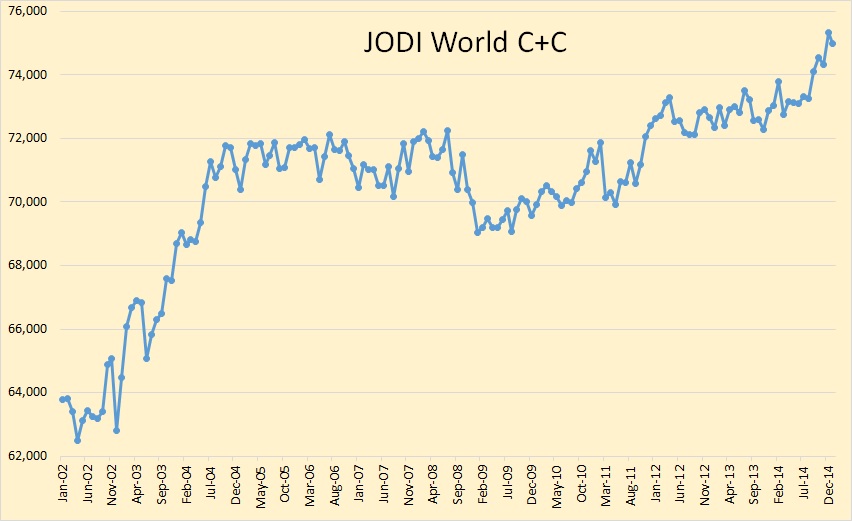

The JODI data just came in with production numbers for January 2015. I really don’t like JODI all that much but they are about two and one half months ahead of the EIA with their world data. And their data is incomplete so I have to substitute the EIA data for the countries that do not report to JODI. So the data I use is about 95% JODI and about 5% EIA. The last data point is January 2015 and is in thousand barrels per day.

We peaked in December at 75,342,000 bpd but dropped 356,000 bpd in January to 74,986 bpd.

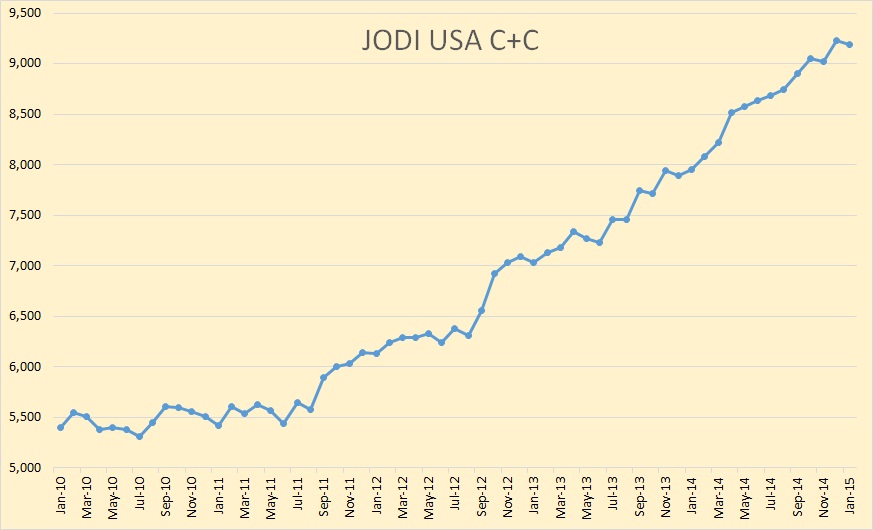

JODI has the US at 9,226,000 in December but dropping 34,000 bpd in January to 9,192,000 bpd. The US did not start its grand ascent until the summer of 2011 when the shale oil boom exploded.

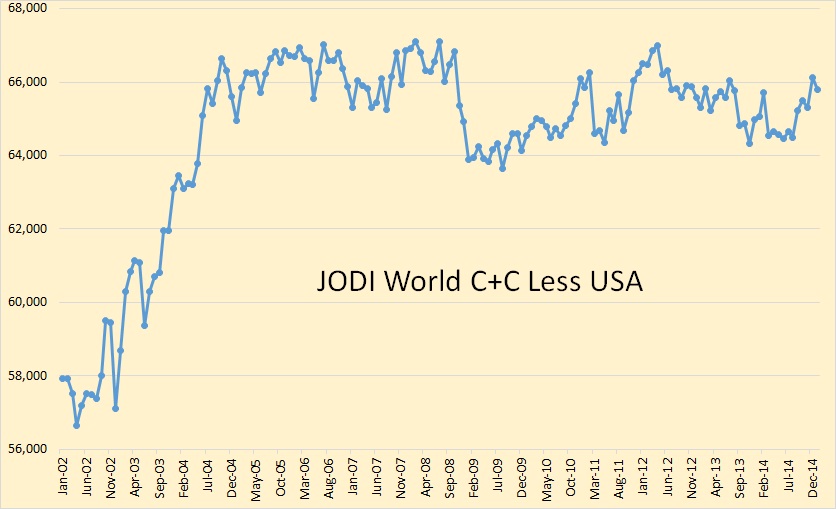

Without that shale surge in the USA here is what World C+C production looks like. Less USA production is down just over 1.3 million barrels per day from its July 2008 peak and down just over 1.2 million barrels per day from its April 2012 peak.

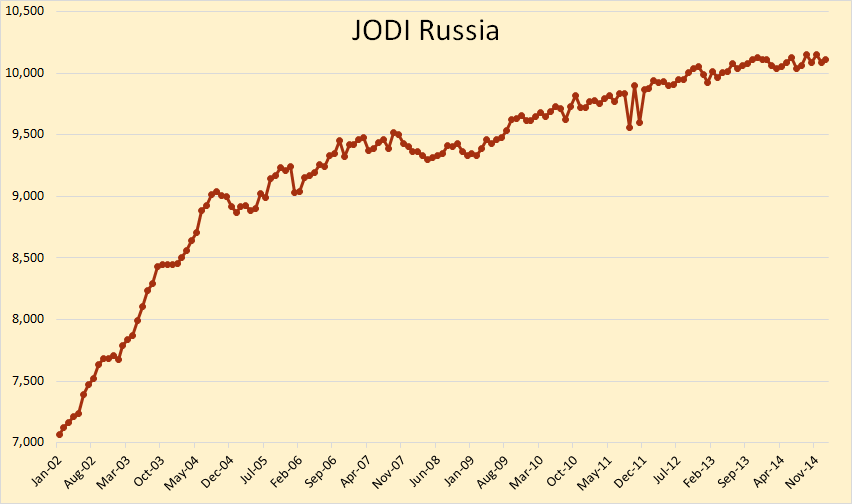

The only other JODI chart of note is Russia. Russian January production stood at 10,110,000 barrels per day. Expect Russia to be slightly down for the rest of the year then down a lot more in 2016.

Iraqi Dreaming

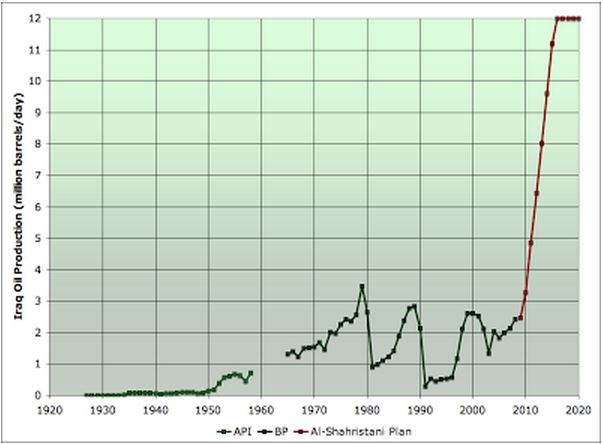

In late 2009 Iraq held a series of auctions for production service contracts at the largest fields. The Iraqi oil minister, Hussain al-Shahristani, estimated that Iraq will be able to produce 6m barrels a day by 2017 based on the deals announced to December 2009. However, the country hopes to raise production to 12 million barrels per day over this period based on all deals it was negotiating at end 2009. 12 million bopd is around 15% of 2008 oil demand, and almost as much as the #1 producer, Saudi Arabia, could provide. These production forecasts seem optimistic, but significant increases remain possible.

Imagine that, 12 million barrels per day. This announcement prompted Stuart Staniford to announce that Iraq Could Delay Peak Oil a Decade, and he created the below graph to show what just might happen.

According to that graph Iraq should be producing about 9.7 million barrels per day right now. However they are just a tad over one third that amount today, they were at 3,320,000 bpd in February according to the OPEC MOMR. And it will never happen. Iraq will, very soon, begin to decline.

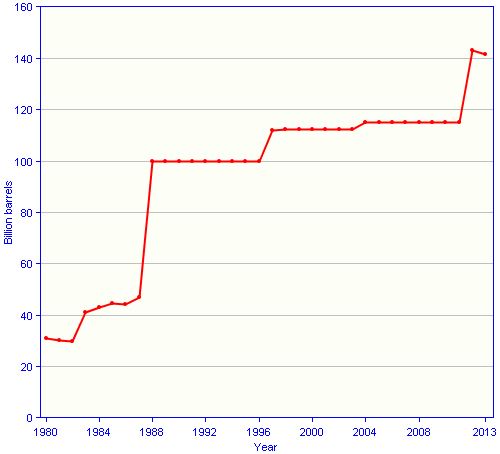

But according to the EIA, the IEA, BP and just about everyone else in the world, Iraq has vast, vast reserves. Wiki has this to say about Oil reserves in Iraq quoting the EIA:

As a result of military occupation and civil unrest, the official statistics have not been revised since 2001 and are largely based on 2-D seismic data from three decades ago. International geologists and consultants have estimated that unexplored territory may contain vastly larger reserves.

The problem is that “international geologists and consultants had nothing to do with it. Iraqi officials in Bagdad decided that Iraq had far more reserves than was originally reported. Below is a field by field of Iraqi reserves.

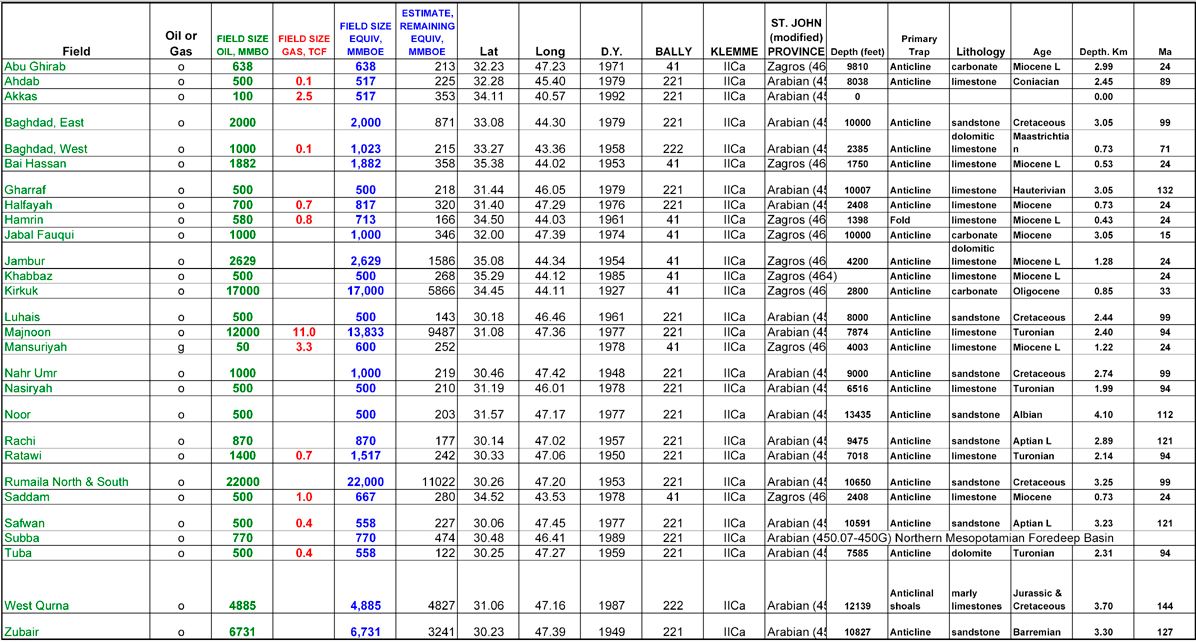

A better view of Iraqi oil reserves can be found in this 2003 paper: GIS in an Overview of Iraq Petroleum Geology. And the entire caption to Table 1 turned out to be a link with every stat on every Iraqi field you would want. That is the location, depth, discovery year, type of trap, lithology, and a few other stats which I have no idea what they mean.

Table 1. Database of giant fields in Iraq, showing basic geologic features and estimates of ultimate recovery and reserves (from Horn, 2003 [with minor revision]). Basic data sources for Horn (2003): Halbouty et al., 1970; Carmalt and St. John, 1986; I.H.S. Energy Group, 1998, Selected giant field data (with kind permission to publish granted 2002); supported by 35 additional sources.

Here below is that chart.

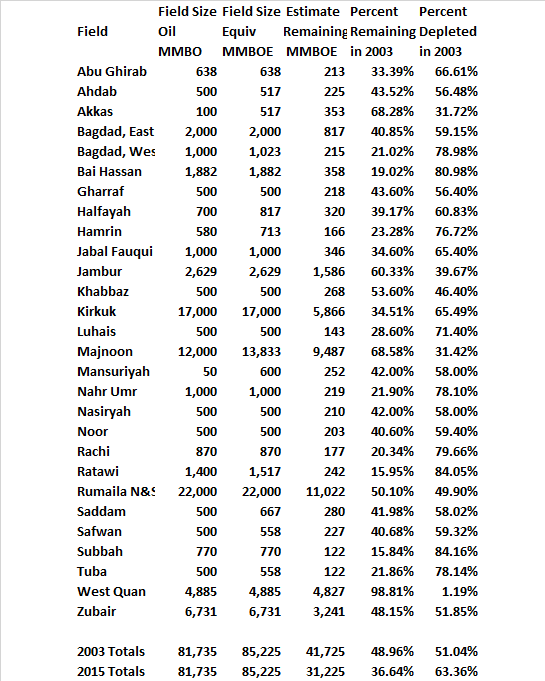

Of course the data is too small to read here but just click on the “Table 1” link and it becomes very readable. I have copied the pertinent data below and added a few calculations.

In 2003 Iraq was 51% depleted. In the 12 years since the end of 2002, Iraq has produced about 10.5 billion barrels. That means they have about 31.225 billion barrels of reserves left.

Every OPEC nation is in about the same position as Iraq including Kuwait and Saudi Arabia. In January of 2006 Petroleum Intelligence announced that Kuwait only had 48 billion barrels of remaining reserves. But it said the data it had seen show that of the current remaining 48 billion barrels of proven and non-proven reserves, only about 24 billion barrels are so far fully proven — 15 billion in its biggest oilfield Burgan.

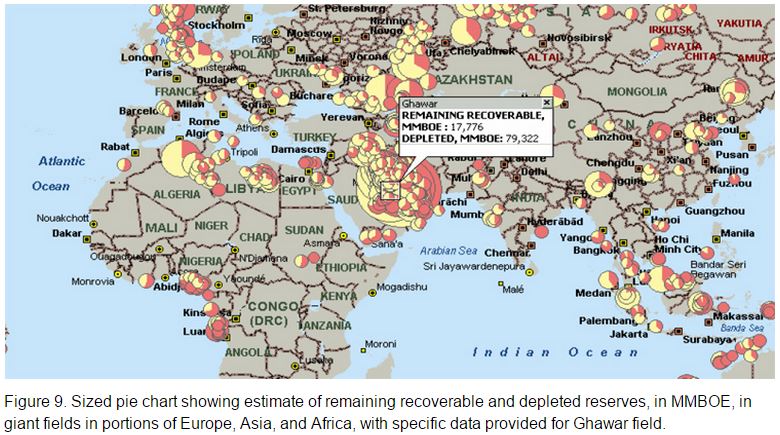

Saudi has the world’s largest oil field, Ghawar, and it is severely depleted. This 2004 paper, Selected Features of Giant Fields, Using Maps and Histograms, has a wealth of information on the discovery and depletion of giant oil and gas fields.

Do the math, this 2004 chart says Ghawar started with 97 billion barrels of oil and was, in 2004, over 81% depleted. Of course the rest of Saudi is not that depleted. They have three fields that have been producing only a few years, Khurais, Manifa and Shaybah. These three fields, along with their other old giants, have enabled Saudi to keep production between 9 and 10 million barrels a day. But it is highly likely that they are about two thirds depleted.

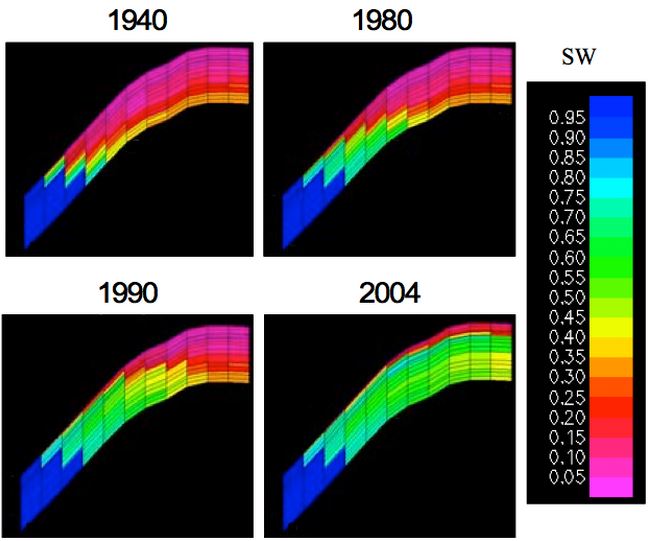

Western flank cross section of North ‘Ain Dar. Source: Figure 9 of Alhuthali et al, Society of Petroleum Engineers Paper #93439, March 2005.

The above was posted by Stuart Staniford The Status of North Ghawar. The the legend on the right is “percent water”. Ain Dar is the north most section of Ghawar. Saudi, along with every other Middle East, North Africa OPEC country, has only one third or less reported reserves remaining.

But how can this be so? How can so many countries be way past 50 percent depleted and still be producing at or very near their peak production. The answer is simple, massive infill drilling with horizontal wells right at the top of the reservoir. From a 2009 Seeking Alpha article Alex Burgansky: Russian Oil and Gas Industry Surprises Analysts:

Russia is a very mature producer. If you exclude all the drilling activity taking place every year, then Russian organic decline in production is close to 19%. To compensate for that organic decline, Russia drills somewhere between 5,000 and 6,000 wells every year.

And from a 2006 Saudi Article:

• Without “maintain potential” drilling to make up for production, Saudi oil fields would have a natural decline rate of a hypothetical 8%. As Saudi Aramco has an extensive drilling program with a budget running in the billions of dollars, this decline is mitigated to a number close to 2%.

Massive infill horizontal well drilling has made it a new ball game. They enable a country like Russia or Saudi Arabia to keep production from declining any great amount until its fields are around two thirds depleted or more. But then when decline finally does set in it will be steep, very steep. Their production profile will resemble a Seneca Cliff.

How many countries are approaching this Seneca Cliff? I have no idea but I would guess most of the big produces like Saudi and Russia are very near hitting that point.

_____________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne@gmail.com

If this is true, and a steep decline is really imminent, then all those countries pumping like crazy are really stupid, because by holding onto their oil they could be making so much more money a few years down the road. Could it be that the old data you quote is in fact outdated and actual recoverable reserves are way higher than what people modelled 10 years back? I just find it hard to imagine that the Saudis wouldn’t simply cut back on production if they know for a fact (and surely they must know the status of their oilfields, and the status of their Kuwaiti and UAE neighbors) that supply shortages are just a few years down the road.

I really liked that book Twilight in the Desert, but in the last chapter the author definitely underestimated the Saudis’ ability to increase production on the Southern in of Ghawar.

The Saudis apparently had a plan to get oil out faster back in the late nineties, executed on it and are getting the oil out. It is very expensive and involves lots of drilling and pumping brine underground. And it worked.

I don’t think it was coincidence. I think they had a good idea how much oil was under there. Ithink they are just lying about how much it is.

Anyway their claim has been absolutely flat for a generation. It’s not even a little bit credible.

Simmons didn’t exactly have much credibility back when he wrote that book, and obviously had never been to the LA Basin and Wilmington field to understand how thoroughly the oil industry understands water handling.

Awesome work as usual!

What is the source for % depletion in your tables and article?

I post your work with links of course on BRY’s investorvillage. Many are highly suspect of your work (not I), only because they think unconventional oil is so large that we don’t have to work about peak conventional oil. I would be very curious about your thoughts on their critique.

Thank you!

Tar Sands Production to the Rescue?

Inclusive of rising net oil exports from Canada, the combined net oil exports from the seven major net oil exporters* in the Western Hemisphere in 2004 fell from 5.9 mbpd in 2004 to 5.2 mbpd in 2013 (total petroleum liquids + other liquids, EIA).

*Canada, Mexico, Venezuela, Trinidad & Tobago, Colombia, Ecuador and Argentina

Coolreit, I always post links as my source. The links are the source or the source of the data is provided at the links.

Unconventional oil, Canadian oil sands and the Venezuela bitumen, is quite large. But that oil will never be extracted at a high enough rate to make a real difference. Also, like shale oil, it is quite expensive and depends on a robust economy to make this oil viable.

The economy of the world is really quite fragile right now, and it is likely that it will get worse. The affordability of unconventional oil will very likely decline along with conventional oil. Unlike a few people on this list, I do not see oil returning to and maintaining a really high price again. It could spike to well above $100 a barrel but the economy will not support such a high price for very long.

Unconventional oil will never be produced in large enough quantities to make a real difference. Ditto for so-called renewables.

Hi Ron,

I agree that unconventional oil cannot be ramped up quickly enough to stop world output from declining. Jean Laherrere estimated 2010 reserves at about 850 Gb, and he accounts for the OPEC reserve inflation, he also expects reserve growth and future discoveries to be about 250 Gb (from 2011 forward), so that is a total of 1050 Gb of C+C, excluding extra heavy oil remaining at the end of 2010 and roughly 950 Gb remaining at the end of 2014.

When I use Hubbert Linearization to estimate future URR of C+C less extra heavy oil, I get 2500 Gb of C+C less extra heavy oil, in my view this is the minimum likely URR unless a social collapse causes oil extraction to cease. Though I admit this is possible, I do not think it is the most likely scenario, note that I do not consider a second Great Depression to be a social collapse, that scenario is in my opinion quite likely after the peak arrives, probably within roughly 10 years of the peak.

It would be interesting to see a comparison of Jodi and EIA data, I believe the EIA data is more accurate than Jodi data.

Hi Dennis:

Quick note from Val d’Aosta: My opinion is you’re wrong to employ URR C+C less extra heavy oil (WITHOUT QUALIFICATION) for your analyses because these reserves are weighed so heavily toward those that will be difficult to exploit and therefore may never see the light of day. More important, would you be able to create a table-of-assumptions and attach it to your projections in the future? It’s difficult for me to visualize projections separate from assumptions even though I realize you typically explain them somewhere. I (we?) would particularly like to see your price assumptions attached because whether or not URR resources are developed (and when) will depend mainly on future prices. Right?

And, Jeffery:

Would you give us the benefit of your (considerable) expertise on how natural gas will come to the fore, VIS-À-VIS oil; as oil reserves become increasingly exhausted? I keep hearing reports about substantial gas reserves in the Arctic, Australia, Russia, etc. but have never seen a creditable analysis as to how this will likely impact our future energy supplies/usage. Of course I know nothing whatsoever about natural gas other than substantial reserves exist in places such as Alaska’s and Canada’s North Slope.

Thanks in advance. Now, back to tonight’s workshop: “Topological K-theory and vector bundles” or maybe I should just head for the closest bar.

Hi Doug,

For my world models there usually are no price assumptions though recently I tried to look at what the economy could afford, by assuming that oil prices which result in prices that cause oil expenditures to be more than 3% of total world GDP, will cause a recession (this is conservative in my opinion) so that oil prices cannot rise above this.

I am not sure if you are talking about the Bakken Model, Eagle Ford Model or the World Model, in the Bakken and Eagle Ford I will do what you ask in the future. For the World, I do not have the data to estimate costs for all the fields in the World ( a nearly impossible task). It is assumed that prices will rise to a level that will make the model’s future output levels possible, clearly if the economy will not support oil prices that make the marginal barrel (most costly to produce barrel) profitable, then the model will be incorrect and extraction rates will be lower.

In several of my scenarios I predicted lower future extraction rates, this would mean that some of the costly barrels would be left until later and only the less expensive oil would be produced. It is impossible to say with certainty what future extraction rates will be as we do not have either future production costs or future oil prices.

Doug,

An interesting approach for estimating future natural gas exports would be to look at the rates of change in some production to consumption ratios (what I call the ECI Ratio).

Hi Doug,

I created a scenario for World C+C output assuming a URR of 3000 Gb based on a Hubbert Linearization of C+C less extra heavy (URR=2500 Gb) and an extra heavy oil (Canadian oil sands and Orinoco belt) URR of 500 Gb (based on Jean Laherrere’s estimate in 2013).

There is no price assumption built into this scenario, it is simply assumed that oil prices rise enough to allow oil companies to make a profit, but no oil prices are included in the oil shock model.

Then I used a simplistic analysis (which is not based on Hamilton’s analysis, that analysis is far more complex) asking the question:

“If the oil shock scenario output is produced, what oil price level can the economy afford without a recession resulting from the high prices?”

I looked at World Real GDP per capita growth (using IMF and UN data) over the 1990 to 2014 period, as well as C+C output (EIA data), oil price data (BP data), and consumer price index(cpi) data from the Bureau of Labor Statistics(BLS). The major assumption here is that if the spending on C+C output in constant 2014$ rises to too high a percentage of World Real GDP (using the purchasing power parity [PPP] method) then a recession will result.

The World seems to be badly affected by an oil spending level that is higher than 3.25% of World Real GDP (in 2008 the spending on C+C output was 3.26% of World GDP). So I assumed oil spending must be 3% or lower to prevent a recession induced by high oil prices.

I also looked at the growth in real GDP per capita for the World from 2005 to 2014 and the average was about 2.6% over those 10 years.

I conservatively assumed that the 2015 growth rate would be 2.2% and that the annual rate of growth would decrease by 3% each year until 2030 (1.4%). I used the UN’s medium fertility population scenario until 2030 and combined it with the assumptions above to create a World Real GDP scenario from 2015 to 2030.

Using the assumption that world oil spending is 3% of World real GDP we can create a scenario for World Oil spending in billions of 2014$ per year. This is combined with our original C+C output scenario to find oil prices (oil spending divided by output is equal to the oil price).

These prices are the maximum oil prices that will not create a recession due to high oil prices (if the multiple assumptions are correct).

I will leave it to oil industry experts to judge if these oil prices are sufficiently high to enable the oil to be produced profitably.

A final note, in 2013 Jean Laherrere estimated that there were 850 Gb of technical proved plus probable reserves remaining at the end of 2010 (excluding extra heavy oil reserves).

My output scenario has 500 Gb of C+C less extra heavy oil produced from 2011 to 2030. There are also 36 Gb of extra heavy oil produced in the scenario over the 2011 to 2030 period. It is also possible that there will be some new discoveries and reserve growth in the future as oil prices rise. Chart below.

Thanks Dennis.

I’m too busy attending talks to respond properly but please note I do appreciate your approach. Meanwhile, my simplistic view is that URR depends primarily on the balance between average world-wide depletion rates, oil prices, and effectiveness of EOR efforts. I think depletion rates are generally under-appreciated in the big reservoirs that matter (owing to extensive infill drilling) AND I’m ALWAYS “under-appreciating” EOR effectiveness extending life/productivity of important reservoirs. So perhaps your approach (and result) is as good as any but I really hate to admit that. 🙂 More later; conference here lasts another week.

Hi Doug,

Thanks, no doubt my scenarios will be wrong. So far oil production has held up better than I have expected, but perhaps many fields will water out at almost the same time, I think this is not likely, but I also didn’t think oil prices would fall to nearly $40/b, if oil prices remain at low levels (less than $50/b) over the long term, my scenario will be incorrect, I expect $100/b by 2017 at the latest.

Haven’t we just learned that already $100-$110 is too high for the world economy?

Hi Matt,

That is by no means clear. The only World recession since oil prices went above $100/b was in 2009 from 2011 to June 2014 average annual real oil prices(2014$) were over $100/b(BP data) and World Real GDP growth was around 3% over that period (based on IMF data).

The current low oil prices are a story of excess supply rather than weak demand in my opinion.

Europe is doing badly due to poor macroeconomic policy during the Great Recession which caused an anemic recovery, the lack of control of Eurozone countries over their individual nation’s monetary policy doesn’t help.

The analysis of demand is being confused by the assumption that the primary driver of demand is “affordability”.

That’s really, really not the case. Instead, increasing efficiency and (secondarily) desirable substitutes are greatly reducing demand growth. For instance, the US is using less oil than in 1979, while GDP is 2.5x as large. That’s efficiency, driven by CAFE regs and sensible industrial/commercial energy management.

Really, increasing efficiency and substitution is more important than production growth. “Affordability” isn’t a significant factor in the US or most of the OECD, where we’re seeing substantial reductions/slowing growth in consumption.

There was an article in Seeking Alpha today which uses the convolution model of yours.

http://seekingalpha.com/article/3021326-oil-will-bottom-in-3-weeks-a-comprehensive-analysis-of-domestic-oil-production

I think that guy has a pretty good handle on the demand supply and the storage situation.

He’s ok, but the model is a bit too simple. World oil production capacity and demand are very hard to predict, and that’s what controls international oil prices.

Agree. The article was US centric to evaluate the shale players.

Ron – Free advice is probably what it is worth – Zero. But, with all of the “just printed” money washing around the world, I would advise anyone who is predicting future numbers to qualify them as “adjusted for inflation.” So, maybe not $100 in 2015 $’s, but who would be surprised if inflation starts to increase dramatically? We are in the midst of the lowest inflation since the deflation of the 1930’s depression. Personally, I do not see deflation with the current world-wide governments, so ????

PS: If the economy goes down, Which would you rather give up – gas to get to work, doctor, etc. or a smart phone with unlimited texting? Winter heat? Or eating out? Food [it all comes by truck] or new clothes?

Ron, your work is exemplary. Thanks.

Note that if one takes into account population growth (as the LTG modelers did for many variables for their World3 model’s reference run), the peak per capita for JODI world C+C occurred in 2004-05 when Deffeyes, et al., called Peak Oil at the time.

Since then, JODI world C+C is down 6-7%, and JODI world C+C less the US is down 10-11%.

This is particularly important in that the world is now where the US was in the late 1970s to early 1980s in terms of oil production per capita, the point at which US real wages peaked and deindustrialization and financialization of the economy commenced with the real, US$-adjusted price of oil in the $70s-$100s. The recession of the early 1980s, oil discoveries, and peak of the US$ in 1985 (Plaza Accord) resulted in the real, US$-adjusted price of oil crashing to the $20s-$30s. As part of deindustrialization and financialization of the economy, the US offshored production and goods-producing employment and replaced wage growth with 25-30 years of increasing debt to wages and GDP and females entering the labor force en masse, reducing average real wages until the debt cycle’s bubble peaked and burst in 2008.

However, the rest of the world does not have the luxury of financializing and deindustrializing their economies via offshoring production (and ecological destruction and pollution) as the US did. Moreover, much of the rest of the world has already taken on unprecedented debt to GDP, especially China, which has created the largest fixed investment and credit bubble as a share of GDP in world history.

So, the world is facing Peak Oil and falling oil production and net energy per capita; unprecedented private and public debt to wages and GDP; real GDP per capita and trade decelerating to a stall; obscene wealth and income inequality, massive financial bubbles, and wealth hoarding at zero velocity, dragging on money velocity; labor’s share of GDP at a record low; “illth” care spending at $10,000 per capita in the US and $26,000 per household; and real wage growth for the bottom 80-90% working class that barely permits subsistence after taxes, debt service, and “illth” care costs.

Therefore, if one properly perceives the emerging conditions in per capita terms, Peak Oil is in the rear view mirror and LTG are already bearing down on us.

And what we hear from many politicians on the right are more and more reactionary statements. As times get tougher, they don’t deal with it in a logical manner. As they perceive threats, real and imagined, I expect them to lash out even more.

Yes, I suspect that will be a given, and many on the left will be self-satisfied in their presumption that their institutional embeddedness and sense of security (including pensions and retirement benefits) will insulate and protect them from the attacks from the right and the larger global structural fallout from Peak Oil, overshoot, LTG, etc.

BC, thanks for a very informative comment that, in my opinion, spot on.

Yes peak oil is in the rear view mirror and limits to growth is already hitting us pretty hard. Sometimes when things happen slowly they are not perceived as happening at all.

But things might just start happening very fast in the future. If the China bubble burst then the dominoes may start falling all over the world.

I read something interesting the other day about fertility rates. Of course fertility rates are falling sometimes by choice. But in overcrowded and very stressful times fertility rates naturally fall. That is it is an involuntary thing that nature causes. It happens in all species including the human species.

Hi Ron,

Thanks, that is very interesting. It would seem that fertility rates would fall rather fast if collapse hits, so that the UN’s low fertility scenario or perhaps even lower would be more likely. In addition overall mortality rates would also rise so that population pressure would be relieved to some degree.

Now if humans breed like rabbits as some people assume, any population reduction would be reversed if conditions ever improved, I think humans are somewhat more intelligent than rabbits (or yeast 🙂 ).

Hi BC,

In the developed world (or at least in the US) median incomes have been plat since the mid eighties and income inequality has grown.

Part of this is the explanation you have given (though we need to look at all energy costs and the net energy of all inputs into the economic system, not only oil) I agree with. A second part of the story in the US, is the active policy to try to undermine unions and, more importantly, a big change in the income tax code to make it much less progressive over the last 35 years.

As far as real GDP growth per capita, it has grown for the World based on IMF data for real GDP in purchasing power parity terms since 1990. Part of this may not be true growth, but just more people being involved in the market economy, this effect is difficult to measure. Chart with real GDP growth per capita in % from 1990 to 2014 and C+C per capita per year (b/year/person).

I wonder what happens if you layer in natural gas? And then coal?

Hi Fernando,

The chart would get pretty messy, I think, you are thinking of one of those stacked charts with oil, natural gas and coal on a per capita basis? Good idea. That way we can look at all fossil fuels, or we could just use primary energy data from BP. Chart below for primary energy per capita.

Fossil fuel per capita in tonnes of oil equivalent per person. Data from BP (energy) and UN (population).

Bingo. It seems oil is being replaced by other energy sources.

Hi Fernando,

Also interesting is that the oil plus natural gas level of energy per capita is quite flat over that period, most of the increase comes from coal.

When all three of these energy sources peak in 2028+/-5 years, we will need a combination of greater efficiency, wind, biofuels, solar, hydro, and nuclear power to keep society functioning.

Prices of all fossil fuels will become more expensive.

Yep. I just sent a Twit to Moises Naim answering his comment about the Saudis wanting to keep people thinking that prices will stay below 100. But I didn’t want to get in a Twitter debate with Naim. I figure the best option is to use $90 after 2016 and start going beyond inflation after 2026. You know, one of those curves you use would do fine.

People use a lot more energy dependent appliances and devices now, but they are more efficient. The houses have been better insulated and furnaces are a little better. Cars are improving in mpg.

All in all, even though we are a more device, computer and appliance driven world, and devices have even penetrated into the third world, it is evened out by efficiency changes. There are now more cars than ever in the world. Still, fuels remain fairly level.

The gain in coal is probably mostly due to China’s huge industrial rise. I wonder when that will level out.

Very interesting analysis BC. Have you got blog, where you flesh this out? I look forward to reading it.

Walter

Walter, thanks. A blog is on my to-do (or bucket) list. (I maintain anonymity for professional reasons at present.)

One of these days. 🙂

Shale oil in the US was produced in large enough quantities to scare the panties off the Saudi’s, I think that qualifies as “enough to make a difference”. Also made it possible for a depleted, over the hill, peaked decades ago country like the US to increase oil production rates faster than at any time in its’ history, and these fields are now the largest producing oil fields in the western hemisphere. Sounds like another measure of “difference” that is significant.

… US to increase oil production rates faster than at any time in its’ history, and these fields are now the largest producing oil fields in the western hemisphere.

I don’t follow oil history closely, but is any of that actually true?

Circa 2009, we read similar hype about the outlook for Brazil’s oil production. One of my favorite all time Bloomberg columns, in 2009, discussed the outlook for Brazil’s oil exports taking market share away from OPEC. In reality, Brazil in recent years has been a net oil importer with a track record of increasing net imports, even counting biofuels as production.

The combined increase in Brazil + Iraq’s net exports from 2009 to 2013 pretty much rounds to zero (an increase of 0.1 mbpd).

Ron, while I appreciate the data and the analysis, something just does not seem right to me. Surely the people with the best knowledge of the state of the reserves in Saudi Arabia would be the Saudis themselves? If as you suggest, they are facing an imminent, steep decline in production, precipitated primarily by the exhaustion of Ghawar, would it not be incredibly and extremely stupid for them to be pumping flat-out at the current low prices? I cannot belive the Saudis are that deluded. They have a quantifiable inventory of a non perishable, non renewable resource, are in fact facing rapidly diminishing stocks and yet they persist in selling off what little they have left at rock bottom prices? Either they know something we don’t or as Thomas suggested in his top post, they are stupid beyond belief!

Do they believe that high prices would trigger a rapid shift away from the oil consuming machines that make up the vast majority of the planet’s transportation fleet? While I understand and appreciate the ideas of Tony Seba, one of whose videos I have posted links to in these forums before, it appears to me that, the new ball game that has been brought about by massive infill horizontal well drilling, will eventually result in a production decline that it will by hard for Tony Seba’s “Clean Disruption” to keep up with. Think of it as a race between transition and depletion. If transition wins that would produce a more desirable out come but if depletion wins, modern civilisation is toast!

Does anybody here think that, if the Saudis cut production to prop up prices, allowing the shale oil boom to continue but, holding back more of their reserves for the day shale oil production starts to peter out, they would be doing harm to their long-term interests? As it is, they could be looking at a future similar to the present conditions in the UK, rapidly rising consumption coupled with rapidly declining production, placing before them the prospect of having to import oil at a much higher price than they sold most of their good stuff for! Who on Earth would they be looking to buy oil from by the time that happens?

Alan from the islands

Alan, take a look at the rest of the world. Alaska for instance. They are already in decline yet they are producing flat out. Are they stupid beyond belief? And Mexico, and Norway, and Great Britain, they are all in decline yet they are all producing flat out. Are they stupid beyond belief by producing all they can while oil prices are so low? Do you think Saudi Arabia should be the only nation that uses logic and saves their oil for a few years down the road? Why do you think they are that much smarter than the rest of the world?

Indonesia, a former OPEC nation, kept producing flat out even as they transitioned from a net exporter to a net importer. That is just how the world operates. Politicians want it all now, while they are in power. They are far more concerned about today than a few years down the road when someone else will be in power.

I don’t know who Tony Seba is but there is no real race between transition and depletion. Transition is a pipe dream believed by people who really does not understand the magnitude of the problem.

Good point about everybody else doing the same thing. I guess I was thinking that maybe some people would learn from the experience of others but, I have enough examples of other situations in my neck of the woods where people go about repeating the mistakes of others. When questioned the typical responses range from, “my situation/circumstances are different” to “I’m smarter than them. They didn’t know how to do it properly”.

I am leaning more and more towards the thought that “the invisible hand” is just that, a hand with no brain controlling it. As a result the “invisible hand” has produced repeated cycles of booms and busts in many areas of economic activity, as tons of players rush in to fulfil a demand resulting in an oversupply that brings about price declines that kill off more of the supply than the market demands that leaves an unfulfilled demand, rinse and repeat.

The pack rat in me, cannot understand those who consume wantonly, thinking that somewhere, somebody will come along to provide whatever it is that they want/need whenever they want/need it.

Alan from the islands

https://www.youtube.com/watch?v=bmnSFdk5ISg

The video linked to above is the 4 minute video trailer for his book “Clean Disruption of Energy and Transportation”. He made a 40 minute keynote address at the AltCars Expo and Conference,Sept 19, 2014. His ideas require being able to continue the BAU growth paradigm into the foreseeable future, for what it’s worth.

From this page at the website export.gov:

“Tony Seba is a lecturer in entrepreneurship, disruption, and clean energy at Stanford University. He is the author of “Clean Disruption of Energy and Transportation – How Silicon Valley Will Make Oil, Nuclear, Natural Gas, Coal, Electric Utilities and Conventional Cars Obsolete by 2030”.

At Stanford, he has created and taught the following courses: “Anticipating and Leading Market Disruption”, “Clean Energy and Transportation – Market and Investment Opportunities”, “Strategic Marketing of High Tech Products and Innovations”, “Finance for Entrepreneurs”, and “Business and Revenue Model Innovation.” He has also taught at top business schools such as the Auckland University Business School, Singularity University, and at some of the world’s top high tech companies such as Google, Inc. ”

Alan from the islands

All those electric cars will be recharged in hubs, probably located every few miles apart in urban areas. As these autonomous cars near empty, they will pull into these hubs and await recharging. These hubs have the potential to absorb a great deal of the variability in renewables. All the electric cars wired together in these hubs for recharging will act as a vast reservoir of stored energy, and when intermittency makes this electricity unavailable, cars further down the recharging line can have their juice cut, or, if necessary, supply power to the grid. This way, the smart grid need not extend to every household, only directly to these charging hubs. They may even be owned by the utilities in some cases.

You know why your car battery last on average 2 to 5 years (which is good)? Its because you are only using about 10% of its potential. The most you can ever use is 50% potential and still you might get 5 years. Anything over 50% and your battery potential degrades rapidly.

Batteries will never replace ICEs.

Lithium Iron Phosphate technology is totally different from lead acid. The analogy just is not meaningful

And yet, EVs are already replacing ICEs: the Nissan Leaf is the cheapest car on the road, and has more than enough range for most commuters. The Volt is cheaper than the average car, has ICE range but uses 10% as much fuel, and it’s battery will last for the life of the car. The Tesla is a far better car than all of the luxury cars in it’s price range.

The lead-acid starter battery in your car isn’t really a useful benchmark.

Yes but they cost way more and the elements neded to Mfg are no where near available in quantities needed to replace even 10% of the current auto #s

Says who?

they cost way more

And, one more time:

EVs are the cheapest cars on the road even without tax credits. With tax credits, they’re insanely cheap. Let’s see. The average car costs about 58 cents per mile to drive.

IRS Average New Car Cost per mile: 57.5 cents per mile.

The Leaf, without tax credit, is the cheapest car you can find to own and operate:

Total Cash Price $25,327

5 Year True Cost to Own: 28,079

Cost per mile: 37.4 cents per mile.

A typical small car like the Honda Civic Sedan is more expensive:

Total Cash Price $21,644

5 Year True Cost to Own: 36,154

Cost per mile: 48.2 cents per mile.

And a Chevy Volt, a car without any compromise because it can run on gas, is less expensive than the average car even without the tax credit:

Total Cash Price $31,500

5 Year True Cost to Own: 40,129

Cost per mile: 53.5 cents per mile.

http://www.edmunds.com/tco.html 1/27/15

If we subtract just the Federal credit of $7,500 (and several states have credits as well), that subtracts 10 cents per mile. The Leaf costs less than half of the average car, and the Volt is substantially less expensive than the Civic.

And, you very rarely go to the gas station, and it’s much more fun to drive!

Part of Nissan’s Thank You Canada sales event!

$300 a month minus what it would have cost you to fill up a similar ICE powered car.

http://www.choosenissan.ca/on-en/leaf/lease

This story from treehugger.com starts out, “Despite the fact that Bolivia alone has enough lithium reserves for 4.8 billion electric cars and that lithium can be recycled from old batteries (it doesn’t disappear after use like oil), some people are concerned about our civilization’s increased dependence on the soft silver-white metal.” Bolivia might have the largest known reserves but they are not the only game in town and in fact, it is believed that there are deposits in Afghanistan that may be even larger than those in Bolivia. This web page shows the countries with the largest lithium reserves worldwide as estimated in 2014 and another page depicts the countries with the largest mine production of lithium worldwide from 2010 to 2014. Bolivia and Afghanistan aren’t on either page.

As far as rare earths go, they are not necessary for making EVs, despite the fact that many do use them. The Tesla Model S uses plain old induction motors in it’s drive train, not a rare earth to be found in those motors.

Might you be a troll by any chance?

Alan from the islands

Recycling is cheating!

They are also among the least bought. Great quality to have as revolutionary thingamabobs.

I recommend you read “The Innovator’s Dilemma”. Revolutionary thingamabobs always start out in a niche for early adopters. Low sales volumes don’t prove anything.

One niche where electrical vehicles are taking over is small municipal utility vehicles.

This is an excellent area for discussion at the moment.

The world is in a race to build a strong enough base of renewable energy capacity AND, critically, infrastructure that makes renewables feasible.

I could be wrong, but I suspect that everyone here agrees that if we had another 20 years of slowly rising oil production alongside stable, $80 barrel oil our civilization would successfully make an energy transition.

There are 2 central issues we’e all concerned with:

1. When will oil production begin to decline – with the likely outcome of a sustained, albeit bumpy, decline in global GDP, and as a consequence a collapse of debt/interest/financial systems putting a halt to the capital intensive energy transition.

2. When will we have a strong enough base network of renewable capacity, electric vehicles, and autonomous vehicles to allow for our global system to survive a permanent decline in liquid fuel supply.

I’d be quite curious what Robert Hirsch would have to say at this point. We’ve technically been transitioning for 10 years now, and by 2025 will be 20 years into a renewable, EV, autonomous world.

Apple is working on an autonomous electric vehicle. They’ve already invested capital in hiring numerous high salary engineers. Apple only commits money to things once they’re dedicated.

I’m no Apple fanboy, but let’s face it, for some reason when Apple releases a product the entire populace, from all political and financial spectrums, rallies behind it. Apple Pay came out, and all of a sudden paying with your phone was a thing! Except every Android phone could already do it a year prior.

When Apple gets behind an idea it changes the landscape. Every hurdle and constraint we imagine for the legal hurdles of autonomous vehicles will be significantly diminished the moment Apple reveals this “product”. It will happen around the same time that the Tesla Model III begins production – a vehicle that will have fully autonomous capability.

We truly are converging rapidly on a new world of transportation. By 2020 if oil goes to $250 barrel many Americans will not be as affected. They will simply open an App, request a pickup from an autonomous EV, and be charged the same price they were when oil was $50 barrel.

The thing about autonomous vehicles is that they will be incredibly cheap to run. Insurance will be radically cheaper without a monkey behind the wheel, maintenance is radically cheaper also.

Since this revolution is being propelled by silicon Valley I would venture to guess Elon Musk’s Tesla and SolarCity will find ways of partnering with Apple, Google, App makers, and others to bring about an ecosystem of PV hubs where these autonomous vehicles charge.

I think big change will happen in transport from 2017-2020. Individual ownership of vehicles will transition over time as being more a luxury than a necessity (something long predicted by us doomer peak oil folks). HOWEVER, the other option won’t be walking or biking – it will be scheduling and ordering cheap, affordable autonomous EV transport through a smartphone app.

With Big Data it will be very, very easy to discover how many vehicles will be required for any given area. Within 2 years of collecting data the systems for autonomous EVs will be able to have “pick-up guarantee” windows of 3-5 minutes.

Getting your check? Order a ride, it’ll be there when you walk out. Need to get groceries? Order a ride before finishing that email and putting on your shoes, it’ll be waiting when you step out the door.

No paying the price tag of owning or leasing, tags, insurance, tires, brakes, oil changes, gas, timing belt, etc.

I mean, look, here’s the real point: in our bodies are billions of erythrocytes (red blood cells) constantly circulating and transporting the goods and wastes of our bodies economy. Industrial civilizations current model of transport is like having 90% of our red blood cells just sitting around the vast majority of their existence.

In evolutionary terms our civilizations transport system is unfathomably wasteful. Merely the product of a short period of time where energy conservation didn’t matter. I am of the firm belief that the forces governing the evolution of economies are identical to the selective forces governing the evolution of organisms.

If we avoid the pitfalls of a collapse scenario until 2020 it is my hypothesis that the roots of this transportation and energy transition will be strong enough to carry us through any ensuing calamities.

I feel as though many here see such a vision as cornucopian. I can’t blame them as a few short years ago I would be the first to rail against such a vision. I embrace the ability to evolve my thoughts as information accumulates for or against my presuppositions. I am wrong more often than not, and I don’t think that will change.

I do think all the pieces are gathered for the making of a surprisingly fast evolution of transport between 2017-2022. The presence of smartphones, the literal “go for broke” dedication of Elon Musk, and the considerable cultural and monetary resources of Apple throwing themselves into the autonomous EV race make too compelling a road for me to fight against.

That being said, wack the energy mole and next thing you approach is the population mole, the water scarcity mole, and the irreversible climate change mole. Regardless, life in 2015 is far more pleasant than I could fathom just a few years ago. I’m beginning to suspect that in 10 years I will face the same realization.

Thoughts anyone? If you roughly agree, why? How do you think it may go slightly differently? If you completely disagree, then I’m also excitedly curious why

I could be wrong, but I suspect that everyone here agrees that if we had another 20 years of slowly rising oil production alongside stable, $80 barrel oil our civilization would successfully make an energy transition.

Yes, you could be wrong and you are.

Hi Brian,

I have to agree with Ron about your statement- “I could be wrong, but I suspect that everyone here agrees that if we had another 20 years of slowly rising oil production alongside stable, $80 barrel oil our civilization would successfully make an energy transition.”

For such a rosy scenario to be possible, I think the key element aside from innovation, is a massive downsizing in global population to a more sustainable level, such as 2-3 billion of the wealthiest of all. This would enable the rosy future to be a possibility, but I don’t see us getting there intact. I say wealthiest because the rosy innovation path is very expensive.

Hi Brian,

We are unlikely to have $80/b oil for beyond 2015, but the economy can support higher oil prices, I think they may be able to go to $140/b by 2020 without causing a recession, the decline in oil output from 2015 to 2020 will be very low (output of 76 Mb/d in 2020) and output decline will remain less than 1% per year through 2025 (72 Mb/d), at that point oil prices will be able to rise to $168/b without causing a recession.

These higher oil prices may allow some of the transition to occur that you foresee, but I am doubtful that it will happen as quickly and easily as you have imagined.

My expectation is that oil prices will be very volatile unless governments step in to regulate oil output in an attempt to smooth the boom bust cycle, this will lead to recession as oil prices rise too quickly for the economy’s ability to adjust. The recession in turn is likely to slow down technological progress in the transportation system.

I could also be wrong, Ron really is the only one who knows what will happen 🙂

And least we forget, in those ten years World population will have increased from our current 7.2 to 8.1 Billion (U.N. projections for 2025). If we can transition and “renewables” be made to “renew” themselves: then what ? Population of 12 or 15 or 20 Billion. Goody.

Monkeys (naked apes) be breeding!

Hi Ed,

Population will peak between 2050 and 2100 and will then decline. UN population scenarios below.

http://esa.un.org/unpd/wpp/index.htm

If population is predominantly FF-‘fed’ and FF’s go in an orca or shark-fin decline, then I suspect the human population to follow suit if alternatives cannot be ramped up fast enough for offset.

“The world needs to wake up to “the ticking timebomb” of youth unemployment.”

A spokesperson is quoted as saying “complacent assumptions about population growth slowing are being proven wrong” and that the global youth unemployment situation must be tackled with the fervor of children’s vaccination campaigns or humanitarian emergencies. As the article goes, it get’s less impressive, wandering off into vague notions and feeble hopes of status quo “economic growth” as somehow being able to ride to the rescue (probably mirroring the report itself).

Sooooo… population growth is not slowing at all.

Hi Caelan,

Why would the fossil fuels go into steep decline? Does collapse cause the steep decline in fossil fuel output? Or does the steep decline in fossil fuel output cause collapse?

I can see a depression resulting from high fossil fuel prices, which would reduce oil demand and perhaps oil prices and might lead to an up and down cycle. The shark fin decline often posited is based on not looking properly at net energy. As long as the system as a whole has enough net energy from all sources, then lack of net energy will not be a reason for collapse.

Ron,

If you pursue the source of that comment, you find “2012 the UN revised its population estimates upwards, stating

Compared with the results from the previous revision, the projected global

population total in this revision is higher, particularly after 2075, for several

reasons. First, fertility levels have been adjusted upward in a number of

countries on the basis of recently available information. In the new revision,

the estimated total fertility rate (TFR) for 2005–2010 has increased in several

countries, including by more than 5% in 15 high-fertility countries from sub

Saharan Africa.”

So, this isn’t anything new. Fertility rates are still plummeting in most of the world, including China, India, and S. America, due to improving education and careers for women. Stubbornly high fertility rates are pretty much a problem in Africa and the ME, mostly due to…a lack of education and careers for women.

“Why would the fossil fuels go into steep decline?” ~ Dennis Coyne

Maybe in part for the reason that Ron mentions(?):

“Massive infill horizontal well drilling has made it a new ball game. They enable a country like Russia or Saudi Arabia to keep production from declining any great amount until its fields are around two thirds depleted or more. But then when decline finally does set in it will be steep, very steep. Their production profile will resemble a Seneca Cliff.” ~ Ron Patterson

I am not necessarily talking about collapse though. That seems more between you and Futilitist.

Ron,

LOL.

Steve

I don’t think we will have 20 years before peak (or even 5 years), much less a stable oil price. I’d say it’s an impossible scenario. Only used it as a reference point for the idea that a relatively smooth transition would be possible under that scenario.

Why do you think a transition would be impossible under such a scenario?

I’m speaking purely in terms of energy transition. Population overshoot, sea level rise, water scarcity, and a host of other consequences of overshoot will inevitably cause a population collapse followed by GDP and financial collapse, but in terms of energy availability alone I’m wondering what your reasoning is.

EROEI of PV and wind are high enough to sustain our current civilization, especially in a world where energy is being used more efficiently.

I haven’t burned a gallon of gas in months with my Volt, and soon I’ll have solar panels and won’t be burning natural gas by proxy through the grid. This is a real world impact, and it does make a difference.

Vehicle miles traveled is down year after year after year in the U.S., which makes sense to me since people are moving into cities and even more people are using Amazon instead of driving to and fro from stores.

Every gallon I don’t burn is picked up and burned by some person in a growing city in India, China, Indonesia, Africa, wherever. I get that, and it is valid, but it ignores the fact that PV and wind are approaching economies of scale large enough to make them cost competitive with fossil fuels.

Throw me a loaf of bread here Ron! Why is it impossible, under any and every circumstance, for us to make an energy transition? Do you think autonomous EVs are a pipe dream? That their impact will be minimal compared to the scope of the issue? If so, why?

I think a lot of people underestimate the magnitude of the impact of the release of the Model III around the same time that Apple, a company with bigger cash reserves and cultural influence than most countries, will have once it releases its autonomous EV. 2017-2020 will be a watershed moment for autonomous EVs. Perhaps that is where you’re skeptical. Maybe you doubt Elon Musk’s ability and go for broke dedication to a world of solar panels, EVs, and autonomous vehicles.

Throw me a bone, I beg you!

Do I think 2020 will be all rainbows and butterflies? Absolutely not. I think 2020 will be a lot like 2012, the world will be fragile and rocky, but will still be held together as the transition marches forward.

Brian, too many people are destroying the world. The world can support, long term, no more than two or three billion people. And even they will still wipe out most of the animals. Our water tables are dropping and will drop further. Rivers are running dry, lakes and inland seas are drying up, topsoil is blowing and washing away, deserts are expanding and forests are being clear cut. And I could go on and on.

And you think some kind of energy transition is going to save us? Even if that were to happen it would only make things worse.

The only thing worse than peak oil would be no peak oil

It is ironic that oil contains the remnants of dinosaurs – perhaps one day they will be able to make more of it from the smug curmudgeons who are certain that collapse is all but inevitable. Did you have so much foresight that you saw the creation of the Internet? Of smart phones? If you didn’t, then what makes you think you know the future of transportation?

Look, we’re starting with a system of transportation that uses an internal combustion engine, about 20% efficient. Then we’re using a 3,000 lb. car to move around a 150 lb. (5% efficiency) average payload, but only using it about 3-5% of the time, all other times parking it. That means that our current transportation system is only .2 x .05 x .05 = .0005 or 0.05% efficient. Do you really think there are no possible revolutions possible with a system that is only one twentieth of one percent efficient at accomplishing what it’s suppose to do.

I’ve been following peak oil since reading Deffeyes back in 2002, I’ve written books about it a decade ago – the fact is that everything is in place already for a clean energy transportation revolution, even if peak oil happens last December. In fact, the sooner it happens, the better – the faster the transition will be. Here’s the reason – they’ll be too much money to be made.

Also, the world already produces enough food to feed nine billion, but two massive boondoggles (ethanol and meat-eating) keep it from going to the right places. Here’s the thing about seven or nine billion people, many with access to the Internet and it’s treasure trove of human knowledge. We’ve all heard about black swans, events out of the blue that cause damage and disruption. But opposite that are green swans, breakthroughs that will occur with great rapidity over the next several decades as the most complex computers ever built (the human mind) all connect in one giant computer together on the Internet. At this point it’s probably equally worth worrying about being taken over and enslaved by robots as civilization collapsing because of peak oil.

Thanks, Brian Rose, for your well-thought and written posts, and to everyone for the thoughtful conversation.

While I think there will be many bumpy roads ahead, I prefer reading about this scenario than about the collapse scenario.

Since I have been told by the collapse advocates that there is nothing I can do to stop it, then it doesn’t matter what I choose to focus on. Therefore I choose to focus on the more optimistic predictions.

It is ironic that oil contains the remnants of dinosaurs –

That’s only the first thing you got wrong. There are no dinosaur remains in oil. All oil is aquatic in nature, the remains of plankton blooms that died and sank to the bottom of a shallow sea where little free oxygen existed.

– perhaps one day they will be able to make more of it from the smug curmudgeons who are certain that collapse is all but inevitable.

curmudgeon – noun – a bad-tempered, difficult, cantankerous person.

And that is how you view all those who believe the world is in deep overshoot and that a natural correction is inevitable.

I would have a much kinder word to describe people who think the future of human life on earth is nothing but a bed of beautiful roses – Pollyannas.

Pollyanna – noun – an excessively or blindly optimistic person.

Hi Ron,

Imagine Pollyanna and Henny Penny had a child with a viewpoint somewhere between the optimistic and pessimistic point of view.

That child’s view of the future would be more realistic.

No everything will not be sunshine and pretty flowers, nor will it be only darkness and thorns. There are both good and bad things that will happen, reality will be a mixture of both.

“Imagine Pollyanna and Henny Penny had a child with a viewpoint somewhere between the optimistic and pessimistic point of view.

That child’s view of the future would be more realistic.”

That would be an example of fallacious averaging. There will only be one future regardless of anyone’s views (wishes).

Besides, Dennis, you have a child’s view of the future, but that doesn’t make it realistic. 😉

Hi Futilitist,

It has been proven that only bad things can happen. After all it is futile to argue with Futilitist because he has an old man’s view of the future, death, destruction, those have been written in stone.

Nothing is known about the future. Reality will be different than the most pessimistic and the most optimistic points of view.

Collapse is not a foregone conclusion.

The irony, Dennis, as I’ve already mentioned, is that a so-called optimistic view that ostensibly upholds such things as wage-slavery/vertical hierarchy/etc. (i.e., not much in the way of purely-democratically-run egalitarian business cooperatives); coercive governance, and ‘technocracy’ is actually pessimistic, so to speak. In part because it keeps us in prisons, in binds.

With regard to going with the current narrative, to ‘what is’, I would respectfully recommend that you at least attempt to push the narrative along more ethical lines.

Your ‘government will step in’ or ostensible faith in industry is against that and upholds the narrative that may get us all killed and/or without that smooth and orderly decline you seem to want.

This is precisely in part why I posted the corporations and capitalism comments yesterday by the way.

Hi Caelan.

So what I think you are saying is that Dennis’ uniquely annoying style of hyper optimistic tone-deafness might actually have some sort of more sinister, ulterior motive or underpinnings. Do I have that about right? Are you suggesting that Dennis’ arguments, and style of argument, might suffer from an ethical defect similar to that of the typical climate change denier? Do I need to fill out another indictment? 😉

Do you think this is this yet another case of BAU Moral Schizophrenia?

http://peakoilbarrel.com/us-rig-count-location/comment-page-1/#comment-502419

http://peakoilbarrel.com/us-rig-count-location/comment-page-1/#comment-502422

Hi Caelan,

I would be happy if society magically transformed into a democratic utopia, where all humans behaved ethically.

I live in the real world, I am not so optimistic to think that human nature will change so that all humans are well behaved.

The humans that inhabit the real world are far from perfect.

I do not foresee BAU continuing, I think there will be many social changes to try to make society as just as is possible.

I have no childlike illusions that human nature will change appreciably, the current system of representative democracy (I think as practiced in Western Europe before the Eurozone nonsense is best) is about the best we are likely to do.

No government would be a disaster at present, maybe in 300 or 500 years humans will be better behaved, but I doubt it.

Note that egalitarian business cooperatives would be fine, in fact I would encourage them. Do you think these should be forced upon people?

People are free to organize into collectives, for the most part they choose not to.

Wage slavery is a choice that people make, should they not be free to make that choice?

Dennis,

All you seem to be doing is rationalizing away the system that you don’t even agree with. It is hardly a representative democracy– whatever that really means– either.

It is also a system that determines in large part how humans behave– your ‘human nature’.

I am not suggesting you hack your arm off, just make at least some effort in shifting the thinking/narrative and/or at the very least make genuine attempts at avoiding supporting and/or making rationalizations for this system.

That is, if you truly want a smooth transition and to avoid anarchy.

Every effort counts.

Are you familiar with permaculture, incidentally? They are making those kinds of efforts.

And their illusions are hardly childlike. They are, rather, grounded in reality such that this system, ironically for your case here, is far from.

@Dennis: Wage slavery is not precisely a choice people make. You might want to make that claim to the so-called 99%, for example, and see what they tell you.

To: “Dennis Coyne”

We have reviewed your latest work and have determined that your character:

Dennis Coyne

has grown stale. Your sunshine level is set *WAY* too high to present a plausible argument anymore.

You are now in breach of contract. This is a serious offense.

Please report immediately to central control for a total character rewrite.

[as usual, destroy this message upon reading]

————:END TRANSMISSION:————

>>and even more people are using Amazon instead of driving to and fro from stores

I have been thinking about this, Brian. Is it more energy efficient to drive to your local Target and buy a box of lego? Or to buy it on Amazon, have it shipped out by plane and delivered via courier to your doorstep?

For this exercise I am assuming that the backend up until the distribution warehouse of either Amazon or Target is similar (18 wheeler from Mexico).

I don’t have an answer. But this much is for sure, just because you eliminate the personal driving to and fro, doesn’t mean there aren’t energy inputs and that they might not be equal to or greater than the individual in his Toyota.

These days I’ve been seeing the latest buying off AliExpress, where you can shave still a couple more dollars off that $49 drone. Individualized purchases, all the way from the factory in freaking China, I say, shaking head with both marvel and disgust.

Short answer: Buying from Amazon is far more efficient.

Long answer: Amazon has numerous hub warehouses that are impressively large. These giant hub warehouses are specifically located to be maximally efficient in terms of shipping.

How many thousands of products are shipped to each individual Target that are never bought? Where do they go after? How efficient was it to sent 20 ironing boards to each of hundreds of Targets?

There are ~1800 Targets in the U.S.

There are ~96 Amazon Fulfillment Centers

The efficiency is in the centralized distribution aspect of Amazon’s operations. Big Box stores must use a shotgun approach and send too many products to too many places. Amazon uses a sniper rifle, and has the advantage of swaths of data about every customer that makes a purchase to fine tune that sniper rifle.

So not only is Amazon far more fuel efficient on its end of the product delivery equation, but you as an individual get the ultimate fuel efficiency savings – you get to burn zero, zip, zilch fuel in the process.

A USPS truck delivering an Amazon package to your door isn’t adding any substantial fuel cost to its already predetermined daily route. That gas was being burned anyway because USPS has a truck driving right by your house either way. Where as you as an individual will be burning fuel specifically for your trip to Target.

Hope this helps give a better real time visual of the significant differences between something like a Target store and Amazon.

This analysis has been done for food, and the answer is that the trip to the grocery store and back takes *far* more energy than any of the shipping before that point.

The home (mostly refrigeration) turns out to be the big energy consumer for food.

“Yes, you could be wrong and you are”

-You certainly made my night Ron……..

…shaken, not stirred….and very dry!

Be well,

Petro

“Old, cranky, and more than a little stubborn, a curmudgeon is the crusty grey haired neighbor who refuses to hand out candy at Halloween and shoos away holiday carolers with a “bah humbug!” ”

You may be right, collapse may be the end result. All I know is the future is unwritten, with more variables than you can shake a million sticks at. Are you some great predictor of events? A modern day Nostradamus? If so, can you enlighten me as to any of your previous predictions, when they were made, and how accurately they came to pass?

Insisting without any possibility of salvation that everyone will die I do believe qualifies you for the above 😉

Sorry to be the bearer of bad news.

Oh and for the record:

http://dinosaurs.about.com/od/otherprehistoriclife/ss/The-10-Deadliest-Marine-Reptiles.htm

When you can make and operate this with renewables i might think you are on to something

They do.

Electric arc furnaces are…electric. They can and do operate with wind, hydro and nuclear power. Almost all US steel production is electric.

Stephen, when water tables are dropping by meters per year, when rivers are running dry, when forests are being clear cut, when species are going extinct by the tens of thousands per year, when most fish have already disappeared from the ocean and when the human population of the earth is about three times the long term carrying capacity of human flesh, it don’t take a Nostradamus to figure out something has to give.

And for the record Mesozoic marine reptiles were not dinosaurs and oil is not the remains Mesozoic marine reptiles. Oil was created from dead plankton, not ancient marine reptiles.

It was thus becoming apparent that nature must, in the not far distant future, institute bankruptcy proceedings against industrial civilization, and perhaps against the standing crop of human flesh.

— William Catton, Overshoot page 172

when water tables are dropping by meters per year, when rivers are running dry

How much water for agricultural production comes from irrigation?

IIRC, it’s only about 10% in the US. US farmers could reduce water consumption by 10% by just eliminating waste, like rice production in deserts…

Most politicians haven’t been dealing with declining fossil fuels, environmental issues related to fossil fuels, and transitions to renewable energy because their support money has come from industries and individuals that benefit from the status quo.

However, there are some very wealthy people in Silicon Valley and some companies with big piles of cash. At some point that money and influence will trump the fossil fuel money. DC will get the message.

Silicon Valley sees opportunities in moving to new forms of energy generation and distribution and to new forms of transportation. They have no reason to maintain the status quo.

I guess they are already buying up politicians to get subsidies. But as they gain power the economy will suffer. I can see a benefit for the chinese to have a huge surge in renewables, they build the expensive components. Maybe this debate is already influenced in the USA by the YENGLI Green corporation?

But as they gain power the economy will suffer

But haven’t we already established that if we continue to be dependent on BAU the economy will suffer as well?

Yes. But I’m worried a poorly thought investment will hurt the economy and render us unable to make wiser investments. I’m starting to see so much bs about solar and wing I think there’s Chinese money behind it.

Hi Fernando,

The transition cannot happen overnight. What is your alternative to fossil fuels? You love throwing cold water on alternatives, do you think efficiency improvements alone will get the job done? Or nuclear and biofuels along with efficiency? Do you envision making the transition with no wind or solar? Or do you like to say it can’t be done because it has not been done before.

Use a little imagination.

I heard a recent conversation.

One said ‘we could just burn our way through coal and as much fossil fuel as we can afford over the next 50 years while we massively downsize (due a conscious choice, or perhaps just to much debt to replace our ourshoot), and continue to innovate and deploy a more energy efficient culture.’

But ‘what about global warming?’ another says. The first replies ‘we just could deploy carbon sequestration chemistry, such as iron seeding of the ocean, on a massive scale’.

The second, third and fourth say “No thanks! That is just a reckless experiment that we will wreak havoc on mother nature!”.

The first replies “Sorry to be the bearer of bad news, but we are already far into that little mother nature killing experiment. For example, wild animals now comprise less than 2% of the global total animal biomass! And there are many rivers that no longer reach the sea. I could go on…”

And the others just quietly reach for their brew.

Dennis, go read my Interview with Ebenezer Rabbet and tell me what you think about my imagination.

http://21stcenturysocialcritic.blogspot.com.es/2015/03/i-interview-ebenezer-rabbet-rabt.html#more

I think the solution is a little bit of everything. I’m also quite concerned by the sheer amount of unsound baloney I read all the time.

I have the faint suspicion I’m a lot more optimistic than Ron, but I’m also fully aware that we need to find options that REALLY work. And I don’t see politicians approaching this with commn sense. We got the full gamut, from Merkel shutting down nuclear plants and building coal to Obama innocently thinking we have endless natural gas reserves. This crap ought to stop.

And just do it, quit all the blabber.

I represent not the 1% and not the 99%, but maybe, in the USA, 10%. Every one of ’em could have merely diverted what they did buy to what they could just as well have bought, and then they too could go around bragging that they spent nothing for electricity and nothing for gasoline last year.

Sure, they put up some money to do that, but absolutely no more than they did already for those lazy days in the islands, and those fancy restaurant meals, and those goddam water jets. Not to mention that most popular car- the F-150 with jazz on it, slurping up what the scientists tell us we gotta get off of entirely -AND FAST.

Now, calm down, wimbi, go take a break and check if that water bucket solar tracking widget is working right again.

But I’m worried a poorly thought investment will hurt the economy and render us unable to make wiser investments.

What wise investments should they be making and will they?

I sell a list for €69 at my wood print shop, it’s in Denton, near Dallas.

Hi Fernando,

Have you watched any of the Tony Seba videos? Probably too optimistic in his vision, but interesting anyway in my opinion. The video is quite long (44 minutes).

https://www.youtube.com/watch?v=rBOf8ai6Yfk

Shorter video at link below (15 minutes)

https://www.youtube.com/watch?v=4PnL9OuabJo

Dennis, I’m going to interview Tony Seba in the future.

Brian. Thanks for that! It mirrors a very advanced version of what we had cooked up with my saturday science seminar kids about 25 years ago, when I gave them the task of redesigning transportation.

One of those bright pre-teens constructed a computer simulation of our little town with such an on-demand go-anywhere transport system, and went on to win a big prize at the state level.

And with the passage of time, those kids are now beginning to run the world, and by chance that kid’s brother is now the town transportation manager, and is enthusiastically pushing all those ideas.

We are having a show and tell on electric vehicles this sunday, and I hear that a too-big crowd has signed up for it.

I have arranged a PR stunt photo with my home brew electric tractor lined up alongside a Tesla, both drivers eagerly leaning forward to hit the pedal to the metal at the drop of the drag race flag out front.

I am thinking of the newspaper caption saying-

“Electric utility tractor outruns Tesla for the first 20 microns of the race.”

Also, at some of the big retirement communities (where most of the residents vote Republican) the transportation of choice is the golf cart.

Florida residents take golf carts to the streets – Video on TODAY.com

An excellent idea. Nobody is getting younger. Here’s a town in Michigan where they introduced back in only parking. They interviewed some people on their opinions, andgot the answer that older people are driving vehicles they don’t feel confident backing up.

http://www.mlive.com/news/kalamazoo/index.ssf/2015/03/road_diets_in_southwest_michig.html

America has gotten itself into a pickle. As the boomers age, they will have to abandon their oversized cars. So their suburban tracts are becoming traps. They don’t have any adequate alternative transportation system, and they are too spread out be be able to afford one.

Golf carts should be encouraged on public streets, presumably on bicycle lanes. It is already happening, but everyone ignores it. Expect to see more and more headlines like this one:

http://www.timesfreepress.com/news/local/story/2015/mar/21/woman-riding-wheelchair-gunbarrel-road-after-dark-killed/294557/

The Peak Oil problem solved.

http://www.frugaldougalsgolf.com/files/2119812/uploaded/solar230top.JPG

I am looking forward to being picked up and taken wherever I want to go when I get old. Probably wander the parking lot for a while looking for my car to go home. Then I will remember, not my car, gotta call.

You are barking up the wrong tree. Cars, autonomous or not, electrical or not, are terrible transportation in densely populated areas. As the population increases, they will disappear by themselves, because they aren’t economically viable.

https://www.youtube.com/watch?v=CTfGOB4xJWQ

The speed is low on this street, but the throughput (passengers /hours) is extremely high by any standard. The cost of building and maintaining this infrastructure is tiny by road standards.

Cities have to pay for infrastructure with the taxes they collect. Low density means lots of infrastructure and a low tax base. Roads and parking lots are an incredible waste of space and expensive to maintain. That is why hard up cities all across America are introducing “road diets”.

http://www.fresno.gov/Government/DepartmentDirectory/PublicWorks/TrafficEngineering/RoadDiets.htm

The result will be reduced oil consumption, regardless of the supply issues.

This illustrates the problem American cities are facing pretty well.

http://granolashotgun.com/2015/03/17/urban-triage/

One good solution to the problem is for cities to tax surface parking. Or course they need to change their zoning laws as well to allow businesses to open without off street parking. Anyway it would encourage businesses to build on underused lots. That kind of infill would reduce average driving distances as well, reducing the need for roads and ICEs.

Brian,

I am broadly in agreement. There is a lot of momentum now behind solar PV, distributed storage and EVs that I don’t think can be held back.

My sense is that continuously rising and cumulative efficiency gains, as well as straight out substitution of systems (transportation, home energy) that required petroleum products to electric, will weaken demand for fossil fuels to a point that it makes the marginal barrel uneconomic to produce.

If efficiency gains and EVs, can keep the average price of oil below the break-even cost to produce it than things will get interesting.

Yes, depletion will eventually cause the price of oil to spike again, but that would just increase the incentive for even greater EV adoption and efficiency gains.

A reminder of how expensive it will be to produce what’s left. From Carbon Tracker

That’s from Carbon Tracker. They blew the numbers for the project listed at the top, Foster Creek. That project is in its sixth expansion on the way to produce 200,000 bopd. The bulk of the CAPEX was spent, it comes in at about $15 per barrel CAPEX.

I have evaluated these heavy oil projects for years, and they do need about $110 per barrel, but that’s caused by cost and schedule risks for the most part. The industry has been way too active and costs escalated too much. The Alberta Provincial authorities have been quite stupid in this area. They need to consult with the Norwegians or Angolans to understand how to slow down things.

But in conclusion, that chart is bs. It’s just stuff they throw out to see what sticks.

Brian Rose, I appreciate your thoughts and I am not going to dismiss them out of hand.

Remember, there are alot of boomers (and older) people out there who are projecting their own fear of decline, disability, and death onto the world system as a whole, which is an incorrect thing to do.

The young fight for life, the adults live, and the old die. It will always be this way.