A Guest Post by George Kaplan

This post covers recent C&C production and future prospects, with a bit on gas, for several mid-size non-OPEC producers. A few have been omitted (e.g. Canada, Kazakhstan, Egypt, UK) for no particular reasons other than lack of time or anything much to say, but may be covered in the future. Many of the countries here have held a bumpy plateau over the last twelve to eighteen months. For most this has come after a period of decline, and some are showing signs that decline might be starting again. Brazil has been on a plateau after a period of increase, and may be about to renew that growth. There is a general theme that oil discoveries and developments are drying up and most of the countries are looking more to gas, but with the current gas glut looking like it might end up worse than the 2014/15 oil glut that strategy may prove difficult in the near term.

Brazil

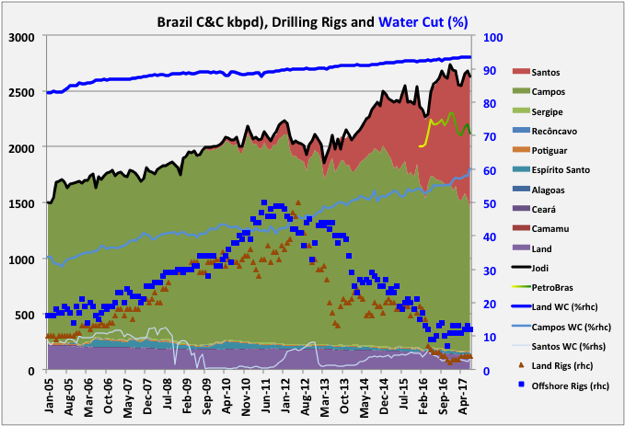

Brazil production peaked in March and has been on a plateau since (data below is through July, there should have been an August update but ANP aren’t very consistent in release dates). They have had several large FPSOs offline for maintenance (generally their FPSOs don’t have the best availability and they have had recent common mode failure issues with the high pressure gas risers, though I don’t know if this is a direct cause of the recent turnarounds). The Campos fields’ average water cut seems to be accelerating, which might also be contributing to a plateau rather than allowing a new peak.

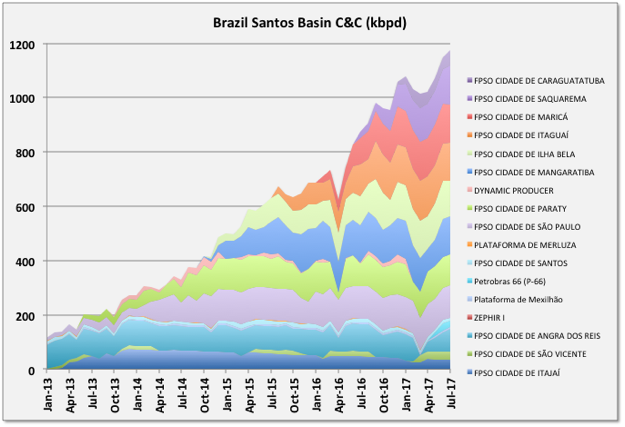

All the new production growth is coming from the Santos basin. PetroBras production contributes about 82% to the total, but gradually falling as the new Santos production is partly foreign owned, e.g. by Shell – one reason they bought BG, and may fall faster now as PetroBras are trying to divest older fields. Their figures come out quicker than ANP and they report a new record in August, but falling slightly in September and October. They have bought the Libra extended test production on-line this month which will add production, and give some indication of future expectations.

There are ten new, large FPSOs due through 2021, and a couple of others possible, which would altogether add about 1.5 mmbpd extra nameplate. However the overall decline rate now indicates they need about three major new projects per year just to maintain plateau, and if the Campos FPSOs’ performance is repeated then the earliest Santos facilities should start to decline this year or next, and can go quite quickly.

Mexico

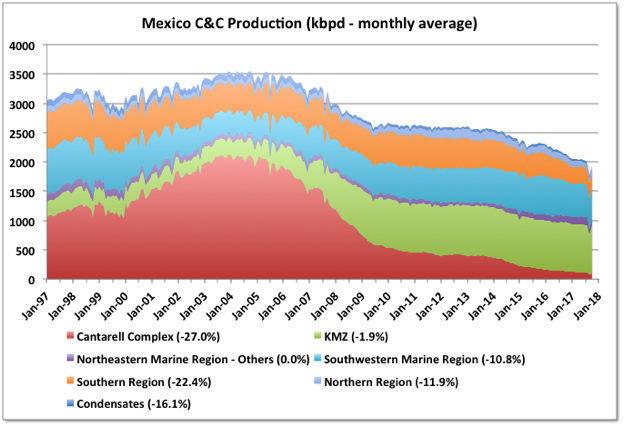

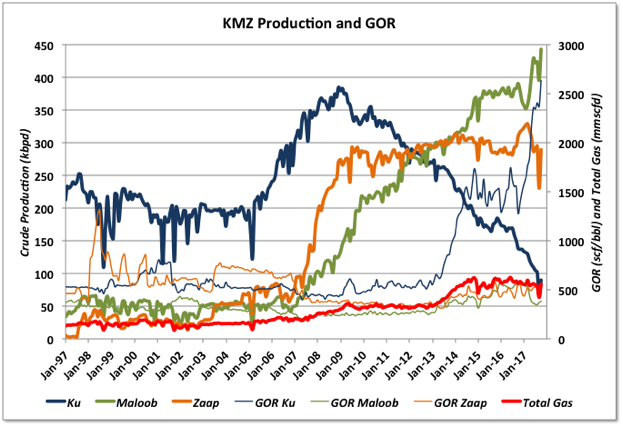

Mexico had a big drop in September production because of hurricanes and planned turnarounds, which has mostly been recovered, but they still continue on a general decline, losing an average of about 15 kbpd C&C per month from August to October (10% y-o-y drop from October 2016). With KMZ showing more signs that it might be coming off plateau this may accelerate (i.e. Ku field looks to have recent gas breakthrough and overall y-o-y decline is up to 1.9%). Abkatun-A2 is due on stream in 2019 (a replacement for a previous platform lost to an explosion and with 60 kbpd nameplate) and there were some recent significant discoveries that should add production in 2021 or so provided the appraisal drilling is successful. There have also been some onshore discoveries that could be brought on-line quickly, but Pemex just seems to keep on losing money so CAPEX funding could be a problem.

Data from: Pemex.

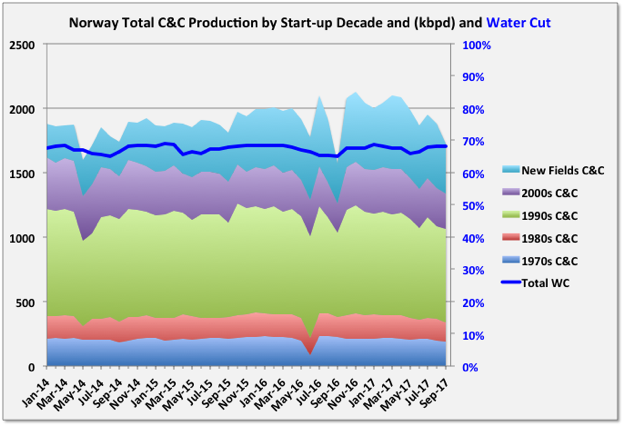

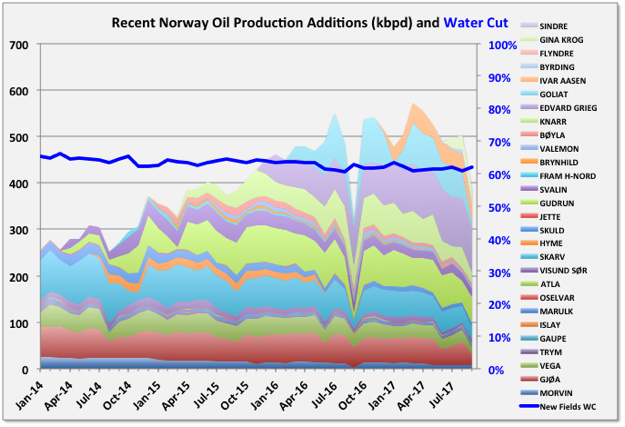

Norway

Norway data is through September. They are in slight decline this year, which has accelerated recently because the Goliat platform is being held offline for safety reasons. Gina Krog (60 kbpd nameplate) is ramping up and Maria (40 kbpd) started this month. The other recent start-ups are showing fairly early and relatively steep decline. There’s no new oil due in 2018 but about 140 kbpd in 2019 (in particular Martin Linge and Oda) and then more than 300 kbpd to start ramping up in 2020 when Johan Sverdrup comes on-line. Martin Linge has had problems and this month Total sold its stake to Statoil, who take over operatorship.

Data from: NPD Fact Pages.

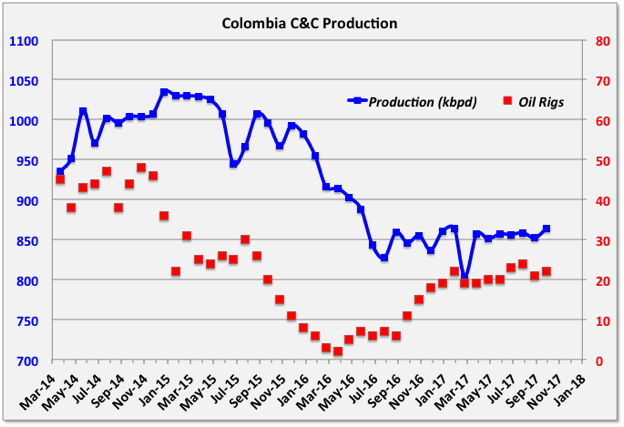

Colombia

Colombia is holding a plateau that will allow them to meet this year’s target of 840 kbpd. There isn’t much else immediately in prospect but plans for more offshore drilling, which has so far been disappointing, and shale deveelopment.

Data from: Colombia Ministry of Mines.

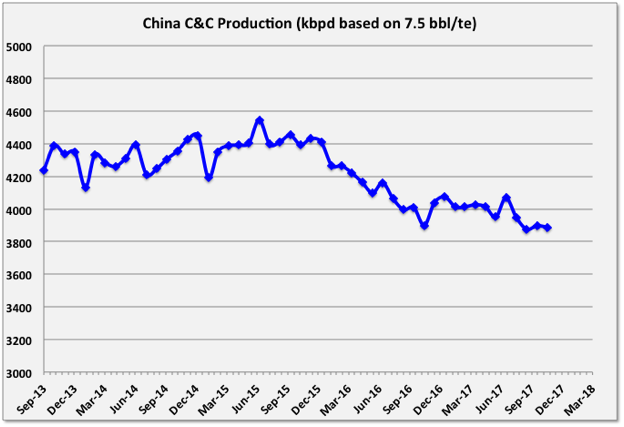

China

China has had some success in arresting their decline rate, but have a lot of ageing fields which use various EOR methods and only a few, smaller, offshore fields in development. There’s quite a bit of exploration activity in the South China Sea.

Data from: National Bureau of Statistics of China.

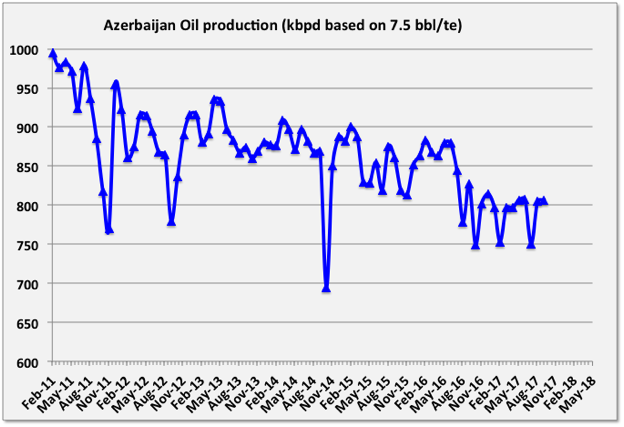

Azerbaijan

Most Azerbaijan oil production comes from the BP operated offshore Azeri-Chirag-Gunashi facilities, and it is declining pretty much in line with the original production application for that development. There isn’t much additional oil in the pipeline but Shah Deniz II (also BP), a large gas field has just started and will add about 50 kbpd condensate, and a similar Total project, Absheron, is in early engineering and due to start-up in 2021.

Data from: SOCAR.

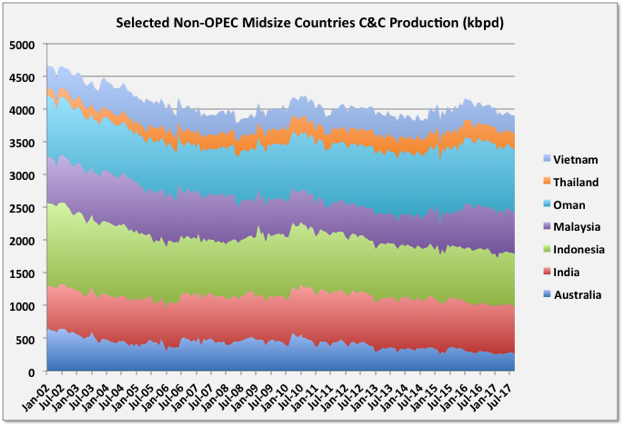

Selected Other Mid-size Producers

All the producers shown are oil importers except Oman, with Indonesia, Vietnam, Thailand and Malaysia switching from exporters in the last fifteen years and India and Australia showing rising import rates in the same period.

Data from: Jodi, EIA, IEA and OPEC.

Oman

Oman has a nice new data and statistics government website but seems to have forgotten to employ anybody to keep it updated, so there’s no production data there after May. They also stopped reporting to Jodi last year but, as with all countries I’ve looked at, EIA estimates look pretty good. They have been meeting their commitments to NOPEC cuts and holding at 970 kbpd. It’s possible, however, that this cut is hiding a peak in C&C production, as they redeveloped some pretty mature and declining, heavy oil fields starting about ten years ago using various EOR methods, including miscible gas, chemical and steam injection projects, and those gains were obviously fading before the cuts. They have some new gas developments, e.g. the Khazzan tight gas project for BP at 200 kboed started in September, but no major oil developments, and nothing big on the cards (Yibal Khuff is a small field at 10 kbpd due in 2020).

India

India is holding a plateau, but never seem to meet monthly targets. They don’t have much new oil production in development (one platform at 75 kbpd due in 2020, and some smaller shallow and heavy oil facilities) and seem to be switching over to concentrate on gas, like a few other countries.

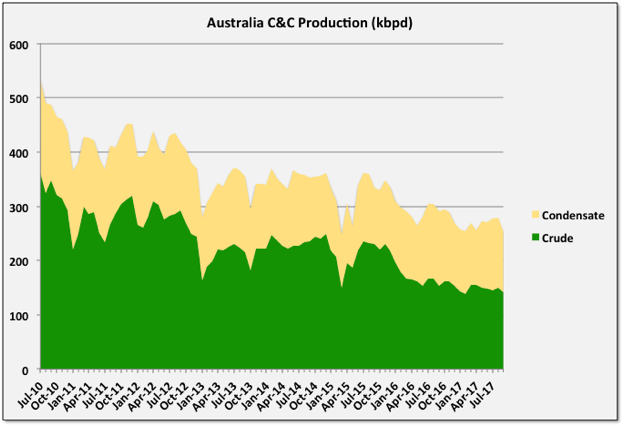

Australia

Australian oil production is in terminal decline. A large proportion of their production is condensate, which has been holding steady, so all the drop is in the crude, which is falling at about 15% per year. A small offshore development, Greater Enfield at 12 kbpd, is due in 2019, but they have potential for natural gas both offshore and onshore (with tight gas and coal bed methane).

Data from: Australian Petroleum Statistics, Commonwealth of Australia 2017.

Vietnam

Vietnam oil production is in terminal decline at aroud 8 to 10% per year, and gas production may have peaked this year. The Ca Rong Do project (a tension leg wellhead platform and chartered FPSO at 30 kbpd) is due in 2020. I haven’t heard much about new exploration but there has been a dispute with China in the South China Sea, which is supposed to have been rectified and may open up some offshore prospects.

Thailand

Thailand is the smallest of the producers shown and has held a plateau for eight or nine years at just above 200 kbpd. It doesn’t have much in prospect for new developments and exploration has been a disappointment recently.

Malaysia

Malaysia has high quality, light, sweet oil (its Tapis grade is among the priciest) and is a large LNG exporter, though gas production looks like it may be plateauing. C&C production has increased from a low in 2015 but is now again in decline with nothing major due for oil after Malikai completes ramp-up this year (60 kpbd, Shell operator), but some smaller gas developments. Almost all discoveries since 2012 have been gas or gas-condensate. There are prospects for deep-water exploration and EOR on some of the mature fields, but these probably need much higher oil prices.

Indonesia

Indonesia had Banya Urip extension, large ExxonMobil oil project, ramp-up last year but is now back in decline. There are some small oil tie-backs due in 2019 at Natuna. The government has promised to attract $200 billion investment to try to stop its production declines, for both oil and gas (in which it has been a major producer but peaking in 2001). However so far there hasn’t been much to show for this. East Natuna is a huge gas field development ($40 billion estimate) that ExxonMobil recently pulled out of saying it wasn’t commercial in current conditions. Masela (Abadi) is another multi-billion project for LNG, much delayed but possibly now in pre-FEED with Shell and Inpex. Ande Ande Lumut is a heavy oil development that looked likely to go ahead but the operator has now down graded the resources from 2P to contingent. Other prospects are mostly gas. The small gas-condensate field, Madura BD at 110 mmscfd and 6 kbpd condensate, started up in August.

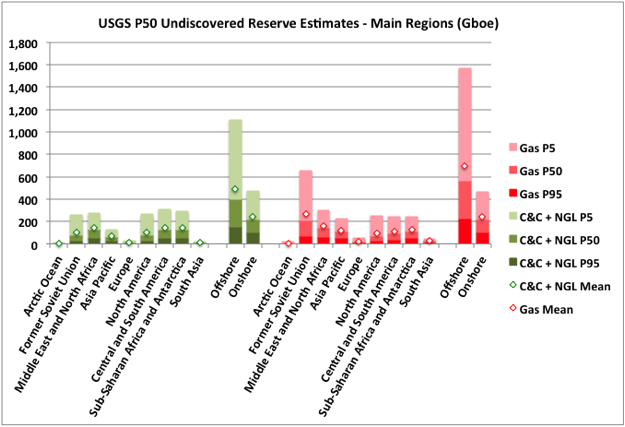

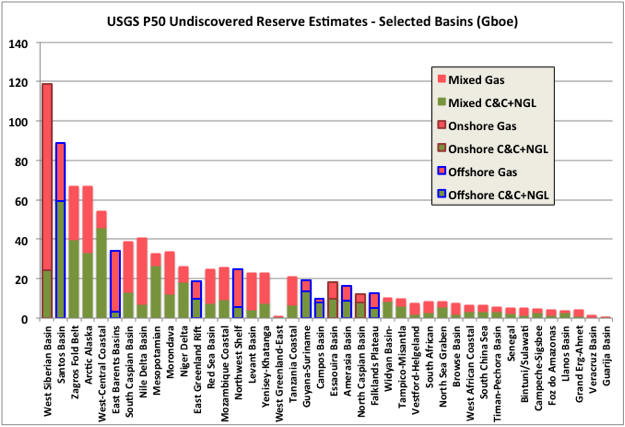

Off Topic Finish – USGS Undiscovered Conventional Resources

I posted these charts as comments on a previous thread and made a bit of a mess of them. They show USGS estimates for global, undiscovered, conventional oil (or actually all liquids) and gas by area and region, from a 2012 analysis: Supporting Data for the U.S. Geological Survey 2012 World Assessment of Undiscovered Oil and Gas Resources, by U.S. Geological Survey World Conventional Resources Assessment Team. It’s worth keeping in mind that these are technically recoverable numbers, i.e. at any cost (for example it’s been suggested – not by the USGS – that a lot more oil in the North Sea could be recovered if coffer dams were built north and south and the sea completely drained so that wells could be drilled all over and produced without needing expensive offshore facilities). These are probabilities and with a wide range from P5 to P95 in all the numbers (nominally there is a non-zero chance that nothing will be found) and I don’t know if the USGS goes back and re-does the analyses as actual data becomes available. On some of their assessments there is a constraint the the resources are expected to be discovered within thirty years, but I don’t think that can be the case here and couldn’t find a statement either way in the briefing reports.

The largest expected resources from the USGS analysis are in offshore regions, and mostly in deep water or other inhospitable areas. The P50 cases (i.e. most likely) given are about 400 Gb oil offshore, 200 Gb onshore and 550 Gboe gas offshore, 200 Gboe onshore.

Recent discovery rates have been around 2 to 4 Gb per year for oil, and a bit more for gas, with each seemingly on a falling trend. Giant fields are rarely found now and average discovery sizes are below 50 mmboe, and also falling. Discovery success rates are also falling, down from about one in five wells to one in twelve to one in twenty in frontier areas (where many of the USGS resources are expected to be found). Therefore it might be expected to take well over a hundred years, thousands of wells and trillions of dollars to find the P50 resources, assuming a BAU trend could be continued. In fact fitting a geometric decline to recent years’ data and extrapolating would give only about 25 Gb total of future oil discoveries

Deep-water wells are expensive, probably over $100 million each, though slightly lower at the moment, but likely to increase quickly if activity picks up again (the deep water drillers have been burning the furniture or chucking stuff overboard to keep their ships running – and that includes scrapping many deep water rigs and laying off a lot of experienced staff). As an example of (currently) an extreme case: say twenty wells, including appraisals, per discovery, average of 25 mmbbls per oil discovery, and $100 million per offshore frontier well gives $800 billion expense to find 10 Gb. That is $80 per barrel that might not be paid out for fifteen or more years and does not include operations and development costs (which would be huge for small, isolated offshore fields). Such a scenario would not happen without oil at maybe $200 or $300 per barrel, and maybe EROI considerations make it impossible at any price. Of course extrapolating trends like this from fairly short ranges of stochastic data can make you look pretty stupid, even from just one or two outliers in the near future.

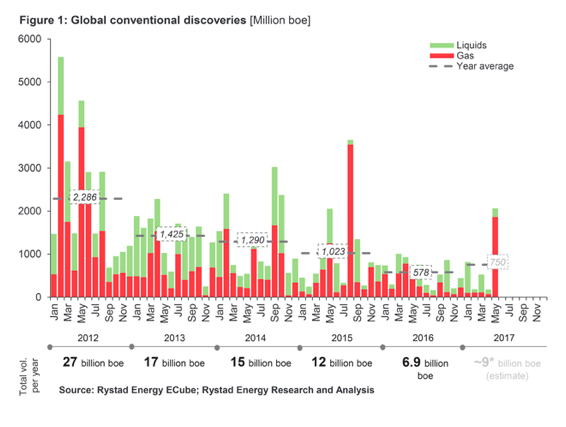

For more details on discovery successes see: 1) HSBC, Global oil supply: Will mature field declines drive the next supply crunch? 2) Rystad, Eyeing Beyond The Short-Term: Discoveries and Their Impact On The Oil Price 10 Years Down The Road. 3) IHS, Oil and gas discoveries dry up to lowest total for 60 years (FT report from February 2017). The image below is from the Rystad report: Rystad.

Usually there are more discoveries in the second half of the year, maybe because of the northern hemisphere summer or because E&Ps like good news for their end of year statements, but 2016 was different and I think this year will be the same and show continued decline. Operators tend to prioritise the best prospects, irrespective of what they think the oil prices will do, therefore every time a well is drilled, whether successful or not, the average chance of success in the pool of prospects declines, and that only changes if some attractive new leases become available, although a discovery will improve other near field prospects. It’s also worth noting that any large, good quality discoveries made recently, like Liza in Guyana or Zohr in Egypt, are almost immediately being fast tracked for development despite depressed oil and gas prices.

The number of wildcat (i.e. frontier exploration) wells has been trending down, and without much correlation to oil price but definitely accelerating since the recent price collapse, for the last twenty five years: for example 2009, following the recession, saw low shallow water activity but no fall in deep-water and a record number of wells for ultra-deep, probably because of new generation DP rigs becoming available, whereas all exploration continued to fall through the high price years from 2011 to 2014. At current trend there will be none drilled within ten to fifteen years (see the FT article referenced above), which suggests to me the E&Ps are running out of places they think there might be things worth discovering. Seismic can’t tell if oil is present but it can find the maximum likely unrisked resource (i.e. the size of the trap), and if that is below a commercial limit then there won’t be any drilling. Gas might be doing a bit better because, although it is significantly discounted against oil price, recently there have been some giant discoveries that can be developed economically, and that trend might continue, plus FLNG might open up some otherwise stranded, smaller prospects.

The chart below highlights some of the high profile basins. I decided on offshore or onshore designation depending on whether the USGS had more than 90% allowance for the basin in the respective location. These are not all the regions considered but include the ten top oil and gas estimates and a few other interesting ones. They are ordered by total, combined P5 estimates, but I’ve only shown the P50 numbers, so riskier areas, like Greenland, stand out.

Santos (Brazil), Mesopotamia (Iraq) and Zagros (Iran) are the three major possibilities for big oil finds (maybe also Arctic Alaska based on recent discoveries). Santos has had mixed lease interest and before that mixed exploration results. E&Ps are probably also waiting for the PetroBras Libra pilot project results. The West Central Coastal basin includes Kwanza province, which had high, and ultimately disappointing, prospects. Nile Delta Basin and Mozambique Coastal have had successful gas discoveries since the report. Guarija is offshore Colombia and has been a disappointment with a couple of dry wells and only gas in the others, though I think Anadarko are planning another well next year. East Barents Basins and Barents Sea indicate mostly gas and therefore it is maybe not surprising that Statoil and Lundin haven’t been successful in their oil exploration (not much gas either, and probably very difficult to develop should they find any). The Red Sea basin has been explored by Saudi and Kuwait, it has pre-salt possibilities, but no announced successes and a distinct waning of interest recently. Guyana-Suriname has had big discoveries by ExxonMobil/Hess. Senegal, I think, includes Mauritania, which Tullow just gave up on, but was the site of the biggest find by far this year: 15 tcf gas (2.5 Gboe) for BP/Kosmos. Campos and Foz do Amazonas, like Santos, are offshore Brazil and have had a fair bit of lease interest but there are ecological issues with the second one. South China Sea has had a border dispute, which might be settled now, and includes interest from Vietnam, Philippines, China and Malaysia.

USGS also show onshore resources by country: they have 12 Gb oil for China but I find it hard to believe that there is a part of that country that hasn’t been thoroughly drilled. For oil China is fourth after Iraq (42 Gb), Iran (13) and Russia (17); Saudi has 10 Gb, but like China that seems to have been thoroughly explored in all the likely spots, and USA 11 Gb. For natural gas onshore the top countries are Russia, Iran, Iraq, Brazil (a surprise to me) and USA.

Hi George,

Nice post.

Did the USGS data come from the link below?

https://pubs.er.usgs.gov/publication/dds69FF

Also a description of the summary at link below

https://pubs.usgs.gov/fs/2012/3042/fs2012-3042.pdf

The undiscovered conventional resources in this study exclude the United States.

The F50 estimate for conventional C+C for the World is 478 Gb, and the NGL F50 estimate is 139 Gb for a total C+C+NGL of 617 Gb, though given the uncertainty it should probably be 500, 100, and 600,or rounded to 2 significant digits at most (620, 480,140 Gb).

I believe these USGS F50 estimates are likely to be too high by roughly a factor of 2 to 3.

The F95 estimates of 200 Gb for C+C and 50 Gb for NGL seem more reasonable.

I wonder if the USGS has a tendency to confound reserve growth with new discoveries.

It seems to me there is a possibility that with high oil prices that reserve growth and discoveries (sometimes called cumulative discovery) might approach the F50 estimate if oil prices were sustained at over $200/b, but it is doubtful that those oil prices (in 2016 US$) could be sustained for more than 5 years.

For that reason I would expect discoveries plus reserve growth would be roughly 200-300 Gb for conventional C+C.

I wonder if the USGS has a tendency to confound reserve growth with new discoveries

I don’t think so – they have a parameter in the Monte Carlo simulation which represents the proportion of an area that has been explored, so they are only considering new discoveries.

Those links look correct, you can get to both from my link at the bottom as well.

They exclude offshore mainland USA (and actually part of East Coast Canada I think) but not Alaska and they have onshore estimates listed for USA in the Country summary.

There’s a new report on North Sea Decommissioning, which now includes Norway, Netherlands and Danish sectors:

https://oilandgasuk.co.uk/decommissioninginsight.cfm

It is from the UK oil and gas trade body so everything is, and alsways will be, awesome.

EIA Petroleum Status Report

I guess that there must be a big error somewhere = Line 13 adjustment +576 kb/day

Crude oil stocks down -3.4 million barrels plus SPR sale -2.4 million barrels

The overall fuel stock level stayed about the same,

Increased +6.3 million barrels = gasoline & distillate

Decreased -6.7 million barrels = unfinished oils & residual fuel oil

Saxo Banks collection of charts: https://pbs.twimg.com/media/DPz4eA9X0AEQD-3.jpg

YTD numbers by TFA https://pbs.twimg.com/media/DPz5aOTXcAAhvz0.jpg

J.Kemp (Reuters) always has a range of charts https://twitter.com/JKempEnergy

The EIA-914 survey tomorrow,

November 29, 2017 – Rystad Energy’s comprehensive well data for the United States shows that domestic oil production could pass 9.9 million barrels per day in December 2017. For comparison, the EIA estimates oil production will reach just 9.72 million barrels per day in its September Short-Term Energy Outlook (STEO). Tomorrow, November 30, the EIA will publish a new EIA-914 survey and petroleum supply monthly report (PSM) with the actual oil production for September 2017. The preliminary estimate by the EIA is 9.34 million barrels per day. Any significant adjustment to this estimate will be the first indication of who is right on where U.S. oil production is heading towards year-end.

https://www.rystadenergy.com/NewsEvents/PressReleases/december-oil-prod-forecast

Mr. Kaplan

I appreciate the time and effort you contribute to this site and feel we all can benefit from your input.

One question regarding offshore …

With the continuing advances of seismic, is there any accepted appraisal of what may exist and be recoverable in the sub salt/pre salt rock?

The enormous expense in actually drilling to “find out” would make the most swashbuckling of wildcatters blanche.

However, if successful efforts are made, it may encourage additional activity.

On a completely separate topic, and one of highest relevancy to the renewable energy stance, 8 hours from this posting, wholesale electricity prices in Victoria and South Australia are expected to hit the $14,000/Mwh ALL afternoon.

While I cannot identify the cause, the weather appears to be cloudy with temperatures in the low 90s (F).

In addition, the quarterly futures contracts for electricity for 1st Qtr 2108 are $173/ Mwh and $147/Mwh for SA and Victoria respectively.

Folks, if you all are not familiar with what the above numbers represent, it broadcasts an unmitigated disaster for those regions as no modern society can remotely expect to function with energy costs so high.

I think recent seismic advances mean that pre and sub salt geology can be reasonably mapped, which wasn’t the case a few years ago, but I’d imagine it’s still not as good as seismic where there isn’t inteference from the salt. As far as knowing if there is anything there, you still have to drill, and even if something is found it still doesn’t look like recovery factors are very well understood. I think the few pre-salt fields in GoM aren’t doing as well as expected and have pretty low recoveries, the Libra extended test FPSO ,which just started producing, has been specifically developed as a low cost option as the operators didn’t want to commit a lot of money without knowing what to expect, and the pre-salt in Kwanza (a mirror in Angola for Santos) has turned out to be a dead duck after some high initial expectations.

Hi Coffeeguyz,

Spot prices at that level suggest, nobody will be buying electricity. Those that need the electricity will have secured supply at a lower price, for others I imagine if electricity is in short supply there will be demand pricing and people will turn down their thermostats during the high price period, not do their laundry, etc and cut back on electricity use.

In any case Australian electricity prices have historically been high, not sure why. I imagine they have some cheap coal, though perhaps transport is expensive.

Dennis

I’ve been trying to understand this whole electricity business, yet – after a year of study – I am still very much a neophyte.

This is especially true regarding Australia as their structure is a little bit different from US.

However, that 14k/Mwh will most definitely be factored into the end users’ bills, but since it may only be a (now) 2 hour block of useage, the lower aggregate pricing over a 3 month billing period is what will be charged.

(Up your way, couple weeks back, ISO wholesale spiked over $1,000/Mwh for 20 minutes. I think Millstone 3 being down and Pilgrim having hiccups is what forced the oil burners to kick in. That 1,000 bucks will be blended in to your aggregate 30 day billing cycle).

What I think is happening right this moment in OZ is the AEMO encouraging a bunch of smaller generators to fire up and that pricing – momentarily at $200 – is succeeding at extra generation.

The ridiculous $14k window has shrunk from 6 hours down to 2 1/2 this late afternoon.

As it is spot pricing in 5 minute intervals, it could drop further.

No matter how you look at it, it’s a heck of a way to do business … and summer has yet to kick in.

That happens all the time if you have not enough pumped storage / other medium time storage facility.

It was before the solar boom here in Germany, too. Always at noon, where peak demand was.

It’s now history, at noon are the prices lowest now.

Eulenspiegel

Your observation addresses one of the key components of renewables … intermittency, which is often conflated with unreliability.

I am not too familiar with either the European electrical market nor the German in particular, but my understanding is the build out of several coal burners might be stabilizing the market some?

Hydro backup offers a great deal of reliability, but – like everything else – many issues there.

Hi coffeeguyzz,

Where I live the rate is about $160/MWhr for residential service and has been at that level for many years. As my usage at home is only 0.3 MWhr per month, this amounts to about $48 per month which is pretty affordable in my view.

I believe the average residential rate in the US is about $120/MWhr and considerably less for industrial users (maybe $50/MWhr).

Note that industrial users do not buy on the spot market, they have a fixed contract and in my state the Electric Utilities are separate from the power producers (they just transmit and distribute (T+D) the power) the suppliers are separate. The T+D is about $80/MWhr and the supply is about $80/MWhr.

The spikes in price are matched by many hours of low prices and it is the average price that matters to the consumer.

I checked wholesale prices for New England from 2014 to 2017 (weighted average for the year) using data from EIA (prices in $/MWhr)

https://www.eia.gov/electricity/wholesale/#history

2014, 85.28

2015, 55.03

2016, 36.50

2017, 34.74

New England data is from the Massachusetts hub

which is labelled “Nepool MH DA LMP Peak”

in the spreadsheets with historical data.

Since 2014 average annual wholesale electricity prices have been decreasing in New England, based on the historical data for weighted average annual prices.

Note that I took the weighted average daily price and multiplied by daily volume for each day for total dollars for the year, then divided by total volume of MWhr for the year to get a weighted annual average price in $/MWhr for each year from 2014 to 2017 for the Massachusetts Electricity Hub.

If you are looking for evidence that the expansion of renewables increases electricity prices, you will not find it in New England from 2014 to 2017.

Although not much of an increase in non-hydro renewable power in New England with an increase from 8% in 2000 to 10% in 2016, most of the change has been a shut down of coal (18% to 2%) and oil fired (22% to 1%) power plants and an increase in natural gas power plants (15% to 49%) over the 2000 to 2016 period. See page 12 of report linked below

https://www.iso-ne.com/static-assets/documents/2017/02/2017_reo.pdf

Dennis

Your numbers are accurate, but your take on it might be a little off.

This past August, New England’s wholesale cost was about the lowest ever, primarily due to temperate weather and the huge shift to natgas fueled electric generation.

My above post referencing $173/$147 for SA and Vic futures electric contract price for 1st quarter ’18 is the WHOLESALE price.

Retail runs 4 to 5 times higher depending upon local conditions.

I’ll follow up a bit more in a couple hours.

Hi Coffeguyzz,

The numbers I reported for New England are also wholesale prices for 2014 to 2017.

I doubt retail prices are 4 to 5 times higher, typically transmission and distribution would be no more than $10US per MWhr and remember that the Australian dollar is about 80% of the US dollar so $147AU is $117US, based on the report linked below

https://www.aemo.com.au/-/media/Files/Electricity/NEM/Planning_and_Forecasting/EFI/Jacobs-Retail-electricity-price-history-and-projections_Final-Public-Report-June-2017.pdf

Retail residential prices are about $240US per MWhr so roughly double the wholesale rate.

In California rates are about $230US per MWhr, so similar to Australia.

Dennis

Your math skills vastly exceed my own, so, please, double check following and correct as necessary …

Your NE wholesale price above for 2917 is 34 bucks per Megawatt hour, equalling 3 1/2 cents per kilowatt hour.

August average US retail electric bill (EIA) 13.19 cents per kWh. About quadruple the wholesale.

Your 2014 NE wholesale is 84 bucks per. SA contract juice price is 173 (Aussie bucks).

Multiplying 17 cents per kWh by 4 about 70 cents kwh retail pricing … by far the highest in the world.

Hi Coffeeguyzz,

Your math is fine, it is the assumption that that retail wholesale ratio in the US and Australia will be the same that is incorrect.

In Australia the ratio is roughly 2 to 1 based on the data I have seen.

The data for Australia is not that good.

I did find the following

https://www.industry.gov.au/Energy/EnergyMarkets/Documents/TheFactsOfElectricityPrices.pdf

and

https://www.industry.gov.au/Office-of-the-Chief-Economist/Publications/Pages/Australian-energy-statistics.aspx#

Maybe someone from Australia is more familiar with the data there.

Coffee, are you aware of the Beetaloo Basin shale in the Northern Territories that Origin Energy and Impex have high hopes for?.

Exploitation/exploration has been stopped because of environmental concerns over fracking – currently the eco types have managed to impose a moratorium, and apparently convince most people of the massive negative impacts that such a major new industry might have on the existing cattle stations etc. The NT has a population density a fraction that of Siberia.

http://www.ntnews.com.au/business/massive-nt-onshore-gas-find/news-story/df65317c6fd1aac2bda4b2b40d5b0db7

Ian

Thanks for the heads up on that.

While I know little of the Australian hydrocarbon market – upstream in particular – I just did a bunch of speedreading and found both Origin’s and Falcon’s sites to have some informative technical and operational information.

Bearing in mind I am using incomplete ‘internet’ data …

Citigroup sez 100 Tcf recoverable.

Origen sez 61 Tcf OGIP in their 2,000 km area, with 6.6 Tcf recoverable (little more than 1 year Pennsylvania output).

Falcon sez 464 Tcf OGIP (a lot).

Stacked play.

Depth of Amungee well under 5,000′ – relatively shallow. Marcellus runs 6/8,500′.

Amungee well had 11 stages, flowed 63 MMcf over 57 days with 2,000 feet of lateral frac’d..

That is impressive for a very early stage test well.

Comparisons to North West Shelf gas resources could be positive if certain factors are applied …

Logistics, especially water.

With China’s Fuling, Argentina’s Dead Cow, and the Permian all dealing with water issues, intense efforts on many fronts are continuously being made to overcome this matter.

Takeaway pipe might be somewhat accessible.

Contamination of aquifers should not be an issue at that depth, but I am too ignorant of the geology to say.

Bottom line, if a widespread cooperative effort were made (good luck with that), this area could economically provide total domestic Australia for many decades in an optimistic, but doable, scenario.

In a slightly more possible view, AGL’s proposed FSRU off Melbourne will be importing LNG from West Virginia, much to the chagrin of the domestic producers.

(The vulnerability of the Gladstone enterprise is far more vulnerable than may be obvious as it relies upon CSG for supply).

Lottsa moving parts.

Will do more checking later.

Thanks for your input on the Beetaloo , there was a fracking ban – an enquiry was held, a precis of the scientific conclusions , published today, is to the effect that with proper safeguards fracking is safe. A social impact report is to follow in March. The area has a low population density – a tenth that of Siberia(IIRC) – with little apart from a few cattle stations to provide employment. The whole exploration effort is stalled awaiting a political decision on fracking.

I understand it is the oldest potential gas field on the planet, 1,600 million year old rock.

The numbers you cite are for one shale, as you say there’s a stacked play. Need a lot more wells to define the plays, find sweet spots etc.

A gas pipeline runs across the basin, there are plans for a capacity increase (if needed).

But where would the water come from?. There are cute ideas such as gas powered atmospheric water recovery systems:

http://iopscience.iop.org/article/10.1088/1748-9326/11/3/034024

Gas would seem a cheap fix for Ozzy problems of expensive non dispatchable renewables damaging the economy.

Dennis

Renewable generation in NE has certainly not boosted prices directly as they play such a minimal role.

(The folks in Rhode Island who just got hit with large increases may beg to differ).

What HAS been a major impact is the staunch resistance to 2 new gas pipelines to assure both reliability and affordability for decades to come.

If you are checking out that much detail in your neck of the woods (which I think is great), track down the new gas plants opening in Salem Harbor and Bridgeport, along with the one in RI.

Check out how much juice Pilgrim puts out and mind that next winter will be its last.

You have 4.5 billion cubic feet of gas heading your way every day, (thanks, in part, to the much-contested AIM expansion).

Keep an eye out how the UK responds in the coming weeks to the predicted brutal cold snap and imagine your neighbors facing a similar situation with scant fuel to both heat and light.

Dennis, I applaud your diligence in delving into these issues as they are important to us all.

Hi Coffeeguyzz,

The pipelines were rejected based on Massachusetts law by the Massachusetts Supreme Court. It the Massachusetts legislature believes there is a problem the Law can be changed.

Note that I am not a Massachusetts resident so have little say in this matter.

I wonder if the Commerce Clause could be used to invalidate the Mass decision, I am not a lawyer.

Other states may be depending on the Gas, I imagine it could take a different route and avoid Massachusetts so that New England states North and South of New England could get enough Gas.

I imagine Connecticut and Rhode Island may be able to get plenty of Gas from New York. A line could probably go across Vermont and New Hampshire to Maine from New York.

I don’t know what has been planned.

http://www.worldoil.com/news/2017/11/30/sen-alexander-introduces-amendment-to-end-wind-production-tax-credit-at-year-end

New England got most of the gas from the Nova Scotia gas fields, Sable and Deep Panuke, which are about to shut down, and the pipeline flows reversed so NS can get what it needs. Before the shale boom they were much more reliant on this gas, and not so long ago. Don’t know if that means much though.

We always have “coldest winter ever” warnings about this time of year, usually from the Daily Mail or Express and the nutjob denier who is Jeremy Corbyn’s brother. It’s pretty cold now but not too bad, and expected to be well above normal by next week. Spain and France are staying cold, and Norway is really cold so maybe the jet stream has split.

(Wrong thread delete if needed)

Your thread, your choice.

VIC Does show an order of magnitude+ spike on the 5 MIN timeslice round 17:00.

https://www.aemo.com.au/Electricity/National-Electricity-Market-NEM/Data-dashboard

It’s Summer so it looks like they need a bit more west facing PV and/or some demand management.

With overcentralized fossilized Grids, Fractional % shortfall and it’s Armageddon time domain.

Is the Australia grid truly deregulated? If so it would bring diversified supplies online as needed. Not much Power traded here. – 10% of Texas Peak Demand. Can you imagine what future prices would be without PV? Australia exports what % of their coal? Guess China needs it more?

LT

Just before 17:00 yesterday, Vic hit over $2,000 and SA over $10,000 Mwh before prices plummeted.

Somewhat coincident with that, the AEMO folks did a market intervention with a RERT announcement, which – best as I understand – prompted the backup gas peaker in Tasmania to fire up and pull ol’ Vic’s butt out of a crack.

The situation in Australia is still a bit of a mystery to me as it seems to be mostly free market with a bit of remaining vertical integration with some producers still in the retail segment.

In addition, somewhat similar to the US, is the different fuel sources for generation … coal, gas, (no nukes), or the wind and sun.

Somewhat clouding the issue is the widespread emplacement of rooftop solar.

The intense political polarization seems to play a large role in the current state of affairs.

George/Coffee – It’s been almost 10 years since I was in the DW GOM game. At that time I was on contract at Devon as a well site pore pressure analyst. My last well was going to be truly historic. It was goin to be the shallowest salt penetration of any subsalt well…600′. It was going to penetrate more salt section then any other well…22,000’+ of salt before it came out into the rock. It might also be the deepest well in the western hemisphere…35,000’+. Apparent as we entered the potential productive section the structure was as mapped. Unfortunately not only no hydrocarbons but no show indicating that any had migrated thru that section. The well was P&A before reaching PTD.

I wasn’t working as a geophysicist at the time but have done so for about 30 years in the GOM Basin. And had watched the development of seismic HCI’s…Hydrocarbon Indicators…since my early days at Mobil Oil in the 70’s. Not entirely sure but while subsalt structural mapping had developed to a fairly accurate degree the data content was not sufficient to do the HCI magic. And it can be truly magical. In the mid 80’s in a shallow gas trend in Texas I hit 23 out of 25 wildcats. And of the two I missed I could prove one due to a misspoted line and suspected the other was also. The magical part: this was in a trend of small stratigraphic traps with a subsurface mapping success rate of 5% to 10% at most. Having worked HCI’s offshore it was the proverbial shooting fish in a barrel. And no competition…at first. The small independents that played that trend couldn’t spell geophysicist let alone bought seismic data.

RG – what was the deepwater prospect you mentioned above?

Subsalt data quality has not gotten to the level where HCIs work, but not all of that is due to the overlaying salt – some is due to the rock properties because of the reservoir depths and the low GOR of a lot of the oils. Fortunately, at least in the more successful GOM subsalt trends, the stratigraphy is fairly forgiving. We aren’t pursing highly channelized reservoirs, like the shallow Texas gas trend you mention above. Rather, the depositional systems are either sheet sands, or highly amalgamated channels systems (which can behave a lot like sheet sands).

SLGeo – Sorry to be such a tease but I would rather not say. It’s been 10 years but I try to still honor my Confidentiality Agreement. Not that I haven’t pushed the limits already. But if you have access to the public data base just search for a very deep dry hole drilled by Devon around that time. Drilling about 22,000′ of salt should make it stand out. If it helps Chevron took over ops not too long afterwards. I just don’t want to mention the lease and well name publicly.

When my new company started chasing deep NG in onshore S La. after I left Devon we were pushing data content well beyond reasonable limits. Extreme data reprocessing to try to bring out NG amplitude data to generate viable HCI events. Worked sometimes but often failed badly. For one thing migration became very tricky. We drilled a dry hole on one deep HCI: all shale. But we remigrated the data and proposed a sidetrack. Our partner dropped out. And we found 200′ of pay in a sand 600′ away from the dry hole. Worked well enough when gas was $5+/mcf. But when prices fell we dropped the program entirely. One of the reasons my owner took a chance on my crazy hz redevelopment idea: we had $200 million to spend and almost no where to put it.

Can’t blame me for trying!

If, and when, NG prices get over, say $5-6 /mcf, I wonder how aggressively the onshore/shallow GOM deep gas play will be pursued. I think there are a lot of undrilled prospects around, and, at least offshore, high quality 3D volumes that image features as deep as 3500′ or so below many of the collapsed salt canopies.

Didn’t see projected ratios of C&C + NGL. How much of each.

BOE doesn’t keep the society functioning. Only BO.

Has PeakOil.com gone kaput?

it appeared to me that it was down for a bit but it is back now.

Dont think so.

I supervised reservoir management teams expected to deliver a “technical resource” estimate. Unfortunately we had very vague guidelines, and I found colleagues in other companies were apparently just as lost as we were.

So I gave them an informal guidance and suggested they prepare rough estimates assuming oil prices were triple our “official” price deck. This was used to extend well and field life, lay out very rough and conceptual EOR and infill projects, and develop marginal areas where per well recovery wasn’t justified.

As Denis points out, if one goes wide open its possible to assume really high figures based on nonsensical approaches.

What we found when we were assuming the triple price deck was that we could increase “reserves” but the rates were low because we had logistics and reservoir performance limits. This means stacking technical reserves on top of proved plus probable reserves doesn’t really increase rates that much, it mostly keeps production steady for a decade or so, followed by a gentler decline for over 50 years.

Potential production increases in 2018, I’m not sure about this as I’ve not heard that increases could be this high from any of the other forecasters. And there is never any mention of production declines in any of these forecasts…

JBC – Even without more shale, the oil market faces an increase of more than 2 million bpd crude supply from producers outside OPEC – more than projected demand growth, says JBC

(The easiest bit to understand is the 2018 Y-o-Y section on the RHS) https://pbs.twimg.com/media/DP34YlgXkAAMjLu.jpg

https://twitter.com/chris1reuters

It does just say “additions from new crude stream” rather than “net”, but that’s not definitive either way I guess, especially as it has one negative point. But there’s no way the North Sea is going to add 400,000 bpd net next year.

(Why are 2016 and 2017 included – was this a prediction made in 2015?)

Yes it would make sense if it was an old one from 2015. Reuters tweets these research notes and so I don’t know anything about them, other than saying that Reuters have always been very reliable.

ClipperData, Nov 30th, OPEC crude exports are closing out November at their lowest monthly level since mid-2016

Chart on Twitter https://pbs.twimg.com/media/DP4gdgOVwAAx7DZ.jpg

https://pbs.twimg.com/media/DP4e6baV4AEEyk6.jpg

ClipperData Blog: http://blog.clipperdata.com/opec-winning

Also http://www.tankertrackers.com

Chart on Twitter: https://pbs.twimg.com/media/DP0XUHlW0AIwnob.jpg

Not sure if this will interest anyone, just looking at JODI crude oil imports and seasonality. No real surprise, it matches seasonal refinery intake and products demand. Demand usually decreases in January more than imports causing the yearly inventory builds.

OPEC – This is a fairly good summary of the news that I’ve been reading about the OPEC meeting today…

Headlines this morning gives the impression that all are now on-board for extending the cuts to the end of 2018. Reading in more detail however shows that it is not at all yet a done deal. And in addition it does not say whether the cuts will be maintained at current level all to the end of 2018. Specifically it seems like there is going to be an option to review and revise strategy at the next meeting in June. I.e. “maintain cuts if needed, but only if needed”. Russian producers are deeply concerned about the end-game. How to wind down the cuts without risking to crash the oil price. As such a sensible outcome in our eyes would be to wind down the cuts gradually through seasonal demand strength in H2-18. The cutters probably do not want to surprise the market positively risking firing up the oil price yet more at the same time as Rystad Energy is calling US crude oil production to hit 9.9 mb/d end of 2017 while also the US oil rig count has started to rise.

http://ravarumarknaden.se/cutters-utilize-seasonal-strong-demand-h2-18-wind-cuts/

The OPEC meeting has ended

– no specific plan to review output at the June meeting.

– quotas for Libya and Nigeria – the two countries’ production to be at 2017 level.

https://www.ogauthority.co.uk/news-publications/publications/2017/uk-oil-and-gas-reserves-and-resources-as-at-end-2016/

The UK oil and gas authority published the 2016 reserve assessment at the end of October. They don’t seem to be following the same methods as the old ministry department did (which I found difficult enough to follow) in how they differentiate between C&C, associated gas, dry gas and NGL. I think they are presenting data based on total reserves in oil fields (which would include associated gas) and total reserves in gas fields (including condensate and NGL), but might be wrong. Either way their conclusions:

To date, a total of 43.5 billion boe has been produced from the UK and UK Continental Shelf (UKCS).

The OGA estimates that UK reserves are approximately 5.7 billion boe (probable) and these alone, based on current production forecasts and not taking into account potential future exploration successes, have the capacity to sustain production for at least the next two decades.

However, there is a significant opportunity to add to these reserves by maturing the UK’s considerable contingent resources. The OGA estimates there are 7.4 billion boe of discovered undeveloped resources. Much of this resource is in mature developed areas and under consideration for development. This will require substantial investment in new field developments and incremental projects.

Replacement of proven and probable reserves remains a concern. In 2016 approximately 600 million boe were produced however only 80 million boe of contingent resources were matured to reserves.

Exploration success in 2016 helped add 210 million boe to the contingent resources.

The OGA’s current estimate of prospective (undiscovered) resources is 6 billion boe, with a range from 1.9 billion boe (lower estimate) to 9.2 billion boe (upper estimate).

Taking account of this range of possibilities for prospective resources, together with the range of discovered reserves and contingent resources shown in the report, the current best estimate of remaining recoverable hydrocarbon resources from the UKCS is in the range 10 to 20 billion boe.

The key curves, below, show remaining 2P reserves are falling, and in fact there was a slight downward revision for total discovered 2P for both, though this may only reflect timing of some developments including some impact of prices so the downward revisions might come back in the future.

I think the statement “have the capacity to sustain production for at least the next two decades” is a bit dodgy – I think they mean production would decline to zero over that time, but the implication of the word sustain is that a plateau would be held (production is about 0.6 Gboe per year, and 2P reserves 5.7).

“The OGA estimates there are 7.4 billion boe of discovered undeveloped resources. ”

Got a problem with this. Just 3 years ago at $120/barrel, this stuff wasn’t getting investment. Why not?

Maybe it needs $300 per barrel, or maybe there were better opportunities and the industry only had/has a fixed capacity for development spending per year, or other.

When you produce 600 million barrel / year this isn’t much – not everyone is a shale producer trying to produce everything in 1 year. Most conventional oil companies plan for longer horizonts.

Other thing: Expensive Infrastructure is only for x barrel / day – you only drill to replace declines – until you discover something really big new.

The Internet like Fossil Fuels is a good example of Inertia locking out evolution. So many things are Broke like IPv4, DNS. Solutions have been ready in waiting for over a Decade. but what me worry. Like Buying a Truck without securing a fuel supply. Implementing DNS_SEC would end much attack nonsense.

http://peakoil.com/generalideas/peakoil-com-server-down-nov-29

What a Gas – PeakOil as sooo fake news

“By 2025, the growth in American oil production will equal that achieved by Saudi Arabia at the height of its expansion, and increases in natural gas will surpass those of the former Soviet Union, the agency said in its annual World Energy Outlook. The boom will turn the U.S., still among the biggest oil importers, into a net exporter of fossil fuels.”

http://gcaptain.com/u-s-to-dominate-oil-markets-after-biggest-boom-in-world-history/

EIA 914 Survey – U.S. crude oil production for September, 9,481 (thousand barrels per day)

https://www.eia.gov/petroleum/production/#oil-tab

quite something. Rystadt might be up to something here (see post further up). Weekly averages for september were 9,330. I wonder if the hurricanes were playing havoc with the data, since Auguet was 9,495 on the weeklies and 9,191 on the monthly.

I suspect if US increase from August to September continues on pace, we have seen the high for WTI for 2017, absent a shock (ie Venezuela for example).

Too bad, $55-65 WTI, we barely knew ye!

I guess US exports are keeping US inventories down and $WTI above $50 at the moment

Bloomberg – U.S. net oil imports, including crude and refined products, last week dropped to just 1.77 million barrels a day, the lowest level in data going back to 1990, the EIA reported Wed.

https://pbs.twimg.com/media/DP5pO8lUQAEqIeN.jpg

Hi shallow sand,

If US output continues its 623 kb/d annual increase and OPEC remains flat then demand will outrun supply unless other non-OPEC nations (Brazil and Canada) can more than offset declines elsewhere. Demand is expected to go up by about 1.2 Mb/d, so if the US increase remains steady and the rest of the World doesn’t increase production by more than 600 kb/d and the demand forecast is ok, then prices might stay where they are today.

A supply disruption somewhere (Venezuela, Libya, Nigeria, or Iraq are all possibilities) might lead to shortages and a price spike.

Always impossible to know, a fall in prices would tend to reduce output eventually.

Texas production per the 914 is 3,574. No comment.

Hi Guym,

The ratio of 914 survey to drilling info data from April 2015 to May 2017 was an average of 0.902. If we assume this remains near that level for July to September, we get 3435 kb/d, 3337 kb/d and 3524 kb/d respectively. The EIA estimates are about 40 to 50 kb/d too high relative to drilling info from April 2017 to June 2017 and also about 50 kb/d higher than the 914 survey divided by 0.902 for July to Sept 2017.

My best guess is drilling info estimate up to June 2017 and then 914 survey divided by 0.902 from July 2017 to Sept 2017.

EIA 914 report at link below

https://www.eia.gov/petroleum/production/

For US C+C from July 2016 to Sept 2017 the average increase has been 623 kb/d per year (52 kb/d each month). This is in line with the estimate of the former CEO of EOG (Papa?) for annual increases in US output through 2020.

How do you think this compares to your most recent post?

Which is more correct, in your opinion? The 3119 average you stated in your last post, or the 3524 amount you just posted above? There is a 400k difference. If we used Dean’s numbers, the EIA is over by more than 500k barrels a day.

Hi Guym,

The last post was based on RRC data and the Sept data was probably less complete than usual. The 914 survey uses the same companies as previous months and for most of the previous months from April 2015 to May 2017 the 914 survey averaged 90.2% of the reported drilling info data, note that the difference between drilling info and the 914 survey was about 325 kb/d.

In order for my previous estimate to be correct, the other 10% of output would have fallen to negative 75 kb/d.

The Sept estimate in my previous post was not very good, because I had no 914 estimate to go on. Even the drilling info data is not complete for the most recent few months, so recent months are difficult to estimate for Texas.

Perhaps Hurricane Harvey made conditions difficult for timely reporting in September, or perhaps the 914 survey is inaccurate.

Note that I also have updated drilling info data through August,

as can be seen on the chart the 914 survey data when corrected by adding the 9.8% of missing output (from smaller companies not surveyed by the EIA) matches drilling info data fairly well through June 2017 (this corrected estimate is actually somewhat lower than the drilling info data from July 2016 to May 2017).

The July drilling info data is likely incomplete, August is quite incomplete and there is no Sept drilling info data reported by the EIA.

Drilled wells are reported by the RRC. Although, the RRC data may lag, they usually tell the trend.

May 593 oil completions

June 510

July 437

aug. 401

Sep. 318

Oct. 257

I threw oct in, just so you could see there probably wasn’tmuch of a carryover into oct from sep. Texas RRC production is trending down, although Harvey complicated things. So, I find it difficult to grasp how so few completions can generate such an upswing in production. This time, I would guess that the 914 is amiss. Maybe, in between, but surely closer to going down, than up.

And I was asking which one you thought was closer, not being critical of you. I said Harvey was going to make a mess out of telling what’s actually happened, and it did. I still am guessing that Oct RRC data will tell a clearer picture, but after this mess, who knows. Usually, hurricanes just mess up offshore production.

Hi Guym,

Sorry didn’t mean to sound defensive.

I would say the more recent estimate is likely to be better.

I do not know why completions are not in sync with output.

Here is one possible explanation. In August production was lower due to Harvey and in September output recovered because there may have been fewer days with production shut in.

In addition maybe pressure built up while wells were shut in and when they were brought online in early Sept there was a boost in output.

Total speculation on my part.

Maybe Mike, SoLaGeo, shallow sand, George, or Fernando can comment because they all know more than me (you may as well as a royalty owner).

I think I will stick with the RRC trend, and question EIA data. If they popped the plug, and it sprayed all over, then it would be in RRC data and some royalty holder would have been paid on it. Trend started down before August, as corresponding declines in completions would indicate. In line with drilling info to as far as posted. Few more months and we can reach a mutual conclusion. That’s September, if any companies received that big of boost in September, it would have been on some company’s third quarter report. I haven’t seen anything that big.

Hi Guym,

If output is reported quarterly and output went down in August and then up in Sept, wouldn’t it be a wash in reported quarterly results?

It seems from the reporting that Harvey had a bigger effect in August, so reduced output in August and then recovery in September makes sense. Note also that from April through July output was increasing based on the drilling info data once we correct for incomplete data.

You can throw out the 914 data if you choose, but an assumption that the 914 survey represents 90% of output usually gets you pretty close (sometimes a bit too low and sometimes a bit too high, but usually about within 40 kb/d of the final RRC data). The range is about 88% to 92% since Jan 2015 (ratio of 914 survey to drilling info estimate excluding the most recent 3 months reported by drilling info as covered in the Nov 30 EIA comparison oil statistics.

Hi Guym,

Were your leases output higher in Sept than in August?

In the estimate below I show the drilling info data reported by the EIA on Oct 31, 2017 and Nov 30, 2017, the numbers on the chart are the difference between the two data sets in July 2017 (302 kb/d) and June 2017 (85 kb/d). The difference in May 2017 was 20 kb/d and for the 5 months previous the difference was less than 10 kb/d (which I ignore).

A corrected estimate for November DI data adds these differences to the most recent 3 months reported (20, 85, and 302 added to June, July, and August Nov DI data).

We do not Drilling info data for Sept so I use the reported 914 survey result, plus the difference between the Nov DI corrected August 2017 estimate and the August 914 survey (337 kb/d).

Note that for the “Nov DI corrected” estimate only the September estimate depends on the 914 survey result in this case. The Jan 2016 to August 2017 estimate uses only drilling info data for the estimate (and the drilling info data comes from the RRC).

Essentially it is an RRC estimate that includes the pending lease data.

Also the way I did the Sept estimate assumes no increase or decrease in the output of the 10% of output from smaller producers. If output from that 10% went down in Sept the actual output would be lower and if it went up output would be higher, that’s why I asked what happened on your leases in Sept (very small sample, but perhaps indicative), maybe Mike could chime in on whether his company’s output was up or down in Sept vs August (which would give us a larger sample).

As I don’t live in Texas, I don’t know, was the impact from Harvey on oil output bigger in August or September? (I thought it was August, but as you know I am often wrong).

As is always the case, clicking on the chart will give a larger view.

I’m not sure of anything, now. Too vast of a disparity between EIA data and RRC data for Sept. I am pretty sure, it is going down, and not up. Completed wells for November will be out soon, and Oct preliminary will be out in a little over two weeks. I will post both, and we can revisit this conversation then. For EIA to be correct, a shitpot of people would not have received royalties from the stuff that was not posted to RRC. That’s not out of the realm of probability theory, but pretty far fetched. As RRC data is online, and basically machine driven, I am more apt to consider the paper shuffling by various estimates by producers to be more apt to mistakes. I received some strangely deficient gas production numbers for Sept., but the oil production looked in line. No, I just found October’s, and gas is dropping on three wells. Probably put them on pumps, soon. Happened on the first two after 9 months, and pumps picked up both oil and gas. Anything is possible.

Hi Guym,

Not sure why you doubt the 914 survey, they have been doing the same thing since Jan 2015, the Drilling info data comes from the RRC (online query plus pending lease data), even that data is incomplete for 3 to 4 months. The 914 survey was 3179 kb/d in Sept. From April 2015 to May 2017 the percentage of output (DI estimate) covered by the 914 survey was in the range from 88.65% to 91.75%.

So the September output might range from 3465 to 3606 kb/d. The average 914/DI over the April 2015 to May 2017 period was 90.18% which suggests 3525 kb/d for Sept 2017. In 3 months we can revisit and see if my guess is correct, I would say for Sept 2017 TX C+C it should be 3525+/-60 kb/d.

Guym,

I wonder if the magic production increase is correlated with the release of oil from the SPR. That would be a reasonable explanation as RRC does not have to report the oil released from the SPR. Releasing oil from the SPR is certainly a supply increase, yet is in my view not’oil production’.

I’ve been following the Alaska drilling news coverage. Seems like the GOP wants to open up the ANWR to claim it will bring in money to help balance the budget. But how many companies would actually bid and then drill?

http://time.com/5011486/anwr-arctic-national-wildlife-refuge-oil-drilling/

The ANWR has not been subjected to exploratory drilling.

Do that. If there is nothing there there won’t be any political fight. If there’s something there, then fight about it.

It’s never made sense to fight without knowing what’s there.

Isn’t the plan to sell the leases first and then discover if there is sufficient oil to drill?

The US has a habit of leaving money on the table when it sells leases. But then again, if your goal is to practically give away access to public lands rather than raise money, then letting companies have it on the cheap is the plan.

Great article! “worldwide 9+% decline rate in 2017”!

http://www.petroleum-economist.com/articles/markets/outlook/2017/oil-demand-beware-the-gap

Every time a new article comes out about this the decline rate goes up one percentage point. While shale is important it’s worth keeping in mind the other influences: 1) More in fill drilling to maintain plateaus and as other prospects became more expensive (it gives a bit more capture, but a much steeper decline. 2) More horizotal wells and MRC completions – they give the oil earlier than vertical wells but it drops off a cliff once the water comes. 3) More deepwater – high initial flows fast decline. 4) Smaller fields and more tie backs – same as 3. 5) Cut backs in brownfield development and planned maintenance after the price crash will be showing up 2 or 3 years later in lower availability and overall declines. 6) I think there must be some impact from so many facilities reaching end of life and needing redevelopment or getting scrapped and therefore not being available of near field discoveries – without building new plant the old plant hits one limit after another (oil, water, gas, power, total liquids, wells, manifolds etc.)

I think I’ve said all this before, so sorry about that.

One wonders how global decline rate is computed.

If it is per well then the sheer number of shale wells is going to amplify global decline rate. Hmmm. Seems unlikely there is well data available for the entire world so I suppose that’s not how it’s done.

Per field? One would think the data for that is similarly not available.

This would suggest global decline rate is an outright guess on the part of whoever offers up a number.

Hi Watcher,

I believe they weight the wells (or fields) by their output in determining decline rate.

George and Daniel. The article Daniel posted is a primary reason we are hangining on.

Peak demand now seems assumed as a fact that is right around the corner, due to electrification of transportation.

I’m not so sure peak demand is right around the corner. I don’t think the entire worldwide fleet of transportation autos can be subsidized by pension funds and crowd funding, like Tesla currently is. Tesla’s should have much higher pricing, which would also mean lower demand and slower transition.

Plus, the average vehicle on US highways is 11 years old? Our kids are driving 2008 and 2011, wife insists on continuing to drive her 2007. I just traded a year ago, but I have to put many miles on per year for work. However, I will put on a lot of miles. I traded a 2011 for a 2017.

In the field we have 6 trucks, 4 ATV’s one tank truck, one single drum rig, one double drum rig, one testing truck, one back hoe, one medium sized tractor for mowing and grading lease roads and one small bucket truck. All of those will be driven until the wheels fall off.

I have read a lot about the Tesla semi unveiling. Seems like a lot of questions. One commenter on SA indicated over three and a half acres of brand new, highly efficient and prime location solar panels would be needed per truck. Another claimed that the electricity needed to “Mega charge” two semis side by side would equal the usage of almost 4,000 US households.

I drive interstates in the US. So Tesla is going to deliver all those WalMart and Amazon orders cross country soon? In addition to the electricity demand issues, Tesla doesn’t even have a factory built to build Semis.

Not trying to cause a “non-oil” post, but I think “peak demand” due to electrification of the fleet could cause what I think WILL cause peak demand, peak supply plus extremely high prices, when fleet electrification takes a lot longer than assumed.

Hi ShallowSand. article re electricity demand for EV… https://www.ft.com/content/f5593480-d29a-11e7-8c9a-d9c0a5c8d5c9

So there appears to be on the Order of 100 gWh Annual Global Battery manufacturing capacity. A BOE is 1.7 mWh. So Global Annual Battery Capacity = 170,000 BOE “capacity wise”. That equals 465 BOE DAILY. Hell, that’s a single well. Is my Math close? As a Solar Installer, we have Installed TWO Powerwalls. They are not useful since they are incompatible by design with most everything, but it “macht nichts” since they won’t exist for years if Tesla wants to profit from car sales. So, eChem production ramp up is everything. Granted a Battery can be charged thousands of cycles, but the capacity has to exist.

https://insideevs.com/battery-cell-suppliers-might-not-be-able-to-keep-up-with-growing-demand/

Much Lower cost kWh’s from PV = Energy game changer.

One Energy company gets the reality of kWh time Shifting.

* PV by Day – Storage by Night *

was the motto of an investor presentation. Li Battery tech makes this possible. Li eChem thrives independently of the charge environment. ie. State of Charge / x.x volts per cell @Dusk does not dictate cell life economics. So a kWh of Battery can leverage a lot of Daily PV kWh’s even in autonomous applications

I know very little about EVs, but the transition that everybody hopes is going to go peacefully, rapidly and globally seems a couple of orders of magnitude more complicated than has ever before been achieved.

Hi George,

Consider that the manufacturing capacity for personal vehicles exists already, if we switch to EVs we switch to something easier to manufacture (electric motors instead if IC engines) with the possible exception of the batteries. Can the manufacture of lithium ion batteries be ramped up? It is not clear to me that this a problem that cannot be overcome. Installing charging stations? Relatively easy, no more difficult than petrol stations.

Obviously it will not happen overnight and does not need to as it will take 10 to 20 years to replace the existing IC fleet of personal vehicles.

Perhaps it will not go smoothly, I have never assumed a smooth path with no bumps in the road, only that it is technically possible.

It was more switching to a grid that could support all those EVs I was talking about, and more the world that is not the USA.

One question: Without oil, how many acres would it need to support a semi by agriculture fuel?

I know in the 19th century about a quarter to a third of all farmland was used for feeding horses – transportation use.

Here in Europe Biodiesel is from rape, about 450 litres / acre in a year.

So it depends how long you drive – you’ll need one or 2 acres per fill up. Over the whole year it’s a lot.

Diesel used to grow up the rape isn’t calculated in.

2.8 gallons of ethanol from a bushel of corn. In a good year USA average yield per acre is 170. So 476 gallons of ethanol per acre.

Corn is barely profitable at current prices and US. Ethanol production using corn is likely preventing a 1980s style farm failure, maybe one even worse.

But US farmland is selling as if corn was selling for $5 per bushel or more.

$10,000 acre or more for Class A soils in Illinois and Iowa. Payout is over 50 years when income and real estate taxes are included.

Consider: 80 acres x $10,000.

$800,000.

Cash rent $250 per acre x $80 = $20,000.

Real estate taxes = $3,000

$20,000 – $3,000 = $17,000 net income annually.

$17,000 x .25 Federal and state income tax (estimated, could be higher or lower) = $4,250.

$800,000/$12,750 = 63 year payout.

The wildcard, of course, is inflation. Every buyer of farmland presently must believe in his or her lifetime there will be major league inflation.

Hi SS,

Nobody ever seems to really understand what controls the price of farmland. My own opinion is no better or worse than that of anybody else I guess. It’s that nothing controls it, and yet EVERYTHING controls it.

The expectation of inflation sure as hell plays a big role. The expectation of future REAL price increases, by which I mean increases in CONSTANT money plays a big role.

These two can be very different, as for example consider that if you can borrow money at four percent, and break even on operations, and inflation is running at six percent annually across the board, with land inflating at six percent or MORE as well……..

After a few years, you can sell out, pay off any loan balance, and realize a substantial cash profit. That profit can still be a hefty one even though it’s in the form of depreciated money.

Sometimes farmers can get purchase money at ridiculously low rates. And REAL farmers, by which I mean anybody who actually FARMS, who lives on or near his property, and does some farming work personally, on a regular basis, are seldom EVER interested in selling. They’re ALMOST ALWAYS interested in buying though. It’s more a lifestyle as a business or profession. For a farmer to move off his home place is about the same order of change for him as it is for a city guy to move to a totally different city, leaving behind everything in the way of community, friends and maybe even family as well.

Then there’s the fear factor. Personally I believe the price of gold short to medium term is determined more by fear than any other factor, with the price shooting up when enough people get afraid that having most or all of their assets in the form of paper or real estate is dangerous, and so they rush out and buy some gold, creating a sellers market.

When things calm down, when the fear subsides, they realize that gold is a lousy investment in a stable environment, lol, and sell it, and the price falls again.

One thing is for sure of course, which is that they ain’t making any more land, except by filling in a hole in the water at extraordinary expense occasionally……. ESPECIALLY first class farm land.

Barring the crash of BAU, good farmland is sure to go up on average over time.

Politics plays a big role. If there’s an oil crisis, and the price of ethanol shoots way up, and government mandates the use of more ethanol, or biodiesel, the price of farmland will go up.

Farmers have extraordinary political power, in relation to our actual numbers, because farm state senators and representatives can and do cut deals with congress critters from other states. I could go on all day.

There’s absolutely no way in hell that we will ever support anything even remotely resembling today’s business as usual by producing biofuels of any sort using any existing farming technology.

But given time enough, and enough change in society,in the way we live, and enough progress in vehicle technology, we could possibly produce enough biofuel to squeak along, for instance if every body drives a super mini two seat fore and aft plug in hybrid car, with a lawn mower sized engine in it so the driver can take it an occasional longer trip. This assumes that trains make huge comeback and or that trucks can be electrified as well as cars.

It’s a hell of a lot easier in principle to justify an electric truck that will be used all day, almost every day, and maybe even two or three shifts a day, than it is to justify buying an electric car that will be used an hour a day on average.

Note that when I say renewables, I am not talking about biofuels.

That’s a dumb approach in my view which causes more problems than it solves.

I am talking about primarily wind and solar, with maybe some pumped hydro backup, widely dispersed and interconnected with an HVDC grid. Some nuclear may be good to have as backup, but it should be next generation that shuts itself down safely when the power goes out. If that is impossible to accomplish, nuclear should just be shut down altogether once solar and wind ramp up to the point that 95% reliability can be maintained. Critical uses such as hospitals will have battery backup and possibly biofuel generator backup.

Hi Shallow sand,

I imagine there is plenty of money to be made producing EVs.

Once the big boys like Toyota, VW, Ford, etc join the fray things will turn very quickly, batteries may be the bottleneck, but I imagine Panasonic, LG, Duracell and other battery manufacturers will be up to the task.

Any battery company not heavily invested in getting into supplying the EV industry is not interested in making money.

Lots of naysayers posting articles on Tesla to support their short positions.

They will be naked soon. 🙂

Tesla – lost $619 million in Q3 – delivered only 3,590 vehicles in November in the US, down 18% from a year ago.

3,590 vehicles amounts to a market share of only 0.26%, of the 1,393,010 new cars and trucks sold in the US in November. Porsche outsold Tesla by 55% (5,555 new vehicles).

They really need to get the Model 3 act together.

Tesla has put electric vehicles on the map. That was a huge feat.

Agree model 3 is important. They will get it sorted and it will sell big imo. I think 2019 sales will be over 500,000. In 2018 maybe 250,000.

China and India have reasons to promote a transition away from fossil fuels. Three main reasons:

1. Reduce dependence on fossil fuel countries.

2. Clean up their atmospheres.

3. An economic development opportunity. Beat out the US in the next generation of energy production and transportation.

While the transition from oil hasn’t fully happened yet, developing countries and the rising global powers would be foolish not to pursue it.

interesting post shallow, thanks. electric will make a lot more sense for lighter duty delivery and local fleet vehicles. it is not clear when, lots of OEMs are launching in 2019 so maybe a few years after that it will be competitive

The tesla truck doesn’t seem to make sense, infrastructure is an issue, route flexibility is an issue. but I think Elon Musk cares about carbon output and is targeting high fuel use vehicles, whether t makes sense to the rest of us or not

Tesla semi makes sense for short haul routes. Long haul can move to trains which can be electrified.

http://www.offshoreenergytoday.com/statoil-not-discouraged-by-fruitless-barents-sea-drilling-campaign-six-wells-planned-for-2018/

Despite poor results this year (one minor oil find at Kayak) and pretty expensive wells Statoil is going to concentrate even more on the Barents Sea next year. I think that says as much about options and prospects worldwide as it does about Statoil’s current reserve problems.

Wow. Behold the power of the Norwegian Sovereign Wealth Fund. Profit is not a requirement.

Statoil isn’t controlled by the wealth fund, I’m not even sure if the fund would be allowed to hold shares in it.

Statoil “wasting” money and the wealth fund are not 100% linked. 78% of the exploration wells are paid by the taxpayer, so that stings slightly, but makes it much easier to take a risk for them 🙂

I’ve long held the position that OPEC and Russia have become, out of necessity, good students of the US shale oil phenomena; they are aware production has peaked in both the Bakken and Eagle Ford plays, that D&C costs have gone up associated with much larger frac’s just to maintain well productivity in the Permian, of well communication issues, of sweet spot saturation and of increasing GOR and obvious signs of depletion. They know these plays are getting gassier and that there in no place to put that gas anymore other than up a flare stack. They have their reservoir engineers analyze realized production trends and understand, fully, exaggerated EUR’s. They have access to SEC filings and totally comprehend how unprofitable the US shale oil industry is, how totally dependent it is on credit, the massive amount of debt the shale oil industry is burdened with, of the revenue required to service that debt and that the entire scheme is totally dependent on federal stimulus that will add to our national debt and ultimately make America economically weaker. They get it. They are not stupid.