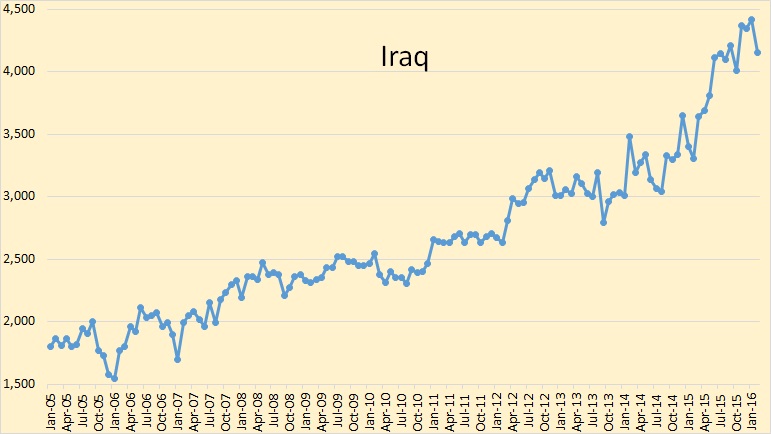

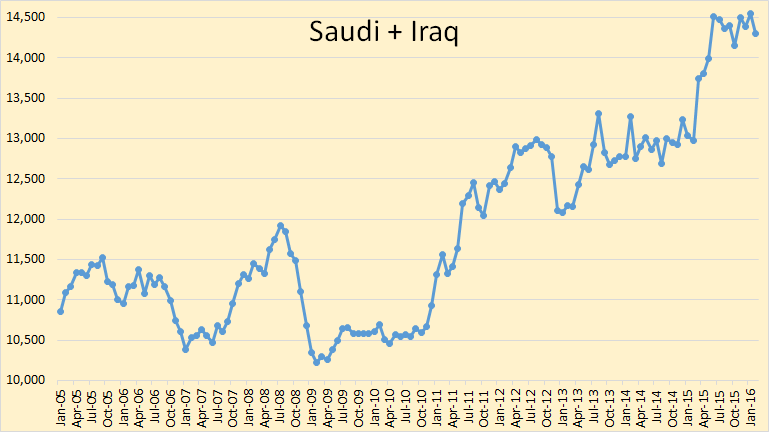

Iraq took a huge hit in February, down 263,000 barrels per day to 4,156,000 bpd.\. This will likely be the norm for Iraq for several years, above 4 million bpd but below 4.5 million bpd.

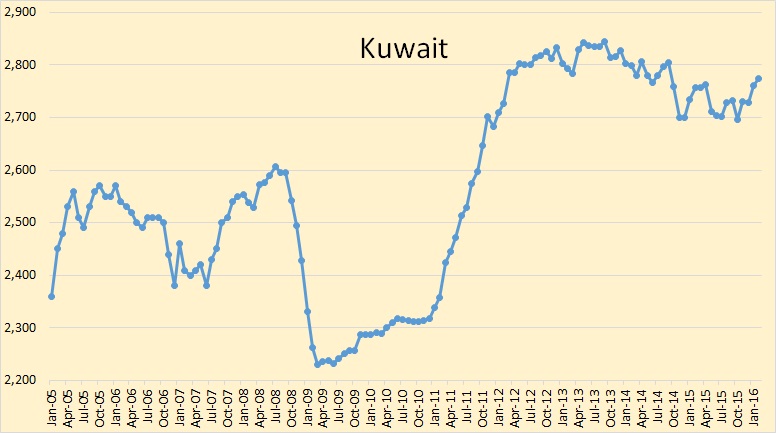

Kuwait has increased production slightly in the last two months but I don’t expect that trend to continue.

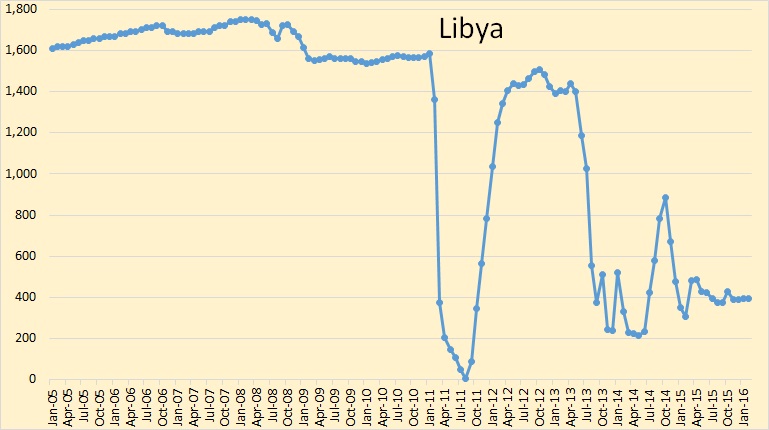

Libya is struggling with their own Arab Spring. There is no way of knowing when, if ever, peace will break out there. I think it extremely unlikely they will produce as much as 1,000,000 bpd within the next 5 years or so. But right now production seems to be holding steady at around 400,000 bpd.

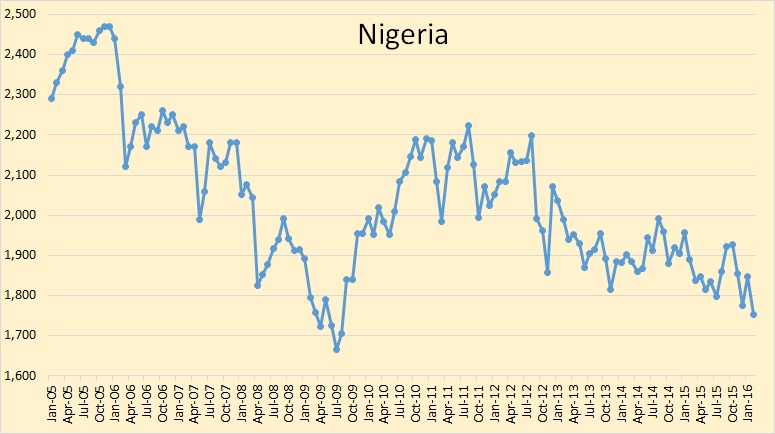

Nigeria is struggling with their own political revolution. But I think their natural decline is now obvious. In February they dropped 94,000 bpd to 1,754,000 1,754,000 bpd, the lowest since August of 2009.

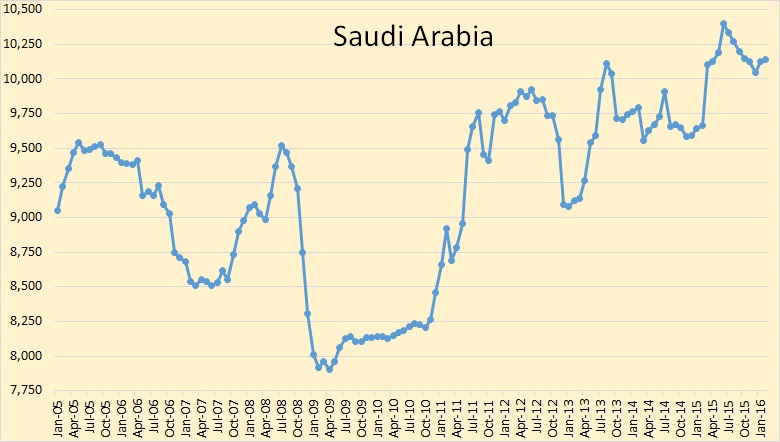

I believe Saudi is producing every barrel they possibly can. They will be lucky to hold this level for much longer.

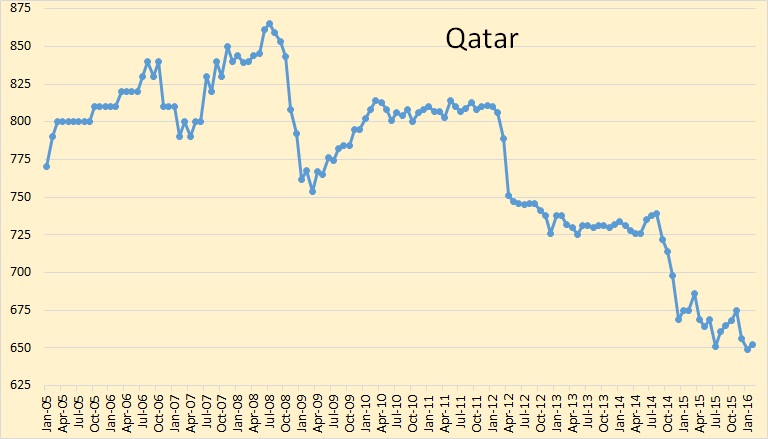

Qatar has lots of natural gas but their oil production has clearly peaked and is now in decline.

The UAE’s infill drilling program, I believe, has petered out. I look for them to hold at around current levels for another year or so before beginning a slow decline.

Not much can be said about Venezuela. Their conventional oil is in decline but their bitumen production is keeping production relatively flat. They took a hit in January however, down 33,000 bpd but were up 2,000 bpd in Feburary.

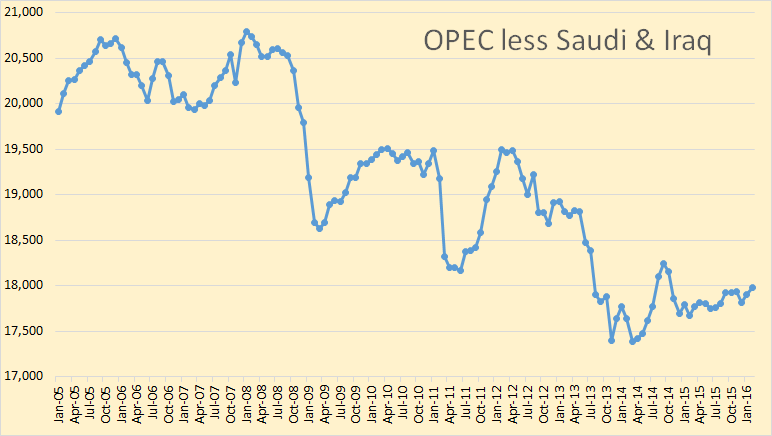

The combined production of OPEC, less Saudi Arabia and Iraq, peaked in January 2008 at 20,790,000 bpd and is down 2,810,000 bpd since that date 17,980,000 bpd.

In he last 12 months Saudi Arabia plus Iraq have increased their production by 1,329,000 bpd while the other 11 OPEC nations have increased theirs production by 308,000 bpd. But that run is over, any major increase in production in the next few years will come from Iran. It remains to be seen whether Iran’s increase will be greater than the decline of the other 12 OPEC nations.

Thanks Ron,

The 2016 world scenario right now looks like a continuation of the decline of the second half of 2015. But the price crisis is actually increasing distress on producers. For as long as it continues the chances of a negative event affecting some of them are increasing. This is not something that can be predicted from the graphs.

The question of how much oil is really in surplus is also going to be a central issue. Jeff Brown pointed to a lot of it being condensate. And perhaps a significant part of Iran’s increase is also condensate, as it was said that much of what Iran had in those tankers that is now selling was condensate. Probably Iran is not getting a very good price on what it is selling now.

Minor quibble Dennis.

You commented- “Libya is struggling with their own Arab Spring”

I think that characterization of what is going there on is off base.

It looks more like the chaos of a failed state rather than a popular uprising to remove an authoritarian government.

The implication of this difference is that a return of Libyan oil production to prior levels is highly unlikely until there is a massive stabilization achieved, and I wouldn’t be holding my breathe for that.

It’s Ron, not Dennis. It all depends on your definition of “Arab Spring” And I see you have provided your own definition, “a popular uprising to remove an authoritarian government.”

Definition of the Arab Spring Bold mine.

The Arab Spring was a series of anti-government protests, uprisings and armed rebellions that spread across the Middle East in early 2011. But their purpose, relative success and outcome remain hotly disputed in Arab countries, among foreign observers, and between world powers looking to cash in on the changing map of the Middle East….

But the events in the Middle East went in a less straightforward direction.

Egypt, Tunisia and Yemen entered an uncertain transition period, Syria and Libya were drawn into a civil conflict, while the wealthy monarchies in the Persian Gulf remained largely unshaken by the events.The use of the term the “Arab Spring” has since been criticized for being inaccurate and simplistic.

The Arabs themselves cannot agree on the definition of “Arab Spring”. It is basically just an uprising of the general population protesting the hardships of their lives. I would say that the Arab Spring, in any country, is just the first stages of a failed state.

I think there is no doubt that what is happening in Libya was caused by the same conditions that has caused similar uprisings throughout the Arab world. The people are hungry and without hope as long as conditions remain the way they are so they riot to try to change them.

It is, very likely, just the first stages of world collapse.

Hi Ron. Good points made. Agreed.

Ron,

Arab spring is a variant of a “color revolution”. From Google search of the term:

Thierry MeyssanPerfecting The Method of Color Revolutions

Color Revolutions, Geopolitics

Sharp Theory of Nonviolence Struggle and Color Revolutions

History Re-Written Kerry Claims US Never Backed ‘Color’ Revolutions

Did Iran REALLY increase production or did they stop selling their oil to Russia, India or Iraq?

Sanctions never really stopped the Iranians .

No one is claiming that sanctions stopped Iranian oil production. It did slow it down considerably. And those production numbers did not come from Iran, they came from others who monitor tanker traffic, pipeline deliveries and such.

Does anyone monitor the Caspian sea?

What for? All countries in the Caspian region are energy exporters and do not need Iranian oil.

There were talks with Russia on possible sales of Iranian oil to Russian refineries, so that Russia could sell more of its own oil for exports. But this plan was not realized for economic reasons.

Iran was not selling oil to Russia and Iraq. They were selling oil mainly to China, India and other countries in Asia. Now they are also selling to Europe.

Alex,

I have read your comment on the last thread and I completely disagree with your point 2 that you make:

“shale companies have always been growth-oriented, and the market (investors and lenders) has been rewarding them for growth rather than capital discipline.”

This a definition of ponzi scheme that you describe and ponzi always end when you run out of greater fools. And shale is at that point. Their relentless drilling of the remaining sweet spots AT ANY price will not change their financials at all.

Oil price will steadily rise as shale start running out of the sweet spots and their production start decreasing so shale will never meet that imaginary price of $80-$100. Shale will run out of sweet spots long before the price is at $80-100 range.

Ves,

What is wrong in my statement?

You asked why companies are still drilling when oil price is $37 and they are making losses?

I said that I do not see economic logic, but they were doing that in the past, continue to do so now, and will continue to drill and complete wells at loss in the future.

I do not mind if you call it “ponzi scheme”, but this is reality.

In the first 2 months of 2016 shale companies sold about $10 in equity, diluting existing shareholders, but they found new buyers.

Bondholders are happy that oil companies’ bonds are up 20% in the past month and are ready to invest more.

Private equity is ready to invest tens of billions in distressed companies.

I do not mind if you call all them fools, but this is reality.

Did I say that this is normal? I didn’t.

Did I say that this will continue forever? I didn’t.

Alex,

If we both agree that shale is continuously drilling regardless of price and profit how can you claim (on the last thread) that shale will make new peak in production at some imaginary future higher price point?

What is the basis of that assumption?

Ves,

This is based on the assumptions that:

1/ sooner or later the potential of infill drilling in the sweet spots will be exhausted.

2/ drilling in less productive peripheral zones will not offset the gradual depletion of the sweet spots.

3/ the impact of technological improvements will not offset the geological factors. In particular, there will be to technological breakthrough enabling a sharp increase in oil recovery rate in tight oil formations.

4/ There will be no new Bakken or Eagle Ford.

Alex,

Well then I misunderstood you on the last thread. I have thought that you are saying that Shale production in BK and EF will return to their peak production once the oil price reaches $70-80? I had impression that you stated that several times in the last while.

Also I got impression that you did not agree with Verwimp model displayed here: http://tinyurl.com/hrek3fd

The model is built regardless of the price according to Verwimp (I don’t know the details). I thought that would neatly explain why shale was drilling relentlessly in the last year and half with disregard for profit, cash flow or shareholder value. The reason could be that there is nothing left there to save for the longer term when the price returns to a profitable level.

This explanation makes sense even though we have to wait a year to prove it for the declines to become terminal in shale basins despite price going higher than it is today.

Ves,

I think that LTO production in the Bakken and EF can return to its peak levels by 2019-2020 or slightly later if oil prices gradually rise to $70-80.

But after reaching this new peaks (which are unlikely to be much higher than late 2014-early 2015 levels) production will start to decline. The decline will not be rapid, so we will see a “long fat tail”.

As you can see, my base-case estimate is different from Verwimp model. And I certainly believe that oil price is very important for LTO production curve, which, due to price cycles, may have at least 2 peaks.

My scepticism of two or more peaks is based on the length of downturn in oil prices. It has been already quite long and violent and the longer it stays it will be harder to reach that second peak in shale oil production. But time will tell.

Ves,

I would agree with you if it were a 15-years down-cycle, like in the 80-90-s.

But this time the downturn will be shorter. The oil market will return to balance by mid-2017, or even earlier.

And although there will be a lot of oil price volatility in the next several months, prices should gradually recover.

Meanwhile, shale oil reserves are still there; infrastructure is already built; there is significant surplus capacity of drilling and fracking equipment, limiting potential growth in services costs.

Assets of distressed companies will find new owners. Some lessons of the shale boom have been learned, so access to capital will be less easy than in the past. Shale companies themselves will be financially more conservative, trying not to overspend too much cash. Therefore I am sure there is no return to previous upstream spending levels, record oil rig counts, and ~1 mb/d annual growth in LTO production seen in 2012-14.

But annual growth of some 300-500 kb/d is possible, in my view. Assuming that the U.S. LTO output declines some 1.5 mb/d by the second half of 2017 from the peak of 4.6mb/d reached in March 2015, it could again reach this peak in 3-4 years.

2019 is probably too optimistic, but 2020 or 2021 is quite realistic, in my view.

BTW, this is what expects the IEA (see the chart below).

AlexS. Note in the Bakken that the number of additional wells from 12/07 to 12/08 and again from 12/08 to 12/09 was very close. Yet production growth was significantly greater in 2008 than 2009. The same is true for 2011-12 and 2012-13.

2015 saw the addition of over 1,400 wells, yet production dropped. It appears that production was hitting a plateau in 2014, despite a record addition of over 2,000 wells.

I am open to interpretation of this data, but my initial reaction is, as in almost all previous US fields, developed in a “boom like” manner, that the Bakken was reaching its peak. The price crash accellerated this peak’s arrival, and likely capped the peak monthly production figure.

Assuming low activity in 2016, it appears that it would take until at least 2018 to return to 2014 well addition numbers. At that point, it appears to me in excess of 4,000 wells would need to be added annually to reach and then maintain production above 1.3 million bopd.

Again, these are “napkin” calculations of mine, I am open to a more detailed analysis.

Note, the monster wells of EOG and Whiting of earlier periods are no longer occurring, per Enno’s shale profile data. This also makes a big difference IMO.

Shallow sand,

The absolute increase in ND Bakken oil production was higher in 2014 compared with 2013. In percent terms the increase was only slightly slower, but annual growth rates were still very strong.

In 2015 annual average ND Bakken oil production increased by more than 100 kb/d, or 10%, despite much lower oil prices.

change in production

kb/d %

2013 195.6 32.6%

2014 228.0 28.7%

2015 102.4 10.0%

Production peaked in December 2014 at 1164 kb/d, but has remained in a relatively narrow range between 1106 and 1153 kb/d in January-November, despite rapidly declining rig count.

A clear declining trend emerged only in December 2015, when month-on-month output was down 28 kb/d, followed by a similar decline in January.

December 2015 and January 2016 were the first months, when Bakken ND production was lower than in the same month of the previous year (-5.8% and -5.4%, respectively).

ND Bakken oil production, kb/d

” I would agree with you if it were a 15-years down-cycle, like in the 80-90-s.

But this time the downturn will be shorter. The oil market will return to balance by mid-2017, or even earlier.”

Alex,

What is the oil market at balance? Price always reflects balance even if manipulation is included. Price of the any stock on the market is always in balance since it is zero sum game. We are always in balance it just sometimes we don’t like the price.

We could easily have a floor price established by majority of producers that will meet next month and after that it is up to rest of high cost marginal oil market to sort out their production. And that is wild guess game how it will evolve since it depends on many things: demand side for oil, availability of credit supply, cost inflation. I can easily foresee that oil stay $40-60 range next 3 years and then where shale production will be in December 2018?

Ves,

The balance is when global liquids consumption = global liquids supply.

Supply has exceeded consumption since early 2014, which resulted in a significant increase in inventories. The oversupply has peaked in 2Q15 and has declined since then. It should further decline in 2H16 due to higher seasonal demand and stagnant/declining supply.

According to the IEA, EIA and OPEC,

global consumption and supply will be balanced by mid-2017. Some people think that the balance could be reached by the end of this year.

After that, demand will exceed supply, leading to a drawdown in inventories.

Absent a deep global recession, the market will be tightening, leading to higher oil prices. Importanly, unlike the 80-s, OPEC spare capacity remains at low levels.

The only factor on the supply side that could deter the increase in oil prices in the medium term is a rapid recovery in US LTO production. But this seems not to be your scenario?

There is no other source of rapid growth in global supply.

AlexS. I agree the way I am looking at the data is more in a leading nature compared to the way you are.

There is a lag, although admittedly shorter than off shore projects.

Still, despite over 1,400 wells, 12/15 production was less than 12/14 production. Will be interesting to see how it plays out.

“The balance is when global liquids consumption = global liquids supply.

Alex,

But through the exchange on the market. And the market is always in balance. It is the price that we don’t like but oil market is in the balance. Oil Producers don’t like the price, but market is in the balance. Some producers will not even like $80 per barrel and will say that market is not balanced.

Ves,

I hope you understand that I mean the balance between supply and demand?

shallow sand,

What do you mean when you mention additional wells?

Is that the number of well completions during the year?

Or the difference between the number of producing wells in December 2015 vs December 2014,

or the difference between the average number of producing wells in 2015 and 2014?

Hi Shallow sand and Ves,

I think AlexS has this right.

For what it is worth, my models and those of Enno Peters confirm AlexS’s view.

About 1900 well completions per year are needed to reach a new peak. At the previous peak in output about 2200 completions were done annually.

Perhaps a new peak will not be reached, this will depend on the number of wells drilled in the future which in turn will depend on oil prices.

Let’s say oil prices climb to $90/b by June 2018 and remain above $90/b until 2020.

Do you think 160 new wells per month will not be reached at that price level?

Alex,

You asked why companies are still drilling when oil price is $37 and they are making losses? I said that I do not see economic logic

There was a very simple, albeit pervert, economic logic in 2015 — top brass bonuses (along with several other factors like pipeline contracts, etc). Redistribution of wealth up should never stop 🙂

But 2016 is a completely different game. “After me deluge” type of thinking on the top run its course: they run out of money and can’t get new loans. For most shale companies it was something like waking up the next morning after several days of binge drinking…

Bondholders are happy that oil companies’ bonds are up 20% in the past month and are ready to invest more.

Are you sure? Which of major banks anticipates bright conditions for junk bond market, and especially shale junk bonds, in 2017 ? I think most banks increased their loss provisions from junk for 2016. In view that survival of companies is in question, inquiring minds want to know, who are those happy investors who by trying to earn some extra points (chasing yield) already lost quite a bit of money and want to lose more. Or this is just new fools from never ending global supply. But like with oil there might be that “peak fools” moment is behind us 🙂 .

http://knowledge.wharton.upenn.edu/article/do-junk-bond-defaults-signal-trouble-for-2016/

BTW Vanguard increased the quality of bonds in their junk bond fund. And that means that they think that the storm is ahead not behind us.

likbez,

There is a difference between bonds and bank loans/credit lines.

Banks indeed almost stopped lending to the US E&P companies in early 2015, although in most cases they did not cut existing credit lines.

But oil companies were able to raise billions of dollars in new bonds and equity sales during 2015. And this is likely to continue this year.

From Bloomberg on equity sales:

Battered U.S. Oil Firms Raise Most in Equity Sales Since `99

http://www.bloomberg.com/news/articles/2016-03-01/weatherford-plans-80-million-share-sale-in-secondary-offering

• Energy companies announced $9.2 billion in stock offerings

• Biggest share sale binge for sector since at least 1999

———————————-

From Reuters on bonds:

Some bond funds bet on longer-lasting rally in energy debt

http://www.reuters.com/article/us-investing-funds-energy-idUSKCN0WD2DM?mod=related&channelName=ousivMolt

Many bond investors who benefited from the recent rally in battered energy debt prices are maintaining or seeking to add to their holdings, viewing the rally as the start of a longer-lasting uptrend rather than a blip.

Fund managers including MacKay Shields, Thornburg Investment Management and BlueBay Asset Management said they had increased their positions or initiated new ones in recent months after energy bond prices cheapened in 2015.

They said energy debt remained attractive even after the latest rally.

“Bad things in energy are already priced in,” said Andrew Susser, head of high yield at MacKay Shields in New York, which oversees $89 billion in assets.

U.S. crude prices slid about 76 percent from June 20, 2014 to $26.05 a barrel by Feb. 11, 2016, nearly a 13-year low. Over the same period, the BofA Merrill Lynch U.S. High Yield Energy Index tumbled about 46 percent.

Since then, U.S. crude has risen about 44 percent, settling at $37.84 on Thursday. Over the same period, the high-yield energy index was up 20 percent.

“The reality of this price environment is setting in and really causing people to take a look at their businesses,” Erickson said. “It is a lot more interesting a place to be looking at today than it was even six months ago.

———————————————

From the same article in Reuters on private equity funds buying distressed energy companies:

DEFAULTS “NOT THE END OF THE WORLD”

Investors said energy assets could remain solid investments even if companies default on payments or file for bankruptcy.

Christian Busken, director of real assets at investment advisory firm Fund Evaluation Group in Cincinnati, said he was recommending clients invest in private equity funds that buy energy assets out of bankruptcy.

“All the things that are happening in the energy markets are setting the stage for higher prices down the road,” Busken said, noting capex cuts. He said private equity funds buying assets of bankrupt energy companies stood to benefit once commodity prices recovered.

A default can halt a company from further degrading its value by paying junior creditors or continuing to make capital expenditures, Susser of MacKay Shields said.

“A default is not the end of the world,” he said.

” he was recommending clients invest in private equity funds that buy energy assets out of bankruptcy.”

These are the new marks for the frackers’ land-flipping scams. The execs of the bankrupt company get paid to do the sale…

Hi Ves,

When do you think oil will reach $90/b, if ever?

In the Bakken, the number of well completions has fallen from 185/month for the 12 months ending in March 2015 to 70 well completions in January.

If US falls by 1 Mb/d, that may be enough to balance the oil market, output in Canada may also fall, the low oil prices will eventually reduce output and oil prices will rise maybe by late 2016, eventually (probably 6 months later) oil output will gradually flatten and then rise, possibly reaching the previous peak, this will depend in part on demand for oil and the price of oil.

Dennis,

” When do you think oil will reach $90/b, if ever?”

No idea.

Dennis, If WTI is on average $40-45 by the end of the 2016 how much US shale and US total production will be on December 2016?

Hi Ves,

The decline might be as high as 1.5 Mb/d for total US output if oil prices remain under $43/b, with shale maybe about half of this (800 kb/d), the EIA is predicting WTI at $35/b in Dec 2016 and $45/b in Dec 2017 (the EIA’s oil price forecast is too low in my view).

Very difficult to predict, it may be that capitulation in the US oil sector is close at hand. In that case output falls by more than I have guessed, but there is no way the EIA price forecast turns out to be correct in that case.

Hi Dennis,

I agree on EIA price prediction in sense that I always stay away from predicting price for anything. Even for my weekly grocery shopping bag. 🙂

Hi Ves,

You are smarter than me. I have no idea what oil prices will be, I should just stop guessing as I cannot get the future price right. It looks to me like the EIA’s most recent forecast of $35/b in Dec 2016 is too low, but like you I cannot predict my grocery bill today, so oil prices in 9 months time are out of the question.

If US falls by 1 Mb/d, that may be enough to balance the oil market,…

And what do you think might happen in the rest of the world? In 2016 oil production will fall in most oil producing countries. Oil production will rise in a very few countries. The oil market may balance a lot sooner than a lot of people realize.

Hi Ron,

You may be correct on that point. If we take the US and Canada out of the equation I think increases in Iran’s output might balance the declines in World minus US+Canada+Iran. The question then becomes (if my previous assumption is roughly correct), how much does US+ Canada decline in 2016? My guess is 1.25 Mb/d.

I would be interested in your estimate, because you track the numbers more closely than me. Or just your estimate for World C+C decline in 2016 would be fine.

Thanks Dennis. I don’t think the increase in Iranian production will come close to offsetting the decline in the rest of the world minus the US and Canada.

I believe the decline in ROW less US and Canada will be about twice the increase expected from Iran.

Breaking it down, Iran may increase production, from February, another half a million barrels per day. That would be almost 700,000 bpd from their January production. The rest of OPEC will be flat to down, most likely down slightly. Non-OPEC, less US and Canada will be down from one million to 1.2 million bpd from their December production numbers.

That is my estimate, for what it’s worth.

Hi Ron,

Thanks. I was under the impression that there were projects coming on line in that would offset some of the 1.2 Mb/d decline in non-OPEC less US and Canada. I may be wrong of course (happens all the time). 🙂

Dennis, you just have not been following the news. Yes there were projects coming on line. But those projects were cancelled.

Hey, start paying attention. 😉

Hi Dennis,

Did you mean 1-2 oil sands project that are very close to completion in 2018? I think there is very minor one.

But here is some hush – hush info from oil sands patch that there will not be any new oil sands project even if the price goes much higher in the near future without export pipeline in place. But who knows.

Hi Ron,

I misread your post earlier, it looks like you are predicting about a 500 to 600 kb/d decline for the World minus US and Canada.

There are many people that follow the details of oil production more closely than me. The two that I am most familiar with are you and AlexS.

AlexS has pointed out to me that the project cancellations will affect output in 2 to 3 years. The projects that will come on line this year were past the point of no return in early 2015 and will continue regardless of the oil price. Whether these projects will be enough to offset the 550 kb/d of decline in the World minus US and Canada is not known (at least to me).

My guess is that it may be enough to offset decline elsewhere. Note that if we take OPEC, US, Russia, and Canada out of the mix we are left with about 26 Mb/d of 2015 average output from the remaining nations that produce oil. If those nations decline by 3% in 2016 (average output for 2016) that would be about 780 kb/d. If OPEC minus Iran is flat and Iran increases output by 700 kb/d, the World declines by 80 kb/d, but only if no new projects come online to offset the decline.

That assumption seems unrealistic to me. I expect average Iranian output to increase by about 400 kb/d for all of 2016, the rest of OPEC and Russia to be flat. If non-OPEC minus US+ Canada+Russia declines by 5% that would be about 1.3 Mb/d and adding Iran we are left with a 900 kb/d decrease. My guess is that output from new projects ramping up in 2016 may offset the 900 kb/d decline so that the decline in World C+C will match the decline from US and Canada, which I estimate at about 1.3 Mb/d (300 kb/d from Canadian decline and the rest from the US). I expect that Supply and demand will be in balance by Dec 2016 and that as demand continues to increase in 2017 the excess oil in storage will be sold off and oil prices will gradually rise reaching $75/b by Sept 2017.

Looking at your OPEC minus Saudi and Iraq chart, it looks like OPEC minus Iran is likely to be flat in 2016.

Hi Ves,

I do not have details on specific projects this is based on charts AlexS has presented from WoodMac and Rystad.

AlexS may have more details as he follows this more closely than me.

AlexS has pointed out to me that the project cancellations will affect output in 2 to 3 years. The projects that will come on line this year were past the point of no return in early 2015 and will continue regardless of the oil price.

Dennis, there are some long term, very expensive projects, that were begun before the price collapse. Most of them will be completed but not all. Some were halted in place. Others, like infill drilling projects, have already been cut.

You are putting all new projects in one basket and assuming one size fits all. Every project is different. Many will be cut, some will not be cut.

So you just cannot declare that the price collapse will not affect production in 2016. If you cannot say that about the USA, if you cannot say that about Canada, then why on earth would you think the price collapse would have no effect on the rest of the world?

Ron,

Thanks for your post.

Although a large number of oil and gas projects were posponed or canceled over the past 2 years, very few of them were scheduled to start production in 2016-2017. It just doesn’t make sense to freeze large investments made in the previous years, if remaining investments needed to complete those projects are relatively modest. Besides, most of those projects are led by oil majors which have solid balance sheets.

The chart below from Woodmac is based on their global project database, one of the best.

HI Ron

The US and Canada have some of the most expensive marginal barrels in the world.

For this reason there will be a big effect relative to other oil producers.

The time value of money, even in a ZIRP world, means projects are (or were) fast tracked if they could be. Brownfield developments, such as those to accelerate production from reserve growth, usually get done over one or two years – unless there is long lead items involved. There are also usually a few shorter term projects that can get to production from discovery in 2 to 3 years. Admittedly there are fewer of these now as discovery rates have fallen so much since 2010, and what is being found is mostly deep water which does not lend itself to fast turn around. However projects such as these that might have progressed would have been cancelled, but would not show on the Wood MacKenzie figures.

In addition major projects were being slowed and reassessed at the FEED stage as far back as 2012 because costs had risen so much, and some of those might have been expected to come on line around now.

Ron,

My impression is a reasonable estimate of Iran increase of production in 2016 is only 0.5Mb/d. Mostly heavy oil and condensate, very little (less then 30% light oil):

Iran’s mature oil fields are in advanced stages of decline. The US Energy Information Administration estimates that Iranian oil fields have natural decline rates of 8-11% and recovery rates of 20-25%.

Iran had planned to employ water and gas injection for enhanced oil recovery. Gas injection in mature field was to have reached 330 million cu m/day by the end of 2016. Since 2011, however, Iran hasn’t been able to reach more than 60% of its gas-injection goals. The average of actual gas injected between March 2006 and March 2011 never increased more than 75% of what was originally planned.

Platts calculations based on current market consensus point to a 0.2Mb/d rise in the first quarter, growing to 0.45Mb/d by year-end. They are going mostly to Europe (Total should already started importing 0.160 Mb/d from around February 16, according to signed contract)

According to the IEA, 60% of Iran’s initial exports could be made up of Iranian Heavy, 30% of Iranian Light and the remainder consisting of a new heavy grade called West of Karun, which is due to make its debut in the second quarter.

Also this is a country on 80 million people, which is moving in the direction of becoming net importer of oil (but not gas). Domestic consumption is rising and a growing fraction of exported oil is returned as refined products.

“During these years which we launched five South Pars phases, it meant an increased production of 150 million cubic meters of gas and 200,000 barrels of gas condensates from the joint field,” Zangeneh added. “Our next priority is oil production from West Karoun fields so that in the next eight months, production will touch 200,000 barrels a day and will increase to 700,000 barrels by the end of the Sixth Five-Year Development Plan.”

“We also hope to increase production of condensates in South Pars field to one million barrels a day by the end of current government’s term,” the minister said. Zangeneh stressed development of petrochemical industry among the downstream projects and said that in less than 20 years, the value of petrochem products multiplied from one billion dollars to 18 billion dollars.

“In few years, it will catch up to 26 billion dollars and by the end Fifth Development Plan it will hit above 40 billion dollars,” he said.

“In the field of refineries, it is decided that the capacity will be boosted from the current 1.7 million barrels a day to 3 million barrels,” Zangeneh added. He anticipated that with continuation of support programs for the production chain, petrochemical production can hit 70 billion dollars a year.” (Source: Safana)

As fields are old, the production costs are rising and I doubt that they can make even tiny profit below $30 a barrel. So currently the incentive for them to increase production is almost non-existent. IMHO this is all PR talk. We will see the prof pro or contra on March 20th.

Iranian oil minister whom MSM like to cite is just trying to project an image favorable for the country. Reality is a completely different thing. For example Iran will get only around 55 billions from frozen funds and will be able to invest only a fraction of them in oil infrastructure as most of those money are already allocated for other projects. foreign money will probably come (Russians and French are interested) but much slower then expected.

Ron,

Yes, the rest of the world may balance out a lot sooner. However, we just saw China’s exports were down a whopping 25% in February. Now, some of that was due to their Lunar New Year, but even if that was adjusted, Chinese exports were down a lot more than forecasted.

Unless, the U.S. Govt sends out $5,000 checks to everyone in the next QE to Infinity policy, I don’t see a balancing out for a while.

steve

I was only talking about oil, nothing else. Not markets in general.

How are the prices going to rise when the customer/end users are broke?

Nobody comes up with compelling stories about how the ordinary people around the world are becoming wealthier. This wealth is needed to pay the high prices/offer the higher bid.

Instead it is about how end users are being blown up in wars, are becoming refugees or migrants, are being slowly ruined by QE and central bank monetary policies, being ripped off by inflation/stagflation/deflation/currency depreciation; how their pensions are stolen, how education and medical care have become so costly as to require loans; how housing costs have skyrocketed; that the finance tendency since Day 1 has been — and is — to lend to firms rather than individuals … who cannot borrow infinite amounts even if they were to gain the same access to credit that firms have.

Individuals have little or no collateral only the willingness to destroy capital. Individuals are the ultimate fools in the markets.

When the customers cannot borrow they likewise cannot meet the price that finance is able to rig in wholesale markets. The outcome is our glut … not only a crude glut but a product glut as well:

https://www.tankterminals.com/news_detail.php?id=3400

It isn’t just crude: trade, commodities, transports, basic manufacturing, retail, equities/junk finance = all into the toilet.

The petroleum industry around the world is being destroyed systematically … that’s all people really need to focus on right now, not the mechanism which seems to be behind a (media driven) veil. High prices for commodities rationalize extraction of hard-to-get-at resource capital. Low prices strand both the capital and the means to get at it. High prices = there will always be some capital to burn. Low prices = burning regime goes out of business.

So … low prices it is.

Steve,

The last thing people will spend money on is food. The second to last is energy. And compared to manual or animal labor the cost of energy is still dirt cheap.

There are more people in the world than ever who can afford to buy a gallon of gas.

Don’t get me wrong. I’m not saying all is rosy, in fact I think many segments of the population are out of the current and starting to drift back downstream.

But the balance is still far tilted towards global increase purchasing power, big time.

Hi Hickory,

I agree, wealth distribution has become worse, but income continues to rise. As the World economy grows by 2% per year (real GDP at market exchange rates), energy demand grows as well, the correlation is very good. The economy will continue to grow and so will demand for energy.

Energy intensity of the World economy has decreased from 1970 to 2014. Energy intensity is energy consumed by the economy divided by the real GDP produced.

In 1970 314 tonnes of oil equivalent(toe) were needed for each million 2005$ of GDP produced and by 2014 energy intensity had fallen to 225 toe per million 2005$ of GDP.

Dennis,

While you produce some fine charts, I hope you don’t believe GDP and energy consumption will continue higher indefinitely. Also I hope you realize GDP figures are overstated due to understated inflation rates.

For example the policy of substitution says if top sirloin beef is too expensive, then we switch to eating ground chuck. If chuck becomes too high, then its plain ole ground beef. Once ground beef becomes too costly, then we switch to ground rat.

Lastly, why don’t you add the debt into your equations and see what the trend lines look like.

Steve

Hi Steve,

No inflation is not understated, the Shadowstats stuff is not believable. If you believe the Shadowstats CPI adjustment and us those numbers to find the real oil price from 1970 to 2012 and do the same using the BLS CPI we get the following chart. Does the Shadowstats estimate for the real oil price in 1980 look reasonable?

You cannot be serious. 🙂

“…Shadowstats stuff is not believable. If you believe the Shadowstats CPI adjustment…” ~D.Coyne

You did not understand any of it correctly. This has very little to do with being “believable”, or not.

Mr Williams is NOT inventing the data. He is simply calculating them exactly as BLS used to do PRIOR to 1990 and according to GAAP methodology.

There were major changes made to the data calculation in 1994 and 1997-1998 (and numerous minor ones since then).

-You are having that “unbelievable” divergence on the charts prior to 1994 because you incorrectly (for you did not understand at all and arrogantly ignored to ask and learn!) applied Mr.Williams’ methodology to data prior to ’90.

So, in simple terms, you REAPPLIED the calculation on the already calculated data.

-Many Fortune 500 companies rely on Mr. Williams’ data and I personally know a few Fortune 50 high level executives who heavily rely on his data for their strategic, long term planning.

A few months ago you dismissed

Ms Tverberg out of hand.. now you are doing to one of the BEST economists alive today…

Judging from what you know and write here about economy and finance, I kindly ask you to reconsider…again.

Be well,

Petro

P.S.: I am not taking sides with Steve, just trying to clarify things a bit…

-Many Fortune 500 companies rely on Mr. Williams’ data and I personally know a few Fortune 50 high level executives who heavily rely on his data for their strategic, long term planning.

Any sources or links for that?

Dear Nick,

Mr William’s calculations are not “official” any more, so no links.

Private subscription to his site/data pool only.

As far as who do I know… I am afraid I am going to disappoint you and not answer that.

Sorry!

Again, Mr Williams does NOT have a proprietary methodology that he invented.

He is using GAAP and BLS methodology prior to ’90.

So his “stuff” (that Dennis does not believe today!) used to be “officially believable” prior to 1990

Be well,

Petro

Hi Petro,

The shadowstats site gives “corrected” CPI.

I used that to find the real oil price (the usual calculation done with a price index and nominal prices). I compared that with the real oil price using the CPI.

The consumer basket of goods changes over time, a proper price index reflects that.

So perhaps you did not understand my chart. It was done correctly. If we use the shadowstats price index, the real oil price in 1980 was $350/b in 2012$.

“The shadowstats site gives “corrected” CPI” ~ D. Coyne

-Let me write it for the 3rd time, since you did not understand the first 2:

there is no such thing as “corrected shadowstats CPI” before 1990.

Mr Williams calculates CPI and other data EXACTLY the SAME as the govt’offices did at that period.

So by applying the shadowstats “correction” prior to 1990 (and especially prior to 1994), you are applying the “correction” to something that was CORRECT in the first place!

“…The consumer basket of goods changes over time…” ~ D. Coyne.

Wrong again!

The basket does not change – IT IS CHANGED over time to “massage” data/results (again, I am not taking sides here – just stating facts!).

-I am not questioning your chart-building abilities!

I am trying to explain to you that your understanding of fundamental economic/financial concepts is narrow and flawed.

You can get upset about it, or try to learn…your choice

Be well,

Petro

Dennis,

Energy intensity of the World economy has decreased from 1970 to 2014.

This is probably due to deindustrialization of the Western countries. Aka “growth of service economy.”

“This is probably due to deindustrialization of the Western countries. Aka “growth of service economy.””

The GLOBAL industrial production did not decrease, therefore, your argument does not make sense. It is only useful in a national e.g. US-centric discussion.

Or if you actually check data for developed countries with quite different share of industry to their GDP you do not see the correlation of low share of industry = low energy intensity!

Hi likbez,

As Ulenspiegel says correctly, for the World your point does not apply. The World Energy intensity has fallen as I have used Global GDP and Global energy consumption.

As long as we don’t do a lot of interplanetary trade, this estimate will be close enough. 🙂

Ulenspiegel ,

GDP does not reflect only production (compare with GNI). It is completely different metric which takes into account the “value” produced by financial services, prostitution (yes in some countries income from prostitution is included into GDP; GB (3-4% or ~£10 billion) and Italy (2% of national GDP) are two examples: https://www.rt.com/news/161140-italy-drugs-prostitution-economy/) and like.

So the country with zero production in which people just wash dirty linen for each for remuneration or trade on stock market has a positive GDP. Other classic example: if somebody marries his secretary and she stays home to look after children GDP drops.

GDP never measures economic efficiency of the country; it measures the level of economic activity. Healthcare is a classic example. The USA spends 20% to subsidize maladaptive behavior between producers and consumers in the medical food chain. Another example is sales of high sugar context flavored water called Coca Cola and Pepsi Cola. It is negatively affect children health leading to obesity and early diabetes, but it is positively reflected in GDP. And then medical expenses for treating diabetes further increase GDP. That brings us to the problem of conspicuous consumption or consumption for the sake of status. Which in the USA is a real national epidemics (Keeping up with Jones). Many other components of GDP (especially FIRE — finance, insurance and real estate) are partially anti-social and their fast growth is a sign of the problems inherent in neoliberal societies rather then social progress of the particular country. This is especially true for the USA, which in this sense is the most wicked (aka neoliberal) country in the world.

This voodoo cult of GDP that dominates US economic discourse since 1991 is just a sign of the level of degradation of economic science under neoliberalism.

See http://www.bloomberg.com/news/articles/2014-05-23/counting-drugs-and-prostitution-in-gdp-makes-a-mockery-of-budget-rules

Hi Likbez,

In that case we just have no idea, GDP, or for the World GWP is the best measure we have, no it is not perfect, but it is what we have.

How do you measure World output?

likbez,

it is claer for me that GDP has some issues. However, the basic point was that GDP is not correlated with energy consumption (some people stille assume), neither we find a correlation of share of industry and energy consumption per unit GDP.

And as long as you do not provide something better than GDP as metrics we should use it. 🙂

Economic energy intensity is falling off pretty fast, in terms of the big picture, although you have to look at the trend over a period of years to see it clearly.

Cars and trucks last longer and get better mileage. Steel is mostly recycled, grain is mostly sod planted, led lights are displacing older types, electrified autos will soon be displacing conventional cars, tighter building codes are forcing building energy efficiency up, etc.

Airliners haul more people more miles per gallon of fuel, ditto cargo ships and containers.

So far as I can tell,Asian industries are improving their energy efficiency, because after all, a dollar saved on energy is a dollar added to the bottom line.

The trend to lower energy intensity per unit of GDP won’t last forever, but there is no reason, so far as I can see, to think it can’t last for a while yet.

The renewable energy industries are just now getting big enough to really matter, and have the potential to grow fast enough to offset the depletion of fossil fuels for quite some time, maybe even for several decades.

We are most likely headed to hell in a hand basket long term, but not necessarily within the next decade or two , or maybe even longer.

Hi Old Farmer Mac,

We may be headed for hell, but as energy intensity decreases, population peaks and declines (more education for women is key here as more educated women have fewer children), and wind and solar energy produce a larger share of total energy consumption, maybe not.

The rates that all of these processes follow will be key. And Yogi had it right, predictin is hard, especially the future…

Dennis said:

“We may be headed for hell, but as energy intensity decreases, population peaks and declines (more education for women is key here as more educated women have fewer children), and wind and solar energy produce a larger share of total energy consumption, maybe not.”

Well, as we all should know by now correlation is not necessarily causation!

https://populationpress.org/population-essays/sixteen-myths-about-population/

There is a need for more research on the relationship between various aspects of women’s status and fertility rates. In his 1991 study of comparative reproductive preferences, Charles Westoff of Princeton University’s Office of Population Research found,

“The relationship between education and the percentage of women who want no more children is positive in several of the countries, but weak or non-existent in many others. In fact, [the data] give the general impression that the intention to terminate childbearing is similar across educational levels…There is little evidence to support any strong pattern of diffusion or differential penetration of norms of family limitation across educational levels or from urban to rural areas. (pp. 5-6)

Abernethy (1993 correspondence) raises some interesting issues:

“Raising women’s legal, health, and social status, and providing women with educational opportunity are very worthwhile objectives in themselves. Nevertheless, only correlational data link these factors to fertility decline. On the contrary, participation in the labor market, particularly if a woman’s earnings make a significant contribution to family income, appears to significantly affect family size targets: Penn Handwerker and Diane Macunovich have found in Third World countries and the United States, respectively, that women prefer and have fewer children when child rearing carries an opportunity cost.

But yeah, I think we can we both agree with Yogi 🙂

I think a bigger factor than population is resources use. We have a huge variation in per capita resource use across the world.

The developing and developed nations promote greater resource use, which of course depletes the planet that much faster.

Meanwhile, some poor person living in a shack uses very little resources or energy.

The rich or well off are not equivalent to the poor, since their effect on the planet is so disparate.

Head count does not tell the real story, it’s food, water, materials and energy use per person that counts. It’s waste that counts.

Hi Fred,

Yes correlation does not necessarily indicate causation. Perhaps having fewer children makes women more educated. 🙂

Yes correlation does not necessarily indicate causation. Perhaps having fewer children makes women more educated…

At the very least it might explain why women with fewer children tend not to be conservatives 🙂

Hi Gonefishing,

Good point. We should tackle the problem in both ways, fewer people due to a Worldwide demographic transition and more efficient use of resources by building products that last and designing products cradle to grave so that more materials can be recycled.

Hickory says – “The last thing people will spend money on is food. ”

Surely you mean the first thing??

I meant that if people are running out of money, that last thing they will forsake is spending on food,. I didn’t express that notion very well. Pardon.

Unless it is to put food on your family?

“The last thing people will spend money on is food. The second to last is energy. And compared to manual or animal labor the cost of energy is still dirt cheap.”

Sure, but *electricity is cheaper than oil*. So yeah, the solar panel factories will still be selling solar panels, but…

Demand seems to be increasing. World GDP is expected to grow. Production capacity is dropping. Prices will rise.

Hi Fernando,

Very concise, I agree.

Steve,

Demand for commodities is at record highs, and has grown steadily since 2009.

Demand for products and services reflect the same reality.

Rapid supply expansion after the 2008 collapse led to oversupply. This is true for most commodities due to a prolonged period of rising commodity prices from 2004-2013. This occurred in all commodities, not just oil.

Don’t confuse oversupply with falling demand. They are two entirely different scenarios, but both lead to lower prices – just for different reasons.

Global deflation is a product of a strong dollar and oversupply.

Worried about slowing growth in China? Don’t forget that China’s economy is several times larger than in 2000. For China 7% GDP growth in 2016 is quite literally equivalent to 20% GDP growth in 2000.

If I have a demand of 1 million smartphones and it grows by 7%, then my demand has grown by 70,000. If I have a demand of 300,000 smartphones, then it must grow by 23% for my demand to grow by 70,000.

The increase in unit demand is the exact same, but the growth rates are radically different. Everyone is focusing on China’s GDP growth without appreciating that their demand growth in terms of volume is at record highs.

“Now they are also selling to Europe.”

They sold all 4 tankers to Europe. So pretty much nothing. Iran will not piss their oil at these prices until there is a deal in terns of production level between major producers. I believe there will be agreement and Iran will increase production gradually.

Ves,

“will not piss their oil at these prices”

Iran behaves itself very strangely (or Western media distorts its position is such a way that it looks like caricature of itself). From one point of view they want a “fair” price for their oil, on the other Iranian oil minister makes multiple stupid statements that play directly into the hands of “low oil price forever” crowd.

Such as “… According to the minister, Iran is not for selling oil at low prices. However, even if prices drop below $30 per barrel the country will increase oil output…”. Is not this a self-contradiction?

And they sign contracts left and right to prove that they can increase exports, essentially replacing Saudi in predatory pricing for oil.

They will supply 0.16Mb/d to Total from this March due to recently signed contract (airplanes for oil barter).

likbez,

Iran CANNOT in the low price environment dictate the level of their production. But Iran is in good position to get their production quotas increased as a geopolitical payback from the Russians after Syrian intervention that would not be possible without Iran and due to “pimple” on SA bottom in the form of money draining war in Yemen that Saudis would really like to wind down and where Iran’s “help” is crucial.

Anyway, the announcement that meeting between Russians and Saudis is in Moscow and not Vienna (Opec HQ) speaks volume. All involved parties have interest to stabilize the price of oil at this point when this little hot war flare up is finished. The motions for that were actually set a month ago.

Thanks for the update, Ron and thank you for your time and work!

While I sincerely hope that this respected forum continues to be interesting, I truly believe that Dennis has some “very large shoes” to fill!

I shall visit these pages from time to time in hopes of reading brilliant mind teasers akin to “Of Fossil Fuels and Human Destiny”, “The Grand Illusion”…etc.

-All the best to you and yours in/for whatever lies ahead!

And Dennis, congratulations to you!

Your time and input will certainly be appreciated.

“…But that run is over, any major increase in production in the next few years will come from Iran. It remains to be seen whether Iran’s increase will be greater than the decline of the other 12 OPEC nations.”… ~ R.Patterson

Remains to be seen indeed!

Be well,

Petro

So much for the media frenzy about Saudia pushing US frackers to the brink.

So much for media frenzy about OPEC pushing US frackers to the brink.

They’re at the brink all right but the push comes from elsewhere. Too much industry dependency on loans is a good place to start. Of course, what else do you have? It’s loans or nothing.

Sorry for the all bold if it comes out that way, but deleting and reposting will get this comment into the spam file.

Debt is a hell of a problem, and no mistake.

A debt overload may be the key factor in bringing down the entire economic house of business as usual.

But debt is not the same thing as resources, human or natural.

Most of the debts currently owed in this old world will never be repaid, and only a damned fool ever EXPECTED them to be repaid.

The game plan has always been to inflate away the worst of the debts run up by government, since these debts have mostly been created at very low interest rates, or else, the plan has been simply to pretend they don’t even exist.

The owners of all this debt, to put it politely, are mostly situated to enjoy some involuntary sex, without the aid of a lubricant. To this extent, I am fully with Steve.

But for now, and for some time to yet to come, there are still plenty of resources, human and natural, to be exploited.

And there is a significant possibility that the people who own the debt will lose the fight to collect. Debts have been repudiated before, and they will be repudiated again, at many levels, from personal to national.

The pyramids were apparently built without debt.

Nazi Germany managed to build the most awesome war machine in history, previous to the outbreak of WWII, while flat “busted”.

Debt is not NECESSARILY going to be the end of the modern industrial economy.

But for damned sure, the grip of the owners of all that debt on the levers of power is immensely strong, and we are going to see a fireworks show worthy of the watching when the shit hits the fan.

Personally I believe it will basically be deflated away. It would be just about impossible to actually REDUCE the amount of money I get in my monthly old age welfare check, in terms of what the bank deposit shows, from the political point of view, but it is not so hard to finesse the economic data used to compute inflation and shrink my purchasing power thereby.

It is hard to steal the pension of a Teamster who is collecting it NOW, but it is child’s play to steal it twenty or thirty years from now, by simply failing to fund it in a realistic fashion. Furthermore, it is as easy as falling off a log to fund it, but in such a way that the invested funds disappear.

Stock in Kodak would be a prime example. Ownership of shopping malls dependent on suburban customers driving there is probably another, with delivery in the future promising to be far cheaper than picking up your own groceries .

If the resources are there, and the people are there, the economy is at least potentially sheltered from the worst aspects of bad debts, assuming populist politics prevail.

I think there is an excellent possibility populism WILL prevail. The Trumps and the Gates and the Koch brothers and their allies in politics may not prevail against the mobs with the torches and pitchforks.

But let’s not forget Yogi. Predicting is hard.

GO Bernie!

Anybody who wants some INSIGHT into why the Trump chump is doing so well, and HRC is getting her ass kicked by Sanders, considering she has the entire D party establishment behind her , and a twenty year head start, can start by reading this opinion column.

Most of us will strongly to violently disagree with some positions held by this guy Pruden,as I do myself.

But when it comes to understanding the mood of the country, and insight into the workings of the minds of voters, I don’t know of anybody better.

http://www.jewishworldreview.com/cols/pruden031516.php3

Hard core liberals will not enjoy many of his columns, because they are mostly aimed at D’s, and particularly at HRC.

But this one is a gem, everybody ought to read it.

http://www.jewishworldreview.com/cols/pruden031516.php3

Mac,

There’s nothing new about exploiting people’s problems, and diverting their anger towards scapegoats, like immigrants.

Trump has proposed a massive tax cut for the 1%, and making life harder for immigrants only helps business exploit them better, and undercuts wages even more for working people.

Trump is the same ol’, same ol’, only worse.

OFM,

I’ve had jobs that were easy, paid well, and were less stressful than average.

I’ve had jobs that were a daily struggle and didn’t pay their fair share.

What I’ve found is that an easy, well paid job can FEEL like an unnecessarily difficult job that pays below market rates. It all depends on who you work with and what they talk about.

We’ve all had co-workers that focus on the smallest faults and convincingly amplify small difficulties to seem large, absurd, and torturous. We’ve had peers that incessantly talk about their friends cousin who does the same job for more – even though your pay is at the top of the market in your area.

The difference between impartial reality, and your peers attitude about reality, can create a convincing schism where you have it good, but it FEELS like an unfair, depressing injustice.

The U.S. economy is 8 years into a steady and record setting expansion. Every month sets a new record for the longest streak of private-sector job growth on record – now at 72 straight months with 14.5 million new jobs over that time.

I’ve know a number of people who truly, genuinely believe that terrorism in the U.S. is out of control… even though there hasn’t been a terrorist attack in the U.S. in 15 years.

I know even more people who believe we’re in recession, unemployment is 10%, Obama is a Muslim (not that that should matter anyway), that illegal immigration from Mexico is out of control (even though there is currently net illegal emigration from U.S. to Mexico), that getting Iran to literally destroy its nuclear weapons program, through IAEA verification, is a sure path to Iran… acquiring nuclear weapons, that war is cheaper than diplomacy, that the Federal Deficit is increasing at record rates… even though it has been decreasing year-on-year-on-year since Obama’s 2nd year in office (and that is AFTER the Tea Party REJECTING the Obama-Boehner budget agreement for $4 trillion in spending cuts for… a sequester of $780 billion – yes, the Tea Party raised the deficit by $3.2 trillion because they… care about the debt?).

The anger in this country is unique in that it is occurring during a period of steady economic expansion in a historic period of security. It is genuinely unprecedented.

My mother is a 60 year old Pharmaceutical Sales Rep. She starts and ends the day with Fox News. She genuinely believes the U.S. is on the brink of collapse, crime and terrorism are out of control, the healthcare industry is doing worse than ever, and that we no longer have any allies internationally (good luck explaining that the Iran deal was a global agreement and the U.S. would have been a pariah by opposing it).

Even though she emphatically believes all of these things she ALSO has this reality in front of her: Her income has increased EVERY SINGLE YEAR of Obama’s Presidency, she has never been let go during Obama’s Presidency, her companies stock has risen faster than before Obama’s Presidency, the entire healthcare sector has experienced rapid growth (in both employment and stock valuations) during Obama’s Presidency, not a single person she knows has been criminalized or experienced a terrorist incident.

Long story short, I know a baby-boomer whose life is better than ever, and has experienced a period of income growth faster than any period of her 35 year career. I know this because she admits this. She simultaneously believes that we’re in an economic collapse, terrorism is out of control, and the U.S. is about to be invaded.

This is the reason Trump exists. It is the result of 8 years of Republican media inventing an alternate reality that perplexes the entire rest of the world. Anyone who knows or talks to enough citizens of other countries sees that the situation we find ourselves in is unprecedented and, frankly, embarrassing.

Many valid points here, but surprised by your comment about “no terrorism” in the US in 15 years. If you define terrorism as ideological driven violence against civilians (or something like that), then don’t forget San Bernadino 2015, Boston Marathon 2013, Ft Hood 2009, Beltway Sniper 2002, and many other incidents that resulted in only 1-2 deaths, injuries, or were thwarted.

Maybe you could characterize attacks on Jews as hate crime rather than terrorism- I don’t know the difference. Or on Muslims, or on gays, or Asians, or Blacks, or on Police for that matter.

I should have specified sponsored terrorism, as opposed to the lone wolf terrorism we’ve seen since 9/11.

It was an attempt to point out that the brand of terrorism that everyone is worried about – sponsored/organized events directly linked to ISIS or Al-Qaeda – has not happened on U.S. soil since 9/11

In 2015 there was a shooting in Tennessee by Islamic terrorists, however according to this article toddlers were a bigger danger that year: http://www.huffingtonpost.com/benjamin-powers/toddlers-involved-in-more_b_8650536.html

so, does anyone have an idea of the potential for offshore Atlantic oil and gas?

Will this make any difference?

“The Obama administration is reversing course on opening Atlantic waters to a new generation of oil and gas drilling, after a revolt by environmentalists and coastal communities that said the activity threatened marine life, fishing and tourism along the U.S. East Coast.

The proposed offshore leasing program being released Tuesday eliminates the administration’s initial plan to auction off drilling rights in as many as 104 million acres of the mid- and south-Atlantic in 2021, according to an Interior Department statement. The proposal also sets the stage for selling oil and gas leases in the Arctic waters of the Chukchi and Beaufort seas, as well as Alaska’s Cook Inlet and the Gulf of Mexico, where 10 auctions were tentatively scheduled from 2017 to 2022.”

http://www.bloomberg.com/news/articles/2016-03-15/obama-said-to-bar-atlantic-coast-oil-drilling-in-policy-reversal

mike

I actually worked on the first offshore drilling platforms off New Jersey in the late 70’s.

The program involved a few oil companies spanning about two years and a couple dozen wells, IIRC.

Although I, myself, departed after five months, the ‘word’ was that gas shows existed in many of the wells drilled, but in insufficient quantities to be commercially viable.

In these type of wildcat operations, the data is usually kept highly confidential … but they would not be considering going back unless there were some upside potential.

On a completely different topic, Lyft and GM announced a plan today to offer short term rentals to Lyft’s drivers (for free in some circumstances) in an effort to bolster the businesses. (Lyft is an Uber competitor). Eventually, the goal is to have autonomous vehicles.

Absolutely brilliant strategy, if it works.

1.3 mmboed and rising by 2035 – more nat. gas than oil. 2 billion boe total recovered by then, but more reserves available:

http://www.api.org/~/media/Files/Oil-and-Natural-Gas/Exploration/Offshore/Atlantic-OCS/Executive-Summary-Economic-Benefits-of-Increasing-US-Access-to-Atlantic-Offshore-Resources.pdf

These are API estimates so probably on the high side.

Only the drill bit knows. And sometimes it doesn’t know.

Even if the potential is trillions of barrels, the political production will always be zero.

BOEM just released a new offshore assessment model.

Mid-Atlantic estimation a whopping (/sarcasm) 2.41 billion bbls of oil UTRR, i.e. nice, but nothing huge,

Western Gulf Of Mexico is 11.57 Bbo, Central GOM is 33.25 Bbo.

Chukchi Sea is 15.38 Bbo, Beaufort Sea is 8.22 Bbo.

For comparison, Bakken and Eagle Ford are around 8 and 5 Bbo respectively.

US consumption is around 7 Bbo/year (“all liquids”, not just crude).

http://www.boem.gov/National-Assessment-2016/

A link to a nice map is there.

The “Fact sheet” makes for interesting reading, includes comparisons with previous estimates and what’s economically recoverable at various oil prices.

ezrydermike says:

03/15/2016 AT 3:14 PM

so, does anyone have an idea of the potential for offshore Atlantic oil and gas

——————————————————————————————–

I wonder? In the past I have seen references to the lack of economic oil and gas onshore or near offshore along the mid and south portions of the Atlantic. I assume that near offshore drilling would have been possible and permitted in this area during the early or mid 20th Century? Was the geology unsuitable?

Mike,

Beauty is in the eye of the beholder. There hasn’t been near enough wells drilled in the Atlantic OCS to really know. But all one has to do is head north and look at the Hibernia fields developed in Canadian waters offshore Nova Scotia to get some idea of the potential.

The risk of ice bergs is substantially lower along the US Atlantic coast so it is reasonable to assume that development costs will be less than Hibernia.

From what I remember of my offshore days we were most interested in the Cape Hatteras area. Do t hold me to that though. It was a long time ago. I doubt the NIMBY crowd has lessened in that area so I am pretty skeptical that an OCS lease sale will ever be held in that area.

Oh I just found this: Obama Bans New Atlantic Offshore Drilling.http://oilpro.com/post/23165/obama-reverses-arctic

http://qz.com/318755/how-one-mans-wild-geological-treasure-hunt-could-set-off-a-new-great-oil-boom/

This is a very interesting read on a possible exploration and production play by BP & Shell in the North Atlantic in Nova Scotia waters.

Hibernia is offshore Newfoundland not Nova Scotia – there are no ice bergs getting to Nova Scotia, and currently no oil production either. There are two gas developments which haven’t been outstanding successes. There have been previous exploration wells for oil, none successful and some (e.g. Marathon) very expensive, it is very stormy and deep water requires DP (dynamic positioned) drill ships. Shell is drilling at the moment but it also has had major problems as the drill ship dropped the riser (2 km of pipe) over the weekend in a storm (well secured previously so no risk to environment), so I assume activity is currently suspended. BP and Shell bid about a billion dollars each for rights there. Exploration success has been better in the Hibernia area, with Statoil particularly active recently.

If oil ever gets short enough the tourists quit coming , the people who own the water front will be happy to see oil produced off shore in NC.

They will extract a sizable ransom from the industry in exchange for stepping aside.

Till then, they will as John S suggests, not a prayer.

Aren’t we missing the monthly Bakken report?

Hi Watcher,

Yes we are, I would direct people to Enno Peters website.

He does a fine job on this,

Based on the latest NDIC data, total oil production in North Dakota fell to 1122 kbo/d in January, again a monthly drop of 30 kbo/d. This decline was slightly higher than I expected. The number of new wells producing dropped to 70.

https://shaleprofile.com/

Thank you Dennis!

Enno,

You are the one who should be thanked for your awesome work!

Thank you.

I concur,

I guess Enno’s site required a huge amount of work.

And it is very helpful for us.

Dennis, Alex,

Thanks, I really appreciate that. I got inspired by the (in my eyes) lack of good information about the shale plays, the impact of shale oil on the global oil market and on many people’s lives, the many questions about it, and the many (again, in my view) incorrect reporting about it. I still read articles on a daily basis that I belief are incorrect based on the data I have presented. My hope is that the site provides easily accessible data that can lead to better informed discussions and understanding.

I see that both of you also make tremendous efforts in understanding and presenting “the truth” in a rational and reasonable way, and I much value that. I also admire the amount of patience you both display in the debates here. 🙂

Thanks Enno,

I agree that AlexS does a wonderful job. I have learned much from both of you.

Yup, but would like to see Ron’s analysis. Always a highlight, and there’s been a fall similar to last month’s.

February Smashes Earth’s All-Time Global Heat Record by a Jaw-Dropping Margin

By: Jeff Masters and Bob Henson , 7:46 PM GMT on March 13, 2016

Yes. And we do know the cause.

And what caused the cause?

Ron,

I put that as “What caused 2015 to be the warmest El-Nino year on record?” Same thing, I guess.

Well said Ron!

Javier- a big el nino year is a symptom of warmth, not a cause of a graph.

Seriously, I have a question for you Javier- have you thought what it would take for you see the earth as being in the midst of a significant warming trend? A particular indicator that would reach the threshold for you? I am truly interested in your thoughts on this. Thank you.

Given the catastrophic impact that climate change will have, does it make more sense to wait until “all the evidence is in” or make changes now given the evidence that exists?

But it’s pointless — nothing is going to change. Whatever is going to happen will happen and no action will be taken to prevent it.

Hickory,

Seriously, I have a question for you Javier- have you thought what it would take for you see the earth as being in the midst of a significant warming trend?

You are way too quick. I am with Javier on that.

You know what Chinese premier said to French when asked about significance of French revolution for mankind or something like that.

He said: Too early to tell.

Returning to El Nino issues. Why not to wait for the next La Niña and see the real amplitude. There is close to a 50% chance for La Niña to develop by fall.

It looks to me like 2011 was the record low Arctic sea ice annual maximum and 2012 was the record low Arctic sea ice annual minimum. If 2016 is both a record low sea ice annual maximum AND a record low Arctic sea ice annual minimum then perhaps Javier will get it through his thick skull. But I doubt. Javier states the current data indicates that the Arctic sea ice volumes are ‘doing just fine’; FYI we’re in second place for record low March right behind March 2011. Javier is either willfully blind, incredibly stupid, a troll or all of the above.

http://neven1.typepad.com/.a/6a0133f03a1e37970b01b8d1abe64d970c-pi

Anybody who looks at the chart linked above and concludes that the data indicates Arctic sea ice volumes are ‘doing just fine’ is not worth taking seriously.

There was a strong El Niño in 1998 however it appears that Arctic sea ice extent was much greater at that time than compared to today. I suggest one does not need a PhD in regressional analysis to come up with some ideas about why that might be. If El Niño is the only culprit, as Javier seems to be suggesting, then 1998 sea ice and 2016 sea ice should be in somewhat similar condition. Yet that is not the case.

http://neven1.typepad.com/.a/6a0133f03a1e37970b01b7c809c471970b-pi

In my house when guests come over for dinner people like Javier are invited to go and sit at the kids table. However I’m doubtful even children would tolerate that much obvious stupidity.

I hope you just earned yourself the ban that was promised if you kept up your disrespectful and antagonistic behavior toward another poster. Bye.

Jimmy, I hate to ask this, but if you could please ‘critique’ Javier’s comments, rather than Javier, it might save your ass on here and avert subverting your own voice, such as to the issue of climate change.

It is suspected that Javier and ‘company’ and/or the drive-by’s, for examples, would like little better than to see you instrumental in your own banishment, thus maybe amplifying a particular chorus by your elimination.

I’m also unsure Dennis would appreciate having to make the call.

Besides, at the beginning, Ron Patterson did make it plain that he was relatively averse to, as he put it, ‘vile’ name-calling, even though he may have transgressed his own rule once and awhile, if not often.

“Morpheus: ‘You have to focus, Trinity.’ ” ~ The Matrix

Jimmy,

I do not say that current El Niño is necessarily behind current low Arctic sea ice levels for the time of the year. It might have contributed not only through temperatures, but through precipitation changes, but we don’t know that for sure.

You have to understand that a record low in Arctic sea ice is only one year data. What happens over several years is what matters. The recovery of 2013 in Arctic sea ice was so big that it surprised cryoscientists.

The long term trend in Arctic sea ice is downwards, this is evident and logical and expected. After all ice is expected to melt if temperatures increase and the planet has been warming.