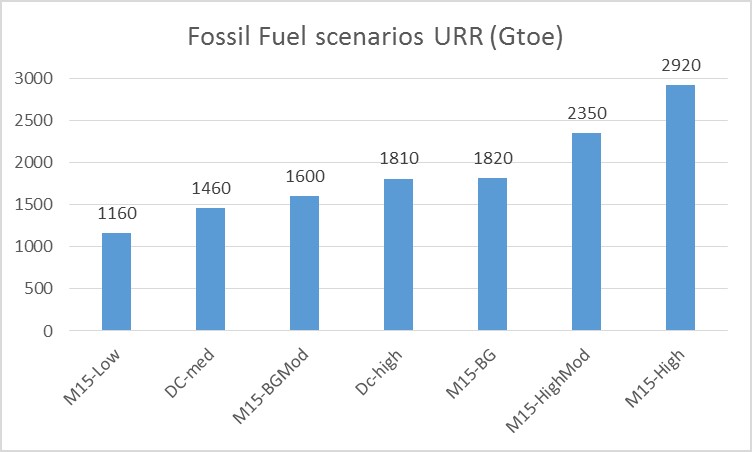

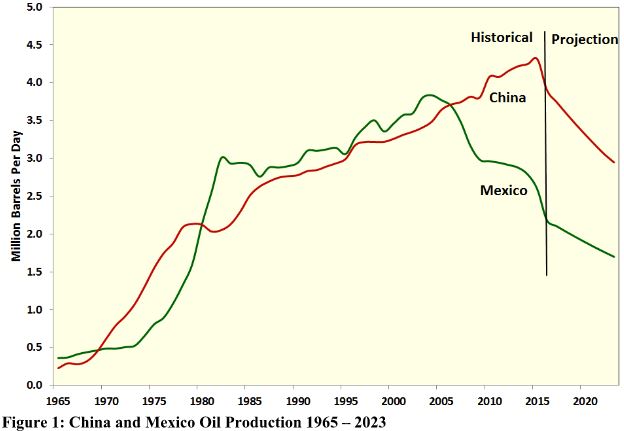

Oil output (crude plus condensate or C+C) is likely to peak by 2020 (or may have peaked already in 2015 or 2016). Electric Vehicles (EVs) and Plugin hybrid electric vehicles (PHEVs) may allow about 40% of current oil consumption to be substituted with electricity, under the simplifying assumption that the use of oil based fuels in PHEVs is minimal due to high oil prices. It is assumed here that high oil prices are the likely result of the decline in oil output. I have modified my medium oil scenario with slightly higher extraction rates, shown in the chart below.