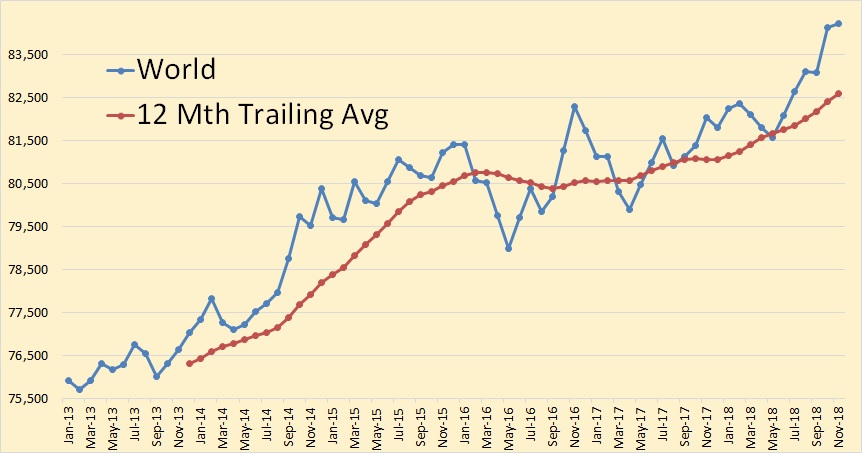

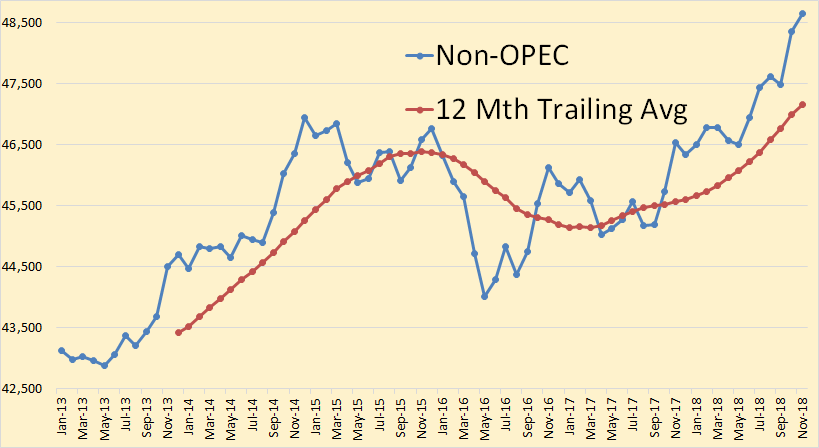

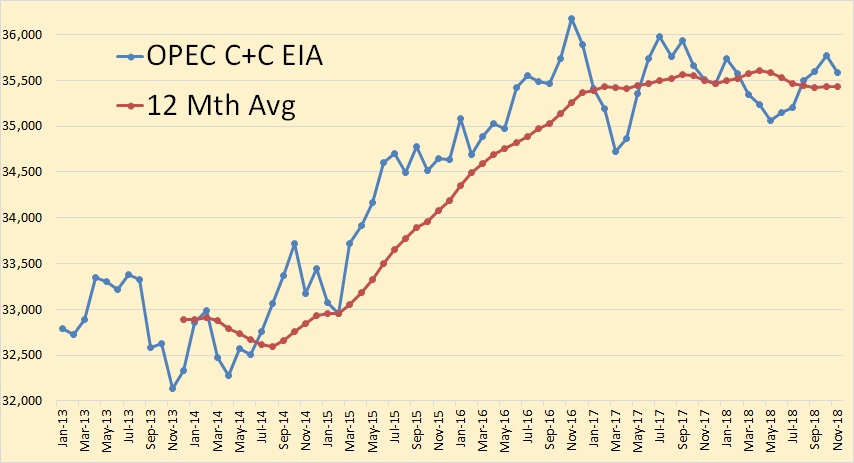

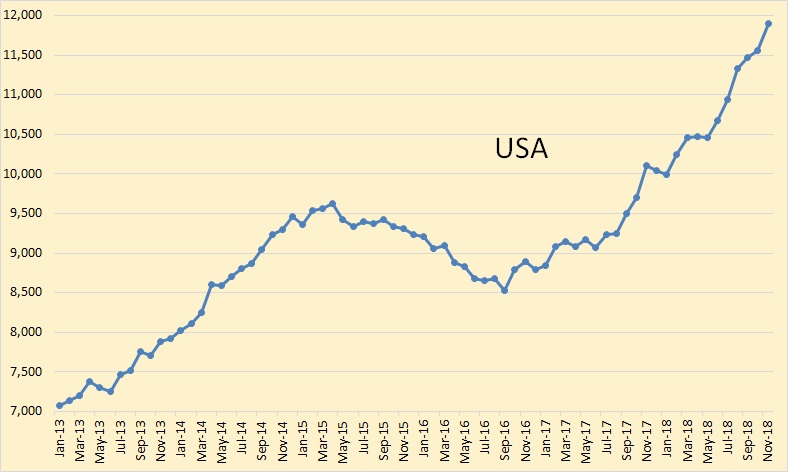

The EIA has just published their data on World and Non-OPEC Oil Production. All data is through November 2018 and is in thousand barrels per day. All data is Crude + Condensate.

World C+C was up 96,000 bpd in November to 84,225,000 bpd.

Non-OPEC was up 280,000 bpd in November to 48,638,000 bpd.

The EIA says OPEC C+C was down 184,000 bpd to 35,587,000 bpd in November.

The USA was, by far, the big gainer in November, up 345,000 bpd to 11,900,000 bpd.

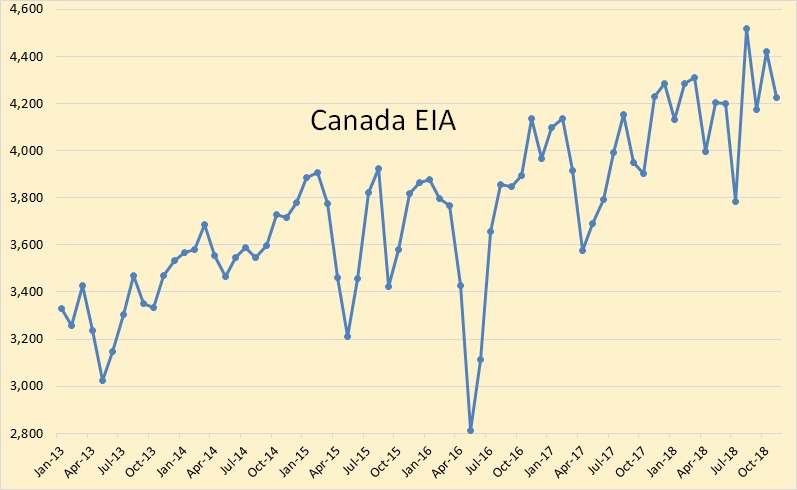

Canada was down 195,000 bpd to 4,295,000 bpd.

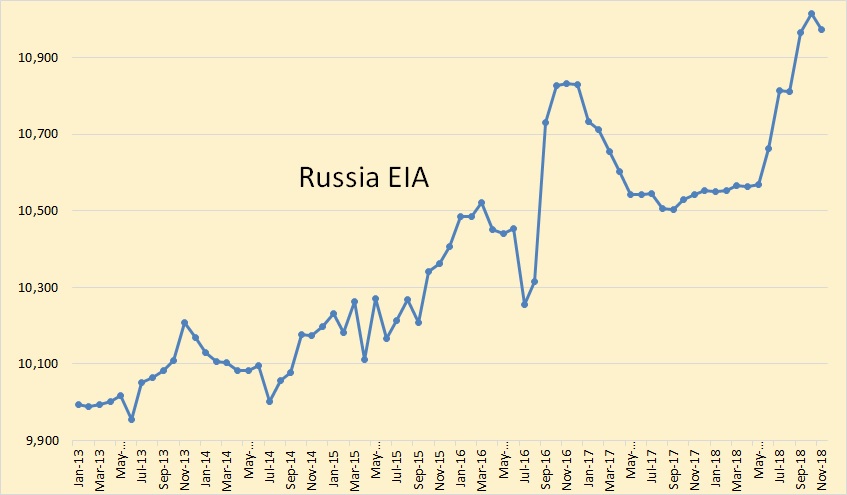

The EIA says Russia was down, in November, 42,000 bpd to 10,972,000 bpd.

China was down 10,000 bpd in November to 3,779,000 bpd.

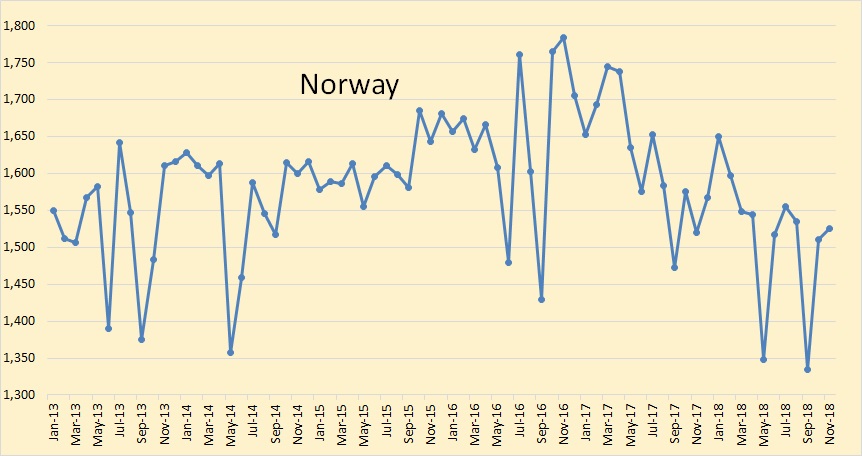

Norway was up 14,000 bpd to 1,525,000 bpd.

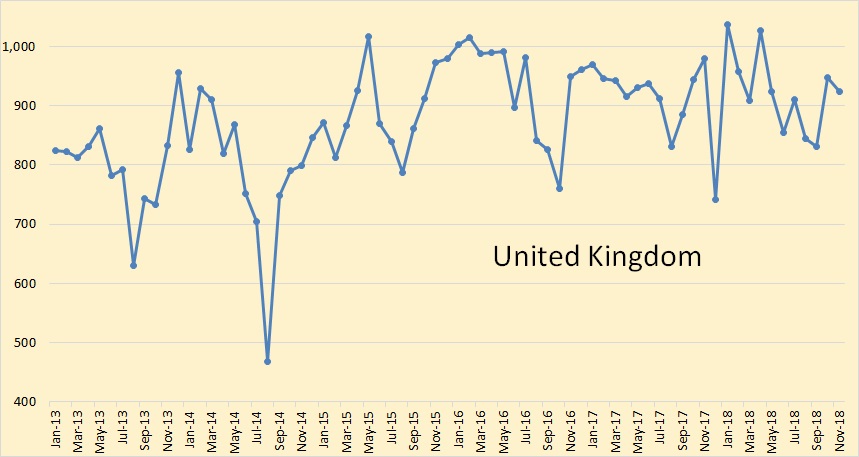

The United Kingdom was down 24,000 bpd to 924,000 bpd.

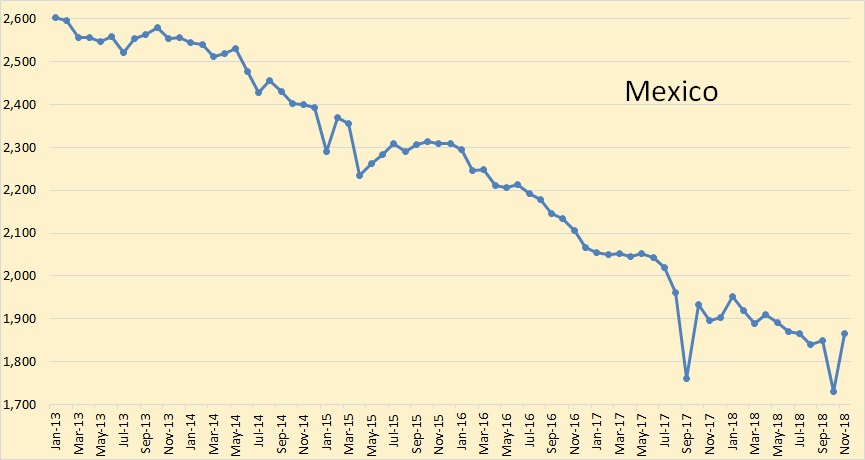

Mexican production was up 134,000 bpd to 1,865,000 bpd in November.

Egypt was up 5,000 bpd to 641,000 bpd in November.

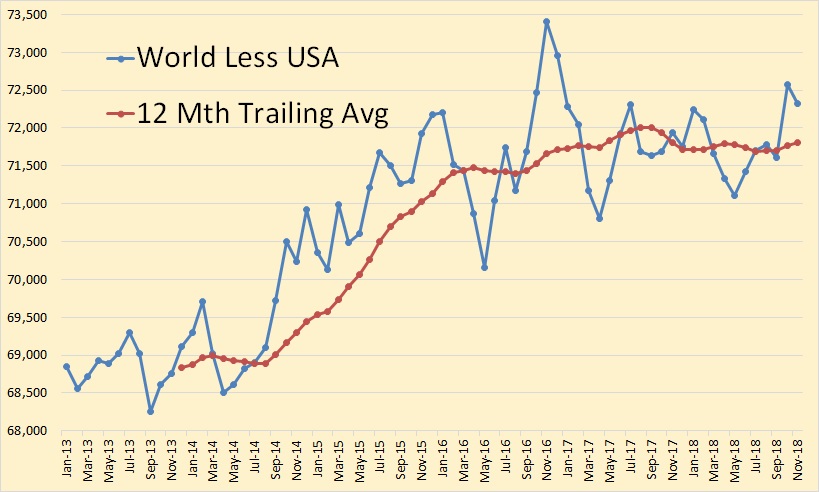

World C+C less USA production was down 249,000 bpd to 72,326,000 bpd in November.

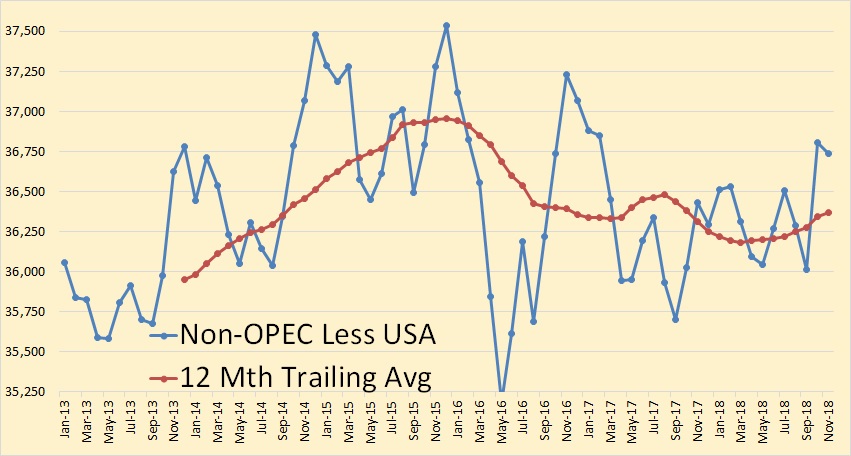

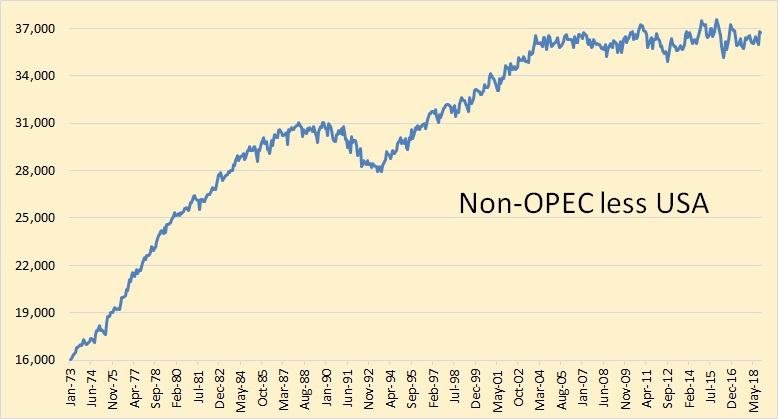

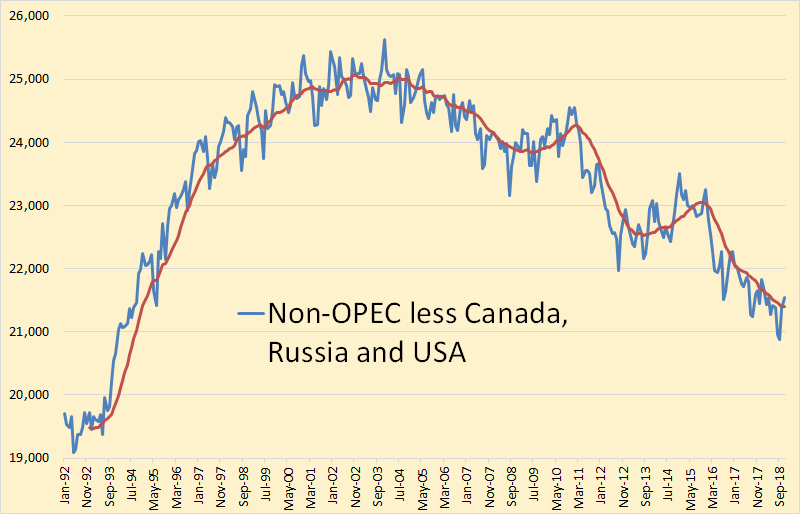

Non-OPEC less USA C+C production was down 65,000 bpd to 36,739,000 bpd in November.

Non-OPEC less USA has been on a bumpy plateau for 15 years. It has been only Russia and Canada that has kept that bumpy plateau going for 15 years.

So it’s up to Canada, Russia and the USA to keep Non-OPEC from tanking. Canada is nearing maximum production due to pipeline constraints and even the optimistic oil experts are saying Russia is near her peak, so it is up to the USA to keep Non-OPEC peak oil at bay. And that means it’s all up to the shale oil patch to keep increasing production.

However….

Olson, Bradley; Elliott, Rebecca.Wall Street Journal (Online); New York, N.Y.

The once-powerful partnership between fracking companies and Wall Street is fraying as the industry struggles to attract investors after nearly a decade of losing money.

Frequent infusions of Wall Street capital have sustained the U.S. shale boom. But that largess is running out. New bond and equity deals have dwindled to the lowest level since 2007. Companies raised about $22 billion from equity and debt financing in 2018, less than half the total in 2016 and almost one-third of what they raised in 2012, according to Dealogic.

The loss of that lifeline is forcing shale companies—which have helped to turn the U.S. into an energy superpower— to reduce spending and face the prospect of slower growth . More than a dozen companies have announced spending reductions so far this year, even as crude-oil prices have rallied more than 20% from December lows. More are expected to tighten budgets as they release earnings in coming weeks.

The drop in financial backing is especially being felt by smaller, more indebted drillers. But even larger, better-capitalized frackers are facing renewed investor skepticism about whether they can keep spending in check and still hit growth and cash-flow targets.

Shares of Continental Resources Inc. fell 5.4% Tuesday after the shale company, founded by billionaire Harold Hamm, disclosed that fourth-quarter spending was almost 10% higher than analyst expectations.

Wall Street support allowed shale companies to persevere through a plunge in oil prices that began in 2014, eventually helping the U.S. surpass Saudi Arabia and Russia as the world’s largest producer of oil , with 11.9 million barrels a day in November, according to the U.S. Energy Information Administration.

Banks have provided financing when producers spend more cash than they take in from operations, something that has happened every year since 2010. They also help companies hedge their future oil production to lock in prices and avoid market volatility, and provide them with revolving loans backed by future oil and natural-gas prospects.

But in 2016, federal regulators concerned about banks’ exposure to shale drillers tightened standards for lending to oil-and-gas companies after dozens went bankrupt amid the drop in commodity prices. The U.S. Treasury Department guidelines require lenders to regard loans as troubled if a company’s total debt reaches more than 3.5 times a producer’s earnings, excluding interest, taxes and other accounting items.

There is more to this article. You can find it by clicking on the link above. It appears that the shale celebration is finally slowing down. But those in the shale cheering section still far outnumber us naysayers.

We shall see.

Another view—

“One thing that Saturday’s events showed is that most Venezuelans know their history. Because of that, they don’t need to be told: Beware of gringos bearing gifts.

“Now let’s see if this same historical sense, combined with the memory of last weekend’s collective victory, can help redirect the Bolivarian Republic to a future conceived along collective and communal lines – the way Chávez himself envisioned it.”

https://www.moonofalabama.org/2019/02/venezuela-no-the-responsibility-to-protect-does-not-apply.html#comments

Just a view from a different perspective–

One might note that Maduro is still the elected leader of the country.

I know anyone with a MSM view has a different perspective.

A different perspective on Maduro’s election

https://www.aljazeera.com/news/2018/05/venezuela-elections-maduro-election-180522054855884.html

A rather MSM objective, even from aljazeera (considered right wing, if you are in the Middle East- liberal on external views).

But, who knows?

Generally a “liberal perspective” , hence the position on Venezuela.

The Venezuelan people believe Maduro is illegitimate, a tyrant backed by gangsters and communist fanatics. Over 60 nations agree with this position, which is backed by the National Assembly, the State Prosecutor (now in exile), and the judges of the Supreme Court forced to flee in 2017 because they weren’t about to follow Maduro’s orders.

On February 23 we saw Maduro and his wife Cilia dancing salsa as his repression forces were shooting up Santa Elena de Uairen, a town inhabited by Pemones who had rebelled against the local National Guard unit keeping away the humanitarian aid convoy coming from Brazil. The next day his Vice President, Delci Rodriguez, a psychopath who stated publicly that the suffering of the Venezuelan people was her payback for the death of her father about 40 years ago, got on TV wearing a Hamas scarf, saying “they haven’t seen but a tiny fraction of what we are capable of doing”.

Yesterday the Supreme Court justices in exile issued a decision supporting the use of force by other nations to provide humanitarian aid and protect the people from the mobster hiding in Miraflores. So the question now for Venezuelans is how to proceed. I realize many communists who write here aren’t about to be swayed by rational arguments, so I’m writing this for decent readers who have common sense:

I have proposed to Venezuelan leaders that a Police Force must be recruited from the Venezuelan exile community, numbering about 20 thousand men and women, which can include military personnel who have fled in recent years (the Colombian government reported yesterday that 160 military had crossed over the border on or since Feb 23, and I’m aware that several hundred Venezuelans are young and fit US Army and Marines veterans). The emphasis is on POLICE, because this force would be heavily armed but its mission would be to escort humanitarian aid and establish law and order over rural sectors of the country where the population is suffering horribly, like Santa Elena de Uairen, San Cristobal, and other areas where almost 100% of the population is against Maduro’s rule and has suffered collective punishment.

Guaidó has the ability to pay $200 million to outfit this force, and additional funds which can be drawn from Venezuela’s state accounts and CITGO dividends. But he doesn’t have the ability to make them into a cohesive force, transport them, or give them priceless air support.

This would have to be provided by others, and the best source would be a US carrier air wing aboard the USS Abraham Lincoln. The logistics support, consisting of the delivery of tons of food, medicine, fuel, water plants, and other consumables can best be delivered to a Venezuelan port controlled by Venezuelans loyal to the Constitution and the National Assembly (Guaidó is Interim President only because he was elected National Assembly President in January 5 2019, and his power derives from this Parliament, which is free to remove him and vote for a different president).

Evidently we want to avoid US boots on the ground, therefore the initial activity to manage the first port taken by the Police would have to be manned by Colombian civilians. It would also be useful to have the Colombian military to provide two battalions of well armed troops to maintain the peace and protect the ports from saboteurs and terrorists. But that’s a bilateral issue between Venezuela and Colombia, the same way any arrangements to stage Venezuelan police forces at Boa Vista before they rescue Santa Elena and the native Pemon who rebelled against Maduro will be a bilateral issue between the two countries.

As the Venezuelan police force begins to free these small sectors of the country we would also need an IMF loan to keep buying large quantities of food, medicine, hospital equipment, camps to house medical personnel near hospitals in well protected settings, seed, agricultural equipment, live cattle, and other items needed to start rebuilding. You wouldn’t understand how much has been destroyed, looted, eaten, trampled or burned by the communists as they tried to implement their “21st Century Socialism”.

So as you can see, I believe the best option is to keep foreigners out of Venezuela as much as possible, for two reasons: I don’t think it’s a good idea for foreigners to die or get hurt when Venezuelan forces can do the job and also because this will water down the propaganda that’s already pouring heavy from the leftist community. But this will work much much better with that US Air wing providing support from a carrier, plus Predators and four AC130’s based in Colombia and at a location I can’t name.

Fernando said:

“I realize many communists who write here …”

You should probably consider crawling back in your hole dude.

Fernando – THANK YOU for your updates, wisdom and analysis on Venezuela. It is great to have a perspective from someone who has real knowledge of what is going on. Please keep these insights flowing.

We continue to pray for the people who are being oppressed and look forward to a speedy resolution to this crisis.

Snowback, you are welcome. I want to emphasize that it’s very important for the US NOT to put boots on the ground, to have Colombian and Brazilian concurrence, and to make sure there’s a mechanism to control the ground using Venezuelan forces. This means that, even though defeating the regime would be easy, the US doesn’t want to “buy” Venezuela the way it bought Iraq. This is why I’m proposing a Venezuelan police force to take small areas, stabilize them, make sure those inside the perimeter are well fed, etc. The Venezuelan Police Force can then recruit more personnel from within the liberated areas, and then hop to a different place and repeat the process. And I’m not proposing capturing oil fields. They are a mess anyway.

Fernando- “I want to emphasize that it’s very important for the US to put boots on the ground”

No thanks.

And no thanks to any move that may end up helping fascists.

I corrected it. I’m opposed to US soldiers fighting on Venezuelan soil.

Here’s a link to a tweet reporting the flow of military going over the border

https://twitter.com/andrewrosati/status/1100421051262083072?s=21

FYI for FL

Key Criminal Revelations From Former Venezuela Intelligence Chief

https://www.insightcrime.org/news/analysis/key-revelations-venezuela-intelligence-chief-maduro/

If one googles ‘Hezbollah + Cocaine’ then one perhaps comes to the realization that this Venezuela thing might be a bit of a sticky wicket if US troops get on the ground. A USA policy failure in Venezuela could be its “Suez Moment”… you know, haven’t won a war in about 25 years (not for lack of trying).

Perhaps China has a Venezuela price?

https://www.independent.co.uk/voices/trump-venezuela-china-us-military-guaido-madero-a8796266.html

USA is turning into a low-energy beta cuck, to use a phrase from the Alt-Right.

haven’t won a war in about 25 years (not for lack of trying)

It is actually quite bit longer than that—–

The author of the Independent article is in la la land, because China has negligible impact on events in Venezuela. Their UN Security Council veto is meaningless because Russia is already set on vetoing resolutions, they can’t project power, see Maduro as an incompetent bumbler who is causing them large losses, and they don’t even share ideology now that China is fascist. Marxists (Socialists and Communists) and fascists are opposed to democracy and human rights, and that’s what glues the dictatorship club together, but it’s not a strong bond, and as Hitler showed, they can easily turn on each other.

The outside agent with the largest influence on events is the Castro dictatorship. The second in importance is Colombia, because it already has 1.2 million Venezuelans who fled Maduro’s misery, and many more are coming. They also see Venezuela serving as a heaven and income source for ELN terrorists, who are now proving the peace process so admired by the left is a failure. This gives Colombia good reasons to support the use of muscle to go after Maduro.

The third influencer is US. After that comes Brazil, and maybe the EU. China doesn’t even make the top ten.

Fernando said:

So then please correct your claim that the readers here are communists. You violated the rules of this forum by spouting sickening political propaganda on a technical thread.

Paul,

Nearly everyone on this thread knows what Fernando’s political agenda is. Is there really any doubt about where he stands? I think quite a few people are interested in his opinions on Venezuela, but you have to realize where he is coming from before forming your own opinion. In regards to the actual technical discussion on oil production, I think he adds far more than most.

The question I have is what about the opening post that started this whole thread about Venezuela? Hightrekker continues to post links to some unknown blog from the “barflies in Alabama”. Who is questioning this political propaganda that is equally sickening to people who see the world differently from you? How about we check in with the opioid addicts in Tennessee or Idaho, or something equally relevant? For being the moderator of this forum you seem to be a little partial yourself in my opinion.

Maybe I don’t really care. Fernando’s not much of a scholar after all.

I wrote

“I realize many communists who write here aren’t about to be swayed by rational arguments, so I’m writing this for decent readers who have common sense:”

It should be evident that a fraction of those who comment here are communists, and a fraction thereof is so extreme that any comments I make will be dismissed. But I also believe the majority isn’t communist, nor do they have irrational and rude behavior like we see once in a while.

Regarding as to why we discuss the Venezuelan political situation, it’s probably in part because as events unfold we can conclude the country will not be producing much oil for years. The other reason may be the way it can influence US politics.

Over 500 active military service Venezuelans have crossed the border into Colombia in the last four days. I understand the regime is trying to seal the border as much as possible, but soldiers in those units are running away if they can. Another 3000 or so have gone absent and are now hiding inside Venezuela.

Fernando, Some time ago, you wrote about a friend of yours who was trying to get out. I hope they have managed to leave, and are safe.

Dclonghorn, if you read my blog, you will see a post called “Beatriz arrived in Chile”. They are now living in Santiago, and just applied for permanent resident status. Chile has a huge flow of inmigrants, including a large number of Venezuelans as well as Haitians flown in by Michelle Bachelet to create a future counterweight to the Venezuelan flow (Bachelet is a communist who just left office, was replaced by Piñera, a center right democrat, the Venezuelans will probably vote right when they become citizens, and this will give the communists a demographic disadvantage).

The large inmigrant flow jammed the government offices handling aliens, so the process has been exasperating. But they are making headway.

Fernando charged with red-baiting “peddling” on lots of science blogs today 🙂

The author of the blog post attacking me in a “science” blog which happens to be heavily laced with politics included this in his material:

https://twitter.com/nevaudit/status/874340837089566720?s=21

In other words, the blog owner, Ken Rice, allowed a committed communist to do a hatchet job on me in his “science blog”. Today a lot of science is hijacked by reds who use it to create Trojan Horses like the “New Green Deal”. And of course the economic impact of a turn of the US towards socialism peddled by marxists will have a huge impact on the world economy…and the demand for oil.

What many don’t understand is that issues such as peak oil, global warming and politics are closely tied. And that’s why the topic is discussed so much. And why the left tries to silence me. I happen to be a student of these subjects and can see how they tie together.

“a turn of the US towards socialism peddled by marxists”

Fernando,

socialism=

Police dept,

Fire dept,

Rural mail delivery,

Highways,

Social security.

Military,

Medicare,

Public schools,

National parks,

NWS,

Coast guard,

etc

You know a little about oil, but know squat about climate.

30 years ago… other people in the seats, same problems.

https://en.wikipedia.org/wiki/Caracazo

There may be a difference. The level of violent repression doesn’t seem as high as in 1989. I don’t say there is no violent repression, just that the situation is not as binary as you describe. Without a clear support of the Venezuelian army to a political side, the use of armed men and weapons to enforce a change would only end up with escalation of violence.

Out of curiosity, what do you think of the opinions of Edgardo Lander? He was a supporter of Chavez, but became critical of his politic since 2005 and is opposed to Maduro. He is also critical of the intervention of the US.

The level of violence is much higher than during the Caracazo in 1989. That event lasted two days, involved looting and chaos similar to events seen in the US such as the Watts riots, but much larger scale, and with excessive police shooting because they lacked tear gas.

The repression now is continuous, day after day, arrests, torture, murder, tear gas, destruction of property, more arrests, occasional rape, more murder, lots of wounded, more tear gas. It’s a grind.

The repression in Santa Elena involved over 100 wounded, I’m not sure how many were killed.

I don’t know Lander. The majority of the lower ranks in the military doesn’t support Maduro, but they are kept in check by a corrupt senior officer corps, and a spy network, plus there are Cuban military placed in the command chain. This is why the repression is carried out by a small group of National Guards, about 5000 National police (PNB), and the colectivos, armed motorcycle gangs.

Venezuela: US increasingly isolated as allies warn against use of military force

https://www.theguardian.com/world/2019/feb/25/venezuela-mike-pence-maduro-guaido

And this is a MSM perspective.

The US should avoid the use of military force at this time. The number of Venezuelan military crossing to Colombia since 23 Feb is up to 340.

Let’s be clear: The Cubans are calling the shots in Venezuela. This became evident when Maduro refused to follow Cabello’s plan to let the food in, and ordered the harsh repression in places like Santa Elena. The Cubans want the US bogged down in Venezuela without support from other nations, because that would help a Democrat win in 2020. They know all the Democrats have is radical candidates, the communist Sanders who spent the last 50 years drooling over the USSR and Fidel Castro, and the others would then proceed to help the Castro dictatorship, withdraw from Venezuela and that poor country would become a Castro colony they can rape at will….with US Democrats providing cover.

This is why the flow of military personnel from Venezuela has to continue for a while, and why they will eventually have to create a Venezuelan police force.

Many countries in this world want the USA bogged down in Venezuela. It’s a great place to engage the Great Satan militarily without having to play “home team”, which usually sucks even if you “win” (like in Vietnam for example)

http://tinyurl.com/y2psgevd

That’s right. I have proposed a countermeasure which I think will get rid of Maduro while avoiding US involvement other than remote air and naval support, and their goodwill with the IMF. And a few hours ago I saw a Bible quote come back in a message which implied my idea was being considered. This is really interesting, I sit here writing emails, comments on blog posts, make a few phone calls, send out tweets, and I actually seem to have a bit of influence on things.

Anarchist here…

Neither Dictatorship Nor Democracy, Our Proposal Is Conflict: Statement by Anarchists in #Venezuela

Many conceptualize the world in large part through a ‘nation-state schema’. Tragic really: Glorified open-air prisoners like those of Plato’s Cave.

Borders come and go, along with notions of WTF being Venezuelan or American mean, and in the high-energy-depletion scheme, many borders and notions will go and be forgotten.

Circa ~2250: “We are people of this lake here… just beside it. See? Look. It’s nice.”

This “Fernando” stuff is blogspam, and should be deleted.

It’s off topic for one thing. Isn’t this thread supposed to be about oil production?

It also encourages others to give off topic responses, a practice sometimes referred to as threadshitting. When you respond to a loser like this, you are distracting from the main topic of the thread, which is oil production. The only way to win this game is not to play.

Finally, it’s overlong content pasted from a crappy blog nobody reads. Basically the author(s) are hijacking this blog because nobody would read their stuff otherwise. If they were getting hits on their blog they wouldn’t resort to this obnoxious behavior.

My advice to other readers is to put this user login on ignore and not to respond to it.

Venezuela is an OPEC nation, and my comments about what goes on are intended to give the readership a better insight on how the country is being taken apart by communists.

“Beware of g****** bearing gifts.”

Do we really need to delve into racism?

CLR. Net operating loss carryforwards for years. For years to come the company will pay zero Federal, North Dakota and Oklahoma income tax.

IMO they haven’t grown enough to justify this.

See the most recent conference call for details.

Looks like a glut of condensates has developed and is getting worse.

Another thing to ponder about shale oil: falling capex, but solid production growth And that’s after three bad years (2015, 2016 and 2017) and low current prices.

Do the US shale oil producers want to establish some kind of “world record” and then “The last one out please turn off the lights.”

How can such a miracle happen?

The US oil production is really Alice in Wonderland phenomenon.

Hi Ron,

From 2003 to 2018 Non-OPEC minus US, Russia and Canada fell by about 1% per year. If we assume the decrease is linear, it has averaged about 235 kb/d each year over the past 15 years. At some point US, Russia and Canada and OPEC will not be able to make up for this decline, my guess remains 2025+/-2 World C+C output begins permanent decline, about a 68% probability it falls in the 2023-2027 range with a 16% probability it occurs before 2023 and a 16% probability it may occur in 2028 or later.

Wow! How did you arrive at those probabilities?

In November of 2018, OPEC was producing flat out. In that month they produced just over one million barrels per day less than they produced in November of 2016. OPEC is not making up for any non-OPEC decline. It is very likely that Russia+ Canada will peak within the next two years. And is very likely that Russia + Canada + OPEC will decline slightly within the next two years. Only the USA has any chance of increasing very much. It’s all up to those shale fields, fields that have a legacy decline of about 6.5 percent per month. Lot’s of luck with that one.

I don’t think that there is any doubt that non-OPEC less USA has peaked. And it is my opinion that World less USA has also peaked. It is all up to the good old US of A.

Ron,

> It is very likely that Russia+ Canada will peak within the next two years.

I agree that Russia is close to its peak. But, at the same time, Russia has a huge Arctic territory with a very low density of population (due to harsh conditions), which probably is not explored that well. Also with their gas reserves, they might be able to increase the condensate production considerably, repeating the USA path.

The other possibility is Russia sliding in chaos after Putin retirement, as there is no any politician of equal caliber able to pick up the helm among the current elite. And there will be “external helpers” like after Brezhnev’s death who will try to get some comprador at the top. Also, the leadership change historically is a huge problem in Russia.

See https://www.quora.com/What-will-happen-after-Vladimir-Putin-steps-down-or-passes-away . This Igor Markov sounds like a typical neoliberal propagandist salivating to plunder Russia the second time as Harvard mafia did in the past, but the problem does exist.

Russia is a kind of ‘A riddle wrapped up in an enigma.’ Everybody wrote Russia off in late 90th. It is difficult to make predictions about Russia.

If I remember correctly, Fernando Leanme used to work at Russia in the past, and he might share his thoughts about this issue.

What is interesting is that due to the use of natural gas in transport, Russia does not consume that much oil internally, which makes an important difference with KSA.

Increasing Russia’s Arctic production is feasible, but this will take many years, and I don’t think it can offset decline to make much of a difference. Yamal has huge gas condensate reservoirs located under the Cenomanian, but they need many more wells. I believe they can produce 1 mmbopd of condensate, but that would take 15 to 20 years.

I believe Putin is smart enough to set up a successful replacement, and the Russian elite will also be keen on a smooth transition because they think they are under attack (yes, they are convinced the USA, Germany, France and others are very keen on making them submit).

1.Russians are not very happy with Putin

2. Most Russians will support him in any circumstances. This is a principle. Otherwise, chaos.

3.95% Rosiyan has a negative attitude towards liberals, as well as to “democratic values” (this is a declaration that has no common with reality)

4.Most Russians dissatisfied with property inequality that appeared in the last 25 years

5. The greatest dissatisfaction is the destruction of industry. The lack of productive labor. (We live with the income of hydrocarbons, the country-gas station). The consequence of globalism.

Sounds reasonable. Putin would be more popular if he did little things, like being stricter giving driver’s licenses, fixing roads and intersections to reduce accidents, and putting in more real pedestrian crossings. Reducing corruption would be a huge plus, but that requires more of a free press and decent justice system, but this is contrary to the Russian soul, which relishes living in pain and writing great books about it.

Putin is unlikely to be able to change the situation

He is forced to balance between the owners of big business oligarchs, which are embedded in the system of corruption and in turn dependat power that can deprive them of their freedom for real crimes and the need to win the election, and for this you need to maintain the necessary minimum level of consumption, pensions, wages, health and other

The level of consumption in Russia does not correspond to the level of development of the productive forces. It is compensated by hydrocarbon production.

Russia is cut off from foreign markets, in the country of the current regulatory bodies (tax, environmentalists, firefighters), the rules are very complex and uncertain, they do not allow production to develop.

And more. Whom Putin will appoint as his successor, the majority will support. Although 60-80% of citizens want the system to be like in the USSR (of course within the geographical boundaries of 2019).

https://en.wikipedia.org/wiki/68%E2%80%9395%E2%80%9399.7_rule

The percentages are from a 1 sigma deviation. The real question is where the years came from.

Jay,

I assume about 3100 Gb of World C+C URR, based on my evaluation of publications by Jean Laherrrere. Steve Mohr, Richard Miller, Steven Sorrell, and the USGS.

https://royalsocietypublishing.org/doi/full/10.1098/rsta.2013.0179

This is combined with Paul Pukite’s Oil Shock Model discussed in detail in

https://www.amazon.com/Mathematical-Geoenergy-Discovery-Depletion-Geophysical/dp/1119434297

I assume 2800 Gb of Conventional C+C URR, 100 Gb of tight oil URR and 200 Gb of extra heavy URR, the extraction rate is for conventional oil only, extra heavy and tight oil are modelled separately.

The range of the peak for plus or minus 2 years is a guess as future extraction rates and rate of development of discovered resources is of course unknown.

The number of potential future paths for extraction rates, development rates, oil prices, technological developments, as well as unknown unknowns is infinite. This is but one realization of the infinite possibilities.

Russia would have declined by now without huge, fracking like CapEx in existing fields. This was from one year ago.

https://www.worldoil.com/news/2017/12/19/rosneft-board-agrees-on-samotlor-development-program

>>>

During 2016-2017 Rosneft and the Russian government have been elaborating in details additional options for the development of unique Samotlor field. As a result a joint decision was made for an investment incentive in the form of an annual mineral extraction tax reduction of RUB 35 billion during 10 years.

ThebBoard has confirmed the Company’s obligations to drill over 2,400 wells during 2018-2027 that would provide additional output in the amount of more than 50 mtoe. The extended Samotlor development program would result in an increase of tax liabilities to budgets of all administrative levels to RUB 1.7 trln. The investment incentives should give new momentum to the development of one of the largest fields in the country and bring significant multiplicative effect for Russian economy.

<<<

2,400 wells in a decade is 240 a year. This article is discussing just Samotlor.

A conventional field drilling a well more often than once every two days. Quite a bit more than that I imagine in the good time of the year with the swings in Siberian weather conditions.

That's nuts. It's also going to shark fin at some point.

Interesting, Schlumberger said during q&a in their q3 they they had a contract for 400 wells 2019-2021 for the saudis, it was ghawar and one neighbouring field to the west that i cant remember name of that all 400 wells were going into. They were also quite honest about its purpose that it was to mitigate declines.

So that makes it pretty much exactly 50% of the russian drill rate per day in samotlor you mention abowe.

I asked in previous thread why that many wells were needed if we are to believe saudis 200gb+ of world class reserves remaining. In my opinion i didn’t get any answer to that question.

Baggen,

Wells need to be drilled to develop oil resources, it really is that simple.

I have never suggested the resources are “world class”, oil is oil, some may be easier to develop and other resources perhaps less so, generally the easiest resources to develop that have been discovered are developed first.

Hi Dennis,

I understand that easiest resources will be developed first, witch ties into my second question why have they developed offshore if they say they have 200gb of reserves, i assume a majority of those 200gb is located inland.

My question wasn’t especially directed at you, im not question your expertise or such im more expressing a general question in hope of receiving some initiated opinions from knowledgeable posters on this site where i do include you among many others.

(I really appreciate your posts and effort btw)

So my “world class” was not addressed as some thing you said, it was my assumption about what saudi considers their remaining reserves officially and if their quality is on par with existing developed fields and resources.

I understand it needs to be drilled to be developed, but then it becomes a bit of the hen or the egg for me. These 400 wells in the coming 3 years would they unlock part of those 200gb assumed reserves or should they be viewed as they will add even more on top of those 200 already existing (well atleast on paper ?) reserves?

Baggen,

My understanding is that there are proved undeveloped reserves, those require new wells. Also note that we have very little information on what the ratio of developed to undeveloped reserves actually is in Saudi Arabia.

In addition the so called “proved ” reserves are likely 2P reserves in KSA.

My guess is that the developed offshore reserves are in shallow water and are relatively easy to develop, but that is a guess.

My understanding is that there are proved undeveloped reserves, those require new wells.

Dennis, I need to know just how you arrived at this understanding? It is my understanding that these are infill wells. The word “infill” implies developed, not undeveloped.

infill drilling Bold mine.

1. n. [Enhanced Oil Recovery]

The addition of wells in a field that decreases average well spacing. This practice both accelerates expected recovery and increases estimated ultimate recovery in heterogeneous reservoirs by improving the continuity between injectors and producers. As well spacing is decreased, the shifting well patterns alter the formation-fluid flow paths and increase sweep to areas where greater hydrocarbon saturations exist.

Infill drilling does increase the ultimate recovery as it gets gaps near the top of the reservoir that otherwise might be missed. But mostly it just pulls the oil out faster. That is most of the oil recovered by infill drilling is not oil that would otherwise be missed.

There are many very small undeveloped fields in Saudi. They are small and remote and are not economical to develop. The larger fields are all very well developed Ghawar, and I assume the field to the west is Khurais. Both fields are not just developed, but overly developed. They have been doing infill drilling in Ghawar for almost two decades. I assume these new Ghawar wells will be in the very southern two fields.

Ron, it’s not gaps near the top of the reservoir. We infill to establish better connection between injector and producer, and this works fine in a reservoir with horizontal layers. I would have to draw you a sketch to show you how reservoir continuity works. Somewhere around here I have a turbidide core photo which shows how it can happen in sand and shale reservoirs I used for a seminar about 30 years ago. Let me see if I can find it.

Hi Ron,

In general, most nations have both developed and undeveloped reserves, I doubt that Saudi Arabia is an exception to this general rule.

Actually, I just realized the term used by the United States is proved non-producing reserves.

The society of petroleum engineers uses the term proved undeveloped as on page below

https://www.spe.org/industry/petroleum-reserves-definitions.php

In any case, it is not clear what the distinction between “proved undeveloped” and “proved non-producing” reserves actually is precisely.

For the US at the end of 2017 41% of “proved reserves” were “non-producing proved reserves”.

My guess is that some of the proved reserves in Saudi Arabia may be classified as non-producing proved reserves.

We have very little information on Saudi reserves, so perhaps all reserves are proved producing reserves.

Perhaps a person experienced in petroleum engineering could comment.

Dennis, the comment went:

Interesting, Schlumberger said during q&a in their q3 they they had a contract for 400 wells 2019-2021 for the saudis, it was ghawar and one neighbouring field to the west that i cant remember name of that all 400 wells were going into. They were also quite honest about its purpose that it was to mitigate declines.

Ghawar, and the field to the west of Ghawar is Khurais. Both fields are 100% developed. So obviously these are infill wells.

Khurais went on line in 1963 but was never fully developed because of very low reservoir pressure. The field was re-developed in 2006 and went on line in 2009 with the aid of a massive water injection system.

There are still places in both Khurais and south Ghawar where infill drilling could mitigate decline. And that is exactly what Saudi hopes to do withthese 400 wells. As the post stated, no one is denying that. But Manifa, which came on line after Khurais, was the last, the very last, undeveloped field giant fields in Saudi Arabia.

Yes, there are a lot of small undeveloped fields in Saudi Arabia. But these fields lay in the empty quarter, deep in the sand dunes. Water would have to be piped in for water drive and pipelines laid through the dunes to get the oil out. If oil goes to $300 a barrel or better we may see some of these fields developed. But I doubt it.

Look up

“Spatial Variability in Carbonates Reservoir Quality: Case Study from the Middle Miocene Dam Formation Outcrop, Eastern Saudi Arabia”

You can read the abstract, and you will get an insight on why an infill well usually accelerates reserve recovery, and also increases reserves. Many of us visualize reservoirs as layer cakes, but reality is much worse. In most cases the rock layers lack continuity, and this leads to poor drainage and sweep.

40 years ago I was taught why a pattern flood was much better than a peripheral flood for optimum recovery, and we studied field performance in cases where the field had been infilled and sweep had improved a lot. Today we understand and model this much better, and it’s likely Saudi reserves include undeveloped oil found in areas they already developed, which eventually will be “infilled” and converted to a tight pattern flood. They may even be including enhanced recovery from CO2 and ethane injection, polymers, soaps, etc. They don’t have to follow SEC guidance, therefore their numbers can be much higher than a company selling stock or bonds in the US can use.

They may even be including enhanced recovery from CO2 and ethane injection, polymers, soaps, etc.

Of course they will. They already have. This headline is from four years ago:

Saudi Aramco testing C02 to get more oil from giant Ghawar field

KUWAIT (Bloomberg) — Saudi Arabian Oil Co. started injecting carbon dioxide to try and boost extraction rates from the world’s biggest oil field as the company steps up plans to recover more crude from its deposits.

Saudi Aramco, as the company is known, already started injection and will put 40 million cubic ft of CO2 into the Uthmaniyah area south of the Ghawar field, it said Thursday in an Arabic statement on its website. About 40% of what’s injected will be stored in the field.

“The project aims to enhance oil recovery beyond the more common method of water flooding, and is the largest of its kind in the Middle East,” it said. The project is part of the company’s efforts to reducing domestic carbon emissions and meeting environmental goals, it said.

Saudi is trying every way possible to mitigate the steep decline in Ghawar. Of course they say they don’t really need to do that. It is all because they are very enviromentally conscious. And if you really believe that????

From what I understand it was also stated by Schlumberger that they are in-fill (infill?) wells… Just sticking more straws in an almost empty bucket. It seems to me that that will bring forward future production(to sustain a plateau) and the eventual decline rate in the future will necessarily be steeper, like a bell curve vs a Seneca Cliff type curve.

I would suggest infill drilling is a good indicator of what KSA feels it’s oil development priorities are. One could make an assumption about why they feel that way. I assume it’s because they don’t have anything better to do with the drilling rigs.

Yes it was stated they were infill wells and i dont know if it was a slip but from memory MD? Also said purpose was to mitigate decline rates.

“I would suggest infill drilling is a good indicator of what KSA feels it’s oil development priorities are. One could make an assumption about why they feel that way. I assume it’s because they don’t have anything better to do with the drilling rigs.”

Could be.

Could also be that they’re looking at the opportunity cost involved with having that money in hand to invest, or stash in secret accounts or London real estate, compared to leaving the oil in the ground to sell it later.

If oil goes up five percent annually, and the stock market goes up eight percent, they would be better off with the money in the stock market.

They need cash, they have an ENORMOUS welfare state to support to keep the priests happy, and the rulers may believe it’s time to stash every thing possible outside the country, against the day they are beheaded unless they flee.

They may actually believe people like Tony Seba, who believe that electric vehicles will become so numerous that the market for oil crashes, in which case it would be better to sell all they can now, rather than later.

Any combination of these and other factors could be in play, between the ears of the Saudi royal family.

That’s not a big deal. 40 years ago I worked in an operation which produced 50,000 BOPD. We had about 800 wells and drilled and completed 50 per year to offset decline, and we also abandoned or converted to injection about 40 wells off the existing producer stock. I believe the staff had about 15 engineers, five geologists, one geophysicist. This included the civil and mechanical staff doing the surface stuff. Later it was decided to raise production to 80,000 BOPD, which required 150 wells per year, as we started developing poor areas. But the business was viable, and some years it made a ton of money.

Hi Ron,

The probabilities are subjective. Just putting a number to what I think the odds are.

As oil prices increase things may change a bit on oil output. My estimate assumes that oil prices will increase at least the 12 month average price over the period from 2019 to 2031, if there is no severe World Depression in 2030-2035 (I think the odd are less than 1 in 3 that this will not be the case) oil prices might continue to increase until either there is a Depression or EVs and Transportation as a Service start to reduce demand for oil (not likely to make a dent until 2035).

I think the peak in US tight oil will probably coincide with the World peak in output and believe this will occur in 2025.

Ron, what is your opinion on Saudi Arabia? A I have said here before, I think that the Ghawar could water out at any time, reducing Saudi output by somewhere in the region of 3 mbpd in short order. It could happen tomorrow, next week, next year, who (outside of Aramco) knows?

Islandboy, Ghawar is not one field, it is five fields. From north to south there is Ain Dar, Shedgum, Uthmaniyah, Hawiyah and Haradh. Ghawar was developed from north to south.

Ghawar Oil Field

Ghawar is currently estimated to account for about six percent of the world’s total daily crude oil output. The field’s production peaked at 5.7million barrels per day in 1981 and later slipped below the five million mark. The development of the southern Hawiyah and Haradh areas during 1994 and 1996, however, raised the production to five million barrels per day again.

Ain Dar, Shedgum, and Uthmaniyah are all in decline and likely in steep decline. Hawiyah and Haradh likely have not yet peaked. However, it is production from Khurais and Manifa and Shaybah that is keeping the decline in Saudi production from becoming obvious. All other fields, other than the bottom two Ghawar fields, and these three latest developed fields, are in steep decline.

Khurais and Manifa were in mothballs for decades. Then they were brought on line, at great expense, to counter the decline in all the other super-giant fields. But the decline in these old super-giants is getting steeper.

Ron,

Weren’t they also brought online before original intended schedule?

Remember i red it somewhere perhaps it was from you.

No, you did not hear it from me. I have no idea if they were brought on line before schedule. But everything that is happening in the Saudi oil patch these days is to mitigate decline.

Their decline rates are increasing so lots of new infill wells are necessary. These infill wells slows the decline rate but increases the depletion rate. So the production profile of the field will not be a bell curve but a curve that has a very slow decline until it doesn’t. And that “doesn’t” seems to have arrived in most Saudi fields.

https://www.google.com/amp/s/mobile.reuters.com/article/amp/idUSKCN1QB1Y2

Thanks.

Interesting, New, Informative

article

Alexey Evgenievich Anpilogov

(Алексей Евгеньевич Анпилогов):

http://zavtra.ru/blogs/novie_tyomnie_veka?fbclid=IwAR2s559y2EhRioWaBUv4X-YW8AzbQFdK1bzvAE1pFzxUHNdFGmpXnKzkm3A

Start:

New “Dark Ages”?

human energy future

Alexey Anpilogov

In the third decade of the XXI century, which is about to come, one of the main problems facing humanity, again, as in the 60s, will be its energy supply, as well as the search for the main “energy carrier of the future.”

The three whales that the world’s energy industry today holds: oil, natural gas and coal are, by their nature, non-renewable sources of energy. True, with regard to oil and gas, this thesis is actively debated at the academic level, but for practical purposes it is indisputable: modern civilization consumes so much hydrocarbons that their natural substitution, if it exists, is not able to compensate for this exemption. The energy sources mentioned above in 2017 accounted for about 81% of world primary energy production, and they still define the image of our modern industrial world, while all renewable energy sources provide only about 14% of primary energy production, and about 5% The balance comes from nuclear energy (International Energy Agency, 2017).

At the same time, the situation with renewable sources is not at all as rosy as it may seem at first glance: out of 14% of renewable sources, 10% is the energy from burning wood and biomass, and 2.5% is hydropower. At the same time, the “fashionable” in the last decade, and having received at the same time gigantic, almost trillion-dollar investments in solar and wind energy projects, are not as high as 2% in the overall balance of the production of primary energy. At the same time, it is not even about the absolute figures for the introduction of new capacities of green energy, which may seem impressive, but about the exponential dynamics of the relationship between “oil-coal-gas” and “green” in the long term. After all, a decade ago, in 2008, the world balance of power generation looked like this: 78% were oil, natural gas and coal, 5% were atomic energy, 3% were hydropower, about 13.5% were wood and biomass, and 0, 5% produced wind and solar energy. Surprisingly, over the past ten years, the transition from “wood and straw” to the energy of oil, natural gas and coal, which occurred naturally, turned out to be two and a half times more significant for the global energy balance than the development of “green” energy technologies.

The phenomenon of such meager growth of “green” energy is interesting in itself: for the first time the capitalist mode of production, in which investments in fixed assets imply quick returns in the form of profits, gives an obvious, albeit programmed failure. Its essence becomes clear if we take into account in the picture the “quiet” transition of the world from “firewood and straw” to oil, gas and coal, which lasted throughout the decade of 2008–2018. This process, which no one financed in a targeted manner or advertised in the world media or Western scientific publications, went forward thanks to economic expediency. At the same time, the planting of green energy was accompanied not only by a powerful public relations campaign and trillions of financing, but also forced almost all countries to accept special, non-economic overpriced tariffs for the purchase of green energy in order to somehow force capital to finance unprofitable production. energy with wind turbines and solar panels.

World energy: a general view

Several reputable organizations are engaged in the problem of the global energy balance. These include the United States Department of Energy (DOE), the International Energy Agency (IEA), located in Paris, and the well-known oil company BP (ex-British Petroleum). Each of these organizations publishes annual reports on the situation in the global energy industry and the prospects for its development. These reports are compiled on the basis of an analysis of the mass of primary information, often of an incomplete and contradictory nature. Nevertheless, due to a certain averaging of all the initial data, the annual reports of these organizations quite fully and clearly reflect the overall world dynamics. In this article, in order to bring the data to one standard, we will rely on the annual reports of BP, unless otherwise explicitly stated in the text.

In accordance with the latest available BP report, global energy consumption reached 13,511 million tons of oil equivalent in 2017 (TNE, eng. “Tonne of oil equivalent”, TOE). At the same time, over the decade between 2007 and 2017, world primary energy consumption grew by an average of 1.5%. That is, the dynamics of energy consumption correlate well with the observed growth rates of the global economy over the same period – an average of 3.2% per year (World Bank and IMF, 2018).

The fluctuations of this second parameter, associated with economic crises and recessions observed in the period under review, make it possible to evaluate the contribution of the notorious “energy efficiency” to the global growth in demand

“this thesis is actively debated at the academic level”.

What does that hint to? Abiotic oil?

No, there does not even remotely a hint of abiotic oil. Read the last two paragraphs again. That is what it hints to. An average growth of 1.5% in energy consumption and a growth of 3.2% in the global economy has been enabled by a continual growth in energy efficiency. This cannot possibly continue, especially the 3.2% growth in global economy. When the global economy does not grow it receeds. This is called a recession.

Ron,

World Real GDP per capita has been growing steadily from 1971-2017, at some point this may slow down, it is not clear when this begins, perhaps in 2030.

https://fred.stlouisfed.org/series/NYGDPPCAPKDWLD#0

Data from

https://fred.stlouisfed.org/series/NYGDPPCAPKDWLD#0

Charting least squares fit on natural log of World Real GDP per capita in 2010 US$ gives average growth rate in World real GDP per capita (constant 2010 US$) from 1971 to 2017 of 1.45% per year. R squared is 99%.

from what I recall the global debt to GDP ratio is about 320% in Q4 2018. GDP growth will cease when debt expansion ceases (FWIW I suspect widely acknowledged peak oil in the rear view mirror, so to speak, will likely play a role in the realization that event)

https://blogs.imf.org/2019/01/02/new-data-on-global-debt/

In 2008 the size of the US economy was $14.5 trillion. A decade later, the size of the economy is $19.7 trillion, so about 36% greater.

Over the same ten years the national debt has grown from $9.4 trillion to over $21 trillion- about 123% greater.

It’s hard to pretend that’s not a problem, but people still do try.

Interestingly enough….

Census Bureau, Treasury, EIA Detail American Insolvency

“And comparing the US primary energy consumption versus the Wilshire 5000 (representing the value of all publicly traded US equity), a funny thing shows up. Flat to declining energy consumption vs. surging asset valuations…this is typically understood as a red flag for phony wealth creation via market manipulation, monetization, and banana republic central banking.”

https://econimica.blogspot.com/2019/02/census-bureau-treasury-eia-detail.html

Phony wealth creation is synonymous with phony GDP.

Survivalist,

Took a quick look at the IMF blog, not sure where 320% comes from, from the IMF:

Global debt has reached an all-time high of $184 trillion in nominal terms, the equivalent of 225 percent of GDP in 2017.

Data from Bank for International Settlements (BIS) at link below

https://www.bis.org/statistics/totcredit.htm?m=6%7C380%7C669

Latest data through 2nd quarter of 2018 has Global credit to non-financial sector at 233.7%, it was 192.7% in the first quarter of 2002 (earliest data point from years with a full 4 quarters of data).

To look at the rate of increase I took the natural log of the debt to GDP ratio to the non-financial sector for all reporting nations, then fit a least squares regression to the entire data set. The average rate of increase in Debt to GDP ratio has been 1% per year.

Real GDP is measured in real goods and services adjusted for inflation.

The measure is far from perfect as unequal income and wealth distribution is not taken into account, also health care services, freedom of choice and many other factors are not taken into account.

There are no perfect statistics, especially in the social sciences, though it is a problem everywhere.

320% comes from IIF in January 15, 2019, sorry Dennis- wrong link

https://www.iif.com/Research/Capital-Flows-and-Debt/Global-Debt-Monitor

According to same Global Debt was 244 Trillion … 318%

Survivalist,

Not a member so I cannot read the report. Two respected organizations give a very different estimate. Generally financial debt is ignored. This bank to bank lending does little to affect the real economy. It is borrowing by private households, businesses, and governments that matters.

Dennis doesn’t believe debt is bad.

Debt, per se, is not bad. Debt is necessary in a growing capatilist society. Without debt, very new homes or automobiles or a lot of other stuff would be sold.

Saying “debt is bad” is like saying “people are bad”. Some people are definitely bad but most are not. Ditto for debt. Some debt, like debt you cannot pay back, is bad. Too much national debt is bad because it causes a high inflation rate. But there is nothing wrong with most debt.

Ron Wrote:

“Debt, per se, is not bad. Debt is necessary in a growing capatilist society. Without debt, very new homes or automobiles or a lot of other stuff would be sold.”

before the 1970’s people paid cash for cars. Now everyone needs a an auto-loan. People that could not afford a new car got a used car. Issue is that Auto loan durations keep going up. Auto-loan durations are now exceeding the operational life of the car. Debt from the old car is rolled over into the new car when purchased. I think we are getting close to the end when most people can afford cars.

Today home buyers don’t need to put any money down to buy a home. Up until about the early 1990’s buyers had to put 20% down. Meaning they have the means and will power to save money & live within their means.

I think most debt is bad. Most people use debt for instant gratification. People are spending well beyond there means and its going to bite back. There are people who are facing retirement, still paying off student loans, mortgages as car loans and have zip saved for retirement. I cannot see how any of this will be good.

SS runs out of money in 2034 (In the very best case). Mostly it will run dry in the mid to late 2020’s and most of the boomers that delayed retirement are forced into retire do to health issues.

My Guess the crap starts hitting the fan in the mid to late 2020s. Some time between 2022 & 2024 it will take every tax dollar just to pay for entitlements, pensions, Interest on the debt & welfare.

“Too much national debt is bad because it causes a high inflation rate”

I don’t see that happen. I see the US and the rest of the world just monertize the debt. Really the USA is the only major nation that isn’t doing QE at the moment. Japan, EU, China, India, etc are all still doing QE since the started more than a decade ago (Japan has been doing QE for more than 25 years). Central Banks will just continue to prop up asset prices, and suppress interest rates from ever rising. US interest rates peaked late last year and likely will fall or remain flat for the next decade or more via Central bank control. No way can the US afford Treasure rates to go up since it would force the US to default on its debt. Its already paying about $400B in Interest. If the rates doubled so would the interest payments.

All that is needed is a for the global economy to breach its tipping point. Perhaps its a decline in Oil production, or some major nature disaster. The global economy is dangling by one arm over an economic precipus.

“SS runs out of money in 2034 (In the very best case). Mostly it will run dry in the mid to late 2020’s and most of the boomers that delayed retirement are forced into retire do to health issues.”

The USA federal government is broke, busted, by any sort of honest accounting, because most of the money that has been promised, as future spending, is OFF THE BOOKS.

The SS trust fund is nothing more than a bookkeeping smoke and mirror trick. There’s no money in it, there’s no third party trustee making sure it’s honest, Uncle Sam is playing all roles. In a REAL trustee situation, one party is paying, a second party is receiving, and THIRD party is playing the role of administrator. The administrator puts the money in trust into something safe( assuming there IS such a thing, lol) and disburses it according to established terms of the trust.

Uncle Sam is running in the hole, and the money in the SS fund is a figment of the imagination, because it is entirely dependent on future tax collections. It’s not held in the hands of a third party waiting for it to be collected, in a real trust, it would BE THERE, not WAITING on it. I’m painting fast with a broad brush, please understand that.

So called monetization of debt can as far as I can see, kick the can down the road, but ultimately…….. government must be able to collect enough revenue to cover it’s promised spending, and that can ONLY happen in a real world situation where the economy is still growing, because the amount of spending that has ALREADY been promised, but OFF the official debt, cannot POSSIBLY be paid, unless the economy is expanding at a rapid rate.

Who believes the man and woman with two kids will be able to enjoy social security, medicare, etc, on the taxes that can be paid by their own two kids?

A typical retiree is now supported to the tune of well over 20,000 bucks annually via SS and Medicare alone. So one parent, onepointone kid, the kid pays 20,000 JUST to cover Mom’s or Dad’s SS and Medicare ? How much MORE to cover everything else?

And lets not talk any bullshit about the taxes business pays. I’ve BEEN in business all my life, and I PASS ALONG my taxes to my customers. The vast majority of all taxes are ultimately paid by consumers. The guy who shows up and cuts your grass for thirty bucks, cash, can do that only because he’s not paying any income tax on that thirty bucks. The guy who takes your check to the bank and puts it into his account necessarily charges forty bucks. YOU THE CONSUMER pay that ten dollar difference.

Money is indispensable because it enables trade and commerce to be carried on efficiently, and it’s a super duper way of keeping track of obligations, who owns what, who owes who what, etc.

But it is not in and of itself anything that actually produces food or clothing or shelter or OIL. The early commies DID know a few things.

At some point, possibly within our own personal lifetimes, a shit load of debt is going to go belly up. The question is this, WHO will get paid, and who WON’T? SOMEBODY , a lot of somebodies, are going to lose their collective ass.

There is a flip side . Generations to come are going to inherit a world with built infrastructure that will mostly last, and all the knowledge and technology so far accumulated and invented. That will help enormously in terms of offsetting their tax burden.

Looks like the House is looking to put in a SS fix.

“House Democrats have proposed a bill that, if passed, would extend the payroll tax to earnings above $400,000 as a way to keep the Social Security fund solvent for at least 75 additional years, according to CNBC. Currently, there is an earnings cap of $132,900; any income above this level is not subject to Social Security tax. The proposed legislation would leave income between $132,900 and $400,000 untaxed but reinstate the payroll tax for income above $400,000. Beyond this, it would also increase the payroll tax generally to 7.4 percent by 2043, up from 6.2 percent currently. “

Raising the cap to 400K won’t fix the problem since so few people make above the current cap of $132K. I am sure they will do the following in the early 2020’s:

1. Start raising the retirement age. This has been the plan since the 1980’s but they won’t do it until they have to.

2. Start increasing taxes for the working class. They likely target Medicare since it already runs about $500B in the red every year and the current Medicare tax is 1.45 * 2. There is no cap on the Medicare tax.

The only reason SS hasn’t need major changes yet, is because older boomers have been delaying retirement having gotten wiped out in the Stock & housing bubbles and getting next to ZIP on CD’s and other Bond investments. However, health issues & perhaps layoffs when the next recession hits will push them into retirement.

I bought my first car in the 1960’s when I was 17, put $500 down and got me a bank loan for $1200. As far as I know people with good credit rating could borrow money and did it. I remember my mom bought a bed on credit at Sears, and later I bought my first color TV on credit to watch the Super Bowl.

Whether or not debt is good or bad is a normative statement, it’s a value judgment.

I’m interested in positive statements- like; the debt is large and much of it will perhaps be defaulted on.

Not saying he is wrong. But from the dialogues we had it seems that articles like this:

https://www.zerohedge.com/news/2017-01-04/global-debt-hits-325-world-gdp-rises-record-217-trillion

Doesn’t worry him much. Or is not a big issue.

Iron Mike,

Incorrect.

Dennis does not believe in absolutes.

The disagreement is how much debt is too much.

Do you own a home? If so, did you pay cash?

I would rather own my home than rent and pay someone else’s mortgage, without debt that would not have been possible.

I think that too much debt is bad, I think too little debt (as in the Great financial crisis when credit markets fell apart) is worse.

Do you believe there should be no debt?

Generally GDP is considered roughly the equivalent of national income in economics.

Mortgage lenders generally consider a debt to income ratio of 3 to 1 as a “safe” level. The same rule could likely be applied to World debt to GDP levels, more than 300% is a problem. At 234% debt to GDP, the World is fine, though lower debt would probably be better, maybe 190 to 200% debt to GDP for the World.

Japan has been over 300% debt to GDP for over 15 years, notn great for their economy, but their main problem is an aging population structure.

Thanks Dennis,

I think with regards to the economic system. Necessities like housing shouldn’t be subjected to speculation. The government should be able to lend out money for housing and other necessities debt free. Luxury items can be debt based. To be perfectly honest, i am out of my depth. But from my limited point of view, the whole global economic system seems to be nothing but a ponzi scheme on a gigantic proportion.

Iron Mike,

My preference is for government involvement in the economy to be minimized.

A properly regulated free market system is efficient and tends to maximize choices by individual families.

People should be able to risk their savings as they see fit.

Perhaps it is different where you live, but generally in the US the government doesn’t choose your home and only the very wealthy tend to own homes without using debt to purchase. One exception would be homes that are inherited.

Most people don’t have that luxury.

Dennis Wrote:

“Do you own a home? If so, did you pay cash?”

Yes.

Dennis Wrote:

“I would rather own my home than rent and pay someone else’s mortgage, without debt that would not have been possible.”

Your still renting: Interest payments + Property Taxes. Stop paying you property taxes to see who really owns your property.

These days most people don’t even bother with a down payment. They are really just renters with a buy option, especially those with interest only mortgage payments. Yes banks are *Still* issue interest only mortgages.

“Japan has been over 300% debt to GDP for over 15 years.their main problem is an aging population structure.”

Japan’s debt is the cause of their demographics problem. When the debt got out of hand and the cost of living soared, the Japanese stopped having kids. Same is true in Europe and the USA. Only the very poor are having Children in the USA or Western Europe. In Japan not even the Poor are having Children.

Dennis Wrote:

“I think too little debt (as in the Great financial crisis when credit markets fell apart) is worse.”

Too much debt was the reason for the Great financial crisis. it was so bad that the bottom the credit markets collapse. It wasn’t until Central banks stepped into to pump trillions into the credit markets. Now the West is trapped like Japan in a Asset bubble or everything Bubble. CB cannot sell off there assets, nor can they ever raise interest rates without triggering a deflationation collapse. Probably with in the next 12 to 24 months the Fed will restart QE again. They have too as the Credit markets are once again drying up. Home sales & Auto sales are declining as borrowers are cutting back on new loans.

Techguy,

That’s great that you can afford to pay cash for a home, most people cannot.

Debt is not a bad thing, too much debt is.

Basically debt to income under 250% can usually be handled easily. The world is slightly under that level according to the Bank for International Settlements (the so-called Central Banker’s bank).

Dennis Wrote:

“Basically debt to income under 250% can

usually be handled easily”

LOL! Try than when Interest rates are at 12% to 14% as they were back in the late 1970’s and early 1980’s!

Debt is completely out of control, Cheap & easy credit is driving up asset prices and driving everyone into bankruptcy. From student loans, auto loans that are in Mortgage amounts, and astronomically housing costs (Rent or mortgage) These days people are paying about 29% of their gross income on housing costs. If I recall correctly people now spend about 10% to 12% of their gross income on car payments. At this point people no longer have the means to save for retirement. 78% of all American workers live paycheck to paycheck.

Again Please explain why debt is a good thing?

>In 2008 the size of the US economy was $14.5 trillion. A decade later, the size of the economy is $19.7 trillion, so about 36% greater.

Over the same ten years the national debt has grown from $9.4 trillion to over $21 trillion- about 123% greater.

You are confusing debt with national debt. Most debt is private, not public. National debt has no influence on oil production.

Is a slow recession a tragedy, with chaos necessarily baked into the equation?

If we are lucky, that will be the global challenge.

If not so lucky, recession will be depression.

Some places more than others, of course.

Russia may be be looking more solid than most in the 2030’s.

Western Europe, not so good.

Hickory,

I imagine growth rates will slow as the World economy becomes more developed (wealthier), just as has occurred in the OECD. Also population growth is likely to slow down over time. It is possible that after a population peak has been reached and started to decline at more than 1.4% per year (perhaps by 2100 to 2150) that World real GDP will decline while per capita GDP continues to increase, though in my view it would be better to reduce the growth rate in GDP for environmental reasons. Many would not agree.

I also think wealth redistribution through highly progressive income taxes and a substantial wealth tax with all loopholes removed is good public policy, and again many or probably most would disagree.

Overall, I was referring to the conditions that will likely ensue after peak fossil.

As very well stated in the post by Opritov Alexander above (and by Ron so many times), the hurdles to replace fossil energy are insurmountable, by and large.

As you have pointed out before, there is a big risk for economic contraction around the time of peal oil.

I expect it to be severe in degree, especially among countries that are elderly, heavily indebted, and heavily dependent on imported energy. And many of these places are your trading partners, no matter what country you hail from.

Indebtedness is not just a transitory or ‘paper’ issue, IMHO. The cost to attempt transition to non-fossil energy will be huge (beyond huge). How do you buy a second home (renewable energy on a countrywide basis), when you are already maxed out on your credit for the 30 yr loan on your current one (maintenance of your current economic activity and dependents)?

As a slight aside, GDP is not very useful when determining the wealth of a country, since it includes frivolous activity that will evaporate in tough times. Financial transactions, hair dressers, restaurants, sports and music entertainment, weddings, luxury items such as fancy cars, boats and fashion, advertising , are examples of GDP components that can evaporate almost immediately when the times get tough and the velocity of money heads towards zero.

GDP considers natural disasters like earthquakes, floods, tsunamis and hurricanes as being favorable to the economy. Add to this the fact that these disasters are hated by the common people who rightly pray that this destruction happens as seldom as possible. Once again, due to the poor fundamentals of the GDP system, the entire science of economics is branded as being anti social. Once again, the true economic fundamentals are not being considered or else the question of economics being an anti-social science does not arise. In this article we will first consider the prevalent viewpoint and then we will debunk the myths pertaining to it.

https://www.managementstudyguide.com/gdp-and-natural-disasters.htm

When a metric values natural disasters as favorable to the economy then you know somethings being missed. I would suggest that repairing after a storm is not growth. GDP makes no distinction between Construction and Reconstruction.

Burn Your House, Boost the Economy

Why GDP is a Flawed Measurement

https://fee.org/articles/burn-your-house-boost-the-economy/

“… GDP is more accurate than GDB since the GDP is linked to the work done to produce a larger interface between civilization and its sources of energy and matter. It’s the interface size that is linked most directly to burning, less so growth of the interface… sustaining home value requires constant burning by civilization.” ~ Tim Garrett

http://nephologue.blogspot.com/2018/09/on-origins-of-economic-wealth.html?showComment=1536674737631#c4191973140713430153

GDB got started here I think

https://un-denial.com/2018/02/08/on-burning-carbon/

Nate Hagens started the idea of GDB, as your link explains.

Jesus H. That is one incredible rant.

Hickory,

If there is a depression many debts will be defaulted on.

So while you are correct that income will decrease, debt will also decrease.

Most of the money is owed to the wealthy so the debt defaults will essentially be a flow of wealth from rich to poor.

The fossil fuel will not cease to be produced overnight. As supply becomes short prices will rise and scarce resources will be put to their most important uses. The high prices also create opportunities for EV producers, solar PV, wind, heat pumps, HVDC transmission, light rail, electrified rail, efficiency improvements in existing buildings and new construction.

A severe depression caused by peak fossil fuels could also lead to a Green New Deal where governments facilitate and accelerate the transition away from fossil fuels.

Imagine a WW2 type effort where the battle was not against the Axis, but against climate chaos.

The nation state has a lot of power to do both harm and good, perhaps many nations will choose the latter.

It is a choice we have to make.

1848 — England: In London, 29-year-old Karl Marx publishes The Communist Manifesto.

Yes indeed, true, read too quickly ..

“The phenomenon of such meager growth of “green” energy is interesting in itself:”

I find this characterisation of “green” energy growth as meagre interesting. All the regulars here should know that I have a particular focus on alternatives to a FF based economy, with an emphasis on battery powered vehicles and solar PV. Solar energy produced less than one hundredth of one percent (<0.01%) of world electricity in 2007 or thereabouts. By 2017 this percentage had climbed to somewhere in the region of one percent and currently is approaching two percent, so one hundred fold in ten years and looking to double in another two. This is meager growth? To put this in perspective, if this growth were to continue at a similar rate for the next ten years, the implication is that all electricity would be coming from solar.

Of course that proposition is ridiculous since we all know that continued exponential growth in a finite physical system is impossible. The question is, when will the growth in solar capacity go linear and finally start to taper off? If we were to trust the projections of the usual suspects, the EIA, IEA and BP among them, this has already happened but reality tells quite a different story. Auke Hoekstra, a senior advisor smart mobility at the Eindhoven University of Technology in the Netherlands has a graphic pinned at the top off his Twitter feed that tracks the projections for global solar capacity installations, from the IEA’s World Energy Outlook, against the actual capacity installations going back to about the year 2000. As seen from the resized graphic below, the IEA’s track record of forecasts for solar PV growth are shockingly bad! Their methodology seems to be, forecast flat to declining capacity additions every year and hope that one day the reality matches their forecast!

If this is the guidance that continues to be given to the FF industries, it could end up being very costly for them. If one does not believe that renewables (and EVs) can have an impact on fuel consumption in the foreseeable future , one will tend to make investment with long term horizons that end up being blindsided by developments that should have been foreseen.

In my neck of the woods, the local electricity utility, with a peak demand of about 650 MW, is on track to commission a brand new 190 MW CCGT supplied by LNG outfit New Fortress Energy. The plant is close to completion and the floating regasification vessel is already in place so, I would imagine they are very close to carrying out tests of the fuel delivery and possibly plant operation. In August 2017 the utility singed a PPA with New Fortress South Power Holdings Limited, which is constructing a 94MW power plant, scheduled for completion by February 2020, on the grounds of a bauxite to alumina plant less than nine miles due east of the new 190 MW plant. I was unable to find any sources for details of the PPA

In May 2016 an outfit won a bid to supply 37 MW of PV power at US 8.5 cents/kWhr for twenty years. Between the winning of the bid and the start of construction it was agreed for the capacity of the facility was increased to 50 MW. This project is under construction and scheduled to start delivering power to the grid before the middle of this year. I suspect the the price of electricity under the PPA for the solar plant is lower than that from the NG plants with the disadvantage that the output will vary with the sunlight the plant receives, while the NG plants can be called upon at any time.