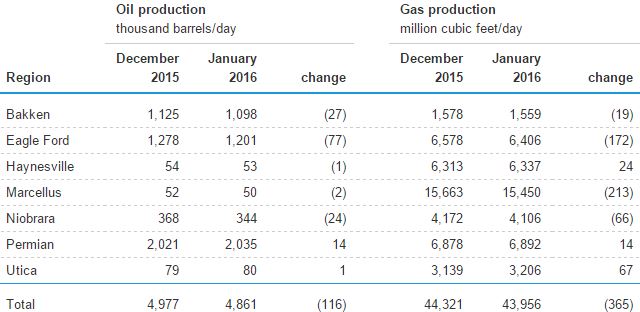

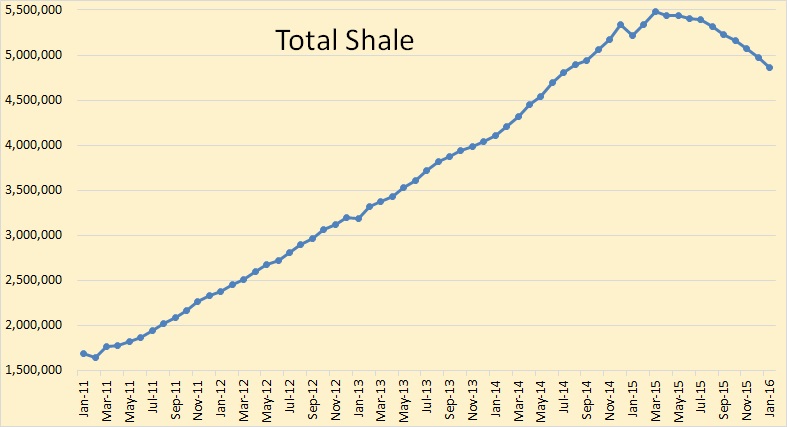

The EIA’s Drilling Productivity Report has US shale oil on a steep decline. The below shale oil production charts are the EIA’s estimate of what shale production will look like through January 2016. Keep in mind this is the EIA’s estimate and not hard production numbers.

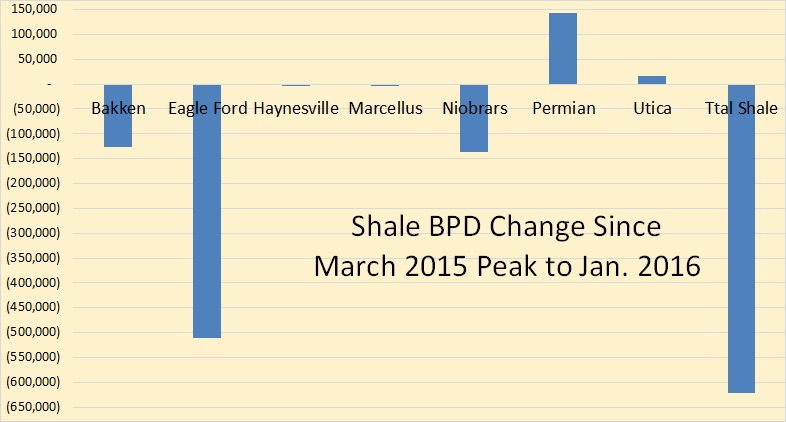

The big drops here are Eagle Ford, Bakken and Niobrara. They have the Permian still increasing in production. An expected drop of 116,000 barrels per day drop in January is very significant.

They have the Bakken in a continual decline after July. It is important to note that the EIA’s Drilling Productivity Report has the Bakken decline, July thrugh September, very close to what the North Dakota Industrial Commission has. So it appears that the DPR is getting better with its production estimates.

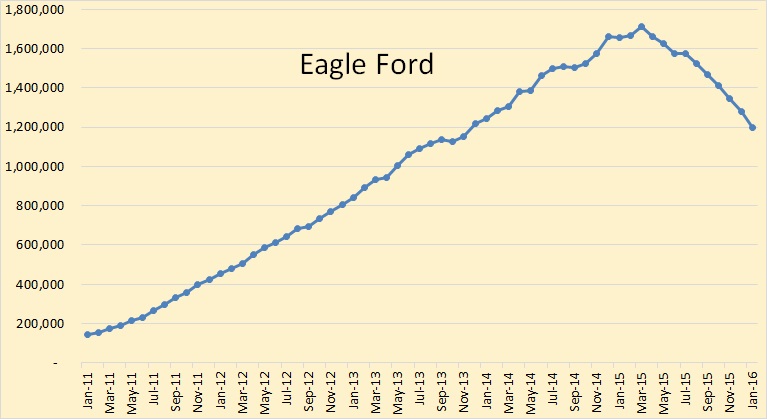

Eagle Ford is where the action is, or isn’t, depending on your point of view. Dropping 77,000 barrels per day to start the New Year does not bode well for shale production in 2016.

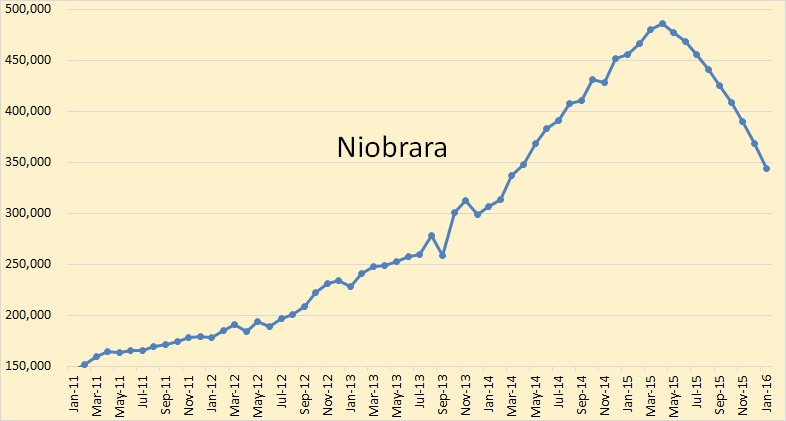

Niobrara appears to have the steepest drop since the March peak. But actually they, if the DPR is correct, will be down 28.37% since March while Eagle Ford is down 29.81%, The Bakken will be down 10.35% while the Permian will be up 7.59%.

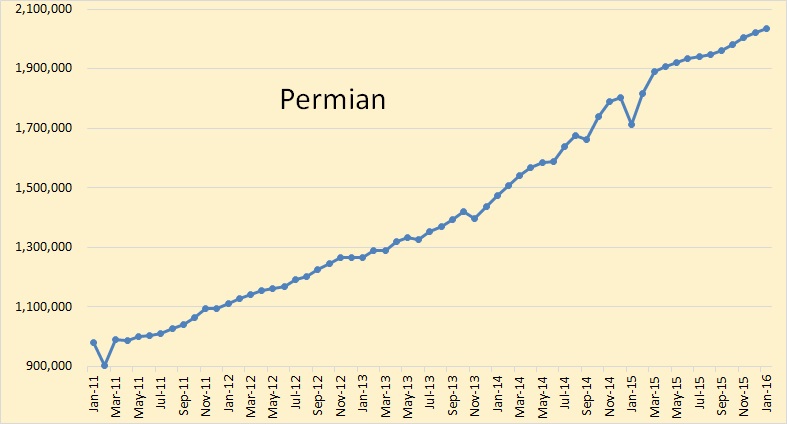

The Permian, which is about half conventional oil, continues to buck the trend and increase production while everyone else is in decline.

Total for the seven shale areas peaked in March and declined only slightly through July but then heads down in earnest after that. Total Shale, if the DPR is correct, will be down 11.34% March to January.

Total shale, if the DPR is correct, will be down 622,000 barrels per day from the peak in March until January.

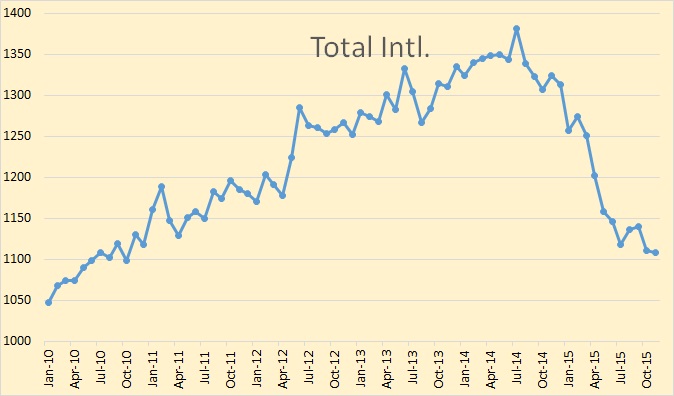

The Baker Hughes International Rig Count is out with worldwide rig count numbers for November 2015.

This total international rig count does not include U.S., Canada, on shore China or any of the FSU countries. In November it hit 1109 rigs, both oil and gas, down 273 from a recent high in July 2014.

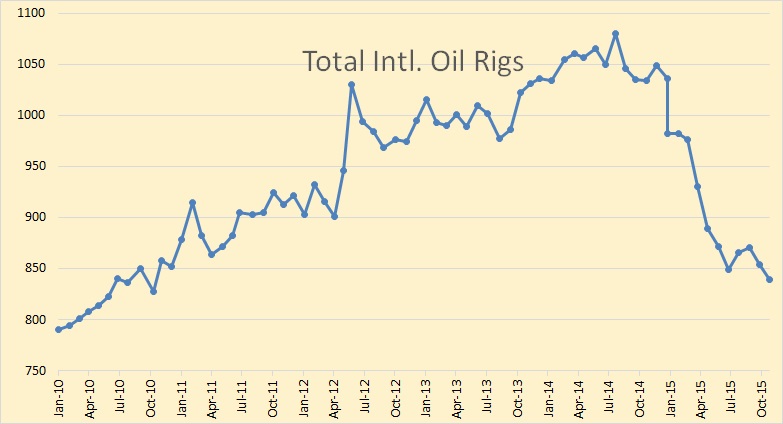

Looking at international oil only rigs gives a very similar picture as does total rigs.

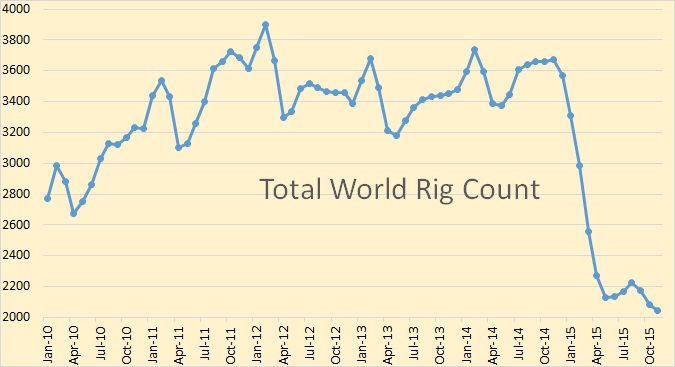

Total world rig count, ex FSU and on shore China, looked like it was heading back up in August but then turned back down and hit a new recent low 2047 rigs in November.

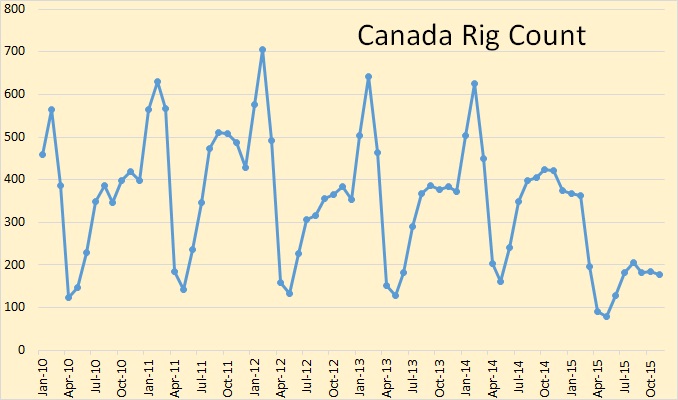

The Canadian rig count is highly seasonal, reaching a high in February and a low in April and May. So it is best to measure Canadian rigs from year to year. In November 2014 Canadian rigs stood at 421. This November they were at 178, down 243 rigs or 58%.

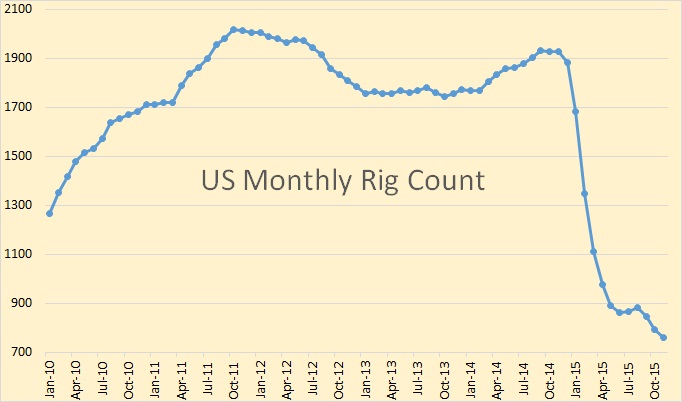

US total oil and gas rigs stood at 760 in November, down 31 rigs on the month.

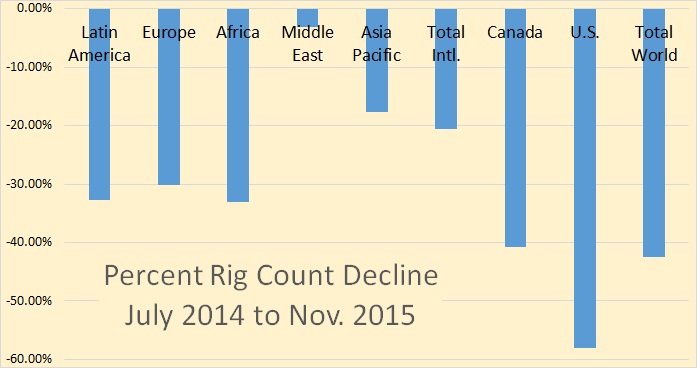

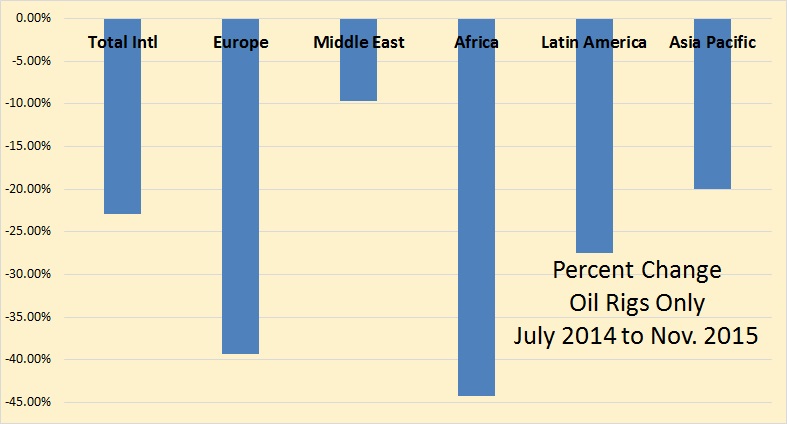

Here I have measured the percent change in rigs from the International high in July of 2014. Note that everyone has suffered heavy attrition in rigs except the Middle East which is down only slightly.

Here we have international percent change of oil rigs only. The Middle East still loses the least percentage and Africa the most.

Below Percent Oil Rig Change for Major Producers, July 2014 to November 2015.

Percent oil rig changes were all over the map. Here I have listed the some changes from major producers, largest decline to largest increase. Iran showed no rigs so no change. This is oil rigs only.

My conclusion from all this, the Drilling Productivity Report as well as the Baker Hughes rig count, is that we are in for a big production drop in 2016. Prices will increase but it will take years before major producers are back up to full speed. And then production will still be well below 2015 production levels.

___________________________________________

I send an email notice whenever I put up a new post. If you would like to be added to that list then email me at DarwinianOne at Gmail.com

Geopolitics seems to be a completely forgotten factor in oil price at the moment. Iran already defying their nuclear pact and Syria being armed with Russian ABM’s now announcing intent to shoot down allied F-16’s.

Syria has very little oil and if Syria does shoot down an allied plane then what?

I do not see the UK or France or the United States invading Syria in retaliation. At the moment the big story is OPEC meeting collapsing so no production cap. Iran is getting ready to supply the world with another half a million to a million barrels of oil per day, which it will do over 2016.

http://www.wsj.com/articles/iran-expects-oil-exports-to-start-rising-as-early-as-late-november-1443115364

Turkey has the possiblity of broading the war. Turkey has invaded Iraq (late last week)and the Iraqi gov’t has asked Russia to intervene (yesterday) on its behalf. Odds favor that the Syrian proxy war morphs into a hot war with KSA and IRAN battling each other. Almost every week there seems to be an event that escalates the conflict.

Iran has a few nukes (Pakastan/FSU black market and make have enough for a one or two bombs from its enrichment projects), so does KSA (Pakastan), and Israel. It may not take much for nuke to start flying in the Middle East. The US and the EU have done nothing but exacerbate the problem. Even if nukes do not get used, it would not take very much convention warfare between KSA and IRAN to distruption ME oil production, and draw in Western powers.

I am sure that when WW3 does begin, it will start in the Middle East.

Hi TechGuy

Everything you have said is certainly within the realms of possibility.

I had not heard that Iraq had asked Russia to intervene with regards to Turkish violation of it’s territory.

I think if Russia did bomb Turkish troops inside Iraq then turkey would withdraw them. There is little prospect of any NATO country backing the Idiot Turks if they go invading another country.

However as you say there are so many opportunities for escalation of violence in the land of the religion of peace.

ISIS want to ferment as much hate and violence as possible, which is really not hard.

At the moment Iran and Iraq are holding off ISIS, with the help of the Kurds and Syrian government forces attacking from their sides.

I only see Saudi Arabia getting far more involved if ISIS blows up a large Saudi oil installation or something of equal importance.

One thing is for sure WW3 will start in the Middle east, exactly how things escalate I am not sure.

Why do you think ISIS would attack Saudi Arabia interests?

You do not bite the hand that feeds you.

Saudi Arabia is the biggest promoter of world terrorism, the biggest buyer of small arms, the biggest threat to regional stability and the biggest impediment to Middle East peace. There is nothing right about that country.

Javier

Saudi Arabia are the biggest sponsors of extremism but ISIS are like a new mafia mob that want to muscle in on the action.

http://www.theguardian.com/world/2015/aug/06/suicide-bomber-attacks-mosque-in-saudi-arabia

Angela Merkel’s deputy accuses Saudi Arabia of sponsoring extremism

Vice Chancellor Sigmar Gabriel told the German newspaper Bild am Sonntag Sunday that it should be made clear to the kingdom that “the time for looking the other way has passed”….

Gabriel’s comments come after the German intelligence agency BND warned of the destabilizing role of Saudi Arabia in the Middle East in a memo shared in the German media last Wednesday.

http://edition.cnn.com/2015/12/08/world/germany-saudi-extremism/index.html

Unfortunately Angela got lost in official narrative. One day paying off 3 billion to Erdogan for his blackmail and the next day accusing SA for exactly same thing. The fire is getting closer to the core and consequences of sleeping with the devil are getting real. She should ask Monsieur Holland about that. All the attention this weekend was on election in Venezuela but the game changer elections were regional elections in France. Nobody is paying attention but the clouds are gathering.

Javier Wrote:

Why do you think ISIS would attack Saudi Arabia interests?

ISIS is very much a rabid dog terriorist group. What happens if KSA cuts off the money? KSA may become an easier target to start a Calphate then Syria and Iraq as Russia now engages them. I can’t say with any certainty that ISIS will go after KSA, but nor can it be excluded.

There is also a risk that of a coup in KSA as not to many people are happy that the King is replacing high level gov’t officials with his family members, a coup could draw in ISIS. I posted an news article about this here a few weeks ago. If a coup does happen in KSA its going to draw in ISIS fighters and probably Al Quada, houthis, etc

Peter Wrote:

“I think if Russia did bomb Turkish troops inside Iraq then turkey would withdraw them. There is little prospect of any NATO country backing the Idiot Turks if they go invading another country.”

I don’t think Turkey will draw in NATO, but I fear that once the proxy war in Syria is lost by KSA, that KSA might start engaging Iran directly. Consider that KSA is also fighting a proxy war in Yemen as Iran is trying to create a lot of chaos in the Arabian peninsula. If KSA starts losing all its proxy wars, I don’t it will sit by and do nothing. At some point KSA might just go full blown berzerk.

I think if the KSA/Iran (aka Sunni vs Shia) proxy war switch to direct confrontation, it will draw in NATO and perhaps China and Russia, once oil exports from the ME are impacted. Consider that NATO and Russia both now have substantial military assets in the Middle east, fighting on different sides of an expanding proxy war, its not a far stretch that it can escalate. Russia also has been dealt a coup in Ukraine, initiated and backed up by NATO.

Once a hot-war between KSA and Iran starts there will likely be a some nukes flying about. You have Iran, KSA, Israel that all posses a few nukes. In the process, its likely to take out NATO and Russia troops. It a very fluid situation its very easy for mistakes to be made draw in nuclear assets of NATO, Russia, Pakastan, India, China, and Europe.

IHS estimate of ISIS revenues:

IHS: Oil sales 43% of Islamic State revenue

http://www.ogj.com/articles/2015/12/ihs-oil-sales-43-of-islamic-state-revenue.html

Islamic State, the jihadist occupier of parts of Syria and Iraq, makes 43% of its $80 million/month revenue from illicit sales of oil, estimates the monthly Conflict Monitor at IHS Aerospace, Defense, and Security.

The firm based its estimate for late 2015 on open-source intelligence, including social media.

“Unlike Al-Qaeda, the Islamic State has not been dependent on money from foreign donors to avoid leaving it vulnerable to their influence,” said Columb Strack, senior IHS analyst and lead analyst for IHS Conflict Monitor.

The group has at least six main sources of revenue: production and smuggling of oil and gas; taxation of the profits of all commercial activities in areas under its control; confiscation of land and properties; trafficking of drugs and antiquities; criminal activities such as bank robbery and kidnap for ransom; and state-run businesses, such as running small enterprises that include transport companies and real estate agencies.

“According to information gathered from Arabic-language social media and our in-country source network, efforts to target the Islamic States sources of revenue are paying off,” Strack said.

Airstrikes by US-led coalition forces have focused on disrupting the Islamic state’s oil income. IHS said the attacks have “significantly degraded” the group’s refining capacity and oil transport capability.

“Although the Islamic State retains its capacity to produce oil, its loss of easy access to Turkey after its defeat at Tal Abyad and the efforts by Turkish authorities to stop smuggling activities along its border with Syria have gradually forced the group to rely increasingly on the internal markets in Syria and Iraq to smuggle and sell its oil,” it said.

Yes, I read that ISIS is doing the refining at fires in private courtyards within villages to avoid bombings. Obviously this greatly affects the quality of the refining, damaging prices.

TechGuy,

“You have Iran, KSA, Israel that all posses [sic] a few nukes…”

Iran and KSA have nukes? Can you quote a source for this?

KSA:

http://nypost.com/2015/05/17/saudi-arabia-to-buy-nuclear-bombs-from-pakistan-report/

Iran very likely smuggled a couple of nukes when the Soviet Union collapsed in 1989. There are articles about this about 10 years ago. I used to have an Washington DC inside contact who also also mentioned it. Iran also has two enrichment factories. I have no idea how much weapons grade material they now have. I would imagine they have enough for at least a few small bombs by now. They been enriching Uranium for over ten years now. Iran has had a covert Nuclear weapon program for decades. Iran also has a very active Ballistic missile program.

T G,

Thanks.

This from RT news:

https://www.rt.com/news/325070-turkey-iraq-troops-crossing/

Russia attacked targets by launching missles from a submarine stationed in the Mediterranean Sea.

http://www.dw.com/en/russia-launches-attacks-on-syria-targets-from-submarine/a-18903123

Any hard information concerning missing USSR ( Russian ) nukes would be appreciated. Ditto Iranian possession of the same.

Links to articles in well known papers or magazines etc.

On December 2, Russia’s Deputy Minister of Defense Anatoly Antonov made a strong statement about Turkish complicity with ISIS. The charge sheet is long and detailed. It mentions many aspects, but the most incendiary is the accusation about “ISIS oil.”

ISIS controls Iraqi oil fields near Mosul. They have been making millions of dollars each day by selling oil from these fields. How does ISIS get the oil from the fields in Mosul to the market?

What ISIS has done is to use the old networks that have smuggled oil from the Kurdish Regional Government without any consideration given to Baghdad’s sovereignty over that oil. This had been a point of contention for decades, since the Kurdish region began to exercise autonomous control of the north. Kurdish oil was sold to smugglers who would cart them in tankers across the border into Turkey. In Turkey the trucks would run the length of the country to the Mediterranean port of Ceyhan. From Ceyhan, which is a port run by the Turkish government, the oil is purchased by transporters whose ships go to Malta, where the oil is transshipped to destinations such as Ashdod (Israel). This has long been a bone of contention between the Iraqi government, the Kurdish Regional Government and the Turkish government. It was documented by Tolga TanıŠin his book Potus ve Beyefendi (2015). Tanis accuses Berat Albayrak, son-in-law of Turkish president Recep Tayyip ErdoÄan, of involvement in this illegal scheme. ISIS has merely replaced the Kurdish Regional Government in the new arrangement.

“where the oil is transshipped to destinations such as Ashdod (Israel).”

are you kidding me?

http://www.opednews.com/articles/ISIS-Oil-by-Vijay-Prashad-Isis_Putin_Smuggling_Syria-151207-747.html

That makes sense.

https://en.wikipedia.org/wiki/Baku%E2%80%93Tbilisi%E2%80%93Ceyhan_pipeline

https://en.wikipedia.org/wiki/Trans-Israel_pipeline

All the oil transportation infrastructure is already there.

Large increase in Kurdish oil exports is another reason oil prices have been falling.

http://www.reuters.com/article/us-russia-oil-hungary-idUSKCN0S12TF20151007

Although ISIS is profiting from Iraqi oil, it is also undermining the country’s oil production:

How ISIS Is Undermining Iraq’s Oil Production Potential

December 1, 2015

http://oilpro.com/post/20528/isis-undermining-iraq-oil-production-potential

ISIS’s activities could place at least 1.5 million barrels per day of potential Iraqi oil output at risk between now and 2020. Three primary factors are at play: (1) physical threats to oil exploration and production operations; (2) sectarian splits within Iraq and (3) outside powers’ unwillingness to fully engage ISIS and root the group out of its strongholds in Iraq and Syria.

Oil Market Implications

Iraq’s Oil Ministry seeks to have the country pumping 6 million barrels per day (“bpd”) by 2020, but analysts at Barclays believe the country’s output will fall 1.5 million bpd short of that official target. The recent deterioration in Iraq’s security environment—both domestically and in adjacent areas of Syria and Turkey—suggests Barclays’ forecast is on the right track and might even be a bit optimistic.

I have said the exact same thing on this blog several times before. But let me expand on this issue some more. The oil production capacity of at least these five countries is artificially suppressed by the still dominant NATO-GCC alliance: a) Russia, b) Iran, c) Iraq, d) Kazakhstan and e) Venezuela.

To be clear, I am not moralizing here, but I am merely saying that the NATO-GCC alliance sees fit to exclude those countries from fully participating in the global market-place on equal terms. It’s good old Real-politik.

The suppressed oil production from these regions, has allowed western oil majors, as well as much more numerous but smaller US shale drillers to increase their own production of quite marginal oil & gas deposits in the US shale patch, the Canadian tar sands, in several deep-offshore sites around the globe etc…

This is at least 50% why the above countries are allied with each other and against the NATO-GCC Empire.

Why is Syria a hotspot?

Peel back the onion:

http://www.alternet.org/world/why-yria-crucial-energy-future-mideast

Happy Daze

Yeah, I was off on the Permian, but I expect it to drop more in 2016 than what EIA anticipates. What has delayed everything some is the hedges oil companies used in 2015. That is pretty much gone in November. Another factor was that the companies had to keep drilling in some areas to hold valuable lease area. Most of that is covered now, with 180 days in between completions, creating more of a drop.

You are spot on that it will take years to ramp back up. Investment money and loans will be pretty scared for awhile, and that will create more of a time lag. What it depicts to me is that EIA and IEA are, once again, pretty off on future projections.

Guy Minton said:

They’re completing some real barn burners in the Permian Basin.

This is a production curve for a well Henry Resources just completed in the section north of a property of mine. In the third month of production, the well produced almost 1200 BOPD and 1 MMCFGPD.

Our lease is with EOG, fortunately for us. In southwest Atascosa. First well looks like it will get about 160k the first year, which would be great if prices were higher. Marginal at 40. They won’t go crazy drilling at that price, but keep it at the 180 day continuous drilling clause. That’s perfect with me. Wait until better prices for the majority.

What is the cost of drilling these in the Permian?

This from Pioneer’s December investment presentation.

Guy,

I took a quick look at EOG’s Eagle Ford shale production in Atascosa county, and yep, it looks pretty dismal.

EOG operates a total of 151 leases in Atascosa county.

Average daily lease production for September, 2015: 148 BOPD and 110 MCFGPD

First production was in December, 2010. Through September 2015, EOG’s 151 leases have produced a cumulative of 18,538,757 BO and 12,176,939 MCFG.

That’s only an average of 122,773 BO and 80,641 MCFG per lease.

During the first nine months of 2015, out of EOG’s 151 leases, only 7 produced more than 100,000 BO.

EOG Resources’ leases in Atascosa County that produced more than 100,000 during first nine months of 2015

It looks like of the seven leases, the only two that are anything to write home about are the Fallow Unit and the Whitetail.

In both cases it looks like EOG completed one well on each lease in April 2012.

Then EOG went back in and completed three new wells on each lease in February 2015.

These new wells look to be very prolific wells.

The second round of wells completed in February 2015 are starting out much better wells than the first well completed in April 2012.

Same story here.

..

This is the production curve for a unitized property a couple of miles to the south. Concho Resources completed two new horizontal wells on the property in the past year.

Separating the production of the two new horizontal wells from the rest of the unit production is guesswork. But if we estimate a base-line from pre-existing production of 65,000 BO and 150 MMCFG per month, then it looks like the two new horizontal wells have produced about 330,000 BO and 0.8 BCFG in their first 8 months of production.

That’s nothing to sneeze at, but it still probably doesn’t cut it at $37/barrel oil and $2/mcf gas.

Oil Production Vital Statistics November 2015

Ron, this post already plastered all over the internet. “World total liquids production up 240,000 bpd to 97.09 Mbpd, a new record high.”

I note Permian still rising.

There is a bearish flag pattern that has yet to resolve that implies a WTI target in the mid-$20s.

But $37 is critical support with a stop at $29.

Euan, the EIA’s Short Term Energy Outlook, and Art Berman, seems to disagree with what I assume is IEA data.

Ron, correct, I am reporting IEA data. I stopped following the EIA since they fell so far behind. But my last month for IEA is October and so I’m surprised to see EIA bang up to date with November data. The pattern of IEA data revisions also complicates matters.

The bottom line is that after a year of oil price crash, total liquids production is still up there at 96 / 97 Mbpd.

From Art’s chart I note there is a 5 month lag from supply surplus to price collapse. Can we expect same when the supply / demand lines cross? We have God knows how much oil in storage and the prospect of Iran coming back with full exports. I find it hard to see short term hope. And when the market does rebalance, which it will do, I’m unsure how the price will react. I’m unsure if the rules of the past will apply. This comes down to understanding elasticity. 1000 idle rigs…..

Hi Euan,

I would think it would be 5 to 10 months after consumption rises above supply that we will see oil prices start to move. To make things simple if we assume consumption is 1 Mb/d higher than supply and storage levels are 300 Mb above normal. it would take 10 months foe supply to fall back to normal levels. I think when storage levels fall to 150 Mb above “normal” levels we might see prices start to rise, but somewhere between 5 to 10 months after consumption rises to 1 Mb/d above supply seems reasonable.

As to when either supply falls (or consumption rises) so that storage levels decrease, I would think first or second quarter of 2016 with oil prices starting to rise in the 3rd or 4th quarter of 2016. My guesses are usually not very good on oil prices.

Dennis, the IEA sees supply ahead of demand for whole of 2016, without Iran. So I dare say / fear that we don’t see a proper rally in price until 2017.

Thanks Euan,

My guess is that the IEA will be a little on the optimistic side with their supply forecast, they usually are. Does their supply forecast seem reasonable to you? I haven’t looked at it closely.

If the world slides into a recession so that demand growth is very slow, then 2017 is a good bet, I may be more optimistic on economic growth of 3% continuing in line with the IMF forecast.

DPR is right lool

Bakken September 2015 : 1,06 mbj

DPR December 2015 : 1,125 mbj

Etc…

Isn’t there a seasonal effect that has to be deducted?

Don’t know how this got here. Refers to the post itself about Dec – January declines expected.

ND, TX, and LA economic indicators:

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2R6J

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2Ln6

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2R7N

Employment:

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2R7T

What is in steep decline is the price of oil company stocks and some are shark fin shaped.

WLL, Whiting Petroleum, is at 12.44 today and losing 13.18 per share.

No more wondering what is happening.

I sold an oil sector stock yesterday and am very glad I did.

All of the worry is gone. The hand wringing is over, what a relief.

It is going to be a record high temperature today and is going to be another one tomorrow. The temp will be 50° F. The record low is – 29 ° F.

Maybe Whiting Petroleum picked the wrong shale play to bet on?

Compare WLL to this.

Or this.

Sure, there are always a couple of winners in the crowd no matter what the business. A couple of flukes.

Across the board, the equities in the oil sector have suffered price drops, losses due to the low price of oil. It is a sea of red. Time for more beer.

Whiting has two trusts, WHZ, which gained a few pennies yesterday, had a high of 8.47 usd, currently at $0.965. The other is WHXT, which is worth 6 cents per share. Net profit interest, a royalty, more or less.

Off topic but I am interested in being able to look up record highs and lows by date and zip code if there is a relatively simple and free way to do so.

Any pointers will be greatly appreciated and thanks in advance.

http://weather.org/weatherorg_records_and_averages.htm

AccuWeather. They don’t call it AccuWeather for nothing. A lot of work has been done to call it AccuWeather.

Type in the zip code at the search, the daily weather stats for the city will be on a the web page, click on the current conditions, there will be a daily almanac for that date. It will have the historical data on the page, the highs and lows for the day.

AccuWeather for Chicago, Illinois:

http://www.accuweather.com/en/us/chicago-il/60608/weather-forecast/348308

Chevron CEO: Oil prices will be higher in a year

http://www.cnbc.com/2015/12/08/chevron-ceo-oil-prices-will-be-higher-in-a-year.html

CE, it’s hilarious over at Gail’s site. Most there really think the price of oil will ‘never’ go higher again, but can only permanently go lower from here due to end game dynamics which have nothing to do with supply & demand – lol.

I put my prediction on that site of $70-80 a barrel in the latter half of 2016. It was ignored but at least they got a different viewpoint.

I don’t share Gail’s view of permanently depressed prices, but I don’t think you should laugh about it. I bet you would have laugh at anybody saying in 2013 that prices were going to do what they have done. Truth is nobody can predict future oil price. Not even producers.

Javier,

Gail and those douches at the automatic earth. Every year, every month, every day, predicting lower oil prices, deflation and collapse, does not make them remotely right when things go their way for a short time. They have been predicting this since 2006 at least. I actually remember having a conversation where I said stocks should be bought in 2008 and Raul said I was an idiot.

We will be at $90 in 18 months. And then Raul Illargi Miejer and Gail will have a great explanation why the end of the world is delayed for yet another 15 years.

I don’t believe that for a moment. But I am sure that in 18 months you will have a great explanation why $90 is delayed for yet another 12 months.

I tell u what….you choose your price, I will choose mine. We see where it lands.

And we can ask Gail to explain what the 40 Million additional cars each year on the roads will run on.

http://ourfiniteworld.com/2015/11/23/why-supply-and-demand-doesnt-work-for-oil/

Only the Chinese cars matter. US car sales likely roll an old one off the back end of the inventory onto the scrap heap. So US car sales, huge though they are, aren’t all new consumption.

No reason the price can’t stay low even with increased consumption. See the predatory pricing wiki.

Oh and btw, you don’t get to pick the time frame that defines what or who is right. The time frame for right is always now.

That is 40 million NEW NET cars.

Total global sales are expected to be 100 Million. 60-65 Million being scrap replacement.

So Global fleet expands by 4% a year from a base of 1 Billion. It is like depletion. Only in reverse :).

And if you saying someone can be wrong all the time and eventually, once, unlike even a stopped watch being right twice a day, by luck have a couple of things right, and you “buy” it. Well then you deserve what you get when you listen to such people. Good Luck!

If those 100M new cars were 40% more efficient than the 60M (20yo) cars they replace, then there would be no net increase in fuel consumption per mile driven.

Not that new cars are that efficient. If people only bought the smallest, least powerful vehicle they actually needed to get from A to B, they would be, and probably even more so.

See the predatory pricing wiki.

Yeah, it was a little unclear. So, I edited it to clarify that this is a very short-term strategy. Prices below the equilibrium point cannot be sustained indefinitely.

Hi Huckleberry Finn, NickG, Stiglar Wilcox, and Chief Engineer,

When Huck says:

We will be at $90 in 18 months.

Would you interpret that as $90/barrel exactly some time during June 2017?

I tend to think Huck meant the oil price will be $90 or higher sometime between now and 18 months from now.

As in the oil price will be at least $90/b within 18 months.

That makes sense.

Hi Dennis,

I understood it to mean that it would make the $85 to $95 range in the May to July time period. I wouldn’t hold his feet to the fire to be any more precise and call him correct within this range.

Stiglar was up a little late last night with Fast Eddy over at Tverberg’s cheating on Ron. He might be a little slow to respond.

You still don’t understand. Doesn’t matter what price you pick. You can only be right by luck, not by foresight. If we do this with enough monkeys one of them will be right and will claim superior abilities.

I work by scenarios and probabilities like many here. Right now we are at the edge of global recession, and if it comes to take place prices are likely to be depressed for a couple of years. If we don’t enter a recession, deflationary forces are going to continue being a strong head wind for oil prices meaning that even if prices recover, near 100 $/b are going to be difficult to achieve unless we get an oil crunch due to important production destruction or major war.

Whatever price you choose it is subject to so many unknown variables as to give a chance similar to picking a number at the roulette. My safest bet is to bet against you.

Go ahead then I pick $85-$95 in June 2017.

I pick inflation accelerating at this point when everyone is looking for deflation.

I pick Gail and Douchus Maximus at TAE saying saying that they are just really early (will be 9 years and counting at that point) not wrong.

Good luck with that then. You are more likely to be wrong than right, but if by chance you happen to be right you are going to feel good and smart. If you want to put your money where your mouth is you have oil futures.

Hi Stilgar,

Thanks for the heads up and thinking of me. An hour ago, Fast Eddy has the Europeans helicoptering money to head off a collapse by Christmas.

I see a 2016 peak in late June or July in the $60 to $70 range. By the Summer of 2017, $90 range is perfectly possible.

Now, I’m hoping oil bottoms around mid January, so that I can fund my 2016 Roth with some real bargains.

Javier – ” Truth is nobody can predict future oil price. ”

Anybody can predict the future. Now getting it right is a little more difficult. Let’s see what story Gail comes up with when the price recovers.

“Fast Eddy has the Europeans helicoptering money to head off a collapse by Christmas.”

Yeah CE, FE holds court over there and the minions line up behind on the idea of near term collapse. I don’t know how he keeps up that kind of tension level.

“I see a 2016 peak in late June or July in the $60 to $70 range. By the Summer of 2017, $90 range is perfectly possible.”

That’s a good prediction too.

See Javier, another prediction.

It is really strange that people can keep that level of tension up over years. I think people wise up, leave and are replaced by new fools.

I find it fitting that the two worst predictors in the blogosphere, Ilargi and Stoneleigh, have to ask for handouts to keep their site running. Makes total sense you would take predictions from idiots who cannot make a few dollars a month to run a website.

Some people pay themselves a salary to run a non profit.

Running a non profit can be QUITE profitable.

Oil price predictions are very common. Every guru and adviser has one. There is even a market consensus. Nobody does a track record, but if they did they would discover is pretty abysmal. Consensus is almost always wrong because for markets to work as intended only a minority has to get them right.

Hi Javier,

Interesting, you say nobody knows what oil prices will be. Then you imply that you know oil prices will not be higher than $89/b, 18 months from now. Which is it?

I get it, only you know what the oil price will be 🙂

You should go to Gail and TAE for some amazing low price porn.

Dennis,

You are back to your old tactic of saying what other people imply when they write, as if you could possibly know that.

Huckleberry Finn said “We will be at $90 in 18 months.” Not over $90. The difference between these two prepositions in English should be clear to you as it is your language.

And I said “I don’t believe that for a moment.”

And now come your strawman interpretation: “you imply that you know oil prices will not be higher than $89/b, 18 months from now.”

What I posted a few days ago was: “High volatility scenario with big price swings as mismatches in production and demand take place due to alternate production destruction and demand destruction cycles in an economy that is contracting in bouts. This is my predicted scenario.”

http://peakoilbarrel.com/oil-forecast-from-a-reputable-firm/comment-page-1/#comment-549332

It is clear that you are looking for excuses in every post that I write to attack my credibility using fallacies.

Your intention is clear because a few days back you said: “Of course, I rarely get oil prices right”

http://peakoilbarrel.com/the-case-for-peak-oil/comment-page-1/#comment-547563

So by your own admission you don’t place much faith on your own price predictions, yet you rush to take a swing at me by building a strawman argument over a prediction I did not make.

This little thing that you have against me is getting out of control. If you don’t want to get professional help, perhaps you could take it easy. Every time I write you can take a big breath and count to ten. It will be good for your own credibility.

Hi Javier,

The oil price now is $40, he said it will be at $90 in 18 months. It is pretty clear that his meaning was $90 or higher for the oil price. Perhaps you thought he meant exactly $90.00 for the oil price exactly 18 months from now, at noon. I did not interpret it that way.

Based on my sensible interpretation, when you said he would be wrong, I interpreted that as an expectation that you believed the oil price would be below $89/b?

Was that incorrect? Your argument was that the oil price would not be exactly $90/b exactly 18 months from now?

As you said to me before, you noticed the 🙂 in the previous comment, yes? Relax.

Absolutely. He said prices were going to be at $90. That means along that month prices are going to be at $90 at some point.

Obviously he has no idea what the price is going to be in the future like everybody else. Otherwise he wouldn’t be here posting. He would have his own island and would be bragging to other billionaires.

If in a casino roulette you are betting on a number for the next spin, I’ll be the house and bet against you. If you bet that it will be a red number in one of the nest three spins, I’m not taking that bet.

I have no idea what oil price is going to be in any time of the future. I assign a bigger probability to a 2-3 years of depressed prices due to economic weakness or downright recession, followed by high price volatility as demand destruction and supply destruction take turns to lead.

A shorter economic downturn followed by an earlier price recovery is also possible, but in my opinion less probable.

So do you think I am the only one that knows what the oil price will be?

HI Javier

I interpreted Huck differently.

My guess is that you may have misinterpreted.

I will let him comment about if he meant 90 exactly or 90 or higher 18 months from now.

I agree that nobody knows what the oil price will be.

I agree prices will be volatile.

I also think nobody knows when the next recession will begin.

In English if you want to say 90 or higher, you can say

90 or higher

above 89

90 or more

≥90

a minimum of 90

but not at 90.

It is not me who is misinterpreting here.

There’s an old saying, that Javier is channeling: “if you’re so smart, why aren’t you rich?”.

If any of us really believe that we can predict the behavior of oil prices at all, we should be placing bets in the futures market.

That includes a prediction of volatility, because that means prices will rise occasionally quite sharply. If you believe that, then you should go long, and sell at one of those price spikes.

So, if anyone is willing to make a forecast on prices of any sort, then they should also explain why they aren’t investing accordingly…

I also happen to think that oil markets are not going to survive in their present form for very long. Once it becomes clear that we are past Peak Oil and that oil exports are going to plummet at double the rate of production, the oil market will change radically or disappear substituted by bilateral arrangements. Markets do not function on restricted goods.

That’s when markets are most valuable.

When the price of oil hit $147, there was no sign of markets failing. Exporters who restrict their sales will mostly hurt themselves: they’ll hurt their exports, and make themselves obsolete all that much faster.

I wouldn’t want to live in Saudi Arabia 50 years from now. I suspect all of the princes will be in the south of France.

Javier wrote:

“I don’t believe that for a moment. But I am sure that in 18 months you will have a great explanation why $90 is delayed for yet another 12 months.”

I concur. With the exception of a crisis in the ME (ie hot war that disrupts Oil exports), its very unlikely Oil prices will rebound. the Emerging market Credit bubble has popped and its not going to reflate anytime soon.

“And we can ask Gail to explain what the 40 Million additional cars each year on the roads will run on.’

Most of those new cars will end up rotting away, as the owner defaults on the payments or has no job to commute to. the US will likely see about a million job losses next year as the Shale bubble pops. Not only will a lot of high paying Oil workers be out of a job, but manufacturing (piping, drilling equipment), and all those that sold goods and services (ie food, cars, homes). We probably will see another round of bank failures as the shale drillers go busts and default.

As far as China, its part of the Emerging Market economy. All commodity prices have dove off a cliff which means growth in China has ended and is in retraction (no matter what the Chinese gov’t says). Tens of millions of Chinese are going to be out of work and aren’t going to be driving as much. Also China is switching to robotic manufacturing which has already eliminated hundred of thousand of jobs this year. This trend is going to continue for many years to come.

My guess is that when Oil prices do recover they will peak between $70-$80 as consumers worldwide, simply can’t afford any higher prices. With this price cap, its going to exclude a lot of undeveloped oil fields (ie no more share, deep water, etc) and we will have a much steeper production decline than most people anticipate.

Hi Tech guy,

If all of your assumptions are correct, that is a good guess.

What do you think has changed since 2011 to 2013 when oil prices were mostly around $100/b for 3 years. People could afford oil at those prices then. If $70 to $80/b is a high enough price to bring on adequate supply, then prices will rise no further. I doubt that will be the case, I think a lack of supply will drive prices higher, unless the World is in a recession, that is possible, but difficult to predict in my view.

DC wrote:

“What do you think has changed since 2011 to 2013 when oil prices were mostly around $100/b for 3 years. ”

The EM (Emerging Market) was is a credit bubble. Credit was cheap for China, India, Brazil, etc. All them went on a massive borrowing binge which drove all commodity prices up. Now that they can’t borrow more, its all collapsing. I don’t believe they will be able to re-inflate the EM credit bubble anytime soon.

DC Wrote:

“I think a lack of supply will drive prices higher”

Yes, it eventually will, but I believe it will cap around $70 to $80. Any higher will result in demand destruction without the availability of cheap and very abundant credit.

DC Wrote:

“unless the World is in a recession, that is possible, but difficult to predict in my view.”

World is almost completely in recession now. Look at the demand for commodities world wide. Since when as the entire basket of commodity prices collapsed and the world not be in recession?

I think almost all of the world is in recession except for a few small regions and the USA. However the USA is falling into a recession and will be by the spring. I look at the USA Trucking, Manufacturing, indexes and they been falling steady almost the entire year and appear to be accelerating in the second half of 2015. There was a bit push by retailers hoping for strong holiday shopping, but does not appear to have materialize.

Hi Techguy,

I will go with the IMF, growth can slow down, without a recession, only when the World economy contracts will we be in a recession, this happened most recently in 2009 and before that in the 1930s.

I think your prediction of impending World recession is not very likely (less than 1/3 chance). Time will tell.

“We will be at $90 in 18 months. And then Raul Illargi Miejer and Gail will have a great explanation why the end of the world is delayed for yet another 15 years.”

Interesting that someone can say with a straight face that oil price nearly tripling in just over a year will make everything right in the world.

Make everything right?

What does that have to do anything with making things right?

I am referring to a specific, chronically incorrect prediction of impending massive deflation, massive unemployment and S & P 500 at 100 and the rest of the good stuff.f which comes from those two intellects. Go the oildrum archives and see how long those nut bags have been getting it wrong. They had one moment in the sun for 6 months in 2009. They would argue they have it again, but their price predictions and all other items of unemployment and deflation have been chronically wrong.

“…end of the world is delayed for yet another 15 years.”

That definitely implies making everything alright.

“I don’t share Gail’s view of permanently depressed prices, but I don’t think you should laugh about it.”

You have a comprehension problem, Javier. I didn’t write Gail, I wrote “most there…” (as in posters on that site). And yes it is hilarious that they somehow think supply and demand no longer determines price. Supply & demand will always determine price; Econ. 101.

You also wrote: “Truth is nobody can predict future oil price.” Actually anyone can predict anything they want, but that doesn’t mean it will come true. I am predicting a rise in price in the range of 70-80 dollars a barrel in the 2nd half of 2016. There I just made a prediction about oil price.

The point was oil price is currently low due to an oversupply, a temporary glut. Once the oversupply dwindles, oil price will rise again and we will all know supply and demand reigns supreme.

Oh, and I’ll laugh all I want when some idea being suggested is outlandish. Maybe you need a good laugh too. Try it you’ll like it.

“The two lower equilbria, e1 and e2, [see graph at link] are not stable. Any drop in price will result in excess supply that will drive prices down the schedule. An upward increase in price from e1 or e2 will result in excess demand that will continue to increase price in a spiral. In the case of e2, it will propel the market up to the one stable equilibrium: e3. If the price increases, supply will exceed demand and it will quickly fall back to e3. If it decreases, demand will exceed supply, the price will rise and the market will again tend toward e3.

The volatile behaviour displayed by most outcomes in this model is in accordance with much real world experience in the stock market, from the downward spiral of Facebook to the internet stock bubble and other frequent historical experiences.” ~ Unlearning Economics

“…prices do not reflect the fundamentals of supply and demand in any particular industry. If they did so, equities and different commodities would not move in relative synchrony, yet they have often done so.

Instead, prices reflect a combination of general confidence (or lack thereof) and the perception of future scarcity or glut, whether or not that perception is, in fact, accurate.” ~ The Automatic Earth

“At least two assumptions are necessary for the validity of the standard model: first, that supply and demand are independent; second, that supply is “constrained by a fixed resource”. If these conditions do not hold, then the Marshallian model cannot be sustained…

The model of prices being determined by supply and demand assumes perfect competition. But:

‘economists have no adequate model of how individuals and firms adjust prices in a competitive model. If all participants are price-takers by definition, then the actor who adjusts prices to eliminate excess demand is not specified’.

Goodwin, Nelson, Ackerman, and Weisskopf write:

‘If we mistakenly confuse precision with accuracy, then we might be misled into thinking that an explanation expressed in precise mathematical or graphical terms is somehow more rigorous or useful than one that takes into account particulars of history, institutions or business strategy. This is not the case. Therefore, it is important not to put too much confidence in the apparent precision of supply and demand graphs. Supply and demand analysis is a useful precisely formulated conceptual tool that clever people have devised to help us gain an abstract understanding of a complex world. It does not—nor should it be expected to—give us in addition an accurate and complete description of any particular real world market.” ~ Wikipedia

See also, Why ‘Supply & Demand’ Doesn’t Work For Oil by Gail Tverberg

I am sorry. I really like Gail but this is just a little absurd.

The model of prices being determined by supply and demand assumes perfect competition. But:

No it does not. Nothing is perfect. There will always be goods that are overpriced and some people will buy them. Likewise there will always be bargains to be found for some lucky folks. But such examples of overpriced and under priced is not the general rule and does not affect the big picture. Where there are millions of buyers and sellers the general price of any product or service will reflect the demand for that product or service.

‘economists have no adequate model of how individuals and firms adjust prices in a competitive model.

Firms do not adjust prices willy nilly, they always try to get the very best price their product will demand. And if the demand for their product is too low, they will either adjust their price down or stop the manufacture of that product. And they use the same principle when buying. They look for the very lowest price they can find for the quantity and quality they want.

It just defies all common sense to say that supply and demand does not dictate price.

Firms do not adjust prices willy nilly, they always try to get the very best price their product will demand. And if the demand for their product is too low, they will either adjust their price down or stop the manufacture of that product. And they use the same principle when buying. They look for the very lowest price they can find for the quantity and quality they want.

It just defies all common sense to say that supply and demand does not dictate price.

You got the word “always” in there.

But I’m pretty sure you didn’t mean it. I’m sure you agree there have been occasions (and dare I say plural) when price was determined by a buyer paying more than they could, or a seller selling for less than he might fetch.

And once you acknowledge that’s true, and I think you would, you’re essentially lost.

Then you are in a situation where you have to add up all transactions that have ever taken place and prove this seeking of the best deal possible is the majority. Odds seem much higher that the majority of transactions that have ever taken place were fathers selling to offspring for lower than “market” price, were governments imposing excise taxes or tarrifs, were predatory pricing, were purchases of military equipment from one’s own manufacturers for higher price than the same function could be purchased outside the borders.

You should, objectively, be seeing that this is correct. THIS is the majority of transactions in history.

Hi Watcher,

And your proof? The rule is pretty simple, in markets that are not controlled by a single seller or a single buyer when the supply of a good is higher prices will tend to be lower or vice versa, likewise when there is a decrease in the demand for a good its price will tend to fall.

In order for markets to be perfectly optimal there needs to be all kinds of unrealistic assumptions made so that one can prove this mathematically.

Real markets are not perfect, but generally when there is an oversupply, relative to demand at some price P then the price will fall to P’ so that P’P. The demand curve can also shift right or left with similar effects an increase in demand (shift to the right) causing higher prices or a shift left causing lower prices (assuming no shift in the supply curve).

Thanks for the elaboration, Watcher.

Ron, unless Gail has a hand elsewhere, none of the quotes are her’s– just the link.

“Artificial scarcity describes the scarcity of items even though either the technology and production, or sharing capacity exists to create an abundance, as well as the use of private property laws to create scarcity where otherwise there would not be. The most common causes are monopoly pricing structures, such as those enabled by private property rights or by high fixed costs in a particular marketplace [oil?]. The inefficiency associated with artificial scarcity is formally known as a deadweight loss.” ~ Wikipedia

“Artificial demand constitutes demand for something that, in the absence of exposure to the vehicle of creating demand, would not exist. It has controversial applications in microeconomics (pump and dump strategy) and advertising.

A demand is usually seen as artificial when it increases consumer utility very inefficiently; for example, a physician prescribing unnecessary surgeries would create artificial demand. Government spending with the primary purpose of providing jobs (rather than deliverying any other end product) has been labelled ‘artificial demand’. Similarly Noam Chomsky has suggested that unchecked militarism is a type of government-created artificial demand, a ‘system of state planning […] oriented toward military production, in effect, the production of high technology waste.’, with military Keynesianism or a powerful military industrial complex amounts to the ‘creation of state-guaranteed markets for high technology waste (armaments).’

Vehicles of creating artificial demand can include mass media advertising…

Another example of artificial demand can be seen in penny stock spam. After purchasing a large number of shares of an extremely low-value stock, the spammer attempts to create artificial demand by implementing a spam-based guerrilla marketing strategy.” ~ Wikipedia

“‘economists have no adequate model of how individuals and firms adjust prices in a competitive model. If all participants are price-takers by definition, then the actor who adjusts prices to eliminate excess demand is not specified’.”

Whoever wrote this malarkey doesn’t even know enough to be dangerous,except to himself and anybody who reads him.

This is an excellent example of the danger of sound bite thinking. UNDERSTANDING usually requires at least a little thought.

“The actor who adjusts prices to eliminate excess demand” in a competitive ” price taking” market is the actor who increases his production in order to take advantage of the high prices associated with “excess” demand.

My folks back in the post WWII era found themselves in the happy position of making a KILLING on their apple production,due to few trees being planted by large growers in the Depression years and hardly any by any body at all during the war years. My folks being workaholics with nothing better to do kept on planting right thru the Depression, as did many other small timers.

The natural consequence of this post war amazing prosperity, with barely literate previously poor farmers (with one decent pair of bibs reserved for church), making doctor and doctor money or BETTER, was of course that EVERYBODY planted more and MORE trees.

The price crashed due to “excess” production.

It took a while for this process to play out of course. One thing the orchard biz and the oil biz have in common is that both necessarily move VERY slowly in terms of adjusting production in response to changing prices.

My parents and grand parents generation did not set out to DELIBERATELY lower the price of apples, but that hoary old INVISIBLE HAND so often mocked by people too worldly and too sophisticated to take supply and demand theory seriously lowered the price FOR THEM. Like it or lump it.

sarcasm light BLAZING.

Rolling on the floor laughing at people who think price, supply and consumption are not related.

Individuals and and industries buy the things that are essential to short term survival no matter the price . You buy groceries even if you quit making the house payment. You feel starvation after twelve hours but eviction takes weeks to months.

We can definitely adapt to using less oil.

But WILL we adapt faster than LEGACY oil production depletes ? This is the sixty four dollar question, because new production sufficient to replace legacy production will not materialize at current prices.

Price wars always come to an end when somebody runs out of cash and credit and has to say uncle.

Legacy production that is yielding cash will still come to market even if it is losing money over all, but new production will not, once the industry has time to adjust.

I personally do not think the world wide economy IS going downhill faster than legacy oil production, or that it WILL go downhill faster than legacy oil production anytime SOON. I don’t think we WILL adapt to more expensive oil FASTER than legacy production declines, although it is probably technically possible that we COULD do so.

Somebody will pay for the production of every last new barrel that IS produced. It will not be produced at a loss, except by miscalculation on the part of oil company management.

IS the economy going downhill faster than legacy oil production?

I just don’t see it.

Oil will go up, because the world must have it and CAN afford to pay more for it, and the ONLY way it will be produced is at a profit.

Arguing about subsidies keeping prices down is a bullshit waste of time. A subsidy is a welfare benefit, no more and no less. It can be paid directly to a producer, or paid by the end user with welfare money. Same thing.

If the profit comes in the form of a forty dollar subsidy on top of a forty dollar ” price” , the REAL price is still eighty bucks.

The industry, except for tight oil, moves like molasses in January, and it will take a while to scale back and sell out the large stock on hand, but the industry IS scaling back. I guess it will take a year or two , but oil is going up again, barring the world wide economy crashing HARD within that same year or two.

I wonder. Iraq, Iran and Russa all seem to be pretty willing to develop new production at current prices. The US, and most of non-opec, not so much. But the picture overall is pretty murky.

Hi Nick,

I forgot to mention that there is still some low hanging fruit in a couple of places, specifically Iran and Iraq. I have not heard much about Russia bringing new production on line short term.

If the marginal new barrel costs eighty to a hundred, the the REAL price is going to eighty to a hundred also. Some of that price may be paid in the form of a subsidy, either to producers or consumers, but the real price will still be the real price.

If peace truly does break out, I suppose Iran and Iraq together can produce enough to offset most or all of the legacy decline for a few years.

My opinions concerning oil markets are based mostly on what I read on sites such as this one. I never do any actual research. If the legacy decline estimates are too high, the current supply glut might last a long time yet.

CEO’s = talking their (burning) book.

Where is the money? Show me the money!

My brother used to say, “real estate prices can only go up because God isn’t making any more land.” I said, “God isn’t making any more people with money, either!” Money is credit: without good credit there is no bid for real estate … also, no bid for oil.

An increase in petroleum output relative to shrinking market => perception of a ‘glut’. => low oil prices.

An absolute petroleum shortage => a rebound against the customers’ ability to borrow => even lower oil prices.

The price action has little to do with in oil fields but rather w/ the loans to customers. That’s why output volumes are disconnected from price. Drillers can obtain loans, customers cannot = the drillers are stranded.

Okay, let’s bring on the inflation arguments!

Throw them away, they don’t work! Whether the nominal price is $20/barrel or $20,000,000/barrel, the buying power of the hapless customer is the the same or diminished. Meanwhile, changing the customers’ number changes the driller’s number at the same time. He must use the same $20,000,000 — and more — to extract his barrel of crude.

More problems include globalization that uses same dollar everywhere, also worldwide monetary stimulus and ‘QE’ … that shifts buying power from customers to drillers leaving them (drillers) with nobody to retire their debts.

Our problem isn’t frackers or Saudi sheikhs, it’s on the consumption side … at the end of your driveway. Using petroleum does not produce any value for the user, it provides ‘utility’ … a bit of time-wasting entertainment and phony-baloney convenience. Using fuel for the greatest part does not offer the user any ability to retire the funds he has borrowed to buy the fuel. Without ability to repay organically, he must borrow or someone — his boss’s customers or the government — must borrow in his name. Because his actual earning power is nil he turns out to be a credit risk and he can’t borrow. He is insolvent … so is the entire fossil fuel industry … so is its lenders and the speculators (markets) who have bet on prices!

There are two ways to do anything: easy and hard. Easy way is to acknowledge our absence of return, recognize this is structural, it runs with industrialization. Next is to get rid of the JUNK; the industrial firms (that are all underwater from a macro standpoint), reform agriculture, jettison the hubristic empire-building and the political messes that go along with it … and learn how to live within a finite (shrinking) energy- and resource budget.

The hard way is to allow circumstances to do the exact same thing w/ max pain: ‘Conservation by Other Means™’ … something that is already taking place in Syria, Greece and Somalia, in Venezuela, Spain, Ukraine, Russia and Portugal, in Haiti, Saudi Arabia, Yemen, and pile of other countries.

Coming to your town. Are you ready or are you still in denial?

Hi Steve from Virginia,

I always read your posts with great interest and often learn something.

When it comes to the world wide economy going to hell in a hand basket, I am a believer. We are in overshoot, we are long on people, short on resources, our money systems are all clusterfucks etc.

BUT I think maybe Old Man Business As Usual will stumble along, staggering sometimes , but still remaining on his feet for a while yet, maybe as much as a decade or two, barring bad luck. With really good luck, he might last even longer.

I take it you think things are going downhill VERY fast already.

How long do you think for instance it will be before automobile sales crash again on a world wide basis? How long until the domestic house market crashes again?

I understand any reply will only be your personal guess.

Agree. Peak Oil, Peak Debt, and Peak Warmth, all at the same time. Lots of fun later.

Hi all,

The drilling productivity report does not do a good job predicting future legacy decline. The only play where they get this right is the Haynesville. Notice that after natural gas peaks the legacy decline rises. For the Bakken, and Eagle Ford they predict a continued fall (increase in absolute value) in legacy decline even though they show output as having peaked. The declines that they are estimating, especially for the Eagle Ford, will be too high. Chart for Haynesville natural gas and legacy decline below.

Devon Energy (DVN) Inks Deals to Survive the Crude Slump

3:50 pm ET December 8, 2015 (Zacks) Print

Independent energy producer Devon Energy Corporation DVN inked three independent deals, all designed to sharpen the company’s focus in the potential emerging oil plays, amid the global glut in crude prices.

Confirming market rumors, Devon Energy has acquired 80,000 net acres in the Anadarko Basin STACK play from Felix Energy LLC, a smaller operator in the oil and gas space, for nearly $1.9 billion (read:Will Devon Energy Acquire Felix Energy to Add More Oil?).

Devon Energy has also announced the acquisition of 253,000 net acres in Powder River Basin, south of its existing assets in Wyoming, having a production capacity of 7,000 barrels of oil equivalent per day (‘BOED”),,of which oil accounts for 85%. Devon is shelling out $600 million to close this deal.

In a separate transaction, Devon Energy’s joint partnership unit, EnLink Midstream, has entered into an agreement to acquire its peer Tall Oak Midstream for $1.55 billion. Tall Oak has midstream gathering and processing assets in the core areas of the STACK oil play, the STACK natural gas system and STACK crude oil system, which are expected to commence operations in 2016.

Devon’s twin acquisitions in the STACK play will catapult the company to an industry-leading position in that play. Upon closing the Felix Energy deal in early 2016, Devon Energy’s production from the region will increase to approximately 80,000 BOE/d .

News sources and time stamps can be misleading. This entire story was in my morning edition of the Daily Oklahoman (OKC), which I picked up in my driveway at 6:30 am this morning. So, the info was out yesterday.

Dennis,

As production from new wells declines, legacy decline will become smaller over time. Yet it will take months. It is simply undeniable that total legacy decline for shale production stands at 350 kb/d and month (or 4 mill b/d annualized). This is somehow compensated by production from new wells, yet shale companies have to re-drill 80% (4mill b/d out of 4.8 mill b/d) of current production every year. Compare this to just 6% of total conventional world production (6mill b/d out of close to 100 mill b/d). This shows the monster task of shale companies to compete with worldwide conventional production. This makes it clear that most investors in the shale patch will never see their money again, if oil prices do not recover to astronomical heights. In my view shale companies have to cut voluntarily production as fast as possible as this is the best way to bring up the oil and gas price and will ensure survival.

Your last sentence assumes they aim to make a profit, which many don’t. The reason they haven’t cut production over the year is debt related. Yes, they need cashflow for interest and repayment. But more importantly, they need to show PDP for their creditors, as many companies heavily rely on debt.

Hi Heinrich,

Your estimate for legacy decline is based on the DPR, the DPR is wrong. At minimum it is inconsistent when you compare the Eagle Ford oil with the Haynesville. You do see that the size (absolute value) of the legacy decline got smaller for the Haynesville when output of natural gas peaked in 2011/2012. Legacy decline in Jan 2016 will be about 94 kb for the Eagle Ford and for a model matching the EIA’s DPR (which is likely too conservative), the Eagle Ford will decline another 300 kb/d by Dec 2016 to about 900 kb/d (if oil prices remain low). The Bakken will decline by maybe 200 kb/d at most from Jan to Dec 2016, decreases in other shale plays may equal the increases in the Permian, possibly the net will be down 100 kb/d for Permian and other plays.

The total US LTO decrease from peak in March 2015 to Dec 2016 will be about 1200 kb/d.

This might be enough to balance the oil market if there are not increases elsewhere to offset declines in the US and Canada. Time will tell.

Kinder Morgan (biggest pipeline people) just cut their dividend 70%.

https://en.wikipedia.org/wiki/Predatory_pricing

New drilling statistics for Texas rrc shows new completed wells for November down to 667. It was at 1472 last nov, and that was a slow month.

Attached is a chart of C+C production for the lower 48 states up to September taken from the Petroleum Supply Monthly. The chart excludes all offshore production and Alaska and so reflects the lower on shore 48 production. Does the almost straight line drop from March to September of 375 kb/d reflect reality or is this an EIA best estimate?

Checking the March to September production drop from the drilling productivity report shows that it is only 202,252 kb/d. So which one is closer to the truth.

The Drilling Productivity Report reflects shale production only. So both could very well be close to the truth. And I believe they are. In this case anyway. There is a lot more to the lower 48 than just shale you know.

If they are both right, that implies that the on land Conventional/Other oil fields declined by about 173 kb/d over 6 mths or 346 kb/d/yr. With total Shale output at the peak of 5.5 Mb/d, that leaves close to 2.1 Mb/d of on land conventional/other oil. That would put the decline rate of the on land conventional/other fields at 16.5%. Seems a bit high to me for conventional fields.

I still think that one or both of them are best guesses. I do not understand how come the info cannot be either more consistent or closer. If the info were closer, say orders of 5%, for the conventional field decline rate, I would agree that both of them could be correct.

Ovi, I received a detailed research note recently which discussed US onshore conventional decline from 1/1/15 to 6/30/15. The data used was sales data which all of the crude oil purchasers sell to IHS Energy. It is extremely accurate IMO.

1/15 US conventional onshore lower 48 was 2.665 million bopd. 6/15 US conventional onshore lower 48 was 2.447 million bopd.

I suspect there were many conventional well drilled in 2014 in US lower 48 onshore, but a huge drop in those in 2015. So the decline numbers do not surprise me.

Unlike LTO, there are finding costs for US conventional. Drillers of those either pay cash or pay back loans to banks on a five year amortization.

Doing the math:

2.665 …. January 15 production

2.447 …. June 15 production

-0.218 …. 5 month decline

-8.18% … Total 5 month % decline

-1.64% … Monthly decline rate

-19.63% . Annual decline rate

Did I get that right?

Ron your calculations are correct. However, I have my doubts regarding the value of the data.

SS: It is not clear to me that one can equate sales data with production data. Note that US inventory data has been on the rise since the beginning of the year. So companies could be selling just enough of their production to cover their financial needs and putting some into storage. What is the incentive to do that?

Looking at the WTI futures curve, it has been in contango for the past year. The current contango with the front month is $1.37 and the 6 month contango is $5.16. This means that a company that has storage can sell their oil into the futures market at a higher price than it would get today on the prompt market. It is for this reason that one needs to question whether sales data can be equated to production data.

I find it difficult to believe that all of those wells/fileds producing those 2.665 Mb/d in January had an average decline rate of 19.6%/yr. We need another data source to confirm such a high decline rate or an explanation of what is so unique about these fields that make them decline at such a high rate.

Hi Ovi,

There are some wells that get shut in at these low prices because they are no longer profitable to produce. A lot of that conventional onshore oil consists of stripper wells and at these oil prices a lot more of them get abandoned.

Shallow sand can correct me as he knows what is really going on.

That is an interesting thought and a plausible explanation to add to the mix Dennis

I recall reading that SA admitted a few years back that its fields were declining at 8%/yr and that continuous drilling and water pumping reduced that to 2%/yr. That is what makes decline rates in the high teens appear to be a bit excessive, unless there is something unique regarding the US fields/wells

Dennis and Ovi. The number one reason for conventional decline is the lack of work overs in 2015.

We routinely “clean out wells” in the summer and fall. We did four total when the price bumped up in May and June. None since.

One problem in addition to lack of work over of producing wells would be lack of work over in injection wells in water floods. This can affect production greatly also.

In our field there are many more workover rigs than drilling rigs (some admittedly can do both). Those rigs are sitting in the yards. I spoke to a friend today who owns two workover rigs. He has not cleaned out a well with his sand pump since July, is strictly doing rod/tubing jobs. He says some wells are being left down now. He is very worried he will have almost no work this winter.

Another I know tests tubing. Slowest he’s been in years. Says many are just not testing, just finding the hole, replacing the bad joint, and running it back in the well.

This year is the first we have ever shut in wells due to economics. Also will be our steepest year over year decline ever.

As I have posted before, I make a 100 or so mile trip every so often. I go through an area that was heavily drilled in the early 1980s. Until about 2004, it was almost all abandoned. Rusted out tanks. Pumping units with weeds and small trees growing around them.

In 2004 I saw activity, they started to clean up everything. New tank batteries, well sites cleaned up, pump jacks pumping. Then, in 2012 I noticed new wells being drilled. Now, it is almost all shut down again.

All of these are small producers. But I assume this is being played out all over the lower 48.

Maybe look at the MLP oil production. I think it has been trending down this year.

Hi Ovi,

I agree decline rates in the teens seem too high, I would expect 8 or 9% annual rates of decline for the average stripper well (Shallow sand would have a better guess, or maybe Fernando). So I was looking for some explanation for your observation, besides simply bad data (a very real possibility IMO).

Ovi,

The Monthly Petroleum Supply reports data from September 2015, yet the Drilling Report is forward looking to January 2016. So, there is a time lag of four months between these two reports and the data are different accordingly.

Hi Heinrich,

Ovi looked at the drilling productivity report estimates through Sept 2015, it is likely that the Eagle Ford estimate in the Drilling productivity report is too low by about 120 kb/d, based on estimates from Dean, RRC, and Bentek. Also the EIA’s estimate for lower 48 onshore output is slightly too low because Texas output is a little higher (99 kb/d higher) than EIA estimates based on Dean’s analysis.

So based on Ovi’s initial estimates, these would be revised to a 275 kb/d decline in lower 48 onshore and about an 80 kb/d decline in LTO output. So about a 195 kb/d decline in non-LTO production. With 2100 kb/d of non LTO output at the peak, that is an 18.6% annual decline in non-LTO (aka conventional) output.

Shallow sand has suggested two explanations:

1. Most new conventional drilling has stopped due to low prices, fewer new wells relative to the peak in March leads to fast decline rates.

2. Lack of work overs on legacy wells which causes faster decline rates.

I would suggest a third explanation (probably already stated by Shallow sand), that many stripper wells have been temporarily or permanently abandoned due to low oil prices.

Taken together these may explain the apparently high decline in output from conventional wells.

Note also that there is a fair amount of conventional oil (roughly 500 kb/d in the Permian alone) included as “LTO output” in the DPR, if this is added to the 2100 kb/d conventional estimate, it becomes 2600 kb/d, there is likely another 125 kb/d of conventional included in the DPR’s eagle Ford numbers, and about 50 kb/d in the Bakken. When these are all added back to conventional output we get 2775 kb/d of conventional output and the annual decline rate falls to 14%. I believe the normal decline rate of these wells (with proper maintenance) is about 9 to 10% per year, new well drilling tends to bring the overall decline rate of conventional down to about 3% in the US.

In summary low maintenance levels (lack of workovers), low completion rate for new wells, and well abandonment may explain these high conventional decline rates.

I will let the experts correct my mistakes.

This may seem like a naive question to some here, but I don’t work in the oil production biz, so here goes.

A graph in the article shows the US rig count going from about 1900 to 800 over the past year. I assume that refers to an active drilling rig (on and off shore). If so, what happens to the idle rigs? Do they get parked and mothballed? If so, that must be costing the owners (borrowers) a lot money in interest/opportunity cost!, and it must mean an awful lot of idle workers.

Secondly, how long does it take for an idled rig to get redeployed and for the oil it produces to get to market once the pricing conditions improve? Weeks, months?

Hickory,

Parked rigs are called stacked rigs, and are either warm stacked or cold stacked.

A warm stacked rig, has a skeleton crew, walking around with a grease gun and turning motors.These rigs are on a ready to go status, with a little dust off.

A cold stacked rig, if you are lucky has had preservatives added where required, pumps fluid ends removed, and on offshore rigs, literally the doors welded shut and left unattended. These rigs will take a fair bit of work to get back to work, depending on how long it has been stacked and on how well it was stacked in the first place. But you are talking around a month or two.

The other issue is certification. All the major machinery requires re-certification every 5 years. This requires full breakdown of the equipment by OEM, Original Equipment Manufacture, or approved repairer. Now you are talking time, and also where cannibalization of equipment can take place between different rigs. It can take months to schedule these overhauls, so from a planning prospective, you are talking 6 months plus.

Hickory,

I have posted this comment in the previous thread.

A brief summary of an article from “World Oil”, with the data from National Oilwell Varco (NOV):

http://www.worldoil.com/magazine/2015/november-2015/features/global-rig-fleet-declines-in-tandem-with-industry-activity

Last year’s tumble in oil and gas prices forced U.S. rig owners to stack numerous units and downsize operations over the past year. According to the 62nd Annual NOV Rig Census, the 2015 U.S. available fleet has declined significantly, as activity levels plummet. Rig counts were tallied for this year’s census in the early summer, after almost a year of weakened commodity prices. The gap between available and active rigs widened, showing an overall, reduced U.S. market.

Key statistics from the 2015 census include the following:

• The U.S. fleet suffered an overall decline of 883 rigs, causing the total available count to drop about 27%, from 3,254 to 2,371 units.

• This net decrease is the result of 1,120 rig deletions and 237 rig additions,

• 237 rigs were added to the fleet over the last year, compared to 387 units for 2014, which is a 39% drop