The Baker Hughes International Rig Count is out.

The rig count data in all charts below is through February 2016.

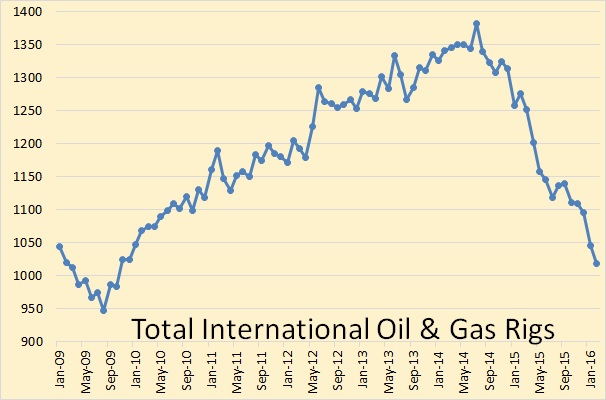

The Baker Hughes International Rig Count does not include the US, Canada, any of the FSU countries or inland China. It does include offshore China. That rig count peaked in July 2014 at 1,382 rigs and in February stood at 1,018, down 364 rigs from the peak.

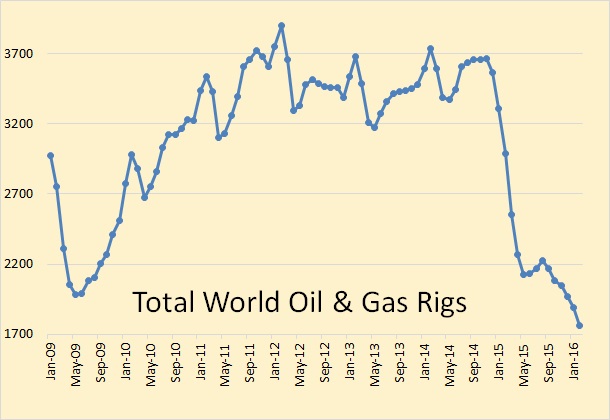

The Baker Hughes total world rig count does include US and Canada but not the FSU or inland China. That total oil & gas rig count stood at 1761 in February, down 52% since December of 2014.

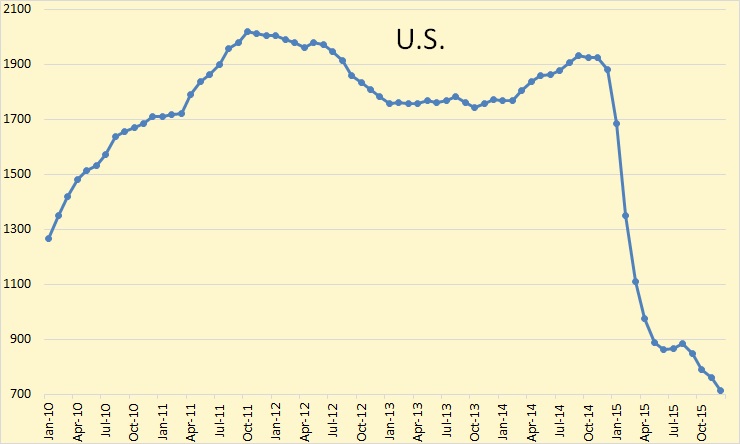

The US monthly total rig count stood at 532 in February, down 72% from November 2014.

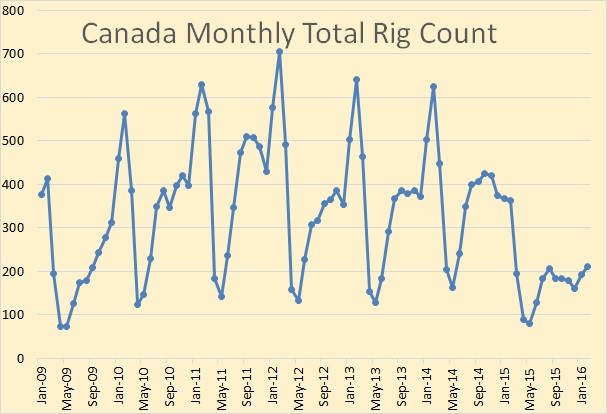

The Canadian total rig count usually peaks in February. It did not in 2015 but stood at 211 this February which will likely be the peak for 2016. That count is down from 626 rigs in February 2014, down over 66%. That was the last pre-price crash February peak.

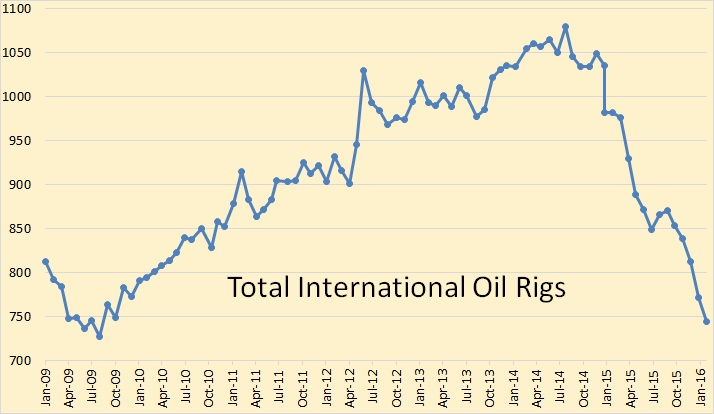

Looking at oil rigs only, total international oil rigs dropped another 28 rigs in February to 744 rigs. That is down 336 rigs or 32% since the July 2014 peak.

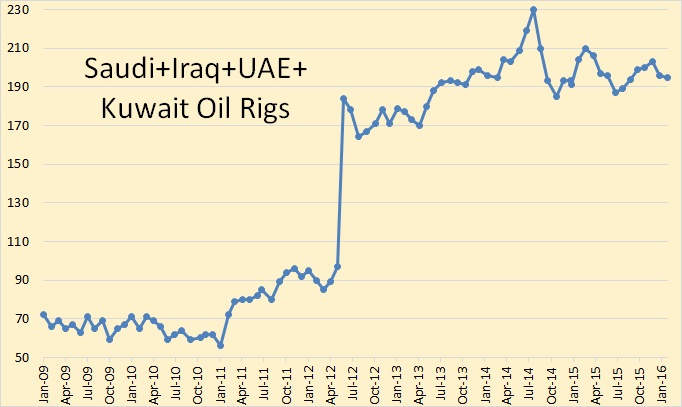

Four nations where the rig count has not collapsed is Saudi Arabia, the UAE and Kuwait and Iraq. The huge jump you see in June 2012 was due to Iraq going from 0 rigs to 78 rigs.

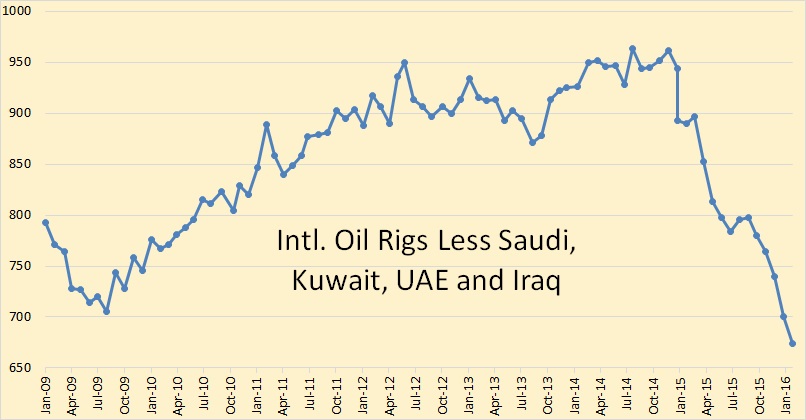

International oil rigs, less Saudi, UAE, Kuwait and Iraq peaked in July 2014 and have declined 30% since that date.

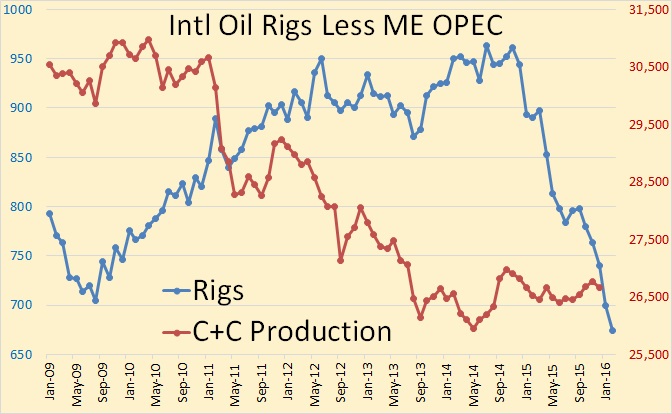

But what has all this done for production… so far.

The production data, right axis, in the above chart is only through December while the rig data, left axis, is through February. Production fell all through the rise in rig count then began to plateau in mid 2013. The rising rig count did not increase production but the falling rig count will almost certainly cause it to decline… after a delay of one to two years of course.

Again, the above oil rig only charts does not include the US, Canada, any FSU nation or China.

Here we go…

Not to worry, once oil goes to $500 we will have oil coming out our ears.

At $500.00 a barrel demand destruction would rule the day and people would be very happy to ride in EVs. At that price I think oil will be done! Sure there will always be niche markets for it. However there is no economy any where in the world that can afford to maintain it’s current way of being at that price.

at $500 a barrel there’ll be world famine. People would be happy to have a enough food to eat and not have to fight to the death for it.

https://gailtheactuary.files.wordpress.com/2011/08/food-price-index-vs-brent-oil-price-june-2011.png

In the image below the red lines are protests/food riots.’

http://blogs-images.forbes.com/williampentland/files/2012/07/food-riots-graphic1.jpg

Hi Jimmy,

People won’t drive their cars very much at $9/gallon for gasoline, there will be plenty of fuel for tractors and less natural gas will be used for home heating as natural gas prices rise so there will be natural gas for fertilizer, when there isn’t enough natural gas, sewer sludge can be processed into fertilizer.

In addition population will peak by 2050 and will begin to decline, the famine scenario is another unlikely scenario, though climate change might have some impacts, fossil fuel decline will also mitigate the climate problem to some extent.

When the UN Food Price Index hits about 220 it seems that people in less developed parts of the world (that’s most of it) get a little uppity and start protests and riots. This is documented in 2008 and again in 2011, when it rose to just under 240 and coincided with an event that became known as The Arab Spring (I recommend we rename it The MENA Fall). It appears there is a strong correlation between oil price and food price, as well as one between food price and political upheaval. It seems to me that it doesn’t matter what people in USA do with their oil (drive or not drive for example) that creates this condition, but that it is the high price condition that impacts the food price, and the food price impacts the behaviour. If petrol hits $9 a gallon in USA driving around will perhaps be the least of our worries. Any anthropologist will tell you that people steal before they starve. Willing to die trying I bet. And as recent events have shown in Europe, people, when properly motivated, can walk a lot further than we might have at first thought likely. Population will be going down much before 2050 I’m sure.

http://www.worldbank.org/en/topic/poverty/food-price-crisis-observatory

http://blogs.scientificamerican.com/primate-diaries/files/2011/08/Food-Price-Index-and-Riot.jpg.jpg

Further to last…. here is an interesting article about Egypt and it’s current financial predicament. Food price features prominent. Matt Mushalik has had some great articles about Egypt also.

https://www.stratfor.com/analysis/dollar-crisis-threatens-egypts-economy?id=be1ddd5371&uuid=df2222e4-b074-4521-8ab5-aeb19f6404fb

http://crudeoilpeak.info/category/egypt

Hi Jef,

I believe you are kidding. Even optimists don’t think the oil price will rise above $200/b by 2025 without crashing the economy and thereby driving oil prices lower.

There is likely to be more oil produced at $200/b than at $40/b, but a peak will occur no matter the price of oil (or it has already occurred in 2015 and higher oil prices may not result in a new annual peak in C+C output).

http://www.marketwatch.com/story/eia-us-shale-oil-output-to-fall-106000-barrels-a-day-in-april-2016-03-07

“Oil production from seven major U.S. shale plays is expected to fall by 106,000 barrels a day in April from March to total 4.871 million barrels a day”

Surprisingly few rigs in Angola (8) and Nigeria (6) given that there are a number of deep sea developments due to start over the next two years.

A large number of indian rigs (99) for their relatively low total production – are these onshore or offshore, oil or gas?

Iran is not included that I can see – is this because of sanctions in the past?

Are there any numbers for FSU available elsewhere – e.g. Azerbaijan connection through BP?

No entries for Uganda but I think there have been recent finds announced there, similarly the Falkland Islands.

UK offshore in death throws at only 7.

Venezuela seems to be doing OK at 69 (cf 71 in June 2014) despite the economic problems there.

Overall not looking good for exploration, development or in-field drilling over the next 3 to 5 years except for the core OPEC countries.

Iran was never included in BHI rig count

What happens to these rigs pulled out of service? What are the financial implications for the companies owning them? How quickly can they be put back to work if oil prices should go up again sufficiently?

“What happens to these rigs pulled out of service?”

They remain idle. What’s worse, newbuild offshore rigs are entering an already oversupplied market.

A recent article on the offshore drilling market:

The downward spiral

Tuesday, 01 March 2016

http://www.oedigital.com/vessels/item/11764-the-downward-spiral

“What are the financial implications for the companies owning them?”

Negative:

Moody’s slashes drillers’ ratings

Wednesday, 02 March 2016

http://www.oedigital.com/vessels/item/11799-moody-s-slashes-drillers-ratings

“How quickly can they be put back to work if oil prices should go up again sufficiently?”

Offshore projects are operated by large companies, which are not as flexible as the US E&Ps in general, and shale players, in particular.

If oil prices rise substantially, these large companies should approve higher upstream budgets and take investment decisions on new projects, which usually takes time.

Then they need to sign contracts with offshore drillers.

Then the rig should be moved to the place where it is needed.

All together, that may take up to 2-3 years.

Hi AlexS,

Due to project cancellations in 2015 and 2016, wouldn’t you expect a shortage of oil in 2018 or 2019 due to a gap in big new projects that may be difficult to turn around quickly. If that happens I would expect a spike in oil prices to over $100/b, it is not clear that LTO output or new conventional drilling will be able to fill this gap. Eventually (maybe by 2020) more output might cause a gradual drop in prices as supply recovers (though this is a big question, it is not clear whether output will return to 2015 levels).

Thoughts? Does that seem a somewhat reasonable scenario from your perspective?

Does $90/b in 2019 seem possible. Assume 2% or higher World Real GDP growth from 2016 to 2019.

When the oil price tanked the Canadian dollar dropped as low as $.70 high 60s. It now seems to have decoupled from the world oil price and lately has hovered around 74 cents. With the change in Govt it also appears to be more and more accepted, (tone of the press and news reports), that our domestic supply and limited exports are acceptable, but that there will be no huge ramping up of Oil Sands development projects regardless of increased oil prices. There is an ongoing discusssion about a Federal Carbon Tax, in addition to what already exists in BC and Ontario. There is also a push for the Energy East pipeline to intercept imports for eastern refineries. Opposition by Quebec seems to be narrow and political in focus, with the population in favour of it by a slim majority. The rest of the country is for it, if news reports are correct.

The drill count is certainly down, and now the Alberta anger seems to be morphing into resignation of a new paradigm and different lifestyle. News reports are about people retraining rather than just waiting for the wages and jobs to ramp back up. Energy production is certainly very important and vital to our needs and lifestyle in Canada, but it is no longer accepted as the be and end all of economic development and progress. Even in my home Province of BC, the blather about LNG export terminals seems to be fading away as a new election cycle beckons.

It’s been interesting to see this and I would be interested if any other Canadians on this forum concur? Is the tone changing in Alberta?

As for climate change awareness, the concensus is that this summer will be a massive fire season in Alberta and Saskatchewan. There is virtually no snow on the ground. My helicopter buddies are being approached for fire contracts on mediums, the mainstay of suppression. Of course we have the El Nino going on big time, with almost unending rain and storms on the west coast. (Today is beautiful, though…warm and springlike). Big storm coming again, tomorrow. The snowpack is excellent this year in the mountains as opposed to last year. At 4500 feet, it is around 15′ in my area. Higher, it is obviously much deeper. Last year we had almost no snow pack and many ski hills shut down. Our river almost stopped flowing by Sept.

Change is good.

regards

Paulo,

A weird complacency has set in. It’s not unexpected, the honeymoon after the surge of effort to see that Harper wasn’t re-elected has left those who otherwise would have been active on the sidelines while they get their wind back.

As I run through the scenarios, I find myself coming to the realization that Canada is hooped, politically and economically.

In Alberta, Rachel Notley is making ultimatums to force B.C. to allow oil pipelines through. In Saskatchewan, Brad Wall plays the East-West card, while touting his local CCS example as climate action when it’s really just a subsidy to the oil industry in the form of CO2 EOR.

Weirdly in the East, it seems Wynne and Couillard don’t seem to have a problem with having the natural gas Mainline that brings Western gas to Eastern Canada repurposed into a dilbit/syncrude pipeline, Energy East. They seem to be oblivious to the implications of having a major supply route for gas removed as an option, and what impact this might have on gas prices at peak winter demand. All those homes and buildings from Windsor to Quebec City, will be largely dependent on North Eastern U.S. Shale production… with it’s inherent rapid production declines.

Trudeau, Wynne and Couillard will find themselves unelectable if they allow Energy East, and after it’s built a sudden spike in natural gas prices occurs because there is no longer a diversity of gas supply. Pissed off households with high heating bills might not forget that at the polling station.

Now that it’s clear that the loonie is a petro dollar. With all the cancelled and delayed projects, idled and stacked rigs, and the relentless decline of existing oil production, the price of oil has a reasonable chance of spiking. And the loonie will spike with it, killing off the recent growth in the Canadian economy that isn’t related to petroleum. Trudeau’s talk of the need to diversify the economy federally, or Notley’s speechifying in Alberta, will be blown to pieces. Nothing kills off the growth of a non-petroleum based export economy faster than a high, rising and volatile currency.

Canada can’t have it both ways. Trudeau and the premiers, for all their speeches to the contrary, can’t change the fact that further growth in Alberta’s bitumen production is bad for the Canadian economy in the medium term, and bad for the most populated provinces in the short term.

Justin should politely ask Barack to introduce economic sanctions to Canada. Economy would be transformed from open mining pit/corporate rentier type to something more diversified and sustainable in a hurry. But it was the Russians that got lucky with sanctions.

Apologies if I’m slightly off topic, but Something interesting from Ugo Bardi:

“The projections that had been circulating during the past few months turned out to be correct. Now, it is official: the global carbon dioxide (CO2) emissions peaked in 2014 and went down in 2015. And this could be a momentous change.”

http://cassandralegacy.blogspot.co.uk/2016/03/an-epochal-change-have-co2-emissions.html

This would roughly tie in with Ron’s estimate of an all liquid peak in 2015. Sadly I don’t think this is much cause for optimism although I have always thought that resource depletion is our most urgent near term threat. He continues:

“The decline might not follow a Hubbert curve but, rather, a Seneca curve. That is, emissions may decline much faster than they grew in the past. That implies, of course, a parallel crash of fossil fuel production and of the world GDP. The resulting economic collapse might keep us within the “safe” climate limits.”

The Seneca Cliff is not a likely scenario.

Why will fossil fuel output rapidly decline?

The economy will crash.

Why will that occur?

Due to the decline in fossil fuel output.

Circular reasoning at its finest.

Many use the debt issue as the cause of the economic crash, but this is less of a problem than many realize.

Who is the money owed to, aliens?

For the planet the assets and liabilities match.

Well he’s hardly the only one theorise about about the occurrence of a Seneca Cliff or a sharks fin curve type decline. Why would it occur? Because after all the low hanging fruit has been picked the unconventional sources generally have high initial production, but high decline rates and god knows what will happen to the super giant fields when infill drilling has run it’s course. Why will the economy crash? Because of the intimate relationship between energy use and all economic activity. If energy rapidly declines so will the economy. I don’t think it will be due to debt that can and will be defaulted on in one form or the other. You know Dennis I think you would make a good sell side analyst. Obviously I hope you are right & I am wrong.

Does not look like Dennis C’s writing style.

Hi Marcus,

Note that I expect a peak and decline. Reasonable estimates of C+C URR of 3000 Gb minimum, based on an HL estimate (which tend to be on the low side) and a conservative estimate of oil sands reserves (in both Canada and Venezuela) of 500 Gb. Note that infill drilling has been happening in the US for a very long time, no Seneca cliff, just moderate decline (until shale boom). Yes we can see sharp declines in offshore areas and eventually in the LTO plays, but this is a small part of total output and the declines will not be synchronized.

The chances of a Seneca cliff in fossil fuel output World wide, in the absence of an economic crash for other reasons, is infinitesimally small.

Chart below with a scenario with C+C URR=3000 Gb using Oil Shock Model.

I notice that many refer to this as a “Hubbert” decline, this is not a Hubbert model based on a logistic equation. The oil shock model is based on discovery data (from Jean Lahererre) and a model of those discoveries being converted to producing reserves over time. Each year new producing reserves are added (from existing discovered resources) and oil is “extracted” from total producing reserves. The historical extraction rate (annual production divided by total producing reserves at the beginning of the year) is found by looking at output and the “producing reserves”.

Based on past extraction rates I guess at future extraction rates (which are obviously not known).

See http://peakoilbarrel.com/oil-shock-model-dispersive-discovery-simplified/

I modified the scenario slightly to account for more recent estimates of 2014 and 2015 C+C output, remember that the URR is very conservative, based on a Hubbert Linearization of World C+C less extra heavy oil (oil sands from Canada and Venezuela).

Fernando agrees that a 2800 Gb for C+C less XH oil is reasonable, here I use 2500 Gb plus 500 Gb of XH oil (3000 Gb total), note that Fernando may think the XH URR estimate is too high, 500 Gb is Jean Laherrere’s estimate. Chart below shows extraction rate and annual decline rate for a scenario with a 2015 peak, consistent with Ron Patterson’s prediction of a 2015 peak. My belief is that this scenario will be too low.

Dennis Coyne “Many use the debt issue as the cause of the economic crash, but this is less of a problem than many realize. Who is the money owed to, aliens?”

The money is ‘owed’ by future generations. The problem is that debt needs to be repaid with interest. Hence growth is necessary. I believe that in the current economic system growth requires oil production to expand. If Peak Oil has already occurred there may well be a Seneca Cliff type event when people realise the consequences. But I do not believe it will happen soon. I think the current low oil price is a White Swan event that is extremely beneficial to the Global system. Beneficial not because it is creating a boom but because it is preventing the forthcoming recession from being a Seneca cliff event. Yes low prices hurt the producers, but their loss is the consumers gain. In national terms Saudi Arabia, Venezuela and Canada are hurting but countries such as Japan, South Korea and Germany have gained. The US has probably come out even. Oil Producers are down but Car Production is up. But the biggest factor in the White Swan nature of low oil prices is that it completely obscures the reason why oil production must fall. I do not believe that Ron was ‘lucky’ in making his prediction of Peak Oil before the price fall.

“obscures the reason why production must fall.” Exactly. “Seneca Cliff type event when people realize the consequences”. I think you meant the cliff will occur when no one realizes what is happening (AKA wiley coyote). D

Hi Jeju-islander,

The money is owed to and owed by those future generations. Interest is simply the pride paid for borrowing. Currently real interest rates (nominal rate minus the rate of inflation) are close to zero so the cost to borrow is very low.

In fact for those with good credit scores auto loans are often at zero nominal rates in the US which is essentially a negative real rate of interest.

For governments that are not encumbered by outside forces (such a those who are members of the EU),it makes good sense to use fiscal policy to boost economic output as the borrowing cost is very low for many nations.

In the case of private debt, the money is owed and borrowed mostly between the wealthy. When there are defaults wealth is transferred from the lenders to the borrowers, the interest payments are in part to cover this risk.

When oil prices are high at peak output the “peak” will be more believable.

Wrote “pride”, but meant price of borrowing

Dennis,

Here’s an interesting thing that’s now becoming clear to economists: oil shocks aren’t primarily bad because of resource limits, they’re primarily bad because they confuse the economy. Suddenly investors (whether they’re oil investors or individuals considering a car purchase) don’t know what to do, and they defer investment, which hurts the economy. Suddenly previous investments (oil rigs, or SUVs) lose value, and the economy appears to be badly misallocated. Suddenly people (and assets) are unemployed, as the economy attempts to reallocate towards a new normal.

For the same reason, the current oil price crash is harmful to the economy. Economists expected low prices to help oil importing countries and oil consumers, but the “friction” of reallocation in the economy has hurt as least as much as new-found oil savings have helped.

One implication, which is supported by real research (I can point you to Prof Hamilton’s article on this, if you like): a *gradual* rise in oil prices won’t hurt the world economy much. If it’s part of a long-term change in public policy away from FF and towards EVs and renewables, the economy will be just fine, as the transition will be understood by investors and the changes won’t scare anyone into deferring investments (much of which will go towards the new tech, replacing traditionally massive investment in old FF tech).

Hi Nick,

The link to the Hamilton article would be nice, he does great work.

“For the planet the assets and liabilities match.”

That would be true only if a large part of those assets wasn’t imaginary. As it is. Trillions have been loaned globally on assets which have no value and sometimes don’t even exist at all.

Hi Strummer,

The books will match. When default occurs both asset and liability are reset for that loan. Asset values always change sometimes up and sometimes down, that is part of the reason for interest payments, to cover risk.

Dennis,

Dennis, I am surprised that since you make models on oil production, you haven’t thought deeply on what type of factors are likely to produce a Seneca decline versus a Hubbert decline:

1. Lack of enough cheap abundant energy to carry out the extraction to the end. Hubbert thought that it was going to be nuclear. As ERoEI declines energy issues will accelerate the oil decline curve.

2. Lack of economical and financial stability. A good economy and finance are required to carry out the extraction to the end. However they are very likely to be negatively affected by the reduction in oil.

3. Lack of international cooperation. International cooperation and fair play is required so everybody assumes part of the decline, otherwise parts of the world collapse bringing down the global economy.

4. Lack of peace in producing areas. Any conflict affecting production would accelerate the decline.

5. Increase of extraction cost to the economy. If the economy needs to dedicate a bigger part of its output to extraction, demand will reduce and decline in production will accelerate.

6. Other peaks as consequence of peak oil. Any limitation in any material or resource will likely accelerate the decline.

7. Lack of technological and production improvements. As they bring forward future production, they enhance the future decline producing a Seneca curve.

8. Lack of export land model. If producers don’t drastically cut their consumption, exports will collapse, and importer countries will be brought down, dragging the global economy.

These are only the issues that I can think that clearly will negatively affect oil production when we are past Peak Oil. There are probably more that I cannot think.

I am afraid that a Seneca decline in oil production after Peak Oil is a certainty that you are leaving out of your models. If you want to know what is going to happen when we do not have enough of something on what we completely depend you need to think outside the box.

Hi Javier,

Energy can be used more efficiently.

Oil is not the only source of energy, there are other fossil fuels, nuclear, hydro, wind, solar, and geothermal power.

As fossil fuels peak they will become more expensive, the relative price of other forms of energy will be lower than fossil fuels and society will transition to alternatives and because energy will be more expensive less will be used per unit of GDP produced.

In addition, World Population will peak (between 20150 and 2070) so GDP growth will slow down as this occurs.

All of the problems you suggest have been with us for a long time, humans will deal with those problems as they arise.

So if you are saying that another Great Depression or World War may occur in the future, I agree.

I cannot predict in advance when those may occur, in the case of a nuclear holocaust a decline in oil output will be pretty low on the priority list.

In any case the point is that without such events there will be no Seneca cliff.

EROEI has to be considered on a societal level for all sources of energy, the EROEI of any individual product is not important because high EROEI sources can make up for the lower EROEI sources.

Rune Likvern used the Red Queen analogy to great effect.

If we think about the oil industry on a treadmill running faster and faster just to stay in place, a gradual decline in oil output might occur as the speed of the treadmill was gradually lessened over time.

A Seneca cliff occurs if someone unplugs the treadmill, and takes a hammer to it so that plugging it back in does nothing.

A World war or Great depression would surely drop all energy output severely,

but in the absence of some large shock to the system, I think it unlikely the plug will be pulled.

I believe a Seneca Cliff oil crash is possible, if we are unlucky and any several unhappy scenarios come to pass.

BUT if we are reasonably lucky, there is an excellent possibility we can adapt to gradually declining oil production, and gradually rising oil prices, assuming we have the presence of mind to do so.

There is room to cut consumption by close to half, just by building more efficient cars and trucks, using rail instead of trucks, etc. Beyond that, there are too many lifestyle changes we can make to easily count them- changes which will leave us on the whole living as well or better than we live now.

People lived just fine before plane tickets got cheap enough for working stiffs to fly the family cross country to visit Grandma, and we will continue to live ok without the sky being crisscrossed with as many as eight to ten airliners simultaneously visible from my farm out in the boonies on any given clear night. Grandma might have to move if she wants to see the grandchildren, that’s tough, but it’s not the end of the world.

ONE factor involving peak oil that REALLY matters is that we mostly avoid seriously discussing oil consumption in newly prosperous Asia.

My personal take is that China , India, etc, are never going to have full fledged western highway systems and two cars parked at every peasant’s hut.

They will probably manage to get to the point they have mostly decent highways and truck transportation for essential goods, if they are lucky.

And if they are REALLY lucky, they might get to the point that every third or fourth hut has a micro mini pure electric or plug in hybrid, most likely with a smallish battery providing a rather limited range.

People who have lived their entire lives in a neighborhood, except when traveling occasionally by bus or train, are not going to suddenly be able to move out to far flung suburbs, the way we do in the USA. Stores and services will continue to exist in combination with residential space in such countries.

We were able to separate living spaces and business spaces because we did it when oil and land were plentiful and cheap. India and China don’t really have that option.

Bottom line, most of the oil produced in the future will continue to be used in the countries using it now. The exceptions will be in countries that are importing on credit, with no way to repay the loans. India and China will get THAT share.

I am with Dennis when he says we owe the giant debts , collectively, to ourselves.

Hence we will not NECESSARILY suffer a major or complete economic disaster as the result of these debts, any more than you will NECESSARILY have a bad accident due to having a few brews and driving home.

The risk of a truly big time economic crash due to the collective debt load is pretty high, no doubt about it.

But history tells us that debts can be written off, in all or in part, thus avoiding some or most of the consequences of failure to pay them.

The REAL issue is how much capital the world really has, in terms of natural resources, manpower, ingenuity, and ecosystem services provided “free” by nature.

Up until a few years ago, I owned a house built cookie cutter style right after the Korean war, that sold for 5,500 bucks turn key, water sewer electrical, lot and all in 1956. It is still in excellent condition, having been upgraded with new windows, new roof , extra insulation, heat pump within the last few years, and with care will last another hundred years easily.

With a declining population now apparently safely in the cards, future generations will inherit awesome amounts of infrastructure that contrary to the pronouncements of gloom and doomers, will be in excellent condition, presuming it is reasonably well maintained.

It costs maybe ten percent on average to repave a highway, repair the culverts and gaurd rails and bridges, etc, compared to building new from scratch.

I may be entirely wrong, but I think maybe housewives will only visit supermarkets in order to enjoy the shopping experience and get out of the house twenty years from now. They will shop online, and a driverless car will pull up with the groceries at the desired delivery time.

Twenty such driverless hired cars will probably take the place of fifty to a hundred personal automobiles. If electricity is gets to be expensive enough, the supermarket will give a discount to shoppers willing to delay delivery while the wind is brisk, and or the sun is bright, so as to charge up the delivery car with renewable power.

Peak oil does not mean the shipwreck of civilization. I once believed it did, but now I believe renewables are coming on fast enough that between improving efficiency and changing lifestyles, we MIGHT manage the peak oil problem successfully.

Just one car in ten being a pure electric is enough to offset the amount of gasoline needed by close to ten percent. We can easily get to the point that ten percent of the cars on the road are pure electrics or plug in hybrids

An oil price spike is probably at least as likely as the recent price crash, and within the next few years, if the economy holds on.

In five years there will be plug in hybrid and pure electric cars at just about every major make dealership, world wide. In five years a lot of poor people will have had the opportunity to own a cheap older electric or plug in car, and the word will be getting around about how cheap they are to own and drive.

Electric cars just aren’t going to sell until they are IN STOCK at dealers stores, and advertised, and people know more about them. Sinking six or eight hundred in a phone is one thing, putting twenty thousand or more in a questinable purchase is something else altogether. Most folks will not buy an electric auto until they get to be common on the road.

If it weren’t for the internet, I wouldn’t know a soul who owns a LEAF or a VOLT or a TESLA.

But the Prius is common enough now, and well enough thought of, that I know four people who own one, three of whom bought theirs used.

And I know a couple of people who are keeping an eye out for a cheap Volt.They are figuring on saving five or six bucks a day on gasoline, if they can find one, getting to and from work. Being gearhead types, they figure the car will run just about forever, since most of the mileage will be on the battery rather than the engine. So when the battery is eventually wears out, they still expect to have a thirty five mpg commuter with a relatively new engine.

Hi Old Farmer Mac,

The point that I did not make clear is that in the absence of a severe shock (total economic meltdown or WW3) a Seneca Cliff is very unlikely.

I agree that many bad things are possible and in the next 35 years it is likely that we will have a major recession (or depression), but I don’t pretend to be able to foresee when that will occur.

I have suggested on several occasions that if someone wants to guess when such an event might occur, I could attempt to model it. I even did a couple of such scenarios in the past see

http://peakoilbarrel.com/oil-shock-models-with-different-ultimately-recoverable-resources-of-crude-plus-condensate-3100-gb-to-3700-gb/

particularly the “pessimistic scenario”

A different Seneca cliff scenario is shown below.

Annual decline rates remain above 2% from 2036 to 2050 in this scenario consistent with a major World Depression over that period, maybe with a major oil war thrown in. Clearly nobody knows when or if such an event will occur, I agree such an event is possible, perhaps humans have learned from previous mistakes. Though based on the history of the last 50 years we have not learned much, so I can understand pessimistic viewpoints.

Dennis,

“The point that I did not make clear is that in the absence of a severe shock (total economic meltdown or WW3) a Seneca Cliff is very unlikely.”

That point is only correct for a resource that:

a) Can be completely substituted without significant loss, or

b) It is not critically necessary.

Otherwise the Seneca cliff is the default pathway as the loss of the resource creates a negative feedback loop on the production of the resource.

I understand that you assume oil is in one or both of those cases. I think you are going to be very surprised by future developments.

Hi Javier,

There will be both positive and negative feedbacks to less oil output, you only consider the negative feedbacks, I consider both. In places where there are already high fuel taxes the impacts will be lower as there is good public transportation and liquid fuels are used very efficiently, higher fuel prices will lead to even more efficiency.

In places like the US the impact will be greater and there will be a quicker transition to more fuel efficient vehicles and a build out of the public transportation network, these transitions increase economic activity and employment which can be positive for a struggling economy. High oil prices will lead to the allocation of a scarce resource to its most important uses.

It is you who will be surprised at how adaptable a market economy can be when the government doesn’t interfere by trying to control prices (as the Nixon administration did in the 1973/74 oil crisis.

Over time high oil prices will both increase output (relative to output at lower prices) and reduce demand in the long run. It will also make EVs, plug-in hybrids and public transportation more attractive which will tend to reduce fuel demand.

Eventually if the economy is unable to adjust there may be an economic crisis. This may lead to positive public policies that will help with the transition (as in the US during the Great Depression, there could be significant changes in public policy).

“There will be both positive and negative feedbacks to less oil output,…”

The negative impacts are a 100 times more than any benefits.

Hundreds of millions will lose their jobs and begin to starve. Whether or not the diesel and NG are there in order to grow food enough to feed the population has never been the issue in the industrial civilization, it is always about being able to afford food.

When people no longer see a future where they can provide for themselves and their families thats when it will all come unraveled.

I would argue that the only reason that that has not happened already is because the world threw trillions at the problem believing that their are no limitations that can’t be overcome with enough money.

This has obviously failed and we are starting to see a crack forming.

By the way this experiment all but guarantees a very steep or at least steeper downside.

Hi Jef,

Why will hundreds of millions lose their jobs and starve? There is much that can be done by governments in the face of high unemployment, building a hvdc grid, building more public transportation, bikepaths, sidewalks, improving homes to make them more energy efficient, installing heat pumps. In the private sector there may be demand for more energy efficient vehicles and appliances and PV solar, people are needed to build all this stuff. There will be demand for all this because energy prices will eventually rise as fossil fuel markets get back into balance between supply and demand.

A lot has been learned about economics since the great depression thanks to Keynes and others. The government response to a second great depression will reduce its severity relative to 1930 to 1939, in fact the GFC would likely have been Great Depression 2, if governments handled the 2008 crisis as poorly as the 29 crash was dealt with from 1929 to 1933.

I do agree there will be negative consequences, this may set into motion positive changes that in the long run may outweigh those negative consequences.

If the economic crash occurs before it is clear that peak oil has been reached (prior to 2030), positive changes in the energy sector may not occur or may happen too slowly.

The best case would be that high oil prices cause a new peak by 2020 and that output remains on plateau until 2025 and then declines at 1 to 2% per year while oil prices remain high (close to $160/b by 2029), perhaps people may be convinced that peak oil has arrived after 5 years of decline in output with oil prices between $125/b and $160/b.

Then an economic crash may cause people to rethink energy policy and we might see some positive things result (along with the negative consequences of a deep recession).

An economic crash before an oil peak at high oil prices would be a disaster, and there is no reason this would not occur, financial crises are not easy to predict in advance.

Sorry Dennis, you did not understand.

Once you enter terminal decline in production after peak oil, there can only be negative [actually positive as they accelerate the decay, but a lot of people don’t get the meaning so let’s refer to the effect] feedback loops that increase the rate of decay and reduce oil production. There can not be any positive feedback loops that increase oil production because we will be in terminal decay, so nothing can change that.

Many of the things that you comment like higher oil efficiency and substitution will likely reduce oil production giving place to a Seneca cliff type of decay.

As you are using your arguments in the opposite way as they should act on oil production, you reaffirm me in my idea that you have not thought very well about these issues.

Hi Javier,

Yes you are correct a positive feedback will accentuate the effect. However in my response to Jef, he was talking about negative consequences rather than feed back loops.

In fact , my comment responding to you I pointed out that there are negative and positive feedbacks, without identifying which is which. So you are taking comments out of context.

So let’s think about what happens as oil output declines.

You claim that there will only be positive feedback loops so that oil output will fall faster and faster eventually dropping vertically to zero output, as that is how a positive feedback loop would manifest.

Is that your model? How about if you present it in a chart? As clearly you have thought this through very carefully.

Eventually oil output will drop rather quickly as substitutes become more attractive economically.

Are there other sources of energy besides oil?

Yes there are.

The critical thing that the economy needs is energy and as the relative prices of different types of energy change over time the economy chooses the types that work best at that set of prices.

My expectation is that it will take time for the economy to transition to lower oil use and that oil prices will increase as the supply of oil falls below demand at lower oil prices.

You assume the economy cannot adjust to the higher oil prices, but it is not clear why based on the experience of 2011 to mid 2014. The higher oil prices will reduce the rate of oil decline, possibly to zero, this price effect would be a negative feedback. They will also lead to greater efficiency of oil use which would reduce the demand for oil (a positive feedback). In a market economy these two opposing forces tend to balance each other so that a market equilibrium is reached.

This equilibrium will be dynamic rather than static, with supply gradually falling and demand gradually falling due to a combination of depletion on the supply side and substitution and efficiency on the demand side.

So again you may not think I understand, but I understand both physics and economics quite well.

In addition I have a physical model that suggests if extraction rates remain near historic levels the decline in oil output will be manageable (less than 2% per year), even with a very conservative estimate of World C+C URR of 3000 Gb, the USGS estimates about 4000 Gb.

Historically the Hubbert Linearization technique has resulted in URR estimates that have been too low, over time I expect the HL estimate of 2500 Gb for C+C less extra heavy(XH) oil will be too low by 300 Gb (USGS estimate is about 3100 Gb).

Hi Javier,

My apologies, you are correct.

I used negative feedback when I should have said positive feed back in my original response to you.

However I believe you first said there would be a negative feedback loop which would lead to a Seneca cliff.

You said:

Otherwise the Seneca cliff is the default pathway as the loss of the resource creates a negative feedback loop on the production of the resource.

Also a negative feed back could reduce the rate of decline, even if it does not cause output to increase, just as a positive feedback would tend to increase the rate of decline.

I agree that at some point a transition to EVs, plugin hybrids, hybrids, and more efficient ICEV along with greater use of public transportation, more telecommuting, and migration to more walkable and bike friendly communities will act as a positive feedback potentially leading to a Seneca cliff as oil prices may fall due to lack of demand. I do not expect the transition will reach that point until 2040 at the earliest, prior to that the fall in demand will roughly match the fall in supply due to depletion and oil prices will remain relatively high, about $125/b or more.

OldFarmer,

Disruptions happening among the disrupters. New grapheme batteries to be produced that should have several times the charge density of lithium types. That will push the range of electric cars to the 300 to 600 mile range. Depending on price point, which should fall with increased production, this could be severe competition for lithium batteries. It also has no tendency to explode.

http://nextbigfuture.com/2016/03/spanish-company-graphenano-claims.html

Yes, they like to claim this and that. If it were true then things will work out. But we hear about these vaporware technologies all the time. Thus far there’s nothing.

I doubt very much this is a hoax.

Cynics do not contribute, skeptics do not create, doubters do not achieve.

That Spanish company, Graphenano, is a scam, GoneFishing. It has been created by Martin Martínez Rovira, a guy that was part of the Board of Bio Fuel Systems, another Spanish company created in 2006 by French Bernard Stroïazzo-Mougin former international gun dealer that provided guns to Chechen rebels. Bio Fuel Systems with a Spanish University professor claimed that it could produce oil from algae at commercial rates at about 7 barrels per acre and day. They got 30 million euros from Italian Investment group Enalg and private investors and built the first oil from algae producing plant in the world. They got 9 more million euros from the Madeira Electric Utility Company to build a plant there. They also got quite a lot of money from Spanish administrations.

In 2013 they suspended payments without having produced a single barrel of oil, they have suits filed against them in Portugal and Spain, and a trial for tax fraud.

Now one of the guys involved comes back with graphene batteries and he is again getting a lot of money from technoptimists that can’t google.

Technoptimists are a gullible bunch. They seem to believe in unicorns and they can be sold one without seeing it.

Luckily, most of the creators and inventors of the world are far too busy to pay attention to your naysaying. Even if this Spanish company is not fully successful, someone else will be.

Just as with the airplane, the radio, vaccines, and millions of other things; the pioneers just keep working, and they ignore the doubters and naysayers. So should we. Otherwise it’s the Dark Ages again or worse.

Funny. I live in a sort of similar appalachian place, and the number of leafs has tripled in the last year, and I know people with volts and even 3 with teslas.

What’s the diff? Maybe, maybe, because I and and a couple of other rather loud people here have pushed out lots of op-eds to the effect that EV/solar makes sense several ways, and we run around with big solar signs on ours and get lots of questions.

Another one. My wife got a call from a Nissan dealer urging her to trade in her 3 yr old leaf for a new one, and she, typically, responded that she liked what she had, it suited her usage just fine, and she saw no reason to change.

The guy then came clean and said he was just looking at his possibility of making money, since “I’m all of a sudden getting lotsa calls for used leafs”.

Local Nissan has put in a fast charger at the shopping center, under a big PV array, not at the dealer.

That’s why I keep saying there’s an EV explosion just ignited, and oil people better take notice, since cars are where they live.

After all, as every ICE guy knows, big explosions start with little sparks.

ANd for every Leaf sold there were more than a hundred trucks and suvs sold too.

Electric car sales worldwide have doubled every year for three years. At that rate they will outnumber ICE cars in less than a decade.

Do you have any data on that assertion. I can’t find much other than this. 50% by 2040.

https://en.m.wikipedia.org/wiki/Electric_car_use_by_country

See references (6) and (27)

Hi Jimmy,

Using sales data from

http://www.gbm.scotiabank.com/English/bns_econ/bns_auto.pdf

and

http://insideevs.com/monthly-plug-in-sales-scorecard/

and assuming the 2015 plugin sales of 0.55 million vehicles continues to double every year and that the 2013 to 2016 (forecast) trend of total passenger vehicle sales continues until 2022, I get to 50% plugin vehicles between 2021 to 2022.

You may suggest the assumptions are not realistic (doubling every year), I would agree with that criticism. Chart below is too small sorry.

Hi Gonefishing,

To be clear, the plugin sales would outnumber ICEV sales in less than a decade, the doubling every year assumption is not very realistic however once we reach about 10 million in plugin sales per year.

Growth rates would probably slow to about a 20% increase per year.

That model (somewhat more realistic) get to 50% plugin sales by 2029. Chart posted further down thread.

Hi Gone fishing,

The “realistic” plugin sales model below.

20% sales increase after 2019, where initially I assumed a doubling of plugin sales every year.

Hi Jimmy,

For passenger vehicle chart I talked about earlier I am reposting chart here so it is larger.

Dennis, of course the EV market and production will reach saturation at some point but the point behind the point is the tremendous decrease in gasoline use that may occur within the next decade.

It takes about 8 million bpd of oil to produce gasoline for the passenger cars in the US. The growth of EV and higher mpg ICE could cut that in half or less, reducing the need for a large chunk of oil production. If it goes all EV we are talking eliminating most of the need for 8 million bpd in the US. Since both locomotives and heavy trucks are getting more efficient, knock off another million bpd or more.

One way or another, the oil industry is going to shrink in the future.

History of auto production

◦At the start of the twentieth century there were only about 8,000 cars in the United States and possibly not more than 25,000 worldwide.

◦Most cars in the early 1900s were located in either the United States or Europe. In 1908, for example, there were only about 20 cars in Tokyo, Japan.

◦There were 300 cars in the United States in 1895, 78,000 in 1905, 459,00 in 1910 and 1.7 million in 1914.

◦In 1903 just under 63,000 cars were built in the world of which about half were produced in France.

◦By 1910 there were 100,000 cars in Great Britain.

◦By 1968 the worldwide figure had increased to 170 million; a figure that had more than doubled to 375 million by 1985.

◦In 2002 there were 530 million cars worldwide, of which about 25% (130 million) were in the United States.

Now there are about 1.2 billion motor vehicles in the world (not counting construction equipment).

From a few thousand to 1.2 billion in 116 years, that is growth. It could not have happened without the growth of highway and road infrastructure.

There are about 90 million new vehicles produced every year so that would be the upper boundary of EV production.

Very soon there will be 1 million EV’s running around in the world. If people drove like they do in the US, that would reduce the use of gasoline by about 1.5 million gallons a day.

If you look at my comment above you will see that cars in the US ( a new high tech machine) went from 300 in 1895 to 1.7 million by 1914. That is a 5666 times gain in less than 20 years.

So why would anyone be surprised if electric cars did a 1000 times gain in that amount of time? The major competition at the time was the horse and the railroad/electric trolley. Considering the roads at the time and the lack of reliability of the new motor car, both of those had a severe advantage over the automobile in several key areas. Yet the change still happened.

People decided that this was the way they were going to travel and that was that. They put up with the noise and the foibles of the machine. Not many people would want to run a 1905 or 1910 car down muddy dirt roads for more than a fun run today. Even down city streets. They were uncomfortable, noisy, broke down a lot, had no synchronous shifting, no good heating, nothing we are used to today. They were expensive. Maybe slightly more convenient or faster than a horse and buggy, but not as reliable and getting fuel was no easy matter.

But I think businessmen saw the writing on the wall and started building purpose built filling pumps and stations. Better than buying a can of gasoline or hand pouring it.

http://aoghs.org/transportation/first-gas-pump-and-service-stations/

Now they are all over the place and cars are lining up like there was no end to it.

The only thing holding back EV sales right now is limited range and higher initial cost, both of which will fall by the wayside within the next few years. Electric charge stations will become commonplace and cars will have greater range to begin with.

I do wish they would bring back the trolley system in cities 🙂 Those were fun and convenient.

Thanks Dennis I appreciate that.

Hi Jimmy,

Happy to help.

Javier, on Sunday the temperature was 64 degrees Fahrenheit in the region where I reside. In 2003, it was 30 degrees below zero.

A 94 degree difference, the world is a much better place when it is warm outside.

Don’t use as much natural gas, don’t have to run to the car, don’t need a parka, mittens, a tuk, none of that.

Warming is far better than cooling.

A little off topic, for sure, just so you know.

126 degrees difference, unless you mean freezing point rather than zero point.

Utter rubbish – please ignore – too much lunch time refreshment, or too long retired!

Many use the debt issue as the cause of the economic crash, but this is less of a problem than many realize.

Who is the money owed to, aliens?

For the planet the assets and liabilities match.

Dennis, I find it alarming that you could believe something so unbelievably simplistic. Did you live through the subprime mortgage crisis? You know, the one that almost sank the economy and would have had it not been for the government bailout?

Speculators, using “liars loans” bought up millions of houses. Homeowners took out second mortgages on their homes to get money for vacations, boats, and many other things. Then the housing market collapsed and these mortgages were near worthless. Yet these mortgages were bundled and sold to other investors as AAA rated investments.

But it didn’t matter because all borrowers and loaners were earthlings, so it’s all a wash!

And that, the subprime mortgage crisis, is just the tip of the iceberg. Money is loaned and interest must be paid on those loans. Do you really believe the shale oil junk bond mess means nothing because borrowed money equals loaned money therefore it is all a wash?

The economy runs on borrowed money. People borrow money to buy houses, cars, boats and other stuff. Drillers borrow money to drill, manufacturers borrow money to expand their business… or in many cases just to keep it running. And if this all collapses, if the money is not paid back and no more money is available to borrow it means nothing because those on both sides are human beings so therefore it is all a wash?

Again, the world economy runs on debt. The economy must grow in order to pay the interest on that debt. If the economy shrinks, for long enough, then the economy crashes. We get a Seneca Cliff.

The US economy has already experienced one Seneca Cliff. It began in late 1929 and it took only a couple of years for the economy to crash almost completely. Billions of dollars were lost. But it should not have mattered because those on every side of all issues were all human beings… not aliens… so it should have been a wash.

One more point. String out a few years like those we had in 2009 and 2015 and you will see a Seneca Cliff.

We are shrinking! The neglected drop in Gross Planet Product

Hi Ron,

There can be financial crises when there is inadequate banking regulation as was the case in the US from 2000 to 2009 (with banking regulation gradually dismantled from 1980 to 2000 in the US).

Debt is not the problem, it is poor governmental oversight of the financial industry that is the problem.

What is important is real GDP not nominal GDP. At the World level here are the annual growth rates of real World GDP (at market exchange rates) from 1980 to 2014 (with 2015 estimated).

IMF data for Oct 2015 can be found at

http://www.imf.org/external/pubs/ft/weo/2015/02/weodata/index.aspx

Chart below uses IMF data to find World Real GDP in billions of constant 2014 US$ at market exchange rates from 1980 to 2015 (2015 is the October 2015 estimate for 2015). There was world deflation in 2015 which caused nominal GDP to fall in US dollars at market exchange rates.

Real GDP grew. The deflation may be related to the general fall in commodity prices world wide.

The average growth rate of real GDP from 1980 to 2015 was 2.9%/year. When we plot natural log of real GDP vs time and find the linear trend (R squared=0.996) the slope of the line is 0.029 or 2.9% per year.

From 2010 to 2015 the growth rate of real GDP slowed to 2.5%/year (r squared=0.999).

Debt is not the problem, it is poor governmental oversight of the financial industry that is the problem.

Debt is not the problem? What you are saying is that it is the government oversight of debt that is the problem. That still leaves debt as the problem, regardless of government oversight.

Junk bonds sold by shale drillers were all in compliance with government regulations. The problem still exists.

Even the subprime mortgage bundling was all in compliance with government regulations. What was needed was government regulations that did not exist… and still does not exist.

What you don’t seem to understand Dennis, is that the current debt based economic system we now have, requires growth. We can have a year or so of no growth without much of a problem. But more that and the problem gets really bad.

I am not going to try to explain to you… again… why our debt based economic system requires growth and without growth it must collapse. It has been done over and over again and explaining it one more time will not make you understand. Eventually growth will stop. It is a struggle right now to keep world GDP ever increasing. It will eventually stop and we will have a collapse. In some places in the world it has already started to happen. And this will spread.

Hi Ron,

Yes the economy needs to grow, you assume it will not due to lack of oil (maybe). What the economy needs is energy, we will gradually transition to other types of energy. The environmental damage will be solved when population peaks and begins to decline. Population growth rates have been slowing and between 2050 and 2070 decline in population will begin. Eventually economic growth may stop and perhaps debt will need to stop as well, though I would think there would always be those with excess savings that are willing to lend at interest.

Yes there are some nations that are struggling and others that are doing better, real GDP growth continues at 2.5% per year (2010 to 2015 average rate) for the World as a whole. For World real GDP per capita growth from 1982 to 2014 the average rate was 1.45%/year. If we assume this rate of real GDP per capita growth continues until 2100 and World Population follows the UN low fertility scenario, we get the following World GDP growth rates to 2100. Clearly the assumptions could be wrong, but if they were correct we should expect lower real GDP growth rates over time as population growth slows and then declines.

Hi Ron,

Can you explain why the economy stops growing? Is the assumption that an energy constraint is the reason?

Note that as population stops growing there will be assets passed down to children at a greater rate, those without heirs that choose not to give away their wealth to charity will have their assets go to the state and can be used to pay down public debt, so there might be less need for borrowing. It is difficult to envision how future society will be arranged, but it will change over time as it always has.

Dennis, are you serious? Do you actually believe that growth can continue forever? And as for the rest of your post, I have no idea how to reply to such an unbelievable post. So I will not even try.

Excellent discussion on economic growth-

https://www.ted.com/talks/robert_gordon_the_death_of_innovation_the_end_of_growth#t-151542

Hi Ron,

No I think economic growth will eventually stop, but not before 2100.

It is possible that per capita growth will slow down,

If we assume it falls to 1% growth per year and population falls at 1% per year, then a steady state of no real GDP growth will be reached in 2125.

At some point a zero real GDP per capita growth rate may be reached and a steady state no growth or decline economy would require a stable population level.

A 1% annual fall in population from 2126 to 2300 would result in 1 billion people in 2300. I imagine we would see population fall more slowly than 1% per year as population approaches 1 billion and growth in per capita GDP will also slow to zero over time. Human society has a long time to figure this all out.

If the planet cannot support one billion people, then population will fall to a level the planet can tolerate. There are varying estimates of this population level.

GDP growth can go on forever. In the year 2200 I’ll charge you $2000 to do your nails with tiny embedded microchips which allow you to play the violin like Julia Fischer. You’ll pay me by selling me a week’s vacation inside a sea floor resort located near the Antarctic coastline, where we tourists will spend hours watching bioengineered plesiosaurs eating giant penguins. Or something like that.

Hi Fernando,

I don’t think GDP growth will continue, it will stop around 2125, possibly sooner.

Population will fall so that a steady state can be achieved even if GDP per capita continues to grow slowly (1% to 1.4% per year).

Hi Ron,

When I asked about growth slowing down, I meant over the short term, say the next 20 years. Growth may slow a little due to energy constraints and slower population growth, a major recession is also likely to start within 15 years.

I do not expect it will be permanent, so we could see a temporary cliff in oil output due to a major recession,but then output will decline more slowly as the economy transitions to using less liquid fuel (and fossil fuels in general).

Over the long run growth will stop, but likely in the 22nd century and the way society is organized at that point will undoubtedly be different than today. The problem of a steady state economy may have been solved at that point.

Hi Ron,

In the case of the mortgage crisis, the poor oversight was not in the bundling of the mortgages that was the problem, it was the mortgages themselves. If the loans were good, the bundling would not have been a problem.

The safeguards put in place from 1933 to 1940 in banking regulations were gradually dismantled in the US from 1980 to 2000 and the only post 1929 banking policy left in place was FDIC (and equivalent for credit unions and S+L) insurance.

The defaults in the oil industry that will occur due to low oil prices are not likely to cause another GFC.

Output will fall, oil prices will rise eventually (by 2018) output may rise close to 2015 levels and perhaps even surpass that output level (a coin flip in my opinion). A lot will depend on the price of oil, $80/b in 2018 makes a new peak more likely, if prices rise more slowly and $80/b (2015$) is not reached until 2020, a plateau is more likely and 2015 will remain the peak year.

“the current debt based economic system we now have, requires growth”

Ron, your comment is just flat out wrong. You need to stop drinking your Republican brother-in-laws Koolaid of fear and distraction. What our system requires is an exchangeable currency and enforced regulations. Just because almost every year of your life you have witnessed growth, doesn’t mean it’s required. Most of you might not like it, but there is no law that says the economy can’t contract or deflation can’t become the norm.

Debt is a tool used to maximize economic opportunity. Without the opportunity of debt our economy wouldn’t be the HUGE size it is today. Innovation and education are the fundamental building blocks of growth. The economy needs the next new automobile or internet to grow.

Your missing the forest because your looking at a tree. The Republicans have been playing the debt fear game to obstruct Obama now for 7 years. Don’t fall for their con game.

Central banks are promoting debt with low interest rates to stimulate growth. They can turn it off in a moments notice in the need of price stability.

Money only has value because of government regulations. It’s simply a means of exchange.

XT5, Your first post here. Welcome to the list even though it is very obvious you don’t know diddly squat about economics.

Recession

1.

a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.

We have, in this nation’s history, had many periods of no growth. They were known as recessions. And if those periods of no growth, or actual contraction of growth, last long enough, it is known as a depression. We had one such period on contraction in the early 1930s.

I know that, theoretically, you can come up with scenarios where the economy does not require growth.

The problem is that this has never happened in the past. Every period in our history where we had no growth, or negative growth, we have had a recession or worse.

“the current debt based economic system we now have, requires growth”

Ron, your last comment above makes a case why you think growth is likely, but doesn’t make a case for your original statement. Actually, part of your post supports my comment:

“you can come up with scenarios where the economy does not require growth”

“Every period in our history where we had no growth”

Again, there is no requirement of growth in the economic system. Only in your expectations.

Productivity curve is looking at lot like it’s turning over exactly as predicted by the limits to growth study (and would be more so on a per capita basis that they used). If the model holds, which I think the authors themselves thought unlikely once one of the major extrema is reached, then the route drop down is faster than the growth phase – again more so on the per capita curve as the population keeps on growing foe a few years. The limit comes from excessive resource extraction costs especially for energy, which limits net availability – i.e. call it peak oil for short hand. The debt issue is either noise on the resource dominated trends or has been caused by the resource issues (e.g. using investment strategies that only worked when resources continually got cheaper to extract) – history will tell which more than we can at the moment.

In the UK the pundits have given up saying our productivity issues will be solved by doing XYZ and know say either we aren’t measuring it properly or it doesn’t matter anyway (I got a strange sense of deja vu).

Hi George,

If we look at real GDP per person, it has grown steadily at 1.4% from 1975 to 2014.

See

https://research.stlouisfed.org/fred2/series/NYGDPPCAPKDWLD

Chart below.

But is GDP the same as industrial productivity. As I understand it if my house burns down and I have to rebuild it, GDP goes up, but overall things are worse than before; if I sell you a meal and you sell me one GDP goes up, but if we both cook at home it doesn’t; I think even if house prices go up but nothing else changes, GDP goes up.

Read up on GDP.

https://en.wikipedia.org/wiki/Gross_domestic_product

House prices only affect GDP when they are new or renovated.

GDP per capita is a pretty good proxy for labor productivity, if the percent of the population that is working remains relatively constant at the World level.

I don’t have World employment statistics.

The thing is, we recovered from the crash of 29.

I don’t see any definitive proof that we can’t recover from a new crash brought on by poor banking and credit practices. I am not arguing that we WILL recover from an economic depression brought on by bad debt, but rather than we MIGHT.

The 29 crash was a USA crash, which also spread to parts of Europe, but not the entire world. And that crash did not happen during a decline of world oil production, but during a dramatic increase in world oil production during that great depression. That made a tremendous difference.

This crash will be a worldwide crash and it will happen during a decline of world oil production. That will also make a tremendous difference.

I would highly recommend “Memoirs of Harry S. Truman Volume One: Year of Decision” for insights into the depression years and the many difficulties encountered in putting the US on a war footing at the start of World War II. Interesting look at how the US dealt with material shortages.

OFM,

It’s different this time!

Google Dorothea Lange and compare with a visit to your local WalMart. You are obviously old enough to recognize the almost total loss of essential skills. We now live in a society that expects to be taken care of. Frustrated expectations on a grand scale make Madame Defarge look like an angel.

Dennis,

A Seneca cliff is consistent with our model for prices. This could happen, but is not likely, if there is a large decrease in extraction (production) and the level of extraction stays low for two consecutive years. A sudden drop in extraction could occur if non-OPEC extraction falls at the same time that war breaks out in the Persian Gulf for example.

I wrote a guest post that Ron says he may post near the end of the month when less data is coming in. I will update the post to discuss this scenario.

Hi Schintzy,

There is not a very good correlation between oil prices and output, output is better correlated with either population or GDP, I think the population correlation is due to the correlation between GDP and population.

Oil prices can fall for two very different reasons, a lack of demand or an excess supply (usually it is a combination of these factors). In 2009 oil prices fell mostly because demand fell due to the GFC, from the fall of 2014 to the present the primary factor is excess supply.

Note that I would define a Seneca cliff as a 4% or higher annual rate of decrease in C+C output. Is that what your model predicts?

Note that I do not think this impossible, just low likelihood (less than 15% probability over the next 10 years).

Hi Dennis,

We used autoregression. We have R^2=.37, that gives a standard deviation of about .6, or better than 50% of the change in demand.

Hi Shintzy,

Did you do a multiple repression on real GDP and oil price (independent variables) vs C+C output.

Most of the change in C+C output is explained by real GDP.

A model of C+C output vs real GDP gives an r squared of .983.

A model of C+C output vs real GDP and real oil price results in an r squared of 0.989.

So most of the variation in C+C is explained by changes in real GDP. The models for the 1982 to 2014 period are compared in the chart below along with the EIA annual data. Annual data was used for the regressions.

We did not use GDP. Only prices and historical C, C, and NGL extraction data. A very humbling result. My intuition that extraction had to drop before prices recover was way off! I will try to finish my post this weekend.

Hi Schinzy,

I look forward to your post and sorry for misspelling your name, twice!

I need to get my eyes checked 🙂

DC Wrote:

“Who is the money owed to, aliens?”

Pension Plans, Investors, TaxPayers and corporations. When debtor defaults is causes pain for someone that owns the debt.

DC Wrote:

” For the planet the assets and liabilities match.”

No, because a lot of if was misallocated. Money spend on labor for stuff that isn’t productive to the economy. ie a new casino (see Atlantic city as a reference), new homes that nobody can afford, or in the case of China, whole cities that aren’t occupied. Not every liability has an asset. To simplify, what if a bank loans a person money, but that person wastes the money on drugs and hookers. There are no assets. Many Business over borrow money that is not used for infrastructure. They may use it to hire more people, pay the building rent, or use it for services. If the company business fails there are no recoverable assets. The only asset would been in the knowledge base of a product/service that wasn’t economically viable.

Then there is also the issue when borrowers use debt to buy over priced assets. For instance, Perhaps a home owner, spend $750K buying a home that is really only worth about $100K. When the borrower defaults, at best the lender may recover about $100K when they sell the home. Where I live I still see lots of homes that got foreclosured in the 2008-2009 bust, and are still unoccupied today. I suspect the value of these homes is declining due to lack of maintenance. The Banks are hording these properties because if they sold them at market value it would take a bit hit. So they just hold them and retain the value as the cost of the loan.

There there is the case of Sovereign debt, when nations like the US, spend over $1T in entitlements and Wealthfare every year. The money spend on these programs has no assets and are just worthless liabilities.

I could go on, but I will stop here.

Hi Techguy,

The note is an asset for one party and a liability for the other. The value attached to the note is the same for both.

If a bank is going to loan 750k for a home worth 100k, then they are not very good at their business. The pain of one party in these circumstances is the gain of the counterparty.

The whole unfunded liabilities argument assumed current law remains in place.

Laws can change. The debt I refer to on the public side are treasury notes. Again the assets backing up the notes are not the question it is the assigned value of the note that is on the balance sheets for assets and liabilities as far as debt is concerned.

Who decides the “proper allocation of resources” you?

Currently it seems you would choose to balance the budget and maybe cut taxes? Do you think roads and bridges are a good idea?

Currently the real rate of interest on 10 year government bonds is negative, seems like a good time for the government to borrow and repair crumbling infrastructure.

Hi Dennis, thanks for your comments on the topic of Seneca Cliff/Curve. May I ask how you feel about ideas that suggest a net oil availability curve within a gross oil production curve may be viewed as something like a Seneca Curve/Cliff. It seems to me that decreasing production and decreasing EROI may compound and push the net oil availability curve into something resembling what might be called a Seneca Curve. Here is an example. Is net oil availability something that you can model if decreasing EROI assumptions are made?

http://energyskeptic.com/2014/net-energy-cliff-collapse-by-2030/energy-cliff/

That curve looks a bit suspect – I think he may have taken the expected EROI for new production coming on stream in a given year and mistakenly applied it to all existing production for that year.

I agree. I’m not saying that curve is representative of any reality or forward projections. I’m saying ‘here is an example’, as in an example of a picture showing a net available curve within a gross production curve that might visually represent the effect of decreasing EROI as well as decreasing gross production. I’m wondering if anyone could do a proper job of modelling this concept.

Hi Jimmy,

The problem I see is that we don’t have good estimates of EROEI.

I think net energy should be looked at on and economy wide basis for all types of energy. Much of the energy input to the oil production process comes from energy that is not oil, electricity produced by coal, natural gas, nuclear, hydro, wind, or solar.

Where are the proper boundries for a net energy analysis?

To me it is simpler to just look at energy output.

This would roughly tie in with Ron’s estimate of an all liquid peak in 2015.

Actually I made no such estimate or prediction. My prognostications deal only with crude oil or crude plus condensate. All liquids include biofuels and bottled gas, (commonly called NGLs). I have no idea what’s ahead for them.

My apologies Ron yes it was a C&C production prediction if I recall correctly. I’m doing this on an old model IPhone so I can’t easily navigate to older posts. Although it still does roughly correlate to a drop in emissions at around the same time.

Marcus,

The Seneca cliff scenario for oil production is also my likely view.

Rig counts did already fall off in a Seneca cliff fashion. So, it is just logical that production for oil and gas will follow. However there is a time lag, which many interpret as production resilience or technological advancement.

As oil production is a mix of conventional and unconventional, on – and offshore production, timing is nevertheless difficult.

Hi Heinrich,

We have seen oil rig counts fall steeply in the past, the only thing close to a Seneca Cliff so far has been 1979 to 1983. If there is a major War among most major oil producers in the Middle East (say Saudi Arabia, Iran, Iraq, and Kuwait), we would see a Seneca cliff until the War ended, then output would recover somewhat, though a transition to EVs, plugin hybrids, more public transportation, and generally more efficient vehicles would make demand for oil far smaller than before.

“We have seen oil rig counts fall steeply in the past, the only thing close to a Seneca Cliff so far has been 1979 to 1983.”

The Demographics is the West was much better than today. Today we have an aging population as well as unsustainable debt loads. You really can’t compare the past with the future. The Younger generation (mostly Millennials) is un-prepared to take over retiring boomers. Millennials were largely poorly educated on the real world and have been coddled into an “entitled” lifestyle. While I am sure there are good working Millennials, they are a very small number of population. I see very few Millennials in any of the companies I work with.