OPEC December Crude Output Falls to 2-Year Low: Survey

Venezuelan Policies

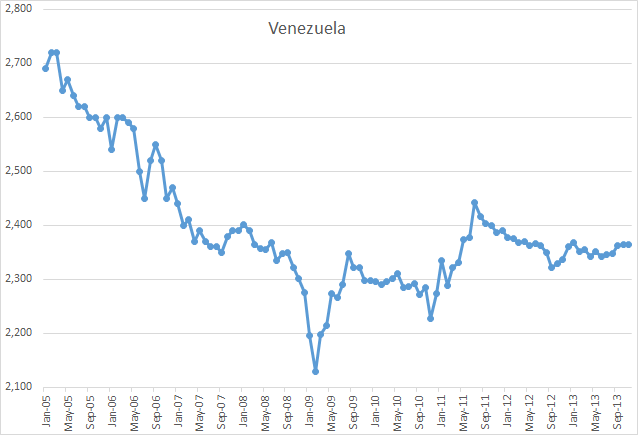

Venezuelan production dropped 235,000 barrels a day to 2.45 million this month, the survey showed. The South American country pumped the least crude since October 2011. Resources have been diverted from energy sector into social welfare programs, sending production lower.

Petroleos de Venezuela SA, the state oil company, was purged after a two-month oil strike intended to oust President Hugo Chavez from power in 2003. Nicolas Maduro, who became president in March when Chavez died, has continued his predecessor’s policies.

“It’s hard to see how the situation in Venezuela gets any better,” said Bill O’Grady, chief market strategist at Confluence Investment Management in St. Louis, which oversees $1.4 billion. “Funds have been used to prop up the government instead of maintaining the oil industry since the PDVSA strike in 2003. It’s clear the country is on an unsustainable path.”

Data for the above graph is from the latest OPEC MOMR published last month and includes data through November 2012. It has Venezuela crude only production at 2,364,000 bp/d in November so it differs considerably from the Bloomberg report above. That report may be using production reported by Venezuela themselves which they reported as 2,854,000 bp/d for November or 490,000 kb/d above what the OPEC MOMR’s “secondary sources” said they produced.

From the same Bloomberg link above:

Libyan Unrest

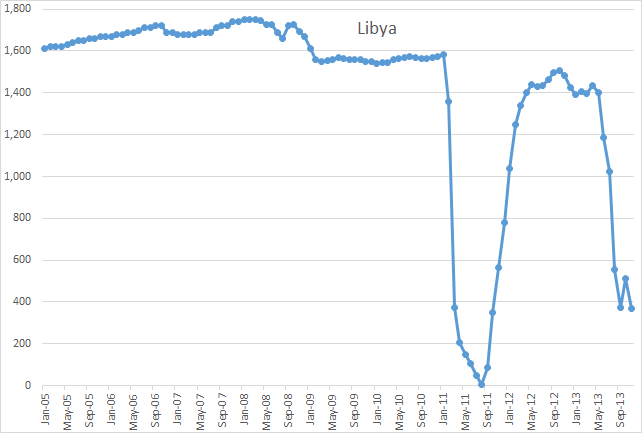

Libyan output was unchanged 210,000 in December, the lowest level since September 2011, the survey showed. Production averaged 1.28 million barrels a day in the first six months of this year before tumbling, according to data compiled by Bloomberg. Two years after the war that swept the late Muammar Qaddafi from power, government efforts to revive the oil industry are being stymied by feuding militias and protests.

“Several producers are benefiting from the Libyan production outages,” said Tim Evans, an energy analyst at Citi Futures in New York. “There are higher prices because of Libya’s problems and other producers are also able to increase market share at the Libyans expense.”

The OPEC MOMR showed Libyan crude only production 371,000 bp/d in November, a considerable difference from the 201,000 bp/d that Bloomberg reports.

Crippled Kashagan oil project a bureaucratic ‘nightmare’

Giant Kazakh oilfield Kashagan, which was brought to a halt by leaks shortly after start-up last year, is grappling with a bureaucratic “nightmare” on top of its engineering troubles as it strives for commercial production in 2014…

Kashagan has cost an estimated $50 billion so far, five times early projections, and its 13-year life is a tale mostly of delay.

The above chart was created with the latest data from the EIA. The EIA seems to have put world oil production on the back burner. Their latest update was for July 2013. All data on these charts are in kb/d.

Of course Kashagan will eventually come on line, perhaps late this year. But it is unlikely to be nearly the bonanza they expect it to be.

UPDATE: Back on November 19th I quoted the IEA World Energy Outlook on whether those OPEC claimed massive “proven” reserves actually exist or not. They said:

Indeed our special study of Iraq in WEO-2012 confirmed that, at least for Iraq, the reported reserves correspond to oil that is clearly there, as demonstrated by the plateau production commitments taken by large international companies with access to the detailed geological information about the fields. Given what is known about the regional geology, the reserves reported by Iran, Saudi Arabia, Kuwait and the United Arab Emirates are reasonable, in a 2P sense, compared to those of Iraq.

Got that? The companies bid on those contracts so they knew something that we do not because they had access to detailed geological information of those fields that we do not. And from a headline today:

Iraq Nears Deal on Oil Output Targets

Iraq’s oil minister said Tuesday the country is close to agreeing to sharp cuts with major Western oil companies in production targets set out for them at some of its largest oil fields, casting doubts over Iraq’s ambitious oil output targets…

And the article goes on to address those lofty crude oil output goals that have so excited cornucopian prognosticators:

Those goals have long been taken with a grain of salt in the oil industry, with many analysts long expecting Iraq to lower them to more realistic levels.

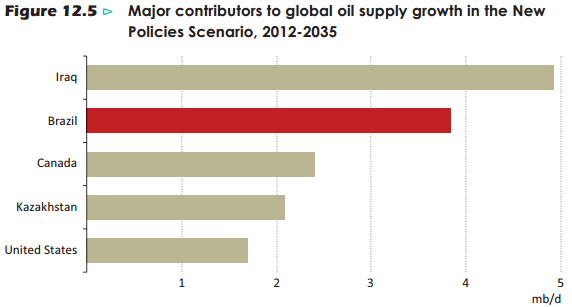

The article does state that analysts still think Iraq can dramatically increase their oil output. I believe however that those are some of the same analysts that predicted, along with Iraqi politicians, that Iraq could increase production to 12 million barrels per day. And the IEA still expects great things from the Iraq. From the IEA’s WEO 2013:

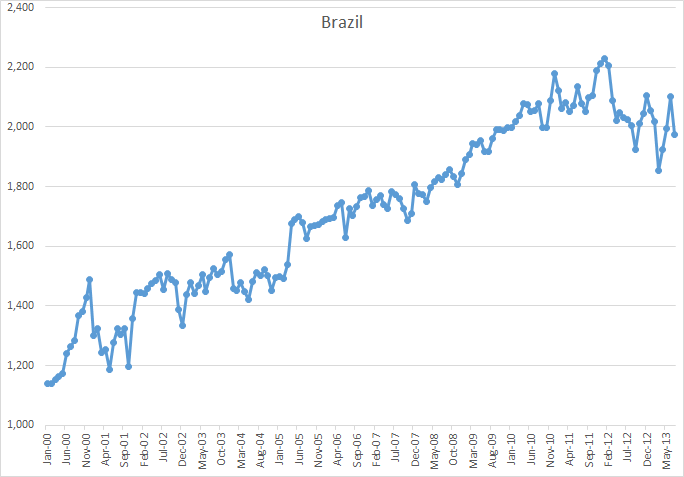

Notice that Iraq and Brazil are the two places where they expect the greatest amount of crude oil increase to come from. But Brazil, like Iraq, is having a very hard time living up to expectations. A couple of recent headlines. First October:

Brazil October Crude Oil Output Falls on Lower Pre-Salt Output

And then November:

Brazil Petrobras Crude-Oil Production Slips 0.1% in November

Again, this data is from the EIA which has updates only through July. But it is obvious that Brazil is not going to live up to the IEA’s expectations. That great pre-salt bonanza is proving to be extremely expensive and like the deepwater GOM it will have a very high decline rate.

One by one, the “white knights” who were expected to save us from peak oil are failing to deliver. The U. S. appears to be the major, if not only, exception. Just got through reading Greer’s “Not the Future We Ordered”. A bit heavy going but the message is clear — we (as a society) will continue to look for reasons to debunk Peak Oil because we can’t resolve the cognitive dissonance between our desire and belief in BAU and the obvious fact that oil is a finite resource. I expect more white knights, such as David Frum’s recent contribution. He expects that PEMEX will throw off the stultifying government bureaucracy and let American oil companies come to the rescue, turning their oil production around and disproving peak oil once and for all! Because, after all, they are Mexicans and can’t possibly produce oil the way Americans can.

Yeah! And if that doesn’t work out, there will be something else.

Mexico is basically a failed state, if everything I have read lately has any truth to it. The corruption is rife, and I would expect that if more Pemex developments are privatized, it would simply foster more corruption.

Question for industry folks. What would your reaction be if you had a relative who was offered a job in Iraq? Is it safe for foreign workers?

Thanks in advance. Paulo

Paulo,

I have not been there, but from a few people I have spoken to who have, security is still a major concern. One Brit expat working on the Chinese operation, was telling be they use APCs to transport them into Basra for their visa extensions.

Another person, a christian Malay, was not happy to go back due to security, though a Muslim Malay who was direct employ by the oil company didn’t have any problems, though he did comment on the tight security.

So would I go there? As a white christian, no, as I feel you are too much of a target. If I was a better fit into the local community, it maybe a little different.

Have I heard of any trouble in the oilfield? No I have not, so maybe my fears are a little an over reaction, but the way I see it, I don’t need to go to Iraq to find work, so why go there. Your family member may not have the same options.

Nigeria on the other hand, I have personally spoken to about more than 5 people that have actually been kidnapped, which i see as real danger, so Nigeria is also off my list.

I worked in Angola while they were still having their little civil war, but the oil fields were not the target and therefore I considered safe enough to work there, so I am not afraid to go to less desirable places. Iraq, may turn out the same, but who knows. I would want to be getting a pretty good premium for the risk even to consider it.

At the end of the day it is a personal decision, so I hope he makes a correct one.

I’ve driven the total length of Mexico several times, and other than the occasional blood in the street, and dealing with checkpoints and AK’s, if you are reasonably street smart, you are OK.

Nothing like Columbia or El Salvador, where one steps oven another line.

Never been to Iraq.

Read the Kashagan article very early this morning from Yahoo. Quite surprising in its quality from the usually gung-ho Yahoo reporters. It’s worth the time.

Someone on The Oil Drum once noted that the nickname for Kashagan is “Cashisgone.”

I strongly doubt either the Venezuelans or the Mexicans will be able to straighten out their troubles within the foreseeable future, barring a miracle of the political and cultural sort.

Such miracles do occasionally come to pass , however, and a decade from now oil production might be on the upswing in either country.A dictator could come to power in either country and turn the oil situation around if he is strong enough to force the necessary short term austerity measures on his people in order to strengthen the country over the long term.

But such as upswing won’t be even remotely enough to offset the ongoing decline in production in other countries.

If I were an Oil exec using my own or my own companies money, I wouldn’t invest a dime in either country without an implicit guarantee from Uncle Sam to send the Marines to protect my investment from nationalization; and we all know how well that sort of thing has worked out historically, don’t we?

I think we may be at the point that the plateau in global world oil production is about to take an easily discernible down turn, if not right now, then within the next year or two.

If this is the case, and I were working at the IEA or the EIA I wouldn’t have enough sense to keep my mouth shut. I would do the right thing and publicize the truth, and get fired.

I’ve been doing that all my life one way or another , and it has a lot to do with the fact that I have to drive raggedy old cars and trucks and work on them myself rather than shiny new ones under warranty.People who don’t go along don’t get along.

But my supply of beans and sidemeat is safe so long as I can continue to work a little on the farm.;-)

No realist should expect such agencies to do otherwise than to downplay any bad news on the energy front to the extent they can get away with doing so.

It is hard not to conclude that the EIA real doesn’t want to discuss anything but Shale, oh and Canada. Or at least delay any news of other producers until there is a turn around (any moment now!…..).

They will have to shut up shop entirely when Shale starts its secular decline.

Given what is known about the regional geology, the reserves reported by Iran, Saudi Arabia, Kuwait and the United Arab Emirates are reasonable, in a 2P sense, compared to those of Iraq.

Wonder if the IEA went through a number of iterations to get the desired wording for this sentence. Relative to each other, the reserve are reasonable because all the above countries including Iraq exaggerate their reserves by the same factor (roughly 3).

Iraq has other problems besides diminished reserves:

I guess the militants are winning. If so or if not there will be greater violence.

Iraq was supposed to supply 12 mbpd as promised a couple of years ago; no way, Jose. Add the 18mbpd expected by IEA from Saudia not long ago … that isn’t going to happen, either.

http://www.peakprosperity.com/forum/82967/prediction-saudi-pretty-much-out-oil

South Sudan should be taken off the board:

http://www.cnn.com/2013/12/23/world/africa/south-sudan-violence/

http://www.skynews.com.au/businessnews/article.aspx?id=938510

Meanwhile, we are stuck with an economy that only functions to sell cars.

An excerpt from my article on the outlook for the US becoming a net oil exporter:

http://www.resilience.org/stories/2013-06-10/commentary-is-it-only-a-question-of-when-the-us-once-again-becomes-a-net-oil-exporter

For a concrete example of how the Export Capacity Index (ECI) concept works, consider two countries that are widely considered to be critically important sources of future crude oil production: Brazil and Iraq. If we extrapolate the 2008 to 2012 rate of decline in Brazil + Iraq’s combined ECI ratio (the ratio of liquids production* to consumption), they would collectively approach zero net oil exports in about 20 years.

Given Brazil’s status as a net oil importer in 2012, even if we count biofuels, it’s instructive to consider what the conventional wisdom was just a few years ago regarding Brazil. In April, 2009 Bloomberg published a column discussing the prospect for Brazil continuing “to take market share away from OPEC.”

We should keep case histories like this in mind when we read in the media about the “Fact” that the US will soon be a net oil exporter, and while there are always uncertainties in forecasting future trends, we can be certain of three objective facts: (1) All oil fields, sooner or later, peak and decline; (2) Global crude oil production is the sum of discrete oil fields that peak and decline and (3) Given an ongoing production decline in an oil exporting country, it is an mathematical certainty that unless domestic consumption in that oil exporting country falls at the same rate as the rate of decline in production, or at a faster rate, the resulting net export decline rate will exceed the production decline rate and the net export decline rate will accelerate with time.

*EIA data, production = total petroleum liquids + other liquids (mostly biofuels in the other liquids category)

Energy Matters Global Oil Supply Update July 2013

Hi Ron, a happy New Year to you. I’ve updated global oil supply stats. E

Global conventional crude oil and condensate production has been following a bumpy plateau just over 73 million barrels per day since May 2005.

All growth in liquids supply since May 2005 has come from natural gas liquids (NGL), unconventional oil and biofuels which together with refinery gains now amount to 17.4 million barrel per day providing a total global liquids supply of 90 million barrels per day.

PS – the IEA have Libya on 220,000 bpd in November. Something needs to be done about the EIA – maybe higher taxes in the USA might help 😉

Hi Euan,

I think you are not a fan of carbon taxes, but I think that would help along with removing subsidies for roads, oil, natural gas, coal, nuclear, and renewable power so that all were playing on a level pitch. In addition, any externalities (including carbon dioxide) should be taxed. Another option is not to worry so much about government deficits when there is so much unemployment, unfortunately politicians on both sides of the pond seem to have forgotten the lessons of J.M. Keynes. None of these things will happen in the United States until a crisis is reached (around 2018 would be my guess.)

I was curious how you define conventional crude plus condensate, there are many different definitions used, it seems that maybe you consider only the oil from oil sands and the extra heavy from the Orinoco as unconventional, is that correct?

DC

Sorry Euan,

I have now read your post (which is excellent as usual). Question answered:

From the Energy Matters Blog:

Note that Euan is including refinery gains as part of C+C production, if it were me I would have left this off of a C+C chart, in most cases refinery gains are part of an “all liquids” chart which includes things like wax, asphalt, road oil, and ethane which are not really part of the energy supply. Also it would be better if these were reported by mass rather than volume and best if reported in BTU or Joules.

I agree 🙂

Regarding taxes, oil production in the UK pays a hefty royalty to the State when it leaves the ground. The production companies then pay hefty tax on their profits and gasoline is taxed extremely heavily – a fuel duty and VAT.

Regarding renewable electricity in the UK (and much of Europe) companies are not subsidised but there are levies that consumers must pay to renewables producers. Best not get engaged in a too detailed discussion of this here.

The system of taxes and levies and price guarantees has become so complex, it will be incredibly difficult to level the playing field.

Hi Euan,

Ron gives us plenty of latitude to discuss any topic related to energy. You are very knowledgeable and I am interested in your views. I agree that the tax situation is complex. I am not familiar with the UK system. In the US fossil fuels are given a lot of tax breaks and most of the roads are built at taxpayer expense. All of these are subsidies for fossil fuels, nuclear power has a big insurance subsidy. Many people complain that wind and solar should receive no subsidy, that is fine as long as all fossil fuel subsidies are eliminated. Even if one argues that climate change will not be a

problem or is not anthropogenic, it still makes sense to raise the price of fossil fuel so society can wean itself.

dc

http://canadafreepress.com/index.php/article/60236

Talking of subsidies the e.u is trying to get the uk to cut it’s wind and solar subsidies. The reasoning being that they are now mature industries and can stand on their own.

The following article has a very interesting graph, showing Gross Total External Debt, as a percentage of GDP, for 22 advanced and for 22 emerging economies. Note the huge increase in the ratio for advanced economies, starting around 2002. I couldn’t help but notice the correlation to my GNE/CNI* ratio charts:

GNE/CNI Ratio* Vs. Annual Brent Crude Oil Prices: http://i1095.photobucket.com/albums/i475/westexas/Slide1_zps5f00c6e5.jpg

GNE/CNI Ratio* Vs. Total Global Public Debt: http://i1095.photobucket.com/albums/i475/westexas/Slide2_zps01758231.jpg

GNE/CNI Ratio* 2002 to 2012, with 2005 to 2012 rate of decline extrapolated to 2030:

http://i1095.photobucket.com/albums/i475/westexas/Slide1_zps9ff3e76d.jpg

*GNE = Combined net oil exports from top 33 net oil exporters in 2005, EIA data, total petroleum liquids + other liquids CNI = Chindia’s net oil imports

Telegraph Article: Debt burdens in developed nations have become extreme by any historical measure and will require a wave of haircuts, warns IMF paper

http://www.telegraph.co.uk/finance/financialcrisis/10548104/IMF-paper-warns-of-savings-tax-and-mass-write-offs-as-Wests-debt-hits-200-year-high.html

Excerpt:

“The paper says the Western debt burden is now so big that rich states will need same tonic of debt haircuts, higher inflation and financial repression – defined as an “opaque tax on savers” – as used in countless IMF rescues for emerging markets. “The magnitude of the overall debt problem facing advanced economies today is difficult to overstate. The current central government debt in advanced economies is approaching a two-century high-water mark,” they said.”

My comments:

What I define as Available Net Exports (or ANE, i.e., GNE less CNI) fell from 41 mbpd (million barrels per day) in 2005 to 35 mbpd in 2012. While there has been a rebound in US consumption, there is some question about how accurately the EIA is accounting for product exports in the short term, but in any case I would argue that the dominant post-2005 pattern, at least through 2012, was that developed net oil importing countries like the US were gradually being forced out of the global market for exported oil, via price rationing.

To the extent that we have seen a rebound in the US economy and in US oil consumption, it’s important to remember how many trillions of dollars in deficit spending we have seen in recent years (largely financed by the Fed).

I think that the fundamental reality we are facing is that we are in the middle of a relentless transformation from an economy focused on “Wants,” to one focused on “Needs.” But governments in developed net oil importing countries refuse to acknowledge, or are incapable of acknowledging, this transformation, and they are desperately trying to keep their “Wants” based economies going via increased deficit spending, despite the post-2005 decline in the volume of Global Net Exports of oil available to importers other than China & India.

Debt as a percentage of GDP chart:

http://i.telegraph.co.uk/multimedia/archive/02779/Chart1_2779973c.jpg

Jeff,

Nice chart. There’s another factor we need to take into consideration. Ron gives us a little latitude here to discuss different topics. However, I believe Energy & Finance are actually interwoven.

That being said, as the advanced countries Debt to GDP increase significantly, the Chinese are buying gold hand over fist. Even though the Western MSM believes gold is a barbarous relic, the Elite Bankers know different.

This can be seen by the Chinese Gold imports from Hong Kong chart below:

http://goldsilverworlds.com/physical-market/china-imports-an-impressive-116-4-tonnes-of-gold-in-july-2013/

Furthermore, of the top 5 gold producing countries in the world, Russia & China now produce more gold than Australia, U.S. & Canada:

Estimated 2013 Gold Production (tonnes)

Russia = 234

China = 430

Total East = 664

Canada = 125

United States = 234

Australia = 265

Total West = 624

To supply China’s insatiable demand for gold, the United States has exported a record amount to Hong Kong & Switzerland in the first nine months of 2013, shown in the table at the link below:

http://srsroccoreport.com/wp-content/uploads/2013-U.S.-Gold-Bullion-Exports-Table.png

The U.S. has exported 176 tonnes of gold to Hong Kong and 131 tonnes to Switzerland from Jan-Sept 2013. The majority of the Swiss gold heads to Hong Kong.

The reason why I bring this up because the Chinese have now purchased JP Morgan’s 6 building complex in Manhattan with the largest private gold vault in the world.

Rumors floating around my group in the precious metal community is that there will be a global currency reset in 2014. Basically, the global currencies will be devalued against gold. It also looks like the U.S. Dollar will have two different 30% devaluations.

It will be interesting to see if this does occur. However, if it does, there will be no warning as itt will take place virtually overnight.

steve

http://www.amazon.com/Immoderate-Greatness-Why-Civilizations-Fail-ebook/dp/B00AVBHKEM/ref=sr_1_1?ie=UTF8&qid=1388789295&sr=8-1&keywords=william+ophuls

JB, that’s a link to William Ophuls book, ‘Immoderate Greatness’, Why Civilizations Fail. Not very long – finished it one read through.

You wrote above; “But governments in developed net oil importing countries refuse to acknowledge, or are incapable of acknowledging, this transformation, and they are desperately trying to keep their “Wants” based economies going via increased deficit spending,…”

Paraphrasing from his book, he writes to the effect that those with the most to lose (wealth) and with power or influence on power do not change course because it threatens their status, their position at the top. Also of political intransience and debasing their currency. He’s a great writer. This book explains a lot about our current situation as a repeat of other civilizations that went bust, and of human nature.

@ tool push

Thank you for your input re safety. I will forward your comments on to my son. A father’s worries are never done, even if their kids are 30 years old!!

Paulo

This question is a bit far afield for now.

But does anybody know how much potential crude oil storage space is available in this US?

I’m referring to places such as worked out salt mines and old oil fields which are used for storage of the Strategic Petroleum Reserve.

I think that there is a substantial long term possibility that actual crude oil production will fall to the point it must be stockpiled for processing for seasonal use in the same way that natural gas is currently stockpiled for winter use.

I know very little oil is used to generate electricity out side the Middle East, and that the use of oil as a heating fuel is declining , but nevertheless there are some serious seasonal peaks associated with agricultural use and summer travel . Existing tank farm storage might be inadequate to meet such seasonal peaks without refineries operating at full capacity during the peaking season.

Once peak oil has definitely arrived, some refineries will shut down for good and it may be be necessary to stockpile a lot more finished gasoline and diesel than in previous times.

Agricultural demand won’t fall off much if at all but summer driving may of course take a big enough hit that stockpiling won’t be a problem.

I imagine tank farms are very expensive to build and that investors will be reluctant to pay for therm, given the probability that by the time it’s obvious they are needed, there won’t be much to put in them in another decade or two.

This is a potential future problem very much like the one the tight oil folks have with transportation. Nobody will pay for the pipelines they need because they expect the need for such pipelines to disappear before the pipelines turn a profit.