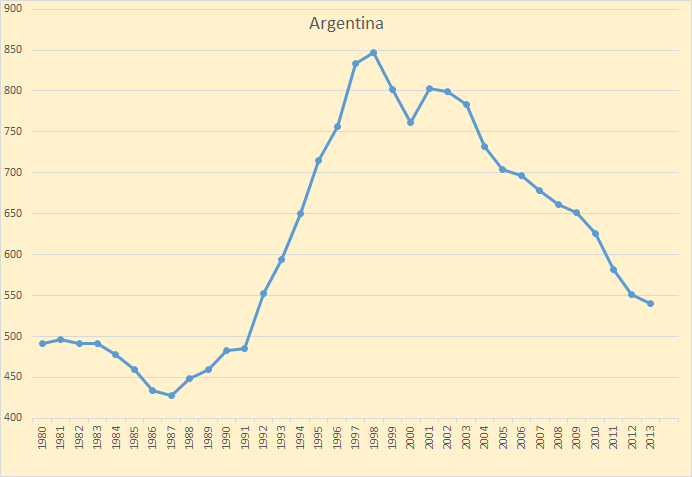

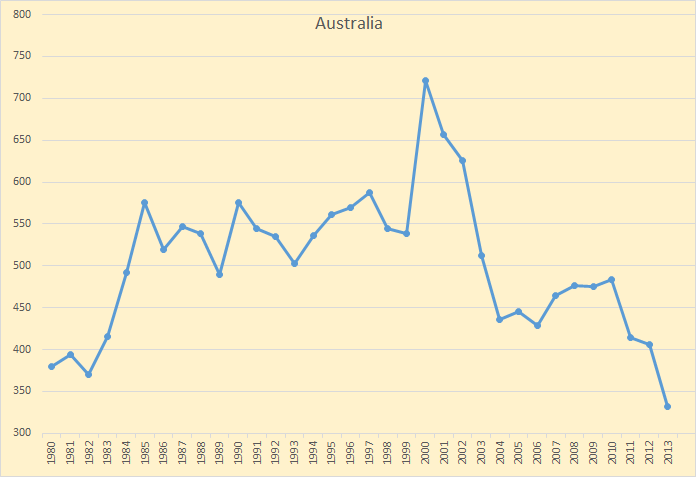

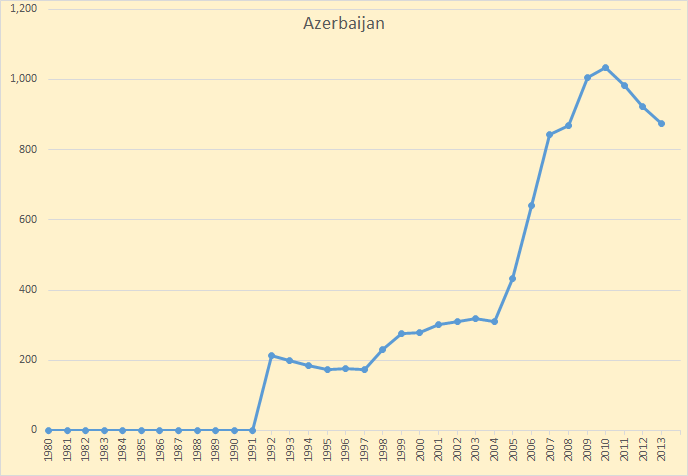

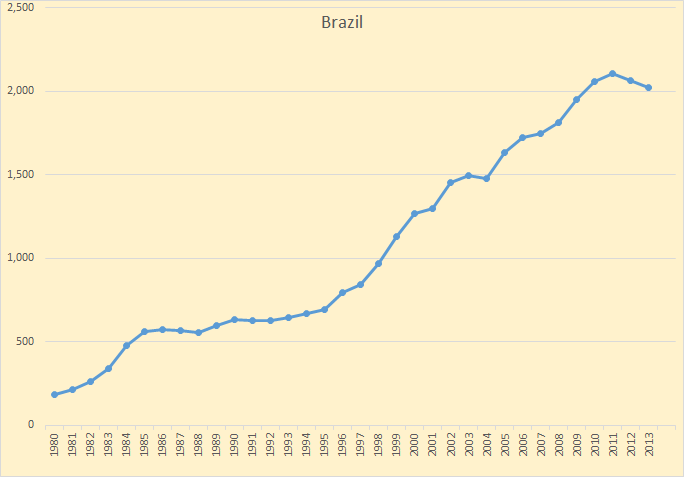

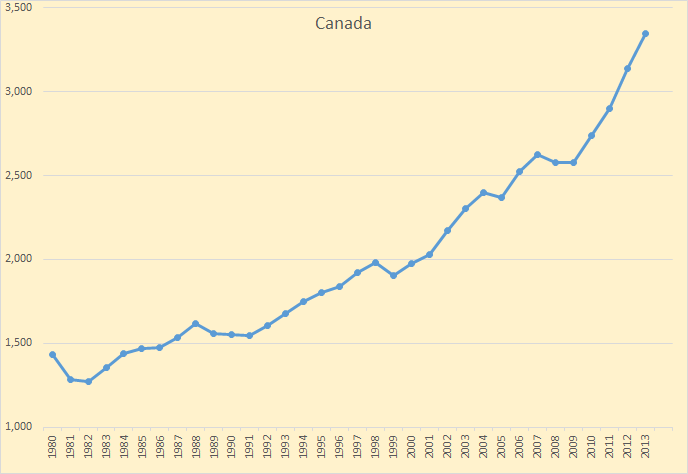

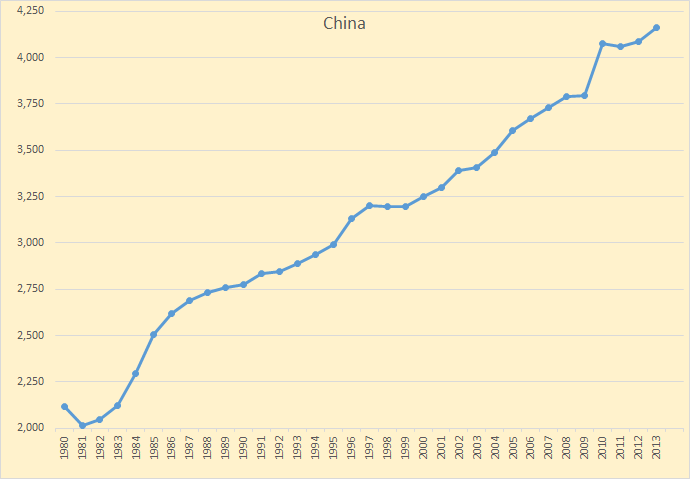

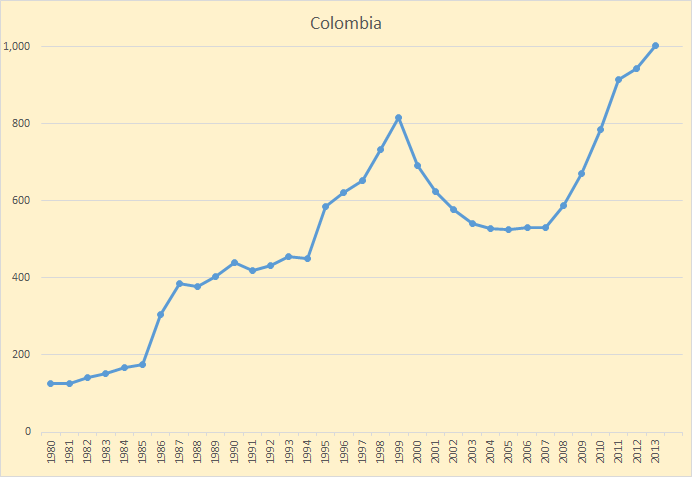

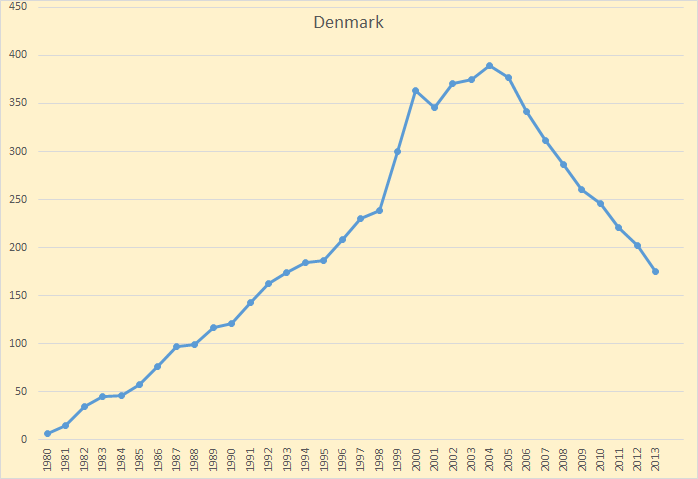

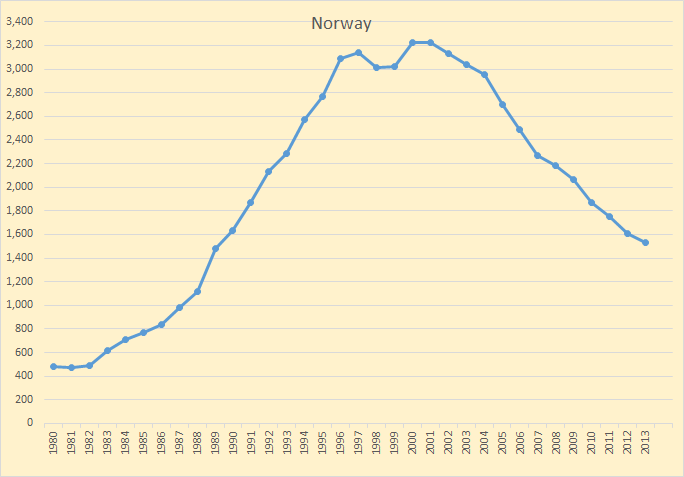

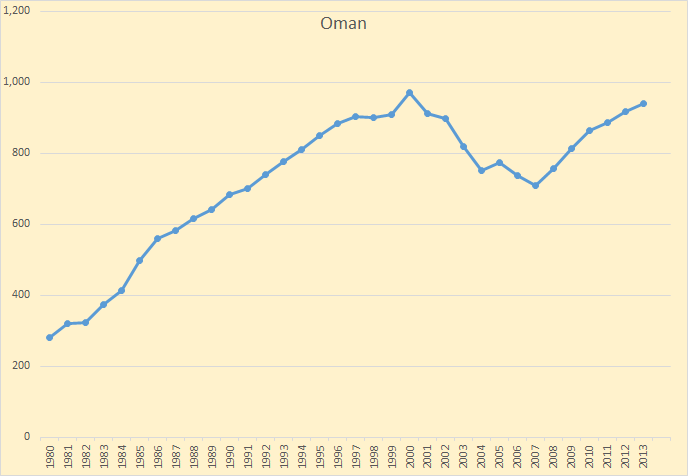

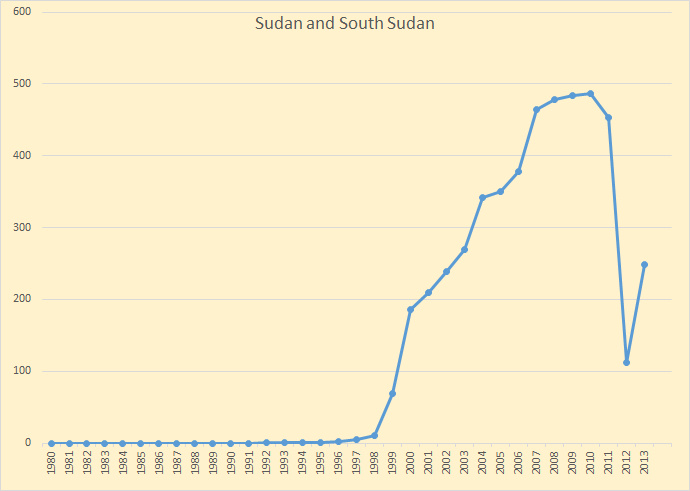

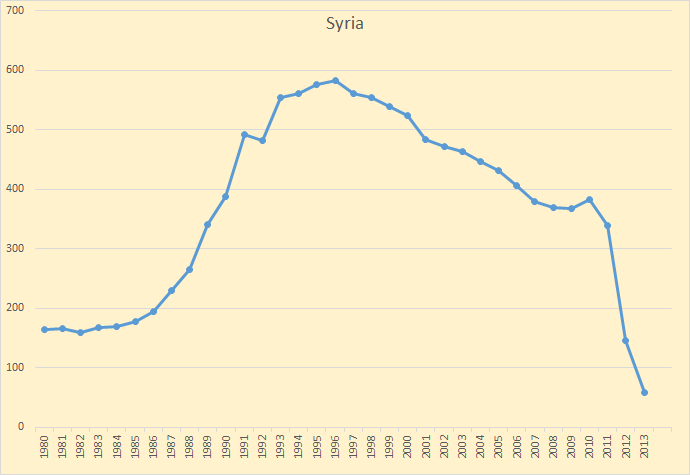

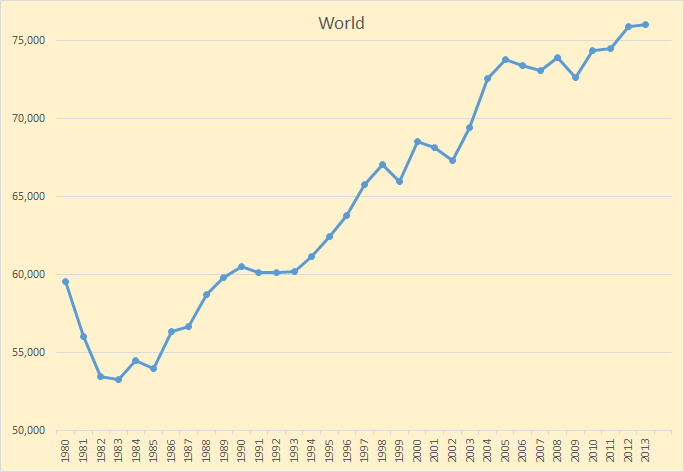

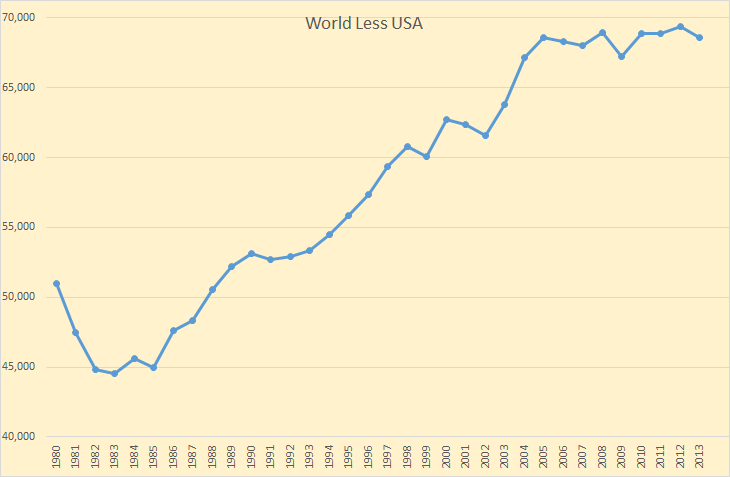

I found that looking at the crude oil production of every country plotted on an annual basis gave one a different perspective.

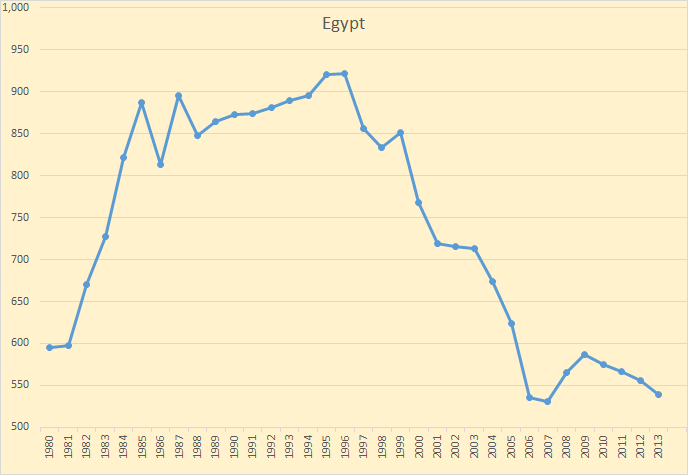

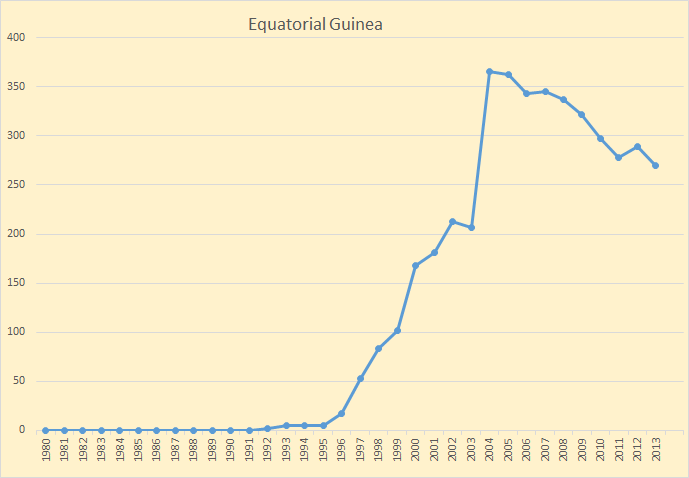

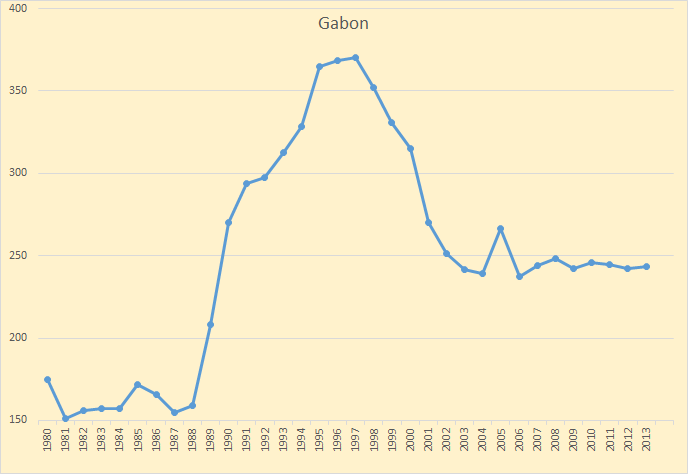

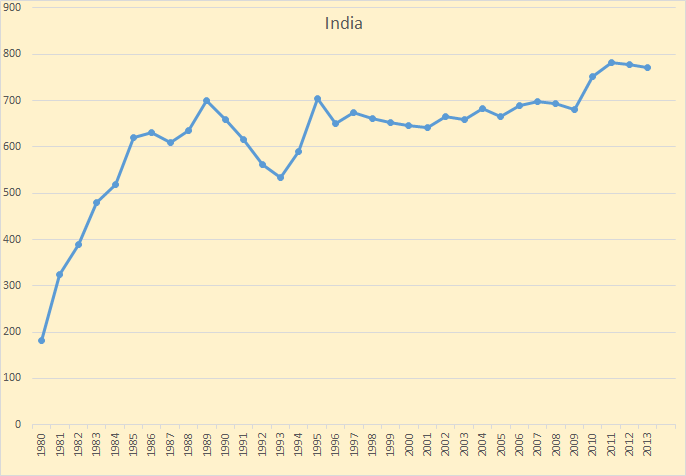

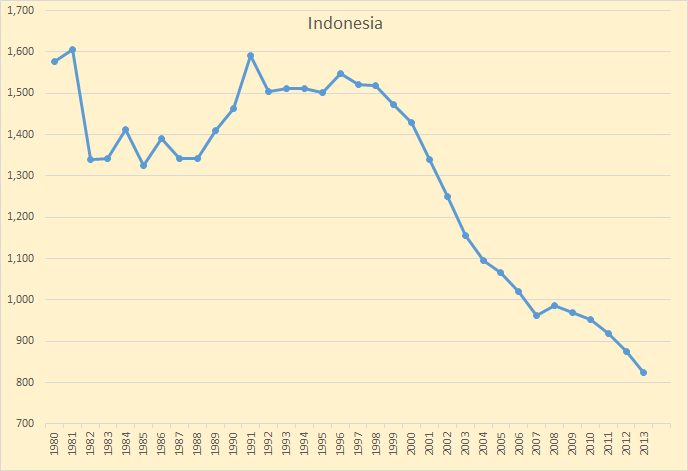

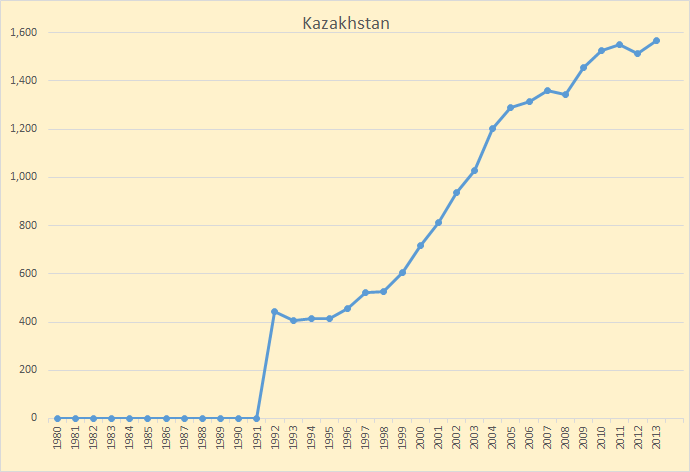

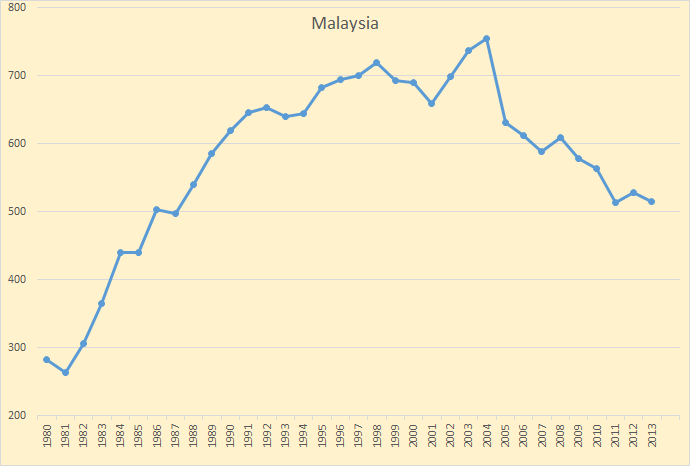

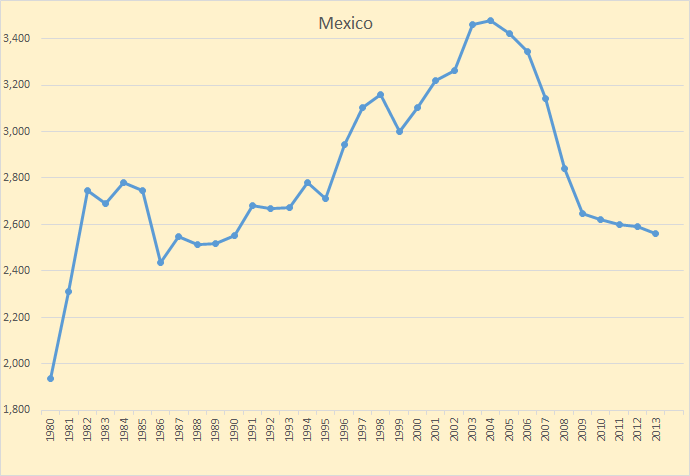

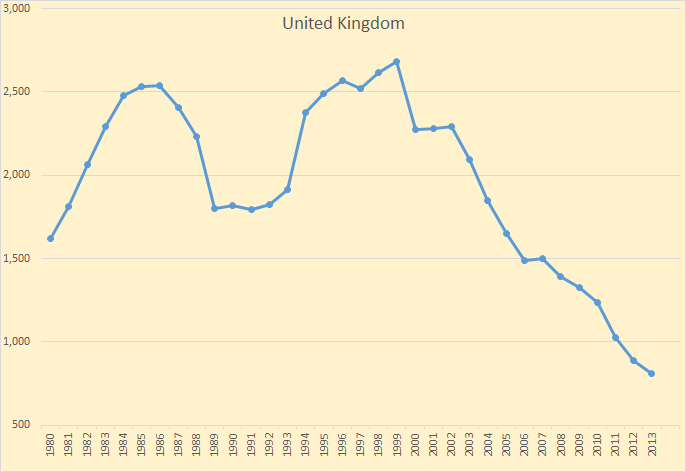

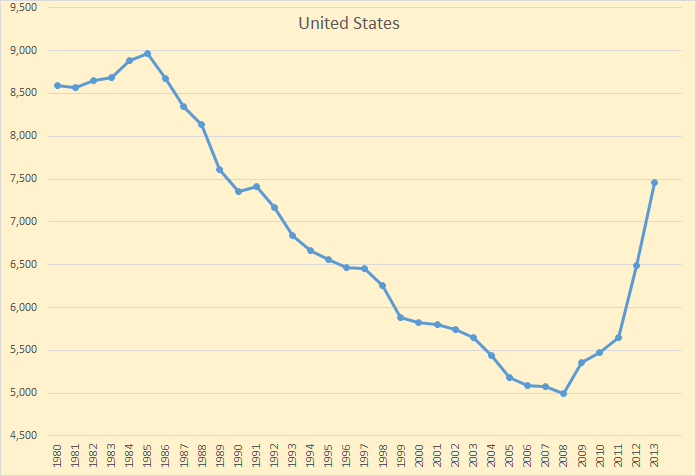

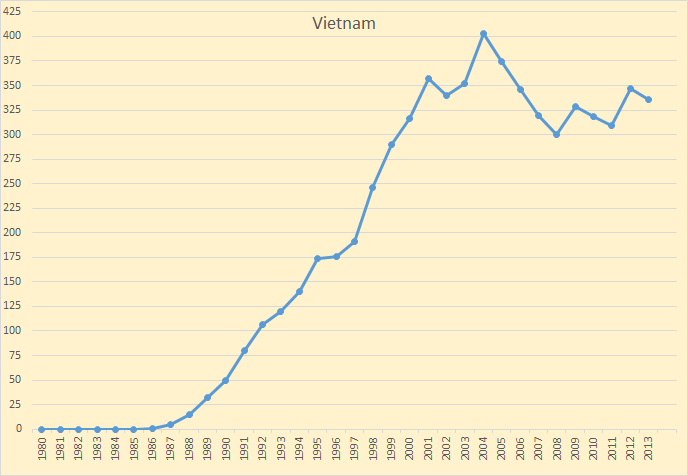

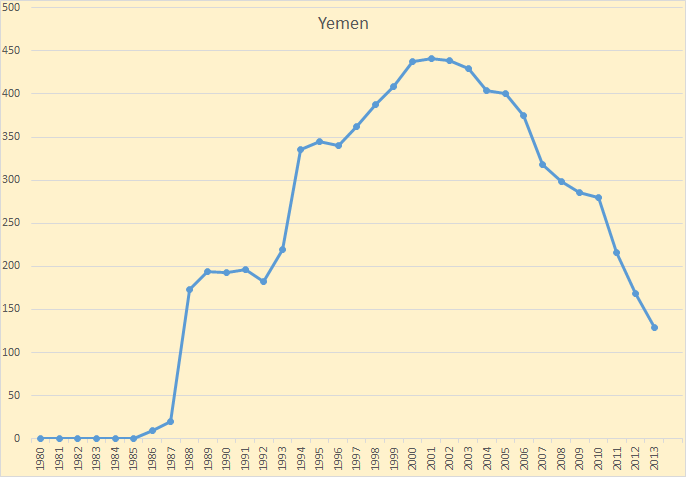

All charts below are through 2013 and in thousand barrels per day.

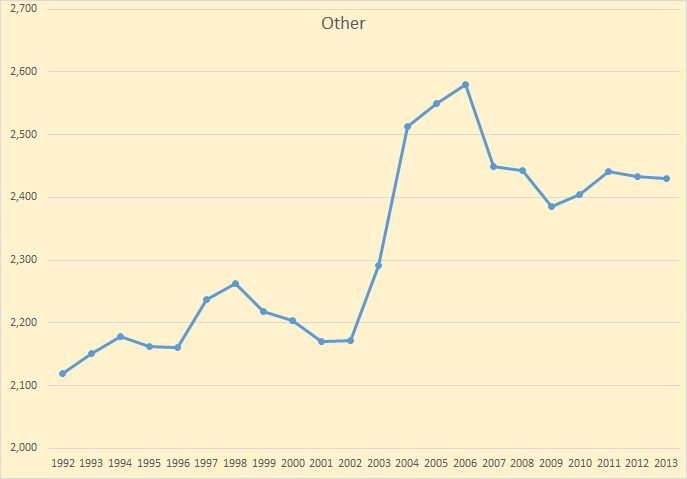

Other is the combined of all Non-OPEC producers not included in the charts above.

Quote of the day from: ‘Peak Oil’ Burned as Exxon, Chevron, Shell See $100 a Barrel

Based on pure economic demand, it should be around $60-70 a barrel, admitted Rex Tillerson, the of ExxonMobil , in 2011. At that time, oil was in the same range of about $100 a barrel. Without speculators, obviously the price of oil would be much lower.

Also worth reading: Big Oil Under Serious Threat

The IEA said in its annual report. Without extra investment to raise production, the natural annual global crude oil depletion rate is 9.1%. The findings suggest the world will struggle to produce enough oil to make up for steep declines in existing fields, such as in the North Sea, Russia and Alaska The effort will become even more acute as prices fall and investment decisions are delayed. Even with investment, the annual rate of output decline is 6.4%.

The article was published yesterday but that quote is from 2008. Apparently the author of the article thought it worth mentioning because it is one of the main reasons Big Oil is in such dire straights today. But what they don’t seem to realize is that the national oil companies have the exact same problem.

198 responses to “Non OPEC Annual C+C Production Charts”

Mr Jonathan Yates is either sort of dense himself or else he is counting on his readers being dense -which I admit is generally a perfectly safe strategy for a businessman or a pr mouthpiece.

But he wouldn’t last five minutes in a debate with a bunch of farmers in a discussion about speculators.Farmers know all there is to know about manipulating markets and so called ” speculators”.

Now it is possible for somebody who makes an early correct guess about a crop coming in light or heavy to make a killing buying or selling futures or actual product but damned few businesses are able to actually buy up and store many thousands of tons of actual real honest to jesus physical corn for instance.

The ones that are capable of doing so are usually going to use it themselves and thereby take themselves out of the market for later season purposes.

Speculation in this sense is pretty much a zero sum game.

There is just simply no way in heaven or hell or here on earth any business – even a multinational bank- can insert itself into the oil business in such a way as to consistently buy cheap and sell high which is what Mr Yates and Mr Tillerson are asking us to believe is responsible for oil selling for thirty or forty bucks a barrel more than they say is justified.

Now is there anybody out there anywhere who is dumb enough to believe that Exon or BP management with all the money and clout and expertise they have on salary are so incompetent as to sell their product for seventy bucks to somebody else who can immediately turn around and sell it again and make a humungous profit approaching seventy percent?Just for buying and selling and maybe paying a few bribes?

Is there any body out there dumb enough to believe there are any oil companies dumb enough to sell at sixty or seventy when they could be getting ninety or a hundred???

Now there are times and occasions when certain business people are able to control the supply of a product that comes to a large market and control the supply of it that reaches end users in a given locality.

OPEC used to be a business organization that had enough clout to control the supply of oil coming to market to a considerable extent.Back in the their glory days the OPEC countries could not only hold back oil but also flood the market and push prices down if they wished to do so. I have no doubt they could hold some back now and push the price up but I doubt if they have enough sustainable excess capacity these days to push them price down to any serious extent for any lengthy period of time such as a year or longer.

There was a time when there were “SEVEN SISTERS” in the oil business and I will not dispute that at times they operated as a cartel or monopoly and manipulated prices.

BUT in either case the doers of the dirty deed of manipulating the market were the OWNERS of the oil- not so called speculators.

Now let us look at the oil business from the consumers end. Individuals can’t shop effectively for a product such as oil to any real extent because there are few suppliers in any given market. But the wholesalers and the refiners are free to go to any seller who can make delivery and they most certainly do so in order to get the best combination of price, quality, and dependable service.

IF an oil pipeline or refinery is not owned by a vertically integrated oil company it is certainly owned by people at least as smart and business savvy as the so called speculators.Will a pipeline and refinery owner charge an extra dime or quarter if he can get away with it? Will the owner of the convenience store nearest your house? Absolutely.

But again the OWNER of the business is the doer of the dirty deed, not some cigar chomping gangster who buys cheap and sells high because he has some sort of strangle hold on the wholesale and retail market.

Is there a cartel that controls diamond prices wholesale and retail? There is, or used to be anyway.The people who own the diamond distribution industry could be called speculators I guess but again they are the OWNERS of the industry, not outsiders.

There are other cartels. There is one controlling the production and distribution of sugar and citrus fruit in the American southern states but again it consists of the owners of the industry plus some politicians in their vest pockets peeking out like Paris Hilton’s fashion accessory miniature dog rather than outsiders.

The Chinese government controls the production and distribution of rare earth metals to a substantial extent- but again the Chinese government is the owner rather than an outsider.

There just isn’t any possible way for ‘ speculators” to insert themselves between the owners of oil and the end users of it in a fashion that would allow them to make profits many times greater than the owners of the industry upstream and down.The only way that could be done would to be to send a squad of gangsters to every board room and shoot a few executives to get the message across- put so much money in the bag (Swiss account ) every week or you are next.

Come to think of it there is such a bunch of all powerful gangsters – tax collectors. The cumulative taxes paid on a gallon of gasoline including all levels from exploration to retailing dwarfs the profits earned by the industry.

Now insofar as our good Mr Yate’s evidence of the demise of peak oil is concerned – the so called evidence he presents hurts his case more than it helps it once the jury’s attention is focused on the fact that real honest to jesus stinky greasy nasty black crude production is flat for the last decade or so while the price is up about four or five times.

But if somebody wants to believe such twaddle – they are going to believe it.And most people want to believe it.

I will add one more thought- the author is some what skilled in mixing in mostly irrelevant truths to his story to support his story. And of course it is conceivable that he believes his own BS.

His estimate of his audience is perfectly obvious in that he is brazen enough to use the ceo of he biggest oil company in the world as a worthy spokesman for his argument. Anybody dumb enough to believe that Tillerson believes that speculators control the price of oil is dumb enough to believe just about anything at all.Why should Tillerson allow outsiders to make several times the profit Exon makes with hardly any risk or work or investment involved? Believing something this irrational is beyond dumb- it is evidence of outright retardation.

It is a clever little trick to portray his own supposed confusion in not understanding Bartletts belief in peak oil.

BUT if he had not been able to understand such matters who believes he could have gotten and held his job?

Portraying Bartlett as brilliant but mistaken is a clever ruse to allow him to get away with implying peak oil advocates are simply mistaken rather than STUPID.

He is thereby inviting his readers to come up to the altar and confess their embarrassing but understandable error in believing that something that comes out of holes in the ground must eventually come up in short supply and join up with the Eternal Church of the Cornucopians.

The new believer will sleep so much better and have his faith in the goodness of God and the USA restored and quit worrying and buy himself a new Surburban or Expedition or maybe even a 32,000 pound motor home.( A bigger one that that requires a CDL.)

Wants and desires trump brains almost every time.

I could go on all evening but nobody who frequents this forum is apt to need this old rooster to rip up this propaganda cow pie to any greater extent than I have already.

Hi OFM,

re: “Is there any body out there dumb enough to believe”…..

People believe what they want to believe and/or need to believe. Some years ago I was discussing PO with some very intelligent friends. I layed out some data and decline rates and got back, “yes, but it is speculation that is really driving the costs”. I couldn’t get past that statement without becoming a pedantic zealot so I simply backed away and retreated to my own beliefs. My friends would rather believe that the game is rigged by speculators than accept there are physical supply and production constraints and that we are ‘there’, or damn close to it.

I am constantly surprised and thankful, despite the GW poised hatchet above our heads, that this Plateau is continuing and still providing time for individuals to try and adapt; both mentally and physically.

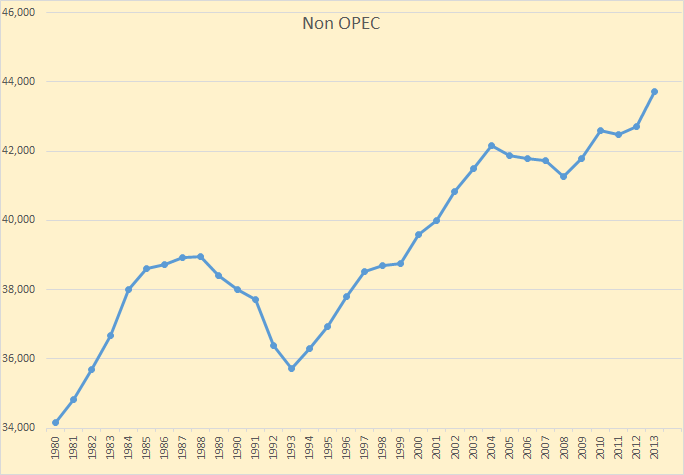

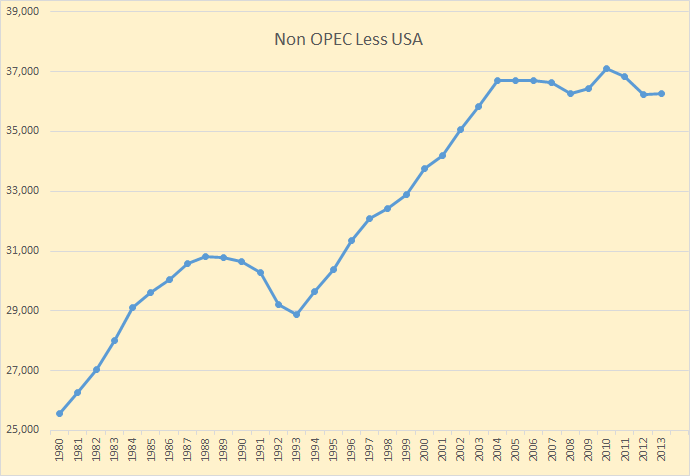

Those graphs are scary and say it all. One after another they portend the future. God help us when the remaining growth producers start to falter. You’ll see some scurrying and hand wringing then. The articles will be full of blame rather than denial.

regards….Paulo

Hi Paulo, I agree totally and have posted that people believe what they want to believe at least a half a dozen times in this very forum.

The question was rhetorically intended for the audience of this forum – which in my estimation is substantially smarter than the average man or woman on the street.

This time I expressed it a little differently saying wants and desires trump brains- referring to the general public of course rather than this audience.

I got it OFM. Glad to see your posts after your long break from TOD. You always have well thought out common sense points and I always read them. They are also very well written.

Paul

Ron, great graphs. So within the non-OPEC, US, Canada, Russia, China, Columbia, and Oman have been rising. Brazil, Kazakhstan, and India are peaking. Others are decliners.

Early sign that world wind and solar power installation may have slowed.

Over the period 2011-2013, the total annual installatin of wind and solar power had been in the range of 70-75 GW a year.

World total annual installation of all types of power plants is about 250 GW. Wind and solar have much lower capacity utilization rates than fossil fuels power plants.

Hi PE

You obviously have the technical and data research skills needed to answer a couple of questions that I believe are critical to understanding how we should look at wind and solar power.

You could do us all a huge good turn if you will answer them for us.

The first one is :

About how much natural gas is saved by a typical utility in relation to the amount of wind and solar power it integrates into its grid?

Wind farms produced about 4.1 percent of our total supply last year. Now if the trade off were perfectly efficient and all load balancing accomplished by using natural gas then we would have saved enough gas to produce that 4.1 percent of total consumption.

About how gas much did we save via wind? I realize part of the saving were probably in the form of coal and biofuels and maybe even a little unused hydro here and there but the answer will never the less throw a lot of sunshine on the value of renewables.

The second question has to do with the price elasticity of coal and natural gas.

I understand this is something that can only be estimated but nevertheless when a technology cuts into the market of a commodity to a significant extent it is to be expected that the price of that commodity will fall to some extent.

Economics is a subject I know only a little about but I do understand that price elasticity can vary substantially short term versus the long term.Estimates for both are no doubt available for both oil and gas but I am not expert at searching for such data and if I found it I would not know how creditable the source of it might be.

Thanks in advance as usual.

Hi Old Farmer mac, many thanks for your flattering comments.

I am actually less competent than you may have believed. I’ll not be able to address all of your questions. But here is some information.

1 GW of wind can produce 1 gigawatt-hour of electricity for any hour when it operates. But a typical wind turbine only operates during one-quarter of the time. Wind industry sometimes claims capacity utilization rates of 35% or even better. But the actual field performance is far worse. The observed capacity utilization rates have been about 25%. A year has 8760 hours. So 1 GW of wind power operates 8760*0.25 = 2190 hours and produces 2190 GWH or 2.19 TWH of electricity in a year.

1 Million Tons of Oil Equivalent = 11.63 Terawatt-Hours of electricity; so 2.19 TWH corresponds to 0.188 million tons of oil equivalent.

But when natural gas is used for electricity generation, part of the energy is wasted. Assuming a thermal efficiency of 38%, it would take 0.496 million ton of oil equivalent of thermal energy to generate 2.19 TWH of electricity.

For natural gas, 1 million tons of oil equivalent = 39.2 billion cubic feet. 0.496 million ton of oil equivalent thus equals 19.425 billion or 19425 million cubic feet. By comparison, US natural gas consumption in the winter months is about 90-100 illion or 90000-100000 million cubic feet per day. So 1 GW of wind power can approximately replace one-firth of the US natural gas consumption in a winter day.

The US now has about 300 GW of coal-fired power plants, 400 GW of natural gas power plants, 100 GW of nuclear power plants, 100 GW of hydro power plants, 60 GW of wind power plants, and a few GW of solar power plants. These are all the power plants the US has built over its entire history–about 1000 GW in total.

If natural gas is used to meet peak power demand or to provide backup, its capacity utilization rates would be similar to wind but natural gas provides an indispensable services to the electric grid. If natural gas is used to provide baseload electricity, like coal, its capacity utilization rates can double or even triple those for wind power plants.

I’ve no idea about the price electricity of coal or natural gas. But as far as the US electric power sector is concerned, it seems to be quite elastic. Historically, coal generates one-half of the US electricity and natural gas generates one-quarter. Last year the natural gas dropped from $4-5/tcf to about $2/tcf. At one point, natural gas overtook coal to become the largest source of US electricity. Now I think coal again accounts for about 40% and natural gas is down to about 30%. Wind is about 3%. Solar is about 0.1%.

In 2012, the US added 13 GW of wind generating capacity, 7 GW of natural gas, and 2 GW of solar. 8 GW of coal fired power retired. Imagine that one day the US will have 1000 GW of wind power (it would take more than 70 years at the current rate), it will be able to replace approximatley 19400 billion cubic feet of natural gas or about 76 percent of the US natural gas consumption in 2012.

But what will be the US natural gas consumption in 2084, with 3% economic growth rate a year from now to 2084? On the other hand, will the US ever build 1000 GW of wind power?

Thanks for all the great data. It will come in handy when I finally get seriously to work on a free little book to be published on the net someday.

Someday somebody is going to answer my key question. IF a wind farm supplies a given utility with a gigawatt hour and that utility uses natural gas exclusively (or nearly so) for load balancing how much gas is thereby saved? IF the utility owns the wind farm the purchase cost of that much gas would be an immediate direct cash reduction in day to day operating expenses- minus of course any day to day cash expenses introduced by integrating the wind power.

IF the wind gigawatt hour is purchased it will save the utility the difference between the purchase cost and the cost of the amount of gas that would have been burnt to generate that gigawatt hour.

This answer would have to be given in cubic feet or cubic meters of gas of course and then the actual price of it computed for any given day unless the utility contracts for its gas deliveries at a fixed price which I think is the usual way of doing things- so far as I have read so far electrical utilities try to stay out of the spot market as best they can.

I know this figure – when I finally locate it- will be an estimate and that it will vary somewhat from one utility to another but surely somebody has the answer.

Any bean counter with access to generation records hour by hour and fuel consumption hour by hour at any given utility could probably come up with the answer for any given day in five minutes or less.The bean counters would include any engineers involved in actual day to day operations as well as accountants.

The reason I am anxious to get an answer is that there are plenty of anti renewables people out there who insist that wind does not save any gas- that a utility using wind actually burns more gas than it would without using any wind.

Now that seems pretty far fetched to me.

But if the utility is forced or mandated to buy the wind power at some fixed price it is possible that maybe it could generate that same gigawatt hour cheaper by buying gas and burning it in an existing up and running gas plant- which would of course be easier and simpler for both the management of a particular utility and for the manager of the grid.

The price of gas may have fallen that low on some occasions in the recent past.

I doubt it will ever fall that low again barring a sudden crash and if it does it will go back up pretty damned quick just as the price of oil rebounded after the last crash.

I don’t know how much wind and solar power can be integrated into our grid without a near total redesign and rebuild of some key components but if my gut feeling is right we will be paying for that redesign and rebuild within the next decade or two as a matter of necessity due to it being cheaper to integrate the wind and sun power than to continue to pay market prices for depleting gas and coal in a world with a growing appetite for energy.

With enough investment in HVDC transmission and wind and solar farms I don’t see any reason we could not eventually get sixty or seventy percent of our electricity from them. This would not solve the backup problem- we would still have to maintain and maybe even expand existing ff capacity somewhat but it sure would cut the cost of buying all that coal and gas to the bone.

A big enough renewables industry combined with a big enough HVDC grid will cut substantially into the load balancing problem in terms of ff consumption.

If the price of FF goes high enough it will be practical to build the renewables industry up to the maximum manageable extent in engineering terms.

I am just a layman but it seems to me that the absolute lowest common denominator in all these debates turns on just one issue- the total costs of fossil fuels going forward- the total cost being the sum of the purchase prices of said fuels and the environmental costs of burning them and the risks assumed in burning them other than environmental damages. These risks include war and acts of god that might stop deliveries for weeks or months such as a major hurricane or earth quake hitting a key industrial region.

There are additional considerations such as the issue of local investments and employment versus paying for imported ff – a huge issue in a country such as Germany or the UK.

good summary. It’s remarkable to me that there is so much so squawking going on about 3.1%.

PE, is this EIA data?

I think one reason the 2012 – 2013 wind capacity is so low is because of the delay in the fed tax credit legislation.

I wonder about rooftop installation / generation numbers. Where do these show up?

The US capacity numbers are EIA data.

The worldwide wind capacity data are from Earth Policy Institute. Solar capacity is from BP. I searched online for the 2013 solar capacity data.

Hard to take the Seeking Alpha article very seriously when they call oil “carbohydrates”.

Goodluck Nigeria – a failed State

With oil production of 2.5 million bpd, significant oil and gas exports have produced a cumulative trade surplus of $298 billion since 1970. Nigeria should be a wealthy, developing nation, but it’s not. Hubbert Linearisation suggests that 61% of Nigeria’s oil may already have been produced.

And three posts on solar that suggest in Scotland, solar has ERoEI less than 1.

The efficiency of solar photovoltaics

Solar Scotland

Solar PV – an irresistible disruptive technology?

The CO2 from embedded energy is in the air today awaiting energy production in 10, 20 and 30 years time that never comes. Solar PV in cloudy climates accelerates emissions.

Great graph!

Here is a link with a ton of good info about Germany’s current gas supply problem.

http://www.spiegel.de/international/business/german-alternatives-to-russian-gas-numerous-but-pricey-a-967682.html

And some more insight (possibly):

https://nexus.nordea.com/#/article/7832

All that happened when some of those graphs were constructed is the person with the ink passed out and the right side of the line then descended to the lower side until the pen dropped from the grapher’s hand. har

They’re just making stuff up and using one country’s name at the top of the chart, all pure fiction. The numbers, the circles, the colored lines, everything is just the pigment of someone’s wild imagination. All good for a laugh or two. There is always some oil somewhere and when that’s gone, it will be somewhere else, so it will never run out. There’s 100,000 years of natural gas, if I may be so bold to predict the real potential of future supplies. There is nothing to worry about and all of the hand wringing is all for naught.

You can be assured that you will rest and sleep like a baby. It’s all good. Nothing to see here, peak oil is just the musings of a few peak oilers on the net flinging words and numbers like they have some real influence and meaning when the reality is there is no end to oil and natural gas. It’s just there and will always be there.

I am not being sarcastic!

A natural gas turbine is part of the Ivanpah solar facility in California.

http://www.energy.ca.gov/sitingcases/ivanpah/

Solar facilities to produce electricity depend upon a fossil fuel to do some of the heavy work.

Wind farms are dependent on fossil fuels and the power grid. They want their cake and want to eat it too.

Can’t escape the need for fossil fuels and the hydro/coal/natural gas/nuclear to generate electricity with decent capacity. Without them, it’s good bye to reliable power supplies.

Coal is going to have a better future with gasification and synthetic fuels. Synthetic fuels derived from coal have a future and just might be superior to oil products used for fuel.

http://www.worldcoal.org/coal/uses-of-coal/coal-to-liquids/

“Coal is going to have a better future with gasification and synthetic fuels. Synthetic fuels derived from coal have a future and just might be superior to oil products used for fuel.”

Unlikely, because it very difficult to scale Coal gasification. To gasify coal efficiently the N2 from air has to be removed. the coal is burned in a tank to produce syngas that is feed to a turbine (for electricity) or to a a chem plant to produce liquid fuels. There is a limit to the size of the tanks and they also need to be clean out routinely to remove ash and slag. You need a thousands of gasifiers just to offset a mpbd of oil. Shell did a NatGas to Liquids plant in Qatar about 5 years ago. The plant produces 120Kbpd and cost ~ $24 Billion. NatGas to Liquids is much easier that coal.

http://en.wikipedia.org/wiki/Pearl_GTL

The US Airforce also tried a syngas pilot for jet fuel at mere $24 per gallon!

Rentech Pilot project for the USAF Jet fuel from NatGas:

http://www.denverpost.com/ci_22691333/rentech-shutter-research-plant-commerce-city-cutting-65

$300 bbl oil would be more cost effective than CTL or perhaps even GTL unless natgas is dirt cheap.

I forget to take MY meds from time to time.

When I do I may post some stuff that is sort of – shall we say poorly articulated? Not quite good humor, not quite sarcasm , not quite serious thoughts.

lol. crazy talk, you’re just talking crazy.

I suppose there may be a company proprietary reason not to publish decline rate numbers for already existing wells, but there shouldn’t really be a reason for the NOCs.

A few years ago a Lukoil executive quoted 6% for this number in an interview, but when asked if that was just Russian property or included Lukoil Africa holdings my recall is the question was not answered, though not as refusal. Rather, the interview just moved on and the reporter wasn’t smart enough to know that was an important question to return to.

Maguerie quotes 3% and gave no source that I recall. IHS has a higher number, also similarly unsourced. Really weird that it’s not an official number, with published methodology.

In California (the 10th largest economy on earth,) yesterday, Renewables outstripped Fossil Fuels by more than 2 to 1.

Almost 3 to 1 if you include Hydro.

I think we need a link for that stat. Exactly what do you mean by “outstripped”. You cannot possibly mean “total consumption”. Perhaps “outstripped” means “growth rate”?

haha ditto

Here’s the California ISO data

http://content.caiso.com/green/renewrpt/20140510_DailyRenewablesWatch.txt

Note that at two o’clock, renewables (non-large hydro) were putting out 8637 Megawatts, and Thermal (nat gas and coal) were accounting for 3807 Megawatts. Hydro was accounting for 1643 MW.

Okay, you were talking only about electricity generation not total consumption of fossil fuels. But if you total thermal, (c0al), nuclear and imports for all hours then they far outstrip renewables. Imports are just electricity they bought from out of state.

Ron, they import some Solar, also. I’m not sure about Wind.

The way renewable production is ramping up in California is quite exciting, but I think we want to be careful about looking at California electricity production rather than California electricity consumption given how much electricity California imports. What we can definitely say is that yesterday (a sunny, windy, not-too-hot day) California-produced renewables made up 25% of California’s electricity consumption. And there were times when renewables exceeded 30%.

However, it looks like California probably imported about a third of its electricity yesterday. (If we don’t take that into account, California could just shift its emissions to other states willing to burn the coal/nat gas for it.) In 2012, (the latest data I can find) of California’s electricity imports from other states, 78% was from thermal or “unspecified” generation sources (which pretty much means not renewables because if it were renewables you can be sure California would take credit for it). While this percentage has probably improved quite a bit since 2012 with all the solar Nevada and Arizona have been adding, since the numbers for 2013 haven’t been announced I think we have to assume that at least 70% of California’s imports are generated by some kind of thermal. So I would say, conservatively, that an additional 23% of California’s electricity came from thermal yesterday on top of what the state generated by thermal.

25% renewables as a percent of electricity consumption in the eighth largest economy in the world (latest data) is nothing to sneeze at, and a great deal more renewable capacity is scheduled to come on line in California over the next six months. However, we have a very hot, non-windy week ahead of us. It’ll be interesting to see what happens.

So California is becoming a parasite? And Hydro is normally counted as renewable. The really interesting thing to see is the make up of the imports. In Europe, wind is much more erratic than it seems to be in California.

California’s no more “parasitic” than it’s always been. Here’s the data from May 10, 2010 (that’s as far back as this data-set goes.)

http://content.caiso.com/green/renewrpt/20100510_DailyRenewablesWatch.txt

As you can see, the Imports are about the same. The difference is in ‘Renewables vs. Thermal (coal, nat gas.)

re: “given how much electricity California imports”

If they keep suing their suppliers (like British Columbia) they won’t be able to continue doing this. I suppose it is easier to litigate than construct and conserve. Too many people, too much consumption, and too few resources make for a shaky future, imho.

Paulo

Well, given renewables production, California could probably have cut way back on imports on Saturday and replaced it with internal thermal generation. I would guess that California has contracts with the other states/power regions stipulating how much they have to buy. As renewables ramp up I would suspect California will be renegotiating these contracts and importing less from other states.

For various political/environmental reasons California does not count large hydro as renewable. California’s onshore wind potential is actually not all that great. Theoretically, northern Europe should be able to make far better use of wind than California.

Factoids:

India is the 4th largest oil importer in the world behind US, China and Japan. Growing fast.

Third largest coal producer. And the location of the greatest concentration of coal fires in the world. haha Go India! Even with all that coal production, they import coal.

India’s oil is concentrated in the west part of the country not too far from Pakistan and most along the seashore. The coal is up northeast near Bangladesh. Oil India Ltd has started some exploration oil drilling up near the coal areas. Not promising so far.

They produce almost all the nat gas they need, mostly from the oil regions, but production has been falling off and imports rising.

A country in the state of development of India will be wanting more and more fossil fuels per capita instead of less per capita which might be the case in well developed countries going forward.

I have no idea where they might get all that oil and gas other than they might outbid other countries in the world market.

An Indian farmer who needs only a couple of gallons of diesel to run his compact tractor or irrigation pump is going to be able to pay a lot more for it than a redneck American country boy with a big diesel pickup trying to hire on at Walmart or Macdonalds.

OFM wrote:

“An Indian farmer who needs only a couple of gallons of diesel to run his compact tractor or irrigation pump is going to be able to pay a lot more for it than a redneck American”

India has a bad inflation problem, so Its unlikely that they will be able out bid the West for Oil and Gas. That said its possible that bottom will fallout in the West causing a western currency collapse.

Former Assistant Secretary of the Treasury, “Wall Street makes profits by …rigging all commodity markets.”

Paul Craig Roberts Warns “The US Economy Is A House Of Cards”

Tyler Durden’s pictureSubmitted by Tyler Durden on 05/11/2014 13:48 -0400in

Authored by Paul Craig Roberts,

The US economy is a house of cards. Every aspect of it is fraudulent, and the illusion of recovery is created with fraudulent statistics.

American capitalism itself is an illusion. All financial markets are rigged. Massive liquidity poured into financial markets by the Federal Reserve’s Quantitative Easing inflates stock and bond prices and drives interest rates, which are supposed to be a measure of the cost of capital, to zero or negative, with the implication that capital is so abundant that its cost is zero and can be had for free. Large enterprises, such as mega-banks and auto manufacturers, that go bankrupt are not permitted to fail. Instead, public debt and money creation are used to cover private losses and keep corporations “too big to fail” afloat at the expense not of shareholders but of people who do not own the shares of the corporations.

Profits are no longer a measure that social welfare is being served by capitalism’s efficient use of resources when profits are achieved by substituting cheaper foreign labor for domestic labor, with resultant decline in consumer purchasing power and rise in income and wealth inequality. In the 21st century, the era of jobs offshoring, the US has experienced an unprecedented explosion in income and wealth inequality. I have made reference to this hard evidence of the failure of capitalism to provide for the social welfare in the traditional economic sense in my book, The Failure of Laissez Faire Capitalism, and Thomas Piketty’s just published book, Capital in the 21st Century, has brought an alarming picture of reality to insouciant economists, such as Paul Krugman. As worrisome as Piketty’s picture is of inequality, I agree with Michael Hudson that the situation is worse than Piketty describes. http://michael-hudson.com/2014/04/pikettys-wealth-gap-wake-up/

Capitalism has been transformed by powerful private interests whose control over governments, courts, and regulatory agencies has turned capitalism into a looting mechanism. Wall Street no longer performs any positive function. Wall Street is a looting mechanism, a deadweight loss to society. Wall Street makes profits by front-running trades with fast computers, by selling fraudulent financial instruments that it is betting against as investment grade securities, by leveraging equity to unprecedented heights, making bets that cannot be covered, and by rigging all commodity markets.

The Federal Reserve and the US Treasury’s “Plunge Protection Team” aid the looting by supporting the stock market with purchases of stock futures, and protect the dollar from the extraordinary money-printing by selling naked shorts into the Comex gold futures market.

The US economy no longer is based on education, hard work, free market prices and the accountability that real free markets impose. Instead, the US economy is based on manipulation of prices, speculative control of commodities, support of the dollar by Washington’s puppet states, manipulated and falsified official statistics, propaganda from the financial media, and inertia by countries, such as Russia and China, who are directly harmed, both economically and politically, by the dollar payments system.

As the governments in most of the rest of the world are incompetent, Washington’s incompetence doesn’t stand out, and this is Washington’s salvation.

But it is not a salvation for Americans who live under Washington’s rule. As all statistical evidence makes completely clear, the share of income and wealth going to the bulk of the US population is declining. This decline means the end of the consumer market that has been the mainstay of the US economy. Now that the mega-rich have even more disproportionate shares of the income and wealth, what happens to an economy based on selling imports and off-shored production of goods and services to a domestic consumer market? How do the vast majority of Americans purchase more when their incomes have not grown for years and have even declined and they are too impoverished to borrow more from banks that won’t lend?

The America in which I grew up was self-sufficient. Foreign trade was a small part of the economy. When I was Assistant Secretary of the Treasury, the US still had a trade surplus except for oil. Offshoring of America’s jobs had not begun, and US earnings on its foreign investments exceeded foreign earnings on US investments. Therefore, America’s earnings abroad covered its energy deficit in its balance of trade.

The economic stability achieved during the Reagan administration was shattered by Wall Street greed. Wall Street threatened corporations with takeovers if the corporations did not produce higher profits by relocating their production of goods and services for American markets abroad. The lower labor costs boosted earnings and stock prices and satisfied Wall Street’s cravings for ever more earnings, but brought an end to the rise in US living standards except for the mega-rich. Financial deregulation loaded the economy with the risks of asset bubbles.

Americans are an amazingly insouciant people. By now any other people would have burnt Wall Street to the ground.

Washington has unique subjects. Americans will take endless abuse and blame some outside government for their predicament–Iraq, Afghanistan, Libya, China, Russia. Such an insouciant and passive people are ideal targets for looting, and their economy, hollowed-out by looting, is a house of cards.

Average:

Ron:

You doubted my claim that commodity markets are manipulated. Do you doubt the Former Assistant Secretary of the Treasury?

Coolreit, I never doubted that interest rates are rigged. In fact rigged is not the proper word for it, the Fed admits that they set interest rates. And that does affect commodity markets. But no, commodity markets are not manipulated. By that I mean that no one, willy nilly, sets the price of oil or gas or even corn or hogs. There is just no way possible that they could do that other than controlling the supply. OPEC occasionally does that and the Hunt brothers tried to do that with silver.

If you think that they are then if you would just explain how it is done then I might accept your explanation. But I have heard many claim that the markets are rigged but I have never heard anyone explain how it is done. If it could be done then someone must be able to explain how it is done.

I was once, for a very brief time in my career, a stock and commodities broker. I know how they work. And there is just no way anyone can, short of buying or selling huge amounts of a given commodity, make the price rise or fall. Of course they can make it move a very small amount by buying or selling a huge amount of contracts. But that does not mean they can make money doing that. For every contract they open they must eventually close. If buying a large amount of contracts make the price rise then when they sell those contracts then the price will fall just as much. They will break even, but only if they are lucky. Most likely they would lose money.

I know electronic traders that trade in milliseconds make money. They are basically “front running”. It should be illegal but it is not. But that only works in the equities market. That system would not work in the commodities markets.

So to answer your question, no the commodities markets are not rigged. The Hunt brothers tried to rig the silver market. They tried to buy up all the silver and corner the market. They lost billions in that attempt. The point is the only way to control the price of any commodity is to control the supply. That is what the Hunt brothers tried to do. They failed. OPEC has, in the past, done a pretty good job however. But now they are all producing flat out. You don’t have a lot of control when you are doing that.

The “Plunge Protection Team” is a joke, it does not exist as such. A group does exist but they do not and cannot prevent plunges in the market.

A Working Group on Financial Markets was created to make financial and economic recommendations to various sectors of the economy in times of economic turbulence. The team consists of the Secretary of the Treasury, the Chairman of the Board of Governors of the Federal Reserve, the Chairman of the SEC and the Chairman of the Commodity Futures Trading Commission. “Plunge Protection Team” was the nickname given to the Working Group by The Washington Post in 1997.

As for Paul Craig Roberts, he’s a corker. He was asst. sec of treas for something or other in the first couple of years of the Reagan Administration. He lasted two years with them. He be a bit of a wild man.

I have long wondered about the claims of gold market manipulation. Are not most of those who short markets repeatedly, eventually forced to eliminate their short positions? Are central bankers exempt? It was amusing when England sold its gold reserves at what turned out to be a massive loss. One can argue that the Hunt Brothers (and associates) bought silver legally. It was Comex that manipulated the market. The following link may be from a biased source but their story is as I recall the situation. I was studying the use of silver in x-ray film at that time including recycling, possible substitutes, poor image quality of low silver films and increased radiation exposure. At the peak price a double coated 14 by 17 inch x-ray film required about two dollars worth of silver. http://members.sonsoflibertyacademy.com/sons-of-liberty-academy-4/module-10-you-can-prepare/the-real-story-on-hunt-brothers-cornering-the-silver-market

I must agree with Ron concerning commodity prices.

It is possible to control commodity prices in a given location to some extent by imposing rationing and to some extent in a given market if a given company controls distribution in that market.This basically means preventing the commodity from being delivered to the end customer who would otherwise buy it – and when this happens it is usually thru a government sanctioned monopoly.

But in the main the only way the price of a commodity can be controlled is to control the supply of it- meaning in essence owning it or at least enough of it to be able to force prices up or down by withholding some or by deliberately flooding the market.

This has been common in the history of the oil business- Standard Oil used to under cut small competitors to run them out of business quite often and quite successfully. OPEC has the power to hold back oil these days and raise prices- if the management of OPEC could stop the member countries from cheating on their quotas.Apparently that power is mostly lacking but if say Saudi Arabia decided to cut sales a couple of million barrels a day the price would shoot up like a rocket.

I just tore this price manipulation argument up like a chicken on a cow turd in the very first comment in this key post.

I will repeat my rhetorical question:

Is any body out there ( who is a regular here) who believes the management of Exon and BP and Royal Dutch Shell- or Pemex or Saudi Aramco for that matter- is incompetent enough to allow a speculator to make more money out of their hard won production than they do by buying it cheap and selling it high without doing the hard work of getting it out of the ground and to refineries?

The mob can send a couple of bad guys to a restaurant in a city up north and extort money from the owner for fear of his windows and his life.That sort of thing does not work in big business.

For that matter it would not even work around here in these backwoods. The bad guys would not last an average of a week apiece before some body filled them full of birdshot – which is invariable fatal at close range. It would be point blank.

As ” Come in here again and I’gonna fill you so full of holes you will look like a sifter bottom.”

We have our troubles with burglars but our indigenous armed robbers stick exclusively to businesses with policies against the employees having a gun handy.

I doubt a mafioso could get within a quarter mile of any employee of Exon who could put his hands on more that a little petty cash ( kept on hand in case a cab or a pizza is wanted in a hurry etc ) belonging to the company.

Now about a little insider trading- as a few million dollars worth per bank and brokerage every hour- made possible without even cheating in the usual sense – because the big banks and brokers can figure out demand and supply faster than everybody else due to having all the data pass thru their hands -I have no doubt that happens.

The banks that own the major credit cards probably know more about the finances of the country than the feds or anybody else – just from data mining their customers accounts.They should be able to outperform the market a little given that handicap.

The seriousness of the situation is exemplified by the rate of gain in production versus increased cost. Since 2000 the gain in production of C+C has been about 13 percent. Compare this to a 400 percent increase in cost per barrel. Any business would dump this scenario ASAP because it makes no sense to put so much effort and money into achieving so little gain. Yet we are hanging much of human civilization on a declining and ever more expensive resource.

In a world that made sense, people would be making every effort to cut utilization of petroleum as fuel. The situation is still running forward however and more resources are being put in place to produce more crude, or anything that can be converted to a fuel. This will lead to a maximum effort, economically and physically, which will lead to exhaustion and reduction of production and then failure of the societal structures. We have seen some examples of this already, and eventually the global reserve structure that can assist in times of crises will also reach maximum effort then collapse.

In a world that made sense, any push toward maximum effort would be in the opposite direction. The effort would be to dramatically reduce dependence on petroleum. The reality is we will lose our dependence on oil no matter what. We can do it the easy way or the hard way. So far the choice by most is the hard way.

Allan,

While I don’t disagree you’re kind of preaching to the choir here and when you say: “In a world that made sense, people would be making every effort to cut utilization of petroleum as fuel”, you might want to add gas and coal to your list.

Perhaps when oceans are a meter higher and half a continent, or so, becomes desert your message will be heard by a wider audience. Meanwhile, don’t hold your breath.

Doug

Doug, I doubt very much that terrible and trying conditions will do more than temporarily shift how people act. They will continue to make bad decisions and attempt to re-align the current paradigm to fit the bad conditions.

Until a large amount of effort is put into studying why humans make and self-reinforce such bad decisions despite knowledge to the contrary, there will be no true change of direction. The changes will have to be led by a total shift in the educational system (originally designed to feed the industrial revolution and now in confusion). Those changes cannot be made without a greater understanding of the psychology of people and societal actions.

I think the answer to this question:

“why humans make and self-reinforce such bad decisions despite knowledge to the contrary,”

is simply that there is no “human mind” at work at the scales at which such decisions are being made. Individuals can make decisions that are rational and sound in light of the facts, but I don’t think that “humanity” or the great collection of humans can make such decisions. Some of the things that “humanity,” writ large, does are simply under control of no one and no thing. Humanity in this situation is simply a mindless force of nature, cutting a swath through space time until it exhausts itself, rather like a hurricane or a volcano. There’s no directing mind at work, just the great mass of humanity doing what it does, triggering reactions and consequences in the environment and this process will continue until it stops. This is regardless of how aware any given individual human being, or groups of human beings are about how “humanity” is impacting the world and itself.

Granted, I haven’t done my dissertation on this conclusion, so I suppose you can’t take it to the bank, but it does seem to explain what we’re seeing in the world at large and what we see in history. Perhaps I’m mistaken, but I’m not getting that sense.

I do agree, there is no unified world human conscious mind to make decisions directly about the world or to even a common knowledge of the world. However, humans do have the ability to muster huge numbers of people, machines, and energy to combat what is perceived as a common enemy. In fact hundreds of millions have cooperated in removing threats. This is done through threat and coercion, but mostly through social training.

If people can be trained to respond to military threats, they can be trained to respond to other type of threats and to work in concert in huge numbers. That has been demonstrated time and again, in fact we do it every day.

The reality is we will lose our dependence on oil no matter what. We can do it the easy way or the hard way.

The choice is between the “hard way” and the “harder way”. There is no easy way. This article explains why.

Peak Oil: A Dilemma Or Two

Ron,

Given human nature, perhaps there are no choices: It’s just the way we do things. When I look at the world population graph you posted earlier, that ugly spike, I see disaster. Why argue if we’re going to grow two or 20 billion new people? There are already (far) too many of us.

Meanwhile, the longer the plateau drags out, the more fuel gets burnt and the really bad climate change scenario shifts from possible to probable and, before you know it, really bad becomes our new reality. You regularly hear climatologists saying (off the record) we had to water down our report to satisfy somebody or other. So where are on that curve, really?

Doug

Hi Doug,

Most realistic population estimates top out at about 11 billion at most, the UN’s low fertility scenario (which is still conservative) peaks at 8.3 billion in 2050.

The low fertility scenario has the world total fertility ratio (TFR=average births per woman over their entire lives) decreasing to 1.75 by mid century and 1.51 by the end of the 21st century. In the Medium fertility scenario the TFR falls to 1.99 by the end of the century, note that for the World the TFR fell from 5 in 1960 to 2.5 in 2010, so for the TFR to fall by less than half in 50 years (in 2060) to a 1.5 level is not unrealistic. Chart for low fertility and medium fertility scenarios below.

Hi Doug,

I think I misread your comment. You meant it doesn’t matter if population grows by 2 or 20 billion (I think). My eye focused in on the 20 billion, population will come down one way or another. If we choose to act we might do it in a less bad way (for humans anyway). For other species the quicker the better (maybe), but if things get really bad really fast then as Ron has pointed out it won’t necessarily be better for wild species as humans will try to do whatever it takes to survive (including eating all the birds from the trees).

Hi Dennis,

Yeh, 2 or 20. I was always taught single digit numbers had to be written out (in text) and the habit remains. Can see how you misread it and thanks for mentioning it.

Doug

Hi Ron,

That link did not work for me.

http://peakoilmatters.com/category/peak-oil/

The above link may work.

A good article, thanks.

Ron:

I will continue to depend on your work on peak oil as a great contribution to the understanding of and about peak oil. With respect to commodity and other markets, I will depend on the Former Assistant Secretary of the Treasury. His bio speaks to his knowledge:

Biography[edit]

Roberts is a graduate of the Georgia Institute of Technology and holds a Ph.D. from the University of Virginia. He was a post-graduate at the University of California, Berkeley and at Merton College, Oxford University.[3] His first scholarly article (Classica et Mediaevalia) was a reformulation of “The Pirenne Thesis.”

From 1975 to 1978, Roberts served on the congressional staff. As economic counsel to Congressman Jack Kemp,[4] he drafted the Kemp-Roth bill (which became the Economic Recovery Tax Act of 1981). He played a leading role in developing bipartisan support for a supply-side economic policy.[3] Due to his influential 1978 article on tax burden for Harper’s,[5] while economic counsel to Senator Orrin Hatch,[6] the Wall Street Journal editor Robert L. Bartley offered him an editorial slot. He wrote for the WSJ until 1980.[7] He was a senior fellow in political economy at the Center for Strategic and International Studies, then part of Georgetown University.[4]

From early 1981 to January 1982, Roberts served as Assistant Secretary of the Treasury for Economic Policy. President Ronald Reagan and Treasury Secretary Donald Regan credited him with a major role in the Economic Recovery Tax Act of 1981, and he was awarded the Treasury Department’s Meritorious Service Award for “outstanding contributions to the formulation of United States economic policy.”[3]

Roberts resigned in January 1982 to become the first occupant of the William E. Simon Chair for Economic Policy at the Center for Strategic and International Studies, then part of Georgetown University.[8] He held this position until 1993. He went on to write The Supply-Side Revolution (1984), in which he explained the reformulation of macroeconomic theory and policy which he had helped to develop.

From 1993 to 1996, he was a Distinguished Fellow at the Cato Institute. He also was a Senior Research Fellow at the Hoover Institution.[3]

Simon Johnson, former chief economist for the IMF and now MIT Professor of Economics has written extensively about the corruption/fraud as well. For example, he wrote, “”The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government – a state of affairs that more typically describes emerging markets, and is at the center of many emerging-market crises. If the IMF’s staff could speak freely about the U.S., it would tell us what it tells all countries in this situation; recovery will fail unless we break the financial oligarchy that is blocking essential reform.” ~ The Atlantic Monthly, May 2009, by Simon Johnson

So, you can believe what you want, but various highly experienced and expert economists and many others like Zerohedge have exposed the massive corruption you choose to ignore.

No, you don’t understand. Sure there is corruption. They find ways to buy when they know a big buy is coming, or sell when they get wind that some hedge fund is about to dump a huge block. But they cannot fix prices. That is impossible. That’s my point. It is impossible to fix the price when there are thousands of traders just waiting to buy or sell when the market moves in their direction. It simply cannot be done.

But the offer still stands. If you think they can do it then tell me how they do it. Surely if you have read all these stories about how it is fixed then at least one of them told how it was done.

$4,000,000,000,000.00 buys a lot. That’s what Quantitative easing has provided the bankers to set pricing in all markets:

“The Federal Reserve is carrying a more than $4 trillion book of debt that was never raised to help the population, while it maintains near zero percent interest rates to provide the big banks cheap money.”

http://www.truth-out.org/progressivepicks/item/22953-the-oligarchy-doesnt-care-about-democracy-just-rigged-markets

Michael Lewis on rigged markets: http://www.cnbc.com/id/101544758

Summarizing The Known Rigged Markets: http://www.zerohedge.com/news/2013-06-12/summarizing-known-rigged-markets

http://www.zerohedge.com/news/2014-04-14/things-make-you-go-hmmm-rigged-markets-all-them

http://nypost.com/2014/04/27/finra-investigating-etrade-for-potentially-rigged-markets/

http://www.marketoracle.co.uk/Article45217.html

You can lead a horse to water, but you can’t make him drink!

“Charles Schwab stated that “High-frequency trading is a growing cancer that needs to be addressed… High-frequency traders are gaming the system, reaping billions in the process and undermining investor confidence in the fairness of the markets.””

http://www.prudentbear.com/2014/04/hft-rigged-markets-and-man.html#.U3DZ1fldXTo

Ron,

The Fed, U.S. Treasury and the PPT -Plunge Protection Team have been manipulated the markets for quite some time… especially since 2008. This is no conspiracy. GATA – Gold Anti-Trust Action Committee proves on several points how the gold market is rigged: http://www.gata.org/node/13829

This goes well beyond hedge funds or banks making profits knowing a big DIP or big MOVE HIGHER is coming. Since QE3 started at the end of 2012, the broader stock markets have gone up 34% while gold and silver were clobbered from $1,700 & $35 to $1,300 and $20.

All the QE was siphoned into the bond and stock markets. You don’t find that MANIPULATED one bit? Come on Ron…. don’t you realize the Fed never stopped tapering…. they just got Belgium to buy the worthless paper garbage called U.S. Treasuries.

While the price of gold fell to below $1,300… the Chinese continue to purchase record amounts of gold… as well as the Russians and Indians. Those here who think gold is a Barbarous Relic… just wait until the BRICS start their own gold-backed currency while the U.S. West dies the death of thousand paper cuts from the worthless Dollar.

steve

Steve,

I think I agree: Think because I know nothing about economics. But its hard for me to see QE as anything but an prop that makes markets look good at the expense of almost everything else. How can anything all that bad if the great DOW is at record high levels, right?

Doug

Steve, you are calling Quantitative Easing “manipulating”? Or, from your link:

For 15 years the Gold Anti-Trust Action Committee has been documenting and publicizing the largely surreptitious manipulation of the gold market by Western central banks, a longstanding policy of gold price suppression aimed at controlling the currency markets and interest rates. While GATA is a research, educational, and civil rights organization, those who object to examination of our topic call us a “conspiracy theory” organization.

There is much conspiracy here, but it is easily ascertainable as fact rather than mere theory, conspiracy occurring whenever people gather in secret to plan or implement some undertaking or policy. Meeting in secret to plan or implement policy is, of course, the very definition of modern central banking.

Give me a break! The Fed sets the Federal Funds Rate which greatly influences interest rates. That is what they do! That is their job. They are trying to stimulate the economy in a recession or prevent inflation in a booming economy. Setting the Federal Funds Rate is not manipulating the market.

Point #2: Five trillion dollars per day changes hands on the FOREX. No one has enough money to control the currency market. It simply cannot be done.

Those conspiracy theorist on that blog haven’t a clue as to what the hell they are talking about. Simply because gold prices are not rising as fast and to the level they think they should be, they claim there is a conspiracy controlling the market. Well just how the hell do they do that?

Well the fed meets in secret so there must be something doing something behind those closed doors to manipulate the market. Right? The Fed is the Federal Reserve Bank. They do not open their doors to the public when they have meetings. That is what banks do. That does not mean they are conspiring to screw gold traders over.

Ron,

The Fed is not an U.S. institution at all. Its owned by mostly foreign banks and entities. I am surprised that you believe the FED is allowed to control interest rates.

Ron, I have a great deal of respect for you when it comes to Energy, but I have to say, you have no clue as to the real value of money. Unfortunately, Americans have no clue that the Fed prints money out of thin air and charges the public an interest rate which the profits go to the members who own the Federal Reserve.

The Federal Reserve is guilty of committing the LARGEST CHECK FRAUD on the planet.

Again, the FED is not an U.S. institution at all. If you think the U.S. Economy is being kept alive by the FED’s QE policy, then you don’t realize it is the biggest transfer of wealth in the history of the country.

The MARKET IS SUPPOSED SET INTEREST RATES… not the FED. Why on earth would you believe a NON U.S. institution would be allowed to set rates in this country?

steve

Again I agree with Ron.

I never understood the fixation on Gold.

People could refuse to trade their goods for gold just as well as they could for dollars. When it comes down to it, gold is really not that useful a metal. It is shiny though.

The late 1800s saw somewhat perpetual deflation because most currencies were locked into gold backing, and the production of the stuff out of the ground just wasn’t fast. So choked money supply was preventing growth.

And then in an after the fact persepective, there is the Goldfinger scenario, where if you mine it and irradiate it, you wipe out currency underpinning and can destroy some country’s wealth base. Or if someone wants to rationalize existence, then postulate instead launching a few tons into the sun. Anyway, in such an instance, the country would have the same population, the same military, the same economy, but because Fort Knox got irradiated (or robbed and launched), you are required to reduce money supply and choke off economic activity. That sort of thing kills people.

To understand the importance of gold, one must only correlate gold prices to oil prices over the long term. They are 1-to-1.

Why would the most useless commodity correlate nearly perfectly to the most useful commodity known to man?

The Fed is not an U.S. institution at all. Its owned by mostly foreign banks and entities. I am surprised that you believe the Fed is allowed to control interest rates.

Steve, I know what the Fed is. Just how dumb do you think I am anyway. And you really need to read my post again. I never stated that the fed controls interest rates. Let me copy and paste what I said again:

The Fed sets the Federal Funds Rate which greatly influences interest rates.

Question: Why were you so shocked at that statement? Do you doubt that the Fed sets the Federal Funds Rate, or do you doubt that the Federal Funds Rate greatly influences interest rates?

Again, the FED is not an U.S. institution at all. If you think the U.S. Economy is being kept alive by the FED’s QE policy, then you don’t realize it is the biggest transfer of wealth in the history of the country.

Again, I know what the Fed is. I have been following US monetary policy for years and I am very familiar with what the Fed is and who runs it. And I never said the economy is being kept alive by QE. I simply tried to explain part, but not all, of what the Fed does.

Everything I wrote is so simple and straight forward. How could you interpret so different. Again:

1. I know what the Fed is.

2. The Fed, or the FOMC, a branch of the Fed, does set the Federal Funds Rate.

3. This does greatly influence interest rates.

4. The economy is not kept by the Fed’s QE policy and I never made any claim that it was.

5. I know the exact value of money. Money has value as long as people have faith that it has value. It is all based on faith. If you believe a dollar will buy a pound of beans and your grocer believes the same thing then the dollar is worth one pound of beans. But if people lose faith in that dollar and will not give you anything in return for it then it is worthless.

But I dearly hope you already knew that. I would not for one minute assume what you know and don’t know unless you specifically stated otherwise.

Ron,

Money based on Faith? Are you kidding me? So, 2000+ years of gold and silver… were complete hogwash?

Ron… there are several high ranking EX-GOVT officials who are quite open how the FED is the biggest Ponzi Scheme in history. Bar None.

This chart says it all. Funny, since QE3 the price of gold fell while the Bond and Stock markets went towards the moon. As we can see from this chart, the price of gold increased right along with the U.S. Debt.

Something funny took place at the end of 2012. Do you really think this is a FREE MARKET…LOL.

Just about any high level trader in the markets realizes this is the BIGGEST PUMP in history. Hell, anyone on Wall Street can tell you without the FED pumping up the markets… we would have a serious crash.

Don’t worry… the crash is coming.

steve

Money based on Faith? Are you kidding me? So, 2000+ years of gold and silver… were complete hogwash?

Steve, for 2000 years money may have been based on gold or silver but the dollars in your wallet is based on absolutely nothing but faith.

What Really Backs the U.S. Dollar?

Since 1971, U.S. citizens have been able to utilize Federal Reserve Notes as the only form of money and for the first time had no currency with any gold or silver backing.

This is where you get the saying that U.S. dollars are backed by the “full faith and credit” of the U.S. Government. In other words, Nixon implied take our paper dollars or don’t.

Nixon took us off the gold standard Steve. I just assumed you knew that since you are a gold bug. I am shocked, shocked I say! 😉

Ron,

Are you kidding me? When did Nixon drop the Gold-Dollar Peg? I never heard of such a thing. Do you mean… we can’t trade in our Dollar for gold anymore?

Lord have mercy…where in the living Hades have I been?

steve

Ron –

This isn’t exactly true. Since 1973, the dollar has been backed by Saudi oil, priced in dollars. If you wanted Saudi oil, you had to have dollars. This led to the US’ ability to print dollars for oil, our “exorbitant privilege” if you will.

Here’s where it gets interesting: If the USD could never lose its status as the sole oil currency, then why would the US ever consider exporting crude oil for…(wait for it)…DOLLARS? 🙂

The answer is simple: The USD has already lost its reserve status as sole oil currency…US financial markets haven’t quite figured it out yet…(but they’re starting to, which is why risk & asset prices are beginning to diverge in USD’s)…

This isn’t exactly true. Since 1973, the dollar has been backed by Saudi oil, priced in dollars. If you wanted Saudi oil, you had to have dollars. This led to the US’ ability to print dollars for oil, our “exorbitant privilege” if you will.

I really haven’t a clue as to what you are talking about. If all Saudi has is Saudi Riyals, or Euros, they could convert them into dollars in a couple of milliseconds on the FOREX. The cost is the difference between the bid and ask price, or about three basis points. (Three cents per one hundred dollars.)

No one must hold dollars in reserve anymore since the FOREX came into existence in 1973. Oil is priced in dollars because we need a common benchmark to set the price. The term “reserve currency” is really a misnomer since no one must hold dollars in reserve anymore.

The FOREX never closes. About 5 trillion dollars in US and other currencies is traded daily on the FOREX. Anyone can get dollars almost instantly on the FOREX. They don’t have to keep any in reserve.

Coolreit, please don’t get upset at me. There are a lot of myths floating around out there. All I am trying to do is dispel them. The fact that oil is priced in dollars means little. I am sure there is some status attached to it, and a whole lot of convenience. Imagine what it would be like if every producing country priced their oil in their local currency.

Ron-

Practically speaking, you are right…but things aren’t that simple.

Every day, the world produces 86m b/d of oil, give or take. Let’s use $100/b for easy math. 86mbd x $100 = $8.6B per day.

That’s $250B per month, $3T per year.

You can say that “if someone wants, they can take oil money out of dollars and put it in any currency they want, but as a practical matter, there are only a couple asset markets big enough for them to handle $3T per year…and after US Treasuries & stocks, the list starts to get fairly short.

Now, imagine you sold oil all these years for dollars and bought US Treasury bonds…as your chart showed, in 1970, your $1,000 face UST bond bought you 500 barrels of oil at $2/bbl. Now that same bond buys you 10 barrels…

That’s a 40-yr time horizon, so let’s use 10 years. 10 years ago, every $1,000 UST bond bought you 40 barrels of oil. Now it buys you 10 barrels of oil. Why would you sell oil and put it into UST’s?

If you are in favor of that, I am happy to announce that you can have a job at my house any time you like…I’ll pay you in IOUs that lose 80% of their purchasing power every 10 yrs! 🙂

Coolreit,

Every day, the world produces 86m b/d of oil, give or take. Let’s use $100/b for easy math. 86mbd x $100 = $8.6B per day.

No, it’s 76 million b/d, not 86. You are counting NGLs and that does not go for $100 a barrel. I have no idea what price NGLs are going for but I don’t think they are anywhere close to crude oil.

As for the rest of your post I cannot really figure out what you are talking about. I am not pushing US bonds or any other product. I don’t care what oil exporters do with their money. But I can tell you that most of it does not go into US debt instruments. It goes to keep their citizens happy. The break even price for most of them is over $100 a barrel.

Re: Coolreit

I would just add that condensate also sells at a discount to crude oil. An excerpt from my post down the way:

“As I have periodically noted, when we ask for the price of oil, we get the price of 45 or lower API gravity crude oil, but when we ask for the volume of oil, we get some combination of crude oil + condensate + NGL + biofuels + refinery gains.

“I’m not an economist, but shouldn’t the price of an item relate to the quantity of the item being priced, not the quantify of the item + (partial) substitutes?”

Steve – post a chart of gold correlating to oil, dating back to 1968.

They correlate nearly 1-to-1…odd thing, no?

If you know that & understand the structure of the gold futures markets, then it makes perfect sense why gold prices in the face of record physical demand.

Not exactly….

Oil Priced in Gold

the price of oil had to be jacked up somehow to make fracking at least marginally profitable… but ow do you do that without citing peak oil?

people like exxon, who’ve relentlessly denied peak oil, couldnt just haul off and suddenly acknowledge peak oil, and say diminishing supplies will make fracking necessary, but we need way higher oil prices to be able to frack

apparently that’s when the “peak oil awareness” project got cranked up… the oil price overshot pretty bad, which caused a global economic crisis which wrecked demand which caused the price of oil to fall way below what was necessary for fracking, but the oil price soon climbed back up again and the fracking got going

so now we got this “peak oil is dead” propaganda blitz

wonderful

Coolhand,

Well, we are basing GOLD’s value on the Dollar. What happens when “Faith” in the Dollar dies the East starts a new Gold-backed currency?

How will Americans value oil then… while they are holding onto worthless monopoly money as the west exported most of its gold already?

steve

So since 1970, oil has generally been around 2.5g of gold per barrel with a range of 1.0g to 4.5g.

Compare that to oil in dollars in that same time, which went from $2 to $147…which is the better store of value?

If there is one commodity in the world that can be price manipulated it would be gold- but while gold has a few important uses other than as money it is not really a commodity in any usual sense of the word.

The price of gold is controlled mostly by fear and secondarily by people who jump into and out of the market when they think the price will be going up or down – these people really are speculating.

But fear is the main thing in pricing gold. When people are afraid that the fiat money is headed to hell in a hand basket the price of gold shoots up.

When some substantial period of time goes by without fiat money collapsing the fear subsides and the price drifts down.

It is as simple as that. Gold doesn’t pay any dividends and it doesn’t draw any interest like cash which can be loaned. It is only natural that once the price gets up there due to fear of a financial disaster of some sort that it will drift back down when the disaster fails to materialize.

Why should anybody expect the price of gold to just keep on going up other than fear of collapse? You can’t eat it and you can’t really even use it as money because the supply is too small.

It seems to be the cast that all central banks plan on deliberate inflation and that when the economy gets into the doldrums all central banks seem to get into the stimulus business after a while.Stimulus means rising prices. When prices go up gold goes up too- and a bank that pays gold for paper is soon out of gold unless it can keep its paper from inflating. I don’t know of any currencies that are not subject to inflation in modern times.

But within this larger envelope central banks are the actual owners of a hell of a lot of gold and as such are big enough to buy and sell and force some variation in the price.

The Hunt brothers weren’t able to corner the silver market but I am willing to consider the possibility that China and India and some other countries are buying on price dips and hoarding gold both in private and in bank hands.

We can call this speculation if we want to but since the parties involved are the actual owners…….

Now as far as any bureaucrat who is not too worried about getting appointed to another high level job making bullshit speeches and claims– most of them are willing to do so for a speaking fee or to help their buddies get elected or get a law passed.

This former asst sec of the Treasury would say damnd near anything he could possibly hope to get away with given a reason. he is not hoping for another appointment in DC -unless maybe the tea party wins control.He isn’t going to be grilled by a congressional or senate committee digging thru his old press releases ever again.

I am a conservative myself but not the kind that controls the present day so called conservative movement or the GOP.

The organizations he works with are hardly any better than propaganda machines in a lot of respects and not above bending the truth into a pretzel in a lot of cases.( This is not to say they are not right about some things -they are right about a whole lot of things.Hardly anybody is wrong about everything.)

The people who know what is going on know when to ignore statements like Tillerson saying oil would be forty bucks cheaper except for speculators or this former asst sec saying everything is scam from start to finish in the market place.

I do not doubt that powerful banks and politicians can manipulate markets to some small extent some of the time in some markets.But such manipulation is not a game changer in any sense of the word.

There is nothing for example to stop any large business – or any small one for that matter— from buying grain directly from a farmer like me. Cargill may be able to control the grain market to a very minor extent. But if the spread between what a farmer sells for and what a baker pays for wheat gets a little too big – farmer and baker can bypass the middle man.

Agree with your general argument (prices aren’t rigged), but to your comment, “Why should anybody expect the price of gold to just keep on going up other than fear of collapse? ”

The reason gold will go up in price is the same reason oil is going up, it’s getting harder and harder to find more of it.

The major gold miners are facing very similar circumstances to the major oil companies, fast rising costs and political headaches that mean even with the price of their product much higher than it was for most of the last few decades, they are struggling to provide a positive return on investment.

Steve:

You have a complete knowledge of the massive fed fraud. Thanks for chiming in!

This is the chart I like to throw around for KICKS & GIGGLES. Americans are invested in the biggest Ponzi scheme in history. Why? Because all those worthless RETIREMENT ASSETS (really liabilities) are backed by a growing energy supply.

Without a growing energy supply, the U.S. Retirement market currently standing at a bloated $23 Trillion in nothing more than a GLORIFIED PAPER TURD ready to be flushed down the toilet.

I am surprised that more here who understand energy, do not understand that paper assets derive their value from BURNING ENERGY… which is getting ready to peak.

I got my BETS on gold and silver. Let’s see where the chips fall.

steve

Coolhand,

Here are some GOLD-OIL price ratios:

1935 = 35 to 1

1971 = 18 to 1 (death of Dollar-Gold Peg)

1980 = 17 to 1

2002 = 12 to 1

2011 = 14 to 1 (gold high for year)

2014 = 12 to 1

Gold has been steadily falling against oil. That is due to the Grand Petro-Dollar Scheme as well as increasing U.S. Treasury debt to over $17 trillion.

steve