Comments related to oil and natural gas in this thread please.

Any Non-Petroleum comments should go under the Electric Power Monthly post below. Thanks.

Comments related to oil and natural gas in this thread please.

Any Non-Petroleum comments should go under the Electric Power Monthly post below. Thanks.

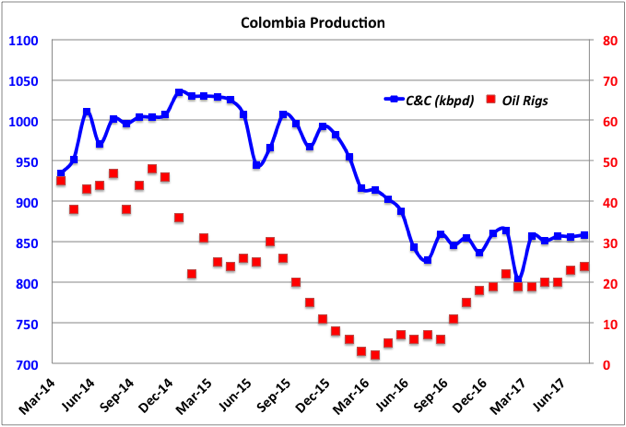

Colombia production is holding a plateau over the past year after a large decline in the last part of 2015 and first half of 2016. August value was 858 kbpd (down 0.04% y-o-y).

Colombia oil reserves at the end of 2016 were 1.66 Gb (down 16.8% from 2 Gb in 2015 which followed a drop from 2.31 Gb in 2014). At the average 2016 production rate of 885 kbpd this gave an R/P of 5.1 years, the lowest for any significant producing country. Most of their production is heavy oil. Ecoptrol, which accounts for more than three quarters of Colombia’s crude and natural gas reserves and output, estimated about 45% of their decline was due to the “pronounced fall in oil prices”. Read More

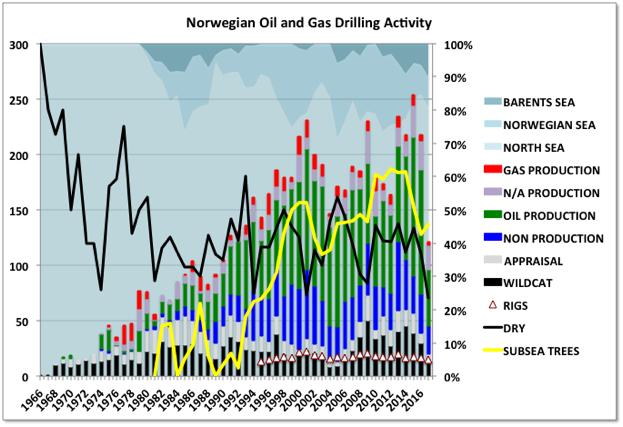

Norwegian oil production peaked in 2000 to 2001; gas production may be peaking about now. Oil hit a low in 2013 and then recovered towards a new local peak, probably concurrent with the gas.

The most surprising thing I find with their industry is that the drop in oil price made almost no difference the drilling activity shown here (all data here and below taken from the NPD – Norwegian Petroleum Directorate – which provides more data than just about any other such organisation).

The chart shows numbers of wells drilled, as stacked bars, and number of operating rigs (unstacked) against the left hand axis, other curves are ratios of total against the right axis. Read More

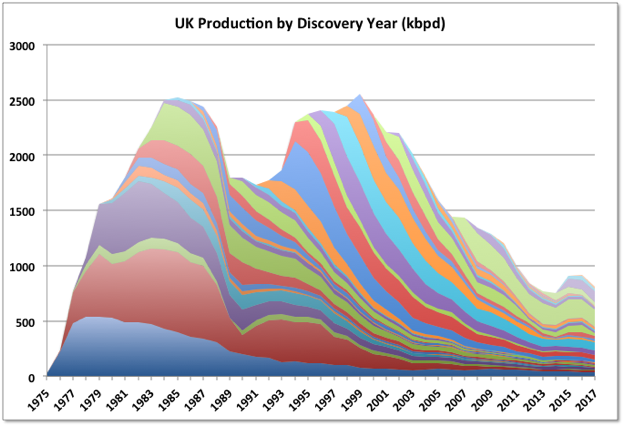

UK oil production peaked in 1999. The peak was probably pushed out a couple of years because of the major production interruptions following the Piper Alpha disaster. Production declined quickly until around 2011, then the high oil price allowed more brownfield and then greenfield developments that created a third local peak in 2016. Production is declining again this year but there are several large projects due that will create another peak in 2018 or 2019 (nearly equal to the 2016 one). After that terminal decline is likely. The chart below shows C&C production split according to the year of first production of the field.

Like all such all diagrams, this shows that the largest fields were developed first and declined the slowest. Read More

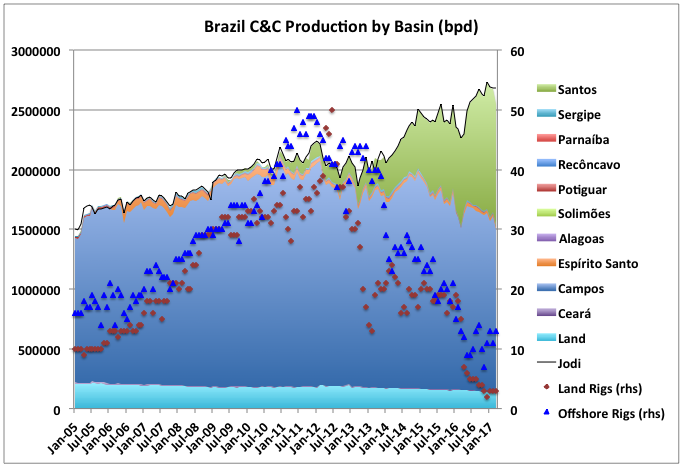

Brazil is a major oil producing country, but in 2016 was still a net importer, though imports dropped significantly and they have been a slight exporter overall so far this year. It is one of the few countries that have consistently grown production over recent years, and possibly the only non-OPEC country that will show overall growth of conventional crude in the ten years to (say) 2022.

Brazil ANP or anp (Agência Nacional do Petróleo, Gás Natural e Biocombustíveis) publishes Excel files for monthly production on all wells. In theory it should be easy to extract field data from these, in practice not so much. The files are downloaded from a database but not always consistently, sometimes in field units sometimes SI, sometimes one month per file sometimes more, around 2010 onshore and offshore was split but naming conventions weren’t always followed, handling of wildcat wells seems a bit arbitrary, and spelling conventions can change. However after more effort than I expected I did download the data and split it by basin and field.

The total production fits Jodi data well except for three periods: 2005 when the reports stated, and doesn’t make much difference; 2010 when ANP split offshore and onshore reporting and the well files are a complete mess; and 2017, which may indicate that some of the data is revised (this should become evident as more releases are made over the next months).