The latest OPEC Monthly Oil Market Report is out with OPEC production data for. The data is “Crude Only” and does not reflect condensate production.

Also the charts, except for Libya, are not zero based. I chose to amplify the change rather than the total.

All Data is in thousand barrels per day with the last data point December 2014.

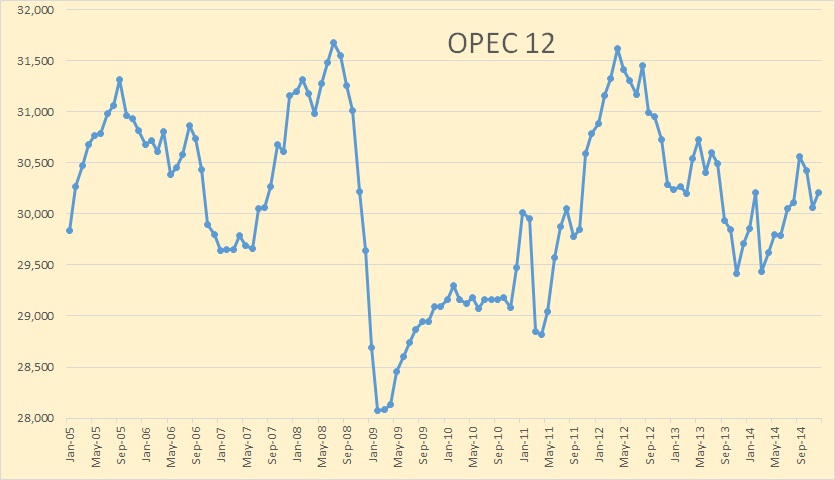

OPEC 12 production has averaged slightly above or below 30 million barrels per day for about two years now and there is little chance it will go anywhere very fast. But what is obvious from the above chart is there has been no surge in OPEC oil production. OPEC’s December production f 30,204,000 barrels per day is still more than 1.4 million barrels per day below the peaks of 2008 and 2012.

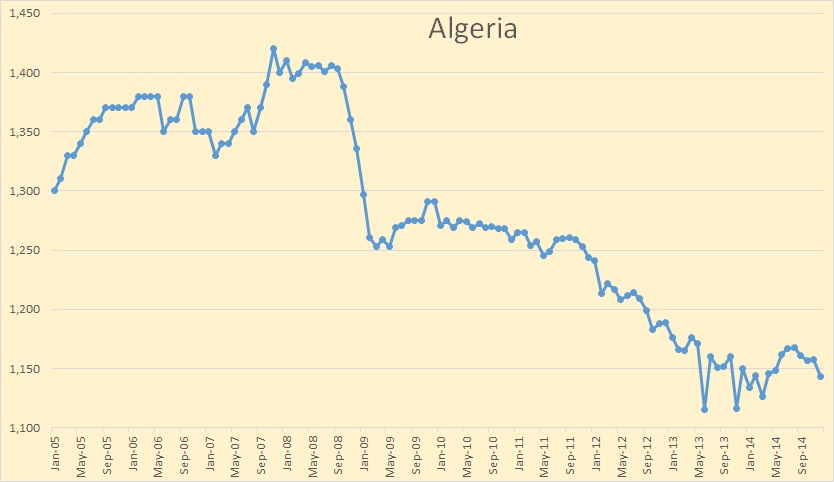

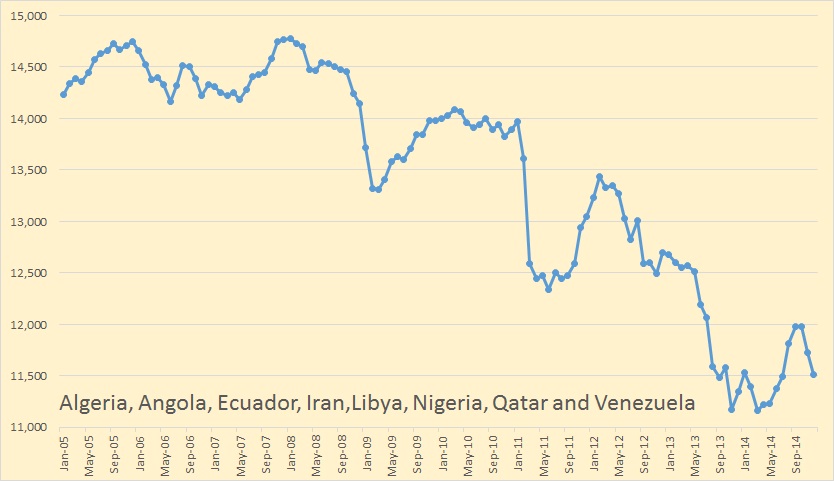

Algeria is struggling to keep production relatively flat.

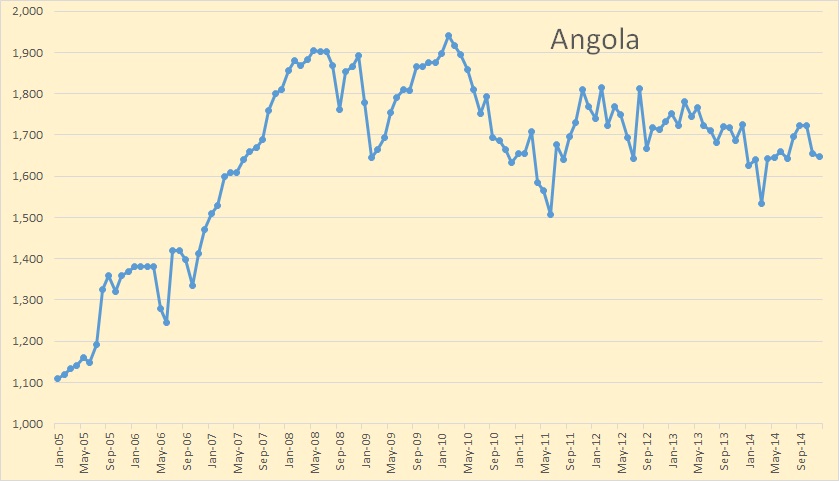

Angola is holding its own… so far.

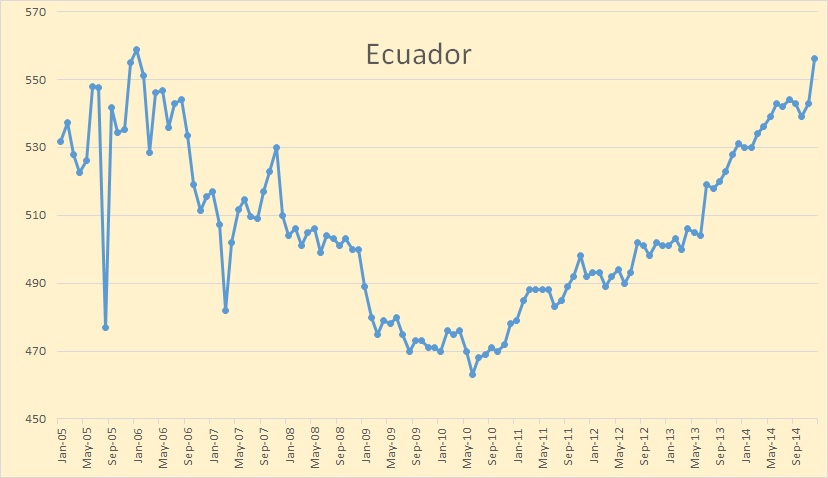

Ecuador increased production by 13,000 barrels per day in December, from 543,000 to 556,000 bpd. Not much but quite a jump for such a small producer.

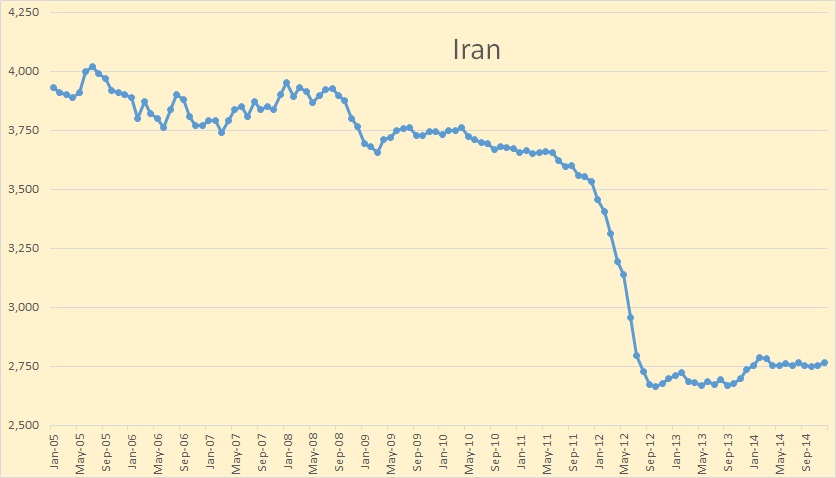

Nothing is happening in Iran. What just might happen in Iran is another thing altogether.

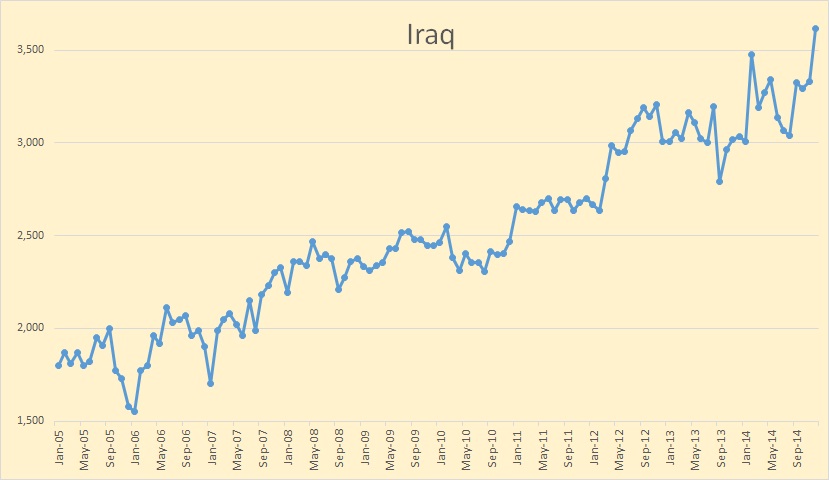

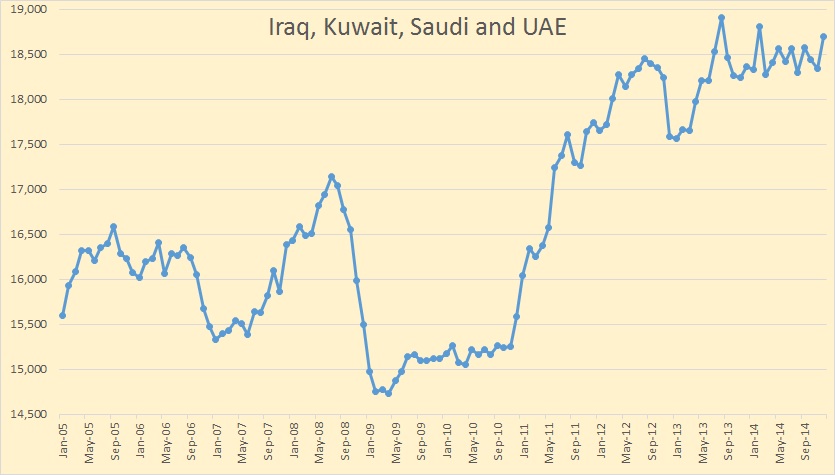

Iraq was where the big OPEC increase came from in December. They went from 3,331,000 bpd to 3,616,000 bpd, an increase of 285,000 barrels per day. This is considerably less than their almost half a million barrels per day increase in February but very significant nevertheless.

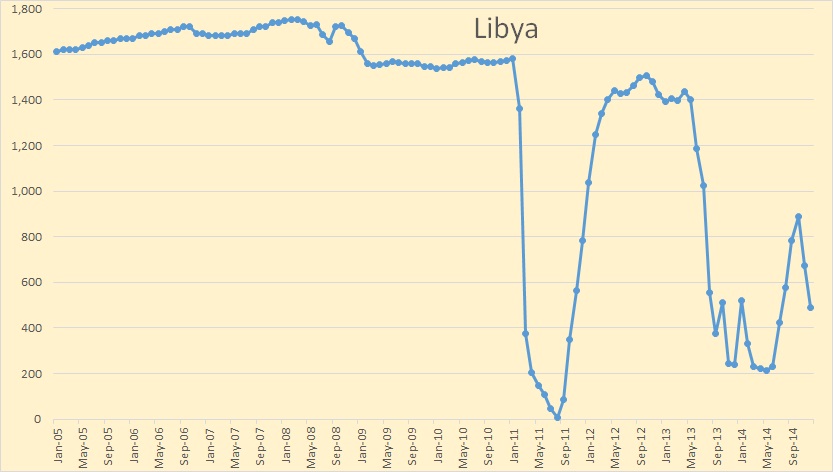

Libya is still having very serious political problems and that is putting it mildly. Who knows what is going to happen there, but it is unlikely they will see these problems solved anyway soon.

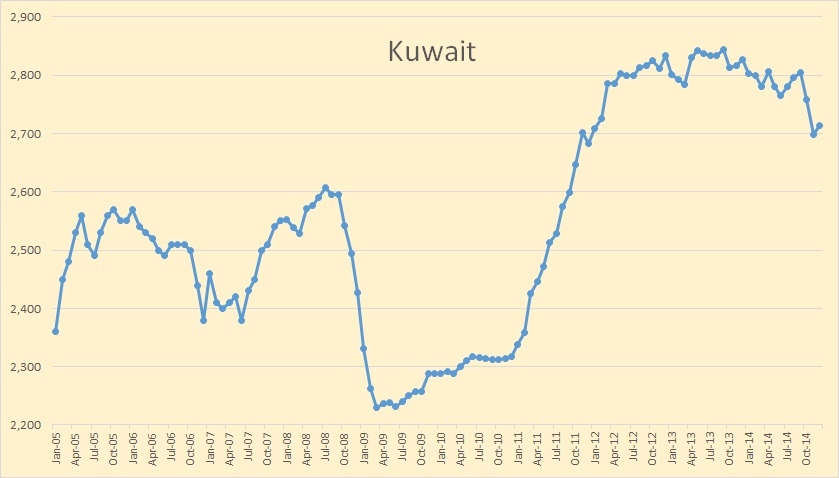

Kuwait’s super-giant Burgan Field is in decline so Kuwait has engaged in a massive infill drilling program to increase production in five northern oil fields—Abdali, Bahra, Ratqa, Raudhatain, and Sabriya (Kuwait’s third largest field) from around 650,000 bpd to 900,000 bpd. They were successful but now they have peaked again and production headed down.

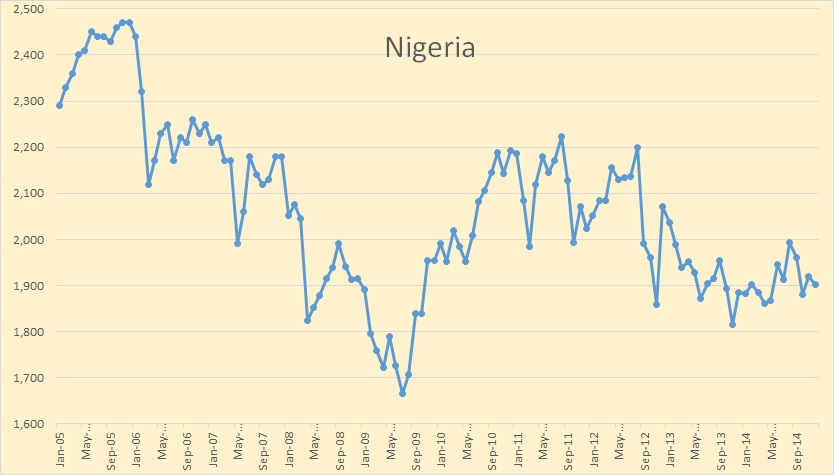

Nigeria’s political problems has been raging for years and there is little hope they will be settled within the next decade or so. Nigeria will be very lucky if they can maintain their current production level.

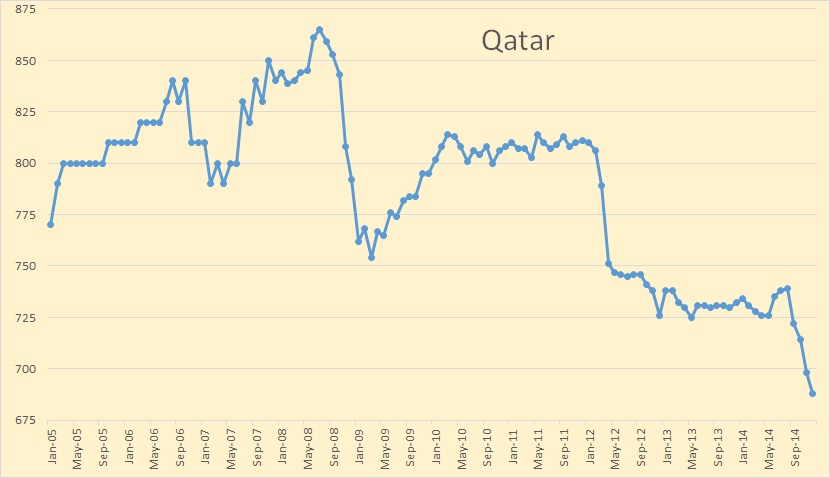

Qatar peaked back in 2008 and is now producing almost 200,000 barrels per say below that peak. From the looks of what has happened in the last fur months they may be in terminal decline. They can only hope that the decline slows. Is this their Seneca Cliff?

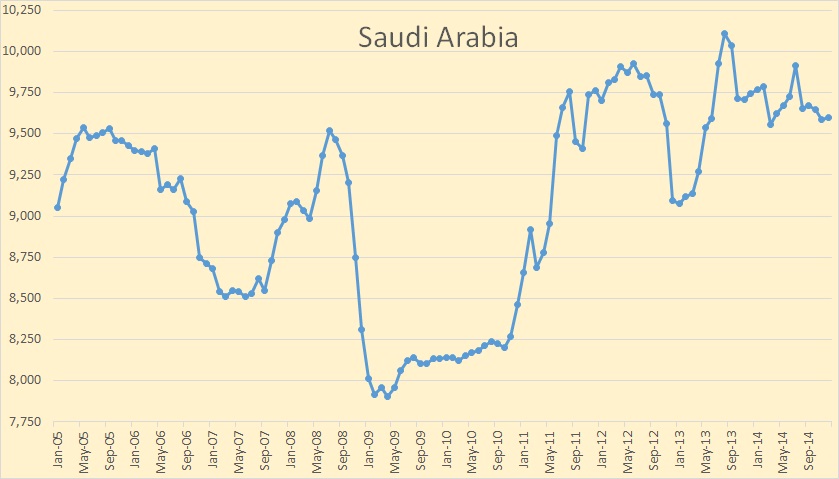

Saudi Aramco to cut drilling costs, hold rig count steady

Aramco deployed 210 oil and gas rigs in 2014, marking an exceptionally busy year.

Saudi has more than doubled its rig count in recent years. Operating 210 rigs even after Manifa is complete? This this means they are drilling about 2500 new wells per year. Why? They are not increasing production, all those new wells are only keeping production flat.

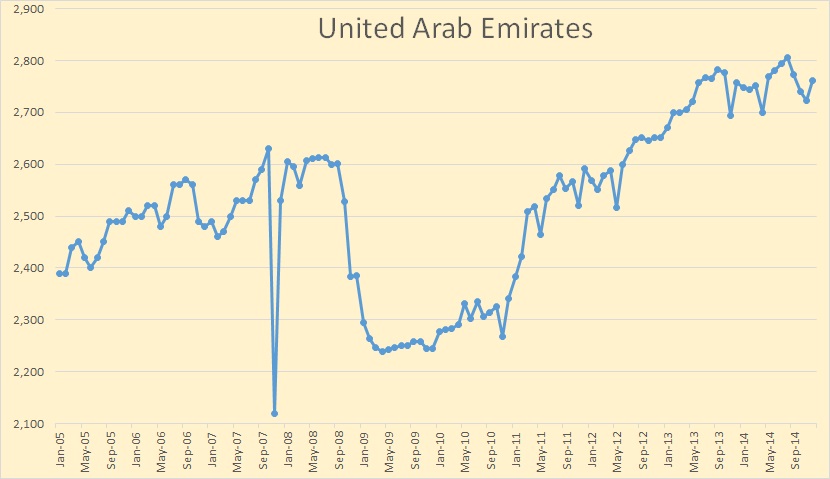

The UAE, like Kuwait and everyone else for that matter, has been doing a lot of infill drilling. They have managed to increase production from their 2008 peak by about 150 thousand barrels per day.

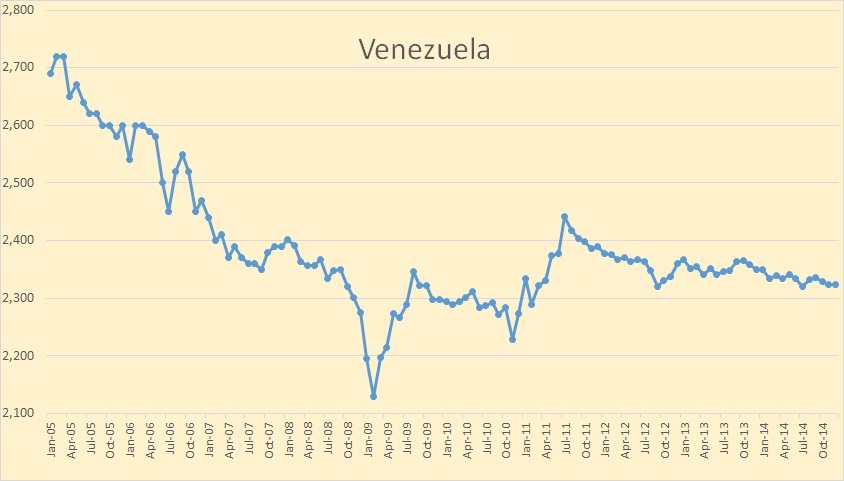

Despite having more oil reserves than anyone else in the world, Venezuela’s oil production continues to languish. Engineers with six years experience in Venezuela make about $400 a month, 9% of the world average and one fourth what they are making just across the border in Colombia.

Which OPEC nations are holding their own and which ones are languishing? OPEC production peaked in 2012 and only four countries have held their own or slightly increased production since then, Iraq, Kuwait, Saudi Arabia and the UAE.

The other eight OPEC countries, combined, peaked in 2005 and have declined by about 3 million barrels per day since then. Of the eight, only Libya and Iran could produce very much more if their political problems were to disappear. However that is not likely to happen in the next few years.

Political problems in the Middle East, Africa and Venezuela will get a lot worse before they get better. Low oil prices will, very likely, greatly exacerbate these problems. And who knows what might happen in Saudi Arabia?

Saudi King Abdullah’s Death Clouds Already Tense Relationship With U.S.

In the short term, the death of the king actually might ease strains in the relationship. The Saudi kingdom, as it enters a period of transition, may feel more vulnerable to external threats and eager to show the world that it still has the solid of backing of the U.S.—the country the kingdom always has seen as its ultimate protector.

But in the longer term, the transition raises questions about how the new Saudi leadership will see its relations with the region and the wider world. Most likely, it will be a period of what longtime Middle East diplomat Dennis Ross calls “collective leadership.”

That in turn may reduce the Saudis’ ability to move decisively on the difficult and contentious issues—toward Iran, Iraq and the Islamic State uprising, as well as oil policy—that the U.S. and Saudi Arabia have been trying to address together.

New Saudi king vows no abrupt policy shifts

“The Arab and the Islamic nations are in dire need of solidarity and cohesion,” the king said.

There is a good video at that last link.

Note: My posts are irregular, usually every three or four days but at different times of the day. Whenever I put up a new post I send an email notification of such. If you would like to be put on that list, or removed from it, post me at DarwinianOne at Gmail.com

How many active oil wells are there in KSA? How about other OPEC producers?

How many active wells are there in SA? Thousands man but how do you define active? Someone said Ghawar has about 3000 production wells. But there are a few hundred water injector, observation and gas wells there too. If you include the Saudi-Kuwait Neutral Zone I’d make a wild guess and say 5000. Ron will probably know better than anyone here.

Shallow,

I believe, that is one of those questions of, “if I tell you, I will have to kill you”.

Someone on the TOD counted SA wells using Google earth. Can any one remember who that was?

Joules Burn was the author.

http://satelliteoerthedesert.blogspot.com/

Thanks Andy,

Joules Burn’s, site is certainly worth a look for anybody.

Thanks for the information. Wish we had more information about production in these countries.

Look at the Google maps

https://www.google.ca/search?q=saudi+oilfields&hl=en&client=firefox-a&hs=WpR&rls=org.mozilla:en-US:official&tbm=isch&tbo=u&source=univ&sa=X&ei=NwFPUaWsBuW02wXesYHYCw&ved=0CFIQsAQ&biw=1229&bih=836#imgdii=_&imgrc=Tsyu4jbf0e8GHM%253A%3B3_OjKYz6H9bu9M%3Bhttp%253A%252F%252Fweb.inetba.com%252Fgregcroftinc%252Fimages%252Farea4map_sm.jpg%3Bhttp%253A%252F%252Fwww.gregcroft.com%252Farea4indexmap.ivnu%3B848%3B971

Ron,

Nice summary of OPEC Crude Oil Production. As you stated with the example of Saudi Arabia, they have increased drilling rigs considerably but have not increased production. Sounds like they are dealing with their own RED QUEEN SYNDROME.

Anyhow, as the price of WTIC falls to the $45 handle, the U.S. continues to pump shale oil as if there is no tomorrow. According tot he EIA’s weekly inventory report, build in oil inventories are the highest since 2001. Furthermore, the IEA states that if current projection of weak demand and robust supply continue, the world will BUMP UP AGAINST STORAGE CAPACITY in the 1H 2015.

That should cause some real fun in the oil markets. Looks like the major oil producers are playing a game of CHICKEN to see who cuts and runs first.

I imagine if global oil production continues a current, or slightly elevated levels… well then, we are heading towards $30 oil.

steve

Steve,

Refinery runs were down nearly 1 million barrels per day from the previous week with import steady. That is a 7 mill barrel build by itself. I feel their was some technical problems with the some refineries. Export of refined products are down a million barrels per day from last year as well.

US refined products were up a bunch as well. Probably going higher. So much for oil independence.

And an additional unknown is the Condensate to C+C Ratio (for both US production and inventories).

The most recent four week running average for net crude oil imports, as a percentage of crude oil inputs, in US refineries is consistent with what we have seen for a while, 43%. This would seem to be inconsistent with a large build in actual crude oil (45 and lower) inventories, and especially a build in 40 API and lower crude, which has the highest distillate yield.

In other words, it’s possible, and perhaps likely, that most of the build in US inventories has been on the light end.

http://www.bloomberg.com/news/2015-01-23/tests-for-oil-guisher-seens-as-misleading-to-investors.html

” In the Eagle Ford field in Texas, the shale boom’s most prolific formation, the tie between a well’s 24-hour test and its 12-month performance was found to be statistically insignificant in a Drillinginfo study by senior research analyst Chris Smith. ”

wow – who would have thunk it…..

rgds

WP

Hi Weekendpeak,

Good article. I imagine this is what oilmen like Rockman were referring to when they questioned if 24 hour IP is a good metric for well quality.

1/2 of that or 350,000 barrels agrees with DC’s analysis. Can’t trust the oil industry playas, but the amateurs do good work 🙂

Incidentally, diffusional processes have an initial strong transient that can screw up the interpretation if the modelers don’t take this into account. No wonder that they overestimated longer-term flow rates.

Again, its instructive to understand how they high-balled the numbers so badly for these fracked wells.

If they used the wrong decline model, they would have vastly overestimated the flow after a few years, but with the correct diffusive model, they would have noticed that this was just part of the initial transient and understood the longer-term flow would have been proportionally much lower.

It’s not that the out-year prediction was statistically insignificant with the initial flow, but more than likely proportionally wrong and thus the prediction was insignificant of the actual flow. Big difference between the two modes of modeling failure.

A Saudi Palace Coup

By David Hearst

http://www.huffingtonpost.com/david-hearst/a-saudi-palace-coup_b_6531246.html

I wonder what the rate of increase has been in high maintenance Saudi princes (and princesses) in the past 10 years?

The total fertility rate or total birth rate per woman has been dropping like a stone in Saudi Arabia according to Wikipedia and the CIA for the last few decades and is now not much over two per woman ( estimated ) but I forgot what it is.

This is an excellent indication that the preachers aren’t totally in control of social policy or else that most of them are smart enough to understand that a six or eight kids per woman birth rate is the broad smooth road to disaster.

BUT the age distribution is skewed heavily towards young people and even at two per woman the population is going to grow fast for a long time to come. Life must have been pretty rough there until recently- there are very few old people in relation to the population.

Right wingers in this country used to accuse women on welfare of having one kid right after another to collect benefits.

Sometime back I saw a figure quoted that the Saudi royal family is thought to number about nine thousand. That is a a pretty good sized family.

Personally I never bought the welfare queen argument- such women are just too dumb or ignorant to insist on birth control or to down and out to care.

But with millions of dollars at stake with every new prince and princess born it could be that the family has a little deliberate population boom going on within the royal walls. If I were a prince of the realm and could raise kids in the lap of luxury with a small part of the treasure they would bring under my control…. I doubt I would hesitate to father a LOT of kids.

Whether this is happening or not I have no idea but I have seen some speculation here and there in odd corners of the net that such is reality.

Having lots of kids in that situation would be a piece of cake .Kids born to the harem count as legitimate according to what I have read. The new king himself seems to have been born to a concubine – or maybe that was the other front running guy hoping for the crown.

“Personally I never bought the welfare queen argument- such women are just too dumb or ignorant to insist on birth control or to down and out to care.”

This is an offensive comment. Which women is it you think are too dumb or ignorant?

This here old redneck ain’t EVER going to knuckle under to pc bullshit.

PC means you criticize only people on the OFFICIAL PC SHIT LIST – I am proudly on that list.

OF COURSE it is OK OK OK FOR YOU to criticize ME for pissing on YOUR CRITERIA of who is dumb as a fence post or too down and out to care.YOU ARE PC and I AM ON YOUR SHIT LIST..

In the cozy little pc world YOU get to decide who says what.

Fortunately our host Ron is not afraid to criticize religions or cults or stupidity in general and until he tells me other wise I will post comments here that I believe are true.

You ask me ” which women” are too dumb and ignorant?

THE ONES WHO HAVE or had ONE KID RIGHT AFTER ANOTHER without the means of supporting them- other than welfare -THOSE women.

Now I was young once and know all about raging hormones and all that stuff.

Young women with raging hormones who get led down the primrose path and left in the briar patch all alone except for the kid ONCE who happen to have WORKING BRAINS generally learn better in choosing prospective boyfriends and mates . The ones with ONE kid are not the ones I am talking about.

I also know a little bit about depression and hopelessness of the emotional and intellectual kind having some experience in that area with friends and relatives and a few courses in the field ( licensed special ed and agriculture teacher and got most of the way thru RN training before dropping out to look after elderly parents)

Fortunately these down and out women are not so common as they used to be. I only know two personally at this time- both of them lily white distant cousins of mine. Twenty five or thirty years ago I knew a dozen or more personally – but I lived in the city then and worked part time in poor neighborhoods as landlords handyman while doing some grad school and thus made their acquaintance.

Bill Clinton who I have grown quite fond of in retrospect had a good bit to do with their thinking more often once he pushed thru his welfare reforms. So maybe most of them HAVE working brains enough to think more before enjoying an unprotected roll in the hay.

When it was in my power to do so I did what I could to help these women better themselves – mostly by providing them with the name and phone number of a local outfit that would pay for birth control for them.

All the men are good looking and all the women are strong and all the kids are above average only in Lake Wobegone.

Refusal to recognize reality is one path to hell on earth.

Now if you were to ask me about my opinion of the BOYS who lied to them and lead them on and knocked them up and mostly left them to fend for themselves and their kids – well I wouldn’t actually be able to post it here. I try not to use the really bad cuss words very much in a place where too many kids might see them and be encouraged in bad habits.

MEN in my moral world look after their kids.

Incidentally I generally think of the entire human species as being as dumb as a fence post COLLECTIVELY in terms of behavior.

I have at times had numerous very liberal and very well educated friends and acquaintances -professionals of various sorts. They all loved down and out people at a distance. I never noticed any of them having their yard guys and house keepers over for dinner.

I don’t actually invite my farm help TO dinner but when we knock off for lunch if we are near the house we have it in the eat in kitchen – together – we don’t have a dining room as such.

ONE more thing-I fully recognize and understand that environment and culture have more to do with poverty and crime than brains ever did or ever will. Just about every semiliterate redneck in or out of jail I know would be an upstanding citizen wearing a suit if he had been born into a professional family rather than to down and out farmers and laborers.

Incidentally I come from the world of down and out people within living memory.

My culture involves hard work and modest living and with that culture in combination with some substantial good luck my family has prospered. I was the first college grad myself.

Now we have some doctors lawyers cpa’s engineers lots of teachers and nurses, as well as plumbers truck drivers carpenters and laborers. Some successful small businessmen. But hardly ANY pc types. Only a couple in jail that I am aware of.

This is not to say we are all law abiding citizens but rather that most of us who aren’t are smart enough to avoid getting caught. 😉

LOL…. Enjoyed your post…Now that I have the “full monty”… I found my head nodding in agreement many times.

However, I would like to add one more thing for your considerations. Over the course of the years I have volunteered at several homeless shelters…. my preference being to volunteer to work/mentor/help with women with children. With the “privatization” of our government social safety nets what I have encountered is many of the not for profit groups are religious… and access to these social services entails following their religious dogma…… volunteering within these groups is extremely difficult for me….. and there are almost none that are not religious based even though they do not advertise it or admit it to the public…

What I have witnessed is the not for profit religious government funded social services encouraging these young women to not access birth control and if the young women has “allowed the horse to slip out of the barn”…. well, this is the punishment for not obeying Gods laws, abstinence only…. (He works in mysterious ways….) and if “you” continue to follow Satan calling worse will happen to you than an unwanted child that you do have not ability to care for……. (like you and your child(ren) and see God has shown mercy by leading you to our door) will lose the current roof over your head that said services are providing… and your ever lasting soul will most certainly burn in the eternal flames of hell) instead of enabling and encouraging these women to have access to care….. ie…. birth control from the get go and clinics if the horse escaped the barn…… BTW… many of these women have or are “recovering” drug addicts…. the explosion is prescription, heroin and meth addiction along with extreme poverty has been frighting…. and overwhelming… in the community that I live in. Drug use permanently damages the brain…… hence the “stupidity” of many of the choices these women make……

Sorry Ron for straying so far from OPEC production…. I enjoy reading your work and appreciate the email heads up when you post them…. but I believe the back side of Peak Oil is going to be more extreme dysfunction in our society as resources become strained and I think we are starting to see it. I am waiting for the banking oil price derivatives shoe to drop…….. it will be interesting to see if TPTB can “kick this can” again… and how far.

Well said all the way Louise. My chin went up and down too reading your comment.

We are cursed to live in interesting times- as a Chinese sage once famously put it.

Macster,

re: “Sometime back I saw a figure quoted that the Saudi royal family is thought to number about nine thousand. That is a a pretty good sized family. ”

Hey, if you were King with billions….hell, if you simply won the lottery, you’d have a big family too. Everyone would be proud to call you Dad, Uncle, Cousin….

True enough but it probably really is that big or bigger. The family clan thing has always been extremely important in that culture to the best of my knowledge and the ” family ” probably numbered a thousand or close to it even as far back as WWII. With tons of money and the women having half a dozen kids each until the mid nineties….. The birth rate is WAY down now though.

Mullahs have preached family planning in several coutries, most noticeably Bangladesh after the big famines. Also after the Islamic takeover in Iran the birth rate collapsed. In fact almost all the big Muslim countries — Indonesia, India, Iran, Bangladesh, Turkey, Egypt — have fairly low birth rates. The big exception is Pakistan.

Pakistan and Egypt appear very close at 2.86 and 2.87. Jordan and Syria are high. Niger, Nigeria, Mali, Somalia, Yemen and Afghanistan are very high.

https://www.cia.gov/library/publications/the-world-factbook/rankorder/2127rank.html

The longer-term OPEC-12 chart is somewhat noisy but nevertheless illustrates an extraction regime that has changed little since 2005. There is nothing to suggest a crash in prices; no real increase in output other than brief periods in 2008 and 2012 (unadjusted for net exports which is what matters in international markets).

The idea that oversupply (Saudi Arabia’s fault) is the reason for the ongoing price collapse is not supported by evidence.

US output isn’t responsible, either. Drillers have not equaled flow that was gained in 1970. At the same time the energy content of current liquid fuel supply has diminished. Low price will cut output numbers from here. Safe to say US peak (output or mj) was in 1970, world peak is likely occurring under our noses.

A copy of a relevant previous post:

Re: OPEC Spare Capacity

As annual Brent crude oil prices rose from $25 in 2oo2 to $55 in 2005, Global Net Exports (GNE*) rose from 39 mbpd in 2002 to 46 mbpd in 2005.

As annual Brent crude oil prices rose from $55 in 2005 to the $110 range for 2011 to 2013 inclusive, GNE fell from 46 mbpd in 2005 to 43 mbpd in 2013.

Methinks that there was a material amount of export spare capacity in the 2002 to 2005 time frame, but I have severe doubts about the 2011 to 2013 time frame. Of course, there were some recent production disruptions related to political unrest, e.g. Libya, and some sanctions, e.g., Iran, but those factors are always at play to some extent.

In any case, depletion marches on, and in my estimation total remaining post-2005 Global CNE (Cumulative Net Exports) have fallen by about 30% since 2005 (through 2013).

*Top 33 net exporters in 2005, total petroleum liquids + other liquids, EIA

I have seen at least one article that says oil consumption is up sharply in the US in the last few weeks compared to the same period last year but I forgot to bookmark it.

But the increase is not supposedly enough to account for production plus imports minus exports. There seems to be more oil going into storage SOMEWHERE every day.

From my layman’s pov it seems that storage would have been all full up weeks ago. What gives?

[looks side to side]

Maybe there’s no oversupply.

Hi Watcher,

Oil supply has increased more than demand has increased, just look at the OPEC market report to verify. This has caused oil prices to drop, some of the supply has gone into storage and more has been purchased due to low prices.

Hi Dennis,

Who is storing? Do you have any info on that? If somebody is storing I would assume that that extra surplus oil has to be bought first? If somebody bought than that is part of the demand.

He never does. Just let him go.

I think there’s a fair chunk being stored on container vessels right now, as the futures curve currently makes that profitable. However the market’s only in contango until about January next year at present.

Can you provide entity name that is storing? Who? Oil companies? Banks? Mike in his backyard?

But if somebody says “somebody is storing somewhere” it does not mean anything.

Ves, just google it, it is all over the net. Google “Contango oil being stored” or something similar.

Crude oil seen stored on tankers in 2015 as contango widens

Global oil traders are likely to store crude in tankers next year, as a widening contango makes large-scale storage at sea profitable for the first time since the financial crisis more than five years ago, industry sources said.

Oil prices have plunged nearly 50 percent since June due to a global supply glut, but the economics for storing crude at sea have mostly remained unfavorable.

However, with Brent for prompt delivery dropping sharply versus later contracts <0#LCO:> in the past week, traders are increasingly requesting to lease vessels for storage.

This market structure, known as contango, allows traders to lock-in profits by buying oil now and selling it forward for later delivery, as long as the costs of storage are low enough.

“The current contango on the ICE Brent market would already be sufficient to make floating storage viable based on average 2014 freight rates,” JBC Energy said in a note.

Analysts at JBC Energy expect 30-60 million barrels of oil to be stored offshore worldwide in the first six months of 2015.

If I understood correctly that article talks of possible future – short term economics of storage. What I am asking that somebody to show me where that surplus of oil went in the past, last six months.

And anyway the article agrees with me and says in the paragraph at the bottom:

“But so far this year, only a few tankers have stored oil at sea as the discount for the front month crude futures has been insufficient to finance chartering. Ship owners have also been resisting calls to lease out vessels for oil storage given a seasonal hike in freight rates.”

So so far nobody is storing anything meaningful.

Funny how that works.

2 million barrels per day of oversupply!!!!!

From June that’s 200 days? 400 million barrels.

Cushing’s total storage is about 50 million barrels. The US SPR is 727 million barrels. So the accumulation would be over 1/2 of the largest oil storage in the world. (pssst, it was not half empty in June)

hahaha it is hilarious that this gets attention.

Or they have stored the oil on land in storage facilities.

Look for oil storage facilities on Google Maps. You have them in every significant sea port (Houston, Rotterdam, Antwerp, Singapore …) All those cylinders are empty. You can make that up by the shadows inside and outside these cylinders. So: There is a lot of storage capacity onshore.

Hi Ves,

If the producers are storing the oil, that would not be part of demand. But if a refiner or middle man is buying oil and storing it that mught be considered demand. I tend to look at refined products and assume those mostly get consumed rather than stored and ignore the intermediate steps.

Looking at the OPEC report shows supply growing faster than demand, these are estimates when there is no room left for storing oil, either more must be consumed or wells need to be choked back to reduce supply.

Basically Watcher is correct that I do not have any inside information, logic suggests that oil that has been produced is either stored or consumed. I think of demand as the final use of the product, like fueling a vehicle with gasoline or diesel.

For 2014 OPEC estimates about 1 mb/d of extra oil, that would be about 365 million barrels of oil that needed to be stored if the estimates are correct.

If I am a producer of oil who has no place to put my oil, what would I do after I have choked back all my wells as far as is practical without damaging the well?

Dennis, Reuters had a article dated 1/12/15 which stated only about 150 million of US 439 million bbl of oil storage was utilized. I have no clue about how any of this is determined or how it plays into weekly inventory reports, just passing along what I read.

Also, have not heard that anyone was cannot sell their oil because storage is full. Cannot say the same for record grain harvest this year, when farmers were many times turned away due to local grain elevators being full. Apples and Oranges I know.

If you are an oil man and find yourself in this situation you will be in the same spot local orchardists have been in for the last thirty years.

You have excess production and NO MARKET. You HAVE to cut back. In the orchard you just push the trees out with a large tractor or dozer. You take out the oldest and worst performing trees selectively. At first.

Eventually there is no orchard left on a lot of farms.

I guess once you hit the point you simply cannot ship oil at any price because there is nobody WILLING and ABLE to take physical delivery you just quit pumping your worst well. Then the next worst. Then the next worst until you get production down to match your ability to ship.

And you hope the price goes back up before you go broke.

Most of our neighbors went broke. We ran at a loss for years to keep Daddy’s morale up. I sold many a load of apples for a lot less than I told him I got for them and ate the difference out of my own pocket.

The market glut eventually cleared to the extent that producers with the best land and capital enough to expand to the necessary new larger scale with new equipment started making a living again.

Oil will go up again too. But not until a lot of people go broke. I feel for the little guys. The big boys will keep right on eating a few bites out of a full pound ribeye and throwing the rest out.

Somebody such as Rockman or Fernando with hands on experience will be able to tell us what happens to a well that has to be shut in . I hear it costs a good bit to get such a well producing again and that it may never produce as much as it did previously. But that doesn’t make it so.

Old Farmer Mac.

I assume that the reason there always seems to be space for the oil is that it does not have a season, like fruit, vegetables and grain. It is always coming, every day 24/7/365 for the most part. Therefore, I assume, it is easier to plan for its storage, there is less risk of building storage that will be rarely used, and therefore a losing proposition. They say the pipeline business is a good one to be in regardless of price of crude because there aren’t droughts where the oil just doesn’t show up unexpectedly.

I’m not at all familiar with orchards, but live in the middle of grain farms. In 2012 there was a bad drought, harvest was finished in two weeks. This year, a lot of rain and not hot, bumper crop and the elevators would usually be full before noon. I guess the farmers in ND really suffered as they had a big crop but could not compete with the oil being railed. Stranded grain, basis was awful, corn under $2 per bushel at times.

I’m not educated in the oil industry, but can tell you from observation that some wells are not hurt at all from being shut down, while others are. Fields that are under water flood need to be kept going, otherwise is appears the “push” through the producing zone disappears. I’m sure there are many here who can give you more accurate information about this.

Also, the wells are subject to a lease. The lease usually has a provision that same is in effect for a period of time, “and as long thereafter as oil or gas is produced.”. The lessee, being the oil producer, cannot shut the wells down for an indefinite period of time, otherwise the lessor may file suit to cancel the lease. Saw this happen several times in the 90s, particularly 1998. The lessee would then be required to remove the equipment and plug the wells. If the lessee does not move the equipment timely, or just walks away from everything, the equipment can be forfeited to the landowner.

You might wonder where the bank is in this situation. They usually will walk away too, rather than foreclose and end up with liability for plugging out the lease themselves.

Living in an area where commodities dominate the local economy, I have observed the commodity price swings for many years. Plays havoc at times. Right now is not a particularly good time for either oil or grain, but there have been some good years immediately prior. The guys and gals hurt the most are ones who recently bought assets on the high end and borrowed to do so. However, if this lasts awhile, all will be hurting.

Really enjoy your posts. Take care!

Dennis, the oil is sold if it’s produced. I think buyers will buy at whatever price allows them to store and hedge while paying off an adequate return. And there’s a lot of storage which can be arranged. For example, there’s space in the Bahamas, in South Africa, and other low cost areas.

How cheap would oil have to get to ship oil out of the way to the Bahamas or South Africa and store it for a few months or longer and then load it up again and haul it on to the refinery where it will be eventually be processed?

I guess a better way of phrasing this question is to ask how much it costs to move a barrel one way by ship.

Bermuda is more or less ” on the way ” from Venezuela and other exporters but it must still cost a good bit to load and unload a ship.

There is obviously a LOT more storage capacity available than I ever would have guessed.

Hi Fernando,

The question I asked:

“What will producers do of storage is full, and wells are fully choked?”

This was intended as a rhetorical question for those who do not seem to understand that prices are determined by supply and demand.

I know that you, Old Farmer Mac, Ron, and most others understand this, there are a few who do not.

The answer is that the oil price will drop until all the oil can be sold (same answer as yours). The oil will be sold at whatever price they can get if oil storage is full and wells are choked as far as is reasonable.

Hi Old Farmer Mac,

Sometimes the EIA reports are inaccurate, especially the weekly data is not very good and does not get revised. The monthly reports are somewhat better, those do get revised as the data improves.

Thanks everybody.

It appears that there is a lot more storage capacity available than I would have ever guessed.If the Reuters article Shallow Sand mentions is accurate there is storage available to stash an extra million barrels a day for a long time yet.

This brings up the question of WHY so much storage capacity should exist. Some of it may be at old closed refineries and such. Maintaining an unused tank farm wouldn’t cost much in comparison to the rent it would pull in at a time like this.

Maybe refiners in past times liked to keep a few months supply of crude on hand in the event of supply disruptions? I know a bunch of old refineries have been closed as bigger and newer ones have taken over the work.I once worked some shut down maintenance around a couple of coal fired power plants where policy was to keep at least two months supply of coal on hand in the event of strikes in the mines or railroads or natural disasters etc disrupting deliveries.

Some years ago at TOD iirc somebody said that in some cases if crude can be bought dirt cheap it can actually be pumped into an old oil well for storage.

I guess that is possible but it sounds mighty iffy.If the well is depleted but still being pumped for a few barrels a day I suppose the oil sent down would come back up sooner or later. I would be afraid it would be MUCH later.

Pumping oil into an old well is a pretty bad idea. The oil is de gassed, has a higher viscosity, and doesn’t get displaced out that efficiently.

If anybody REALLY wants to store oil they can do much better using a steel tank or an old tanker.

Maybe this has already been posted:

http://www.businessinsider.com/shale-boom-funding-2015-1

haha OPEN CHOKE!!!

Investors shouldn’t rely on well tests they can’t interpret.

Well, the companies provide help interpreting, because they are so helpful.

BTW, it’s not investors this is pitched to. It’s lenders. Ain’t a lot of secondary offerings being pitched.

In that case the lenders can do better due diligence. I assume they don’t care because they can resell the product. I’ve seen them operate, they seem to like dark corners, make lousy deals, get their commissions, and that’s life.

I believe the term during the housing bubble was “We would do this deal if it was structured by cows.”

The sensation of a P85 Tesla is the rush of torque in your gut without the racket is an unique “aural experience”. The noise screams energy not making it to the tires. Now it’s just a matter of sounding “BAD”

http://tech.slashdot.org/story/15/01/22/1619252/fake-engine-noise-is-the-auto-industrys-dirty-little-secret

Baker Hughes: US rig count down 43, oil rigs down 49, gas rigs up 6.

Bakken oil rig count down 13 (!), to 151.

Eagle Ford and Permian oil rigs down 6 each

Compared to October 2014 highs:

Bakken -47 (-23,7%)

Eagle Ford -38 (-18,4%)

Permian -87 (-15,5%)

DJ Niobrara -14 (-28,0%)

SOME NORWAY NEWS (or TIME FOR SOME ANTI-GLOBAL WARMING COMMENTARY?)

ARCTIC ICE CAP SLIDES INTO THE OCEAN

http://www.sciencedaily.com/releases/2015/01/150123081723.htm

“Satellite images have revealed that a remote Arctic ice cap has thinned by more than 50 meters since 2012 (about one sixth of its original thickness) and it is now flowing 25 times faster….over the last two decades, ice loss from the south-east region of Austfonna, located in the Svalbard archipelago, has increased significantly. In this time, ice flow has accelerated to speeds of several kilometers per year, and ice thinning has spread more than 50km inland — to within 10km of the summit.”

I’m opposed to global warming unless it’s kept to no more than 1 degree above last year’s temperature.

Fernando,

Silly Fernando… don’t you realize industrial civilization adds aerosols in the atmosphere that when stopped would push global temperatures up 1.3 C in a short period of time? Dear man… we already way above 1 C when you factor in this and all the heat that went into the deep ocean.

We are screwed OL BOY..

steve

If the heat went into the deep ocean then I’m not worried. Why worry if it’s already down there? I’m more worried about surface temperatures.

Hi Fernando,

I assume you are joking. Eventually the ocean warms to the point where no more heat can be stored there unless surface temperatures rise. I am assuming you know some basic thermodynamics and physics.

Dennis, I have an engineering degree. I also studied physical oceanography, and worked a summer internship program working for NOAA. My job aboard a research vessel involved taking ocean temperature using expendable bathythermographs. The data was being used by a PhD candidate who wrangled a large grant to model ocean dynamic processes.

With that behind us, I suggest you look into the processes which drive surface energy into deep water, consider water volumes, heat capacities, and such factors.

Now I have an additional angle, which I’m sure you will enjoy: just for kicks, take your estimate of remaining resources of oil, gas, NGL and coal, deduce the amounts used for plastics, and burn what’s left. Then remember the carbon cycle mass balances. Estimate CO2 concentrations over time. Then derive the surface temperatures using basic equations (or use a CGM). When you have the answer come back and tell me whether you still worry about ocean energy content below 300 meters.

Here’s a version of the above

http://21stcenturysocialcritic.blogspot.com.es/2014/09/burn-baby-burn-co2-atmospheric.html

http://21stcenturysocialcritic.blogspot.com.es/2014/11/obama-china-europe-co2-plan-results.html

And since sea level rise us the only serious impact from ocean energy uptake:

http://21stcenturysocialcritic.blogspot.com.es/2014/09/drowning-islands.html

Fernando said:

It is pretty clear that these oil professionals do not understand how diffusion works. For thermal energy to get to the deep, the surface has to warm. The process of random walk downward ensures that the excess heat profile is maximum at the surface, i.e. at the originating location of the excess.

Don’t forget to add salt to your thought process.

Is introducing salty versus fresh water a randomized process?

Thought so. Thus it adds a stochastic element to diffusion and the random walk process.

It’s not that simple. I suggest you read a bit about water salinity influence on water circulation in the ocean.

I suggest that you learn about stochastic processes. Better read this blog post that I wrote a couple years ago:

http://theoilconundrum.blogspot.com/2013/03/ocean-heat-content-model.html

sea level rise us the only serious impact from ocean energy uptake

What about CO2 induced ocean acidification?

What about hurricanes? What about changes to rainfall patterns?

NAOM

Hi Fernando,

The ocean turns over on the order of 1000 years or so. As the ocean absorbs the excess heat from the atmosphere, its temperature will increase, when the ocean temperature is equal to the average atmospheric temperature. Then the ocean stops taking up heat from the atmosphere (on a net basis over the average year).

I suppose one could argue that we shouldn’t worry what happens 1000 years from now, but once the ocean has warmed, it will take a long time to cool.

To get an idea of what kind of temperature changes we might see once this happens we can look at temperature changes over land only, which are much higher than over the entire planet where the ocean is absorbing a lot of excess heat.

A bit surprising you cannot seem to see this.

Dennis, you just have to work the heat capacities to get a sense for the overall figures. By the time the ocean layer below 2000 meters warms 1 degree C the surface will be toast. But we really don’t have so much CO2. Don’t forget I was taking exams on this material in the 1970’s and I had a refresher when I worked with the Arctic projects offshore Russia. I’m not trying to drop my CV here, but I do hope you understand I usually write about things I know a little about.

There are a few areas that are generally ignored in the global warming equation.

1) equilibrium of undersea methane hydrates

– The earth is about at a maximum for methane hydrate storage. A portion of that will be near temperature boundaries that allow release of methane with small warming of deeper ocean layers. Thus releasing a very potent greenhouse gas without much change in ocean temperature.

2) albedo effects – Since visible light is not intercepted by the atmosphere other than by cloud formations and can pass both inward and outward without heating, snow and ice cover on this planet control about 14 watts/m2 of insolation at the surface. The losses of snow cover (mostly in spring and summer), loss of sea ice in the arctic, and loss of ice caps control as much heating of the surface and ocean than do the greenhouse gases. Since the trend is increasing loss of ice and snow, they will soon control more solar energy than the greenhouse gases.

As boreal forests progress northward into the tundra, the albedo is reduced by the darker trees compared to tundra surface, further increasing the rapid heating in the Arctic and eventually globally.

3) Planned reductions in industrial pollution will have another warming effect, about 1 to 1.5 degrees C total possible.

4) Rapid deforestation has increased the plume of CO2 into the atmosphere and ocean.

5) Ocean current destabilization – It may not take much ocean heating to slow, disrupt or stop the thermohaline current, especially the Arctic current. If this happens, heat near the equator will be trapped and some northern regions will experience a severe temperature drop. In any case major climate change will occur. Environmental changes will be severe as well as agricultural. This can happen in less than a decade.

Fernando,

All you have to know is that the vertical eddy diffusion coefficient in the open ocean is about 1 cm^2/sec. This is on the same order as solid copper — and we all know what a good thermal conductor copper is!

http://oceanworld.tamu.edu/resources/ocng_textbook/chapter08/chapter08_05.htm

If it wasn’t for this turbulent mixing due to eddy processes, the diffusion would not be very strong, as water by itself is not a very good thermal conductor.

The AGW deniers thrive off of misinformation so they stick to the basic principle and ignore the reality. That is the way they work and how they sucker in gullible skeptics.

The ocean is primarilly heated by the sun, not the air. Dark open water can absorb 70 percent of the insolation. Conduction and infrared radiance then warms the air. Greenhouse gases such as CO2, H2O, NO2 and other asymmetrical stretching molecules intercept and reradiate the infrared radiance from ocean and land.

Hi AllenH,

Good point. My point was that the ocean takes up a lot of the excess radiative forcing due to increased greenhouse gases. The heat capacity of the ocean is much larger than land, but over time the ocean will warm and the rate of heat uptake will be reduced and the rate of temperature increase of the atmosphere will increase.

IF the extra heat being trapped by the extra co2 really does make it into DEEP water then it probably won’t matter much because by the time it makes it back to the surface the fossil fuel age will be long over and the co2 will be on it’s way back down again barring massive volcanism etc.

I have read up on this stuff – extensively, for a layman.

It would take a VERY long time for the deep ocean waters to heat up even one degree and a very long time after that for the natural circulation to bring that ( somewhat warmer ) water back to the surface.

But is there any good evidence the heat is making it into the deep ( meaning thousands of feet ) water?

To the best of my knowledge it seems that the upper few hundred feet of sea water as opposed to deeper water is where the heat is winding up.

If this is true then that ( extra ) heat will find it’s way into the atmosphere in the not too distant future as the surface waters warm some more and gradually turn over. Near surface waters turnover takes place on a time scale measured in years or decades at the most unless I am mistaken.

I am not an engineer but I do know a bit about probability. A person with deep technical expertise I lack might just do well to examine the elephant from another perspective?

If the last few years prove there is no warming trend-WHERE ARE THE COOL YEARS that should be intermingled with these warm ones?

The ABSCENCE of cool years is evidence in and of itself of a warming trend.

Every where I look I see positive feedback effects emerging that will contribute to more warming but very few clearly identifiable negative feed back effects emerging. Far northern waters will less ice and more bio mass will darken and absorb heat far far faster than just recently exposed water with low bio activity for instance.

Yes, ocean surface heating is a large factor in world weather. Monsoons can shift or disappear creating havoc and starvation in large parts of the world.

Heat gets into the deep ocean mostly when warm salty water dives down. Saltier water is denser, and surface water gets salty from evaporation, so the oceans are somewhat unstable.

For example there is a underwater waterfall at the Straits of Gibraltar that carries warm salty water from the Mediterranean surface to the bottom of the Atlantic.

Old farmer, it always comes down to attribution of the ongoing global trend. I like to couple that to economics and to remaining fossil fuels we can exploit.

I have a suggestion for the group. Each of you estimate the CO2 concentration we would get if Dennis Coynes shock model oil production forecast is true. Pile on natural gas and coal if you wish. Then come back and report the CO2 concentration and temperature 50 years from now.

I think it is all about timetables and urgency. There are multiple reasons to move the world economy away from oil, and even from coal and natural gas. That doesn’t mean stop using them altogether, unless they become scarce, but it could mean improving efficiencies, eliminating unnecessary uses, and finding substitutions when available.

The CO2 discussion is relevant only in terms of timetables and acceptable substitutions. It doesn’t change the main focus of this forum, which is that oil will not continue to be as plentiful as it has been.

Hi Fernando,

I have done that already and get CO2 of about 550 ppm with reasonable estimates for coal, natural gas, oil, cement production, natural gas flaring, and land use change.

This is roughly a doubling of CO2 above preindustrial CO2 levels of 280 ppm throughout most of the Holcene.

If we use the best estimate of equilibrium climate sensitivity of 3 C, that is the amount of warming we will see. It takes thousands of years for the CO2 levels to naturally decline with no more human carbon emissions.

A rise in average global temperatures of 3 C may not seem significant and if it occurred over 3000 years or so we might be able to adapt more readily. Ecosystems cannot adapt readily to rapid changes over a few hundred years. This is where biologists are smarter than the average engineer.

I agree. I would add natural gas and coal to it. The North Sea and Groningen sure looked huge 50 years ago, today they are old and worn down.

Hi Fernando,

Given that you are a petroleum engineer it occurs to me that you just might have a friend or two who are power plant engineers. I have been searching long and hard for any actual verifiable data on how much extra oil or coal or gas an electrical utility has to burn to maintain enough hot spinning reserve to compensate for integrating wind and solar power.

I am well enough acquainted with the issue to know that it will be different for each utility and from area to area if the utility is a really big one that spans hundreds of miles.

This sort of info is VERY hard to come by. Asking any organization or company involved in renewable energy gets a boiler plate qualitative answer and asking a utility directly gets you ignored.

If you or anybody else knows where such data can be found I will be very grateful indeed for the info.

Old farmer, check the planning engineer series at Curry’s

http://judithcurry.com/2014/10/22/myths-and-realities-of-renewable-energy/

http://judithcurry.com/2014/11/05/more-renewables-watch-out-for-the-duck-curve/

http://judithcurry.com/2014/12/11/all-megawatts-are-not-equal/

This guy seems to know a lot about the subject. If you read these three posts and want to get more material let me know.

Fernando,

I wouldn’t pay attention to anything that Judith Curry says or promotes. For being a former head of an Earth Science department, she is displaying quite a political agenda and very little by the way of scientific aptitude.

http://www.sourcewatch.org/index.php?title=Judith_Curry

And why am I telling you this? You probably already know the situation and are just trolling to get others to read the junk that Curry promotes.

Jesus, why would referring a friend to a post by an electrical engineering get you so riled up? Curry has a pretty good website. I think she’s the object of character assassination and libel, but she seems to take it rather calmly.

No, Curry is clearly angling for a political appointment in a possible future Repub administration. So what we do is point out her weaknesses in basic math and science.

Old farmer, do try those links. We got a lot of character assassination going on. The planning engineer posts are very good.

How do we know this is an electrical engineer? They’re anonymous.

I don’t mind anonymity, but it means that you can’t rely on authority. Heck, clearly people on peakoilbarrel don’t take *any* authority’s word for granted – they have to prove things. I don’t see any evidence here.

I looked at the first blog post – oddly enough, it criticizes renewable advocacy for not using facts or figures, yet it uses no figures or sources at all – it just provides very political and subjective opinions.

For instance: “you need ridiculously high valuations for carbon reduction to justify significant increases in renewable generation. ”

That’s a strong statement, and clearly has a strong anti-climate change mitigation agenda. It needs very strong backup with facts, figures and sources, yet none are provided.

Mac. I am not the guy to give a real answer, since while I spent a lifetime in energy R&D, the stuff I worked on was no bigger than I could lift.

But I knew a lot of power company people, since I was trying to sell them the idea of distributed power scattered all over the place, an ancient concept promising lots of advantages, like great system stability, and “waste” heat to use for the laundry, etc etc.

So I am guessing that anybody used to thinking about big stuff, including wind farms and solar fields, is fairly likely to be fixated on his own immediate pile of problems, and not much interested in other details, since his cake isn’t done yet and needs tender loving care.

So, real answer around here, anyhow, “haven’t got around to that one just quite yet”.

Of course, there’s the Germans, Danes and other people with some remaining sense and big hunks of wind/solar who have got around to it, but not yet quite got it actually figured out.

So, as usual, I see a problem, don’t wait around and jsut start to think up a fix as long as the fix does not involve anything I can’t lift.

I run my house and car on PV. but, of course, in this place and time of year, PV power can get mighty thin for a month or two, way too long for any short term storage like a battery or flywheel.

BUT. I have and use a lot of wood. Chemical energy can store for a plenty long time, and the stove behind me here is cranking out about 10kW of heat on this chilly morn. Plenty to make up the PV deficit if run thru any mediocre heat engine-generator.

Aha! Solution to the intermittent problem.

Pile of wood + wood pyrolyzer + gas bag short term storage + Honda or other +battery ( can be small) +inverter and usual rest of system.*

(Any component I can lift, reluctantly.)

* frantic mechanic running around every hour of night and day vainly trying to keep his nest of snakes running well enough so hausfrau does not notice.

Note same concept can scale to big bldg, community, state, country, world.

What I found is simply that electrical engineers who design or optimize large power networks are highly knowledgeable and have observed real life data, and are trying to solve real life problems. There’s a significant difference between real life as it is, and the dreams of people who want us to embrace our inner peasant and live in wonderful isolation in tiny farms growing organic veggies and checking the weather in a high speed internet network.

I agree, “real life” is the key. Power Engineers have enough on their plates dealing with maintaining standard transmission and distribution systems across wide networks. I talked to one guy recently, who I shared an EE class with eons ago, who said that he has more than enough work dealing with the threat of ice storms, sabotage, lighten strikes on sub-stations, monitoring hydro-water storage levels, silly inspectors who’ve never had a real job, disposing of old equipment (some of which is highly toxic), dealing with unions, planning for expanding electrical requirements for new mining projects that may or may not go ahead, etc., and no time for bothering with rinky-dink solar systems and windmills which might represent less than half of one percent of his customer’s power needs.

Oh I forgot, power thieves who manage to kill themselves trying to get “free electricity” and whose death ties up a dozen people for weeks with all the stuff that goes with bodies that didn’t die naturally. He said there were about 12/year here in BC.

On the other hand the planning engineer series includes very intelligent and educated comments from engineers who have to deal with power system integration in the California grid.

You know, when I was in charge if a large technical department I used to have a group with a 30 day time horizon, a different group looked at the next six months, a different set of teams looked at up to 30 months, and I had a few geologists and a couple of engineers looking at really odd long range plans. I think a well run company delivering large amounts of energy should be doing something like that.

Worldwide, solar is 1% of total power production, wind is 4%, and both are growing fast.

Sounds like your friend’s customers are a little backward.

He isn’t my friend. He’s an ee who wrote a series of educational posts for a general audience at Curry’s. One of the problems he points out are the extremely serious grid instabilities caused by intermittency. I suggest you try reading his material. I don’t know his “customers”.

Actually, I was responding to Doug Leighton’s post.

no time for bothering with rinky-dink solar systems and windmills which might represent less than half of one percent of his customer’s power needs

Doug,

That comment says it all. That engineer doesn’t care about whether conventional power is polluting or risky in the long-term – he just doesn’t want his life made any harder than it already is.

That’s perfectly understandable, but it really isn’t a good reason to not transition away from risky and dirty power sources.

The usual bullshit putdown–out of thin air. You know nothing about how I live- truth to tell, I am a russian undercover agent, reporting to directly to Putin only. My task is to subvert the entire power system of the evil capitalists, and so far I am making excellent progress.

Lots and lots of highly competent systems designers have come to the same conclusion over the years- large numbers of distributed small power plants, down to the individual home size, plus SMALL short term storage, battery or otherwise, is a HIGHLY STABLE power system- with solar/wind, too.

Why not used? ” We like real big central power plants”.

I heard about distributed power advantages from my undergrad thermo prof in 1947.

Look up CHP, and if you don’t think it is possible to make a highly efficient small power system, look up NASA isotope space power.

The same NASA type power source, redesigned for domestic use- any combustion fuel, would be inexpensive, and like NASA’s, last a hell of a long time with NO MAINTENANCE AT ALL.

Here is a great balanced overview of the two sides in Energy Transition debate. Summarises the positions of the renewables optimists and the technician pessimists:

http://www.resilience.org/stories/2015-01-21/our-renewable-future

Conclusion: change is coming whichever way you view it.

Yes, that is the best piece I have seen on our changing energy and economic future and should be required reading for anyone attempting to be part of this debate.

I think consumption and lifestyle contraction is already happening. We’ve got income inequality that reduces the middle class. We’ve got recession that further reduces economic activity. We’ve got a growing tiny house movement embraced by people who, either by choice or by necessity, are realizing they don’t need so much stuff. We’ve got more people discovering walking, biking, and public transportation (either for health reasons, convenience, or economics).

I wish more economists would move away from trying to encourage growth. They suggestions aren’t preparing us for a no-growth future.

So much of the world’s energy use has been wasteful because of decades of cheap oil and before that cheap coal. A lot of the waste could be eliminated.

Just for fun, I quote the power company bill I just got today.

current month total kwH-10.

one yr ago- 110

your average monthly use last 12 months- -minus 421KWH

My PV max rating- 8kW.

My house and car- all electric, all very good

Everybody real happy.

Electrical engineers have solved the problems they were given to solve. It is based on the idea that the cheapest way to produce electricity is to have a huge plant with constant output, for example a nuclear power plant.

However, it is now cheaper to produce intermittent electricity. This changes everything. So electrical engineers will have to solve the problem.

You argument boils down to “Twas ever thus”. But the electricity business is experiencing what they call a paradigm shift in Silicon Valley. On current trends it is unstoppable.

In venture capital circles these days the idea of applying Silicon Valley thinking to industries like energy, transportation etc is very popular. Look at how google has invested in smart meters and self driving cars, and all big IT companies are investing in renewables. Elon Musk raises money selling the same idea.

Anyway there is a lot of money betting that the way things used to be done in the electricity business is no longer up to date. We’ll see how that works out.

” So electrical engineers will have to solve the problem”=”let them eat cake”

As Isaac Hayes said “Thus far the solutions are hyperbolicsesquedalimystically expensive.”

Great description, and often a description of my life. But, I suspect, a description of life in general.

somebody is thinking distributed solar is going to be really big, soon…

“Already, the SolarCity plant, scheduled to open sometime during 2016, would be one of the world’s biggest factories, with the annual capacity to make enough solar modules to generate 1,000 megawatts of electricity. SolarCity executives have said they need the Buffalo plant’s capacity to meet what they see as the continued rapid growth in the demand for new solar energy systems.”

http://www.buffalonews.com/business/prospectus/solar-energy-building-a-new-industry-in-wny-from-the-ground-up-20150123

OFM – two issues:

1) spinning reserve to deal with short term transients

This is about 1 – 1.5% of the power, so a percent or two of what the added renewables are – ASSUMING one hasn’t used batteries, flywheels or in some cases pumped hydro for this.

2) longer term reserves (different names in different places) to deal with intermittancy.

Depends on the ramp rate and inefficiencies at partial loads of the fossil fuel systems, looks like a few percent to maybe 10%, but very situation dependent.

I would start with the Western Wind and Solar Integration Study,

and references therein, and things that refer to it.

http://www.nrel.gov/electricity/transmission/western_wind.html

And on that page there are some other studies up in the sidebar.

“Key Findings

The integration of 35% wind and solar energy into the electric power system will not require extensive infrastructure if changes are made to operational practices.

Wind and solar energy displace fossil fuels. A 35% penetration of solar and wind power would reduce fuel costs by 40% and carbon emissions by 25%–45%… ”

You will actually get some numbers, instead of the hand-waving at judithcurry’s blog.

There is a lot of propaganda out there against wind and solar,

because they are causing fossil fuel interests big losses in revenues.

Wind energy, backup power, and emissions

http://www.awea.org/Issues/Content.aspx?ItemNumber=5454

The beacon study referenced therein is now at:

http://energystorage.org/system/files/resources/beaconemissionreport_1_8_07.pdf

http://aweablog.org/blog/post/correcting-fossil-fuel-industry-misinformation-about-germanys-success-with-renewable-energy

This paper says 6% of the wind power is needed as gas turbines, for

a 500 km diameter area.

http://www2.hawaii.edu/~mfripp/papers/Fripp_2011_Wind_Reserves.pdf

How about 99.9% renewables penetration?

If you have access to a university library, you could dig in to this:

Cost-minimized combinations of wind power, solar power and electrochemical storage, powering the grid up to 99.9% of the time

http://www.sciencedirect.com/science/article/pii/S0378775312014759

More high penetration studies at:

http://cleantechnica.com/70-80-99-9-100-renewables-study-central/

Most of those studies you publish are flawed. There is a lot of bs, arm waving, and “costs will go down”, but I just don’t see anything I consider solid engineering from the solar camp. And by now the blogosphere and media is crawling with items I think are put up by people with corporate connections. The solar power industry is mostly about corporations which require heavy subsidies as part of their business model. In a sense solar power is turning out to be like ethanol from corn, an industry powered by subsidies and government diktat, which in turn was driven by intensive lobbying by Archer Midlands Company.

Here in Spain we have a real grid with real rebewables. We also pay real electricity bills. The solar power kit is huge, cost a bundle, and it works well because the hydropower facilities are used as a counterweight to the solar intermittency and inability to generate at hours of peak demand.

My opinion is formed by both my engineering education, the material I read (including the real world engineering discussed at curry’s), and close observation of the Spanish power grid performance and the issues being discussed in the local newspapers.

Which takes me to the punch line…I am convinced we are running out of fossil fuels. I’m not sure about the timing, but I think we may not get the technology ready by the time we see prices zoom.

So rather than indulge in this phantom engineering and science and the endless bs about conspiracies by oil companies, I prefer to keep my feet on the ground and see if this looming crisis can be solved by adults, and not by cartoonists drawing happy faces because solar power is such a great solution we already found.

Mac,

As you say, hard info is very hard to find. I have some somewhere, but for the moment here’s a recent thing:

“When the second plant comes online this summer, peak solar output on Kauai will approach 80 percent of power generation on some days…KIUC has had to ask more of its diesel and gasoline-fired generators, improving their ability to ramp up during frequency droops. The heavy ramping puts wear on the machines, increases air pollution, and negates some of the petroleum savings promised by the solar plants. “I think we have lost a couple of percentage points on efficiency over the last year,” Rockwell says. “The maintenance impacts are yet to be seen.”

http://www.technologyreview.com/news/534266/hawaiis-solar-push-strains-the-grid/

So, maybe 2% loss of efficiency for the (much more expensive) diesel generation that the solar replaces.

Again, they haven’t tried Demand Response, which would be much cheaper and more effective (I emailed the guy in charge).

Since the Greenland Ice Cap is melting and Svalbard islands are in a similar latitude, I don’t find it unusual that that ice cap is melting also. Svalberg has lower altitude, thinner ice cap, a lot of barren rock surrounding the ice cap and much more shoreline per km2 of land than Greenland. So with all those warming factors, Svalberg’s ice cap should melt rapidly compared to the Greeenland ice cap.

Since the Arctic ice and northern region ice cap and snow cover have more global warming potential than the input of CO2, any losses of ice there are deeply significant.

Svalbard isn’t that big. I have a photo of Emma Thompson in my blog holding up a sign. She went there for a Geeenpeace propaganda tour. It seems to be a popular spot.

“Svalbard isn’t that big.”

Bullshit. Austfonna ice cap on Svalbard covers 8,105 km2 and is the second largest by volume in Europe, after the Vatnajökull in Iceland.

That’s not big. Nothing in Europe is that big. I can’t even put large dishes in my new dishwasher. And when I fall asleep my feet go over the border into Belgium.

Doug,

Well hello there…. “BULLSHIT” you say!! LOL… good for you. Nice to see you throw a few choice words when necessary.

I tell you, after reading what Mr. Lily of the Valley and that Nifty Guy Neal had to say about Global Warming and Carbon… we don’t survive what’s coming.

We are just to DAMN STOOPID….LOL

steve

NOTE: That should actually be MISS LILY OF THE VALLEY.

“Svalbard isn’t that big.”

Austfonna has lost 1/6 of its depth. If that is 1/6of its volumevolume, it has lost 258 cubic kilometres out of 1550.

A 1mm increase in sea level is a volume increase of 360 cubic kilometres.

Austfonna has contributed 258 cubic km in two years. That would be an increase of 1.7mm or 0.35mm/year.

The long term rate is currently 3.2mm/ year. Austfonna alone has increased that by 10%.

https://robertscribbler.wordpress.com/2015/01/17/denying-the-neverending-heatwave-nasa-noaa-jma-show-2014-broke-new-heat-records-will-republicans-ever-listen-to-science/

If most of it disappears sea level will rise 5 to 6 mm. That’s small time.

Most of the ice at the North Pole is floating. If it all melted, it would actually LOWER the sea level.

Um, no.

Think about it.

NAOM

Picture an egg in a frying pan. That is our milky way galaxy. Our sun is on the outer edges of the white part of the egg. It takes 226 million years to orbit the galaxy only once. If you look at the milky way galaxy sideways, it’s very thin. As our sun travels around, it oscillates a small amount above and below the center of the galactic plane. It takes 11000 years to go from above to below and back. When it passes through the center, the pull of the Galaxy’s gravity affects our sun in a small way. The pull of our sun affects us in a small way too. At the present time, we are dead center into the transition from above to below. This explains what is happening to the global temperatures. It’s not the end of the world. It just means more bizarre weather ahead for the next century or so. The result of that is you can’t equate anything like the ice caps melting with some kind of bizarre and desperate need for a cap’n trade or carbon credit scheme. Anybody seriously buying into these things would be a worthy candidate for a lobotomy to see what went so horribly wrong with the person’s neurons.

Gosh LILY ,

We all thank you for researching this issue for us and figuring it all out for us. I suppose it took you all of thirty minutes to find the answers for us.

Oh to think of the YEARS we regulars here have wasted learning all about the physics of the atmosphere and such nonsense.

Thanks to your enlightening me I want to go back and kick my physics professors asses for leading me so far astray. My biology professors too.

Actually, the solar system lies several dozen light-years north of the galactic plane, possibly farther. Furthermore, we are continuing to travel northward, away from the plane of our Milky Way galaxy at roughly 0.7 km/sec. In fact, we won’t be physically passing through the galactic plane for another 30 million years, give or take. But, we get enough bullshit here without stupid stories equating galactic dynamics to eggs in frying pans. Do you think you’re talking to a collection of playschool kids?

Sorry Mac, you beat be to it.

Doug, Lily gave me the best laugh I’ve had in a week. It takes an imagination to dream up bullshit like that.

Mr. Leighton, I don’t think you are understanding me. Once again, let me emphasize the earth has become slightly warmer in the past few decades simply because we’re passing through the galactic celestial plane. This happens every 11000 years or so like clockwork. During this time the galaxy pulls on our sun and increases gravity slightly and as a result, the sun’s pull on all the planets increases. Of course here on earth we’ll feel this a bit more because we’re on one of the Inner Planets. But make no mistake, all the planets influenced by our sun have had a proportional temp. increase in the past few decades for the exact same reason. NASA is aware of this but is being bamboozled by O and his far left government in order to secure government funding. Thus NASA and other agencies are forced to continue toeing the official AGW line and to mislead the public with false claims as to the real reasons behind the global warming.

NASA is aware of this but is being bamboozled by O and his far left government in order to secure government funding.

This is the wrong place to post this. People here do read for themselves.

You’re trying to suggest that the world’s entire scientific community is being duped by Obama? Yeah, right.

Go peddle your theories elsewhere.

I have run up on a few people who are actually as stupid as our Lily is pretending to be. But my guess is that Lily is somebody just having a little fun.

People can actually have fairly decent intellects in just about all respects and yet be totally naive and gullible in respect to any kind of pseudo science message – if the messenger is one they look up to for some reason.

Now I don’t actually know if Rush Limbaugh ever talks about global warming but I suspect he does occasionally and that he calls it a conspiracy of power grabbing money hungry democrats or worse.

But he is an authority figure to a LOT of people and such people accept what he has to say as gospel.

We like to think we are too smart ourselves to fall for such arguments from authority but in reality just about all of us HAVE to accept some arguments of this sort. I know only about as much law as most well informed laymen -I accept my attorneys arguments on the basis of his ” authority”. I know more anatomy and physiology than I do law but I accept my physician’s arguments as well.

Most of us accept the opinion of our mechanics and plumbers as a matter of practical necessity. I can paint – not really well but well enough to get by – when I am in doubt I call up a friend who is a pro and take his advice.

Lily – tell us please – Who are the astronomers who consider the most accomplished?I am in the mood to play games for a while if you want to play.

I think we could start compiling a list of reasons given in this forum as to why no one should pay any attention to GW:

1. The numbers are wrong. The global isn’t getting warmer.

2. In the history of the planet, this is nothing.

3. The galactic celestial plane

And of course the thing that ties them all together: It’s a conspiracy to take away our stuff.

Let’s throw something up on the wall and see if it sticks. If one of these ideas gains traction, that’s what we’ll use.

Gentlemen, You have to admit that considering the seriousness of the subject we generally discuss here this lady has brought some much needed comic relief to this forum. While I will concede that thorium reactors, flying pigs, and my all time favorite, pink flying magical unicorns urinating crude and condensate while passing high BTU methane gas all over the place COULD solve a few of the problems we have….I sincerely doubt it and intend to forego a belief in magic for one in math.

A functioning thorium reactor was created in the 1960s by ORNL (Oak Ridge).

They have recently announced their intention to build another one in 10 years.

Given that they have the intellectual property of the functioning reactor I wouldn’t be surprised if they were successful.

China and India are pushing for them too.

Magical unicorns and flying pigs I don’t know ….lol!!!

http://www.forbes.com/sites/jamesconca/2015/01/07/nuclear-power-turns-to-salt/

Not sure if this will be successful. But I consider this good news, in a situation where there is not much.

If intelligently developed (which IMO won’t happen) you can use the extra energy to build Coal to Liquids, Gas to Liquids and Kerogen to Liquids.

I have a young daughter and I am a complete idiot.

Thorium! Thorium! Thorium!

The Greenhouse Effect seems very easy to understand at a high level. Isn’t it taught in the 6th grade? I couldn’t explain the details, but I am amazed at the number of people that can’t figure something out that is so straight forward.

Anyone who thinks the planet won’t warm by putting more greenhouse gases into the atmosphere is a fool.

Thorium! Thorium! Thorium!

and

CTL! GTL! CTL! GTL! until we get more electric cars!!!

LOL!!!!

What part of CO2 is not a true greenhouse gas do some people not understand? I bet most of the anthropogenic global warming believers have absolutely no idea what percentage of earth’s atmosphere CO2 even makes up! Also take a look at Mars. Its’ atmosphere is mostly CO2 but its ambient temperature is -110 degrees Fahrenheit. If CO2 was a true greenhouse gas Mars would be a sweltering sauna, but no, that’s not the reality.

CO2 is one carbon and two oxygen molecules combined. Plants grow better in CO2 rich environments. Farmers even pump CO2 gas into greenhouses to stimulate growth. (yes plants grow well in CO2 in “greenhouses”…but CO2 does not cause the temperature to rise in green houses…as it the sun that warms up the panels and traps the heat, not the CO2.

The Democrats have been chomping at the bit for years to set up a massive tax on the CO2 that is beneficial to plants, and therefore life itself since any basic science course will teach how all Oxygen on earth comes from the plants which originally took in CO2. What we really need to come to terms on is how global warming is all cyclical based on the sun, sunspot activity, and the polar magnetic fields around our planet. We are far better off adapting to the warming by growing more and better crops in areas which couldn’t support them before than we are running around screaming about some kind of imagined damage that will never come.

Please carefully read the references I included before attempting to insult my arguments and claim they are false. I don’t appreciate people who do this without having first read the citations. Thank you.