The EIA published, last month, AEO2015 Preliminary Oil & Natural Gas

Production & Price Results. And just below the title they wrote:

DRAFT – DO NOT CITE

But I am not citing anything, just informing you of what they said. 😉 What they mean however is that they reserve the right to change their mind before the report comes out early net year. And I can certainly understand that. All Oil data is in million barrels per day.

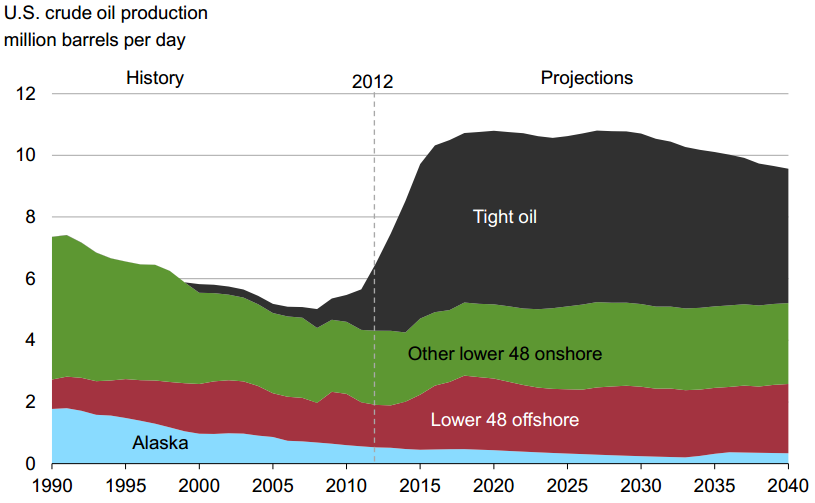

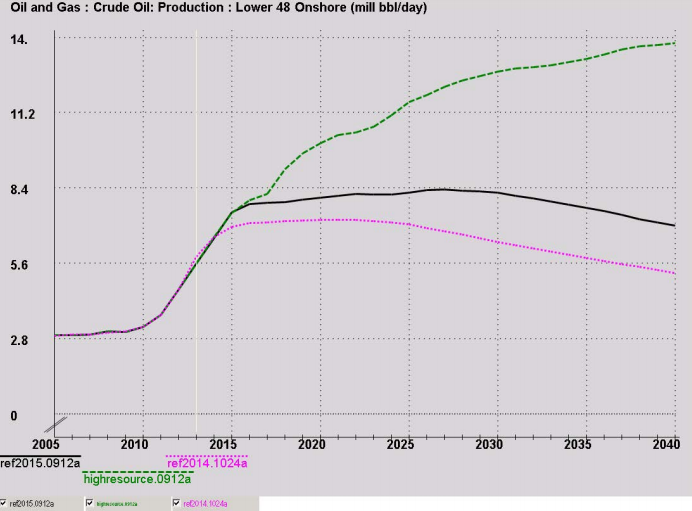

They have lower 48 production hitting a slowly increasing plateau in 2016 and peaking at just under 8.4 million barrels per day in 2027.

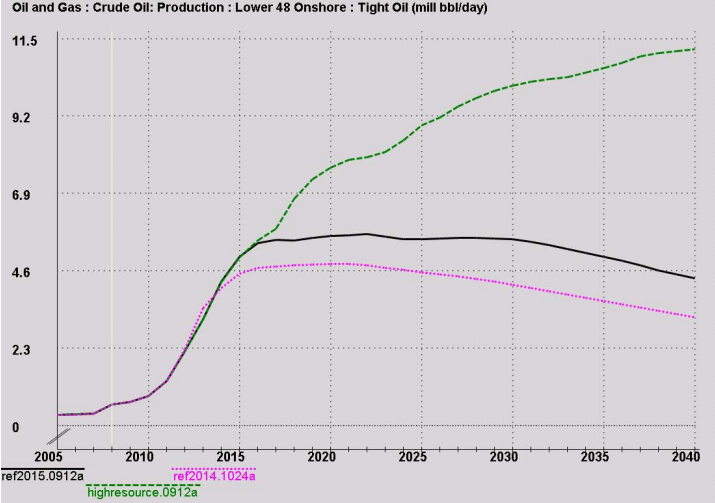

They have US Tight Oil production following pretty much the same profile, hitting a plateau in 2016 at about 5.5 million barrels per day and holding flat until starting a very slow decline in 2030.

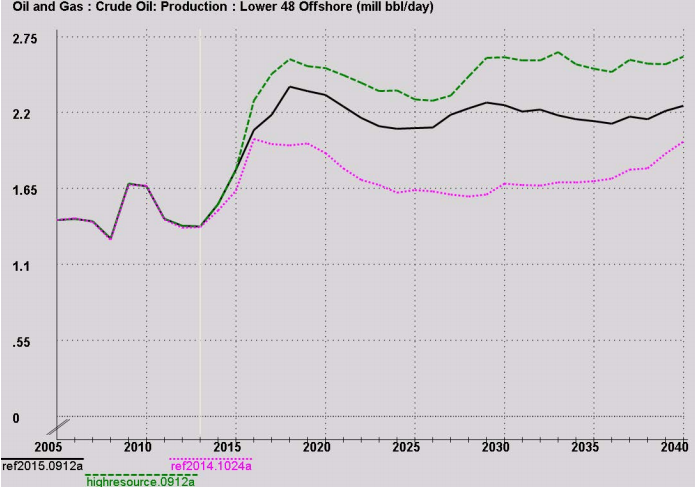

They have US Offshore moving above 2 million barrels per day in 2016 and peaking in 2018 at about 2.35 million barrels per day. US Offshore currently stands at 1.5 mbd so I think they are quite optimistic. And here is their projection to 2040. Only tight oil and Alaska shows any significant decline after peaking in 2018 due to offshore peak in that year.

And here is their projection to 2040. Only tight oil and Alaska shows any significant decline after peaking in 2018 due to offshore peak in that year.

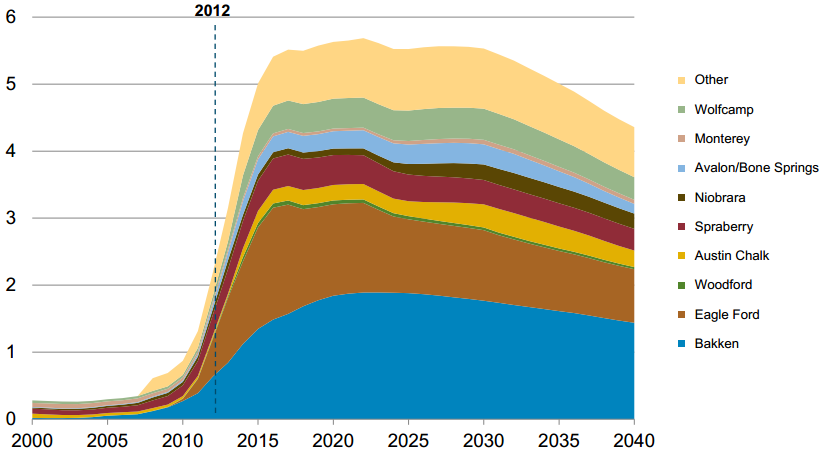

This is a stacked chart of all light tight oil production. The Bakken is the big dog here, outproducing Eagle Ford from 2018 all the rest of the way.

This is a stacked chart of all light tight oil production. The Bakken is the big dog here, outproducing Eagle Ford from 2018 all the rest of the way.

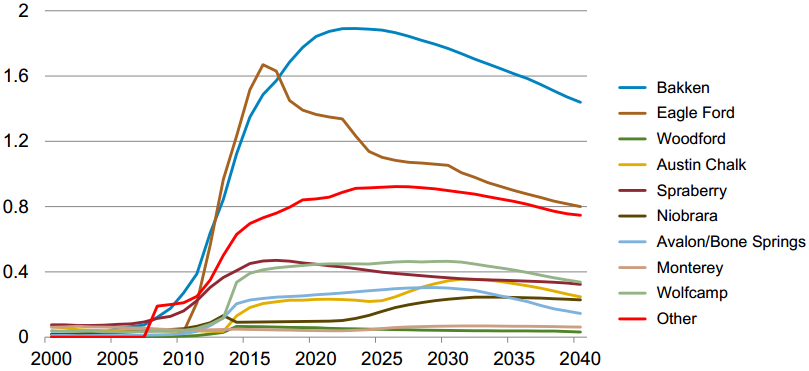

This is the most interesting chart of all. Look at Eagle Ford, peaking in 2016, down slightly in 2017 then down sharply in 2018, then dropping to half its peak in 2040. All the other shale plays hold their plateau and only drop slightly beginning around 2030.

This is the most interesting chart of all. Look at Eagle Ford, peaking in 2016, down slightly in 2017 then down sharply in 2018, then dropping to half its peak in 2040. All the other shale plays hold their plateau and only drop slightly beginning around 2030.

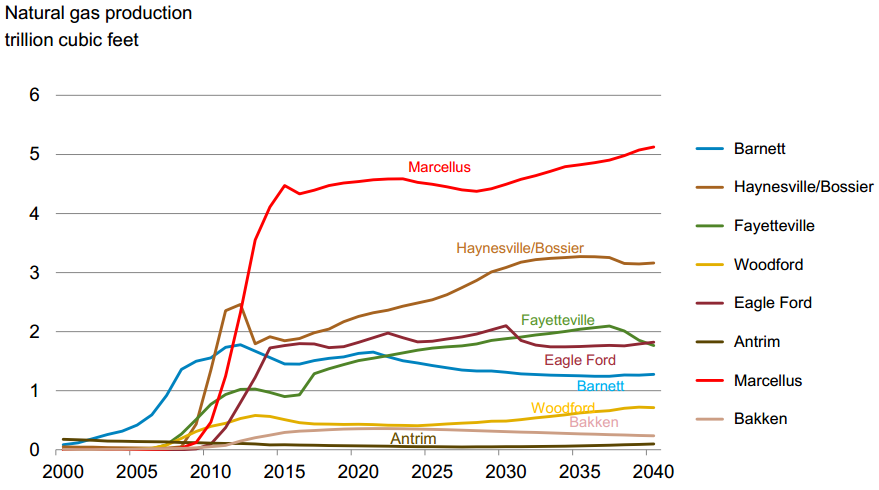

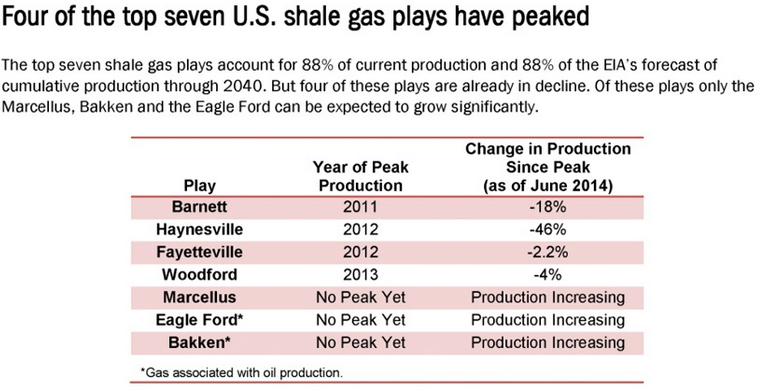

Shale gas by source. Notice that no one except Barnett is post peak. Contrast this with what the Post Carbon Institute says:

Shale gas by source. Notice that no one except Barnett is post peak. Contrast this with what the Post Carbon Institute says:

Source, Post Carbon Institute.

Source, Post Carbon Institute.

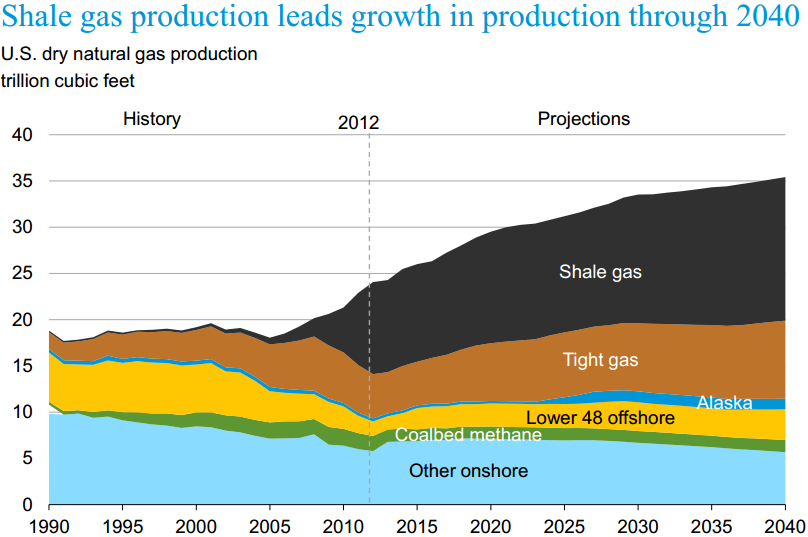

The EIA has US gas production onward and upward right through 2040 when we will be producing about 10 million cubic feet more than we are today.

The EIA has US gas production onward and upward right through 2040 when we will be producing about 10 million cubic feet more than we are today.

And I just had to add this:

De Smog Blog: U.S. Energy Policies Based on Inflated Fracking Predictions

Lon Burnam, a Texas State Representative from Denton Texas, who lost his latest bid for reelection after serving 18 years, gives his opinion of the Texas Railroad Commission.

At 6:10 into the second video interview at this link:

Reporter: When people in the government, like members of the Railroad Commission, start insinuating that money is coming from Russia to support activist in Denton, what’s your response to that?

Burman: Hogwash! And besides, who are they to talk? I mean they are all corporate whores to the industry, every one of those railroad commissioners.

Note: I send an email notice when I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com

Note #2: In the comments section, previously after 25 original comments, it went to a second page. I changed that number to 100. That is original comments, replies to comments don’t count. Now it will hardly ever go to a second page. Please let me know if you prefer this or would rather have it page after 25 original comments.

Ron,

I think the EIA has done a swell job here. They have the Marcellus shooting up in a nearly vertical graph (70%) and then plateauing for the next 500 years.

Looks about right to me.

steve

Well… on second thought,

The EIA shows in their “Forecasted data” that the Haynesville peaked in Nov 2011 at a hefty 7.2 bcf, but is currently producing a smidge more than 3.9 Bcf. That’s a 46% decline in 3 years. I wonder how they get that graph of the Haynesville to bounce back higher.

Maybe its the much higher natgas price coming from the BOATLOADS of LNG we will be shipping to countries that don’t have sustainable economies to purchase it.

Regardless… looks like PEAK OIL IS DEAD. The EIA’s graphs say its so.

steve

Now that’s funny

As I frequently point out, the year over 20% decline* in Louisiana’s annual marketed natural gas production from 2012 to 2013, presumably because of a decline in gas production from the Haynesville Play, is pretty strong support for the Citi Research estimate that the underlying decline rate US natural gas production is about 24%/year. At 24%/year, just to maintain current production for four years, we need to replace roughly 100% of current US natural production in four years.

*This was the net decline; the gross decline from existing wells in 2012 would be even higher.

Steve,

The Hainsville to me looks very much like it has a higher cost structure than the Marcellus. The Marcellus has grown leaps and bounds but is basically bound by take away capacity restraints. In the next couple of years many of the north bound pipelines will be reversed and depending on timing and how good the Marcellus really is one of three things could happen.

1/The Marcellus could lower the Henry Hub price by bringing more capacity to La. and the Hainsville will further contract.

2/The LNG plants kick in and overwhelm the Marcellus production, forcing up Henry Hub, and making the Hainsville economic again.

3/The Marcellus faulters, the LNG plants are in full swing, and the US has really expensive Nat Gas, and the Hainsville really get a boost.

I doubt if you will find anyone saying the Hainsville is out of gas, it is just out of cheap gas to compete with the Marcellus. The question really is, how long and how much can the Marcellus continue to produce nat gas $2-$4 mcf?

Toolpush,

You bring some worthy points indeed. However, the European and Western economies are being propped up by some of the highest quality bailing wire and duct tape.

These economies died back in 2008-2009. What we have now are Zombies walking around eating the living to stay alive. Well.. that’s really not the example I was trying to get across. Let’s try this…

Most of the European and Western nations are what I label as “FLESH EATING ECONOMIES.” They really aren’t sustainable, so they have to absorb some of their arm, leg or left testicle to stay alive.

Now… this seems to be working fine as there are still several body parts remaining, but I highly doubt this sort of activity will go on for many years. Basically, what I am trying to say is that the Fed and Central Banks are propping up a system that should have imploded a half a decade ago.

I really believe the days of building STRIP MALLS, STARBUCKS & PARTY STORES are over. Don’t see how the world will be able to afford unconventional oil & gas for long.

steve

“Don’t see how the world will be able to afford unconventional oil & gas for long.”

Steve, I agree the Shale oil is expensive oil, and you most likely have valid points concerning the economy, but that is not my expertise, so I will not argue those points.

My point is that the Marcellus, maybe unconventional, but it is cheap unconventional. Here is todays EIA Nat gas report.

http://www.eia.gov/naturalgas/weekly/

“Marcellus prices remain low. Prices at Marcellus trading points fluctuated during the report week, decreasing by Friday in anticipation of lower weekend demand. Prices rebounded on Monday and ended the report week 3% lower on Tennessee Zone 4 Marcellus and Millennium East Pool, at $2.15/MMBtu and $2.34/MMBtu, respectively.

Pipeline constraints to move Marcellus production out of the region remain the main reason behind Marcellus prices trading persistently lower than the Henry Hub. Several new projects are being developed to alleviate the constraints and move Marcellus production to markets in the Northeast, Southeast, and Midwest. Four new and expansion projects totaling 1.1 Bcf/d of capacity were scheduled to come online in October, and three more projects with a combined capacity of 1.3 Bcf/d are scheduled to start up this Saturday, November 1. As the new projects are being commissioned, pipeline capacity constraints, which limit deliverability of Marcellus gas, are expected to be gradually lifted.”

$2.15 mcf, where as Henry hub, right next door to Hainsville is approx $4. we will have to wait and see if the Marcellus has the legs everybody claims it has, or if Jeffrey Brown is correct and they get overwhelmed in fighting the decline rate

Of course, it’s when, not if, that the production from new wells can no longer offset the declines from existing wells, i.e., Peaks Happen.

Year over year, from July, 2013 to July, 2014, the industry was able to offset declines. US dry gas production was 70 BCF/day in July, 2013 and 70 BCF/day in July, 2014. However, at about a 24%/year decline rate, we need about 17 BCF/day of new dry gas production, every year, just to maintain current production.

To put this in perspective, Canada’s 2013 dry gas production was 14 BCF/day. Based on the Citi report, in order to maintain current US dry gas production we need to put on line the productive equivalent of all of Canada’s current dry gas production, every single year, times 1.2. Or, over the next 10 years in order to maintain current dry gas production, we need to put on line the productive equivalent of 12 Canadas.

Jeff,

I agree with your points and decline rates and replacement production, and it is when, and not if, whn the peak occures but it amazes me how reliant the US is planning to become on the Marcellus. The spreadsheet from EIA, has so many pipelines currently being built, or reversed that when they come on line it appears the Marcellus will nearly supply all of the US plus part of Canada, and why did I forget Mexico. This is not in 30 years time, all these pipelines will be on line in the next 4 years.

Either a lot of people are going to loose absolute fortunes or the Marcellus is really really big. I don’t have the answers, but we will not have long to wait to find out. If the big money is wrong, and supply can not keep up with the decline rates, the US is going to be in deep shit very quickly.

I am just a spectator from a far, with some money in LNG companies at home, so I actually don’t want the Marcellus to too successful. You are the people that are going to live it. I don’t believe, due to the way the shale plays are developed, that it will be easy to fine tune the total production rates. The US is either going to awash with gas or the gas market will fall over and you will be paying LNG import rates for your gas.

It will be a fine line between those two extremes. All I can say is good luck, because you will be needing it.

Here are the latest EIA estimates for the Marcellus Play:

http://www.eia.gov/petroleum/drilling/pdf/marcellus.pdf

Another way to illustrate the decline rate problem is that, in round numbers, we need to put on line (slightly more than) the productive equivalent of current Marcellus production, every single year, just to offset declines from existing wells.

Given 70 BCF/day of US dry gas production in July, 2013 and 70 BCF/day in July, 2014, the increase in Marcellus production + new wells in other areas only served to offset declines from existing wells, from July, 2013 to July, 2014.

toolpush,

The current pipeline buildout does look like the Marcellus is expected to be huger than seems, um, modest, but all that infrastructure will serve Utica output too, so maybe the Utica will help make dreams come true.

The Utica isn’t presented here, I’m guessing because it hasn’t much production history yet.

Synapsid, toolpush, et. al, I am glad someone finally brought up the Utica because – in case few have noticed – these past few months (weeks, in the case of Magnum Hunter Resource’s well), the results of the now-being-drilled wells in the dry gas areas of the Utica are stunning, to say the least.

Rice Energy had a 41 million cubic foot IP well in May (700 million cubic feet in less than two months production) in a well situated in Ohio. MRH had the monster of all monster wells with a 46.7 million cubic foot IP a few weeks back in West Virginia. Shell announced a 26 million cubic foot IP in a well 400 miles north in Tioga county, PA.

All these wells are in the Utica formation.

The Utica is far larger than the Marcellus in areal extent and – at 900 foot thick pay zones – actually thicker than the Mighty Marcellus.

Any and all predictive analysis (such as Mr. Hughes recent release) that does not include the Utica’s potential is destined to be woefully inaccurate.

coffeeguyzz,

Thanks for this. That’s more Wow! than I’d anticipated.

Toolpush & Jeffrey,

Anything can happen in the short run. Just look at the precious metals. Lord have mercy… being totally decapitated. However, we in the gold and silver community understand this is a temporary situation as demand for these metals goes up exponentially at these bargain basement levels.

Regardless…. the U.S. is producing a lot more total natgas production, however we are SUCKING more than ever from the NATGAS TEET. Matter-a-fact, last year we consumed over 26 Tcf.

The little men running around the U.S. Govt believe the hogwash that we have a 100 year supply of natgas, so they are gutting the Coal Fired Plant industry. Even though we produced a RECORD amount of natgas, we still import nearly 10% of our supply from our friendly Canucks north of us.

I would imagine the GUTTING of the Coal Industry will continue as Americans get a warm-fuzzy knowing they are doing their part in stopping the negative impacts of GLOBAL WARMING (hehe).

Who knows if we will ever export LNG. But if we do, I doubt it will be the SILVER BULLET that saves the U.S. Shale Gas Industry.

steve

I came across large ant nests out in the woods. The cleared area of the nest at the surface ranged from about 6 feet to 15 feet in diameter. The ants themselves ranged quite far from their nests. The limiting factor for resource gathering seemed to be other ant nests in the area which limited the range and area they could travel. Basically, they bumped into each other.

Well, we have been bumping into each other for a long time now. Our range of gathering is dependent upon a combination of fuel sources, industrial and military might. In reality we have been gathering from the other side of the world via ships and planes for a very long time now. There is not any further to go and we keep bumping into each other politically and militarily.

So beside the limited nature of some of our resources, we simply have run out of planet.

I don’t see scavenging or trading with the moon or Mars as a viable resource. Nor is empty space full of food, water and other resources.

It’s not just the malls that will go.

This comment is pretty far afield given that this forum is about oil and energy mostly but we do occasionally discuss whether we can trust the government and the mainstream media to tell us the truth.

So perhaps it is worth thinking about this quote which pretty well typical of the coverage of the case of the cop shooter in Pennsylvania who was caught today.

Frein’s capture may finally shed light on some of the questions that have baffled authorities and the public since the shooting, including a motive for the ambush and how Frein was able to stay one step ahead of the intense search for so long.

THE PART that is simply fucking totally inexcusable is that just about every acticle or reference to this case has alluded to a supposed lack of a known motive.

There could not possibly be even a barney fife cop or a reporter worthy of the name in the entire US who doesn’t know with about 99.99 percent likelihood what Frein’s motive is.

I won’t waste any more space on it.

Anybody just interested can just google his name. The rest of the story is freely available.

I am not so cynical about the media as some regulars here but I grow more cynical in this respect from one year to the next.

It is no wonder that people are so easily mislead by the media because most of us are too busy and too lazy to investigate any question beyond whatever is in the headlines and the first paragraph of whatever the MSM puts out in a sound bite.

The first day I saw this guys name on the net I googled it and read a couple of articles about him being badly assaulted by some cops.These articles seem to have vanished.

Ron may well want to delete these comments as too far off topic.

Funny how they have vanished isn’t it!?

Don’t worry, the media NEVER means to deceive or mislead.

people are so easily mislead by the media because most of us are too busy and too lazy to investigate

People actively want to be misled by the media. It’s much more fun than worrying about reality.

Look at the rants of Watcher and SRSRocco here. Think what a rush it gives them to write that stuff. Heart beating a little faster, sweaty palms… Eschatology is sexy in America.

Being obnoxious is a competitive sport, which explains the comments section of a lot of web sites.

Look at this: http://brainshavings.com/obama-nicknames/

They are so proud of themselves.

The media is there to feed people fake facts to make it seem real, and to get people riled up. It attracts viewers. Fox News claims it’s entertainment when it gets caught lying. Check out the insanely bad advice Jim Cramer spews out. Listen to the background music. It is designed to give you an adrenaline high.

Ilambiquated,

I think (my experience tells me that) there are ‘mainly’ three things (happening) intersecting within ‘Bread & Circuses’ (massmedia brainwashing):

With the Men: Preconceived ideas. Men possess more the intellect to inquire, but have problem to overcome the indoctrination.

With the Women: They just don’t want to hear. They’re too selfish to even inquire on these big issues.

And the third: Religion and Education Indoctrination.

Religion: Inability to face the truth. Give me easy answers and solutions. Predispose to myths and conspiracies.

Education: The high the education, the more of the inability to tell the truth. Predispose to corruption and hypocrisy.

So, you’re right when you wrote: “People want to be misled… It’s much more fun than reality.”

Just not sure that anyone at ‘Peak Oil Barrel’ fit that ‘People’s’ label of being easily brainwashed.

Ilambiquated,

I gather your “Definition” of my posts here as RANTS is about as good of a term as any. However, I believe there is a lot of factual and circumstantial evidence to support my rants.

Today, many Americans have become quite SMUG thinking they have outsmarted the rest of the world by believing those Trillions of DIGITS in an account are wealth. We here who understand PEAK OIL realize those DIGITS are ENERGY IOUS.

I will continue to RANT now and then.. if you don’t mind. But, I would imagine in say 3-5 years, the world will be a much different place. Let’s just see how things unfold.

steve

I don’t mind 🙂

Fox News is by far the most watched news channel in USA. Clearly your in the minority and incredibly clueless….Hope you and your communist party get the thrashing you deserve in the upcoming elections. Obama is currently ranked the worst ever president in the history of USA, 39% approval only from his base of all the illegals, blacks, and those who is recently out of prison.. .They love to keep people poor because if they actually got a job and made serious money and actually had to pay a cent in taxes, they wouldnt vote for the communist Obama party anymore.

Dem’s say Republicans are the party of the rich while Obama goes and parties with the hollywood tree hugger sluts, all the while laughing at those who live in the slums that are stupid enough to keep voting for him…Sickening

Lets see I have 2 choices here for this election:

A) Vote republican and get rewarded for getting an education, hard work, driving a F350, and living in a large house in good neighborhood

B) Vote democrat and watch the lower class get worse off, middle class be stagnant, support more illegals, sit on my ass and collect welfare, weak leadership from behind foreign policy, be told I cant have any guns for protection, cant have a campfire every night in my backyard, no big Trucks & SUV, more job destroying regulations, etc..etc.

Here is my indirect answer:

O – One

B – Big

A – Ass

M – Mistake

A – America

That was… beautiful. All that is missing is the illustration.

I love that photo. Here is the background behind the morans photo

Link appear broken. Try this http://knowyourmeme.com/memes/get-a-brain-morans

Fox News is not a news channel at all, it is far right wing commentary. This site is a Peak Oil site not a political commentary site.

However we do tolerate some political comments, at least from people who post on energy as well. You have had your political commentary, now you can post on peak oil or related subjects.

Hi Ron.

Re: Eric29

Normally, when I come to your site, I feel like I’m hanging with my peers, most of whom know more about the topics at hand and politely tolerate my presence. But this …this is a guilty, guilty pleasure. Makes me feel smart (probably in a bad way), makes me laugh, and makes me feel like the end of the world is rushing at us at an ever increasing pace and that there’s nothing we can do about it. Kind of like the scene in Dr. Strangelove where General Turgidson explains that Major Kong’s plane has an excellent chance of getting by the Russian air defenses.

-Lloyd

“A) Vote republican and get rewarded for getting an education, hard work, driving a F350, and living in a large house in good neighborhood”

I always viewed it as some of the rewards for getting an education and hard work was an F350 and a large home. I didn’t realize one gets rewarded for driving a F350 and living in a large home. Just call me old fashion. Clearly one of America’s big problems is buying the F350, large home and watching Fox News before getting the education(starting with grammar) and hard work(borrowing to buy the house and/or truck with little or no money down, think 2008 financial crisis which happened under a Republican President).

If we all voted Republican and owned an F350, the price of fuel would be $20 a gallon because of the lack of ability to produce enough oil for every individual to drive to the store in their four ton toy. Is that really the vision of the Republican Party ?

I think the F350 owners should be thankful for the Leaf owners who don’t compete for the use of oil based fuels.

Please go back to 25 comments a page. I find it helps me quickly know whether anything new has been published (as compared to a lot of the inter-comment discussion which has become huge).

Okay, back to 25.

I like the 100 better.

Me too – it’s much easier to find stuff.

I like the 100 comment layout.

I have set it back to 100.

Hello everyone,

I have a question that has been stirring in the back of my mind for a couple of weeks, and now that I have a moment I would like to throw it out to the distinguished oil minds that occupy this blog.

Based on the data I have seen over the years, it seems highly probable that the Saudis are on the verge of terminal decline in their oil production. If that is true, why are we seeing so many news articles like this:

Gloves off over oil: Saudi Arabia versus shale

http://www.cnbc.com/id/102096725

EXCLUSIVE-Privately, Saudis tell oil market: get used to lower prices

http://uk.reuters.com/article/2014/10/12/oil-saudi-policy-idUKL2N0S70J720141012

I could post more stories like this and I am sure such stories have been posted here in other areas. The reason this is making me scratch my head a little bit is it would seem that the Saudis could use this pull back in oil prices to reduce production and save oil for “future generations”, something the Saudis have in the past publicly declared they would like to do:

http://www.saudigazette.com.sa/index.cfm?method=home.regcon&contentID=2010070377026

The Saudis must know that shale is a bubble waiting to burst. They also must know what their own oil situation is.

Thoughts?

Best,

Tom

“EXCLUSIVE-Privately, Saudis tell oil market: get used to lower prices”

Folks who have never been fierce competitors typically don’t understand situations like this.

The Saudis, who had nothing to do with the price decline, have an opportunity to take the US shale oil industry in their fists, and crush it. They achieve this by doing largely nothing, or maybe shorting Euros and Sterling with their Sov. Wealth Fund (or printing up Riyals with their CB) and drive the dollar up. If the yardstick gets longer, that which you measure with it gets smaller (aka price of oil).

They can smash that industry ruthlessly, and if they are playing to win, that’s what they should do.

Hi Watcher,

Why should they do that? This means selling their oil for less now. The shale operators could shut down operations (as far as new drilling) for a while and wait for the Saudis to come to their senses. The oil will still be there to be extracted later. Why sell your oil now for less, bragging rights? That’s great as long as you don’t mind getting less revenue for your oil over time.

It is about greed, greed is good. The Saudis must like giving their oil away at a discount, not good business. Some companies might be driven out of business in the US, but price wars usually benefit no one. Maybe the Saudis believe the hype from the EIA.

Hi Dennis,

I agree that it makes no sense to sell oil at a discount. But is it really possible that the Saudis are completely ignorant of the financial reality in the shale plays and that they are relying on the EIA for information? Maybe I am simply assuming that the folks running things in Saudi Arabia are competent. Maybe that assumption is not valid. But something seems amiss.

Best,

Tom

All right.

First of all, the Saudis haven’t done anything at all. They didn’t ramp up production to produce the oil price crash. So the discussion about them “doing something” to raise prices . . . is required how? Anyone can do that something, if they believe that in the absence of any data indicating a supply spike in the past 3 months (or a demand collapse) there is something they should do to supply to achieve their goal. Not really any point in it since there is no indication either supply or demand in the past 3 months varied from 6 months ago.

But more to the point.

Greed is good? Power is better. Victory trumps greed. Crushing a threat is goes far beyond potentially meaningless pieces of paper. Saudi Arabia could dictate policy to the US if the US starves without Saudi oil.

And as I have pointed out, once NoDak evacuates a return to high price will not restart that activity. The junk bond lenders will have been defaulted on. They won’t lend again. NoDak will have to pay to cap and abandon all those wells owned by bankrupt LLCs. They will pass legislation requiring huge escrow any time in the future there are signs of another boom. If we think $60 shuts it down now, these added costs and realities and the absence of population who all left will make that price $160 to restart.

KSA . . . or Russia . . . has a chance for to permanently eliminate US maneuvering room. You think global dominance gets trumped by having to accept 30% less money for oil? That’s just silly.

However.

Odds are 50/50 the government will intervene and subsidize the companies. The politics will be very difficult.

There are lots of precedent for this. All kinds of weapon systems are provided contracts to keep the assembly line staffed and expertise fresh, and the votes are often bipartisan.

That’s highly unrealistic. The Saudis need their income far more than the US needs their oil.

First the U.S. could easily cut oil consumption dramatically overnight and eliminate oil imports without starving: look what it did in WW2. Heck, the average car only carries 1.2 passengers and only gets 22MPG. If the US dramatically cut consumption, it would never return anywhere close to previous levels: KSA would lose that market forever.

Second, the production capability of LTO would not go away. Companies might go bankrupt, others would just buy the leases, and equipment, and return to production with a much lower cost base.

Hi Watcher,

Wells don’t need to be capped, new wells just won’t be drilled. The companies that are in better financial shape will cut back on their expansion plans, but will not necessarily go bankrupt. The oil industry goes through these kinds of shake out every time oil prices drop.

Nobody is saying Saudi Arabia made prices go up. Usually when prices drop Saudi Arabia cuts back on production to bring prices back up.

They usually do not behave the way Watcher thinks they should. Maybe they read this blog and are following your advice 🙂

Can’t leave a non producing well uncapped. Illegal. A bankrupt LLC won’t collect any oil and the courts dividing assets among creditors will be facing quite the backlog.

It will take years. Gotta cap it.

Somebody buys the assets, not the debt. The story is as old as the oil patch.

You wouldn’t destroy a producing asset, the creditors would never allow it.

Hi Watcher,

Once the well is drilled the $9 million spent on the well is a sunk cost. The cost to pump the oil is only about $4/barrel.

The wells will still be producing, if companies go bankrupt the wells will be sold to solvent companies, the wells get capped when they are down to 7 b/d after 20 to 25 years.

No new wells will be drilled if prices fall far enough (to under $55/b), but that does not mean that all the wells get capped, just the wells that are at the end of their productive life.

I specifically said it would take years. A bankrupt company doesn’t go to court until there’s a slot on the docket. The regs require cap and abandon after a short period of no flow. Done.

Hell, you think asset distribution happens fast? There are STILL foreclosed houses on bank balance sheets. Why would oil wells be different? Do you really think the high yield market is going to leap forward to provide DIP financing for this avalanche?

The wells will cap. NoDak will have to fund it. And then pass legislation requiring escrow for future players, which will raise the price reqd to get underway again — but if the need for oil is desperate enough it won’t matter. Gov’t will step in and provide the DIP money.

Hi Watcher,

My guess is that these things do not necessarily work the way you think they do.

Do you think that the government will move quickly to cap the wells? Do governments do anything quickly?

Until the company is actually in bankruptcy court they can continue operations. The oil is worth $60/b and costs $4/b in OPEX to get out of the ground, subtract taxes and you have a $41/b net. I would think until the court case takes place that this oil will be pumped. You think differently, it would be interesting to hear the perspective of some oil men that have some idea how this works in the real world. I will admit that I don’t know, I am not in the oil business, nor have I ever owned a company that has gone bankrupt.

Fair enough.

You are “in bankruptcy court” via a filing. You may not have a case heard for years after that filing.

This is a big deal. There are a lot of wells in question and when people start to see paycuts / hour cuts then it gets easier and easier to leave town and not endure that winter.

You probably should do some reading on Debtor In Possession financing.

Don’t be silly.

The rules are adapted to fit the case. No bankruptcy court or local government is going to order or allow producing, profitable wells to be capped.

A special administrator will be appointed, creditors will be allowed to take over operations – something will be done.

Look at GM: despite the idiot suggestions of Republicans, things were arranged so as not to dismember the company and disrupt the entire industry (supplies would have been bankrupted – even Toyota objected to a simple liquidation).

At this point I think the Saudi’s backs are against the wall and they will produce all out regardless whether prices are $120/barrel or $60/barrel. Today’s Saudi Arabia needs billions of dollar to pay for welfare, health care, subsidize their gasoline and diesel, cover their princes opulent lifestyles, and keep their oil production from dropping dramatically. And yes, they’re secretly hoping the recent price drop will wipe out a good portion of US light tight oil production. On the other hand, they don’t necessarily like the current 25% loss in revenue but what can they do about it?

Hi Frugal,

Let’s think about this. Prices were $100/b now they are $85. At about 10 Mb/d, this is a loss of $15 million per day of income. Lets say the Saudi’s cut production by 1 Mb/d and prices increase to $100/b, they come out ahead by $5 million/d in this scenario. If prices only rise to $94.40/b they will come out even. It may be that they are trying to punish the LTO producers in the US, but they if my guess about cuts and prices is correct, it is an expensive strategy.

Hi Dennis. Like everyone else I really don’t know what is going inside Saudi decision makers heads, but I can guess. And my guess is that Saudi is damn tired of being the only one expected to cut production.

Back in 08 everyone cut production but before one year was out everyone but Saudi, Kuwait and the UAE were back at full production. Then when high prices returned everyone was back at full production. But both the UAE and Kuwait have instituted massive infill drilling programs and both are now over 200,000 barrels per day above their 2008 peak. And no OPEC nation shows any signs of cutting production.

I will just bet that when OPEC next meets Saudi will lay down the law. They will say that we will cut production when everyone else cuts production but we will damn well not be the only one to cut production… or something to that effect. 😉 But until they get concessions out of other OPEC nations they will do nothing.

Hi Ron,

This does make sense. It will be interesting to watch–could make for an interesting post?

Best,

Tom

Hey Tom,

I really think your comment speaks to the most interesting thing going on in the Oil world now. How to make sense of the Saudi response.

If they are seriously concerned about “maintaining market share” they must be expecting a long period of no/low economic growth. But still, why should they be concerned about market share loss, when they can always get it back (with lower prices) later. The other question is who, long term, has the capacity to take more market share, especially at the cost of selling cheaper. I don’t think anyone has cheaper production cost than KSA.

I’ve always thought the biggest concern to KSA is (should be) really, really high oil prices. So, why not sell a little less now, and stockpile for the future. It seems to suggest (assuming they are behaving rationally) that KSA is genuinely not worried about being able to meet any demand spikes that could de-stabilize the system by driving price to dangerous levels failing a rapid spike in production. I know Ron doesn’t believe they have that kind of spare production, which has been my gut-feeling as well, but this response seems to suggest they think they do. Or that they don’t foresee any such demand spike for quite a while, maybe never.

Hi Ron,

That could be the case. I would think that all OPEC countries are being hurt by lower prices. If the low prices stick your call for an early Bakken peak may turn out to be correct (you expect a Bakken peak by the end of 2015 at the latest as I recall.)

I agree. Low prices now mean low investment in 6-12 months, and that takes a big cut out of initial production spikes.

And when the Bakken peaks, the world may peak as well. Or it may not. The peak has been delayed so many times, one thinks that it will never happen.

As I recall Lloyds of London and the U.S. Joint chiefs of staff said that 2015 was a likely date for the peak.

If prices remain at $80/b or less 2015 sounds right to me. If prices go back to $95/b or more before 2015, I think a more likely date is 2017 or 2018.

At ten million barrels per day, the 15 dollars is 150 million dollars short each day.

Ronald,

Thank you, I was mistaken. $150 million/d or $54 Billion per year.

Hi Dennis,

You hit the point exactly–they could take a little stress off their fields and likely not cost themselves too much if anything in the process. Ron’s suggestion below that they no longer want to be the only producer to cut production does make some sense. But in the context of their own looming peak and the fact that tight oil is on the verge of peaking, I am still left to scratch my head a bit.

Best,

Tom

Make that “Ron’s suggestion above“

Some normalized values for Saudi Arabia, for 2005 to 2012 (no material change in 2013, same trends continued):

The Saudis will have enough for themselves for a long time. They don’t really need anything more than that.

Hi Watcher,

They need more than oil, they need the money that it brings in. What are they going to eat, sand?

That’s right, they import almost 100% of their food. Without oil exports, they’re dead.

You don’t have to do 9 mbpd to buy food. And that’s part of “having enough for themselves”.

DC,

Is Saudi Arabia one of the countries buying up farmland in Africa and maybe elsewhere?

Barring some entirely unlikely unforeseen miracles on the agricultural front they are going to have to import most of their food for the duration of their population boom. Unless most of them die from a plague or in a war this must mean that they are going to be importing vast quantities of food for many decades at least even if they were to lower their birthrate to well below replacement.

And it seems unlikely that any of the sand country oil exporters will be able to develop enough indigenous industry to supply their own needs for most things ranging from a to z….. so they must export substantial amounts of oil or die of starvation while sharing rides on their grossly inadequate fleet of camels.

Big chunk of that population are not Saudis. Imports. Could be deported.

And for the 10th time, why are we talking about the Saudis? THEY DIDN’T DO ANYTHING.

Why is the presumption it is they why must cut production?

Why must anyone cut production? There was no 3 month supply spike or demand collapse.

Exactly, it’s just random finger pointing. It is sort of entertaining for someone that lived through the seventies to hear people accusing the Arabs of ruining America by making oil too cheap though. 😉

No, it is not random finger pointing. From my initial post.

Gloves off over oil: Saudi Arabia versus shale

http://www.cnbc.com/id/102096725

EXCLUSIVE-Privately, Saudis tell oil market: get used to lower prices

http://uk.reuters.com/article/2014/10/12/oil-saudi-policy-idUKL2N0S70J720141012

And one more time. The only thing that has changed in the past 3 months was the dollar spiked and ISIS (and the Kurds) sell oil at $40/barrel.

Nothing special happened in shale. Nothing special happened in KSA. Nothing different is going on from what was going on 6 months ago. Other than ISIS and the dollar.

You completely forgot about ebola.

Good.

Call.

And of course the slowing economies in Europe (especially Germany and signs of weakness in Asia):

http://economictimes.indiatimes.com/industry/et-auto/news/industry/weak-german-output-numbers-send-europe-into-reverse/etvertical_articleshow/44607918.cms

http://online.wsj.com/articles/china-data-weighs-on-asian-shares-1410744328

So let’s see, relative strong U.S. dollar, war in the Middle East allowing ISIL to significantly undercut the price of oil, potential global pandemic brewing, and major economies in Europe and Asia showing signs of weakness. But other that THAT nothing has changed recently.

Best,

Tom

And perhaps a winding down of Chinese purchases for their strategic oil reserves, which effect should be affecting the markets about now?

Long time lurker and TOD student. Appreciate your work Ron.

Thanks.

You missed the point. Nothing on the supply/demand front changed.

Dollar spike is likely responsible for most of the price fall.

Ebola is a good call. That could cause a presumption of future catastrophe.

There’s no evidence Europe’s GDP decline is smacking their consumption all that deeply, though that will be a powerful datapoint to see, because if it does then GDP will be pretty conclusively linked to oil consumption.

From your first link: “The bearishness in the global oil market is all being driven by the U.S. shale revolution”

Doesn’t sound like the Saudis are doing much.

I disagree with his assessment. But I don’t see how it supports your claim.

As to your second link all it shows is that the Saudis don’t want to cut production. But I’m on Frugal’s side in this argument — they don’t really have a lot of options.

Hi Watcher,

Something must have changed to cause prices to decrease by 15%. Typically OPEC responds by cutting production to a fall in prices.

Note that the dollar has gotten weaker against the British pound and Euro over the last year, so this is not likely to be the explanation for the fall in oil prices. A weaker dollar means that imported goods, like Brent Crude would tend to increase in price ceteris paribus.

Nope. The time frame is the time frame. The dollar has spiked in the relevant months. The last year or so isn’t relevant; only the relevant time frame. Other commodities have fallen in the same time frame, priced in the longer yardstick.

Go look at .DXY, the dollar index, since June.

Watcher,

You are right that the dollar is stronger not weaker and most of the change has occurred over the July to Sept period. The change in exchange rate does not explain all of the change in oil prices. If you look at the change in Brent in Euros it fell by 9% from June to September, if we do the same in US Dollars (June to Sept) the fall in Brent is 15%.

The Brent price has fallen further since September.

As of Oct 27 the Brent price has fallen by 26% in US dollars and 17.5% in Euros.

So the strong dollar (relative to the Euro) explains 8.5% of the fall in Brent crude prices (in US Dollars). We need to look at supply and demand for oil to explain the 17.5% fall in Brent prices from June to October (4 week average spot prices from the EIA) in Euros (I used monthly average Euro/dollar exchange rates for June and October to convert Brent prices in $/b to Euros per barrel.)

As I wrote a couple of threads ago, there is a feedback loop going on here. The strong dollar pushed down the oil price, and the cheap oil pushed up the dollar — because fewer dollars get sent overseas to buy oil. Weak demand in China and Europealong with reduced US imports thanks to LTO could have started the loop.

another interesting thing is that chaos in the Mideast doesn’t seem to make people s panicky as it used to.

No I am wrong above. Dollar has gotten stronger relative to the Euro not weaker, the price of a US Dollar in Euros has gone from 0.73 Euros to 0.79 Euros (roughly) in the last 12 months, clearly this is an increase in the price of a dollar which means the dollar is stronger not weaker by about 8%.

The increased strength of the dollar explains about half of the 17% fall in the price of Brent Crude (from $100/b to $85/b).

The rest of the change is either a change in the supply curve or a change in the demand curve (or perhaps a bit of both).

I last did this examination several weeks ago and the explanation was then about half as well. If you understand DXY you’ll understand the yuan is not well represented and they are lot of oil involvement.

I phrased it at least half, but you also need to be aware that this is a spike. This is a huge short term move on the dollar. And you’ll find that Japan just made it even worse. The Yen crashed Friday (which means the dollar spiked even more).

This is not the way the world used to look. You had to have a country conquered to get currency moves like this pre 2008.

Big chunk of that population are not Saudis. Imports. Could be deported.

No they could not. No one is in Saudi who is not doing a job for the Saudis. If they sent all the expatriate workers home then they would have to shut down production.

Saudi Arabia does seem to have some slack considering migrants, they deported 4% (370,000) of their stated migrant population (9 million) in a period of 5 months up to March 2014.

Interestingly the final guardian article is dated October this year and has a link back to the first one I’m linking, the link description however has changed the figure from 250,000 to 2 million people deported.

I’m not saying that they’ll deport all their expatriate workers but it definitely appears big changes are afoot in KSA.

http://www.theguardian.com/world/2014/jan/22/saudi-arabia-deported-foreign-migrant-workers

The interior ministry said late on Tuesday that the foreigners had been residing in the country illegally and were in violation of labour laws. It did not elaborate.

The deportations began after 4 November with a nationwide campaign targeting many of the kingdom’s 9 million migrant labourers after years of lax law enforcement.

Not sure about the sources for this article http://www.ibtimes.co.uk/saudi-arabia-deport-one-million-people-anti-immigration-crackdown-1471035

Saudi Arabia is to deport more than one million people who live and work illegally in the kingdom.

The kingdom announced on March 2014 that it had deported over 370,000 foreign workers in the previous five months. Of these, thousands were Ethiopians, accused of having illegally crossed the country’s border through Yemen.

And one final article that popped up as I dug http://www.theguardian.com/world/2014/oct/17/saudi-supermarket-saudisation-women-workers

The public sector can no longer absorb the 200,000 young people leaving university every year, witness their 11.5% unemployment rate

Companies are now required to employ a minimum quota of local workers: 7% in building, 50% in insurance and 90% in banking

Ministry of Labour figures show that real progress has been achieved on Saudisation and jobs for women. The share of private sector jobs held by Saudis has risen from 7% to 16% since 2011

If the oil runs out, I don’t think exportation of foreign nationals will really be necessary. The Saudis will get taken out and shot and the place will go back to being called Arabia.Most of the foreigners will leave in a hurry.

Well, the news is out.

It turns out “sanctions on Russia” has a new meaning. It means “send them cash directly” without bothering to concern yourself with who is going to burn the nat gas you’re paying for. The EU and IMF appear to be paying Ukraine’s bill — both back billing and for billing in advance.

Now that’s how you surrender quietly.

NPR continues their hit job on Russia over Crimea.

But Russia holds all the good cards at the moment.

It will be interesting how long welfare for Willy Wonka and his gang of friends will last.

Dave,

Amazing how the RIGHT & LEFT now all BEND OVER for their corporate masters. Believe me you, I don’t think Putin is an angel. However, this strategy to destroy Russia will certainly backfire when PUTIN and CHINA finally say enough is enough.

steve

If you are a neoliberal economist, Russia is a wasteland.

If you are a reason based materialist, it is just the opposite.

Russia has a long way to go to become a well run country. That last thing it needs is more land. The Crimea is worthless compared to the vast stretches of the Russian steppes.

The Crimea was important in the 18th and 19th century. It isn’t any more. That the Russian government is ready to sacrifice its relationship to the outside world for the Crimea is a very bad sign –like the Serbian government’s attempted suicide over Kosovo, which was a big deal in the Middle ages.

Putin’s frets about the survival of the Russian language are understandable. Russian has crashed since the cold war ended. But he is just turning more and more people away from it by saber rattling. It’s hard to find anyone in Eastern Europe these days who admits to speaking Russian fluently. Grabbing the Crimea will make it even harder.

Wasn’t there something about a big gas find off the Crimea? If that is so, then Russia achieves 2 things. One, they gain access to that gas for themselves. Two, they prevent Ukraine from getting that gas and becoming independent of Russian gas. Any thoughts?

NAOM

I am pretty sure Putin’s motives are 90% nationalist here. The Crimea is a red flag for Russian nationalists. “Rescuing” the Russian diaspora in Eastern Europe and Central Asia is another huge thing.Putin has more or less said he considers himself president of all Russians, whether they live inside the current borders or not, and he aims to defend them.

I was in our Prague office last week and everyone I talked to was very annoyed and apprehensive. Nobody believes there are any motives except nationalism. Lots of WWII comparisons.

Probably nothing there.

Ilamb,

The headquarters of Russia’s Black Sea Fleet are in Sevastopol. This is not a minor matter to Russia.

Play time over?

http://cluborlov.blogspot.com/2014/10/putin-to-western-elites-play-time-is.html

Russia’s economy is bleeding to death. They have zero aggregate growth, inflation pushing 10% and a collapsing currency, plus the $20+/barrel miss in oil prices in their budget. They also will shortly have declining oil *production*, by their own admission.

There’s nothing to like over there.

Finally…. Someone who knows what the hell they are talking about.

Or maybe just words YOU agree with because you are an Obamabot

I have no idea what an Obamabot is… I am an American from Alabama.

However the Republican’s have been all over Obama for not doing more to support the Ukraine. The right, and Fox News, are staunch of their condemnation of Putin, putting down Obama at every turn for not acting firmer against Russia. The Ditto Heads blast Obama at every opportunity because he has not sent arms to the Ukraine.

I have noticed those who support Putin never miss a chance to condemn, not just Obama, but America’s every action anywhere in world. I will never understand this hate America campaign.

Wow, doesn’t it feel cool and sexy to call people names?

“Russia’s economy is bleeding to death.”

Measured in joules?

“They have zero aggregate growth, inflation pushing 10% and a collapsing currency, plus the $20+/barrel miss in oil prices in their budget.”

What’s Japan’s growth? Italy’s? France’s? Dare I say it . . . Germany’s? And you do realize Japan would love 10% inflation? Are begging on their knees for, please, 10% inflation?

What does collapsing currency mean? Measured in joules, I mean? How is the Ruble doing per domestic joule produced? How’s the Pound Sterling doing per domestic joule produced.

Is anyone starving in Moscow because of a change in price of barrels measured in dollars?

This is not the world of the past. That is all gone as of 2009. It’s never coming back.

Beside’s which, did Germany’s Reichsmark value vs the French franc matter at all in 1939 to who would be master and who would be slave? Japan’s yen in 1989 was hugely powerful. What did that matter to their future?

You either pump enough oil for yourself or you are at the mercy of those who do.

Yea, but the bankers and neoliberal economists don’t care about reality.

This is not the world of the past. That is all gone as of 2009. It’s never coming back.

So true, but most can’t even comprehend it.

But we will probably still using Russian Rockets to salvage what we can.

Or you go electric.

Oil is expensive, dirty and risky. It’s obsolete. Time to kick the habit.

There is nothing that is as portable as oil. Coal and natural gas are cheaper than oil but they are both fossil hydrocarbons. Oil will become obsolete when something cheaper takes its place. Nothing has. Oil is not a habit, it is necessary to help feed, clothe and house 7.2 billion people.

“There is nothing that is as portable as oil.”

Not really true – batteries work very well for 90% of transportation.

“Coal and natural gas are cheaper than oil but they are both fossil hydrocarbons. ”

Electricity from almost any source is cheaper than oil.

“Oil will become obsolete when something cheaper takes its place. Nothing has. ”

A Nissan Leaf is the cheapest car on the road to own.

“Oil is not a habit, it is necessary to help feed, clothe and house 7.2 billion people.”

There are no uses for which there’s no replacement.

Not really true – batteries work very well for 90% of transportation.

I would say that long haul trucks, ships at sea, riverboats pushing barges and aircraft make up far more than 10% of transportation.

Let me repeat, there is no form of energy as portable as liquid petroleum.

Yeah, I’m speaking too loosely. What I really mean to say is that those applications of liquid fuel that cannot be easily eliminated, might add up to roughly 10% of current oil consumption.

So, for instance, long-haul trucks will be mostly be replaced by rail, not batteries.

Long Haul trucks will be mostly NG

Hi Ron,

Ships can use coal, or biofuels, trains can replace long haul trucks ( though clearly this cannot happen overnight, but as oil prices go up gradually trains will replace trucks and will gradually be electrified.

You are certainly correct that petroleum is convenient, the question is how much we have to pay for that convenience, the more that oil prices increase, the fewer long haul trucks and the more that ships will conserve fuel by slowing down or switching to other forms of energy like coal or biofuels. There may also be less World trade in things like autos. Rather than ship cars built in Japan to the US, the Japanese will open factories in every continent and ship cars by land (on electric trains), though without much petroleum there will be fewer cars and a higher proportion of cars would be EVs.

Such a transition(and whatever form it takes) will by no means be easy, and it may not even be likely, but I do not think it is impossible. The sooner that mankind realizes that peak oil, followed by peak natural gas, followed by peak coal is a reality, the sooner we can get to work on the transition to more wind, solar and nuclear power, more electrified rail and light rail, and more high voltage DC transmission to upgrade the electric grid.

Long-haul trucks can easily be powered by overhead wires along the interstates, with only enough battery for local delivery. The overhead wires are already used for buses in some cities, e.g. Seattle.

Techsan, They could be switch to over head wires, but that is a huge infrastructure task and maintenance nightmare. Some traffic will go rail. But CNG will be a much easier and cheaper first step. EV’s and CNG Hybird EV’s for local deliveries. City buses have been doing it for years with almost twice fuel economy.

… and those overhead electric lines for the quite short-range buses in Seattle (one says “Mt. Baker” on it though certainly does not get as far as that mountain, while a diesel bus readily can) have delightfully high capital costs, usually requiring a fed grant or somesuch to be affordable, hence most of the bus fleet burning surprise of surprise, Carbon. Granted, Metro is mostly stuck trying to serve unservable sprawl, but that’s America for you. Maybe with the collapse back down to actually walkable neighborhoods and folks not coffined up in cars, there might be a few electric lines that can be maintained where there is demand for such? This, of course, assumes that road maintenance in the face of higher energy costs will remain affordable, versus the alternatives, such as letting the roads crumble, which they are doing a quite splendid job of at the moment.

Yep, most on this blog are like the Austrians in 1913 arguing who their next Hapsburg ruler is going to be.

We really need a larger box to view things.

The larger box of pre-emptive nuclear strike to suppress competing consumption seems to be . . . for some reason . . . more horrible than losing big chunks of one’s own population.

It’s very odd.

Well, I’m pretty confident that you’re not serious.

Still, it’s worth saying for other readers:

If Chinese consumers choose to invest in vehicles that are that are oil dependent, that’s their problem. Please note that the Chinese government is investing heavily in electric rail, and that more electric bikes are sold than gas-fueled cars.

Oil is an albatross. It’s obsolete. Competing to consume it is like competing to consume opium.

http://www.theglobeandmail.com/report-on-business/rob-magazine/why-the-oil-sands-matter-to-every-canadian/article21331322/

This is a rather long article that goes into much more depth and detail than most about the history. economics and politics of the Canadian tar sands industry and well worth reading.

The EIA must be a big place and nobody must talk to each other. In the graph AEO preliminary report, they have the Marcellus falling next year, by my eye balls, yet on today weekly gas report, they talk about the Marcellus being pipeline retrained, and link a wonderful spreadsheet itemizing how many projects are coming on line, starting from last week through to 2018.

http://www.eia.gov/todayinenergy/images/2014.10.15/EIA%20pipeline%20table.xls

Now there are going to be a lot of empty pipes with producers paying take or pay contracts or the graph above is a total miscalculation. We will soon find out, but it appears the AEO, thinks the Marcellus is going to run out and the Hainsville will need to grow to replace it? It doesn’t look right to me?

As we’ve discussed, all it would take is an oil-commensurate crash in NGL price to defund those fields.

Watcher,

NGL prices have crashed.

http://marketrealist.com/2014/02/low-natural-gas-liquids-prices-cut-wet-gas-producer-revenues/

They have only recovered some due to exports and the very cold winter last year. Most ethane is burnt as Nat gas as it is not worth while to separate it out and pipe it some where.

The Marcellus is producing cheap Nat gas, any NGL is cream, after seeing all the pipelines being built, the question is can the Marcellus support the whole USA nat gas market on its back. I feel it must break somewhere, but a lot of people have put a lot of money into take or pay contracts, so we are going to have to wait, but NGL is not the main story, it is just a little extra on the side.

toolguy, that’s a February article. The relevant crash would be just 3 months old, if NGLs are following oil (and I think they always have).

Hard to see how natgas pays the bills. I am pretty sure I read quotes about how wells would not be drilled if they were not expected to be wet.

Watcher,

You are very good at the short dismissive answers and no back up.

“I am pretty sure I read quotes about how wells would not be drilled if they were not expected to be wet.”

Don’t just think it show the proof.

The gas will be produced as those pipelines don’t get federal approval unless a market and a viable supply is proven.

Nah that wasn’t intended to be glib. Lemme find some of the quotes:

http://www.ogj.com/articles/2014/06/us-needs-ethane-export-capacity-to-sustain-shale-gas-boom.html

“Hopper said NGL production is propping up the economics of shale gas production.”

http://www.frackcheckwv.net/2014/06/27/critical-issues-for-marcellus-fracking-industry-not-environmental/

That link seems to flesh out the first:

“An unprecedented spread between oil and natural gas prices in the US has made NGL more valuable than dry gas, Hopper said. As a result, shale gas drilling in the US and Canada is predominantly focused on liquids-rich areas—notably the Marcellus and Utica shales.

Data from Baker Hughes Inc. show that drilling in dry gas shale plays, like the Barnett and Haynesville, has dropped off sharply in recent years due to weak US gas prices.

Hopper said NGL production is propping up the economics of shale gas production.”

Watcher,

The NGL helps in plays that are running out of sweet spots.

For the Marcellus it helps too, but Hughes analysis suggests there is plenty of room left in the Marcellus sweet spots.

Most of the other shale gas plays such as the Haynesville, Fayetteville, and Barnett are likely to be past their peak unless an increase in natural gas prices increase drilling rates in those plays.

“As a result, shale gas drilling in the US and Canada is predominantly focused on liquids-rich areas—notably the Marcellus and Utica shales.”

Watcher,

It looks like RBN energy reads this site, as today they have an article on the Marcellus /Utica and how it will effect Henry Hub.

They do make your note of wet gas producers being producing down to $2 mcf, but also state dry gas producers at $2.50 mcf. This was the point I was trying to make, it is not just the wet gas producers that can produce cheap Nat gas, and the fact that a mass of pipelines are due to open shortly, is likely to effect Henry hub. Note they even mention today’s, lower NGL prices.

https://rbnenergy.com/the-battle-for-henry-hub-ominous-implications-of-natural-gas-oversupply

“Today the opponents are Northeast gas versus gas from Texas, New Mexico, Oklahoma and North Dakota. And the productivity arms race has changed the battle plan. Many producers in Northeast Pennsylvania can profitably produce gas at prices less than $2.50/MMbtu. Many wet (high BTU, high NGL content) gas producers in Southwest Pennsylvania, West Virginia and Ohio can operate profitably at prices well below $2.00/MMbtu by selling higher value NGLs (even at today’s lower NGL prices).”

Actually NGLs may be a liability soon, if they can’t find a home for the ethane. In one of your references it mentioned the massive amount of ethane being rejected into the Nat gas stream and it was approaching the max BTU that is allowed. Once this limit is reached, ethane becomes very much like nat gas in the Bakken, the cost of disposal becomes greater than its use, and therefore it will have a negative value.

Once these pipelines start opening or reversing, then it will be time to see how good the Marcellus/Utica is?

The Bank of Japan just . . . it’s hard to provide a metaphor.

They will buy more bonds next year. 70 Trillion yen this year will become 80 Trillion yen next year. Their ETF buying (yes, equities in the Japan stock market) will be 3 Trillion yen next year.

At 110 yen to the dollar this is 727 billion dollars. $60 Billion USD per month next year. I believe at Bernanke’s worst he was at 80B/month and only 40 of those were US Ts. Japan’s GDP is less than 1/3 US.

So, we still think money . . . means what? That money is created from nothingness. The announcement moved the yen : USD just 1 penny. It all . . .means nothing.

At some point they will create enough money to crank up inflation unless they can figure out a way to destroy it at about the same rate it was created without killing the patient due to the withdrawal pains.

My gut feeling is that the economy in many places may now be as badly hooked on government handouts as any drug addict is hooked on herion.

What all this printing of money basically amounts to is that increasingly large parts of the economy are in fact as surely on welfare as any food stamp recipient with the only real difference being that it is make work welfare rather than just check cashing welfare.

This cannot end well.

75 Trillion?

http://www.bloomberg.com/news/2014-10-30/shadow-banking-grows-to-75-trillion-industry-fsb-says.html

This cannot end well. is a understatement.

The FSB, a global financial policy group comprised of regulators and central bankers, found that shadow banking increased most rapidly in Argentina, which saw a 50 percent jump, and China, where growth was more than 30 percent.

China tried reining in shadow banking last year realising what a risk it posed, their attempt promptly failed and caused a scare that another crisis may occur.

http://en.wikipedia.org/wiki/Chinese_Banking_Liquidity_Crisis_of_2013

The Chinese Banking Liquidity Crisis of 2013 was a sudden credit crunch affecting China’s commercial banks evidenced by a rapid rise on 20 June 2013 in the Shanghai interbank overnight lending rates to a high of 30 percent from its usual rate of less than 3%.

On 19 June 2013, instead of injecting additional funds and easing its monetary policy, China’s central bank People’s Bank of China (PBOC) told commercial banks to “make full use of incremental funds and revitalize stock options.

There were concerns even that the “massive, shady trade”[3] in over-the-counter credit could place China’s financial security and social stability, at risk.[3] By 2011 half of the loans in China were in shadow banking with no regulatory scrutiny.

Remember that the Shadow Banking system has to be looked at relative to total World Wealth which is $263 trillion, so about 28% of assets are in the shadow banking system. Note that half of the wealth is owned by the top 1% and the top 10% of wealthholders account for 87% of total World assets. In most cases the Shadow Banking system is debt held by wealthy people that is owed to other wealthy people.

http://www.theguardian.com/business/2014/oct/14/richest-1percent-half-global-wealth-credit-suisse-report

In most cases the Shadow Banking system is debt held by wealthy people that is owed to other wealthy people.

That’s a big reason why I think we can work around debt non-repayment. Much of the wealth appreciation in the world today is driven by trading back and forth among the wealthy. They own stocks, they own art, they own expensive homes. These things are considered wealth because other wealthy people are willing to buy them. If there were no market for them, that wouldn’t necessarily impact the 99%.

Think about it. Wealthy individuals and wealthy corporations aren’t really investing much right now to create industries and jobs. They are focusing on wealth accumulation. So it isn’t like the world economy is booming and if they would redraw the capital, everything would crash. They have already been withdrawing capital, so that’s the way we are going already, I don’t think debt or lack of it would impact all the people in the world who don’t have it already.

Except that they have monstrous homes (7,000, 10,000, 20,000 square feet) that are heated and air conditioned, they fly in private 737’s (and they fly a lot), they own collections of dozens, if not hundreds of cars…they need that money to buy all the fuel they’re using, and the real estate and other property they own is priced to reflect the energy it took to build it.

They aren’t accumulating it- they’re spending it.

-Lloyd

they own collections of dozens, if not hundreds of cars…they need that money to buy all the fuel they’re using, and the real estate and other property they own is priced to reflect the energy it took to build it.

They can only drive one car at a time. Those collections of cars aren’t using fuel. They are sitting in a garage. Similarly, the wealthy are only in one house at a time. Their other homes aren’t using much energy because they are empty.

The wealthy consume far less than if that wealth were spread around to the middle and lower classes. From that perspective, having a few very wealthy people and lots of poor people is better for the environment because it significantly reduces global consumption.

Lloyd, I answered as if you were serious. But it just occurred to me that maybe you were kidding.

Boomer: it takes a lot of energy to make a cubic foot of concrete: more and bigger houses, more energy consumed, or more embedded energy purchased. Not to mention the mansions that are torn down and rebuilt because the owner only wanted the lot (afraid I used to read Vanity Fair a lot…)

Houses have to be climate controlled to avoid mould, warping, etc. I don’t think the super-rich are pinching pennies and letting those oil paintings on the wall degrade and the floors buckle; this can happen in cold or hot climates. Every square foot they own is 70 degrees. Unless they’re going bankrupt.

The embedded energy in a collection of cars is enormous.

Those cars are frequently in climate controlled storage, and there was an article in Wired today about how expensive cars from the Middle East are transported to London when the owners visit. (http://www.wired.com/2014/10/best-london-neighborhoods-spotting-supercars/) My guess is that they fly them there.

This article (http://www.dailymail.co.uk/news/article-2283321/A-rare-glimpse-opulent-world-super-luxury-private-jets-like-Jackie-Chans-dragon-plane-princes-flying-palace-Donald-Trumps-100-million-ride.html) gives us a peek inside the private 747 of Prince Al Waleed. I’m pretty sure that even with his entourage included, they are using dozens of times the fuel even a business class passenger uses. And consider that this thing is not a hangar queen- he bought it because he uses it. So he flies much more than the average person, and he uses exponentially more fuel each flight. Oh, and he has a few other planes as well.

We are using up all the oil we produce, and if you read this blog, you should realize we are producing essentially all the oil we can produce. It will all be used whether the poor use it or the rich use it. The rich are not doing us a favour by using up all the oil to save us from ourselves. They are using that oil because they want the Bentley in Los Angeles by Tuesday. Simple as that.

-Lloyd

So you are serious.

The consumption by the wealthy is in no way comparable to using that same wealth to provide basic living for millions of people.

As the 99% in this country get poorer, what the wealthy are spending will not drive the economy if the economy is based on consumption. Like I said, the wealthy are doing their part for the world’s environment. Fewer cars purchased and driven. Less energy use in homes. Smaller homes lived in. People are downsizing because they don’t have the money. Now, I suppose we could encourage them all to take on debt again, but then we’re likely to have another boom-and-bust.

Here, this is what I am talking about.

https://en.wikipedia.org/wiki/Marginal_propensity_to_consume

MPC and nature of country

The MPC is higher in the case of poor than in case of rich people. When a person earns a higher income, the cost of their basic human needs amount to a smaller fraction of this income, and correspondingly their average propensity to save is higher than that of a person with a lower income. The marginal propensity to save of the richer classes is greater than that of the poorer classes. If, at any time, it is desired to increase aggregate consumption, then the purchasing power should be transferred from the richer classes (with low propensity to consume) to the poorer classes (with a higher propensity to consume). Likewise, if it is desired to reduce community consumption, the purchasing power must be taken away from the poorer classes by taxing consumption. The marginal propensity to consume is higher in a poor country and lower in the case of rich country. The reason is same as stated above. In the case of rich country, most common of the basic needs of the people have already been satisfied, and all the additional increments of income are saved, resulting in a higher marginal propensity to save but in a lower marginal propensity to consume. In a poor country, on the other hand, most of the basic needs of the people remain unsatisfied so that additional increments of income go to increase consumption, resulting in a higher marginal propensity to consume and a lower marginal propensity to save. This is the reason MPC is higher in the underdeveloped countries of Asia and Africa, and lower in developed countries such as the United States, the United Kingdom, Singapore and Germany.

I’ll have one more go at this, Boomer; meet me at the bottom.

-Lloyd

Sigh. Old normal thinking.

It Doesn’t Have To Mean Anything. Whatever has to be done . . . not to fix the problem . . . but to merely keep the wheels turning will be done. Anything. No limits.

Money supply growth is supposed to reflect the needs of a growing economy. This is why gold has no function anymore. Money supply cannot be limited to gold supply that has no connection to population gain or GDP gain. If a few tons of gold were put on a rocket and launched into the sun, you cannot allow that to shrink the economy.

And this is the reality of old normal vs new normal. Money supply no longer reflects anything but CB flailing. It should not be discretionary. It is not supposed to be a tool for dictating economic behavior. It is supposed to reflect, not define. The tool for managing (what is supposed to be free markets) is interest rates. What destroyed that was getting to 0% and realizing destruction was continuing. So Bernanke decided . . . about 6 weeks before a prez election, that he would uncork $80 billion/month of new money.

As for the “At Some Point” meme, not a believer. They will do anything. They will frame people for rape (Dominique Strauss Kahn), they will interfere in national elections (Greece), and they will keep printing and manage yardsticks to define prices.

Oil is the only thing that can stop this. Nothing else.

Dave & Farmer Mac,

The markets today are totally INSANE. Just look at the Dow Jones… at another ALL TIME HIGH…LOL. And if that isn’t crazy enough, the Japanese Nikkei had to be halted last night as it reached its daily limit. For pete sakes, you can’t make this stuff up.

The broader stock markets today are nothing more than RIGGED CASINOS to keep the poor PAPER MACHE INVESTOR SLOBS invested in a financial system whose life expectancy is growing shorter each and every passing day.

Ironically, CNBC viewership is at an ALL TIME LOW as the DOW is hitting new records. Looks like the BS Propaganda Machine is losing some creditability.

God Hath A Sense Of Humor…..

Oil just dropped to $79.xx.

Some reasonable people, one would think, will ask . . . why is Japan doing this? Abe and Kuroda said things would going great.

Maybe none of it is working.

Yesterday, the North Dakora light priced 66 $/bbl. Today, probably lower:

http://hotlineprinting.com/oph/index.html

See also here for the current nasty (oil) rail economics:

https://rbnenergy.com/under-pressure-narrowing-crude-differentials-squeeze-bakken-rail-economics

Therefore, I am very skeptical about future oil production from Bakken.

Actually, we do not have to wait much to know who is right: the next 2-3 years will be crucial, and already next summer/winter will give some important indications, since some models expect the Bakken to reach its maximum oil production in the summer 2015.

Dean,

Those links are great thanks.

Bakken at $65.72 on Oct 31.

Another good RBN article is

https://rbnenergy.com/netback-netback-to-where-you-started-from

Where prices stand today, Bakken producers would get there best price by using pipelines to get their crude to Cushing (transport cost of $9/b) or the Gulf coast (transport cost $11/b).

With WTI around $80/b and assuming a $2/b discount for Bakken crude a producer can net $69/b by shipping their oil to Cushing rather than selling at the wellhead. If the Louisiana Light Sweet(LLS) oil price is more than $2 above the WTI, then the “netback” oil price will be higher for Bakken producers if they ship by pipeline to the Gulf Coast.

Based on this information, the average Bakken well producing 320 kb over a 23.5 year life needs $58/barrel at the wellhead to breakeven, this is equivalent to a WTI oil price of $69/b.

Chart below reflecting a new scenario reflecting $11 for transport and Bakken discount with WTI oil prices starting at $80/b, remaining flat until August 2015 and then rising 1.8% per year until 2040, reaching $125.40 (2014$) in August 2040. Well cost is assumed to be $9 million (2014$) and is unchanged over the 2014 to 2037 period (when drilling stops at 31,500 wells).

Thanks for the interesting update!

D.

Hello,

I have a Bakken “Red Queen” update up at Fractional Flow

Growth in Global Total Debt sustained a High Oil Price and delayed the Bakken “Red Queen”

Haven’t read that yet, Rune, but I am about to. Wanted to pontificate a thought first.

If shale is destroyed by low price and NoDak evacuates and leaves tons of trash and open holes behind, my previous theory was that would be forever. The HY (junk) bonds that have been funding things will default and the lenders will be burned.

So . . . if the oil price then rises again and the industry wants to ramp up, I have been thinking those junk lenders will not be interested in another burn experience and there would be no money available for the drillers.